Upwards movement continues as expected. The Elliott wave target remains the same.

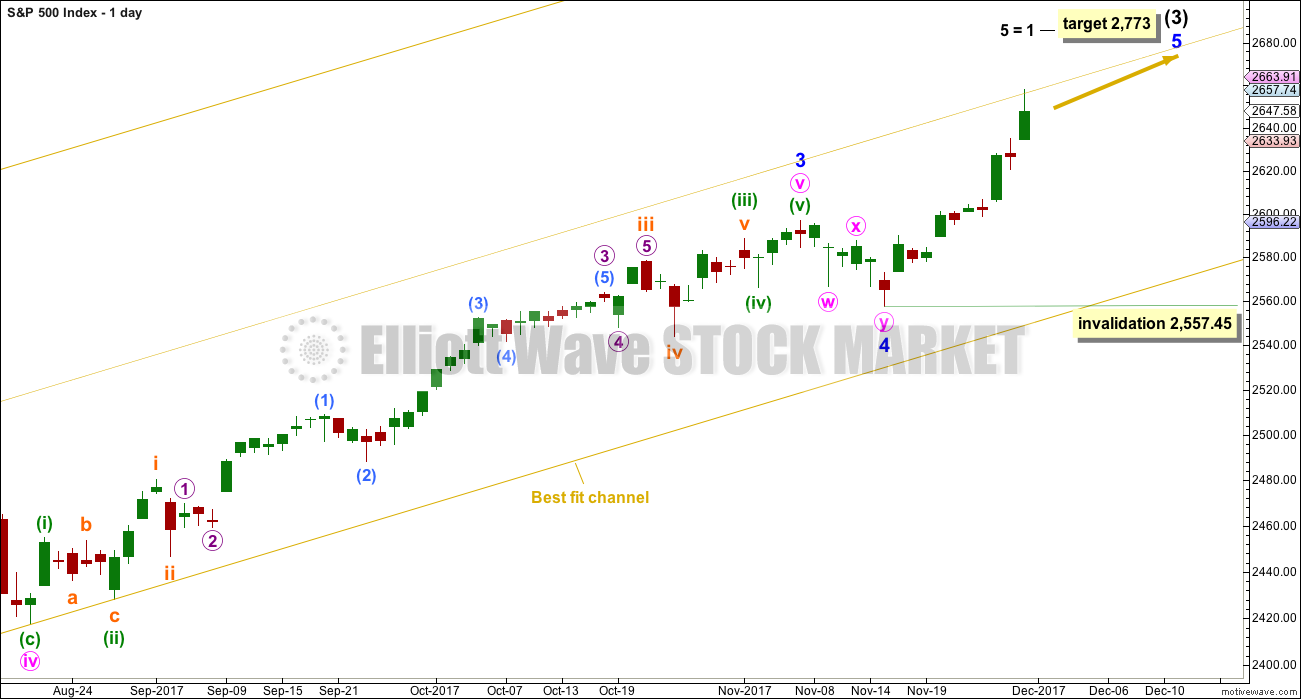

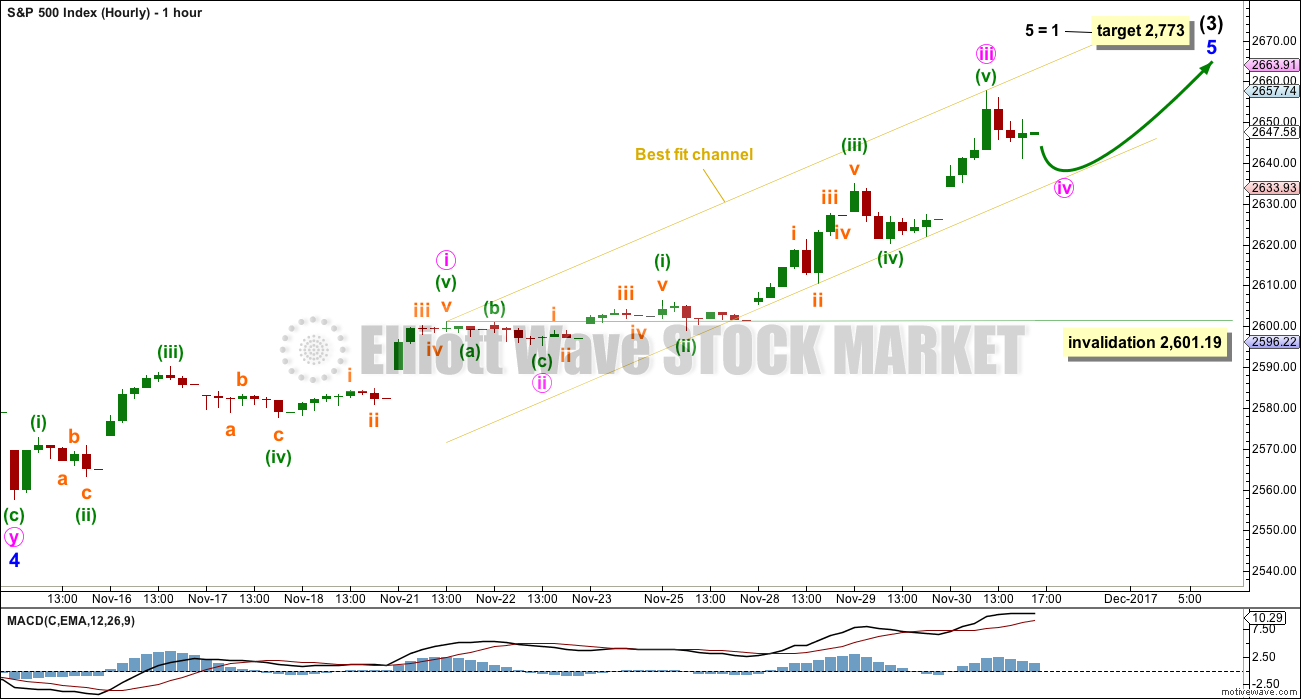

Summary: The next Elliott wave target is 2,773. While price remains above 2,606.41 and within the yellow best fit channel on the hourly chart, then assume the upwards trend remains intact.

The structure is incomplete at this stage, but some indicators are extreme and some weakness is beginning.

Always trade with stops and invest only 1-5% of equity on any one trade. All trades should stick with the trend. The trend remains up.

Last monthly and weekly charts are here. Last historic analysis video is here.

The biggest picture, Grand Super Cycle analysis, is here.

