Upwards movement continues, albeit with some weakness.

Both Elliott wave counts remain valid.

Summary: A pullback or consolidation is most likely still underway. It may end sometime next week. A downwards swing may continue that may end slightly below 3,214.68, or it may fall short of this point.

Alternatively, it is possible the pullback was brief and shallow and over on the 31st of January. This alternate wave count may become the main wave count if evidence of weakness in bearish divergence with price and On Balance Volume or the AD line disappears.

Three large pullbacks or consolidations (fourth waves) during the next 1-2 years are expected: for minor wave 4 (underway), then intermediate (4), and then primary 4.

The biggest picture, Grand Super Cycle analysis, is here.

Last monthly charts analysis is here with video here.

ELLIOTT WAVE COUNTS

FIRST WAVE COUNT

WEEKLY CHART

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common, and it is clear at this stage that cycle wave V is an impulse and not a diagonal.

At this stage, cycle wave V may take another one to two or so years to complete.

A channel is drawn about the impulse of Super Cycle wave (V) using Elliott’s first technique. Draw this channel first from the high of 2,079.46 on the 5th of December 2014 to the high of 2,940.91 on the 21st of September 2018, then place a parallel copy on the low at 1,810.10 on the 11th of February 2016. Cycle wave IV found support about the lower edge.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A new high by any amount at any time frame above this point would invalidate this main wave count in favour of one of the two alternate wave counts in the monthly chart analysis which are much more bullish.

The daily chart below will focus on movement from the end of minor wave 1 within intermediate wave (3).

Within cycle wave V, primary waves 1 and 2 may be complete. Within primary wave 3, intermediate waves (1) and (2) may be complete. Within intermediate wave (3), minor wave 4 may not move into minor wave 1 price territory below 3,021.99.

Within cycle wave V, the corrections of primary wave 2, intermediate wave (2) and minor wave 2 all show up clearly on the weekly chart. For cycle wave V to have the right look, the corresponding corrections of minor wave 4, intermediate wave (4) and primary wave 4 should also show up on the weekly chart. Three more large multi-week corrections are needed as cycle wave V continues higher, and for this wave count the whole structure must complete at or before 3,477.39.

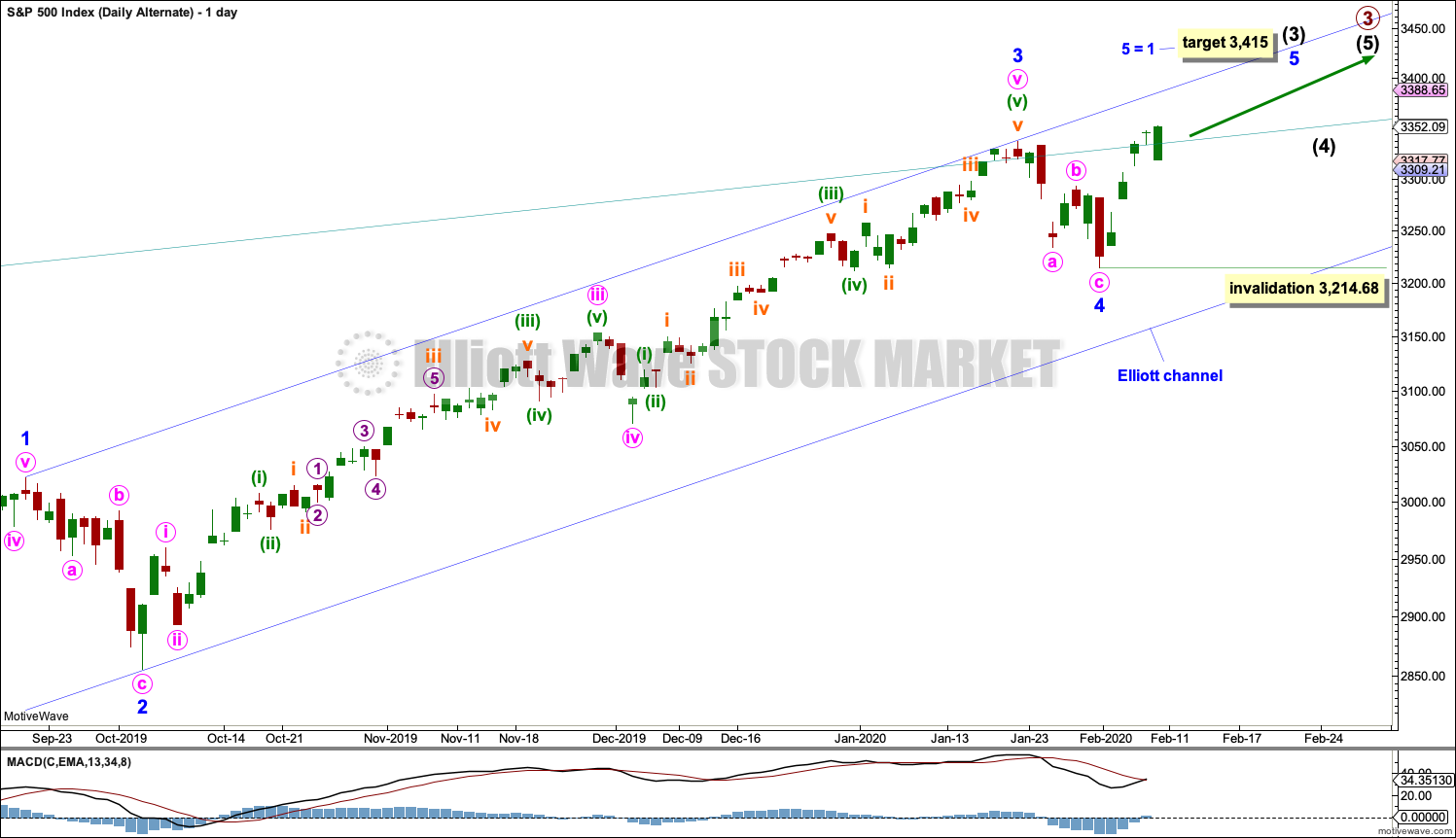

DAILY CHART

All of primary wave 3, intermediate wave (3) and minor wave 3 may only subdivide as impulses.

