Price continues to move sideways.

A large symmetrical triangle may be forming.

Summary: Sideways movement is expected to continue for maybe as long as another 19 sessions. Thereafter, the upwards trend should resume towards the final target at 2,500.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

It is possible that primary wave 3 may be over.

There is another idea which sees only intermediate wave (3) within primary wave 3 complete. This idea is charted and presented below as an alternate today.

Primary wave 4 may continue.

Primary wave 2 was a flat correction. Primary wave 4 may be exhibiting alternation as a triangle.

Primary wave 2 lasted 47 days (not a Fibonacci number). So far primary wave 4 is incomplete. If it exhibits a Fibonacci duration, it may end in another 19 days to total a Fibonacci 55.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

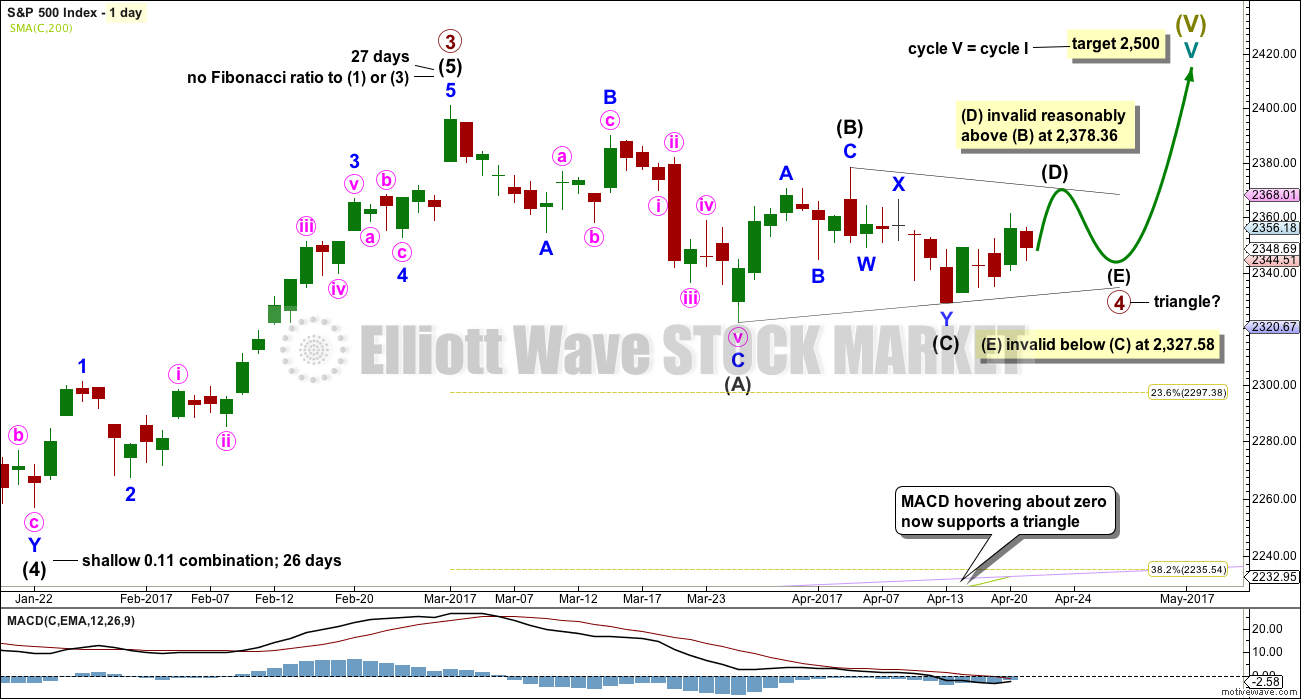

DAILY CHART

This wave count looks at the possibility that a large regular contracting triangle may be completing for a fourth wave.

This idea is now supported by MACD hovering about the zero line as the triangle unfolds.

There would still be adequate alternation between the shallow 0.40 expanded flat of primary wave 2 and the more shallow triangle.

Primary wave 2 lasted 47 days. Triangles are some of the longest lasting corrective structures. So far this one may have lasted 36 days. It may end in a total Fibonacci 55 days.

A contracting triangle may not have intermediate wave (D) move beyond the end of intermediate wave (B) at 2,378.36.

A barrier triangle may have intermediate wave (D) end about the same level as intermediate wave (B) at 2,378.36; as long as the (B)-(D) trend line remains essentially flat the triangle would remain valid. In practice, this means that intermediate wave (D) can move a little above 2,378.36. This is the only Elliott wave rule which is not black and white.

