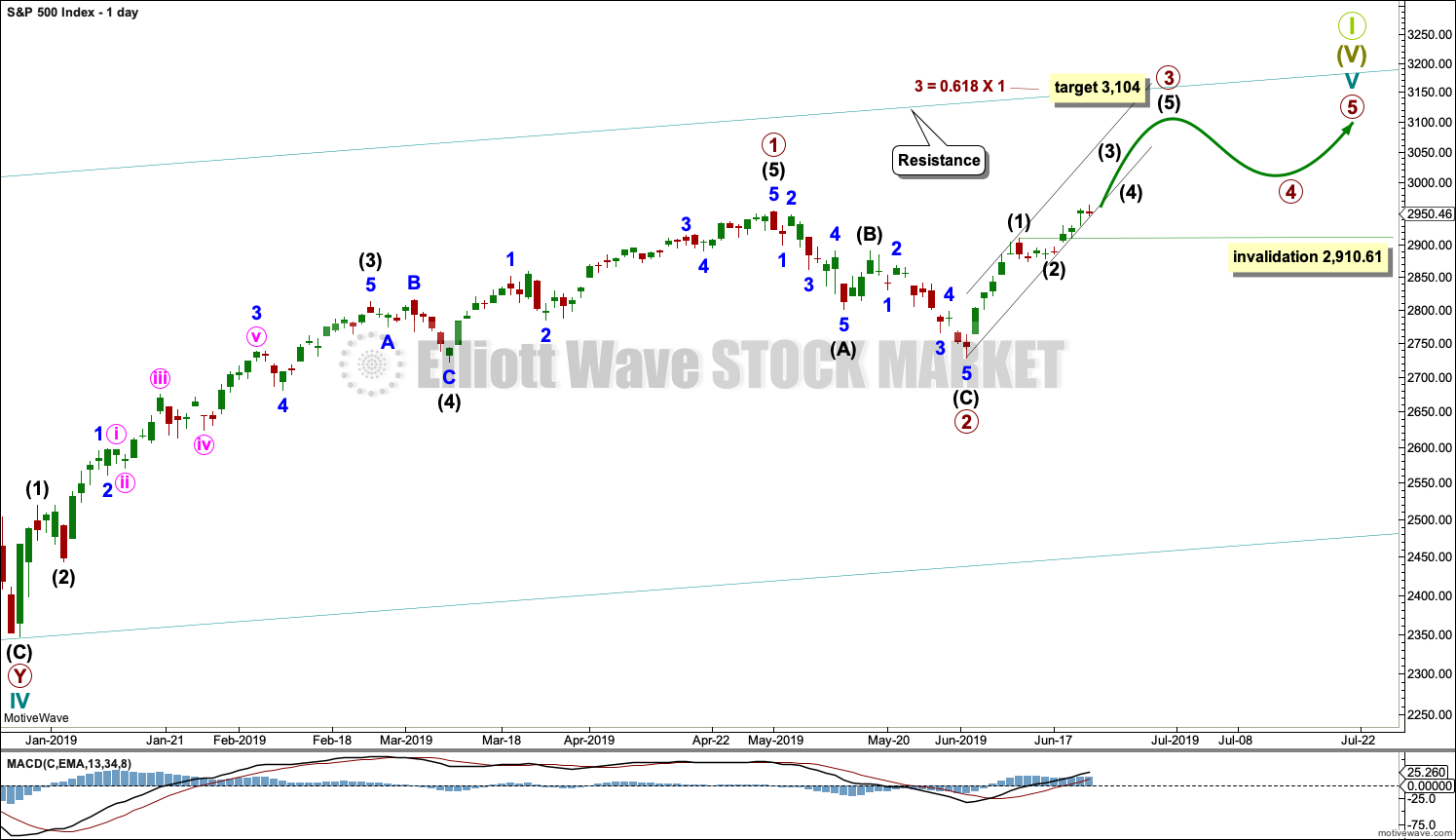

Further upwards movement continues as expected from the Elliott wave count.

Summary: The low of December 2018 is expected to most likely remain intact.

The next short-term target is at 3,068 (Elliott wave) to 3,079 (classic analysis from the pennant). This next upwards wave may exhibit further strength. Look for corrections to continue to be very shallow and brief.

The mid-term target remains at 3,104 for a more time consuming consolidation or pullback, which may also be shallow.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

The structure of cycle wave V is focussed on at the daily chart level below.

Within cycle wave V, primary waves 1 and 2 may now be complete. Within primary wave 3, no second wave correction may move beyond its start below 2,728.81.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

DAILY CHART

Cycle wave V must subdivide as a five wave motive structure. Within that five wave structure, primary waves 1 and 2 may be complete.

