The main Elliott wave count expects more upwards movement, and it has strong support from classic technical analysis, particularly a very bullish On Balance Volume and rising market breadth.

Summary: On Balance Volume and the AD line remain very bullish, supporting the main Elliott wave count. The next target is now at 2,521 to 2,526. It may now be met within a few days.

Stay nimble and keep stops tight. This trend is extreme and over stretched. There is reasonable downside risk.

Always trade with stops and invest only 1-5% of equity on any one trade.

Last monthly and weekly charts are here. Last historic analysis video is here.

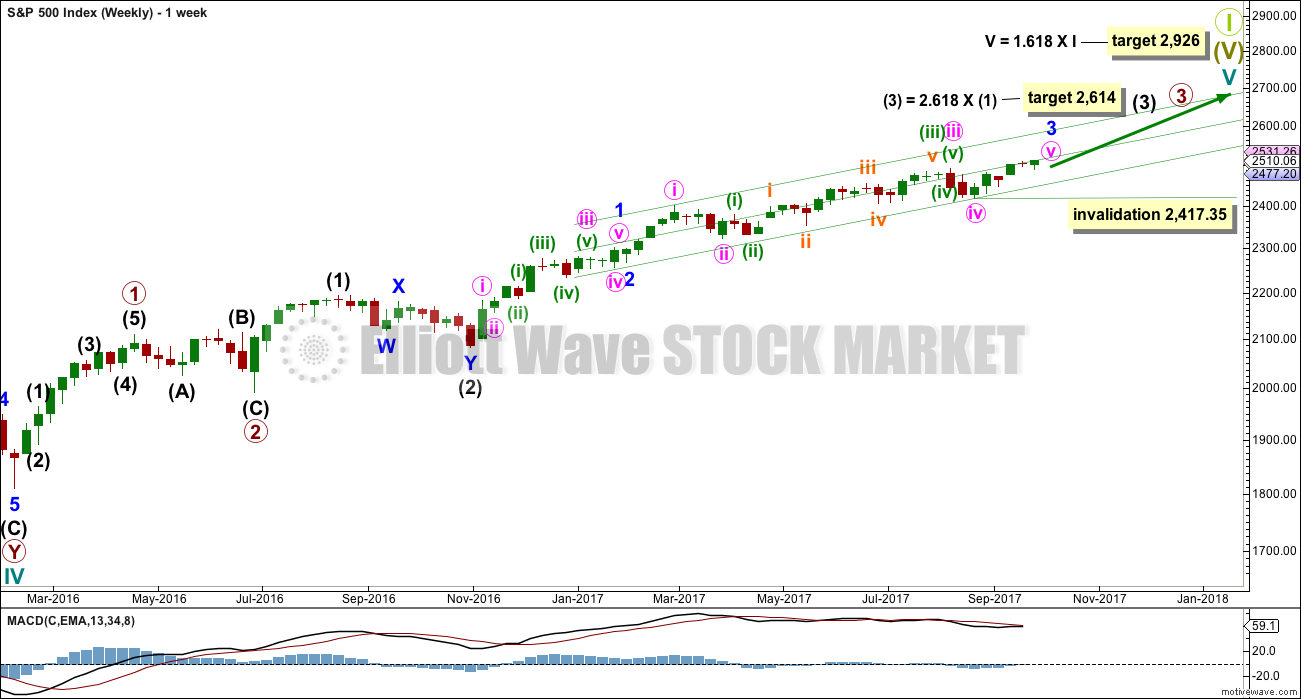

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count has strong support from a clear and strong bullish signal from On Balance Volume. While classic analysis is still very bullish for the short term, there will be corrections along the way up. Indicators are extreme and there is considerable risk to the downside still.

If primary wave 3 isn’t over, then how would the subdivisions fit? Would it fit with MACD? What would be the invalidation point and would the Fibonacci ratios be adequate?

Of several ideas I have tried, this one has the best fit in terms of subdivisions and meets all Elliott wave rules.

Despite this wave count appearing forced and manufactured, and despite persistent weakness in volume and momentum for this third wave, On Balance Volume does now strongly favour it. It may be that as a Grand Super Cycle wave comes to an end, that weakness may develop and persist for very long periods of time (up to three years is warned as possible by Lowry’s for the end of a bull market), so this weakness may be viewed in that larger context.

Within minute wave v, no second wave correction may move beyond the start of its first wave below 2,417.35.

The next reasonable correction should be for intermediate wave (4). When it arrives, it should last over two months in duration, and it may find support about the lower edge of this best fit channel. The correction may be relatively shallow, a choppy overlapping consolidation, at the weekly chart level.

DAILY CHART

To see details of the whole of primary wave 3 so far and compare and contrast with the alternate wave count, see the analysis here.

Minute wave v to complete minor wave 3 must subdivide as a five wave structure. It looks like an incomplete impulse. So far it looks like subminuette waves i through to iv are complete. Within subminuette wave v, no second wave correction may move beyond the start of its first wave below 2,488.38.

