For the very short term, a small bounce or sideways consolidation was expected to continue. A slightly higher high and higher low fits this expectation perfectly.

Summary: For the very short term, a sideways consolidation may now continue for a few sessions. Within the consolidation, tomorrow may be a downwards day.

Thereafter, the pullback is expected to continue lower. It may continue now for another few weeks.

The first target is at 2,722 and thereafter at 2,579. The low of December 2018 is expected to remain intact, and this pullback is expected to be followed by a strong third wave up to new all time highs.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

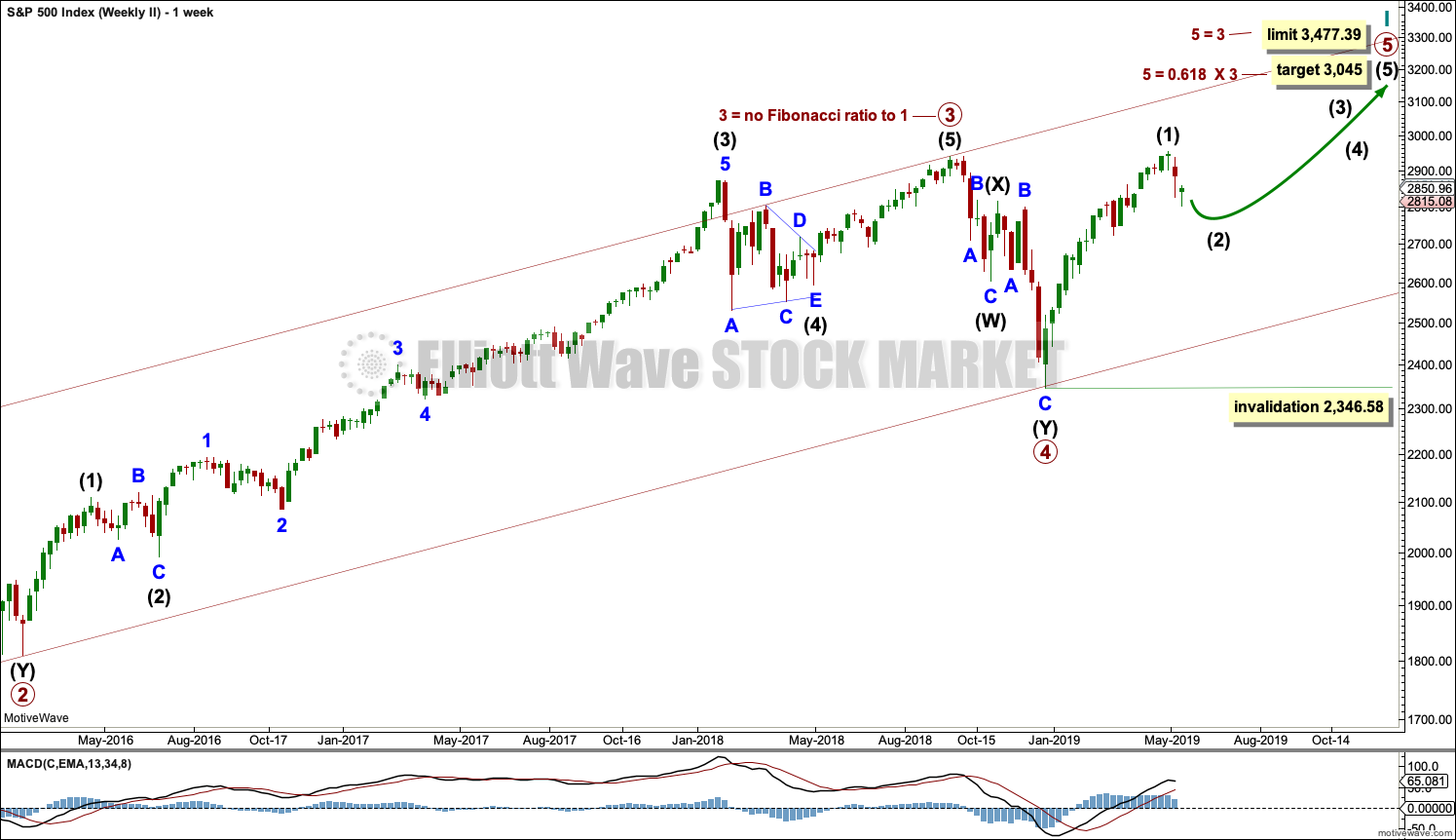

The two Elliott wave counts below will be labelled First and Second rather than main and alternate as they may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

