Yesterday’s analysis expected that a new low below 2,819.88 would see a pullback to end below 2,796.13. The low for the day was 2,802.49, just above 2,796.13.

Summary: It still looks most likely that price may continue sideways for another two to few days to complete a small triangle. Thereafter, the upwards trend should resume.

If the triangle is invalidated, then a combination may be unfolding sideways. This would expect strong support to remain about 2,800.

The bigger picture remains extremely bullish.

The mid to longer term target is at 2,922 (Elliott wave) or 3,045 (classic analysis). Another multi week to multi month correction is expected at one of these targets.

The final target for this bull market to end remains at 3,616.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

ELLIOTT WAVE COUNT

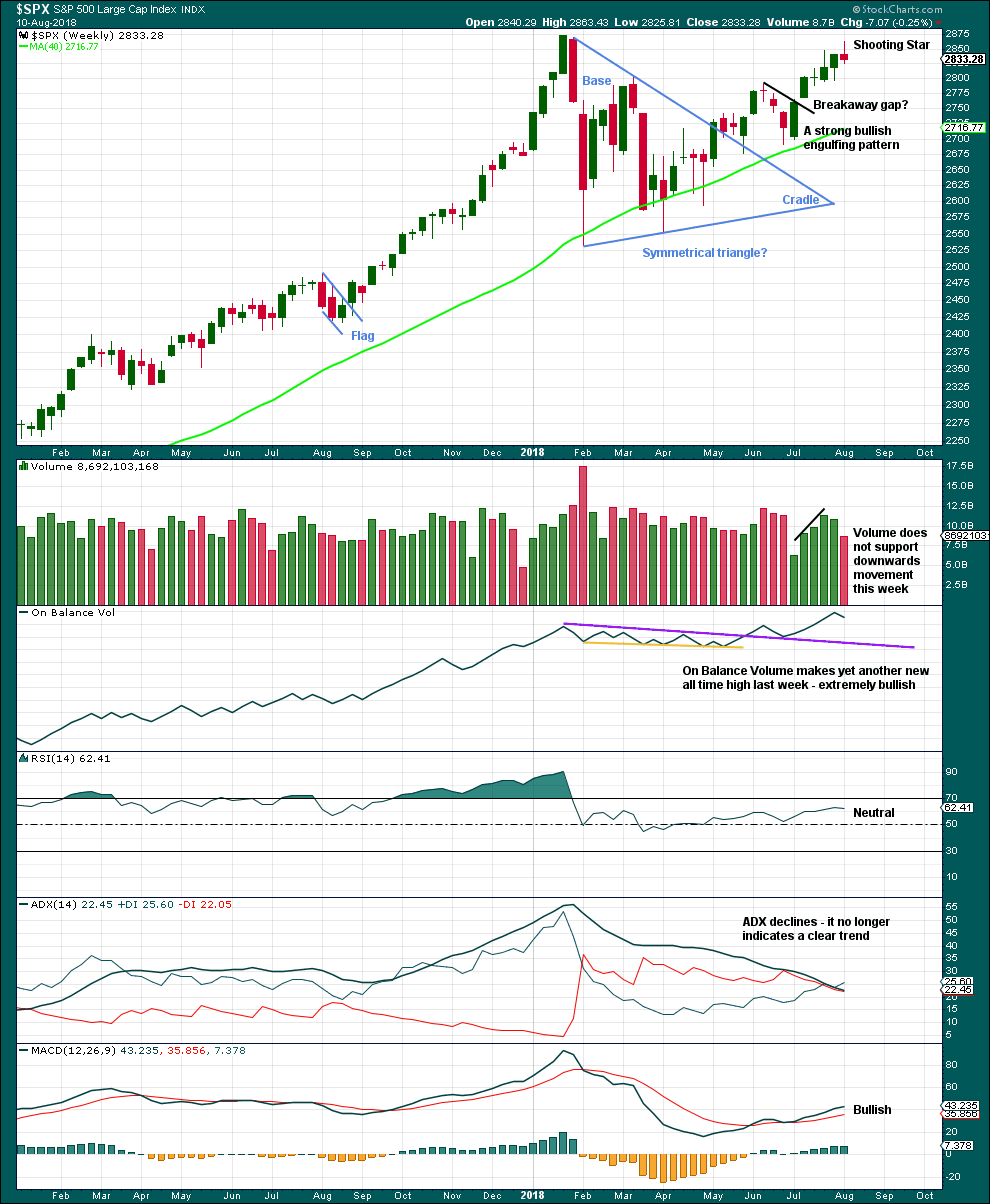

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62. However, the lower edge of the black Elliott channel drawn across the ends of intermediate degree waves should provide very strong support for any deeper pullbacks, holding price well above the invalidation point while intermediate wave (5) unfolds.

