Identified support at the last gap remains open today, but only just. A clear price point is given to members, which will indicate a change from bull to bear if it is passed.

Summary: The trend is up. Assume the trend remains the same while price remains above 2,876.16. If price moves below this point, then the probability of primary wave 4 having arrived will increase. However, this would still require a new low below 2,802.49 for reasonable confidence.

The last gap may be a breakaway gap, which may offer support at 2,876.16. Gaps can be useful in trading as a place to set stops.

Stops for long positions may be pulled up to just below 2,876.16.

The mid to longer term target is now either 2,950 (Elliott wave) or 3,045 (classic analysis). Another multi week to multi month correction is expected at one of these targets.

The final target for this bull market to end remains at 3,616.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

ELLIOTT WAVE COUNT

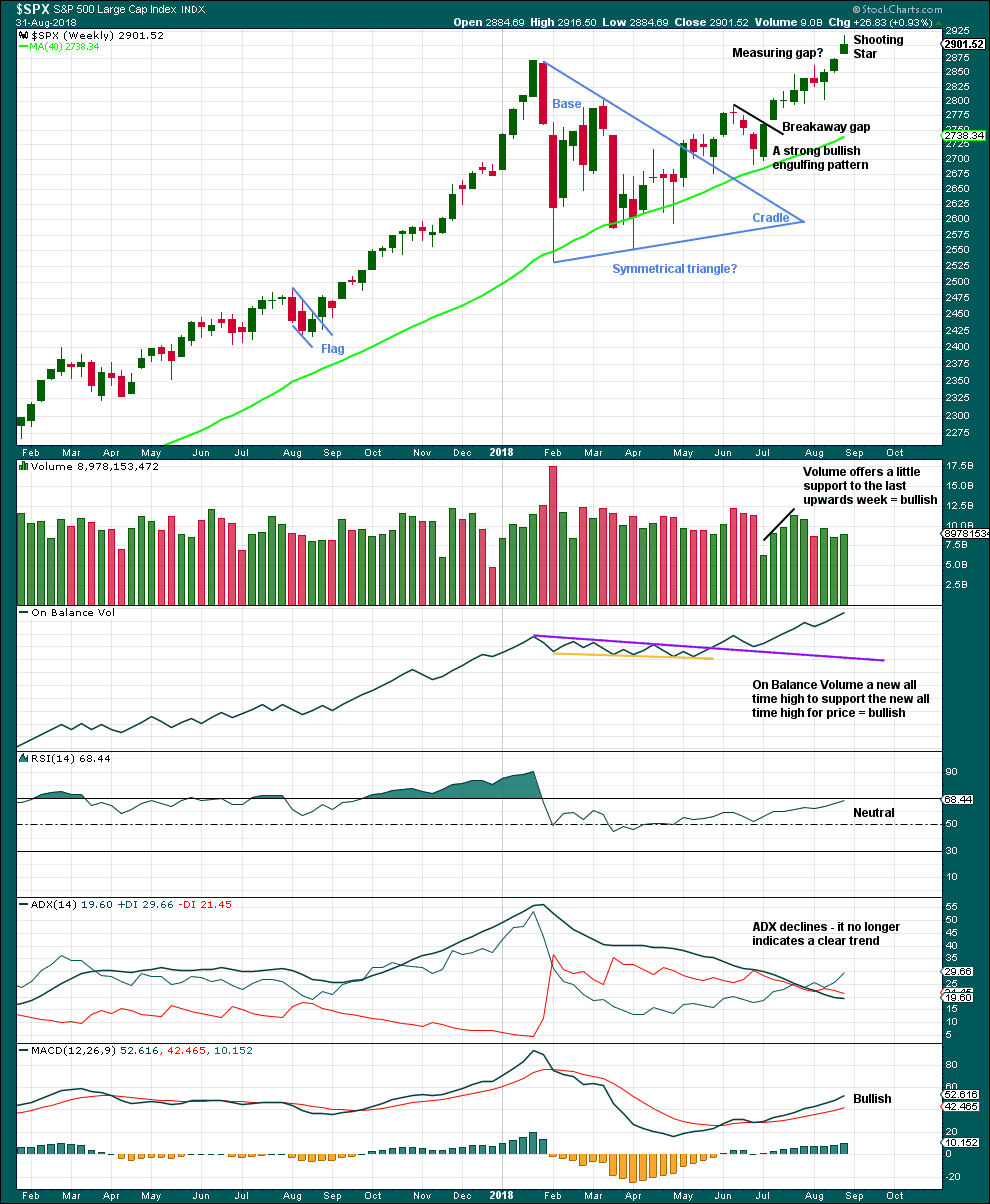

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62. However, the lower edge of the black Elliott channel drawn across the ends of intermediate degree waves should provide very strong support for any deeper pullbacks, holding price well above the invalidation point while intermediate wave (5) unfolds.

At this stage, the expectation is for the final target to me met in October 2019. If price gets up to this target and either the structure is incomplete or price keeps rising through it, then a new higher target would be calculated.

A multi week to multi month consolidation for primary wave 4 is expected on the way up to the final target. This large correction may now be fairly close by in terms of time; classic analysis will be watched carefully to identify early warning signs of its approach.