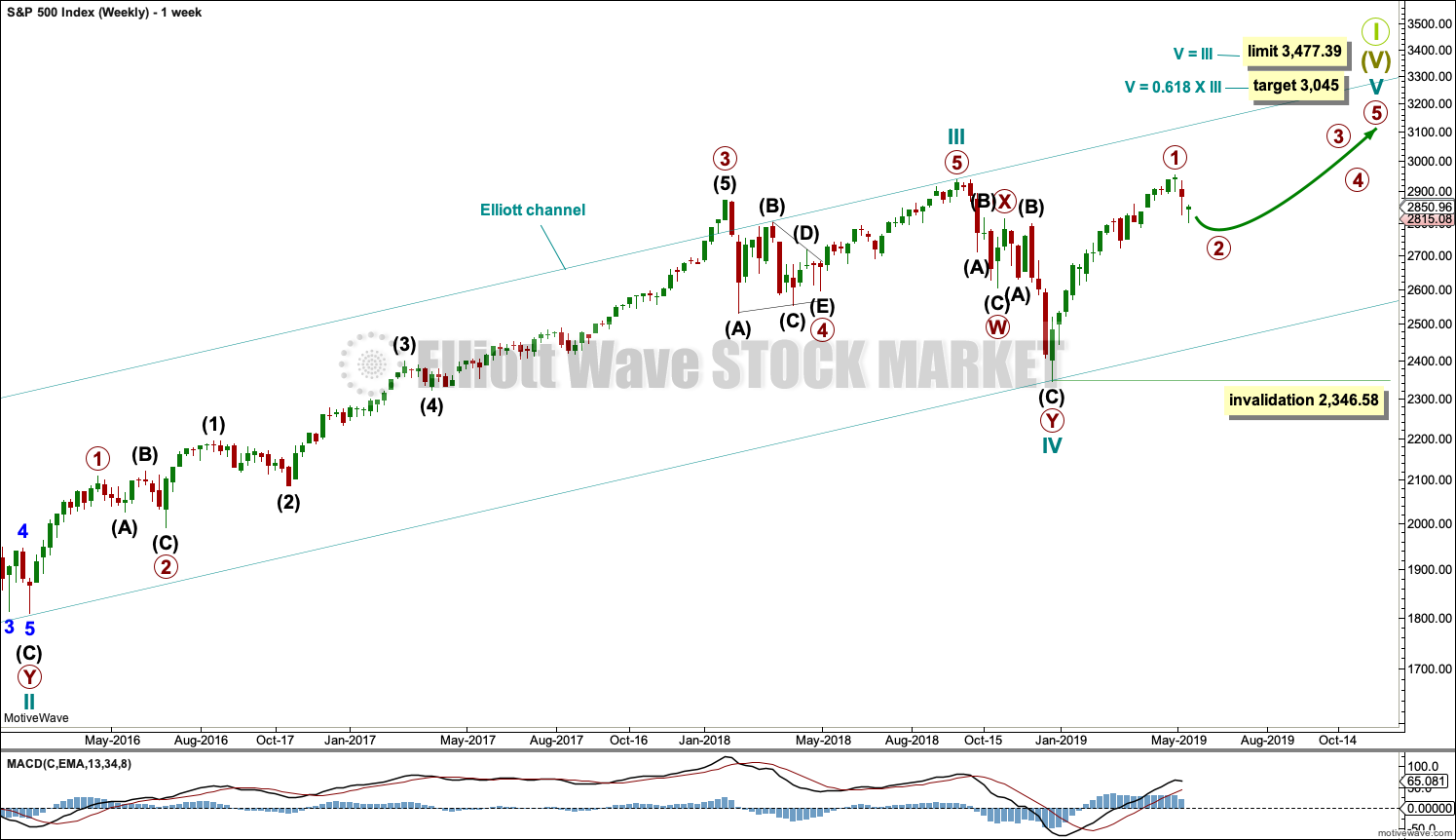

FIRST WAVE COUNT

WEEKLY CHART

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39. This limit may still apply if the degree of labelling within cycle wave V is changed all down one degree.

A final target is calculated at cycle degree for the impulse to end.

The structure of cycle wave V is focussed on at the daily chart level below.