At this stage, the expectation is for the final target to me met in October 2019.

A multi week to multi month consolidation for primary wave 4 is expected on the way up to the final target.

The last bullish fifth wave of minor wave 5 to end intermediate wave (3) exhibited commodity like behaviour. It was strong and sustained. It is possible that the upcoming wave of minor wave 5 to end intermediate wave (5) to end primary wave 3 may exhibit similar behaviour, so we should be on the lookout for this possibility.

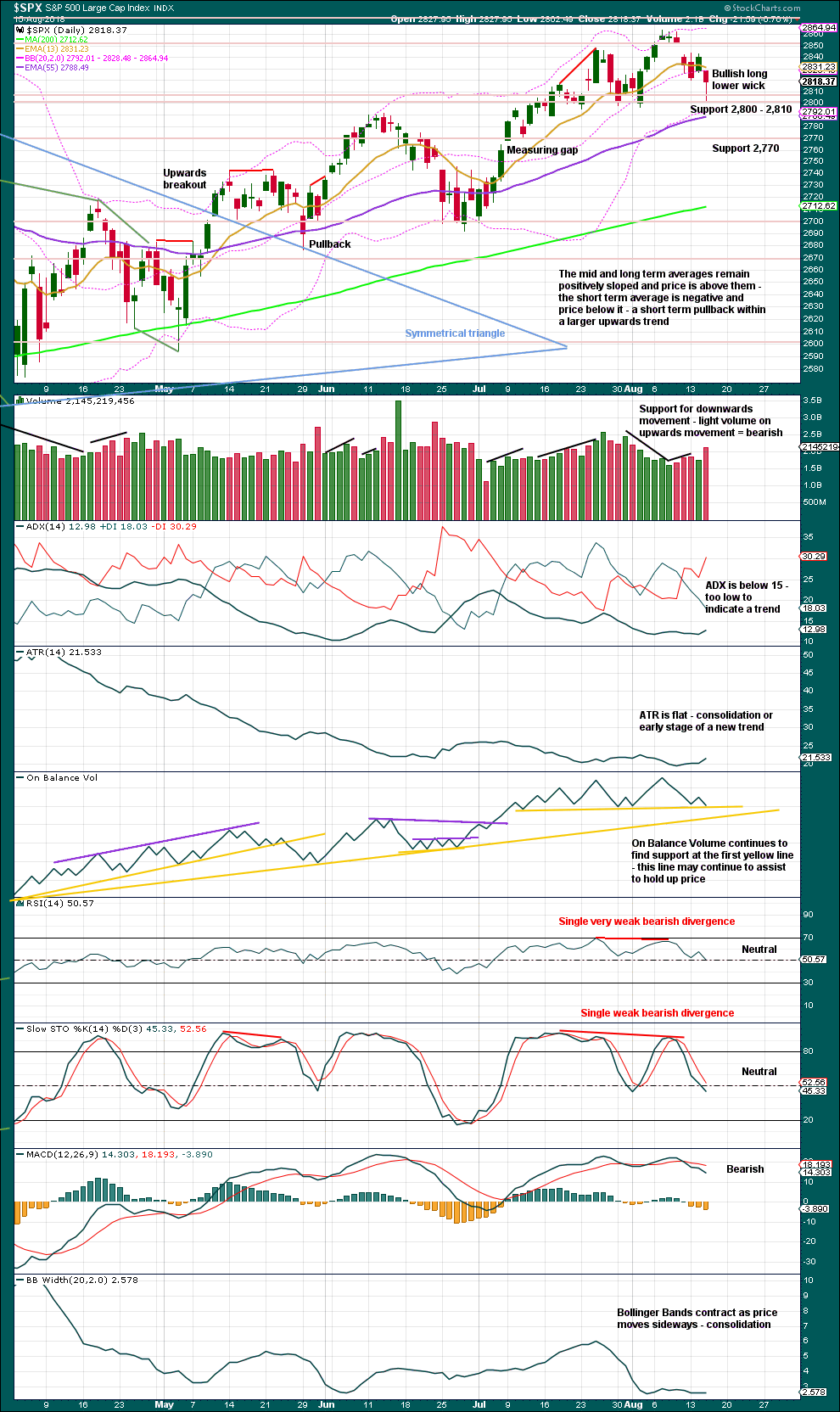

DAILY CHART

Intermediate wave (5) would be very likely to make at least a slight new high above the end of intermediate wave (3) at 2,872.87 to avoid a truncation.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 and 2 are complete.

