A red daily candlestick was expected for Wednesday’s session. Price has made a lower low and a lower high, the definition of downwards movement, but the candlestick has closed green after a rally at the end of the session.

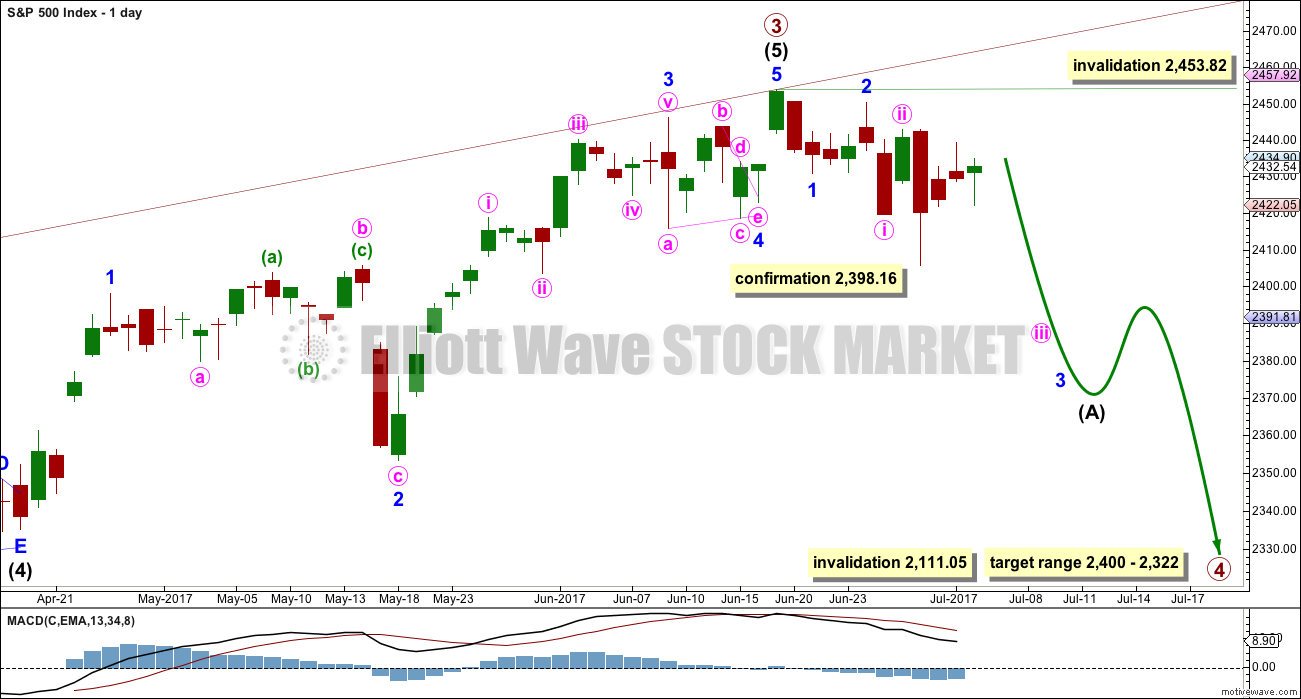

Summary: Expect now a multi week to multi month pullback has begun. The target zone for it to end is about 2,400 to 2,322.

Expect downwards movement from here to now start to show an increase in momentum. The short term target is at 2,390.

If choosing to trade this correction, remember to always use a stop and invest only 1-5% of equity on any one trade. Less experienced members should reduce equity to only 1-3%.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