Minor wave 3 now looks complete.

Minor wave 2 was a sharp deep pullback, so minor wave 4 may be expected to be a very shallow sideways consolidation to exhibit alternation. Minor wave 2 lasted 2 weeks. Minor wave 4 may be a longer lasting consolidation. Minor wave 4 may end within the price territory of the fourth wave of one lesser degree; minute wave iv has its range from 3,154.26 to 3,070.49. However, this target zone at this stage looks to be too low.

Minor wave 4 may not move into minor wave 1 price territory below 3,021.99.

When minor wave 4 may be complete, then a target will again be calculated for intermediate wave (3).

When intermediate waves (3) and (4) may be complete, then a target will again be calculated for primary wave 3.

Draw an Elliott channel about intermediate wave (3): draw the first trend line from the end of minor wave 1 to the end of minor wave 3, then place a parallel copy on the end of minor wave 2. Minor wave 4 may find support at the lower edge of this channel if it is long lasting or deep enough. It is possible that minor wave 4 may breach the lower edge of the channel as fourth waves are not always contained within a channel drawn using this technique. If minor wave 4 breaches the channel, then it shall need to be redrawn using Elliott’s second technique.

Price has again reached the upper edge of the teal channel copied over from the weekly chart and then quickly reversed to close back within the channel on Friday. This trend line has strong technical significance and so a further reaction down from here is a reasonable expectation.

Minor wave 4 may subdivide as any corrective structure, most likely a flat, triangle or combination. Within all of a flat, triangle or combination, there should be an upwards wave which may be fairly deep. Minute wave b may continue a little higher. The common range for minute wave b within a flat is from 3,337.77 to 3,384.45.

