A consolidation or pullback was expected to continue and to be relatively brief and shallow. A small range downwards day fits this expectation.

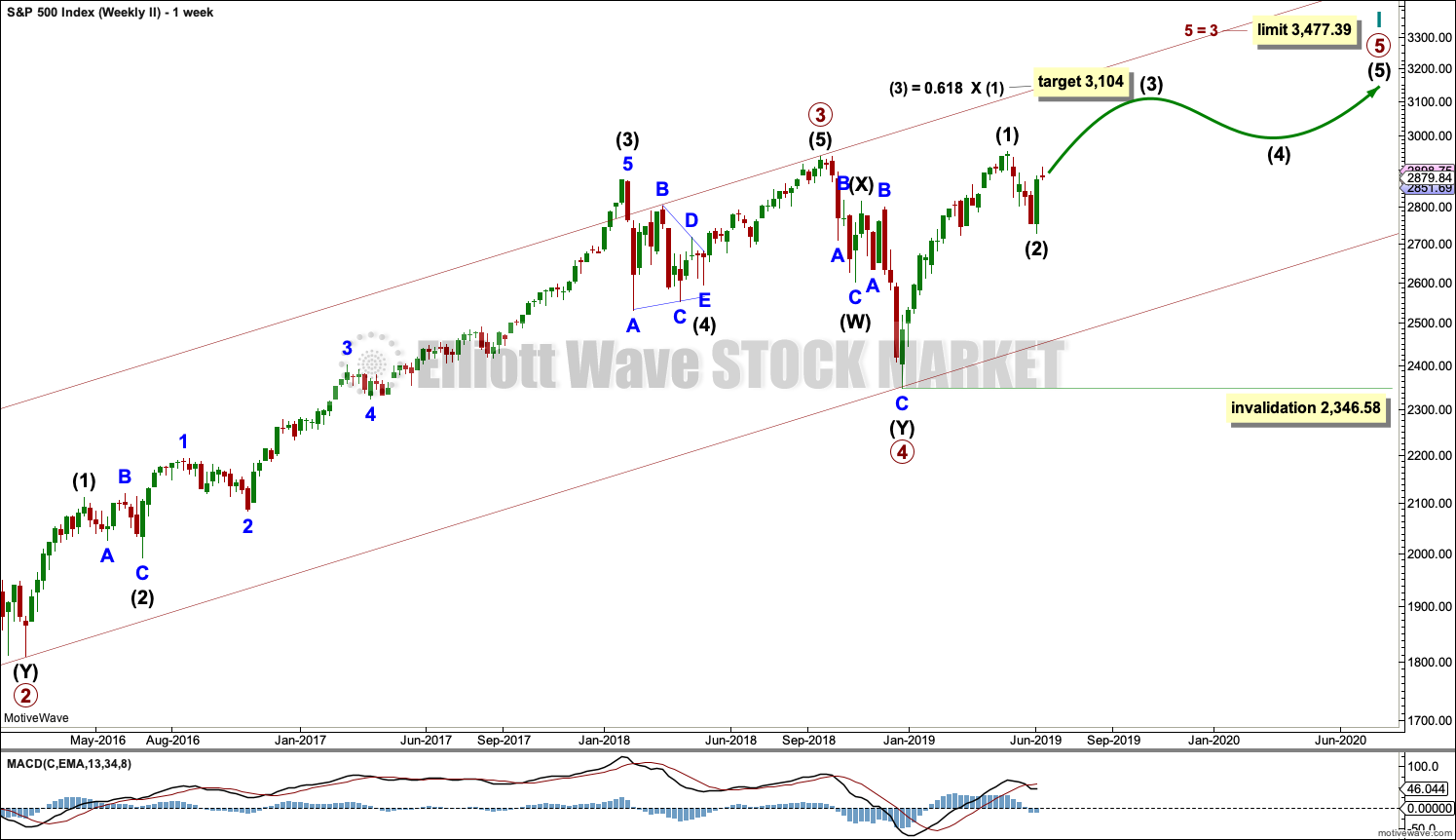

Summary: The low of December 2018 is expected to most likely remain intact.

