For the short term, downwards movement was expected for Thursday’s session. An inside day completes as a red daily candlestick, mostly meeting expectations but not as clear as hoped for.

Summary: With the last wave up now looking very much like a three, have some confidence that primary wave 4 is underway. Look for price to move either sideways or lower with a lot of overlapping choppy movement for a few weeks.

In the short term, a quick spike up to just above 2,467.57 may be followed by a turn down to new lows.

Last monthly and weekly charts are here. Last historic analysis video is here.

ELLIOTT WAVE COUNT

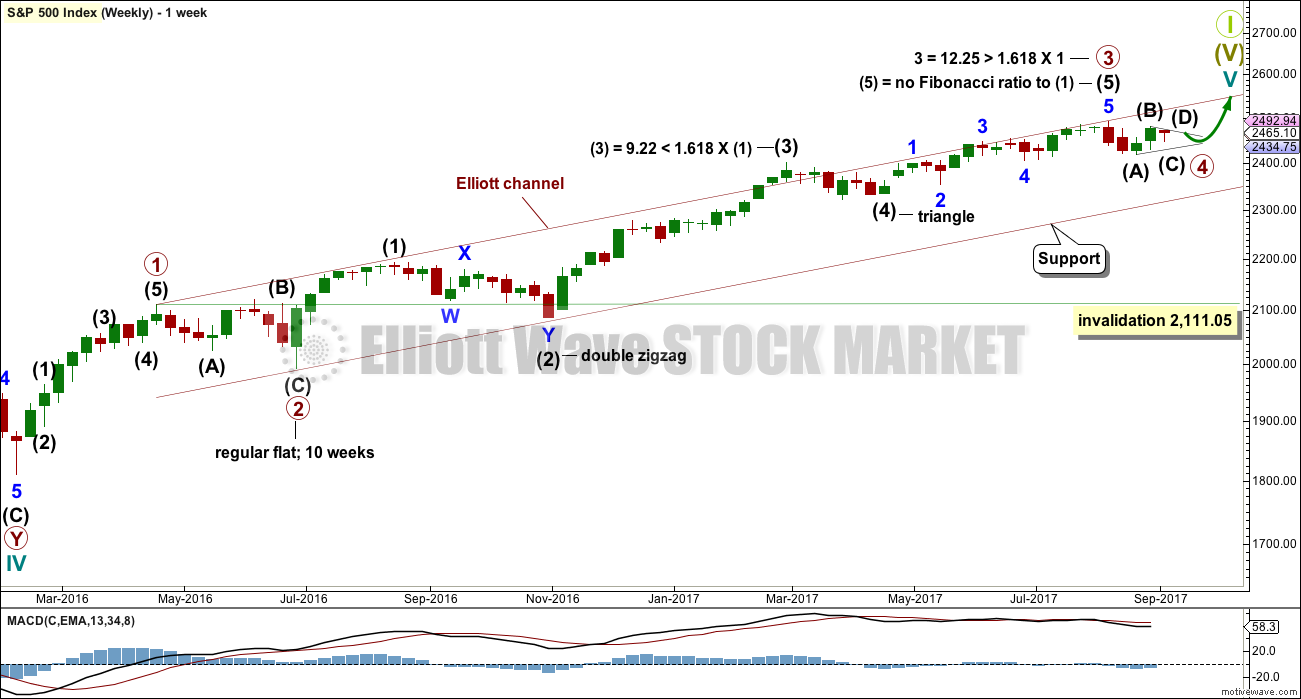

WEEKLY CHART

Primary wave 3 now looks complete. Further and substantial confidence may be had if price makes a new low below 2,405.70, which is the start of minor wave 5 within intermediate wave (5). A new low below 2,405.70 may not be a second wave correction within an extending fifth wave, so at that stage the final fifth wave must be over. Fibonacci ratios are calculated at primary and intermediate degree. If primary wave 3 is complete, then it still exhibits the most common Fibonacci ratio to primary wave 1.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

Primary wave 4 should last about 8 weeks minimum for it to have reasonable proportion with primary wave 2. It is the proportion between corrective waves which give a wave count the right look. Primary wave 4 may last 13 or even 21 weeks if it is a triangle or combination. So far it may be completing its fourth week.

If primary wave 4 unfolds as a single or double zigzag, then it may find support about the lower edge of the maroon Elliott channel. If it is a triangle or combination, it may be more shallow, ending about mid way within the channel.

At this stage, the analysis gets complicated because there are several possible structures that primary wave 4 may be. The ideas for a triangle, combination, double zigzag, and single zigzag will be separated out into different daily charts in order for members to have a clearer picture of how price may behave for each. It is still impossible for me to tell you with any level of confidence which structure primary wave 4 may take, so all possibilities must be considered. I can only say that a single or double zigzag, or a triangle, would be most likely to exhibit good alternation with the flat correction of primary wave 2.

The final target for Grand Super Cycle wave I to end is at 2,500 where cycle wave V would reach equality in length with cycle wave I. If price reaches the target at 2,500 and either the structure is incomplete or price keeps rising, then the next target would be the next Fibonacci ratio in the sequence between cycle waves I and V. At 2,926 cycle wave V would reach 1.618 the length of cycle wave I.

