Downwards movement continued for Monday exactly as was expected for the short term from last Friday’s analysis.

Summary: Today’s bearish daily candlestick along with bearish divergence between price and both of inverted VIX and the AD line indicate this pullback is not complete. The main hourly Elliott wave count expects the pullback to end below 2,796.34 but not below 2,791.47.

If the pullback makes a new low below 2,791.47, then look for support about the lower edge of the pink channel on the daily chart.

The bigger picture remains extremely bullish.

The mid to longer term target is at 2,922 (Elliott wave) or 3,045 (classic analysis). Another multi week to multi month correction is expected at one of these targets.

The final target for this bull market to end remains at 3,616.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

ELLIOTT WAVE COUNT

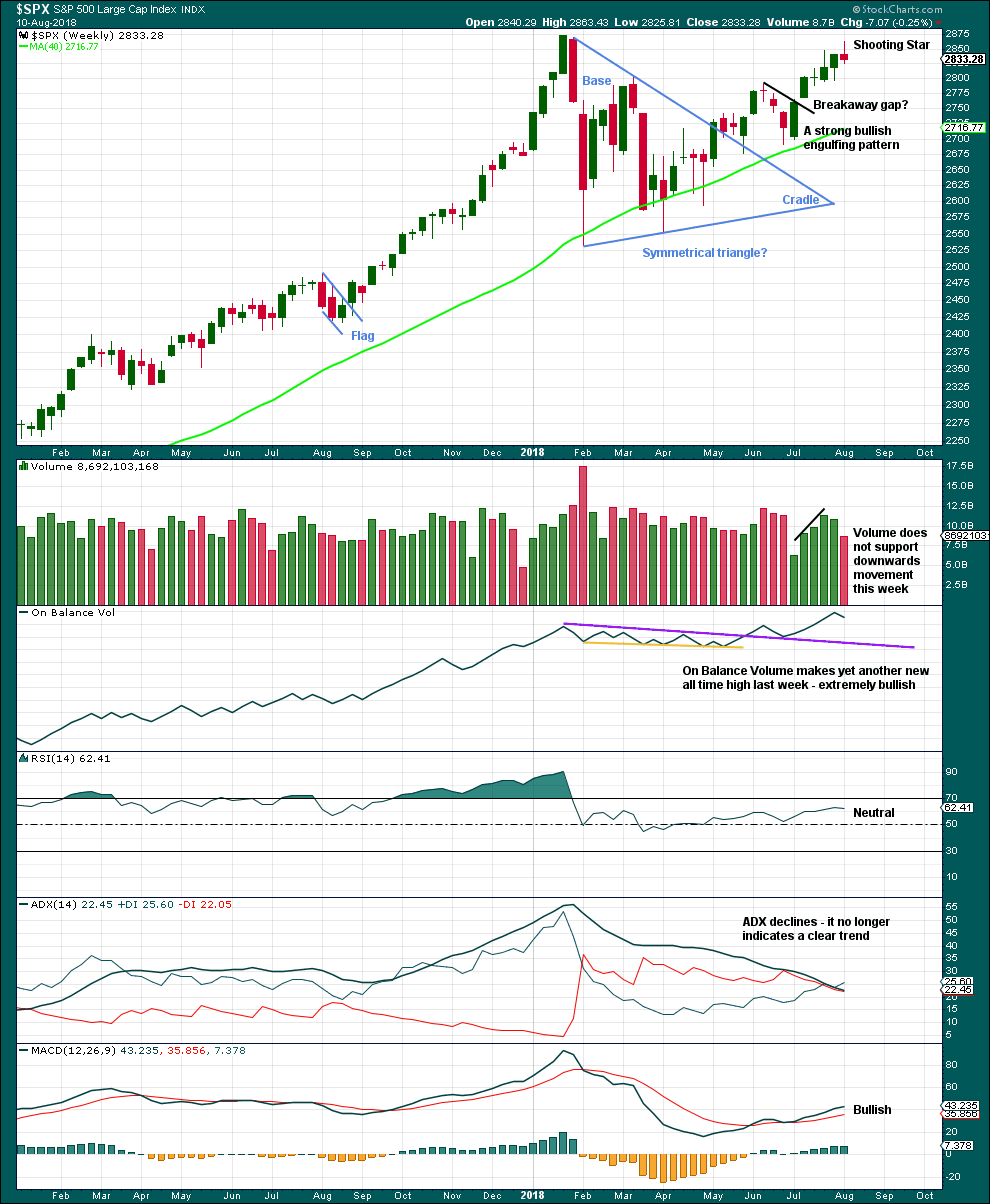