The last bullish fifth wave of minor wave 5 to end intermediate wave (3) exhibited commodity like behaviour. It was strong and sustained. It is possible that minor wave 5 to end intermediate wave (5) to end primary wave 3 may exhibit similar behaviour, so we should be on the lookout for this possibility. This may be beginning to happen now.

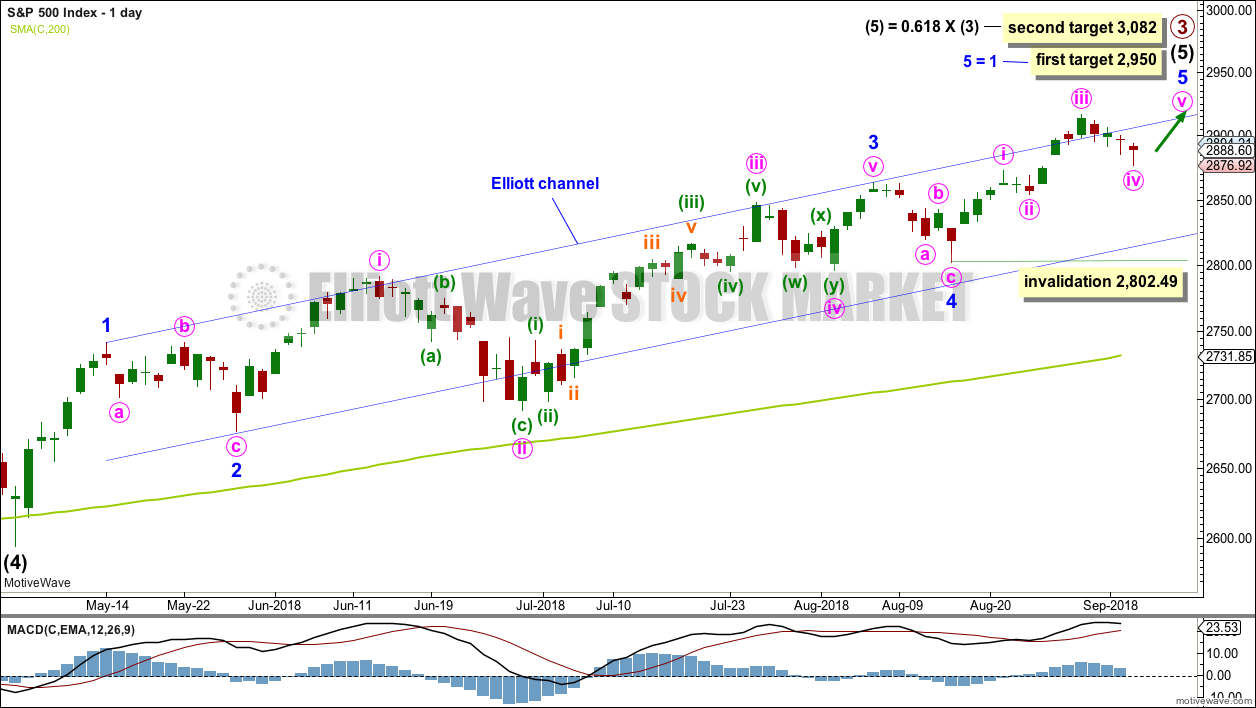

DAILY CHART

Intermediate wave (5) avoided a truncation now that it has a slight new high above the end of intermediate wave (3) at 2,872.87.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). Intermediate wave (5) has passed equality in length with intermediate wave (1). The next target was at 2,922, 1.618 the length of intermediate wave (1), which may have been almost met.

If price continues rising through the target at 2,950, then the next target for intermediate wave (5) may be 0.618 the length of intermediate wave (3) at 3,082.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 through to 4 may now all be complete.

The channel is drawn about intermediate wave (5) using Elliott’s first technique. Price has closed above the upper edge but now has returned to within the channel.

Assume the upwards trend remains intact while price remains above 2,802.49. The trend remains the same until proven otherwise.

It is possible that primary wave 3 was over at this week’s high and primary wave 4 has just begun. However, a new low below 2,802.49 is required for any confidence whatsoever in this view.