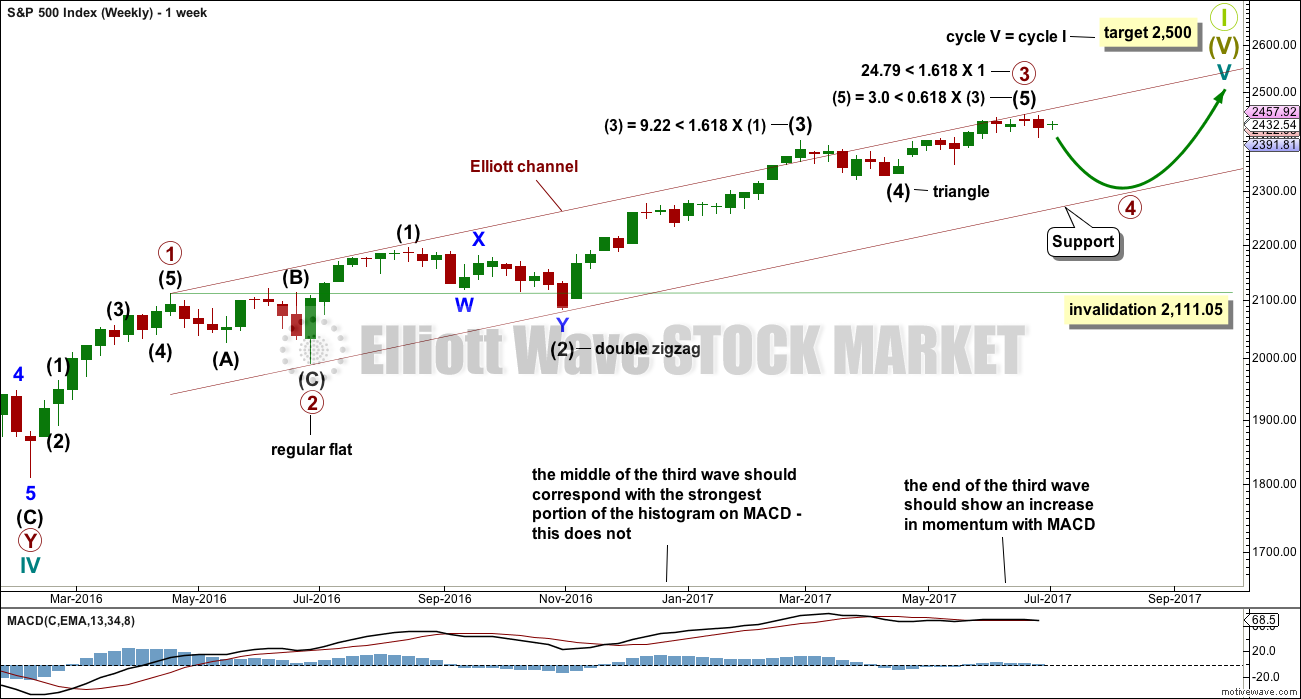

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Price has indicated that this should be the main wave count.

Primary wave 4 may now be underway.

Primary wave 2 was a regular flat correction that lasted 10 weeks. Given the guideline of alternation, primary wave 4 may most likely be a single or multiple zigzag or a triangle and may last about a Fibonacci eight or thirteen weeks, so that the wave count has good proportion and the right look. So far it has lasted only one week. This is far too brief to be considered complete or even close to complete.

Primary wave 4 may end within the price territory of the fourth wave of one lesser degree. Intermediate wave (4) has its range from 2,400.98 to 2,322.35.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

DAILY CHART

If primary wave 4 unfolds as the more common single or multiple zigzag, then it should begin with a five down at the daily chart level. This is incomplete.

If minor wave 2 is not over, and if it continues any higher (as per the new alternate hourly wave count below), then it may not move beyond the start of minor wave 1 above 2,453.82.

When intermediate wave (A) is complete, then intermediate wave (B) should unfold higher or sideways for at least two weeks.

