Downwards movement remains above the invalidation point on the daily chart. The short-term hourly chart is today relabelled after the pullback of this session.

Summary: This pullback may end in another one session with a slight new low. Thereafter, the upwards trend may resume with increased strength. The pullback is expected to not move below 2,963.44; if it is deeper than expected, it should find support at the lower edge of the best fit channel.

A short-term target for the middle of a third wave to end is now at 3,097.

A mid-term target for a third wave at intermediate degree is now at 3,148.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

The structure of cycle wave V is focussed on at the daily chart level below.

Within cycle wave V, primary waves 1 and 2 may now be complete. Within primary wave 3, no second wave correction may move beyond its start below 2,728.81.

Cycle wave V may subdivide either as an impulse or an ending diagonal. Impulses are much more common. Ending diagonals normally have second and fourth waves that are deep; the common depth is from 0.66 to 0.81 the prior wave. So far a correction within cycle wave V has not been deeper than 0.5, so a diagonal at this stage looks very unlikely (but remains possible).

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

Daily charts below will now focus on price movement from the high of primary wave 1.

DAILY CHART

Cycle wave V must subdivide as a five wave motive structure. Within that five wave structure, primary waves 1 and 2 may be complete.

Primary wave 3 must move above the end of primary wave 1 (this rule has now been met). Primary wave 3 may only subdivide as an impulse.

Within the impulse of primary wave 3, intermediate waves (1) and (2) may both be complete.

Intermediate wave (3) may be incomplete. Intermediate wave (3) may only subdivide as an impulse. Within the impulse, minor wave 3 may be incomplete. Within minor wave 3, minute wave i may be complete. The current pullback may be minute wave ii within minor wave 3.

Within minor wave 3, minute wave ii may not move beyond the start of minute wave i below 2,963.44.

When primary wave 3 is over, then primary wave 4 may be a shallow sideways consolidation.

Thereafter, primary wave 5 should move above the end of primary wave 3 to avoid a truncation.

Primary wave 1 lasted 86 sessions, 3 short of a Fibonacci 89. Primary wave 2 lasted 22 sessions, 1 longer than a Fibonacci 21. Primary wave 3 may end about a Fibonacci 55 sessions, give or take two or three sessions either side. This is a rough guideline only.

So far primary wave 3 has lasted 31 sessions.

Draw the best fit channel to contain all of intermediate wave (3). Draw the first trend line from the end of intermediate wave (1) to the end of minor wave 1, then place a parallel copy on the low labelled intermediate wave (2). Copy this channel over to the hourly chart.

