A small upwards day closes red.

Yesterday’s analysis expected a shallow consolidation may continue sideways, which is exactly what is happening so far.

Summary: Assume that while price remains above 2,791.47 either a shallow consolidation may continue sideways for a few days or a brief pullback was over at the last low. A new high above 2,848.03 with support from volume would indicate the correction is over.

A new low below 2,791.47 would indicate a deeper pullback may continue. The target for it to end would then be about 2,752.

The bigger picture remains extremely bullish.

The next target is about 2,915, where another consolidation to last about two weeks may be expected.

The invalidation point remains at 2,743.26.

The mid to longer term target is at 2,922 (Elliott wave) or 3,045 (classic analysis). Another multi week to multi month correction is expected at one of these targets.

The final target for this bull market to end remains at 3,616.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

ELLIOTT WAVE COUNT

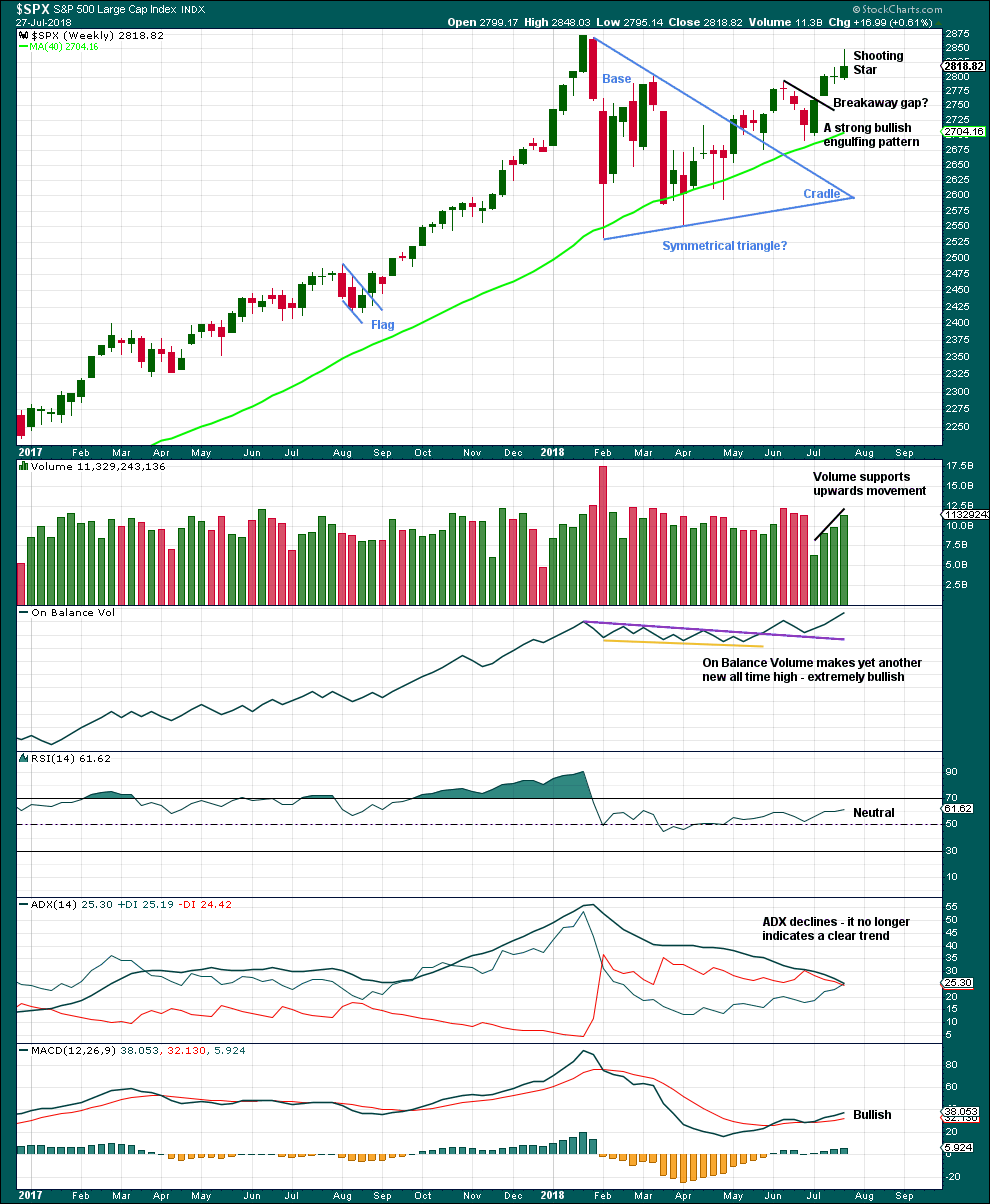

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62. However, the lower edge of the black Elliott channel drawn across the ends of intermediate degree waves should provide very strong support for any deeper pullbacks, holding price well above the invalidation point while intermediate wave (5) unfolds.

At this stage, the expectation is for the final target to me met in October 2019.

A multi week to multi month consolidation for primary wave 4 is expected on the way up to the final target.

The last bullish fifth wave of minor wave 5 to end intermediate wave (3) exhibited commodity like behaviour. It was strong and sustained. It is possible that the upcoming wave of minor wave 5 to end intermediate wave (5) to end primary wave 3 may exhibit similar behaviour, so we should be on the lookout for this possibility.

