A little upwards movement fits the main Elliott wave count best.

Both Elliott wave counts remain valid.

Summary: The probability of the bearish wave count must now be considered to have increased: there are now bearish signals from On Balance Volume, VIX and the AD line. However, the trend remains upwards while price remains above 2,802.49; a series of higher highs and higher lows remains in place.

A new all time high above 2,916.50 would confirm the bullish wave count. At that stage, the target would then be in a small zone from 3,041 (Elliott wave) to 3,045 (classic analysis).

A new low below 2,802.49 would strongly indicate the bearish wave count is most likely. The target for a multi month consolidation of primary wave 4 would then be at either 2,698 (0.236 Fibonacci ratio) or 2,563 (0.382 Fibonacci ratio).

The final target for this bull market to end remains at 3,616, which may be met in October 2019.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

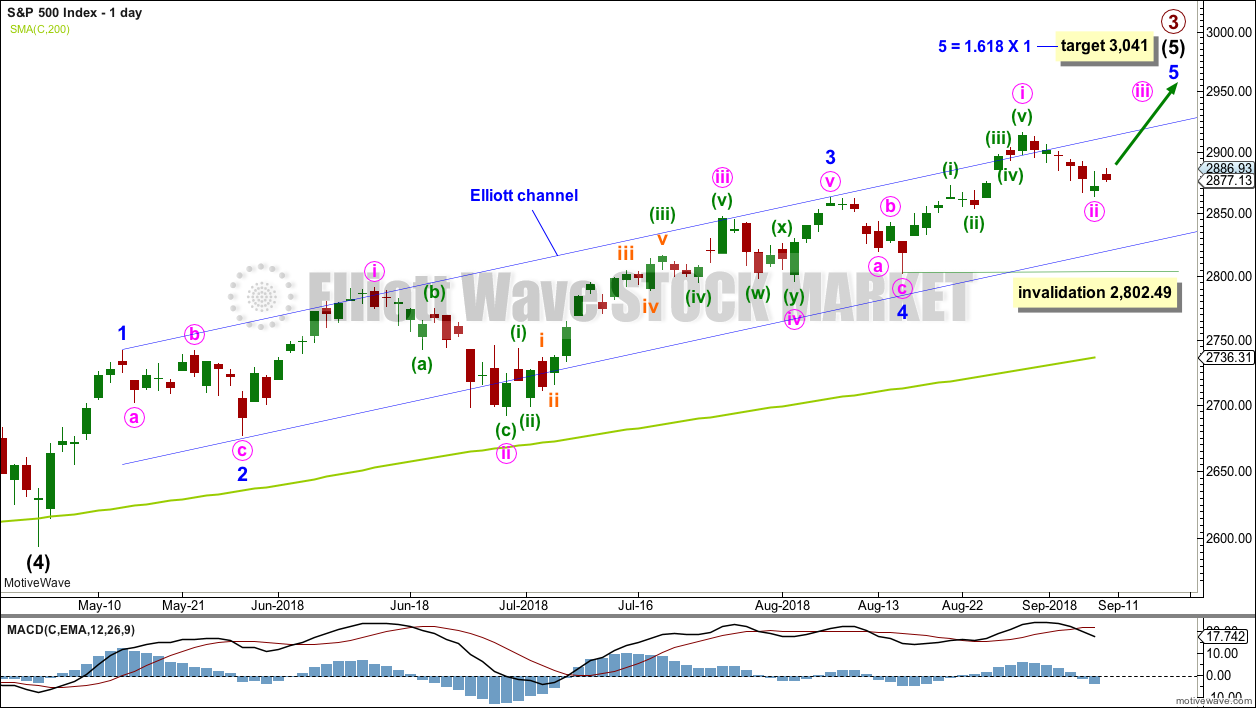

MAIN ELLIOTT WAVE COUNT – BULL

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

The channel is redrawn about cycle wave V from the ends of primary degree waves.

At this stage, the expectation is for the final target to me met in October 2019. If price gets up to this target and either the structure is incomplete or price keeps rising through it, then a new higher target would be calculated.

DAILY CHART

Intermediate wave (5) avoided a truncation now that it has a new high above the end of intermediate wave (3) at 2,872.87.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). Intermediate wave (5) has passed equality in length with intermediate wave (1). The next target was at 2,922, 1.618 the length of intermediate wave (1), which may have been almost met.

A target for intermediate wave (5) to end is recalculated at minor degree. Because this target is so close to the classic analysis target at 3,045, it does have a reasonable probability.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 through to 4 may now all be complete.

Assume the upwards trend remains intact while price remains above 2,802.49. The trend remains the same until proven otherwise.

