A strong bounce today is analysed to see if there is evidence of a sustainable low here.

Summary: There is no evidence to suggest the larger bull market is over. Downwards movement over the last four weeks is expected to most likely be a deep pullback, which has precedent in this secular bull market that began in 2009. It may be over at today’s low.

Today registered an 80% up day and completes a bullish long lower wick.

A new low below 2,728.81 would indicate a deeper correction that may end at the lower edge of the teal multi-year trend channel.

The biggest picture, Grand Super Cycle analysis, is here.

Last monthly charts analysis is here with video here.

ELLIOTT WAVE COUNTS

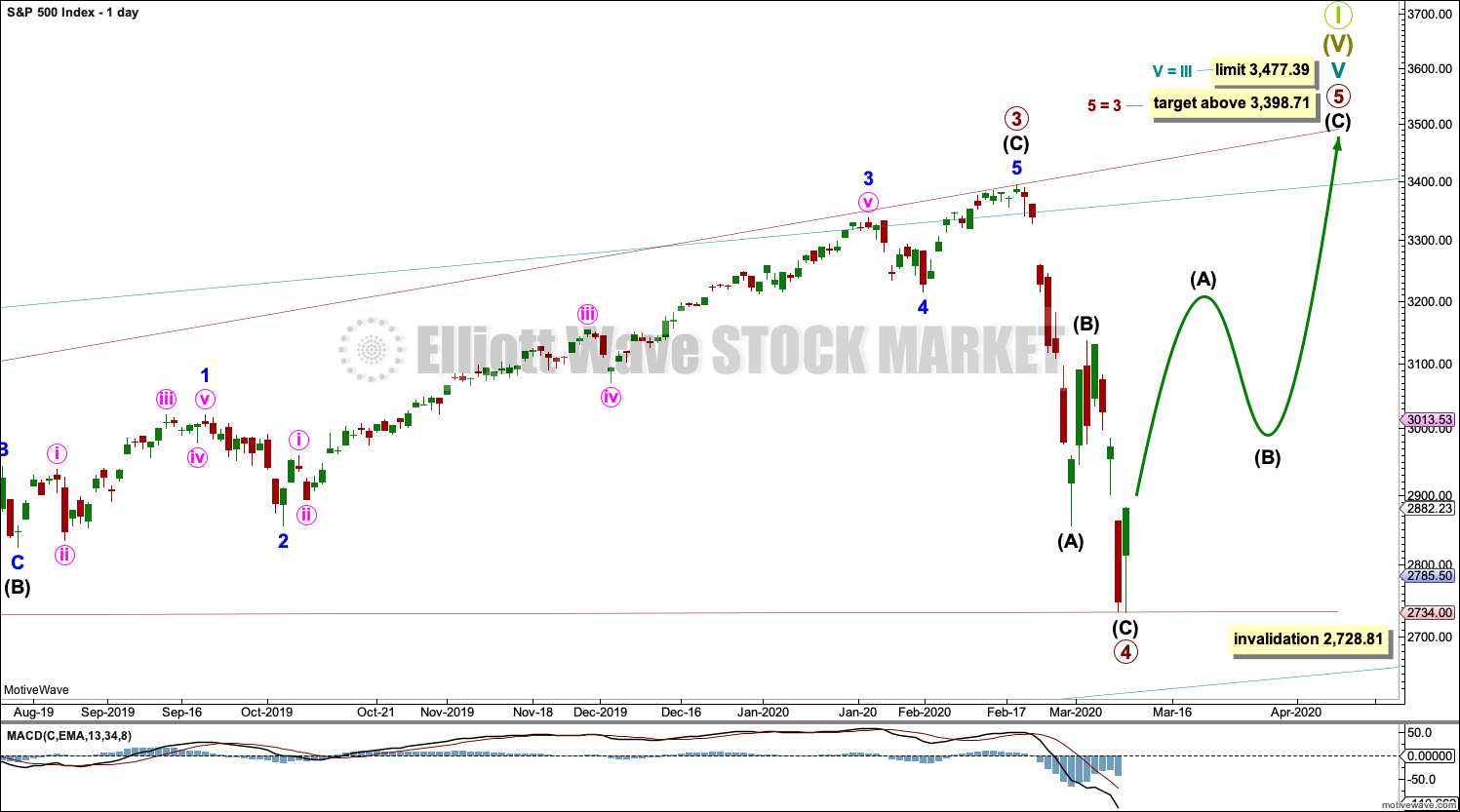

FIRST WAVE COUNT

WEEKLY CHART

Cycle wave V may subdivide either as an impulse or an ending diagonal. This wave count considers a diagonal. The alternate considers an impulse.

A channel is drawn about the impulse of Super Cycle wave (V) using Elliott’s first technique. Draw this channel first from the high of 2,079.46 on the 5th of December 2014 to the high of 2,940.91 on the 21st of September 2018, then place a parallel copy on the low at 1,810.10 on the 11th of February 2016. Cycle wave IV found support about the lower edge. The lower edge of this channel is currently very important and should be watched closely tomorrow.

The middle of the third wave overshoots the upper edge of the Elliott channel drawn about this impulse (off to the left of the chart). All remaining movement is contained within the channel. This has a typical look.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A new high by any amount at any time frame above this point would invalidate this main wave count in favour of one of the two alternate monthly charts which may be seen in last published monthly analysis.

At this stage, cycle wave V may end within this year or possibly into next year.

The daily chart below will focus on movement from the end of intermediate wave (B) within primary wave 3.

