A little more downwards movement to begin the new trading week remains above identified support. The Elliott wave count remains the same.

Summary: The trend is up. Assume the trend remains the same until proven otherwise.

The last gap may be a breakaway gap, which may offer support at 2,876.16. Gaps can be useful in trading as a place to set stops.

Stops for long positions may be pulled up to just below 2,876.16.

Primary wave 3 may now be over; but, although there is a little support for this possibility from VIX, there is no reasonable bearish signal from the AD line nor On Balance Volume. Expect that price most likely may continue higher with brief shallow corrections along the way up.

The mid to longer term target is now either 2,950 (Elliott wave) or 3,045 (classic analysis). Another multi week to multi month correction is expected at one of these targets.

The final target for this bull market to end remains at 3,616.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62. However, the lower edge of the black Elliott channel drawn across the ends of intermediate degree waves should provide very strong support for any deeper pullbacks, holding price well above the invalidation point while intermediate wave (5) unfolds.

At this stage, the expectation is for the final target to me met in October 2019. If price gets up to this target and either the structure is incomplete or price keeps rising through it, then a new higher target would be calculated.

A multi week to multi month consolidation for primary wave 4 is expected on the way up to the final target. This large correction may now be fairly close by in terms of time; classic analysis will be watched carefully to identify early warning signs of its approach.

The last bullish fifth wave of minor wave 5 to end intermediate wave (3) exhibited commodity like behaviour. It was strong and sustained. It is possible that minor wave 5 to end intermediate wave (5) to end primary wave 3 may exhibit similar behaviour, so we should be on the lookout for this possibility. This may be beginning to happen now.

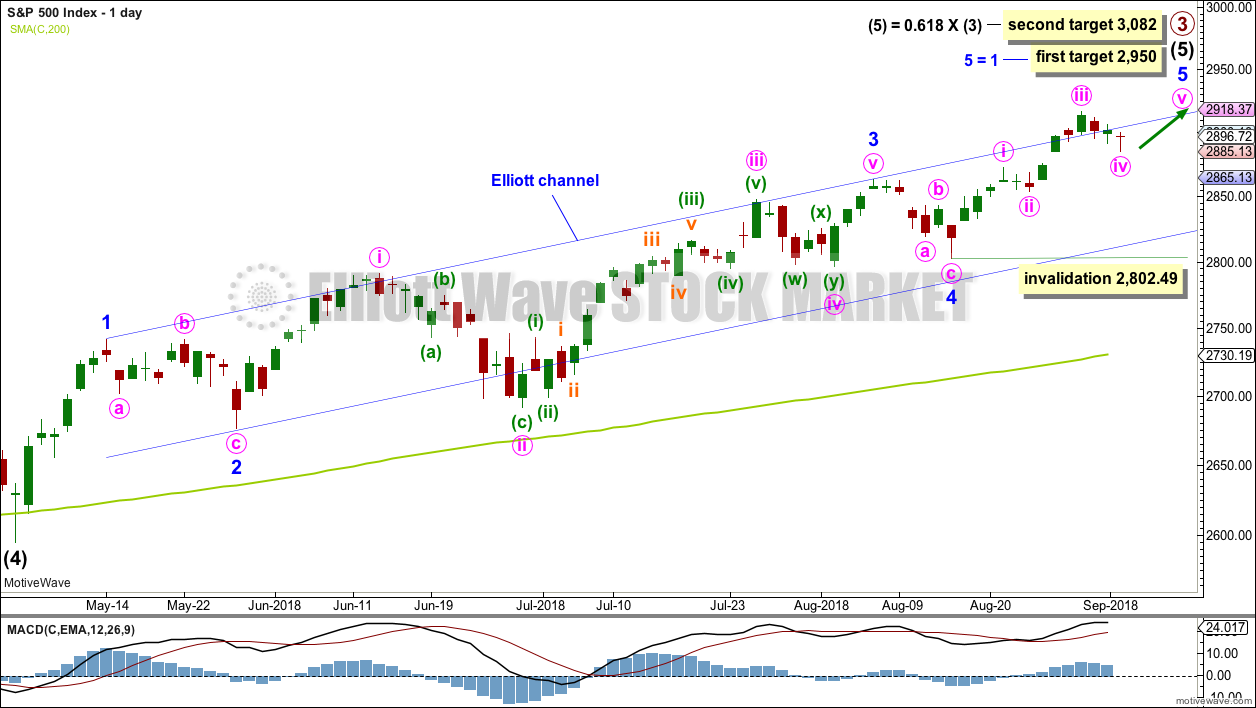

DAILY CHART

Intermediate wave (5) avoided a truncation now that it has a slight new high above the end of intermediate wave (3) at 2,872.87.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). Intermediate wave (5) has passed equality in length with intermediate wave (1). The next target was at 2,922, 1.618 the length of intermediate wave (1), which may have been almost met.

If price continues rising through the target at 2,950, then the next target for intermediate wave (5) may be 0.618 the length of intermediate wave (3) at 3,082.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 through to 4 may now all be complete.

The channel is drawn about intermediate wave (5) using Elliott’s first technique. Price has closed above the upper edge but now has returned to within the channel.

Assume the upwards trend remains intact while price remains above 2,802.49. The trend remains the same until proven otherwise.

It is possible that primary wave 3 was over at this week’s high and primary wave 4 has just begun. However, a new low below 2,802.49 is required for any confidence whatsoever in this view.

