All three short term Elliott wave counts remain the same, as does the daily Elliott wave count.

Summary: A Shooting Star reversal candlestick pattern appeared yesterday. The main hourly Elliott wave count still expects a reasonable pullback to begin here and to end below 2,796.34 but not below 2,791.47.

The bigger picture remains extremely bullish.

The mid to longer term target is at 2,922 (Elliott wave) or 3,045 (classic analysis). Another multi week to multi month correction is expected at one of these targets.

The final target for this bull market to end remains at 3,616.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

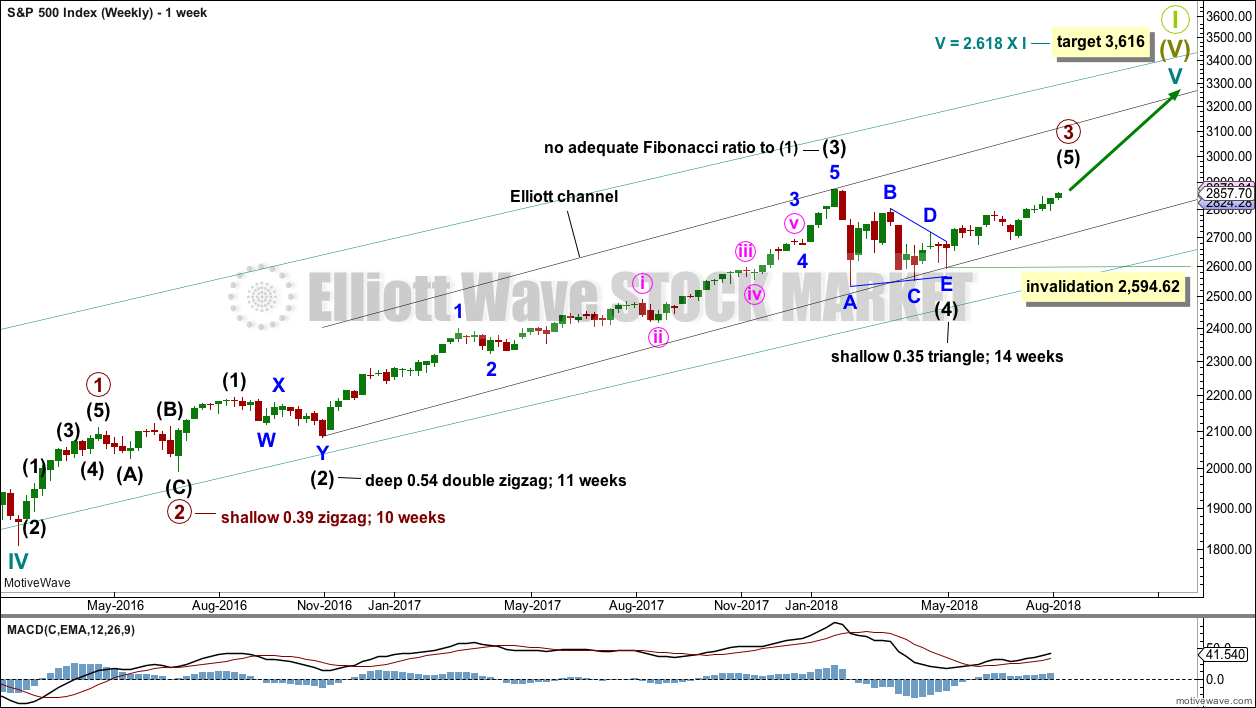

ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62. However, the lower edge of the black Elliott channel drawn across the ends of intermediate degree waves should provide very strong support for any deeper pullbacks, holding price well above the invalidation point while intermediate wave (5) unfolds.

At this stage, the expectation is for the final target to me met in October 2019.

A multi week to multi month consolidation for primary wave 4 is expected on the way up to the final target.

The last bullish fifth wave of minor wave 5 to end intermediate wave (3) exhibited commodity like behaviour. It was strong and sustained. It is possible that the upcoming wave of minor wave 5 to end intermediate wave (5) to end primary wave 3 may exhibit similar behaviour, so we should be on the lookout for this possibility.

