Last analysis warned that some small range downwards days or doji may show up at this stage. A small red candlestick for Wednesday’s session fits this description.

Summary: Today’s short term bearish divergence between price and both of VIX and the AD line suggests another downwards day tomorrow, which may find a low about 2,766 and may remain above 2,764.41.

Overall, this is expected to be a small pullback within an ongoing upwards trend.

The next short term target is about 2,878; a consolidation lasting about one to two weeks may be expected at about this target. Following that, another consolidation lasting about two weeks may be expected about 2,915.

The invalidation point may now be moved up to the last swing low at 2,691.99.

The mid to longer term target is at 2,922 (Elliott wave) or 3,045 (classic analysis). Another multi week to multi month correction is expected at one of these targets.

The final target for this bull market to end remains at 3,616.

Pullbacks are an opportunity to join the trend.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

ELLIOTT WAVE COUNT

WEEKLY CHART

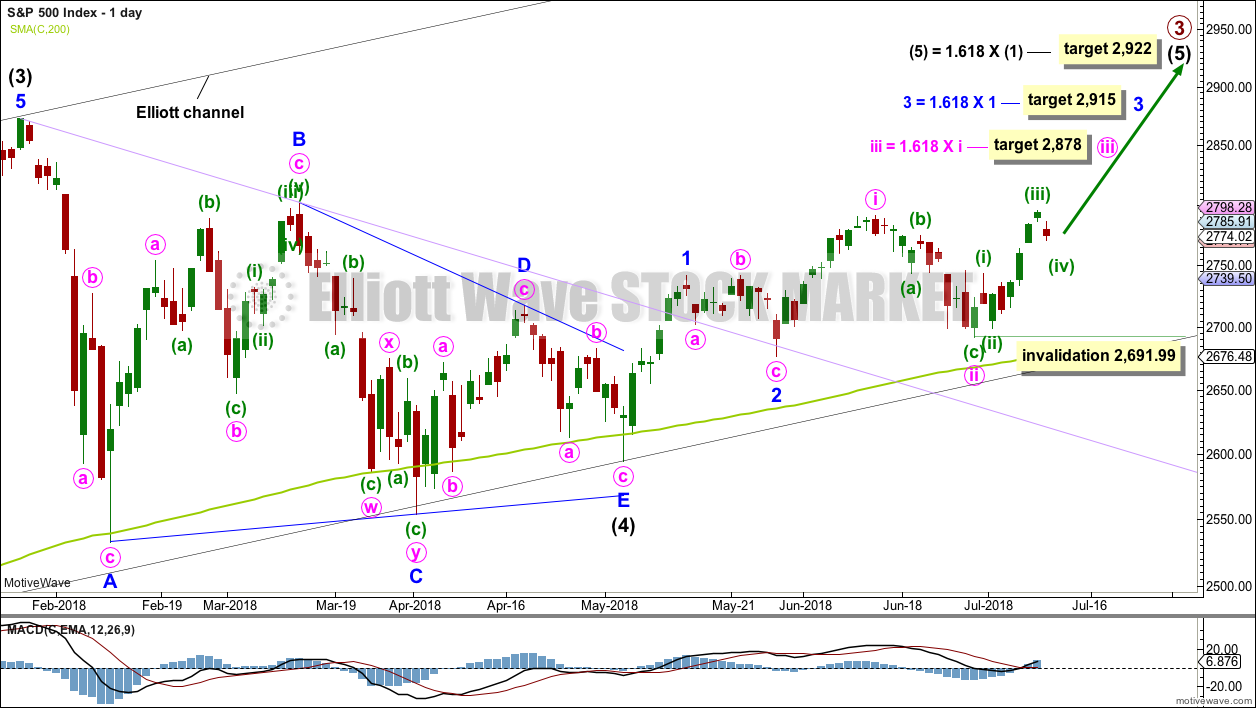

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62.

At this stage, the expectation is for the final target to me met in October 2019.

A multi week to multi month consolidation for primary wave 4 is expected on the way up to the final target.