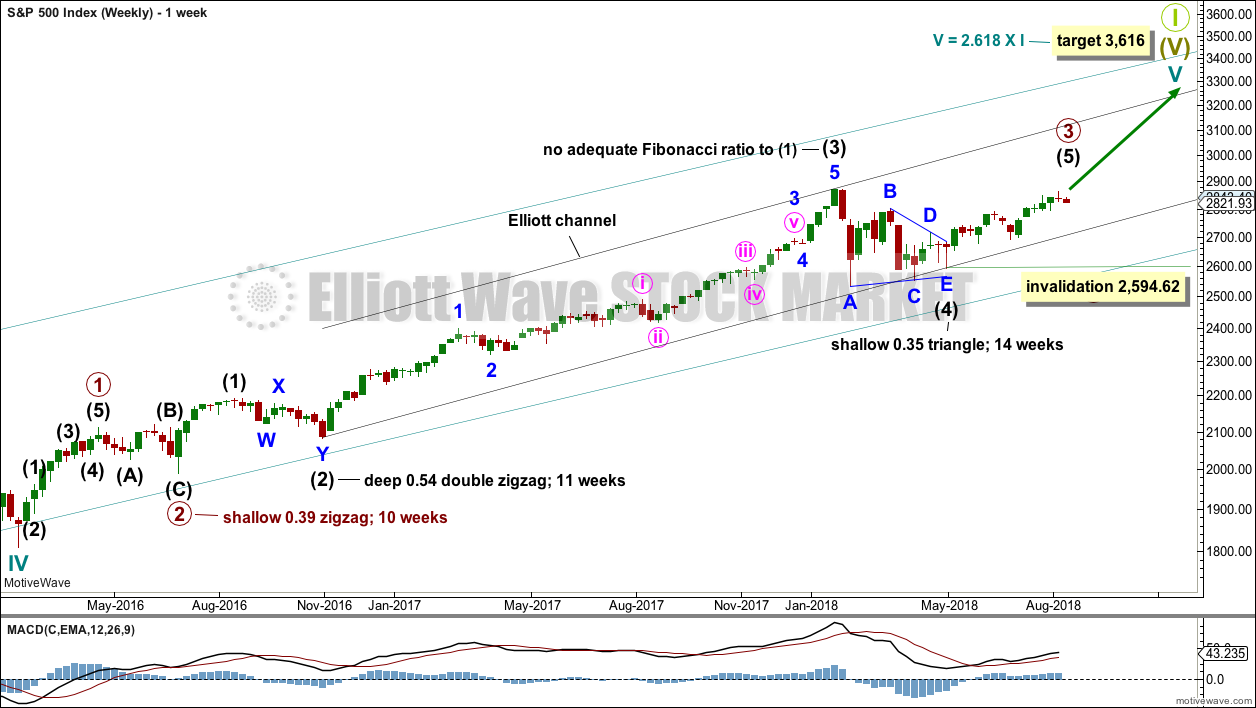

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62. However, the lower edge of the black Elliott channel drawn across the ends of intermediate degree waves should provide very strong support for any deeper pullbacks, holding price well above the invalidation point while intermediate wave (5) unfolds.

At this stage, the expectation is for the final target to me met in October 2019.

A multi week to multi month consolidation for primary wave 4 is expected on the way up to the final target.

The last bullish fifth wave of minor wave 5 to end intermediate wave (3) exhibited commodity like behaviour. It was strong and sustained. It is possible that the upcoming wave of minor wave 5 to end intermediate wave (5) to end primary wave 3 may exhibit similar behaviour, so we should be on the lookout for this possibility.