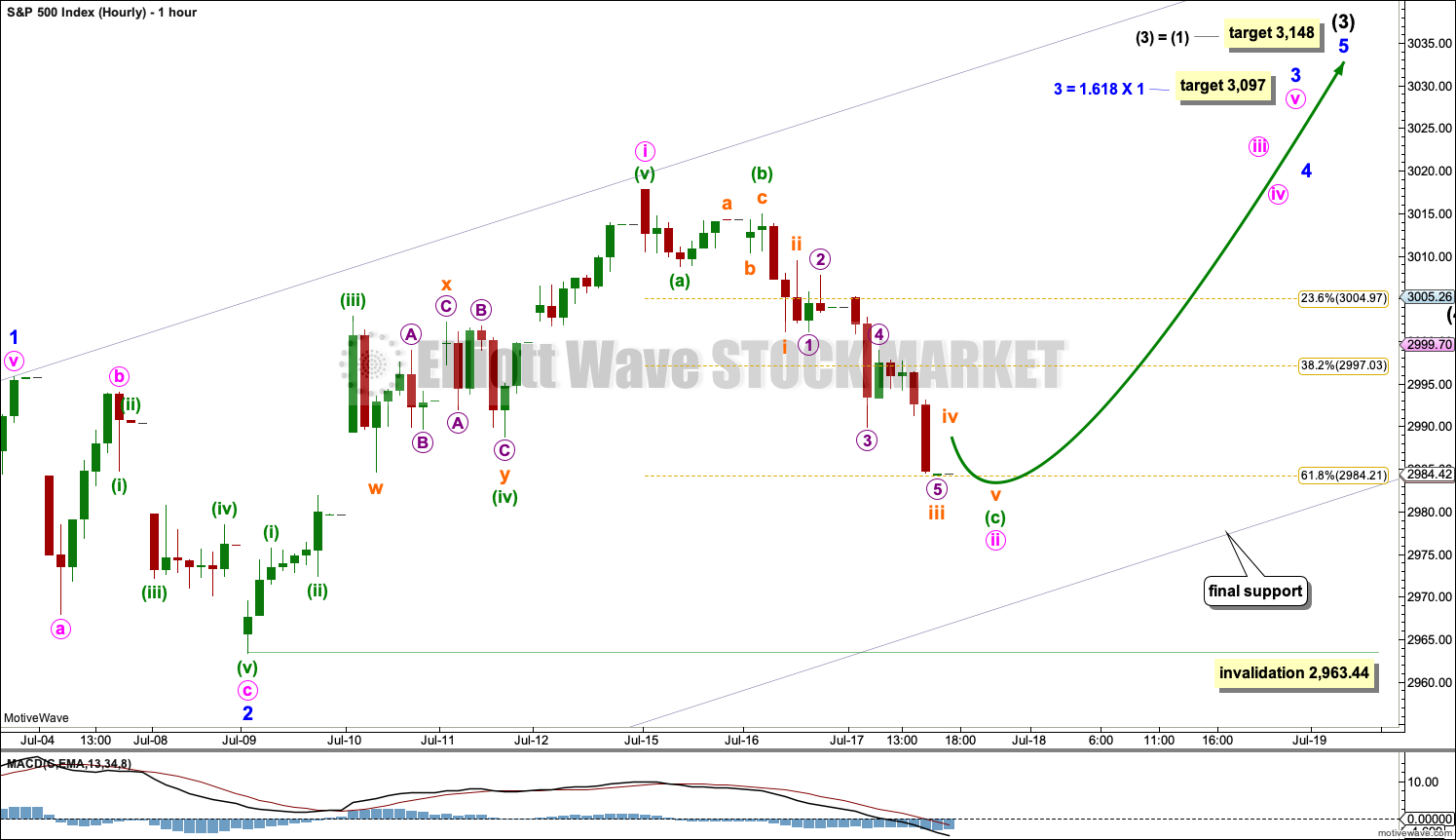

HOURLY CHART

Downwards movement of this session is now back into minor wave 1 price territory, and so this pullback may not be minor wave 4. This indicates minor wave 3 is most likely incomplete. The degree of labelling today within minor wave 3 is moved down one degree; minor wave 3 may be extending.

Minor wave 3 may only subdivide as an impulse. Within minor wave 3, only minute wave i may be complete and minute wave ii may end close to the 0.618 Fibonacci ratio of minute wave i at 2,984.21. However, classic technical analysis today suggests more downwards movement for tomorrow, so minute wave ii may be deeper. Minute wave ii may find final support about the lower edge of the best fit channel, which is copied over from the daily chart.

Minute wave ii may be subdividing as a zigzag. Within minute wave ii, minuette wave (c) may be almost complete. Minuette wave (c) may need subminuette waves iv and v to complete the structure.

When minute wave ii is complete, then the next upwards movement expected would be a third wave at four degrees: minute, minor, intermediate and primary. This would be expected to exhibit a strong increase in momentum.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