Ending diagonals require all sub-waves to subdivide as zigzags. Primary wave 4 of a diagonal must overlap primary wave 2. This rule is now met. Primary wave 4 may not move below the end of primary wave 2 below 2,728.81.

This ending diagonal would be expanding. Primary wave 3 is longer than primary wave 1, and primary wave 4 so far is longer than primary wave 2. Primary wave 5 would need to be longer than primary wave 3 for all rules regarding wave lengths of expanding diagonals to be met.

Downwards movement for this main wave count must end here for the wave count to remain valid. If primary wave 5 begins here, then it must be longer than primary wave 3 at 3,398.71.

DAILY CHART

All sub-waves of an ending diagonal must subdivide as zigzags. This is the only Elliott wave structure where a third wave sub-divides as anything other than an impulse.

Primary wave 4 must subdivide as a zigzag. Intermediate wave (B) within the zigzag may have been more brief than expected, and it may have been over last week. Intermediate wave (C) for this wave count may now also be over here.

Diagonals normally adhere very well to their trend lines, which may be tested within the sub-waves. The upper 1-3 trend line is tested at the end of minor wave 3 within intermediate wave (C) within primary wave 3.

Primary wave 4 may not move beyond the end of primary wave 2 below 2,728.81.

HOURLY CHART

It is possible to see primary wave 4 as a complete zigzag. A best fit channel is drawn to contain almost all of this movement.

A new high above 2,977.24 would invalidate the alternate below for the short term and provide some confidence in this main wave count.

A breach of the best fit channel would provide further confidence that a sustainable low may be in.

Strong confidence that a sustainable low is in place would come now with a 90% up day or another 80% up day tomorrow.

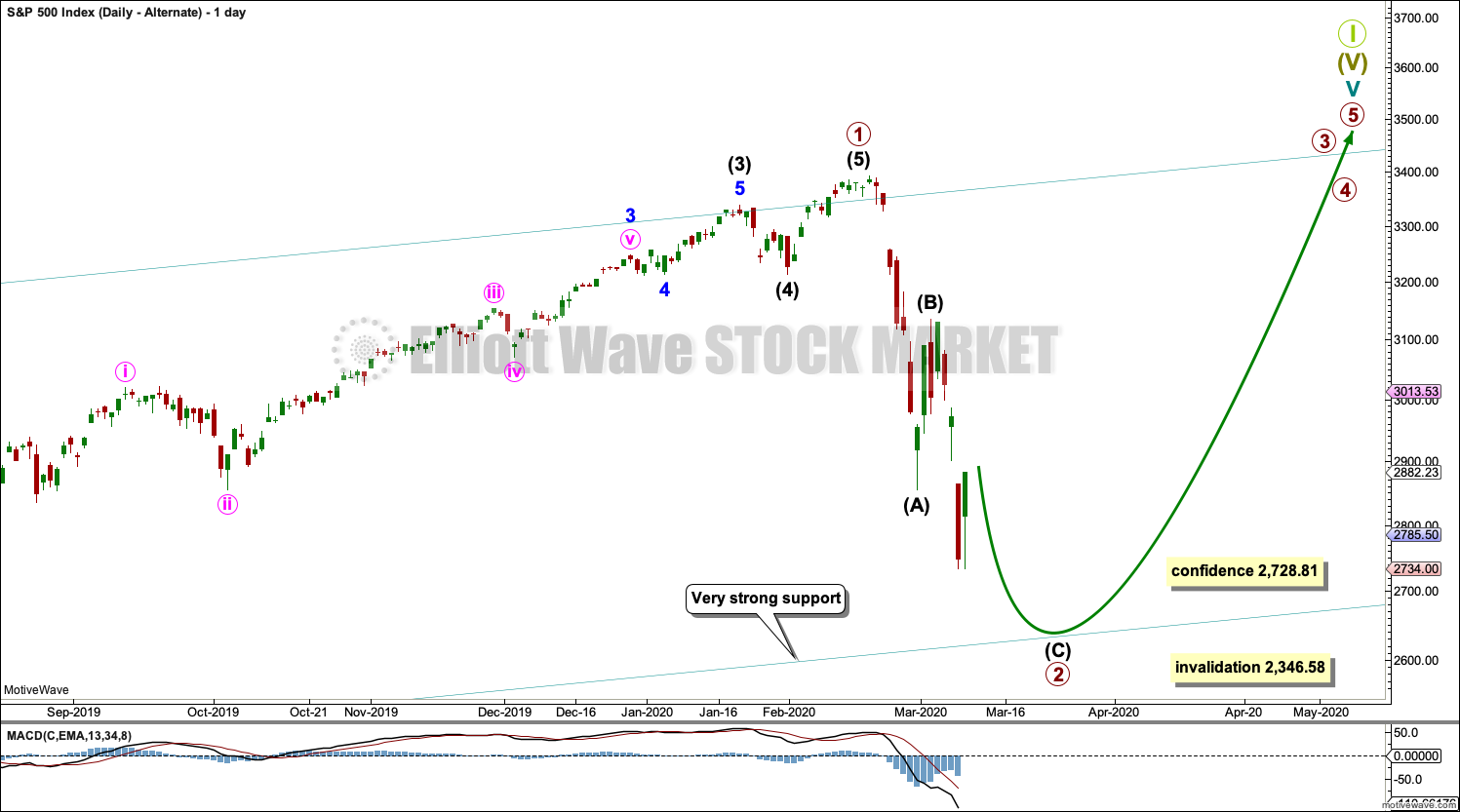

ALTERNATE WAVE COUNT

WEEKLY CHART

It is also possible that cycle wave V may still be unfolding as an impulse. Within the impulse, only primary wave 1 may be over at the last high.