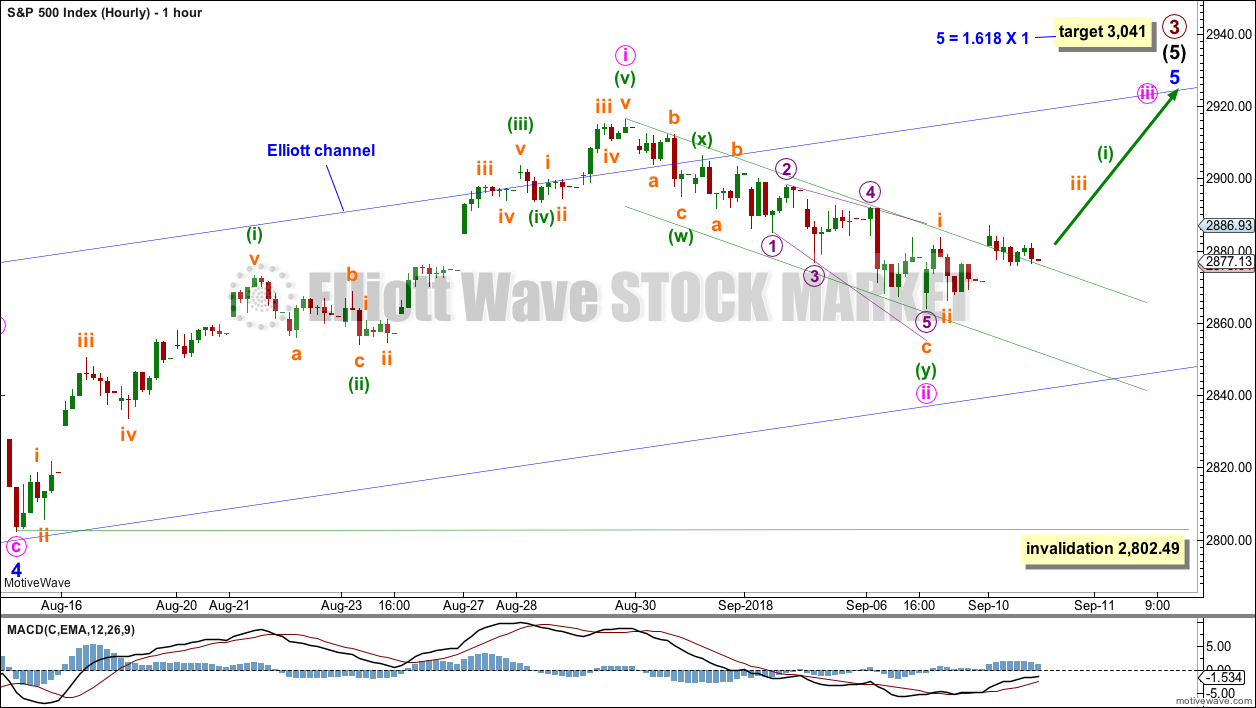

HOURLY CHART

Because we should assume the trend remains the same, until proven otherwise, this will still remain the main wave count while price remains above 2,802.49.

Within intermediate wave (5) so far, minor wave 1 was relatively short and minor wave 3 extended (but does not exhibit a Fibonacci ratio to minor wave 1). Two actionary waves within an impulse may extend, so minor wave 5 may be extending.

Within minor wave 5, minute wave i may have been over at the last high. Minute wave ii may now be a completed double zigzag, ending just below the 0.382 Fibonacci ratio of minute wave i.

Upwards movement for Monday has breached the small channel drawn about minute wave ii. This may be an early indication that the pullback for minute wave ii is over and now minute wave iii may be underway.

If minute wave ii continues any lower, it may not move beyond the start of minute wave i below 2,802.49.

