A small pullback was expected to be relatively brief and shallow. So far price is meeting this expectation.

Gaps will be used for trading advice for members with long positions.

Summary: A brief shallow pullback may have ended at today’s low. This may present an opportunity to join the upwards trend. Stops may be set just below the last gap which has its low at 2,356.18. The target is at 2,469.

A new low below 2,344.51 would be bearish; if that happens, expect price to continue lower to 2,319.

Always remember my two Golden Rules for trading:

1. Always use a stop.

2. Invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly and weekly charts are here. Last historic analysis video is here.

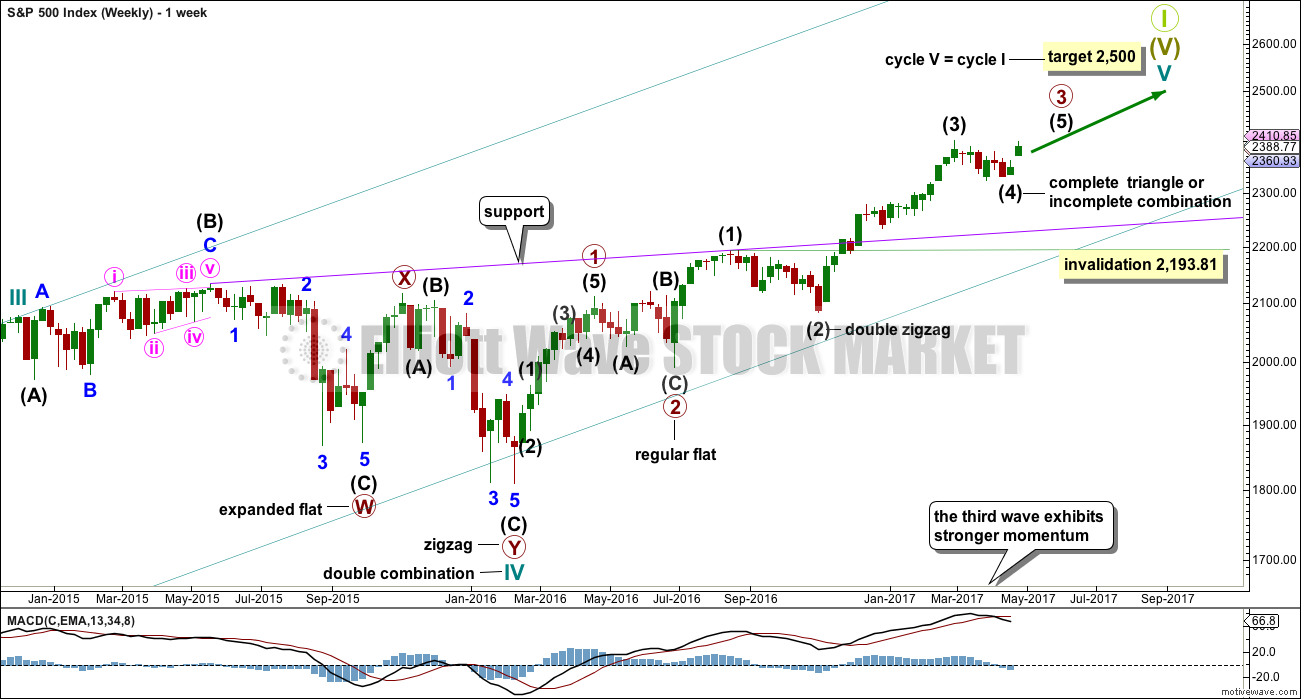

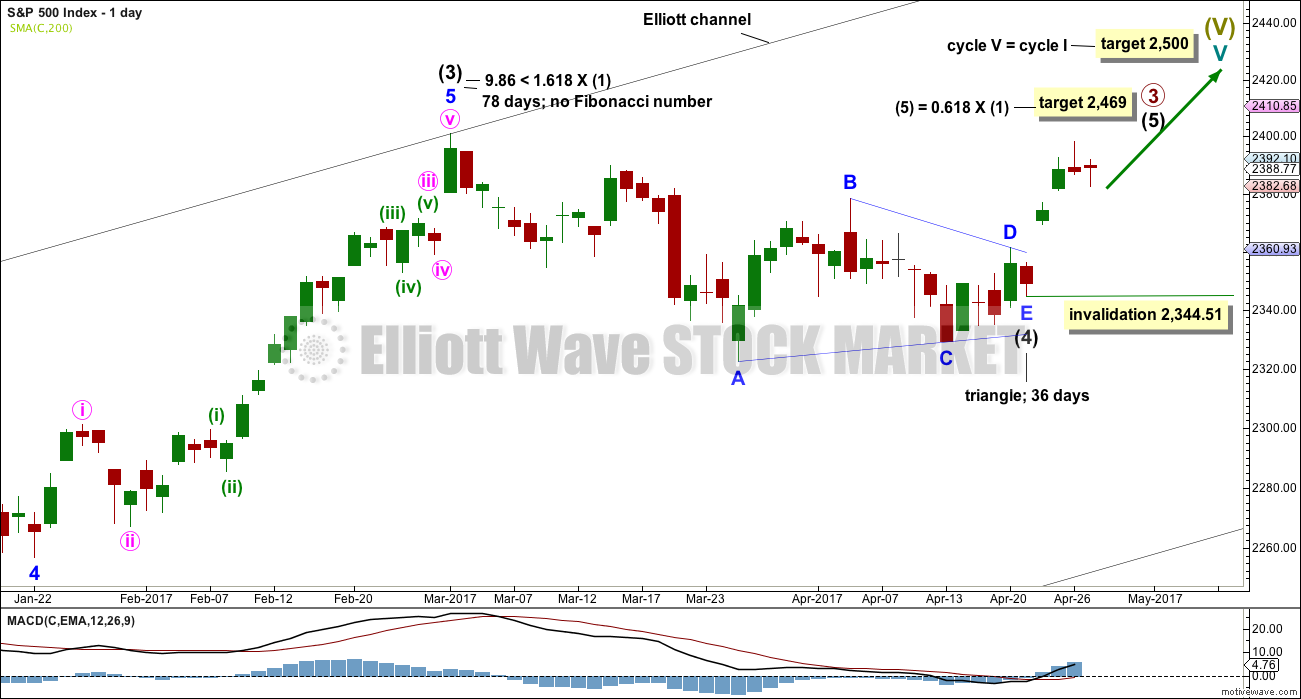

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the middle of primary wave 3 a stretched out extension, which is the most typical scenario for this market.

Primary wave 3 may be incomplete. A target is now calculated for it on the daily chart.

There is alternation within primary wave 3 impulse, between the double zigzag of intermediate wave (2) and the possible triangle or combination of intermediate wave (4).

When primary wave 3 is a complete impulse, then a large correction would be expected for primary wave 4. This may be shallow.

Thereafter, primary wave 5 may be expected to be relatively short, ending about the final target at 2,500.

DAILY CHART

Primary wave (4) may be a complete regular contracting triangle. It may have come to a surprisingly swift end with a very brief E wave.

There is already a Fibonacci ratio between intermediate waves (3) and (1). This makes it a little less likely that intermediate wave (5) will exhibit a Fibonacci ratio to either of intermediate waves (1) or (3); the S&P often exhibits a Fibonacci ratio between two of its three actionary waves but does not between all three.

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,344.51.

