The first target at 2,481 to 2,482 was met and passed by 2 points early in the session.

Summary: We should always assume the trend remains the same until proven otherwise. While it is possible today that primary wave 3 may be over, assume that it may continue higher while price remains above 2,430.98. The target for it to end is now at 2,497.

If price moves strongly lower over the next few days, then the probability that primary wave 4 has arrived will increase. Confidence may be had if price makes a new low below 2,430.98. If that happens, then expect a multi week to multi month pullback to end about 2,320.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

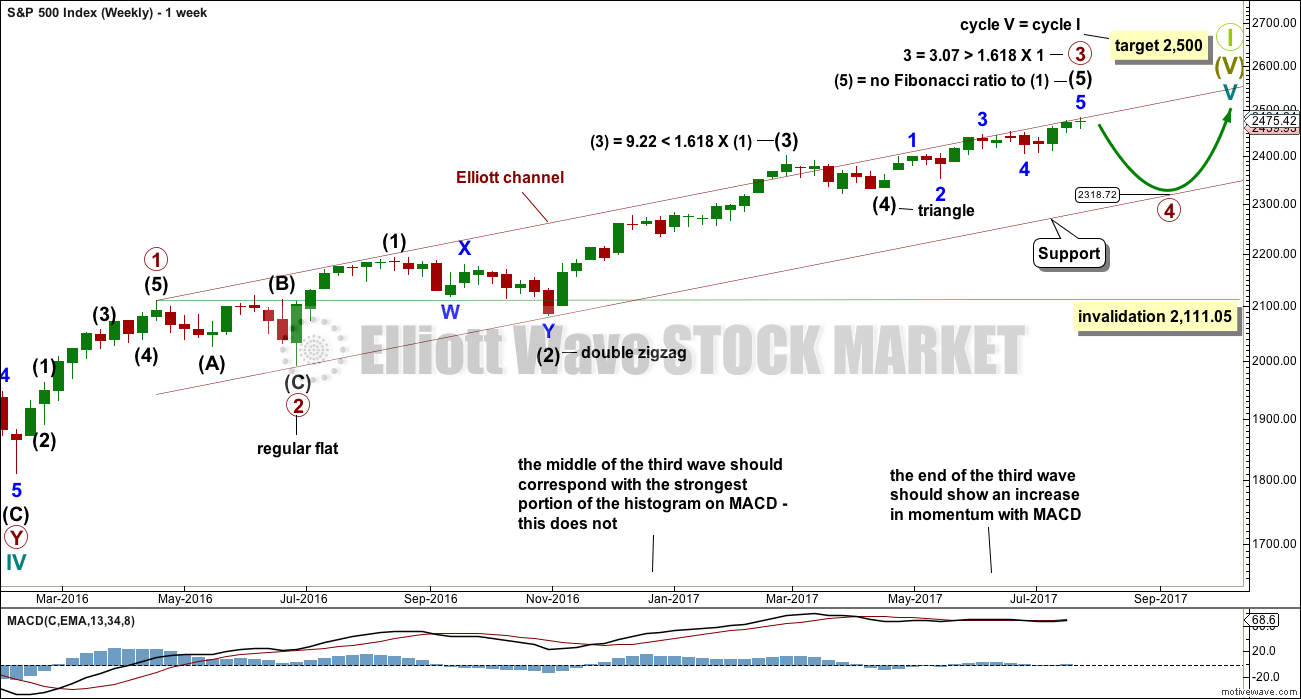

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

It is possible today that primary wave 3 is complete. However, some confidence may be had in this view only with a new low below 2,405.70. Fibonacci ratios are calculated at primary and intermediate degree. If primary wave 3 is complete, then it exhibits the most common Fibonacci ratio to primary wave 1.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

Primary wave 4 should last about 8 weeks minimum for it to have reasonable proportion with primary wave 2. It is the proportion between corrective waves which give a wave count the right look. Primary wave 4 may last 13 or even 21 weeks if it is a triangle or combination.

If primary wave 4 reaches down to the lower edge of the Elliott channel, it may end about 2,320. This is very close to the lower range of intermediate wave (4); fourth waves often end within the price territory of the fourth wave of one lesser degree, or very close to it.

If price reaches the target at 2,500 and either the structure is incomplete or price keeps rising, then the next target would be the next Fibonacci ratio in the sequence between cycle waves I and V. At 2,926 cycle wave V would reach 1.618 the length of cycle wave I.