Subminuette wave iv has now lasted three sessions to one session for subminuette wave ii, the structure still has a reasonably normal look at the daily chart level.

So far minuette wave (iii) has lasted 21 sessions. The structure is still incomplete at the hourly chart level, so it may not exhibit a Fibonacci duration.

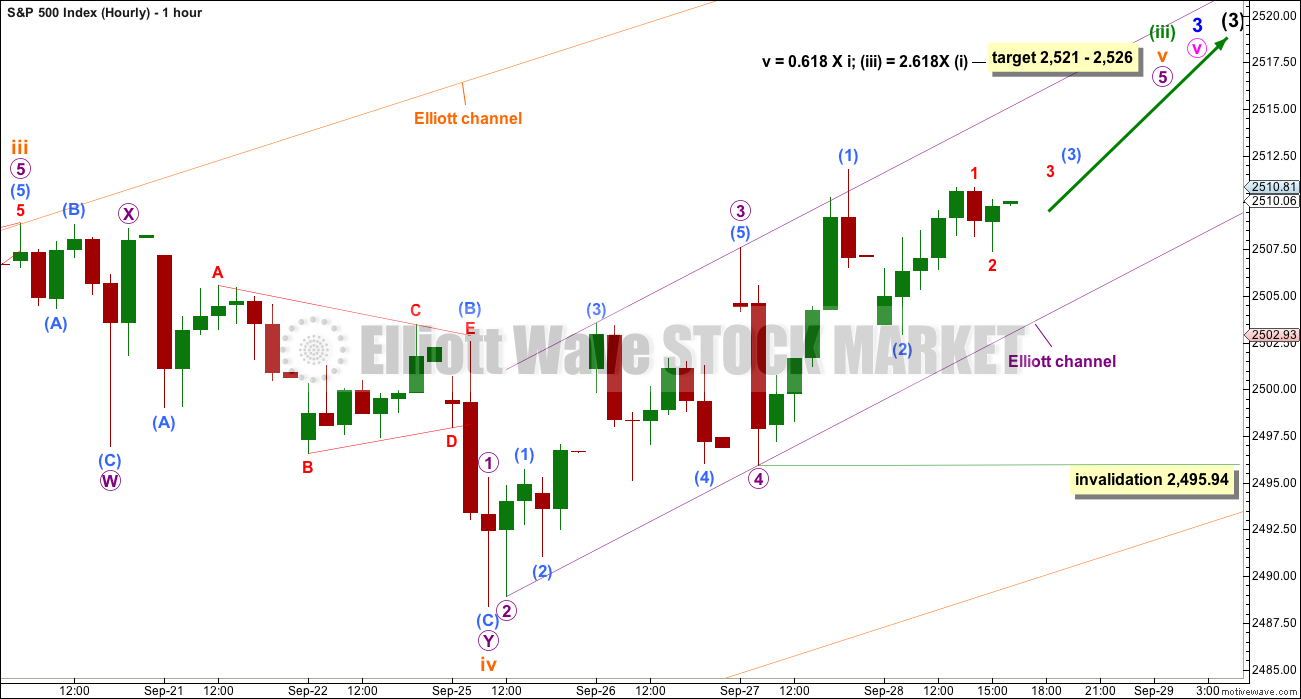

HOURLY CHART

Subminuette wave iv will fit as a completed double zigzag structure (all subdivisions fit on the five minute chart). There is still some alternation between the single zigzag of subminuette wave ii. There is good alternation in depth.

The target is recalculated and is now a 5 point zone.

It is possible that minuette wave (iii) could be over at yesterday’s new all time high, falling well short of the targets. This possibility will be considered if price makes a new low below the start of subminuette wave v at 2,488.38. At that stage, downwards movement could not be considered as a second wave correction within subminuette wave v, so subminuette wave v would have to be over.

The small pullback within this last session, which is labelled sub-micro wave (2), has a strong three wave look to it on the five minute level. This strongly suggests that upwards movement for now is not over.

The degree of labelling within subminuette wave v is today moved up one degree. The final fifth wave of micro wave 5 may be extending up towards the target. Within micro wave 5, the correction of sub-micro wave (2) may not move beyond the start of sub-micro wave (1) below 2,495.94.