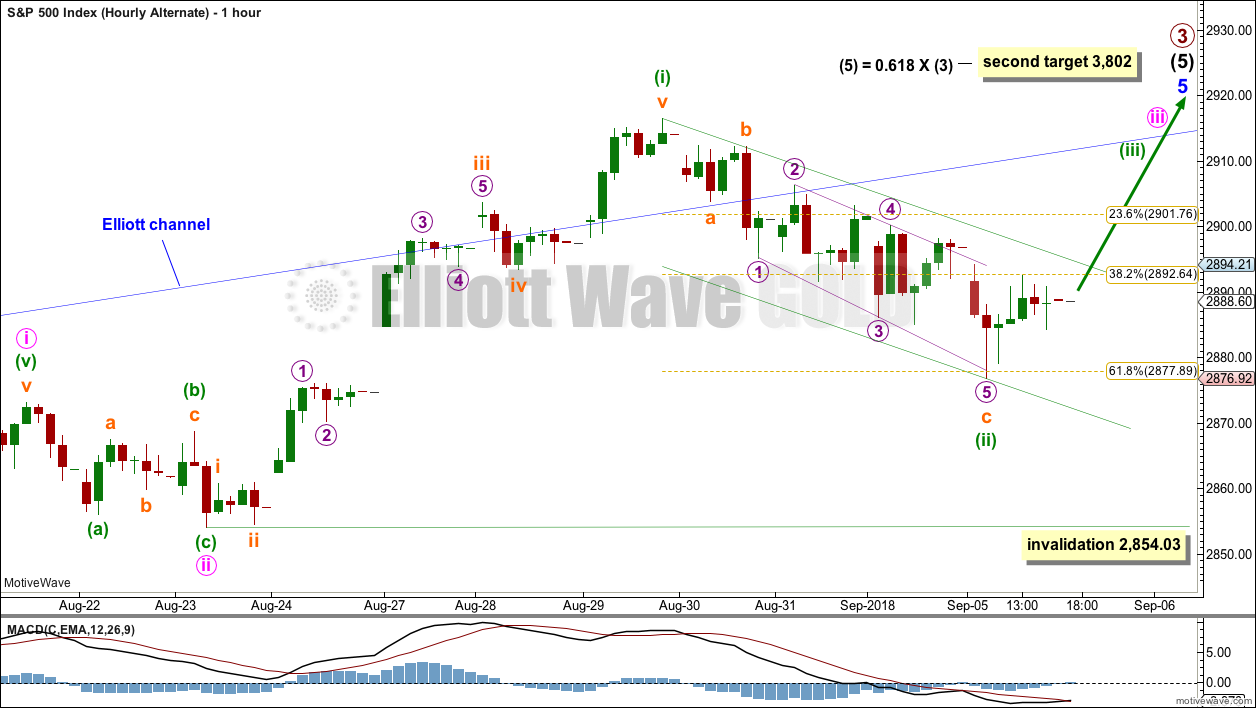

HOURLY CHART

Because we should assume the trend remains the same, until proven otherwise, this will remain the main wave count while price has not breached the last open gap at 2,876.16.

Minor wave 5 may unfold as either an impulse or an ending diagonal. An impulse is more likely.

Minute waves i through to iv may be complete.

Minute wave ii was a 0.27 shallow single zigzag. Minute wave iv may have moved a little lower today to complete as a deep single zigzag. There is alternation in depth with minute wave ii, but no alternation in structure.

Minute wave iv may not move into minute wave i price territory below 2,873.23.

For this main wave count, minute wave iii is shorter than minute wave i. A core Elliott wave rule is a third wave may never be the shortest actionary wave within an impulse. For that rule to be met here, minute wave v is limited to no longer than equality in length with minute wave iii.

ALTERNATE HOURLY CHART

A more bullish wave count can be seen by simply moving the degree of labelling within the last wave up all down one degree. It is possible that minute wave iii is not over, and that only minuette waves (i) and (ii) within it are complete.

Apart from the degree of labelling, this wave count sees all subdivisions in exactly the same way as the main hourly wave count.

This wave count would expect to see some increase in upwards momentum as a third wave at two degrees moves higher this week. The first target at 2,950 may be inadequate. A higher target is calculated at intermediate degree.

With minuette wave (ii) moving lower today, it is now larger in duration than minute wave ii, one degree higher. This does sometimes happen for this market; the S&P does not always exhibit good proportion. The probability of this wave count is slightly reduced today, but it still remains valid.