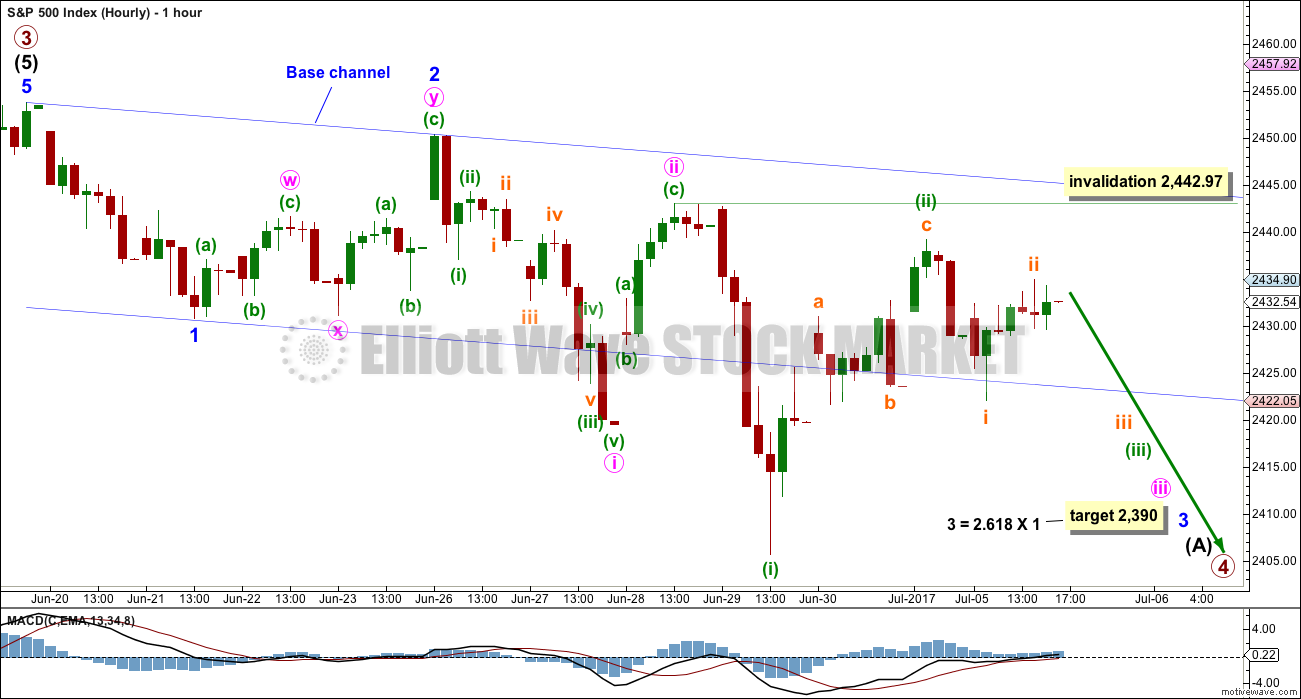

HOURLY CHART

Minuette wave (ii) is another very deep correction.

There are now four overlapping first and second waves downwards. This indicates an increase in downwards momentum should happen this week, if this wave count is correct.

Minuette wave (ii) may not move beyond the start of minuette wave (i) above 2,442.97.

Minuette wave (ii) may be complete. On the five minute chart, subminuette wave b will subdivide as a double combination.

Sideways movement for Wednesday’s session may have been yet another first and second wave for subminuette waves i and ii.

At 2,392 minute wave iii would reach 1.618 the length of minute wave i.