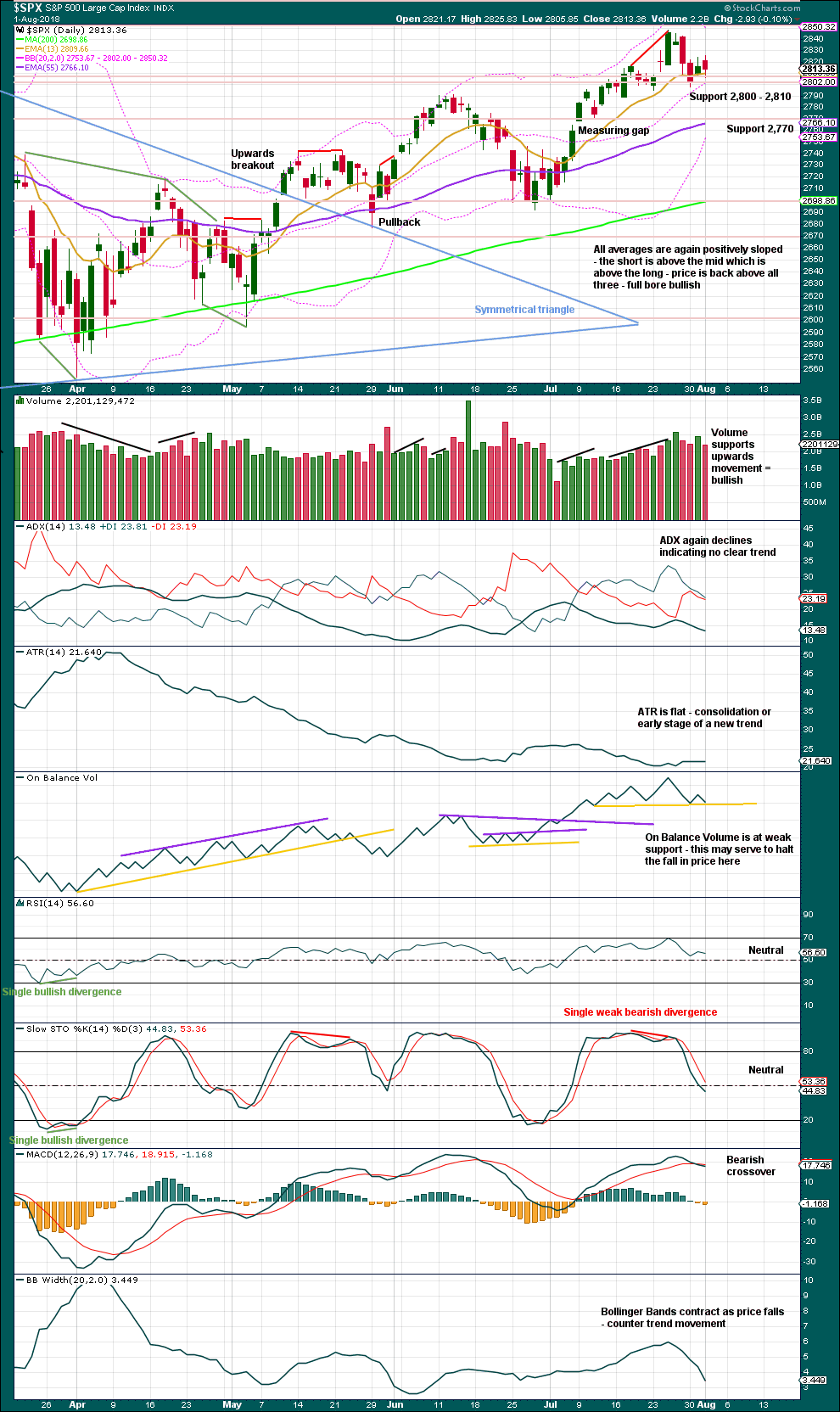

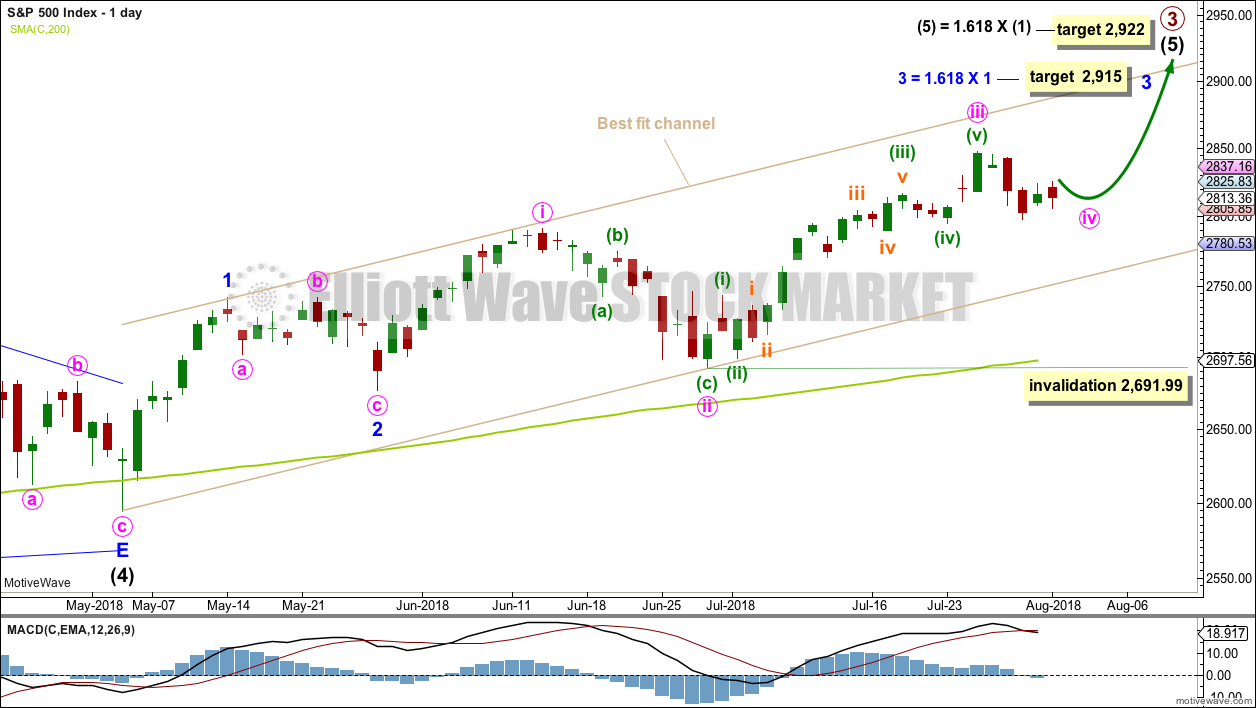

DAILY CHART

Intermediate wave (5) would be very likely to make at least a slight new high above the end of intermediate wave (3) at 2,872.87 to avoid a truncation.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

It is possible that minute wave iii could be over at last week’s high; if it is complete here, it would not exhibit a Fibonacci ratio to minute wave i. If minute wave iv unfolds here, then it must be very shallow to remain above minute wave i price territory at 2,791.47.

At this stage, it is possible that minute wave iv was over as a relatively brief zigzag at the last low, or that it may continue sideways for a few days as a flat, combination or triangle. Both ideas are outlined in hourly charts below.

If downwards movement continues below 2,791.47, then the best alternate idea would be to move the degree of labelling within minute wave iii all down one degree and see only minuette wave (i) within minute wave iii complete at the last high. Downwards