Minor wave 3 may only subdivide as an impulse. A target is calculated for minor wave 3 to end, which expects to see the most common Fibonacci ratio to minor wave 1. Minor wave 3 may last several weeks in total and should look like an impulse at the daily chart level. When it is complete, then minor wave 4 may last about one to two weeks in order for it to exhibit reasonable proportion to minor wave 2. Minor wave 4 may not move into minor wave 1 price territory below 2,742.10.

Within minor wave 3, minute waves i, ii and iii all look complete and minute wave iv may still be incomplete. If minute wave iv were to continue further, then it would have better proportion to minute wave ii and would exhibit alternation in structure. This idea also has support from classic technical analysis.

It is also possible that minute wave iv was over at the last low and minor wave 3 was over at the last high. A new low below 2,791.47 could not be a continuation of minute wave iv, so the correction at that stage would be labelled minor wave 4.

The channel is drawn using Elliott’s first technique. The upper edge has provided resistance. This channel is copied over to hourly charts.

If the main hourly wave count below is invalidated with a new low below 2,791.47 and price keeps on falling, then look for strong support about the lower edge of the Elliott channel on this daily chart; the pullback may end there.

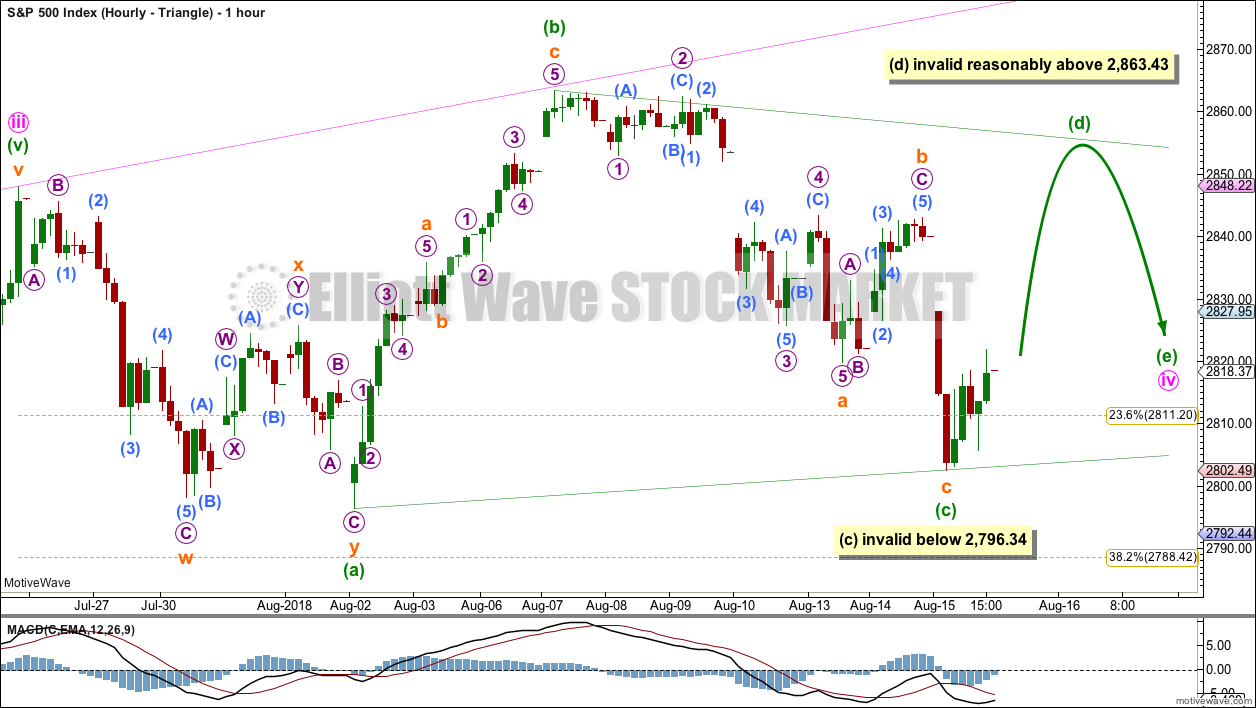

MAIN HOURLY CHART – TRIANGLE

The wave count for a possible triangle is slightly adjusted. Downwards movement today may have completed a zigzag for minuette wave (c) of a running contracting or barrier triangle.