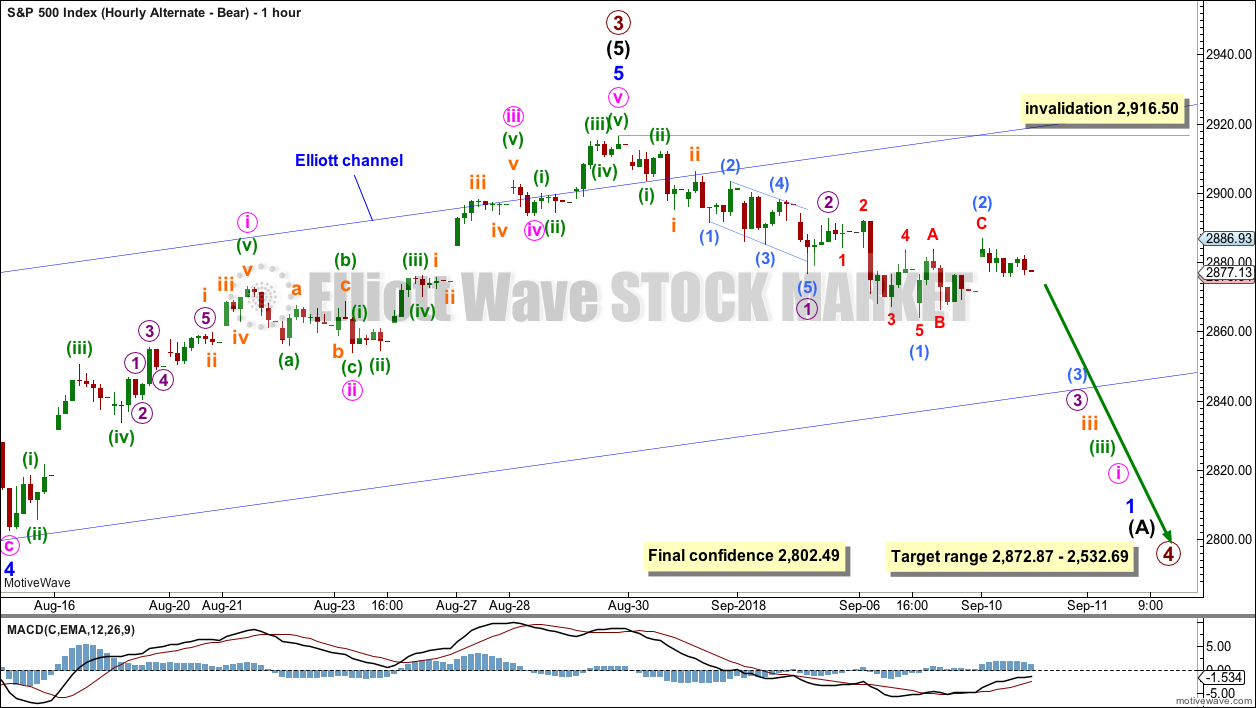

ALTERNATE ELLIOTT WAVE COUNT – BEAR

WEEKLY CHART

It is possible that primary wave 3 was over at the last high. Fibonacci ratios are noted on the chart.

Primary wave 2 was a shallow flat lasting 10 weeks. Primary wave 4 may be expected to exhibit alternation in one or both of depth and structure. Primary wave 4 may last about a Fibonacci 8, 13 or possibly even 21 weeks to exhibit reasonable proportion to primary wave 2.

Primary wave 2 shows up on the monthly chart. Primary wave 4 may be expected to last at least one month, and likely longer, for the wave count to have the right look at the monthly chart level.

Primary wave 4 may end about the lower edge of the maroon Elliott channel. Primary wave 4 may end within the price territory of the fourth wave of one lesser degree: intermediate wave (4) has its price territory from 2,872.87 to 2,532.69.

If primary wave 4 is deeper than expected, then it should find very strong support at the lower edge of the teal channel. This channel, copied over from the monthly chart, has provided support for all deeper pullbacks within this bear market since March 2009.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

DAILY CHART

The first movement down within primary wave 4 should be a five wave structure, which should be visible at the daily chart level. While that is incomplete, no second wave correction may move beyond the start of the first wave above 2,916.50.

Within the target range of 2,872.87 to 2,532.69 sit the 0.236 and 0.382 Fibonacci ratios of primary wave 3. The 0.236 Fibonacci ratio at 2,698 would be the first target. If price keeps falling through this first target, then the next target would be the 0.382 Fibonacci ratio at 2,563.

Primary wave 4 would most likely be a zigzag, combination or triangle. Within a combination or triangle, minor wave A (or X) should subdivide as a three wave structure, most likely a zigzag. Within a zigzag, intermediate wave (A) must subdivide as a five wave structure.

Within primary wave 4, downwards waves may be swift and very strong.

HOURLY CHART

At this stage, there may now be a series of four first and second waves complete. This wave count would now expect to see an increase in downwards momentum this week.

Classic analysis is giving weak bearish signals. It is time to more seriously consider this wave count.