DAILY CHART

The daily chart shows only the structure of intermediate wave (5); this structure is an impulse.

There is perfect alternation between the deep expanded flat of minor wave 2 and the shallow double zigzag of minor wave 4.

There are no adequate Fibonacci ratios between minor waves 1, 3 and 5. This is not uncommon for the S&P500. Minor wave 3 exhibits strongest momentum and is the longest actionary wave, so this wave count fits with MACD.

It must be accepted that it is entirely possible that primary wave 3 may not be over and may continue higher while price remains above 2,405.70.

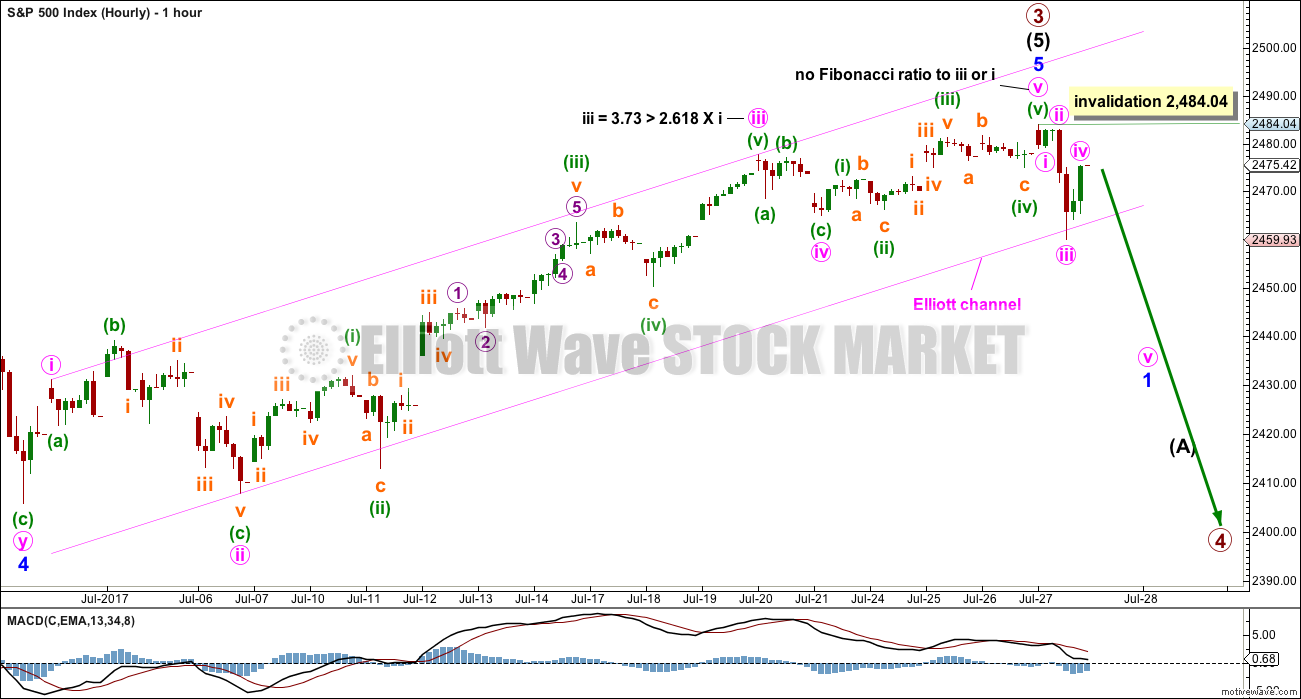

FIRST HOURLY CHART

Minor wave 5 may now be a complete five wave impulse. Within minor wave 5, there is an adequate Fibonacci ratio between two of its actionary waves. This is common for the S&P500.

Downwards movement during this session bounced strongly off the lower edge of the pink Elliott channel containing minor wave 5. A strong breach of that channel would indicate a trend change, but it may not necessarily be a trend change at primary degree.

If primary wave 4 has begun, then it should begin at the hourly and then daily chart level with a five down. That is incomplete. While it is incomplete, no second wave correction may move beyond its start above 2,484.04.