DAILY CHART

It is possible that intermediate wave (4) is a complete regular contracting triangle, the most common type of triangle. Minor wave E may have found support just below the 200 day moving average and ending reasonably short of the A-C trend line. This is the most common look for E waves of triangles.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

Price has clearly broken out above the upper triangle B-D trend line. This indicates that it should now be over if the triangle is correctly labelled.

A trend line in lilac is added to this chart. It is the same line as the upper edge of the symmetrical triangle on the daily technical analysis chart. Price found support about this line.

A target is now calculated for minute wave iii to end, which expects to see the most common Fibonacci ratio to minute wave i. Minute wave iii may last about two to three weeks. When it is complete, then minute wave iv may last about one to two weeks in order for it to exhibit reasonable proportion to minute wave ii. Minute wave iv must remain above minute wave i price territory.

So far minute wave iii may now have just passed its middle, the strongest portion. Within minute wave iii, no second wave correction may move beyond the start of its first wave below 2,691.99.

A target is calculated for minor wave 3 to end, which expects to see the most common Fibonacci ratio to minor wave 1. Minor wave 3 may last several weeks in total and should look like an impulse at the daily chart level. When it is complete, then minor wave 4 may last about one to two weeks in order for it to exhibit reasonable proportion to minor wave 2. Minor wave 4 must remain above minor wave 1 price territory.

The last bullish fifth wave of minor wave 5 to end intermediate wave (3) exhibited commodity like behaviour. It was strong and sustained. It is possible that the upcoming wave of minor wave 5 to end intermediate wave (5) to end primary wave 3 may exhibit similar behaviour, so we should be on the lookout for this possibility.