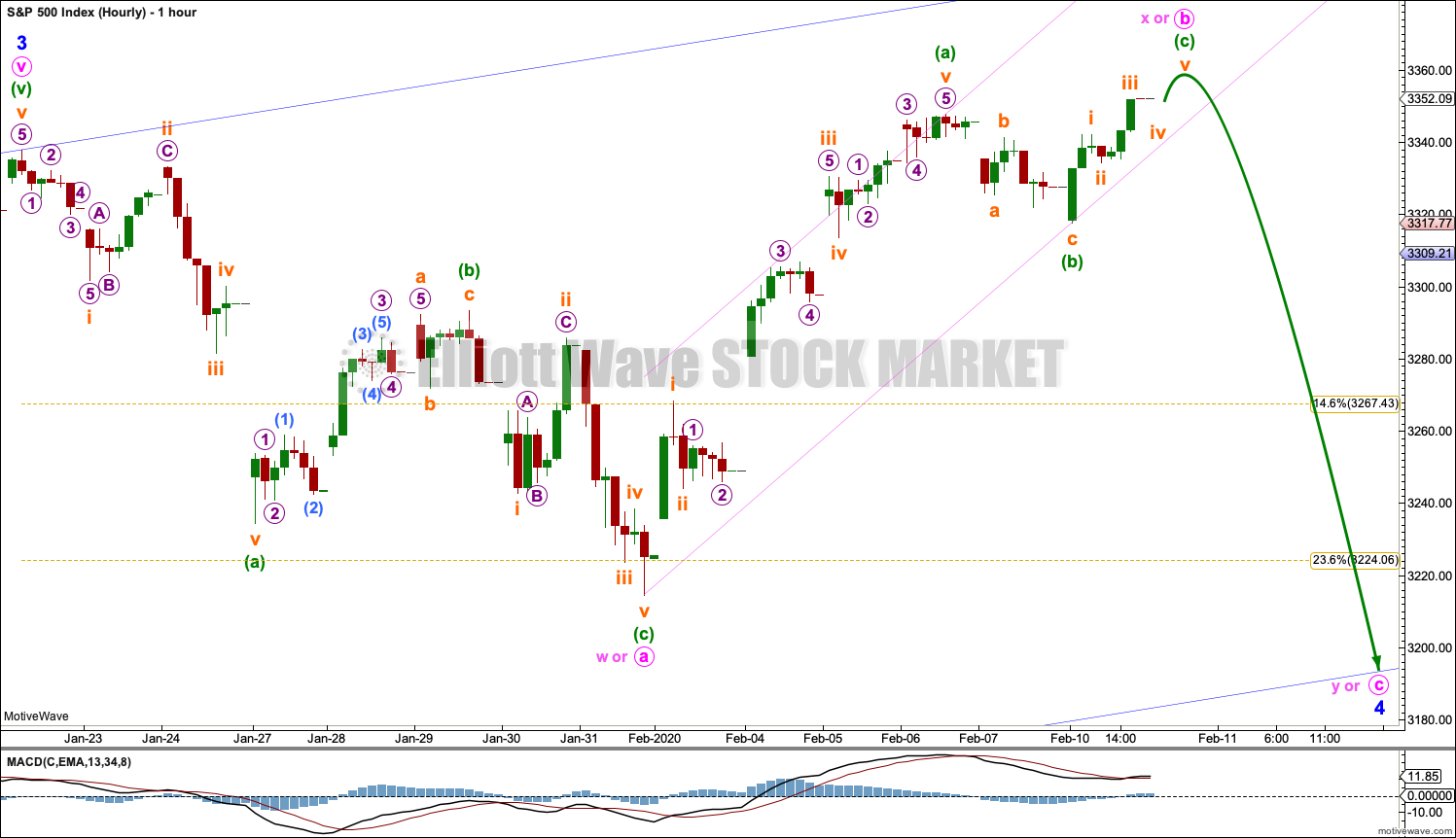

HOURLY CHART

Minor wave 4 is here labelled a possible expanded flat correction, but it may still morph into one of either a combination or a running triangle.

If minor wave 4 unfolds as an expanded flat correction, then within it minute wave c downwards may begin tomorrow. Minute wave b may be very close to completion with only a small correction for subminuette wave iv and then a final upwards wave for subminuette wave v required.

The common range of minute wave b within a flat correction would be within 1 to 1.38 times the length of minute wave a, giving a price range from 3,337.77 to 3,384.54. Price is still well within this range. Unfortunately, there is no rule stating a limit for minute wave b. A guideline suggests it would be very unlikely to be longer than minute wave a at 3,460.86.

The blue channel may be used as a guide to where an expanded flat may end.

If minor wave 4 unfolds as a running triangle, then minute wave b may extend higher. Minute wave c may not move beyond the end of minute wave a below 3,214.68.

If minor wave 4 unfolds as a combination, then minute wave x within it may extend higher. Minute wave y would need to unfold as either a flat or triangle. Minute wave y may end about the same level as minute wave w at 3,214.68, so that the structure takes up time and moves price sideways.

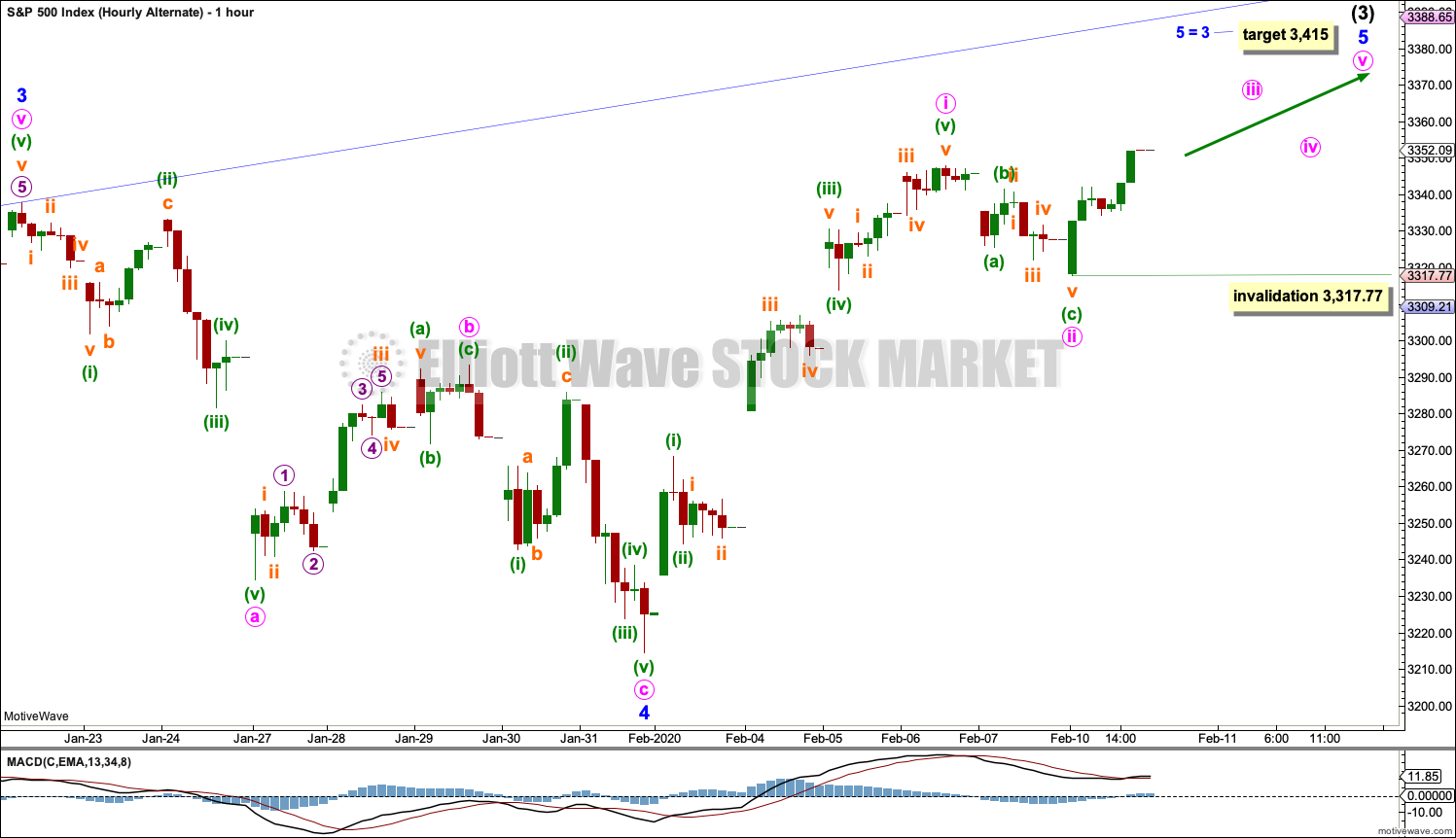

ALTERNATE DAILY CHART

This alternate daily chart looks at the possibility that minor wave 4 may be a complete zigzag over at the last low. This alternate chart does not have as much support from classic technical analysis as the main wave count.