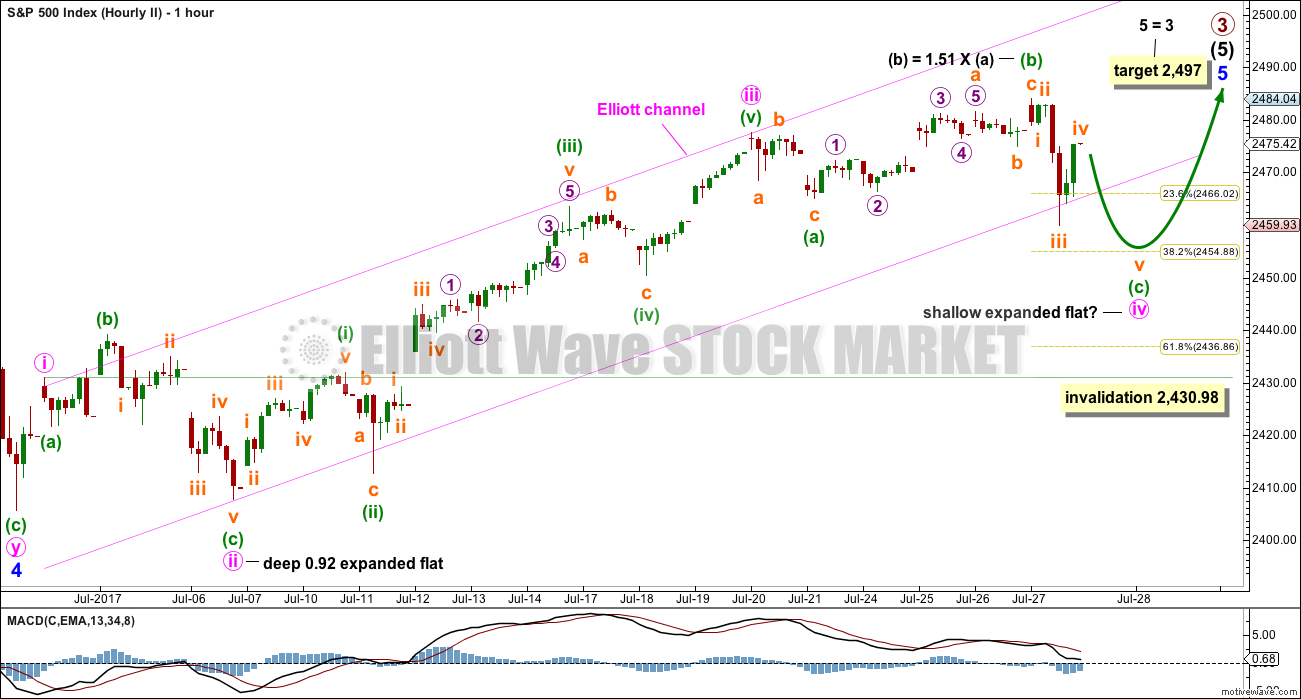

SECOND HOURLY CHART

It is still possible that minor wave 5 is incomplete, that minute wave iv is still unfolding.

This wave count must be an alternate because there is inadequate alternation between minute waves ii and iv: both are expanded flats. There may still be good alternation in depth, but alternation is a guideline and not a rule and the S&P500 does not always exhibit perfect alternation.

Minute wave iv may end tomorrow about the 0.382 Fibonacci ratio of minute wave iii. This would require minute wave iv to breach the Elliott channel drawn using the first technique. If that happens, then the channel would need to be redrawn using the second technique: a trend line first from the end of the second to fourth wave, then a parallel copy on the end of the third wave. The following fifth wave may end mid way within the channel, or at the upper edge.

Minute wave iv may not move into minute wave i price territory below 2,430.98.