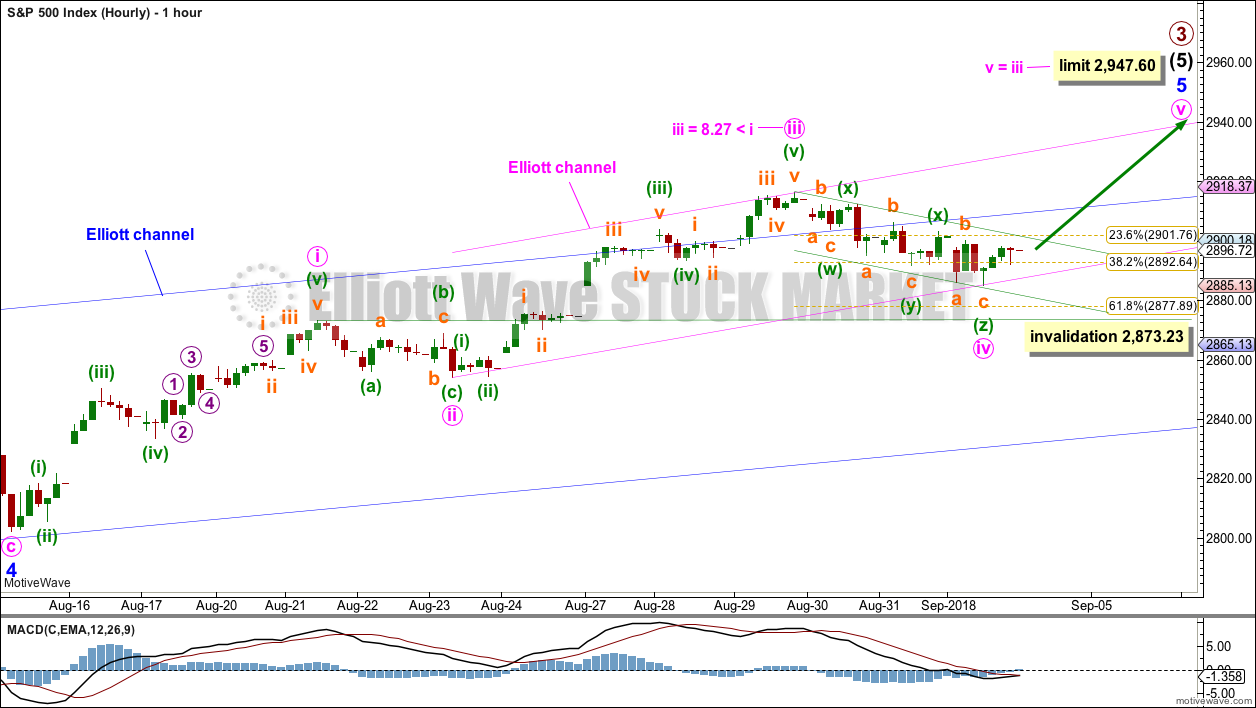

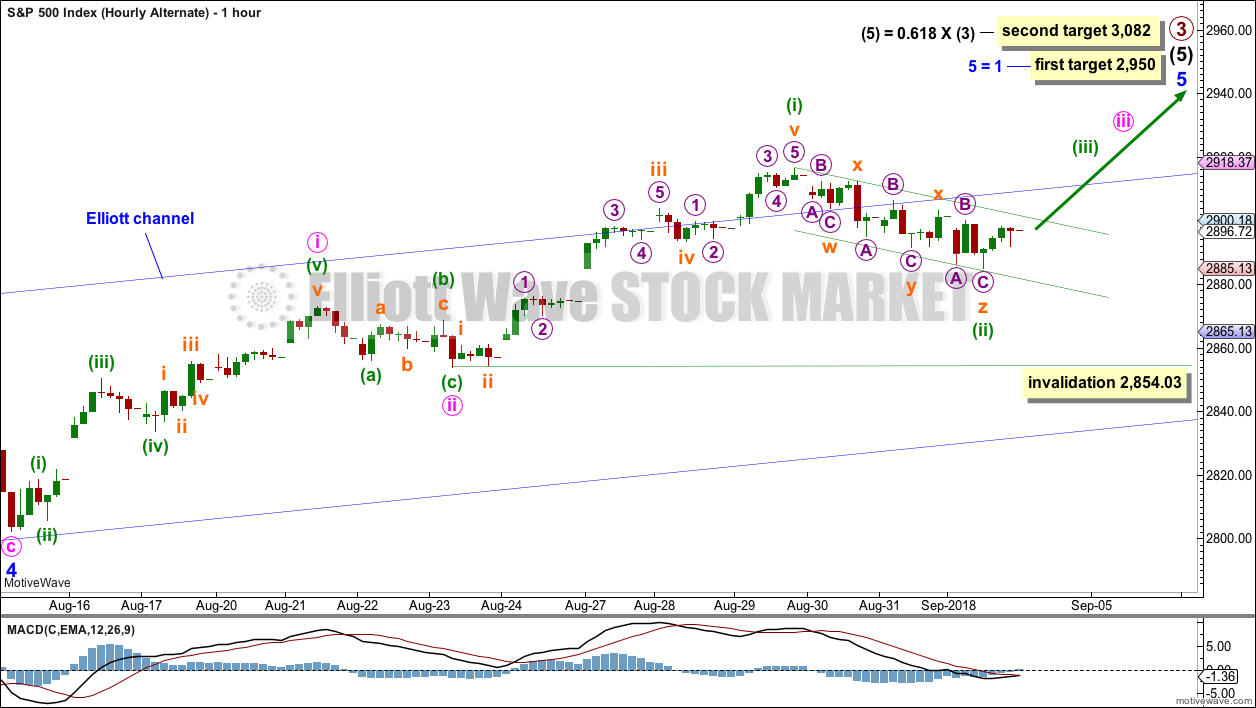

HOURLY CHART

Minor wave 5 may unfold as either an impulse or an ending diagonal. An impulse is more likely.

Minute waves i through to iv may be complete.

