Last analysis expected that a pullback was not over. Downwards movement for the start of the new week fits this expectation.

Summary: Some bullish divergence today between price and the AD line, along with a long lower candlestick wick, suggest the pullback may be over here. The first short term target is at 2,824. The second target is at 2,915. A breach of the best fit channel on the hourly chart would add confidence that a low is in place.

If price continues to move lower, then the target for the pullback to end is at 2,651. Bearish divergence today between price and VIX supports this view.

Pullbacks are an opportunity to join the trend. An upwards trend is expected to develop, which has very strong support from new all time highs from the AD line and On Balance Volume.

The long to mid term Elliott wave target is at 2,922, and a classic analysis target is now at 3,045.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

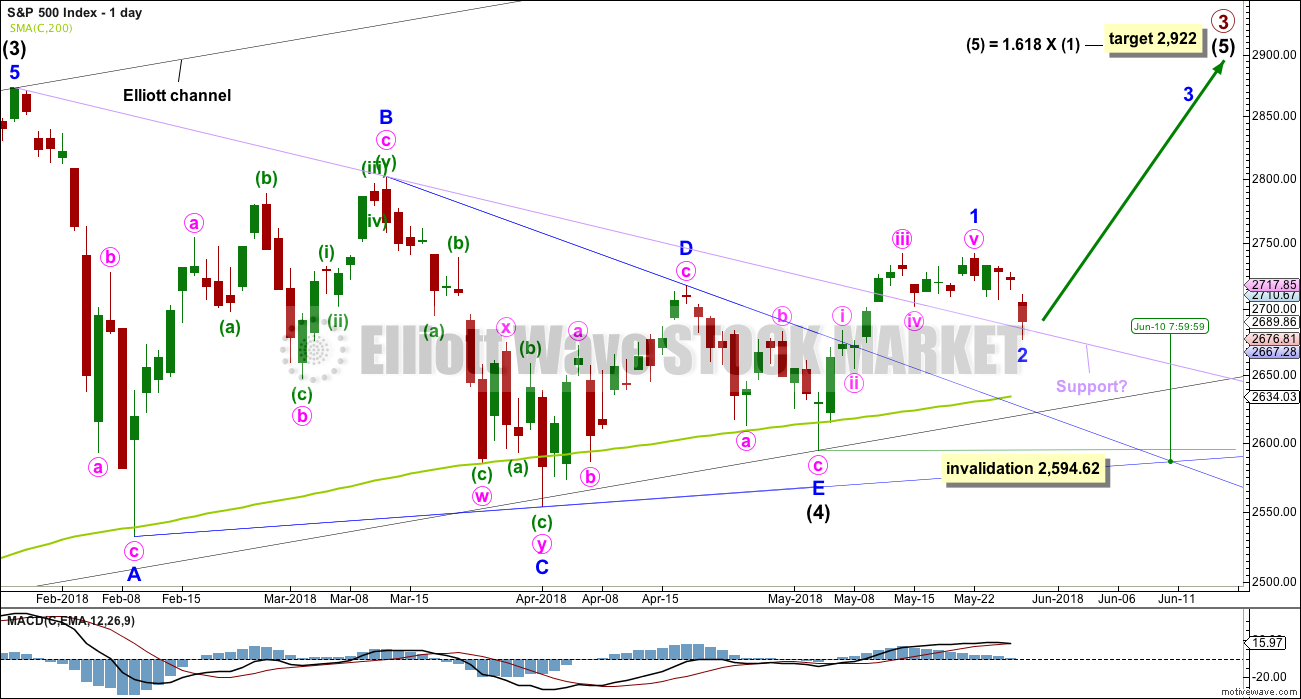

ELLIOTT WAVE COUNT

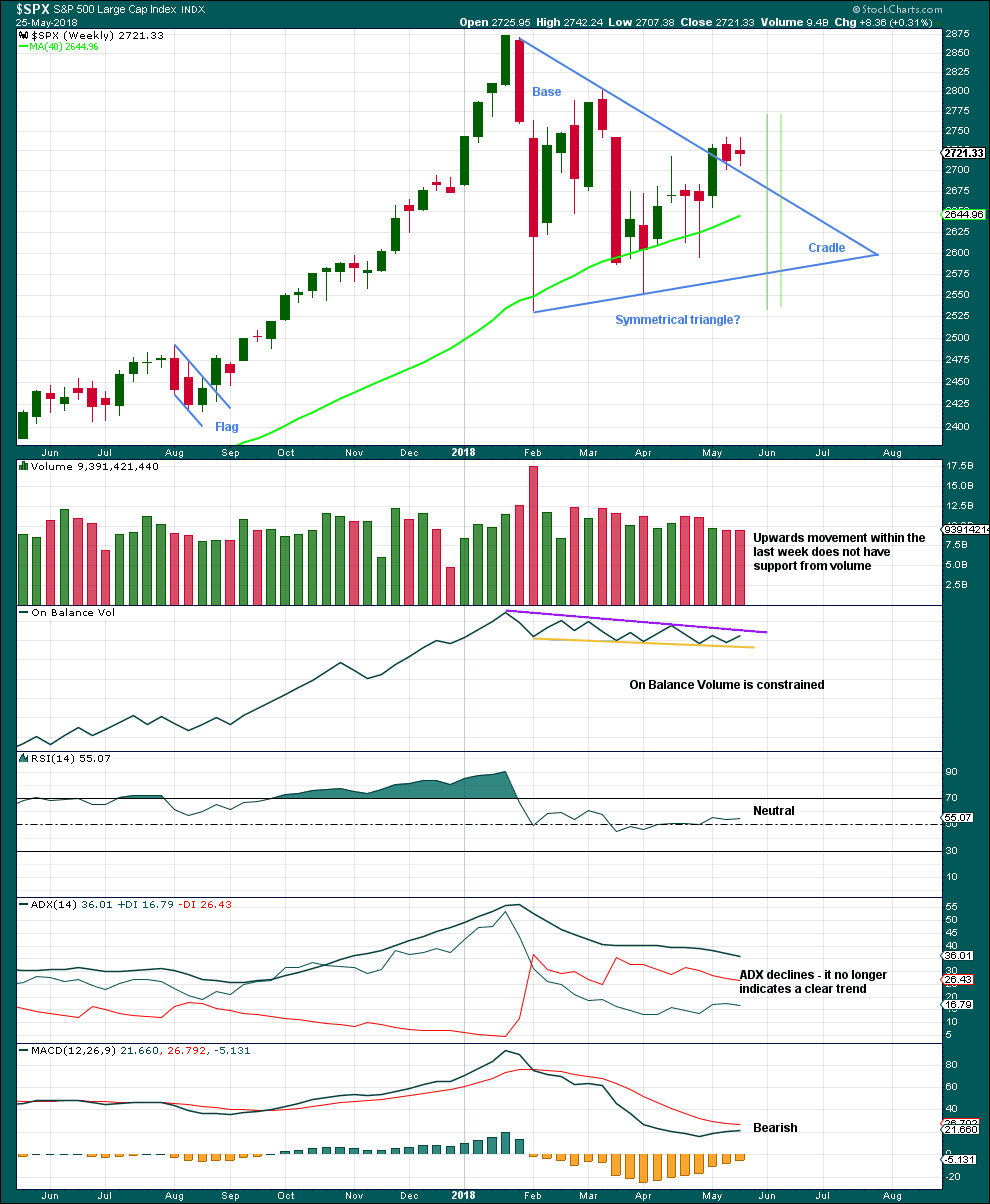

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

If intermediate wave (4) were to continue further as either a flat or combination, both possibilities would require another deep pullback to end at or below 2,532.69. With both On Balance Volume and the AD line making new all time highs, that possibility looks extremely unlikely.

If intermediate wave (4) were to continue further, it would now be grossly disproportionate to intermediate wave (2). Both classic technical analysis and Elliott wave analysis now suggest these alternate ideas should be discarded based upon a very low probability.

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62.