Only one sub-wave within a triangle may subdivide as a multiple and all remaining triangle sub-waves must be single corrective structures. In this example, minuette wave (a) fits best as a double zigzag.

Within both a contracting and barrier triangle, any continuation of minuette wave (c) may not move below the end of minuette wave (a) below 2,796.34.

Within a contracting triangle, minuette wave (d) may not move beyond the end of minuette wave (b) above 2,863.43. Contracting triangles are the most common type.

Within a barrier triangle, minuette wave (d) may end about the same level as minuette wave (b) in order for the (b)-(d) trend line to remain essentially flat. Minuette wave (d) may end slightly above minuette wave (b) and the triangle would remain valid; the upper invalidation point is not black and white. Barrier triangles are not the most common type, but they are still reasonably common.

For both a barrier and contracting triangle, minuette wave (e) may not move beyond the end of minuette wave (c). It would most likely fall short of the (a)-(c) trend line.

When Elliott wave triangles complete, the resulting movement out of them usually begins with strength.

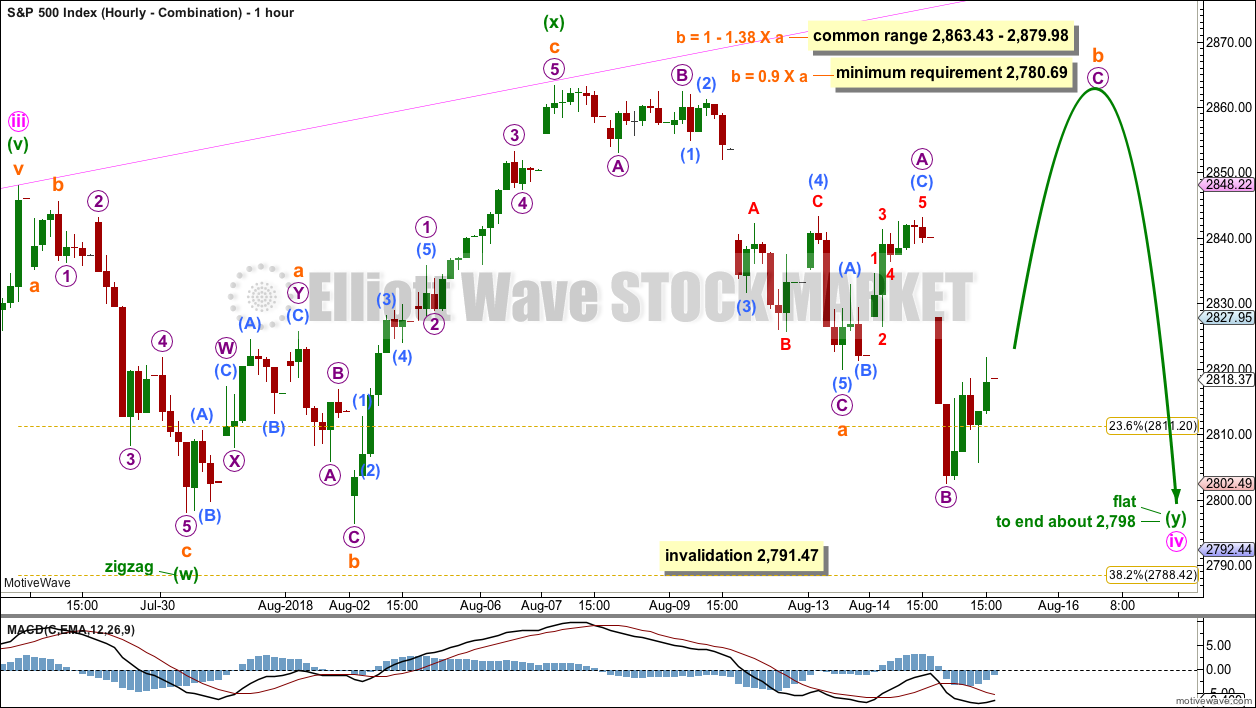

MAIN HOURLY CHART – COMBINATION

If the triangle is invalidated, then at this stage it looks most likely that minute wave iv may morph into a combination.

The first structure in a possible double combination may be a completed zigzag labelled minuette wave (w).

The double may be joined by a completed three in the opposite direction, an expanded flat labelled minuette wave (x).

The second structure in a possible double combination would be very likely to be a flat correction; the most common two structures to make up a double combination are one zigzag and by a very wide margin one flat.

