Price has moved sideways in a slightly larger range to print another doji candlestick.

Two hourly Elliott wave counts are presented today.

Summary: The first Elliott wave target is again at 2,614. A target using the measured rule is 2,634. The second Elliott wave target is 2,773. As price approaches each target, if the structure is incomplete and there is no weakness in price, then the next target will be used. But if price approaches a target and the structure is complete and there is some classic weakness, then a high may be in place.

The structure is incomplete at this stage, but some indicators are extreme and some weakness is beginning.

Always trade with stops and invest only 1-5% of equity on any one trade. All trades should stick with the trend. The trend remains up.

Last monthly and weekly charts are here. Last historic analysis video is here.

The biggest picture, Grand Super Cycle analysis, is here.

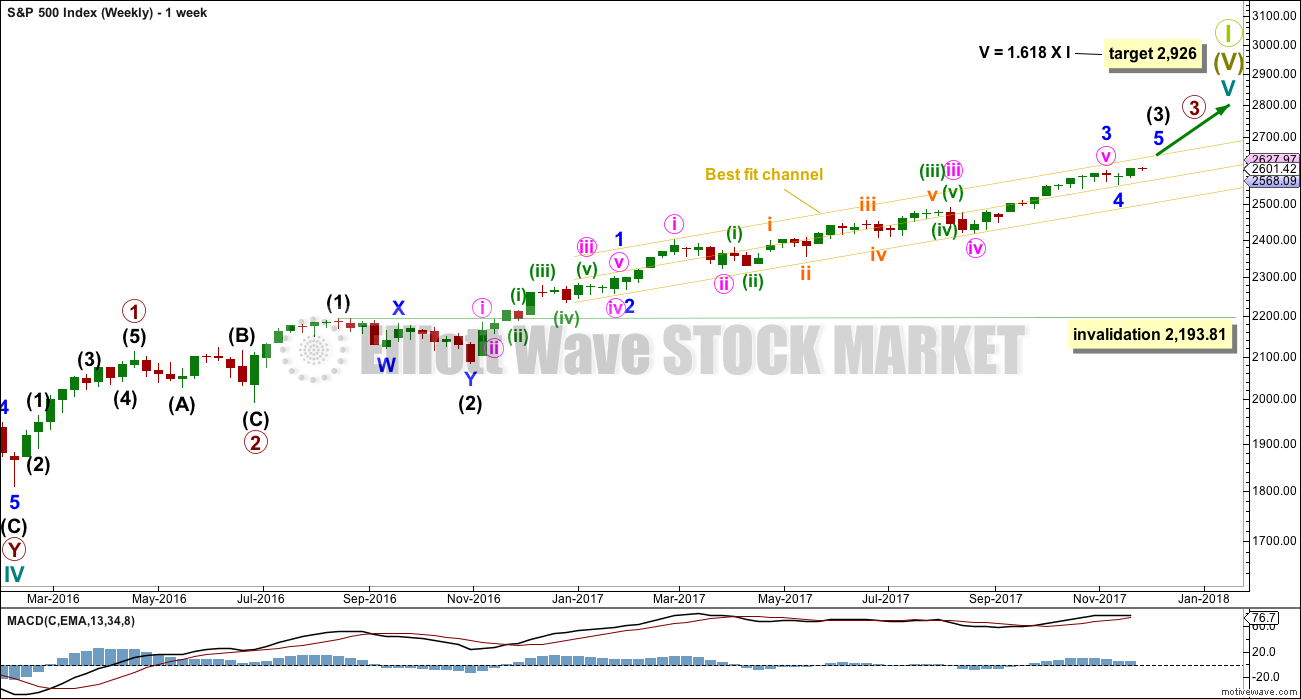

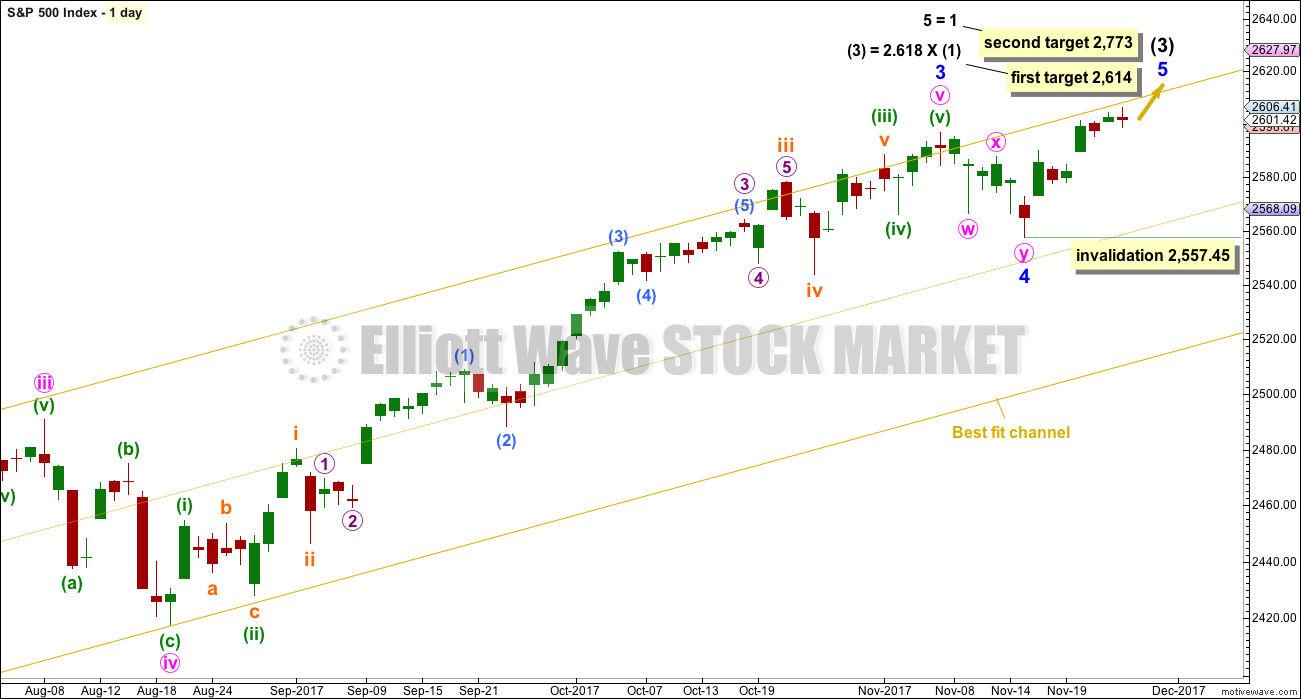

MAIN ELLIOTT WAVE COUNT