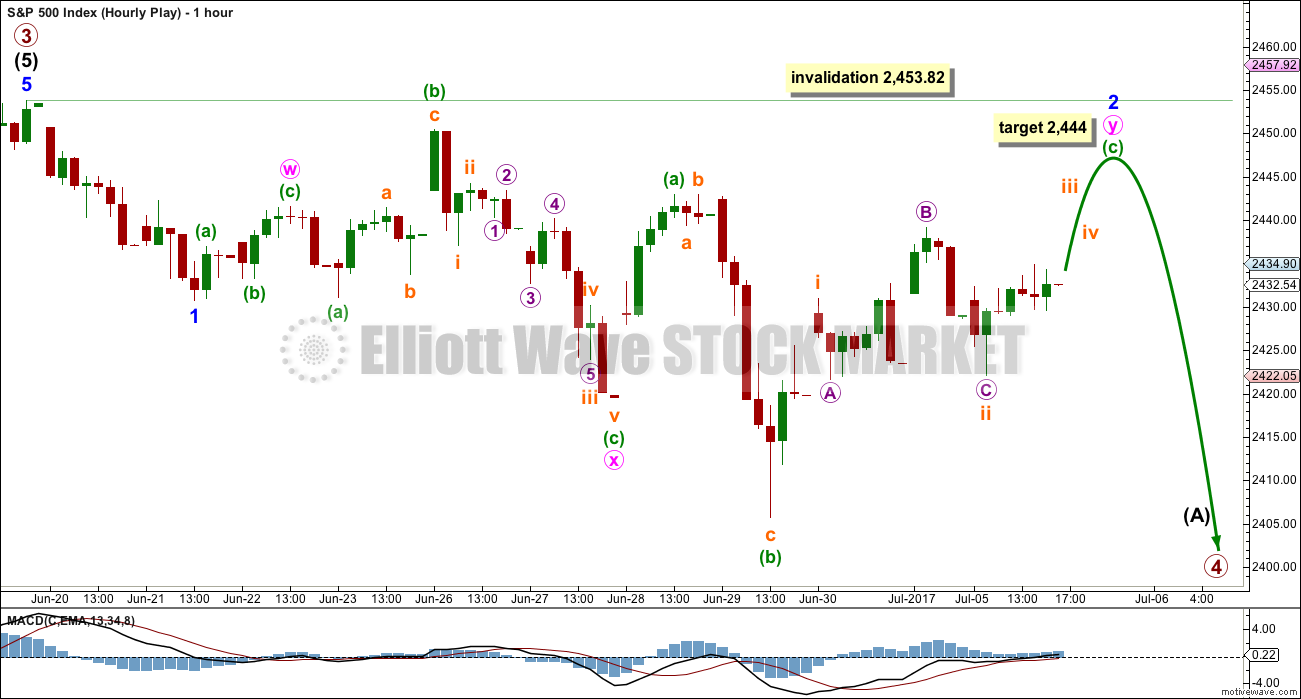

ALTERNATE HOURLY CHART

What if minor wave 2 is incomplete? It may be unfolding as an expanded flat or a combination.

Overall, so far minor wave 2 has a downwards slope and not a sideways look to it. This may be redeemed if price moves higher through this week, to complete minuette wave (c) upwards.

There is a convention within Elliott wave that when wave B of a potential expanded flat reaches more than twice the length of wave A, the idea of a flat continuing should be discarded based upon a very low probability. That idea may also be useful in thinking about combinations. When wave X within a combination reaches more than twice the length of wave W (or Y), the idea of a combination continuing should be discarded. Here, minute wave x is 2.04 times the length of minute wave w.

This wave count has a very low probability, but at this stage it is the best alternate that I can find at the hourly chart level.

Minor wave 2 may not move beyond the start of minor wave 1 above 2,453.82.

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

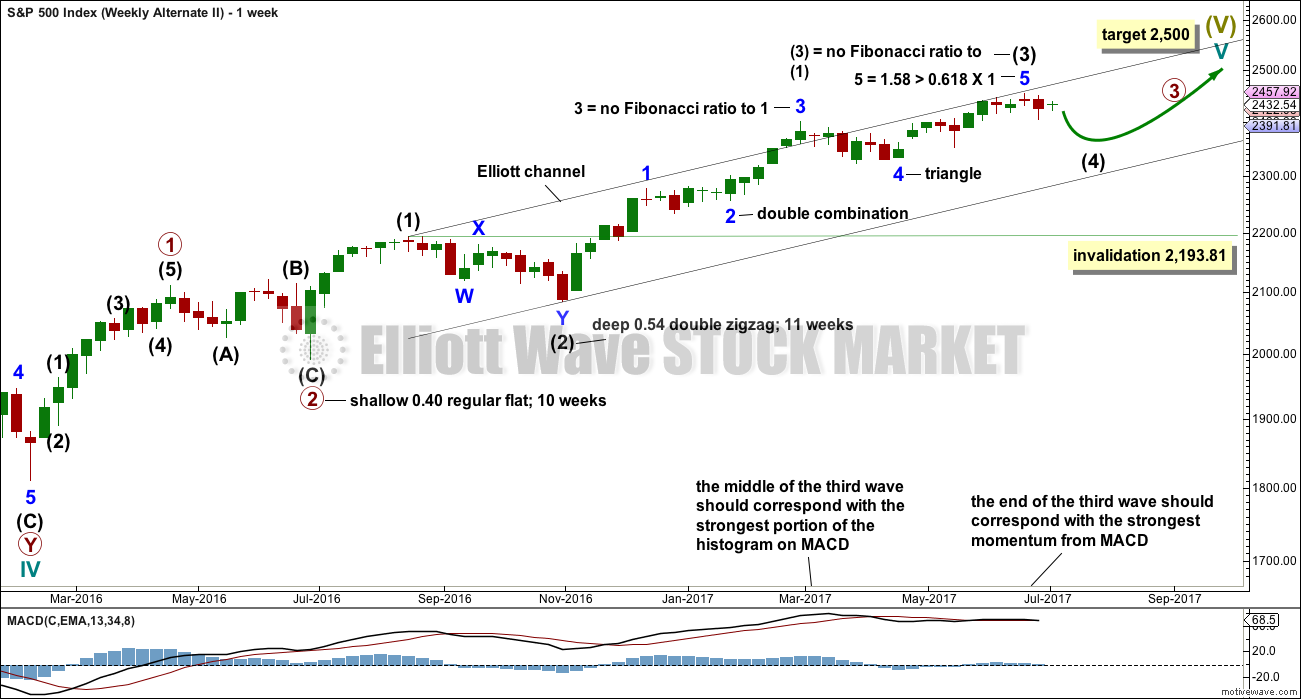

This idea is new. This alternate wave count allows for an even longer more drawn out end to cycle wave V. It may not end until next year.