Within cycle wave V, primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

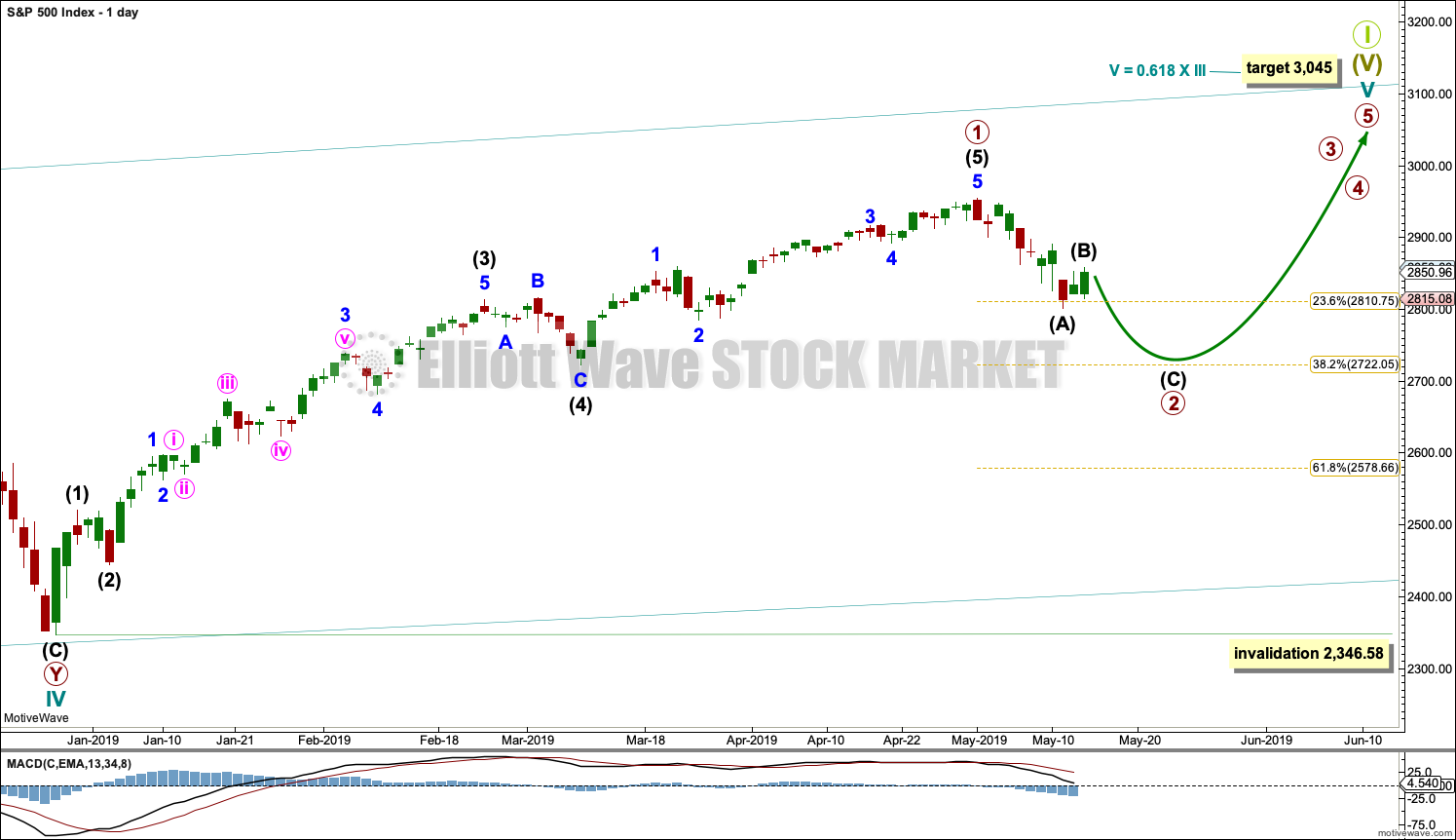

DAILY CHART

Cycle wave V must subdivide as a five wave motive structure. The current pullback will be labelled primary wave 2.

A best fit channel drawn about primary wave 1, to contain all of it, has been breached by primary wave 2.

The most likely structures for primary wave 2 would be a single or multiple zigzag. The first target for primary wave 2 is the 0.382 Fibonacci ratio at 2,722. The next target is the 0.618 Fibonacci ratio at 2,579.

Primary wave 1 may have lasted 18 weeks. Primary wave 2 has so far lasted 2 weeks. It may continue for another 3 weeks to total a Fibonacci 5 or another 6 weeks to total a Fibonacci 8.