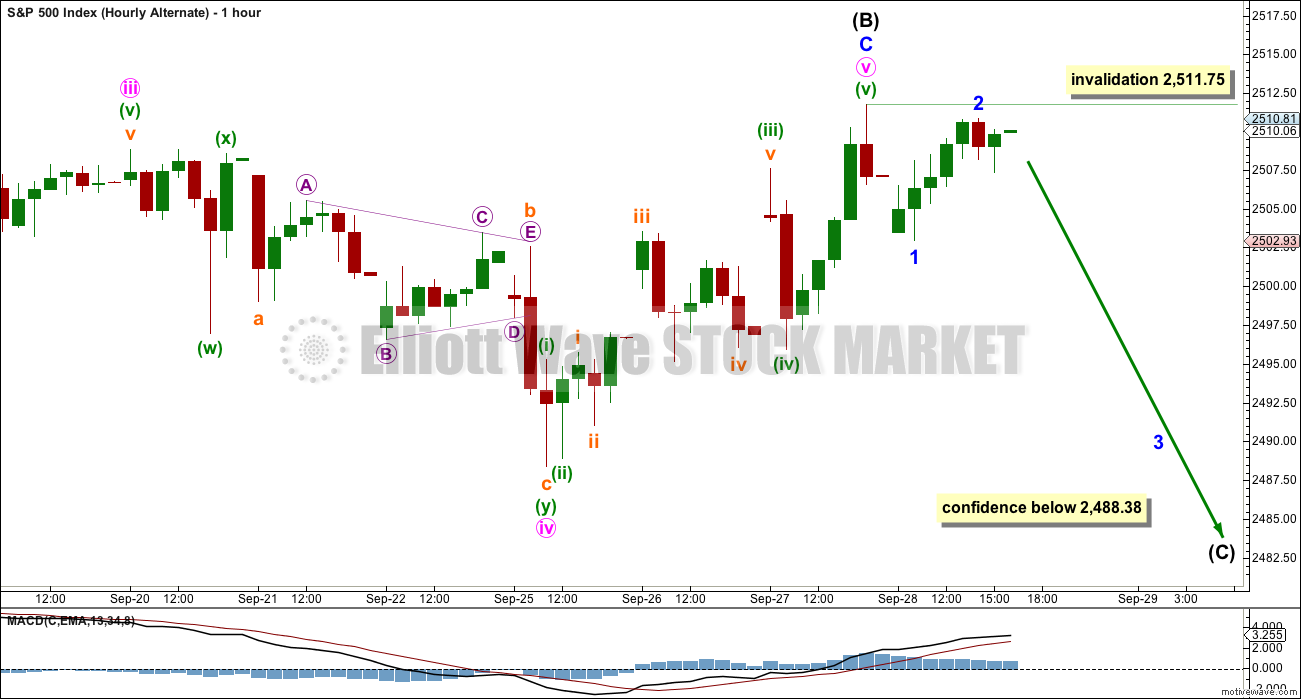

ALTERNATE WAVE COUNT

WEEKLY CHART

Primary wave 3 may be complete. Confidence may be had if price makes a new low below 2,480.38 now. That would invalidate the main wave count at the daily chart level. Fibonacci ratios are calculated at primary and intermediate degree. If primary wave 3 is complete, then it still exhibits the most common Fibonacci ratio to primary wave 1.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

Primary wave 4 should last about 8 weeks minimum for it to have reasonable proportion with primary wave 2. It is the proportion between corrective waves which give a wave count the right look. Primary wave 4 may last 13 or even 21 weeks if it is a triangle or combination. So far it may have completed its sixth week.

If primary wave 4 unfolds as a single or double zigzag, then it may find support about the lower edge of the maroon Elliott channel. If it is a triangle or combination, it may be more shallow, ending about mid way within the channel. At this stage, a single zigzag has been invalidated and a double zigzag is discarded based upon a very low probability. It looks like primary wave 4 is to be a very shallow sideways consolidation rather than a deeper pullback.

Only two daily charts are now published for primary wave 4: a triangle and a combination. It is impossible still for me to tell you with any confidence which of these two structures it may be. The labelling within each idea may still change as the structure unfolds.

The daily charts are presented below in order of probability based upon my judgement.

The final target for Grand Super Cycle wave I to end is at 2,926 where cycle wave V would reach 1.618 the length of cycle wave I.

DAILY CHART – TRIANGLE

This first daily chart will illustrate how price might move if primary wave 4 unfolds as a triangle.

Intermediate wave (B) may be a single zigzag. One of the five sub-waves of a triangle should be a more complicated multiple; most commonly that is wave C. If intermediate wave (B) is correctly labelled as a single zigzag, then intermediate wave (C) may be a longer lasting and more complicated double zigzag.

The triangle may last a total of a Fibonacci 13 or 21 weeks.

Both intermediate waves (A) and (B) look like three wave structures.

Intermediate wave (C) may not move beyond the end of intermediate wave (A).

HOURLY CHART

Intermediate wave (B) may be continuing higher. It is again possible that the structure is complete, but there is no evidence yet of a reversal.

This wave count is now less likely. But it remains possible because running triangles are not rare structures and intermediate wave (B) is within a normal length.

However, this wave count does not have much support from classic technical analysis. It must be understood to be a less likely alternate at this stage.

Today, the small downwards wave labelled minor wave 1 would have to be seen as a five wave structure. This is possible, but it does not look right at the five minute chart level. That reduces the probability of this labelling at the hourly chart level being correct today.

