A new high above 3,375.63 indicated more upwards movement was expected. The next target remains the same.

Summary: The trend is up.

The target for the next interruption to the trend is at 3,415.

Two more large pullbacks or consolidations (fourth waves) during the next 1-2 years are expected: for intermediate (4) and then primary 4.

The biggest picture, Grand Super Cycle analysis, is here.

Last monthly charts analysis is here with video here.

ELLIOTT WAVE COUNTS

FIRST WAVE COUNT

WEEKLY CHART

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common, and it is clear at this stage that cycle wave V is an impulse and not a diagonal.

At this stage, cycle wave V may take another one to two or so years to complete.

A channel is drawn about the impulse of Super Cycle wave (V) using Elliott’s first technique. Draw this channel first from the high of 2,079.46 on the 5th of December 2014 to the high of 2,940.91 on the 21st of September 2018, then place a parallel copy on the low at 1,810.10 on the 11th of February 2016. Cycle wave IV found support about the lower edge.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A new high by any amount at any time frame above this point would invalidate this main wave count in favour of one of the two alternate wave counts in the monthly chart analysis which are much more bullish.

The daily chart below will focus on movement from the end of minor wave 1 within intermediate wave (3).

Within cycle wave V, primary waves 1 and 2 may be complete. Within primary wave 3, intermediate waves (1) and (2) may be complete. Intermediate wave (3) may be over at any stage now. Intermediate wave (4) may not move into intermediate wave (1) price territory below 3,027.98.

Within cycle wave V, the corrections of primary wave 2, intermediate wave (2) and minor wave 2 all show up clearly on the weekly chart. For cycle wave V to have the right look, the corresponding corrections of minor wave 4, intermediate wave (4) and primary wave 4 should also show up on the weekly chart. Minor wave 4 now shows up on the weekly chart, and so now two more large multi-week corrections are needed as cycle wave V continues higher, and for this wave count the whole structure must complete at or before 3,477.39.

DAILY CHART

Minor waves 2 and 4 for this wave count both subdivide as zigzags; there is no alternation in structure. Minor wave 2 is deep at 0.83 the length of minor wave 1, and minor wave 4 is shallow at 0.26 the length of minor wave 3; there is alternation in depth. Minor wave 2 lasted 10 sessions and minor wave 4 lasted 7 sessions; the proportion is acceptable and gives the wave count the right look.

There is no adequate Fibonacci ratio between minor waves 1 and 3. This makes it more likely that minor wave 5 may exhibit a Fibonacci ratio. The target expects minor wave 5 to exhibit the most common Fibonacci ratio within an impulse.

Within minor wave 5, no second wave correction may move beyond its start below 3,214.68.

When intermediate waves (3) and (4) may be complete, then a target will again be calculated for primary wave 3.

Price has now printed two full daily candlesticks above the upper edge of the teal channel, which is copied over from the weekly chart. This trend line may now be about where price may find some support.

