Price completed an outside day, mostly sideways movement to close as a small range doji. On Balance Volume gives another important signal today which may tell us what direction price may move tomorrow.

Summary: Another bearish signal as On Balance Volume moves down from resistance supports the idea that primary wave 4 is still underway. This idea now expects a downwards swing from here.

In the short term, a new low below 2,459.99 would add confidence to the view that the upwards swing is indeed over and the next swing downwards has begun.

Last monthly and weekly charts are here. Last historic analysis video is here.

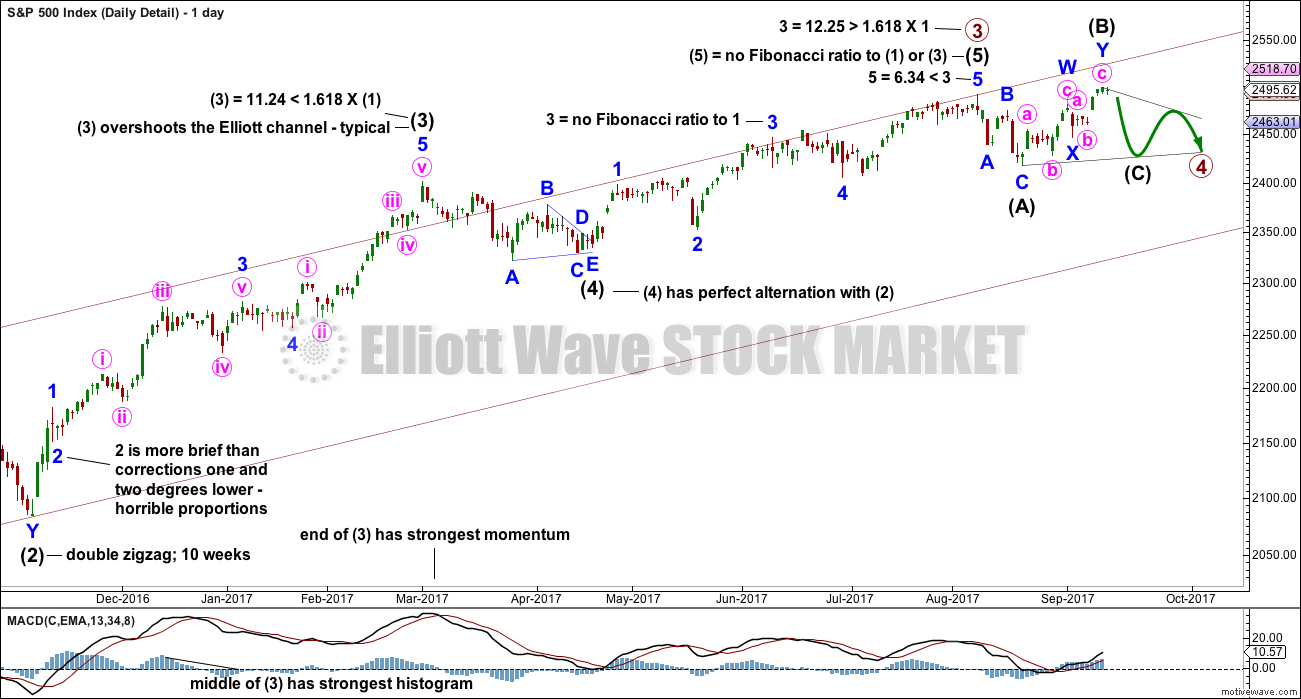

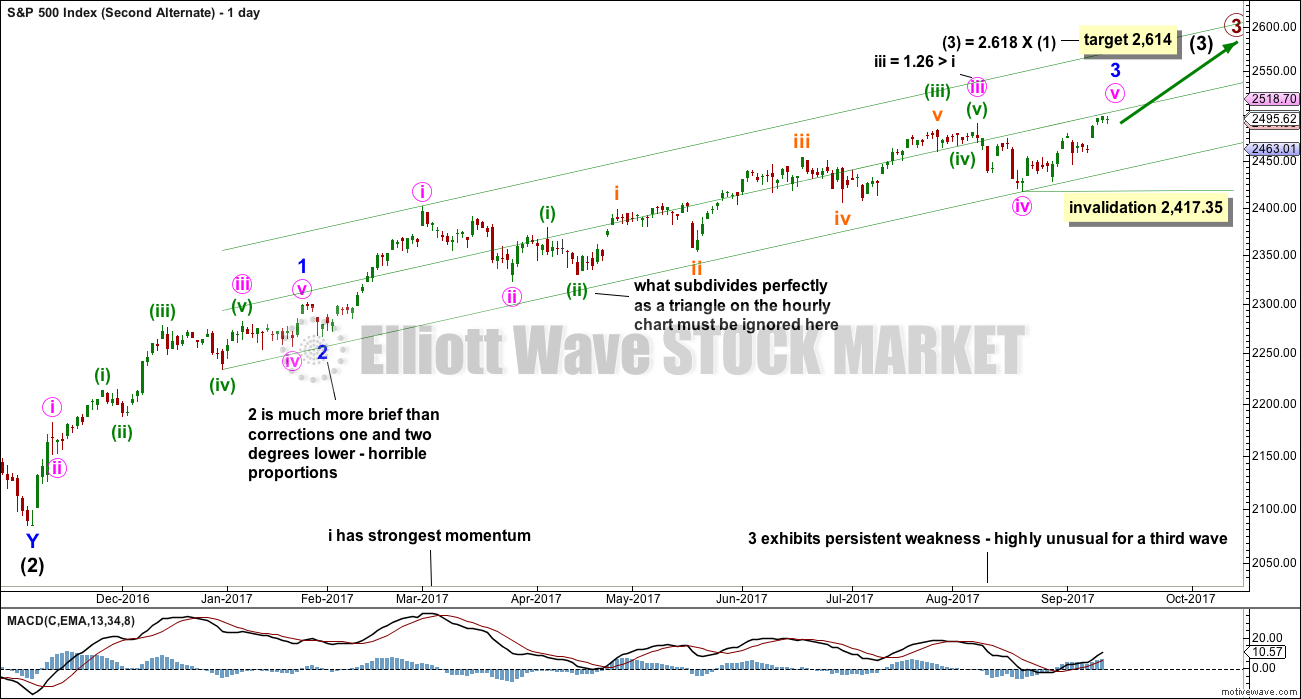

ELLIOTT WAVE COUNT

WEEKLY CHART

Primary wave 3 now looks complete. Further and substantial confidence may be had if price makes a new low below 2,417.35 now. That would invalidate a new alternate published below. Fibonacci ratios are calculated at primary and intermediate degree. If primary wave 3 is complete, then it still exhibits the most common Fibonacci ratio to primary wave 1.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

Primary wave 4 should last about 8 weeks minimum for it to have reasonable proportion with primary wave 2. It is the proportion between corrective waves which give a wave count the right look. Primary wave 4 may last 13 or even 21 weeks if it is a triangle or combination. So far it may have completed its fourth week.

