The main Elliott wave count again expected upwards movement. Monday has made a higher high and a higher low above Friday, the definition of upwards movement. This was expected.

Summary: While we should always assume the trend remains the same until proven otherwise, divergence today between price and the AD line and inverted VIX is bearish. This may be resolved by one or two days of downwards movement.

If price makes a new high above 2,453.82, then the target is still at 2,500.

A new low below 2,422.88 would confirm a deeper pullback to last weeks is underway. The target zone is 2,400 to 2,322.

Always use a stop. Invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

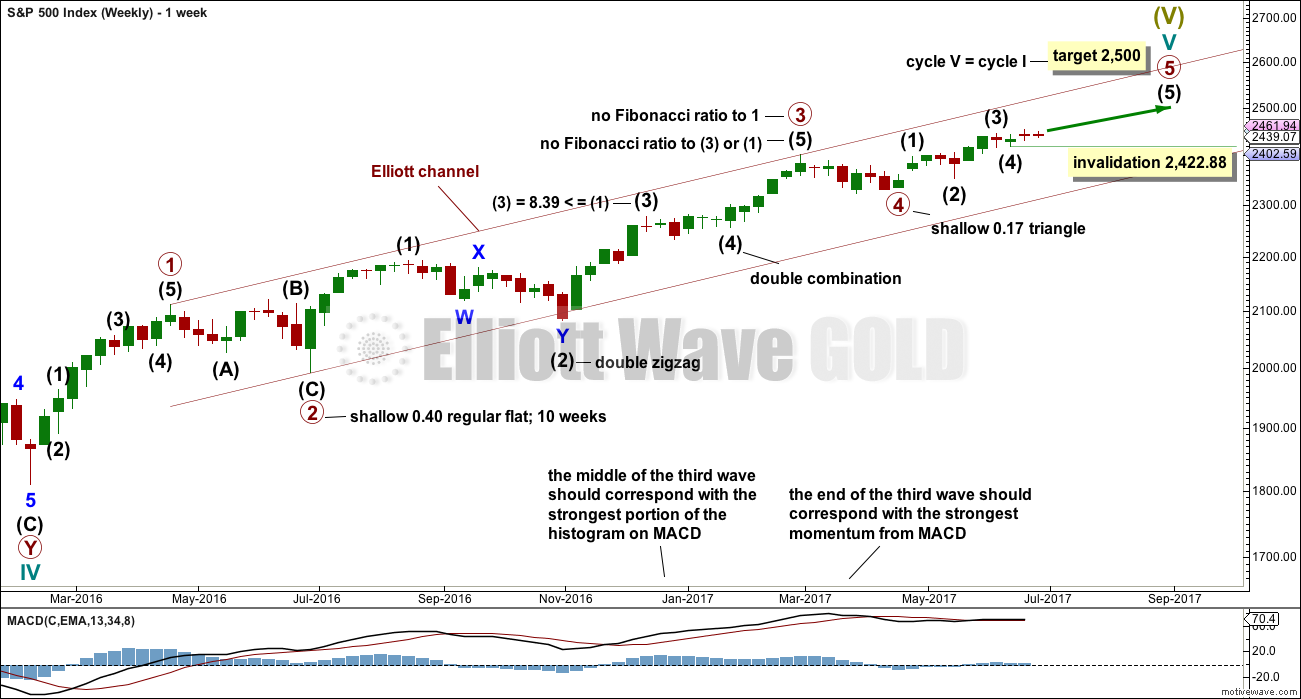

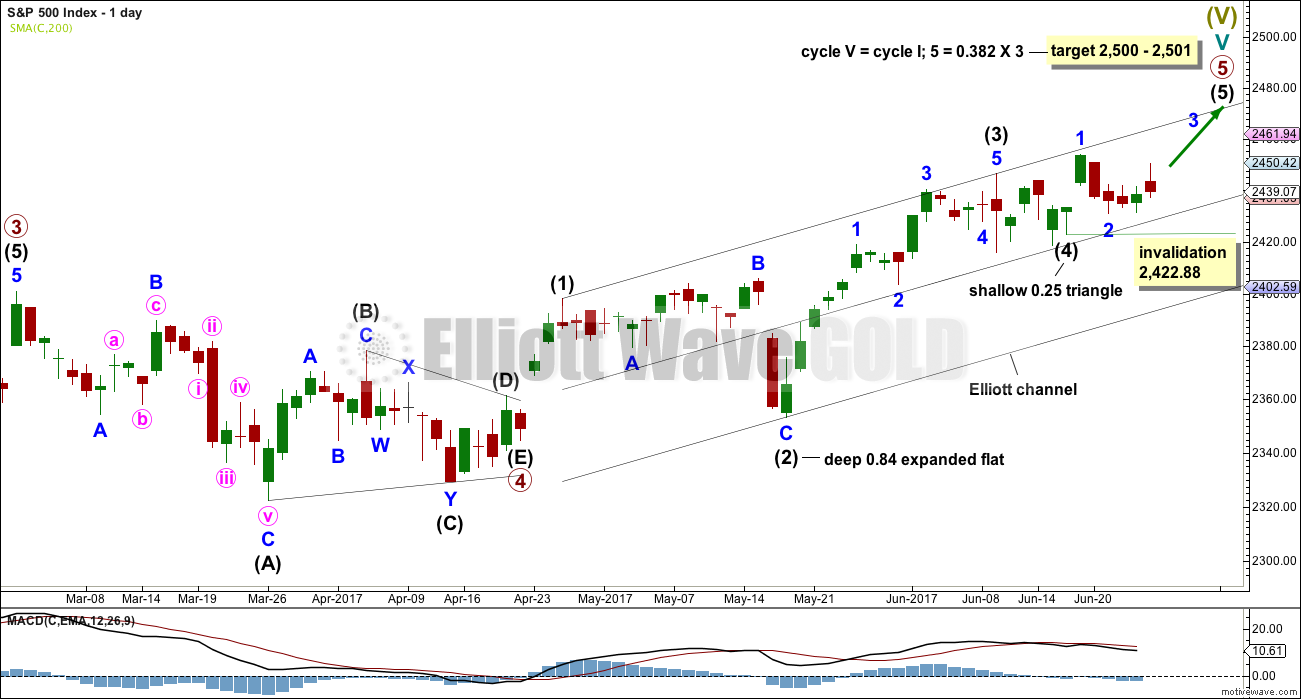

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count has a better fit with MACD and so may have a higher probability. However, at this stage it expects the bull market to come to an end quickly. With market breadth not yet exhibiting any divergence with price this looks unlikely. The alternate should be taken seriously.

Primary wave 3 may be complete, falling short of 1.618 the length of primary wave 1 and not exhibiting a Fibonacci ratio to primary wave 1. There is a good Fibonacci ratio within primary wave 3.

The target for cycle wave V will remain the same, which has a reasonable probability. At 2,530 primary wave 5 would reach 0.618 the length of primary wave 1. If the target at 2,500 is exceeded, it may not be by much.

There is alternation between the regular flat correction of primary wave 2 and the triangle of primary wave 4.

Within primary wave 3, there is alternation between the double zigzag of intermediate wave (2) and the triangle of intermediate wave (4).

Within the final wave of intermediate wave (5), no second wave correction may move beyond its start below 2,422.88.

DAILY CHART

Primary wave 5 must complete as a five wave motive structure, either an impulse (more common) or an ending diagonal (less common). So far, if this wave count is correct, it looks like an impulse.

Intermediate wave (3) is a complete impulse. Intermediate wave (4) may be a complete triangle.

Intermediate wave (5) must be a five wave motive structure.

Within intermediate wave (5), minor wave 1 is now complete. Minor wave 2 may not move beyond the start of minor wave 1 below 2,422.88.