The target for a third wave up to end remains at 3,104. Along the way up, two consolidations or pullbacks are expected and the first may end in another one to two sessions, at about 2,865 to 2,863.

The next wave up is expected to be a third wave at intermediate degree within a third wave at primary degree. Look out for any surprises to be to the upside and look for the next wave up to exhibit strength.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The first two Elliott wave counts below will be labelled First and Second. They may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39.

The structure of cycle wave V is focussed on at the daily chart level below.

Within cycle wave V, primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

In historic analysis, two further monthly charts have been published that do not have a limit to upwards movement and are more bullish than this wave count. Members are encouraged to consider those possibilities (links below summary) alongside the wave counts presented on a daily and weekly basis.

DAILY CHART

Cycle wave V must subdivide as a five wave motive structure. Within that five wave structure, primary waves 1 and 2 may be complete.

Primary wave 3 must move above the end of primary wave 1. Primary wave 3 may only subdivide as an impulse. Within the impulse, no second wave correction may move beyond the start of its first wave below 2,728.81.

When primary wave 3 is over, then primary wave 4 may be a shallow sideways consolidation that may not move into primary wave 1 price territory below 2,954.13.

Thereafter, primary wave 5 should move above the end of primary wave 3 to avoid a truncation.

A base channel is drawn about primary waves 1 and 2. The lower edge is drawn from the start of primary wave 1 to the end of primary wave 2, then a parallel copy is placed upon the high of primary wave 1. Along the way up, corrections within primary wave 3 may find support about the lower edge of the base channel. Primary wave 3 may have the power to break above the upper edge of the channel.

Primary wave 1 lasted 86 sessions, 3 short of a Fibonacci 89. Primary wave 2 lasted 22 sessions, 1 longer than a Fibonacci 21. Primary wave 3 may end about a Fibonacci 55 sessions, give or take two or three sessions either side. This is a rough guideline only.

So far primary wave 3 has lasted 7 sessions.