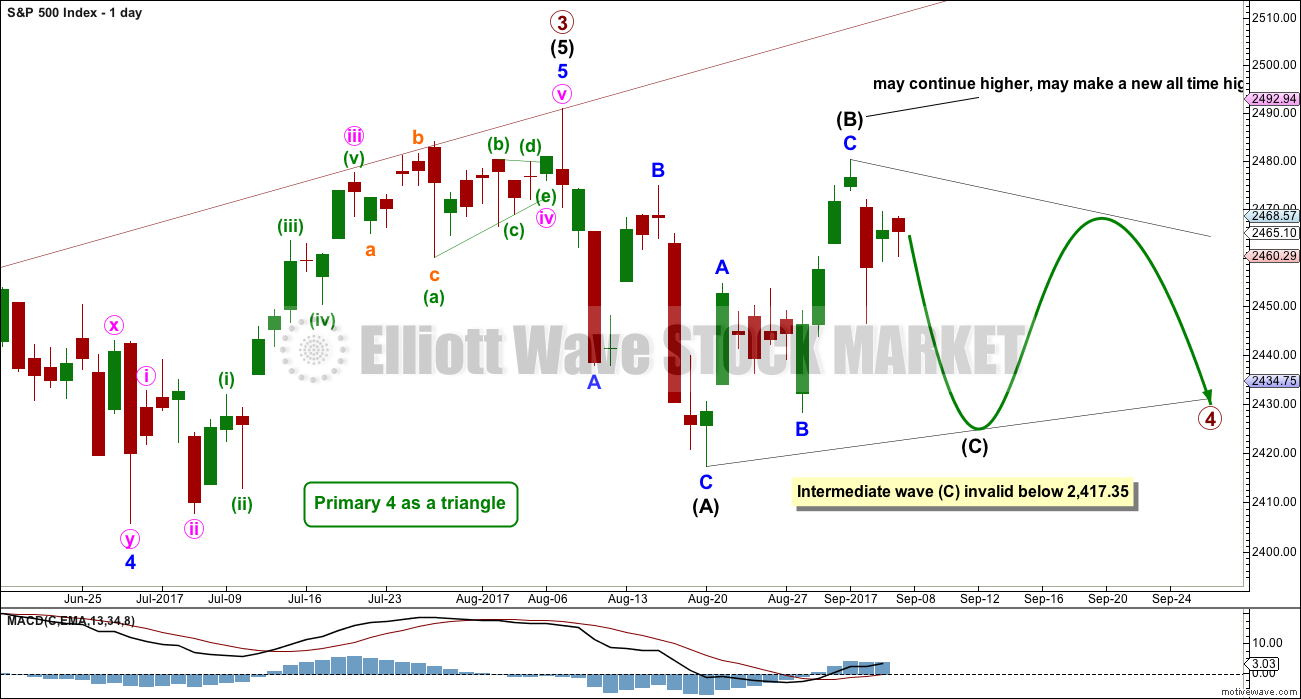

DAILY CHART – TRIANGLE

This first daily chart will illustrate how price might move if primary wave 4 unfolds as a triangle.

Intermediate wave (B) may possibly be complete at last week’s high. If it is complete there, then it would be a 0.86 length of intermediate wave (A), which is very close to the common range for triangle subwaves of about 0.8 to 0.85.

It is still possible that intermediate wave (B) may continue higher as a double zigzag. One of the five sub-waves of a triangle should be a more complicated multiple; most commonly that is wave C, but it may be any sub-wave. If intermediate wave (B) does continue higher, it may make a new all time high as in a running triangle. For the short term, if price makes a new high above 2,480.38, then a double zigzag continuing higher for intermediate wave (B) would be charted for the main daily wave count.

The triangle may still last a total of at least eight weeks, and possibly longer.

Both intermediate waves (A) and (B) look like three wave structures.

If intermediate wave (B) is over, then intermediate wave (C) may be more complicated and time consuming than either of intermediate waves (A) or (B). Intermediate wave (C) may not move beyond the end of intermediate wave (A).

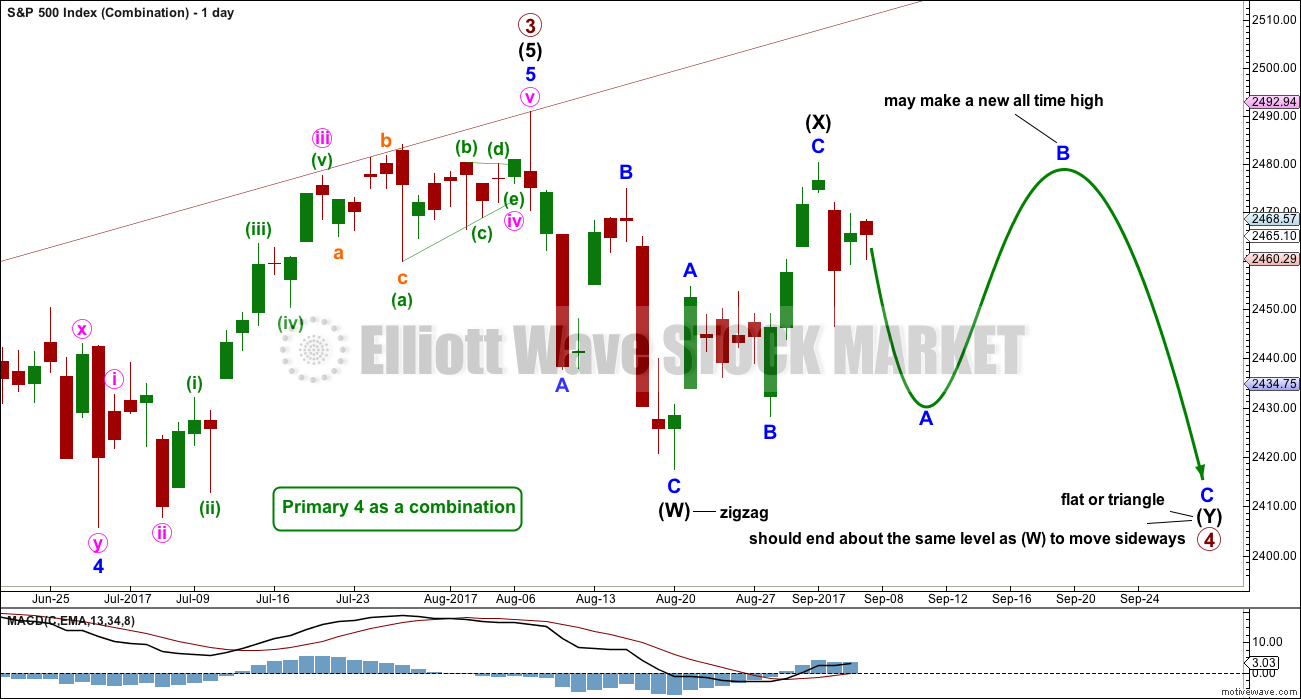

DAILY CHART – COMBINATION

A combination for primary wave 4 would still offer some alternation with the regular flat of primary wave 2. Whenever a triangle is considered, always consider a combination alongside it. Very often what looks like a triangle may be unfolding or may even look complete, only for the correction to morph into a combination.