DAILY CHART – COMBINATION

A combination for primary wave 4 would still offer some alternation with the regular flat of primary wave 2. Whenever a triangle is considered, always consider a combination alongside it. Very often what looks like a triangle may be unfolding or may even look complete, only for the correction to morph into a combination.

There may only be one zigzag within W, Y and Z of a combination (otherwise the structure is a double or triple zigzag, which is very different and is now discarded). At this stage, that would be intermediate wave (W), which is complete.

Combinations are big sideways movements. To achieve a sideways look their X waves are usually deep (and often also time consuming) and the Y wave ends close to the same level as wave W.

This wave count sees upwards movement continuing as intermediate wave (X). Unfortunately, there is no Elliott wave rule regarding the length of X waves, so they may make new price extremes. I am applying the convention within Elliott wave regarding B waves within flats here to this X wave within a combination: When it reaches more than twice the length of intermediate wave (W), then the idea of a combination continuing should be discarded based upon a very low probability.

With intermediate wave (W) a zigzag, intermediate wave (Y) would most likely be a flat correction but may also be a triangle. Because a triangle for intermediate wave (Y) would essentially be the same wave count as the triangle for the whole of primary wave 4, only a flat correction will be considered.

But first, an indication would be needed that the upwards wave of intermediate wave (X) is over. As yet there is no evidence of this.

TECHNICAL ANALYSIS

WEEKLY CHART

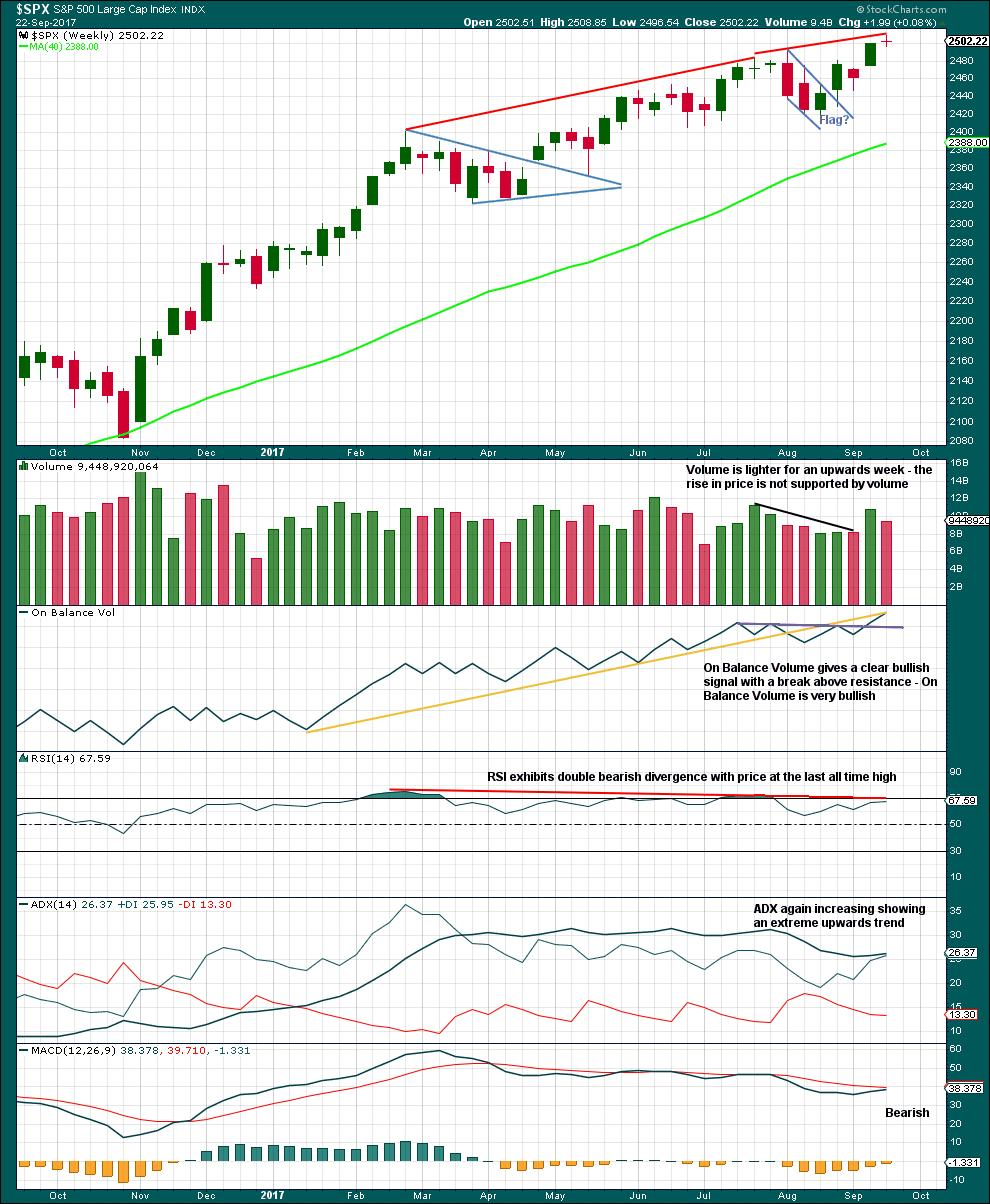

Click chart to enlarge. Chart courtesy of StockCharts.com.