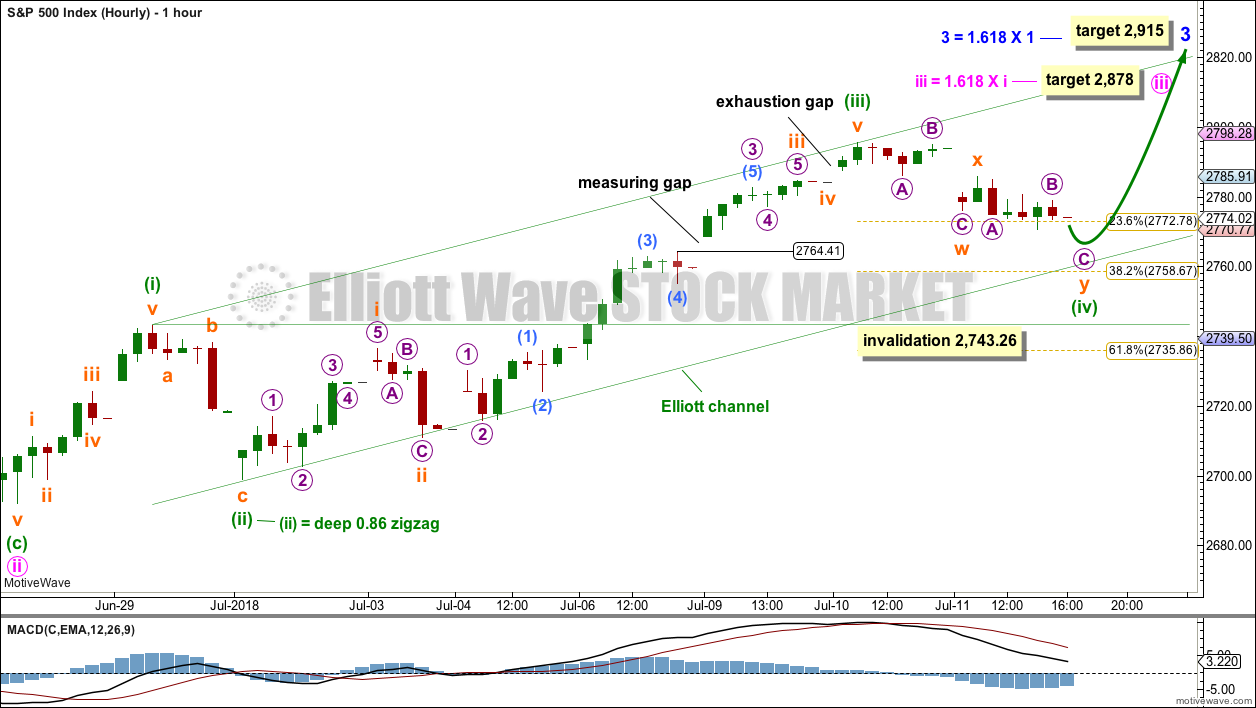

HOURLY CHART

Due to bearish indications from the AD line and VIX today, along with support today from volume for downwards movement, it is possible now that minuette wave (iii) could be over at yesterday’s high. This relabelling also fits with channels; the channel is now redrawn about minute wave iii using Elliott’s first technique.

If the last two gaps are correctly labelled, then the measuring gap may offer support and may remain open.

Minuette wave (iii) exhibits no Fibonacci ratio to minuette wave (i), but it is longer than 1.618 the length of minuette wave (i).

Minuette wave (ii) was a deep double zigzag. Given the guideline of alternation, minuette wave (iv) would most likely be a shallow flat, combination or triangle. So far it looks like it may be an almost complete combination: flat – X – zigzag. Subminuette wave y may end about the same level as subminuette wave w, or not much lower. About 2,766 subminuette wave y would reach equality in length with subminuette wave w, and it may be about this point that minuette wave (iv) may find support at the lower edge of the green Elliott channel.

Minuette wave (iv) may not move into minuette wave (i) price territory below 2,743.26.