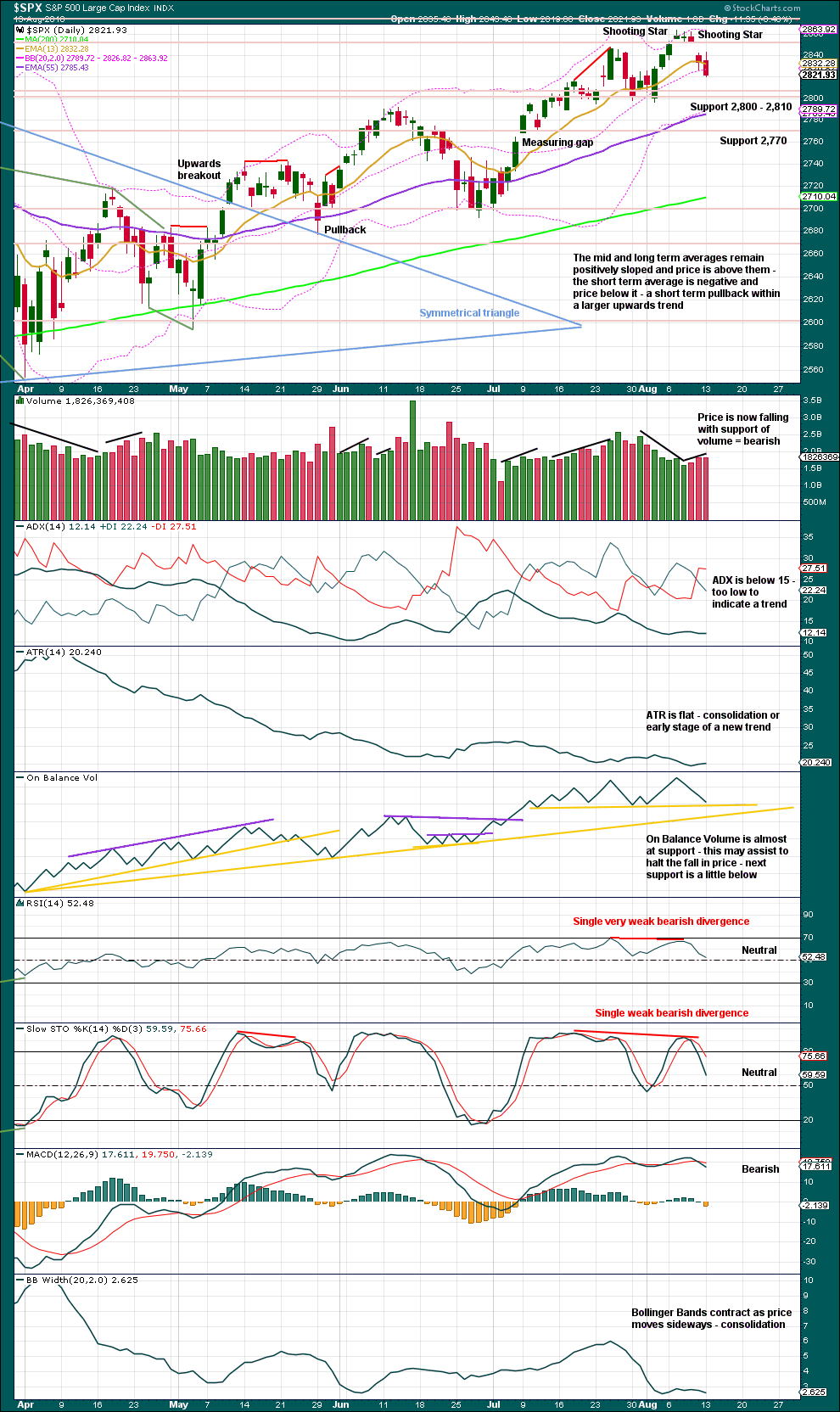

DAILY CHART

Intermediate wave (5) would be very likely to make at least a slight new high above the end of intermediate wave (3) at 2,872.87 to avoid a truncation.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 and 2 are complete.

Minor wave 3 may only subdivide as an impulse. A target is calculated for minor wave 3 to end, which expects to see the most common Fibonacci ratio to minor wave 1. Minor wave 3 may last several weeks in total and should look like an impulse at the daily chart level. When it is complete, then minor wave 4 may last about one to two weeks in order for it to exhibit reasonable proportion to minor wave 2. Minor wave 4 must remain above minor wave 1 price territory above 2,742.10.

Within minor wave 3, minute waves i, ii and iii all look complete and minute wave iv may still be an incomplete expanded flat correction. If minute wave iv were to continue further, then it would have better proportion to minute wave ii and would exhibit alternation in structure. This idea also has support from classic technical analysis.

It is also possible that minute wave iv was over at the last low and minor wave 3 was over at the last high. A new low below 2,791.47 could not be a continuation of minute wave iv, so the correction at that stage would be labelled minor wave 4.

The channel is drawn using Elliott’s first technique. The upper edge has provided resistance. This channel is copied over to hourly charts.

If the main hourly wave count below is invalidated with a new low below 2,791.47 and price keeps on falling, then look for strong support about the lower edge of the Elliott channel on this daily chart; the pullback may end there.