Minor waves 2 and 4 for this wave count both subdivide as zigzags; there is no alternation in structure. Minor wave 2 is deep at 0.83 the length of minor wave 1, and minor wave 4 is shallow at 0.26 the length of minor wave 3; there is alternation in depth. Minor wave 2 lasted 10 sessions and minor wave 4 lasted 7 sessions; the proportion is acceptable and gives the wave count the right look.

There is no adequate Fibonacci ratio between minor waves 1 and 3. This makes it more likely that minor wave 5 may exhibit a Fibonacci ratio. The target expects minor wave 5 to exhibit the most common Fibonacci ratio within an impulse.

Within minor wave 5, no second wave correction may move beyond its start below 3,214.68.

ALTERNATE HOURLY CHART

Minute waves i and ii may be complete.

Minute wave iii upwards may have begun. It should exhibit some strength and have at least a little support from volume. So far it does not.

Within minute wave iii, no second wave correction may move beyond the start of its first wave below 3,317.77.

SECOND WAVE COUNT

WEEKLY CHART

This second wave count sees all subdivisions from the end of the March 2009 low in almost the same way, with the sole difference being the degree of labelling.

If the degree of labelling for the entirety of this bull market is all moved down one degree, then only a first wave at cycle degree may be nearing an end.

When cycle wave I is complete, then cycle wave II should meet the technical definition of a bear market as it should retrace more than 20% of cycle wave I, but it may end about either the 0.382 or 0.618 Fibonacci Ratios of cycle wave I. Cycle wave II may end close to the low of primary wave II within cycle wave I, which is at 1,810.10. It is also possible that cycle wave II could be fairly shallow and only barely meet the definition of a bear market.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5. Primary wave 5 may still need another year to two or so to complete, depending upon how time consuming the corrections within it may be.

Primary wave 5 may be subdividing as an impulse, in the same way that cycle wave V is seen for the first weekly chart.