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

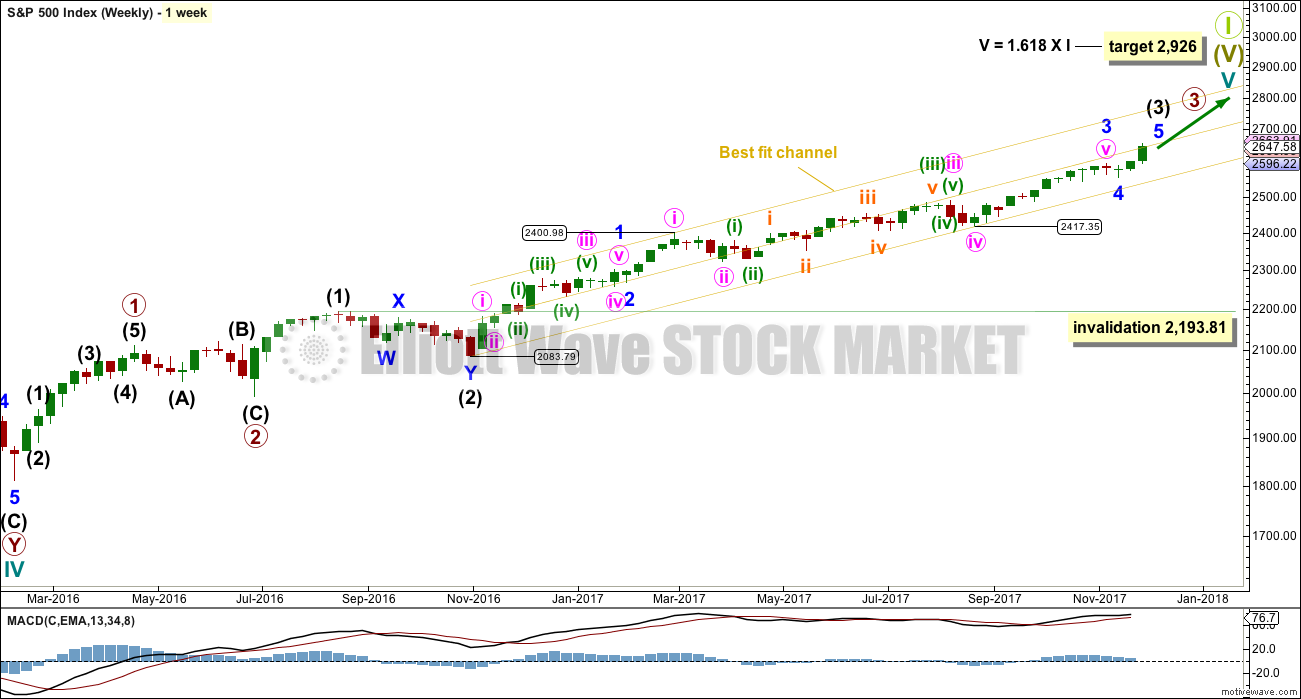

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the corrections for primary wave 2 and intermediate wave (2) both show up clearly, both lasting several weeks. The respective corrections for intermediate wave (4) and primary wave 4 should also last several weeks, so that they show up at weekly and monthly time frames. The right proportions between second and fourth wave corrections give a wave count the right look.

Cycle wave V has passed equality in length with cycle wave I, which would be the most common Fibonacci ratio for it to have exhibited. The next most common Fibonacci ratio would be 1.618 the length of cycle wave I.

Intermediate wave (3) may now be nearing completion. When it is complete, then intermediate wave (4) should unfold and be proportional to intermediate wave (2). Intermediate wave (4) may be very likely to break out of the yellow best fit channel that contains intermediate wave (3). Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81.

The yellow best fit channel is today redrawn. Price points are given so that members may replicate this channel.

DAILY CHART

Minor wave 4 may now be complete. It will subdivide very well as a double zigzag. This provides only a little alternation in structure with the single zigzag of minor wave 2. There is also poor alternation in depth: minor wave 2 was very shallow at only 0.16 of minor wave 1, and minor wave 4 would be only 0.12 of minor wave 3. Alternation is a guideline and not a rule; it is seen more often than not, but not always.

The target calculated for minor wave 5 expects it to exhibit the most common Fibonacci ratio for a fifth wave. This target would not expect a Fibonacci ratio for intermediate wave (3) to intermediate wave (1).

Within minor wave 5, no second wave correction may move beyond the start of its first wave below 2,557.45.

HOURLY CHART

With an increase in upwards momentum for Thursday’s session, it looks like minute wave iii may have ended at today’s high.

The short term best fit channel is here adjusted. Minute wave iv may continue either sideways or a little lower when markets open tomorrow; it may find support at the lower edge of the short term channel.

Minute wave iv may not move into minute wave i price territory below 2,601.19.

There is no Fibonacci ratio between minute waves i and iii. When minute wave iv is complete, then the target may be calculated at minute degree. A new target will probably be reasonably lower than the current target at 2,773.

TECHNICAL ANALYSIS

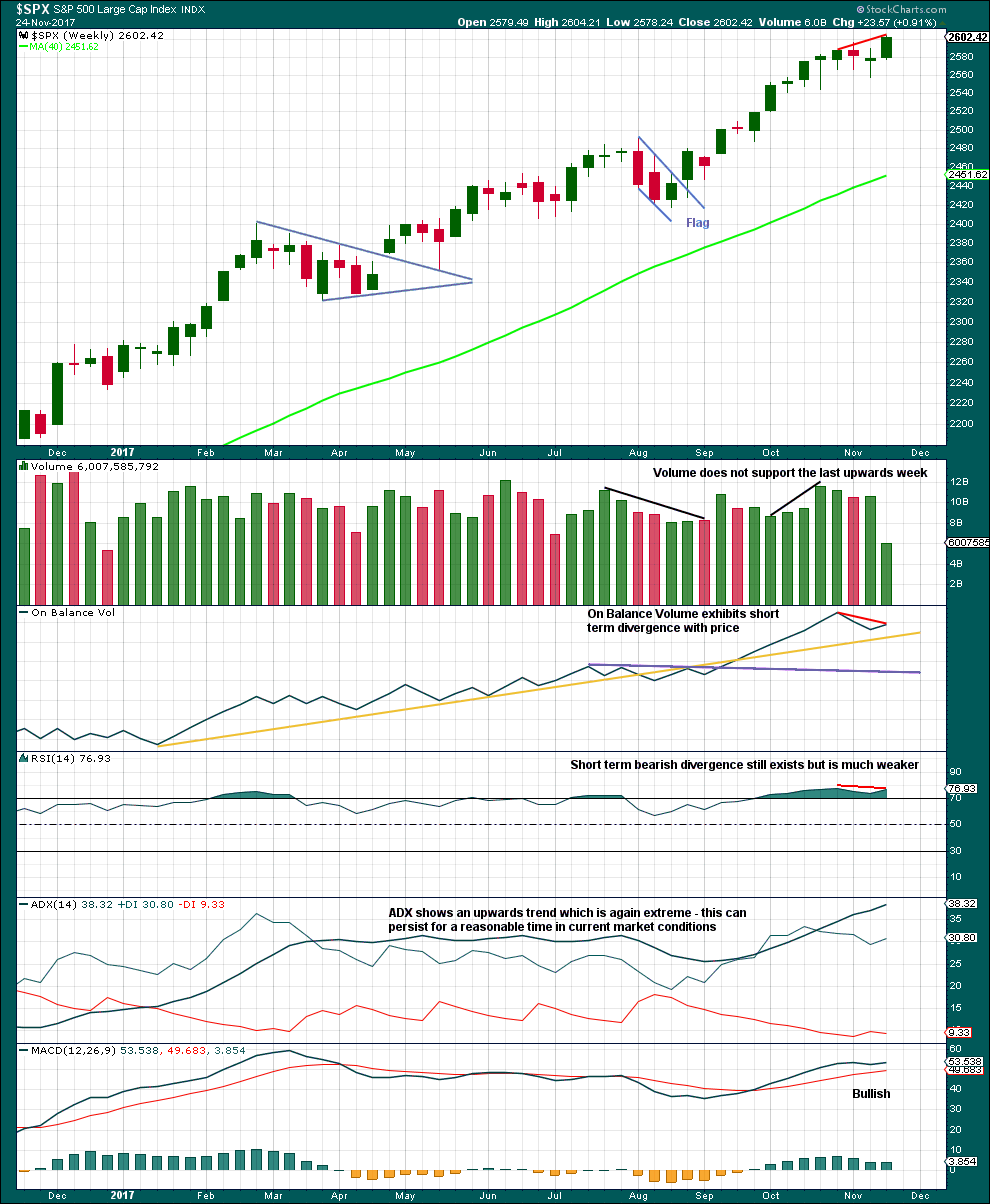

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Lighter volume for a week with a US holiday in it would be expected. On its own, this lighter volume should not be taken as a signal that a high is in place.