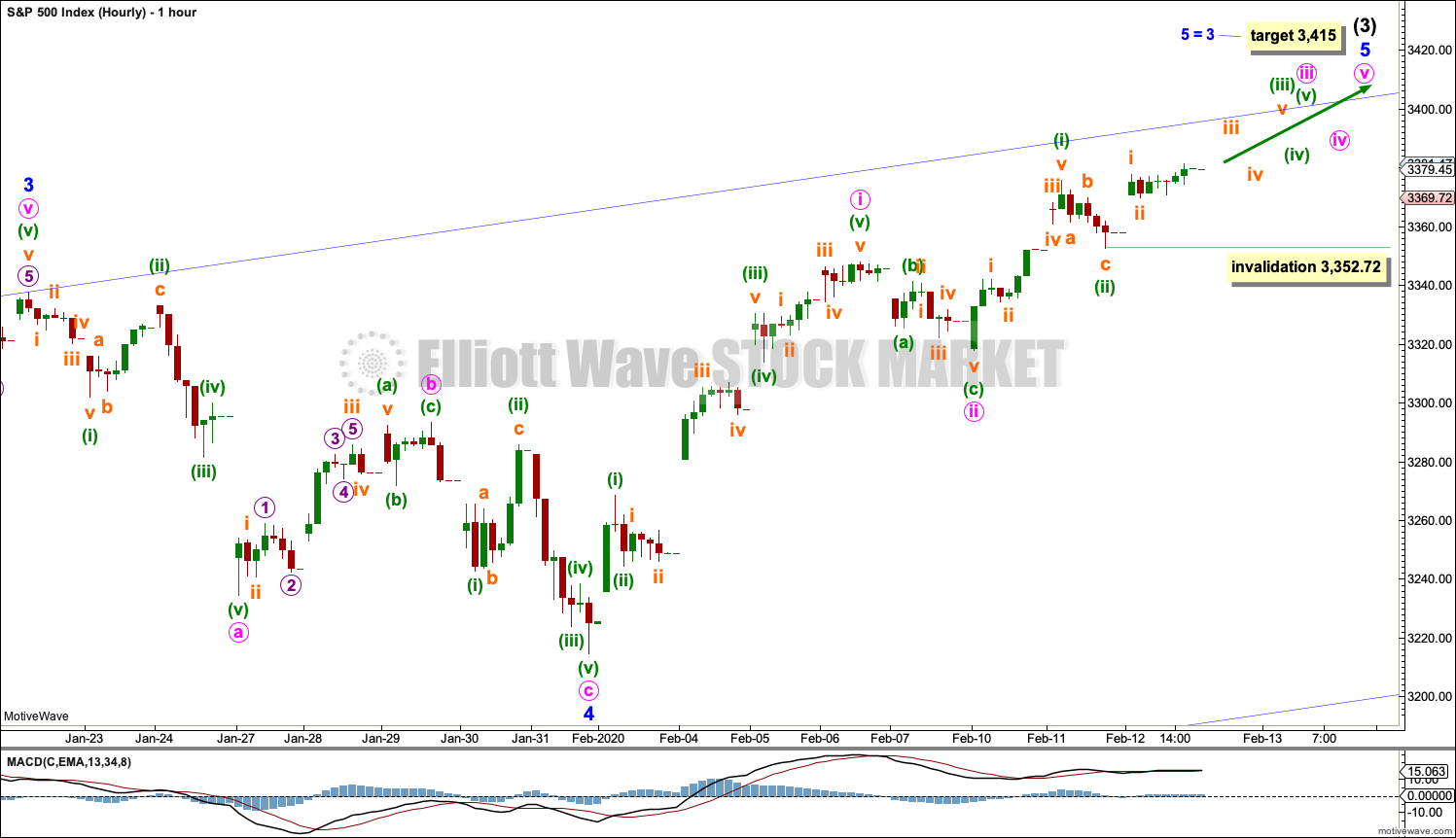

HOURLY CHART

Minor wave 5 may subdivide as either an ending diagonal or an impulse. An impulse is much more common and so shall be charted unless overlapping suggests a diagonal.

So far within minor wave 5, minute waves i and ii may be complete. Minute wave iii may have begun. Within minute wave iii, minuette waves (i) and (ii) may be complete.

This wave count now expects the next upwards movement may be a third wave at two small degrees. Some increase in momentum may be expected.

Minuette wave (ii) may not move beyond the start of minuette wave (i) below 3,317.77.

The alternate has been discarded due to a new all time high today and technical support for this main wave count.

SECOND WAVE COUNT

WEEKLY CHART

This second wave count sees all subdivisions from the end of the March 2009 low in almost the same way, with the sole difference being the degree of labelling.

If the degree of labelling for the entirety of this bull market is all moved down one degree, then only a first wave at cycle degree may be nearing an end.

When cycle wave I is complete, then cycle wave II should meet the technical definition of a bear market as it should retrace more than 20% of cycle wave I, but it may end about either the 0.382 or 0.618 Fibonacci Ratios of cycle wave I. Cycle wave II may end close to the low of primary wave II within cycle wave I, which is at 1,810.10. It is also possible that cycle wave II could be fairly shallow and only barely meet the definition of a bear market.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5. Primary wave 5 may still need another year to two or so to complete, depending upon how time consuming the corrections within it may be.

Primary wave 5 may be subdividing as an impulse, in the same way that cycle wave V is seen for the first weekly chart.