If primary wave 4 unfolds as a single or double zigzag, then it may find support about the lower edge of the maroon Elliott channel. If it is a triangle or combination, it may be more shallow, ending about mid way within the channel. At this stage, a single zigzag has been invalidated and a double zigzag is discarded based upon a very low probability. It looks like primary wave 4 is to be a very shallow sideways consolidation rather than a deeper pullback.

Only two daily charts are now published for primary wave 4: a triangle and a combination. It is impossible still for me to tell you with any confidence which of these two structures it may be. The labelling within each idea may still change as the structure unfolds.

The daily charts are presented below in order of probability based upon my judgement.

The final target for Grand Super Cycle wave I to end is at 2,500 where cycle wave V would reach equality in length with cycle wave I. If price reaches the target at 2,500 and either the structure is incomplete or price keeps rising, then the next target would be the next Fibonacci ratio in the sequence between cycle waves I and V. At 2,926 cycle wave V would reach 1.618 the length of cycle wave I. The target at 2,500 now looks to be too low, particularly if primary wave 4 is shallow.

DAILY CHART – DETAIL

In order for members to compare and contrast this main wave count with the new alternate published below, it is necessary to publish a chart showing all movement from the low labelled intermediate wave (2), which is shown on the weekly chart. I would not want to try and see any alternate which does not have primary waves 1 and 2, and intermediate waves (1) and (2), in any other position than that labelled on the weekly chart. Any variation should be taken from that point.

This wave count fits with MACD. The end of a third wave is very often the strongest portion of MACD, and the middle of the third wave is very often the strongest portion of the histogram on MACD. In this way MACD can be used to assist in labelling an impulse.

It is very common for the S&P to exhibit Fibonacci ratios between only two of its three actionary waves within an impulse . Rarely will it exhibit Fibonacci ratios between all three actionary waves. The lack of a Fibonacci ratio for intermediate wave (5) and for minor wave 3 within it is entirely acceptable.

This wave count also fits neatly with the Elliott channel. It is extremely common for the end of a third wave within an impulse to overshoot the Elliott channel, because it is usually the strongest portion of movement.

This wave count has a neat fit in terms of subdivisions and fits with most common behaviour for this market. For this reason I have confidence in it.

The only problem here is one of proportion for minor wave 2 within intermediate wave (3). But then the S&P does not always exhibit nice proportion between its corrective waves.

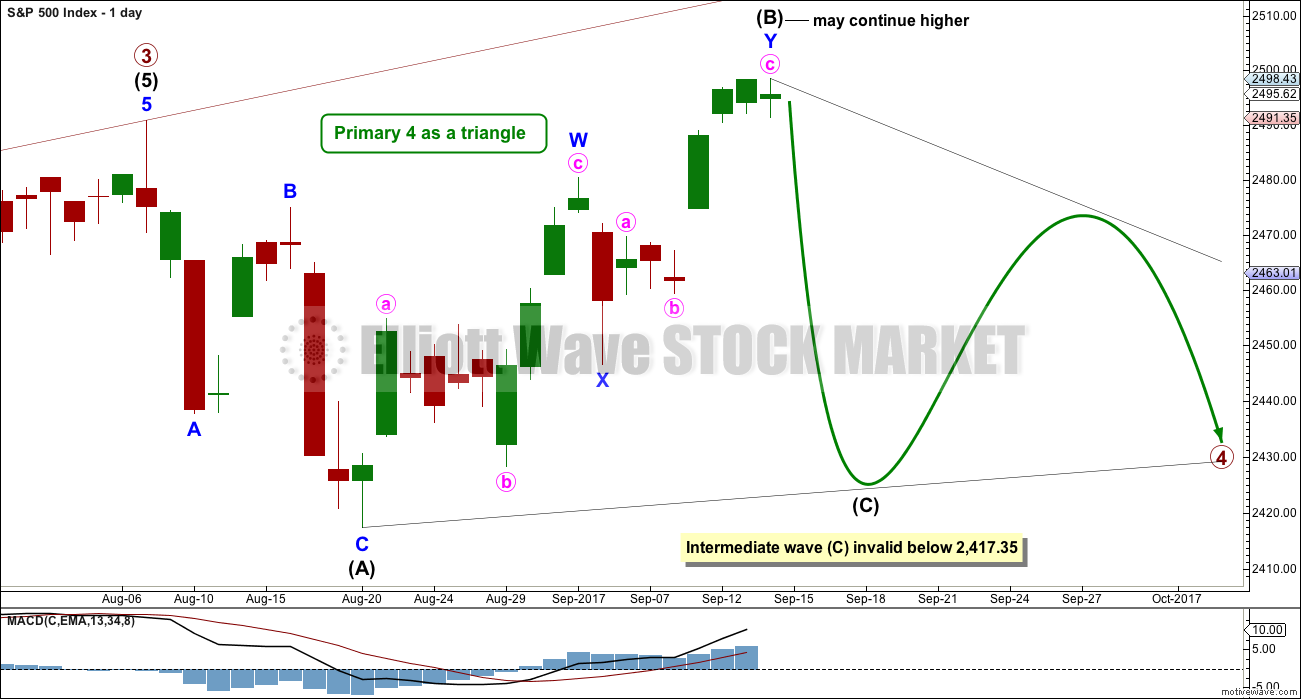

DAILY CHART – TRIANGLE

This first daily chart will illustrate how price might move if primary wave 4 unfolds as a triangle.

Intermediate wave (B) may be continuing higher as a double zigzag. One of the five sub-waves of a triangle should be a more complicated multiple; most commonly that is wave C, but it may be any sub-wave. Intermediate wave (B) has made a new all time high, so it may be a running triangle.

The triangle may still last a total of at least eight weeks, but so far it is ending its fifth week and may only be completing wave B. It now looks like it will need to take longer. If longer, then a Fibonacci 13 or 21 weeks may be expected.

Both intermediate waves (A) and (B) look like three wave structures.

Intermediate wave (C) may not move beyond the end of intermediate wave (A).

