Upwards movement continues as expected.

Analysis of volume and breadth within this session indicates some strength. What happens tomorrow regarding volume and breadth will be important.

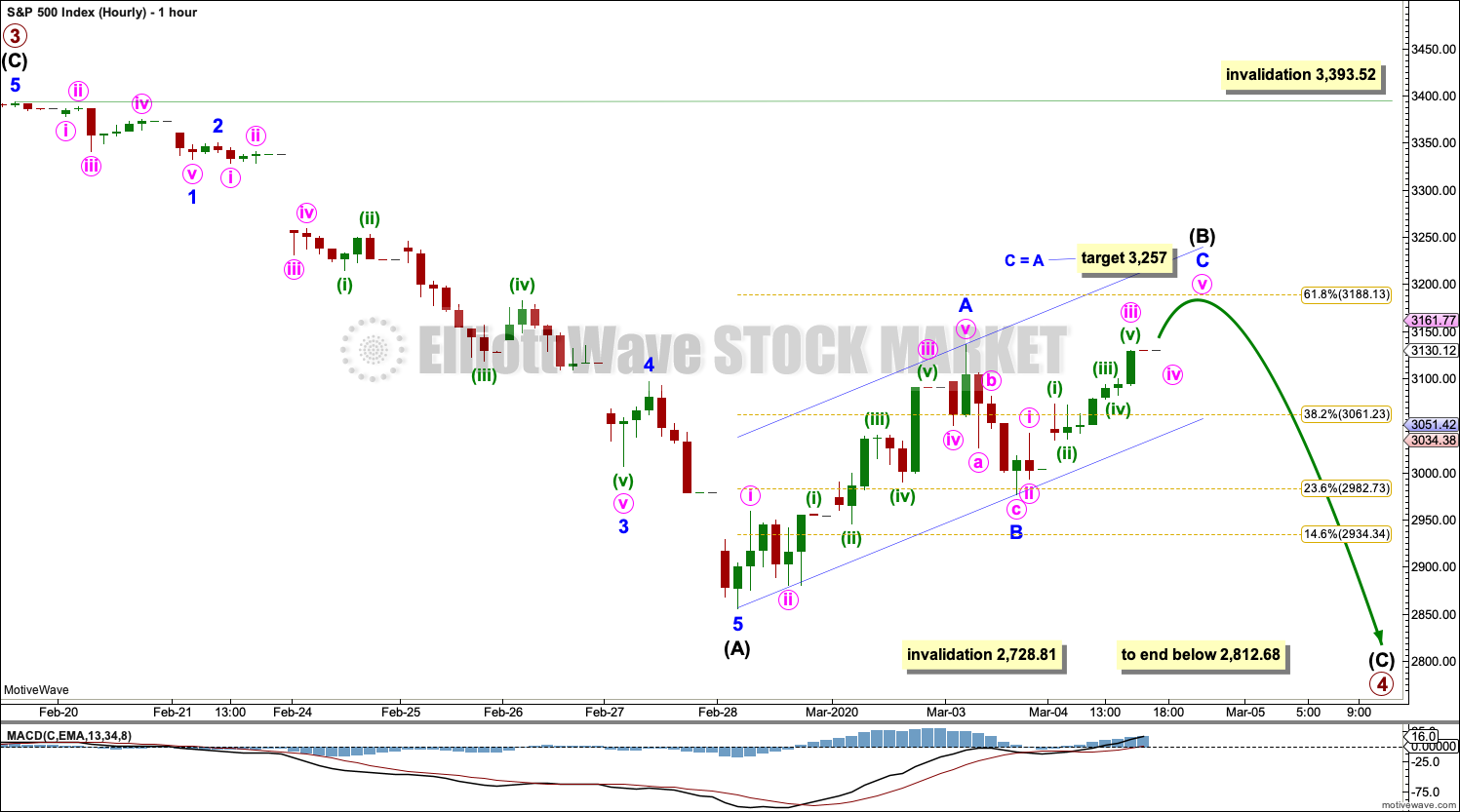

Summary: There is no evidence to suggest the larger bull market is over. The current pullback is very deep and not likely to be finished yet. At its conclusion, it may present a good buying opportunity.

For the short term, a bounce or sideways consolidation may continue for wave B. Targets for it to end are either 3,188 or 3,257. Thereafter, wave C may end below 2,812.68.

A new low below 2,728.81 would indicate a deeper correction that may end at the lower edge of the teal multi-year trend channel.

The biggest picture, Grand Super Cycle analysis, is here.

Last monthly charts analysis is here with video here.