Primary wave 1 is seen as an impulse. Within primary wave 1, there is poor proportion between the corrections of intermediate waves (2) and (4) and minor waves 2 and 4. This gives the wave count a forced look, but it is valid. The S&P does not always exhibit good proportion, so a little flexibility in the right look is sometimes required.

Primary wave 2 may be unfolding as a zigzag. It may find strong support about the lower edge of the multi-year teal trend channel.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

If the main wave count is invalidated with a new low below 2,728.81, then this alternate would then be used.

The limit is removed from this alternate. If only primary wave 1 is over at the last all time high, then more room would be required for the structure of cycle wave V to complete than the limit would allow. This alternate may fit with one of the alternate monthly charts.

DAILY CHART

This wave count allows for more downwards movement here. Primary wave 2 may not end until price comes down again to test the lower edge of the teal channel.

Primary wave 2 may be subdividing as a zigzag; this is the most common Elliott wave structure for a second wave. Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

It is possible that primary wave 2 could be over at today’s low. Both the main Elliott wave count and this alternate Elliott wave count may remain valid over the next several months.

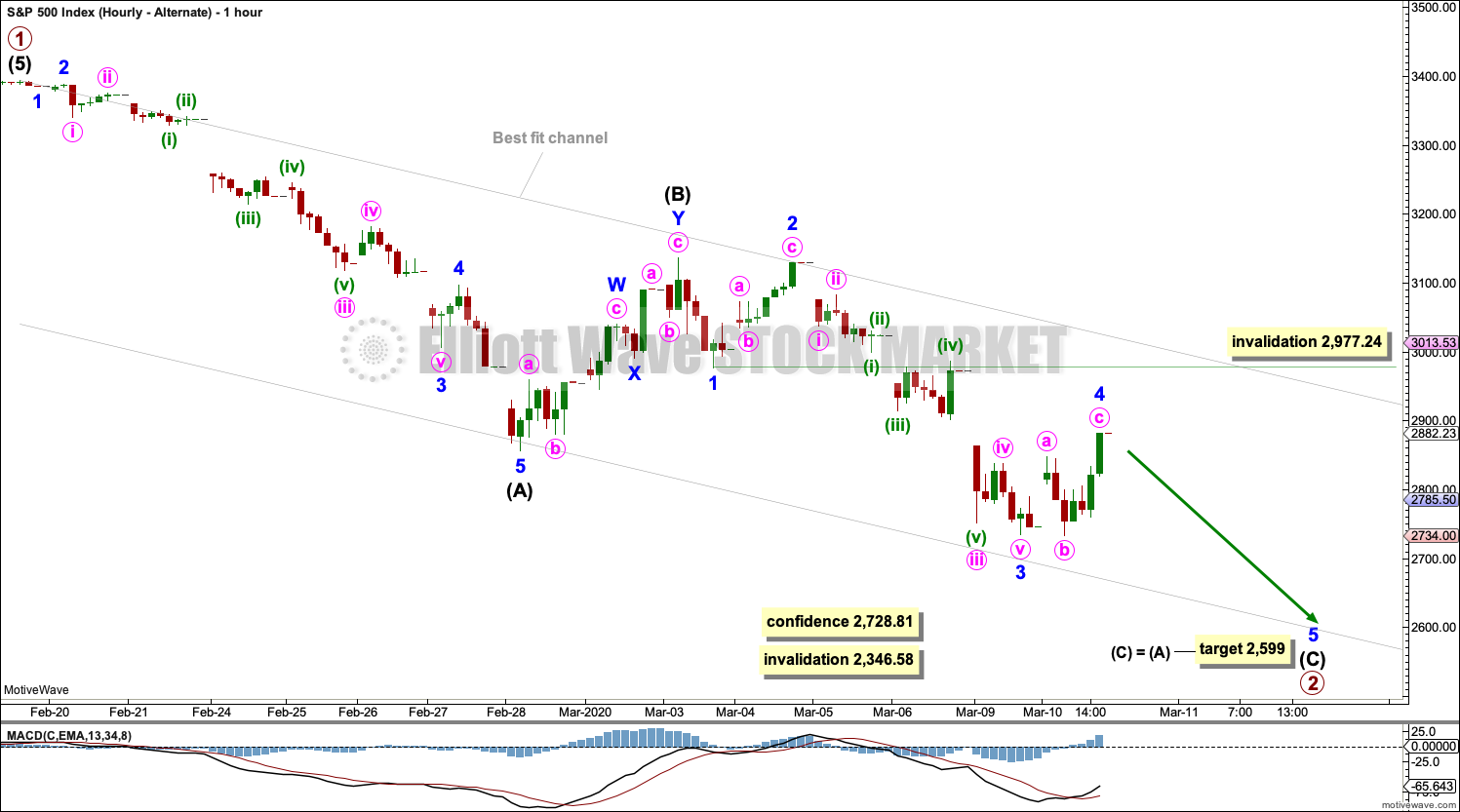

HOURLY CHART

Primary wave 2 may be incomplete. A target is calculated that may be a little too low. It would require a small overshoot of the lower edge of the teal channel. The lower edge of the channel may be a better guide to where primary wave 2 may end.