TECHNICAL ANALYSIS

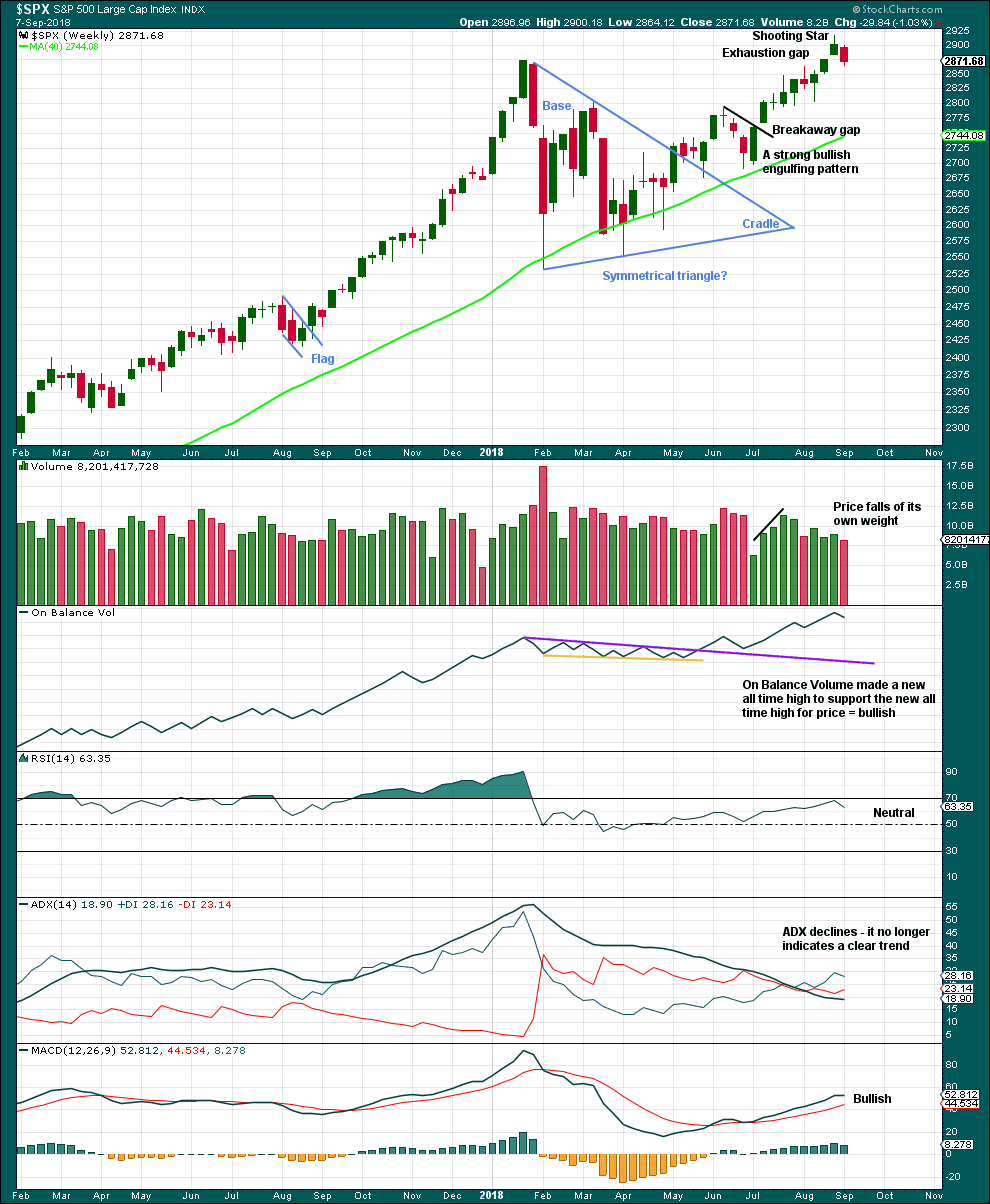

WEEKLY CHART

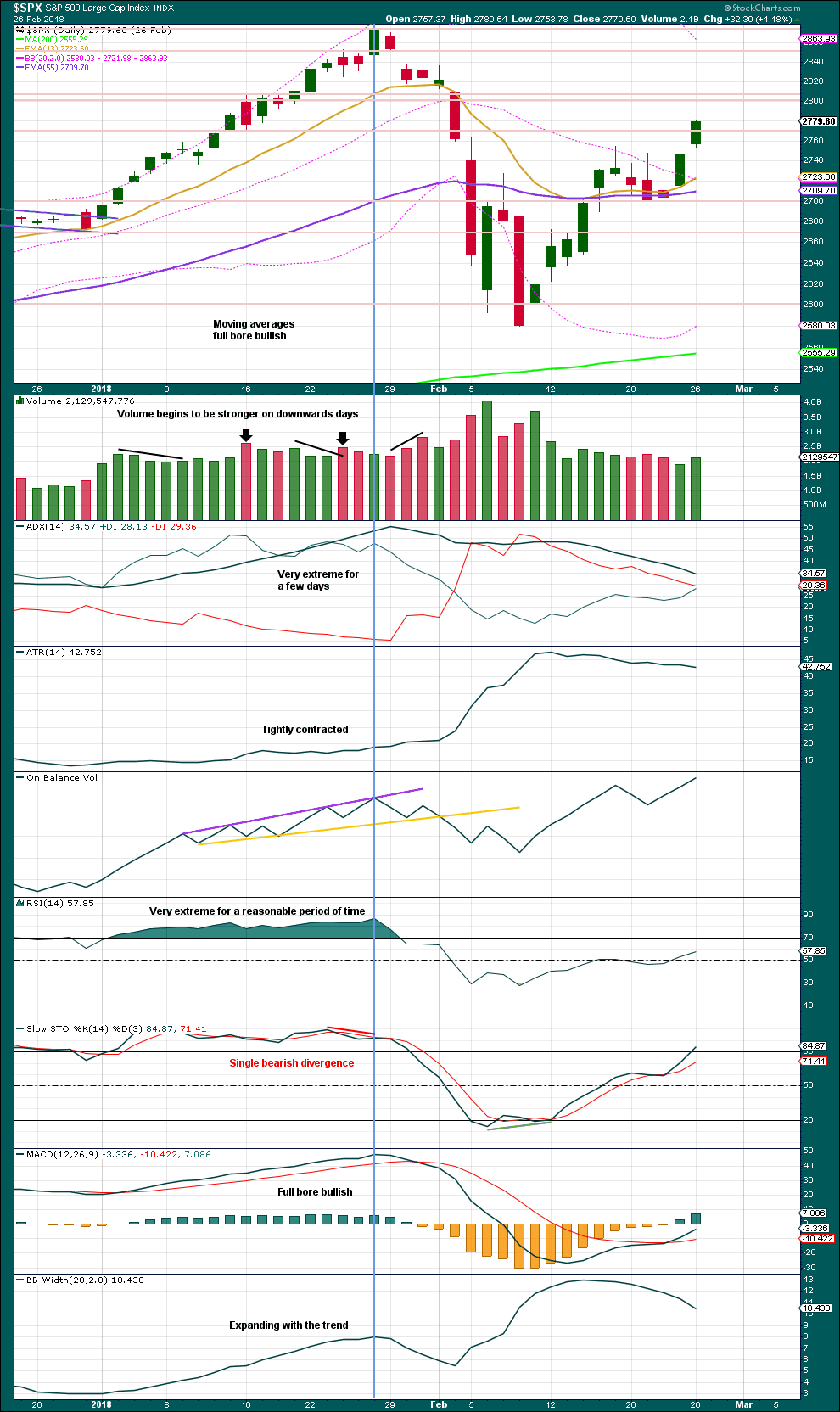

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete. The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is very close to the new Elliott wave target at 3,041.