WEEKLY CHART

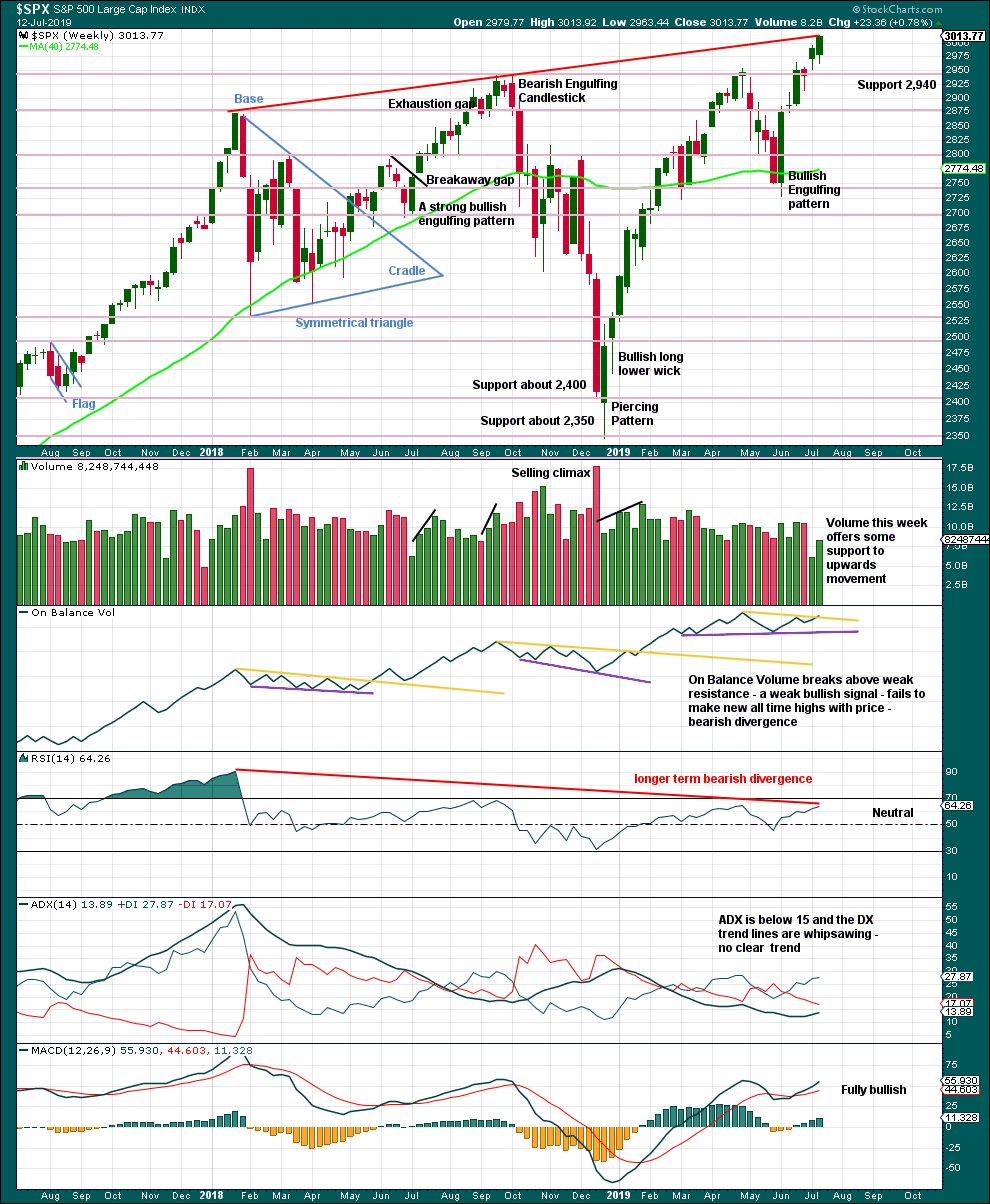

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has closed near the high for the week and volume supports upwards movement. This suggests more upwards movement this week. It is now possible that this expectation may be met and resolved.

Longer-term bearish divergence between price and RSI fits the Elliott wave count: the most extreme reading from RSI corresponds with the end of a third wave, and now a fifth wave at cycle or primary degree exhibits some weakness compared to the third wave.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The upwards trend may be currently interrupted by a pullback. This pullback may reasonably be expected to remain above the last small swing low at 2,963. Support below that is at 2,954.

Volume suggests this pullback is not yet over.