If minuette wave (y) unfolds as a flat correction, then within it subminuette wave b must retrace a minimum 0.9 length of subminuette wave a. Subminuette wave b may make a new high above the start of subminuette wave a as in an expanded flat correction.

Minuette wave (y) would be most likely to end about the same level as minuette wave (w) at 2,798, so that the whole structure has a typical sideways look. The purpose of second structures in a combination is to take up time and move price sideways. Combinations are analogous to flag patterns in classic technical analysis.

This possible combination may take a few more days to complete. Support about 2,800 would be expected to hold.

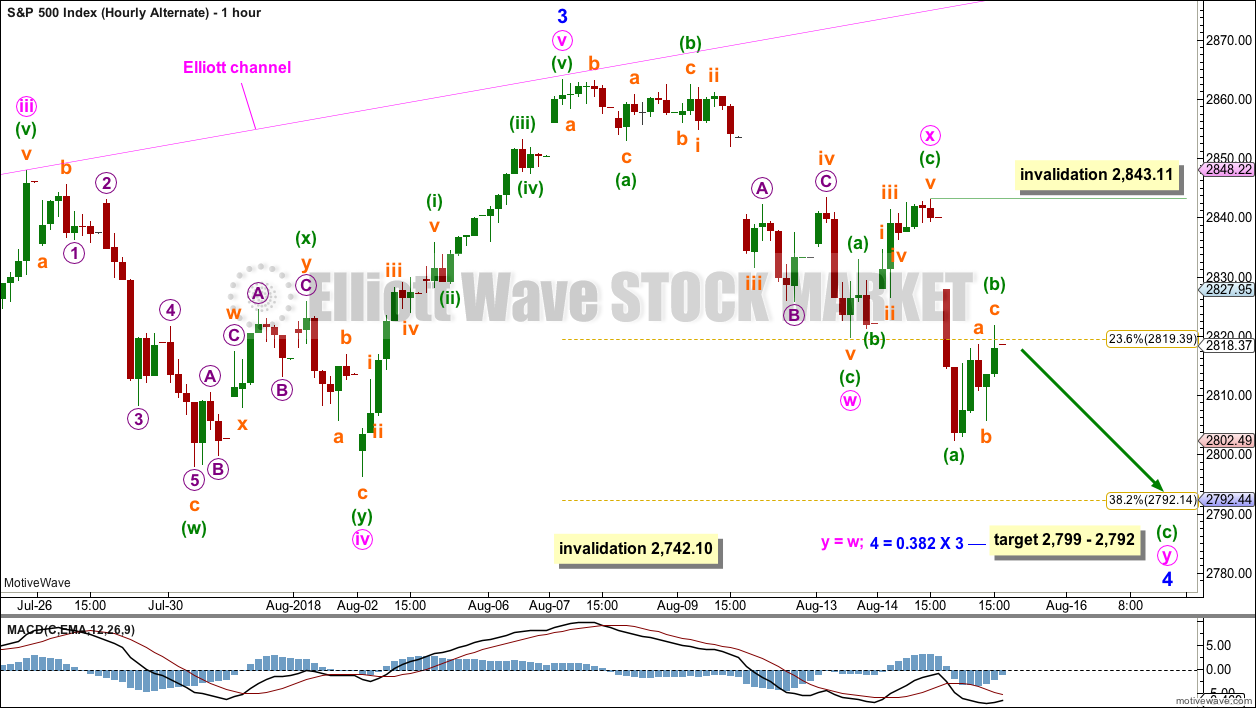

ALTERNATE HOURLY CHART

Here, the degree of labelling within minute wave iv is moved up one degree.

It is possible that minute wave iv could be over more quickly than was expected. If minute wave iv is over, then the possibility of an earlier than expected end to minute wave v must be considered.

Minor wave 3 may have been over at the last high. Minute wave v is seen as a five wave impulse in order for this wave count to work. This does not have as good a fit as the main wave count, which does see this wave as a zigzag.

The structure of minor wave 4 is changed today to consider a double zigzag. The first zigzag in the double may be complete, labelled minute wave w. The double may be joined by a complete three in the opposite direction, a brief shallow zigzag labelled minute wave x. X waves within double zigzags are usually brief and shallow. This one looks typical.

The second zigzag in a double may complete a double zigzag for minor wave 4. A target is calculated at two degrees.

When a double zigzag may be complete, then that may be minor wave 4 in its entirety, or the degree of labelling may be moved down one degree and only minute wave a of a flat or triangle may be complete. The degree of labelling would be decided at that point based upon the look on the daily chart in terms of proportion to minor wave 2.