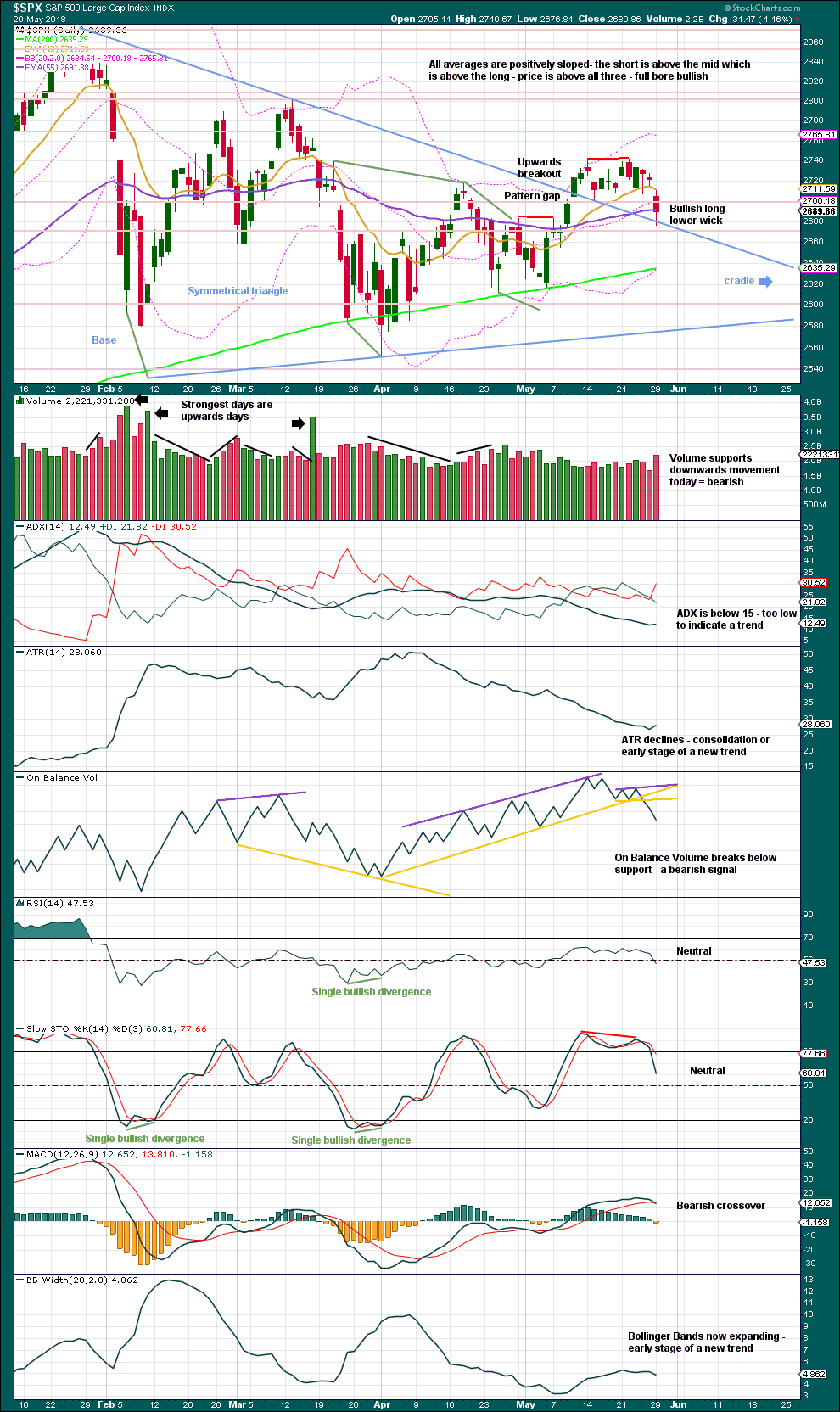

DAILY CHART

It is possible that intermediate wave (4) is a complete regular contracting triangle, the most common type of triangle. Minor wave E may have found support just below the 200 day moving average and ending reasonably short of the A-C trend line. This is the most common look for E waves of triangles.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

Price has clearly broken out above the upper triangle B-D trend line. This indicates that it should now be over if the triangle is correctly labelled.

A trend line in lilac is added to this chart. It is the same line as the upper edge of the symmetrical triangle on the daily technical analysis chart. Price today found support about this line, closing above it. A breach of that line does not mean the classic triangle is invalid and that price must make new lows, only that the pullback is deeper. Look for next support at the blue Elliott wave triangle B-D trend line.

Sometimes the point at which the triangle trend lines cross over sees a trend change. A trend change at that point may be a minor one or a major one. That point is now about the 10th of June.