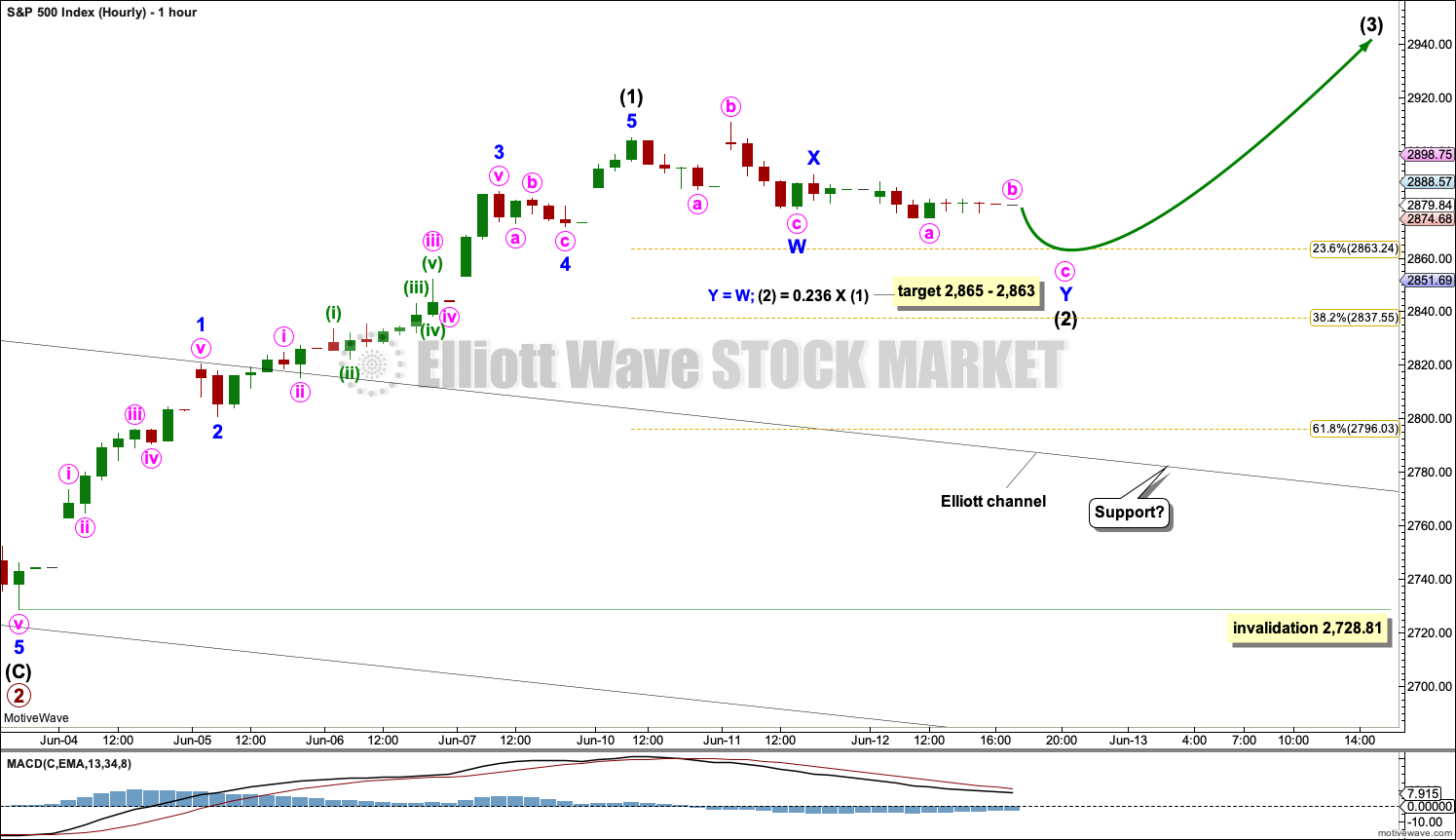

HOURLY CHART

Following a five up, a three back should develop. This will be labelled intermediate wave (2).

Intermediate wave (2) may unfold as any corrective Elliott wave structure except a triangle. Today intermediate wave (2) will be labelled as an almost complete double combination. The first structure in the double may be a complete expanded flat labelled minor wave W. The double may now be joined by a small three in the opposite direction labelled minor wave X. The second structure in the double may be an incomplete zigzag labelled minor wave Y. A target is calculated for minor wave Y.

Intermediate wave (2) may also be unfolding as a single or double flat correction. Labelling within it may yet change again as it continues.

Due to the strong upwards pull of intermediate wave (3) within primary wave 3 just ahead, intermediate wave (2) may be forced to be relatively shallow. The 0.236 and 0.382 Fibonacci Ratios will be favoured targets. Today a possible target zone is calculated for intermediate wave (2) to possibly end in another one to two sessions. If intermediate wave (2) is deeper than this, then the lower edge of the black Elliott channel may provide final support for a back test.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 2,728.81.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is almost identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