Primary wave 3 must move above the end of primary wave 1. Primary wave 3 may only subdivide as an impulse. Within the impulse, intermediate waves (1) and (2) may be complete. Intermediate wave (3) has moved above the end of intermediate wave (1) meeting a core Elliott wave rule. When it arrives, intermediate wave (4) may not move into intermediate wave (1) price territory below 2,910.61.

When primary wave 3 is over, then primary wave 4 may be a shallow sideways consolidation.

Thereafter, primary wave 5 should move above the end of primary wave 3 to avoid a truncation.

A narrow best fit channel is drawn about primary wave 3. Although the S&P500 does not always fit neatly within channels, along the way up the lower edge of the channel may provide support. If the channel is breached by downwards movement, then the lower edge may provide resistance when price turns back upwards.

Primary wave 1 lasted 86 sessions, 3 short of a Fibonacci 89. Primary wave 2 lasted 22 sessions, 1 longer than a Fibonacci 21. Primary wave 3 may end about a Fibonacci 55 sessions, give or take two or three sessions either side. This is a rough guideline only.

So far primary wave 3 has lasted 14 sessions.

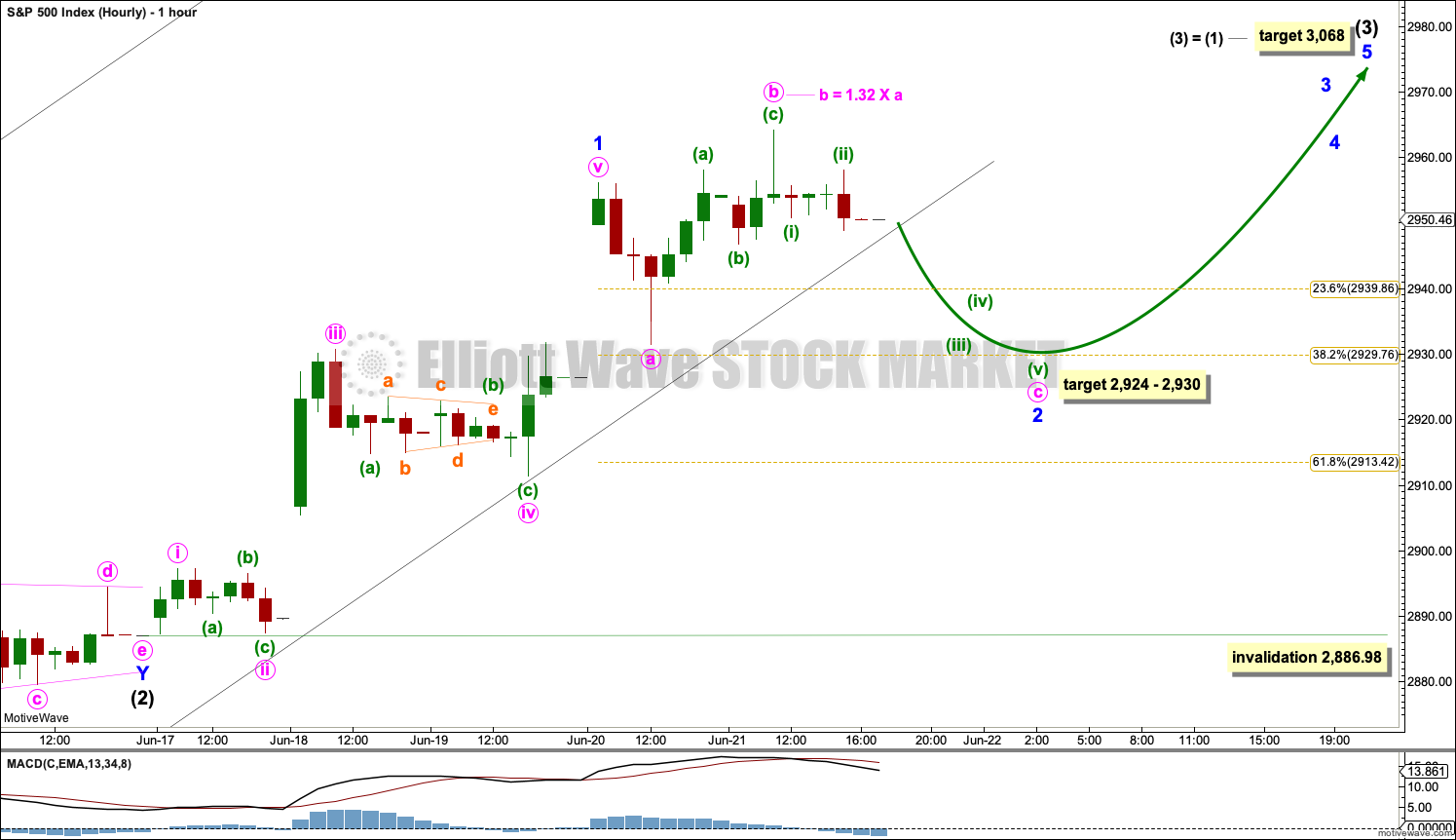

HOURLY CHART

A target is calculated for intermediate wave (3) to end.