Some weakness and overbought indicators should be expected as intermediate wave (3) comes to an end.

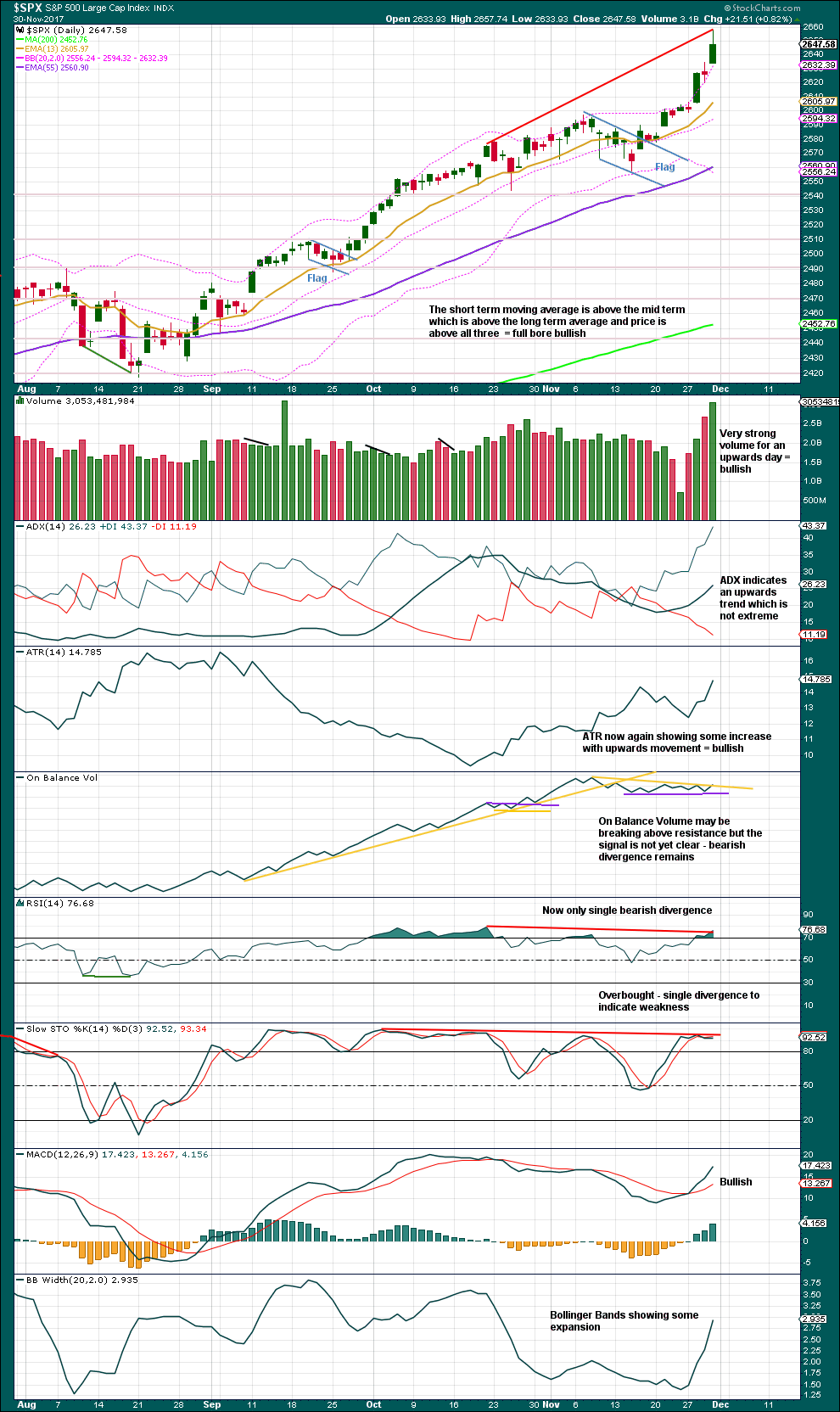

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Another upwards day shows: an increase in volume, ADX remaining bullish, and now ATR showing some increase.

There is still some divergence between price and RSI and Stochastics and On Balance Volume to indicate some weakness. This is not a useful timing tool though; it can only be taken as a warning that a high is approaching. Yesterday’s triple divergence between price and RSI was noted, but that has mostly disappeared today to only single divergence. This is an illustration of why divergence is not a timing tool because sometimes it just disappears.

If On Balance Volume makes a new high, then this chart would be fully bullish. While it exhibits divergence, it will still exhibit some weakness.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Again, price and VIX have strongly diverged today. Price has moved higher, but inverted VIX has moved lower. The rise in price did not come with a normal corresponding decline in volatility; instead, volatility has strongly increased, which is unusual. This was noted two days ago but the divergence did not lead to any downwards movement. The normal interpretation of this divergence would be to indicate weakness in price, because volatility is not a leading indicator.

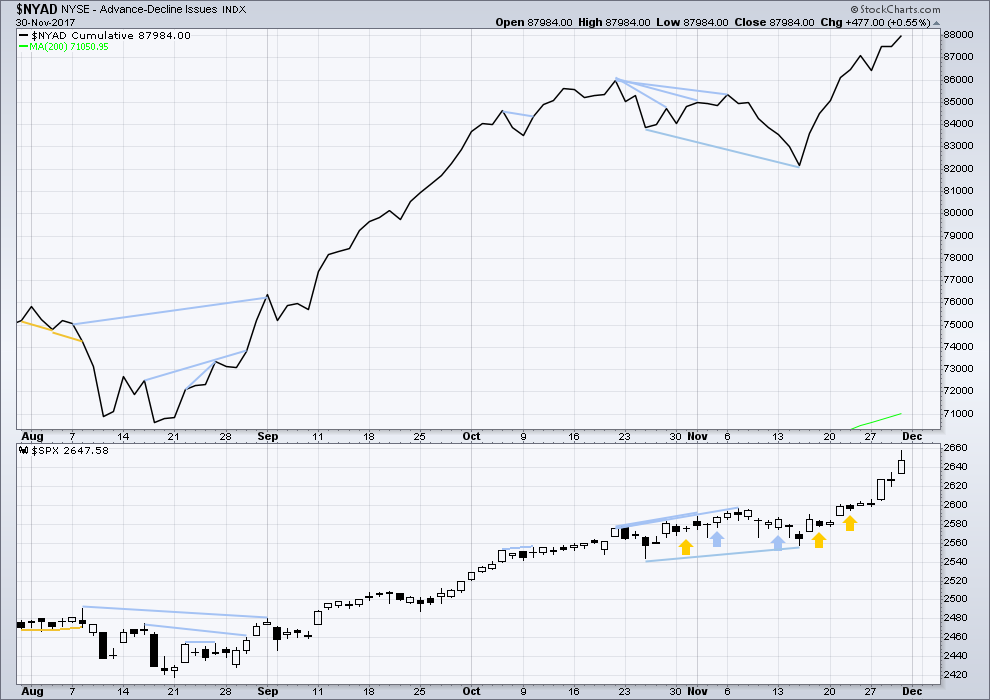

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

All of large, mid and small caps last week have made new all time highs. The rise in price has support from market breadth.