The current correction may be one degree lower, intermediate wave (4), which may not move into intermediate wave (1) price territory below 2,193.81.

Intermediate wave (2) lasted 11 weeks. Intermediate wave (4) should be in proportion to intermediate wave (2) for the wave count to have the right look. So far intermediate wave (4) has only lasted one week and is now beginning its second. It is far too early to say it could be complete. At its end, it may total a Fibonacci eight or 13 weeks.

TECHNICAL ANALYSIS

WEEKLY CHART

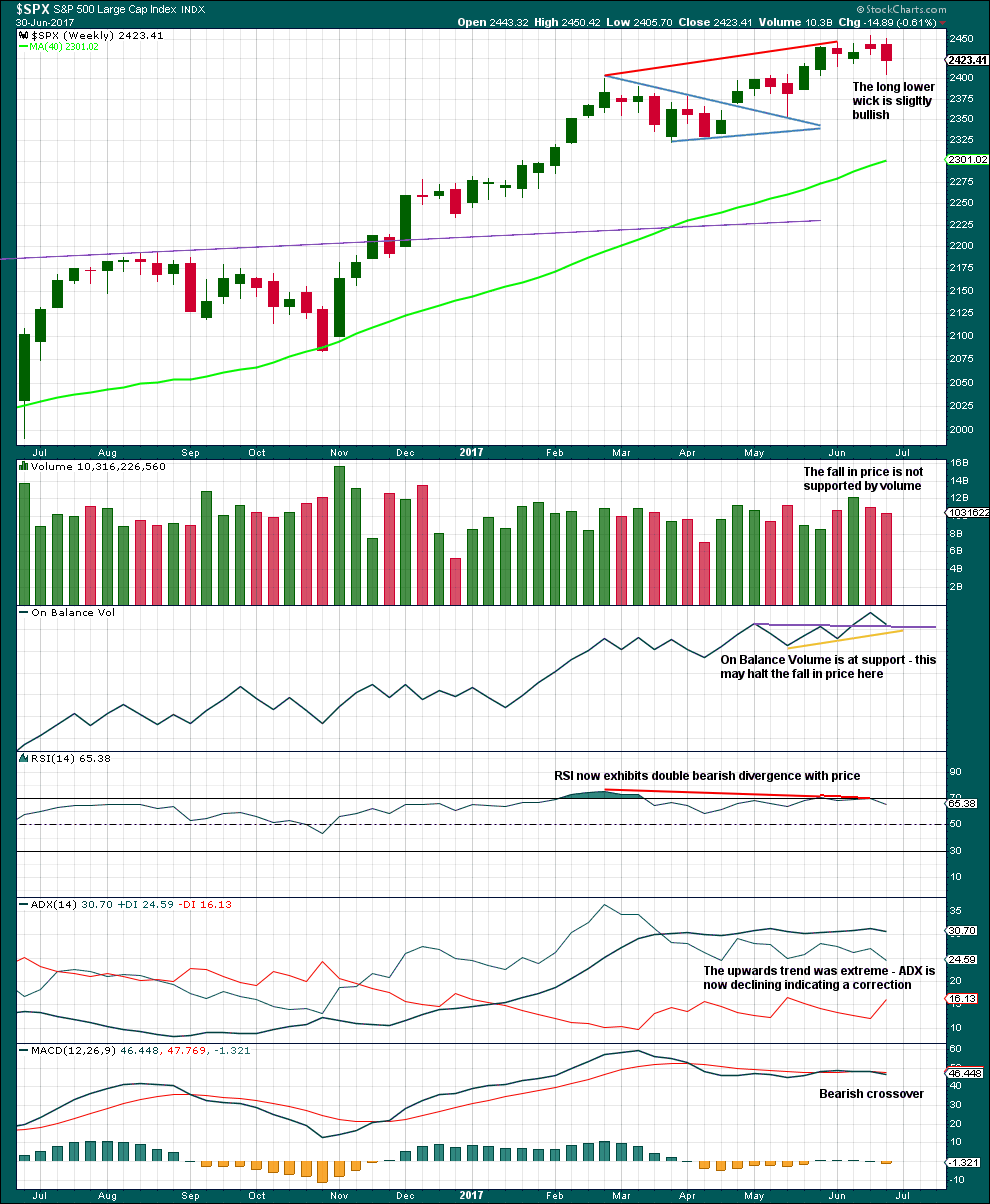