BREADTH – AD LINE

WEEKLY CHART

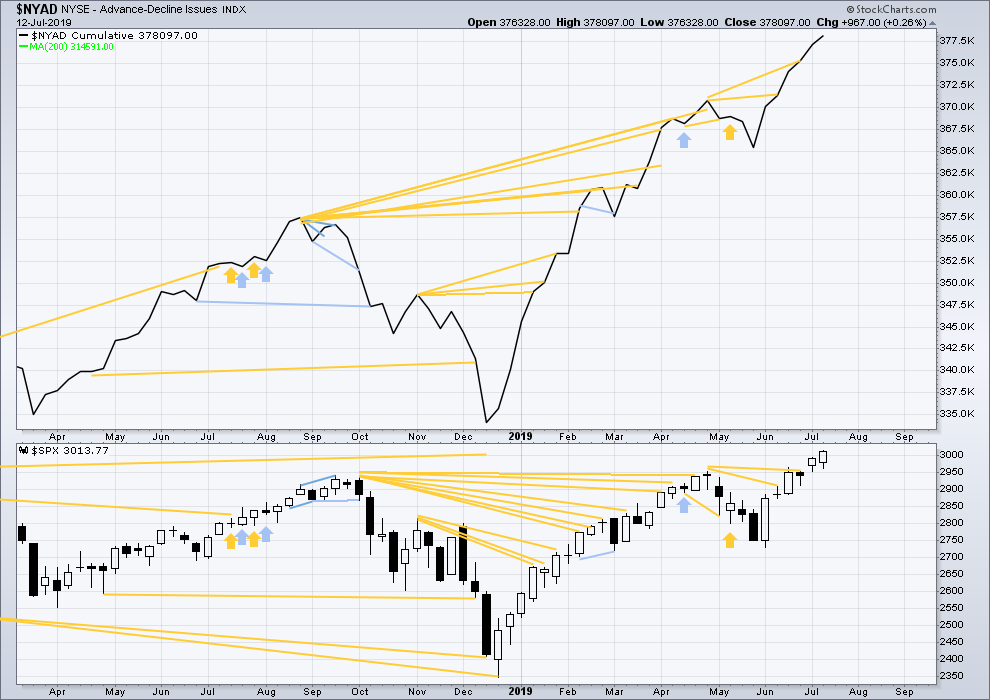

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs again this week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid November 2019.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

Last week the AD line again makes new all time highs with price. Upwards movement has good support from rising market breadth, indicating a healthy bull market.

Mid caps remain below their all time high of 24th April 2019, and small caps remain below their all time high of 25th February 2019. Weakness is beginning to develop in small caps and mid caps. This is normal behaviour during the later stages of a bull market, and may be expected to develop further before the bull market may end. Tops are a process and that process may last months to even years.

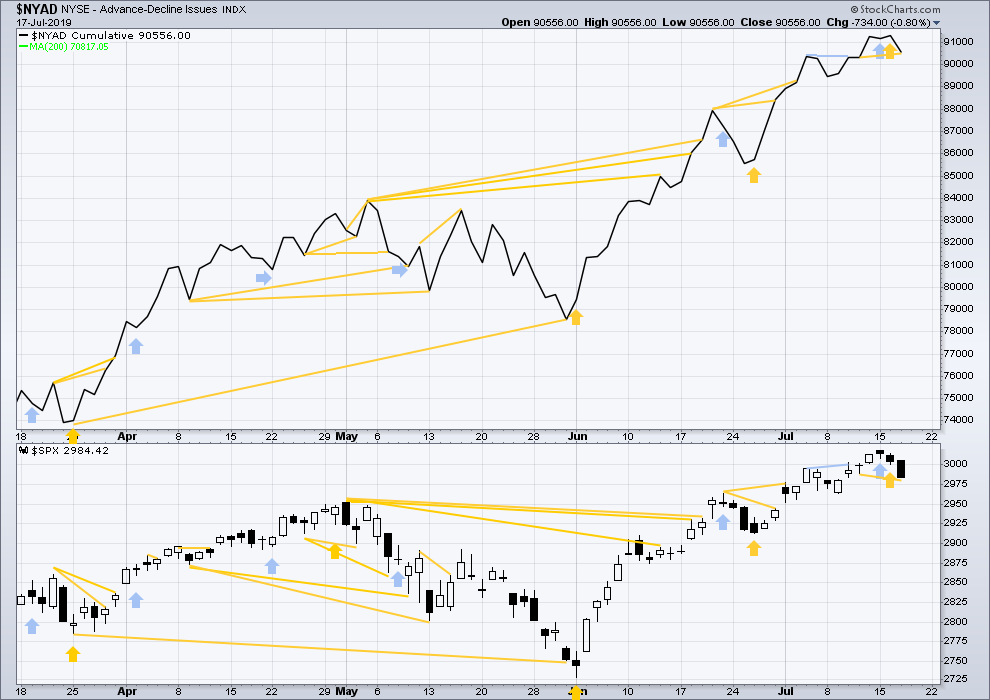

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Short-term bullish divergence noted in yesterday’s analysis has not been followed by upwards movement, so it is considered to have failed.

Today price has made a slight new low below the prior low of the 11th of July, but the AD line has not. Price is falling slightly faster than market breadth. This divergence is bullish for the short term, but it is weak.