TECHNICAL ANALYSIS

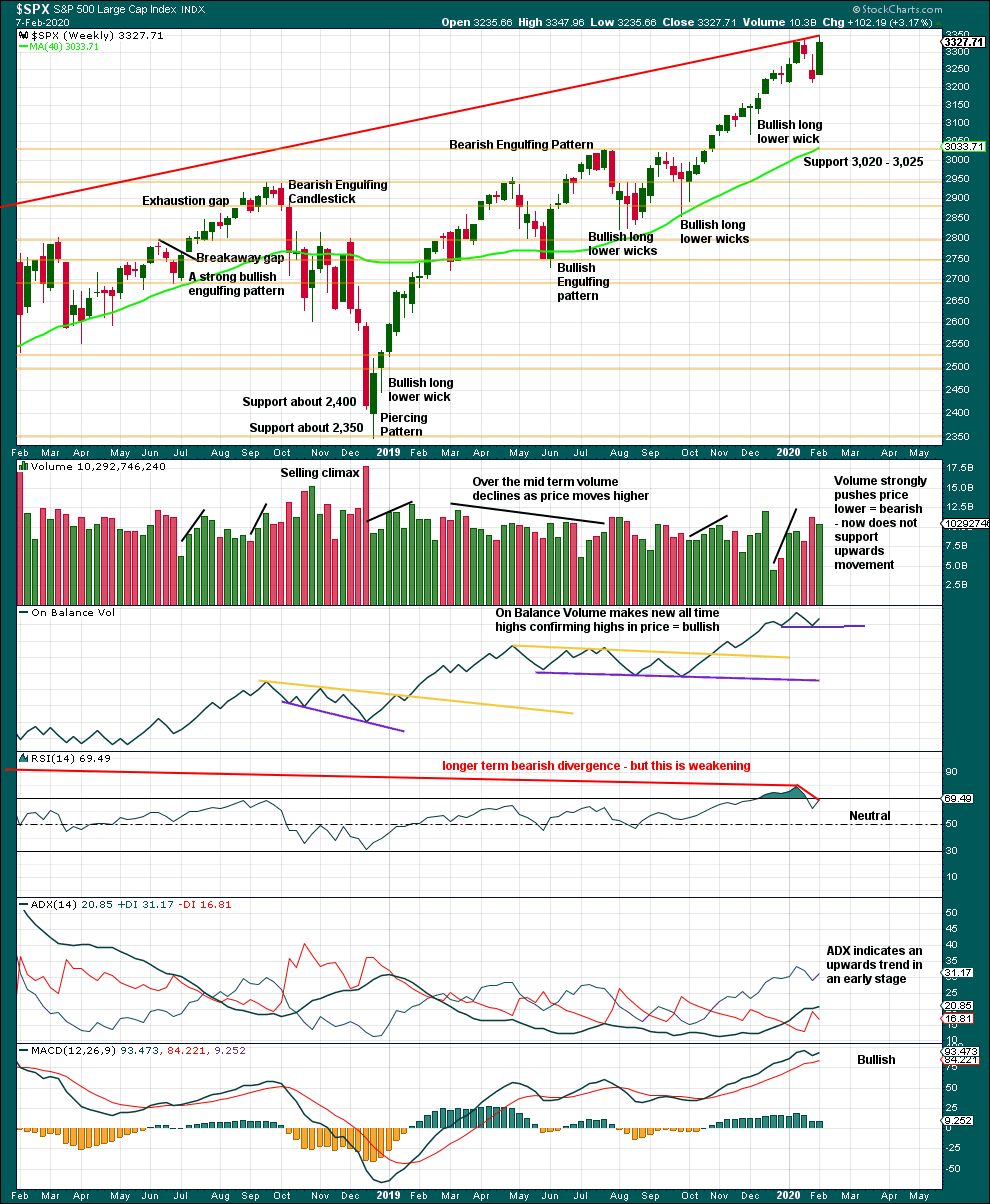

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

It is very clear that the S&P is in an upwards trend and the bull market is continuing. Price does not move in straight lines; there will be pullbacks and consolidations along the way.

This chart is overall bullish. There are no signs of weakness in upwards movement.

A pullback or consolidation has begun. This is relieving extreme conditions. Look for strong support below about 3,020 to 3,025.

Although price has made a slight new high last week, it has not done so with conviction. Volume is weaker than the prior downwards week, and RSI and On Balance Volume exhibit short-term bearish divergence.