DAILY CHART

Intermediate wave (5) would be very likely to make at least a slight new high above the end of intermediate wave (3) at 2,872.87 to avoid a truncation.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 and 2 are complete.

Minor wave 3 may only subdivide as an impulse. A target is calculated for minor wave 3 to end, which expects to see the most common Fibonacci ratio to minor wave 1. Minor wave 3 may last several weeks in total and should look like an impulse at the daily chart level. When it is complete, then minor wave 4 may last about one to two weeks in order for it to exhibit reasonable proportion to minor wave 2. Minor wave 4 must remain above minor wave 1 price territory above 2,742.10.

Within minor wave 3, minute waves i, ii and iii all look complete and minute wave iv may still be an incomplete expanded flat correction. This remains the main hourly wave count, and technical reasoning is outlined in the classic technical analysis section below.

The channel is drawn today using Elliott’s first technique. The upper edge has provided resistance. This channel is copied over to hourly charts.

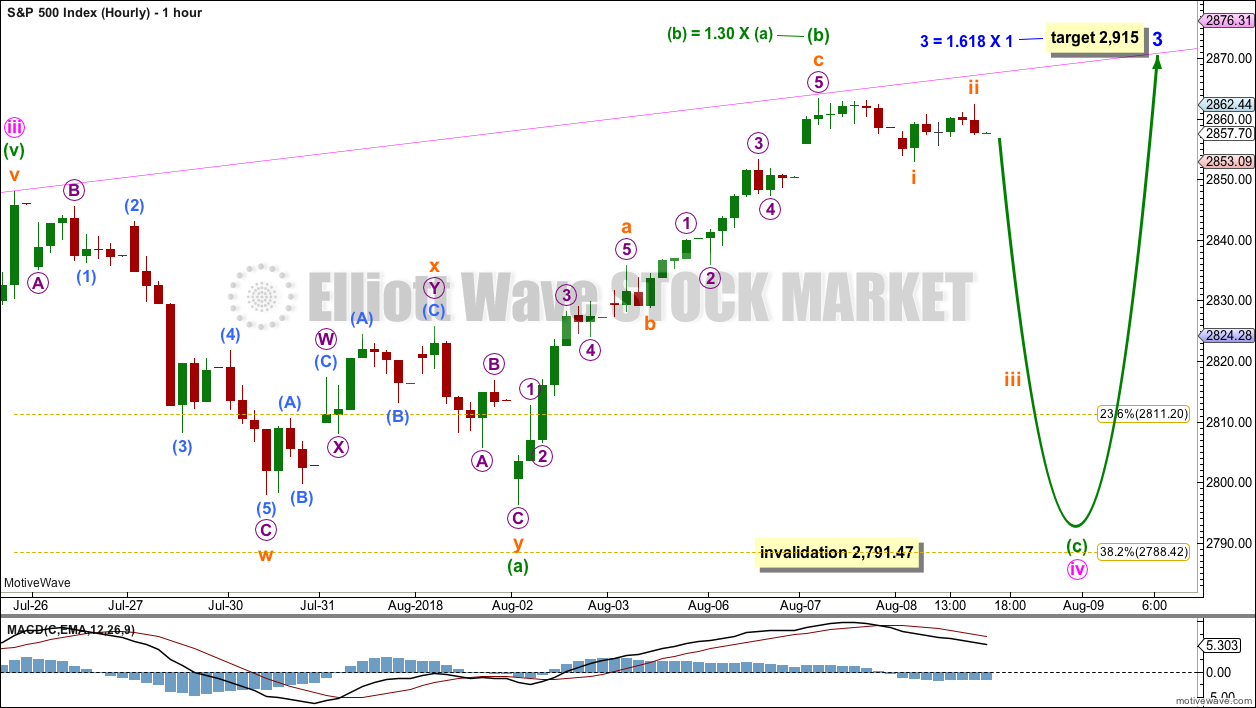

MAIN HOURLY CHART

This remains the main wave count today.

It remains possible that minute wave iv is an incomplete expanded flat correction.