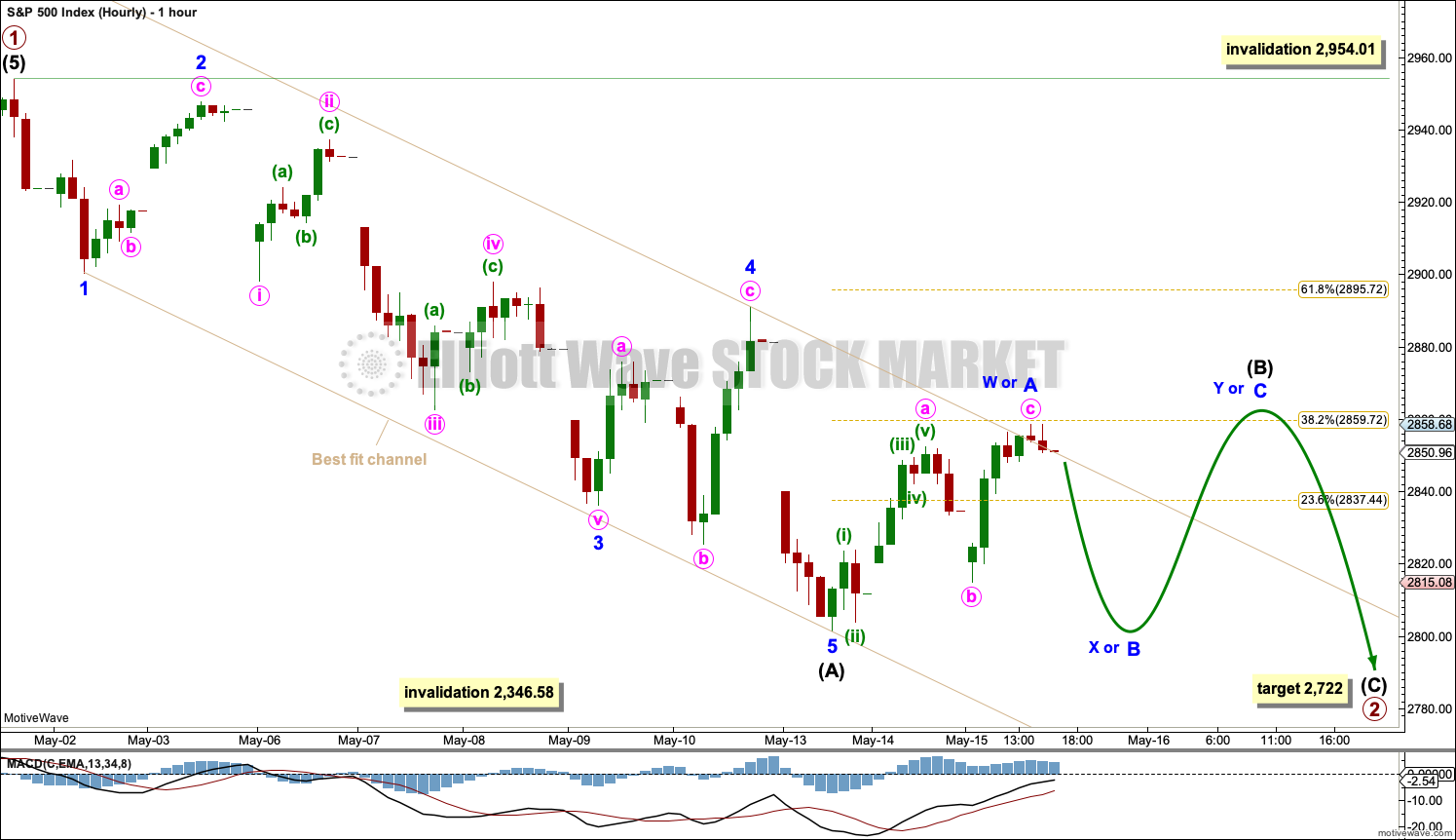

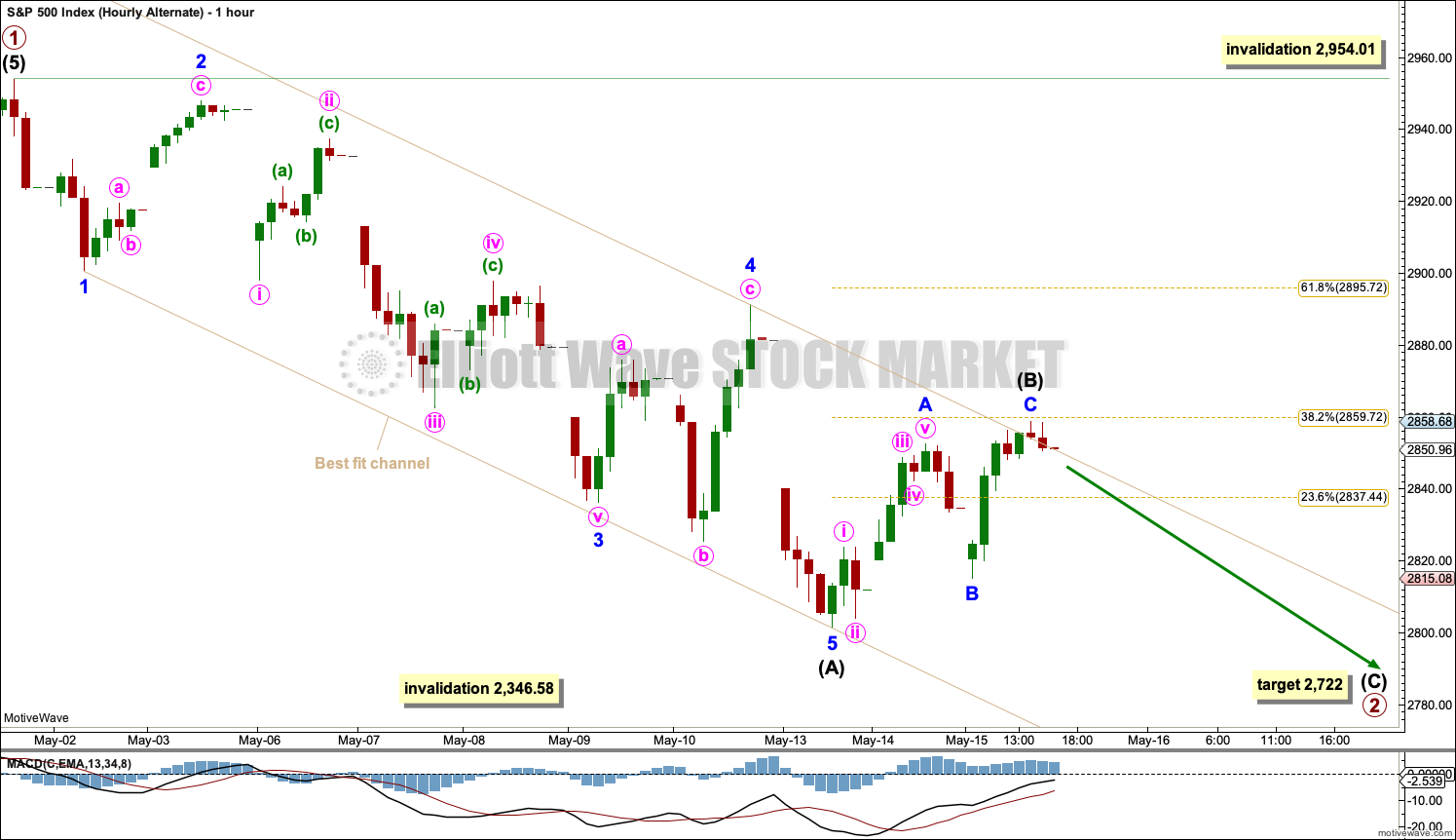

HOURLY CHART

The most likely structures for primary wave 2 are a single or double zigzag. Both would begin with a five wave structure downwards at the hourly chart level. This may now be complete.

A zigzag would subdivide 5-3-5. Intermediate wave (A) may now be a complete five wave structure. Intermediate wave (B) may now unfold. Intermediate wave (B) may not move beyond the start of intermediate wave (A) above 2,954.01.

Intermediate wave (B) may be any one of more than 23 possible Elliott wave corrective structures. It may be a quick sharp single or double zigzag, or it may be a more time consuming complicated consolidation subdividing as a triangle, combination or flat. Focus over the next few sessions will be on identifying when intermediate wave (B) may be complete and intermediate wave (C) downwards may then begin.

One of the most common structures to unfold in a B wave position is a flat correction. Flats subdivide 3-3-5. For this example, intermediate wave (B) may continue sideways as a flat correction, and within it minor wave A may now be a complete zigzag.

Minor wave B may now unfold lower. It may make a new low below the start of minor wave A as in an expanded flat correction.

When minor wave B is complete, then minor wave C may move above the end of minor wave A to avoid a truncation.

Overall, a flat correction may continue for another week to two.

Intermediate wave (B) may also be unfolding sideways as a combination. Within the combination, the first structure may now be a complete zigzag labelled minor wave W. The double may then be joined by a three in the opposite direction labelled minor wave X. When minor wave X may be complete, then a second structure may continue sideways, labelled minor wave Y, which would most likely subdivide as a flat correction. A combination may continue sideways for another week to two.

