The session began with a new high and then continued overall sideways to close as a doji.

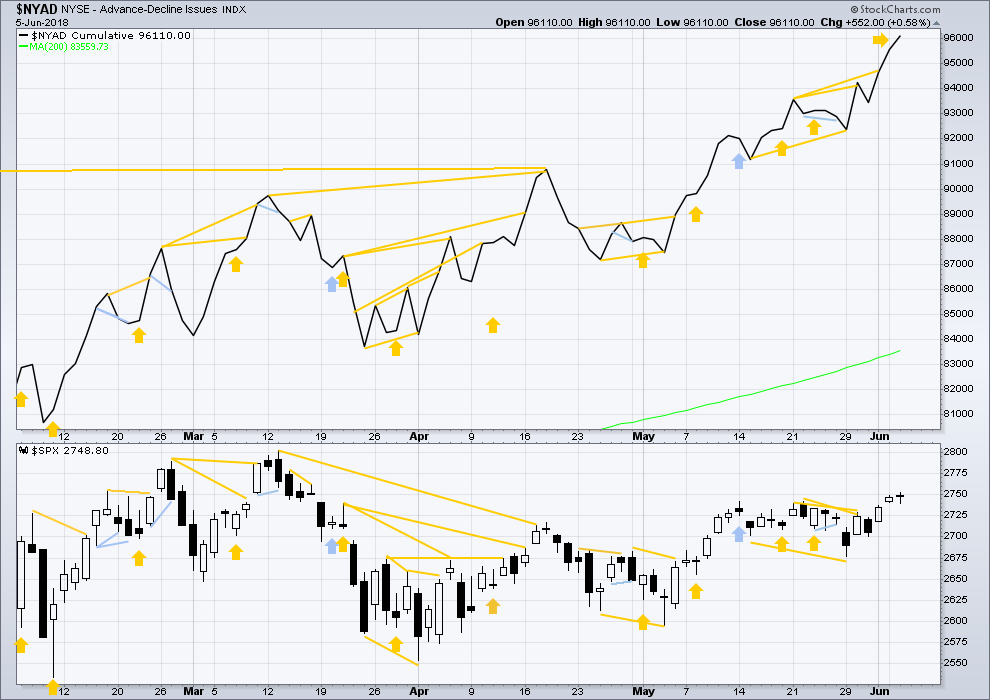

The AD line gives another strong signal today.

Summary: The short term target is at 2,824 or 2,915. The mid to longer term target is at 2,922. The final target for this bull market to end remains at 3,616.

The Elliott wave count has good support from classic technical analysis.

Pullbacks are an opportunity to join the trend. An upwards trend is expected to be developing.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