Within the expanded flat, minuette waves (a) and (b) both subdivide as threes. Minuette wave (b) is still within the most common range for B waves within flat corrections, between 1 and 1.38 times the length of wave A.

Minuette wave (c) may have begun here to be a steep sharp pullback. It would be very likely to make a new low at least slightly below the end of minuette wave (a) at 2,796.34 to avoid a truncation and a very rare running flat.

Minuette wave (c) must subdivide as a five wave impulse.

The downwards wave labelled subminuette wave i may be seen as a complete five wave impulse on the five minute chart.

Minute wave iv may not move into minute wave i price territory below 2,791.47.

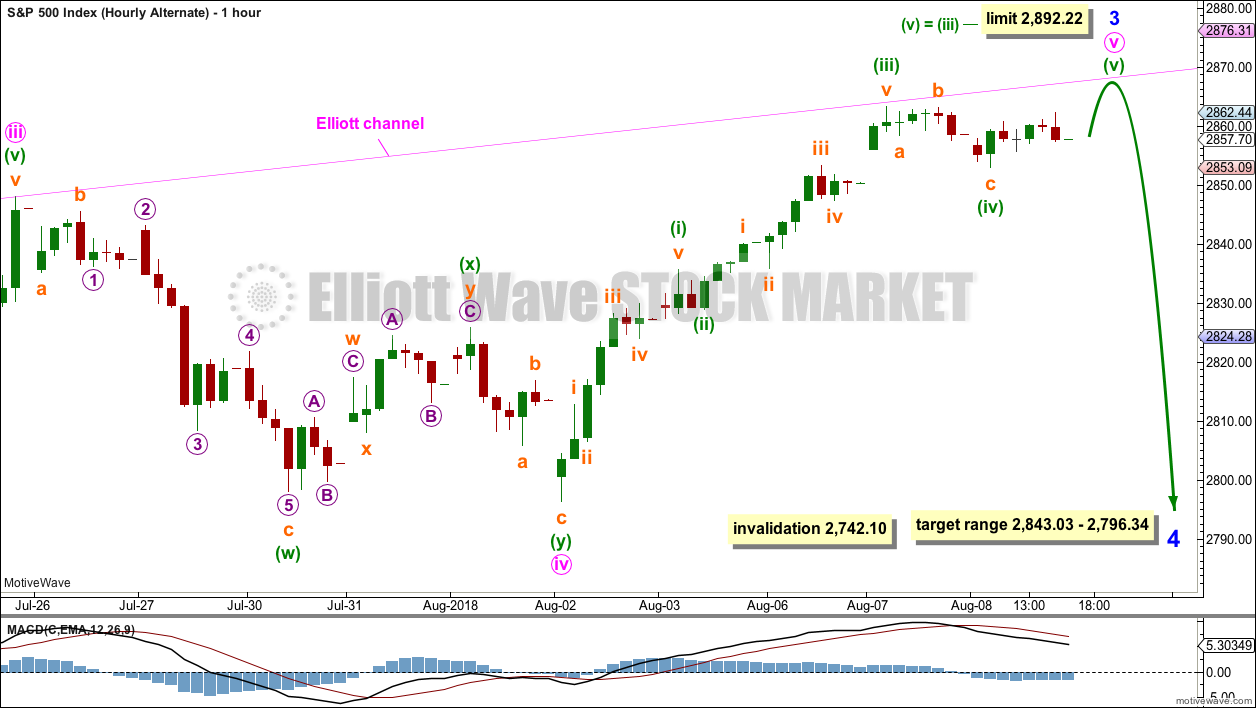

ALTERNATE HOURLY CHART

Here, the degree of labelling within minute wave iv is simply moved up one degree.

It is possible that minute wave iv could be over more quickly than was expected. If minute wave iv is over, then the possibility of an earlier than expected end to minute wave v must be considered.

For this labelling of minute wave v, minuette wave (iii) is shorter than minuette wave (i). This limits minuette wave (v) to no longer than equality in length with minuette wave (iii) at 2,892.22.