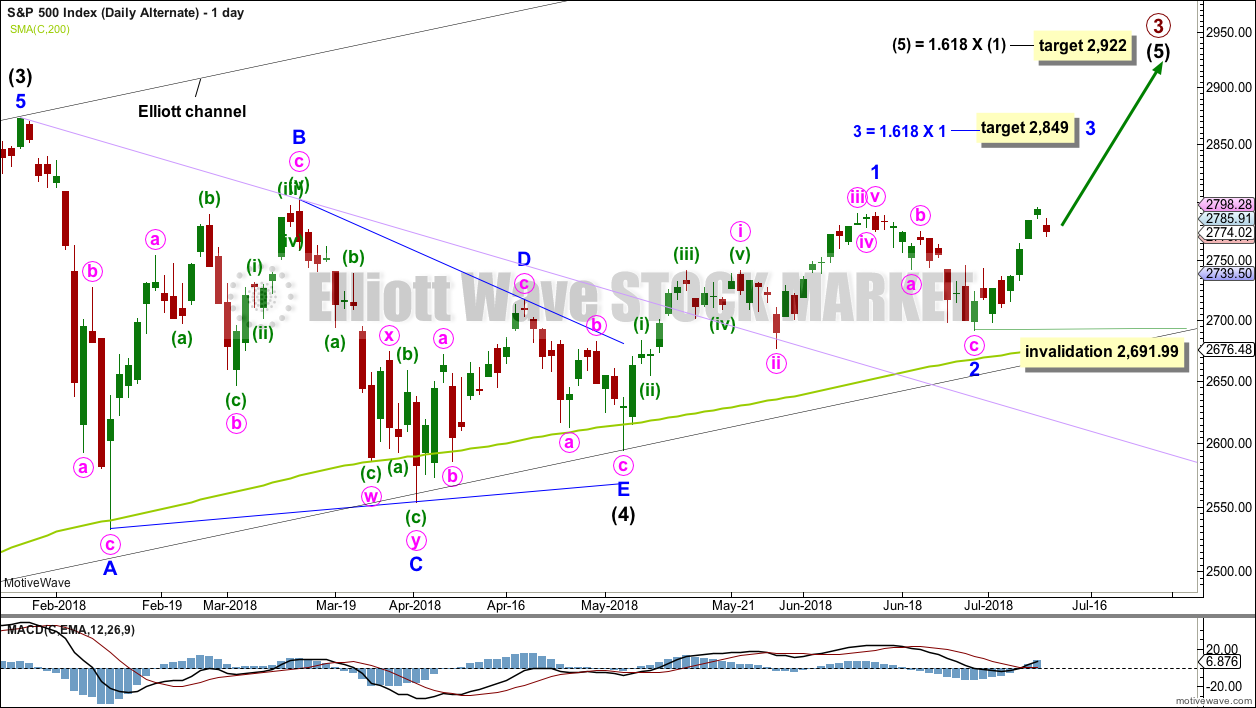

ALTERNATE DAILY CHART

It is possible that minor wave 1 may have been over at the last high. Minor wave 3 may be in its very early stages.

At the daily chart level, this wave count does not have as good a look as the main wave count. Minor wave 1 has a three wave look, but it should look like a five. However, this market does not always have fives that look perfectly like fives, so this possibility should still be considered.