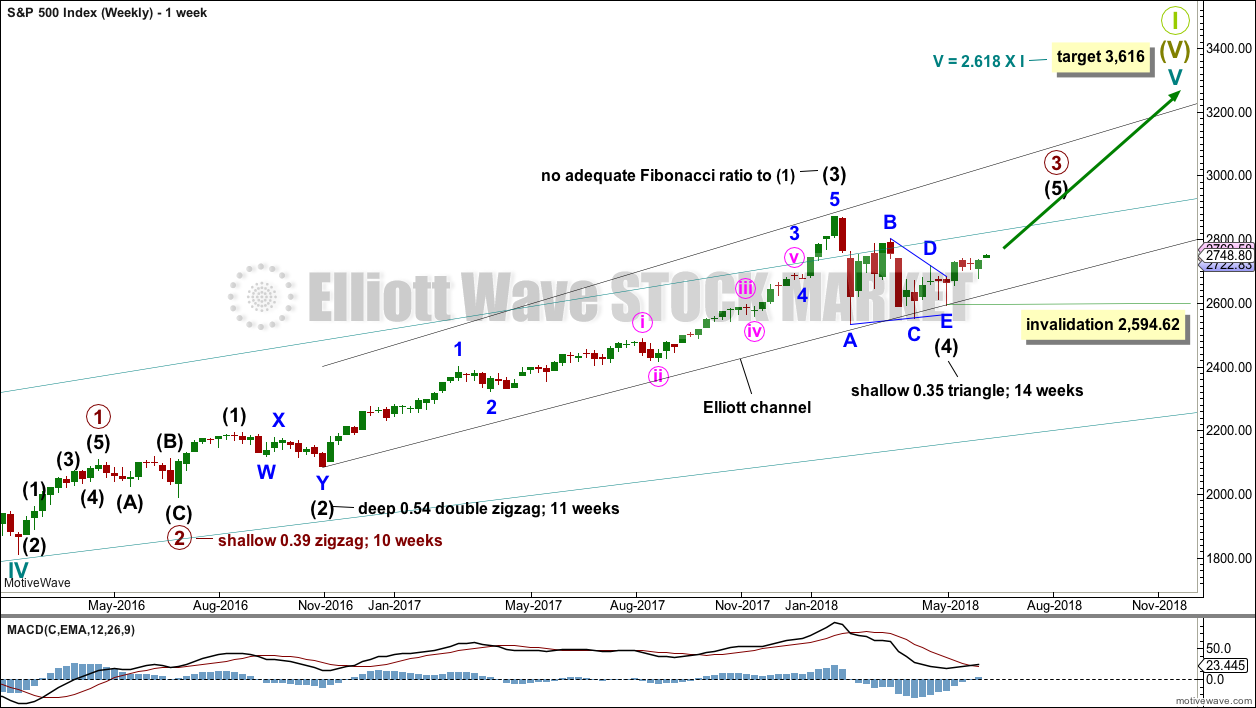

ELLIOTT WAVE COUNT

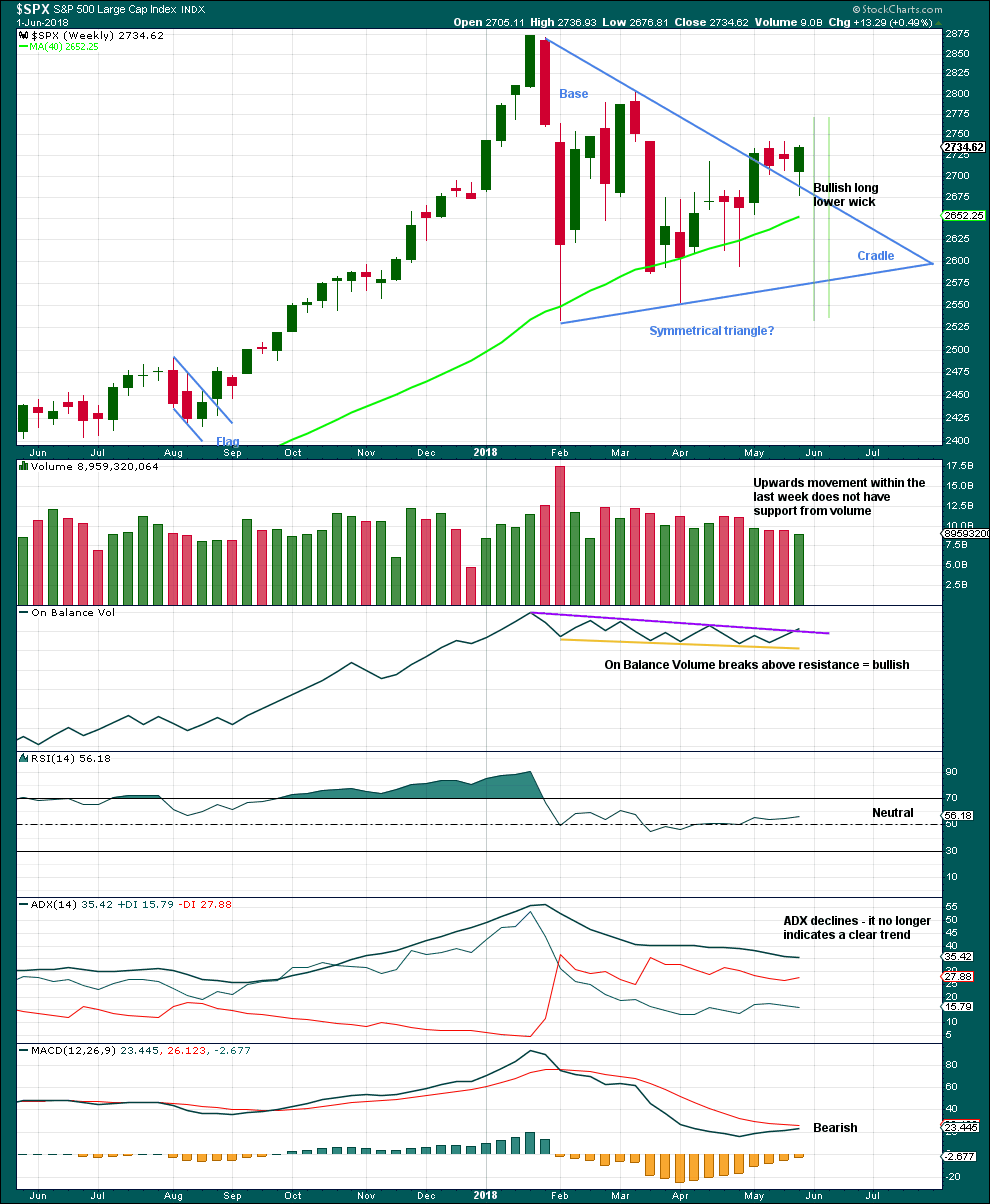

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

If intermediate wave (4) were to continue further as either a flat or combination, both possibilities would require another deep pullback to end at or below 2,532.69. With both On Balance Volume and the AD line making new all time highs, that possibility looks extremely unlikely.

If intermediate wave (4) were to continue further, it would now be grossly disproportionate to intermediate wave (2). Both classic technical analysis and Elliott wave analysis now suggest these alternate ideas should be discarded based upon a very low probability.

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62.