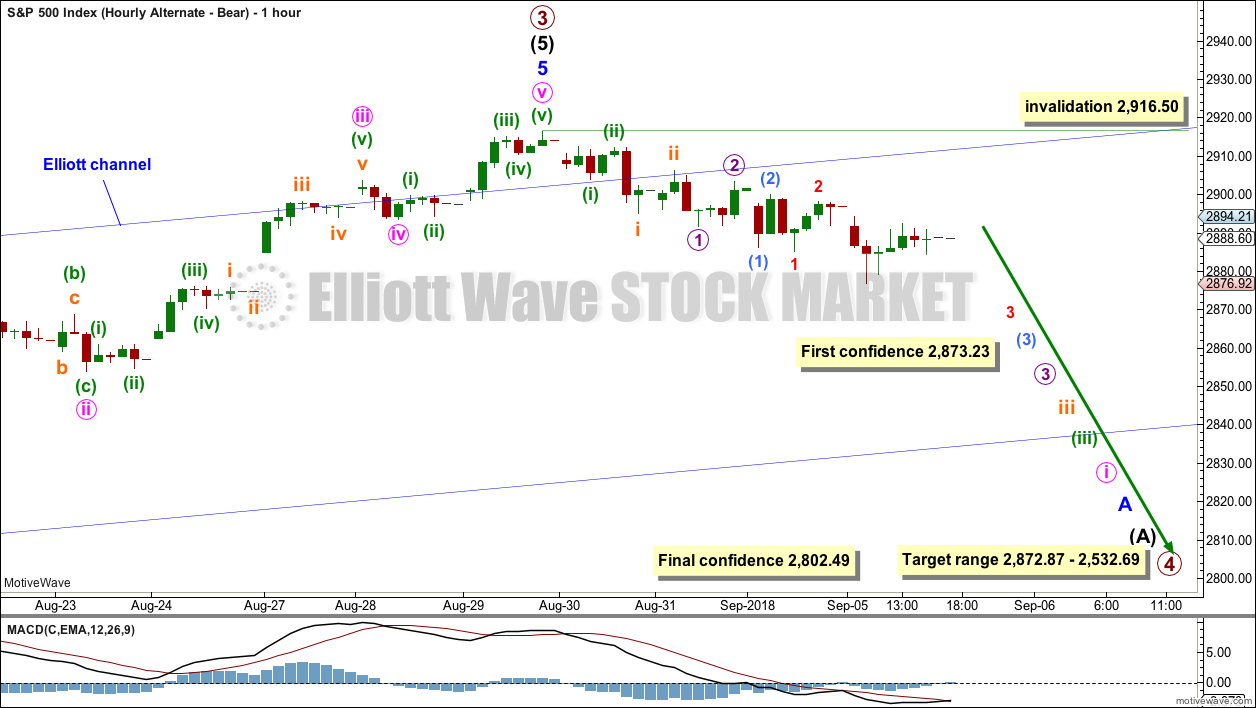

ALTERNATE HOURLY CHART – BEAR

It is possible that primary wave 3 could be over. There is a little support at the end of last week from classic analysis for this wave count but not yet enough for any confidence.

This wave count is published for members as only an outside possibility to consider, and to provide a road map if this low probability outcome does occur.

If primary wave 3 is over, then within it intermediate wave (5) would be just 5.16 points short of 1.618 the length of intermediate wave (1).

If price makes a new low by any amount at any time frame below the first confidence point, then this wave count would slightly increase in probability. A new low below the second confidence point would be required for any reasonable confidence in this wave count.

At that stage, a multi month consolidation for primary wave 4 would be expected. Primary wave 4 may end within the price territory of the fourth wave of one lesser degree: intermediate wave (4) has its range from 2,872.87 to 2,532.69. Within this range sit the 0.236 and 0.382 Fibonacci ratios of primary wave 3: at 2,698.24 and 2,563.22. These would both be reasonable targets for primary wave 4, with the 0.236 Fibonacci ratio slightly favoured as it would see primary wave 4 sit better within an Elliott channel.

Within primary wave 4, downwards waves may be swift and very strong.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

At this stage, there may now be a series of six first and second waves complete. This wave count would now expect to see an increase in downwards momentum this week.

A bearish signal today from VIX adds to a cluster of recent bearish signals. A weak bearish signal today from On Balance Volume and good support from volume today for downwards movement add a little support to this wave count.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete. The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,950, so the Elliott wave target may be inadequate. It is 37.28 points below the new higher Elliott wave target.

A new all time high for price has support from another new all time high from On Balance Volume at the weekly chart level. This is bullish.

Price can rise in current market conditions on light and declining volume for a reasonable period of time, so lighter volume last week does not mean that the rise in price is unsustainable for the short or mid term.

Another upwards gap may be a measuring gap; it should be assumed to be so until proven otherwise. While this gap remains open, it may be useful in calculating a new short term target at 2,992. If this gap is closed, it may then be considered an exhaustion gap, and that may be taken as a signal that primary wave 4 may have arrived.

This weekly candlestick closes as a Shooting Star. From Steve Nison CMT in “Japanese Candlestick Charting Techniques”, page 74:

“The Japanese aptly say that the shooting star shows trouble overhead. Since it is one session, it is usually not a major reversal signal as is the bearish engulfing pattern or evening star. Nor do I view the shooting star as pivotal resistance as I do with the two previously mentioned patterns.”

This weekly candlestick is a small warning; it may not be read as a reversal signal.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. This is the definition of an upwards trend. But trends do not move in perfectly straight lines; there are pullbacks and bounces along the way.

Breakaway and measuring gaps can be useful in trading: stops may be adjusted using these gaps. If the last gap is closed, then it would not be a breakaway gap but would then correctly be an exhaustion gap, so a reasonable correction would be expected and long positions should then be closed. If the last gap is closed, that may be taken as a signal that primary wave 3 may be over and primary wave 4 may have arrived. If primary wave 4 has arrived, then this gap may be closed tomorrow.

Current market conditions with price rising on declining volume and low ATR may be sustained even while upwards momentum increases. This has happened before; most recently up to the high of the 26th of January, so it may happen again.

The trend is up, and it looks like it is strengthening. ADX has now indicated an upwards trend; when rising from low levels and coming up from both directional lines, this is the strongest signal ADX can give.

At this stage, there is no candlestick reversal pattern to support the idea of primary wave 4 arriving, but it must be noted that on the daily chart intermediate wave (4) was not heralded by a candlestick reversal pattern.

A bearish signal from On Balance Volume is weak because the trend line only had three tests. Strong support today from volume for downwards movement is reasonably bearish. It is possible that these signals indicate primary wave 4 has arrived.