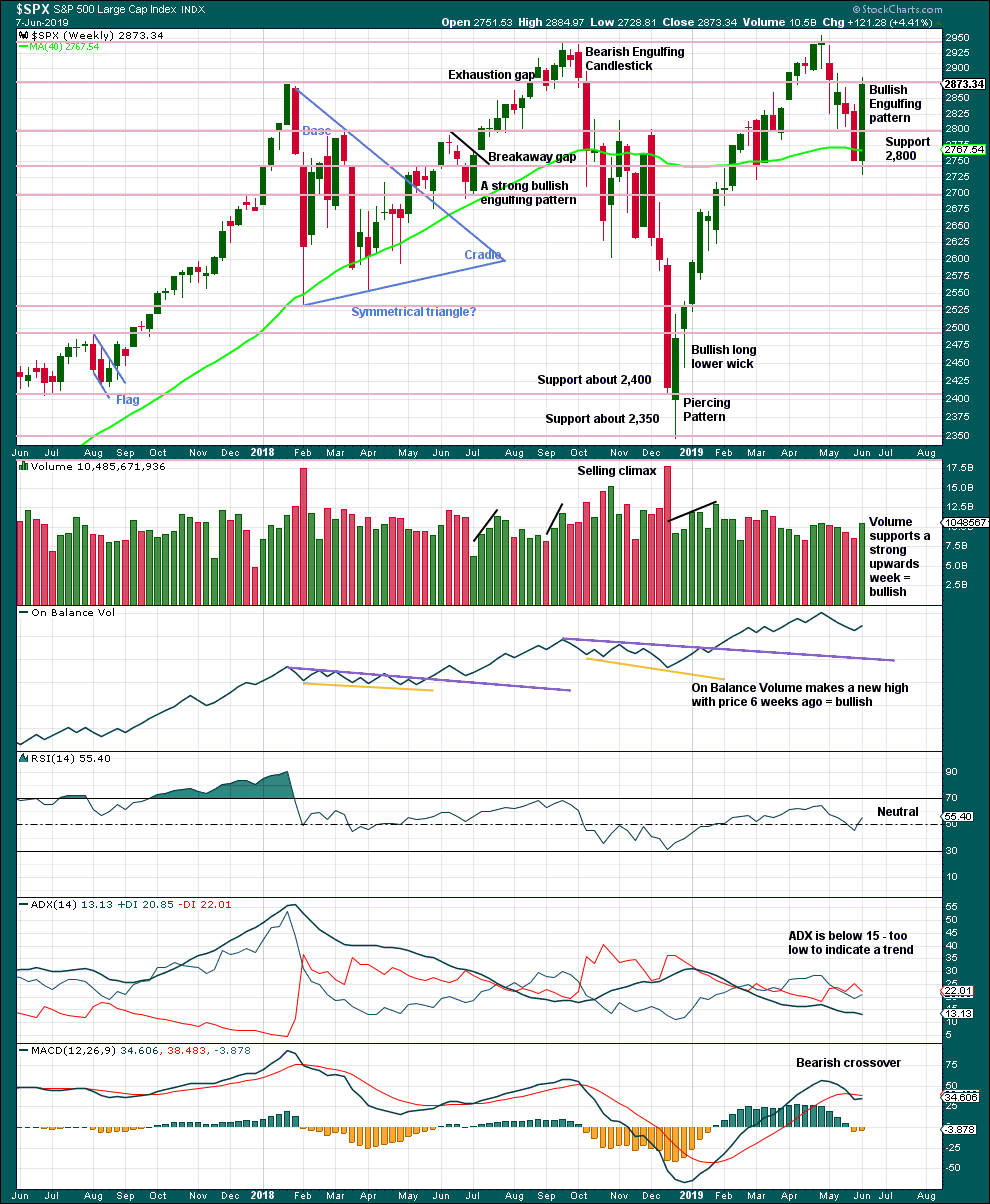

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

Weight will be given in this analysis to the strong bullish reversal pattern, which has support from volume. This supports the main Elliott wave counts.