A strong weekly candlestick gaps higher and has support from volume. This looks like a classic upwards breakout after a small consolidation, and there may have been a small flag pattern in it. This supports the main Elliott wave count.

If the flag pole is taken from 2,405.70 to 2,490.87, then a target for the next wave up may be about 2,527.

The bullish signal from On Balance Volume is clear. It should be given reasonable weight. This supports the main Elliott wave count.

ADX is still just extreme. If the black ADX line crosses above the +DX line, then the upwards trend would no longer be considered extreme. RSI still exhibits double bearish divergence. This trend is extreme; beware that the alternate wave count may still be correct.

DAILY CHART

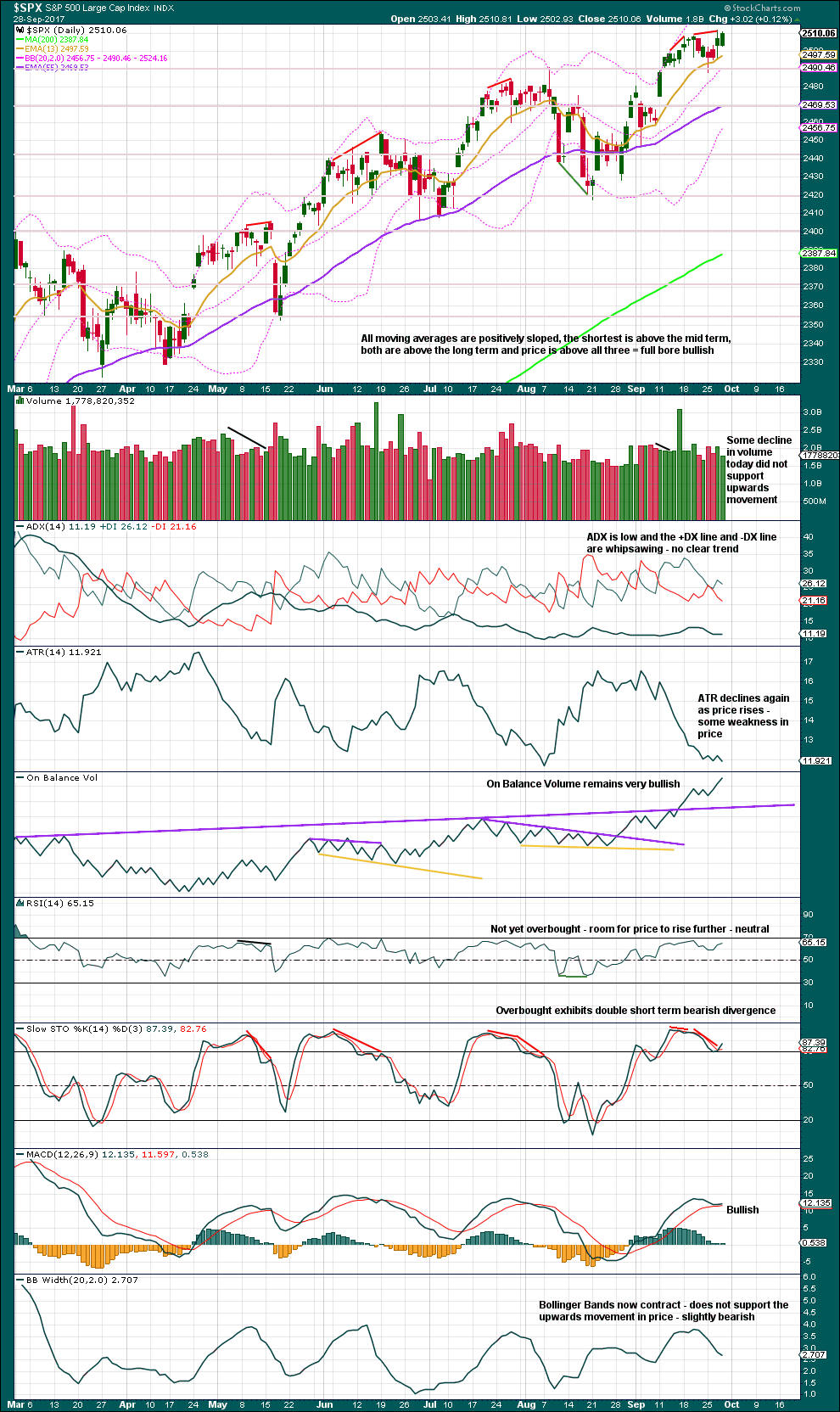

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume shows some weakness today, but this will not be taken as an indication that a pullback should likely begin here. This weakness in volume is a feature of this market at this time. As evidence of this statement see the fall in volume yet persistent rise in price from the 18th to the 30th of May this year.

