Yesterday’s main hourly Elliott wave count expected a low was in place and price should move higher the following session. This is so far exactly what is happening.

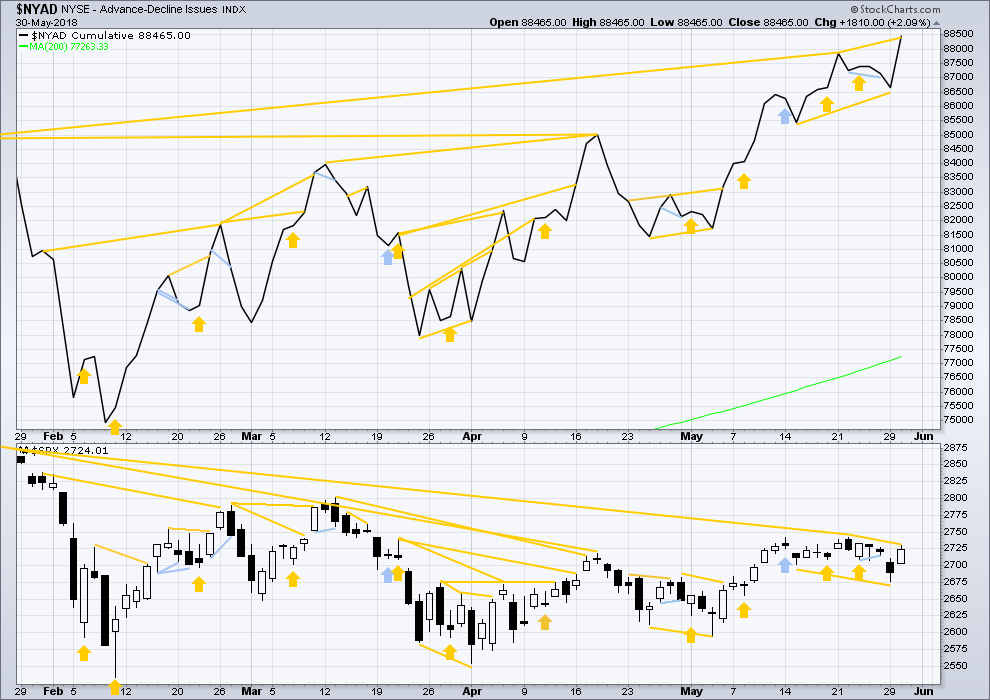

The AD line gives a very important signal today, which should not be ignored and will be given weight in this analysis.

Summary: The short term target is at 2,824 or 2,915. The mid to longer term target is at 2,922. The final target for this bull market to end remains at 3,616.

Another new all time high from the AD line today, which moved strongly higher, adds confidence to this analysis.

Pullbacks are an opportunity to join the trend. An upwards trend is expected to develop, which has very strong support from new all time highs from the AD line and On Balance Volume.

The long to mid term Elliott wave target is at 2,922, and a classic analysis target is now at 3,045.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