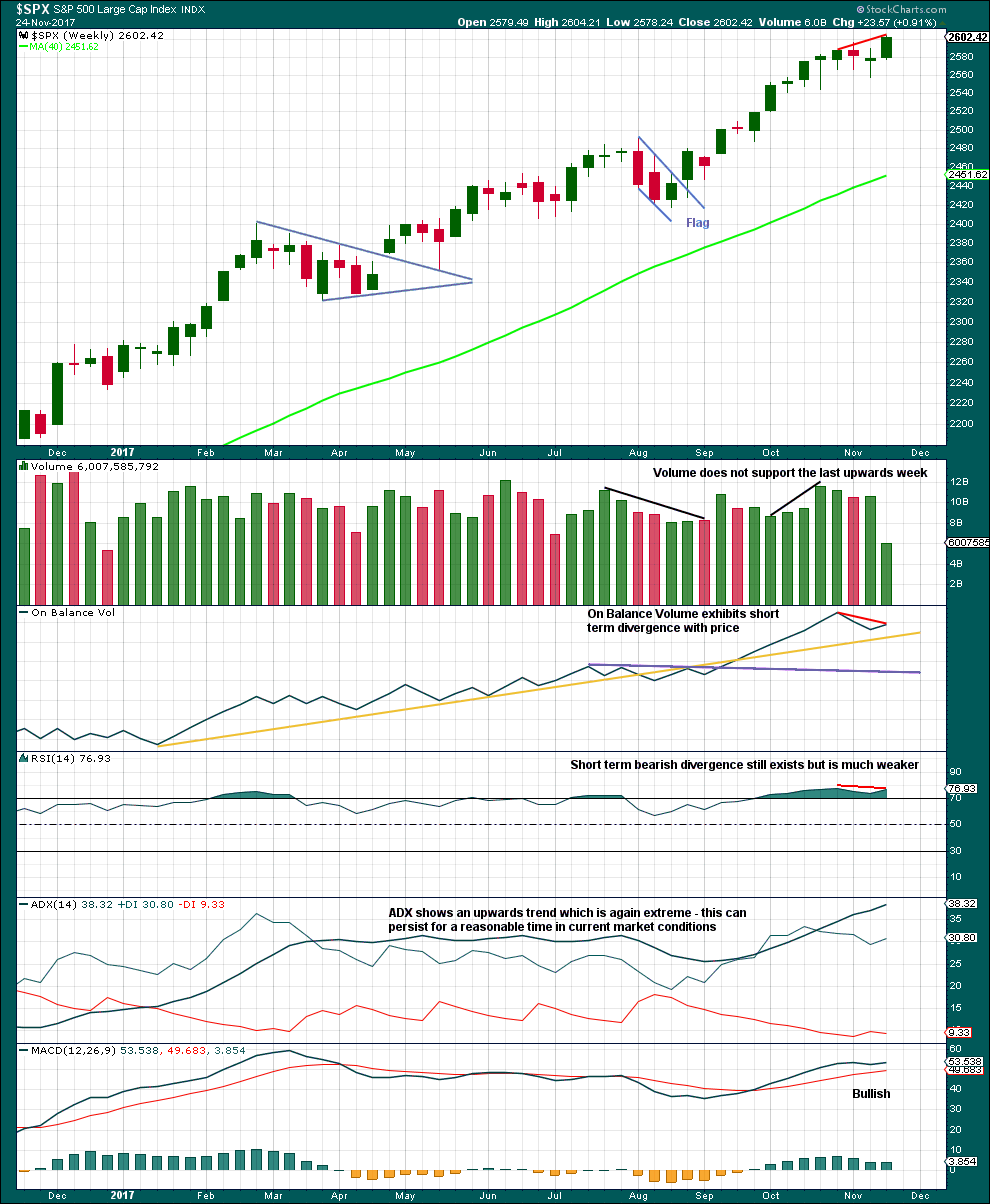

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the corrections for primary wave 2 and intermediate wave (2) both show up clearly, both lasting several weeks. The respective corrections for intermediate wave (4) and primary wave 4 should also last several weeks, so that they show up at weekly and monthly time frames. The right proportions between second and fourth wave corrections give a wave count the right look.

Cycle wave V has passed equality in length with cycle wave I, which would be the most common Fibonacci ratio for it to have exhibited. The next most common Fibonacci ratio would be 1.618 the length of cycle wave I.

Intermediate wave (3) may now be nearing completion. When it is complete, then intermediate wave (4) should unfold and be proportional to intermediate wave (2). Intermediate wave (4) may be very likely to break out of the yellow best fit channel that contains intermediate wave (3). Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81.