On Balance Volume remains very bullish and this will continue to be given reasonable weight in this analysis. So far it has proven to be a more reliable indicator for price.

Stochastics can remain extreme for quite reasonable periods of time for the S&P in a bull trend. It is not particularly helpful as a timing tool for highs; it is only a warning of an extreme market and for traders to be aware of an approaching pullback, which can be sharp.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

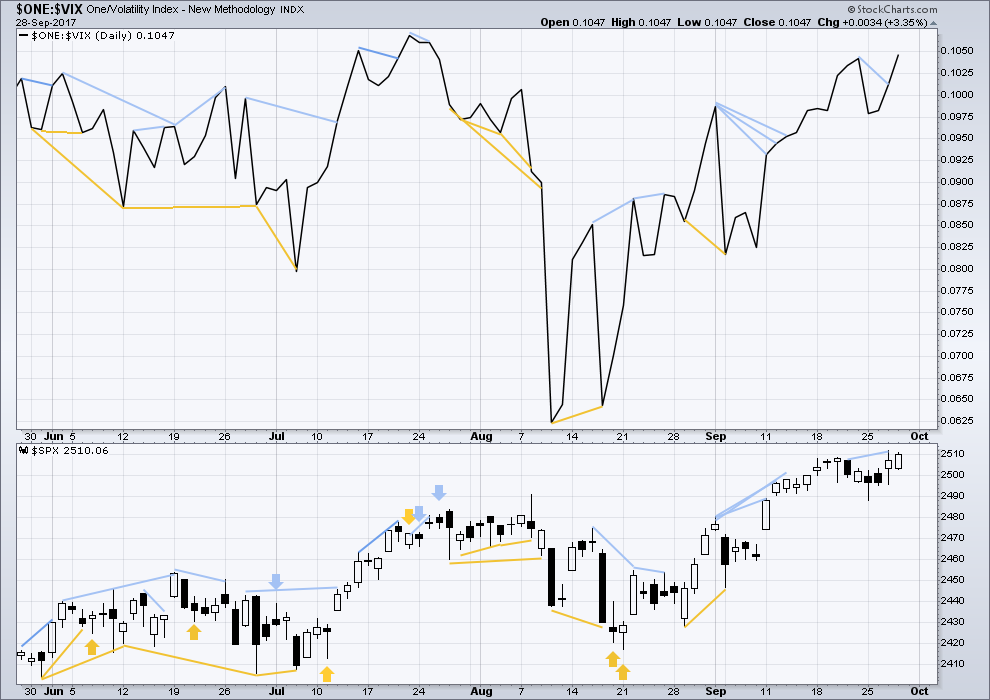

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is still mid and longer term bearish divergence, but it has been noted in the past that divergence over a longer term does not seem to work as well for VIX. Short term bearish divergence has disappeared.

Short term bearish divergence noted in last analysis has now disappeared. There is no new short term divergence today.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

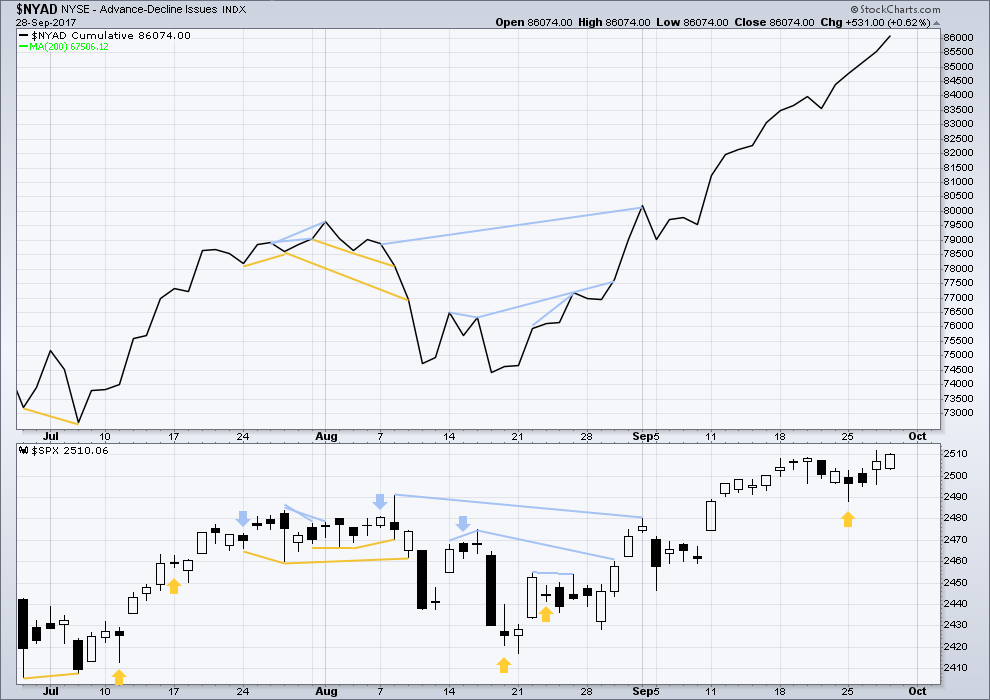

With the last all time high for price, the AD line also made a new all time high. Up to the last high for price there was support from rising market breadth.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