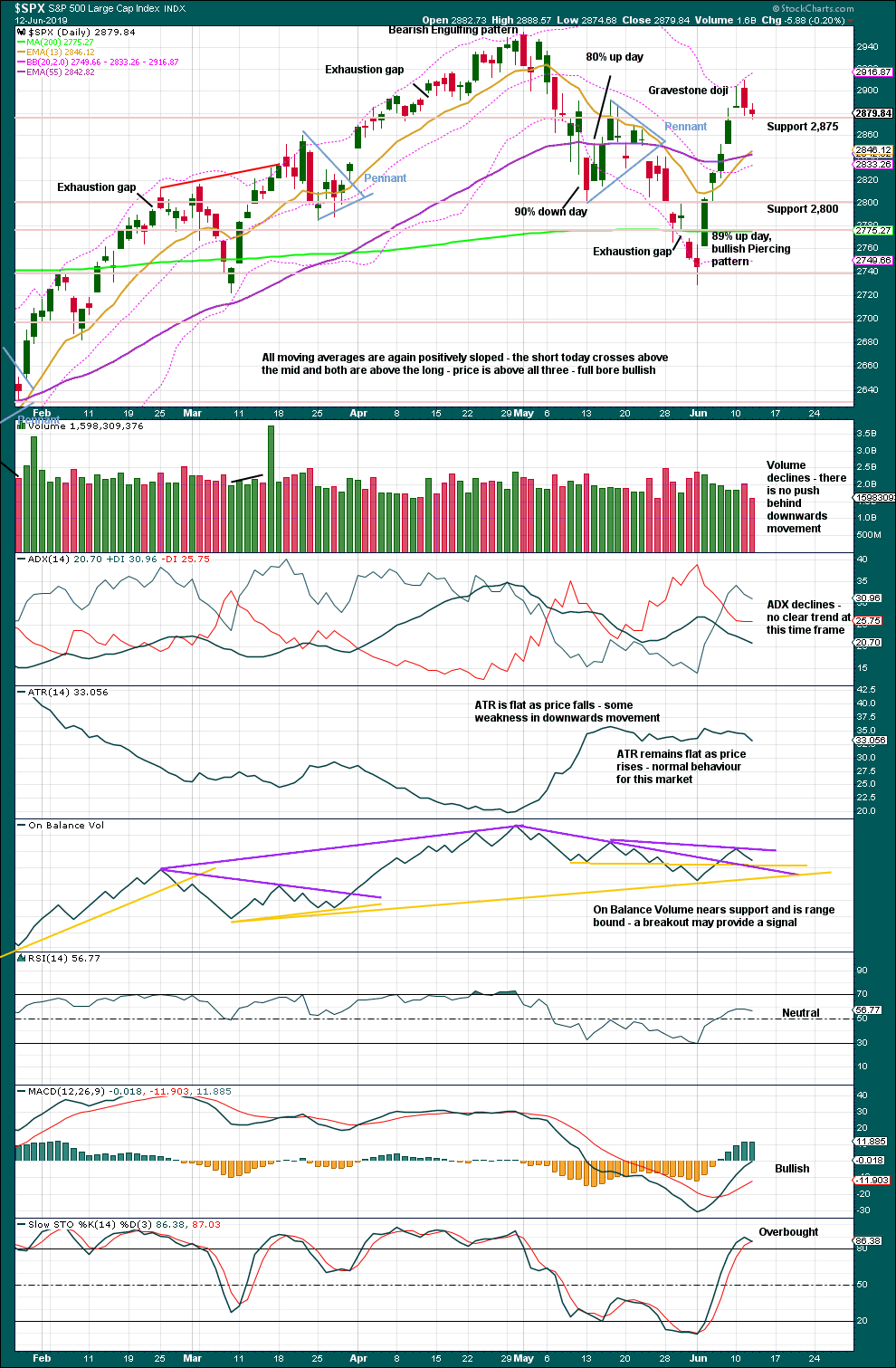

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Candlestick reversal patterns indicate an end to one trend and a change to a new trend. But there are three different directions for price: up, down or sideways. Candlestick reversal patterns make no comment on the direction of the next trend (full reversal or sideways) nor for how long the next trend may run. The Gravestone doji may be followed by a full 180 degree reversal and a new downwards trend, or it may be followed by some sideways consolidation.

Overall, this chart remains fairly bullish. While the larger trend is up, it would be wisest to assume that downwards movement at this time frame is most likely a counter trend movement and presents an opportunity.

Today a very small range day with decreased ATR and weak volume looks like a small counter trend movement. This does not look so far like it may develop into a deeper pullback or be part of a new downwards trend; the S&P usually exhibits strength in its downwards trends.