movement would then be labelled minuette wave (ii), which may not move beyond the start of minuette wave (i) below 2,691.99. However, downwards movement should find support reasonably above the invalidation point at support about the lower edge of the best fit channel.

A target is calculated for minor wave 3 to end, which expects to see the most common Fibonacci ratio to minor wave 1. Minor wave 3 may last several weeks in total and should look like an impulse at the daily chart level. When it is complete, then minor wave 4 may last about one to two weeks in order for it to exhibit reasonable proportion to minor wave 2. Minor wave 4 must remain above minor wave 1 price territory.

A best fit channel is added in taupe to this chart. It contains all of intermediate wave (5) so far. The lower edge may provide support for any deeper pullbacks. The upper edge may provide resistance.

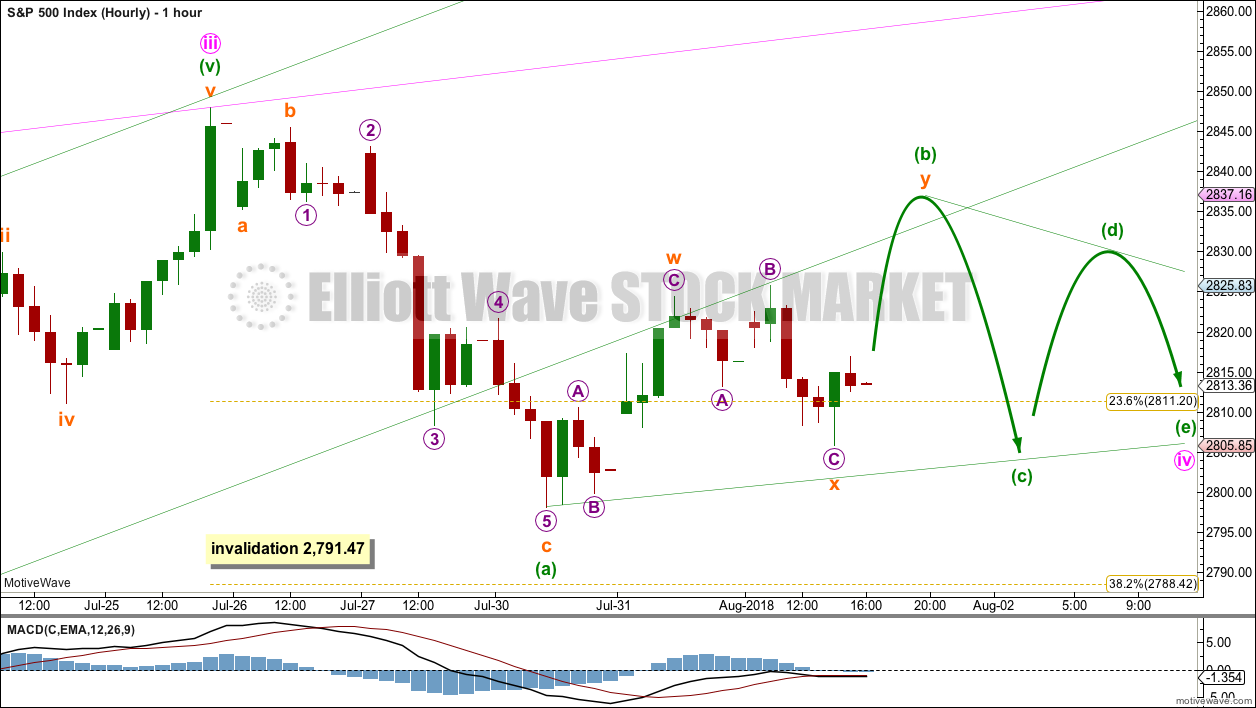

FIRST HOURLY CHART

If minute wave iii was over at the last high, then there are reasonable Fibonacci ratios within it.