Minuette wave (iv) can be seen as a single zigzag today on the five minute chart. For this wave count, it should be over at today’s low. If price continues lower tomorrow, then this alternate wave count may be discarded based upon poor proportion between minuette waves (ii) and (iv).

Minute wave v could be over with only one slight new high. Minor wave 3 could be over very quickly, and minor wave 4 may then begin.

Minor wave 4 may be reasonably expected to last at least about two weeks, and possibly up to about four weeks. It would most likely end somewhere within the fourth wave of one lesser degree; minute wave iv has its range from 2,843.03 to 2,796.34.

Minor wave 4 would most likely be a flat, combination or triangle. These are all sideways types of corrections.

SECOND ALTERNATE HOURLY CHART

If minute wave iv is over, then it is also possible that minute wave v may not be close to completion and that it may extend further.

Minute wave v may be subdividing as an impulse, and within it minuette wave (i) may be very close to completion.

Within minuette wave (i), the small correction for subminuette wave iv may not move into subminuette wave i price territory below 2,829.03. Subminuette wave iv should be over here. If price starts to move down fairly strongly tomorrow, then this wave count should be adjusted to see minuette wave (i) over at the last high.

There is more than one way to label the upwards movement within minute wave v which meet all Elliott wave rules.

TECHNICAL ANALYSIS

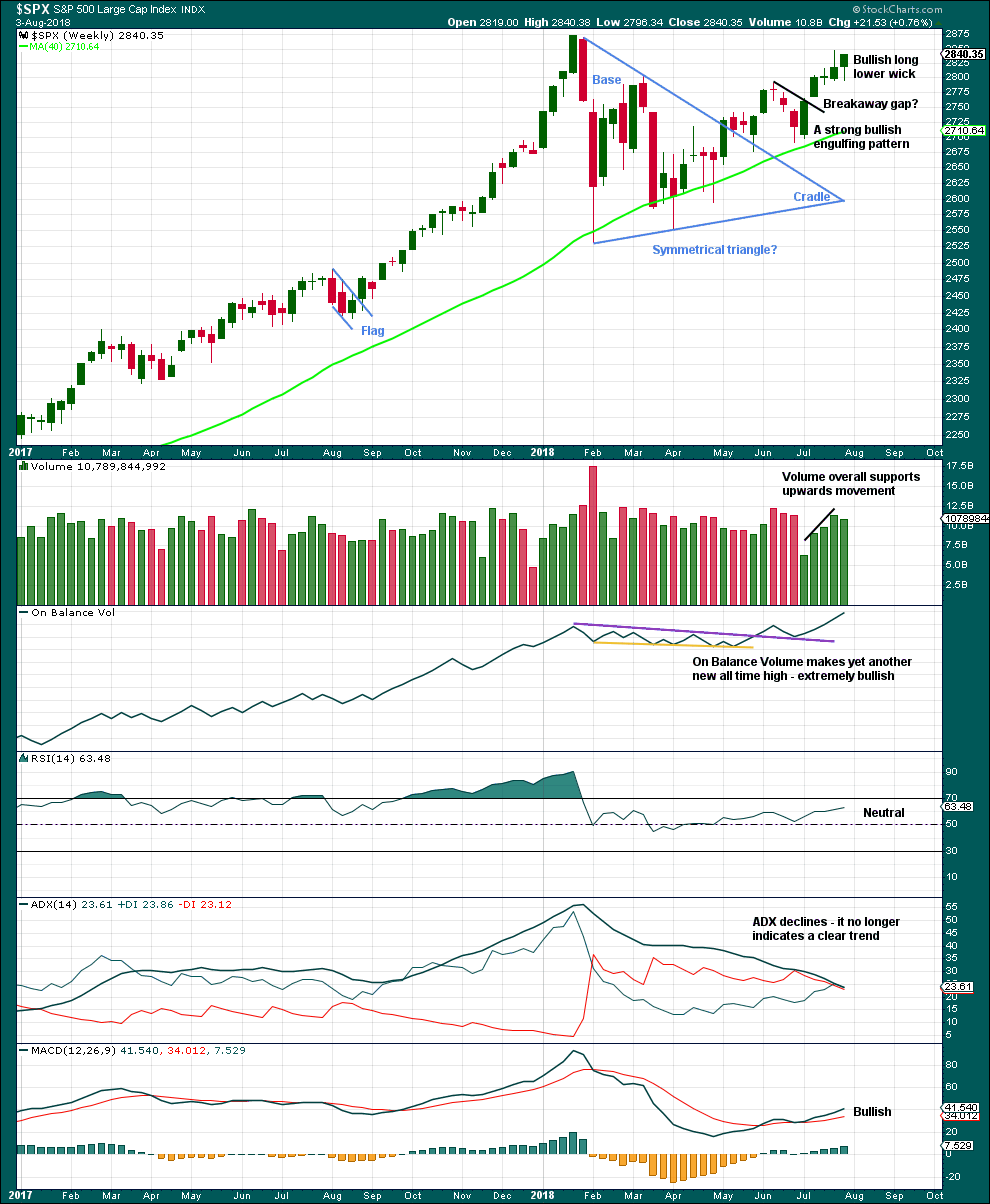

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Another new high for On Balance Volume remains very bullish indeed, but that does not preclude another small pullback within this developing upwards trend. It is still expected that price is very likely to make new all time highs, but it will not move in a straight line.

Last week’s candlestick is bullish with a long lower wick. But it lacks support from volume, which may suggest a B wave.