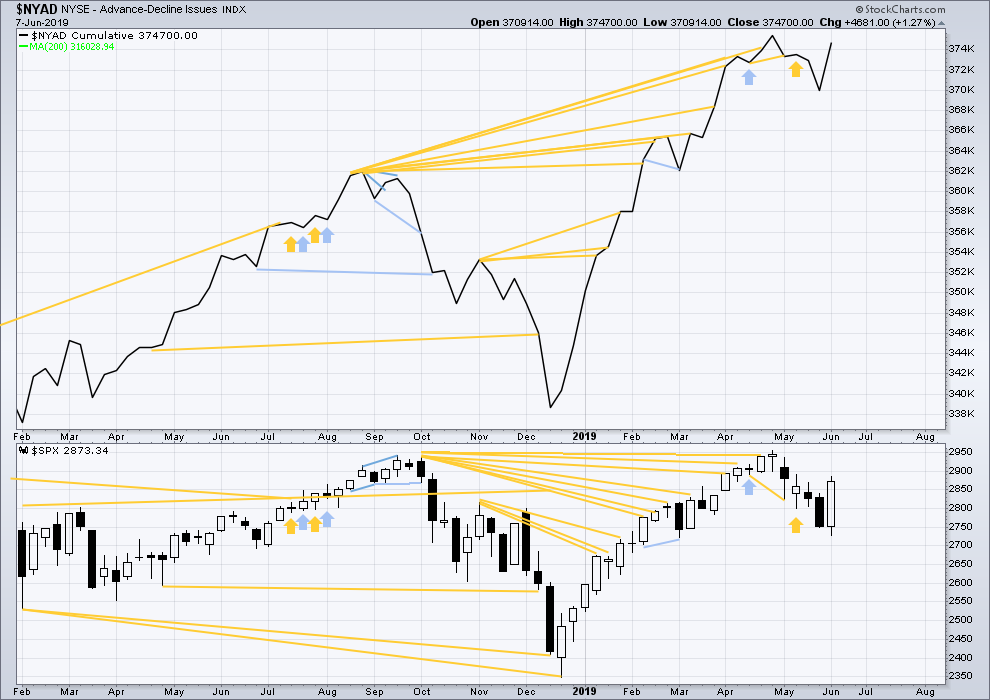

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bear markets from the Great Depression and onwards have been preceded by an average minimum of 4 months divergence between price and the AD line with only two exceptions in 1946 and 1976. With the AD line making a new all time high on the 3rd of May, the end of this bull market and the start of a new bear market is very likely a minimum of 4 months away, which is the beginning of September 2019.

In all bear markets in the last 90 years there is some positive correlation (0.6022) between the length of bearish divergence and the depth of the following bear market. No to little divergence is correlated with more shallow bear markets. Longer divergence is correlated with deeper bear markets.

If a bear market does develop here, it comes after no bearish divergence. It would therefore more likely be shallow. The alternate Elliott wave count outlines this potential scenario.

Price has moved higher last week. Upwards movement has normal support from rising breadth. There is no divergence.

All of small mid and large caps are moving higher. Large caps are strongest; this is normal for the later stages of a bull market.