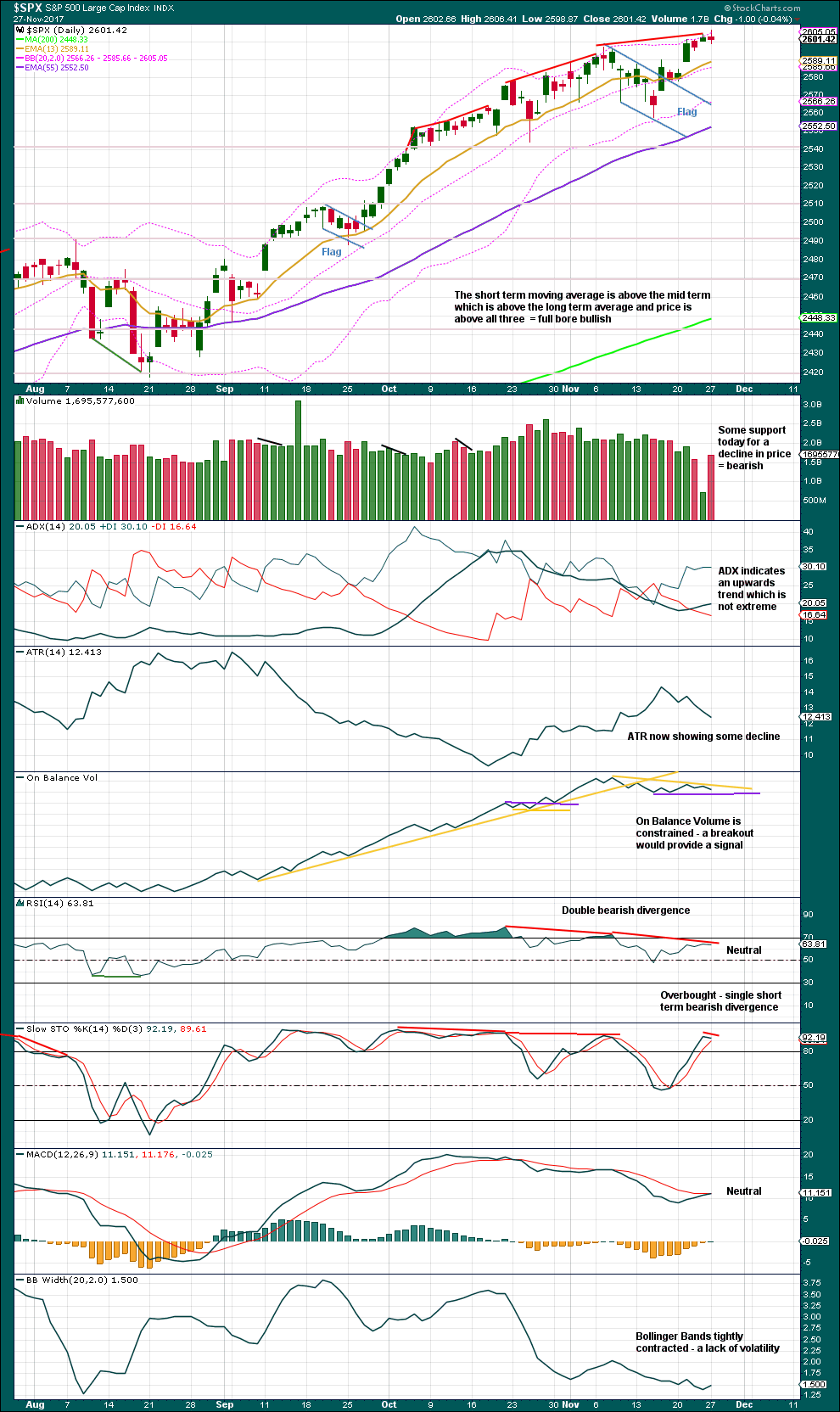

DAILY CHART

Minor wave 4 may now be complete. It will subdivide very well as a double zigzag. This provides only a little alternation in structure with the single zigzag of minor wave 2. There is also poor alternation in depth: minor wave 2 was very shallow at only 0.16 of minor wave 1, and minor wave 4 would be only 0.12 of minor wave 3. Alternation is a guideline and not a rule; it is seen more often than not, but not always.

The first target at 2,614 would see a Fibonacci ratio between intermediate waves (3) and (1), but no Fibonacci ratio for minor wave 5. This would be acceptable. There is already a somewhat reasonable Fibonacci ratio between the two actionary waves of minor waves 3 and 1, so minor wave 5 may not exhibit a Fibonacci ratio to either of minor waves 3 or 1.

The second target calculated for minor wave 5 expects it to exhibit the most common Fibonacci ratio for a fifth wave. This target would not expect a Fibonacci ratio for intermediate wave (3) to intermediate wave (1).

If price gets up to the first target, and the structure may be complete and there is some divergence with price and Stochastics or RSI, then members are warned that it would be possible for a high to be in place for the mid term. But if price keeps rising through the first target, then the second target would be used.

Within minor wave 5, no second wave correction may move beyond the start of its first wave below 2,557.45.