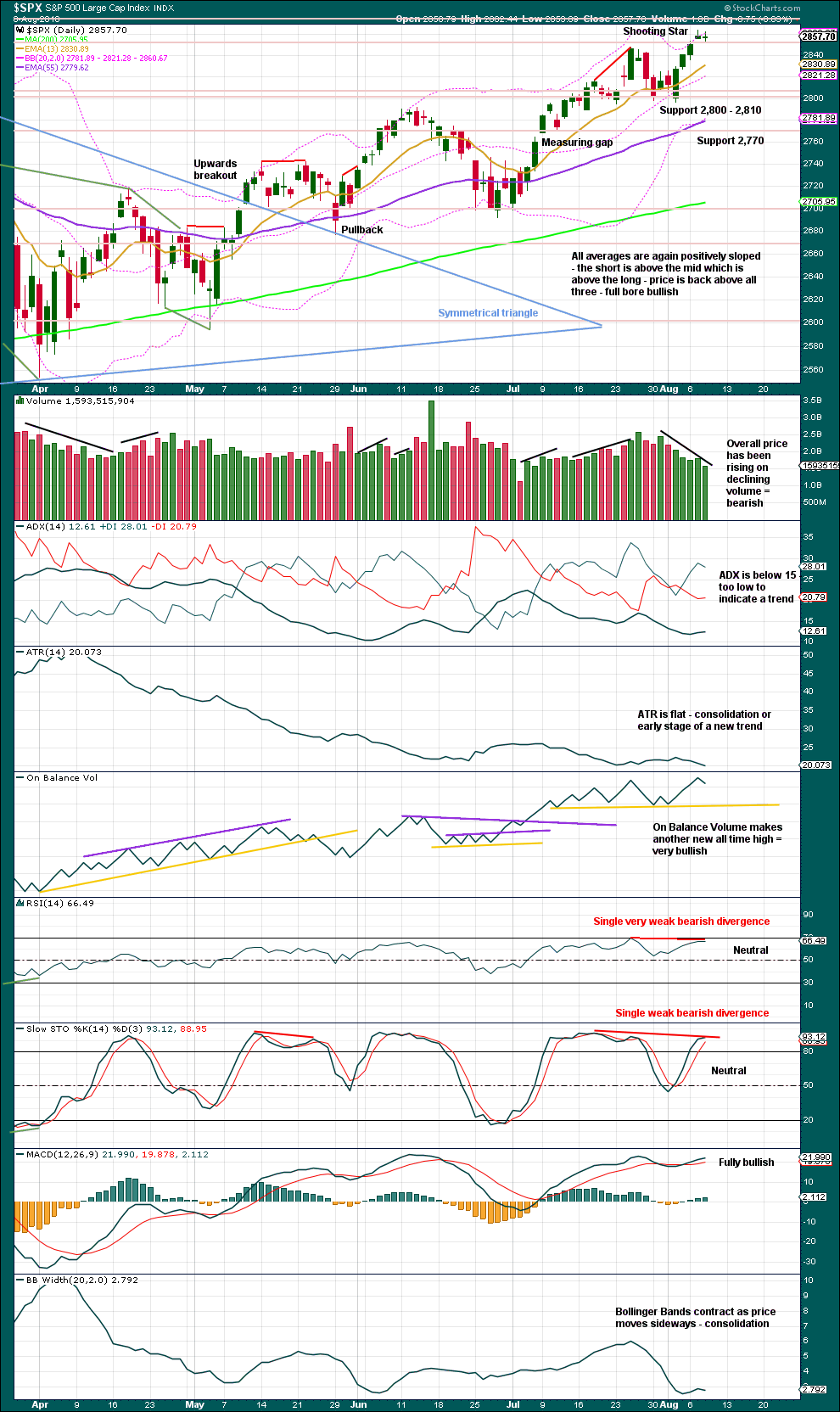

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete. The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. This is the definition of an upwards trend. But trends do not move in perfectly straight lines; there are pullbacks and bounces along the way.

A bearish warning comes from the Shooting Star candlestick that gapped higher, but it is very small though and this reduces the bearish implication. There are three recent examples of Shooting Stars on this chart: on 31st of July, 26th of July, and 11th of June. The second two examples came after an upwards trend and were considered bearish reversal candlesticks. Both were closely accompanied by new all time highs from On Balance Volume and some bearish divergence with price and Stochastics. Both were