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume and On Balance Volume last week suggest upwards movement from here. But the purple trend line for On Balance Volume has only been tested twice before, so its significance is only weak.

ADX, RSI and MACD last week point to lower prices in the next few weeks.

DAILY CHART

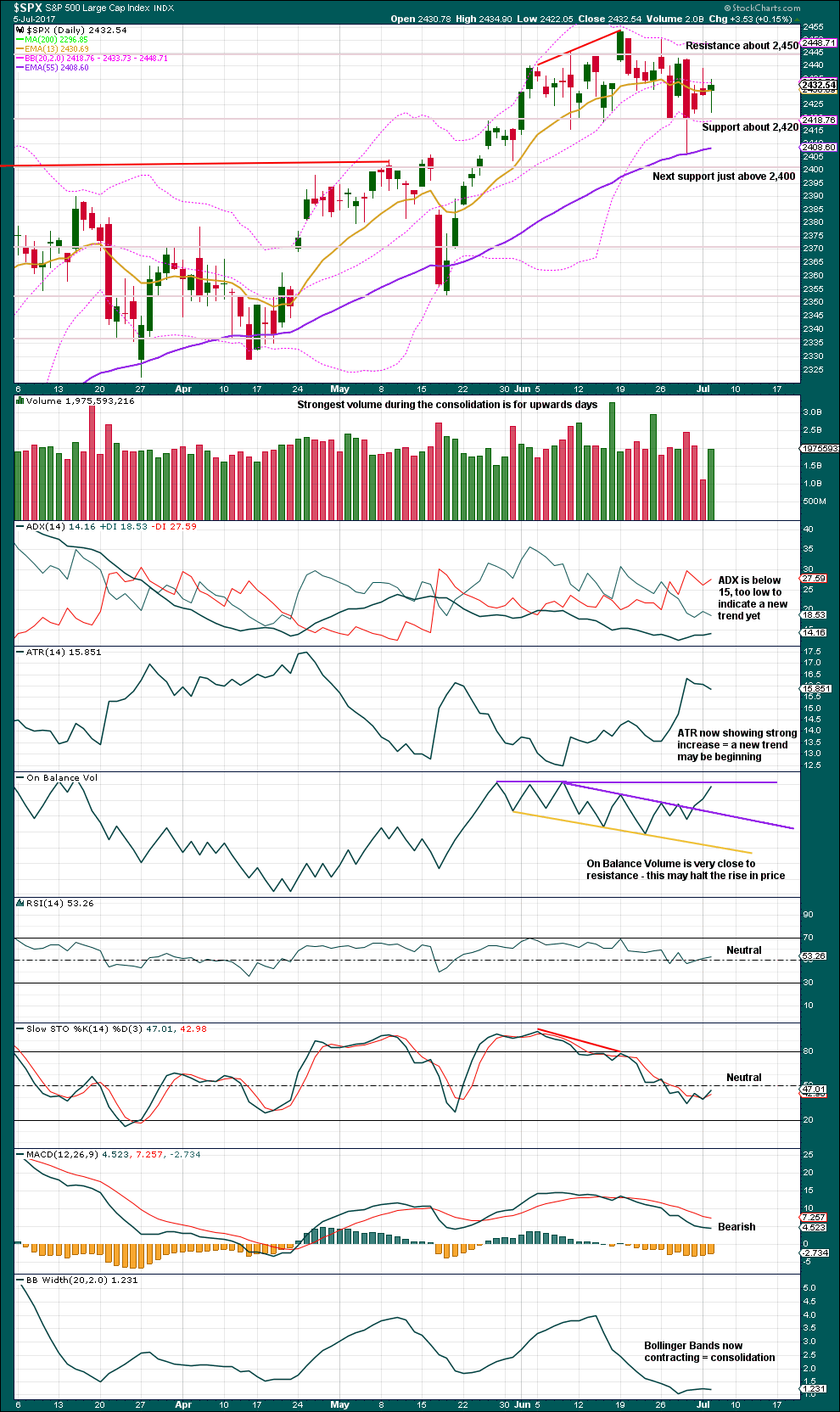

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is consolidating with resistance about 2,450 and support about 2,420. During the consolidation, it is upwards days that have strongest volume suggesting an upwards breakout as more likely than downwards. This is in contradiction to the Elliott wave count.