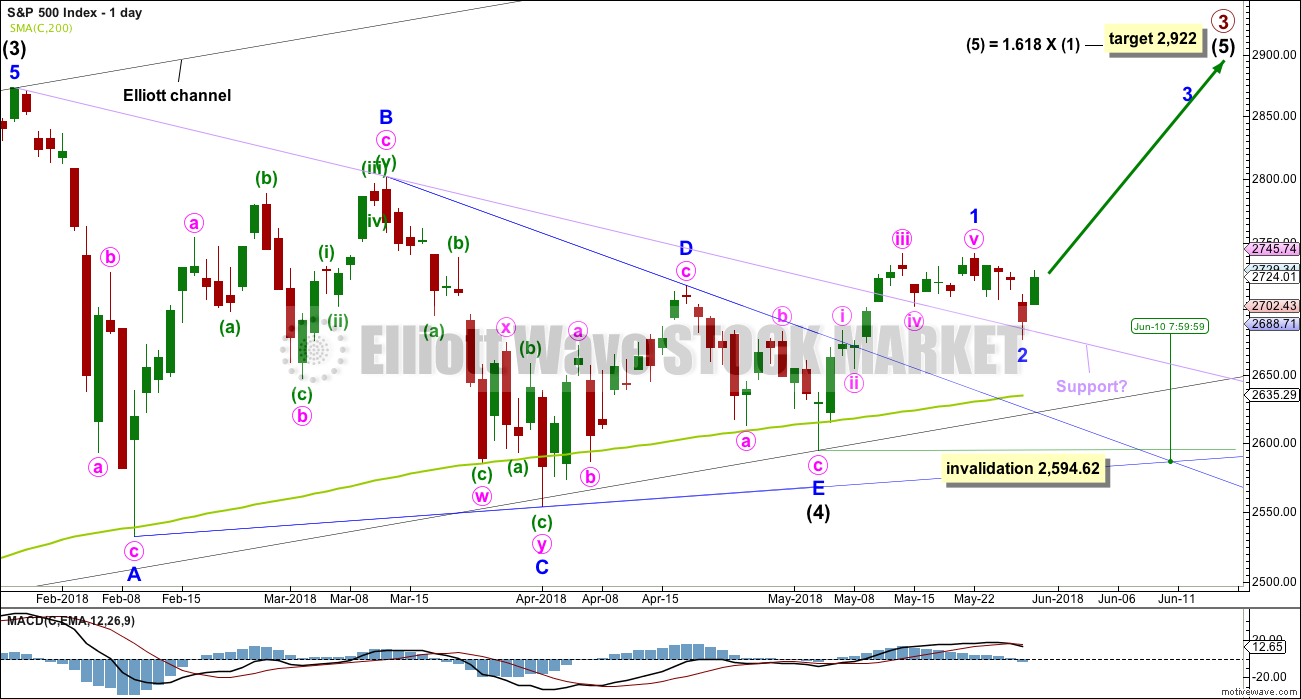

ELLIOTT WAVE COUNT

WEEKLY CHART

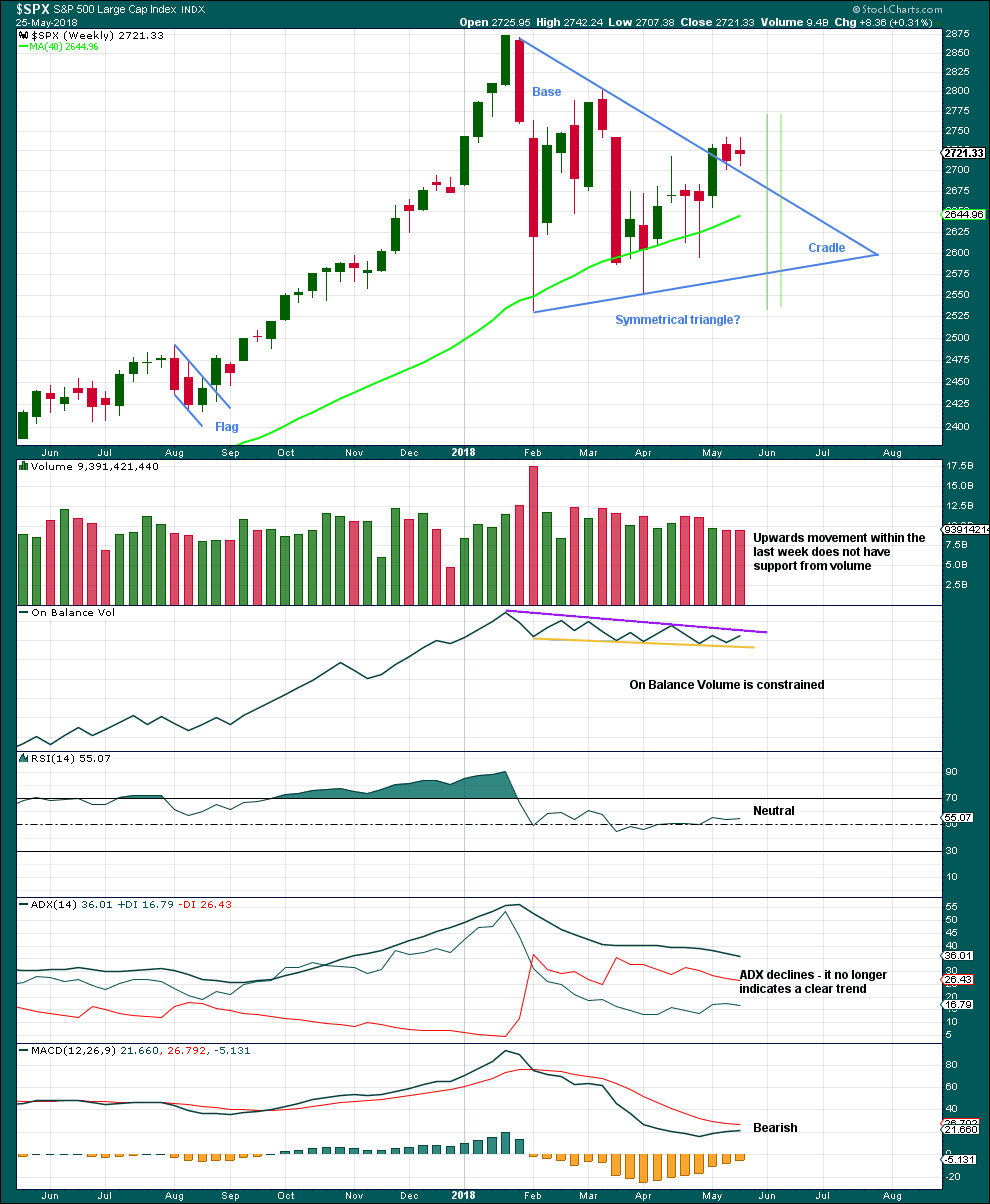

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

If intermediate wave (4) were to continue further as either a flat or combination, both possibilities would require another deep pullback to end at or below 2,532.69. With both On Balance Volume and the AD line making new all time highs, that possibility looks extremely unlikely.

If intermediate wave (4) were to continue further, it would now be grossly disproportionate to intermediate wave (2). Both classic technical analysis and Elliott wave analysis now suggest these alternate ideas should be discarded based upon a very low probability.

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62.