ELLIOTT WAVE COUNTS

FIRST WAVE COUNT

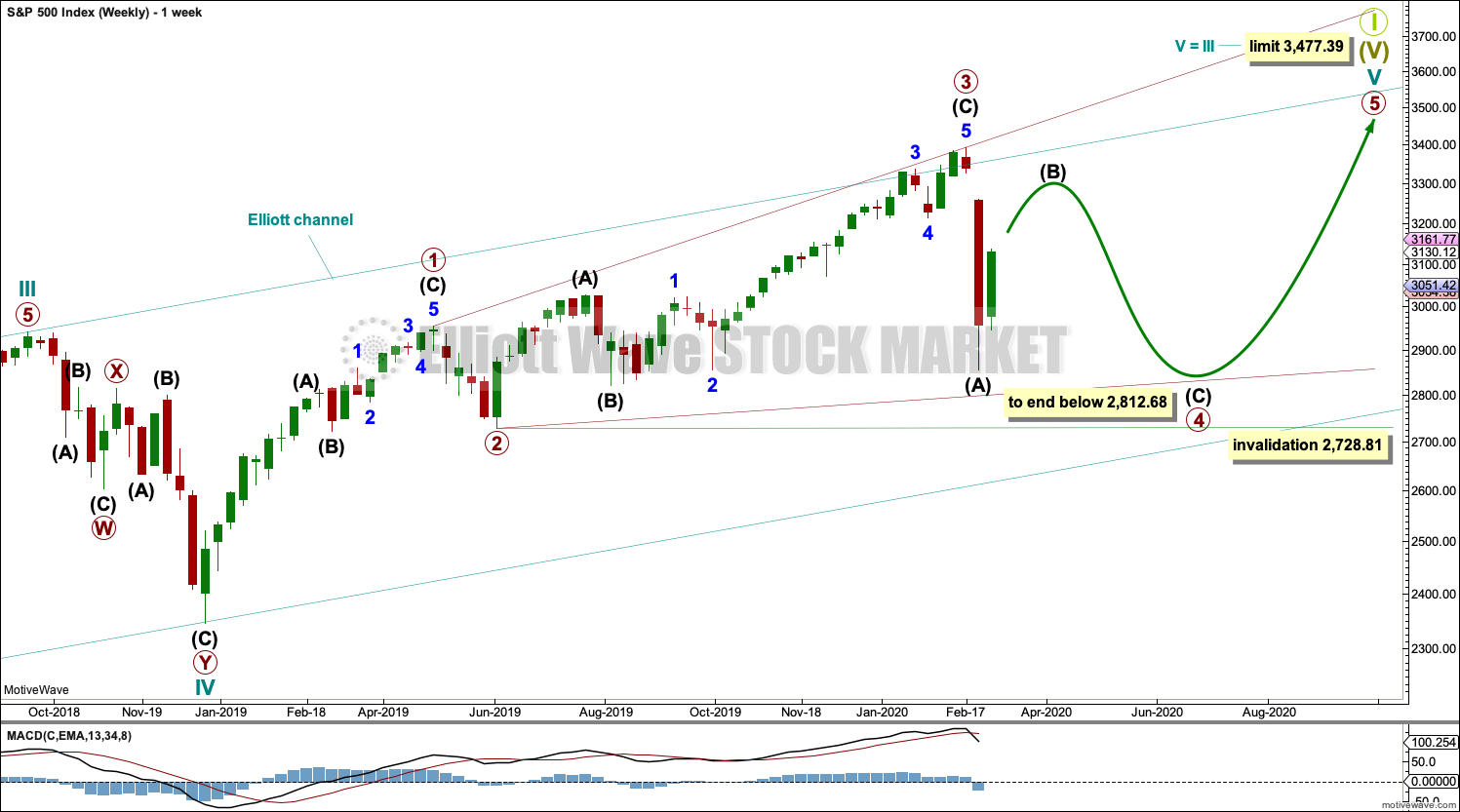

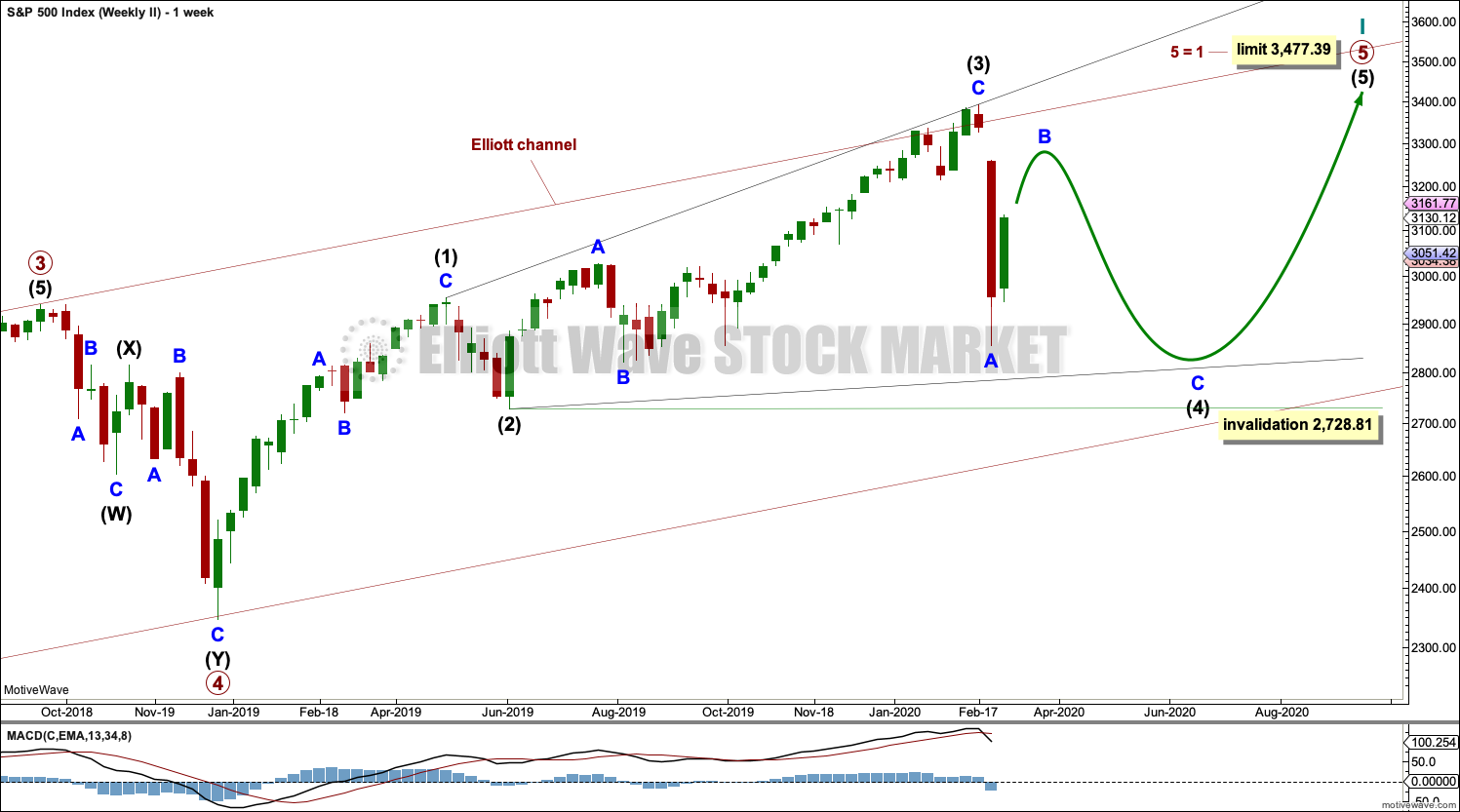

WEEKLY CHART

Cycle wave V may subdivide either as an impulse or an ending diagonal. This wave count considers a diagonal. The alternate considers an impulse.

A channel is drawn about the impulse of Super Cycle wave (V) using Elliott’s first technique. Draw this channel first from the high of 2,079.46 on the 5th of December 2014 to the high of 2,940.91 on the 21st of September 2018, then place a parallel copy on the low at 1,810.10 on the 11th of February 2016. Cycle wave IV found support about the lower edge.

The middle of the third wave overshoots the upper edge of the Elliott channel drawn about this impulse. All remaining movement is contained within the channel. This has a typical look.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A new high by any amount at any time frame above this point would invalidate this main wave count in favour of one of the two alternate monthly charts which may be seen in last published monthly analysis.

At this stage, cycle wave V may end within this year or possibly into next year.

The daily chart below will focus on movement from the end of intermediate wave (B) within primary wave 3.

Ending diagonals require all sub-waves to subdivide as zigzags. Primary wave 4 of a diagonal must overlap primary wave 2. This rule is now met. Primary wave 4 may not move below the end of primary wave 2 below 2,728.81.

This ending diagonal would be expanding. Primary wave 3 is longer than primary wave 1, and primary wave 4 so far is longer than primary wave 2. Primary wave 5 would need to be longer than primary wave 3 for all rules regarding wave lengths of expanding diagonals to be met.