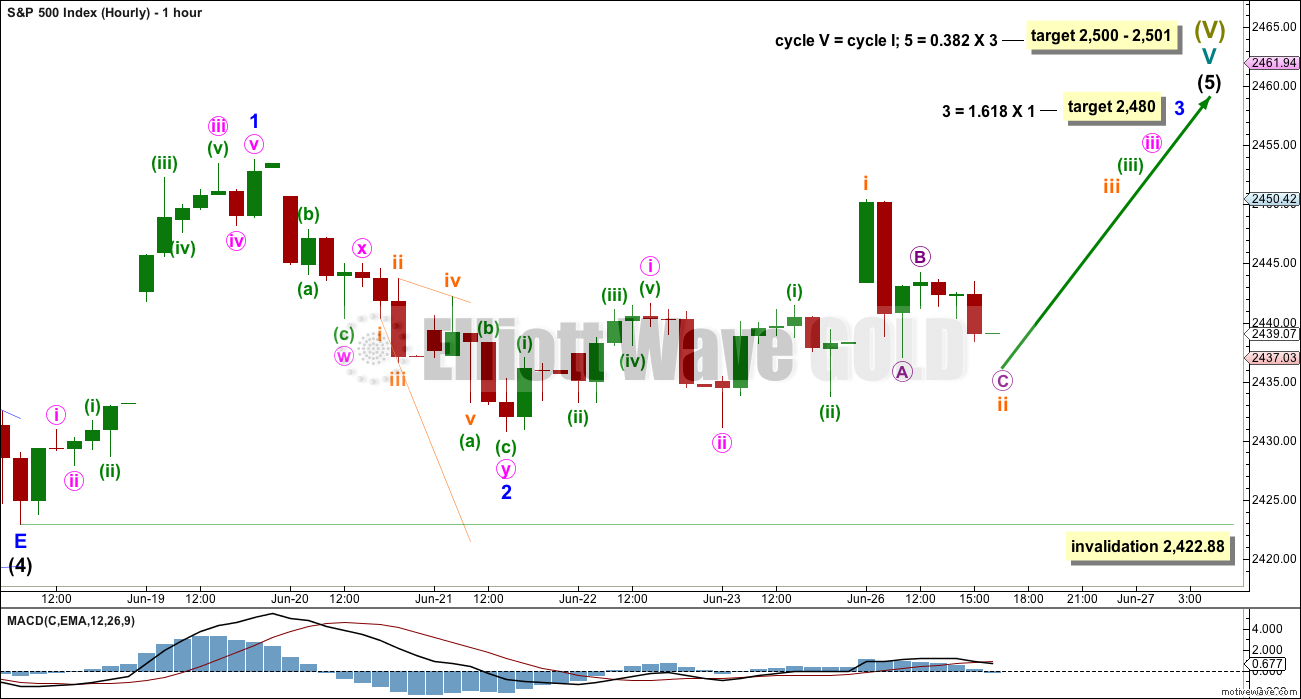

HOURLY CHART

Minor wave 2 is now a very deep correction and fits as a double zigzag.

Downwards movement for minor wave 2 does look choppy and corrective, compared to prior upwards movement for minor wave 1 which looks clearer and impulsive.

Minor wave 3 may be beginning slowly with overlapping first and second waves.

If minor wave 2 continues further, it may not move beyond the start of minor wave 1 below 2,422.88.

At the hourly chart level, this wave count has a better fit for recent movement.

It is not possible to label today’s high as wave B of a continuing expanded flat for minor wave 2 because it has not retraced the minimum 0.9 required length of the prior downwards wave, which would be wave A of the flat. If minor wave 2 is continuing sideways as a flat correction, then a little more upwards movement is needed first to a minimum at 2,451.51. This is not very far away at all from today’s high.