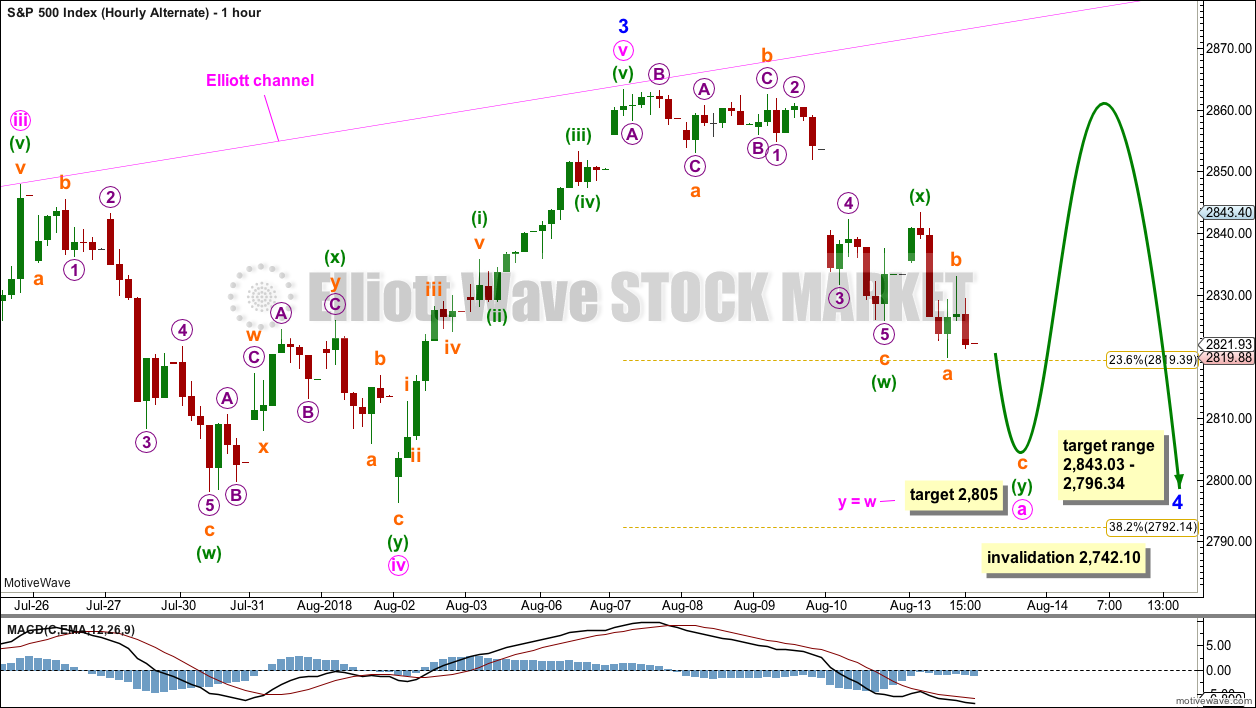

MAIN HOURLY CHART

This remains the main wave count today.

It remains possible that minute wave iv is an incomplete expanded flat correction.

Within the expanded flat, minuette waves (a) and (b) both subdivide as threes. Minuette wave (b) is still within the most common range for B waves within flat corrections, between 1 and 1.38 times the length of wave A.

Minuette wave (c) may be a steep sharp pullback. It would be very likely to make a new low at least slightly below the end of minuette wave (a) at 2,796.34 to avoid a truncation and a very rare running flat.

It is also possible to see minuette wave (a) over earlier as a single zigzag at the low labelled subminuette wave w. If this idea is correct, then minuette wave (c) only needs to make a slight new low below 2,798.11 to avoid a truncation.

Minuette wave (c) must subdivide as a five wave impulse.

The downwards wave labelled subminuette wave i may be seen as a complete five wave impulse on the five minute chart.

Within the impulse of minuette wave (c), subminuette waves i through to iv may now all be complete and subminuette wave v may be extending. When waves extend, they show their subdivisions at higher time frames; here, subminuette wave iii is extended and shows its subdivisions of micro waves 2 and 4 on the hourly chart. If subminuette wave v is also extending, then it may also show its subdivisions of micro waves 2 and 4 when it is complete on the hourly chart.

Minute wave iv may not move into minute wave i price territory below 2,791.47.

For this main hourly wave count, the upwards wave labelled minuette wave (b) is seen as a zigzag; this labelling has the best fit.

For the two hourly alternates below, the structure (labelled minuette wave (b) on this main hourly chart) is labelled as an impulse; this labelling does not have as good a fit.

ALTERNATE HOURLY CHART

Here, the degree of labelling within minute wave iv is moved up one degree.

It is possible that minute wave iv could be over more quickly than was expected. If minute wave iv is over, then the possibility of an earlier than expected end to minute wave v must be considered.

Minor wave 3 may have been over at the last high. Minute wave v is seen as a five wave impulse in order for this wave count to work. This does not have as good a fit as the main wave count, which does see this wave as a zigzag.

The degree of labelling within minor wave 4 is moved down one degree, because it would be too brief for minor wave 4 to be over in just one more day. It may be that only minute wave a of a flat or triangle may be completing lower as a double zigzag.

A target is given for the double zigzag to end. When a double zigzag may be complete, then minute wave a may be complete. If minute wave a subdivides as a three, then minor wave 4 may be unfolding as a flat or triangle. A triangle would be more likely as it would then exhibit alternation with the expanded flat correction of minor wave 2.

Within a triangle, there is no minimum nor maximum length for minute wave b, which may make a new high above the start of minute wave a at 2,863.43. Minute wave b should exhibit weakness.

Minor wave 4 may be reasonably expected to last at least about two weeks, and possibly up to about four weeks. It would most likely end somewhere within the fourth wave of one lesser degree; minute wave iv has its range from 2,843.03 to 2,796.34. If it does not end here, then it may end about the 0.382 Fibonacci ratio of minor wave 3 at 2,792.