Intermediate wave (3) may only subdivide as an impulse. Within intermediate wave (3), minor wave 1 may be complete.

The black best fit channel is copied over from the daily chart. If this wave count is wrong, it may be in expecting a pullback for minor wave 2 early next week, which may not come because support at the lower edge of the channel may halt downwards movement here.

Minor wave 1 fits well as a five wave impulse.

Minor wave 2 may be unfolding as an expanded flat correction. Within the flat, minute wave b subdivides well as a zigzag and is within the most common range of 1 to 1.38 times the length of minute wave a. At 2,924 minute wave c would reach 1.618 the length of minute wave a. This is close to the 0.382 Fibonacci ratio of minor wave 1, giving a 6 point target zone.

When minor wave 2 may be complete, then there may be a series of three first and second waves complete. This wave count would then expect a strong increase in upwards momentum..

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

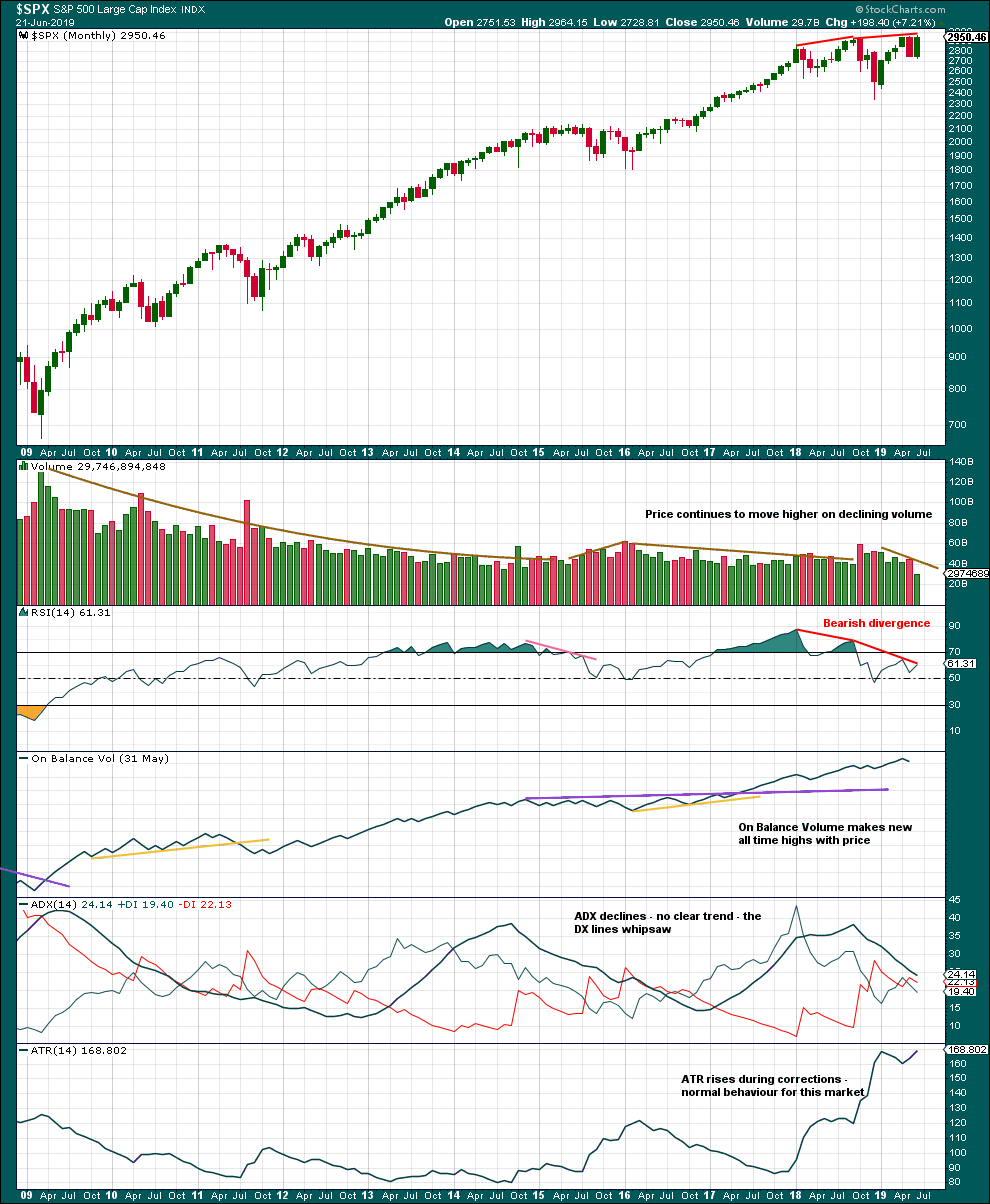

MONTHLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

This monthly chart shows the entire bull market from the low in March 2009.