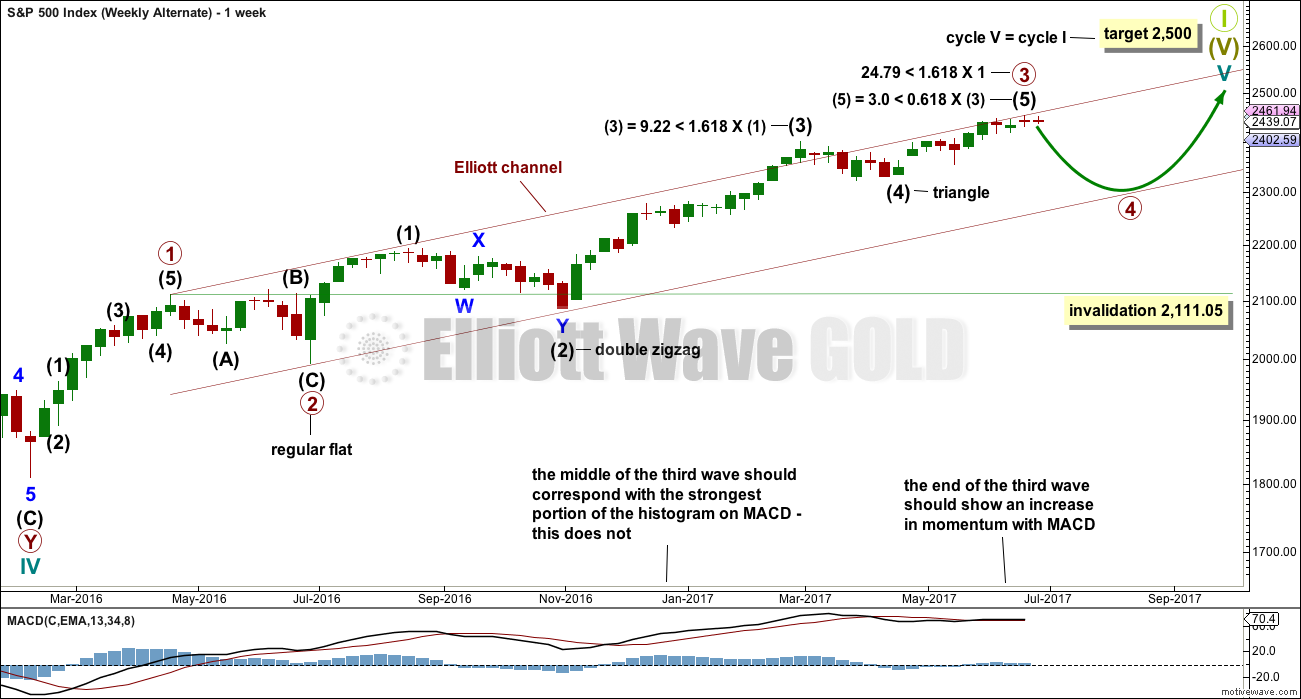

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

It is possible that primary wave 3 is either over now or may be very soon indeed. It is possible that a deep multi week or multi month pullback may begin for primary wave 4.

This wave count would allow for primary wave 4 to unfold with a corresponding decline in market breadth. Primary wave 5 may then continue higher towards the target, allowing for at least 4 months of divergence between market breadth and price to develop before an end to the ageing bull market. This would have a neat fit with prior major trend changes from bull to bear of every single bear market in the last 90 odd years.

Primary wave 2 was a regular flat correction lasting 10 weeks. Primary wave 4 may exhibit alternation as a single or multiple zigzag, or as a triangle. It should last at least 10 weeks and possibly longer.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

A cluster of Hindenburg Omens have been noticed at this time, on the 4th and 31st of May. This does not mean the market must crash now, it is only a warning that the market conditions are conducive to a crash. The probability of a crash based upon the Hindenburg Omen is about 20%, which means the probability that a crash will not occur is about 80%.

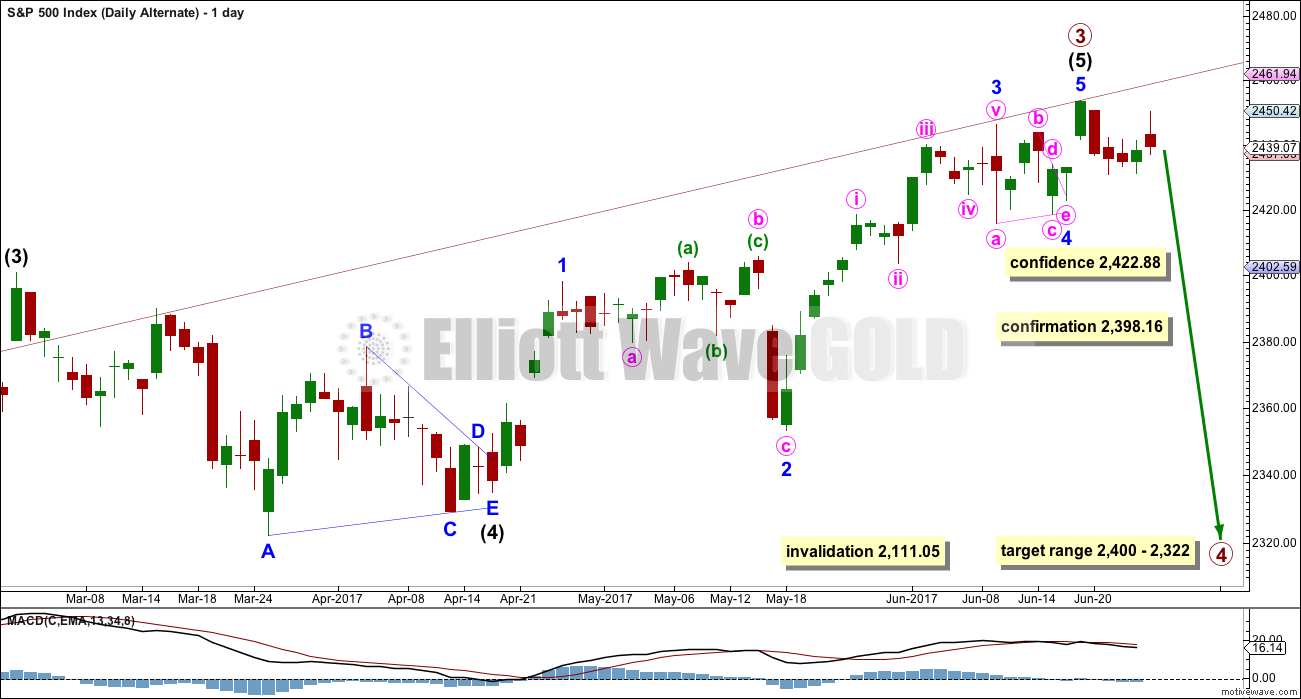

DAILY CHART

Minor wave 5 of intermediate wave (5) of primary wave 3 may be over here, or it may continue higher.