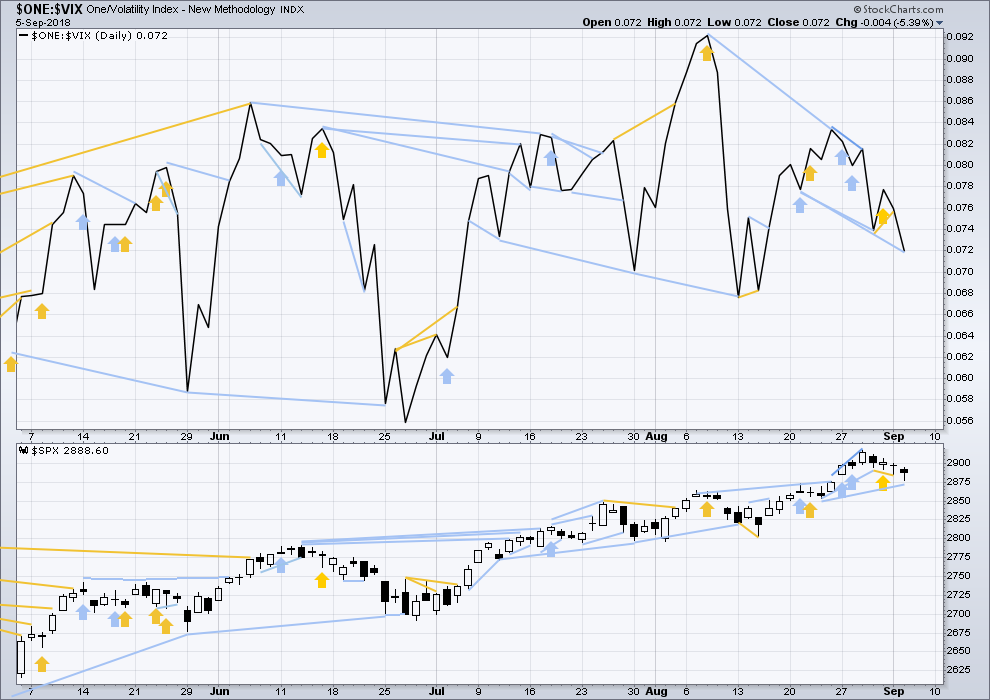

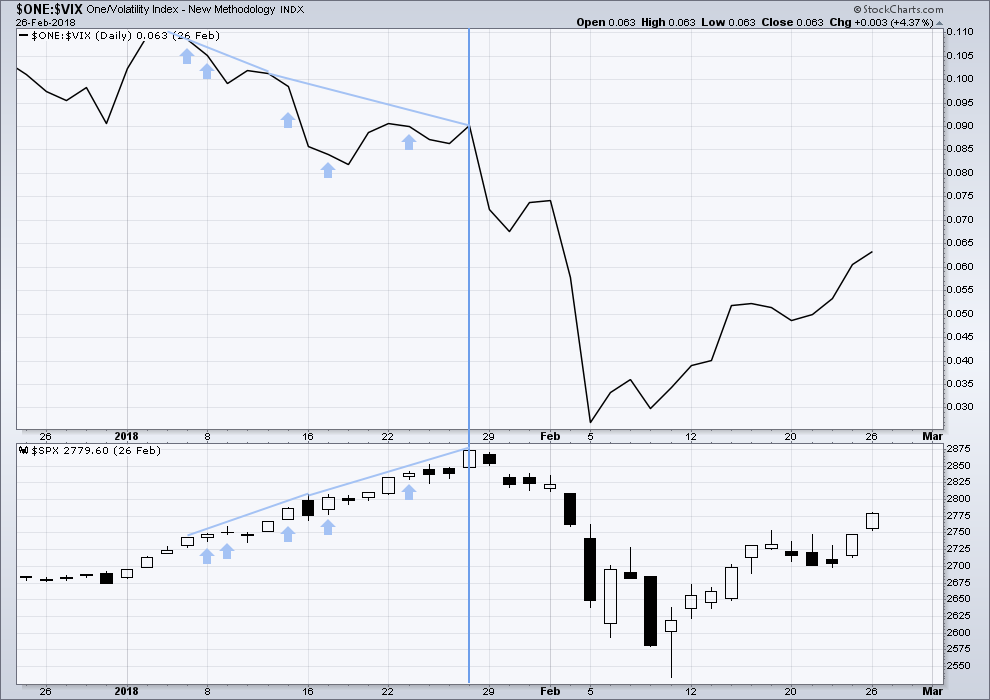

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

At this time, there is mid term bearish divergence between price and inverted VIX: price has made a new all time high, but inverted VIX has not. This divergence may persist for some time and may remain at the end of primary wave 3.

There is single and weak short term bearish divergence between price and inverted VIX: last week price moved higher, but inverted VIX moved lower. Price has not come with a normal corresponding decline in market volatility although it has made new all time highs; volatility has increased. This may be an early warning that primary wave 4 could begin here or fairly soon. It is possible that more instances of weekly divergence may yet develop before primary wave 4 begins.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is mid term divergence with a new all time high from price not supported by a corresponding new all time high from inverted VIX. This divergence is bearish.

Inverted VIX has made a new low below the low six sessions prior, but price has not. This divergence is bearish and strong. However, it is also possible that this is only an early warning and that further bearish divergence may develop before primary wave 4 begins; inverted VIX may not be very useful as a timing tool, only a warning.

There is now a small cluster of bearish signals from inverted VIX, which offer a very small support to the idea that primary wave 4 may begin here or very soon.

Inverted VIX has made a new short term swing low, but price has not. Downwards movement from price comes with a strong increase in market volatility. This divergence is bearish.

There is now a cluster of bearish signals from inverted VIX, but this is still slightly countered by two recent bullish signals. The balance is bearish, but it is not as clear as it was at the end of intermediate wave (3).