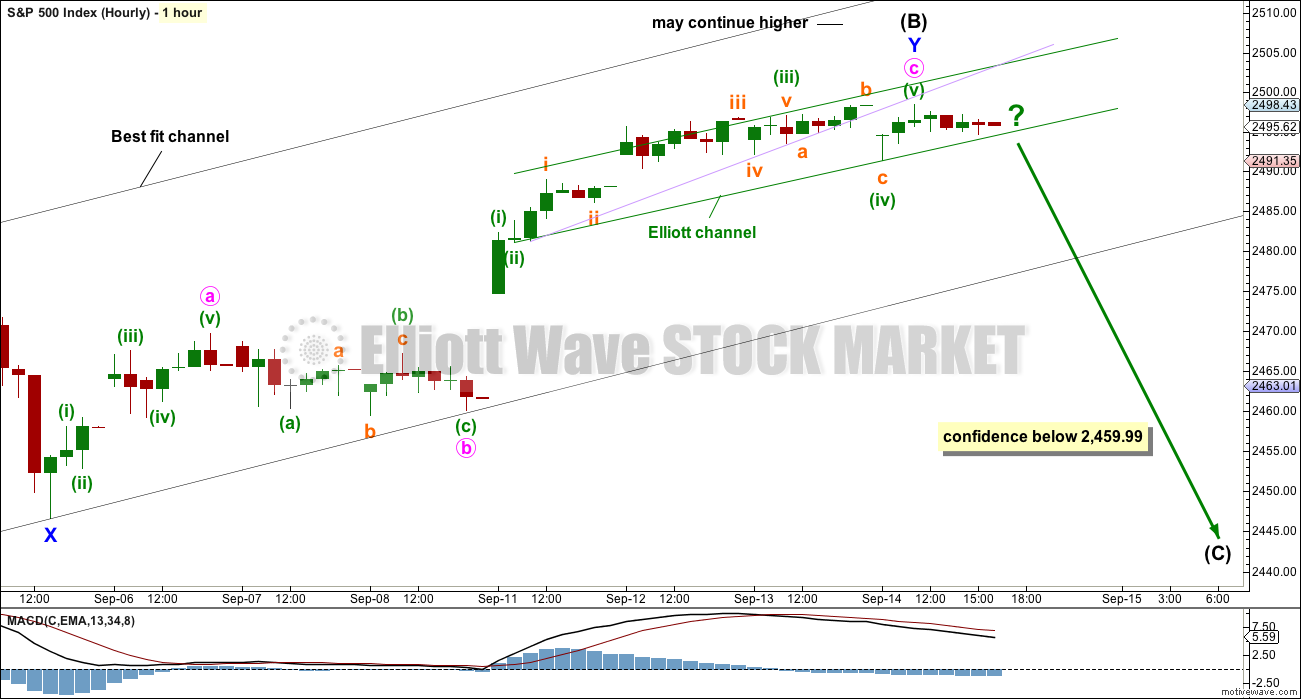

HOURLY CHART – TRIANGLE

A double zigzag may be complete for intermediate wave (B).

Use the black best fit channel. If price breaks below the lower edge, then expect the upwards swing is over and the next swing down has begun. While price remains within this channel, then it is entirely possible price may continue higher again tomorrow; minute wave c may not be complete.

The low for today’s session may have been the end of a small expanded flat correction for minuette wave (iv). If this labelling is correct, then there is now perfect alternation between a quick zigzag for minuette wave (ii) and a more time consuming expanded flat correction for minuette wave (iv). The channel about minute wave c is drawn using Elliott’s second technique.

A breach of this channel by downwards movement tomorrow would be the earliest indication that intermediate wave (B) would be over. For reasonable confidence the wider black best fit channel would still need to be breached.

A new low below 2,459.99 could not be a second wave correction within minute wave c, so at that stage minute wave c would have to be over. That would provide strong price confirmation of a trend change.

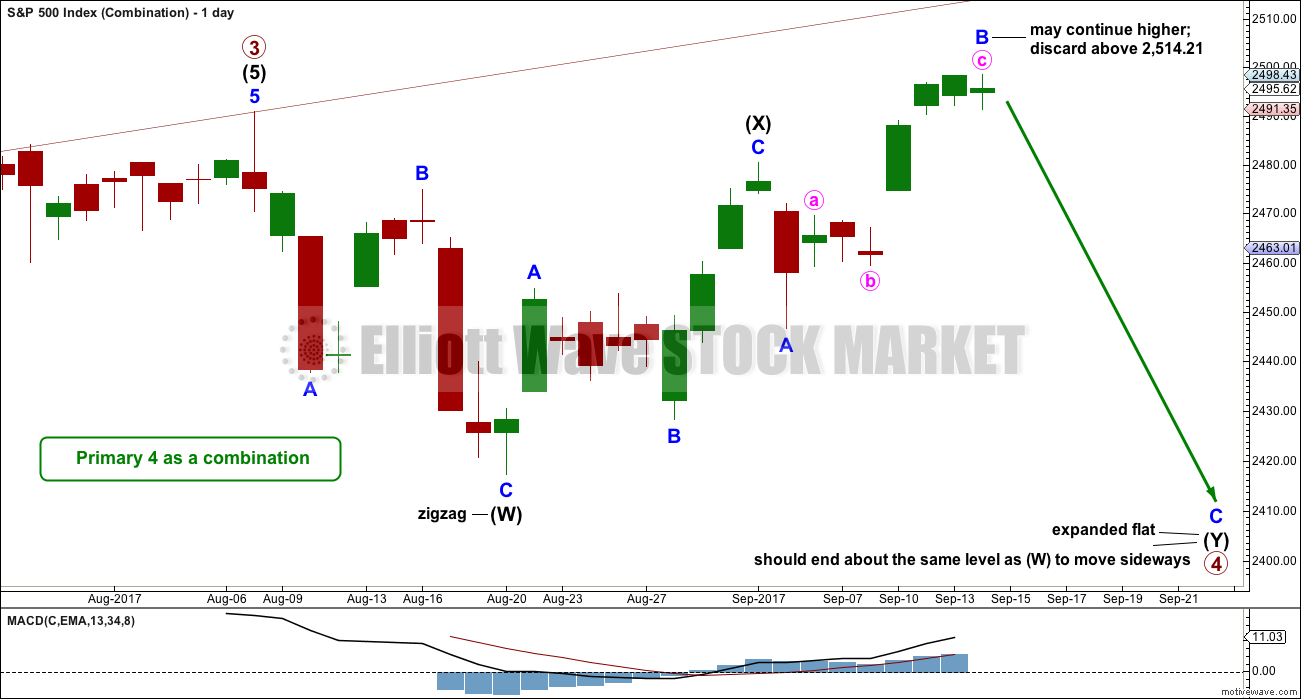

DAILY CHART – COMBINATION

A combination for primary wave 4 would still offer some alternation with the regular flat of primary wave 2. Whenever a triangle is considered, always consider a combination alongside it. Very often what looks like a triangle may be unfolding or may even look complete, only for the correction to morph into a combination.

There may only be one zigzag within W, Y and Z of a combination (otherwise the structure is a double or triple zigzag, which is very different and is now discarded). At this stage, that would be intermediate wave (W), which is complete.

Combinations are big sideways movements. To achieve a sideways look their X waves are usually deep (and often also time consuming) and the Y wave ends close to the same level as wave W.