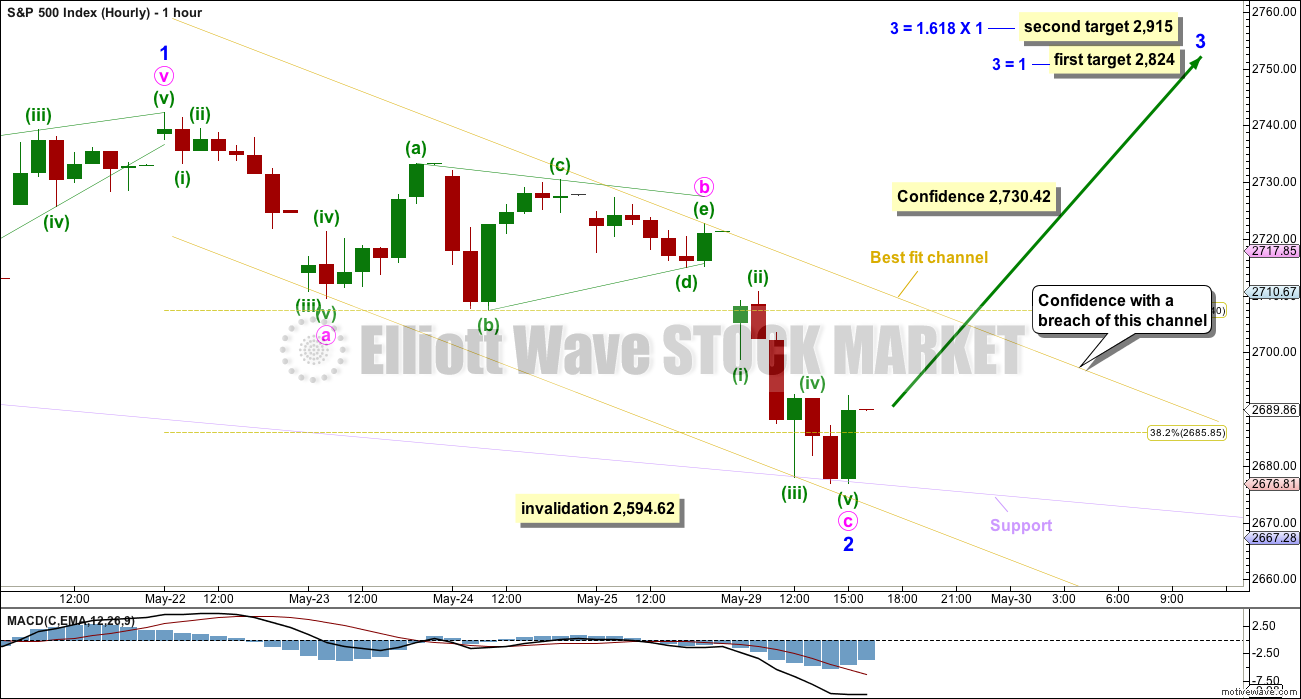

HOURLY CHART

Minor wave 2 may be a complete zigzag. There is no adequate Fibonacci ratio between minute waves a and c.

The daily chart is on a semi-log scale. This hourly chart is on an arithmetic scale, and this is why the lilac trend line sits slightly differently on each chart. On this hourly chart, price perfectly found support at the lilac trend line today. Minor wave 2 ends with a strong bullish engulfing candlestick pattern.

A best fit channel is drawn to contain all of minor wave 2. If upwards movement breaches the upper edge of this channel, it would provide reasonable confidence that minor wave 2 should then be over.

Two targets are given for minor wave 3. If price reaches the first target and keeps on rising, then the second target would be used.

Minor wave 2 may not move beyond the start of minor wave 1 below 2,594.62. Only when price breaks above the best fit channel would the invalidation point be moved up to the end of minor wave 2.