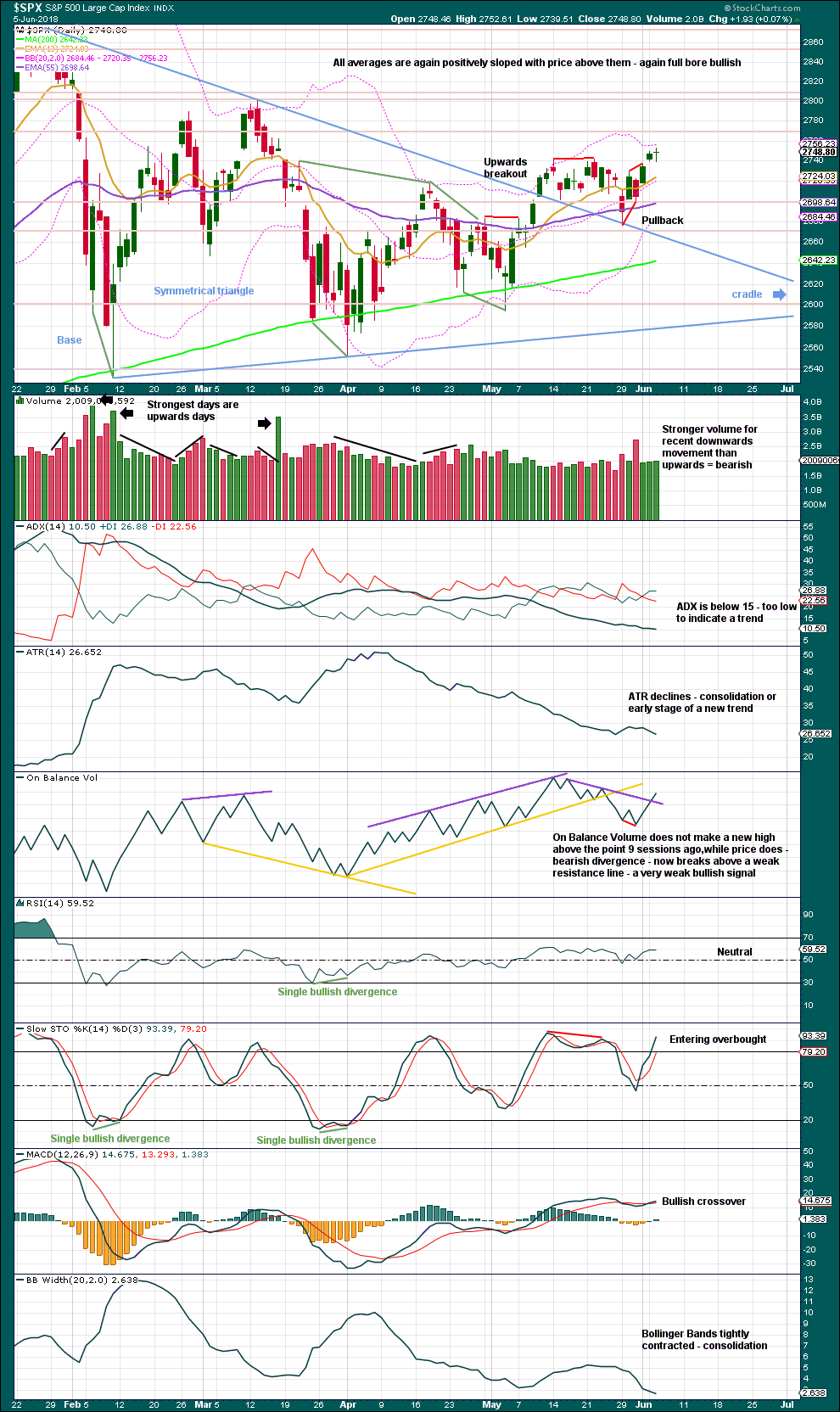

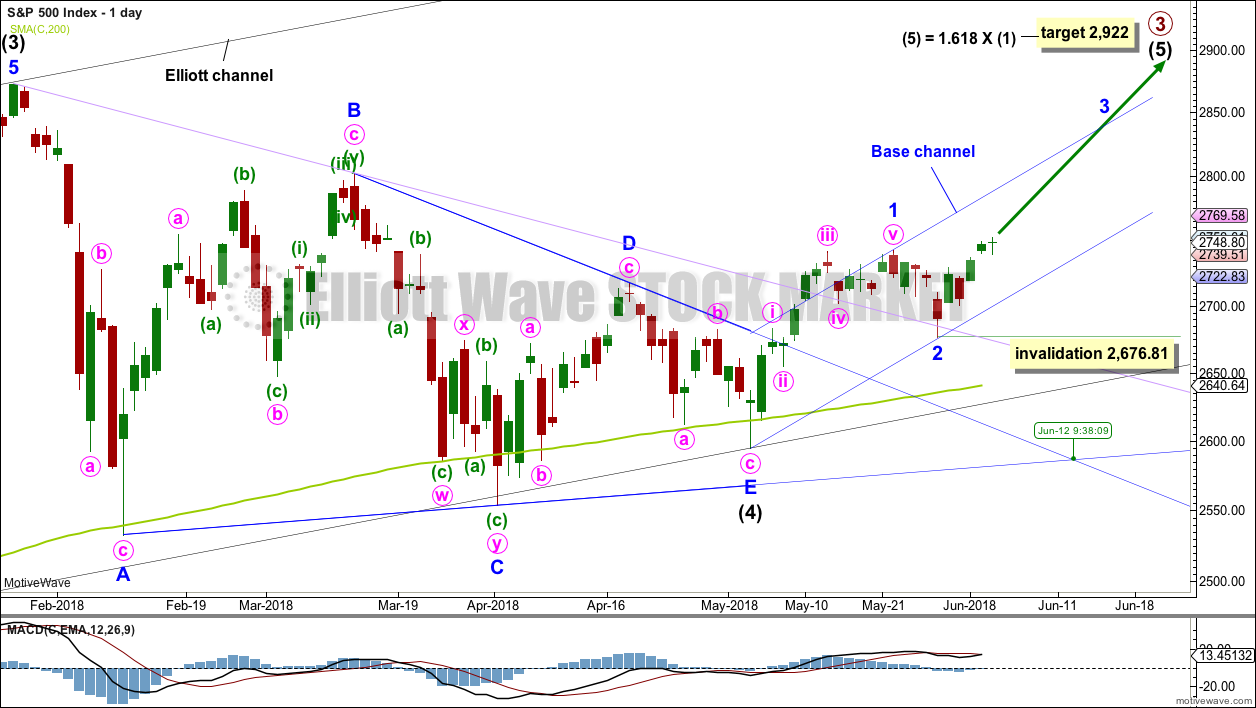

DAILY CHART

It is possible that intermediate wave (4) is a complete regular contracting triangle, the most common type of triangle. Minor wave E may have found support just below the 200 day moving average and ending reasonably short of the A-C trend line. This is the most common look for E waves of triangles.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

Price has clearly broken out above the upper triangle B-D trend line. This indicates that it should now be over if the triangle is correctly labelled.