Greatest strength as measured by RSI was in what the Elliott wave count sees as the end of a third wave. This wave count fits with classic technical analysis.

Declining volume persisting for years fits an expectation for a Super Cycle degree fifth wave. This fits the first weekly chart. Although declining volume may also appear within a first wave, this may be less likely.

RSI currently exhibits strong bearish divergence over several months, which is a warning of some underlying weakness developed and persisting. This may continue as a fifth wave comes to an end.

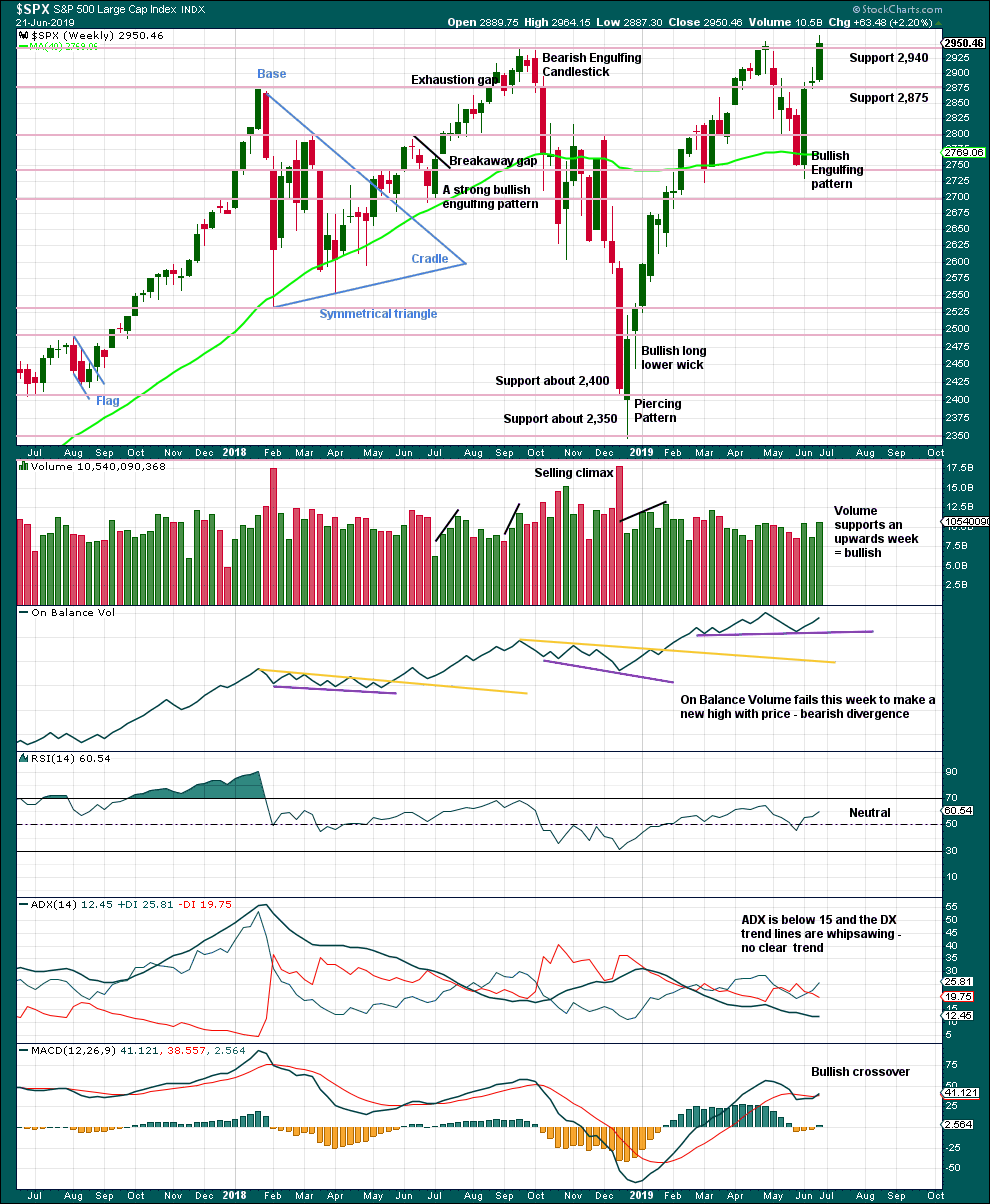

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

While price has made a new all time high on Friday, it has not closed at a new all time high. However, a strong bullish candlestick with support from volume suggests more upwards movement overall next week.