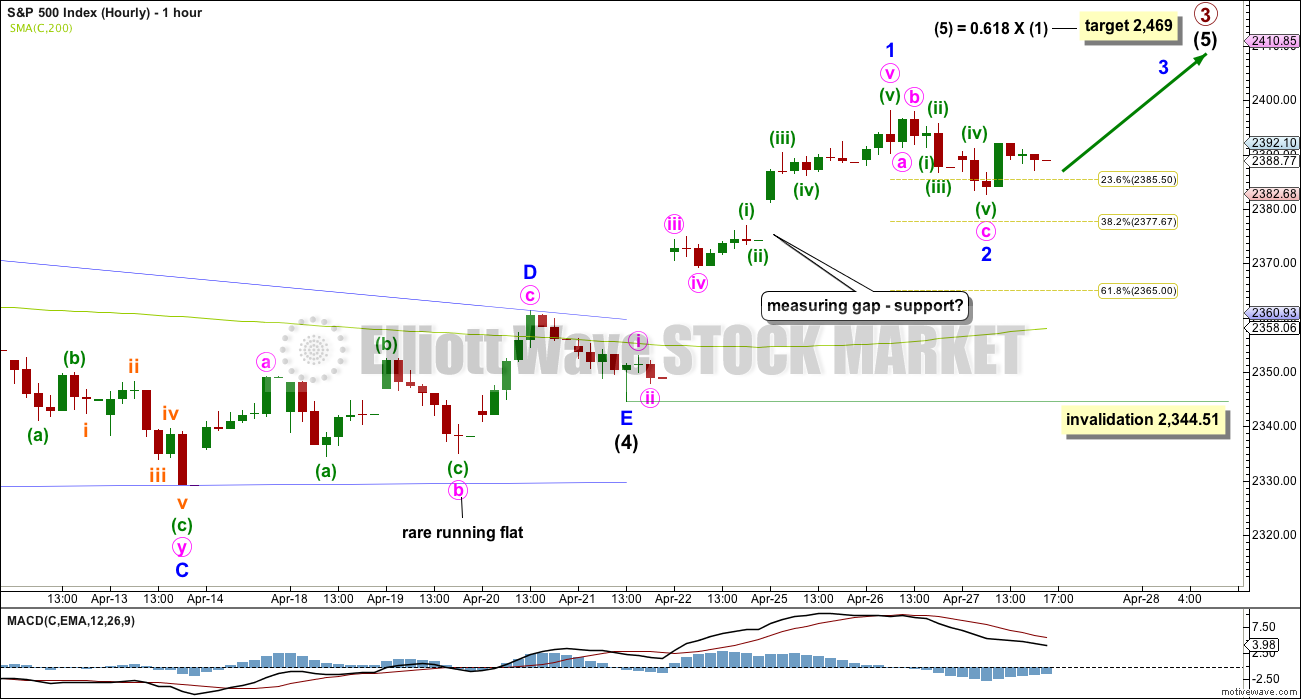

HOURLY CHART

The triangle may have come to a surprisingly quick end. Triangles normally take their time, so this quick end does slightly reduce the probability of this first wave count. The rare running flat within minor wave D also slightly reduces the probability. For these reasons an alternate is provided below.

If the triangle is over, then the next wave up has begun. A five up may be complete. A three down may now also be complete for minor wave 2.

If the last gap is correctly named as a measuring gap, then it may not be filled; the lower edge may provide support. If this is the case, then minor wave 2 may be a relatively shallow correction, which should now be over. Within a new trend for this market, the early second wave corrections are often surprisingly brief and shallow.

If price closes the gap, then use the 0.618 Fibonacci ratio as the next target for minor wave 2.

Minor wave 2 may not move beyond the start of minor wave 1 below 2,344.51.

If price does make a new low below 2,344.51, then the alternate below shall be used.