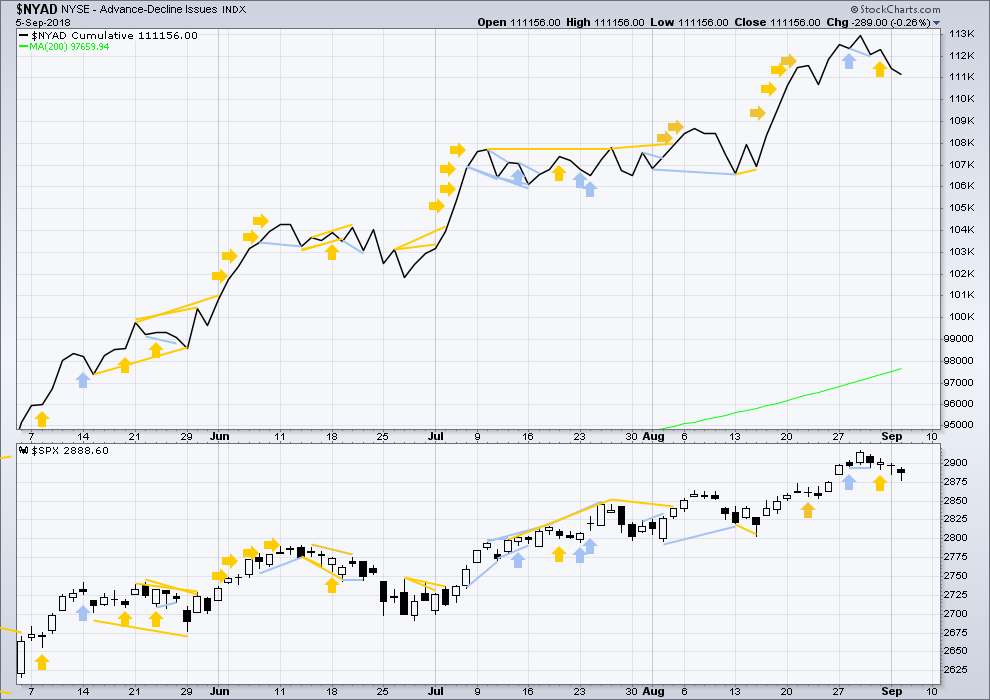

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

The AD line and price both moved higher to new all time highs last week; there is no divergence. The rise in price has support from rising market breadth. This is bullish.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

Bullish divergence noted on Friday has not yet been followed by upwards movement. It looks like it has failed. There is no new divergence today. Downwards movement has support from falling market breadth, but breadth is not falling faster than price.

All of small, mid and large caps made new all time highs on the 27th of August. There is a little divergence here in breadth with large caps continuing to make new all time highs on the 29th of August and small and mid caps lagging.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Nasdaq and DJT and now the S&P500 have all made recent new all time highs. For Dow Theory confirmation of the ongoing bull market, DJIA needs to make a new all time high.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