Price moved higher today and has support from a rise in market breadth. This is bullish.

DOW THEORY

Only DJT has not made a new all time high last week. The S&P500, DJIA and Nasdaq all this week made new all time highs.

Failure to confirm an ongoing bull market should absolutely not be read as the end of a bull market. For that, Dow Theory would have to confirm new lows.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

Published @ 06:33 p.m. EST.

A few months ago I cited Jason Goepfert who was also bug-eyed at the remarkable extremes we were seeing in sentiment and which was also being reflected in historic low levels in VIX. We have all watched in amazement as the markets have powered SUBSTANTIALLY higher since those observations. Several days ago I suggested persistent VIX divergence with price could be one thing that signaled an impending market top, and we certainly had a very pronounced example of this the last few sessions. Jason also noticed. Here is his observation:

“This is not a normal market.

The last time, before Thursday, that the S&P 500 rose more than 0.75% and closed at a new high, but the VIX “fear gauge” also rose at least 5%, was March 23, 2000.”

He did not elaborate as I presumed he figured anyone reading his site would be intimately familiar with the implications of what he was saying.

If your memory needs jogging, March 24, 2000 (corresponding to 12-1-17 in the analogy), was the exact high on both the NASDAQ 100 (NDX) and the S&P 500 prior to declines of 83.5% and 50.5% respectively.

Back then I was not nearly as interested in, or attentive to matters of volatility as I am now and have no recollection of being alert to, or even interested in that anomaly.

Not so today, as you are all probably all too well aware!! 🙂

Stay Frosty!

https://www.sentimentrader.com/blog/daily-sentiment-report-lite

Does anybody know why the financial news media has been so eerily silent on the matter of Venezuela’s bond default? This ought to be huge market moving news but all I can hear are crickets!

Just a little known provision of the Tax Bill that the dumb ass market also has not factored in… Certainly the algos haven’t…

20% Corporate Rate starts 2019

100% Expensing starts Jan 1, 2018

So the investment in plant, equipment & other … will take up all the Free Cash flow of these corporations to reduce the taxable income in 2018.

All that investment will also reduce profits.

Where does that Free cash flow come from? Stock Buy Backs

Couple that will the reduction in liquidity from reduction of Central Banks Balance Sheets and you get a major adjustment in the only inflation of the last several years… Stock Prices.

INVESTOR SENTIMENT READINGS

High bullish readings in the Consensus stock index or in the Market Vane stock index usually are signs of Market tops; low ones, market bottoms.

Last Week

2 Weeks Ago.

3 Weeks Ago

Consensus Index

Consensus Bullish Sentiment

76%

76%

77%

Source: Consensus Inc., P.O. Box 520526,Independence, Mo.

Historical data available at (800) 383-1441. editor@consensus-inc.com

AAII Index

Bullish

36.0%

35.5%

29.4%

Bearish

31.6

29.0

35.2

Neutral

32.4

35.5

35.4

Source: American Association of Individual Investors,

625 N. Michigan Ave., Chicago, Ill. 60611 (312) 280-0170.

Market Vane

Bullish Consensus

71%

70%

70%

Source: Market Vane, P.O. Box 90490,

Pasadena, CA 91109 (626) 395-7436.

TIM Group Market Sentiment

Indicator

49.6%

51.6%

52.9%

Source: TIM Group, 3 Columbus Circle, Suite 1592

New York, NY 10019 (844) 207-1445. timsupport@timgroup.com

TIM Group Market Sentiment is a proprietary indicator derived from actionable trade ideas sent by the sell-side to their buy-side clients over the TIM Ideas platform.

Over 3,000 institutional salespeople from more than 250 firms use the TIM Ideas platform to send approximately 100,000 ideas per month to over 350 buy-side firms globally. Ideas cover 120,000 stocks from 188 exchanges in 63 countries. The Market Sentiment score ranges from 0 (most bearish) to 100 (most bullish) and represents a completely objective, real-time view into the advice that sell-side firms are providing their buy-side clients.

Citigroup Panic/Euphoria Model

http://www.barrons.com/public/page/9_0210-investorsentimentreadings.html

Now that TAX reform has passed…Another interesting week coming up starting Monday…

If we get a fifth wave up starting with a candle already above the B bands, it would be the very first time I have ever seen that happen. Parabolic blow off top perhaps?!

I have stated many times in the past couple of years that the last piece of the puzzle we are missing to complete the bull market is a blow off top where the individual investor is “all in”. I think we are now witnessing that blow off top.

By the way Verne, you asked the other day if there is anyone on this forum who has been her longer than you. I am not sure about that. But I joined in January or February of 2012. My five year anniversary is just around the corner. Just in time for the Mother of All Bear Markets.

I just went back and looked at Lara’s historical commentary and analysis of the SPX. The oldest post she shows is February 3, 2012. There I see what may be my first post on the forum. Boy oh boy, time sure flies by and a lot of things have happened since then.

Thanks Lara for five years of excellent analysis and commentary.

Verne & Rodney,

Few years for me but took a break in between to strategize before resubscribing. All good and slowly working out…

I believe I was a member in Feb 2014 … then left for a while, not sure when and returned in early 2016.

Me approximately the same as you, Joseph, plus or minus a few months.

You’re most welcome Rodney 🙂

And all these years later (7 years now for EWSM) I still enjoy analysing this market, and I’m still learning!

well ok,,, so Rodney was first,,, but I was the first to say first…dilly dilly..

I think there are a few very quiet members! 🙂

LOL

There are still a few original members. You know who you are, on that old initial GrandFather rate 🙂

Yes, quite a few quiet members.

Another unusual departure today is none of the usual Friday smashing of the VIX price. Of course we have another half hour of market action so that could change. We should see a big move coming up, either up or down, but which??!!

I am on the sidelines…..

Have a great weekend all!

There is something truly unsettling about these manic market declines that are so frantically reversed. The market has no natural ebb and flow. I am reminded of the recent Artemis article that contended that it was not volatility that was broken, but the market…so eerie…!

Looking back for the last year, I cannot find any similar daily candle. It’s unique! Bullish.

Yes… everything is bullish. Bad news is bullish… Bearish candle stick patterns are bullish. Flattening Yield Curve is Bullish. All wave counts are bullish.

Every pro is bullish.

Every individual is bullish.

Market caps 4, 5 & 6 times revenue is bullish.

All Pro-forma EPS art is bullish.