Here, intermediate wave (X) is very deep.

Intermediate wave (Y) may be a flat correction or a triangle. A flat correction should be expected for intermediate wave (Y).

Intermediate wave (Y) may be unfolding as an expanded flat, the most common variety. So far minor wave B may be a 1.53 length of minor wave A, slightly longer than the most common range of up to 1.38. If minor wave B reaches twice the length of minor wave A at 2,514.21, then the idea of an expanded flat should be discarded based upon a very low probability.

It is also possible that intermediate wave (X) is continuing higher as a double zigzag, as labelled on the triangle daily chart. While waves W, Y and Z within combinations may only be simple corrections labelled A-B-C (or A-B-C-D-E as in the case of triangles within combinations), the X waves within combinations may be any corrective structure including multiples. However, while this is valid, it is fairly unusual. I am always uncomfortable with labelling X waves as multiples until price proves in hindsight that they were, because of the low probability.

Minor wave C should move below the end of minor wave A. This structure may take another few weeks to complete.

DAILY CHART – ALTERNATE

This alternate is new in response to concerns from members that primary wave 3 may not be over.

If primary wave 3 isn’t over, then how would the subdivisions fit? Would it fit with MACD? What would be the invalidation point and would the Fibonacci ratios be adequate?

Of several ideas I have tried, this one has the best fit in terms of subdivisions and meets all Elliott wave rules.

However, this wave count is manufactured and forced. It does not fit with MACD. Because this possible third wave, if it is not over, exhibits long term and persistent weakness this wave count must be judged to have a very low probability. It is published primarily to illustrate why confidence is had in the main wave count. This wave count is not supported by the classic technical analysis given below, both at the weekly and daily chart levels, particularly the bearish signals recently given by On Balance Volume.

A target is provided for members who find that this wave count may fit with their own technical analysis, should they wish to attempt to trade an expected upwards movement.

Within minute wave v, no second wave correction may move beyond the start of its first wave below 2,417.35.

Despite a green candlestick, today it has closed as a doji and the balance of volume was downwards during the session. There is no strong bullish signal today from On Balance Volume to swap over the wave counts. This remains an alternate.

Low probability does not mean no probability. Low probability outcomes do occur sometimes, and when they do they are never what was expected as most likely. That is the nature of probability.

TECHNICAL ANALYSIS

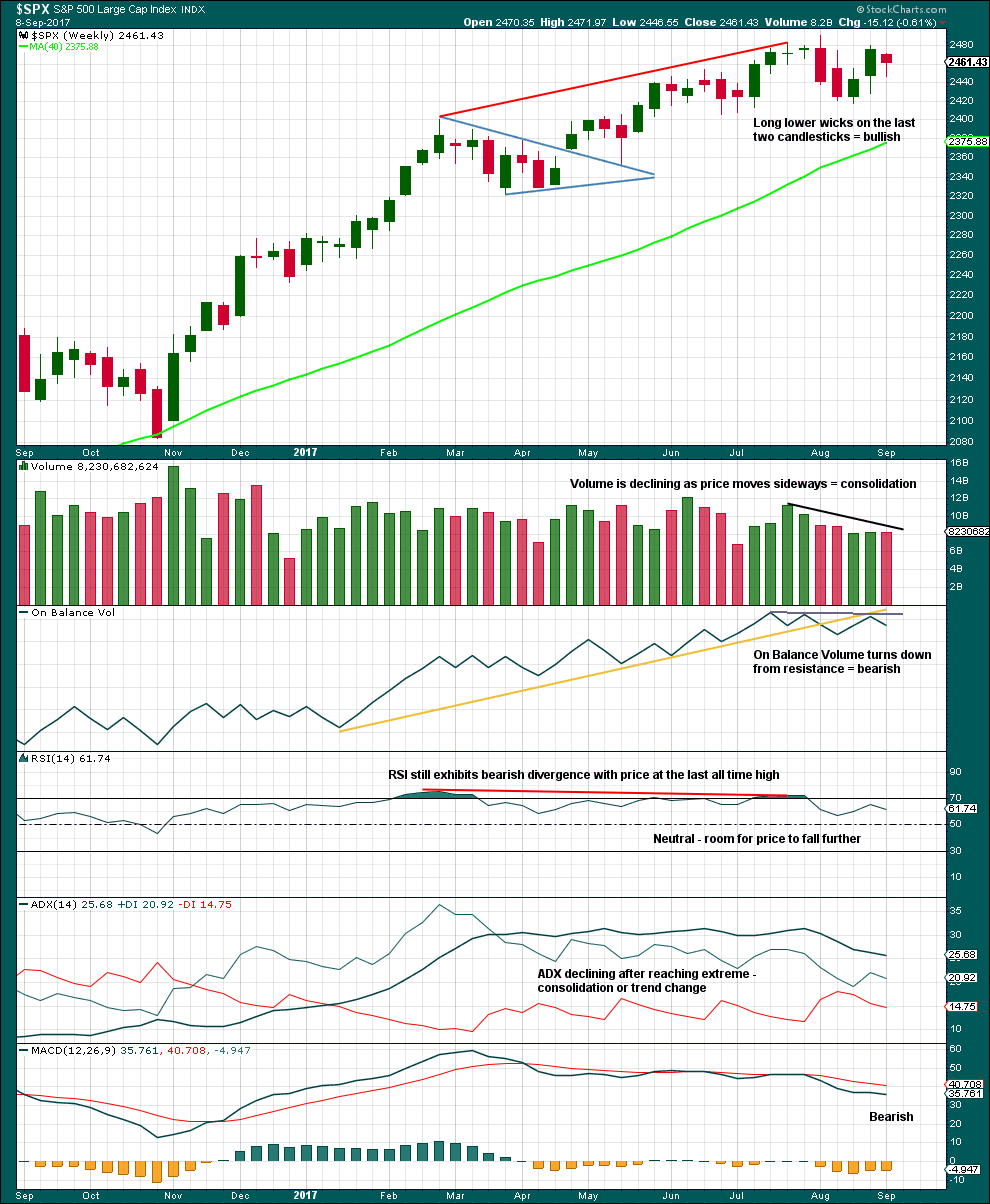

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An inside week closes red and the balance of volume was down. Volume shows a slight decline; during the week, the market fell very slightly of its own weight. This will be read as neutral; the slight decline in volume is very small.

Overall, this chart is bearish. Give reasonable weight this week to the bearish signal from On Balance Volume because it supports the Elliott wave counts.