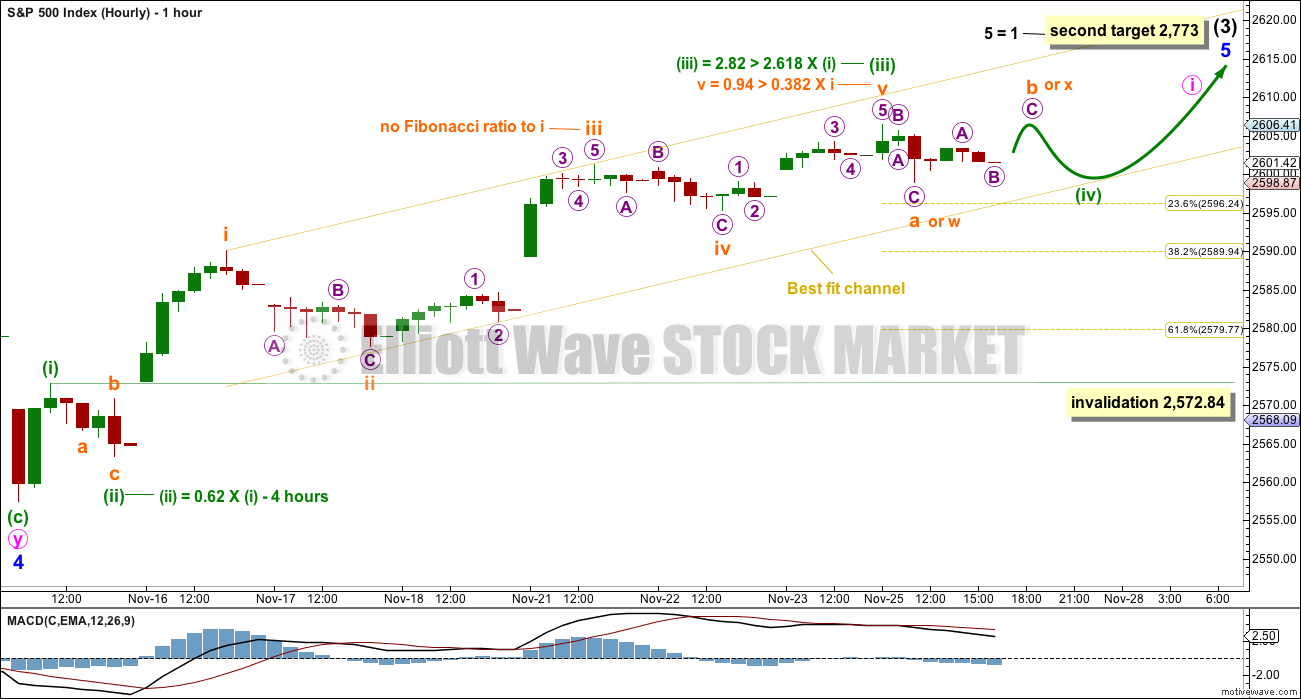

HOURLY CHART

The degree of labelling within minor wave 5 is moved down one degree for the main wave count today. We should always assume the trend remains the same until proven otherwise. When this five up is complete, we should assume the upwards trend remains intact, so we should assume only minute wave i within minor wave 5 may be complete.

This new degree of labelling does not fit with the first Elliott wave target, but it does fit well with the second Elliott wave target.

So far within the first five up, minuette waves (i) through to (iii) may be complete. Minuette wave (iv) may complete tomorrow.

Minuette wave (ii) was a deep zigzag. Given the guideline of alternation, minuette wave (iv) may be a flat, combination or triangle; at this time, it cannot be determined which of these three options it may be.

Minuette wave (iv) may not move into minuette wave (i) price territory below 2,572.84.

When this five up is complete, then that would be labelled minute wave i. A pullback for minute wave ii would then be expected.

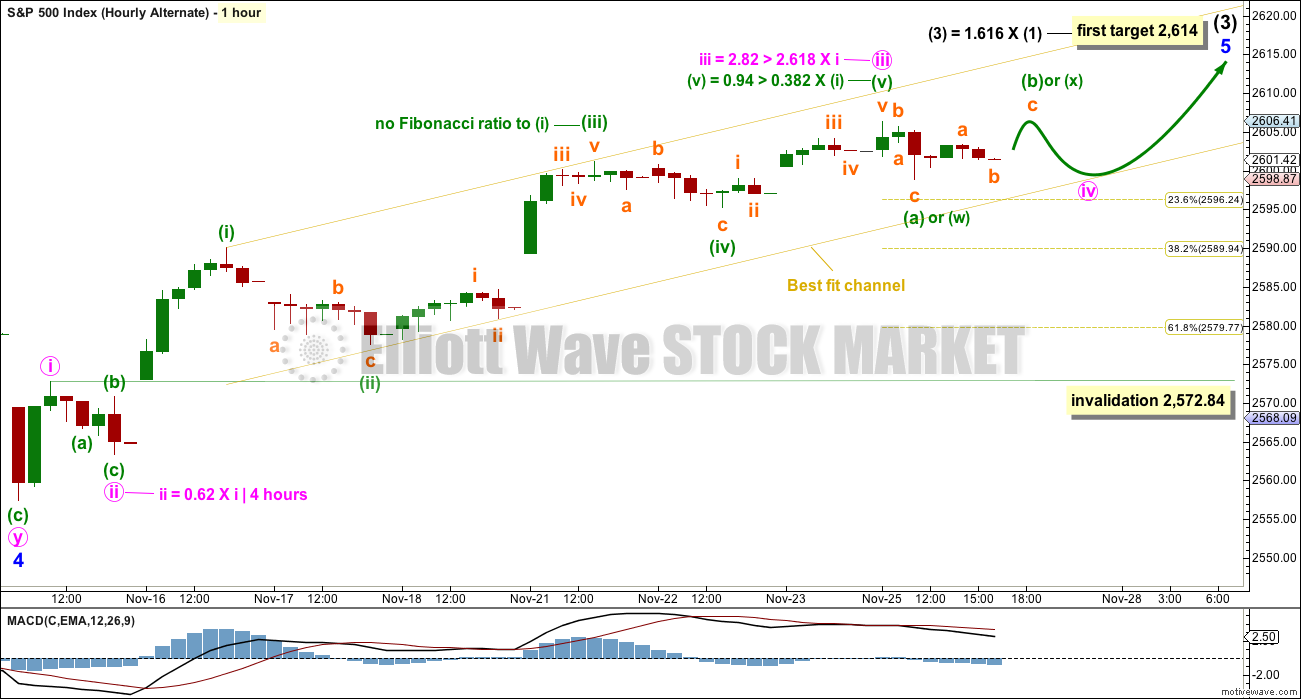

ALTERNATE HOURLY CHART

This was the main wave count in last analysis.

This wave count would fit very neatly with the first Elliott wave target at 2,614.

Both wave counts are identical with the exception of the degree of labelling within the current wave upwards. For this alternate, when the small fourth wave and the final fifth wave afterwards are complete, then intermediate wave (3) in its entirety may be complete. This wave count would then expect a reasonable trend change and the start of intermediate wave (4), which may last about two to three months.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Lighter volume for a week with a US holiday in it would be expected. On its own, this lighter volume should not be taken as a signal that a high is in place.

Some weakness and overbought indicators should be expected as intermediate wave (3) comes to an end.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The target using the measured rule for the flag pattern is at 2,634.