Fourth and second waves of diagonals most commonly end somewhere between 0.66 to 0.81 of the prior wave. This gives a target zone for primary wave 4 from 2,954.81 to 2,855.10. However, this diagonal is expanding and primary wave 5 needs to be longer in length than primary wave 3, which was 664.71 points for this rule to be met. This rule needs to be met prior to the upper limit for cycle wave V at 3,477.39, so primary wave 5 would need to begin below 2,812.68.

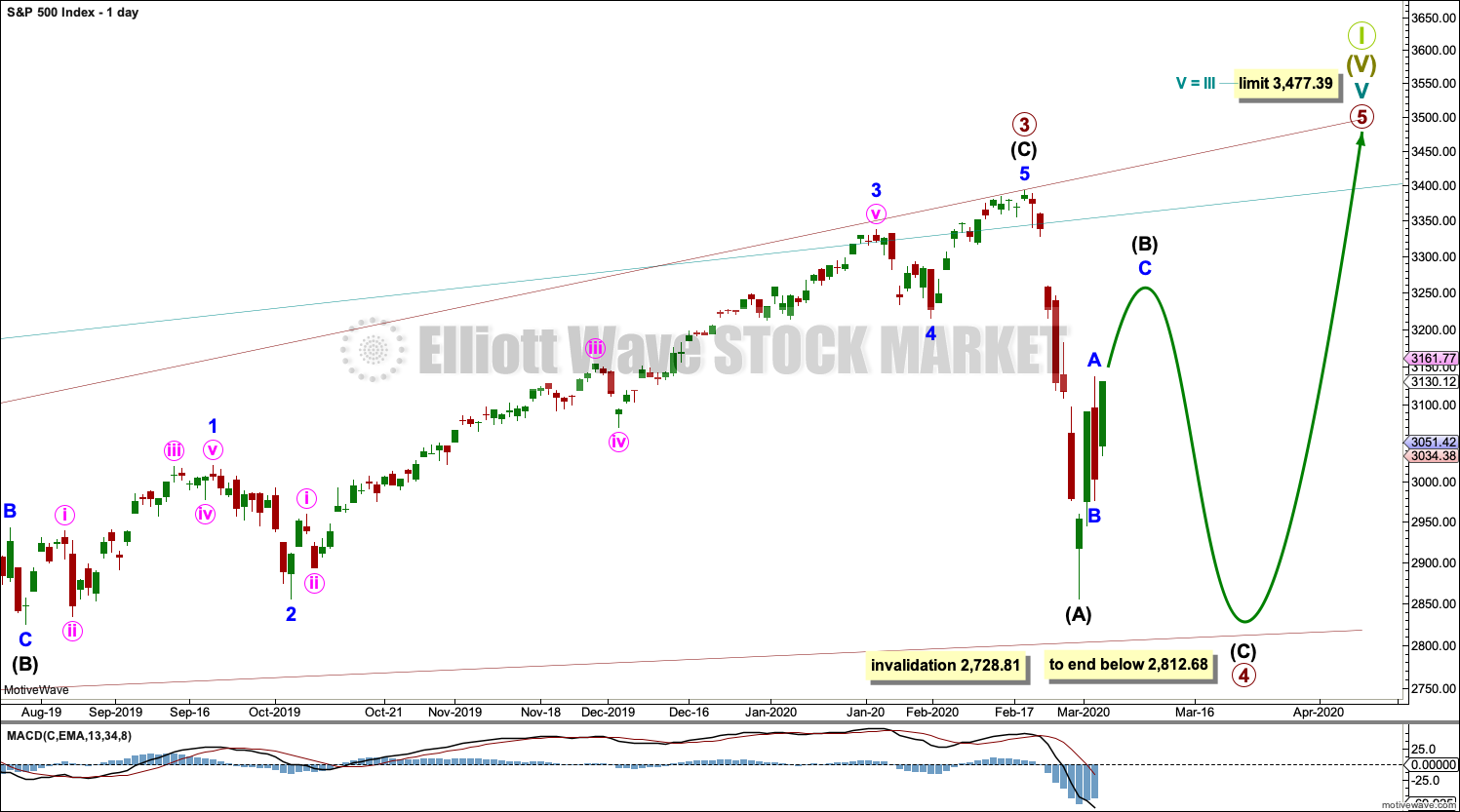

DAILY CHART

All sub-waves of an ending diagonal must subdivide as zigzags. This is the only Elliott wave structure where a third wave sub-divides as anything other than an impulse.

Primary wave 4 must subdivide as a zigzag. Within the zigzag, a sharp bounce or a time consuming sideways consolidation for intermediate wave (B) may be underway.

Diagonals normally adhere very well to their trend lines, which may be tested within the sub-waves. The upper 1-3 trend line is tested at the end of minor wave 3 within intermediate wave (C) within primary wave 3.

Primary wave 4 may not move beyond the end of primary wave 2 below 2,728.81.