A trend line in lilac is added to this chart. It is the same line as the upper edge of the symmetrical triangle on the daily technical analysis chart. Price has found support about this line at the last two small swing lows. The suppport at this line has reasonable technical significance now that it has been tested twice, and this line should be assumed to continue to provide support until proven otherwise.

Sometimes the point at which the triangle trend lines cross over sees a trend change. A trend change at that point may be a minor one or a major one. That point is now about the 12th of June.

Minor wave 3 may only subdivide as an impulse, and within it the subdivisions of minute waves ii and iv may show up as one or more red daily candlesticks or doji.

Within minor wave 3, no second wave correction may move beyond the start of its first wave below 2,676.81. Along the way up, any deeper corrections may now find support at the lower edge of the base channel drawn about minor waves 1 and 2.

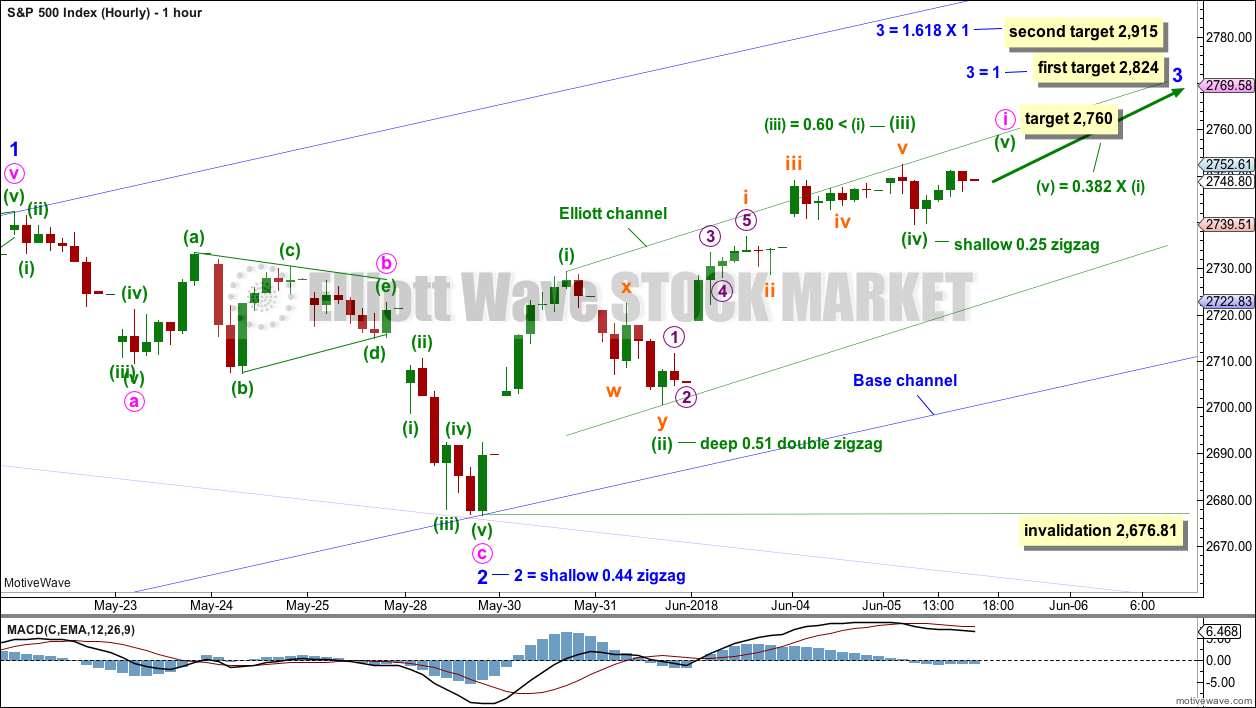

HOURLY CHART

Minor wave 2 may be a complete zigzag. There is no adequate Fibonacci ratio between minute waves a and c.