There may only be one zigzag within W, Y and Z of a combination (otherwise the structure is a double or triple zigzag, which is very different and is considered below). At this stage, that would be intermediate wave (W), which is complete.

Combinations are big sideways movements. To achieve a sideways look their X waves are usually deep (and often also time consuming) and the Y wave ends close to the same level as wave W.

Here, intermediate wave (X) is very deep.

Intermediate wave (Y) may be a flat correction or a triangle. Within intermediate wave (Y), minor wave B may make a new high above the start of minor wave A as in an expanded flat or running triangle; this may include a new all time high. There is no upper invalidation point for a combination.

While intermediate wave (Y) may be a triangle, it is much more likely to be a flat correction. The combination of one zigzag and one flat within a combination is the most common by a very wide margin. A flat correction should be expected for intermediate wave (Y).

Within a flat correction, minor wave A must subdivide as a three, most often a zigzag and minor wave B must then retrace a minimum 0.9 length of minor wave A. Thereafter, minor wave C should move below the end of minor wave A. This structure may take another few weeks to complete.

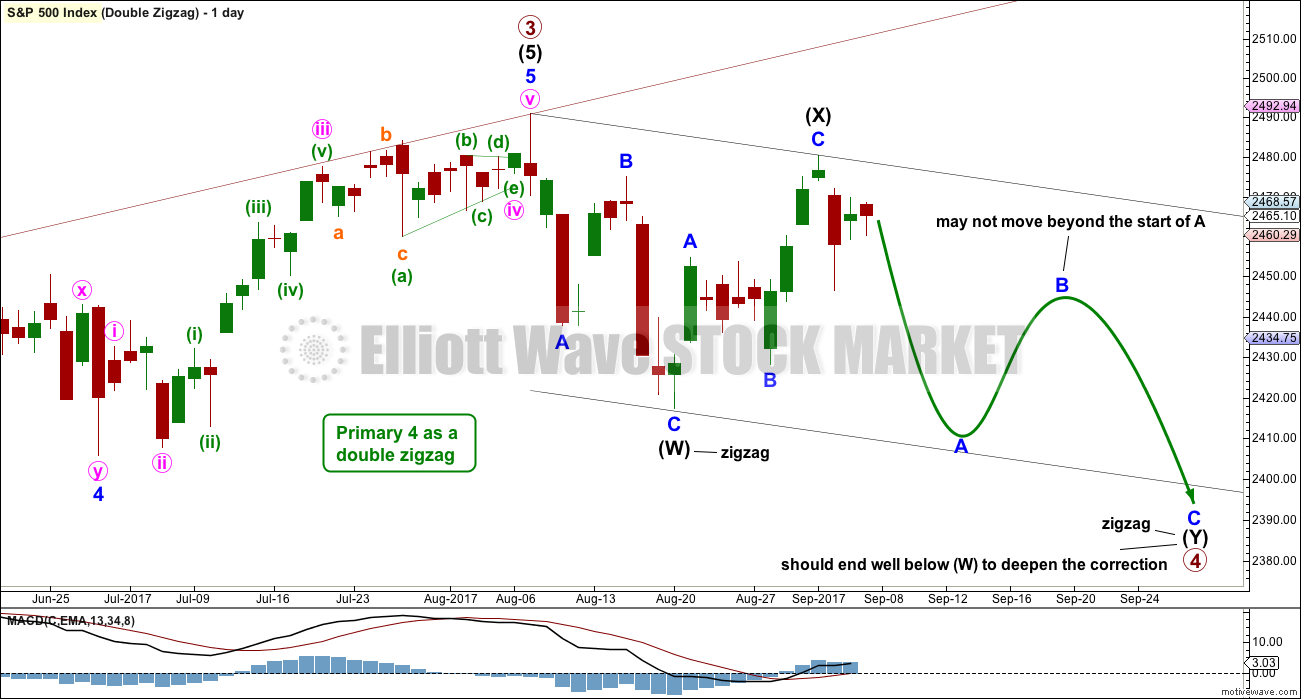

DAILY CHART – DOUBLE ZIGZAG

While combinations and double zigzags are both labelled W-X-Y, they are very different structures.

Double zigzags (and very rare triples) belong to the zigzag family of corrections. Combinations are more closely related to flats (these are sideways movements). Double zigzags have a strong slope, as do single zigzags. The second zigzag exists when the first zigzag does not move price deep enough; its purpose is to deepen the correction.

To achieve a strong slope the X waves of double zigzags (and the very rare triple zigzags) are almost always brief and shallow. Here, intermediate wave (X) is neither brief nor shallow reducing the probability of this wave count.

Within the second zigzag, minor wave B may not move beyond the start of minor wave A.

It would still be possible for this wave count for primary wave 4 to end about the lower edge of the maroon channel on the weekly chart.

A channel is added today about intermediate waves (W) and (X). For all three ideas at the daily chart level, if my labelling is correct, then any upwards movement at this stage should find very strong resistance at the upper edge of this channel. This channel is copied over to the hourly chart below.