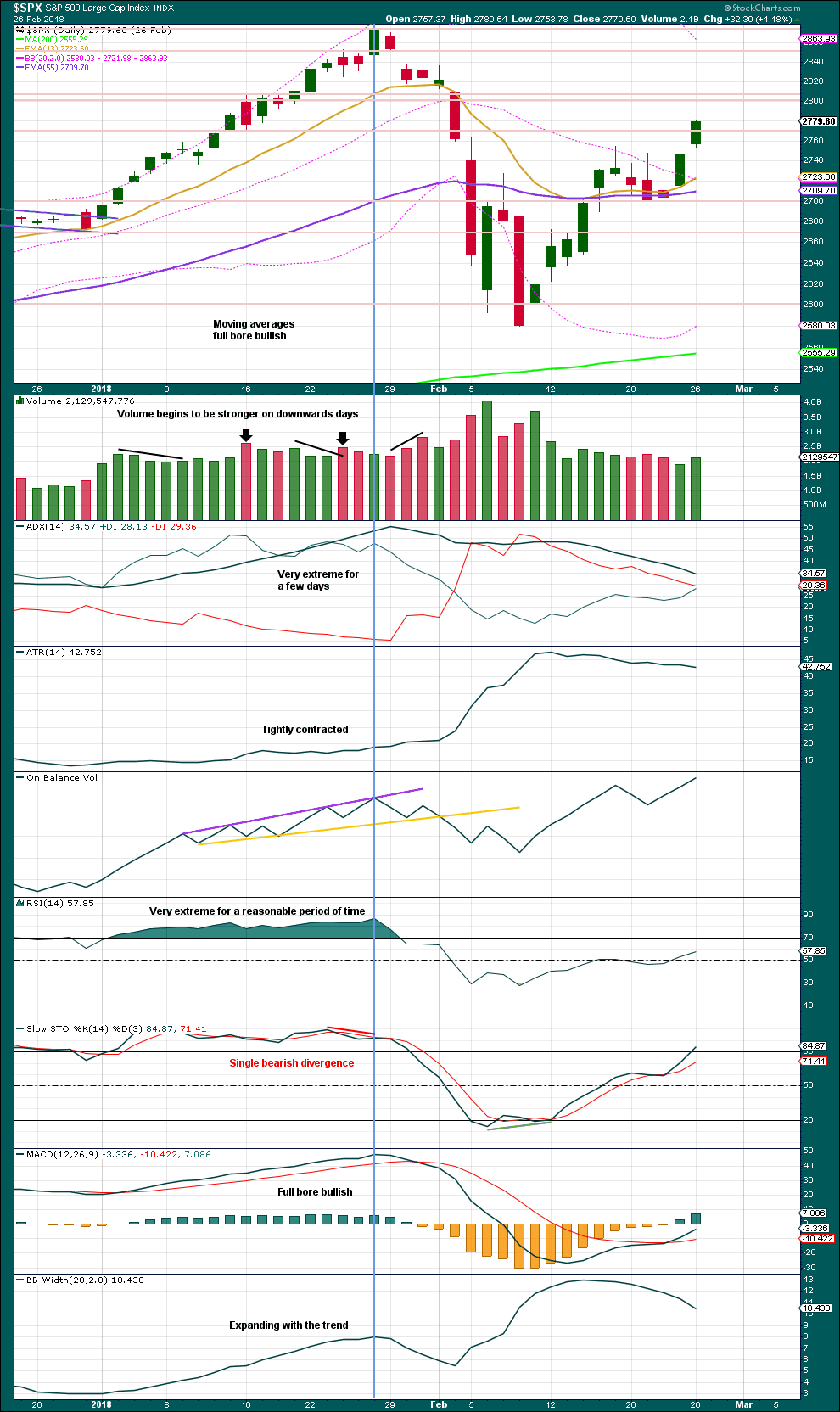

ANALYSIS OF THE END OF INTERMEDIATE WAVE (3)

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart looked overly bullish at the end of intermediate wave (3). The only warning in hindsight may have been from volume spiking slightly on downwards days. There was no bearish divergence between price and either of RSI or On Balance Volume.

Single bearish divergence between price and Stochastics was weak, which is often an unreliable signal.

VIX

Click chart to enlarge. Chart courtesy of StockCharts.com.

The strongest warning of an approaching intermediate degree correction at the daily chart level came from inverted VIX.

There was strong double bearish divergence at the high of intermediate wave (3), which is noted by the vertical line. There was also a sequence of five days of bearish divergence, days in which price moved higher but inverted VIX moved lower.

AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There was only single bearish divergence between price and the AD line at the end of intermediate wave (3). Approaching the high, there were no instances of price moving higher and the AD line moving lower.

Conclusion: When studying the behaviour of price and these indicators just before the start of intermediate wave (4), we may see some clues for warning us of primary wave 4. A cluster of bearish signals from VIX along with a bearish divergence from price and the AD line or On Balance Volume may warn of primary wave 4. The next instance will probably not behave the same as the last, but there may be similarities.

At this time, it does not look like primary wave 4 may begin right now, but we need to be aware of its approach.

Published @ 09:32 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

3082?

That’s still pretty bullish!

Yep.

HI Lara

I think you made a typo 3802 for the S & P?

lol your more bullish then any analyst on wall street lol.

I’m so sorry everybody!

Yes, I mean 3,082.

It was right on the daily chart, but I mixed up the number on the hourly. How embarrassing!

Updated hourly wave count:

today this will be the main wave count.

another long lower daily candlestick wick still looks bullish

the trend remains the same (up) until proven otherwise with a breach of 2,802.49

I still need to figure out what structure minute ii could be.

if I can’t see a complete structure then it may move lower towards the 0.618 Fibonacci ratio

Buckle up….! Third waves on deck… 😉

Ready for a big tumble down the “slope of hope” or yet another slog up the “wall of worry.” Still waiting for a clear break up or down.

Indeed, it’s not at all clear yet, and as I stare at the longer term hourly and daily, I think there are many ways of counting it in a bullish manner still (i.e., as an incomplete 5 wave move up). At the big picture level, I see 3 roughly equivalently sized consolidations on the way up. A complete structure requires an even number. Also, the larger swings in the overall structure aren’t overlapping yet.

My concern will notch up higher if 2862 is penetrated (the pivot high from 8/7 – 8/8). If that holds, well, I guess by definition we aren’t in P4 yet.

And finally, even if price moves down sharply, there is a very wide and well defined channel. Moving to the bottom of that channel and then resuming bull mode is a completely nominal thing to do. Whether some kind of bullish count can support it, tbd!

VIX pretty much telling us what to expect… 🙂

ignoring WC for the moment, structurally re: channels and retracements, market appears headed to the gray ellipse area pretty fast. Likely turn spots are 2846 (62%), 2827 (78%), 2802.5 (100%), and the rising lower channel line (which is already above the 100%).

The interesting thing is that the NDX is already down on top of its structurally similar lower channel. So if we generally get more selling here, NDX will be breaking down immediately in a much more significant manner, and the selling panic might start up and spread across markets.

Enjoy your comments and analysis Kevin . THANK YOU – IMO some congestion here at the 1/26/18 ( 2873 ) area . Your chart not going back that far . breaking thru it – looking at 100 % retracement to the 2802 . Large resistance down there . may be back and fill for a while .

You’re welcome Fred. Something to keep me busy and my fingers away from the “buy” and “sell” buttons!! It’s increasingly appearing that we have a major pivot high in place, at the very least. Whether it’s the top of the P3…I don’t know! I know I’ll be a believer if price breaks the lower channel line…but by then a large bite of the P4 down is already over. So…I’m assessing an incremental plan to getting more in line with it should price starting pushing lower again here.

That VIX smack down was quite feeble indeed! Where are the short sellers?! 🙂

No doubt long vol traders are anticipating an aggressive attack on the VIX move above 15. If we see an intra-day gap up past 15 we are likely going a lot higher in vol.