Today moved price lower, but the balance of volume was upwards and the candlestick closed green. The long lower wick is bullish. Upwards movement during this session has support from volume, and this too is bullish.

On Balance Volume may again here be the leading indicator. If it finds resistance and turns down from the next purple line, that would be a bearish signal. If it breaks above that line, that would be a bullish signal and then the Elliott wave count would be in doubt.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

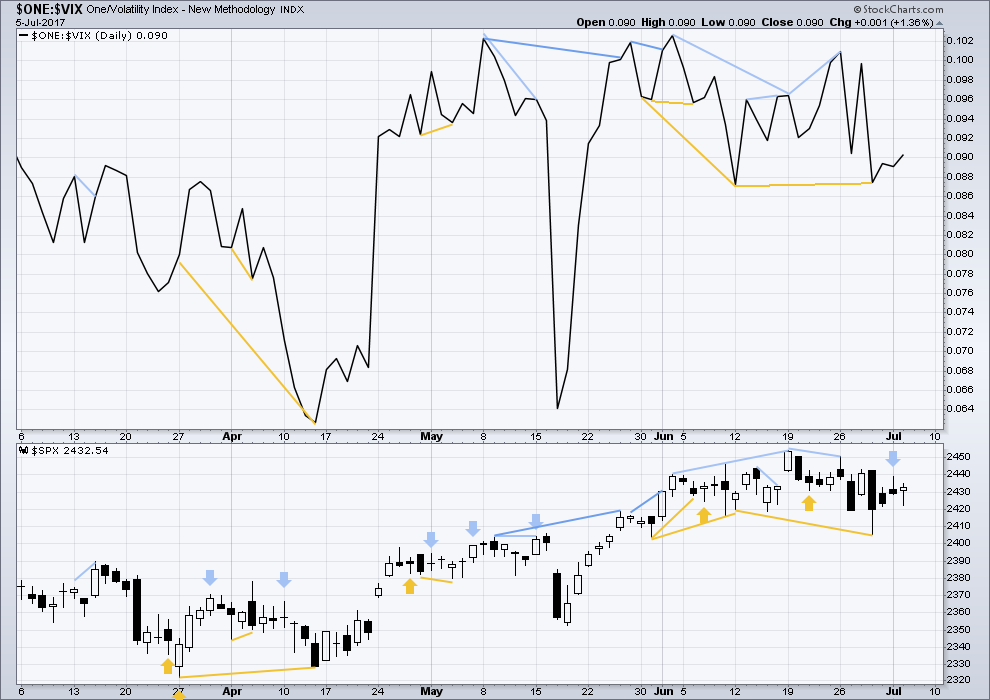

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Single day bearish divergence has now been followed by a downwards day. It may be resolved here, or it may need one more day to resolve it.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

