More downwards movement for Friday was expected.

Summary: A low may now be in place. Some confidence may be had in this view if price breaks above the yellow channel on the hourly chart. A target would then be at 3,020.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

MAIN ELLIOTT WAVE COUNT

MONTHLY CHART

The large expanded flat labelled Super Cycle wave (IV) completed a 8.5 year correction. Thereafter, the bull market continues for Super Cycle wave (V). The structure of Super Cycle wave (V) is incomplete. At this stage, it is subdividing as an impulse.

There is no Fibonacci ratio between cycle waves I and III within Super Cycle wave (V). This makes it more likely that cycle wave V will exhibit a Fibonacci ratio to either of cycle waves I or III. Cycle wave V has passed equality in length with cycle wave I. The next two Fibonacci ratios in the sequence are used for two possible targets for it to end.

The teal channel is drawn using Elliott’s first technique about an impulse. Draw the first trend line from the ends of cycle waves I to III (from the months of July 2011 to December 2014), then place a parallel copy on the low of cycle wave II. Cycle wave IV has found support very close to the lower edge of this channel, so the channel looks about right. The lower edge should continue to provide support, and the upper edge may provide resistance if price gets up that high.

Copy this large channel over to weekly and daily charts, all on a semi log scale. The lower edge will be important.

Cycle wave II was a shallow 0.41 zigzag lasting three months. Cycle wave IV is now seen as a more shallow 0.28 double combination lasting 14 months. With cycle wave IV nearly five times the duration of cycle wave II, it should be over there.

Cycle wave I lasted 28 months (not a Fibonacci number), cycle wave II lasted a Fibonacci 3 months, cycle wave III lasted 38 months (not a Fibonacci number), and cycle wave IV lasted 14 months (one more than a Fibonacci 13).

Cycle wave V has begun its 24th month. The structure needs several more months to complete. It may last another 10 months to total a Fibonacci 34, which now looks reasonable.

It is also possible that cycle wave V may not exhibit a Fibonacci duration.

Within cycle wave V, the correction for intermediate wave (4) may not move back down into intermediate wave (1) price territory below 2,193.81.