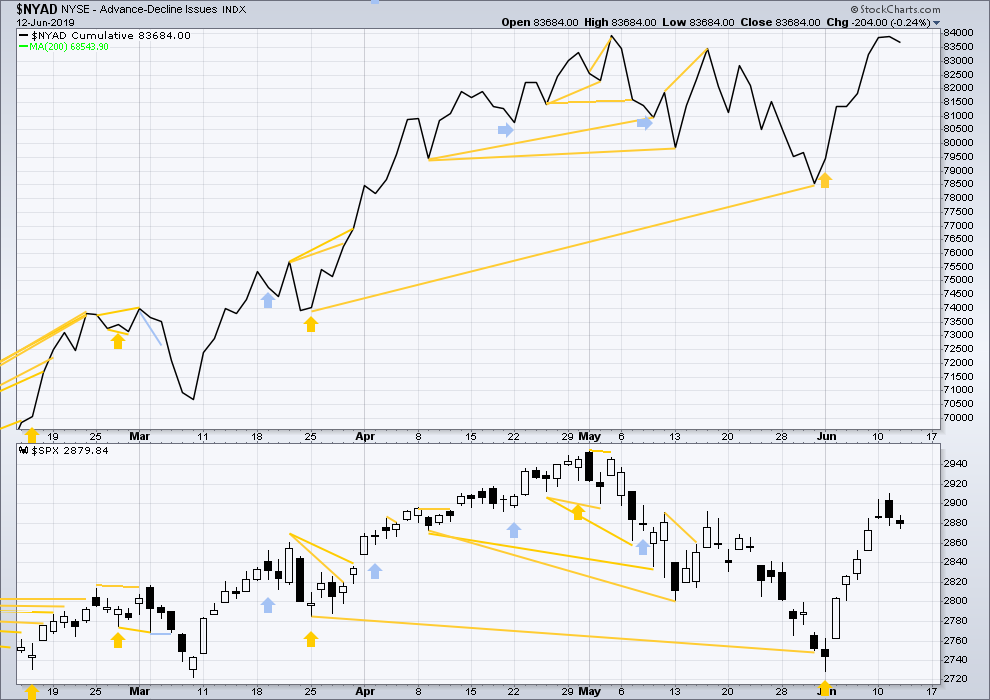

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Today both price and the AD line moved slightly lower. There is no new divergence, but the AD line remains extremely close here to a new all time high while price has a greater distance to go. Breadth is rising faster than price, which is bullish.

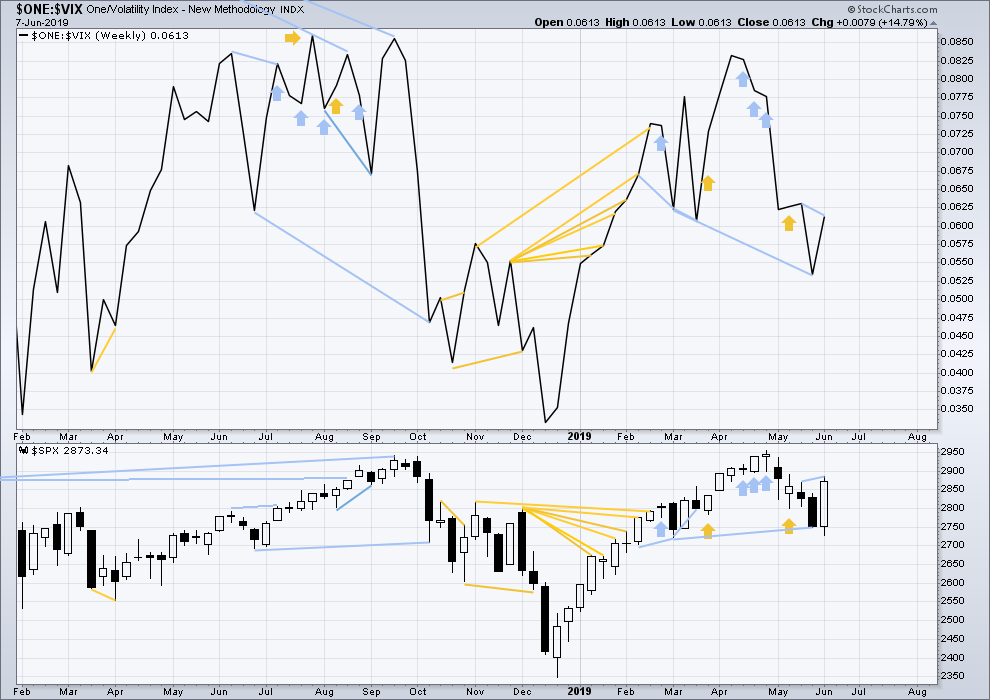

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Inverted VIX has made a new low below the low of the 4th of March, but price has not. Downwards movement comes with a strong increase in VIX, which is increasing faster than price. This divergence is bearish, but will not be given much weight in this analysis at this time.

Last week price has made a new high above the high of two weeks ago, but inverted VIX has not. Price is rising faster than VIX is falling. This divergence is bearish for the short term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Price has moved higher for Friday, but inverted VIX has moved lower. Upwards movement in price does not come with a normal corresponding decline in VIX. VIX has increased for the session. This divergence is bearish.