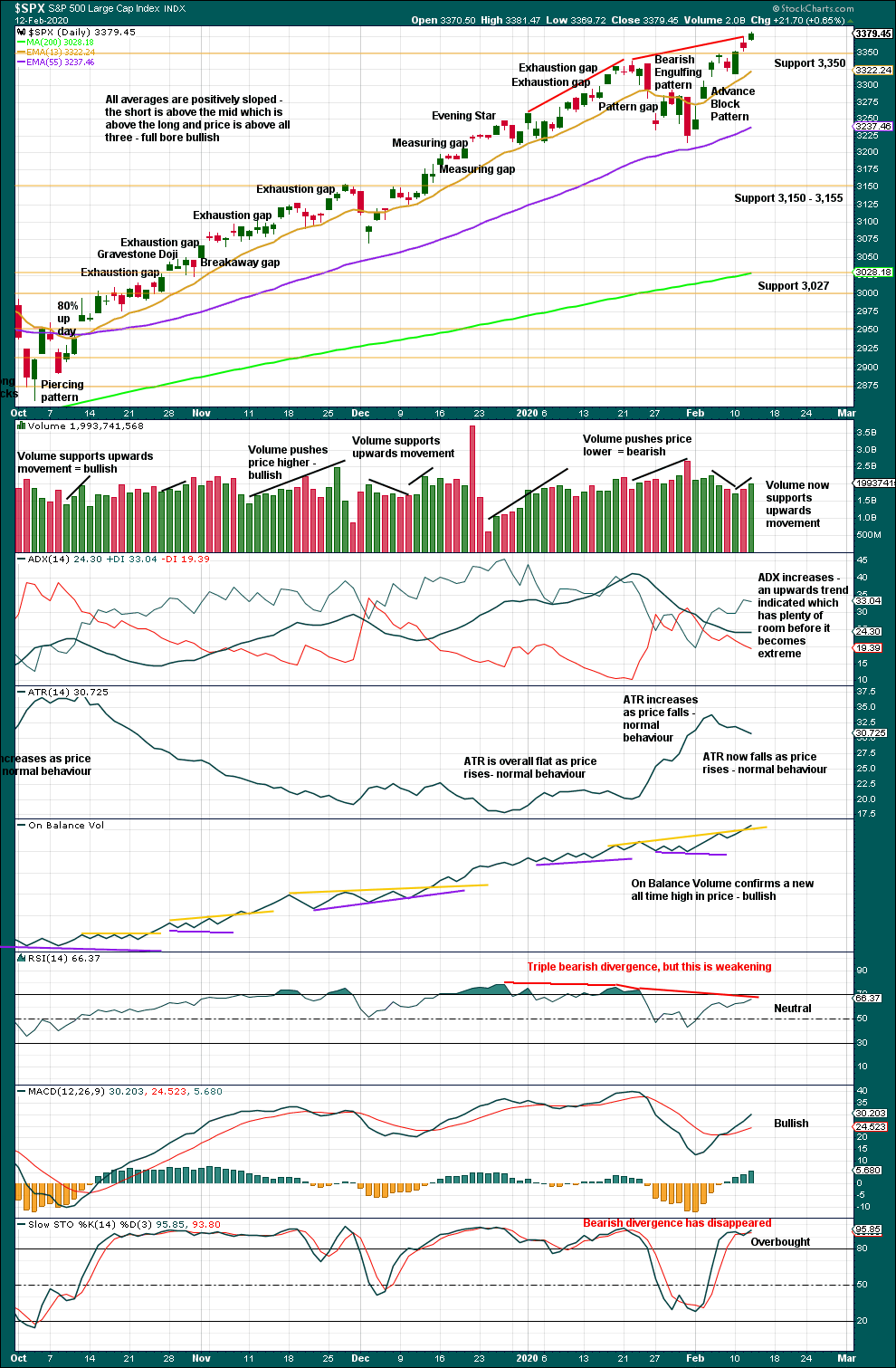

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The larger trend, particularly at the monthly time frame, remains up. Expect pullbacks and consolidations to be more short term in nature although they can last a few weeks.

Another new all time high for price today has support from volume, confirmation from On Balance Volume, and ADX now indicating an upwards trend. It is possible that bearish divergence with price and RSI may disappear.