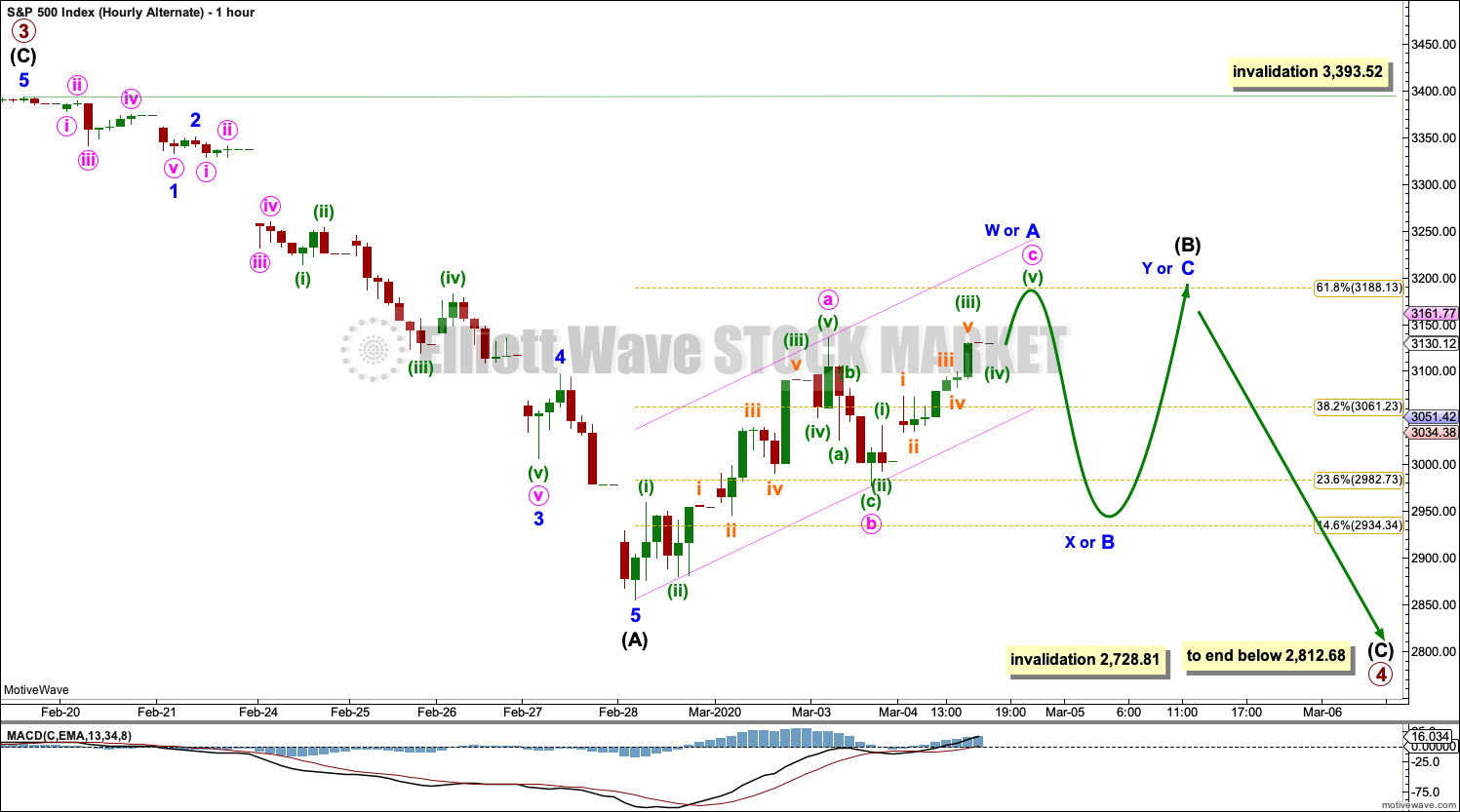

HOURLY CHART

Primary wave 4 within a diagonal must subdivide as a zigzag. Within the zigzag, intermediate wave (B) would very likely show on the daily and weekly chart for primary wave 4 to have the right look. Intermediate wave (B) now shows up on the daily chart.

Intermediate wave (B) may not move beyond the start of intermediate wave (A) above 3,393.52.

This first hourly chart looks at the possibility that intermediate wave (B) may be unfolding as a zigzag. This is the most common Elliott wave corrective structure, so this wave count has a higher probability than the alternate hourly chart below.

Within the zigzag, minor wave C may be an incomplete five wave impulse. Within minor wave C, minute wave iv may not move into minute wave i price territory below 3,041.76.

Draw a small channel about intermediate wave (B) using Elliott’s technique for a correction: draw the first trend line from the start of minor wave A to the end of minor wave B, then place a parallel copy on the end of minor wave A. Assume intermediate wave (B) is incomplete and may continue higher while price remains within the channel. If the channel is breached by downwards movement, then intermediate wave (B) may be over and intermediate wave (C) downwards may then have begun.

ALTERNATE HOURLY CHART

It is also possible to move the degree of labelling within intermediate wave (B) down one degree. Intermediate wave (B) may be unfolding sideways as a flat, combination or triangle. All of these structures begin with a three wave structure, or minor wave A or W, that may be an incomplete zigzag.

When minor wave A or W may be complete, then minor wave B or X may be a deep pullback.

The small channel drawn about minor wave A or W is the same on both hourly charts. Use the channel in the same way.

SECOND WAVE COUNT

WEEKLY CHART

This second wave count sees all subdivisions from the end of the March 2009 low in almost the same way, with the sole difference being the degree of labelling.

If the degree of labelling for the entirety of this bull market is all moved down one degree, then only a first wave at cycle degree may be nearing an end.

When cycle wave I is complete, then cycle wave II should meet the technical definition of a bear market as it should retrace more than 20% of cycle wave I, but it may end about either the 0.382 or 0.618 Fibonacci Ratios of cycle wave I. Cycle wave II may end close to the low of primary wave II within cycle wave I, which is at 1,810.10. It is also possible that cycle wave II could be fairly shallow and only barely meet the definition of a bear market.

An ending expanding diagonal is still viewed as nearing an end. This wave count labels it primary wave 5. Primary wave 5 may still need another year to two or so to complete, depending upon how time consuming the corrections within it may be.

Primary wave 5 may be subdividing as a diagonal, in the same way that cycle wave V is seen for the first weekly chart.

ALTERNATE WAVE COUNT

WEEKLY CHART

It is also possible that cycle wave V may still be unfolding as an impulse. Within the impulse, only primary wave 1 may be over at the last high.

Primary wave 1 is seen as an impulse. Within primary wave 1, there is poor proportion between the corrections of intermediate waves (2) and (4) and minor waves 2 and 4. This gives the wave count a forced look, but it is valid.

Primary wave 2 may be unfolding as a zigzag. It may find strong support about the lower edge of the multi-year teal trend channel.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

If the main wave count is invalidated with a new low below 2,728.81, then this alternate would then be used.

The limit is removed from this alternate. If only primary wave 1 is over at the last all time high, then more room would be required for the structure of cycle wave V to complete than the limit would allow. This alternate may fit with one of the alternate monthly charts.