TECHNICAL ANALYSIS

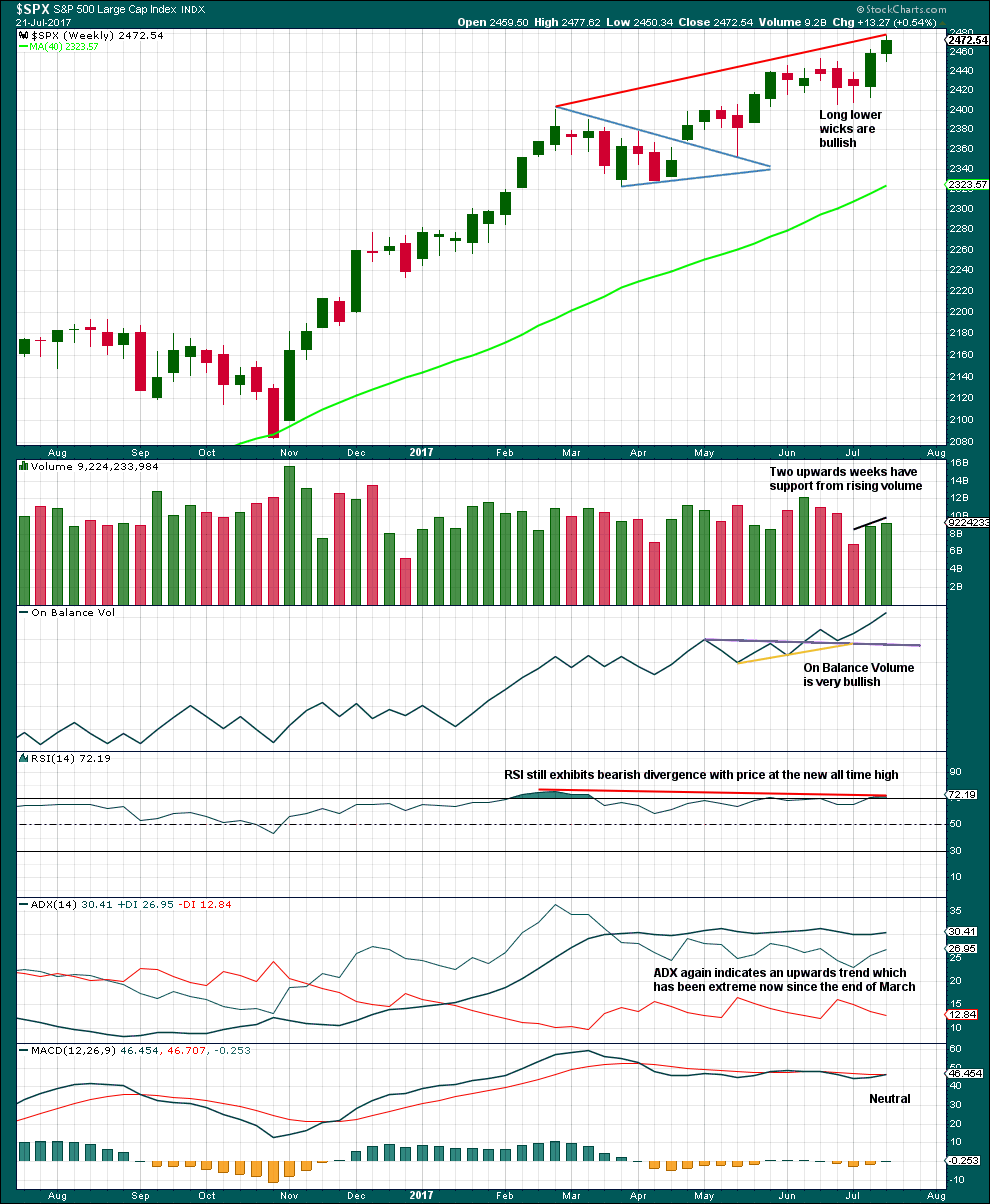

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume is bullish. On Balance Volume is very bullish.

ADX is extreme and usually at the weekly chart level this quickly leads to a pullback to last two to four weeks. During the current bull market, which began in March 2009, ADX has only reached extreme on four previous occasions. On each of those occasions it was immediately followed by two weeks of downward movement in one case and four weeks of downwards movement in the other three cases.

In all four prior cases the pullback was sufficient to bring ADX down back below the directional lines and below extreme.

This time ADX has remained extreme for 17 weeks although the ADX line has not been rising for the whole time, only fluctuating. This trend is looking very stretched, but at this stage it may be better to rely upon Elliott wave structure and other indicators to tell when the next multi week pullback may begin.