The shooting star candlestick pattern now has some bearish confirmation with a downwards week which closes the last gap. The gap is now correctly named an exhaustion gap. The target at 3,044 may not be met.

However, it is also possible that the downwards week last week is a typical backtest of support after the new all time high.

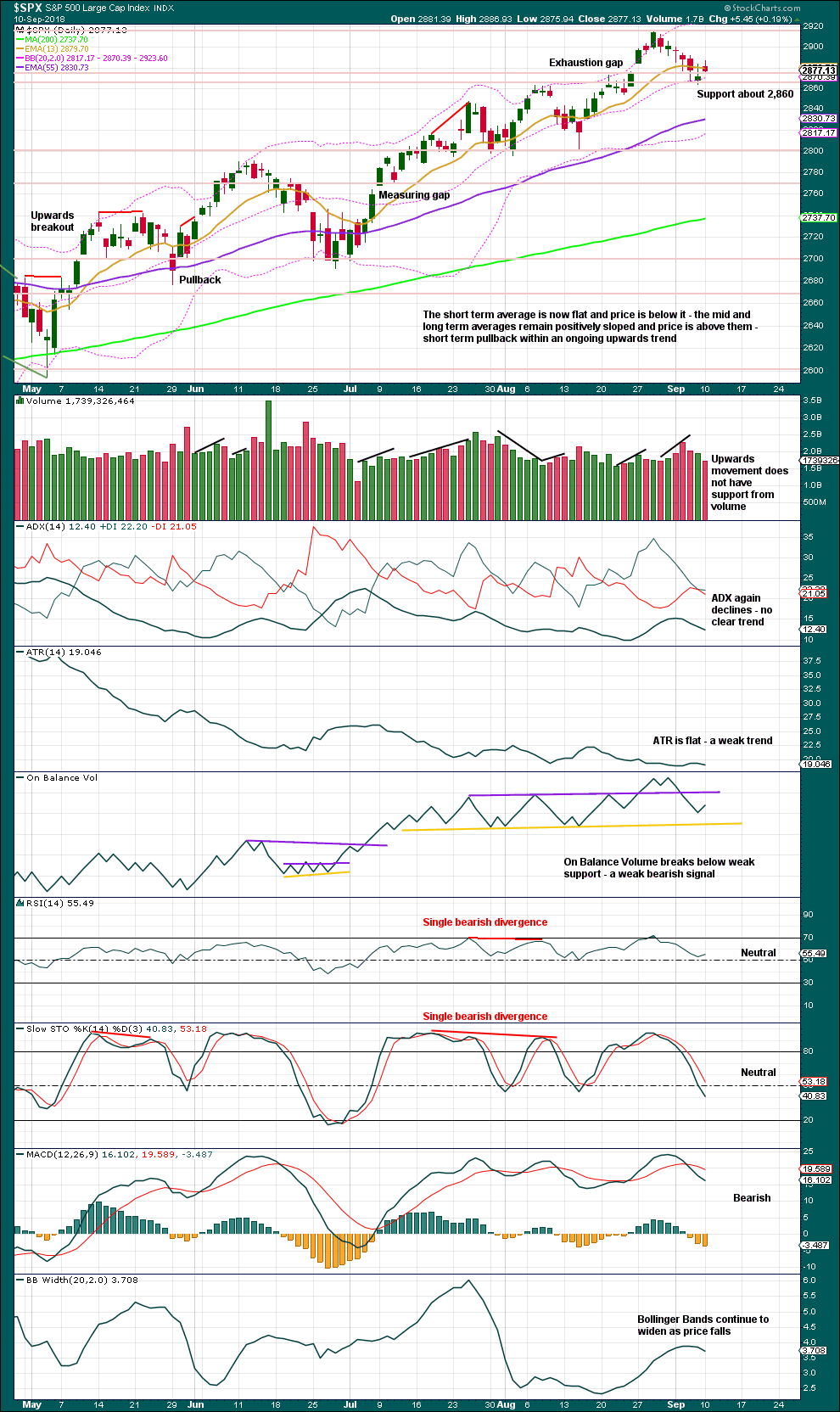

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. While the last swing low at 2,802.49 has not been breached, there will still be a series of higher highs and higher lows in place; the upwards trend should be assumed to remain intact until proven otherwise.

At this stage, downwards movement looks corrective; this does not look like a convincing start to primary wave 4. ATR is weak and volume is now declining.

The signal last week from On Balance Volume breaking below support is very weak only. The trend line had only three tests then was weakened with a breach of resistance.

An exhaustion gap is the most bearish signal on this chart, and it is for this reason that a bearish alternate is now charted at all time frames.

Support about 2,860 is holding so far. This pullback may be only a test of support about the prior all time high.