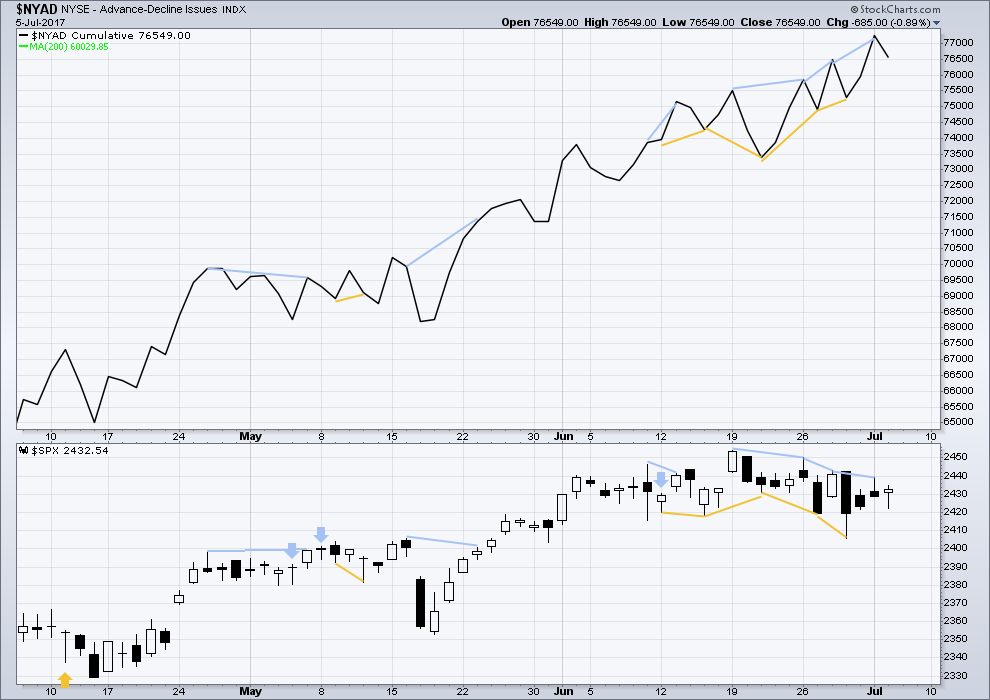

With the last all time high for price, the AD line also made a new all time high. Up to the last high for price there was support from rising market breadth.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

Bearish divergence noted in last analysis has now been followed by one downwards day. It may be resolved here, or it may need one more day to resolve it. There is no new divergence today. Price fell with a corresponding decline in market breadth.

The mid caps and small caps have made new all time highs along with recent last all time high for large caps. The rise in price is seen across the range of the market, so it has internal strength.

However, there is now some weakness becoming evident within small and mid caps. The number of equities down 20% or more from their all time highs is greatest in small caps, next in mid caps, and least in large caps. This is only an early sign of weakness developing.

Historically, almost every bear market is preceded by at least 4-6 months of divergence with price and market breadth. There is no divergence at all at this time. This strongly suggests this old bull market has at least 4-6 months to continue, and very possibly longer.

DOW THEORY

The DJT today has finally made a new all time high. This confirms a continuation of the bull market.

Nasdaq still has not made a new all time high. Modified Dow Theory (adding in technology as a barometer of our modern economy) indicates some weakness at this time within the bull market, but there is zero indication that it is over.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

This analysis is published @ 07:33 p.m. EST.

The market has no sellers, that is the problem. It is literally declining under its own bloated weight. Volume today is low for a third wave. I guess we need to get used to slow-motion third waves until we get some kind of fear inducing catalyst.

Yea but… remember, it’s the big summer holiday week here in the US.

Well, it would seem as if banksterism is manifesting itself in the form of tortuous slow motion second waves. We now have remarkable five nested first and second waves. How long can they keep this up???!!!

They’ve trained the algos one way, and they’ll break them the other. I see a bear nest and a move to 2270, with a decent probability the top is in. I don’t believe this market will give the traditional topping signals we’ve seen in the past, and most market constituents, both clients and managers do not know how to handle volatility. Further, risk parity is beginning to get blown at, smart beta/low vol etfs are ticking time bombs, on top of the margin calls that will begin around 2300. Whether it’s now or 6 months from now, it’s going to be pretty epic!

I have had the same feeling for quite some time. There is something different…ominous about this market and the way it has been acting. Even the great McClelland has been talking about the usual signs that always accompany tops and projects at least another year of the bull run. My theory has been that the market will not fall if the banksters can stop it from doing so and that is based on how I have seen them react to declines for a very long time now. This implies that once it starts falling it is going to have a long way down to go.

I was looking at the chart of ORLY and what it did yesterday and suspect we are going to eventually see something similar with these indices.

Indeed, same with APRN

Back into short positions. Why did I let the banksters rattle my cage?!

Gotta go with Lara’s count…AND price targets. 🙂

Because they’re very good cage rattlers?

That’s the psychology of second wave corrections. Don’t they do it so very well!

ln spades!

Just want to say your video on developing an alternative count is very interesting and educational. Thank you.

Cheers, Nick. I do those very occasionally. It’s good to hear you find it useful. I think I’ll do them a bit more often.

Learning EW rules and guidelines is the easy part. Doing EW IRL is hard. My theory is if you can see my thinking process it may help.

hi

Hi Doc 🙂