Minute wave ii was a 0.27 shallow single zigzag. Minute wave iv may have completed as a fairly rare triple zigzag; its subdivisions fit very well, and it looks like a triple zigzag should, in that it has a clear slope against the prior trend. Support at the last gap on the daily chart remains.

Minute wave iv may not move into minute wave i price territory below 2,873.23.

For this main wave count, minute wave iii is shorter than minute wave i. A core Elliott wave rule is a third wave may never be the shortest actionary wave within an impulse. For that rule to be met here, minute wave v is limited to no longer than equality in length with minute wave iii. This would see minor wave 5 be reasonably close to the target at 2,950.

ALTERNATE HOURLY CHART

A more bullish wave count can be seen by simply moving the degree of labelling within the last wave up all down one degree. It is possible that minute wave iii is not over, and that only minuette waves (i) and (ii) within it are complete.

Apart from the degree of labelling, this wave count sees all subdivisions in exactly the same way as the main hourly wave count.

This wave count would expect to see some increase in upwards momentum as a third wave at two degrees moves higher this week. The first target at 2,950 may be inadequate. A higher target is calculated at intermediate degree.

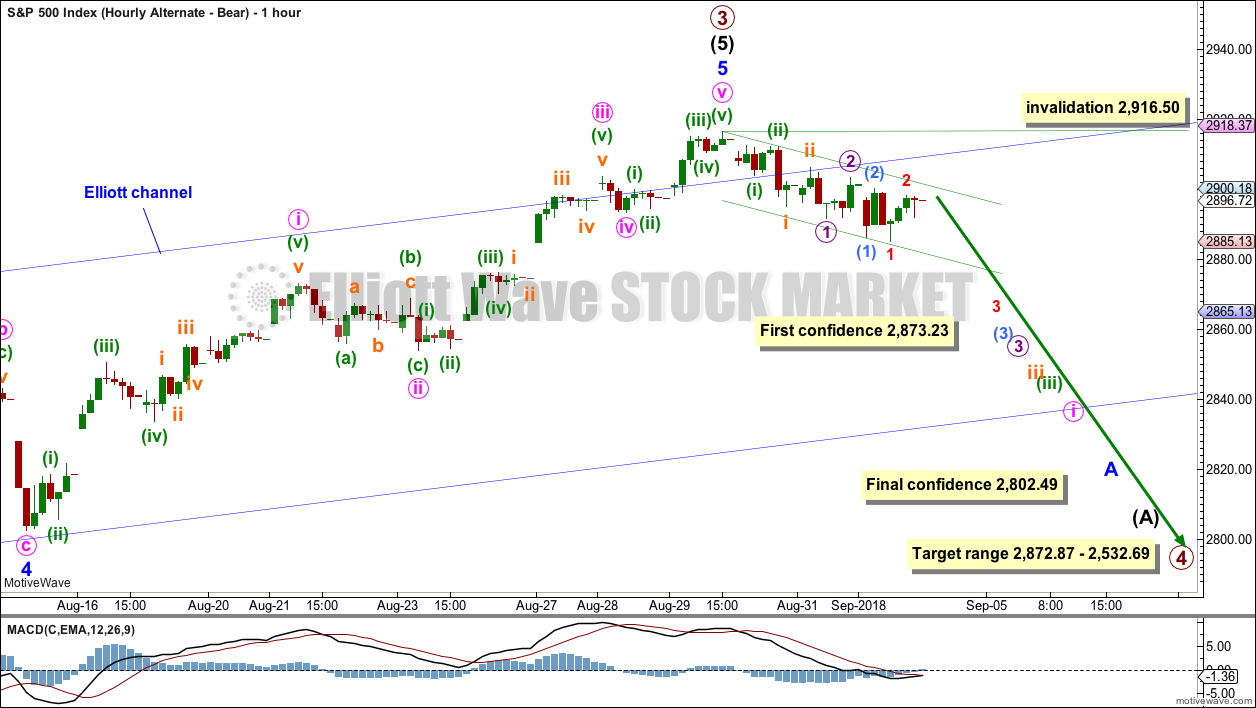

ALTERNATE HOURLY CHART – BEAR

It is possible that primary wave 3 could be over. There is a little support at the end of last week from classic analysis for this wave count but not yet enough for any confidence.

This wave count is published for members as only an outside possibility to consider, and to provide a road map if this low probability outcome does occur.

If primary wave 3 is over, then within it intermediate wave (5) would be just 5.16 points short of 1.618 the length of intermediate wave (1).

If price makes a new low by any amount at any time frame below the first confidence point, then this wave count would slightly increase in probability. A new low below the second confidence point would be required for any reasonable confidence in this wave count.

At that stage, a multi month consolidation for primary wave 4 would be expected. Primary wave 4 may end within the price territory of the fourth wave of one lesser degree: intermediate wave (4) has its range from 2,872.87 to 2,532.69. Within this range sit the 0.236 and 0.382 Fibonacci ratios of primary wave 3: at 2,698.24 and 2,563.22. These would both be reasonable targets for primary wave 4, with the 0.236 Fibonacci ratio slightly favoured as it would see primary wave 4 sit better within an Elliott channel.

Within primary wave 4, downwards waves may be swift and very strong.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

At this stage, there may now be a series of five first and second waves complete. This wave count would now expect to see an increase in downwards momentum this week.