There is slight bearish divergence today between price and Stochastics, but this is not clear and strong enough to be a good signal for a trend change.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Both price and inverted VIX turned downwards today. The fall in price during Monday’s session had support from a normal and corresponding rise in volatility.

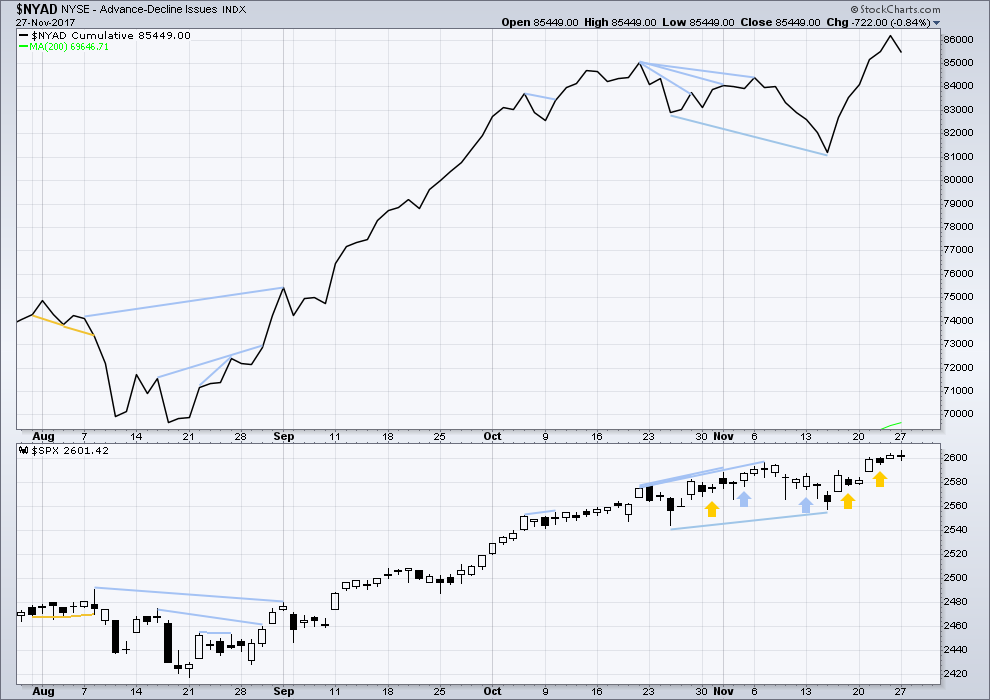

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

All of large, mid and small caps last week have made new all time highs. The rise in price has support from market breadth.

Both price and the AD line turned downwards today. The fall in price during Monday’s session has support from a fall in market breadth. This is bearish.

DOW THEORY

Only DJT has not made a new all time high last week. The S&P500, DJIA and Nasdaq all this week made new all time highs.

Failure to confirm an ongoing bull market should absolutely not be read as the end of a bull market. For that, Dow Theory would have to confirm new lows.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

Published @ 08:18 p.m. EST.

Apple sold 6 million iPhone X over thanksgiving weekend alone…. I think the stock is going to rocket into the earnings. Anyone else looking at the big apple? Lara have you done a EW review of Apple recently?

I’m seeing a lot of topping patterns in the flyers like AAPL, GOOG, NVDA, AMZN, FB etc. Then again, if we’re going to melt up 10 points I don’t see how those don’t go higher.

Sales pulled forward… Remember it has to be sales vs estimated sales and actual must beat. I doubt it will.

I don’t actually have an EW count of AAPL. I learned the hard way with that one that it doesn’t have sufficient volume for reasonable looking EW structures, which makes EW analysis of it more miss than hit 🙁

Individual equities, even the big ones like AAPL and GOOGL, don’t have as much volume as indices or heavily traded commodities.

Interesting; the SPX is up almost 25 points or 1% and VIX is still printing green.

Someone writing SPX options knows elliott wave?

VIX action very interesting today so was UVXY action.

Also, interesting action in after hours for both.

Everyone should read that Francesco article on volatility I linked to yesterday. I learned a few things that I was not aware of about the short vol trade. Absolutely hair-raising! 🙂

Great piece, and it will matter someday. Hopefully, sooner rather than later.

That article / podcast is the second time in two days I’ve heard about the very low velocity of money over the past few years.

The market has shot its last _ _ _ _ (Blank) today! Starts with the letter L.

I don’t see how it can get to 2773?

NK missile launch toward Japan!

Missile Hits into Japan’s “Economic Zone”! As per Abe’s statement.

Plunge protection to the rescue, nothing to see here…..

The Launch Team from NK!

I hope Trump is smart enough to ignore him. He will not last the Winter with the sanctions on his country. I predict that his generals will get rid of him rather than starve to death…

I’ve got just one more comment to make in addition to my long one below on global warming.

The large oil companies make trillions. I’d bet my entire life savings and equity on them using some of that $$ to create and spread propaganda. If we stop buying their products, they’ll die. They won’t die quietly.

Just like the tobacco companies.

I understand the science of global warming. And I’m very concerned indeed.

No doubt the oil companies spread propaganda Lara. But, as a surfer, you know the destruction of the ocean, which produces much of our oxygen is more attributed to ag runoff, over fishing, plastics, coral bleaching etc vs. carbon in the atmosphere. Moreover, matter can neither be created nor destroyed, so while it’s good to be concerned with global warming, transferring carbon from the ground to air and back to the ground is not the singular or primary concern. Moreover, to date, efforts by the UN etc and initiatives such as the Paris agreement, are a complete joke and basically transfer wealth from Europe and the Americas to China without any sustainable and measurable impact for the environment.

Gotta disagree with your logic, Chris. Tranferring excessive carbon into the air IS the singular concern. It leads to an uninhabitable planet. Maybe it was going to happen down the line a few thousand or million years. But it’s not, it’s happening now, and its our and our children’s planet. The economic havoc, the social havoc, etc., will be unprecedented in the history of the civilization of man. In my opinion. I don’t know much about the Paris agreement and it’s impacts on short term financial flows etcetera, but to me, that’s all just noise in the system. The big picture is what is of concern, and there’s no stopping it, because we as a SPECIES cannot adapt and change our way of living fast enough to stop it. No time to evolve and change course. Massive change is coming fast.