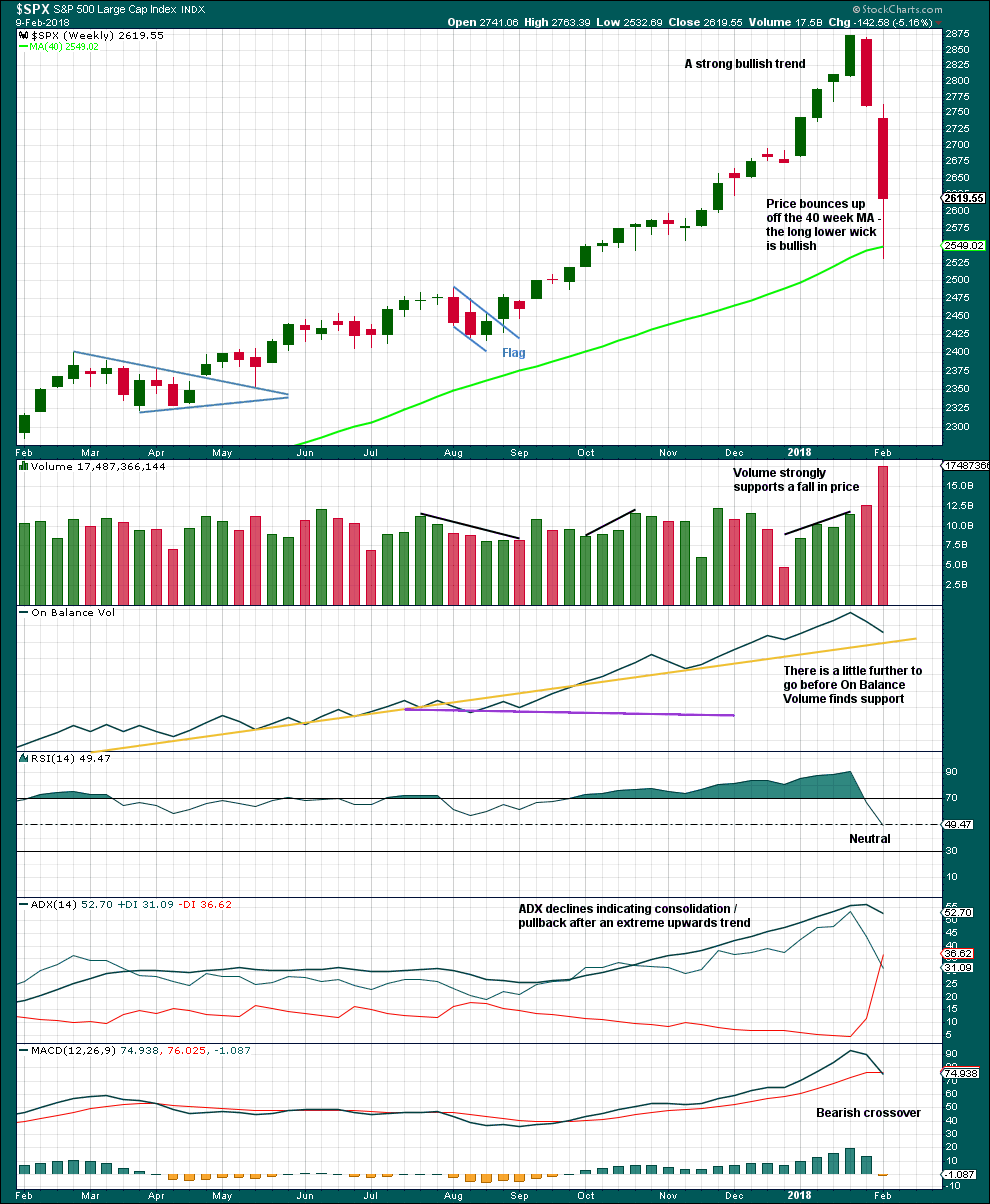

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Due to its size intermediate wave (4) looks proportional to intermediate wave (2), even though their durations so far are quite different.

Intermediate wave (4) has breached the Elliott channel drawn using Elliott’s first technique. The channel may be redrawn when it is confirmed as complete using Elliott’s second technique. A best fit channel is used while it may still be incomplete to show where it may find support. Price points are given for this channel, so that members may replicate it on a semi-log scale.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81.