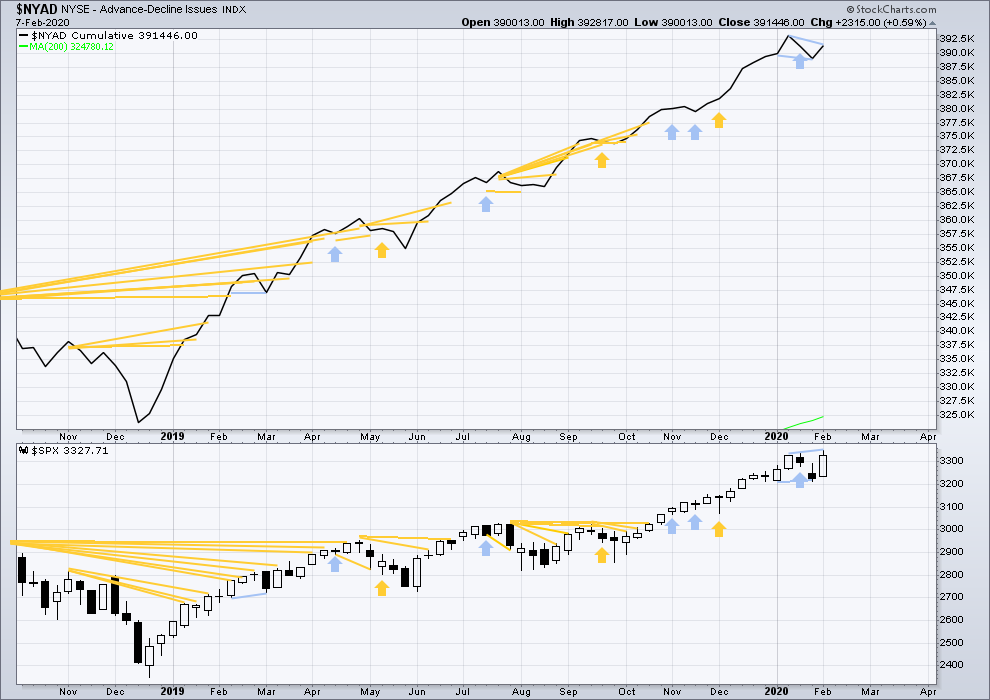

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs last week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid May 2020.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

Last week price has made a new high, but the AD line has not. There is now short-term bearish divergence that supports the main Elliott wave count.

Large caps all time high: 3,375.63 on 11th February 2020.

Mid caps all time high: 2,106.30 on 17th January 2020.

Small caps all time high: 1,100.58 on 27th August 2018.

For the short term, there is a little weakness now in only large caps making most recent new all time highs.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Today both price and the AD line make new all time highs. Upwards movement has support from rising market breadth. This is bullish.