DAILY CHART

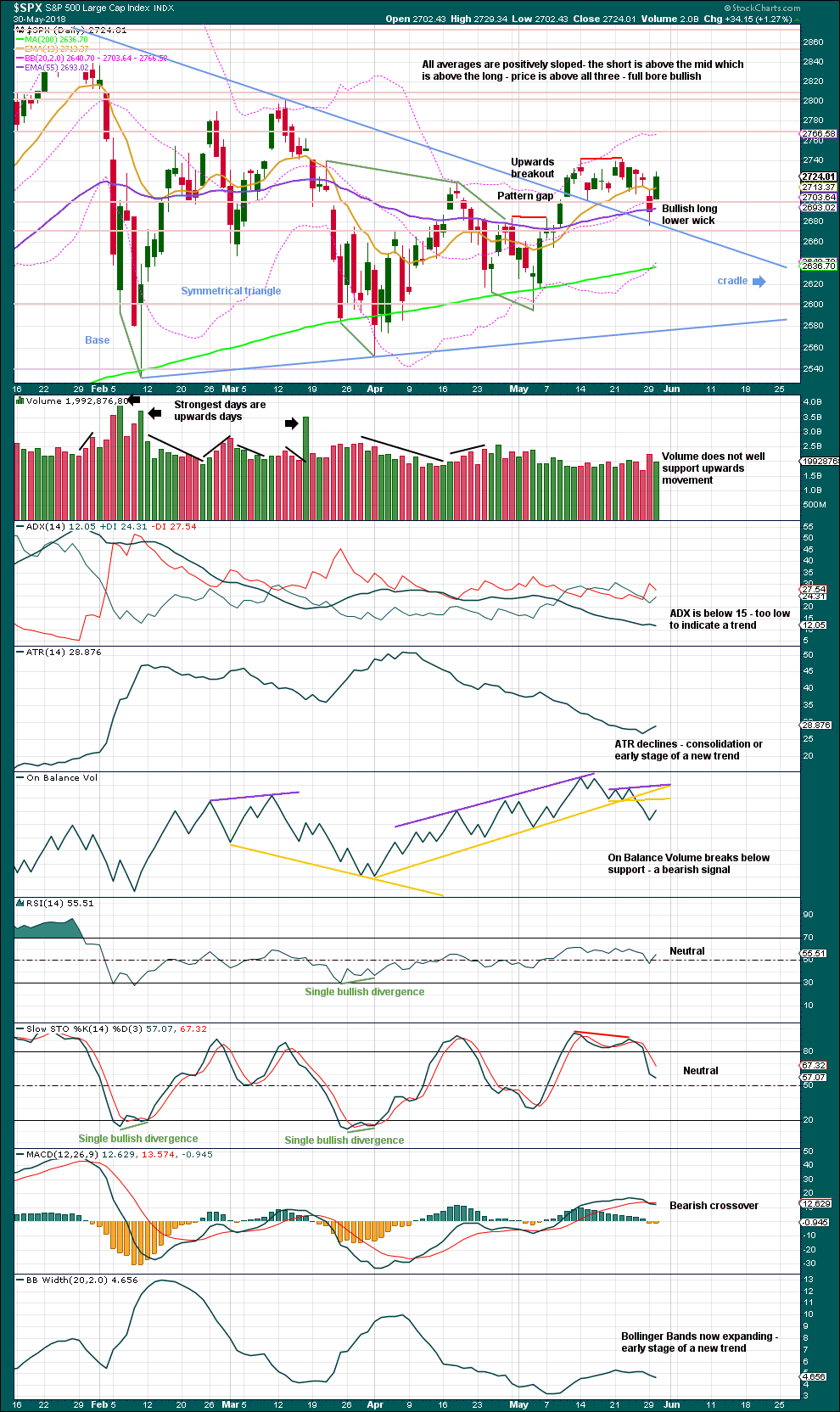

It is possible that intermediate wave (4) is a complete regular contracting triangle, the most common type of triangle. Minor wave E may have found support just below the 200 day moving average and ending reasonably short of the A-C trend line. This is the most common look for E waves of triangles.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

Price has clearly broken out above the upper triangle B-D trend line. This indicates that it should now be over if the triangle is correctly labelled.

A trend line in lilac is added to this chart. It is the same line as the upper edge of the symmetrical triangle on the daily technical analysis chart. Price has found support about this line at the last two small swing lows. The suppport at this line has reasonable technical significance now that it has been tested twice, and this line should be assumed to continue to provide support until proven otherwise.

Sometimes the point at which the triangle trend lines cross over sees a trend change. A trend change at that point may be a minor one or a major one. That point is now about the 10th of June.