Minute wave ii was a very deep 0.87 single zigzag lasting 11 sessions. Minute wave iv would most likely be shallow, and most likely exhibit alternation in structure with minute wave ii as a flat, combination or triangle.

If minute wave iv is a triangle as labelled, then within it minuette wave (b) may be an incomplete double zigzag. Minuette wave (b) may make a new high above the start of minuette wave (a) at 2,848.03 as in a running triangle. There can be no upper invalidation point for this wave count for this reason. However, minuette wave (b) should exhibit weakness; it should have weak volume and momentum. If price makes a new high with strength, then this wave count would be discarded.

If minute wave iv is a triangle, then minuette wave (b) within it would most likely still be incomplete. To see it over at today’s high would see it far too shallow; the triangle would not have the right look. However, this wave count must see micro wave C of subminuette wave w as a five wave structure. This can fit on the five minute chart, but it looks forced.

If minute wave iv is a flat correction, then within it minuette wave (a) may be a complete zigzag. Minuette wave (b) may now be unfolding higher as a double zigzag, which may make a new high above the start of minuette wave (a) as in an expanded flat correction. Minuette wave (b) must retrace a minimum 0.9 length of minuette wave (a) at 2,843.03. The most common length for minuette wave (b) within a flat would be from 1 to 1.38 the length of minuette wave (a), giving a range from 2,848.03 to 2,867. Minuette wave (b) should exhibit weakness in either or both of volume and momentum.

If minute wave iv is a double combination, then the first structure in a double may be a complete single zigzag labelled minuette wave (w). The double may now be joined by an incomplete three in the opposite direction labelled minuette wave (x). Minuette wave (x) may subdivide as any corrective structure that may make a new high above 2,848.03 but should exhibit weakness. When minuette wave (x) could be complete, then the second structure in the double would most likely be a flat correction and would be labelled minuette wave (y). Minuette wave (y) would most likely end about the same level as minutte wave (w) at 2,798.11, so that the whole structure takes up time and moves price sideways.

If minute wave iv is a double combination, then within it minuette wave (x) would still most likely be incomplete as X waves within combinations are almost always deep.

For all of these structural ideas minute wave iv may continue overall sideways for a few more sessions.

Minute wave iv may not move into minute wave i price territory below 2,791.47.

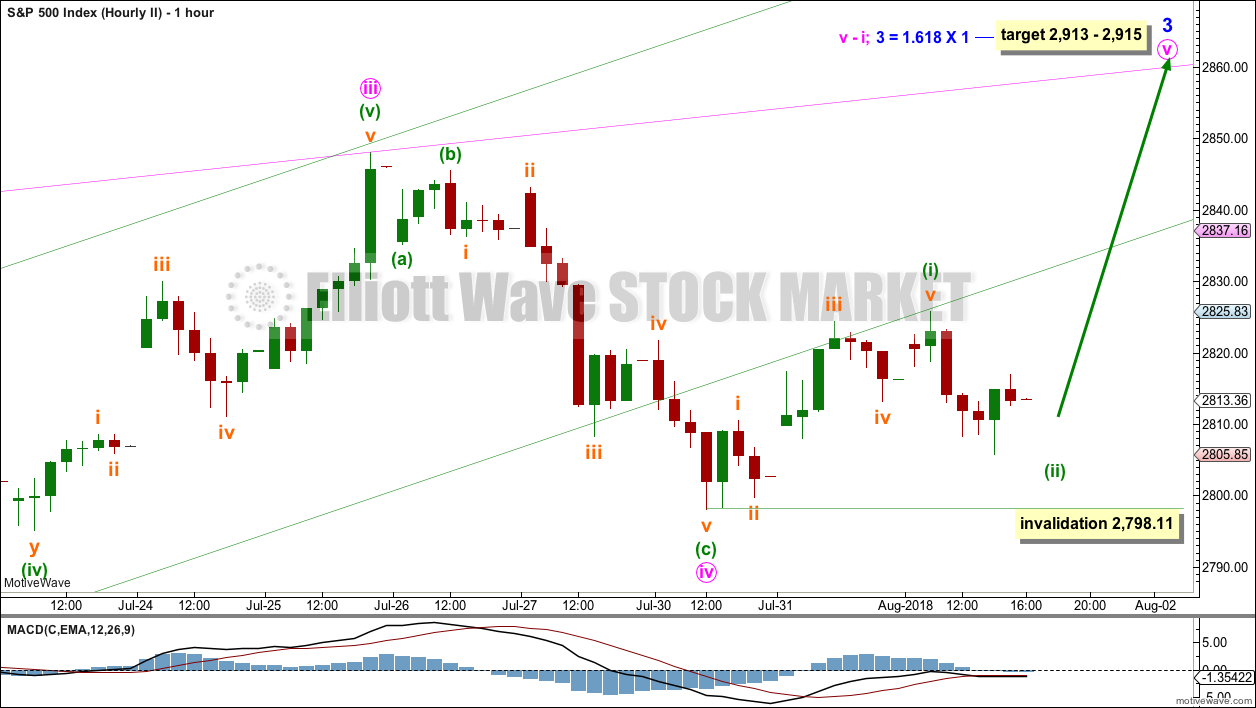

SECOND HOURLY CHART

It is also possible that minute wave iv was over at yesterday’s low as a single zigzag.