TECHNICAL ANALYSIS

WEEKLY CHART

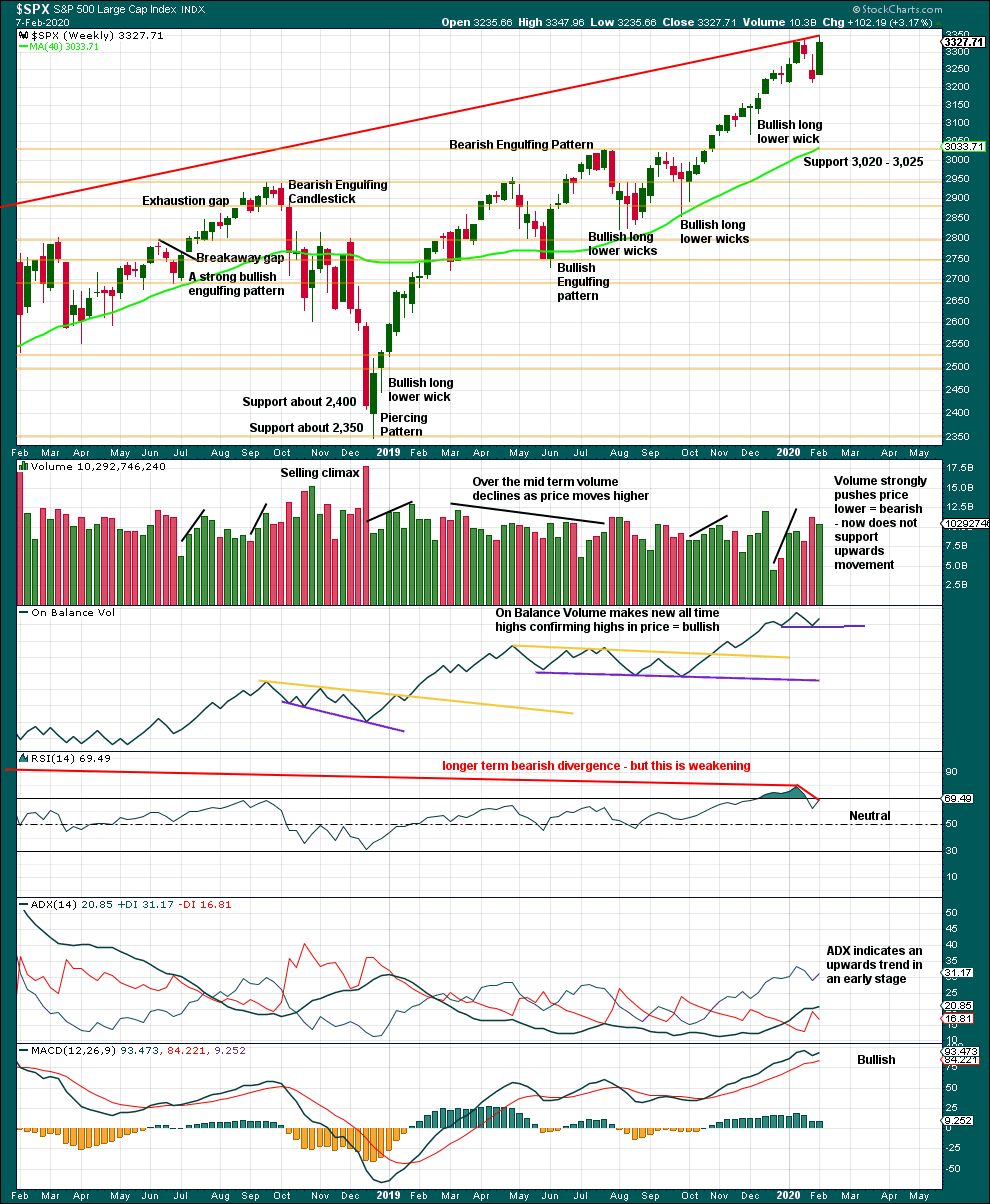

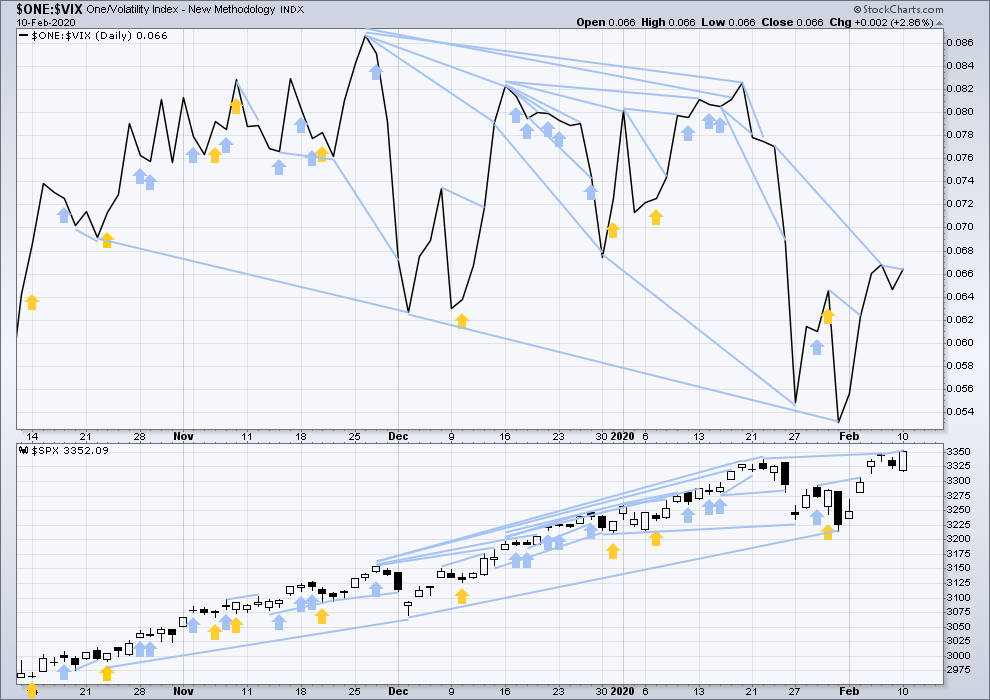

Click chart to enlarge. Chart courtesy of StockCharts.com.

It is very clear that the S&P is in an upwards trend and the bull market is continuing. Price does not move in straight lines; there will be pullbacks and consolidations along the way.

This chart is overall bullish. There are no signs of weakness in upwards movement.

A pullback or consolidation has begun. This is relieving extreme conditions. Look for strong support below about 3,020 to 3,025.

Although price has made a slight new high last week, it has not done so with conviction. Volume is weaker than the prior downwards week, and RSI and On Balance Volume exhibit short-term bearish divergence.