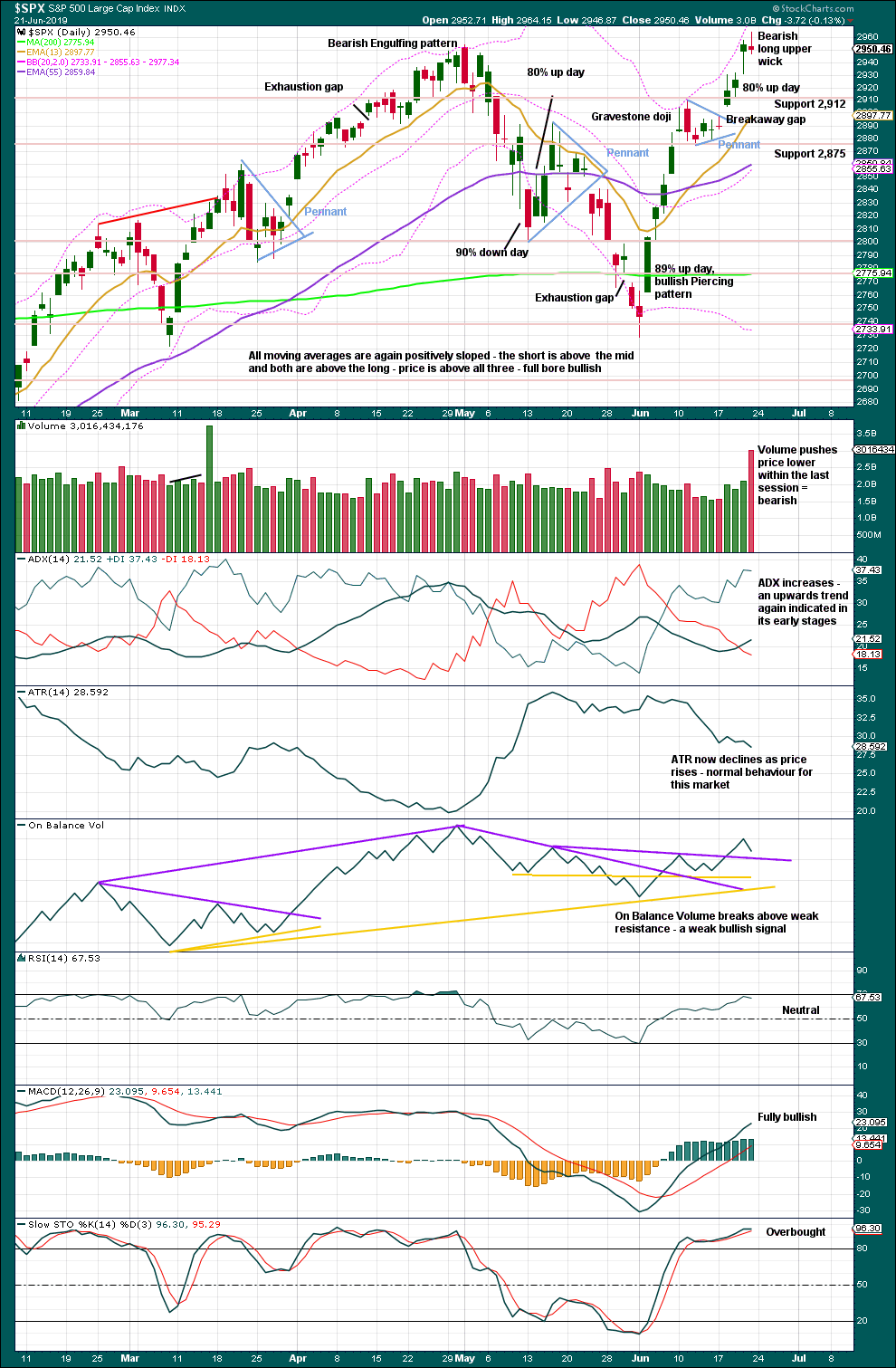

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A target from the flag pole is recalculated about 3,079. This is 11 points above the short-term Elliott wave target at 3,068.

The breakaway gap may offer support at 2,897.27.

For the very short term, the bearish long upper wick and push from volume for downwards movement within Friday’s session suggest some more downwards movement on Monday.