However, it would be very brief and so disproportionate to minute wave ii. Minute wave ii lasted 11 sessions. Minute wave iv would have lasted only 3 sessions.

There would be no alternation in structure as both minute waves ii and iv would be zigzags. Alternation is a guideline, not a rule, and alternation in structure does not always occur.

There would be excellent alternation in depth: minute wave ii was very deep and minute wave iv would be very shallow.

Within minute wave v, no second wave correction may move beyond the start of its first wave below 2,798.11.

A five up is labelled as minuette wave (i). This wave count requires the upwards wave labelled subminuette wave iii to be seen as a five wave impulse. This can fit on the five minute chart, but it looks forced.

If price makes a new high above 2,848.03 and meets one or more of the following conditions, then this would be the main wave count:

– support from volume

– a new high from On Balance Volume

– a new high from the AD line

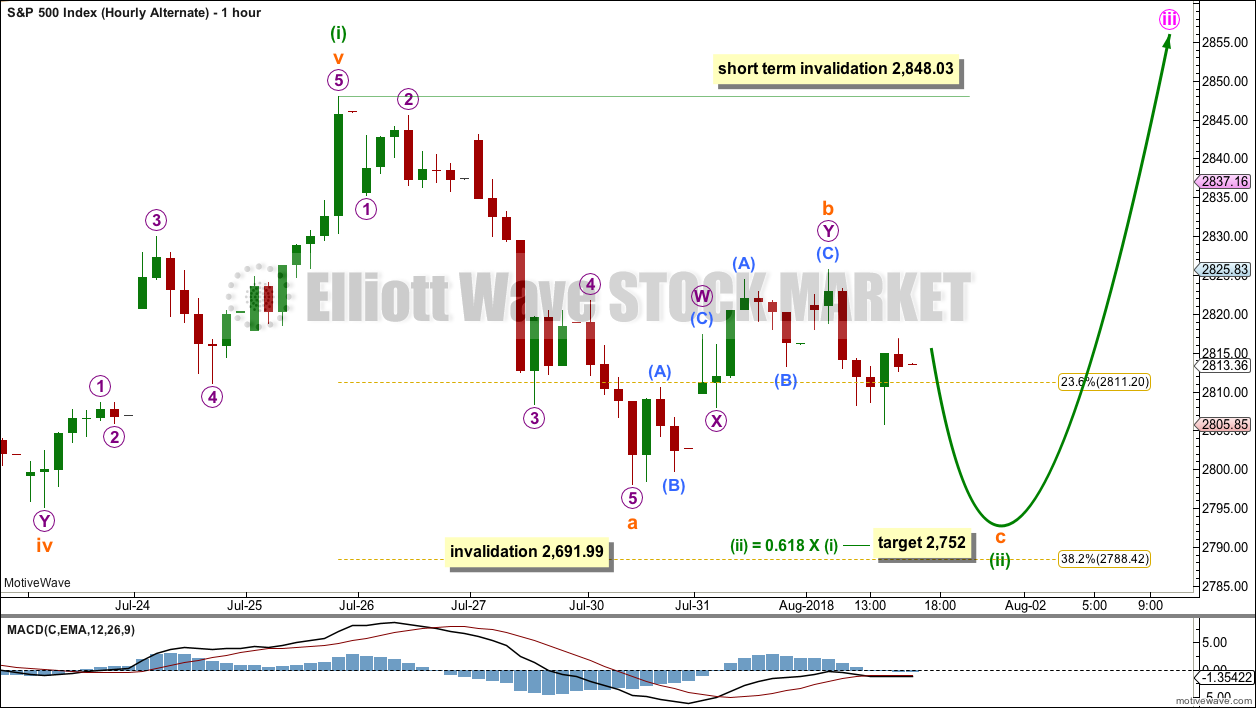

ALTERNATE HOURLY CHART

This alternate hourly wave count is the same as yesterday.

This alternate wave count moves the degree of labelling within minute wave iii all down one degree.

If minuette wave (i) was over at the last high, then downwards movement of the last two sessions may be the start of minuette wave (ii). A target for minuette wave (ii) would reasonably be the 0.618 Fibonacci ratio of minuette wave (i) about 2,752. However, if this target is wrong, it may be a little too low. There may be support just above this point at the lower edge of the best fit channel, which is seen on the daily chart.

Minuette wave (ii) may not move beyond the start of minuette wave (i) below 2,691.99.

This wave count sees the last small upwards wave as a complete double zigzag labelled subminuette wave b. This has the best fit today at the hourly chart and five minute chart levels.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Recent new highs for On Balance Volume remains very bullish indeed, but that does not preclude another reasonable pullback within this developing upwards trend. It is still expected that price is very likely to make new all time highs, but it will not move in a straight line.

A Doji candlestick followed now by a Shooting Star, which did not gap higher, is reasonably bearish for the short term. A pullback or small consolidation may result.