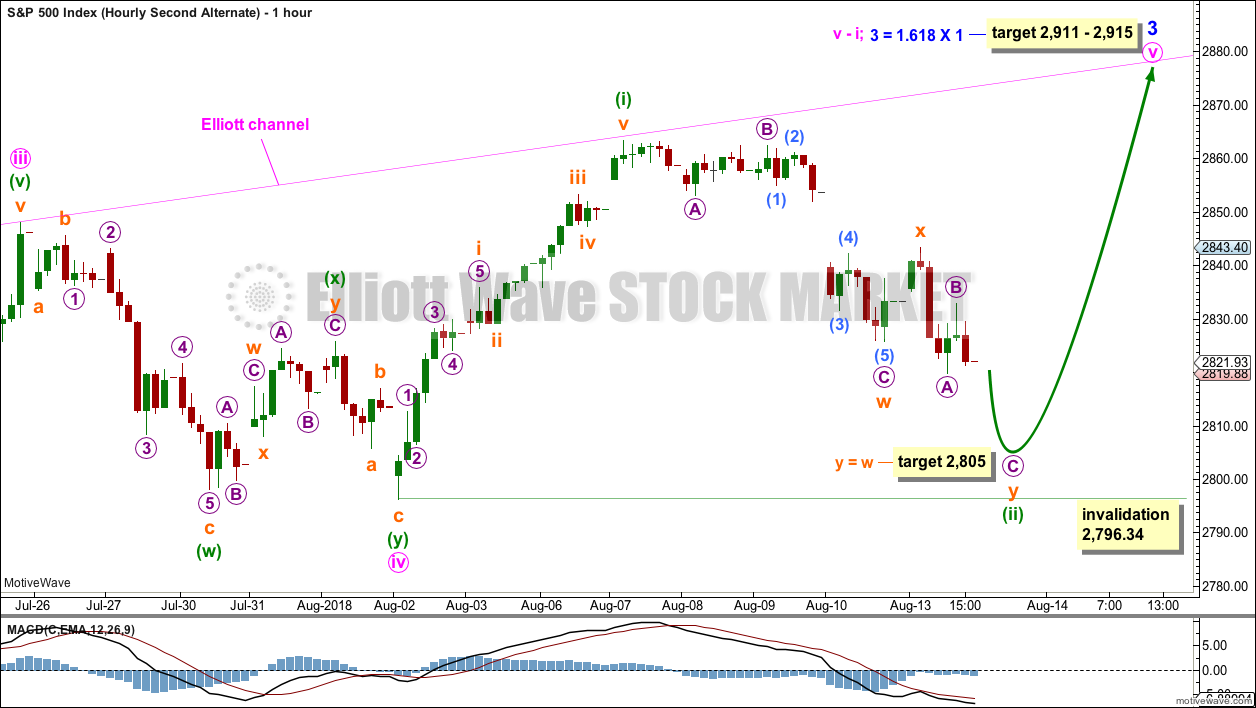

SECOND ALTERNATE HOURLY CHART

This second alternate wave count moves the degree of labelling within the last upwards wave down one degree. Minute wave v may be incomplete, and only minuette wave (i) within it may be complete.

Minuette wave (ii) is labelled as an incomplete double zigzag.

As soon as minuette wave (ii) is over, then this wave count expects an increase in upwards momentum as minuette wave (iii) moves higher.

If minuette wave (ii) continues any further, it may not move beyond the start of minuette wave (i) below 2,796.34.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Another new high for On Balance Volume last week remains very bullish indeed, but that does not preclude another small pullback within this developing upwards trend. It is still expected that price is very likely to make new all time highs, but it will not move in a straight line.

Last week’s candlestick is a Shooting Star pattern. This is a bearish reversal pattern when it comes after an upwards trend. Look for a downwards week this week.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete. The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. This is the definition of an upwards trend. But trends do not move in perfectly straight lines; there are pullbacks and bounces along the way.

There are now two Shooting Star candlesticks at or about the last high. This is now a stronger bearish warning. There are three recent examples of Shooting Stars on this chart: on 31st of July, 26th of July, and 11th of June. The second two examples came after an upwards trend and were considered bearish reversal candlesticks. Both were closely accompanied by new all time highs from On Balance Volume and some bearish divergence with price and Stochastics. Both were quickly followed by reasonable pullbacks. This is almost exactly the same situation now, and it now looks like it is happening again here. It is for this reason primarily that the main Elliott wave count expects to see a reasonable pullback continue.

The bigger picture remains extremely bullish with another new all time high from On Balance Volume as recently as the 7th of August.

There is strong support for price about 2,800, and On Balance Volume is almost at support. If On Balance Volume stops at support, then the pullback may end tomorrow. If On Balance Volume breaks below first support, there is a new support line which may allow for another one or two days of downwards movement. Both support lines have reasonable technical significance.

Today is fairly bearish with support from volume, a close very close to the low, and a longer upper candlestick wick. Expect another downwards day tomorrow.