TECHNICAL ANALYSIS

WEEKLY CHART

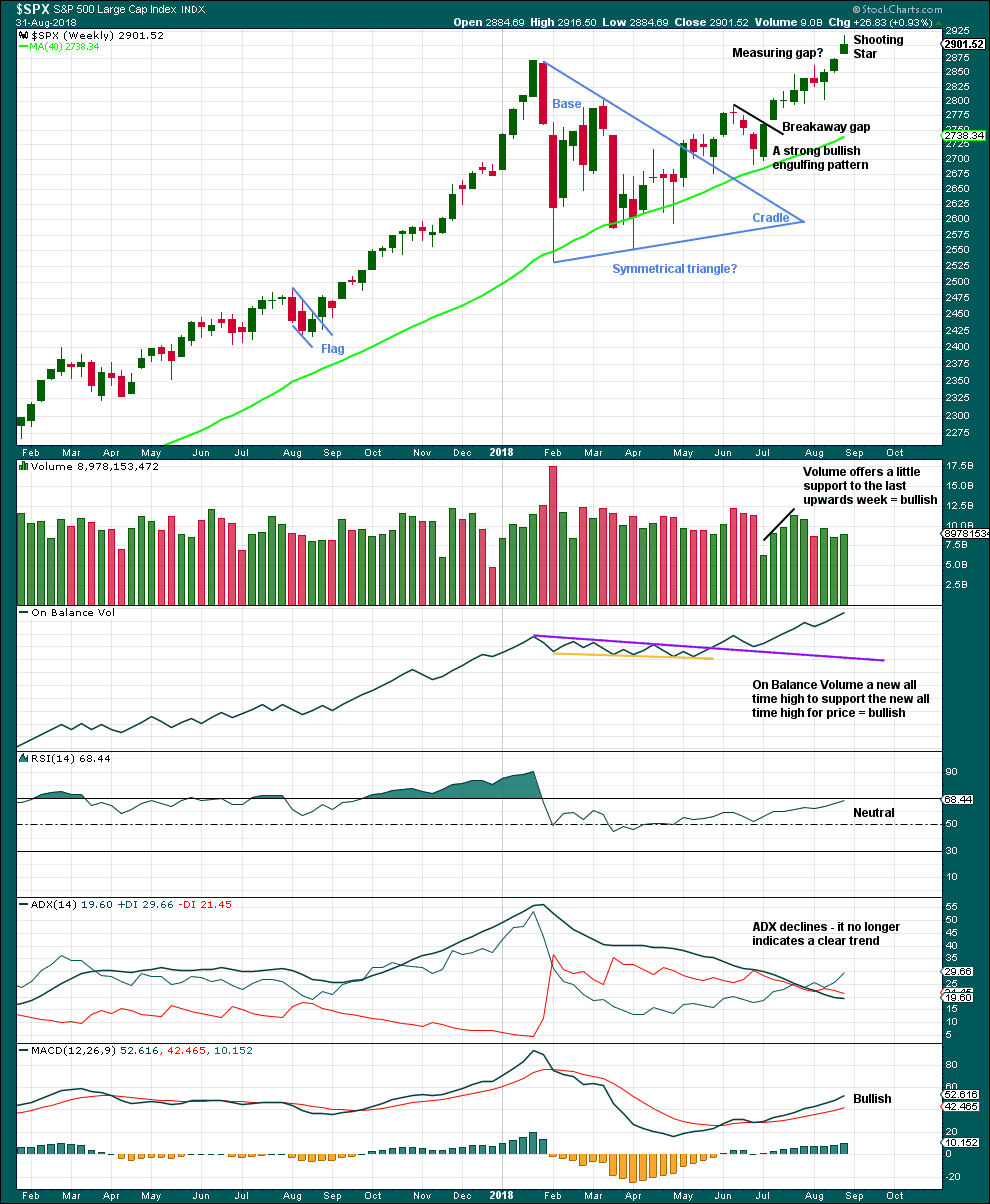

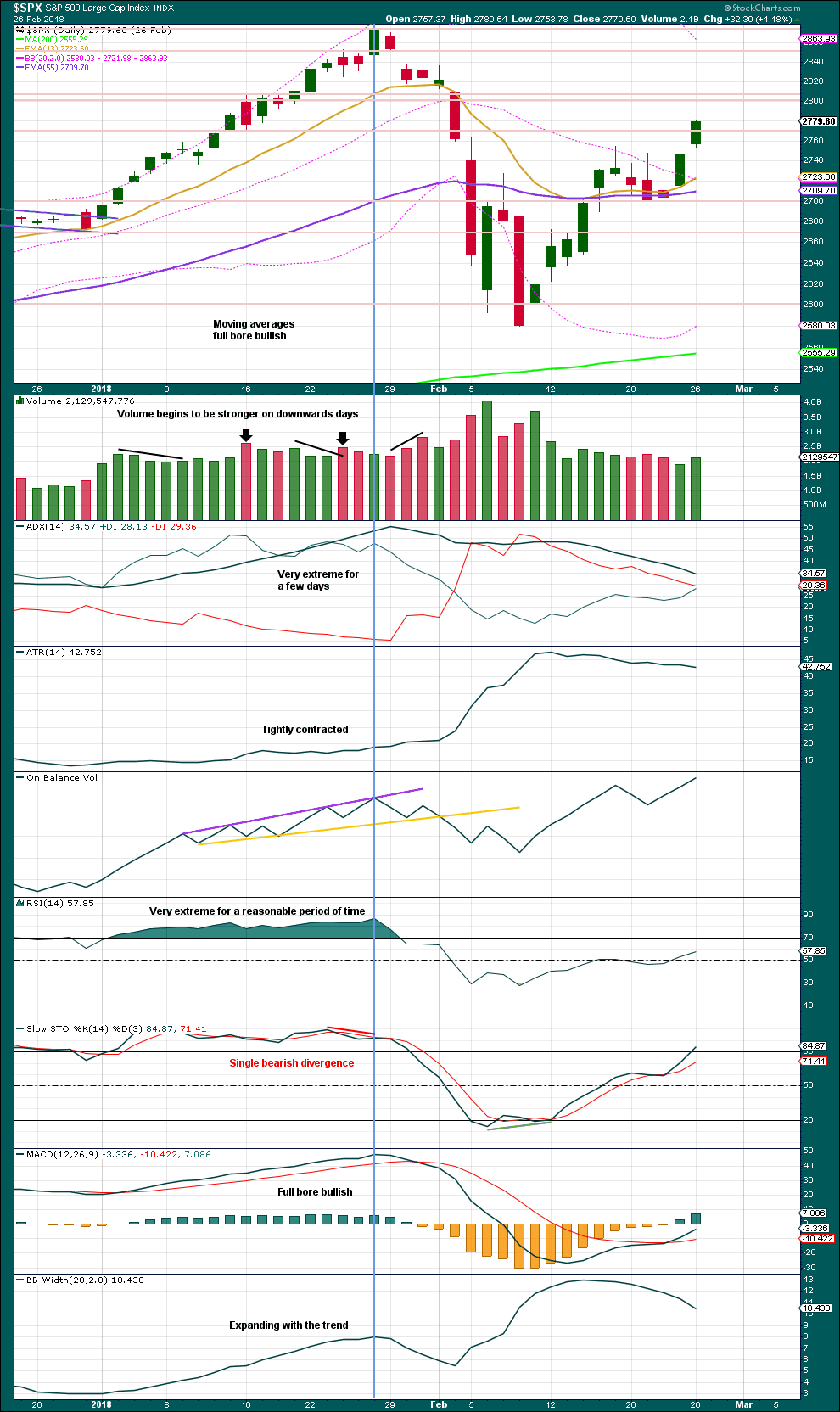

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete. The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,950, so the Elliott wave target may be inadequate. It is 37.28 points below the new higher Elliott wave target.

A new all time high for price has support from another new all time high from On Balance Volume at the weekly chart level. This is bullish.

Price can rise in current market conditions on light and declining volume for a reasonable period of time, so lighter volume last week does not mean that the rise in price is unsustainable for the short or mid term.

Another upwards gap may be a measuring gap; it should be assumed to be so until proven otherwise. While this gap remains open, it may be useful in calculating a new short term target at 2,992. If this gap is closed, it may then be considered an exhaustion gap, and that may be taken as a signal that primary wave 4 may have arrived.

This weekly candlestick closes as a Shooting Star. From Steve Nison CMT in “Japanese Candlestick Charting Techniques”, page 74:

“The Japanese aptly say that the shooting star shows trouble overhead. Since it is one session, it is usually not a major reversal signal as is the bearish engulfing pattern or evening star. Nor do I view the shooting star as pivotal resistance as I do with the two previously mentioned patterns.”

This weekly candlestick is a small warning; it may not be read as a reversal signal.