Bullish volume and another new all time high from On Balance Volume are very strong bullish signals.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete. The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. This is the definition of an upwards trend. But trends do not move in perfectly straight lines; there are pullbacks and bounces along the way.

This bull run now has some support from volume and strong support from On Balance Volume making new all time highs.

The short term volume profile is bullish. Support remains strong here at 2,800. If price closes below this support area, then next support would be about 2,770.

Overall, this chart remains very bullish. But trends do not move in straight lines, and at this time it looks like a small consolidation may continue, which could still also turn into a deeper pullback.

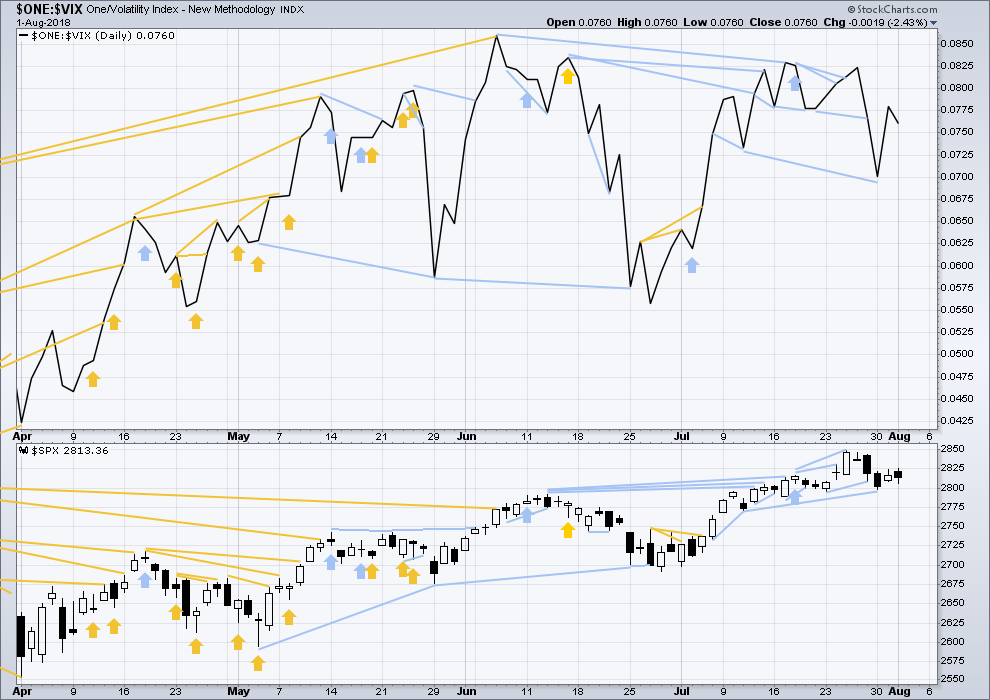

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

There is bearish divergence at this time between swing highs of inverted VIX and price, and now two weeks in a row of upwards movement from price and downwards movement from inverted VIX. This is now a reasonable warning of a possible pullback or consolidation, but it is not as strong a warning as that back in January. The last two weeks of upwards movement in price is not particularly strong (completing a Doji and a Shooting Star, not strong upwards candlesticks), so this divergence is not as significant.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Last noted mid term bearish divergence has not been followed yet by more downwards movement. It may still indicate downwards movement ahead as there is now a cluster of bearish signals from inverted VIX.

There is no new divergence today between price and inverted VIX.