TECHNICAL ANALYSIS

WEEKLY CHART

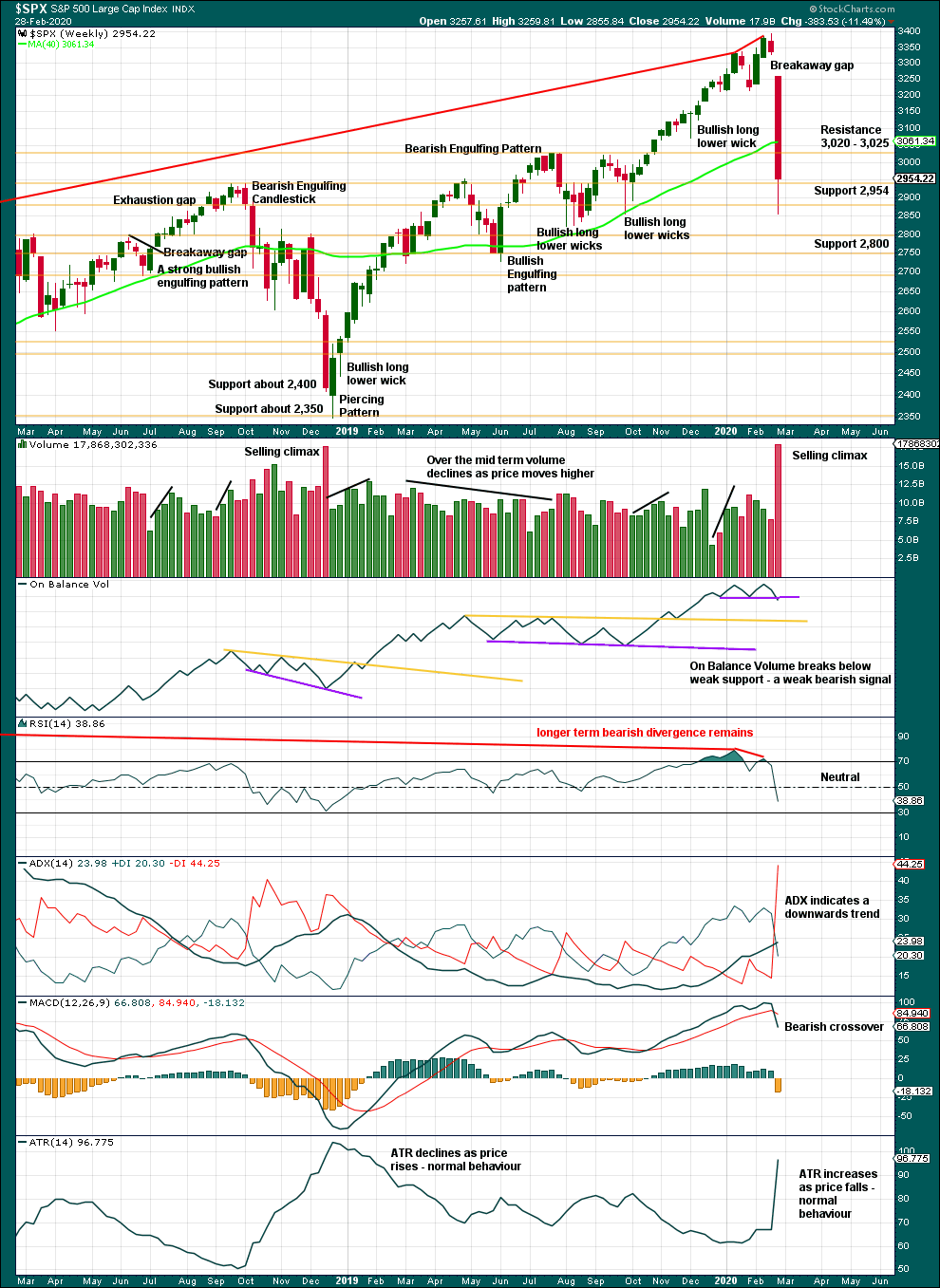

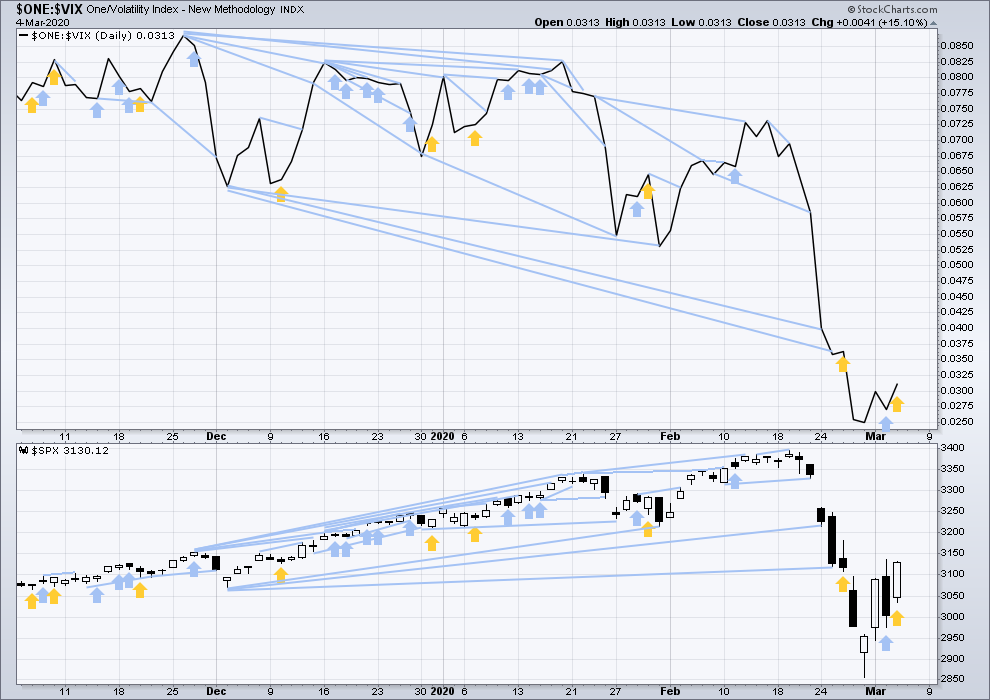

Click chart to enlarge. Chart courtesy of StockCharts.com.

Risk of a pullback identified has been followed by a 15.8% drop in price (high to low) so far. This dramatic drop in price has precedent within the larger bull market. It does not necessarily mean the secular bull market must be over.

At the weekly chart level, conditions are not yet oversold; this pullback may be expected to continue further.

For the short term, the volume spike last week may be a selling climax. In conjunction with a bullish long lower wick on this weekly candlestick, a bounce may be expected about here.