Well Kevin, we can certainly agree that the bigger picture is unstoppable. So sad we’ve destroyed most of the wonderful resources the earth has provided us.

I really helps to be able to read the actual literature on the issue of global warning and most people would be quite surprised at what it reveals. I think for the average person, reading Christopher Moncton’s work, whatever side you are on, will be quite informative. Here is a big clue, there is nothing happening on earth that affects temperature as much as that big yellow object we are orbiting…not even close!! 🙂

I’ve read a fair few scientific papers on the science behind the theory.

Now you’re talking. That is it. The sun. By the way, current statistics and charts show that the rise in CO2 levels follow the rise in heat from the sun, not the other way around as many believe.

His “work” has been thoroughly discredited. Don’t waste your time on that kind of propaganda. Wouldn’t be surprising if he’s getting cash from Exxon, frankly. There are a thousand better sources of real scientific information.

Every time I hear a comment like that, it is usually a sure sign that the person has not read the material. Thoroughly discredited by whom, may I politely ask? There is bad science on both sides of this argument although a lot of outright fraud seems to come more often from proponents, and the East Anglia Climate Research Unit scandal, although best known, is certainly not the only instance. The ice core evidence is still being fiercely debated as proponents had to come up with an explanation of why Co2 increases clearly lagged temperature rises according to the evidence from the cores. There have been a few interesting papers offering an explanation but it is all still conjecture. None of us were there! 🙂

BTW, there is a reason the term “Global Warming” was changed to “Climate Change”.

Can anyone tell me what it is?

Of course if you know anything about cycles, even without being aware of the current debate, the answer would be obvious! 🙂

Because the earth stopped warming.

Verne, do you remember the Global Freezing “settled science” hysteria in the 1970’s? When the data didn’t support that after a while, they changed their tune then also!

“Climate Change” of course the climate is going to change… its been changing for millions of years! But the Brainwashing continues in the education system and in the political world.

Alternate hourly chart updated:

I’m going to label it like this at this time because MACD is showing some slight decline in momentum. That looks like a fifth wave.

That could certainly change, and if it does then I’ll label it differently.

That was a remarkably quick and shallow correction! Again! Seems to be the pattern.

I’ve looked on the five minute chart to see if it could have been a triangle and that doesn’t fit. Hence the labelling as a quick zigzag. That fits.

Yep. Looks like a fifth… 🙂

and now…. looks like a third

I’m relabelling it

2621.09 and IN CAME JOHNNY!!! I love fibo projections, they are right far more often than wrong.

Let’s see if it holds.

Kevin, Do you see us still in Intermediate wave (3)?

I wish I knew Johnny. I’ll say this: I always believe Lara before I believe myself! That said…my bet is that some timeframe 5 wave just completed, rather that we just finished the 3 of that 5 wave as Lara is calling here. Why? Because of the perfect hit on the 1.62 extension. My best guess would be that this is minute 1 overall of the minor 5, and we’ve got MILES to go to the upside, after a minute 2. But it is possible we enter intermediate 4 right here, and relative to a possibly rocky road for the tax bill in the next few days/weeks, that would make a certain kind of sense. In other words…I don’t know!!! I think it’s a function of what happens in DC now, personally. I did buy a bit of VXX the moment price turned at the top here, just because SOME kind of a turn there was pretty much certain.

Oops, looks like Lara’s call is indeed right, a little 4 here, and a final 5 up to complete either the minute 1 of the minor 5…or the complete minor 5. The former seems far more likely (unless war breaks out on the Korean peninsula over the next few days/weeks). The bulls are ferocious: massive tax cuts for corps tends to do that! Clearly (to me), the market is predicting ultimate success of this tax bill.

Wow, don’t blink. Price action today seems to reflect some pretty bullish news that we are not privy to yet. As you mentioned, likely some serious confidence in the success of this tax bill. Market has had plenty of excuses to sell over the past few weeks but there is no weakness. Price action rules.

Indeed, it’s wild. That said…either a substantial minute 2, or a VERY substantial intermediate 4 now due. I’ve just closed about 4 long positions that just didn’t move today (or just got me back to BE), in an attempt to avoid what I perceive as too much downside risk now. Got JPM and GS today, but could and should have gotten larger bites, exiting early (“fear of losing profits”) is always my challenge.

Wow… Launching to the moon! Straight UP! Unstoppable move! Never, ever… to pull back! Just hold forever, no need to trade.

You had to use that word Joseph….”launch”!!! I’m laughing…but not really. And isn’t it bizarre how they launch…exactly as SPX hits the 1.62% extension? The world is somehow strangly synchronously fractal in ways we can’t imagine, and I say so because such synchronicity happens over, and over, and over, in my experience. Some “reason” always shows up right when price hits key fibo decision points and turns. Very strange.

Brexit… has been agreed on! Cost about the mid-point!

Fifth wave is apparently extending.

Daily SPX above upper BB. I am not sure it will go too much higher.

The external 1.618 extension of the Nov 7 high to Nove 15 low is at 2621.2 and I view that as a key target/decision point for this move, which is now well past the 1.28% extension (the first external target of such a move). I’ll be watching for a turn and sell triggers (for some long positions, not for going short!) around that price point.

I am out of long trades today at the 2610 target. Still holding 256 puts from bull 256/258 put credit spread. I am heading to the sidelines on long trades until we can confirm which is the correct degree we are looking at…

You got it. Looking for a correction of some sort to give us clues as to the degree of labeling and possible long entry point. I do think the main hourly count will prove out, ie we are completing Minute 1 of Minor 5 with a target of 2772. But only time will tell.

While anything is possible, the move above B bands seems terminal to me….

Cha Ching!

Well played Rodney.

Very challenging to see this push as part of a 4 wave at this point.