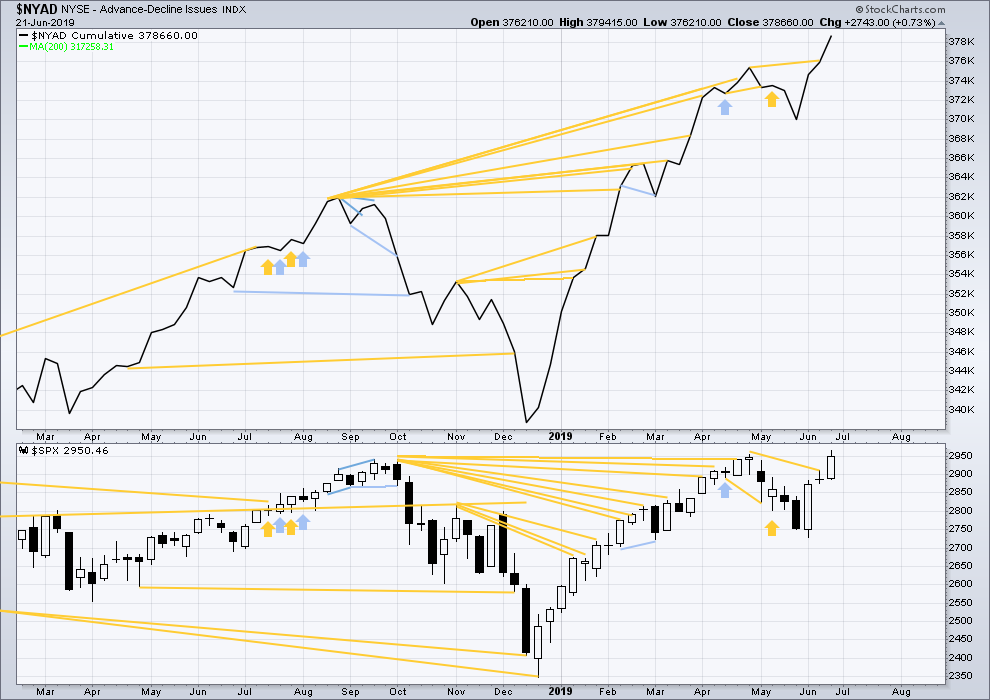

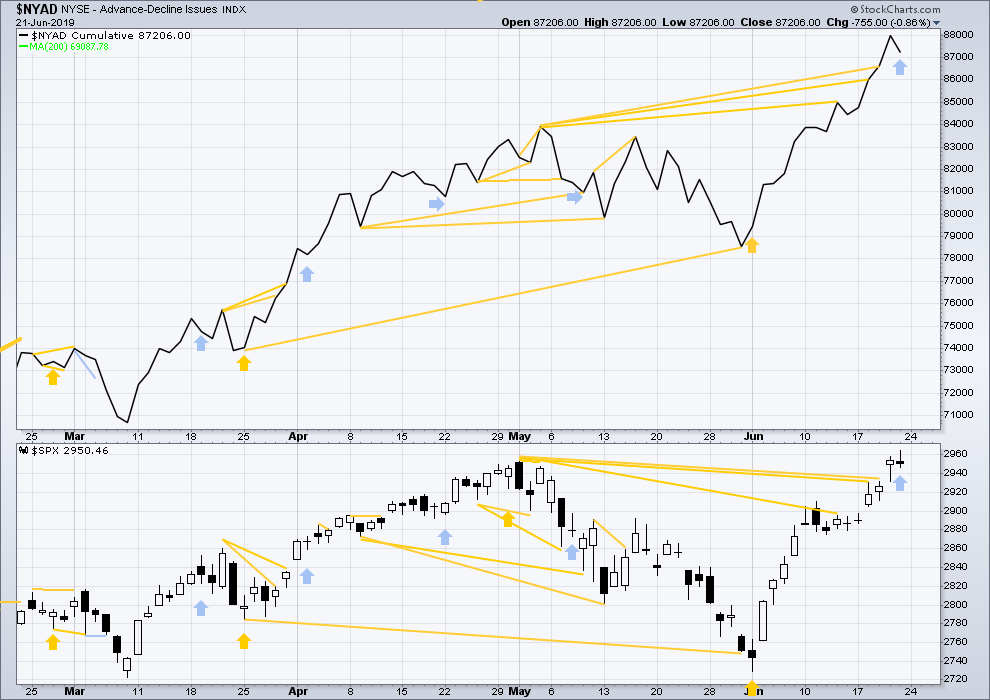

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making new all time highs this week, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is mid October 2019.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow.

This week large caps have made new all time highs, but mid caps are a little distance off doing so and small caps are lagging far behind. This is normal in the latter stages of an aged bull market.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

On Friday price moved higher, but the AD line has moved lower. Upwards movement for Friday did not have support from rising market breadth. This divergence is bearish for the short term.