Minor wave 4 may be reasonably expected to last at least about two weeks, and possibly up to about four weeks. It would most likely end somewhere within the fourth wave of one lesser degree; minute wave iv has its range from 2,843.03 to 2,796.34. If it does not end here, then it may end about the 0.382 Fibonacci ratio of minor wave 3 at 2,792.

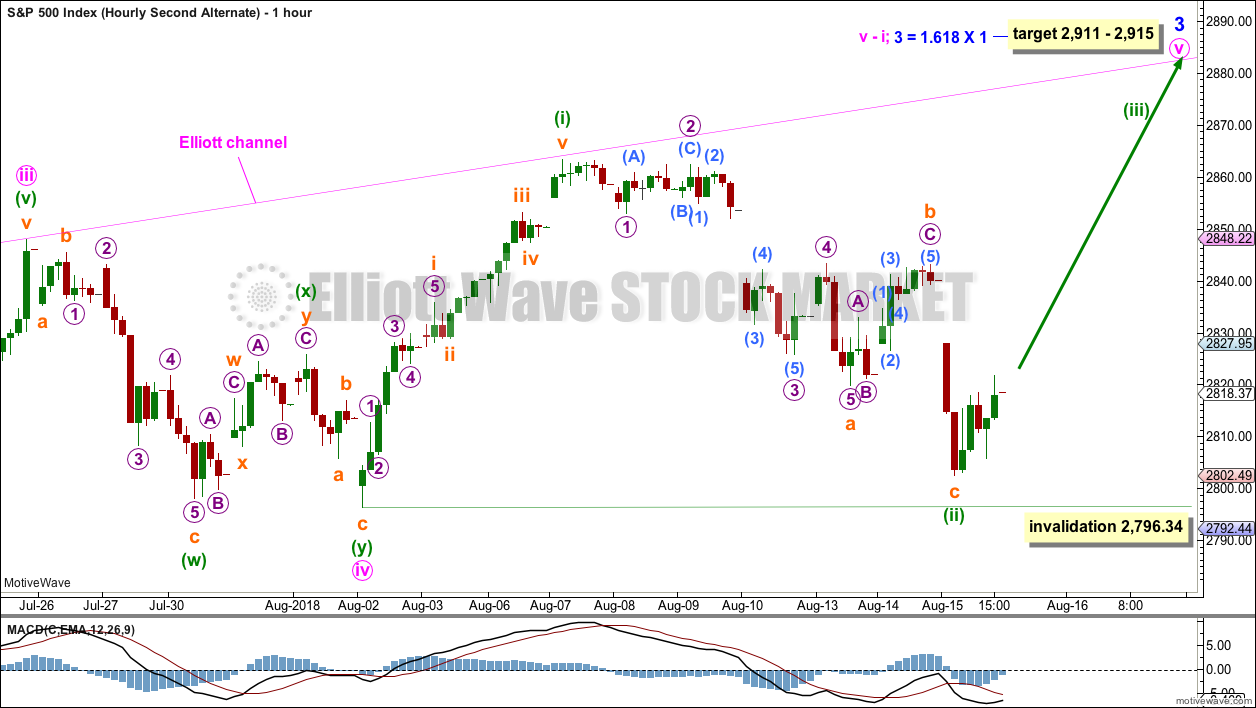

SECOND ALTERNATE HOURLY CHART

This second alternate wave count moves the degree of labelling within the last upwards wave down one degree. Minute wave v may be incomplete, and only minuette wave (i) within it may be complete.

Minuette wave (ii) is labelled as complete single zigzag.

This wave count expects an increase in upwards momentum as minuette wave (iii) moves higher.

If minuette wave (ii) continues any further, it may not move beyond the start of minuette wave (i) below 2,796.34.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Another new high for On Balance Volume last week remains very bullish indeed, but that does not preclude another small pullback within this developing upwards trend. It is still expected that price is very likely to make new all time highs, but it will not move in a straight line.

Last week’s candlestick is a Shooting Star pattern. This is a bearish reversal pattern when it comes after an upwards trend. Look for a downwards week this week.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete. The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. This is the definition of an upwards trend. But trends do not move in perfectly straight lines; there are pullbacks and bounces along the way.

Support about 2,800 remains very strong with three recent tests and no close below this point. Each test of this support area strengthens its technical significance.

Support at the first yellow line for On Balance Volume has now been tested four times. This line now has very reasonable technical significance. It looks like a small consolidation may complete. Expect support at 2,800 is very likely now to hold.