The daily chart is on a semi-log scale. This hourly chart is on an arithmetic scale, and this is why the lilac trend line sits slightly differently on each chart. On this hourly chart, price perfectly found support at the lilac trend line. Minor wave 2 ends with a strong bullish engulfing candlestick pattern.

Copy the base channel over from the daily chart. Use the lower edge as final support for any deeper corrections along the way up towards the end of minor wave 3.

Minor wave 2 was relatively shallow, less than 0.5 of minor wave 1. Look out for corrections now within minor wave 3 to possibly be more shallow than otherwise expected.

Two targets are given for minor wave 3 to end, and both fit with the higher target for primary wave 3 to end on the daily chart. If price keeps on rising after the first target has been reached, or the structure is incomplete, then the second target will be used.

The degree of labelling within minor wave 3 is moved down one degree today. It may be that within minor wave 3 only minute wave i is coming towards an end. A target is calculated for it to end.

Within minute wave i, between minuette waves (ii) and (iv) there is inadequate alternation in structure but very good alternation in depth.

When minute wave i is complete, then minute wave ii may not move beyond its start below 2,676.81. Minute wave ii may be relatively shallow, but it should find support at the blue base channel if it gets that low.

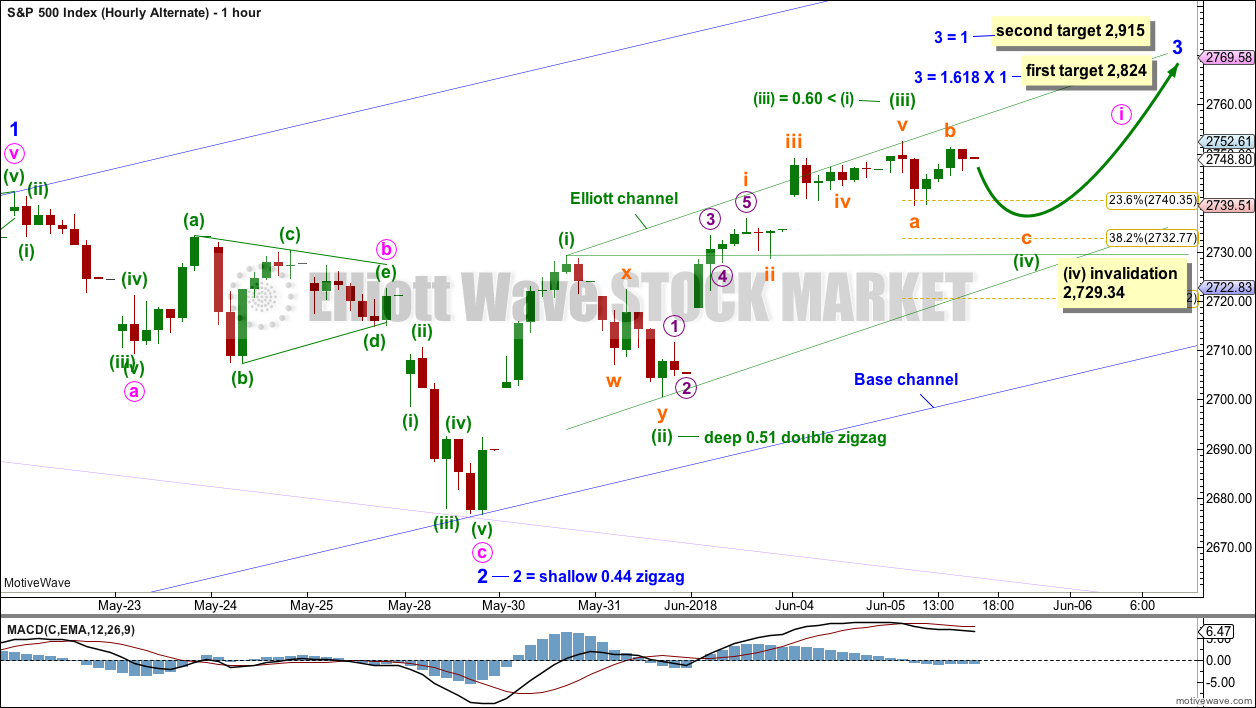

ALTERNATE HOURLY CHART

Within minute wave i, it is also possible that minuette wave (iv) is not over and may continue sideways for another one to very few sessions as a flat, combination or triangle. Most of these structural options are sideways types of corrections, with the exception of an expanded flat which could see minuette wave (iv) move lower towards the 0.382 Fibonacci ratio.

If minuette wave (iv) continues sideways, then it would have better proportion to minuette wave (ii) and would exhibit better alternation.

Only another new all time high today from the AD line gives me cause to judge this alternate wave count as slightly less likely.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