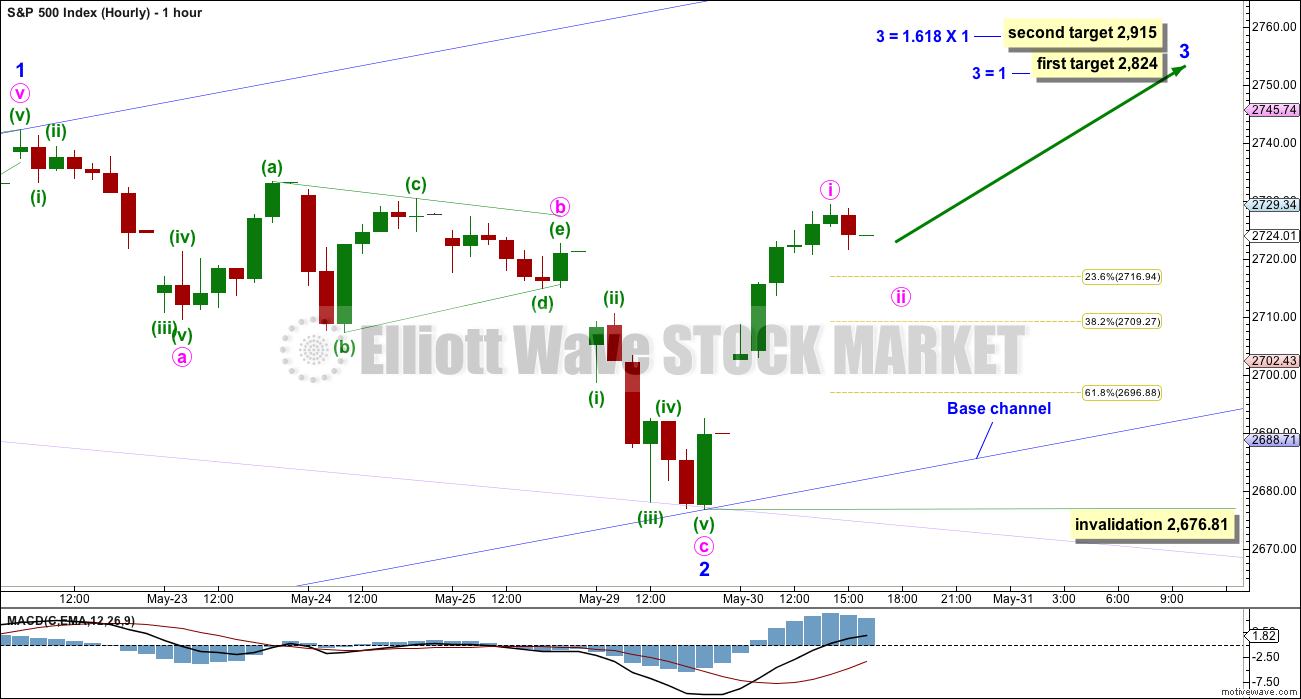

HOURLY CHART

Minor wave 2 may be a complete zigzag. There is no adequate Fibonacci ratio between minute waves a and c.

The daily chart is on a semi-log scale. This hourly chart is on an arithmetic scale, and this is why the lilac trend line sits slightly differently on each chart. On this hourly chart, price perfectly found support at the lilac trend line. Minor wave 2 ends with a strong bullish engulfing candlestick pattern.

A base channel is added to minor waves 1 and 2: draw the first trend line from the start of minor wave 1 on the low of the 3rd of May, to the end of minor wave 2 at yesterday’s low, then place a parallel copy on the end of minor wave 1. Corrections should find support about the lower edge of this base channel as minor wave 3 unfolds along the way up.

Minor wave 2 was relatively shallow, less than 0.5 of minor wave 1. Look out for corrections now within minor wave 3 to possibly be more shallow than otherwise expected.

Minor wave 3 must subdivide as an impulse. If it is extended, then within it minute waves ii and iv may show up on the daily chart lasting from one to a few sessions. If minute wave i is over at today’s high, as labelled, then tomorrow may print a doji or red candlestick. However, a very strong bullish signal from the AD line today suggests more upwards movement tomorrow. Minute wave i may not be over as labelled and may be continuing higher tomorrow.

Two targets are given for minor wave 3 to end, and both fit with the higher target for primary wave 3 to end on the daily chart. If price keeps on rising after the first target has been reached, or the structure is incomplete, then the second target will be used.

With the classic technical analysis now very bullish, a more bearish alternate hourly wave count will not be published today.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

From Dhalquist and Kirkpatrick on trading triangles:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout.”

For this example, the breakout may have now happened. There was a high trading range within the triangle, but volume declined. A downwards week may be a typical pullback following the breakout. If the pullback is not over, then expect support still about the upper edge of the symmetrical triangle top trend line.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete, and price has completed an upwards breakout. There may be some small cause for concern that the upwards breakout does not have support from volume. However, in current market conditions only some small concern is had here. Rising price on light and declining volume has been a feature of this market for years, yet price continues to rise.

After an upwards breakout, pullbacks occur 59% of the time. This pullback now looks complete and most typical.

Symmetrical triangles suffer from many false breakouts. If price returns back into the triangle, then the breakout will be considered false and the triangle trend line will be redrawn.

The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

Although volume today is lighter than yesterday, it is still stronger than the two downwards days prior to that.