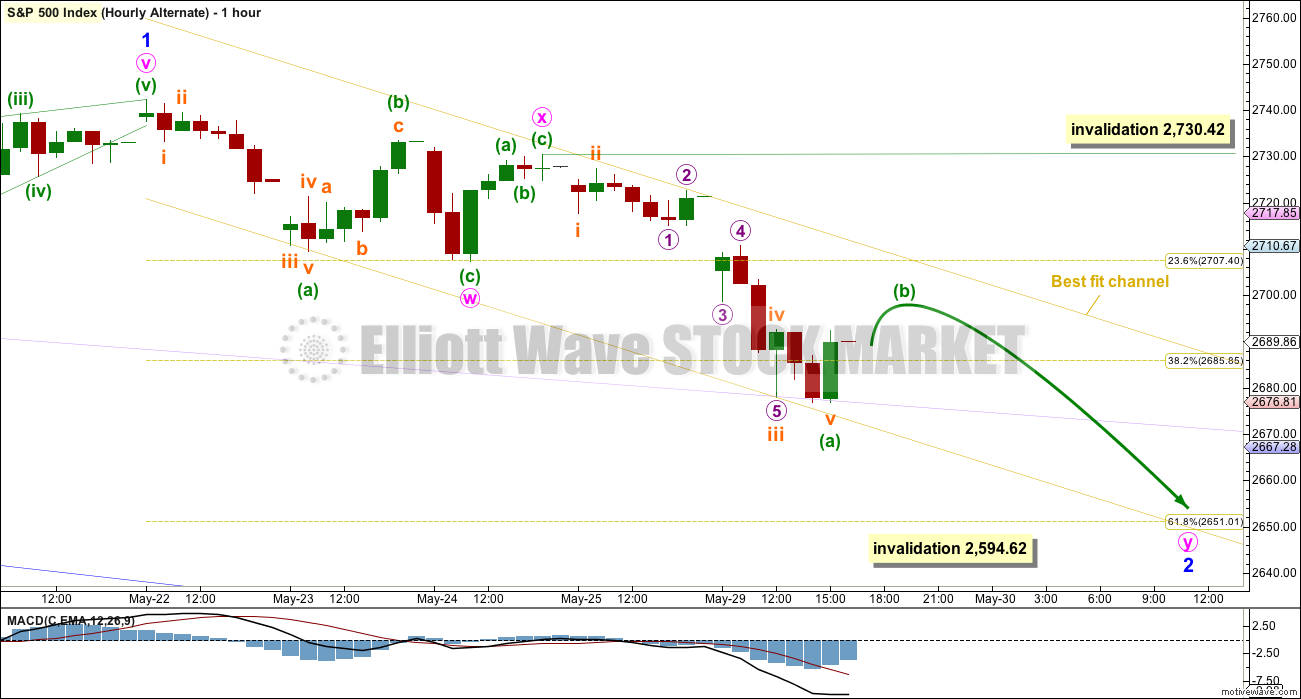

ALTERNATE HOURLY CHART

It is also possible that minor wave 2 may not be over. It may continue lower as a double zigzag, ending closer to the 0.618 Fibonacci ratio of minor wave 1 at 2,651.

Within the second zigzag of the double labelled minute wave y, minuette wave (b) may not move beyond the start of minuette wave (a) above 2,730.42. However, minuette wave (b) should find resistance about the upper edge of the best fit channel. If price breaks above that trend line, then this alternate wave count may be discarded prior to invalidation due to a very low probability.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

From Dhalquist and Kirkpatrick on trading triangles:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout.”

For this example, the breakout may have now happened. There was a high trading range within the triangle, but volume declined. A downwards week may be a typical pullback following the breakout. If the pullback is not over, then expect support still about the upper edge of the symmetrical triangle top trend line.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete, and price has completed an upwards breakout. There may be some small cause for concern that the upwards breakout does not have support from volume. However, in current market conditions only some small concern is had here. Rising price on light and declining volume has been a feature of this market for years, yet price continues to rise.

After an upwards breakout, pullbacks occur 59% of the time. The lower wick of today’s candlestick found support about the upper triangle trend line, and this may be where the pullback ends if it has a most typical look. The long lower wick looks bullish.

Symmetrical triangles suffer from many false breakouts. If price returns back into the triangle, then the breakout will be considered false and the triangle trend line will be redrawn.

The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

While On Balance Volume is bearish, it is not overly so. There will be no bearish divergence while On Balance Volume has not made a new swing low below the prior low of the 3rd of May.