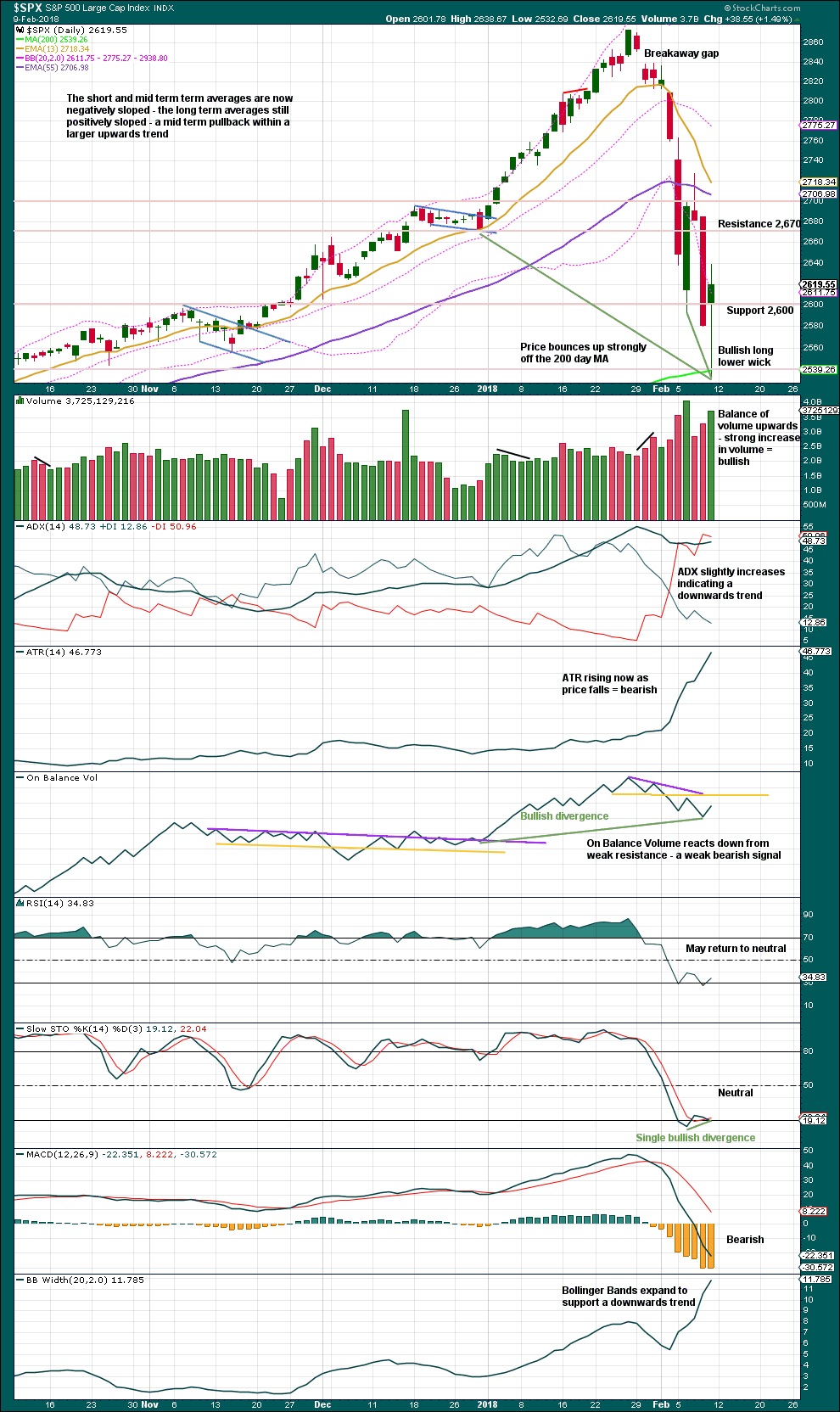

DAILY CHART

The S&P has behaved like a commodity to end intermediate wave (3): a relatively strong fifth wave with a steep slope. The high looks a little like a blow off top. This is being followed by a sharp decline, which is typical behaviour for a commodity and not common for the S&P.

There are adequate Fibonacci ratios within this wave count. It is common for the S&P to exhibit a Fibonacci ratio between two of the three actionary waves within an impulse, and uncommon for it to exhibit Fibonacci ratios between all three actionary waves. This means that the lack of Fibonacci ratios for intermediate wave (3), minor wave 3, and minute wave v is not a concern. This is normal.

Friday’s low is only a little above the lower edge of the best fit channel. The very long lower wick on Friday’s candlestick is bullish. It looks like intermediate wave (4) may now have found its low.

