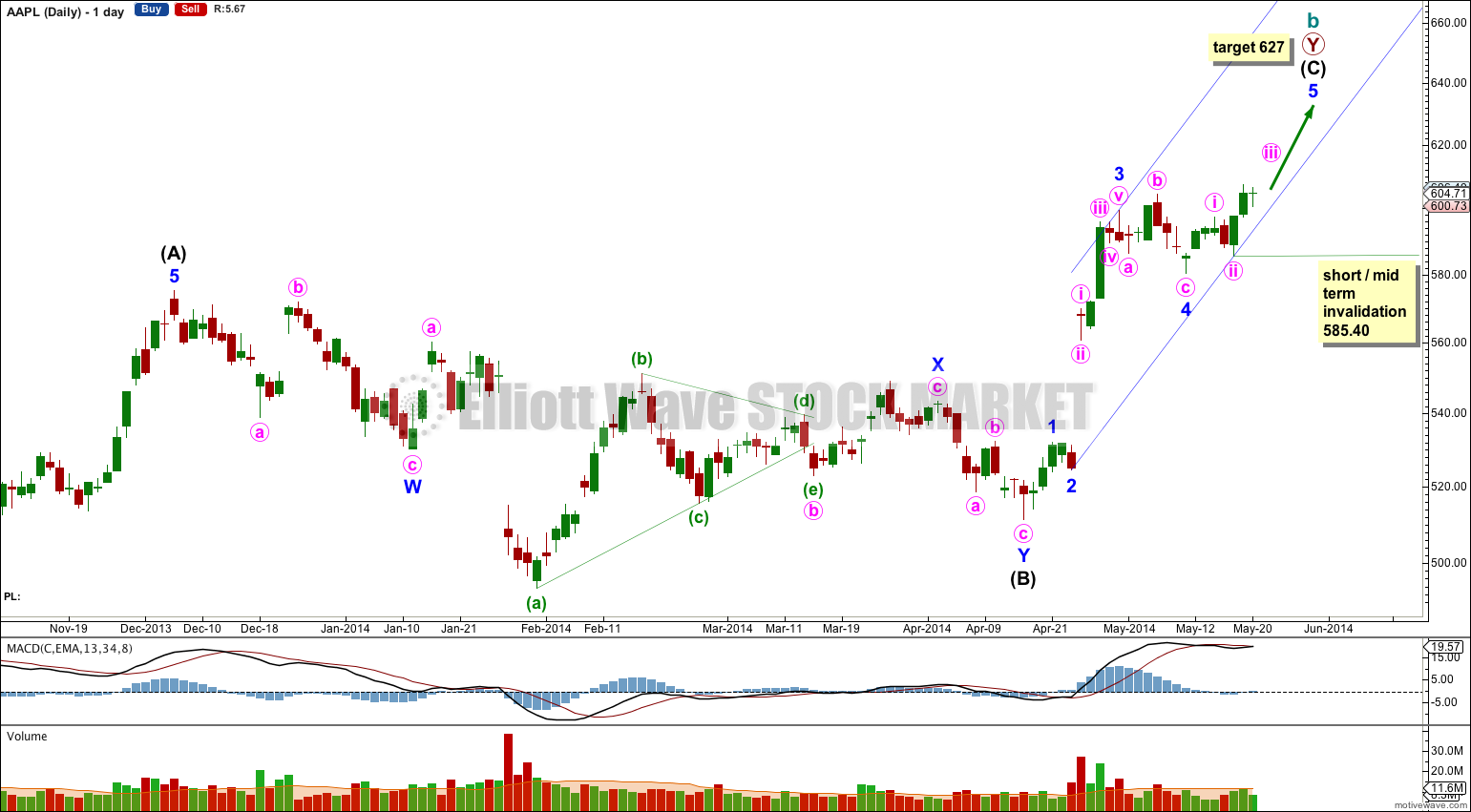

Upwards movement continued as wave count expected.

Click on charts to enlarge.

Because the downwards wave labeled here cycle wave a subdivides so well as a five wave impulse, with an extended third wave, the correction cannot be over there.

This means that upwards movement from the low at 385.10 should subdivide as a corrective structure and may not move beyond the start of cycle wave a above 705.07.

Cycle wave b may be completing as a double zigzag. The channel drawn about it is a best fit. When this maroon channel is clearly breached by downwards movement I shall have confidence that cycle wave b is over and cycle wave c downwards is underway.

Cycle wave c would be extremely likely to make a new low beyond the end of cycle wave a at 385.10 to avoid a truncation.

Cycle wave b is incomplete. Within it intermediate wave (C) is unfolding as an impulse, and minor wave 4 has recently completed.

At 627 minor wave 5 would reach 0.618 the length of minor wave 3. Because there is no Fibonacci ratio between minor waves 3 and 1 I will expect to see a Fibonacci ratio for minor wave 5.

Within minute wave iii of minor wave 5 no second wave correction may move beyond the start of its first wave below 585.40.

lara

any idea on new target as 627 has been surpassed?

lara

what is the next logical target as 627 has been surpassed?