Intermediate wave (C) must subdivide as a five wave structure; it may be an almost complete impulse. Within the impulse, minor wave 4 may not move into minor wave 1 price territory above 2,977.24.

TECHNICAL ANALYSIS

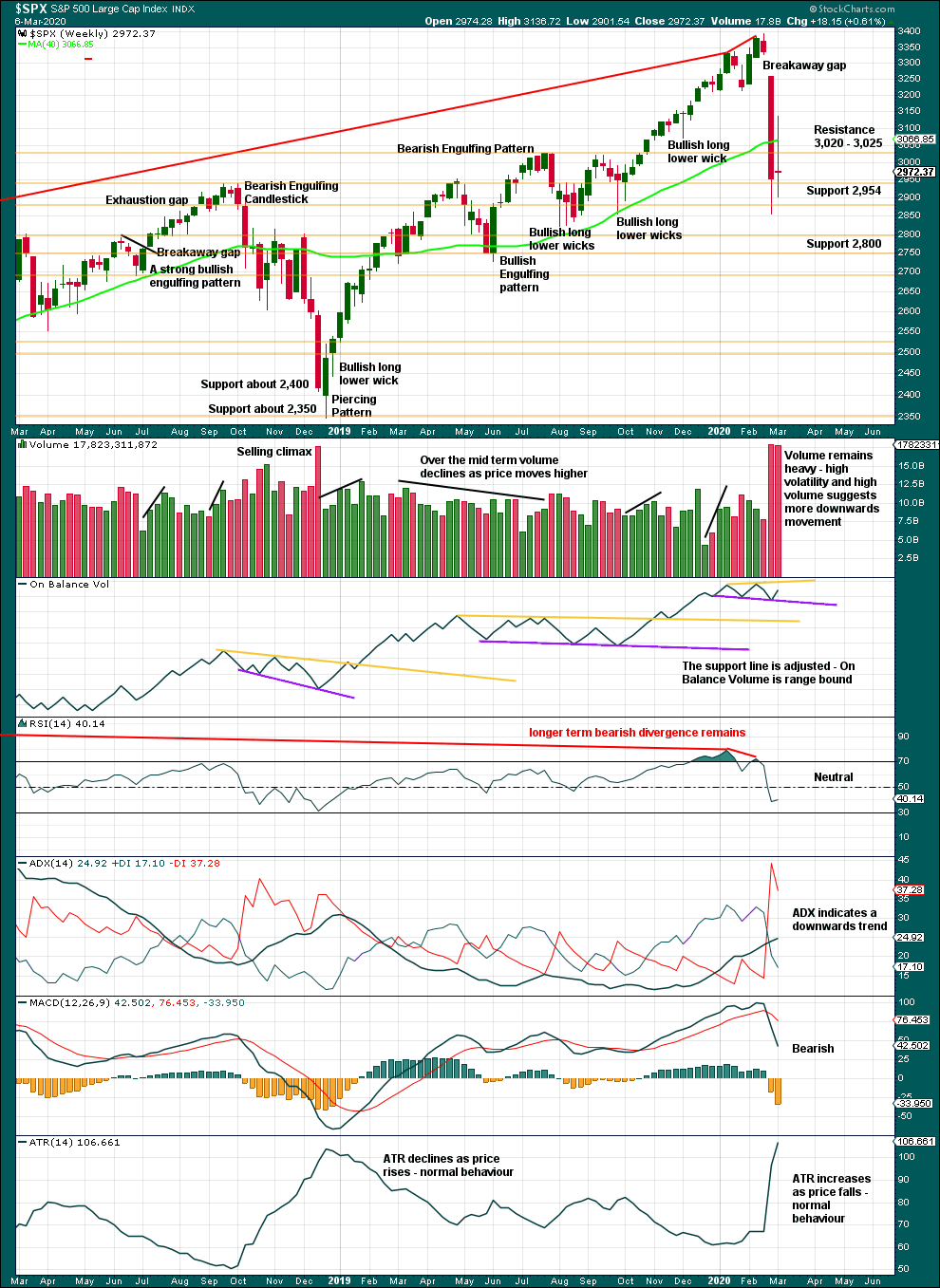

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A 19.4% drop in price (high to low) so far has precedent within the larger bull market. It does not necessarily mean the secular bull market must be over.

At the weekly chart level, conditions are not yet oversold; this pullback may be expected to continue further.

A long legged doji last week represents a pause, a balance of bulls and bears. This is not a reversal pattern; doji appear within trends or consolidations.