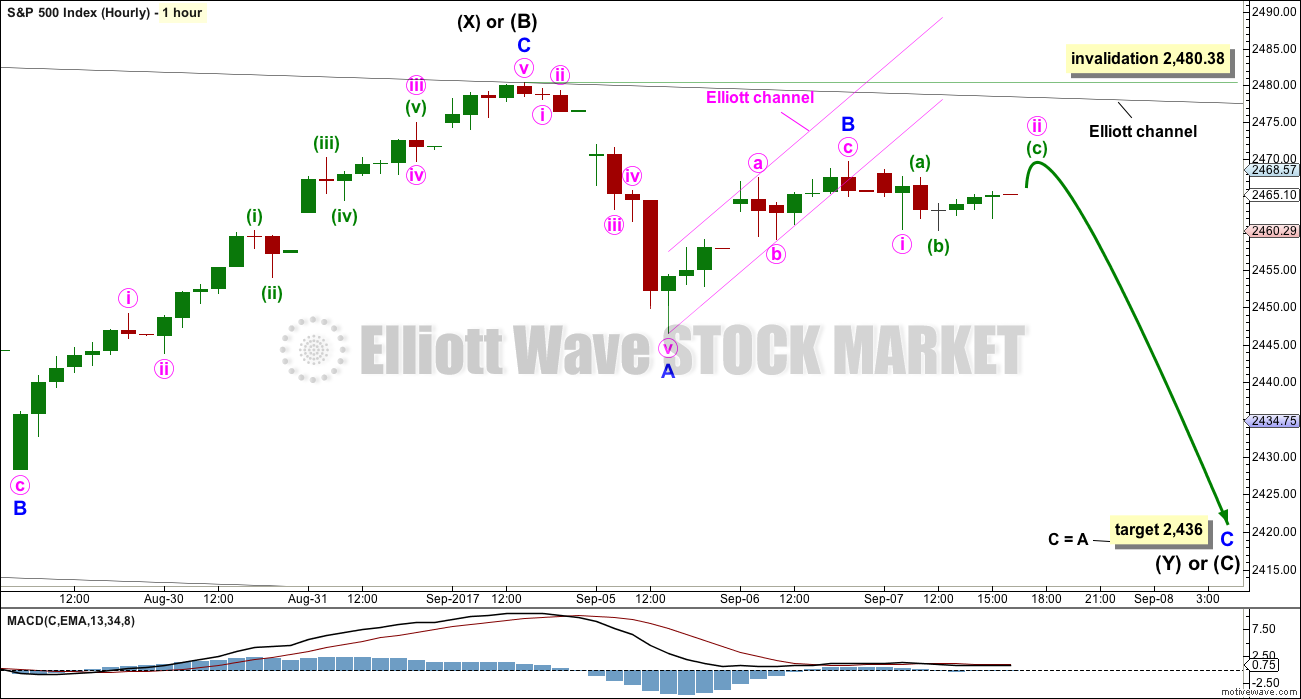

HOURLY CHART

This hourly chart will suffice for all three daily charts above. All three daily charts see the last upwards movement as a complete zigzag for intermediate wave (B) or (X).

With a three down (labelled intermediate wave (A) or (W) ), and now a three up complete, some reasonable confidence may be had that this market is in a larger correction which is incomplete.

Minor wave B may have ended just above the 0.618 Fibonacci ratio of minor wave A, a common point for B waves to end. There is no Fibonacci ratio between minute waves a and c.

A small channel in pink is drawn about minor wave B. This small channel was breached by sideways movement during Thursday’s session. This is an indicator that the upwards zigzag labelled minor wave B is over and the next wave has begun. The next wave is expected most likely to be the start of minor wave C, but it may also be an X wave within a double zigzag if minor wave B is not over.

If minor wave B continues higher as a double zigzag (a fairly common structure), then it may not move beyond the start of minor wave A above 2,480.38.

If minor wave B is over, then tomorrow minute wave ii may not move beyond the start of minute wave i above 2,469.64. Minute wave ii is labelled as an incomplete flat correction. To avoid a truncation and a very rare running flat minuette wave (c) should end above the end of minuette wave (a) at 2,467.57 and below 2,469.64.

How low the next wave goes should offer some clues as to the larger structure of primary wave 4.

ALTERNATE WAVE COUNT

DAILY CHART

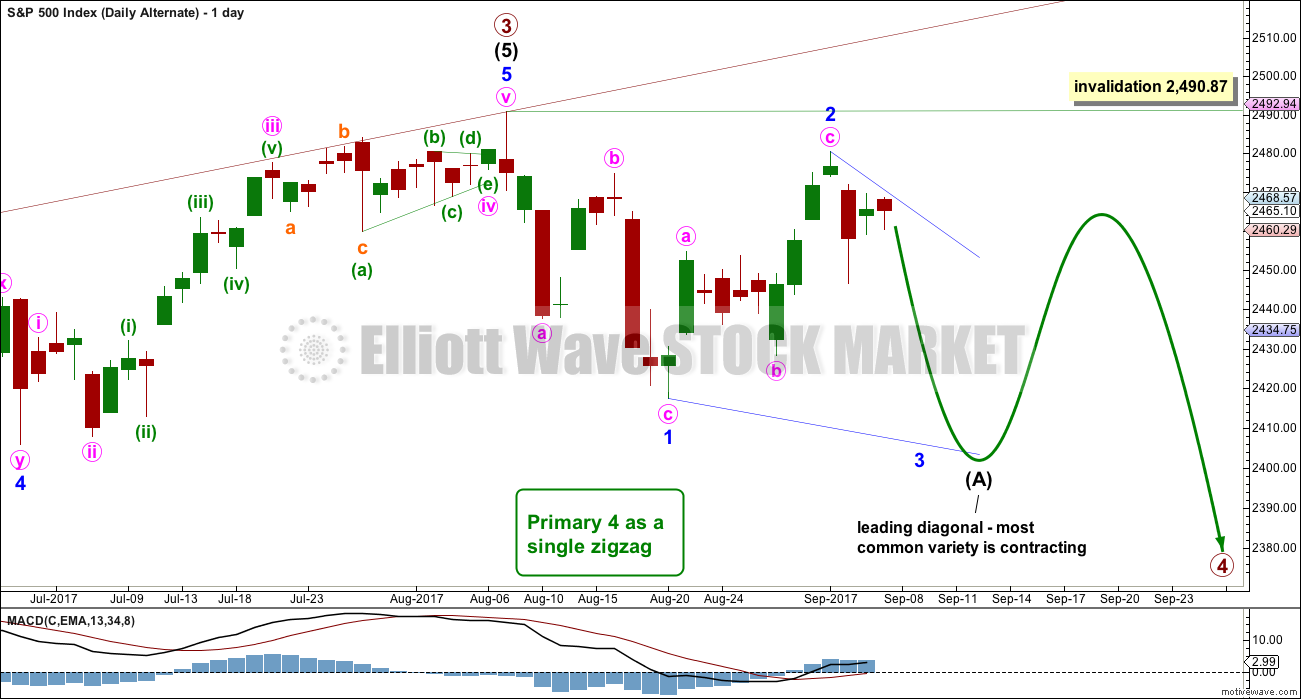

The first three daily charts all consider the possibility that the first wave down was a complete three. This alternate considers the possibility that a five down is still underway.