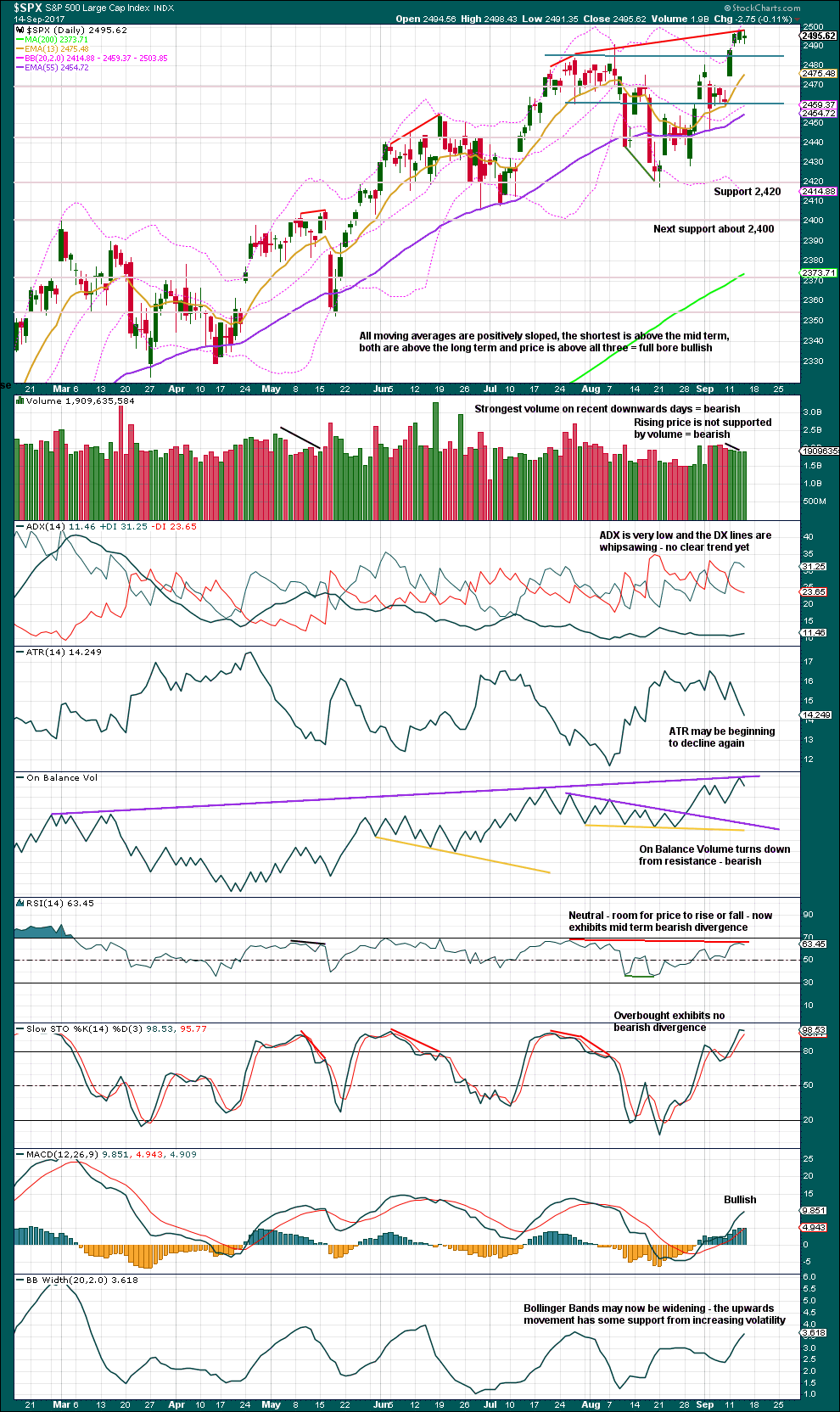

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

We have an upwards breakout to a new all time high, but it does not have support from volume. Upwards breakouts that are not supported by volume are suspicious. Be suspicious of this one.

However, it is noted that fairly recently on this chart there is evidence of a sustained upwards bull wave that began with weak and declining volume back on the 18th and 19th of May. Those two daily candlesticks also had long upper wicks suggesting bearishness, yet price continued to drift higher before finally turning into a sideways consolidation 10 sessions later. It is possible that may happen again. At this time, this market is exhibiting some highly unusual characteristics, such as the ability to drift higher on light and declining volume. This does make technical analysis and trading so much more difficult.

Today completed a green doji, which was an outside day, and importantly the balance of volume during the session was downwards. This means that On Balance Volume today gives another bearish signal. All recent signals from On Balance Volume have been bearish at both the daily and weekly chart level. This supports the main Elliott wave count.

Volume for this session is slightly higher. With the balance of it downwards, this is interpreted as support for downwards movement during the session, and it is bearish.

Only moving averages and MACD are bullish.

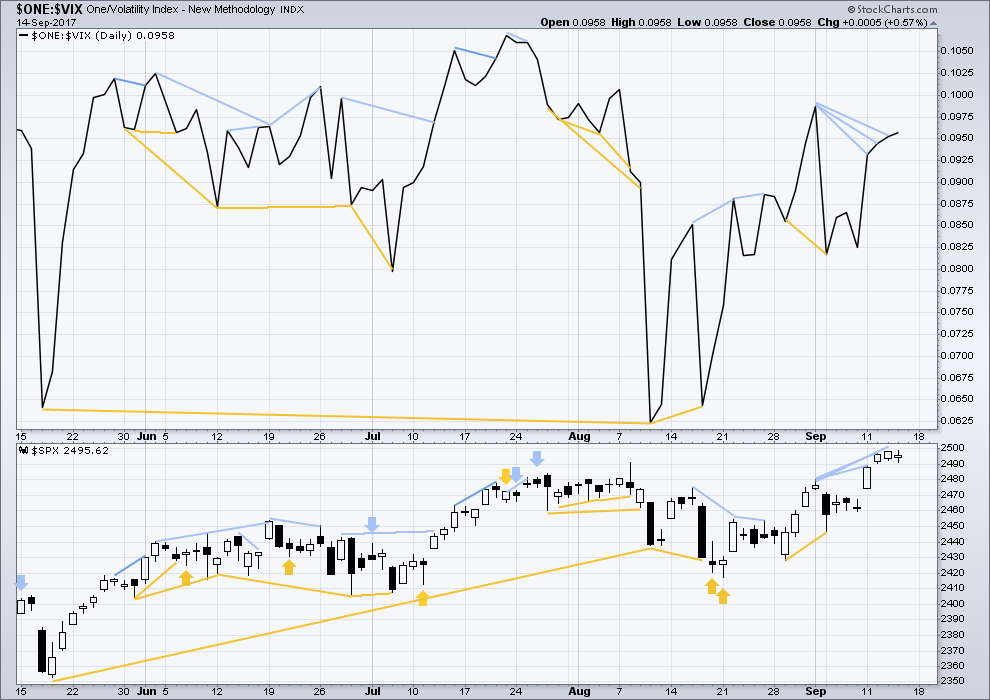

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Regular bearish divergence between price and inverted VIX noted over the last two days has not been followed by any downwards movement, so it is considered to have failed.