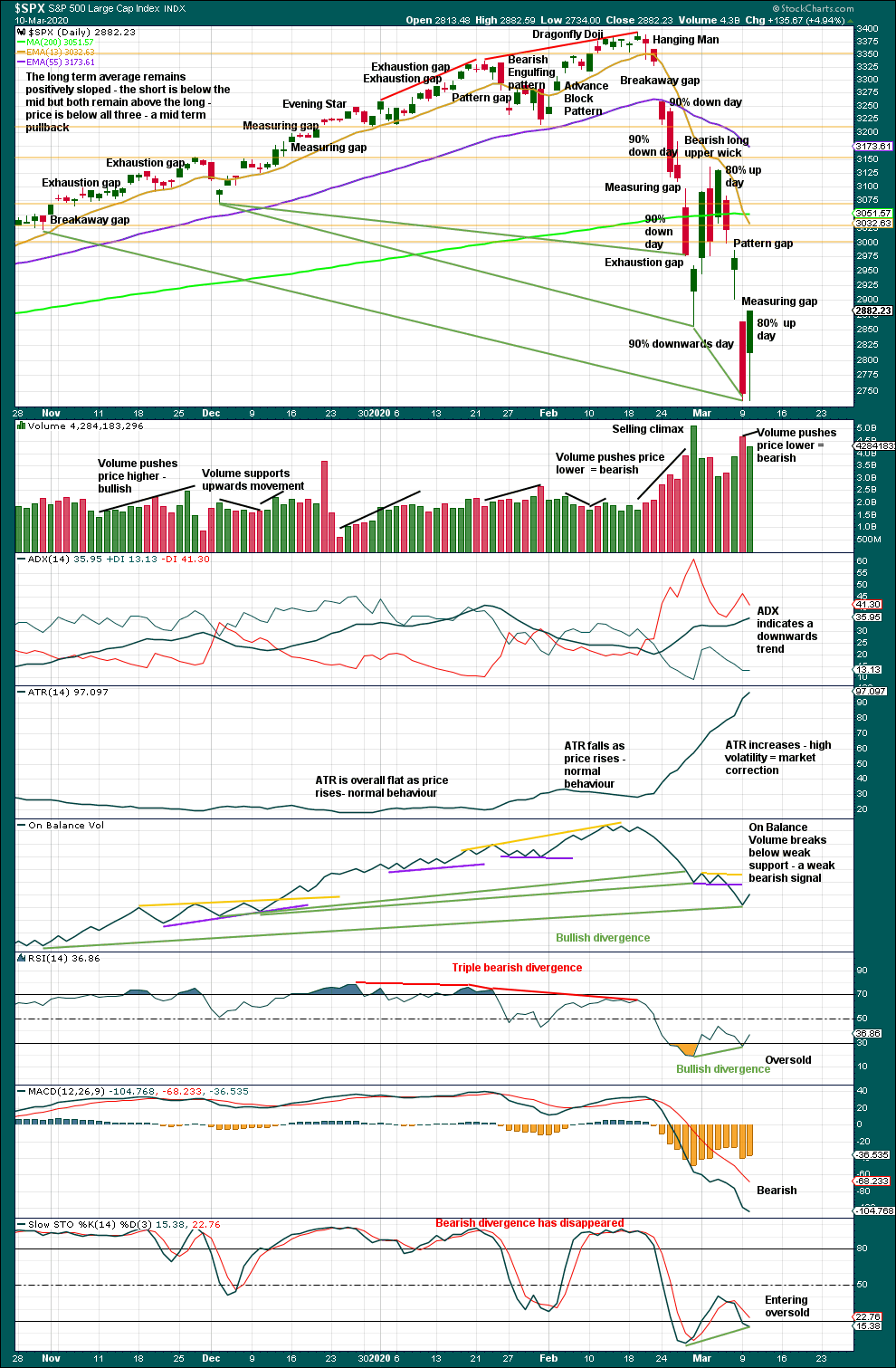

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are now four 90% downwards days in this strong downwards movement.

The following indicators now suggest a low may be in place here or very soon indeed:

– RSI reached deeply oversold and now exhibits short-term bullish divergence with price.

– Stochastics reached oversold and now exhibits short-term bullish divergence with price.

– On Balance Volume continues to exhibit bullish divergence with price.

The following indications will be looked for to provide confidence that a low is in place:

– A 90% upwards day.

– Two back to back 80% upwards days. This requires tomorrow to also complete an 80% up day.

– A bullish candlestick reversal pattern.

While the long lower wick today is bullish, it is not long enough to complete a hammer candlestick pattern as it is less than twice the length of the real body.

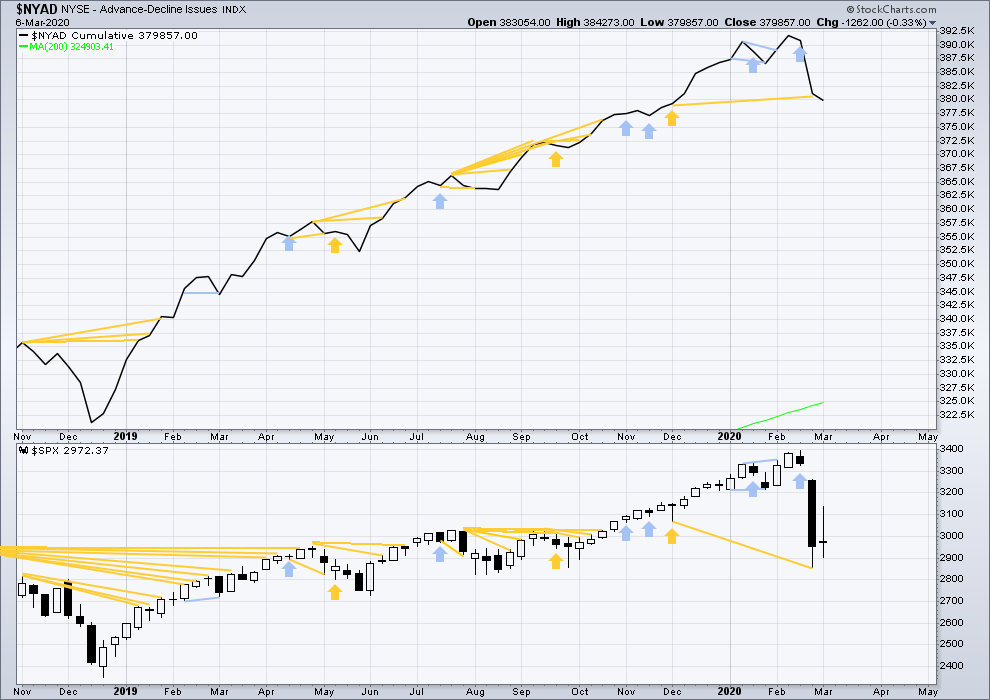

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs with last all time highs from price, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid June 2020.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

Last week price has moved sideways and the AD line has slightly declined. This is very slight bearish divergence.