DAILY CHART

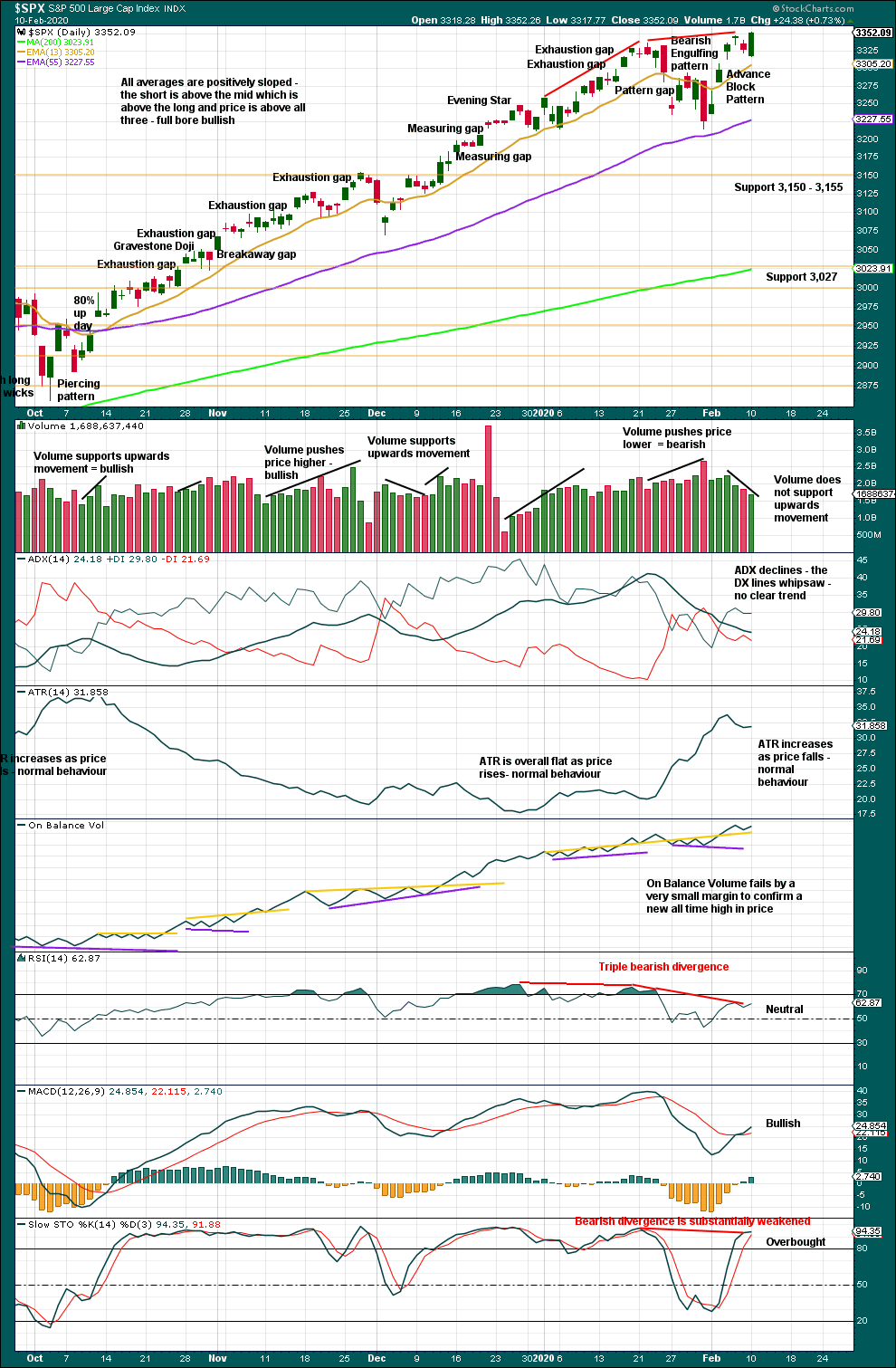

Click chart to enlarge. Chart courtesy of StockCharts.com.

The larger trend, particularly at the monthly time frame, remains up. Expect pullbacks and consolidations to be more short term in nature although they can last a few weeks.

In a bull market which may continue for months or years, pullbacks and consolidations may present opportunities for buying when price is at or near support.

Sustainable lows may be identified by a 180° reversal of sentiment in a 90% down day followed by one or more of the following things:

– Either a 90% up day or two back to back 80% up days within 3 sessions of the 90% down day.

– RSI may reach oversold and then exhibit bullish divergence.

– A strong bullish candlestick pattern with support from volume.

In the absence of bullish reversal signs, expect the pullback or consolidation to continue.

This upwards movement still exhibits some weakness. It lacks support from volume and both of RSI and On Balance Volume exhibit bearish divergence, although bearish divergence with On Balance Volume is very weak.

BREADTH – AD LINE

WEEKLY CHART

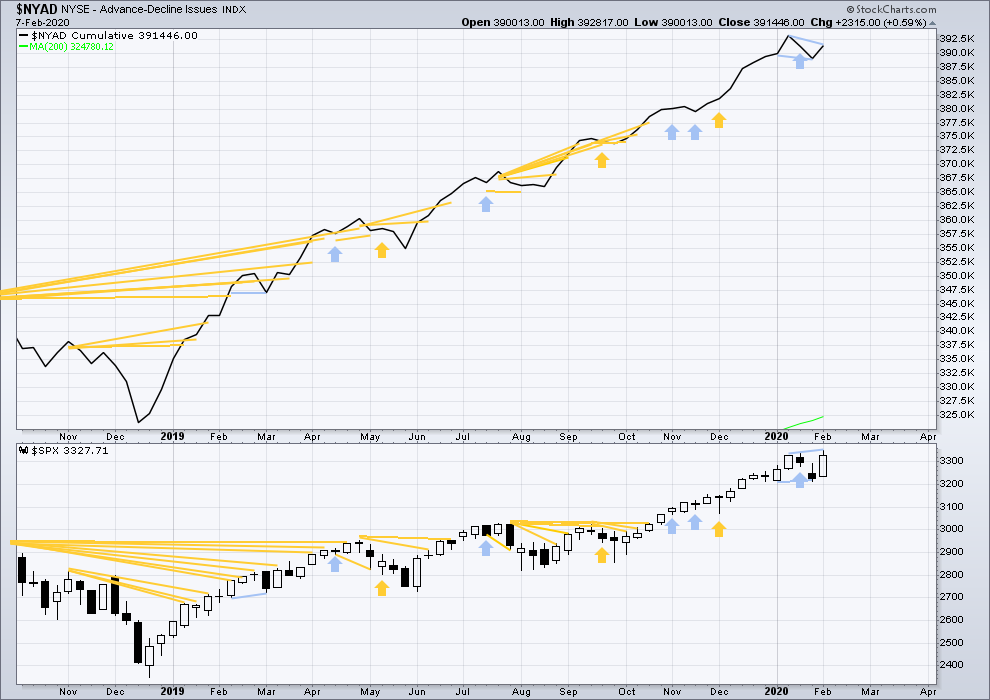

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs last week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid May 2020.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

Last week price has made a new high, but the AD line has not. There is now short-term bearish divergence that supports the main Elliott wave count.