With the new high today from price, there is still regular bearish divergence between price and inverted VIX. The new high in price does not come with a corresponding normal decline in market volatility, so there is weakness within price.

During this session, price completed an outside day and the balance of volume was downwards. Volatility has slightly declined during the session and this may be interpreted as bullish for the very short term, but it is so weak a signal it will not be given any weight.

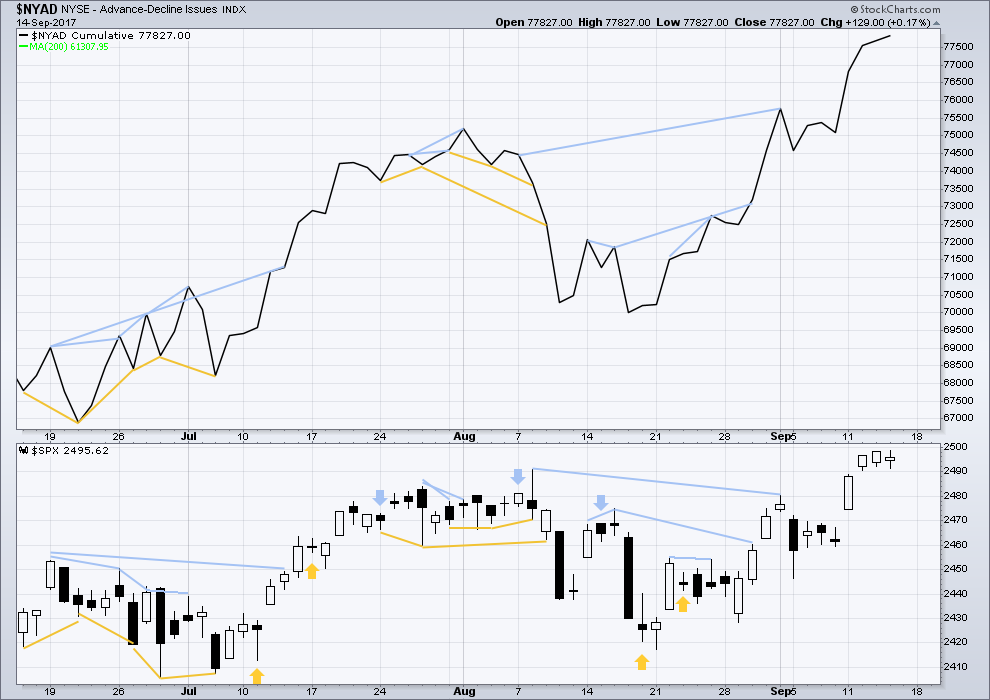

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

With the last all time high for price, the AD line also made a new all time high. Up to the last high for price there was support from rising market breadth.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

There is again no new divergence today between price and the AD line. The new high today for price has support from rising market breadth. This is bullish.

DOW THEORY

The S&P500, DJIA, DJT and Nasdaq have all made new all time highs recently.

Modified Dow Theory (adding in technology as a barometer of our modern economy) sees all indices confirming the ongoing bull market.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

Published @ 08:28 p.m. EST.

For many of us who have been watching price action and analysis with Lara the last few years, there is probably the feeling that this bull market will run interminably and that the banksters are absolutely indomitable. Once again, after broad expectation of at least a minor downside correction, the market sprints in the opposite direction. In my humble opinion, while the signs are now pointing to short term bullishness for price in the market, I think this most recent development is ominous. It seems to me that the only path to a continued bullish run of several more months for this market was for there to be be at the very least a 5% correction and the best wave structure that pointed in that direction was the expanded flat we were all expecting. I am now becoming fairly convinced that without that mild correction we were all expecting, we are most likely in a terminal wave up, and the next move down will not be corrective, but the start of a major bear market. I know that there are some technical arguments that would militate against that view, but if there is one thing this market has done with aplomb is defy the usual technical metrics as we all have learned the last few years. I am now expecting a continued blow off move to the upside that I believe will be terminal to the entire bull run from 2009. I am basing that view on the conviction that no amount of bullish sentiment, regardless of how extreme, nor the depth of central banksters’ pockets can ultimately abrogate the principle of reversion to the mean. Currently price action deviation from the mean by some metrics remain at absolutely historic levels, particularly market price to sales ratio. I am also starting to think that some of the other usual metrics have been somehow compromised and no longer paint a true picture of market conditions. I pointed out recently how market makers were ridiculously skewed in their pricing of option chains expiring last Friday so the Black-Scholes pricing model they have been using since the advent of options is itself behaving strangely. We are trading markets that are hopelessly broken, and In my view nothing any more can be taken for granted. Things may not be at all what they seem, and particularly when assessed by the metrics we have all become accustomed to. The bottom line? I think we are going to see something wholly un-anticipated in some form of an exogenous shock to the financial world, therefore, we should expect the unexpected…and trade accordingly. That perfect tag of 2500.00 by ES was eerie.

DJI is a few hundred points from its own 1.618 retracement from the 1980 low and 2007 high. It is entirely possible that we are closer to a final top than we thought.

Do you see what I see?

A huge volume spike today for the S&P. A strong bullish signal from On Balance Volume…

Can this data be trusted? I’ll be doing the analysis tomorrow now, too exhausted after 4 1/2 hours hiking in steep bush to reset trap lines in the Kiwi reserve.

In the mean time I would like to wait anyway to see if this data remains the same or changes overnight from Stockcharts. If it remains the same…. the alternate wave count despite all it’s problems will be the new main wave count.

Lara, Should we give low/no weightage to OBV that is affected by events like “Triple Witching Day” ? Thanks

I thought we can assign no weightage to OBV on Triple Witching Day like events but still give appropriate weightage for other normal days as we have had good signals from OBV in the past.

If it breaks a trend line then it breaks a trend line. I don’t think it matters why, the important thing is the trend line.

Having said that however, occasionally OBV will break a trend line only to then turn and break back below it, creating a new point to redraw the line from.

That might be what’s happening here.

The 3 dates this year with highest volume are 3/17, 6/16, and 9/15. What do they all have in common? They are the quarterly ex/div dates for SPY, DIA, and the SPDR ETFs. I am not an expert on these things, but it seems like this probably has something to do with the source of the discrepancy. If you look at a chart of DJI you see exactly the same pattern. Looking back since 2006 (as far back as ThinkOrSwim volume data goes) you see the exact same phenomenon, i.e. the 3rd Friday of March, June, September, and December has abnormally high volume (these days also happen to be “Triple-witching days” FWIW). Since most people just auto-reinvest dividends, a spike in volume is to be expected, right? There’s no net flow of money in or out with a dividend, but volume will certainly spike up. As far as I can tell, the behavior of the indices right after these dates seems uncorrelated with what happened on the ex/div date… I’m not sure what the implications are for the OBV line here. It’s probably worth noting that SPY itself, along with /ES futures, saw a very slight decrease in volume compared to yesterday.