Tax Bill passing… even though priced in since election day 2016 is bullish.

Huge Debt loads and highest margin debt ever is bullish.

A single painting selling for 450 Million is bullish.

Everything is bullish. Bullish, Bullish… Bullish!

Have a very bullish weekend.

Bullish wishes to you too my friend…NOT!!! 🙂

This is a very unusual situation. I am looking at market price sitting above upper B bands at the same time we are expecting an interim bottom in price. I have never seen this before, and I guess there is a first time for everything, but I am stepping back to see how this plays out. I find it quite weird personally…

I guess they will hold through the weekend and will not buy any additional protection.

At least I don’t see any sign of it here at 3:15PM ET… yet.

Vote: a roll call now… then 30 min more of debate. Then other after that. So vote is after the close for sure!

Buying the 50% portion I sold on that spike of VIX right now and I am holding into Mon/Tues. or so.

I think you are probably going to get a better price the next few days… 🙂

The Quants may be right about VIX 15.00 being the event horizon for the vol short cohort. It faces fairly stiff resistance every time it clears 14.00. Interesting price level to watch.

It going to be quite something if price gaps up through that level.

Vote will be after the close (“later this afternoon”)… confirmed.

So, I think we are going to get that final wave down in the indexes for today and up in the VIX real soon. Correct me if I am wrong, but it must hit a new daily low to complete ABC or 123, etc… right? New D high for VIX.

20 min chart all indexes.

They either need to sell or buy protection or both.

It is possible to see a complete abc for minute four as per Lara’s update…

With a bounce up off todays low and minute iv remaining above minute i price territory, this is still the preferred wave count.

A new target can be calculated at minute degree now. This will be the preferred target for now.

On the hourly chart that candlestick ending minute iv with the long lower wick is very bullish. And on the daily chart todays candlestick is very bullish indeed.

Yep. It has always been in the past. I have rarely seen the long lower wick at the same time price was trading well above the upper B band. Of course there is not too much any more in this market that surprises me. Just when you think that distortions cannot become any more extreme, that is exactly what you get….

$1.5 trillion in cash giveaways to the rich and the corporates is an awful lot of distortion, so I would say everything is proceeding about as we might objectively expect. Yes, it’s all a bubble, and the oligarchy running the circus is blowing a hell of a lot of hot air (borrowed from the common citizens, who will have to pay it off themselves later, as well as broadly lose their shirts when it blows; the smart/big money will be out the door first!) into it, but it’s a long, long ways from popping. And to think…Clinton had the economy on wheels and was PAYING DOWN the national debt in 1997-2000. Then along came George W, and off we went over fiscal cliff, spending billions on foreign wars of market conquest for the corporates, and cutting taxes like crazy. Huge new deficit growth, way to go! Then a massive recession. Obama got things reasonably back on track. But now…back to spend more and cut taxes, and add piles of new debt, so the rich can get richer TODAY!!! What a country.

I am really interested to see how the market reacts to passage of this bill. The smartest people I know are citing myriad reasons for why it is NOT going to have the salutary effect on the economy that is being predicted and an efficient market should reflect that reality if it is indeed the case. I know they are trying to fix the issue around small businesses which was my own complaint about the entire thing. They are supposedly going to take a couple of percentage points from the C Corps and give it to small businesses. It would certainly improve the legislation imho…

I’m betting on Lara’s target for now. Even holding over the weekend…if senate passage occurs after market today, my best guess (and it’s only that, but backed by Lara’s call to some degree) is a large gap up open, and then a fast climb on Monday. Could be dead wrong. The intermediate 4 is looming! We’ll see!

Kevin,

Seasonally positivity will push towards 2700 first and then to 2776 target…TAX reform passed by Senate so onwards and upwards until the music stops.

Based on this, a pullback and turn anywhere above today’s low becomes a minuette 2. And a high leverage/low risk (invalidation point will be very close below) entry point opportunity. I’m watching the 2620 fibo zone where there was a lot of stopping and turning this morning as a key decision area for the bottom of such a minuette 2. Other fibos that could act as turn points are 2635 (price on it right now), and 2629.

Closing UVXY bullish put credit spread for just about a 100% return.

Will reload on final wave up.

I would expect signs of trouble will again show up in a futures dive, in which case we could assume a third wave down would be underway…otherwise, move down corrective and we are going up with a complete retrace of this decline…

Body of VIX candle sitting right on top of 200 day MA. How price trades around it the next few sessions should be quite revealing.

Opening stink bid for Dec 15 SVXY 115 strike puts for limit price of 4.50.

Chances are I will get filled on any new market high. If I get filled and we get a strong reversal signal in the market, I will be dubbing those puts my “official” Xmas trade this year…and of course backing up the 18 wheeler…. Cheers! 🙂 🙂 🙂

Here’s hoping for one more chance to grab some cheap vol on the last wave up….! 🙂

Probably a complete Zig Zag for a minute or minor four. We have been repeatedly seeing these corrections complete with remarkable rapidity so nothing really new here….

This morning was just an initial taste of what’s on the menu in the not-too-distant-future methinks…! 🙂

Not convinced we have had a major trend change. I am looking at the gaps that remain open that will almost certainly be taken out with the first impulse down after we have had an actual change of trend. I think we have another wave up. VIX long upper wick outside B bands very reliably signal short term trend reversal. Last wave up should be about another six or seven trading sessions…

Unfortunately, that seems to make sense and we have support from Lara’s analysis. We all seem to be bearish and anxiously awaiting the trend change. Maybe in time for Christmas 😉

It is not necessarily “unfortunate”. We simply trade what we see, right? 🙂

True. Unfortunate for me because I have had such a bearish bias to my trading. I need to get better at trusting the analysis, could have done much better if not leaning short for large parts of this rally. On to the next wave!

I hear ya. Even when I am spouting bearish sentiment, I ALWAYS have active trades based on Lara’s current analysis. It has been a very profitable practice!! 🙂

And by the way, did I mention her targets are absolutely awesome??!!

If that long lower wick today’s candle not filled out prior to the close, we will certainly see one more final wave up before a longer lasting turn…a second wave correction should conclude well before the end of the session. A new low would be a great opportunity for a quick scalp on options expiring today…yum! 🙂

I want to see S&P futures down 100 points to confirm the start of an impulse down.

I wish this had happened yesterday! 🙂

You got it in regular hours… a 40 min long down candle in ES

You know these Banksters Joe. I want to see it go down and STAY down. I want Mr Market to grab them by the throat and not let go…until then, I am wary… 🙂

Should get another wave down in all indexes as the initial wave down appears to be impulsive as it lasted for about 40 min straight down across all indexes. Using 20 min Chart.

Please correct me if I am wrong on that.

Either a A/B/C or a 1/2/3, etc

VIX… would be up opp of indexes.

62% retrace has now occurred on all indexes according to my data.

So next wave should start soon. If wave one for 40 min straight in one direction was an impulse.

Yep!

I am really curious. Are we seeing the typical BTFD lemmings or are the banksters still going for broke??!! Maybe both! 🙂

We’re seeing a minute 4. Nothing less, and nothing more. So far. It’s clearly corrective to my eye. Could change I suppose but the preponderance of the evidence is definitely…just a minute 4 playing out.