TECHNICAL ANALYSIS

WEEKLY CHART

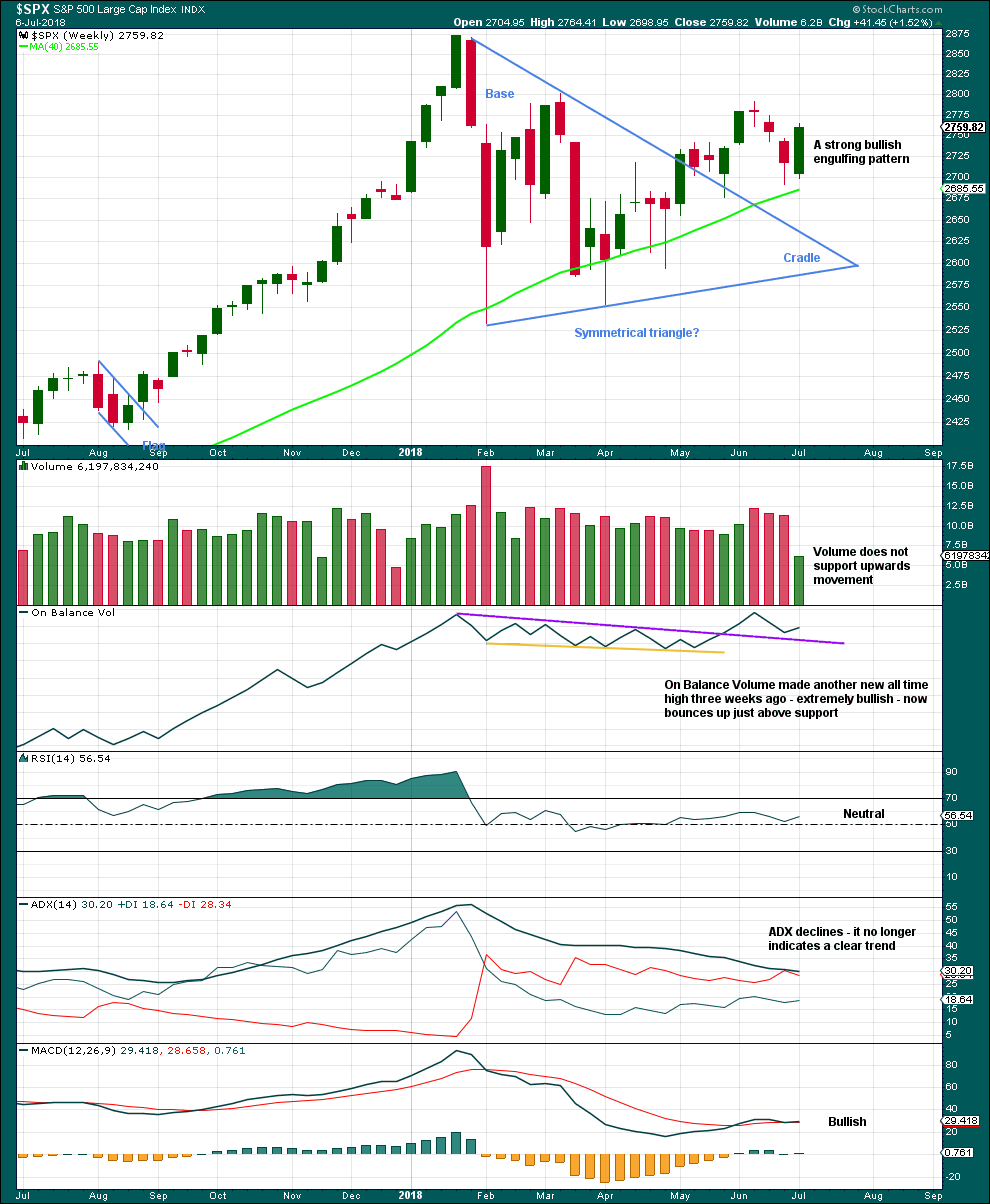

Click chart to enlarge. Chart courtesy of StockCharts.com.

After two weeks of falling price, a strong candlestick reversal pattern on the weekly chart is very bullish.

The lack of volume last week is not of a concern, because it was a short week with one and a half days closed to trading for the 4th of July holiday. We have to look inside the week at daily volume bars to judge the short term volume profile.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete. The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. This is the definition of an upwards trend. But trends do not move in perfectly straight lines; there are pullbacks and bounces along the way. While price has not made a lower low below the prior swing low of the 29th of May, the view of a possible upwards trend in place should remain.

The measuring gap gives a short term target at 2,838. The target will remain valid while this gap remains open.

Recent new all time highs from On Balance Volume at the daily chart level is extremely bullish and should be given weight in this analysis. This adds confidence to the Elliott wave count.

Support today from volume for downwards movement suggests another downwards day tomorrow. Look for support at the measuring gap.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in timing the end of primary wave 3.

At this stage, at this time frame, there are no short or mid term signals from divergence between inverted VIX and price.