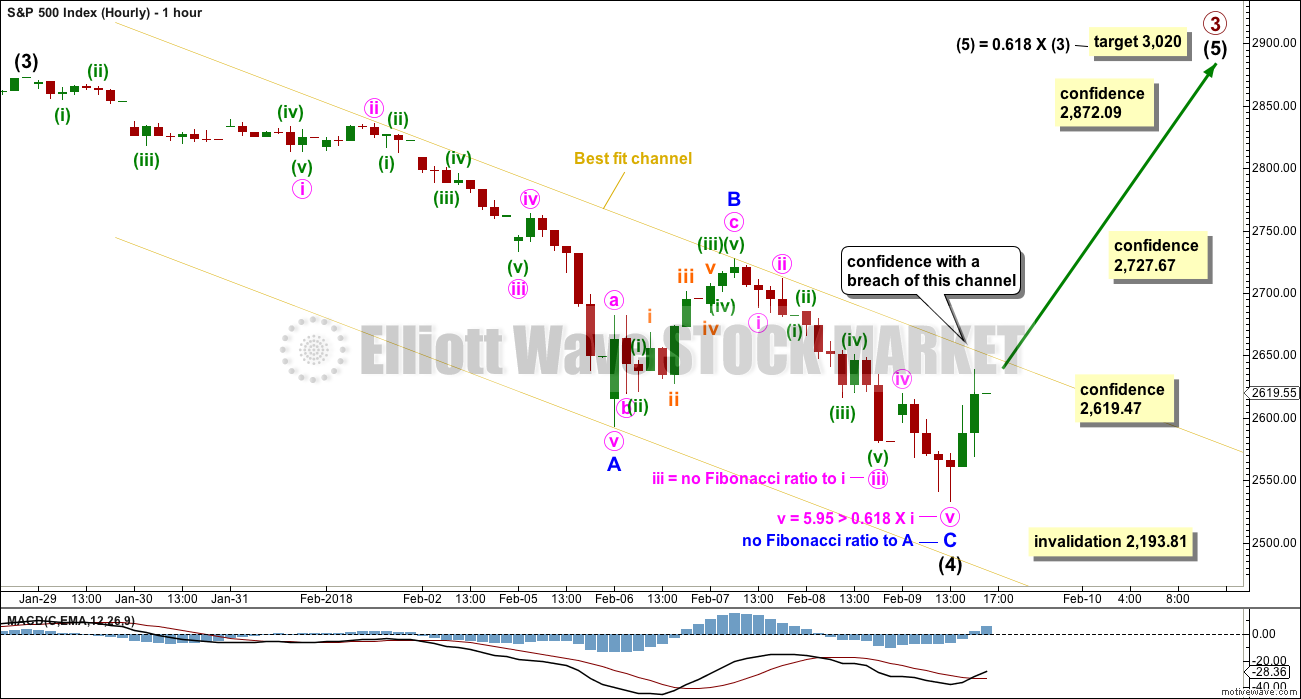

HOURLY CHART

A zigzag downwards may now be complete.

2,619.47 is the start of minute wave v within minor wave C. A new high above this point cannot be a second wave correction within minute wave v, and so minute wave v must be over.

Price remains within the best fit yellow channel. The bottom line at this stage remains that the risk of new lows must be accepted while price remains within this channel. A breach of this channel next week would add reasonable confidence to this wave count.

2,727.67 is the start of minor wave C. A new high above this point could not be a second wave correction within minor wave C, and so at that stage minor wave C would have to be over. This would add further confidence to this wave count.

A new all time high would add substantial confidence to this wave count.

Confidence points are given so that members may manage risk. Further confidence may be had in this wave count as each price point or trend line is passed. It is up to members to decide on their level of accepted risk and judge when to trade on this wave count accordingly.

Always trade with stops and invest only 1-5% of equity on any one trade. Risk management is the most important aspect of trading.

If this wave count is correct, then long positions opened about here may be held to several months.

ALTERNATE WAVE COUNT

WEEKLY CHART

This alternate wave count is published with the caveat that at this stage it must be judged to have an extremely low probability for the following reasons:

1. There is no divergence between price and the AD line at the all time high. All bear markets within the last (almost) 100 years began after a minimum of 4 months divergence with the AD line. If this wave count is correct, then this is the first time in almost 100 years when divergence did not occur.

2. There is no divergence between price and RSI on the monthly chart at the last all time high. This is again highly unusual prior to a bear market.

3. The bear market may have begun suddenly without a normal prior increase in market volatility. Normally, corrections unfold prior to the end of a bull market that increase by degree prior to the bull market ending.

However, low probability (even as low as I judge this to be) does not mean no probability. I would rather members are aware of this risk and manage this risk accordingly.

This wave count absolutely requires a clear breach of the teal channel on the weekly chart before any confidence at all may be had in it. A breach would be a full weekly candlestick (not just daily) below and not touching the lower teal trend line. This channel is copied over from the monthly chart.

Thereafter, a new low by any amount at any time frame below 2,111.05 would add substantial confidence to this wave count. At that stage, downwards movement could not be a fourth wave correction within an ongoing impulse as it would be back in first wave price territory of primary wave 1.

If this wave count is correct, then a once in multi-generations trend change may have occurred. Grand Super Cycle wave II would be expected to last at least 20 years, and possibly a generation. It would be very likely to end substantially below the end of Super Cycle wave (IV) at 666.79.

I judge the probability of this alternate wave count to have such a low probability that I was hesitant in publishing it. But I am also aware that just because this kind of end to a bull market has not been seen in almost 100 years does not mean it cannot happen.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This pullback has now brought RSI well back down into neutral territory. ADX is declining from very extreme. A possible trend change to down is indicated, but as yet no new downwards trend at this time frame.

In the first instance, support should be expected for On Balance Volume at the yellow trend line. A breach below this line by On Balance Volume would be a very strong bearish signal. A bounce up off the line would be a strong bullish signal.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Friday’s daily candlestick is not properly a hammer reversal pattern because it has too long an upper wick. However, the lower wick is very long and this is very bullish. Particularly as the low was very close to the 200 day SMA.

This pullback has brought RSI down from very overbought to just oversold. RSI can move back into oversold and remain there for a few days, or it can move back now further into neutral territory.

Overall, it looks like a low may now be in pace.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Price moved lower with a lower low and lower high for Friday, but inverted VIX moved higher. This single day divergence is bullish.