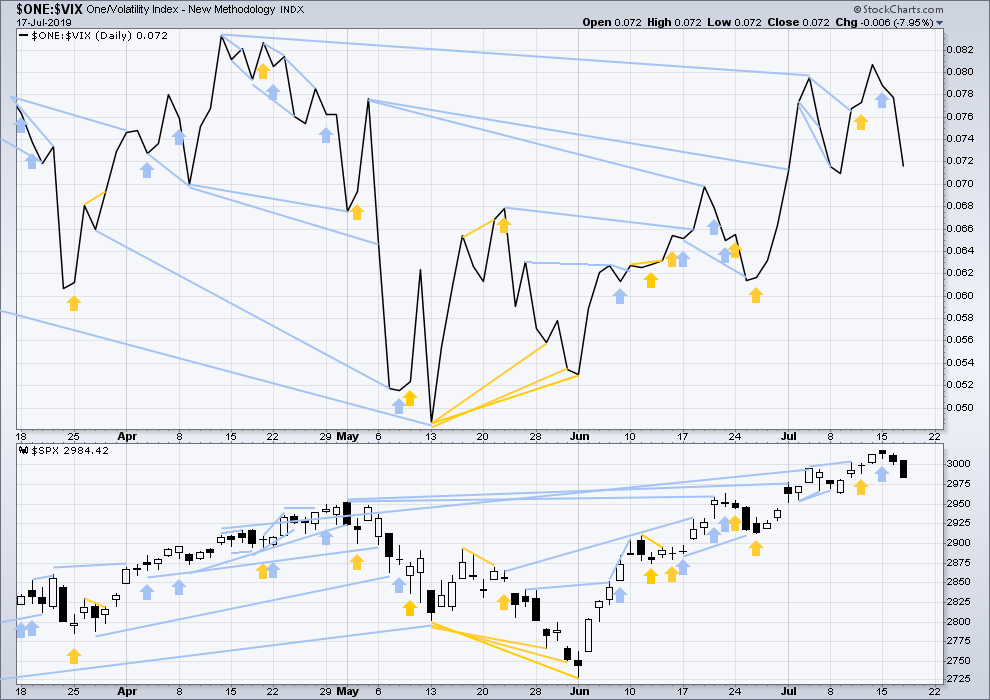

VOLATILITY – INVERTED VIX CHART

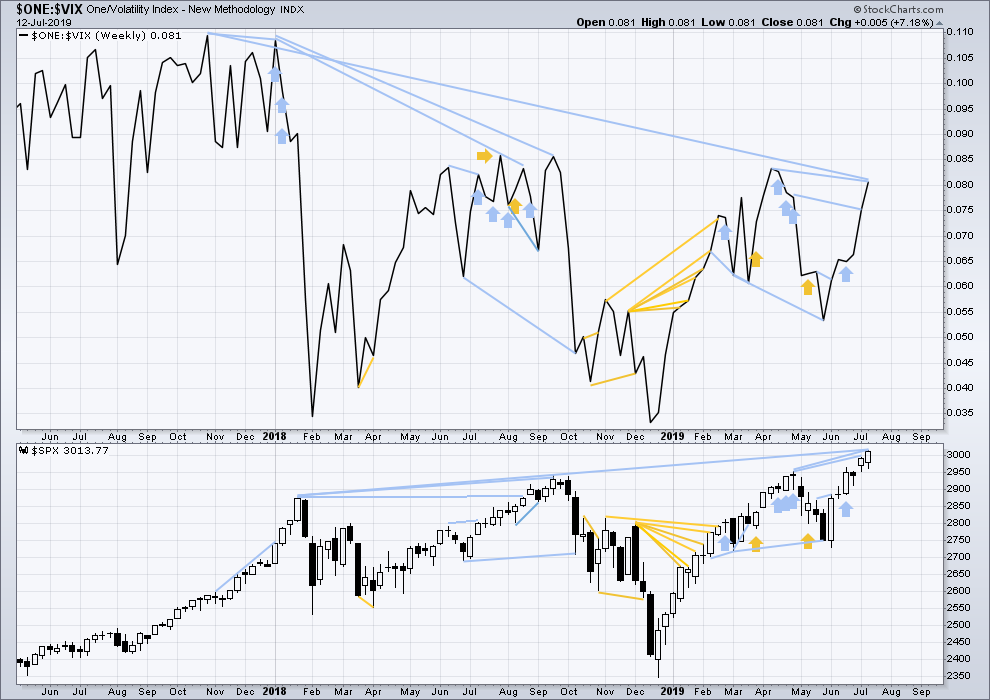

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The all time high for inverted VIX (which is the same as the low for VIX) was on 30th October 2017. There is now nearly one year and eight months of bearish divergence between price and inverted VIX.