DAILY CHART

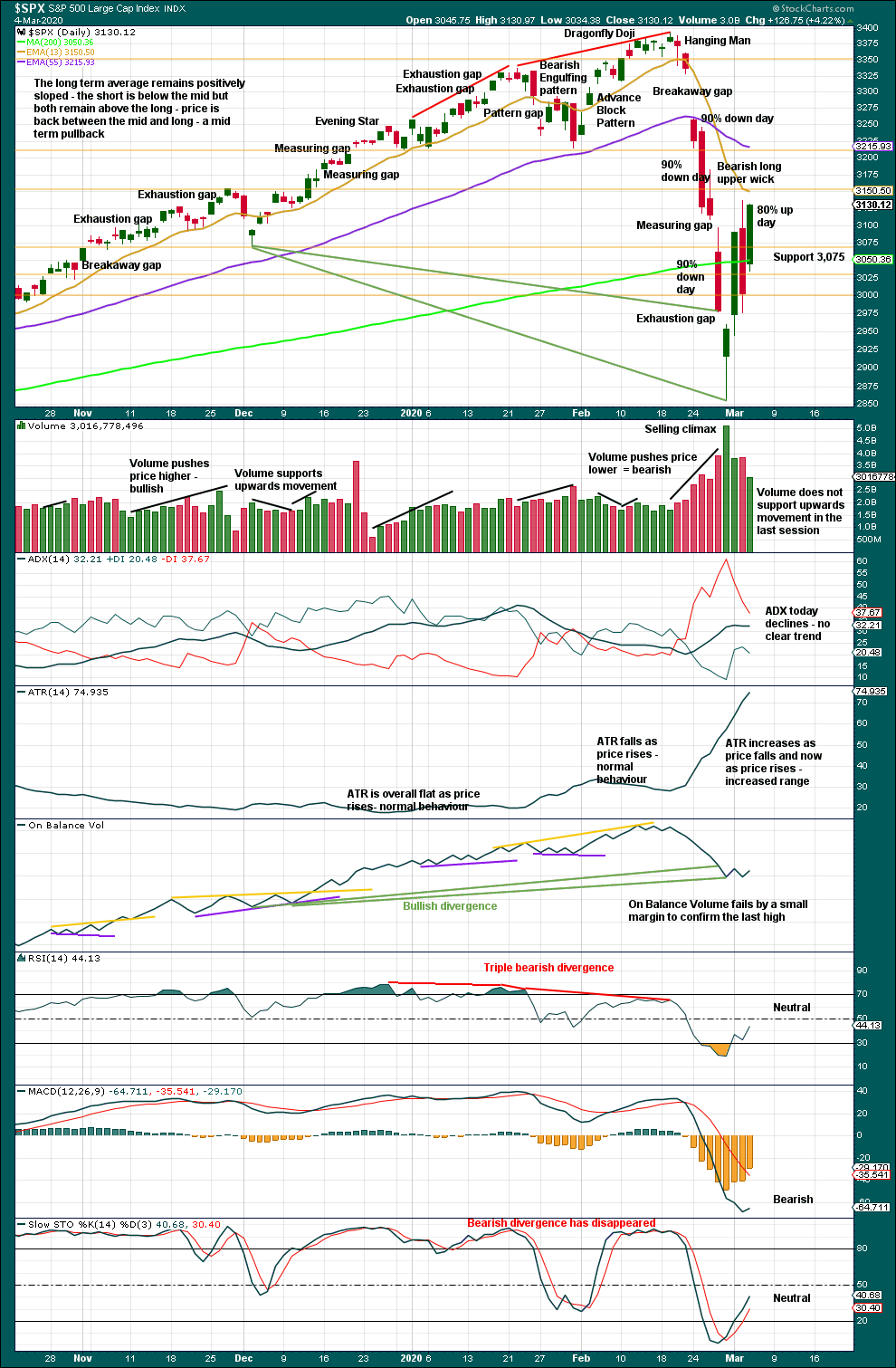

Click chart to enlarge. Chart courtesy of StockCharts.com.

There are now three 90% downwards days in this strong downwards movement.

Following a 90% downwards day, either a 90% upwards day or two back to back 80% upwards days within 3 sessions would be required to indicate a 180°reversal in sentiment and indicate a sustainable low may be in place.

Now Wednesday meets the requirement of an 80% upwards day. For a sustainable low to be indicated, tomorrow must meet the requirement of either an 80% or a 90% upwards day. If it does not, then some confidence that a B wave may be continuing could be had.

BREADTH – AD LINE

WEEKLY CHART

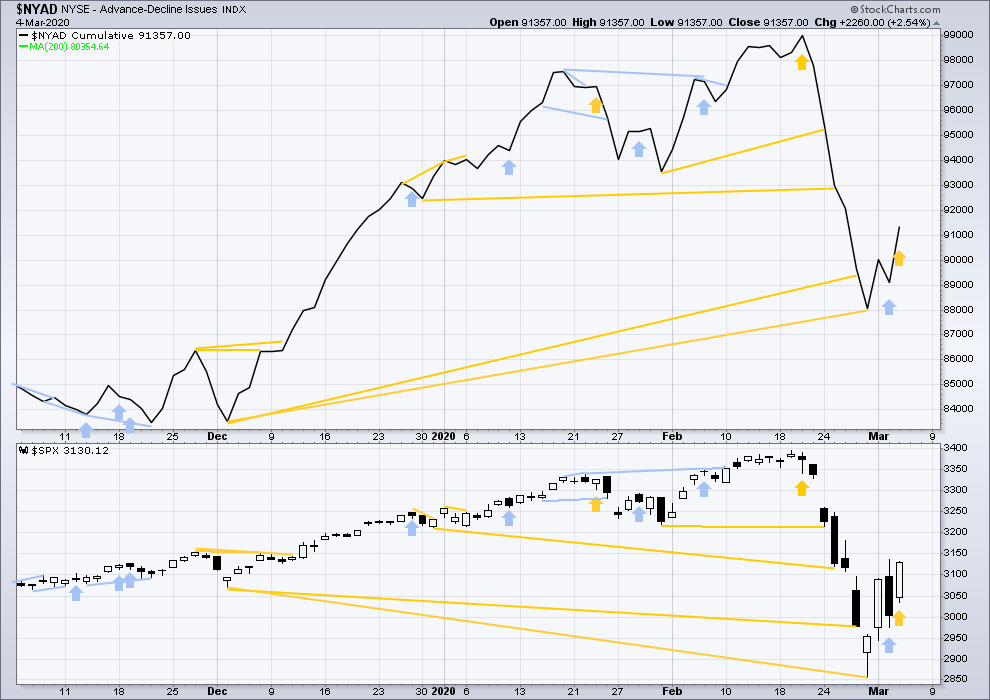

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs with last all time highs from price, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid June 2020.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

Last week price and the AD line have both moved lower. Price has made new lows below the prior swing low of the week beginning 2nd December 2019, but the AD line has not. Price is falling faster than market breadth; breadth does not support this fall in price. This divergence is bullish and fairly strong, and it supports the new Elliott wave count.

Large caps all time high: 3,393.52 on 19th February 2020.

Mid caps all time high: 2,109.43 on 20th February 2020.

Small caps all time high: 1,100.58 on 27th August 2018.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Both price and the AD line have moved higher today. Price has not made a new high above the prior session, but the AD line has. This is an instance of single-day bullish divergence. This may support the Elliott wave count which expects more upwards movement tomorrow.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