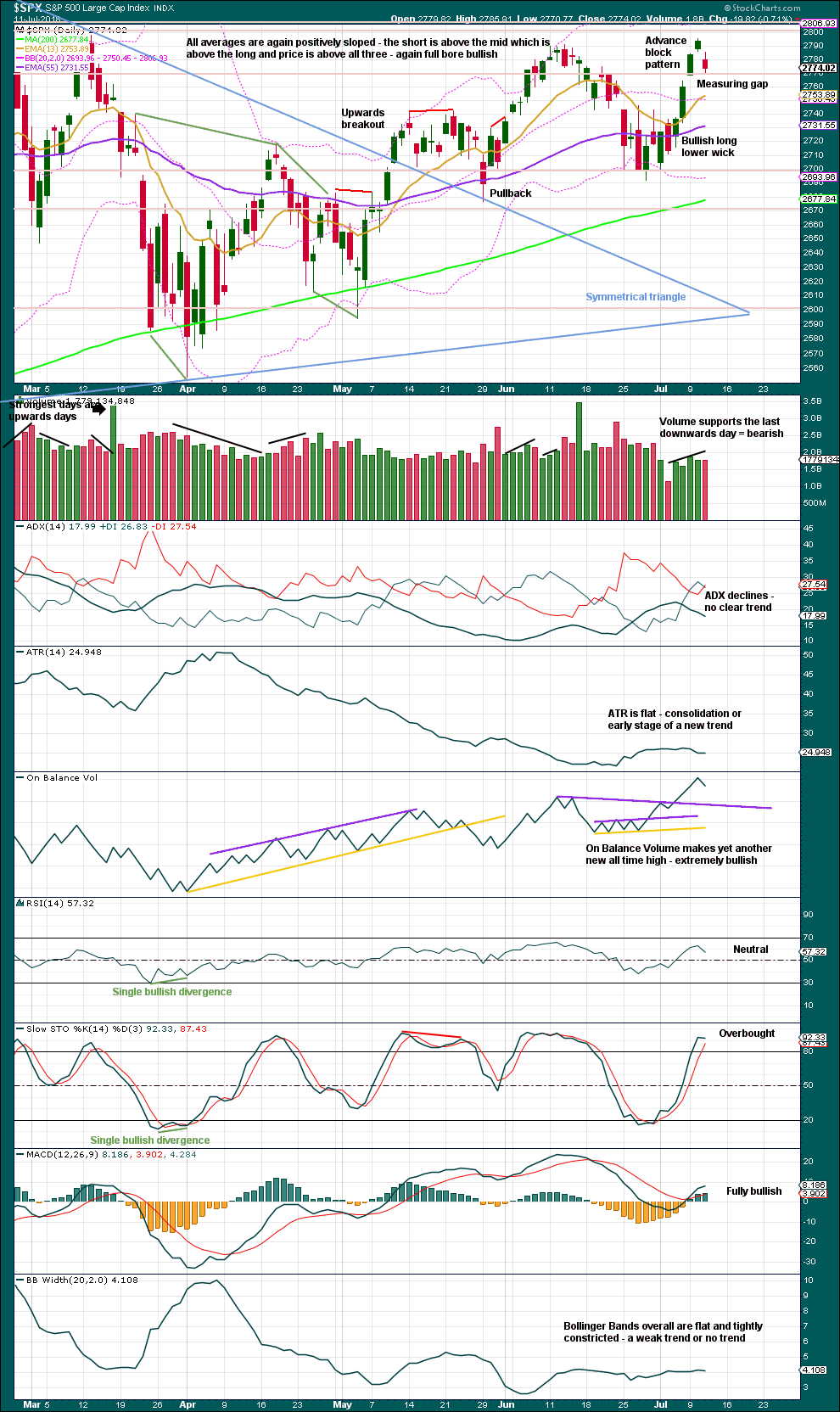

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is mid term bearish divergence between price and inverted VIX: inverted VIX has made a new swing low below the prior swing low of the 29th of May, but price has not. Downwards movement has strong support from increasing market volatility; this divergence is bearish. However, it must be noted that the last swing low of the 29th of May also came with bearish divergence between price and inverted VIX, yet price went on to make new highs.

This divergence may not be reliable. As it contradicts messages given by On Balance Volume and the AD line, it shall not be given much weight in this analysis.

Inverted VIX has made a new low below the low three sessions prior, but price has not. This divergence is bearish for the short term and may be resolved by one more downwards day.