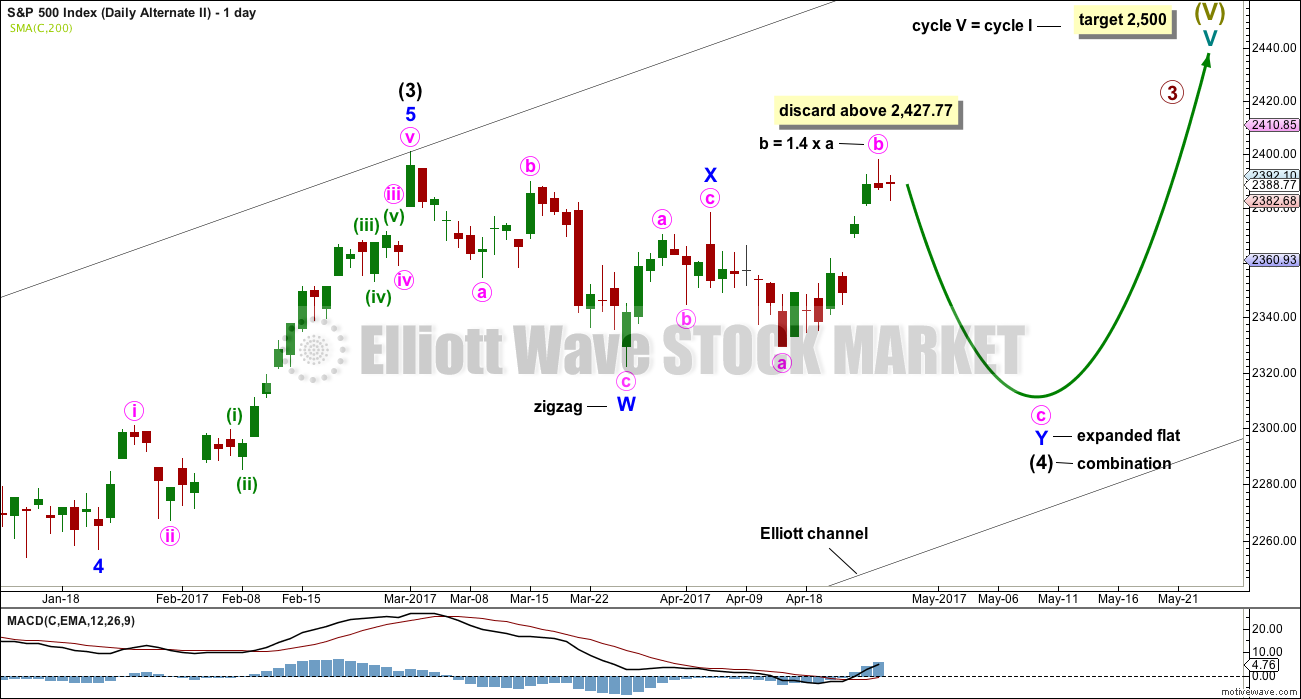

ALTERNATE DAILY CHART

What if intermediate wave (4) was not a complete triangle but is still unfolding as a double combination?

Double combinations are very common structures. This would still provide perfect alternation in structure with the double zigzag of intermediate wave (2). Although double zigzags and double combinations are both labelled W-X-Y, they are very different structures and belong to different groups of corrections.

The purpose of combinations is the same as triangles, to take up time and move price sideways. Intermediate wave (2) lasted 58 days. So far intermediate wave (4) has lasted 38 days. If it continues for another two or three weeks, it would still have excellent proportion with intermediate wave (2).

Although this wave count actually has a better look than the main wave count, it does not have support today from classic technical analysis. For this reason it will be published as an alternate with a lower probability.