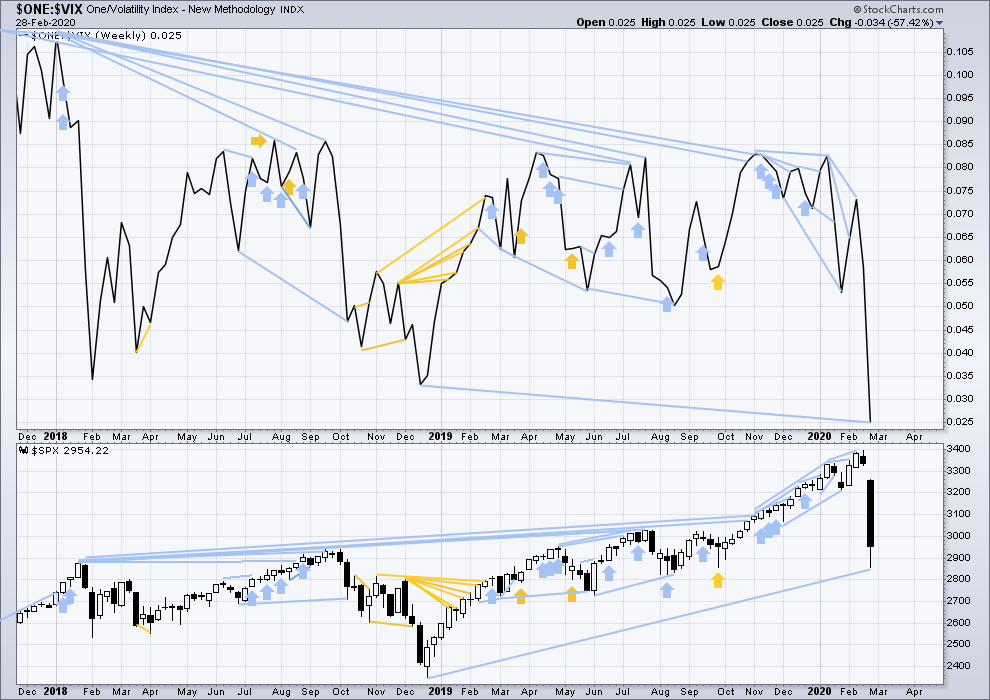

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX was on 30th October 2017. There is now over two years of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It is clearly not useful in timing a trend change from bull to a fully fledged bear market.

Last week both price and inverted VIX have moved lower. Inverted VIX has made new lows below prior lows of weeks beginning 17th / 24th December, but price has not. Inverted VIX is falling faster than price. This divergence is bearish. Because this disagrees with the AD line, it shall not be given weight in this analysis.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Price and inverted VIX have both moved higher. Inverted VIX has made a new high above the prior session, but price has not. This is a single instance of bullish divergence. Because this agrees with the AD line today, it may be given a little weight.

DOW THEORY

Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Dow Theory would confirm a bear market if the following lows are made on a closing basis:

DJIA: 21,712.53

DJT: 8,636.79

S&P500: 2,346.58

Nasdaq: 7,292.22

Published @ 06:34 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

We are touching the bottom of the channel from the outside – is it just testing it before going down for good or will it go through it to continue wave B?

Lara,

Could minor B be forming an a-b-c to finish below a @ 2976+, OR,

could minor B be forming a triangle before finishing in an up swing for (B)?

Quick arrival to Panama. Good for you!

Yes to both. I saw your chart below and I like it.

If there is weakness in downward movement today I may relabel my main chart like yours.

Ola from Panama City!

Hourly chart updated:

This is my first glance wave count. I’m not convinced though that intermediate (B) is over, the range of downwards candlesticks looks to be declining. Intermediate wave (C) would more likely begin with strength.

Alternate hourly updated:

If there’s weakness in downwards movement today this may become the main hourly count.

If intermediate (B) unfolds as a flat correction then within it minor B must now retrace a minimum 0.9 length of minor wave A at 2,883.73.

If intermediate (B) is a combination or triangle then there is no minimum requirement for minor X or B within it.

Greetings Lara…Glad for your safe trip to Panama. I’m confused with your chart. It appears you have Intermediate B complete without minor C surpassing the high of minor A. Is it possible for this to be a truncated wave?

Yes, that would be a truncation. And that was my first take when I opened up charts, and it’s not my last. And it’s not what I’m going to publish in today’s analysis now that I have end of session data to analyse.

Here is what I think:

Another massive move is coming and they clearly intend to keep traders guessing.

A strangle on options expiring tomorrow is one way to skin that kitty…

313/275 can be had for a couple Washingtons… 🙂

LOL!

3000.00 dog-fight!

You were right yesterday – it’s always about 3K fight. But I think this time bulls are losing it.

Don’t underestimate the banksters…!

I mean they have to give it up temporarily to come back strong:)

https://www.elliottwavetrader.net/marketupdate/Dreaming-Of-December-2018-202003025787546.html

Avi just published free charts fr. 03/02.

I see a double top at the 50% retrace of the A wave down. And significant pivots broken and the up channel broken. And Lara’s hourly B wave continuing counts all busted. And a >3% down day off yesterday’s close.

‘Nuff for me re: B wave; it’s likely over. I’ve bought and sold puts twice now today, and have a 1/3 load at the moment, waiting to add more yet again. I’d love for the market to go up and let me get in cheaper!!

And where is Verne, alerting us all to the “coiling” structure here over the last 1.5 hours, entered from above? I guess I have to step in for him…

Danke…! 🙂

Don’t forget the island reversal…

Hi Verne,

you mean the island we left on top at 3393?

High at 3131.50…

Flat again here. My best intra-day day ever. But it is workin’ for a livin’, lol!! Well, sort of…work isn’t work if you don’t have boss!

Another massive “buy-stop” on any break of 3000.00….

Gid-yap! 🙂

Way to go…it is not as easy as it looks…as you know well…! 🙂

It’s risky business. Key for me is the comfort that I have big time confidence in the final resolution of this mess. This market is heading down…eventually. That enables aggressive short plays, and today, the market kept delivering on them over and over!

Many options –

Minute b in minor B continuing with lower low @ 2970

Or it was minute (i) completed for minor C and today completes minute (ii)…

Or 3rd Option that minor B completed already, and we are on our way down

As 3k is important level, I’ll go with option 2, let’s see

RUT is strongly indicate the B wave is over…

And RUT is the weakest of the indices. Not a bad place to short. I’m back loaded up in both IWM and SPY.

Peter, I did not see your chart until posting this. I’m taking another stab at this. I see about same as you…

I like this better than my first take above actually

Traders dream market. The average day is running what, 3.5% now? Insane.

Couldn’t help myself, took my IWM and SPY put profits around the lows here. Incrementally reloading on the way back up.

Eventually, this house crumbles. I’ve only found ONE pundit talking about the potential of a SERIOUS bear market: Jeff Cooper. He identifies the likelihood of SPX going to the 2700 area, and points out how if it rolls back down from there…things could get “serious”. Otherwise, everyone is just talking about nominal C waves down here. I’m in Cooper’s camp: there’s potential for a massive bear market. But one day at a time.

There is time for that in few months as temporary help might arrive sooner to calm the markets. Anyone watching the volume compared to previous sell offs from recent weeks

A few years ago a really smart guy I know told me the cayalyst for equities implosion would be exogonous and come from the corporate bond market. He also admitted at the time that he was not sure what the catalyst would be.

We now have a pretty good idea.

It is truly amazing how these things work out….

HYG puts?

JNK too! 🙂

maybe?