DAILY CHART

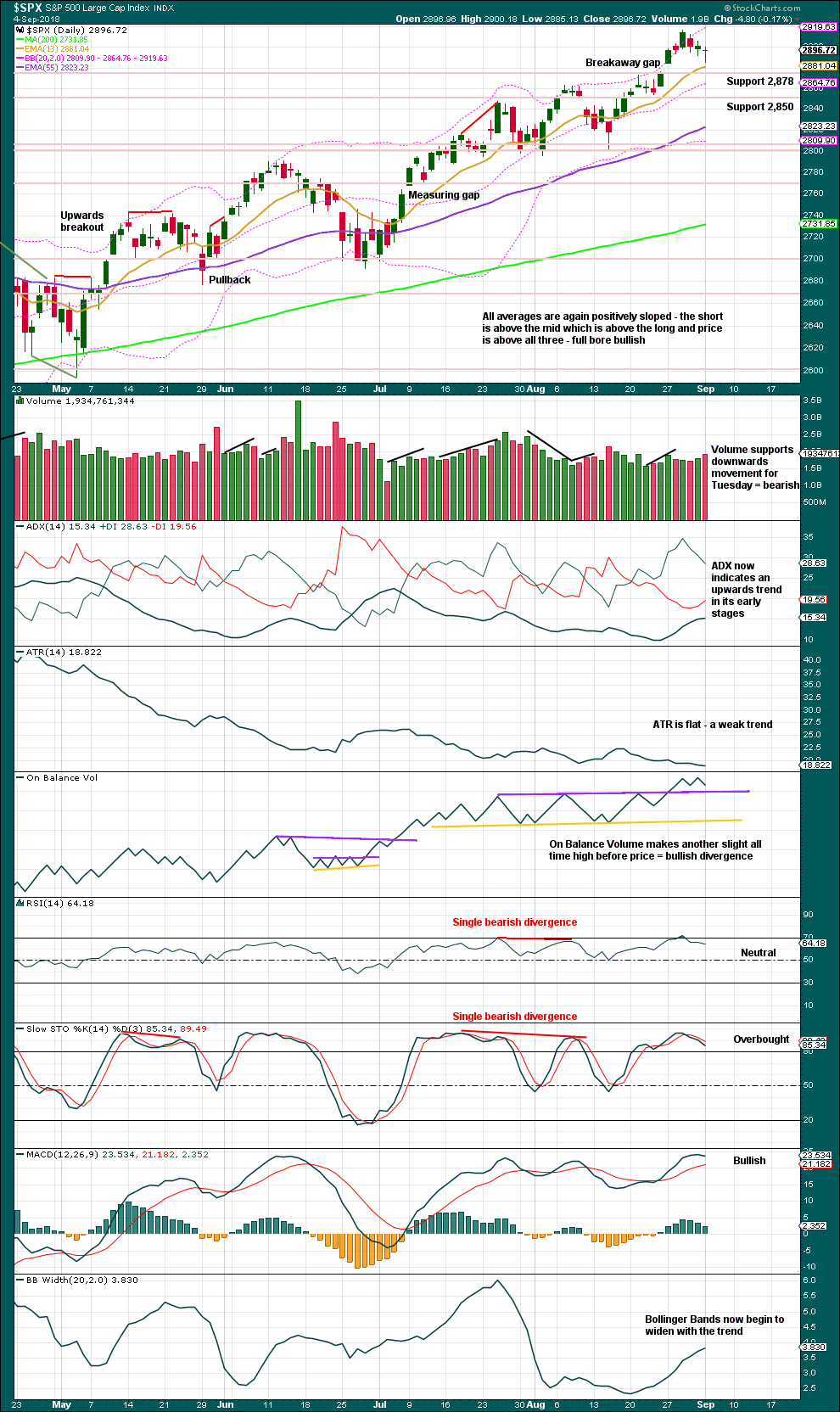

Click chart to enlarge. Chart courtesy of StockCharts.com.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. This is the definition of an upwards trend. But trends do not move in perfectly straight lines; there are pullbacks and bounces along the way.

Breakaway and measuring gaps can be useful in trading: stops may be adjusted using these gaps. If the last gap is closed, then it would not be a breakaway gap but would then correctly be an exhaustion gap, so a reasonable correction would be expected and long positions should then be closed. If the last gap is closed, that may be taken as a signal that primary wave 3 may be over and primary wave 4 may have arrived.

Current market conditions with price rising on declining volume and low ATR may be sustained even while upwards momentum increases. This has happened before; most recently up to the high of the 26th of January, so it may happen again.

The trend is up, and it looks like it is strengthening. ADX has now indicated an upwards trend; when rising from low levels and coming up from both directional lines, this is the strongest signal ADX can give.

At this stage, there is no candlestick reversal pattern to support the idea of primary wave 4 arriving, but it must be noted that on the daily chart intermediate wave (4) was not heralded by a candlestick reversal pattern.

A doji candlestick indicates a balance of bulls and bears for Tuesday, with the bears slightly winning and supported by volume. There are three instances on this chart of downwards days with support from volume that were followed by more upwards movement, so this support today from volume is bearish but not very much so.