Large caps all time high: 3,393.52 on 19th February 2020.

Mid caps all time high: 2,109.43 on 20th February 2020.

Small caps all time high: 1,100.58 on 27th August 2018.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Both price and the AD line have moved higher today. Neither have made new swing highs. There is no new divergence.

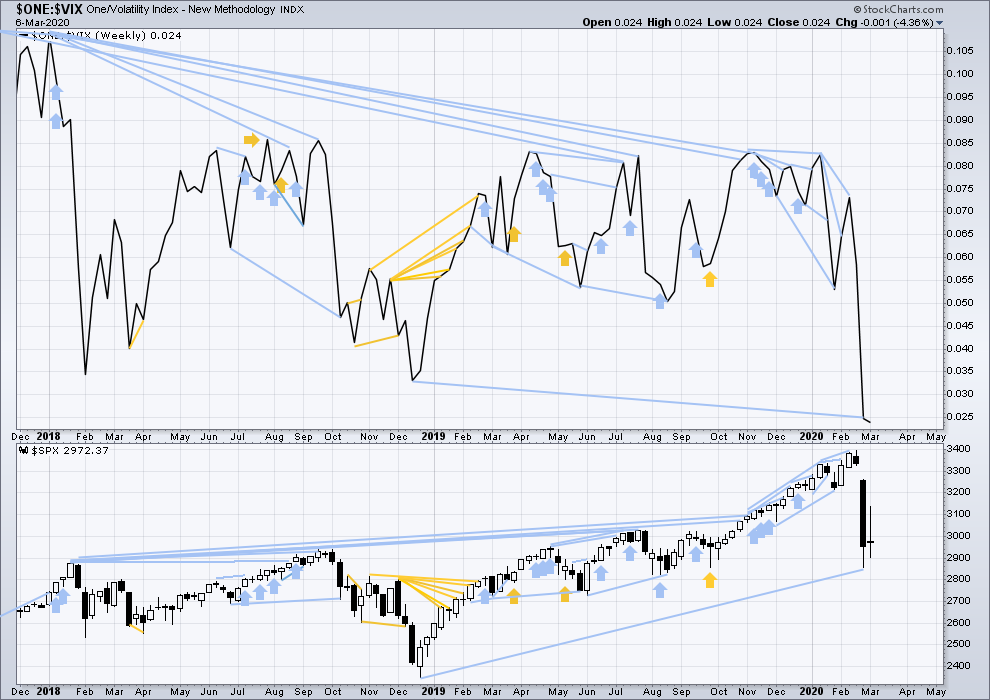

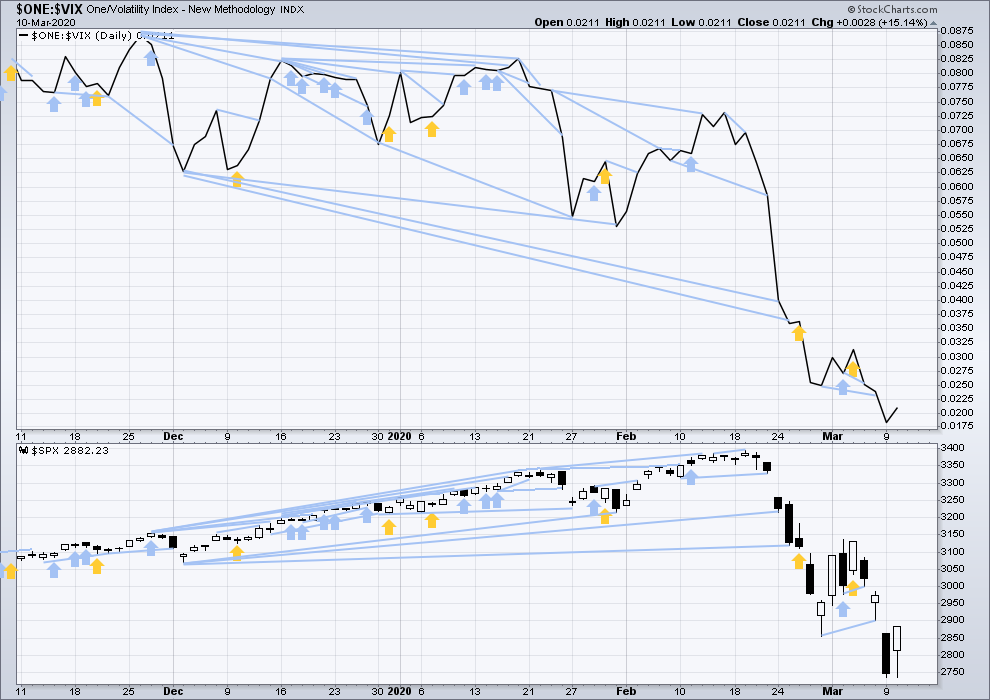

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX was on 30th October 2017. There is now over two years of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It is clearly not useful in timing a trend change from bull to a fully fledged bear market.