Maybe this will give the bears some hope? Ye old wedge pattern. Sometimes it’s meaningful.

Thank you. One motivating factor to sell short term long positions was the risk we have if we are completing Intermediate 3. I did not want any leveraged positions with that possibility on the table.

Indeed! And these quacks tell us with a straight face- “Take your medicine (“tax cuts”), it’s good for you!” 🙂

Verne,

The current administration like all previous administrations the biggest crooks onboard (aka Goldman Sachs). Their control over the trading platforms will be tweaked to fit the larger agenda. Other problem is when you look around at other markets around the world, there is none with the depth and breadth of US markets…. it will attract money until crypto becomes a real alternative..

Fas-er-nating. Is it all of minor 5 (it will be if the tax bill fails!), or is it just the minute 1 of minor 5 (it will be if the tax bill passes!).

$1.5 trillion onto the backs of the 80% of the people, and 80% of the money into the pockets of the top 0.5% richest. That’s got to be the largest theft in history, right? Ah, kleptocracy at work! “It happens” when corporations are people, money is speech, and speech is unlimited (Many thanks to Chief Judge Robert and his merry bank of corporate shills at the SCOTUS, doing the bidding of the oligarchy there), enabling the total buyout of the government by Big Money, and the total corruption that immediately follows: “we want our payday for putting you in office”. All $1.5 trillion worth. Meanwhile…how to jiu-jitsu this theft of all thefts and make some coin off it!!

The largest theft in history has been the central bank nationalization of the markets to the tune of 40 trillion (min est.) since 2008, in addition to the loss of purchasing power that the regular population has been forced to endure. Nonetheless, this tax bill is ridiculous. Income shouldn’t be taxed in my opinion, at any level.

Agree 110% …. if anyone has found reliable trading platform for bitcoin and other crypto currencies, please share.

I have no experience with it, but GBTC seems to be the tradeable instrument. Yesterday it was up 23% early, but fell to “only” a +14% or so day. Today it was quickly up a fresh 14%. It’s the tulip bulb craze of all tulip bulbs!!!

BitStamp.

That was Cesar’s conclusion after some research. We have an account there.

Looking to short Bitcoin after the bubble bursts. But that could be a while yet.

For now, my recommendation would be to buy and hold actual Bitcoin. Which you can do I believe via BitStamp accounts. Look for the blowoff top, and when looking at that you have to look at a chart covering some years.

Chris… I agree 200% with that fact of the central bank nationalization of the markets! Price discovery has been in effect eliminated with these actions!

However, I believe that this Tax Bill will create additional economic growth (main key is the 100% expensing of investment in plant, equipment and technology & change to territorial tax system) … real growth in the USA along with many real higher paying jobs in the USA being created where you actually make things again (no more, would you like fries with that, jobs).

This when coupled with the cut of regulations that already have occurred and much more that will occur is the recipe missing since the 1980’s. Next up will be the infrastructure Bill which is the 3rd piece of the puzzle.

BUT, BUT, BUT… An adjustment period in Paper Assets will occur! Investment in company revenue growth will put an end to stock Buybacks and thus financial engineering!

It will be invest in your business or eventually be put to death from new competitors! The way the system is suppose to work!

I agree in theory Joseph, and Trump has rolled back regluations that help small businesses like mine. However, for true growth to occur a default on the national debt is necessary, coupled with massive spending cuts and capital constraints on Washington. Real growth requires demand growth, which can not occur without deflation first. Without those, we will continue to AMZN the whole world. Further, this does not take into account job losses do to AI, Automation, and Robotics, which in my opinion will force universal income to avoid civil war.

Keep in mind you can’t do everything in one bill or all at once… Congress and especially the Senate can’t walk and chew gum at the same time! SO it’s one thing at a time for now!

They will only be able to work effectively to accomplish a great deal at once… if and when Term Limits can be placed on these two bodies. Two Terms in the Senate should be the limit and 5 terms in congress. Any more time than that & they all become CORRUPT and bought!

I believe after the main parts of the Trump agenda are implemented a major restructuring of every Government Agency and everything else must take place. A Private Sector Style restructuring… where everything that remains has a real purpose and that purpose executed with as much efficiency as possible using the latest technology.

If this can be accomplished… the savings over the following 10 to 20 years will be enormous! ONLY after that is accomplished should some of the major entitlements be looked at for reforms.

It you can’t make the main operations of Government work well and as efficiently as possible, you will never solve the debt problem… at best you only delay the judgement day.

A shift of manufacturing back to the USA so we have a balanced economy (Manufacturing & services almost equal) in the USA will create demand growth in the USA.

This plus a goal of USA to be energy independent at a cheap cost.

All of your points are correct Joseph and yes manufacturing in the US can be competitive, and it would be hugely beneficial to be energy independent. I’d love to see the addition of Nuclear, and hyrdo-electric as well.

No infrasture bill; no money!! No investment in the USA: no demand! Shrinking middle class, poor getting only poorer. What IS next up is the elimination of ALL social services and safety net programs. Spending on any and everybody who isn’t part of the 1% will quickly be eliminated by the corporate oligarchy running the show. The only infrastructure investment you will ever see of significance in this country again will be privatized, and available for a hefty fee and affordable only by the top 5% of the population. Medical care for all but the wealthy will soon be history (though a black market medical system will arise of course), and as the country sinks deeper and deeper into debt, of course social security and all medicare etc. type support will be removed in the interest of “the country”. Public K-12 education will continue to rot (once the absolute best in the world!), and lets face it, “public” colleges were effectively privitized long ago by unwillingness of the government to fund them. Meanwhile, the southwest will become totally uninhabitable due to weeks on end of 140-150 degree temperatures, and there will be a massive migration north. Coastal areas will be severely flooding within 30 years, as sea level rise of 8-10 feet will occur within 100 years. Massive hurricanes will largely obliterate the southeast. Our world is going to utter hell, and Trump and his minions fiddle, dance and sing, while they raid the US treasury. Our children will live to see it and be part of it. It will not be pretty. Sorry to be morbid, but as someone told me long ago, “Kevin! Face the future, don’t walk backward into it and let it break over your head!”.