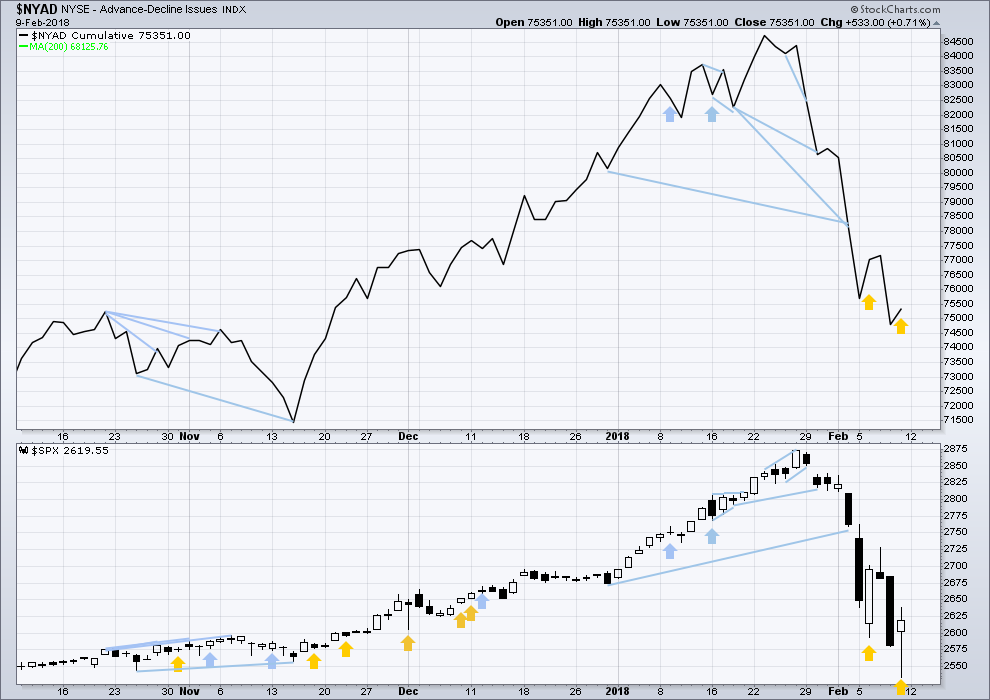

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

All of small, mid and large caps this week moved lower. The decline has support from wide breadth.

Breadth should be read as a leading indicator.

Price moved lower with a lower low and lower high for Friday, but the AD line moved higher. This single day divergence is bullish.

DOW THEORY

All indices have made new all time highs as recently as three weeks ago, confirming the ongoing bull market.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

Published @ 06:09 p.m. EST on 10th February, 2018.

My, aren’t things getting feisty!!! Lol!!! Love it. Battle of the Bulls and the Bears!

How much fun is a real market!

This behaviour reminds me of the ramp after the first drop if 1,000 plus points…No fear but will be interesting to see who all are buying this ramp ahead of the CPI release.

Updated hourly chart:

It looks like a five up is completing. It’s doing that typical thing the S&P does of slowing down at the end forming a rounded top. Which makes a channel about it impossible.

Look out for a three down which may find support about the upper edge of the yellow best fit channel now.

Verne, I’m taking the gains on the bulls spreads and sitting out….Wave looks like it could roll and can’t lose money taking gains!!

I also took my profits off the table on SVXY. It’s not behaving the way I’d expected it to…

I also took the money and ran at the open albeit a bit early, although put contracts did not go much higher with the market ramp. Still looks like sideways price action on the 5 hour chart so we could see another downside break…watching futures with interest…

Methinks we are in the midst of a 2 wave abc higher

1st of Lara’s confidence levels of 2619.17 is well exceeded.

And I believe it has broken through the top channel line. 2nd piece of evidence giving confidence the immediate trend has changed from down to up.

Indeed. However, my view at the moment (changeable!!) is that price has just completed the first “1” up as a 5 wave impulse, and a 2 is due. I see a 1-2-3-4 and today an ending diagonal 5. That all said, could be dead wrong…

I’ll add that the high here is right at the symmetric move projection of 2669-2670. So multiple factors suggesting that any turn down here will be significant.

I agree with your count. looking to complete a 2nd wave tomorrow and then up in a third.

Still wave 3? Where my bulls at?!

Taking a small short here SPXU and RWM. Could be wrong….but it looks at least short term toppish to me.