The rise in price today is again supported by a rise in market breadth. The AD line continues to remain very bullish.

DOW THEORY

The S&P’s new all time high is confirmed by DJIA and Nasdaq also making new all time highs. DJT has also now made new all time highs, so the continuation of the bull market is now confirmed.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

Published @ 09:19 p.m. EST.

I am having an awesome time in HK Verne! My friend has me totally organised. She is even planning on taking me out Stand Up Paddleboarding… not something I would have thought to do in Hong Kong.

I’m in Causeway Bay, a shoppers paradise. And with my local friend I am being taken to all the best places to shop, eat and drink.

We have a few members in Hong Kong, some have been with us for a few years. I’ll be emailing you too, but just in case the emails we have on file for you aren’t ones you check regularly I would like to contact you here in comments too.

If you would like to meet up while I am in Hong Kong then please email me admin@elliottwavestockmarket.com.

I rolled calls into next week and will maintain as a hedge against my long vol position.

I do think the end is near…!

Have a great week-end everyone, and I hope Lara is having a ridiculous amount of fun in Hong Kong! 🙂

Honestly, I am convinced this market is never going down. We will be at 2600 by next week.

It will. We will see at the very least an interim top on Monday.

The big question for me is whether it will be the top of a third or a fifth wave.

If the first impulse down cleanly takes out 2470, and I do mean the FIRST wave. None of this choppy, back and forth BS we have been seeing on the mini impulses down intra-day but a monster red candle demolishing banksters and bulls alike with huge downside volume, it could signal we are in for one helluva ride. Remember we could see a massive wave down to as low as 2120 and STILL be in a bull market. A move like that would do a fantastic job of dispelling the current bull mania in the market and be a perfect set-up for a final wave up into mid to late 2018.

I plan on being fully short by the close on Monday.

BTW- It is often very helpful to take a look at what other indices are doing to get an idea of what could be on the horizon and RUT is showing classic symptoms of climatic buying -monstrous volume above upper B band! 🙂

Well, I’ve just read Lowry’s weekly report and it is VERY bullish. Expanding demand, contracting supply, an increase in health in small caps (higher % at or within 2% of their highs).

These signs are more typical of an early bull market.

These signs are very bullish.

I think we have to go with the trend, it’s up. If we want to make money then trade the information we have at hand. It’s full bore bullish.

I think we are in the fifth of an intermediate wave. Stochastics are all massively overbought. Vix is too low to sustain another significantly upward week.

But like I said, it really does feel like this bull market is never going down. Even 10 point downturns on SPX are bought up with such frightening rapidity that it wouldn’t surprise me if we see 2600 by October’s end.

Get ready for the end of day, end of week, end of month, end of quarter ramp. It should be most amusing. I picked up a few more calls expiring tomorrow in anticipation…lol! 🙂

BTW, there is no way they are going to let this end without DJI joining the ATH party so DIA calls were a no-brainer!

I have continued to focus on what I believe to be insanely mis-priced implied volatility in the markets by trading the moves of VIX above and below the 10 strike pivot. We got enough whipsaw the last week or two to allow accumulation of a substantial position at at pretty much a zero cost basis. Either I am going to see a huge windfall with any move of VIX substantially above 10.00 next two weeks or will wind up having just paid very nice commissions to my broker to get positioned! 🙂

I remain confident in the inevitability of the mean reversion trade and just hope that my timing is not off…

The last four predictions of VIX spikes by Chris Vermeulen ware complete busts and shows his predictive model needs some tweaking as regards timing. I do agree the market remains insanely overbought and will not do so indefinitely…

It’s been pointed out that the RUT benefits the most from the so called “tax plan”, and hence is driving the RUT to outperform the other indices for the last 3 weeks. This tax plan is huge relative to impact on earnings, and in general I believe it is getting priced in, and is the fundamental driver of the bull market “against other odds”. If it fails (and what legislation of any significance has Trump succeeded with?), that’s going to drive a very significant correction. As I see it, the key to success or failure is the question of where the fiscal hawks come down; the plan will add a massive new amount of debt and deficit, but so far, the fiscal hawks are all hiding (see front cover NYTimes today); gee, maybe their position in the past wasn’t about principles, but politics?? So we will see. I do look at the tax plan as the bellweather of this market for Q4.