Boy… you have been drinking the Cool Aid for way too long!

Try some Johnny Walker Black… to flush out your brain!

I have no further comments. Time will tell!

The Treasury has already been raided over the last 10 years! If nothing at all is done the Debt will go to 30 Trillion… it’s on auto pilot.

If you believe in rising oceans…

The solution to both the fresh water problems of the future and the rising oceans is to build major strategicly located desalination plants all over the world along with pipelines and other transports to deliver to where needed.

That’s the real solution to this specific problem… NOT this nonsense that the Parris accords came up with.

The state of Israel already has the desalination technology.

It would be interesting to see the math on that. My guess is that such an approach, at say 1000 such desalinization plants, would reduce rising levels by perhaps an inch a decade? Maybe? Insignificant re: 8-10′ of rise. Our melting ice caps and ice sheets and glaciers (and don’t forget “Greenland”, which will one day be green again!) hold A LOT of water! And don’t forget…ALL water recycles…back into the ocean.

While I concur with your statements regarding affordability only by the top 5%, the statements on environmental predictions may not be so rooted in hard science as you may think. Remember in the 1970s, scientist said we wont have oil by 1985, and in 2005, no glaciers etc etc etc. No questions pollution and destruction of the ocean is of paramount importance, but in my opinion the focus should be re-directed away from a fossil fuels only narrative, to one of holistic approach.

In the 1970’s, the so called settled science was on “Global Freezing” not warming!

Plus… planet Earth has frozen over and warmed many times over millions of years… that is just natural changes. No human is going to change the natural course of things.

Yes, because if mankind hadn’t intervened, the earth was probably slowly but surely headed into a new ice age. We’ve intervened. The science is crystal clear. The ice is melting faster than the models have predicted, probably because of unfactored in feedback loops or other factors. The rate is going to skyrocket as all of the permfrost melts, releasing tremendous amounts of CO2. Yes, earth will abide. But mankind and civilization as we know them today definitely will not. The corps who run America today don’t care; they are sworn to do anything/everything to increase short term profits, for their shareholders, and to amp their yearly bonuses. We are doomed by our own greed. It’s fascinating, because mankind, AS INDIVIDUALS, are astonishingly intelligent. But as a species, we are faced with change that is too rapid for us to evolve sufficiently in time to address. Evolution can’t keep up with the changes we ourselves are inducing. It’s not dissimilar to the passengers pigeons, whose only survival mechanism was mass numbers in a flock. They couldn’t adapt to the gun, and once their flock sizes were smaller…total collapse and now 100% gone. Humans won’t disappear…but in 200 years, you won’t recognize our world, and I’d expect a population of humans at about 20% of current levels. All I’m doing is projecting the current trends (“we must assume a trend will continue…”). What you are doing in your projections Joseph is magical thinking: you believe that every trend happening today is going to change/reverse. There’s little to no reason to believe so.

No they had no idea in the 1970’s … just like they have no idea now!

Underwater volcanoes melting Arctic Ice, says geologist!

So it’s man and NOT this??????????????

A new NASA study is adding evidence to a theory that there is an enormous geothermal heat source sitting beneath the ice.

It’s called a mantle plume. It’s positioned beneath a region named Marie Byrd Land. It potentially explains a lot.

This mantle plume — some of which are known as supervolcanos — pumps out some 200 milliwatts of energy per square meter.

The background heating from beneath the Earth in non-geologically active areas is about 40 to 60 milliwatts.

The one under Antarctica appears to be roughly in the same league, at up to 150 milliwatts.

This is the real science…. Not that politically influenced brainwashing science coming out of the UN and the great global society agenda.

The global cooling from the 70’s? That was a pretty brief and not widely shared view amongst scientists.

The science on global warming is actually pretty solid and agreed upon by almost every scientist on Earth today.

This is the basic physics of it:

Some molecules have the ability to hold energy. When their energy levels reach a certain point they will then release energy, in the form of heat. Not all molecules do this. O2 doesn’t. CO2 does. And CH4 (methane) does even more.

And so if you increase the proportion of molecules like CO2 and CH4 in the atmosphere then you increase the amount of energy held in the atmosphere.

Humans have been releasing carbon into the atmosphere at a growing rate since the industrial revolution. The CO2 in the atmosphere as measured by the Moana Loa observatory in Hawaii is at the highest rate since human evolution. At no point in our evolutionary history has it been this high.

We can measure concentrations of gasses in our atmosphere for many thousands of years in the past by looking at small air bubbles trapped in ice as it melts. Ice cores.

Recently the arctic tundra has been seen to be thawing. Large amounts of CH4 are being released. This is very concerning, because CH4 will hold and release roughly 30X more energy than CO2.

Which is why the scientists are so concerned.

After much reading, thinking and discussing this (particularly with my sister who has a Phd in organic chemistry) I am very concerned.

I’m glad I have only one child.

The mantle plume under Antartica has been there for an estimate 100 million years. Yes, it’s contributing to the surprisingly fast collapse of Antartica ice shelves. No, it is not the cause nor driver of global warming. As Lara explained, we are. The science is crystal clear. We were propagandized for the last 50 years to believe otherwise, by those who darn well knew (and know): Exxon Mobil, among others. It’s rather amusing actually, because when you consider it objectively, it would appear that the leaders who perpetrated such incredible fraud, at the cost of our planetary habitat, are criminals of such magnitude that even comic book villians pale by comparison. I mean…effing the WHOLE PLANET to make a buck??? I guess the only step up from that re: immoral and criminal would be effing the whole world RIGHT NOW to make a buck, wouldn’t it? Oh my how depressing, time to mellow my mind thank you very much! And thanks Lara for the science: facts matter!!!! Depite the continuous attacks on reality by many of our “leaders”….science and facts still matter.

Spot on Joseph. The only annihilation man can do to this earth is via nuclear war

Foist Doc!