Last week price has moved sideways and inverted VIX has moved slightly lower. This divergence is bearish for the short term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Both price and inverted VIX have moved higher today. Neither have made new swing highs. There is no new divergence.

DOW THEORY

Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Dow Theory would confirm a bear market if the following lows are made on a closing basis:

DJIA: 21,712.53

DJT: 8,636.79 – a close below this point has been made on March 9, 2020.

S&P500: 2,346.58

Nasdaq: 7,292.22

Published @ 05:57 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Kevin’s comment he tried to post is here:

”

A trend is by definition “real”. But of course it’s always backward looking and no guarantee that it continues; in fact what we can always know for certain is that every trend eventually ENDS. That said, I agree with Lara’s basic thesis: assume as trend in motion will continue; make it prove it’s ending.

I also view trend as “more important” than EW count. EW count is mildly speculative; there are multiple alternatives. Trend isn’t speculative (though whether it continues is.)

As for measuring trend, there’s a sea of choices. Basic trend lines and relative slope (slope changes based on the time scale, so it’s relative slope between different trend lines on the chart that is important) is one way. DMI (ADX and DI+/DI-) is another way, but I find traditional interpretation of that to be “slow” (too delayed). Of course moving averages and their slow are a kind of measure of trend. I use my own “quantitative” (meaning, based on price change, NOT on any particular structure) trend indicator MVTI on thinkorswim which gives me the color coded bars, which tell me instantly what trend state is with 5 degree of trend state.

Then when you get to daily/weekly and we start to have historic measures of percentage moves like we have here, we are in “crazy strong” trend space. I don’t have a tool for measuring that. When I look at the action since the ATH, I also note that all of the corrective moves up have been rather weak; max of 50% retracements, vs. 62% or 78% levels, further telling me “the trend is REALLY strong here”. And the reversal back down from the close yesterday is an example of what happens when the down trend is hyper-strong; traditional bottom pivot structure and reversals to the upside fail quickly.

There’s a page on MVTI explaining it on my web site if you are interested. I find it an excellent way to look at a quad chart at different time frames (montly, weekly, daily, hourly) and instantly know what the immediate trend state is across all of them.

May the trend be with you!”

Is anyone having problems accessing comments or logging in?

Not me.

The ending diagonal is not working anymore. So SPX is in a 2. This end of day rally is suspect… Could we have finished A of 2?

I agree , we have gone thru 2728.81 . I now guess our ALTERNATE is now in play , Correct ? I never really understood how a 4 th wave could enter first wave territory . May be count a diagonal when it finished . Anyway , waiting for Laura’s expert count .

Fred, with impulse structures, you’re right, a fourth wave may not enter first wave price territory. The wave count Lara has been considering recently, until today, was an ending diagonal. In that case, its fourth wave *MUST* enter first wave price territory. Hopefully that helps.

Thank you Curtis . Just frustrated .

all ok

No

No problems, it’s all good, thanks.

Lara, turns out my problem seemed to be the message content. I email you (admin) the copy of the text causing the failure. Different text…no failure.

Great. Thanks Kevin, I’ve passed your message onto Cesar.

There you have it…! 🙂

Have a great evening everyone!

See ya tomorrow, GW…

A break of 2720.00 with an impulsive candle would be fairly conclusive imho…

IWM, NYSE, and DJIA have made new lows today. IWM has led the way down. Will it continue?

SPX 2764 and 2728 mentioned below have both given way to selling pressure. Look out, this could get nasty before we reach a sustainable low. Yesterday’s 80% up day is negated.

But, NYMO (McClellan Oscillator) is still above the lows of yesterday and Monday. This is another positive divergence. However, only the close matters. Watching very carefully.

What are you talking about?

Day’s Range 2,732.28 – 2,825.60

Low so far is 2707

It should have read 2734 and 2728 mentioned earlier today.

UVXY should swiftly clear 50 to confirm impending downward break….

Few things in trading are as difficult as waiting for patterns to fully play out…it is frequently what separates the…well, you know… 🙂

They have been strenuously fighting to prevent confirmation of a directional break and they will either succeed…or fail….

Somebody told me today that circuit breakers are turned off at 2:00 pm CST during the cash session and I had never heard that before. Does anyone know if that is accurate?

It seems to me that is a recipe for pandemonium if true…

Knock, knock, knock, on heavens’s door…

see you at 2600?

I was looking more for 2345 or 1900(even better)

Below 2733.15 triggers coil break…

If that breaks along with 2728 (low in early June 2019), the next support is at 2580 (trendline 2016 low to 2018 low). So 2600 SPX may be in the cards for a bottom and time to take long positions. If that doesn’t hold look out for 2200-1800 SPX.

Patience Patience Patience for long term, long trend bulls.

TLT has come down hard from the recent high. This may provide some support for equities. I emphasize ‘may’ provide support.

Hiya Rod.

A few months back I told a few traders that the enormity of what the banksters were doing would likely bring SPX 1800 into play if things got away from them.

Everyone thought I had gone stark raving mad.

At the time I was unsure of what kind of catalyst could unleash that kind of carnage…now we know…

Hope you picked some cheap plays on your read of the markets. I frankly thing govt’s have no clue and all these efforts are just attempts to see what might stick …I was hoping to see news ‘biden’s win on Tuesday leads to massive market selloff..’

The size and duration of this coil could be presaging a very violent move.

Cannot rule out another initial head fake before heading in the the final direction.

I would expect a gap higher in VIX if the direction of resolution is down….