I agree with Kevin. I think today’s action is a corrective wave with new ATH’s to come. However, I am not sure the correction is over and I don’t know what degree is this correction. My long term account is still 50% long.

Let’s be clear. Rodney’s not agreeing with me. He’s agreeing with Lara’s analysis, which is where I put my hat too. Every shred of evidence says this is merely a corrective 4 wave. Everything else is mere speculation, because there’s no significant set of evidence it is anything but a corrective 4 wave. That could change. But the most likely scenario is the 4 wave plays out over the next few days (maybe until the final bill comes out of committee and all the congressional corporate/billionaire shills are ready to pass it in both chambers), and then the next 5 takes off. That’s what the preponderance of the evidence indicates. IMO.

Should get another wave down in all indexes as the initial wave down appears to be impulsive as it lasted for about 40 min straight down across all indexes. Using 20 min Chart. Clearly an inter day impulse with a compete ~62% retracement. Need another wave down today to complete the following if the EW stuff really works.

Either a A/B/C or a 1/2/3, etc

VIX… would be up opp of indexes.

Please correct me if I am wrong on that.

I do not believe that “40 minutes straight down” gives any indication of an “impulse” (which I assume, perhaps incorrectly, means or implies “a 5 wave in the direction of the primary trend”). It’s a huge uptrending bull market, and corrections are frequently going to go “straight down” for a period, then over time play out some kind of corrective structure. Here, likely either a big flat, or perhaps a triangle. Not impossible the initial spike down (I can easily count an ABC on the 2 minute chart of SPX) is the complete correction, but unlikely given it’s very short time period. More likely a W, now we have the Y bounce, and an X down is coming. So yes, quite possibly more down…to complete the correction.

If waves are fractals… then 40 min straight down on 20 min chart has merit. It was 40 min straight down on every index. If that’s not impulsive then impulse wave must be re-defined!

It could have been a C wave of an abc correction.

No… that was wave 1 down (impulse) or up in VIX. In every index. 20 min chart.

Tax Vote won’t be until after the Close today! They have to do vote arama for a couple of hours and that has just started.

You really think market players want to be long over the weekend?

They have to Buy protection if they stay long… NO?

After what we saw today anyone long over the weekend would have to be insane, but what’s new about that? 🙂

Assuming we are not the only ones hedging the long position, I would think into the close majority of the crowd will be net neutral or somewhat short in case vote fails…

That will play right into marketplaces hands 😉

Remember that the vast bulk of the “crowd” are not actively trading. They are in like lambs in the field. Getting fatter most days. Eventually they will get slaughtered. Probably not today or Monday though.

Lara,

I like the 2773 target as market behavior is very bullish indeed.

Another technical analysis I was reading yesterday indicates BUY Signals on SPX and NASDAQ index at close yesterday. Let’s see where all these indicators lead markets.

How interesting. Some attributing the market’s swoon to the rumor that Flynn has named Trump as the one that told him to talk to the Russians. That is really way to funny!

The idea that the president elect did something wrong by talking to a foreign government is beyond absurd. This thing has become a complete circus, and I am at loss to understand why Flynn lied about it in the first place.

If the nature of the collaboration was illegal (i.e., involved illegal hacking, or use of illegally obtained materials…which clearly DID go on, but was the Trump gang part of it at any stage? Were they informed and FAILED TO NOTIFY AUTHORITIES? And instead promoted the use of the illegally obtained info? Or even promote the illegal hacking to begin with??? Hmmm), there is some serious, oh, what was the word of the year again??? Oh yes, “complicit”, i.e., working with others in an illegal activity. So yea, Flynn turning state witness might be a Very Big Deal very quickly. I personally will party like it’s 1999 when the indictment of Trump gets nailed to the White House door! Soon now, perhaps. I sure hope so.

It was about sanctions…

Ah yes, sanctions! The ones congress insist on, and Trump doesn’t want to invoke. I wonder why? Russia has been “developing” Trump since the late 1980’s. He’s compromised by the Russians 5 ways from Sunday. He launders their money. He enables the Russian oligarchs to come reside in the US for months to have their babies so they have dual citizenship. He worked with them to manipulate the election. He’s structured our national energy policy to be 1000% favorable to the Russian economy (and not ours!!!), which is 70% dependent on oil and gas; Russia DIES in a clean energy future, and Trump is doing everything possible to deny a clean energy future. Sorry, but as I see it…the evidence indicates that he is nothing more than a pawn of the Russian mafia (which Putin runs), and belongs in jail cell. The overt facts alone leads to that conclusion (how could you write an energy policy for the US that fails to even ACKNOWLEDGE THE EXISTENCE of clean/alternative energy, when the solar space for example is the fastest growing job area in the US?????!!!!).

We will see…

Logan Act…

The ultimate bearish indicator…an article of “cheering on President, market achieves new heights” on the front page of the NYTimes this morning! I guess a few banksters looked at that and said “ahhh…time to sell!!” Lol!!!!

If this is a second wave, we should see about a 62% retrace of the impulse down, and then…look out below…!

Which Index S&P? or?

I was trading VIX and SVXY…

So wave 2 down in VIX 62%? Then I assume 3 up? Is what you mean?

That too…! 🙂

DJI and S&P 500 mainly…

You are not very clear in what you mean when you post Verne.

Sorry about that Joe. You are right in that it is often me just thinking out loud. Was there something in particular I need to clarify?

Thanks, I pieced it together over a few of your posts and after thinking about what you said.

You guys still see VIX 17+ on this move near term?

I was expecting a test of the recent high as the trigger for taking profits and we did hit 14.58. The long upper wick means we could see a significant retrace, unless we just saw wave one of a larger impulse down….

Which index are you referring to?

I was talking about VIX.

The reference to a possible impulse down was the market…

Hey Joe, don’t be afraid to cash in some of you winnings…! 🙂

Sold 50% … UVXY came off after and looking to buy that back… if VIX going 17+ near term.

Been away from the computer for a bit today. Wow, am I glad I exited my leveraged long positions yesterday!

Impeccible timing Rodney!! As Verne said, “beware the parabolic move!”.

However, stepping back form it a bit…it’s just a 4 in progress, and arguably it’s not even a “large” 4 so far, it’s about nominal given it’s timeframe. The 50% fibo from the Nov 14 low to the high a day or two ago has held, and price will now “ring like a bell” for a bit.

The ballsy play is of course picking off the bottom. It’s hard not to notice that the best buy points in this bull market tend to me the lows of these sudden large-ish spikes down. The challenge is knowing when the ARE at a bottom, because it literallys lasts about 30 seconds. The only way to take it (IMO) is to use the fibo’s and scale as each one is approached. Takes belief in the overall EW count and belief that “the end” is not here yet. I ain’t good at it yet, but I’m warming up to it. At least I show a comfortable profit for the day, despite being a long only player today; always my goal, profit every day.

Notice how violent the drops are and it appears the flush happens in very short period unlike the past when things dragged on for days. Like the idea if cashing profits frequently as opposed to waiting for the mother load.