Today price moved slightly lower, but inverted VIX has moved a little higher. Downwards movement today in price does not come with a normal corresponding increase in VIX. This divergence is bullish.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices having moved higher following a Dow Theory bear market confirmation, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91 – a new all time high has been made on the 29th of April 2019.

Nasdaq: 8,133.30 – a new high has been made on 24th of April 2019.

Published @ 07:28 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

It looks to me like we have a new ATH in t he daily advance-decline line. Most likely we will see this on the weekly close on Friday as well. Support for the idea that new ATHs in price are coming soon.

Hourly chart updated:

Essentially no change from yesterday. Still expecting intermediate (2) is most likely incomplete

Well I got my SPY 290. Now short until 287….. see you in SLC

Well played Beethoven!

Here’s an interesting play…

When it’s about 7-8 days until options expiration, and a stock is well set up for at least a small pop upward in price…instead of buying it and putting on a limit order at 3% profit and a stop at 15% (or where ever, the key attribute being “deep” to avoid random price fluctuation stoppage), what if I sell a put expiring in 8 days? With a strike price right at or slightly below my 3% profit target price? What I’m finding is that I bring in about 3% worth of cash right there, my profit target. Now if at expiry price is above, I make my 3% just like I would if I’d bought and sold at my profit target. If at expiry price is below, I get assigned, and set up my profit target limit sell and my 15% stop. If I exit at “profit”, I’m exiting flat relative to the assigned price and sell price, but I’ve still made 3% on the sale of the put. If I stop out…instead of losing 15%, I only lose 12%. Hey hey boo boo, this sounds like a win-win!

So what’s the downside? First, you can’t quickly take profit; if the stock jump up over 3% on the first day after the put sale, you pretty much have to wait for the 7-8 days and hope price stays above that, because achieving the 3% profit level requires both elimination of all intrinsic value and all premium value. Which in turn delays reinvestment of all proceeds including profit into the next trade, and of course it’s not just how much you make per trade…it’s how fast you can cycle through winning trades with compounding! On the other hand, in bull conditions, I find this overall methodology tends to run an average of about 8-10 days to close anyway. So 8 days to wait isn’t “bad” per se.

But what happens if the stock sells off to the 15% stop price, before the expiry of the put? Ouch. Buying it back means you give back the 3%, and take the full loss as expressed by intrinsic value in the sold put minus whatever premium decay you’ve accumulated. So even this scenario would appear to cut loss size a small amount.

What am I missing here? This sounds like a rather valuable trade off of cutting loss size by 20% on losers (15% -> 12%), at a price of winners always taking 8 or so days (vs sometimes taking only hours). And cutting loss size by 20% sounds huge to me, when we are talking about (realistically) a system with +EV of 1-3% overall (which can make you rich, no doubt about it). Every tiny bit of edge is critical, and this seems like a way to get a pretty large dollop!

Tell me where I’ve gone astray in my thinking. (Someone’s going to say “of course, that’s why you never buy a stock, you always sell a put!”, right?). I’ve just never fully thought it through quantitatively before.

Hey everybody, I’ve just published an updated US dollar analysis over at Elliott Wave Gold. You can find it here.

I can ONLY be a dollar bull….. there is a dollar liquidity crisis IMHO. It explains the tariff push…..

You are not going to believe it, two nights in a row I am #1.

But please note; there can be no king here in this monarchy because it is a matriarchal monarchy. The only queen is Queen Lara. Long live the Queen!

Rodney’s on FIRE! May you have good tidings tomorrow!

LOL

Well, there are very few matriarchal societies about.

Not sure I want to really be the leader of one though… I think you’ll have to sort yourselves out 🙂 I’d rather a democracy

Haza!

Thinking about this…I’d much rather have presidential tweets providing informed wave counts than new tariffs, myself…

Lara for President!!

Forget Tariff Man…it’s time for Elliott wave Woman!