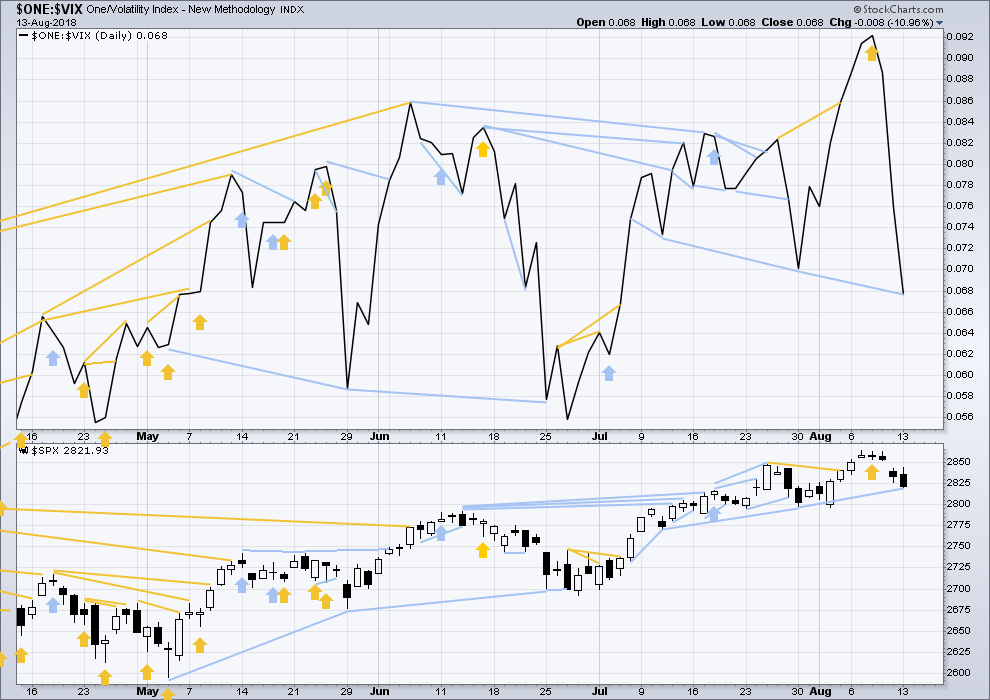

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

Last week completes an upwards week with a higher high and a higher low.

While price moved higher, inverted VIX moved lower. Downwards movement during last week does not have support from increasing market volatility. This divergence is bearish.

Inverted VIX is still some way off from making a new all time high.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Last noted mid term bearish divergence has not been followed yet by more downwards movement. It may still indicate downwards movement ahead as there is now a cluster of bearish signals from inverted VIX.

Inverted VIX has made a new swing low below the prior low of the 11th of July, but price has not. This is mid term divergence that is bearish.

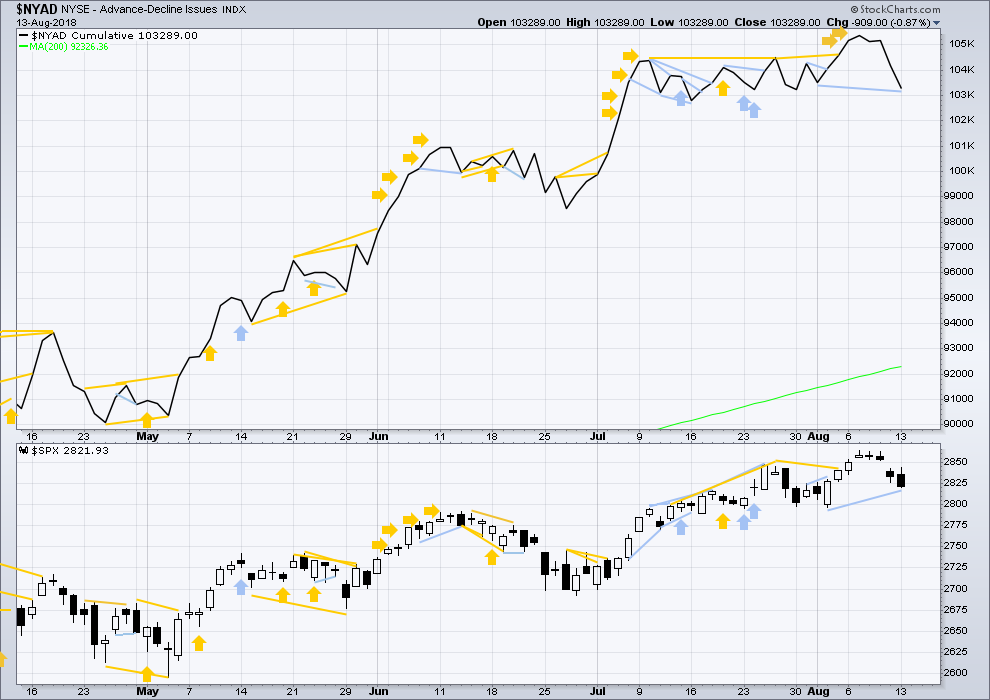

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

At this stage, there is very strong bullish divergence between price and the AD line at the weekly time frame. With the AD line making new all time highs, expect price to follow through with new all time highs in coming weeks.

Price last week has moved higher, but the AD line has moved lower.

Upwards movement within this last week does not have support from rising market breadth. This divergence is bearish for the short term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

The AD line today has made a new short term swing low below the prior low of the 1st / 2nd of August, but price has not. This divergence is bearish for the short term.

Small caps and mid caps have both made new all time highs. Only large caps have to follow through; they do usually lag in the latter stages of a bull market.

Mid caps have a Gravestone doji at the high and a Shooting Star reversal pattern just below the high. This looks bearish for the short term.

Small caps have another slight new high, but now there are is also a Gravestone doji and a Shooting Star about this high. This looks bearish for the short term.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Only Nasdaq at this stage is making new all time highs, with another new all time high on the 25th of July. DJIA and DJT need to make new all time highs for the ongoing bull market to be confirmed.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 08:08 p.m. EST.