From Dhalquist and Kirkpatrick on trading triangles:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout.”

For this example, the breakout may have now happened. There was a high trading range within the triangle, but volume declined. Last week may be the end of the pullback, with a long lower wick slightly overshooting the triangle trend line.

The bullish signal from On Balance Volume Last week is reasonable, but really does need to be clearer for confidence. If this week continues upwards, it would be clear and then should be given reasonable weight.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete, and price has completed an upwards breakout. There may be some small cause for concern that the upwards breakout does not have support from volume. However, in current market conditions only some small concern is had here. Rising price on light and declining volume has been a feature of this market for years, yet price continues to rise.

After an upwards breakout, pullbacks occur 59% of the time. The pullback looks typical. With price now moving up and away from the line, it does look like the pullback may have been over last week.

On Balance Volume made a new all time high on the 14th of May at the daily chart level. This signal remains overall very bullish.

The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

The short term volume profile remains slightly bearish, but in current market conditions this will not be given much weight in this analysis. On Balance Volume moved higher today with price, but it has not yet made a new high above the prior high of the 14th of May or the 22nd of May, yet price has again done so. With On Balance Volume lagging, this is still a short term bearish signal.

The bullish signal from On Balance Volume is weak because this line has only two anchor points and is not very long held.

Stochastics may remain overbought for a reasonable period of time during a bull trend for this market.

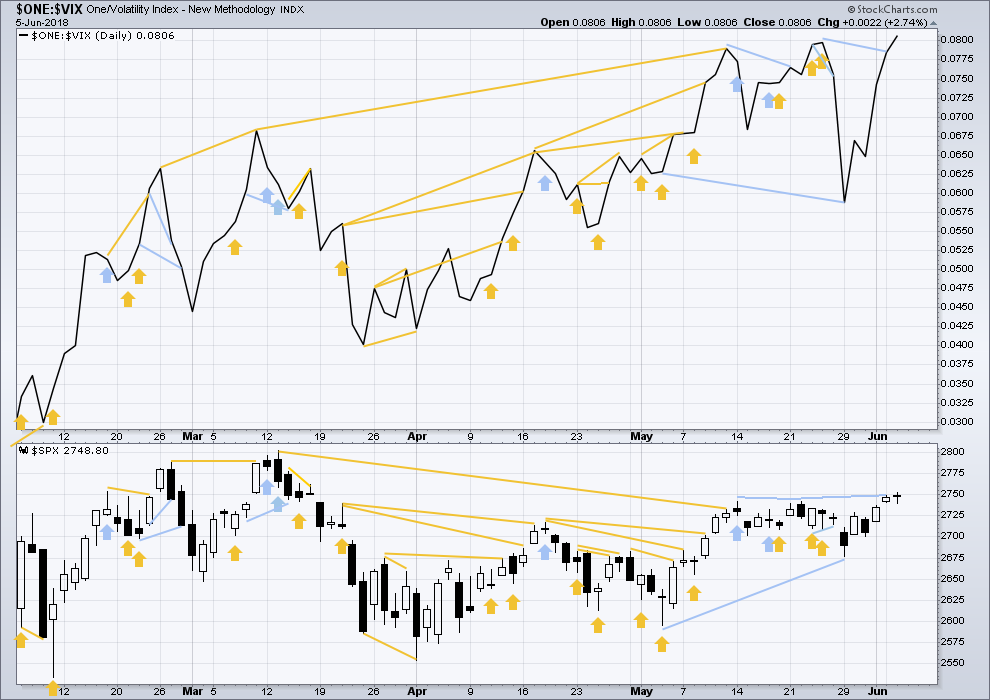

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Bearish divergence noted in last analysis has now disappeared; it was not followed by a downwards day, so it may have failed. There is no new divergence; both price and inverted VIX moved higher, and both have now made highs above the prior closest swing highs.