If intermediate wave (A) is an incomplete five down, then the larger correction for primary wave 4 would be a single zigzag.

Intermediate wave (A) may not now be an impulse, because the first wave down is clearly a three and not a five. It may be a leading diagonal.

Leading diagonals have sub-waves one, three and five that most commonly subdivide as zigzags, although they may also be impulses.

Within diagonals, the second and fourth waves must be zigzags and are commonly from 0.66 to 0.81 the length of the prior wave. Here, minor wave 2 would now be 0.86 the length of minor wave 1, not too much deeper than the common length.

Minor wave 3 must make a new low below the end of minor wave 1 below 2,417.35. It would most likely be shorter than minor wave 1, which was 73.52 points in length, as contracting diagonals are the most common variety.

Minor wave 2 may not move beyond the start of minor wave 1 above 2,490.87.

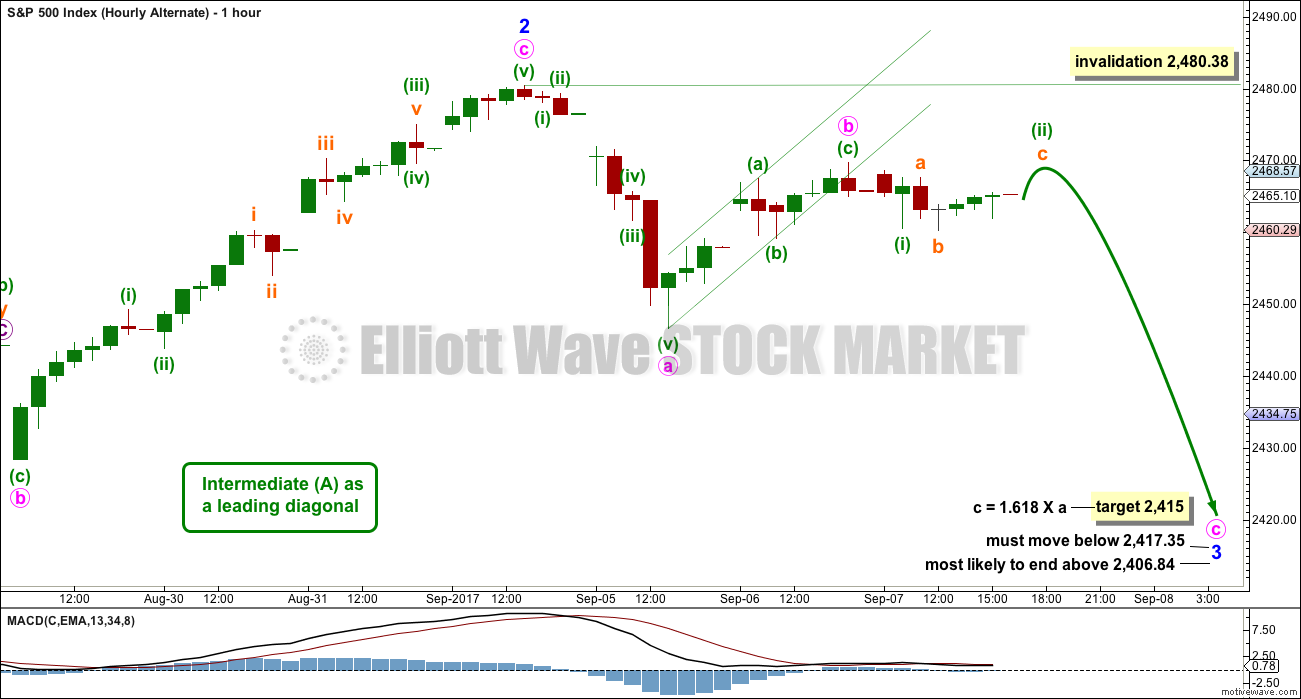

HOURLY CHART

Subdivisions at the hourly chart level are the same for all wave counts. Only the degree of labelling and the larger structure differ. All wave counts see a zigzag complete downwards to the last low, and now a zigzag upwards complete.

The most common type of leading diagonal is a contracting variety. In a contracting diagonal the third wave should be shorter than the first wave and the fifth wave shorter still, so that the third wave is not the shortest. If this leading diagonal is contracting, then minor wave 3 must move below the end of minor wave 1 at 2,417.35, and must end above 2,406.84 to be shorter than minor wave 1. The target would meet these conditions.