Minute iv could still be an expanded flat with minuette (c) incomplete.

But it’s now also time to chart and publish the possibility of a triangle completing for minute iv.

Either way, the structure is incomplete. And the idea that minute wave iv is continuing will remain my main wave count; either a bit lower, or sideways.

Yep. We need a new low methinks! 🙂

Ditto

We know what VIX does at the end! 🙂

This SPX 2842 price is the edge of a volume hole just above. Price here either drops back to the lower volume node down another 10 or so points, or pushes up and through to the next node up, which is around 2854. Usually when moving through volume holes price moves rather quickly. (“Range expansion” through the volume hole -> “range contraction” at the volume node).

Heavy hitters loading VIX futures. Looks like the bankster raid on weak shorts just about done. Have a great evening everyone!

RUT on the daily tf is showing 7 straight days of squeeze. If current momentum is any indication, it’ll blow hard out of it to the up side. And perhaps SPX is launching a motive wave up. It’s time to stay alert for confirming long triggers, IMO. A rather large move might just be right around the corner.

I think your charts and analysis is top notch Kevin. But the more and more we meander here below 2843 without thrusting up above it, the more antsy I get about this being a top here with a final plunge coming.

I’ve entered long MS here and so far very profitable, but will take the money and run in a flash if we fail to close above 2843… This current move up right now is the 4th attempt to go above 2843.

I personally often resolve that tension Ari by using long term sythentic longs (calls way in the money and expiring 3-6 months out) with stops based on a broad violation of the bullish wave count (which pragmatically means I give ’em plenty of rope). If they go under water no sweat, as long at the WC stays generally as bullish as it is, there’s no issue for me. With those in play, when the market signals and triggers short, I do the opposite: I use extremely short periods options, generally close to or at the money, that offer super high leverage, require relatively little $$ outlay for the returns I’m targeting, and hence carry far less risk in terms of $$ (but arguably more because it’s a counter trend trade: the monthly and weekly are UP!). That’s what I do, anyway, allowing me to play both sides, much of the time.

At this point in time I’m not short; nothing in the price action so far tells me it’s time to get short. It may in another minute…but I see too much bullish evidence to fight the tape. Only if the tape “insists” will I consider a tactical short.

I have a very similar strategy. The in the money calls don’t have as much time premium. Thanks for sharing that!

And both MS and GS are both up exactly 1.27% at the moment… Cheers 🙂

NDX is now into it’s second hour of squeeze on the hourly chart, and the 5 minute has been squeezing for about 7 periods too (but exiting now to the upside). Some price movement is coming soon in these markets! I continue to perceive the upside as quite a bit more likely.

I see that… But I also see SPX forming a rising wedge pattern of sorts… specially on the 15 minute chart.

I sure hope we get up past 2845 by closing time to get some relief from this meandering… its getting pretty close.

Meanwhile holding on to my MS long position…

I’m going short and then going to yoga…. hope to see you at 2800

Smarter than most. C waves can fool even experienced players!

🙂

Some seriously nice reward/risk here in NFLX. If you think 61.% retrace bounces have significance and are good places under which to stop. I do.

Move up today clearly corrective, as per main count. The trend is your friend.

The SPX chart monthly trend is UP. The weekly trend is UP. The daily trend is DOWN but today is a huge reversal bar to the upside. The hourly trend has moved from down to neutral. The 5 minute trend is UP. I like to be friends with the weekly trend, myself.

As for it being “clearly” corrective, I have no such clarity at all. SPX has bounced very strongly here off of both a major 62% fibo and off two significant up trend lines. And right now SPX is running at 9-1 advancers/decliners. Looks and feels like fresh motive wave action.

Only wave counting evidence would suggest this may be corrective. Which isn’t enough for me. The other evidence just doesn’t support this being corrective. Yet it may be. We’ll see.

Thanks to both Verne and Kevin. Really good to weigh different perspectives in context of the wave counts. Prevents me from leaning too heavy one way or the other, thanks!

Sure! Lots of opinions makes a market.

Most welcome Jonathan. Lara’s targets are the key to smart entry and exits, and that goes for both upside and downside turns. I was a subsciber for a very long time before figuring that out. You can save yourself a lot of angst and thrashing around by simply being disciplined and paying attention to them! I hope to exit short legs of bear call spreads at tomorrow’s lows. Best of trading fortunes! 🙂

my currrent view at the hourly level. The macd has swung to “up”. Bounce off 61.8%, and generally off two trend lines from the daily level tf.

The single red down bar at the last hour of Friday really stands out. I called it out at the time, but I will admit I didn’t go load the truck up with puts, and obviously in hindsight it was a klaxon going off “dive! dive! dive!”. Paying attention is the start; understanding and heeding the signs comes with more and more experience and confidence.

Anyone else seeing a possible 3-3-5 off yesterday’s low? Potentially one small thrust upward, and then downhill for a couple days. We might know by early afternoon.