For the very short term, a long lower wick today looks like an upwards day may result tomorrow.

The bigger picture remains extremely bullish with another new all time high from On Balance Volume as recently as the 7th of August.

If On Balance Volume breaks below first support, there is a new support line which may allow for another one or two days of downwards movement. Both support lines have reasonable technical significance.

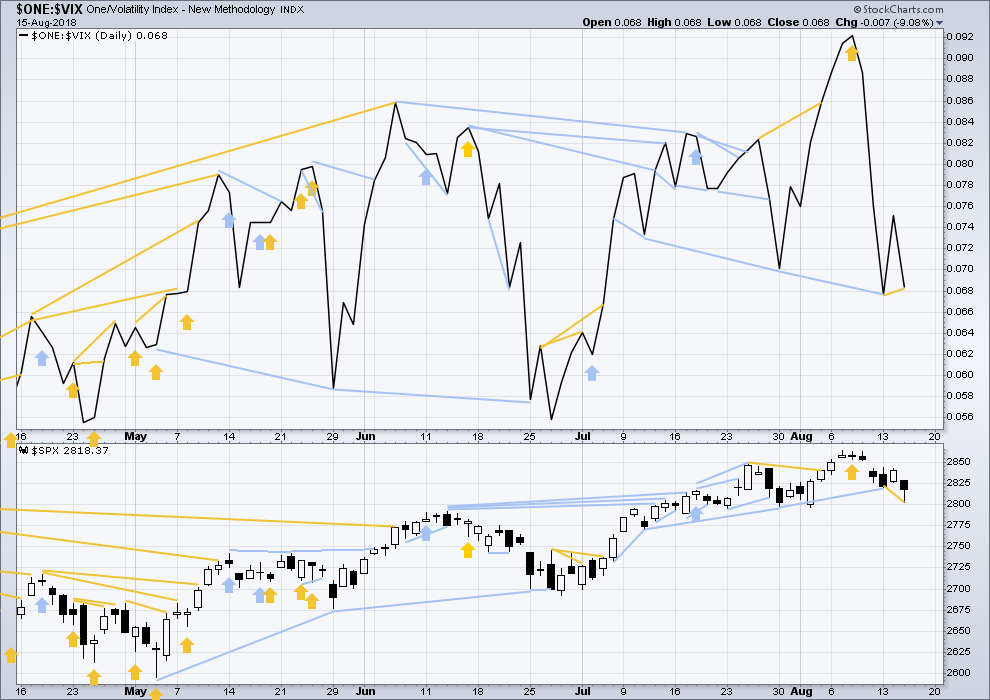

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

Last week completes an upwards week with a higher high and a higher low.

While price moved higher, inverted VIX moved lower. Downwards movement during last week does not have support from increasing market volatility. This divergence is bearish.

Inverted VIX is still some way off from making a new all time high.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Last noted mid term bearish divergence has not been followed yet by more downwards movement. It may still indicate downwards movement ahead as there is now a cluster of bearish signals from inverted VIX.

Short term bearish divergence has now been followed by a downwards day. It may now be resolved.

Price today has made a new low below the low two sessions prior, but inverted VIX has not. Downwards movement during today’s session does not have support from a corresponding increase in market volatility. This is short term bullish divergence.

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

At this stage, there is very strong bullish divergence between price and the AD line at the weekly time frame. With the AD line making new all time highs, expect price to follow through with new all time highs in coming weeks.

Price last week has moved higher, but the AD line has moved lower.

Upwards movement within this last week does not have support from rising market breadth. This divergence is bearish for the short term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

Short term bearish divergence noted in last analysis has now been followed by a downwards day, so it may now be resolved.

Price today has made a new low below the low two sessions prior, but the AD line has not. Downwards movement during today’s session does not have support from a corresponding decline in market breadth. This short term divergence is bullish.

Small caps made another new all time high yesterday. Mid caps have made new all time highs on the 7th of August. Only large caps have to follow through; they do usually lag in the latter stages of a bull market.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Only Nasdaq at this stage is making new all time highs, with another new all time high on the 25th of July. DJIA and DJT need to make new all time highs for the ongoing bull market to be confirmed.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 08:42 p.m. EST.

Hourly chart updated:

(d) would look best if it moves a bit higher, then the (b)-(d) trend line would sit along the upper edges of the candlesticks of the beginning of wave (c). Triangles normally adhere very well to their trend lines.

is there a most common ratio for (e)?

For gold (for which I’ve done some research) I found E waves range from 0.53 to 0.94 the length of wave D.