SPX price is approaching symmetry with the Feb 6-7 low to high (same move length). Often moves like this are symmetrical with recent moves. 266-70 or so is the symmetric top. We’ll see. It’s possible price has just completed its first 5 wave impulse up here, I think all requirements are met…and it’s time for an 2 pullback.

oops, 2669-2670 is the symmetric move top.

Possibly this.

Hi Kevin if your right about the SPX stopping at the 2669-2670 mark.

What kind of pullback do you think for the 2nd drop.

Thank You

Assuming we get a completed 5 wave up here or soon, then I’d expect a 2 to pull back nominally 62% of the up move. Assuming current day’s high’s hold and the 2 kicks in, then 2582.5 is about 62% back to the friday low. However, any of the major fibnacci retrace points going down could end up being the termination point of the 2, really. I say 62% as nominal because 2’s are usually/often quite deep. But I’d be watching for a turn and new buy triggers at each of the 38% and 50% retrace prices too.

At this point, if the wave 1 high is in, 2586 is my nominal target for a 2 wave down.

There is a significant chance the 5 wave up isn’t complete, in particular the final 5 wave of the 5 up isn’t complete, and is only in the 2 phase, ala the chart. Also shown is the 5 wave complete alternative. I dunno!!!

Well, sorry I should have seen and published that 5 minutes sooner. One minute after posting (5 minute delay), price took off in what looks like a 3 of the 5 of the 5 wave up off the Friday bottom. Though it could also be the 5 of the 5, I suppose. And there are other ways to read it. Nothing’s certain in this work!!!

Don’t think it’s a triangle because wave b is a five down. Cannot make head nor tale out of this pattern though???

I guess I should put triangle in quotes. Very often what I refer to as such does not meet formal EW rules. My main interest is not so much a correct definition, as getting the directional break right.

ES tracing out yet another triangle. Incredible!

Last time around they executed a very slick fake-out upside break before the downside break. Lower prices ahead, head-fake or not it would appear…stay nimble.

(Another bearish sign was that VXX put option prices barely budged even with this morning’s upside pop.)

Verne,

Assuming that this is another head fake, what and how would you position yourself for the expected down move…I understand this is just hypothetical assumption but want to be aware of the plays/positions that would be useful to watch and monitor.

The reason I ask is cause we noticed wage increases in Jan. and now CPI due on wednesday might surprise on the negative side and markets will be primed for another drop…

If it is a head-fake, I would expect the 50 day to be formidable resistance, so I would wait to see how price reacts there before making any serious directional comitment of capital.

Thanks Verne!

Resistance at the upper downward sloping channel line. This is to be expected. Now for the next confidence point we must move up through that channel line. Meandering sideways through it does not count. It must be by upward movement.

On the SPX 5 minute chart we have a 3 wave pattern up so far. If this is an impulse, wave 4 must stay above 2610. Wave 5 would bust through the upper channel line to complete an impulsive five wave move up. Thereafter we would look for a 3 wave correction back down to the upper channel line of the past week’s downward move. That is often a good low risk long entry point.

Rod,

I personally would wait for the numbers coming out on Wednesday. As looks like Retail folks are jumping early but serious money is waiting to see the economic numbers coming out mid week.

It’s one of those “backing and filling” type days. So far. Which means tiny bite day for me. Anyone notice that Friday’s action was a Larry Williams “oops” day? Usually following immediately by bullish action. Not so much yet today.

Leading diagonal 1 after the completed ABC 4 wave? Otherwise, this looks like a big bear flag to me.

I guess in EW terms, looking a lot like an X wave, perhaps.

This?

The down channel line and the 62% retrace of the C wave both lie around 2651-2654, then the 38% retrace of the entire 4 down is just above that at 2661.5. That 10 point range area of 2651-61 may be key this morning.

Solid fail in attempt #1!

Might buy some SPX calls at open for March 2 expiration. I agree with Lara’s analysis that this is quite possibly the end of the selling. Feels like we’re setting up for a *yuuuuuuge* rip sometime soon. Relatively heavier volume for Tuesday & Friday up days shows the bullishness underlying this market is definitely still there.

Wow, futures up quite sharply as Europe begins trading. VIX heading down as well. Not that it’ll happen today, but I do think we could see a +100 handle day before all is said and done. If history is any indicator, the rally will be absolutely furious when it returns. I recall in 1999, just a year after the 1998 crisis that saw dramatic downturns in NDX and SPX, we saw NDX double. Not that we’ll see that happen again, but just demonstrates the type of unbelievable price action you can see toward the end of a bull market.