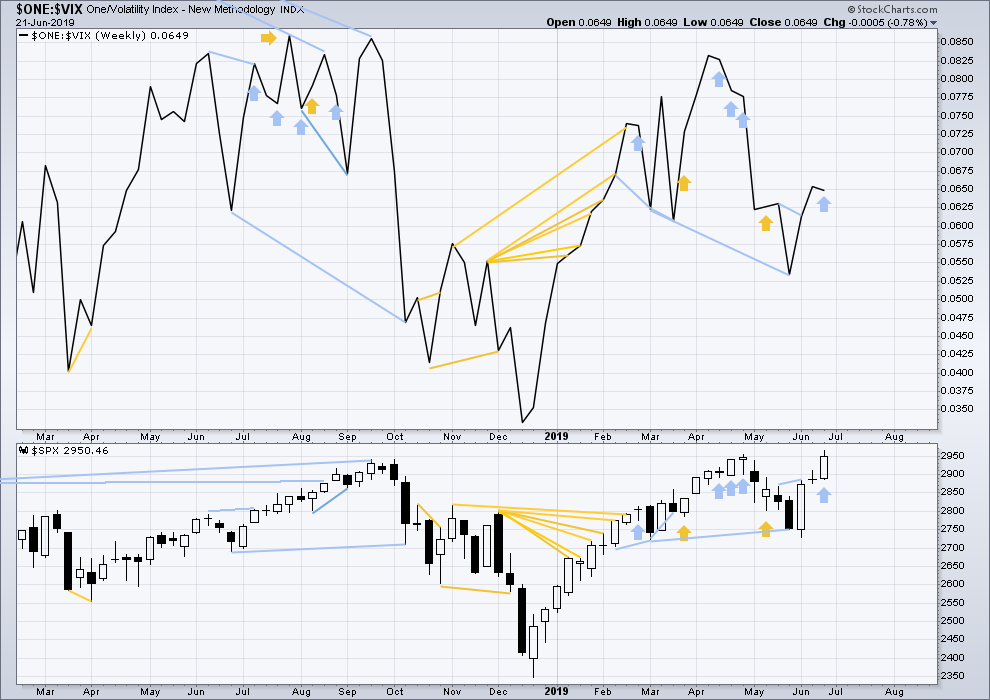

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Long-term bearish divergence remains. It may develop further before the upwards trend ends.

This week price moved higher, but inverted VIX has moved slightly lower. This is a single week of bearish divergence. The divergence may yet develop further before it is followed by reasonable downwards movement.

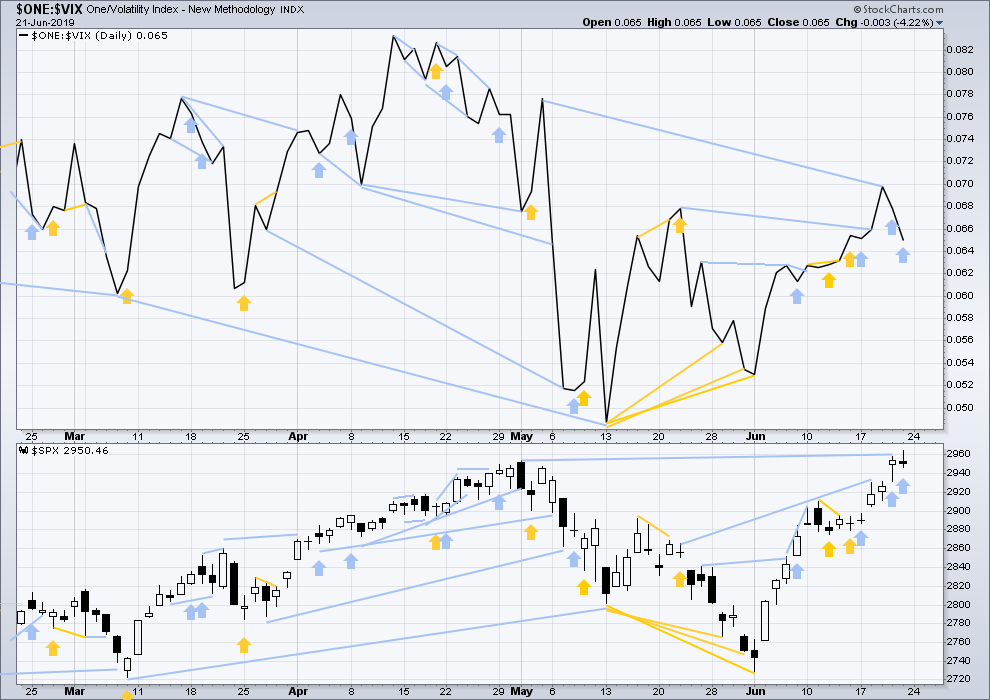

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

On Friday price has moved higher, but inverted VIX has moved lower. There are now two sessions in a row of single day bearish divergence. The rise in price to new all time highs does not come with a normal corresponding decline in VIX. This divergence is bearish.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91 – a new all time high has been made on the 29th of April 2019.

Nasdaq: 8,133.30 – a new high has been made on 24th of April 2019.

Published @ 04:11 p.m. EST on June 22, 2019.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Hourly chart updated:

Minor 2 may continue lower tomorrow to complete the structure of minute c

H&S topping structure now on /ES hourly with overnight data…

on the other hand, SPX is sitting on floor support (lower Darvas box line), and is approaching a reasonable upward trend line as well.

so we’ll see…

yeah all boxed in…. Doesnt feel like a C down …. yet

what triggers you into a short here Peter?