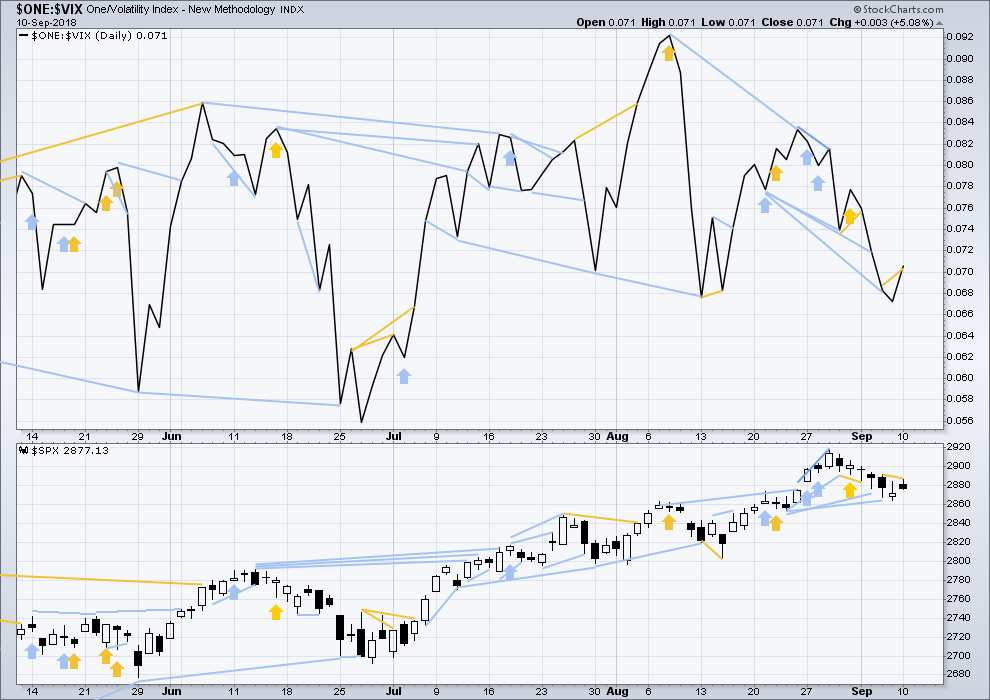

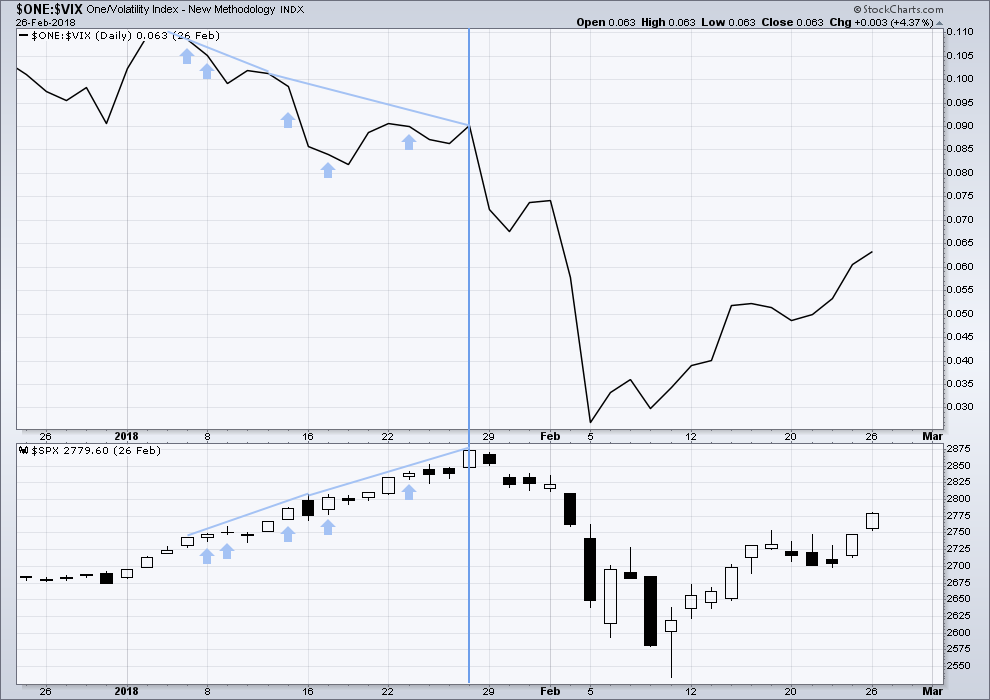

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

At this time, there is mid term bearish divergence between price and inverted VIX: price has made a new all time high, but inverted VIX has not. This divergence may persist for some time. It may remain at the end of primary wave 3, and may develop further to the end of primary wave 5.

There is now strong bearish divergence between price and inverted VIX last week. Inverted VIX has made a strong new swing low below the low 4/5 weeks ago, but price has not. Downwards movement from price comes with a strong increase in market volatility.

There is now some reasonable warning that primary wave 3 could be over.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is mid term divergence with a new all time high from price not supported by a corresponding new all time high from inverted VIX. This divergence is bearish.

The cluster of bearish signals from inverted VIX continues. Volatility is increasing faster than price is falling. This increase in volatility is bearish. This was seen just prior to intermediate wave (4).