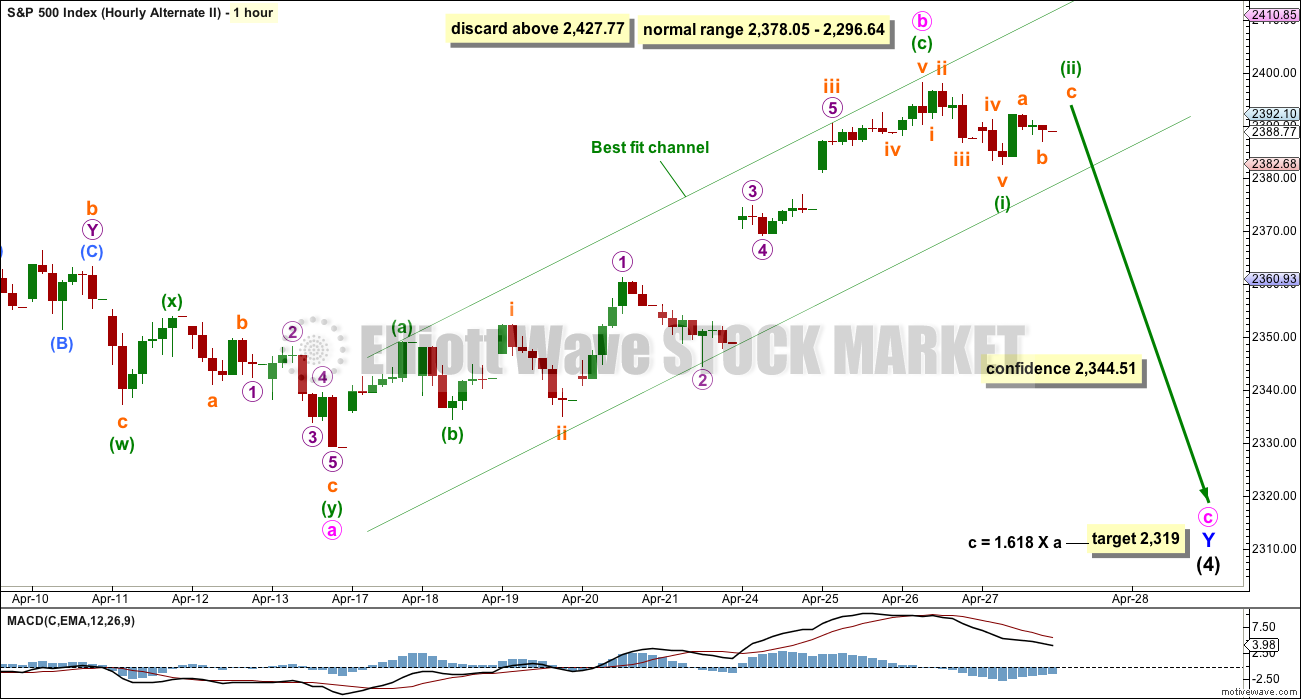

ALTERNATE HOURLY CHART

The problem of the running flat seen on the main hourly chart is here resolved.

The second structure of the combination may be an expanded flat labelled minor wave Y. There is no rule regarding the maximum length of B waves within flats, but there is an Elliott wave convention that states when the potential B wave reaches twice the length of the A wave the idea of a flat should be discarded based upon a very low probability. That price point would be at 2,427.77.

The most common Fibonacci ratio is used to calculate a target for minute wave c. If minute wave b moves higher, then this target must be moved correspondingly higher.

A best fit channel is used to contain minute wave b. If this channel is breached by downwards movement, it would be indicating that minute wave b is over and minute wave c is then underway.

Downwards movement within Thursday’s session fits better as a three than it does as a five. That structure offers more support for the main wave count than this alternate.