For both contracting and barrier triangles, intermediate wave (E) may not move beyond the end of intermediate wave (C) below 2,327.58.

HOURLY CHART

Only one of a triangle’s five subwaves may subdivide as a more complicated multiple. So far this may be intermediate wave (C).

Intermediate wave (D) may be an incomplete zigzag. The common range is based upon my experience over the years with triangles; they often exhibit subwaves which are about 0.8 to 0.85 the length of the prior wave.

Within intermediate wave (D), minor waves A and B may be complete and minor wave C may be completing as an ending diagonal, most likely to be contracting because that is the most common type. I cannot see intermediate wave (D) over at Friday’s high at this time because it would have a count of five; it must have a corrective count of 3, 7, 11… etc.

When intermediate wave (D) is over, then a final zigzag down for intermediate wave (E) may unfold. This would be most likely to end short of the (A)-(C) trend line. If it doesn’t end there, then it may slightly overshoot the trend line.

This chart is somewhat squashed up; it does not show that the triangle is expected to continue for another few weeks.

The purpose of triangles is to take up time, move price sideways, and test our patience. They do the latter extremely well.

If this structure unfolds as expected, then we shall have a good entry at the end of the triangle to join the larger upwards trend for a fifth wave up to 2,500. More experienced traders may try to trade the subwaves of the triangle, but this does involve a greater level of risk. Trading a consolidation using a reversion to the mean approach or a swing system from support to resistance and back again necessarily involves more risk than trading a trending market.

I have considered the suggestion that intermediate wave (B) may be continuing sideways, that it may not be complete. That would require the degree of labelling within intermediate wave (B) to be moved down one degree, and that would have been only the first zigzag in a double for a more complicated intermediate wave (B). The problem then becomes in labelling the wave down from the high of 2,378.36 on the 5th of April (here labelled intermediate wave (B) ). This downwards wave fits only as a double zigzag, and that does have a very neat fit. This wave would have to be labelled as an X wave. While X waves may take any corrective form, including a multiple, they rarely unfold as multiples. This must necessarily reduce the probability of this idea and for this reason I will not publish a chart of it at this time. I explain this problem in more detail in today’s video.

ALTERNATE DAILY CHART

This wave count is identical to the main wave count up to the low labelled intermediate wave (2). Thereafter, the upwards wave here labelled intermediate wave (3) is seen differently.

It is possible that only intermediate wave (3) is over, that primary wave 3 is incomplete.

The triangle may be moved down one degree; it may be only intermediate wave (4).

Because this alternate idea does not diverge from the main wave count for some time it will not be published daily. It will again be published only when or if it begins to diverge from the main wave count.