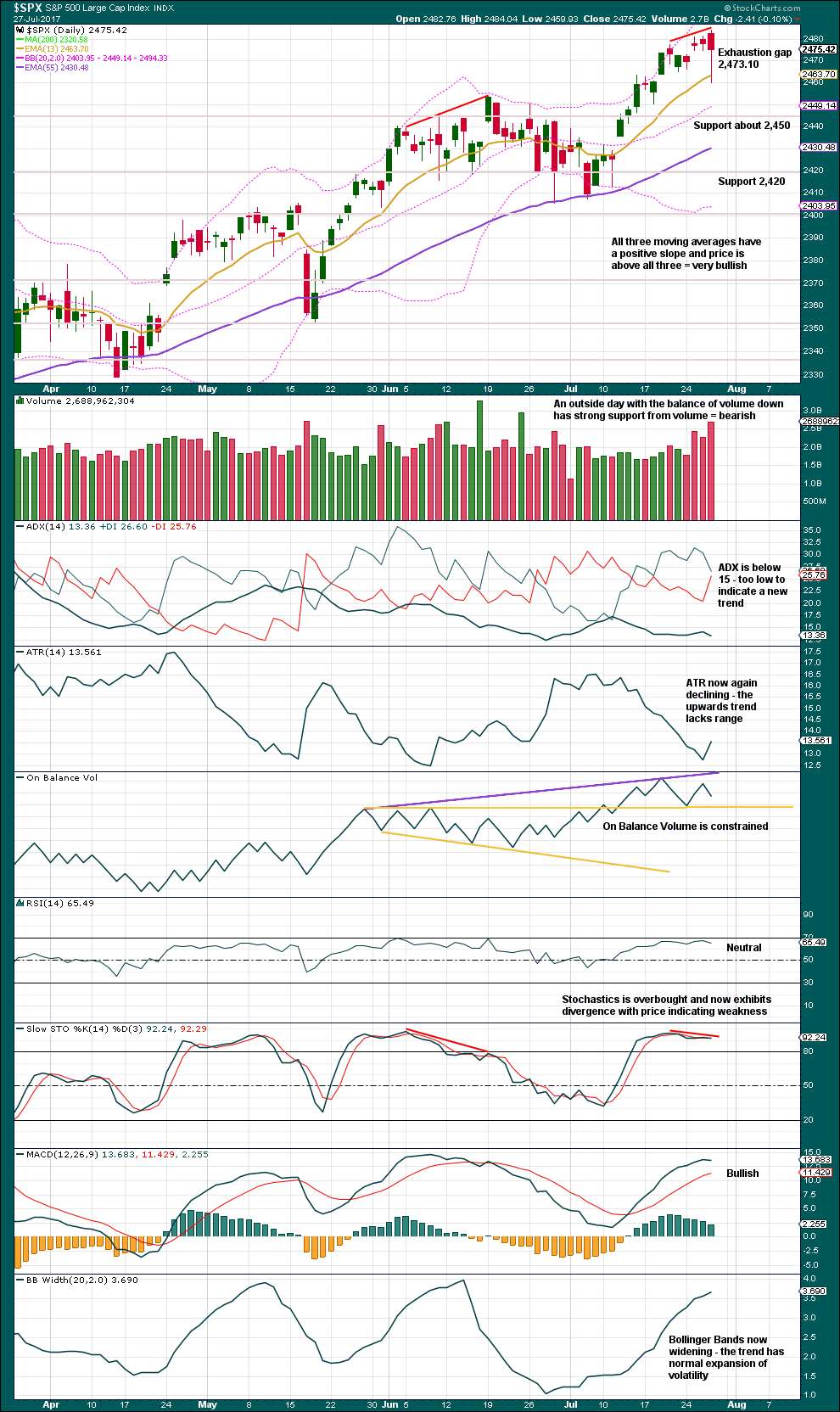

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last gap is closed, so now it is technically an exhaustion gap. Look for a consolidation or pullback here.

Volume is bearish. Stochastics indicates some exhaustion for upwards movement.

However, the long lower candlestick wick today is bullish.

If On Balance Volume can break below the next support line, that would be a reasonable bearish signal.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Three bearish signals from VIX in a row has now been followed by one strong downwards day. It may need one more to be resolved.