Inverted VIX has still not made a new high above its prior all time high of the 3rd of January.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Small caps have made another new all time high, but mid and large caps have yet to do so. This divergence may be interpreted as bullish. Small caps may now be leading the market.

Breadth should be read as a leading indicator.

The AD line is daily making new all time highs. This is a very bullish signal and will be given the most weight in today’s analysis. Price is likely to follow within days or a very few weeks.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

At this stage, only DJIA has made a new major swing low. DJT also needs to make a new major swing low for Dow Theory to indicate a switch from a bull market to a bear market. For an extended Dow Theory, which includes the S&P500 and Nasdaq, these two markets also need to make new major swing lows.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 09:24 p.m. EST.

Updated hourly chart:

With the increased slope of this upwards movement I’m changing the wave count at the hourly chart level today.

The middle of the third wave may be upon us.

Ka-Ching! Good news to my ears, Lara.

I am leaning towards Kevin’s thought of a slow grind forward and upwards. The daily SPX is above the BB. So we can expect another correction or stall in the next few days to let the BBs catch up. At some point the “Afraid of Missing Out” crowd will go long again. That will provide some more buying strength.

Yes, I think we’re back to that low ATR and low VIX environment. A steady grind higher, with small corrections along the way up to end primary wave 3.

SPX tracking my (slowest) prior move speed line. 2770 is a symmetric move projection that could turn this market, then lots of symmetric move resistance and 78% fibo around 2800.

The bull is on the move again. I suspect (though one can never be certain!) that the market “mode” is now back to the 2017 standard of extremely low volatility and steadily grinding higher (in general). The wild whippy market we kind of have grown to expect over the last 6 months…no more for now. And the VIX spikes will be much smaller, and I won’t be surprised by VIX below 10 again fairly soon.

Yeah Kevin, you’re not wrong with your 2017 reference. VIX shorts are back to a similar magnitude as last year, and what’s most interesting is the smart money index highlights extraordinary outflows, yet as we are speaking to major institutional allocators, hedge funds, etc most have done an about face from last year, bullish to hyper-bearish. As a contrarian, I have to take the other side to some degree. Everything my firm does and I do personally is very short term and hedged, so all I prefer is volatility. I do think a new high is in the cards, but I’m personally allocating heavy to VIX due to transport non-confirmation and topping formations in NASDAQ and Russell. Point being I think a large 2nd wave is required to build momentum enough to make a new high. Just my half cent.

Valuable insights, thank you Chris.

You’re most welcome. It is very important not to ignore countries and currencies entering huge bear markets, and be very mindful the clock is ticking. Despite all the tom-foolery we can all see from the banskters, see the patterns of gap up sell offs to 10-11am lows, then ramp in a rising wedge, they ultimately will stop and the structural and fundamental global problems, that were not solved in 08-09 will come back swiftly and with mucho vengeance. BTW Kevin PM looks interesting here….

Good insights, Chris. Very helpful. Thank you!

Long at the moment, but staying really nimble…

Verne, VIX calls holding…going to full position (not trading advice)

Haha! I was bug-eyed that my stink-bid got filled and went to check and saw an 11.73 low today! Can you believe it? Got another 50% pop on that one.

Re-opened stink bid. This time even stinkier! 🙂

The Commercial COT position not budging at over 500K net short E-minis….

I can’t believe I’m continuing to say I’m shocked, but it’s been two years. I certainly don’t mind the opportunity to go huge long at these levels.

I am now sitting on my largest long vol position in quite some time….Yikes!

I am assuming those Commercial guys are smarter than I am! 🙂