TECHNICAL ANALYSIS

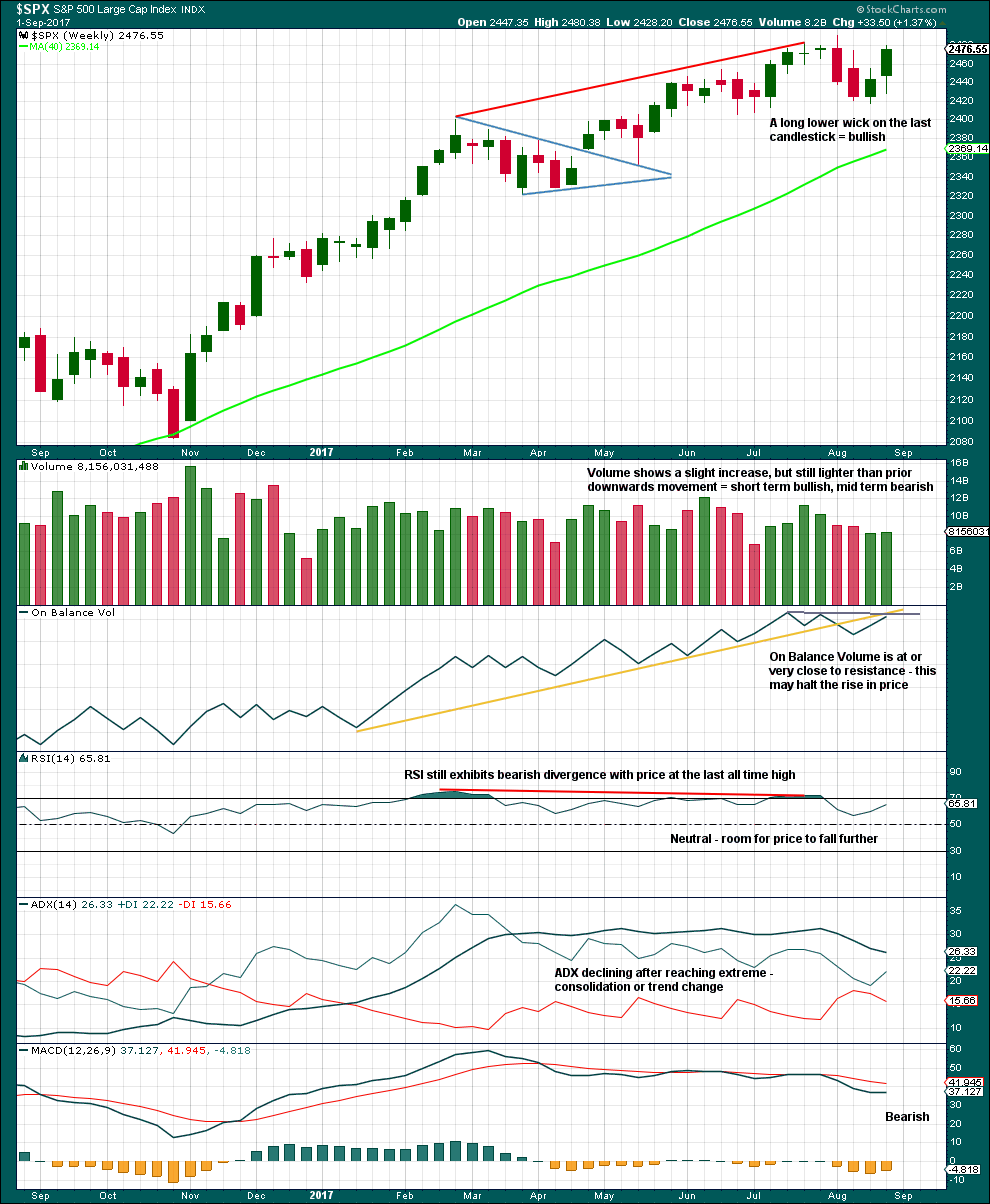

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An upwards week has a long lower wick and slight support from volume. In the short term, it is entirely possible that this upwards movement is not over.

However, volume remains relatively light, relative to recent downwards weeks. There is still more support for downwards movement than upwards, so it still looks like a consolidation may be continuing.

Consolidations do not move in straight lines. Price whipsaws from support to resistance, and back again. At this stage, it looks like that is what price may still be doing.

ADX had been extreme for a long time and is now declining. The black ADX line is now declining but has not yet been pulled down below both directional lines, so the consolidation or pullback may be expected to continue.

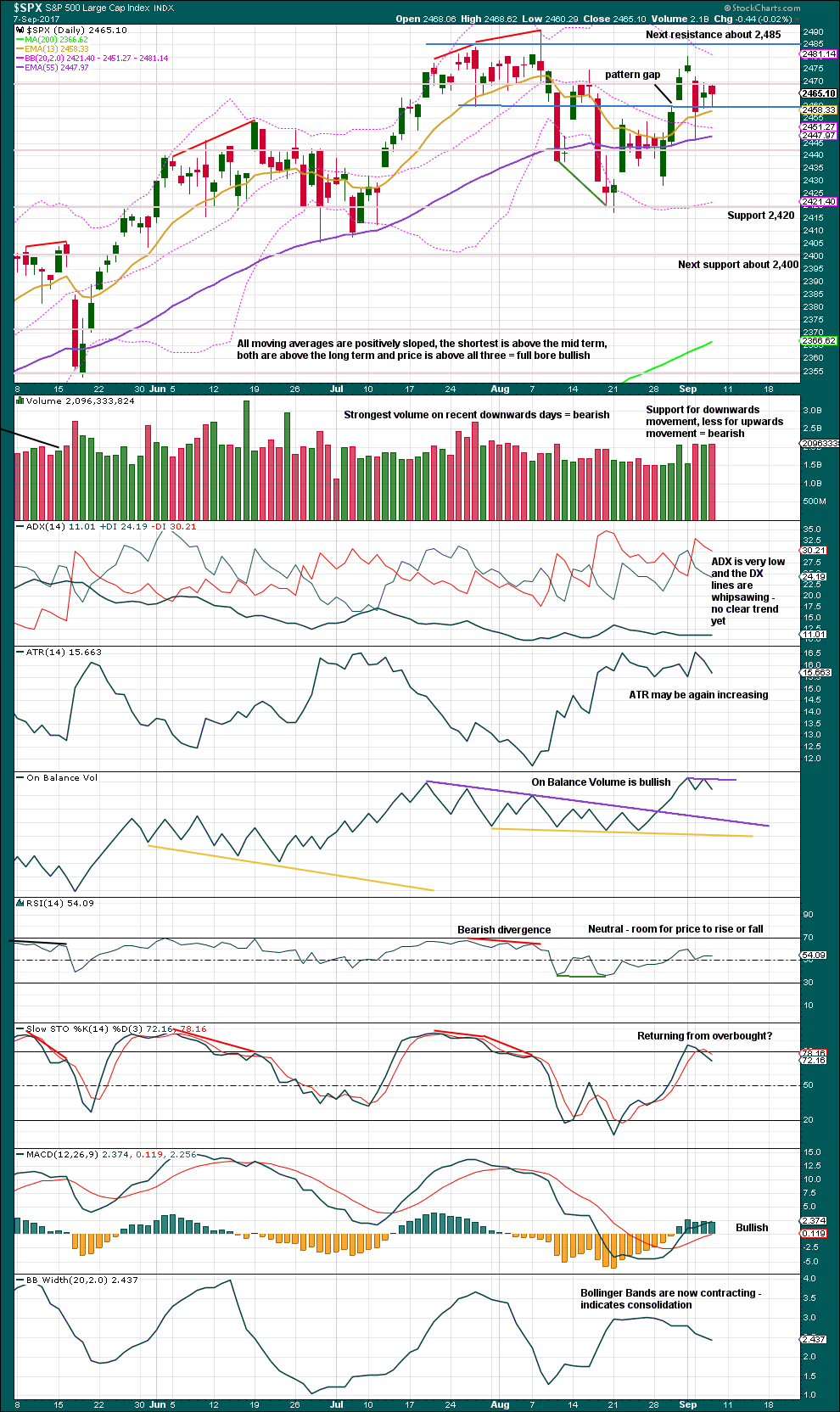

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Only if an upwards breakout to a new all time high is seen, which very importantly should have support from volume, would the view that price is consolidating have to change.