I make no claims about the quality of my personal analysis, but others around here were claiming there seems to have been a lack of selling pressure this week. Not surprising, since no one wants to sell just days before the ex/div date.

For those who would like to discount the volume from yesterday’s session especially OBV, I would ask, “At what point do you cease that slippery slope? What about excessively light volume on holidays or preholidays, do we discard that data as well? What about excessively large volume for a black swan event, do we discard that volume as well?”

I followed Joseph Granville, was a student of his and a personal acquaintance. God rest his soul. He would not discard the data from any day. In fact, he would have said, “The new high in OBV in early September predicted a new ATH in SPX price.” That is the primary reason I have been long the last several weeks.

We can explain the bull market in a variety of ways. Some say it is the banksters. Others blame the Federal Reserve and other central banks. Many think it is foreign sovereign funds pouring into dollar denominated equities. Some might even pin it on aliens. It makes no difference to me who or what is behind the bull market. What matters to me is that it is a bull market and I want to be on the correct side. If that markets are being manipulated, they will eventually correct. I believe EW and TA will be able to guide us through that.

I eagerly await Lara’s weekend analysis and commentary.

The volume on triple-witching day, whether it be from contract expirations or also ex/div related phenomena, is consistent and predictable. Excessively light volume on holidays should be taken in context as well. And there is literally no reason at all to discount Black Swan event volume.

The break in OBV in early September was not really associated with any predictably abnormal volume days, so sure, it was probably predictive of the new ATH in price. But I don’t see how you can justify putting heavy weight on volume signals for days when you are guaranteed to have high volume for the index. Look at literally every 3rd Friday of March, June, September, and December, and the patter is always the same. There was no high volume for futures or ETFs yesterday. And it’s a major ex/div day to boot. You are going to have an abnormal decrease in sellers.

As far as your last statement… EW and technical analysis have not done a very good job at all of showing they are predictive of the arrival of P4. I am not saying they should be perfectly predictable, and I certainly don’t mean to be overly critical, but we have been hearing that P4 is imminent since the dip in mid-June. Just 3 weeks ago, everyone here was in complete agreement that P4 had begun. It goes to show that no analysis is perfect. But then why are you so confident we will know when P4 has begun?

As Lara has pointed out, nothing in TA is 100 %. The current market is one of the wiliest and most unpredictable I have ever seen. As I have opined on more than one occasion, even some measures of formerly reliable technical signals are now less so with market price failing to do what wold be normally expected, for example, experience at least one correction in a 12 month period. In addition, we have also seen that varying technical measures sometimes offer conflicting signals.

A remarkable number of traders and hedge funds have simply thrown in the towel in the last five years, including some very well-known and experienced market players. The correct disposition I think under the current circumstances is to keep and open mind, and remember that no one can predict with absolute certainty what the market may or may not do. This is why as traders we adhere to stop losses when the number that says we are wrong is triggered.

Jimmy makes some legitimate observations and of course it is entirely possible that P4 has not arrived although it seems unlikely.

It is also possible that it is over, and that also seems equally a remote possibility. Improbable, does not mean impossible, and I for one will be in the camp that believes a fifth and final wave up is underway if price continues higher beyond 2500.00 next week.

Triple witching week probably a factor. Another interesting historical note is that the week following triple witching in the third quarter usually bearish. If the market continues to do what it has all year, yet another seasonal expectation of bearishness could be negated in this month of September. The bull rampages on! 🙂

So, I just checked my account. My target profit was reached in the last 6 minutes of today’s market action. All my longs liquidated at that point. It was probably not the final top. But that is okay. I leave the last few points for someone else. For me, the risk of downside action is gone.

I am headed to the mountains next week for ten days. Maybe by then the rounding top will be ready to precipitously head southward. I hope everyone here has a great weekend.

Nice Rodney. Have a wonderful time in the mountains.

another slow curving rounded top?

or another consolidation before the next wave up (alternate)?

plenty of weakness in this upwards wave, but this market has shown plenty of weakness in sustained bull runs so that doesn’t mean too much and makes it impossible to distinguish the two situations 🙁

Looks like they want to ring the 2500 bell. Once that is done and out of way, as Kevin indicated 2501-2503 zone, maybe market can finally turn down.

Yep! It sure is looking like we go higher next week. We probably have a fractal of the July 26 to August 8 run unfolding. It is really strange to see price pinned to the upper B band so frequently these days. If anybody every doubted the potency of CB buying all you have to do is look at that price action- very unnatural. We will eventually have a mean reversion; the problem is we have no idea how long this can continue. I have lightened up my positions with near term bullish positions and mid-term bearish ones. Have a great week-end all!

Nice round number!

I have been of late a great contrarian indicator. Just when I start getting all bullish waiting for an expected market turn…voila! lol!

The RUT volatility index (RVX) hit a historical low this morning. IMO this is the top of a corrective wave in a downtrend. Next week’s FOMC meeting will bring P4 out in full force.

The long term trend is up. The intermediate term trend is up. The short term trend is up. I’m making the very bold assumption at least two out of three will continue (I’ve heard that advice before?). I’m increasingly getting in line with that assumption. Goodbye, P4, or I should say, see you later on down the road, next week, next month, whenever.

You cannot argue with price. It is starting to look like a motive wave up underway, especially when you look at other indices and step back and look at the chart from a bit farther out. It would be one of the few instances in which OBV has issued a false signal, but well in keeping with how many other metrics appear to have been busted in these central bank driven markets….

If we have an upwards week next week OBV will assuredly break the trendline in question.

Considering the increasingly tenuous link between so many market metrics and what the market actually ends up doing, I am seriously considering whether many indices may indeed be in a final wave up. While this could still be a corrective wave underway, each day it continues higher makes that less likely. As improbable as it seems due to its brevity, if this is a final wave up then the corrective fourth wave must have ended. We may be closer to an end than we think….

GS bottom/turn with price/stochastic divergence. EW wise it looks an awful lot like the completion of an expanded flat correction after a sharp 5 wave up.

I feel it is very likely there will be a return of volatility next week with a decent drop in S&P to below 2446. Last few days are low volume distribution presaging a drop. IMHO.

The low volume has been highlighting market weakness for quite some time now. Unfortunately, it has not been very useful in telling us anything about a likely market downturn as a result….another busted metric it would seem….