I’ve established a small beach head hedge via a small butterfly for Jul 1 in SPY, centered at 291, extending to 293 and 289. That’s around a 61.8% retrace level (of the 6/12 low to the ATH), and surprise, right at the same level is the 23.6% of the larger upswing. So that seems a reasonable pullback target here for the next week…assuming a C down kicks in. The trendline is busted. Next would be the hourly SPX low at 2948, then the /ES (w/overnight data) H&S neckline, which translates to about 2942 in SPX. Each of those breached will tell me to consider adding to that ‘fly.

I have to say that daily bar on Friday sure looks like a key reversal bar…

when Lara gives me possible C down and a target, I buy some puts and AIM (stop is half the value of the option or a breech of the (ii) whatever comes first) these small bets have excellent risk/reward ratios and protect my longs …. yes its EW gambling

Been studying a lot of pivot structure (double bottoms, inverse H&S, and distorted versions of the same, which are actually more common that the pure forms). To that end, drawing a lot of swing structure over my charts, and learning to recognize (and trust) the indications of “mode switch” from down trending to bottom in formation. Here’s a combo inverse H&S and double bottom formation in development in ATHM (which is a very nice high volatility stock for trading IMO), setting up to break to the up side per the likely swing lines projected forward in time. I’m already long here, but getting bigger on a break through the blue pivot high neckline of the H&S might be a good play (should it happen per the model).

Anyone notice how when you put down a set of fibo retrace levels (I strictly use 23.6%, 38.2%, 61.8%, and 78.6%) over an up move with a clear pivot high defined by a significant retrace, how many pivots over the course of the up move lay right at or around the fib levels? Oh yea, I see it ALL THE TIME. So I’m defining a new analytic tool which I’m calling “Fibonacci Fitting”. Wherein, on a move up that is NOT probably complete, you project a total Fibo set of retrace lines, looking for an overall top price for the structure that causes “a lot of fit” of the pivots with the levels. And bam!! You have a good hypothesis for where the overall top pivot is going to occur. If/when a pivot DOES form there, you have a substantially higher confidence in it’s significance. And that’s edge.

Here’s INTC daily showing exactly this function at work. Obviously I didn’t project this in advance in real-time, and the question remains “how often do you find a lot of fit and the ultimate high indeed falls where projected?”. Questions to be investigated, but I think this has high power potential. It is somewhat similar to EW projections of length based on common fibonacci relationships…but different because it doesn’t require any wave analysis at all. You just look for the overall height(s) that create “a lot of fit”. So here’s INTC, and I’ll try to post some forward looking projections soon as examples that we can track. Fibonacci Fitting, that’s trademarked folks…lol!!

Here are three daily charts for AXSM. The first shows the overall up move (6 months worth) as “complete”, and shows the Fibonacci fitting justifying that.

The second shows a higher Fibonacci fit structure, with even more fibonacci fit, pointing to an ultimate higher price point for the overall move.

The third does the same, showing a yet higher overall target price.

I view this kind of like the “electron shell” model, where electrons can “pop” from one shell to another…but never “in between”. Similarly, the ration targets for this price move up “should” (are more likely to) end at a point where the structure of the overall up move has “a lot of fit” with the finally resolved retracement fibos.

Why do I believe this? Because when I do fibo retrace structures of completed moves, I find lots of such support/resistance action around most/all of the fibo levels. As shown in one example in the previously posted INTC chart. I don’t so often see lots of random price pivots with few to no matches against fibo levels.

Constructive criticism of the theory welcome!!! Here are the three example charts.

The second, higher level projected fibonacci structure for an ultimate swing high…

And the third and final, yet larger/higher projected fibonacci structure that creates lots of “fit” of upward price action to the resulting retrace fibo levels.

Note that model #1 I view as less likely than #2, not for any reason associated with the AXSM chart, but rather because we have such a bullish EW count for SPX. That makes model #1 a bit suspect. The power of multiple analytic tools brought to bear on the question, “what is price likely to do???”.

Here’s the technique applied to the current run up in GLD. Not lots of fit…but the two best fits I could find (both projections on the same chart). The lower one looks better (resistance at the 78.6% and lots at the 61.8%).

Projecting an overall high of 135 area, or for the higher structure, about 140.

The monthly RSI divergence looks scary but if you compare it to the situation around April of 2016 it’s very, very similar and “good things happened” thereafter for several years.

I’ve look through all the squeezes in SPX monthly data going back to ’35, and what happened generally after they stopped. The totals: 16 occurrences (of 2 months of squeeze or more, I ignored single month squeezes of which there are only a couple). 11 followed by many months or more of bullish action. 1 went generally sideways. 4 were followed by months of bearish action. However, all 4 of those squeezes were in obvious monthly downtrends, which is not today’s set up at all. So I like the history of what happens with this kind of setup (4 months now of squeeze with the monthly time frame showing a mild uptrend as of this month). 11 out of 12 times since ’35, that’s been followed by months of strong upward price action.

Hey Kevin…..great info about the monthly squeeze….thanks for sharing!

Numero Uno!

Let’s see if that translates to big Wave (3) gains this coming week!