Price again found support about 2,460. An inside day closes red with the balance of volume downwards. Volume shows a slight increase. Again, there is more support recently for downwards movement than upwards; the volume profile remains bearish.

A new small resistance line is added to On Balance Volume.

One of the best techniques for trading a consolidation is to use resistance and support along with Stochastics to indicate when price may turn. This is a high risk strategy though: price can overshoot resistance or support before turning, and Stochastics is useful but not as an exact technique for timing a turn. Losses can be large but should be few while profits may be many and small. Only the most experienced traders should attempt it.

At this stage, it looks like price may have turned just below resistance with Stochastics just reaching into overbought. The risk here is price may move higher to resistance about 2,485 and Stochastics may dip again into overbought before the upwards swing is over and the next swing down begins.

It is absolutely essential that good risk management and money management techniques are used. Anyone trading a consolidation without using stops is inviting financial losses.

Please use my two Golden Rules of risk management: always use a stop and invest only 1-5% of equity on any one trade.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is no new divergence today between price and inverted VIX.

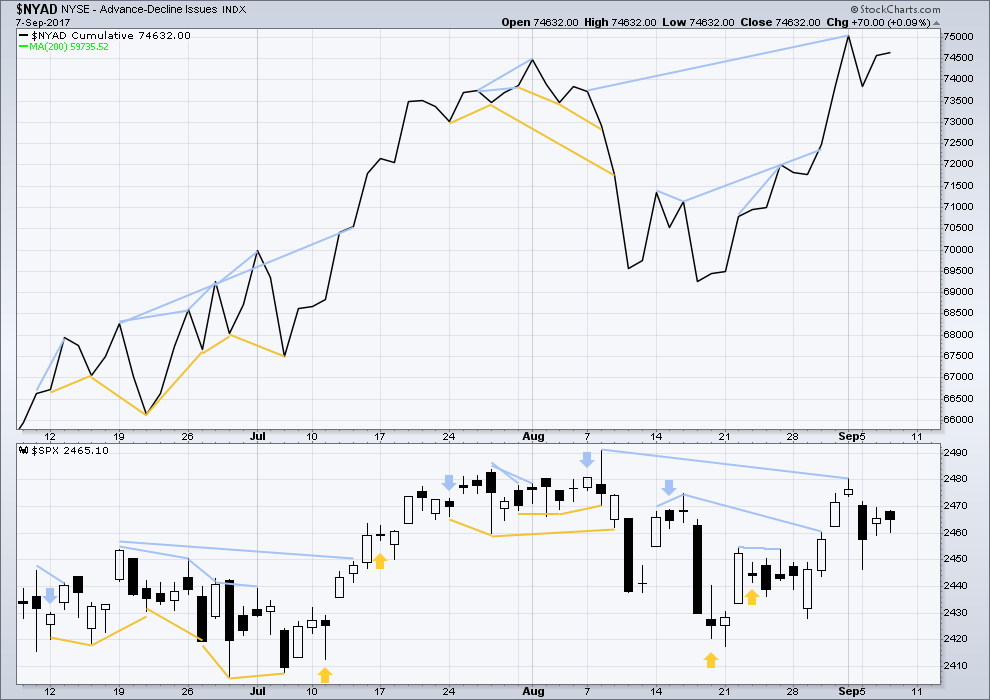

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

With the last all time high for price, the AD line also made a new all time high. Up to the last high for price there was support from rising market breadth.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

There is no new divergence today between price and the AD line.

DOW THEORY

The S&P500, DJIA, DJT and Nasdaq have all made new all time highs recently.

Modified Dow Theory (adding in technology as a barometer of our modern economy) sees all indices confirming the ongoing bull market.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

Published @ 10:07 p.m. EST.

Hourly chart updated:

While I’m not completely comfortable with how this triangle looks, the trend lines aren’t converging very much, it does fit and meet all EW rules, and MACD is right on zero.

It looks like minor B is not done, this sideways drift looks like some kind of B wave, maybe even a B wave within a B wave…. within a B wave.

And so when the consolidation is complete a short sharp thrust may occur, which may find resistance at the upper edge of the black Elliott channel.

And then finally the next wave down may occur.

As far as can tell, on balance volume turned down pretty sharply today. If you extend the daily chart back to May there’s a resistance line that’s been tested at least 7 times and failed on its last attempt. OBV has been the most reliable indicator of technical breakouts.

Over the past 3 months there has been a lot of technical damage in overseas markets, especially DAX, FTSE, KOSPI, & NIKKEI. They have not seen ATHs since June or May.

Thank you very much Jimmy for the tip re OBV.

My trend line was a bit short… if you hadn’t pointed this out I would’ve missed it.

There’s short term hidden bullish divergence with price and OBV…. but in my experience it’s not very reliable. I’ll not give it any weight. It works much better with trend lines.

Looking today like the bankster ramp of KSS at an end.

September 22 40 strike puts at bid ask of 0.40/0.50

It would appear that the bears are not in the least bit interested in playing tug-of-war. The strategy seems to be to let the bulls wear themselves out defending critical pivots. If that thesis is correct, this meandering is going to continue into the close, and we will get a decent gap down at the open on Monday, followed by another few days of the bulls trying to bid price back up toward 2060.

Looks like my speculative diamond short trade is a bust.

Have a great week-end everyone, and if you are heading out of Florida, safe travels!

Anybody see the “180 reversal” (a Jeff Cooper “hit and run trading” name for two big daily bars side by side where one closes in lower 25%, and the second in the upper 25%, or VV) in B yesterday? I did, and put on his trade to buy just above the high yesterday. After some pullback action, I took it off. OOOPS. Giant push up. My life is all about trying to learn to be patient…

I think minor B perhaps has not finished and is going higher

I agree with you Nick. And that is another entirely valid wave count. A double zigzag.