TECHNICAL ANALYSIS

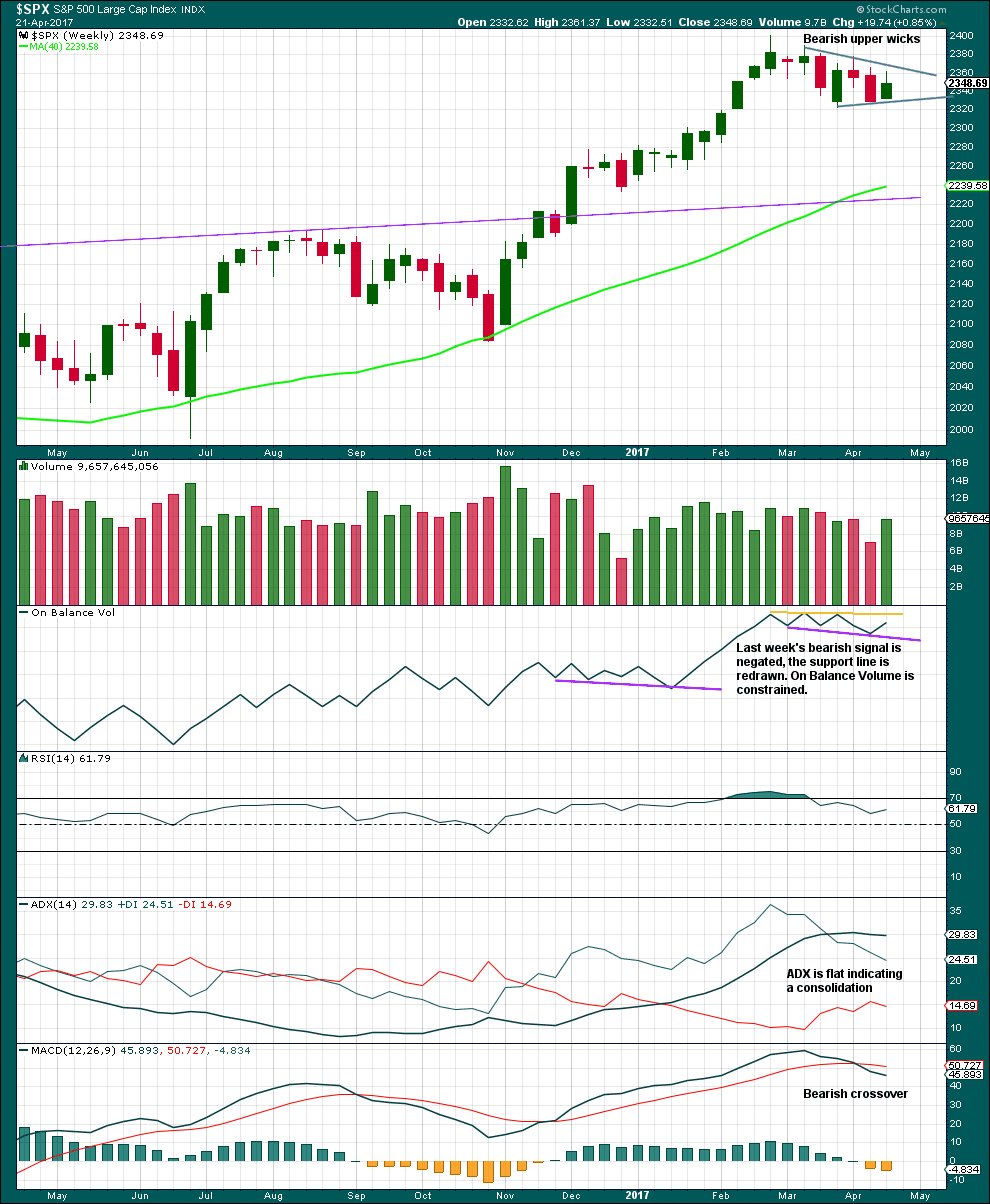

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An upwards week has stronger volume, but the bearish wicks of the last two candlesticks indicate more downwards movement.

On Balance Volume is constrained between support and resistance.

ADX indicates a consolidation. This supports the triangle.

RSI is neutral and MACD is bearish.