There is very short term bullish divergence today between inverted VIX and price: inverted VIX has made a new high above the high of two sessions prior, but price has not. Upwards movement today from price comes with a stronger decline in market volatility.

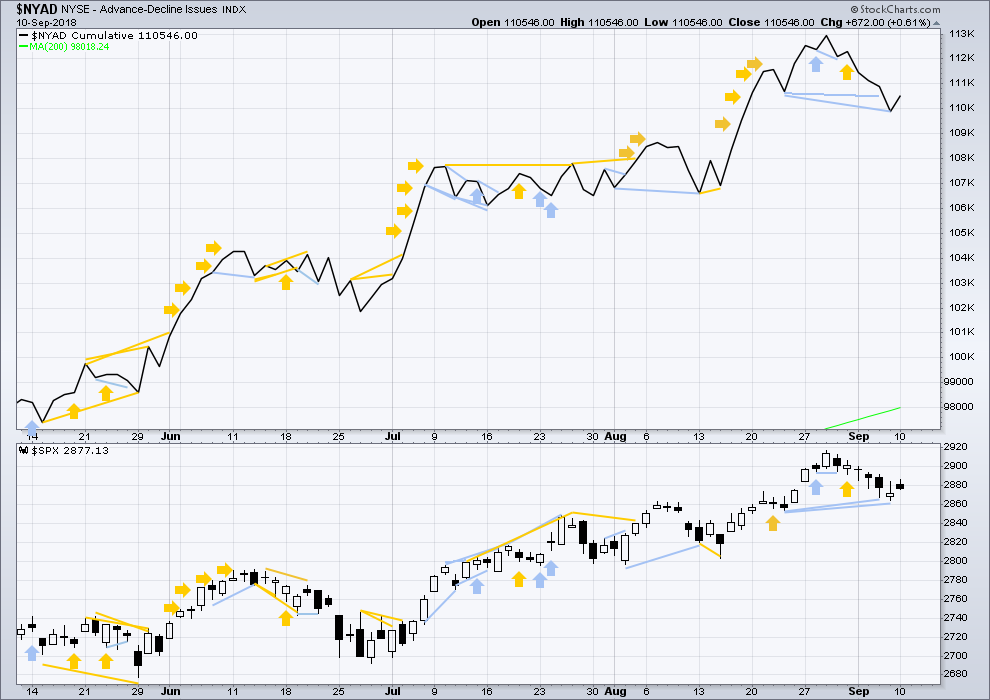

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

There is now short term weak divergence between price and the AD line: the AD line has made a new low below the low two weeks ago, but price has not. Downwards movement last week has strong support from declining market breadth. This divergence is bearish and may be all that is seen from the AD line to indicate a start to primary wave 4.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

The AD line is falling faster than price. Although the divergence at this time frame is not very strong, it is still bearish. There is no new divergence today between price and the AD line.

All of small, mid and large caps made new all time highs on the 27th of August. There is a little divergence here in breadth with large caps continuing to make new all time highs on the 29th of August and small and mid caps lagging.

All of small, mid and large caps saw a fall in price last week. The fall in price has support from market breadth.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Nasdaq and DJT and now the S&P500 have all made recent new all time highs. For Dow Theory confirmation of the ongoing bull market, DJIA needs to make a new all time high.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

ANALYSIS OF THE END OF INTERMEDIATE WAVE (3)

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart looked overly bullish at the end of intermediate wave (3). The only warning in hindsight may have been from volume spiking slightly on downwards days. There was no bearish divergence between price and either of RSI or On Balance Volume.

Single bearish divergence between price and Stochastics was weak, which is often an unreliable signal.

VIX

Click chart to enlarge. Chart courtesy of StockCharts.com.

The strongest warning of an approaching intermediate degree correction at the daily chart level came from inverted VIX.

There was strong double bearish divergence at the high of intermediate wave (3), which is noted by the vertical line. There was also a sequence of five days of bearish divergence, days in which price moved higher but inverted VIX moved lower.

AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There was only single bearish divergence between price and the AD line at the end of intermediate wave (3). Approaching the high, there were no instances of price moving higher and the AD line moving lower.

Conclusion: When studying the behaviour of price and these indicators just before the start of intermediate wave (4), we may see some clues for warning us of primary wave 4. A cluster of bearish signals from VIX along with a bearish divergence from price and the AD line or On Balance Volume may warn of primary wave 4. The next instance will probably not behave the same as the last, but there may be similarities.

At this time, it does not look like primary wave 4 may begin right now, but we need to be aware of its approach.

Published @ 08:28 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Good morning everybody. It looks like today is going to print a strong looking bullish candlestick.

This adds support to the bullish main wave count.

The invalidation point here is VERY short term. If this last little pullback is micro wave 4, then it may not move into micro wave 1 price territory. If the invalidation point is breached then I would relabel micro wave 3 as sub-micro wave (1). The invalidation point for that would be at 2,866.78.

Bear alternate hourly updated:

I can fit a leading contracting diagonal into the last movement down, but it doesn’t look very good.

Minuette wave (i) fits as a zigzag, with subminuette wave c an ending expanding diagonal. It meets all EW rules but it just looks really wrong. Within micro wave 5 sub-micro wave B overshoots the 2-4 trend line, that looks wrong. The trend lines do diverge, but only just.