It does seem to have the most common length from about 0.75 to 0.85 of wave D.

Fractal structure presents itself with the overlapping fibos when the new up move retrace lines are put in. That’s only because the pivot was at a “fractal point” that creates such overlap.

Boy oh boy Elon Musk sure is behaving badly. It’s rather shocking to see from someone who was supposed to be a great business leader. Visionary? Yes. But capable steady hand at the top he is NOT! A CEO can’t tweet about possible buy outs…particularly when they are little more than vaporware!! Unbelievable immaturity.

To get a market collapse of the size of the end of the Grand Super Cycle (Lara’s current target: market top Oct 2019), a lot of things will have to start going seriously wrong in the world in the ffew months and years following that high. One possibility is severe economic problems for China, who have created half the increase in world debt in the last decade (according to this article). “Will China’s Economy Fall Next?”, worth a gander.

You have a link?

Search for it. Last time I referenced a newspaper here it created a firestorm.

Not quite. It only received a resulting claim of “fake news” which I would not allow as the claim was unsubstantiated. So I deleted both comments.

On the topic of the economy as relating to China, I think we’re safer.

Its just the topic of the current President of the USA that is so very divisive.

CAT has hit and bounced off a 38% fibo retrace of the 2016-2018 up move. That could be it for CAT’s big sell off. Maybe for a time, maybe for a long time. I’m selling puts below market myself…

Selling long calls for a monster trade.

Reloading maximum volatility and going on vacation.

See everyone in a week! 🙂

Have a great time Verne!

Enjoy your time off Verne!

I view squeezes (21 period bollinger bands inside 15 period keltner channel lines) as frequent indicators of impending large range expansion moves. RUT continues to go up and down in a wide range on the daily chart, and is now in day 9 of a squeeze at that tf. We know a big motive wave up is getting very close to due in SPX. I think RUT could (“should”) blast off with it big time.

Anyone have a target for the D wave of this triangle to end… if it’s a triangle, which seems probable. There should be some resistance close to 2855 I think

The upper down trend line of a triangle will (would) be defined by a pivot high here…so it could end up “anywhere”. So it’s not super predictable. Lots of resistance of various forms 2850-55 for sure, including a 78% (2850.5) derived fibo retrace and of course the high end of the gap. If it gets to 2850 watch very carefully for a turn; that is the most likely price IMO.

As for “what this is”, my view is that it doesn’t matter at the moment. It will only define itself via future action. The critical and only question of significance to me is whether it’s turning back down, or not (triangle/combo, vs. iv is over and a new motive wave has launched). I’m tired of 2800; let’s move on!!!

2850.49. Will it hold? The force is strong with this market…

Ah, the power of the 78.6% derived fibo!! Functionally, for me, the most critical fibonacci (derived) levels are the 61.8%, the 78.6% (sqrt(.618)), and the 1.272% (sqrt(1.618), used for price extensions above/below a previous swing in the same direction). These are the ones that most often operate as pivot levels. In my experience.

This move up to 78% was the 3rd wave of D wave maybe. Now a small 4th wave correction, with the 5th wave coming.

But if we’re in the second alternate count, this is just getting started. We shall see

Wow, Kevin… 2850 then turn down, just as you called it.

I take zero credit, it’s just the awesome fractal structure of the market. And knowing what fibo/derived fibo levels tend to be the highly functional ones.

Now trading it with limit orders…that takes some confidence! But I can’t tell you have often I kick myself not NOT doing exactly that. Well, it always about getting better. I will start trying to do that more often.

Ari’s point is well taken, this does look like a little 4 on the hourly. So maybe we get up close to a double top here before the turn. And maybe…this is motive wave action instead of further minute iv action. It’s time!!

Anyone on Ameritrade seeing no data for RUT? I’ve got data for everything else, including /RTY (U8), but nothing for RUT. Oops, also zero on my InteractiveBrokers feed. Very strange! Perhaps the servers that officially compute and serve the RUT value are down?

Meanwhile…I guess it’s now wait and see re: the main and yet another leg back down for a big flat…or the second alternate hourly and the iv is complete and this is a launch of a iii of a v of a 3.

Lara, your work here is so valuable! Such care and attention to detail. So open minded to alternatives. Thank you!

That’s very kind Curtis, thank you!

I’ll second Curtis’s motion, thank you!

I do have one request though. In the future, can we all just skip the corrections?

Wouldn’t that be nice.

I’ll put my request into Mr Market.

Not sure the request will be granted though…