If you’re profiting every day, then you are most certainly doing it right. That’s really awesome 🙂

I was wrong about one thing. I thought the futures blow-up would happen overnight when no one was paying attention. The fact that this is happening during the cash session in plain sight suggests to me that the banksters are in a whole heap of hurt dudes…! Do y’all see what is going on there??!! 🙂

I am looking for a quick visit to at least the lower B bands to rid us of some of this frothiness. What happens from there is anyone’s guess imho…

Yikes. Nice quadruple on SVXY 115 puts.

Look for the banksters to trash around like bass on a line…

So awesome!! Who wants to go on surf trip?

I would if I could, but would probably get smacked up the side of the head by the surfboard. A pity! I heard we have some awesome waves on the North End of Tortola! 🙂

A day surfing is always a great day! I’m in. Big damn waves in the market to-day!!!

🙂 I got some very nice clean 2-3ft waves the other day.

I’m hoping that Cesar and I can have a trip to Tahiti next winter (our Southern hemisphere winter that is).

This is how ALL parabolic rises resolve…

I was a little early on by DIA 239 puts but that was a helluva trade!!

Well played sirs!!! Strangely enough, I’m profitable on XIV today myself…lol!!! Though I did watch my account go seriously underwater for a few minutes…then up! then down! faster than I could even consider trading it. All is well now…

As I said. Whipsaw. I have a funny feeling who is going to loose the contest but I am not saying….! 🙂 🙂 🙂

Time to take some vol long profits.

hahahahahahahaha

Hear me now and believe me later, if all those vol shorts somehow got wind of what the stealth exit implied for them and start jumping the gun….it could be UGLY! 🙂

Could be, could be. It’s also not impossible that instead of closing below 2600 today, SPX will close back around 2650. My next set of fibo supports are a 50% at 2607, and then several in the 2596-2597.5 range.

Could be, could be. It’s also not impossible that instead of closing below 2600 today, SPX will close back around 2650. My next set of fibo supports are a 50% at 2607, and then several in the 2596-2597.5 range. Some good buys will be setting up soon…

Vol trades literally EXPLODING! What the…!!!!!

O.K. people. What have I been saying ad nauseam about where we would see the earliest evidence of the banksters’ loss of control?! Go take a look…

Just saying…

All on Business Shows today, everyone of them saying, “another leg up from here” when passed.

We all know what that means… if you have been following my posts today.

Chris, Verne…. VIX just spiked to 11.93 now 12.48

UVXY to 14.45 now 15

In an instant… Wow!

I’m evolving (learning??) that on days like this (“4 days”), I do best just taking any little profits I can pretty much anywhere I can, “with extreme prejudice”. The whippy market giveth a little…and quickly taketh away! So I just cash quick on the little gives. Not a day to think about a nominal score. Just scratch out a little scratch. The 5 up is coming….

We are about to see some serious whipsaw as the Banksters contend with a top heavy market. Unless you are VERY nimble, it’s SOH time for most….

Indeed! Whippity whippity!!!

the SPX low for that spike down was right at a 100% retrace and just slightly above a 38%. Maybe some more backing and filling now but I suspect that’s it for todays low. Also sets up a possible (likely?) triangle 4 going forward for a few days.

Picked off some XIV pretty close to the low so far today, and now a spike up in SPX and down in VIX…baaaaaby!!! Sweet. Pass that bill and let’s see price go to the moon, wtf not. Cash off the backs of the poor and middle class, if you can’t stop the theft, best to be on the right side of it!

I also bot some svxy at 111.25.

UVXY will be down 5-10% if passes. Have a 263.5/263 spy put spread protection.

I hope you had a tight stop. The break of that 112.00 shelf was significant…

Ha. I’m a mush! I got stopped out around here, 106. Hoping my put spread finished in the money, I think it will, and I’ll come out small green but playing with fire!

Need some fire-proof mits? 😀

After reading some of the posts here this morning, we have a real market among the posters on this site.

I have entered my short DOW order at a stink Bid for now. I may adjust later as this Tax vote gets near.

I am long the VIX since 9.77

“Bull Markets end on good news not bad news” A yes on Tax vote is considered good news.

Lara’s EW count has us a year to several years from the end of the bull market (ignoring the impending larger and larger 4’s coming, each of which will then be eclipsed by new highs). This market is just getting going, and the tax bill is going to light another engine on the rocket. This bull market ends with the end of the Grand Super Cycle, and the start of a depression/recession that will almost certainly dwarf the ’29-mid 30’s depression. Not close to that yet.

I am once again more than a little annoyed at the RIDICULOUS spreads on vol instruments. Sadly for them, they are in the money! 🙂

61.8% fibo at 2634.6

23.6% fibo at 2633

Key decision area to downside today…which is just a little bit aboe gap start at 2632.5 or so, adding the significance of that zone.

RUT retrace fibo 23.6% at 1529, and a symmetric projection to the exact same price adding to the significance of 1529 as a decision point for a turn (should it get down there).

relentless manipulation in the ES this am, certainly am used to but there’s no telling when and why they would stop

Chris,

Why would they let this fall so easily…they probably got more shorts trapped for the next leg up…

Touche’

Au Contraire mon Ami, this market is not falling with their permission. They continue to do everything in their power to prevent it. If and when sellers appear, you will see what I mean…

Banksters are rattlesnakes. After a bit of digging, I suspect the ones implicated in the short vol debacle have hit on an ingenious way out the back door without drawing too much attention. What better time than when everyone is all a twitter about new all time highs. The sound of the rattle is VIX’s steady climb while the market remains propped up. Look for this to continue…at least for a bit longer…

I understand what you are saying, however, I don’t see the volume of this unwind. If the vol short is as big as you say… and I believe you as I have read about it as well, then the volume to unwind has to be HUGE and can’t be hidden.

Huge volume if every one is trying to unwind simultaneously, yes, but that is exactly the point! The smart ones don’t want every one heading for the exits at once…capisce?! 🙂

agreed… but you should still see the incremental increase in volume. I don’t, but if you can show me… I would like to go deeper into that.

Probably. We cannot however exclude the “greater fool” theory of others still entering the trade, even at this late stage.

See what I mean??!! 😀

Actually glad that almost flat… I rather have the vol play out during regular hours.

I also would like to see & feel action before I put my DOW short back on.

In any event today and the next few days should be highly volatile. I am certainly well positioned for that at the moment.

Chris, if you will be viewing the action today & the next few days, I would like your current view and any updated view on realistic targets for VIX… also at the point you think it may be the end or near the end of the move higher. Not as for a day trade… but for a swing trade of a few to several days.

I am very new to vol trade and don’t want to ride back down. Would like to exit at a near optimal point.

Joseph, first off, vol is not an easy thing to trade and the vehicles do not lend themselves to prudent risk management. It requires constant oversight in my opinion. Because I’m PM for a Fund, I can’t map out a strategy for you on a message board. Please feel free to get my contact from Lara, and I’m happy to discuss further.

I don’t need a strategy, I am already in at a 9.77 VIX… I am not asking for specifics just your view on a realistic target for VIX on this specific move up from a 9.77 VIX over the next several days to 10 days.

I know the risks, I am currently a seasoned advisor a ChFC with years of experience on WS in addition to this.

I will ask for your email.

Look for VIX to at least test recent high prior to a beat down, a good place to take some off the table or roll… 😉

SVXY just broke support shelf around 112. Should now be resistance…

realistic target is infinite as we have never had short vol outside of the futures market until this cycle, near term 17 seems like a good exit.