TECHNICAL ANALYSIS

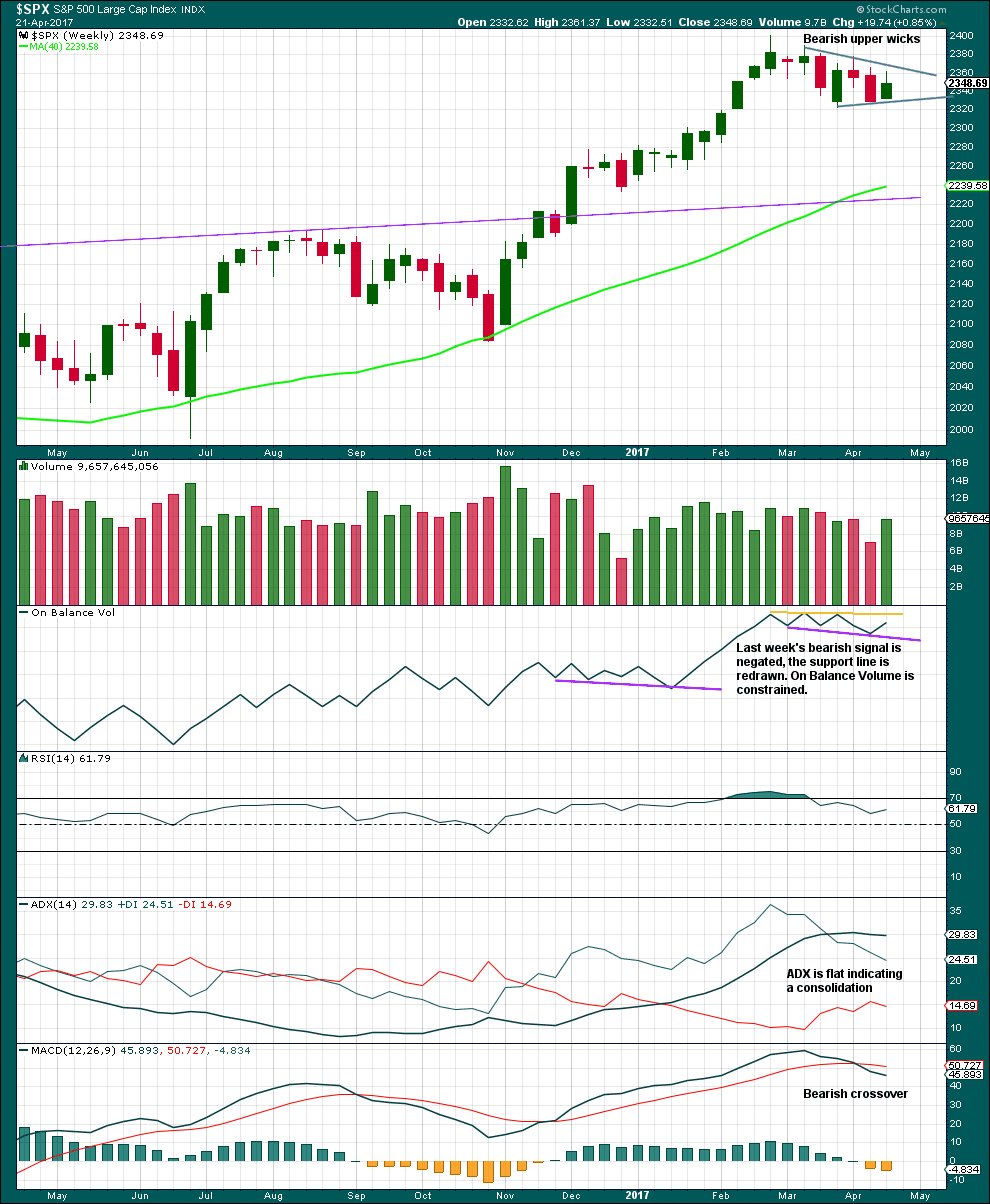

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An upwards week has stronger volume, but the bearish wicks of the last two candlesticks indicate more downwards movement.

On Balance Volume is constrained between support and resistance.

ADX indicates a consolidation. This supports the triangle.

RSI is neutral and MACD is bearish.