Always assume the trend remains the same until proven otherwise; assume the trend is upwards until price makes a new low below 2,422.88.

If price moves below 2,422.88, then this would be the main wave count.

Primary wave 4 may end within the price territory of the fourth wave of one lesser degree. The price range for intermediate wave (4) gives a target range for primary wave 4.

HOURLY CHART

A correction at primary degree must begin with a five down at least at the hourly chart level.

I have spent some time looking at the downwards wave labelled minor wave 1 on the five minute chart. A wave that moves in a straight line is only either an impulse, zigzag or zigzag multiple. This downwards wave will fit very neatly as a double zigzag, but I cannot see a solution for it as any other structure. I cannot see a solution for it as a five wave motive structure, which minor wave 1 must be.

Minor wave 2 may not move beyond the start of minor wave 1 above 2,453.82. Minor wave 2 may have continued a little higher as a double zigzag.

TECHNICAL ANALYSIS

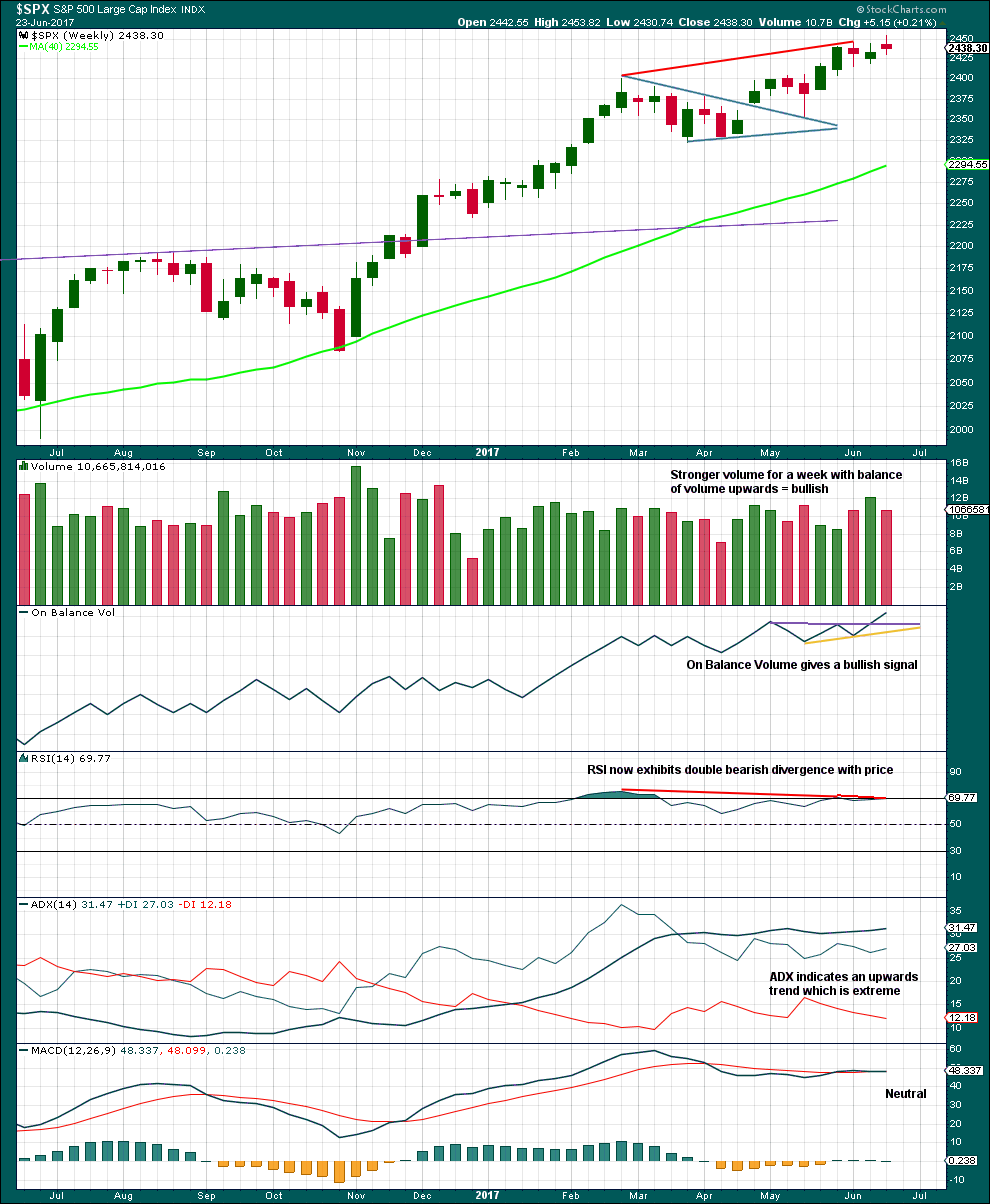

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is moving higher with a higher high and a higher low, but upwards movement is weak. Volume is light and the candlestick is a small spinning top pattern.

Give weight to On Balance Volume though. This strongly supports the main Elliott wave count.

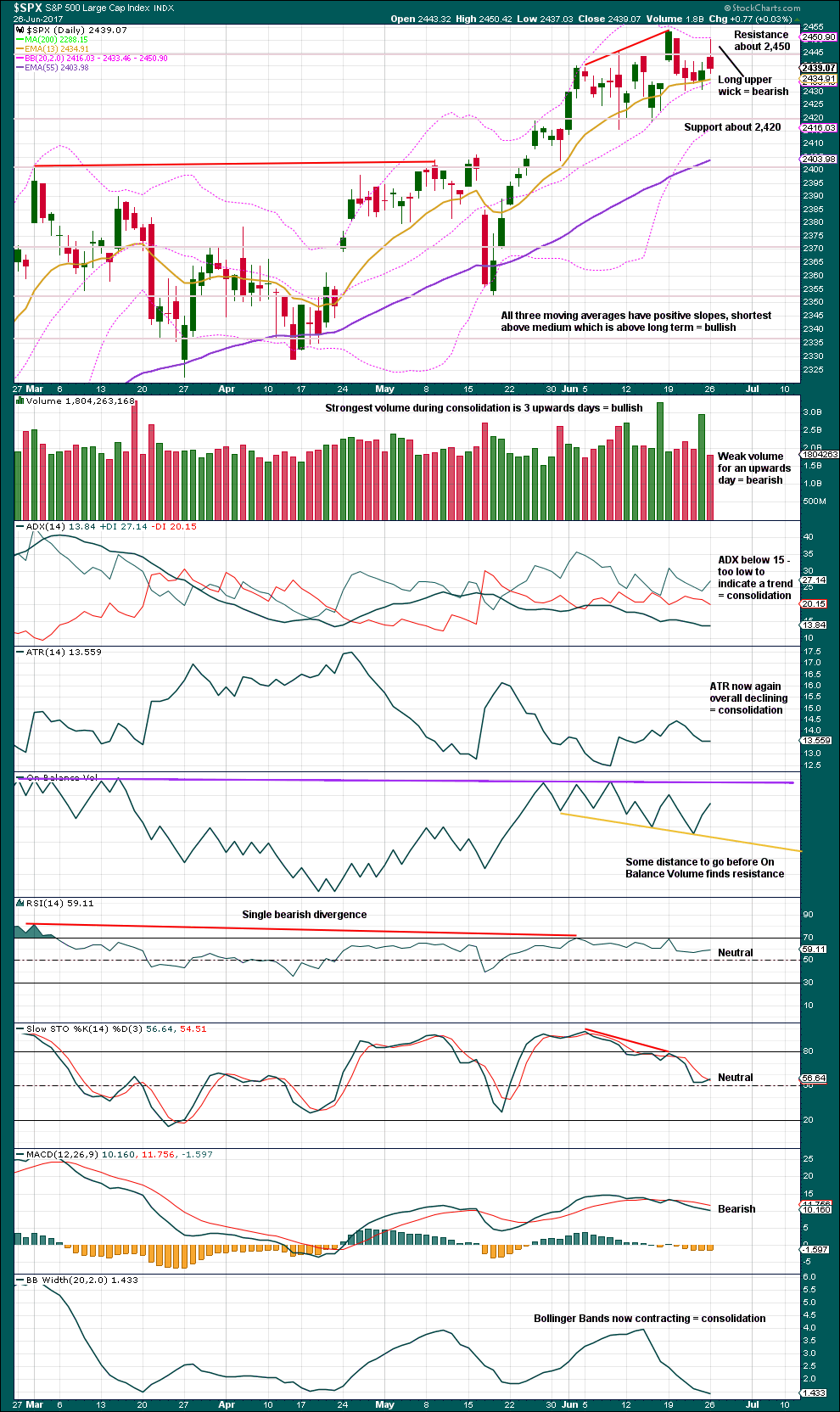

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Light volume and a long upper wick on today’s candlestick is bearish for the short term.