quickly followed by reasonable pullbacks. This is almost exactly the same situation now, so it may happen again here. It is for this reason primarily that the main Elliott wave count expects to see a reasonable pullback begin here.

Just because this situation has recently appeared twice before and been followed by pullbacks does not mean that this time it also must be followed by a pullback. It only means that the probability of a pullback here is heightened. Nothing in technical analysis is certain.

The bigger picture remains extremely bullish with another new all time high yesterday from On Balance Volume.

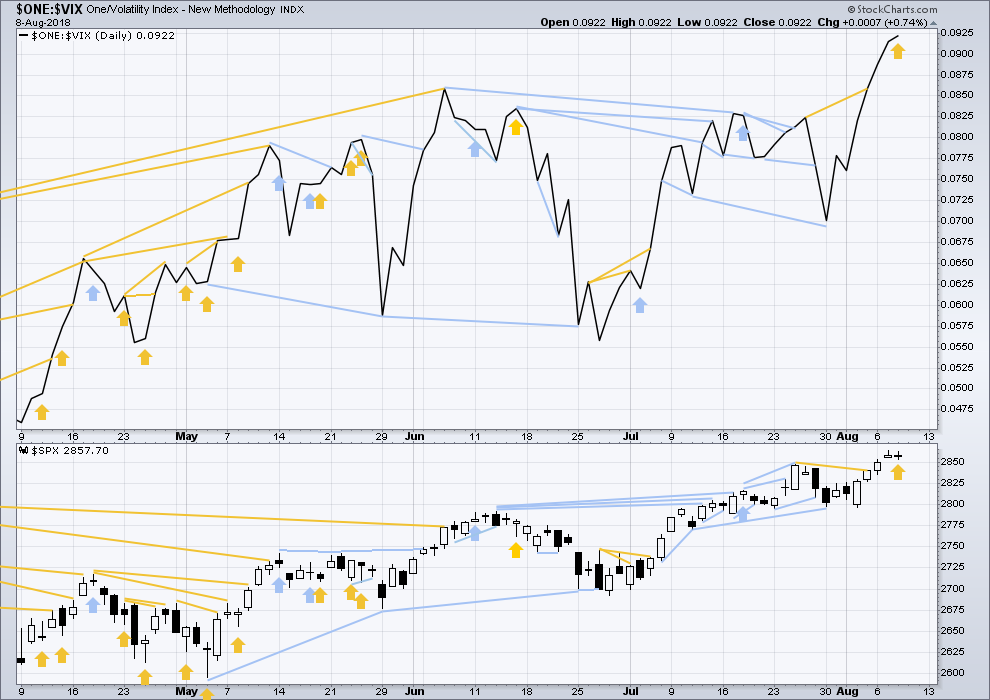

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

Last week completes an inside week that closed green, and the balance of volume was upwards.