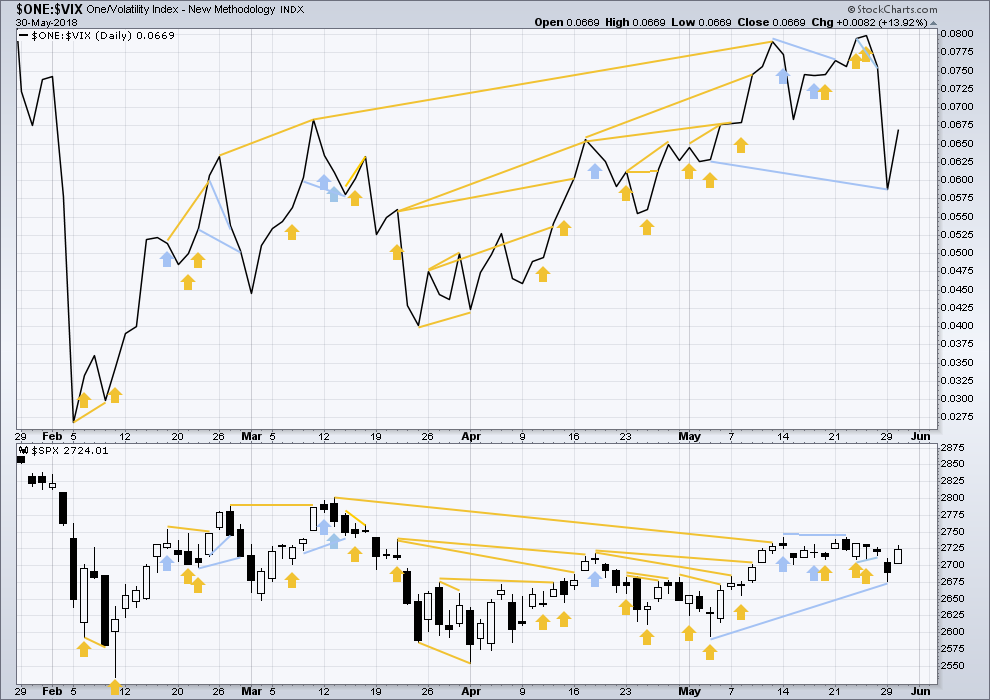

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Last analysis noted some mid term bearish divergence yesterday between price and inverted VIX. This has now been followed by a strong upwards day, so the bearish divergence may have failed.

Price moved strongly higher and volatility declined today. There is no new divergence.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Small caps have made another new all time high today, but mid and large caps have yet to do so. This divergence may be interpreted as bullish. Small caps may now be leading the market.

Breadth should be read as a leading indicator.

There has been a cluster of bullish signals from the AD line in the last few weeks. This also overall offers good support to the main Elliott wave count.

The new strong all time high is extremely bullish and supports the Elliott wave count, which expects price to follow through.

The AD line and price both moved strongly higher today. Upwards movement has support from rising market breadth. Another strong new all time high from the AD line is very bullish and will be given much weight in this analysis.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

At this stage, only DJIA has made a new major swing low. DJT also needs to make a new major swing low for Dow Theory to indicate a switch from a bull market to a bear market. For an extended Dow Theory, which includes the S&P500 and Nasdaq, these two markets also need to make new major swing lows.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 09:47 p.m. EST.

So far the last gap remains open. If that’s a breakaway gap it may provide support and remain open. If it’s a pattern gap it will be closed.

Another second wave correction showing up on the daily chart will make minor 3 look like a good impulse when it’s done.

changing the labelling of minute ii to a double zigzag: w-x-y after checking the subdivisions on the 5 and 1 minute charts.

Is it possible the 2 is a larger WXY, with the push up yesterday the X, and this just the start of the Y down? Since this 2 hasn’t reached the 62% yet…such a count would enable that to happen (tomorrow I suspect).

This possibly??

Possible Kevin but I have your wave X as an impulse, especially with the large gap May 30th. Will be watching for this however.

Yes, that’s entirely possible.

Really, the main reason why I discarded any alternate that would see minor wave 2 continuing and moving lower is because of the strength of the AD line. It moved so strongly higher yesterday to new ATHs. That’s so bullish.

Also, the possible X wave looks more like an impulse, although yes, it could also be a single or double zigzag.