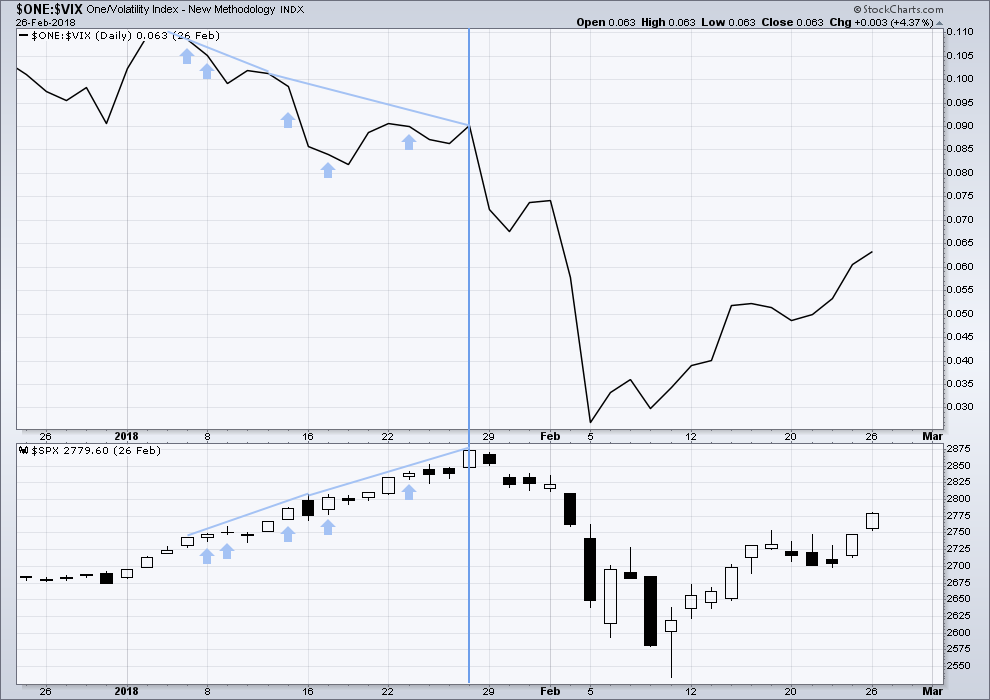

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

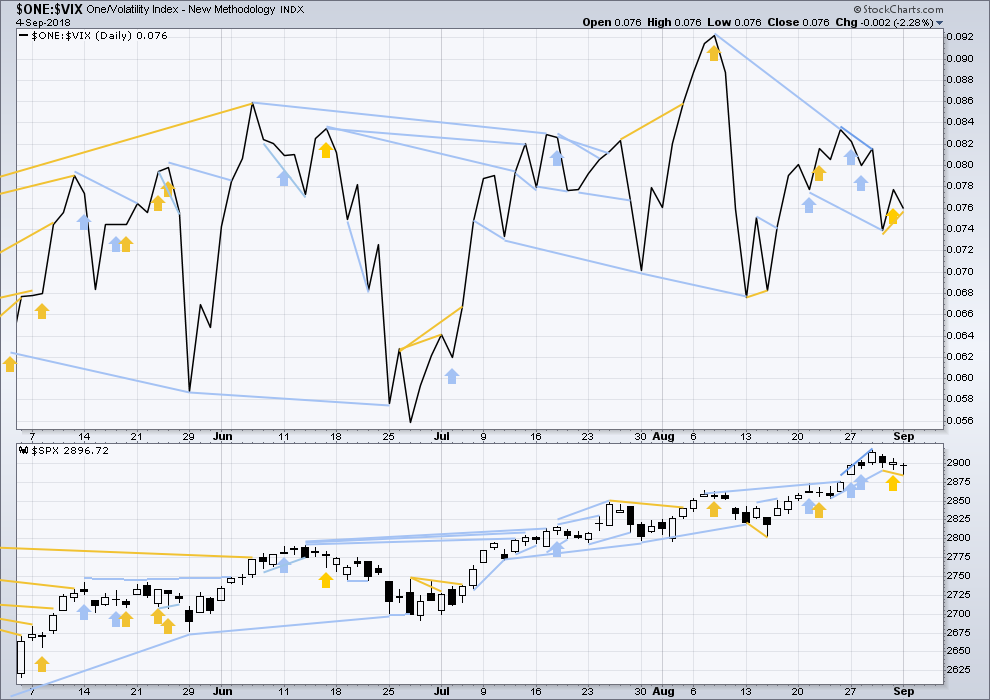

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

At this time, there is mid term bearish divergence between price and inverted VIX: price has made a new all time high, but inverted VIX has not. This divergence may persist for some time and may remain at the end of primary wave 3.

There is single and weak short term bearish divergence between price and inverted VIX: last week price moved higher, but inverted VIX moved lower. Price has not come with a normal corresponding decline in market volatility although it has made new all time highs; volatility has increased. This may be an early warning that primary wave 4 could begin here or fairly soon. It is possible that more instances of weekly divergence may yet develop before primary wave 4 begins.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is mid term divergence with a new all time high from price not supported by a corresponding new all time high from inverted VIX. This divergence is bearish.

Inverted VIX has made a new low below the low six sessions prior, but price has not. This divergence is bearish and strong. However, it is also possible that this is only an early warning and that further bearish divergence may develop before primary wave 4 begins; inverted VIX may not be very useful as a timing tool, only a warning.

There is now a small cluster of bearish signals from inverted VIX, which offer a very small support to the idea that primary wave 4 may begin here or very soon.

The small recent cluster of bearish signals from inverted VIX is now countered by two more recent bullish signals. Price today made a new low below the low of two sessions prior, but inverted VIX has not made a new low. This downwards movement from price does not have a normal corresponding increase in market volatility; for the short term, this is bullish.

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