Upwards movement last week has support from declining market volatility. Inverted VIX has made a new short term high, but price has not yet; this short term divergence is bullish.

Inverted VIX is still some way off from making a new all time high.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Last noted mid term bearish divergence has not been followed yet by more downwards movement. It may still indicate downwards movement ahead as there is now a cluster of bearish signals from inverted VIX.

Price moved lower today, with a lower low and a lower high, but inverted VIX has moved higher. The fall in price today has not come with a normal corresponding increase in market volatility. This divergence is bullish.

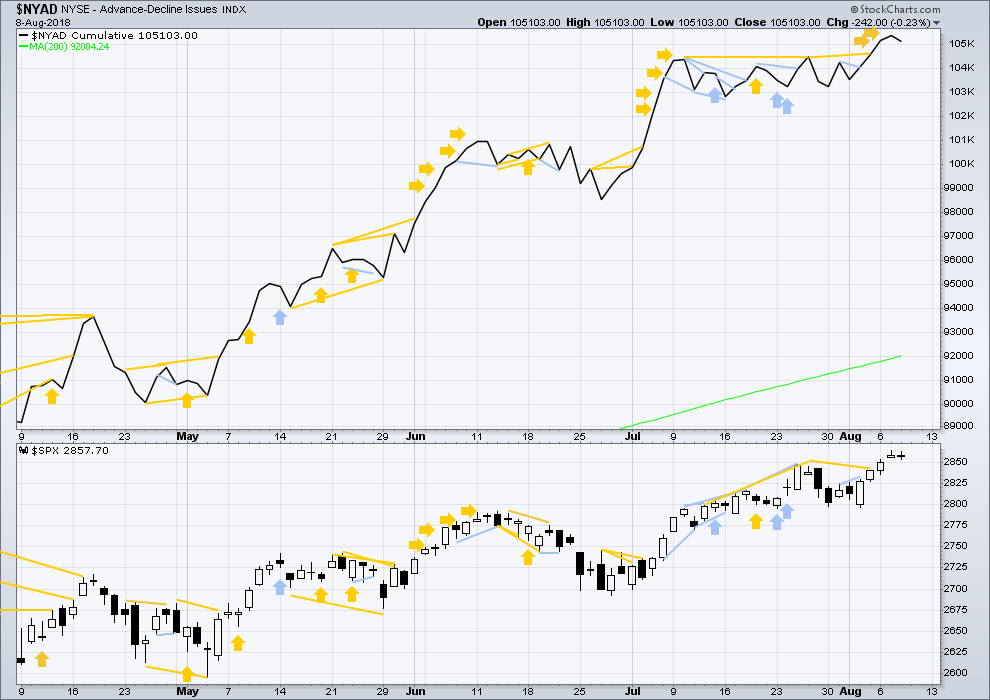

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

At this stage, there is very strong bullish divergence between price and the AD line at the weekly time frame. With the AD line making new all time highs, expect price to follow through with new all time highs in coming weeks.

Price last week completed an inside week with the balance of volume upwards. Upwards movement has support from rising market breadth. Another new all time high this week from the AD line is bullish.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

Both price and the AD line declined today. The fall in price today has support from declining market breadth, which is bearish. There is no divergence today.

Small caps and mid caps have both made new all time highs. But they both have Gravestone doji for yesterday’s candlesticks, suggesting pullbacks in both here. Only large caps have to follow through; they do usually lag in the latter stages of a bull market.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Only Nasdaq at this stage is making new all time highs, with another new all time high on the 25th of July. DJIA and DJT need to make new all time highs for the ongoing bull market to be confirmed.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 08:28 p.m. EST.