The yellow support line for On Balance Volume is redrawn today. I have more confidence that this line is now drawn correctly.

Bollinger Bands, ADX and ATR all agree that the market is consolidating. Price is moving sideways and is range bound with resistance about 2,450 and support about 2,420. Expect an upwards breakout as more likely than downwards based upon volume for the 16th of June being strongest during this consolidation.

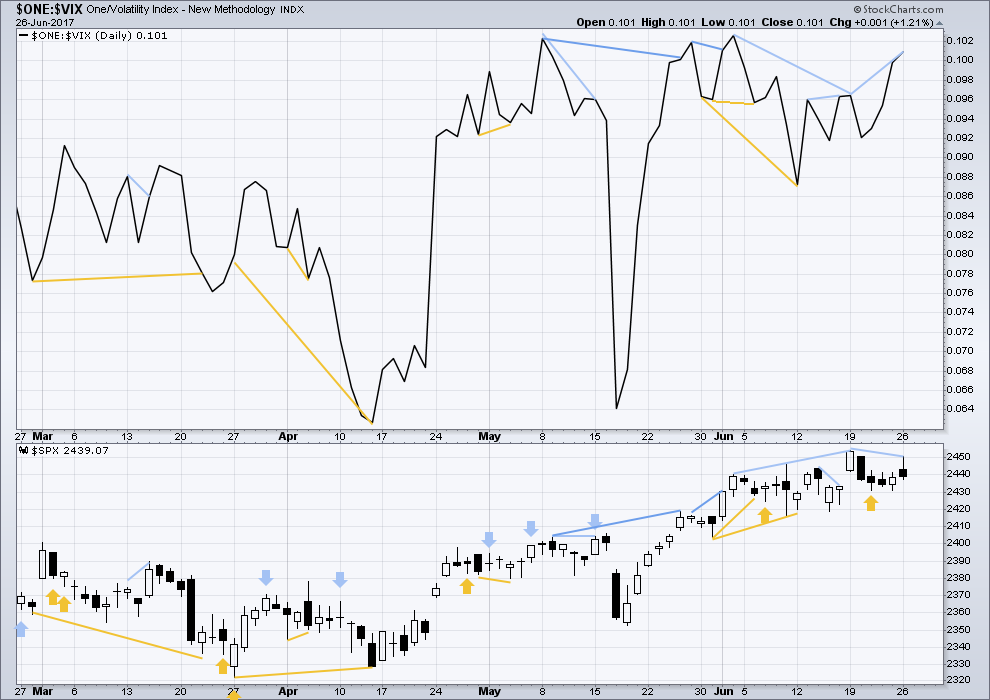

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is still bearish divergence between price and inverted VIX: from the last all time high of the 19th of June price made a lower high, but inverted VIX made a higher high. This indicates weakness within upwards movement during the last two sessions.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

With the last all time high for price, the AD line also made a new all time high. Up to the last high for price there was support from rising market breadth.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

There is new divergence today between price and the AD line: the AD line has made a new all time high, but this has not been matched by price. This divergence is bearish and indicates weakness within price.

The mid caps and small caps have made new all time highs along with recent last all time high for large caps. The rise in price is seen across the range of the market, so it has internal strength.

However, there is now some weakness becoming evident within small and mid caps. The number of equities down 20% or more from their all time highs is greatest in small caps, next in mid caps, and least in large caps. This is only an early sign of weakness developing.

DOW THEORY

At the end of last week, DJIA and the S&P500 have all made new all time highs. DJT and Nasdaq last week did not make new all time highs. However, at this stage, that only indicates some potential weakness within the ongoing bull market and absolutely does not mean that DJT and Nasdaq may not yet make new all time highs, and it does not mean a bear market is imminent.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

This analysis is published @ 10:23 p.m. EST.

You can always tell when someone is being paid to say what they are saying. There is an analyst at Stansberry Research (who shall remain nameless to protect the guilty 🙂 ) who has been making the case recently for what a great place China is to invest right now. With all due respect, I have to wonder if he is looking at the same China the rest of us are looking at, with the world’s most manipulated markets, mal-investments, malfeasance when it comes to accounting, and a debt to GDP ratio that dwarfs anything on the horizon…THAT China?