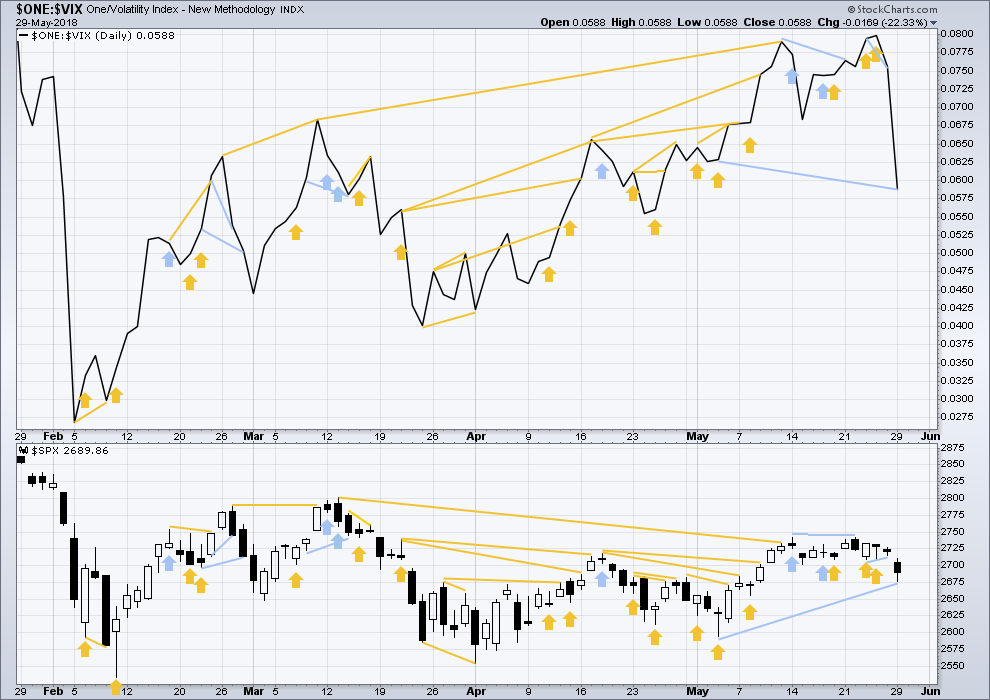

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Inverted VIX moved strongly lower today to make a new low below the prior low of the 3rd of May, but price has not yet made a corresponding new low. VIX is read as a leading indicator, so this divergence is bearish.

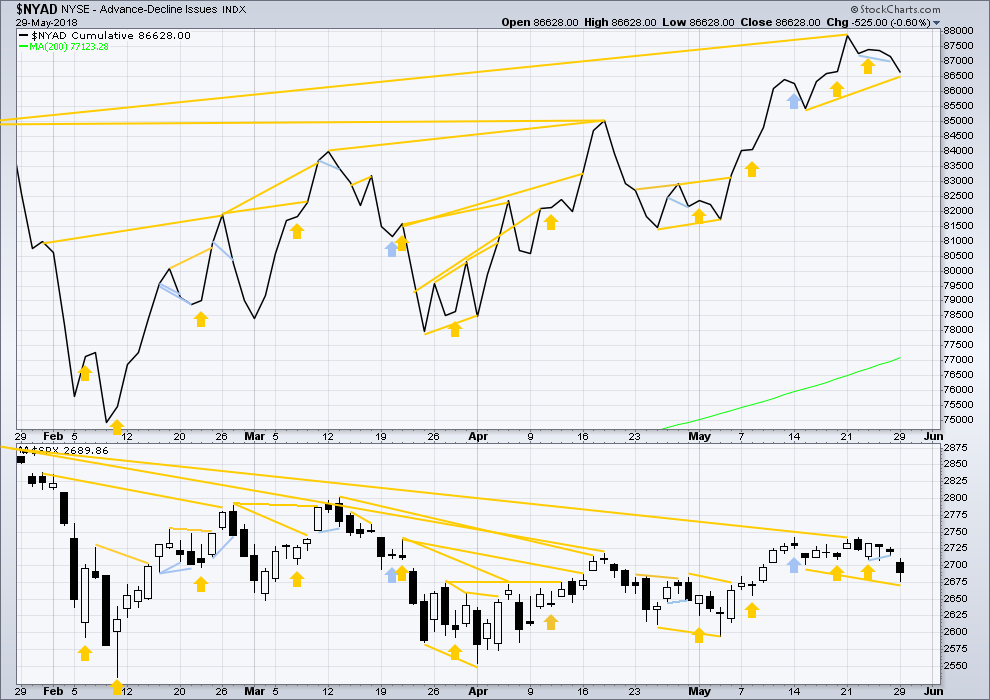

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Small caps continue to make new all time highs, but mid and large caps have yet to do so. This divergence may be interpreted as bullish. Small caps may now be leading the market.

Breadth should be read as a leading indicator.

There has been a cluster of bullish signals from the AD line in the last few weeks. This also overall offers good support to the main Elliott wave count.