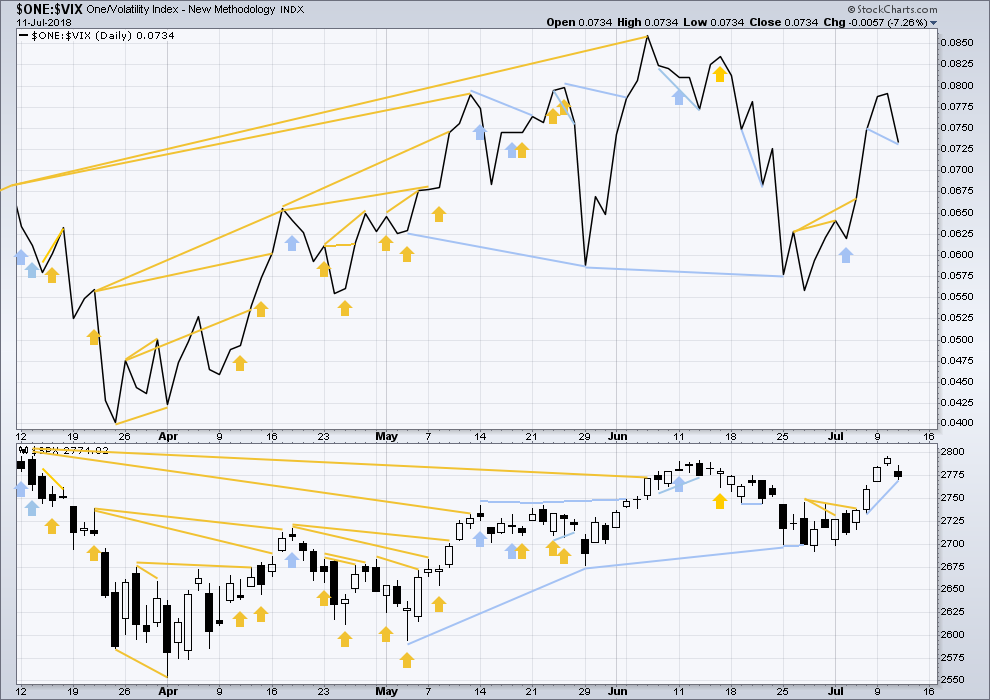

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

At this stage, there is very strong bullish divergence between price and the AD line at the weekly time frame. With the AD line making new all time highs, expect price to follow through with new all time highs in coming weeks.

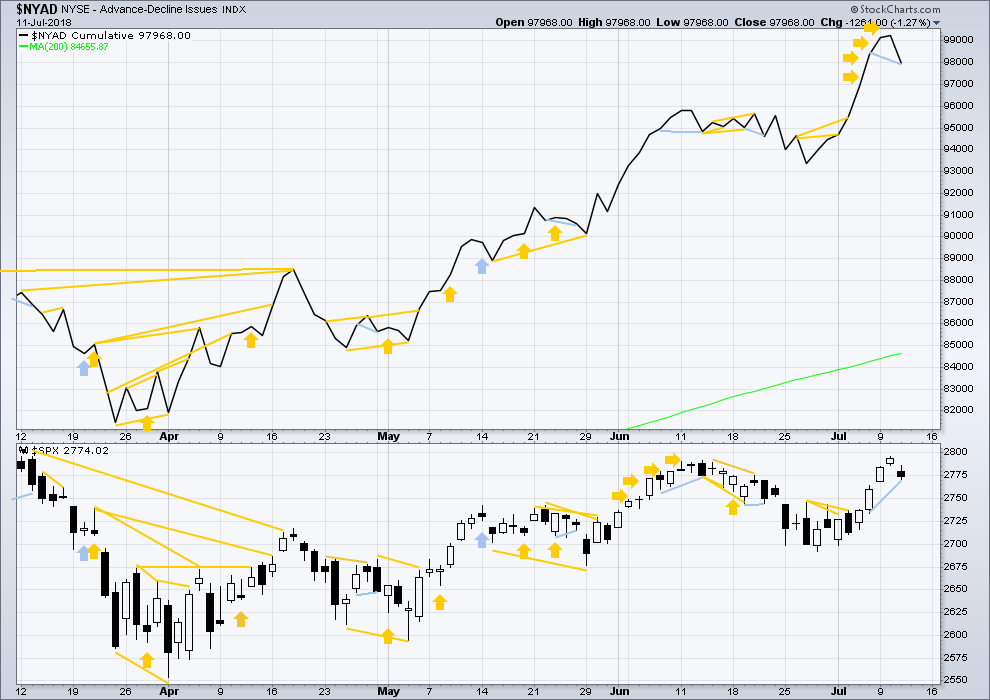

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

All of small, mid and large caps have moved higher last week. Small caps have made new all time highs as recently as 20th of June. The small caps may be leading the market as they tend to in the latter stages of an ageing bull market.

Breadth should be read as a leading indicator.

The AD line has made a new low below the low three sessions prior, but price has not. This divergence is bearish for the short term and may be resolved by one more downwards day.

Overall, recent new all time highs from the AD line remain extremely bullish for the longer term trend.