There are already whispers of a growing tsunami of a credit crisis in the nation, as it is getting to point where issuance of new debt to paper over the rising wave of defaults on previously issued debt is becoming increasingly untenable. With their magic accounting and shady record-keeping, does anyone really know what Chinese companies are truly worth? I read today that Hollywood is for the first time going to audit the Chinese movie industry as they suspect some shady goings-on. They estimate about 10% of box office receipts are routinely skimmed off the top. There are a few smart folk that think the global deflationary depression is actually going to start over there, as faltering economies are no longer able to buy all the useless trinkets they manufacture, and destined for world wide land-fills.

Having said all that, if that guy at Stansberry is indeed being paid to talk up the Chinese market, it appears to be working. The ETF that represents the presumed best companies, ASHR is posting a new 52 week high today. But look at WHERE it is doing so! Caveat Emptor!

Lara; I noted with great interest the difficulty you had mentioned regarding how to label that first wave down in the alternate count and was curious if it may now be more lucid.

I was having the same kind of headaches about how to view the NDX break-down from two weeks ago as I could not possibly conceive of the retrace since that time being any kind of second wave, having lasted two weeks to the initial wave down two days. I am still not sure what to think of it as today’s follow through appears to have confirmed the break-down. Of course that could all change overnight with us waking up to sky-high futures! Never underestimate the banksters! 🙂

I can make it fit by going down to the 1 minute chart and allowing some gross disproportion. I don’t like it, but then the S&P just doesn’t always have nice proportions.

I’m glad I left it and allowed for the fact that although I couldn’t see a solution, that doesn’t mean one can’t exist.

Here’s the 5 minute chart, the solution I’ve had to accept.

And here is the 1 minute chart showing the breakdown of the middle of the third wave.

I’m not happy with the proportions of second and fourth wave corrections within this impulse. This count looks forced to me.

But subsequent price action indicates it’s probably right.

Thanks! 🙂

It looks like Rodney found you-know-who…!

Verne, Here is the chart

Brilliant. Thanks for posting.

I do need to ask though, is this copyrighted material? Is it legal for you to share this here? If not I’ll have to take it down.

Thanks so much K. The chart I had in mind was one in which they actually had a chart of SPX and had pinpointed on the chart with small round dots where a double Hindenburg had been observed on the same day – both in NYSE and NASDAQ. If I remember correctly there were only three of four in all the time they have been recording the observation. In one instance nothing serious happened. The other three were all just before the largest declines we have seen in the last few bear markets.

looks like the alternate is taking center stage

Yes, we have. That’s great 🙂

XBI RTM trade will trigger today with second close back inside BBs. Selling 80 puts and rolling half into 78 puts.

2422 oh so close.

This move probably still corrective. The real deal is going to take those pivots out with authority.

First time in a bit, I am fully hedged against a drop into tomorrow.

Exited most long trades with break of 2420. Futures so far saying more downside. Let’s see what’s left in bankster tanks….the end of day slide quite a departure from the usual scheme.

There are two additional interesting developments with regard to the Hindenburg Omen. First is double omens where the conditions are met on two indices on the same day. Those are extremely rare yet they happened TWICE recently. A few weeks ago I found only one article on the subject and it had a truly eye opening graph of the three instances it occurred. Strangely ennough, that article and accompnying graph has vanished from the web. Very peculiar.

The second thing is Omen clusters. Five or more increases the odds of a greater than 15% (crash definition) decline to better than 1 in three, around 38%. So far we have had six observations. McHugh crunched the numbers for multiple observations.

I will keep hunting for that graphic of what the market did after double omens. Quite strange how it disappeared and the complete absence of any Google hits on the topic.

verne,

I saved the article can send you a copy if needed

Awesome! Would it be possible to post it (the chart) here? I wanted to show it to Lara.

Hindenburg omen usually uses the highs and lows from the NYSE,I think that is a combination of markets. There has to be 2.2 % new highs and new lows at the same time. This is only one of the criteria. So very curious to see this cluster, who calculated it and what they used as inputs. There may be a reason it was deleted. I’d trust mchughs calculations, he’s been doing this for a while

The chart showed confirmed double omens (same day) on Nasdaq as well as the NYSE. It is not often it happens.

I think we are going to see new highs The NDX re trace is just too long to be a second wave so that implies a new high there as well. This has enormous implications as it could mean a final wave up, unless wave three is not yet done. We should know which soon enough.

Once again, a perfect contrarian indicator! 🙂