I observed recently that it does not appear that delta prices in a lunar effect. What is striking is that the last few days delta has been discounted! I guess one could argue expectation of a new moon high. Unless VIX heads back to the abyss, we just witnessed the most startling mis-pricing of downside risk ahead of a possible full moon low we have seen in many months…!

VIX moves past 11.25. Time to buckle up, if it holds… 🙂

Well that was an exciting end the last 45 minutes. Still not stopped out. Just 16 cents below price with my stop.

“Every time I think I am out, they keep sucking me back in.”

Michael Corleone in The Godfather Part 4, I think, maybe part 3.

I think you are right on Lara. Tomorrow morning may start with a gap down.

I think today’s VIX candle is a hammer. It is green and has a very long lower wick. Very bullish for VIX and bearish for SPX, at least short term (days).

Yep! It has been screaming…”Buy Me!” the last few days… 🙂

It may now be winding up a bit for a stronger fall tomorrow…. two first and second waves may now be complete

if the main count is correct that is

This is getting amusing. Now in 2nd hour of SPX squeeze. “It’s gonna blow.” Which way…

As Verne says, it’s winding tight.

First time I’ve seen an hourly bar paint red (“down trend”) in a WEEK. Current bar.

Hmmm….

I’ve gotten short…

Note: it appears to be breaking down out of a 3 hour squeeze as well. “It’s a gonna go!!”. Odds are pretty good, anyway.

Shall we call you pee wee? 🙂

COST is severely extended. This week it is now showing a reversal candle at the top. I’ve taken a short position via a put spread.

In short with a tight stop.

Market says, “Sorry, not yet.”

VIX well under 11…even I bought a call.

Hehe! That’s an easy double dude. We filled the gap from last January! 🙂

Exiting long positions to today. The suspense is killing me! 🙂

The “process” of topping appears to be continuing. Unless/until there’s a break out to the upside past 2863, I have to assume the next coming move is down, and probably sharply down. While it’s still hanging in the balance, to my eyes it’s tipping to the bear side here.

long upper wicks on the last few 4 hour candles… but the jury is still out on this move to upside or down, but I agree… looks like downward wave coming soon.

I’m not being convinced though with the way VIX and UVXY are acting.

Where’s Verne when we need him??? 🙂

je suis la 🙂

RUT is popping out of 3 days of squeeze to the long side.

GLD showing a hint of life to the long side with a break of the 9 week down trend line. NUGT following suit.

Something interesting to me – SPX is down but UPRO is up slightly. An anomaly. Does it mean the pro’s are not buying today’s initial selloff? I am not sure. But I have not yet been stopped out. Hmmmm.

Or, does it mean the banksters are hard at work preventing this market from falling?

There seems to be some lag time with these ETFs. DIA was also in the green although DJI was printing red.

I was here last night and found no comments. Again this morning just before the open there are no comments. So I will take 1st place by default.

SPX futures before the open are up about 4.5 points. The bull is not yet dead. Lets see if the 2663.43 SPX can be taken out. (See my chart of the ascending triangle posted late yesterday afternoon. This triangle has a 2874 target.) Or will it be 2853.09 to the downside showing the bears hand.

By the way, a grizzly bear’s hand and swipe with the hand is very powerful. A bear can easily decapitate a human with one swipe. If it hits a human in the body, it can break the spine and spinal cord in half. Have a nice day on those thoughts.

Futures slip to about up 3.25 minutes before the open. The battle will continue this morning. I expect a resolution today.

New moon partial solar eclipse on August 11…magnet?

I’ll stick with thinking about a great white chomping me in two, thanks. (Are there great whites in indonesia? be safe Chris!). There are great whites here, just down the street and in the water.

But I no worry, I swim in the market every day, lots of sharks about!

Indonesia’s too warm for Great Whites. But they have plenty of other sharks…

Pretty sure the biggest danger for Chris though is a bit of sunburn from being out in the surf for about 8 hours straight…..

Oh wow! Glad there’s no bears down here in New Zealand!

Maybe in real estate…eventually? 🙂