SPX is facing a historical re-balancing later this month and this will likely contribute to increasing volatility. An awful lot of tech stocks will be leaving the index.

For Lara: Been having an issue logging in today. I had to re-set password.

What I found is that the Login in the menu that goes across the top of the webpage is working.

The login on the right side of the page does not and the login that comes up after I click on todays work also does not work.

I thought I would make you aware of this. Today was the 1st day with this issue.

Joseph thank you very much for letting me know. I’ve emailed your comment to Cesar and he will find out what’s happening, and hopefully fix it!

Because that’s not good…

Anyone else having any problems logging in today?

Quite a few quants consider VIX 15 to be a critical level for the risk exposure tolerance of risk desks. A smash back below would probably signal a bit higher to go before the downside really gets going. A close above is going to produce a lot of red overnight as leverage trades scramble to either hedge or unwind.

Hi Verne

At this point are you longing the VIX?

or are you going to wait to see if this closes below or above 15?

Thank You

I sold my last batch of VXX 28 strike calls for 3.00 even this morning. I am looking for a re-entry opportunity in the event short sellers put in an appearance. I will be reloading long positions on any close above 15 for VIX, probably via more VXX 28 strike calls. 🙂

Thank You

Also any thoughts on the RUT index?

for anyone here

Back up to upper Darvas box (yellow line) at 1732? Probably. At the higher TF…I have no real clue for all the general market reasons we know.

Looking at the daily, RUT’s almost tagged the 38%, but given our (okay my) growing bearishness here, RUT down to the 62% at 1693 wouldn’t surprise me in the least.

Looks like RUT and DJI lagging Nasdaq but they will likely play catch-up.

I think Fred is correct about the 2800 pivot. If this is indeed P4 we are going to slice through like a hot knife…

I guess the market isn’t real fond of billions upon billions in US tariffs on Chinese goods, and the coming vice-versa. How to put a healthy airplane into a steep nose dive! If this tariff situation blows up big time over the next several days, then maybe just maybe that bearish alternative is indeed right where the market is at, and the plane is set for an exciting plunge where the passengers lose much of their cookies! Crazy times.

SPX tagged and turned of the 38%. NDX tagged and turned of it’s lower channel line.

Maaaaaaybe that’s it. Maybe.

The steep positive divergence on the recent lows of VXX suggests we could revisit the 40 price level. We should get there just about in time for the ProShares UVXY reverse split on the 18 and a great shorting opportunity as a result of that ludicrous scheme.

Too bad the volatility short sellers are starting to wise up. I was really enjoying those frequent manic spikes beliw 12 but they are becoming both less frequent and manic. I guess they are getting tired of having their booties scalped to the tune of a few hundred contracts every time they pull that stunt!

Come on guys….just one more..! 😉

Don’t forget Proshares impending rip-off of people’s money with yet another ridiculous reverse split of SVXY and UVXY. Two words. CREDIT SPREADS!!! 😀

Split occurs after close September 17.

Does anyone know why OpEx liquidation procedures for VIX changed? It used to take place at the open on the day of expiration but did so after the close for September 5 contracts. The spread on deep in the money calls on Tuesday was absolutely atrocious (0.95!!!) with bids far below even intrinsic value of in the money calls so while I almost never hold VIX contracts through expiration (out of the money spreads excepted) I decided to hold onto them. I never got the usual Wednesday a.m. notice of liquidation but didn’t tbink too much about it as it was only 50 contrcts.

The liquidation notice came at 2.00 a.m., and since VIX moved higher Wednesday the fill at 1.31 for the 12.50 strike calls was much better tban the 0.60 bid at the closeTuesday.

What is really strange is the VIX contracts don’t usually trade on the day of expiration, a lesson I once learned the hard way. Has that changed?! Very strange!

A move up through the TL then the upper Darvas box and I’m triggered on the long side.

Note the continuing hourly squeeze (red dots top indicator). MACD is in position for a strong bullish turn if price breaks upward tomorrow.

Obviously we’ve got major invalidation points very close underneath. Tomorrow is a cusp day. A break down could cascade into an avalanche…but I agree with Lara, at a higher level, there just hasn’t been sufficient indications of that brewing here.

We’ll see!!! Trade safe and always manage risk first and foremost.

SPX scribbling on the trend line….but a perfect hit and bounce off of that Darvas box! It should go soon though…NDX looks like it’s finished it’s big iv wave, and RUT is bullish. NFLX’s sell off is amusing; yesterday the perfect hit and bounce on a big 62% fibo (335.8), and today…off to the races back to the upside. I was late out of bed and by the time I get every running, it was already up over 2%.

Well this day changed it tone quickly. Was just starting to look like a range expansion day….and boom, everything sells off back into the gunk in all markets. Oops!

NDX has come down to right on top of it’s major 62% retrace. A very likely turn price. SPX ain’t going far until NDX turns too.

NDX shoving down towards that 78% derived retracement fibo now.

Tariffs haven’t even been formally announced yet; later today, or tomorrow? Is the market praying for some sudden deescalation? Sure feels to me like a one-two punch of US then retaliatory Chinese tariffs at the multi-hundred-billion $ level is going to take the market into a serious tail spin. But then…I’m often wrong about these things.