Large caps all time high: 3,352.26 on 10th February 2020.

Mid caps all time high: 2,106.30 on 17th January 2020.

Small caps all time high: 1,100.58 on 27th August 2018.

For the short term, there is a little weakness now in only large caps making most recent new all time highs.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Price has made another new all time high, but the AD line has not. There is now double short-term bearish divergence between price and the AD line. Breadth is not rising as fast as price.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

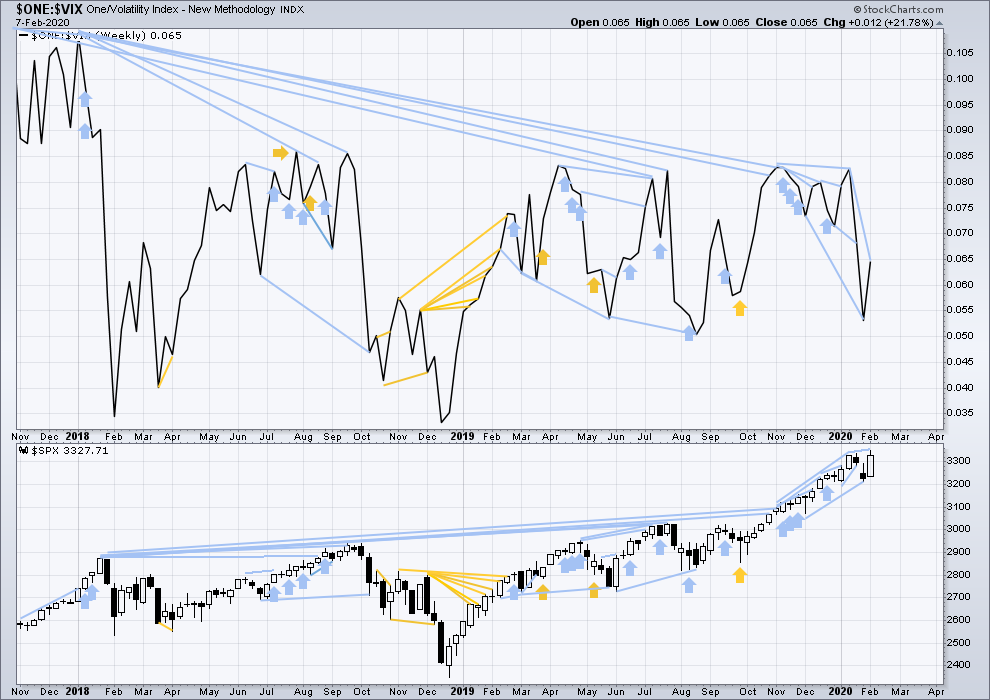

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX was on 30th October 2017. There is now over two years of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It is clearly not useful in timing a trend change from bull to a fully fledged bear market.

Price has moved higher and made a new high, but inverted VIX has not. There is again short, mid and long-term bearish divergence. This supports the main Elliott wave count.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Price has made a new all time high, but inverted VIX has not. There is again all of short, mid and long-term bearish divergence.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Published @ 09:10 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

News on Manufacturing resumption changing by the day

https://apple.news/AY45HXj2dRXqtMZDExkRTvQ

What’s interesting is that if we look at ES with invalidation price being at 3357.75 (same top as SPX’s 3347.96 invalidation for the current alternate count), then ES broke below that point briefly. Not sure if it matters as ES is not SPX but it was done during open session on SPX.

kind of looking like a bull flag on the 5 minute charts, most equity markets.

Can you smell those hot cakes?

added some Feb 24 SPY 324 puts as we violated the gap, meh – only 50 cents

If we hit the 320 target, almost a ten bagger Doc!

Hi Peter,

what does “violated the gap” mean? The gap has not been filled yet as of now.

I wouldn’t buy a crazy bet if we just dipped ours toes in the gap.. no science to this

Got it. Looks like it retraced now and didn’t fully fill the gap yet. The wick is long on the bottom – if stays that way, could be a signal for the next bull run. It could simply be minuette ii as per Lara’s alt count or maybe already main count now:) If it’s a beginning of wave C, then it should be invalidated if the price breaks 3375.63 (ATH), I believe.

Lara – do you agree with that invalidation statement?

Considering the size of the move down at the end of this session, yes, I’m going to put an invalidation point on that wave count at 3,375.63.

Yummy! 😉

Alternate hourly chart updated:

Despite weakness in this upwards movement I may have to swap the main and alternate daily / hourly EW counts over today.

The invalidation point is reasonably close at least. It can shortly be moved up to the high of minute i at 3,347.96.

Main hourly updated (this may be swapped over today, lets see how the session ends)

Minute b or x is now 1.31 times the length of minute a or w.

This is still within a common range for wave B within an expanded flat.

If On Balance Volume and the AD line make new highs today, if volume supports upwards movement, if there is any strength in todays upwards session (if it closes green) then the probability of this wave count would reduce and it would become an alternate,

Hi Lara

Is this now the alternative count?

Thank You

Or is there still some hope with this count

This is a really REALLY hard decision to take today.

I want to swap them over, mostly because price just keeps on going up, but I fear that as soon as I do that price will plummet in wave C of an expanded flat.

Lowry’s data today show a little strength with breadth 68% and up volume 71%. The AD line today confirms new highs in price.