Peter, that’s exactly what I mentioned this morning- we are still in the channel as long as we don’t go below 2980-2990. I have the same picture:)

Except an up channel is normally defined by connecting lows, and such a channel here puts today’s movement outside of (below) the lower channel line. This channel as drawn has a arbitrary lower channel line as I see it. But yea, we may still in the B up. Less and less likely, but may-B (yuck yuck!).

yeah, that channel is useless, but if the gap stays open, just maybe I sell my calls tomorrow for some pay-o-la

Or the C wave is tracing an ending diagonal, 1 yesterday and 2 ended a few minutes ago

does that comply with EW rules?

So far we broke the channel and might be going to 2980-2990 area for BB lower range. As I mentioned this morning, that’s how it played out. If we don’t come back by the end of the day in the channel, it would be officially broken to the downside. Interestingly, as i said earlier, /ES broke that channel this morning already.

Watch SPX 3000.00

Mind the GAP!

Just curious. Could the B be subdividing as a abc, where the current b is playing out as a flat. Forgive me, not sure as to the degree.

Looks reasonable, good eye!

That’s the trouble with corrections, you just never really know until they are just about wholly complete.

SPY is in a volume valley here; not a stable price. Next node down is 299-300. Next nodes up, 308 then 310-311.

current 1min SPX Chart. Her alt still poss. but definitely shorting for now.

Otherwise: Done w/A , falling in a crc (a=5 impulse down)of B, just about to start (iii) down

share a chart?

Could this be the Alt. count w/Minor A being a w-x-y move which would allow y to be and a-b-c so now we are moving up into last part of minor A?

did todays invalidation also kill the alternate?

Yea I think that’s likely a means of keeping a B up alive. Currently the minor C appears as a 3 wave, not 5 wave, so you’ve got to remodel everything of B as 3 wave WXY moves as you’ve suggested Melanie.

For me, I’m not getting too hung up on the minutia of alternative B wave counts. I’m reacting to prices breaking lower pivots to build a short position. If I have to suffer heat because B continues further, so be it. I’m using mid April options to enable an ability to take some heat.

I’m also considering broader context. This B wave move overall is rather weak (unable to crack 50% so far), relative to expectations. AND, we just had a 50 point rate cut and NOTHING. This all adds to the probabilities of strong downward movement coming in my opinion.

And if suddenly the world gets healthy and the market takes off to the upside, I lose. I think the probability of that here is exceedingly low. So I’m pretty comfortable with initiating short positions (have some, will keep adding on further breaks of pivots).

Agreed. We had emergency rate cut, Bernie Sanders basically out of the race, and $8 billion in government stimulus and still nothing. VIX hasn’t really softened at all. Risk is to the downside.

patience rewarded. are you adding?

Just noticed that so far we retraced 50% from 2018 low and 61.8% would be around 2750, while 123.6% target from the current drop is at around 3725 (which is exactly around where invalidation point of the current count is). So if the logic remains in this market, 2725-2750 might be the bottom of this correction.

This site publishes nice coronavirus stats, with many intraday updates

https://www.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

This data looks good EXCEPT…the data for TODAY is very partial. Based on prior days, I’d say that 3/5 bar is going to grow a fair amount, maybe even double. Which makes this data look somewhat concerning to me. Exponential growth will (IMO) tank this market; my $0.02, could be wrong, etc etc.

Kevin – see attached, curious on your thoughts of total infected (red) vs currently sick (blue) or recovered (green). We are trending down on currently sick and the recovered daily has so far outpaced newly infected, though both are flattening.

My sense is the only thing that matters is new infections day by day, and it’s growth (or non-growth). How many people are sick and/or have recovered I don’t see as particularly material. It’s the Harvard call that 40-70% of the world is going to get this virus that I want early visibility of, and that’s all about the growth rate of new infections.

It’s also important to keep in mind that some percentage of infected have no symptoms, confounding all statistics as well as being a serious infection spread problem (people go out and mingle who “aren’t sick” and infect others).

Great, thanks Kevin. Hopefully no Resident Evil scenarios will materialize!

I don’t see the count busted in the cash session …

I had to reload calls … Monday SPY 319

Fail

choppy out there today

Under 3041.76 and Lara’s count is busted, and it’s a logical time to initiate a short campaign. Then again under the pivot at 2976.63. And/or more aggressively, a break below 3000.

I’m big time time short buddy

But have taken a good hit as well today watched it go from basically 3100 to where we are now

I had a pilot position. Have doubled. Will double again on further confirming triggers. SPY puts, April. And some IWM puts, April

Why is it busted under 3041. It can still go a tad below 3000 and still be in the uptrend channel. It looks like it might hit the lower BB today at 2980-2990 and come back up again. We’ll see

Minor C up’s minute i high is there. We expected a final minute iv then v. If this minute iv breaks that minute i high…the count is dead. Time for something new. Maybe there’s still a way to count a living B wave up, but the primary thesis (for me) switches to “B wave is over…look for more confirming triggers”.

We already broke 3041 level.

No break yet, turn off the channel and above the top of the i. “Just a deep iv” until proven otherwise. I’m suspicious that won’t be long though, but the market will inform us.

It’s all speculative as there are so many possible correction structures possible.

If the rally from the bottom last week is developing in an ABC:

B may still be unfoding, as a triangle (we’ve done abc, waiting for end of c, d and e), as a flat (we’ve done ab, in c to under 2980), … and C hasn’t even started

C may be subdividing (we are in 2 of C)

The good news is that we are not making an 80% up day (yet?), which woukld raise question about the sustainability of the low last week. Any weakness in the market reinforces the idea that we are in a correction of the drop, and the next happy trade is short at 3190/3260 (target to define in real-time as the market subdivides of course) to play a 10%+ down move.

forget my last comment – think Minor B might be over.

It’s actually interesting – on /ES we did break the uptrend channel down with an hourly, but if the price stays around 3025 and higher, then SPX uptrend channel is not broken yet on an hourly.

I think the wave main wave count is wrong. I think we are just finishing Minor B, with Minor C to follow.

Futures are deep in red zone so maybe we are not going to see 3,188 unless the magic hand appears again.

It might very well be the c of B to make a low in 2950-60 then we get back to the high then the drop… tricky market

FED injected another $100 billion via repos yesterday. This makes two days in a row that FED has come out with big bag full of monies. Wow a $200 billion in total in last two days.

The $100B is for the overnight facility. These are not additive numbers: 100 provided day 1, and 100 provided day 2 equal 100 provided for 2 days.

You are correct as one day expiration and hence the market reaction. Today another one-day $87 billion and one 14 days $20 billion. Keep rotating the money…

I’m flying to Panama tomorrow and so won’t be able to update the hourly chart prior to NY close.

Thank you all for your understanding.

Hopefully your adventures take you to Bocas del Toro…

will you rent a surfboard?

For this initial visit we’ve left surfboards in Texas with family.

If all goes well we may be back to stay much longer and then will bring boards with us.

Yas! back to back..

Missed again 🙁