The new strong all time high is extremely bullish and supports the Elliott wave count, which expects price to follow through.

Bearish divergence noted in last analysis has now been followed by a downwards day. It may be resolved here, or it may require another downwards day to resolve it.

Both price and the AD line moved lower today. Price made an new low below the prior low of the 15th of May, but the AD line has not. This divergence is bullish, and it indicates underlying strength in market breadth.

The AD line remains much higher than the prior swing low of the 3rd of May. Overall, the AD line remains bullish for the mid to long term.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

At this stage, only DJIA has made a new major swing low. DJT also needs to make a new major swing low for Dow Theory to indicate a switch from a bull market to a bear market. For an extended Dow Theory, which includes the S&P500 and Nasdaq, these two markets also need to make new major swing lows.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 09:15 p.m. EST.

The AD line today moves strongly higher to make another new all time high.

This is very bullish. I will not have a bearish alternate in the face of this.

This gives me strong confidence in the overall trend, up. Price is extremely likely to follow through with new all time highs.

Updated hourly chart:

So far this is looking pretty good. Let us see what volume is like at the end of this session, and what On Balance Volume and the AD line in particular have to say.

If I see a bullish signal today from the AD line I will discard any alternate that sees minor wave 2 continuing. If not, then I’ll have an alternate.

Did any of us doubt the classic TA indicators that this market would turn after yesterday’s sell off?

Okay, maybe a little…(and for a few of us, probably a lot).

But I’m still impressed, it’s as if it executed to a script. Rodney wanted the retest of the TA triangle (and 50 day and major pivot support) and it happened to within a few points, then turned and and launched the minor 3. Exquisite!!!

Hope you bagged your entry there Rodney.

If I know Rod, I suspect he is patiently waiting for break-out confirmation. I sold the long calls from my call spread today. We have strong ongoing negative divergence at recent highs.

Any move past 2733.30 firmly invalidates any possible larger triangle and if that happens I am backing up the 16 wheeler! See ya’ll

Friday!

2676.81 for invalidation perhaps?

Oops! Yes!

Sorry guys. And thanks Verne for pointing that out.

Momentum appears to be waning. If this is a “1,” it looks pretty convincing to me at the moment. Looking for a believable “2” now before I hop aboard.

Got past the first test: broke the upper down channel line.

Now the next test: there’s some kind of “i” up here. Should be a ii down coming right away (now) and it’s of course got to stay above yesterday’s low. THEN the test: DOES THE MARKET LAUNCH A STRONG iii? Or do we stay gyrating in this 2700-2740 consolidation zone? I guess the simple way of saying is is, can SPX push past 2742 and KEEP GOING??? If so, it’s like the old song says, “people get ready, cause a train’s a coming! don’t need no ticket, just get on board!”.

Kevin, wat are your thoughts on iwm! It only tagged the 23.6% retrace. Doesn’t it seem too shallow for a minor 2? My best guess is that iwm is on the last leg to finish minor 1. If thats the case, spy will have a hard time crossing 275

Glad you asked Jules, hadn’t looked there in a day or three.

Here’s what I think the most important chart is. Weekly. Buy calls out 6+ months and GET ON BOARD would be my basic view here. Protect yourself as you see fit (spreads, stops, countering positions, etc.).

FYI…I just did…

Let it rip!!! I added yesterday too!

Upper down channel line reached. It’s test time. Hourly main? Or hourly alternate?

Looks like the gap gives support right at the 0.618…. assuming this wave is done

If SPX starts dropping tomorrow it’s going to 2650, and it will not stop there, the big money will take it deeper 200 day and 21 period bollinger. Then it will be accumulation for them, and for some of us.

The junction point visited by the lows today is a study in classical technical analysis. A retest of a huge symmetric triangle (and bounce). A test of the 50 day at exactly the same spot. And a test of lots of historical support (pivot highs).

The channel I shared over the weekend got filled and lives on, per Lara’s main calling for deeper lows to complete the overall 2. Bam!!!!

Wave up looks corrective…I could be wrong…

By looks corrective, did you mean to say banksterized?!? Lol. Looking to re-enter VIX and shorting IWM here…(not trading advice)

🙂

Going short IWM, and Long VIX exactly now, perhaps to my detriment. (not trading advice)

Looking for impulsive move back below 50 day. Volume tepid….