The rise in price is not coming with a normal corresponding decline in VIX; VIX remains elevated. This long-term divergence is bearish and may yet develop further as the bull market matures.

This divergence may be an early warning, a part of the process of a top developing that may take years. It may not be useful in timing a trend change.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Both price and inverted VIX today moved lower. Both have made new lows below the prior low of the 11th of July. Inverted VIX is not falling faster than price. There is no new short-term divergence.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81 – a close above this point has been made on the 3rd of July 2019.

DJT: 11,623.58 – to date DJT has failed to confirm an ongoing bull market.

S&P500: 2,940.91 – a close above this point was made on the 29th of April 2019.

Nasdaq: 8,133.30 – a close above this point was made on the 26th of April 2019.

Published @ 07:17 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Kevin I’m now thinking the leading diagonal may be the main count now that the low on the 18th has been taken out on Sept ES.

It’s also broken the lower edge of the best fit channel on the daily and closed below it.

If the low on the 9th is taken out I think that confirms it.

Thats my conclusion too after looking at TA today on weekly and daily charts. There’s a strong bearish engulfing candlestick on the weekly with support from volume.

Are LDs normally followed by fast and deep corrections?

My eye problem was fixed with laser yesterday and now I’m as close to guaranteed good vision as I’ll ever get. All recovered and back into charts today. Thanks everyone for your patience.

Hourly chart updated:

Another first and second wave may be complete.

I’m leaving the invalidation point where it is to allow for the possibility that minute ii may be completing, that this downwards movement today may be minuette (c). But that looks unlikely if the lower edge of the best fit channel is going to provide support, because that trend line would force minuette (c) to be truncated.

Here’s how I have the action mapped out at the 5 minute level as of an hour in on Friday morning….very bullish overall! Love the abc structure of the down move, giving high confidence this is a new motive wave up, not a B or X wave.

Suspicious that the little minuette (ii) wave after the initial minute [i] up may be complete now as an expanding flat.

Now it looks like the ii wave may be a flat with a larger C wave down just initiating. Might go to the 61% or the 76-78%.

hit and turn at the 78% (2980). which is also a ii pivot low from yesterday morning. Long tail on the 5 min. Which doesn’t mean much, but I’m still an expectant bull here.

Alternate:

As per Kevin’s idea, intermediate (1) could have been over at the last high as a leading contracting diagonal. However, the probability is low for two reasons:

1. Leading diagonals, while not rare, are much less common than impulses in first wave positions.

2. In this example both minor waves 2 and 4 are much more shallow than second and fourth waves within diagonals. The common range is from 0.66 to 0.81, here minor 2 is very shallow at only 0.22 and minor 4 is shallow at 0.39.

If however the main count is invalidated, or price moves below the lower edge of the best fit channel, then this may need to be the new main count. But only if the main count in this analysis is invalidated first!

If that happens then the expectation for intermediate (2) to reach the target on this chart would be a minimum. Second wave corrections following leading diagonals in first wave positions are usually very deep indeed.

EW analysis updated:

Weekly chart:

This remains the same. The second weekly chart remains exactly the same as well.

Daily chart updated:

The bounce today is nicely very close to the lower edge of the best fit channel.

So far this looks like a very typical series of overlapping first and second waves.

(I’ve charted Kevin’s idea of a leading diagonal for intermediate wave (1) and will make further comment on that later. For now, it’s a viable count but has a reasonably lower probability than this count. Will publish later with comment.)

Hourly chart updated after session close:

The bounce today looks strong, which is exactly how the beginning of a third wave at 4 degrees should begin.

The invalidation point will remain the same for now.

Classic analysis daily chart:

A bullish signal from OBV and some support from volume today suggests the pullback may be over here.

The larger trend remains up.