Then again, these banksters have become so laughably predictable we should be looking for ramp into the close so seal the bullish tenor of September…. 🙂

I’m quite suspicious that the placement of the purple 3 with circle (subminuette 3?) was correct in YESTERDAY’S (9/29) update, and misplaced today. As structured today, the 5 looks ill-proportioned. WIth that 3 at the high on Wednesday, we then have a quick 4 down, a leading diagonal as a 1, a small zig-zag 2, and I suspect price is just completing the 3 of the 5.

It’s in the same place, I just moved it up one degree today.

I did that because the expected micro (purple) 2 was so brief and shallow, so it looked like an extending fifth wave …..

Lowry’s also thought the August downturns would amount to more of a downturn than we got… right?

DJI failing to confirm new SPX highs. If that does not change by the close I am taking my marbles and going home….the same goes for DJI taking out this morning’s lows. 🙂

I am truly conflicted over what to do with my SPX calls. I think I am going to go with the wave count and roll ’em into next week.

Now that I have decided to do that, watch SPX head South for 50 points… lol!

90 mins later….. this train ain’t stopping. Atleast until I see some 5 min crossovers….

You probably won’t. Most bearish traders are doing exactly what you are. They are not going to step in front of this runaway train and so I seriously doubt that we will see any turn during the regular session. I think a lot of folk are starting to figure out what is going on and simply waiting for the other shoe to drop. This is why I think the action in futures is going to be so critical. I think there is a lot of bearish capital patiently waiting for signs that the banksters are on the run and this will I expect happen in the futures market, where their attempt to reverse another thousand point decline spectacularly and obviously runs into serious trouble. Can you imagine what is going to happen at market open when and if that signal appears?!

Just as volume to the upside has been miniscule, I think it is going to be like a tsunami to the downside. If fact if you look at the overall volume profile the last several months, downside volume increases, upside volume decreases….

The successive opening gaps down in DJI have also been quite peculiar in the context of an impulsive wave higher. I don’t think I have ever seen that happen even for corrective waves in a larger impulse.

It’s our “new normal” Verne.

Let us go with the flow (up) and be flexible as a gymnast 🙂

XLU has bounced off 61.8% retrace, which happens to be right where a symmetric projection of the last significant pullback lies as well. I’m looking for buy triggers.

Yeah Kevin, I bought it at open. Stop at 52, target 54.10, wouldn’t mind catching a dividend as well.

Sweet! I took another few positions in ETF’s in strong weekly uptrends that have pulled back a bit and appear to have initiated turns: FXI, IEMG, TLT, XHV, and XLV. Everything is tidily stopped under those turn points. I figure even if the market does make a major break in few weeks, I should be well over BE at least on these combined plays. Turned out to be a nice morning for launching them…as per the main count predicted!!! TY again Lara.

Nicely done, and you’re most welcome 🙂

I see a rising wedge in SPX from Sept 26 onward.

If you look carefully, there are actually a series of repeating rising wedges going back to August of last year, which in itself comprises a large wedge. The price action is totally freaky, as if price is being ramped higher by brute force. Even more weird is the price breaks from the many smaller wedges within the larger one have not been signaling a trend change but instead we have been seeing price embark on yet another rising wedge. Wedgea think of that folks? 🙂

Well, this renarkable bull continues to rampage. Here we are at the conclusion of the most historically bearish month in which have seen, and are sitting close to all time highs. What is even more incredible is that we entered the month already extremely stretched to the upside! Will October be the month that we finally get the fiirst correction we have hsd in 18 months (unprecedented) or will it be the month we get something else?

I do really hope it is just a correction as I have been so looking foward to riding that final wave up. I must say the longer a corrective move is delayed, the more I wonder iff that final wave somehow snuck up on us… 🙂

Futures saying the bulls still firmly in control…goodbye September, see ya next year!

It really seems like the time will be upon us without notice. But that being said, there are signs everywhere.

Yeah. I have a feeling the denouement is going to be sudden, brutal, and as you intimated, unexpected. And here I was hoping for a neat and orderly fourth wave that would give us all a crystal clear entry point for that final manic wave five to the top… *Sigh* 🙂

It’s not gonna be that easy. My guy says no 4th wave and maybe a manic up to 2600 range to exhaust. The reason breadth is not going to be a signal is due to the commoditized allocation of capital to etfs, distorting price discovery of the underlying. Likely just running out of buyers couple with a strong catalyst.

I have to say I really thought the departure of baby boomers from the workforce (10K per day) would have resulted in a much greater capital outflow from equities markets. It could be that retirees are continuing to plow a portion of their benefits back into the market, despite mandatory withdrawal rules.

Beat ya Doc!

I was busy,,wabbit,,,she has long ears like you

You guys really make me laugh 🙂 🙂 🙂

Thanks!

🙂