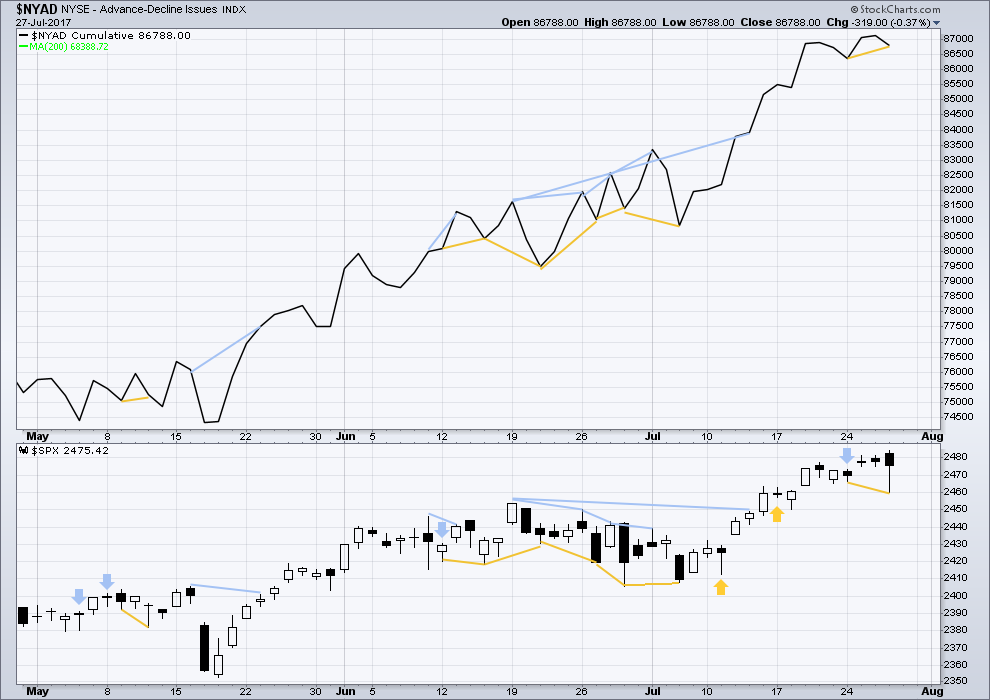

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

With the last all time high for price, the AD line also made a new all time high. Up to the last high for price there was support from rising market breadth.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

There is today short term bullish divergence between price and market breadth: price has made a new low below the prior low of the 24th of July, but the AD line has not. This indicates some weakness today within downwards movement from price; it does not come with a normal corresponding decline in breadth. This divergence favours the second hourly chart.

Lowry’s measures of internal market strength and health continue to show a healthy bull market. This week has seen a further increase in internal health of the market, so we may have some confidence that this bull market shall continue.

Historically, almost every bear market is preceded by at least 4-6 months of divergence with price and market breadth. There is no divergence at all at this time. This strongly suggests this old bull market has at least 4-6 months to continue, and very possibly longer.

DOW THEORY

The S&P500, DJIA and DJT have all made new all time highs.

Nasdaq has made a new all time high. Modified Dow Theory (adding in technology as a barometer of our modern economy) sees all indices confirming the ongoing bull market.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

Published @ 12:53 a.m. EST on 28th July, 2017.

For both counts I still have at least one more short wave down to complete a five down. For the first count it would be the first five down of P4, for the second count it would be wave C to complete an expanded flat correction.

Price remains neatly within the Elliott channel, so not confidence yet that P4 may have arrived.

The turn in this bloated top heavy market is like turning an air-craft carrier- torturously slow, and sloppy; just like what characterized the climb. Maybe next week…?

Have a great week-end all!

So far RUT finding support at a previous significant resistance level around 1426-1427. Until we see a break below that I am not convinced the selloff is broad enough to portend the beginning of P4.

FWIW the thing that appears to be keeping RUT from a deeper pullback seems to be support in the energy sector. Crude is up again and staring down the 200dma.

The dissymmetry of DJI and SPX will have to be resolved at some point. It could happen with a big impulsive wave down in DJI while SPX completes it own wave down with a co-incident second wave turn. No big wave down in DJI futures indicated though….

Watching Paint Dry today Vern

Hopefully the calm before the storm

Hopefully, Paresh…. 🙂

The similarity to June 9 is remarkable. That swoon in the Nasdaq saw a rotation from tech to financials and ATHs in the Dow and SPX shortly thereafter. If this downturn is also a rotation I think it suggests there is still upward momentum. I will be keeping an eye on how RUT behaves today. A long red candle could indicate a broader pullback is in play, imho.

All the indexes appear to be in a 4th wave triangle nearing completion, but these have broken the opposite way of expected many times before…

There are some big problems I am seeing with the idea of a primary degree trend change. One would expect the majors to all move in tandem and the fact that they are not means something else is probably going on. The stubborn repeated reclaim of the critical 2470 pivot is a huge red flag and telling me that this move down is corrective.

I certainly did not expect it, but this sideways affair of late has always resolved in higher prices. Very strange market indeed.

A little known feature of SPX is known as the “Gap Omen”.

It essentially says that every time the index gaps open to a new all time high, the gap is closed. This has been the case 100% of the time in the last eight instances since 2015. 😉

Thank you for that Verne. Just googled it. Fascinating. Until it fails might as well short every gap up that occurs to new highs.

Most welcome Daniel. Interesting isn’t it? I wanted to mention it yesterday but was a bit reluctant as I did not want anyone going “all-in” in case it failed this time. So far the omen is batting 1000! 🙂

🙂