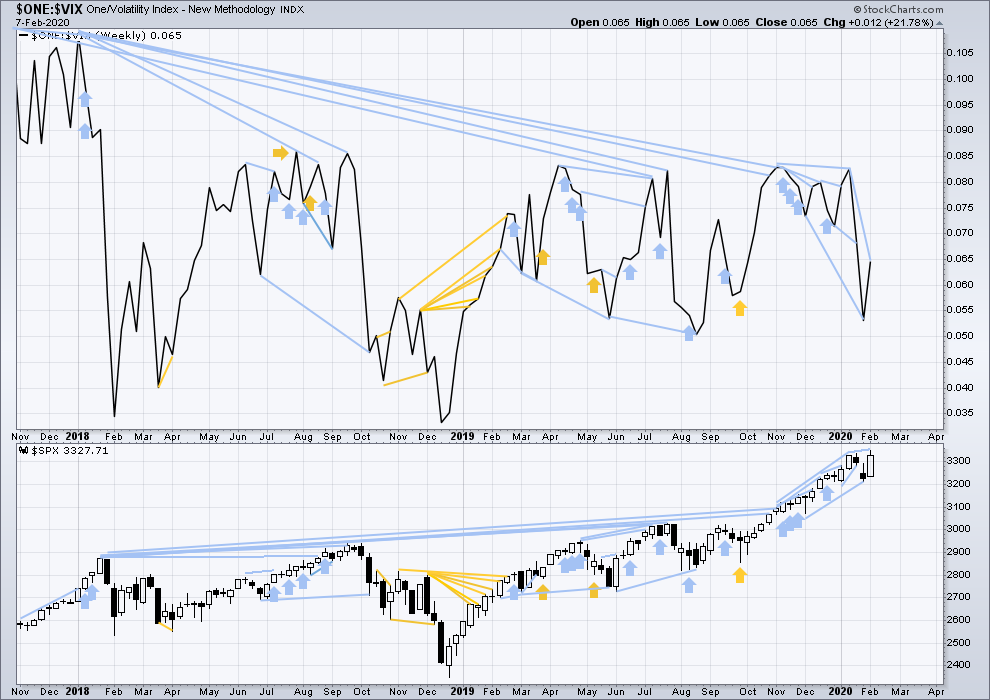

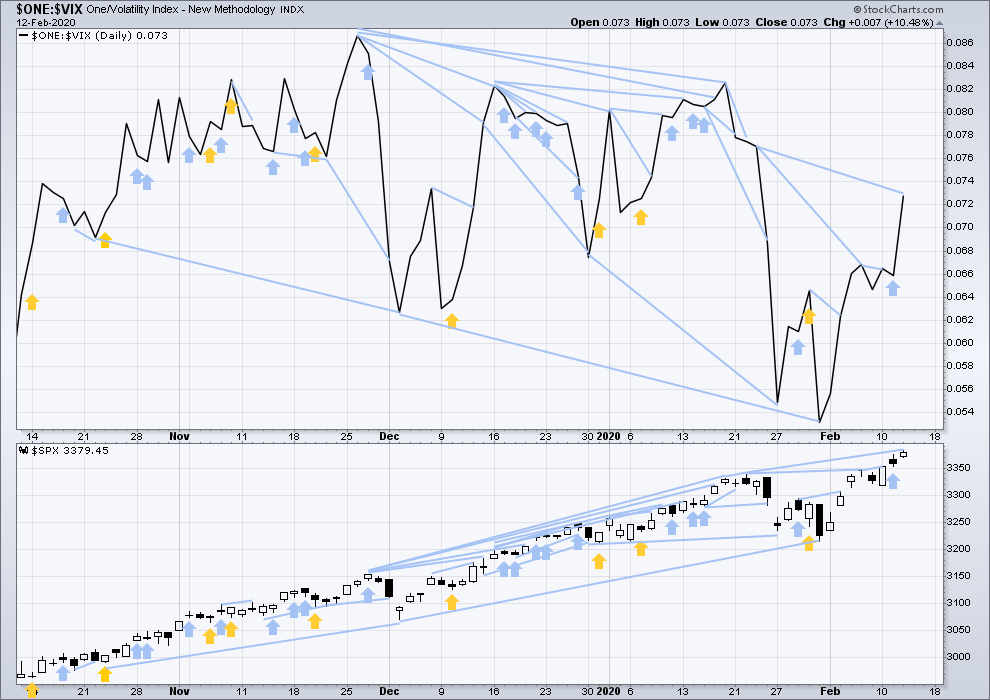

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX was on 30th October 2017. There is now over two years of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It is clearly not useful in timing a trend change from bull to a fully fledged bear market.

Price has moved higher and made a new high, but inverted VIX has not. There is again short, mid and long-term bearish divergence. This supports the main Elliott wave count.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Price has made a new all time high, but inverted VIX has not. There is still mid and long-term bearish divergence.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Published @ 09:46 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Looks like up to $100 billion for next few weeks.

Friday, 2/14/2020 – Thursday, 3/12/2020 At least $100 billion

Hourly chart updated:

Three overlapping first and second waves may now be complete within minute wave v. If this is correct then some increase in upwards momentum may be imminent.

The upper edge of the blue channel may provide some resistance. If resistance is broken there, look for it to then provide support.

I am having trouble posting the chart. Here is the string. Scroll down on his Feb 09 update…

https://www.elliottwavetrader.net/marketupdate/Parameters-For-Upcoming-Week-202002095738892.html

So he is basically saying we are still in wave B of minor 4, if i understand correctly. And resistance should be between 3380-3390 before correction. Meaning, sometime now. We’ll see

Avi is showing 3 different poss. counts on 1 chart, grn, yell, blu.

If memory serves me correctly, grn=primary, yell=2nd, etc.

If you hunt his site you can find info on his counts. His charts are not the clearest.

I’m sure some of you are very aware of Avi Gilburt’s Free updates.

Attached is a 60min. chart dated Sun(really Fri)Feb 09.

His ‘yellow’ count is quite similar to Kevin’s. Anyone who has been following his free updates knows he has been far behind Lara in coming to an impulse rather than ending diagonal count. His target is quite high for 2020 [3700 region]. Thoughts?

Rishi…could you place the address string of where you are finding the Fed ‘repo’ info? Thank you…

https://apps.newyorkfed.org/markets/autorates/temp

Hope this helps

https://www.newyorkfed.org/markets/domestic-market-operations/monetary-policy-implementation/repo-reverse-repo-agreements/repurchase-agreement-operational-details

can you translate?