Of note, new Hindenburg Omens abound, but that’s not worked for years either…..

Yep! We have had five in a row recently!

It is just a continuation of the clanging of the warning bells.

EWO still red today so we probably are looking at some kind of corrective B wave imho. Man I love snagging cheap vol!! 🙂

Lara, isn’t a LD 5-3-5-3-5? your first wave down within your LD, its 5 alright but its all ABCs (a LD with 3-3-3-3-3 within a LD?). Could you better explain how this is valid?

FWIW, I have also been trying to count this as a LD but have not been able to put it together. So, I am just trying to learn what is valid.

Leading diagonals more commonly have all sub-waves subdividing as zigzags. But waves 1, 3 or 5 may sometimes appear to be impulse.

So they most commonly sub-divide the same as ending diagonals.

Thx. I guess I need to get better reference material. Here is what I read – which is what threw me:

“Notice that wave 4 overlaps wave 1, just as it does in the ending diagonal triangle pattern. However, the ending diagonal triangle has a 3-3-3-3-3 subwave structure, but the leading diagonal triangle shows a 5-3-5-3-5 pattern.”

I found this on several sites.

The only reference I would recommend ever for EW rules and guidelines would be Frost and Prechter’s “Elliott Wave Principle” 10th edition.

It has a handy list of them.

There is an awful lot of absolute rubbish online about Elliott wave. And sadly, I’ve also seen some rubbish in published textbooks.

Here’s the thing. Frost and Prechter is the original, based on R N Elliott’s work. Frost and Prechter did a bunch of research to back up their book.

If anyone else ever wants to re-write Elliott wave rules, then they need a bunch of research to support their re-writing. Because the basic premise of Elliott wave is it is rule based. And the rules (all bar one) are inviolate.

Anyone else on the forum likes Ribena black currant syrup?

I have been drinking it since I was a wee lad.

GlaxoSmithKline sold it to a Japanese company and they have totally ruined it!

In order to avoid a UK 17% tax on sugar they took out the sugar and substituted Sucralose (Splenda). They then added insult to injury by trying to duplicate the consistency by adding DEXTROSE!!!

Is there no justice in this world, I ask you??!! 🙂

Nope. No justice whatsoever.

Micro 3 looks very small vs micro 1&2?

It’s more brief than micro 1. But it is longer in length.

Sept 11th… We will never forget!

Lara, it appears the login issues have been fixed!

So much for Gold & Silver… Ouch! When will this turn? Will it Turn?

9/11/2001 A day that will go down in infamy. May we never forget. BTW, they sang the national anthem at the site today. I trust no one was kneeling.

There is a good chance gold and silver will be much lower before they turn up with any lasting rally. As soon as I say that perhaps I put a hex on the gold bear market and it turns around.

I was just checking the weekly charts of GDX. It appears to me if GDX does not hold at the 12.50 level, it could be headed for 5.50. Yikes! There is much support at the 16 level through 12.50. So this would be a long way off in time. But it might fit with a weekly SPX target of 3600.

2019 is going to be an interesting year.

Cesar fixed the problem last night. What would I do without my wonderful webmaster? He’s so patient and methodical.

Thank you all for your patience, because that took a while.

I think we are going lower Joe, and the fifth and final wave down is going to probably be quite brutal. I am hedged with some very frisky DUST and JDST calls. I think we are going to seem some crazy moves higher in those two beasts before this is all said and done!

SPX and NDX continue to squeeze at the hourly TF.

Up or down from here…I think up but no certainty!

I’m suspicious. This choppy price action since Friday’s low is beginning to look corrective to my eye — at least at the moment.

Indications are SPX is entering into the early stages of a minute iii of a minor 5.

The high leverage entry point with good confidence is right now. IMO.

You called it. It looks to me like we are seeing strength to the upside which negates the current bear count as it needs strength to the downside today and tomorrow in order to remain viable. At this juncture, every point to the upside further decreases the probability in the bearish EW count.

Indeed Rodney, “things are proceeding as Lara has foreseen!”, or I should say, “has indicated is the most likely of the alternatives”.

I’m counting on a lot more as this WC unfolds! Meanwhile, today has been very nice.

Yesterday was starting to look bullish for sure. But this morning’s low changed my short-term view. This move up could be a “c”. Just a thought to consider.

I eagerly await Lara’s update.

I think it is corrective. We need a C down to complete this wave. ES back-testing prior support…the banksters and market makers know lots of stops set around 2894 so odds are we get a run of stops with a brief intra-day ramp past that pivot. 🙂

RUT and DJX in a multi-hour squeeze as well! I don’t remember ever seeing all four major indices squeezing at one time frame simultaneously.

But hark!! Is that dull roar of an approaching herd of bulls I hear???

My, my, the banksters are thrashing around this morning! Feeling a bit panicky?

You can be sure there was massive shorting of that laughable ramp..Hehe!

Vol on sale people!!! 🙂

They are incessant to the point of insanity; the SPX candle at 10:59am is just sad. I do like Goldman calling out the China national team today. Watch China call out our FED too. Discounting and price discovery be damned……..

Guten Morgen! 🙂

Same to you my friend.