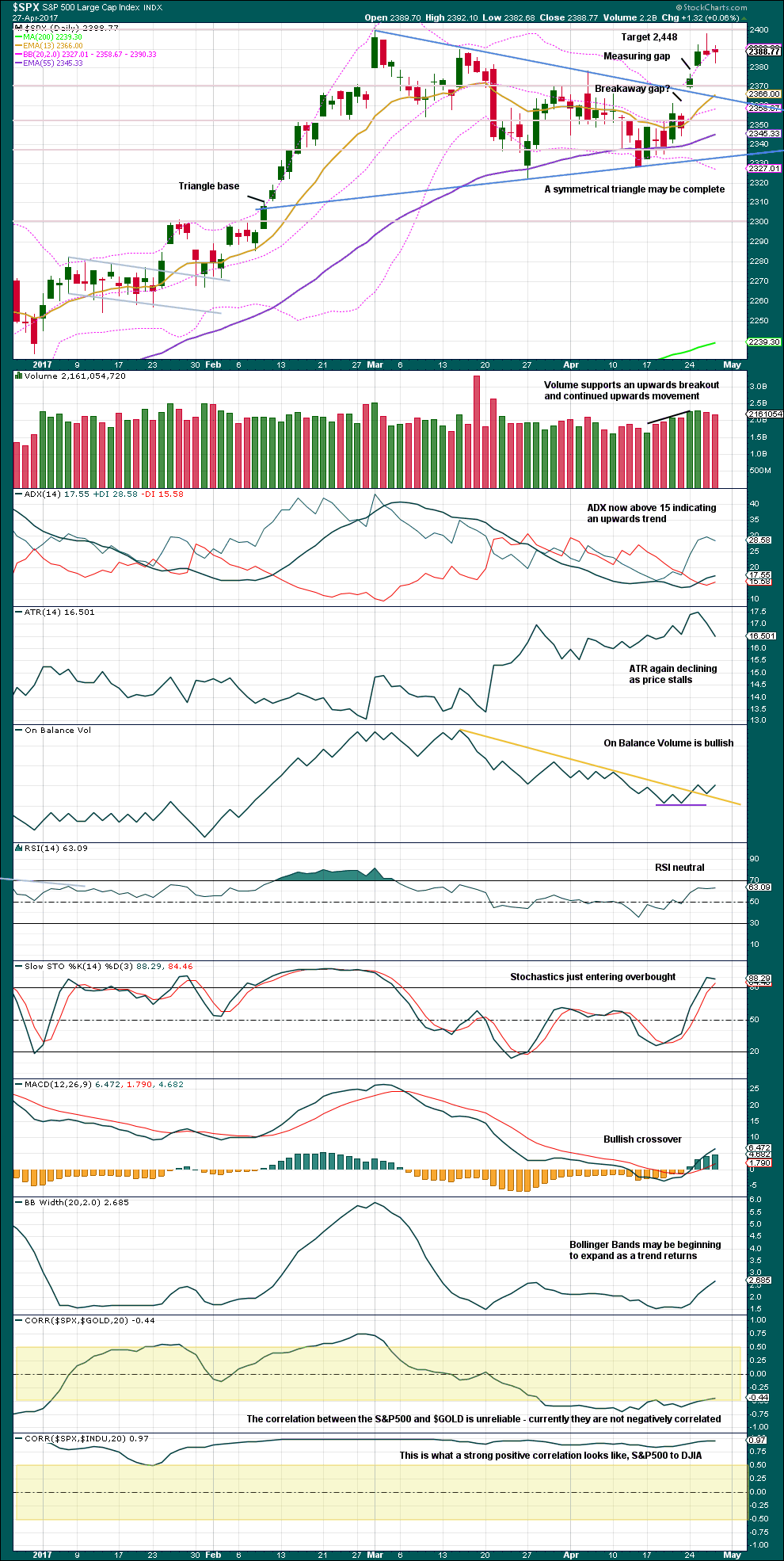

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Yesterday’s candlestick had a long upper wick, which was bearish. Now today’s candlestick has a long lower wick, which is bullish. These two candlesticks look like a small pause within an upwards trend.

So far the last gap is offering support. Long positions may still place stops just below the gap, based upon the assumption that the gap would be an exhaustion gap and not a measuring gap if it is closed.

Volume offers more support for upwards movement than the downwards movement of this session. This looks like a small pullback. ATR agrees.

Overall, this chart is bullish.

Note that the negative correlation between Gold and the S&P 500 has today broken down; these two markets are mathematically not correlated today. The correlation coefficient is above -0.5.

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

It is noted that there are now six multi day instances of bullish divergence between price and inverted VIX, and all have been followed so far by at least one upwards day if not more. This signal seems to again be working more often than not. It will again be given some weight in analysis.

There is single day divergence with price and VIX today: price moved lower, but volatility declined. This indicates weakness within price, so it is interpreted as bullish. This supports the main Elliott wave count.

There are four prior instances of bullish single day divergence noted on this chart. The first two did not indicate the immediate next direction but the second two did.

There are seven instances of bearish single day divergence noted on this chart. Only four of those seven may be considered to have worked, so the odds are not much better than flipping a coin.

This divergence is noted but will not be given weight.