Thanks to both. If that 17 in your view changes… a posting about it would be appreciated.

As to infinite, I would agree… but unless that happens very soon, I am not going to be in the trade long enough.

UVXY pre-market 14.03 Bid… traded as high as 14.40 early this morning.

VIX at 11.53

Today will be very interesting indeed!

Hi Lara, thanks for the early delivery. I was wondering about minor three not penetrating the upper channe boundary..lateness of the hour perhaps?

UVXY ‘s last trade in after hours was at 13.94 … 4PM close was 13.45

Tomorrow and the next few trading days should be very interesting. I think I am going to put my DOW short back on tomorrow… got stopped out after I put it on today.

Looks like futures have turned down /ES -10 /YM – 61 /NQ -25.75

That 13.94 trade was at 7:00PM ET

Old Buddy calling end of 5’s again tonight in DJIA, DJTA and S&P… final high

Did we miss that obvious shot across the bow from VIX today?! 🙂

I have been in UVXY since 9.77 VIX. My 2nd entry in this. Looking for that spike above VIX 14.51 for an exit point.

The 1st trade in this (8 days ago) I got stopped out pretty quick. You really have to pick a good entry point with UVXY to make a profit.

I think I have that right entry this time as long as the up move continues a few more days.

Just need to get my DOW short on as it rolls over from the high and catch a real wave down.

Algos definitely hunt the stops. 17/20 range is realistic

For Uvxy but it could exploded at anytime. Layer in and layer out is the method I’ve used my whole life. Should work near term again.

No matter the outcome; Verne as you alluded to, what a blessing to get positioned favorably coupled with great risk reward. We could see low 20s tomorrow if the bill doesn’t pass, if not within a few weeks. Grabbed the longest dated Djia put I could, just for paper trail and for record keeping purposes.

Oh really? Yikes! I had just about given up on those SPY 256 strike puts from my 256/258 spread… 😉

That 13.94 trade was 10,987shares at 7:59PM ET … correction on the time.

I have to say I am a bit surprised that they are still calling tops. One principle,

I am forced to conclude we do NOT yet have one! 🙂

DOW in overthrow… once it goes below last weeks lows which is back below ew trend lines… he says “Bull Over”. Last night said same for the 3 indexes. He also said bull turns on good news… not bad news. Tax Bill passing is the good news.

Those statements line up with my view of buy the rumor and sell the news. Since election day 2016 it has been buy the rumor. Let’s face it the markets were grossly overvalued before the election and got more over valued to an extreme since the election. Sorry, but the revenue increases and eps numbers so far in 2017 does not support the move that already occurred + the effect of the tax bill over the next 12 to 18 moths does not support the move that already occurred.

I completely agree. By every ressonable historic measure, the market is grossly over valued…

One of the problems with Prechter and company is that they have stubbornly refused to acknowledge the role central banks have been playing in market price action. They present their wave counts with an arrogance that assumes the market has to comply with that particular view. It is really disturbing that no mater how many times they end up with egg on their faces to they don’t seem to learn anything from the experience. I feel sorry for their subscribers who make trades based solely on their call; they are loosing them an awful lot of capital.

Futures breaching EW channel…

One of the first signs that the smarter folk have started to unwind their gargantuan short vol trades will be a sharp move up in UVXY as issuers lighten up their short futures positions…I suspect we are going to see many reverse splits before this party is all over…

Who knows, but I don’t think it is quite time to short, both on instinct and Lara’s analysis. I’m consistently wrong, but my gut tells me that this Senate bill finds a way to pass tomorrow morning and it coincides with minute v rally. I’m curious what the new target will project as. Then, finally, reality sets in and maybe we can all celebrate the much anticipated and elusive intermediate iv.

Jon, the Tax Bill passing is priced in… it has been buy the rumor since election day 2016 and now will be sell the news. The market will sell off after it’s passed. You may get an initial spike that will last no more than 48 – 72 hours. But my gut tells me that the bulk of that initial spike occurred yesterday.

I am putting my short on again today in DOW… with a tight stop. Although if I am able to put it on pre-market I will wait on putting the stop on.

I don’t think it is. That is why we rallied so hard yesterday. You can lookup odds from betting parlors and various websites and the odds are still around 60% that it passes. There is a lot of pessimism that they still cannot execute this.

Those same betting parlors had odds far against Brexit passing and Trump winning the Presidency. So do you still believe or trust in that garbage?

See my post above… Tax Bill passing is priced in.

It’s going to pass. The GOP holdouts are pure show, trying to look good to their voters. Guaranteed everyone of them folds under a claim of “I got what we wanted voters”, in the end, and votes yes. The good conscience “no’s” have already voted (McCain as one example). They are all corporate shills, in the end, and all beholden to those who score HUUUUUUGE on this thing, who won’t pay their reelection tickets if they vote no.

Pass through Businesses and Corporations are the employers in the USA.

Without them, nobody has a job!

Last 20 years,You chase them out of the USA with bad Tax policy and regulations… you lose jobs in the USA. Only jobs that remain would be service jobs… this what we had left, service jobs. (Would you like fries with that?)

This Tax Bill along with the deregulation done & other to be done… will start a new wave of start up small business in the USA (last 9 years more businesses folded than started up… Only 1 Reason for that, but I don’t want to go there today)

Corporations will also turn back to manufacturing in the USA. This has already started thanks to President Trump. It will accelerate with Tax Bill.

Joseph, if you haven’t noticed, our economy is already doing very well. Also, our effective tax rate on business is already the 5th lowest in the world. The amount of dis-information floating around to support the tax theft is astounding. This is pure kleptocracy at work. They are stealing $1.5 trillion from the future common citizens, and will severely damage the US in the process. They know this. They don’t care. They the politicians need to get reelected; this is how they achieve that, by placating the major $$ donors. The major $$ donors don’t care; all they care about is short term income and profits and bonuses. It’s an awesome cycle of greed. If they wanted to truly stimulate the economy, you OBVIOUSLY do that by stimulating DEMAND, by giving more money to the consumer with tax cuts. The rich don’t want that. They want a cash pay out now. The argument that a cash pay out now will stimulate the economy has been proven over, and over, and over, to be bunk.

Let the price action and your caution guide you Jonathon. Lots of opinions here and elsewhere; they are just opinions, and I strive hard (real hard at times!) to minimize their effect on my plan and execution. No one knows what the market is going to do, period.

I’ll add that for me personally, there’s way, way, way too much upside momentum to consider a short, and on top of that, Lara’s EW map says only a small 4 here, then more up. So I’m literally not even thinking about that as a possibility right now. That’s just me though.

Momentum has increased these last two weeks so I’ve adjusted the best fit channel on the weekly chart. Now minor 3 is mid line.

As for the daily chart, I’ve adjusted that too. Channel now drawn from the end of intermediate (2) on 4th November 2016 at 2,083.79 to the low of minute iv within minor 3 on the 21st August 2017 at 2,417.35, parallel copy on the high of minute i within minor wave 3 on the 1st March 2017 at 2,400.98.

Minor 3 high is now in the lower half of that channel, yesterday’s high right about the mid line.

woo hoo

Anybody seen my poppy?