OIH on the hourly is both very close to the lower Keltner channel, and close to the 38.6% retrace fibo. A long would be with the trend, as the 14 period ADX on the daily is up at 40 with the DI+ well above the DI-. So possibly a good pullback buy, with fibo support to use to define risk, if it turns here and gives some buy triggers.

OIH not happening, but I’ve jumped on CELG, KMX, AVGO and FB to try to score a little coin here as perhaps the QQQ’s turn up.

In both of the last 2 similar consolidation periods in the SPX (Aug 14-15, Aug 23-28), price moved sharply after breaking…THE OTHER WAY FIRST. Aug 14-15, there was a significant headfake up, then a slamming move down. Aug 23-28, we had the big opening gap down, then a run up for almost 3 straight days. Another headfake here is quite likely, I suspect. I will strive to not jump on the first move, and watch for a turn and push back through the other way. If that happens and it breaks out “the other side” of the consolidation range, I will pounce.

If Wednesday’s high gets taken out, SPX is in the double zig-zag up scenario, and I will take a moderate long position. The gap above should get taken out, and that will be my target move.

Stranger things have happened, but traders going into this week-end long the market may well be a whole new trading paradigm in my experience! 🙂

I got filled at 0.11 on my speculative diamond puts.

Looking at DIA hourly chart. I can draw reasonable triangle lines over and under the action since the ATH, with an A, B and C in place. Bears (that’d be you and I!!) some attention…

Every now and then a situation arises that is so beyond the pale ludicrous it demands a speculative foray. I know the marketplace can be an insane place, but considering what is going on, for traders not to be running for cover is beyond insane. I suspect that could change in a hurry. I am buying 218 strike DIA puts expiring today for 0.12 as a pure you-know-what and giggles speculation. 25 contracts with fun money. 🙂

I still idly try to rationalize the market, realizing that it is hopeless. Currently, my take is, the market views massive debt spending by the US gov’t driven by what will end up an epic hurricane season (and the first of what, 100 years of epic seasons???) as GOOD FOR BUSINESS. In the short term. Eventually, it won’t be anymore, because too much of any good thing isn’t good. But right now…hey, more destruction, more debt spending, more business activity, more profits, more bonuses…so stocks will go up. I find the only kind of thinking that fits market action tends to be super short term, max 6-12 months out. The fact that Florida (and Arizona due to heat, and perhaps California due to drought/no water, and others…) may not be liveable in 10 years…not yet getting priced in!!! Yet.

I just don’t think most human beings are actually rational.

Fear and greed aren’t always very rational.

It seems that in DJI particularly, they are determined to keep price above the 50 day SMA. When it finally falls through it I think the drop is going to be quite steep. Today was the sixth failed attempt to breach it!

On days like today when you see both VIX and market price heading higher you know somebody’s a’lying…big time! I think it’s the banksters! lol!

Love to see divergence. Nice clues. Let’s see what breadth has to say….

Okay, not EW related but this is about riding waves….

We had delivered today the latest edition to the quiver. 9’0″ of pure wood; pawlonia with cedar and kauri stringers, tail block of kauri, redwood and ash. Heavy, built for nose riding on smaller days. Apparently this is Cesar’s board…. discussions about sharing are beginning …… 🙂 🙂 🙂

A piece of pure wooden artwork. Made by our friend, magic in the water, Craig Freeman.

I am not a surfer but that is one awesome looking board! 🙂

Epic!!! A true wave sliding work of art.

Beautiful!! Though not for me, I’m not sure I could carry it down to the water!!! I’ll stick with my Stuart Hydrohull 9′ thruster for longboarding.

🙂 IKR! almost want to hang it on the wall for a bit…

TBH Kevin, for me, 9′ just isn’t big enough. My next board? Maybe over 10′ if I can 🙂 🙂 But we’ll see how this wooden board goes….

Oh, and I think we measure waves a bit differently down here. When we say the surf is 2ft, we measure from the back of the wave, so it’s just under 4ft on the face.

A 4ft wave would be just under 8ft on the face, so nicely over my head. That’s my limit.

Verne, I do hope that any friends and family you have in your home of BVI are okay after Irma.

You’re in Chicago, right?

We are actually somewhat South of Chicago (about 150 miles) in Champaign-Urbana at the University of Illinois. I have been looking at some video of my home island of Tortola and the damage is extensive. Thankfully there have not been many fatalities.

I actually in the last 15 minutes finally got a call back and everyone is safe. So glad to hear that great news! Homes can always be rebuilt. Thanks so much for asking.

ps Was sad to hear Richard Branson’s beautiful home and nature retreat on Necker Island was completely destroyed. Praying for the folk in Florida that they will be able to weather the coming storm. A friend of mine who is a pilot thought he would have to fly into Miami last night. Thankfully they cancelled the flight after he got to Charlotte so he was able to return home early this morning. I was so happy!

I’m happy to hear it’s all OK for you.

The banksters and other assorted bullish traders were able to stave off yet another assault of the bears on the DJI 50 day SMA. They have expended an enormous amount of capital defending this critical pivot. It does seems to me that they are trying to manage an orderly retreat and futures are suggesting that this pivot will fall today on the bears’ fifth charge. The next natural support level is the 200 day SMA and if the 50 day SMA is breached, this P4 correction could eventually take us to that support area. I am not sure how that would comport with an unfolding triangle but there is now in the markets a strange incongruity between the level of complacency and the actual downside risks to the market. These anomalous conditions can often present incredible trading opportunities when they are recognized early and positions taken ahead of their resolution. VIX should soon present yet another 5-10X short trade window after the upcoming spike.

Orderly retreat. Nice. Yes please. An easy step down would be nice.

Maybe they’re doing us a favour?

I think they are…! 🙂

They were all over it at open. It’s really getting sad……

The smoke n’ mirrors team has indeed been deployed full force. When you see these kinds of ridiculous price movements you know they are getting very desperate and a serious plunge ( or “droopage” as Tim Knight would quip) is just around the corner. 🙂

turd in a row for da doc