There has still not been a 90% or two 80% up days, RSI still exhibits strong bearish divergence and overall volume is still declining. Overall it’s possible this is a B wave.

I may need to sit on the fence and give you all price points which may indicate which scenario is more likely; a new high tomorrow above 3,375.63 invalidates an expanded flat continuing (main count above) while a new low below 3,317.77 adds confidence an expanded flat continues lower.

Both volume and $NYAD appear to be strong at the moment.

Price needs to move and CLOSE below 3252.09 to confirm end of upward wave.

DJIA gap already closed and price there need to stay below 2978.07 on close…

Hi Verne,

where did you get 3352.09? I see 3351.96 as the previous high yesterday before gap up this morning. Am I missing something?

Top of gap… 🙂

Yep. I have it very slightly different at 3,352.26, but if that gap is closed then it may be an exhaustion gap.

At the end of this session it remains open, so it should be considered a measuring gap. Until proven otherwise.

The market price structure looks very similar to the structure leading up to mid-October. Consolidation, break out to the upper right. Followed by weeks of up ward price action then.

Price action speaks and assume a trend will continue. Yearly/quarterly/monthly/daily strong up.

That all said I closed a big sold NDX put spread for nice profit earlier want to resell a similar for a lot more money soon. I’m suspicious a small multi-day correction starts up here; NDX is WAY outside it’s upper volatility bands on the daily and hourly. I want to sell against next Friday’s expiration.

I’m not shorting in these conditions. The higher tf trends effectively drive -EV pressure on such trades; they are against the broader and stronger current. In a secular bull market, I’m buying the corrections.

Equities up, bonds down, gold down, oil up. Synched up.

The Battle Continues!

Rising bearish wedge for final move up. Get ready…!

No hot cakes today?

You should be ALREADY positioned…!

Just for fun, picked up a wagon-load of IWM 167.50 puts for this Friady for 1.00 even.

Reloaded DIA 297.50 puts after being temporarily stopped out yesterday and added at the morning’s highs….

Yup, bought some at the open 🙂

Ah the life of a trader, at my sister’s beach house (Cambria CA) one block from the ocean with white water views, listening to the sound of the surf roll in through the open windows as the sun rises. Sweeeeeeeeeeeet!!!!!! And the market moving my way, what could be nicer. The sweet smell of ocean and money…

Fascinating article in Quanta Magazine, “The Grand Unified Theory of Rogue Waves”, referring to giant rogue ocean waves…but might similar principles operate in the realm of market “waves”? I dunno…but maybe! Q4 of 2018 for example…rogue wave???

Reading “The Quantum Enigma” by Wolfgang Smith. Fascinating!

Pretty good book.

Latest quantum theory news: “space” itself may merely be a function of quantum entanglement. So…there is no “stuff” in our universe (no actual “particles”), and no “space” either. And the quanta transmit information between themselves instantaneously across any/all distance, violating all of this universe’s physical laws (specifically the speed of light limit for the transmission of any/all information). Sounds a bit to me like this is all a quantum level simulation running on a transcendental (to this universe of space and time) “computer” (a poor analogy but the only one we have). The fact that events that are unobserved aren’t rendered until required by conscious observation is a another giveaway of what’s really up. The double slit experiment: photos unseen of past events will “become” one way or another based on the existence of other data about what happened. I.e., you have data the photon when through slit A or B…look at the photo of which side it went through, sure enough it shows a dot of light aligned with slit A or B, consistent with your separate data. Destroy the data of which slit it went through FIRST before looking at the photo, then look at the photo…oops!!! It shows a diffraction pattern instead (“undefined” which it went through). So the photo isn’t “rendered” until required, and once you change that requirement in the present moment…what has “happened in the past” as captured in your photo changes to fit. Sounds to me like an optimization; why simulate the universe if no one is looking? It takes lots of computing power to “render” quantum state. Which means it IS all about consciousness…loads of twilight zone music here!!!!

I respect those indications the market may turn sharply down. They look ominous.

But the price structure looks very bullish to me

The weekly macd did a bullish cross back in Nov; that usually heralds many many months worth of weeks of upward price movement. Similarly the monthly squeeze that lasted 8 months turned off a few months ago, and that usually heralds 10+ months of strong upward price action. The monthly trend is strong up (not shown here). The weekly trend is strong up (upper left chart, green bars). The daily has just moved back to up trend (upper right, blue bars). In doing so, it’s broken above a double top structure in new ATH territory; effectively, a break up out of a consolidation zone (or Darvas box or what have you). The hourly back to up trend and the 5 minute is of course strong up. From the perspectives of all these technicals, this market is launching. I’m long for a bit now. But I have my “bail and bias short” level, marked with the red line, to control my several long positions.

It will be very interesting to see how this situation plays out. “Fascinating…”

Sorry that chart isn’t readable that way. Here’s a better.

Wondering re this as a possible alternate.

240 mins SPX

Perhaps, except for the underlying weakness. Hopefully we’ll get a bit more clarity today or tomorrow.

Looks viable but Lara’s alternate hourly is better proportioned.

The main is obviously under some severe pressure now, if not terminal. Yet another gap up day…”the force is strong with this one”. Climbing a wall of worry!! Not mid-east troubles, not impeachment, not CV, not nothin’ slowing down the flow of big money into US equities! Like all the green on my board…now if I can just get to next Friday when most of my sold put spread premium expires (SPX, NDX, RUT, AMGN, MRK, SQ, PTON, AVGO, ABT, AMD). A true major C down now would not make me happy…

Uno