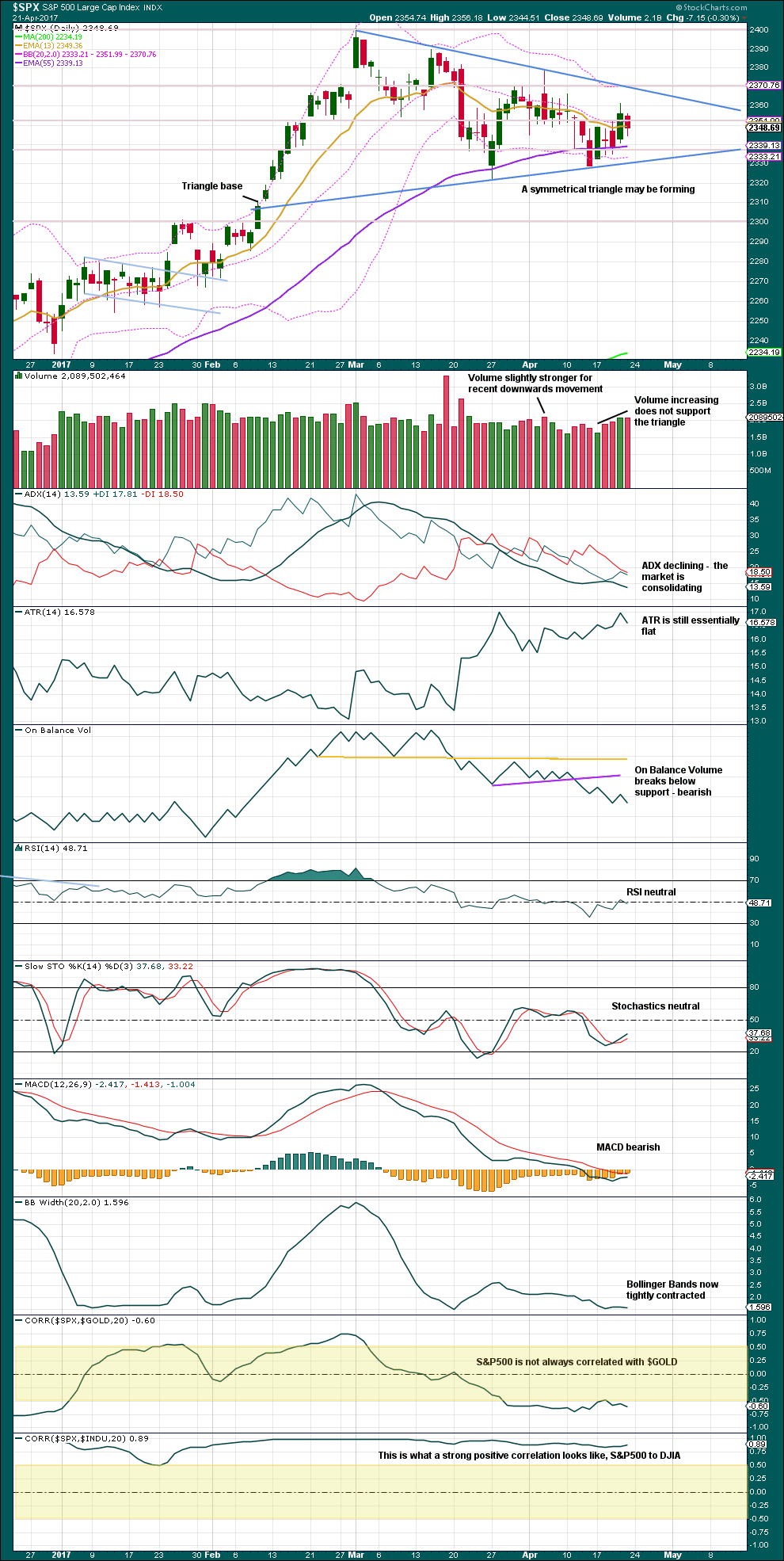

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A large symmetrical triangle looks like is forming. With two minor swing highs and two minor swing lows, trend lines may now be drawn about this pattern.

Volume usually trends downwards during a triangle pattern (86% of the time). In this case, that is not happening yet but may still do as the triangle continues.

More white space is added to the right hand side of the chart. The apex (or cradle) will be seen as the triangle continues. A breakout from a triangle commonly occurs between 73% to 75% of the length of the triangle from base to apex (Kirkpatrick and Dhalquist, page 318).

After the breakout, pullbacks occur 59% of the time. High volume on the breakout should be expected, which would increase the performance of the breakout.

ADX and Bollinger Bands support the idea of a consolidating market.

MACD remains bearish. On Balance Volume remains bearish.

RSI and Stochastics remain neutral.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

It is noted that there are now six multi day instances of bullish divergence between price and inverted VIX, and all have been followed so far by at least one upwards day if not more. This signal seems to again be working more often than not. It will again be given some weight in analysis.

There is no new divergence today noted between price and VIX.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

The rise in price has support from a rise in market breadth. Lowry’s measures of market breadth do not at this stage warn of an impending end to this bull market. They show an internally healthy bull market that should continue for at least 4-6 months.

No new divergence is noted today between price and the AD line.

DOW THEORY

The DJIA, DJT, S&P500 and Nasdaq continue to make new all time highs. This confirms a bull market continues.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

This analysis is published @ 01:09 a.m. EST on 22nd April, 2017.

A barrier triangle?

Now only wave E.

I don’t think this is going to need a month to complete. It should be done now within a few days. This correction may not exhibit a Fibonacci duration.

Looks like that was a fifth wave up so if it’s going to retrace, now’s the time…

Yep. Should be turning down now.

If that wave count is correct and I have every confidence it is, I will be sitting on a very sweet quadruple over the next day or two. if it continues its upside tear and demolishes the triangle I will be royally spanked and sent to bed without any supper tomorrow evening… 😀

If we are going to get a final wave down for the possible triangle, I imagine it should start before the close after such a huge gap open. VIX should also bounce strongly off the day’s lows. Of course, nothing about what this market does necessarily follows any logical sequence any more, so maybe instead we get a gap down tomorrow…

SPY 237 calls down to 0.55 so if we don’t get a reversal soon I will concede the point! 🙂

Oops! I meant puts.

Now they have moved back up to 0.75 so not so much under water. I suspect we get another pop with a red candle above BBs tomorrow so I am going to sit tight on my short trade. Have a great evening everyone!

SPX apparently want to revisit that 2378 area on this move up. If that gap remains open into the close I am scaling back short positions.