If this move started Aug 21 is an impulse 5 wave…oops, it NOT! It’s too overlapped to break down into a 5 wave impulse model, at first glance anyway. (If someone can do it I’d love to see a posted chart.) It looks corrective to the upside. But I keep trying because…I want to know when it will end!!! Lol!! So I have to fall back on my symmetric move projections and extensions, and I have two symmetry projections that fall in the 2501-2502.5 zone, and then there’s still the 1.27% extension at around 2513. I remain confident that somewhere in there, a turn and significant pullback will initiate. Meanwhile, I have a small but growing set of long positions to scalp some cash and who knows, maybe the market blows by 2513, gotta be ready for anything.

The market simply continues to defy any attempt to make reasonable conclusions about what kind of wave is unfolding. Nothing to do but wait for situation to clarify…

Is this rational? (sorry for unconventional labelling).

It does appear we are in for a repeat of the July 26 to August 8 price action with dojis and spinning tops yet price remaining pinned against the upper B band for many days on end. Remarkable and weird price action redux.

SPX gaps down, DJI gaps up…markets remained fractured…

If the current wave is done, VIX needs to climb past 12.00 with conviction in the form of a fat green candle….

For any who like longer term value plays, while I’ll never ever ever ever eat there myself…CMG is probably rediculously undervalued at this point (killing a few customers will do that to a company). It’s doubled bottom in the last few weeks (probably with some bullish divergence too) and price looks pretty darn stable at the bottom. I’ve a small longer term play position and may add if this market doesn’t go over a cliff, etc. etc.

I certainly wish them well, but I for one will not be darkening their door-step. Very particular about my edibles! 🙂

GS, a bellweather and a component of the DJI, has doubled topped now over the last month, and cracked this morning to the downside. I view it as significant for finance, at the very least (which I am short…). Markets stable…but the 80 or so “trading” stocks I follow are almost all uniformly red so far today. P4 lives…by a thread, but I think we just might see a few downside fireworks today. One anomaly that I took a long position in today: UL. Slow performer, but looks very solid for a longer term play. Opened gap up, moving up. One last note: TTM_scalp_alert (a john carter study on thinkorswim) fired a sell signal on SPX 20 minute chart. With any downward follow through today, I expect a similar sell signal on the daily.

This market seems to have every excuse to go down, but simply won’t. Overnight futures are already in the green when charts and news indicate red. Is there any chance we are in a Primary 5 wave? Thanks

We had a brief discussion on the site today about the VIX and what we can glean about the market by the way VIX is trading. We all know the technical definition and the implications for traders of market volatility. If you have been paying attention the last few years though, while you make not have been able to explain or precisely quantify it, something has not seemed quite right about VIX has been doing. Take for example the way VIX traded today. The current reading of 10.44 is suggestive of very low expectations for volatility in the market in the next 30 days, also described as an absence of fear on the part of traders. People also forget that the VIX also determines the PRICE (premium) one one pays for insurance against such implied volatility in the form of option prices. A low VIX is typically strictly interpreted, or so we are told, as a low put/call ratio, which suggests fewer puts than calls being purchased, which in turn suggests little fear of any impending market decline. On the matter of pricing under such circumstances as these, what would you expect the relative pricing to be of the exact same SPY strike put and calls with the exact same expiration date?

Let’s get even more specific. What would you expect to be the relative cost of acquiring SPY 250 strike calls vs puts expiring tomorrow?

As you can easily check, the price of the 250 puts is 116 bid, the price of the call is 0.14 bid, a better than 8 to one disparity!

If you understand why this is absolutely incredible with VIX trading at under 11, when considered from a historical context, you understand why you cannot believe the official line about what the VIX supposedly is telling you about the market.

There is a reason why they refer to it as IMPLIED volatility.

BTW, I do not know why this strange situation exists and if you got what I am saying you can see that something is very, very wrong here. I have heard a lot traders smarter than I try to explain this peculiarity but I still have no good answers for why we are seeing numbers like these. Bob Kudla of Trade Genius told me about a system being employed for suppressing volatility and goosing market price that is truly quite fantastic and I have no proof but when I look at what has been going on, it makes perfect sense.

The SPY put – call disparity has to do with SPY going ex-div on Friday, no?

Verne, there’s more than one of those systems…..

Also, for what’s its worth, not only are we continuing to deal with mass power and data outages here in FL, there’s now a very real sewage problem in Orlando and Miami. Lift stations are knocking out power and spewing nastiness all over the place. Thank God I’ve got satellite and cloud servers or I would not be able to run my fund. The damage estimates aren’t even close to real, and I would wager we see insurance bankruptcies, bailouts, or both. I can’t believe Florida performed so poorly with such a weak storm. Fl and TX are main growth/GDP drivers and the overhang will last a few quarters and not be “transitory” as they like to say.

I am not sure why they are down-playing the impact of this hurricane. I know a lot of folk in Florida are very upset as they are still being prevented from returning to their properties. The damage in the Caribbean has been horrific, including my home island of Tortola. They paid an Israeli company an awful lot of money to build the main government building on the island and I cannot believe the plans did not include hurricane shutters for 9 foot arched windows. As you can imagine they were promptly blown out with the majority of the subsequent damage being due to water intrusion- this could have easily been avoided for an additional few thousand dollars. Incredible!

Wow, talk about a cheap hedge….unreal amounts of negligence all over the place

The health of the insurance sector is I think a real wild card.

Remember how the troubles of AIG were central to the last crisis? I suspect the rules about how they may invest their reserves are now even more lax than they were 17 years ago and the recklessness probably still continued and got worse. Lots of propaganda out recently about how they are not going to take as big a hit as folks are projecting and I find that quite interesting….

I believe it… ! 🙂

Looks like they are crushing it again today….at least making a valiant attempt….

To quote Yul Brynner in the great musical “The King and I”:

“It is PUZZLEMENT!”

I’m on the fence wanting to play probabilities of impending doom with a few 30 day SPY Puts -vs- waiting for confirmation after the anticipated drop begins.

I’m pretty sure Lara might lean toward: Confirmation, confirmation, confirmation! I know in the deep recesses of my brain that waiting for confirmation is the right play.

But for the impatient among us, what would be the most mild degree of confirmation of a downturn to act upon?

If VIX crosses 12.5 and closes above to the upside, regardless of what the market is doing… GO! 🙂

Excellent. Thx Verne.

Breaking out of the channel lines is the first confidence point Lara notes in her commentary. But, unfortunately, the SPX often breaks out of channel lines only to reverse and keep going in the same direction. But it is the first confidence point noted.

Thx Rodney

That is fascinating. Sounds like we need a LONG VIX measure, and a SHORT VIX measure, in addition to the “combined” VIX that we have, to really tease apart meaning and implications. The complexity of the intertwined financial instruments is so high, I’m sure big money is playing any and every game possible to maximize returns and lower their own risk.

first comment,,I have nothing else to contribute