On Balance Volume gives a bearish signal today at the daily chart level.

I’m going to publish the idea you’ve posted above Kevin as an alternate. There may be another low in coming days before the pullback is finally done.

Looking for ending diagonal for end of minute wave II….

this is what I get, have to go down to the 1 minute to see how it fits

the second zz works if submineutte b is a triangle

Had exact same ZZ earlier but didn’t like the way it came off of the low. It is looking better now but still not convinced. Going to put in a buy stop higher if it takes off.

It’s a wonder to me that market isn’t tanking fast and hard now, given external events. Or maybe it’s coming very soon. I’m quite suspicious the next significant direction will unveil itself starting perhaps around 2:30 edt (hour from now). I will have hedging shorts at the ready in case investors lose patience with the external economic chaos. In theory though…the break should be UPWARD. Guess I’ll just get my mind neutral and be ready.

looks like SPX needs to go to the 62% retrace to complete a ii down here. Or maybe even the 78% before it’s over. It is a rather clear ABC down, and I suspect the C down isn’t complete yet.

I’m thinking we are in 3 of 5 of the C and final corrective wave. Almost time to go long in short term account.

Psychologically the purpose of second wave corrections is to convince us that there has been no trend change, that the old trend remains. They do it right before a third wave takes off.

At the end of a second wave correction there should be a strong tendency to doubt and question.

Go with the AD line and On Balance Volume at the weekly chart level. They’re right way more often than they’re wrong. And they’re data based, not emotion.

Agreed Lara. And my take is that the 2nd wave down here hasn’t completed its “convincing” yet! It hasn’t reached the 62%, which is the more common retrace for a 2 than the 38% (which it has reached). And I don’t think the psychological pressure is quite high enough yet (I have a little meter attached to my finger and I chart my worry state right up there with the price action, it’s a solid contrary indicator when it peaks!).

It could certainly move lower, and today after the close there is now a new bearish signal from On Balance Volume which means I have to consider an alternate idea that minor 2 isn’t done.

But, as far as expecting it to end closer to the 0.618 Fibonacci ratio goes, we can look back at past second wave corrections to see how likely this could be.

There are plenty that were shallow and brief within intermediate (3), at the beginning of primary 1, primary 2 itself, and the beginning of intermediate (1) within primary 3…

In other words, there is plenty of precedent for minor 2 here to be shallow.

this is looking decidedly indecisive!

well this looks nice….

Everything on track Peter! EW has all kinds of different values, and one I find of import is the accuracy of its projections once you get into a motive wave situation. In fact it’s kind of an interlocked thing: the fact it starts tracking the projections itself confirms the motivewave in play.

I’ve got buy triggers on the 5 and 15 minute, and the hourly is close…

This is the danger zone where one can get crushed: get incrementally longer and longer overall, and suddenly the market starts tanking; “shouldn’t” happen but mentally and preparation wise it’s really good to have a CLEAR PLAN re: what is “failure” of this setup/count, and what actions will I take if failure occurs? Otherwise, it tends to be stare at the screen and watch the balance drop fast…never real good.

what about yesterday’s gap up…. does that need filling?

Not necessarily. But we might whipsaw around here for a while longer to shake out some new long positions. Ouch!

I expect 2-3 hours of consolidation before renewed upward movement. Tends to be the case when the energy (choppiness) index on the hourly bottoms out, as it did at the highs yesterday. Sufficient to settle a 2 and provide a base for what might be a rocket ship of a 3.

As Lara stated, corrections may be even more brief and shallow as we proceed. Today I will acquire the second half of my long position which will be about 35 or 40 SPX points off the Minor 2 low and successful retest of the Intermediate 4 triangle upper trendline. This half will be in small caps whereas the first was large caps (SPX). RUT has successfully broken up out of an ascending triangle and retested the upper trendline. Classical analysis gives a move to approximately 1800 or roughly 9%.

Have a good day all.

And thank you Lara for the excellent analysis and commentary.

Sounds like a good strategy.

And you’re most welcome Rodney.

SPX hit the 38% retrace zone of yesterday’s move and is indicating that might be it for the little 2 down.

yes