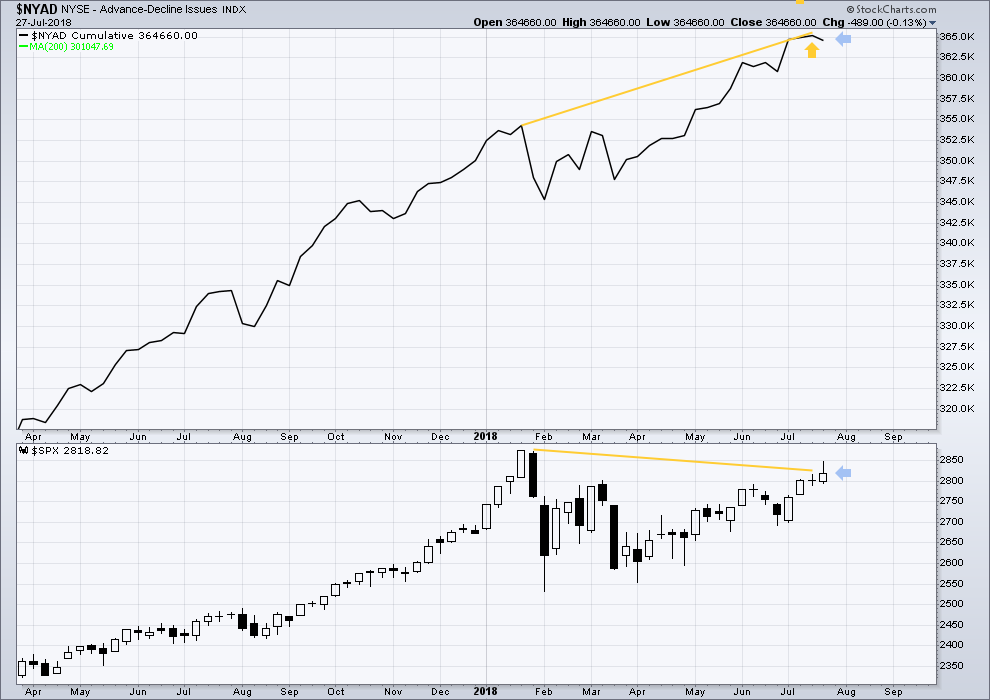

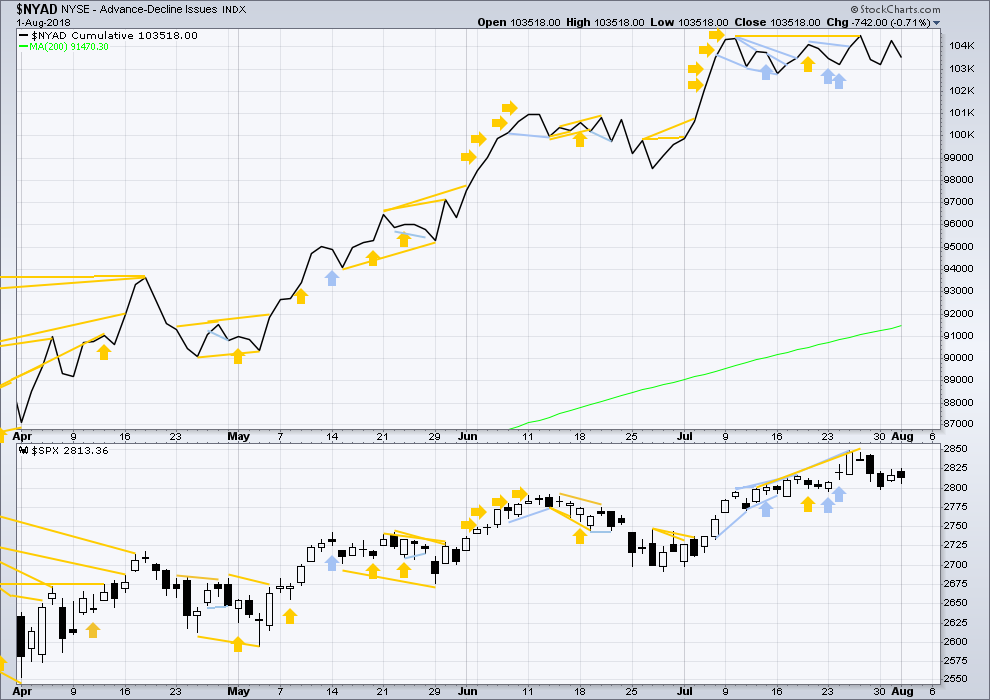

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

At this stage, there is very strong bullish divergence between price and the AD line at the weekly time frame. With the AD line making new all time highs, expect price to follow through with new all time highs in coming weeks.

Price moved higher last week, but the AD line moved lower. This single week divergence is bearish for the short term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

The last signal from the AD line was very bullish, with another new all time high last Thursday.

There is no new divergence today from the AD line.

Small caps have made another slight new all time on Friday. Mid caps made a new all time high on the 10th of July. Only large caps have to follow through; they do usually lag in the latter stages of a bull market.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Only Nasdaq at this stage is making new all time highs, with another new all time high on Friday of last week. DJIA and DJT need to make new all time highs for the ongoing bull market to be confirmed.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 09:28 p.m. EST.

I’m a-guessing we’re in the alternate hourly, with a completed ABC (WXY) down for the minute iv wave, and now the initial minuette i of the minute v of a minor 3. Minuette ii right around the corner to put the fear in everyone…then it’s time to pile on.

Oh shucks the Master beat me to it. Lookin’ goot!!!! While I did much better in this iv than I have been (every day at/above target, a target I may need to adjust soon!)…I LOVE upward impulses!

I held my nose and piled into calls exiring manana on the close above 2800. Holding 190 straddle…just in case…

1.90 cost basis, that is….

Now that the session is closed and StockCharts data is finalised, I can see some weakness in today’s upwards movement. Weak volume, weak rise for On Balance Volume and the AD line.

This could be a B wave…

this will be the main hourly chart today:

minute iv may be over now as a shallow double zigzag.

this is how the subdivisions fit best

The SPY 281.5 straddle expiring tomorrow should be very much in the green if this is a legitimate move up and expected to continue by the market makers. The calls are up but not by nearly what one would expect, and the puts are way down putting the straddle down around 0.33.

What does that tell ya? 🙂

P.S. I know bankster B.S. when I see it!! ‘Nuff Said!

I’m outta here. See ya manana!

Call me paranoid, but what I am seeing today in the markets is waaaaaay too cute, by a stinkin’ mile…. 🙂

Verne,

Bullish sentiment is showing similar behaviour as Jan 2018. We all know what followed it.

Context sometimes helps. Monthly SPX. Hasn’t been in a down trend since July 2015. Raging bull mode continues. Someday it’ll stop. Maybe today. Maybe not. My bet is not.

Though I will say, we have to take care re: a possible significant double top here. Once price is through that, “coast is clear” for awhile.

and of course….”trust in the wave count, Luke!!!”.

Trust…and verify.

These people are NOT NICE!

A lot of gullible traders are going to get royally you-know-what.

You trade at your own risk if you don’t recognize that simple truth…. 🙂

Selling SPY 282.50 calls for 1.38.

I refuse to let profits sit in this market, I don’t care what I think the signals are saying.

If we close above 2800 I will be rolling that position into 280 calls expiring tomorrow and continue the scalping approach…can’t be too careful…! 🙂

“I’ve got that bullish feelin’….” NDX daily. Lots of channel upstairs to explore!