The news came out by the end of the day before market close that Fed announced repo cuts (further shrinking repos).

Depends which ones as they are buying treasuries to shore up the demand side. Games they play..

This is not going to end well. It’s like a drug addict that cannot stop. Once the easy money are over, it will be a great fall. And as Verne said BTDs will be punished a lot. It’s a matter of when.

I view his yellow count as more similar to Lara’s. He just doesn’t break out the action in July-Sept’19 into a sequence of 1-2’s, but rather a single extended intermediate 2. But he’s matching that 2 with the Jan’20 correction as a 4, similar (but with less proportionality) to Lara’s matching of the minor 4 to the minor 2. In fact, proportionality there is really quite poor…but as Lara says, “there are many possibilities”.

Anyway, since I for the most part trade swings that are weeks long, not months long, “I don’t care” too much about precise big picture counts. I’m much more focused for example on when the current swing up from the Jan 31 low is going to end, because my monthly income trades are just that, put on roughly monthly with a goal of giving me cash to pay bills with. Selling below market put spreads works well for me for that. Getting such a trade caught up in a significant swing down can be…painful.

As for the end of 2020 target of 3700…right on!!! I have a butterfly for Jan ’21 in SPX for 3600-3700-3800 (bought one each of 3600 and 3800 calls, sold two 3700 calls). I arrived at that target by looking a similar moves of consolidation on weekly/month charts covering the last 10 years (I showed those weeks ago, my “box” charts). Obviously, this is a long term trade, but it’s not really for me based target-wise on EW counts, it’s based on historical price moves after similar monthly time frame technical set ups (monthly macd bullish cross, multi-month squeeze terminating, and the break up out of consolidation zones). That trade is still very much available to anyone interested in it (but buying it on a significant pullback would be ideal).

An update to my RUT count.

Up up and away. Through the 76-78% retrace zone of the January sell off. The back vertical line is at Friday 2/21, when my sold put spread (added more to it today) expires.

Some possibility RUT is in fact in a correction, the move up is a B wave, and a C down is about to launch, as there’s a clean ABC structure up and now it’s just about tagged my “next up” Fibonacci projection swing completion level. Always good to be aware of alternatives…

This market doesn’t care – on a way to set up ATH again today:) Any second now – maybe:)

Or could it be the distribution phase?

For the S&P, it’s stronger pullbacks usually begin with at least a little strength.

Usually.

NASDAQ positive….lol

One possibility is a i wave up of some degree is complete here off the minor wave 4 low.

Agree. That’s exactly what I published after the close yesterday

So what would be the target on the upside in this case?

Focusing on the end of this current price swing, the current high structures the price move quite nicely with the Fibonacci structure, supporting the count well. The areas of fit are marked with gray ellipses.

The next two blue lines up are where I find the next two levels of reasonable fit.

Well, with this count, the minute i is circa 170 points, so it will definitely invalidate the current monthly/weekly main count which has 3477 as limit..

I have the feeling that it will likely disappoint few traders that are looking for significant drop. I am watching the Fed action in repo markets carefully as until that is closed, normal markets will not surface. If the repos are stopped for one month, you are likely to see a massive selloff.

Good point, Rishi. But we all know what it will end at some point. This cannot go on forever fundamentally, the question is timing and this is always an issue:) The more they pump artificially, the more volatility we will have going forward. After all, Fed might be creating this bubble.

My take is it will have to be black swan event as the USD with its defecto world currency status affords US luxury to print as much as they like.

Nothing is free in this world. It’s always about leverage – one way or another. There is no much growth without leverage, but when it becomes excessive, it bursts sooner or later. Black swan should come from something related to leverage no matter how you put it. All the problems happen because of that in the long run.

The article “Sorry Bears, 2020 Is A Cyclical Upturn” is pertinent. A search for it finds it at the top of the search list. Lots of supportive economic data for the claim.

Fed is relentless in injecting liquidity…report out from Fed states fourth oversubscribed term=repo…now we know what is moving the market

Hi Lara,

so in case the hour count gets invalidated by breaking below 3352.72, what count do we have then? Are we coming back to original 4 minor count in place or 4 minor ended regardless?

Yes. Or intermediate (4) if the last upwards wave subdivides as a five.

But right now, the alternate has been invalidated and there is only one count left.

Guys, if this is a public forum and all can read the comments posted here, please no cryptic one-liners, and irrelevant remarks, please! PLEASE!!

Uno

Ni

San