Price may reasonably be expected to follow through in coming weeks.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Only Nasdaq at this stage is making new all time highs. DJIA and DJT need to make new all time highs for the ongoing bull market to be confirmed.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 08:36 p.m. EST.

minuette (iv) was over already, still labelled as a double combination.

now for the end of minute wave iii. at 2,822 minuette (v) would reach equality in length with minuette (i). that should now be our first target for minute iii to end.

if price keeps rising through 2,822 then we can use the second target at 2,878

in my comment to Verne below, I’m going to take a look at the strength or weakness of today’s upwards move

if there’s reasonable weakness I’ll consider it could be a B wave

but if there’s strength I’ll discard the idea

I guess they are going to move the fracas to the futures market. It should be a most interesting evening. Cheerio! 🙂

That pump at 3:24 was insane. These idiots a scared silly.

Amazing weekly divergences at these new NDX highs…!

If we get a turn today, VIX should gap higher as smart money front runs the move…

Lotsa fur flying as they go at it over 2800.00, lol!

There is gonna be some PAIN for the looser, haha! 🙂

GS breaking a down trend line in place since early March! I’d prefer a decent bounce, but more backing and filling may occur. Earnings coming up…

Note that when (I don’t think it’s “if”) sector rotation back into financials starts up again, that might put jet packs on SPX.

And vice versa. XLF has pinged almost 5 times on a bottom; if it goes, there could be a very large sell off. But if some bank reports are viewed positively, watch for financials to start ripping.

ES facing formidable resistance at 2800.00 pivot. Two prior visits were rejected.

Third time the charm??! 🙂

Doji on ES 15 min.

If significant, we get a green VIX in short order.

Another huge bankster day Verne, covered IWM short around 10am, reloading now and QQQ. I’ve got negatively diverging momentums all over the place.

Yep! They are hard at work indeed!

Waiting for a green VIX to snag me some serious booty!! 🙂

Hey Verne,

What are you using to play VIX ?

I have not been trading it directly of late. I just use its price action for other short entries.

Caution: obviously the iv wave is over. However, the v wave up could now be over as well!! What I hate about v waves: they only HAVE TO get beyond the top of the iii to complete. And this one has. That said, I think the likely completion target is 2819 at the 1.28% (derived) fibo, and then the next higher degree iv wave will start. But that higher degree iv wave COULD start anytime now!

We could be completing the B wave of a flat. B waves are notorious “sucker” waves!

🙂

True. Unlikely, but true. Dare I say, “the Force is strong with this one!”.

Huge volume pocket overhead; above the March pivot high at 2803 is only 2 weeks of price activity. You don’t think there’s any stop orders sitting right above the 2800-2805 zone do you? Lol!!!! That’s tinder waiting to be burned. Or it sells off here again. FOR SURE it’s not sitting still at the 2795-2800 zone for long. Down to regroup before trying again…or up and through in blaze of glory in fairly short order. We’ll see!

I’ll be considering that at the close of the session. If there’s reasonable weakness within it, then it may be a B wave.

But if there’s strength, particularly from volume, then I’ll discard the idea.

Oil (/CL) is in a nice pullback in a secular uptrend. It’s come to a cluster of fibo’s and could turn here, or it may go to the next (and arguably more significant) fibo’s in the 67.3-67.9 range. I’m watching carefully for a turn off one of these, and will look to GUSH to generate a little coin off it.

A move down to complete wave four should cut the price of SPY 276 calls expiring tomorrow by better than half. Opening stink bid to buy at limit price of 1.10 or better….speculative trade…

The C wave down of four should hold above 2750 before the fifth wave up.

We could be at one degree higher….possibly…. 🙂

I expect this gap open to be filled….

Not today it appears, rabbit!

That’s Mr. Wabbit to you Doc…

while I’m mildly hopeful this turns into an up trend day…it reminds me of the start of the prior 2 wave, which started “small” and with indications of done…only to sell deeper, jack up again, sell deeper, jack up again…what, 3 or 4 times?

I do note that on the SPX daily, the bars are continuing to ride on top of the 5 period EMA, which tells me that this larger wave up is NOT complete and could go a lot farther. A significant turn here isn’t really well lined up with our count. I still see 2819 just up ahead, despite my mild healthy paranoia.

this (spx daily). The heavy white EMA is the 5 period.

Lara, great summary.

Clear, concise with targets and generic timelines.

thank you very much Davey!