Short term long opportunity: TDOC, in strong uptrend at daily/weekly, well positioned re: CV (phone in doctor service), has retrace strongly today to 61.8% and indicating it may be heading back up…

But it ran up so fast similar to what TSLA did. Not a good entry unless gets cheaper, IMHO. Maybe short term trade only.

I think open gap may be a magnet….

Here’s a really OUT THERE question.

With the general reaction to CV spread being “stay home, self quarantine” etcetera…

Is it possible the stock market are shut down at some point for weeks????? The ultimate indicator of an economy in a slowdown to beat all slowdowns? Just speculating here as I watch this market slowly degrade.

I’ll admit it, yesterday’s action sucked me in a bit on the long side. BAIL!!!! A great example of failing to SALUTE THE STRONG STRONG TREND first and foremost. I went with the shorter term structural action, which in normal times would probably have been good! Took my medicine this morning, didn’t taste good.

Hi Kevin,

could you please advise how we know that the strong strong trend is there and not just fake. Could you advise at what signs you look at? Its interesting as I’m definitely eager to learn from you as more experienced trader on this topic. As I want to avoid those moments as well in the future as much as possible.

Thank you.

I wrote a response…and every time I try to post it, I get an error!!! Don’t know why.

I’ll try again in succinct form: trends are always REAL. But no guarantee they continue. That said, “assume they will” is a strongly preferred tactic.

Measure them with trend lines (relative steepness and LENGTH of time indicates “strength”). Measure them with quantitative tools (DMI/ADX, CCI, my own custom MVTI, or others). Even moving averages (slope of) measures trend. I like MVTI because of it’s sensitivity, and it’s ease of “reading” particularly across multiple time frames.

Hope this helps. May the trend be with you!!

This is a longer, more violent Cobra than I have seen in quite some time.

It is very counter-intuitive to short the top range of the coil but as you can see, it’s like free money. Not sure if we will get another wave….in may ways were are in uncharted trading waters, so tread with care…! 🙂

Couldn’t agree more, normal patterns and the like are all suspect here. I will say it again FOR MYSELF because I failed in this regard yesterday: THE MASSIVE TREND IS YOUR FRIEND. And it’s down down down baby. Don’t fight the tape!!!

And I was successful based on YOUR coaching! …. and Verne … and Lara…. thank you

🙂

If I indeed helped, you are welcome.

To all the naysayers comparing this virus to regular flu and thinking it will go away as fast, here is Joe Rogan’s podcast to watch (1Hr+) with an acclaimed doctor. Please watch – it will open your eyes to realities of this virus and that we didn’t even see any of it yet. It’s not a panic but awareness that has to be built here. We are in a long haul and it won’t end tomorrow. Based on that, fundamentally, I believe markets didn’t price it in even close to what reality is.

The link is not allowed here, so just look for “Joe Rogan Experience #1439 – Michael Osterholm” on YouTube.

On the topic of highly leveraged ecosystem we are in: BA today announced to plan full drawdown of $13.8B loan – once big pieces start falling, the domino effect in this system might be unavoidable. This is a fundamental issue with that virus – not the virus itself, but the catalyst it becomes to bring the whole system down.

To all the naysayers comparing this virus to regular flu and thinking it will go away as fast, here is Joe Rogan’s podcast to watch (1Hr+) with an acclaimed doctor. Please watch – it will open your eyes to realities of this virus and that we didn’t even see any of it yet. It’s not a panic but awareness that has to be built here. We are in a long haul and it won’t end tomorrow. Based on that, fundamentally, I believe markets didn’t price it in even close to what reality is.

https://www.youtube.com/watch?v=E3URhJx0NSw&t=4543s

On the topic of highly leveraged ecosystem we are in: BA today announced to plan full drawdown of $13.8B loan – once big pieces start falling, the domino effect in this system might be unavoidable. This is a fundamental issue with that virus – not the virus itself, but the catalyst it becomes to bring the whole system down.

Today’s data is only PARTIAL.

The trend has definite exponential growth properties at this point (though it’s still early days).

I notice yesterday had a double bottom structure at 2733. And now more backing and filling above it, with each turn at the 61.8% retrace level of the last swing. Looks like a bottom pivot is probably forming.

Here’s the 61.8% ping ponging chart.

And bottom pivot leads to what? new lows?

A bottom pivot means a price turn back to the upwards direction. Which to a minor degree already happened; question now is, will it hold and continue, or get retested and possibly break? Structurally looks like it would hold. But factor in the tremendous down trend at the daily level, and then the fundamentals of what’s driving the down trend…and I get much more pessimistic about it. Waiting for clarity, tough market.

Completely agree – very very challenging.

Watch the battle of the round number at 2800.00….

Now that uptrent channel was broken again. I guess Verne was right about “Cobra”. They lull you in this fake uptrend to flush it later. Very tricky

Not to mention GS pulling the rug overnight ….

What’s that Peter??

GS manager says virus hit may be worse than market expects

I think that’s a very appropriate comment from Mr. GS. Re: my question yesterday, is recession priced in yet? Answer was a resounding “no”. Merkel just spoke truth: up to 70% of Germans may get this virus. If we get that kind of spread around the world (and the daily data indicates it’s heading in that direction, not the other way at this point), watch out below.

Back and filling (or pivoting back down!) in the overnight futures market, down over 50 points from the close, but appears to be stabilizing.

Now down close to 70 points or 2.7%. Hopefully, things turn around overnight.

Did I draw this correctly?

one….

That was quick!

when you are holding puts, gotta make sure that alternate is still alive

LOL 🙂

🙂