Be careful, small and mid-caps already in the red.

Lara,

For main and alternate counts, is it possible to produce a matrix that lists the cycle or degree of wave along with the assumed wave count #? As a EW beginner, its easy to get a bit lost as to which degree or count is being referenced. Thanks for your help!

Jonathan, I’m not sure if this is exactly what you’re looking for, but Lara’s wave notation chart on the right side of the web page might help.

Actually, the wave notation chart was very helpful. Thanks Curtis.

I would love to see that chart populated with the assumed counts that we are in for each, or at least the Cycles, Primary, Intermediate, and Minor.

Lara,

Have you produced an alternate that would move all labels down one degree on your monthly and Grand Supercylce charts for what you now label as Supercycle 5. It seems to me that from 2009 to 2019 (~ 10 years long), is too much shorter in time frame that super cycle 1 (~50 years long) and super cycle 3 (~70 years long).

It seems to me the current targets of 2926 and 3616 could be only Cycle I wave of Supercycle (IV).

Thoughts?

I’ll second that question! Well noted, Rodney.

I have a question on the same theme of “what are reasonable time relationships between common timeframe waves?” So far, this 4 is only 2 weeks in duration, while the corresponding 2 wave was 11 weeks. Does this tell us that there is substantial probability this 4 is not over as a simple ABC, but is going to execute something more complex (triangle, combination, etc), thereby achieving a more balance duration? I’m suspicious of a giant triangle or flat or combo here.

I was thinking the same thing Kevin, but I also think the speed and depth of this correction makes it possible that that was it. The size of this four is much greater than the corresponding two.

You’re absolutely right.

While the durations fit at cycle degree, it’s not looking such a good fit at super cycle degree.

And yes, the degree within all of super cycle (V) could be moved down one. We may be finishing only cycle I of super cycle (V).

Which means that cycle II may not move below 666.79.

When a high is in place and I can be confident enough of a trend change then this is an alternate idea that must be considered.

There is no way to know which scenario is correct. Both would be valid. One calling for a multi generation collapse of the market, the other only a deep correction but still a bear market to last one to several years.

Not quite sure how classic TA can distinguish between the two ideas. I’ll keep reading and thinking and researching on that.

Lara,

A couple of other TAs have identified a strong possibility that markets make a new high into next 4 weeks and then drop into an extended bear market that could last 9 years or so.

Appreciate that your note above with the mentions of the same. Perhaps we should look at what will work best if that possible scenario becomes reality.

taking another look now at the Grand Super Cycle analysis;

Super Cycle (I) was over 60 years, its a long drawn out extension.

Super Cycle (III) was about 65 years and again is a long drawn out extension.

Which means (if this is correct of course) that Super Cycle (V) may not extend. It should be shorter.

Super Cycle (II) lasted just 8 years. Super Cycle (IV) lasted just 9 years.

The guideline of how long waves of each degree should last is a rough guide only, and we have to be very flexible with it. Corrections for the S&P tend to be much more swift and violent than bull markets.

What I can’t be flexible on though is the EW rule about only two of the three actionary waves extending. That rule can’t be broken.

So for that reason I’ll consider that we may only be ending cycle I of Super Cycle (V), but I have to judge it to have a lower probability.

And I have absolutely no problem with a relatively brief Super Cycle degree wave.

That should have been SuperCycle (V) at the end of my comment, not (IV).

Hi Lara, could you please explain what the ratio is of minor 5 to minor 1 on your main daily chart? I am not sure what your annotation of “5=3.24<0.618×1-5" means?

minor wave 5 is 3.24 points greater than 0.618 times the length of minor wave 1

Lara, I also can get a count of bearish nested 1s and 2s. Do you see that as well?

Yes, that’s also possible. Which it would be for the very bearish alternate weekly.

The idea would be invalid above 2,727.67.

Another possibility is that int. 4 is not yet done, and we only concluded the A leg of an ABC, or perhaps even some kind of triangle. Additional time would give a bit better time proportion with int. 2.

True, although it already now looks very good at all time frames.

But yeah, another alternate idea which is entirely valid and which I’ll need to consider.

First to the post!! Where is the Rabbit??

Oh my! Look at the time! All that market eccitement wore me out Doc!