The fact that 2840-43 cannot be taken out to the upside decisively does worry me a bit. But if SPX can get above that its probably going higher… This may very well be a corrective bounce heading into a sell off below 2800.

SPX and NDX A/D running about 7-1 this morning, rather bullish for the day.

Look at DAX. 🙂

Based on the DAX US equities should have been in a bear market for the last 4 months. Not highly correlated with US markets as far as I can see. But sure, it was weak in their day session, so perhaps that bleeds into US markets. The AD ratio is coming down…

O.K. I will be quiet. 🙂

I know I make these calls a bit early and am sometimes wrong. But to my eye, this iv wave (or ii?) is now most likely completed. Both because of the strength today, and the fact the market (SPX) turned right at/on two different uptrend lines. Looks solid to me. Confirmation would obviously be a fill of the overhead gap. (I know there will be counts that will suggest it isn’t over, and they may end up being valid. But multiple possible counts at the tail end of corrective waves is par for the course, and waiting for 100% confidence in a new impulse leaves too much $$ on the table IMO.)

Loving the bull run in RUT, too!!

Hey Kevin, curious about your opinion on bank stocks that got hammered during this Turkey “crisis.” In particular Morgan Stanley which is spending its third day under its BB… I know you were thinking of shorting BAC, but what are your thoughts on going long MS since it seems to be oversold. I was thinking of going long GS near 225, but MS seems to be a better buy under the BB…

Thanks in advance…

I don’t “know” or really trade fundamentals Ari. As for BAC short…took my tiny profit already. Too much bull market strength today and looking at some serious upward momentum coming right down the pipe at us (if it’s not already here!) per Lara’s count. So today’s action tempered by short enthusiasm.

As for MS, well going long MS is seriously counter-trend relative to the weekly and the daily and the hourly. That said, it just bounced off a 61.8% fibo and perhaps there’s a decent short term long there with stops right under 47.3 or alternatively under the lows on 7/2. Not a trade I’ll be taking. I prefer to have the strength of the weekly/monthy trend at my back, when possible!

Now, perhaps contradicting myself…I just took a synthetic long on GS. What’s different with GS? GS broke it’s huge weekly downtrend about 2 months ago, and is arguably in an up trend at the weekly level (my trend indicator actually shows neutral, after a bunch of up bars that continued to be in “down trend” status). GS has a generally similar shorter term structure, with a nice bounce off a 61.8% as well. So I like GS, but don’t care so much for MS due to the weekly structure.

Got it. Thanks Kevin!

Guten Morgen!

The last few years I have come to consider volatility akin to a caged tiger.

In that colorful analogy, the bars of the cage would of course be represented by the international bankster cabal, who have embarked on a relentless course of the destruction of price discovery, distortion of risk perception, and in general conditioning market participants to act with reckless abandon when it comes to their leveraged exposure in equities. We have been living in the era of “T.I.N.A”, and the remarkable one-way direction of equity prices the last several years would certainly appear to justify such recklessness. The bars of the tiger’s cage weakened

just enough earlier this year to allow him to deliver a serious swipe to a few too-close bystanders. I yet have to see a reliable number of how many hundreds of millions were lost by people long SVXY and other short vol instruments during volocaust. The subsequent losses in premium just from the ProShares tweak after the event was over 100 million! As many of you know, there are at least two of us on this forum who believe that incident back in February was only act one, with the other shoe yet to drop. When? Of course no one knows for certain, but drop that shoe will. In the meantime, it is looking like this morning the banksters are giving us another great opportunity to grab a tiger by the tail!

Happy Trading! 🙂

COP weekly. Heck of a bull trend…but it sure looks like folding over action here, and even a modest and “typical” pullback as has happened about 4 or 5 times so far in the bull run would be a nice $6-8 move. I will consider a “longer duration” type position here on good sell triggers at lower tf’s. However, I might temper my decision making here based on what’s up next few days with /CL. We’ll see.

AMGN is approaching a cusp and a short set up. Breaking the TL and breaking the immediately prior daily swing low might just do it for me. The sell periods are sharp and steep, and if one kicks off here there’s 10 points easy for it to move.

Oil is in a bull market on the weekly and the daily/hourly are getting well set up IMO. The first /CL price move down to a symmetric projection (thick white lines) exactly and bounced, and now price has extended deeper to a second symmetric projection exactly and bounced again, but this second bottom is also on top of overlapped fibo’s (50% and 78.6% derived) around 66. My hypothesis is that this turn is going to be good, if we get further validations (triggers for an entry). For me here that would be price above 67.88, breaking the latest down trend line on the hourly and inverting swing polarity to “up”. I may enter for one unit there then wait for a pullback to enter a second unit. I’ll probably utilize a spread on OIH, but I’ll use /CL as a trigger for a stop. Any move below those fibo’s, I take action.

That fits with my US Oil analysis Kevin. I’m expecting it’s about to complete an intermediate degree correction within a larger upwards bull trend. I expect a bit more downwards movement to complete it about 61.12 – 61.22, and within the next two weeks.