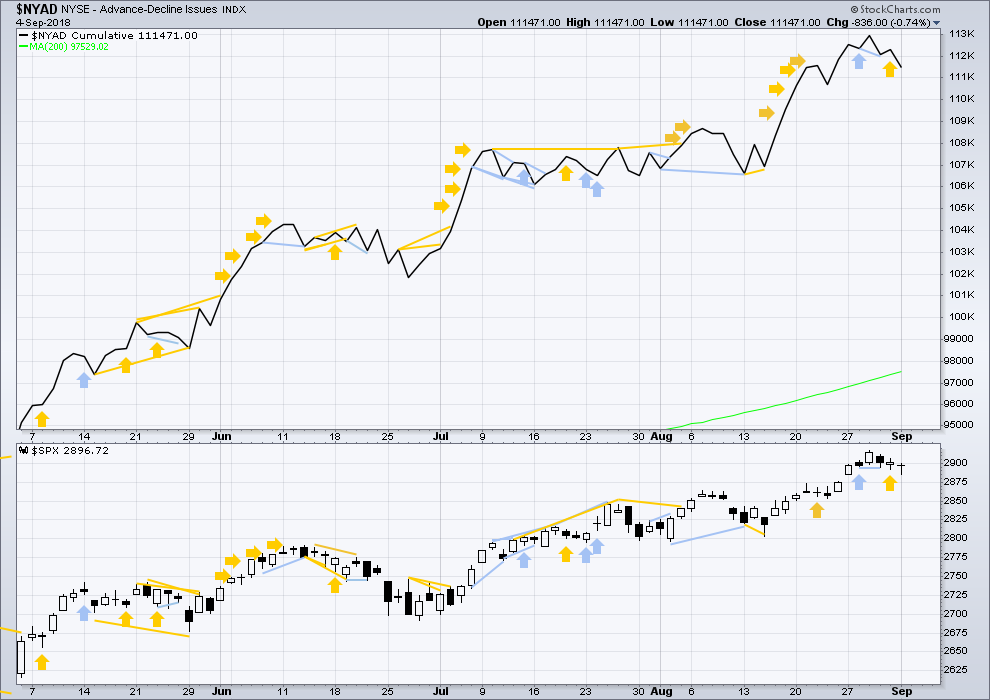

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

The AD line and price both moved higher to new all time highs last week; there is no divergence. The rise in price has support from rising market breadth. This is bullish.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

Very weak bearish divergence noted two sessions ago has now been followed by two days of downwards movement. It may now be resolved.

Bullish divergence noted on Friday has not yet been followed by upwards movement. It may have failed, or it may yet be indicating upwards movement ahead for the short term. There is no new divergence today.

All of small, mid and large caps made new all time highs on the 27th of August. There is a little divergence here in breadth with large caps continuing to make new all time highs on the 29th of August and small and mid caps lagging.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Nasdaq and DJT and now the S&P500 have all made recent new all time highs. For Dow Theory confirmation of the ongoing bull market, DJIA needs to make a new all time high.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

ANALYSIS OF THE END OF INTERMEDIATE WAVE (3)

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart looked overly bullish at the end of intermediate wave (3). The only warning in hindsight may have been from volume spiking slightly on downwards days. There was no bearish divergence between price and either of RSI or On Balance Volume.

Single bearish divergence between price and Stochastics was weak, which is often an unreliable signal.

VIX

Click chart to enlarge. Chart courtesy of StockCharts.com.

The strongest warning of an approaching intermediate degree correction at the daily chart level came from inverted VIX.

There was strong double bearish divergence at the high of intermediate wave (3), which is noted by the vertical line. There was also a sequence of five days of bearish divergence, days in which price moved higher but inverted VIX moved lower.

AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There was only single bearish divergence between price and the AD line at the end of intermediate wave (3). Approaching the high, there were no instances of price moving higher and the AD line moving lower.

Conclusion: When studying the behaviour of price and these indicators just before the start of intermediate wave (4), we may see some clues for warning us of primary wave 4. A cluster of bearish signals from VIX along with a bearish divergence from price and the AD line or On Balance Volume may warn of primary wave 4. The next instance will probably not behave the same as the last, but there may be similarities.

At this time, it does not look like primary wave 4 may begin right now, but we need to be aware of its approach.

Published @ 07:17 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Hourly chart updated:

Minute iv will now fit as a much more common single zigzag, with an ending expanding diagonal for subminuette wave c.

The gap is not yet properly closed, and so while it remains open the view should remain bullish.

If that gap is closed then the view will switch to bearish. But it will be bullish, until proven otherwise.

Minute wave iv is now looking a bit too large in comparison to minute wave ii…. but then, this market just does not always have neat proportions.

Price action in VIX had been totally hilarious today.

Like an inflated ball, the banksters kept trying to push it under water and it kept popping right back to the surface. Funny. Very!

I am amazed at how little open interest there is on vol instruments. I think the posse is sitting on most of ’em. lol!

Have a great evening all.

Tech today hasn’t just taken it on the chin, it’s had its head pounded into the pavement! NFLX is off 5.5%, my integrated tech ticker of the FAANG stocks is down 2.5%. And yet NDX is only down 1.5%. Rising interest rates helping finance which is perhaps saving SPX, and of course the R2K is leading overall. Interesting and strange mixed up day. I still think there’s a push up to 2920-2960 to come before the P3 is complete. But I suppose anything is possible.

3rd approach …

We really should see a green print in ES ahead of completion of this possible small fourth wave. It is very peculiar how futures have remained red all session ahead of what should be a completing impulse up. Red flag?!

Holy Mashed Potatoes!

I completely missed Lara’s alternate count showing a completed primary three!

How in tarnation did I miss that? I really need to get some contacts! 🙂

I was wondering about those multiple breaks from bearish rising wedges!

She buried it for good reason. But dang… at this point, who knows?

……………the SHADOW knows!!!!!………..

If the shadow knows, I wish she’d tell me.

Traders aggressively selling futures in the middle of a cash session is a rare sight indeed! Looks like something big is headed our way….

SPX back into hourly squeeze as it hesitates at the top of the down channel.

Second attempt

Time to break IV channel

First rejection

So far 2873 SPX has held and the gap is still open but only by a hair’s breath. If it breaks then, as Kevin notes below, it requires a change in the wave count. If it then returns to the underside of the broken wedge as Verne points out, it will be “Run for the Exits” and accumulate short positions time, imho.

All that being said, the triple zig-zag main hourly count still is valid. This may be an opportunity for short term traders to pick up some long positions with a close stop at 2873 SPX. A possible 5 or 10 point loss with a possible 100 point move up.

Me, I have enough long positions right now.

I as well Rodney. Well, I have other issue short positions too, but in SPX, I’m long. In QQQ as well, as of a few minutes ago.

Right now everything is still reasonably nominal for this being a minute iv that is perhaps complete right here. Verne’s comment about rising VIX was at almost the exact high point; it’s down several % pts since then.

I’m not particularly enamored of “wedges” as predictive structures, myself. But I don’t want to start a technical analysis debate, because hey, it’s all just probabilistic mumbo jumbo!! Lol!!! “There are many paths” and all that, and I do believe that’s absolutely true re: trading (and spirituality).

I as well Rodney. Well, I have other issue short positions too, but in SPX, I’m long. In QQQ as well, as of a few minutes ago.

Right now everything is still reasonably nominal for this being a minute iv that is perhaps complete right here. Price has turned up above the 38% fibo and the vix has backed down several % pts.

What I’m watching for carefully is a break of that down trend line; that will be my trigger to ADD to my longs, because it signals to me that indeed the minute iv is likely complete.

We have a breakdown out of bearish rising wedges in several indices.

It is possible that we could get a fifth wave truncation as price moves back up tag underside of broken wedge. VIX futures in a steady climb as strong hands accumulate. The bankster smack-down attempts are getting stuffed.

But it does not need to be a truncation as the tagging of the underside of the broken wedge can still make a new high since it is sloping upwards.

Quite correct. I overlooked that!

That single red hourly bar from Friday has evolved into this (lots of hourly red bars!), but so far, the 23% retrace is holding. Cusp is just ahead: break down to lower retrace levels, or up and through the down trend line? More news at 11….

Flash update: SPX now in hour #2 of a volatility squeeze. It’s a gonna blow soon!

Sorry I do not know how to read your charts. Do they give indication of which way it will ‘blow’?

Only if you can find it Rodney! A squeeze is merely a contraction in volatility, ultimately resolved through an expansion (up or down). Which way it’s going to go you’ve got to assess with other tools and reads.

Obviously this one resolved down. In fact, the 2nd hour of squeeze “turned off” when price zipped down.

If price goes below 2873.23, then we’ve got the minute iv impinging into the minute i price territory, and the minor 5 wave model that is our current main gets zapped I believe.

just to be perfectly clear: the upper of the two indicators across the bottom is a squeeze indicator: the little green dot in the middle of the histogram that turns into a red dot for the last 2 bars. It goes red when the 21 period Bollinger bands (top and bottom) move inside the 15 period Keltner channels. It indicates that price is in a small/tight range relative to nominal action, and often such an environment is followed by a rapid “unwind” with sharp price movement up or down. The higher the TF and the longer the squeeze holds, the more pent up energy that will eventually lead to price movement. Or so the theory goes. It’s a valuable tool.

Thanks.