AD line:

Price moved lower today with a lower low and a lower high, although the balance of volume was upwards and the candlestick is green. Upwards movement within the session has support from rising market breadth.

Downwards movement from price and upwards movement from the AD line is bullish divergence, this supports the view a low may now be in place.

Likewise there is a single day today of bullish divergence between price and inverted VIX. Because this agrees with the AD line divergence it is given a very little weight, as confirmation of bullish divergence.

I’ve just sent an email to everyone letting you know that I will most likely not be able to do your analysis today. I have to visit a hospital for an eye examination, and the procedure may leave me unable to see for a few hours.

If I am unable to see, I’ll not be able to complete your analysis.

I’ll be updating all charts here in comments right before I go into hospital, I’ll make a comment with each.

Normal analysis resumes tomorrow.

Thank you all very much for your understanding and patience.

Hourly chart updated:

The structure of minute ii as a zigzag is now complete.

The bounce up off todays low looks extremely strong, that is exactly what I would expect to see for the beginning of a third wave at four degrees.

above 2983.6 and the bullish symmetry of the ii down is broken. then the thing to look for is bottom structure (effectively a ii down to close to the lows here, forming some kind of inverse H&S or distorted double bottom look). Then it’s a buy on the break of prior pivot highs.

i’m off for gambling of a different sort, a night at the peppermill in reno. “What we we doing Raymond?” “Counting cards, just counting cards…” Lol!!! Loved Rainman.

Best of luck. You are a great resource in this chat room.

set up on McKesson (MCK) on my site specktrading (dot com).

SAGE and NTRA also.

Thank you, Kevin! Good stuff there.

This is SPX weekly. Gray boxes show dark cloud or bearish engulfing candles initiating massive price movements down. However, note the middle one: total head fake! We have dark cloud cover (and maybe bearish engulfing but need a lot more down today/tomorrow for that). As the Grateful Dead sang, “when life looks like easy street there is danger at your door!”.

Also note there is a kind of triple top potential here: the upper channel line across the two prior major tops just happens to pass right over the exact top of our recent high. “Slanted top triple top”.

Well I put on a little insurance, a SPY put butterfly 288-290-294, broken wing, in the money on anything south of 293.6, peak at 290. Pretty cheap at $38/fly. Pays $350 at the peak, and if the market sell off real big, I’m assured of $170/fly.

Took that fly off for a couple $ profit. I’ll wait to see if the indications are that this is indeed a ii wave down complete…or an impulse A down of an ABC, in which case, I put on the fly again but only as the B up completes. Strategy kicks tail over tactics. A slightly profitable “whoops, reset…”.

What will you look for to signal a B up complete?

I’d imagine a resolution with Huawei could be the ignition point… or the fail point?

pole position!

I’m laying in wait for a juicy wave 3.

You can’t not like that count. I mean, you can’t get a whole lot more lined up with Chinese boxes of 3’s. I’d certainly like it to play out that way. I’m not convinced in the face of what appears to be a very weak earnings season opening up.

Meanwhile, I’m tracking the downward movement and thinking about how a deeper move might go. Seems to me this model is valid, and thus has some probability.

The B wave would be the killer head fake of course…

I would have counted it like that, but I think within your blue 1 there is a small overlap between the high of <1> and <4>; <1> high is at 2,964.15 and <4> low is at 2,963.44.

A leading diagonal?

Each leg can be seen as a 3?

Or does 4 need to be deeper?

Checking rules and guidelines again, am I correct in saying 1,3 and 5 of a LD must be impulsive ?

So sorry Kevin, of course, and yes, you’ve put the trend lines there.

Yes, it could be a leading diagonal. The second and fourth waves are much more shallow than normal at only 0.22 and 0.39, but it meets all EW rules.

Halpin: within leading diagonals waves 1, 3 and 5 are most commonly zigzags, but they may also be impulses. They can be either.

Here’s my current take on this move, I think this is exactly per Lara’s hourly. One more little v down should do it. But…it is possible this is not an ABC down, but a complete impulse A of an ABC correction. Careful Will Robinson!

If it does turn out to be a 5 wave move, then after this move gets to new lows, there needs to be one more correction and then a final v down, to match what would then be a long and shallow ii wave to start the whole thing. If it makes that structure and then starts moving up, we’ll have confidence it’s a completed A of ii instead of a completed ii. Lessee whadda happens….