Quite a few charts displaying extreme price action today way above upper B band, including the Euro and NDX composite along with it corresponding ETF, the triple Qs.

I am now quite a bit underwater in my short triple Q trade but I had a very generous 25% stop and it came close with this monster gap up. I will be adding to position once we get a close back below the upper B band.

The gap open in the markets is redolent of bankster BS. They must be getting quite desperate. Look at that absolutely pathetic volume. Who are they kidding?

This is in my opinion is very bearish market behaviour. Crude has already rolled over.

An SPX close above its 50 day SMA means I am wrong on these bearish trades. A move above 2380 will mean the same thing imho…

USO getting ready for another plunge and is lagging crude. Getting ready to roll down 9.50/11.00 bearish credit spread…

Adding second batch of SPY 237.00 strike puts for 0.77, lowering cost basis to around 0.85 per contract.

Filled at 0.87, 50 SPY 237 April 28 puts.

Buying to open VIX May 10 12.00 strike calls At 1.15

50 contracts….

Crude futures have now turned negative and that to me indicates this futures ramp is a tempest in a tea cup. I shorted that ridiculous pop in the Euro and I think I am sticking with Lara’s expectation of an E wave down to complete the triangle. I’m loading a big short position at the open with a target of SPX 2330.00

Buying this week’s expiration SPY 237.00 strike puts at the market . One half order at the open. Second half fifteen minutes after the open.

Verne look at the breakdown of Chinese equities across the board, seems like they’re leading crude

Curious that FXI is up, but the A-shares index (ASHR) is down. The Chinese have done a remarkable job of keeping the true state of their economy under wraps.

Very little reporting in the west of the number of huge SOEs missing bond payments.

Super shady; correlations that worked even months ago are now no longer valid. No risk here, move along…….

Possibly a barrier instead of symmetrical?

Definitely looks possible. Although a bit of sell-off in futures keeps the symmetrical alive. Might be a little squeeze with the cash open?

I like the short play for the E wave.

The gap open last Thursday, and now sky high futures seem like the kind of price action one sees at the triangle’s conclusion. Could it possibly be complete?

FTSE analysis done and will be proofed shortly. Coming soon to a website near you 🙂

Futures looking like we will get that third wave up of the possible ending diagonal for minor C of intermediate D tomorrow. It will have to go high enough to allow minute wave four to retrace back into minute one territory and it sure looks like it will get off with a nice head of steam when the market opens. May be worth a scalp to the upside…

I bought weekly SPY calls just after close, Friday. Sell at open or hold. That is the question! Should open up at the 400-500% range. Everything I hoped for and more.

Nice! 🙂

Thanks for the great weekend video update Lara.

The more I look at the weekly chart I posted, the more I think that we’re doing Intermediate 4.

After Intermediate 2, I’m doubtful that the corrections we’ve had since then provide balance of wave size and proportions or as Elliott says the ‘right look” to the wave count.

Another way of looking at it is to say that if we are doing Primary 4, where did Intermediate 4 occur in order to achieve the proportion in time and price to Intermediate 2 that he talks about? I doubt that the high of Dec 12 to the low of Jan 23 provides that.

Also the more time that passes,the more the rule of alternation is satisfied in that Intermediate 2 being a double zig zag and retracing approx 55% of Intermediate 1, contrasts nicely with the current triangle and 25% retracement of its equivalent 3. And we haven’t finished wave 4 yet.

Of course time will tell so it should be very interesting to see what happens at the next major high.But I doubt it will be “the” top.

I agree actually. I think I like your wave count (intermediate (4) triangle) better than mine (primary 4 triangle).

And as Verne points out below, that would allow for a short brief intermediate (5) out of the triangle before price moves into primary 5.

Yes I agree. Down for a prolonged Primary 4 to balance Primary 2. Then up to finish. I believe we’re still many months away from Cycle V top.

The alternate is also quite intriguing. Moves out of triangles are often sharp and short, so that would fit better with an intermediate five up out of the triangle, rather than a primary five so far as brevity is concerned. I have also been struck by the absence of downward momentum for a wave of primary degree, so the wave actually being of intermediate degree would make a lot of sense. Thanks to Peter for the idea!

I was wondering if for the ending diagonal of minor C of intermediate D, a return to just the end of minor B of D would be enough of a move down for intermediate E. It seems it would not be too far from the AC trend-line to serve as the end point for the larger triangle. Just thinking out loud…

Surprisingly, there has been no comments yet.