I like these “scroll up” days! “Oh…price is up off the screen AGAIN!”

BLUE (as dangerous and volatile an issue as you’ll find…but instantly less dangerous than usual since earnings were 24 hours ago) sold off in anticipation of earnings…and then sat quiet on the earnings, at a double bottom point (daily tf). Now it’s giving indications of turning back up. I expect it’s now going to range between 150 and 180. The 145 puts can be sold for over $500. If you end up buying, you are in around 140 net. Current price is 156. I like selling premium.

Ordinarily, one would naturally interpret today’s price action as being quite bullish, no?

Let’s see what happens…. 🙂

I sure like these bull runs in RUT/IWM on the 1 and 5 min tf’s. Soooo easy to jump on board and make some coin.

Are we looking at a possible ED in Tripple Q???!!!

You just know somebody is on the verge of getting really whacked in this crazy market.

The SPY 281.50 straddle expiring tomorrow can be had for a mere 1.90 and should return some serious coin! 😉

The last significant iv wave did something like 5 or 6 up/down waves underneath a down sloping trend line, each wave going deeper. If price turns at the current down trend line…we could be in for a similar ride. On the other hand, pushing up and through that trend line would seal the deal for me: it’s v up time.

broken…

Now it needs to hold. Up and away action and perhaps its time to add gas to the fire…

Speaking of market distortions, can anybody explain to me why Chipotle is up over 1.5% today when their restaurants keep poisoning people? I am shorting the stock purely on principle…

people love Chipotle, and people love poison : cannabis, ETOH, opioids…..

ETOH? Haha! You must be a Chemist!

Nasdaq powering higher on the strength of Apple’s fifth wave up. Then what…??!!

AAPL targeting 211/213 for this ramp before heading down>

Wish I’d held onto s few of those calls…lol!

no one has died recently

If the banksters want to keep throwing around free money who am I to start arguing with ’em? No siree, not me! lol!

Buying Triple Q 175.50 Aug 10 puts for a buck even…hehe! 🙂

Ooopsie!

VIX gap higher on 5 minute. 🙂

Taking a glance at DAX, it is starting to look to me like what we have is a co-ordinated bankster pump on the verge of an epic fail…lol!

They gotta close that gap, and do it TODAY, or they are TOAST!

Reloading hedge with SPY 281/282 bear call credit spread….

I read with great interest an article by another long-time GORO investor who has tossed in the towel. He points out that the fundamentals remain strong and the earnings report was favorable but the”technicals” ( stock decline on good news) have deteriorated of late. As a long-time holder of GORO, my reaction has been exactly the opposite. I sold a boatload of naked December 5.00 strike puts for

0.35. I would be tickled to get more shares on assignment for 4.65.

Not like that’s gonna happen! lol!

Word is starting to get out about GORO’s Gold and Silver dividend program. I am surprised the Chinese have not already snapped it up!

https://seekingalpha.com/article/4193432-gold-resource-corporation-packing-bags#/alt1

When in doubt, wait it out.

Yes indeed! 🙂

The bulls have to decisively close the open gap and make it stick.

If this gap becomes an area of resistance, we are headed for the 200 day. We will have evidence of that with a rare intra-day gap higher in VIX and a take out of this morning’s lows.

Taking double on SPY 280 puts.

As I indicated, the bears have already lost the 2800 pivot battle, whether they know it or not. Waiting for close to add to calls.

R u thinking today’s low was the bottom of A in the triangle ?

I’m seeing today’s low as the potential low for minute iv… of course I could be wrong…

I am going to be very honest with you.

I have given up trying to count the waves in this distorted market. I am happy to let Lara do the heavy lifting in that department. I am now simply watching the money flow around contested pivots to try and make entry and exit decisions. This remains a scalper’s market. I sold QQQ 176 puts for 2.50 this morning that are already back to trading for half that amount…in less than an hour!

It remains a very treacherous market. Tread very carefully!

SPX has behaved within Lara’s EW roadmap constraints PERFECTLY now for months and months. I’ve been taking great advantage, and I hope that nominal and “inside the lines” behavior continues.

I haven’t seen any “distortion” or “treachery” myself. Well…in the market!!!

Haha! Tell that to FB shareholders… 🙂

So the impulse up is invalidated, the triangle is looking ugly….. the only way left is down?

I would suspect the gap fills or very close to it…then backing and filling today.

A push through the gap and up would (IMO) mean the iv is over. But I don’t think that’s the likely scenario.

As for how much further down (if any) in the backing and filling…no idea. I’ve shown what I consider the “reasonable possibilities” in the chart with the symmetric projections. This market could easily fall a lot more before this iv finishes. Just another painful, slow iv wave….

Symmetric projections of the prior 5 down swings (time and price).

Note how they line up with the fibo retrace lines. That there is is a kind of proof of fractal geometry of the market, the most powerful tool in the kit, bar none.

EEM is in a strong down trend at the weekly tf (descending TL). But on the daily shown, the trend has turned back to up, and price is approaching the “decision point” (as I call this kind of converging TL structure). The best trades are stalking exercises to start.

Lots of similarity in the range contraction action at the daily time frame in /ES with 5/14-18 (two gray boxes). If that pattern continues, price should “fill out” the gray box in some widening price action, and price at the lower edge (2786-2790) is an excellent long swing trade set up.