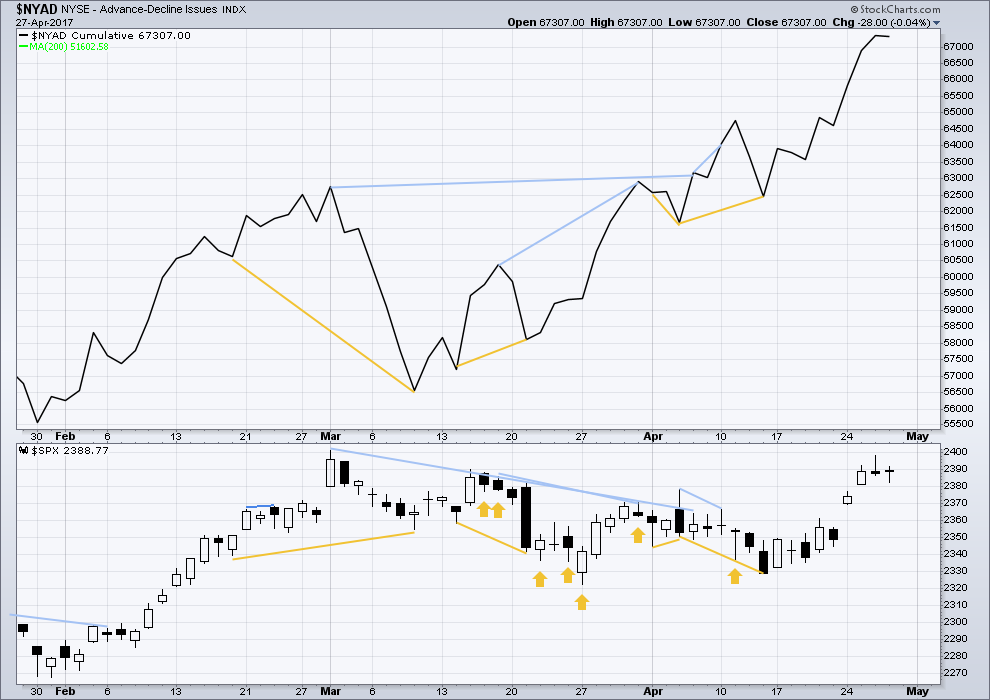

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

The rise in price has support from a rise in market breadth. Lowry’s measures of market breadth do not at this stage warn of an impending end to this bull market. They show an internally healthy bull market that should continue for at least 4-6 months.

No new divergence is noted today between price and the AD line. There is still longer term bearish divergence, but this has not proven reliable lately, so it will not be considered.

DOW THEORY

The DJIA, DJT, S&P500 and Nasdaq continue to make new all time highs. This confirms a bull market continues.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

This analysis is published @ 09:16 p.m. EST.

Looking for triple Qs to close gap at 135.74 for quick downside scalp.

Still holding 130 puts a few weeks out…

Declines still choppy and overlapping so banksters still clearly in control. I think we could be in for one more short final wave up before we get some good momentum to the downside….brutally boring!

NDX led to the upside, a bit concerning that it is not leading to the downside…

IWM finally tired of cavorting above B bands. The numerous other similary frisky frolickers should shortly follow methinks… 😀

Gap filled as well on the Russell, stochastic cross, as well as negative divergence from the previous high; looks like a island reversal in the making. NASDAQ is due, could key off 5-7% methinks. Shorted AMZN at open, holding for awhile.

Market hard to read right now. I would almost prefer to see it put in some kind of double top. We could see a hard sell-off into the close and a final manic wave up next week. I am not sure how long we can continue without some kind of real correction. Of course I have been saying that for quite some time! 🙂

yes indeed, been very hard to read since 2015. I believe that’s really when bankster allocations shifted from bonds to stocks in earnest. I’m surprised on how quickly my AMZN short is in the green and by how much. I wasn’t planning to cover until I saw an 8 handle but $22 in day is silly.

Brave man! That thing has been an absolute beast, and every short seller’s nightmare! I think it is one of the stocks that has NDX trading at ridiculous standard deviations. Nicely done!

Probably much more room to fall.

Yeow! After looking at that chart, it seems to be a put or two is in order! 😀

lot’s of divergences, silly gap, downgraded before open and I figured it’s gotta be close to best execution I’m gonna get. My initial targets are $840-$860 range. Took a little gain off the table, just to not be an a-hole

Isn’t it amazing that over 50% of SPX gains last few quarters came from just ten stocks?! I am keeping a very sharp eye on NDX. Weakness there will be an early warning.

Just went 100% long in short term account using TNA. Will go 100% long in medium and long term accounts by end of trading day.

Have a great weekend all.

Numero Uno. My one and only. Cheers.

hey,,,guess not

Congrats! You bested the Doc! 🙂