ALTERNATE HOURLY CHART

It is possible today that intermediate wave (B) may be a complete zigzag. However, this would be relatively brief and shallow. This wave count is today not supported by the AD line, so it is labelled an alternate.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

WEEKLY CHART

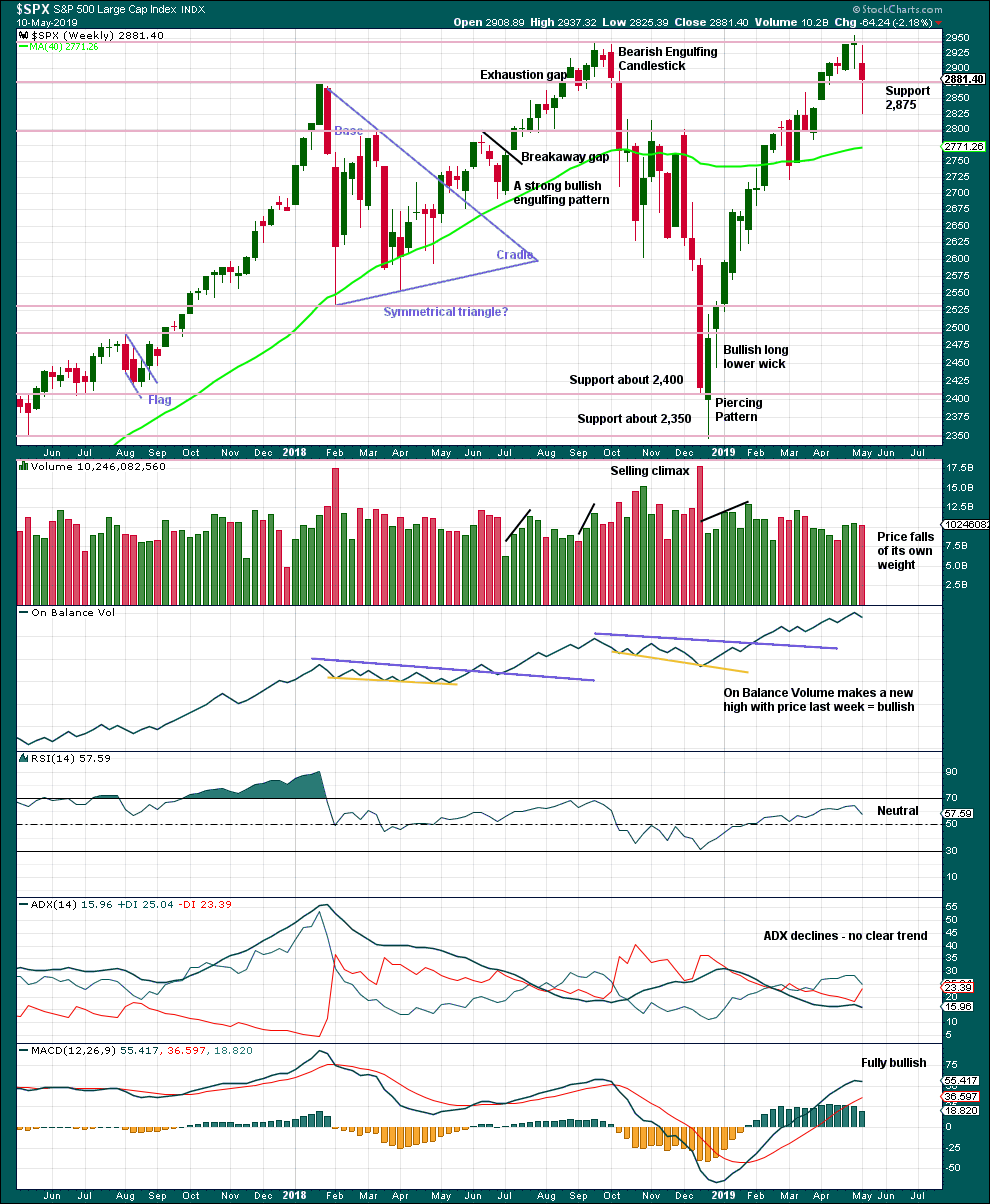

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

The longer lower wick last week is bullish, but the reasonable length of the upper wick reduces the bullishness here.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The short-term volume profile is still bearish. Price may now be in a short-term range with resistance about 2,875 and support about 2,800.

BREADTH – AD LINE

WEEKLY CHART

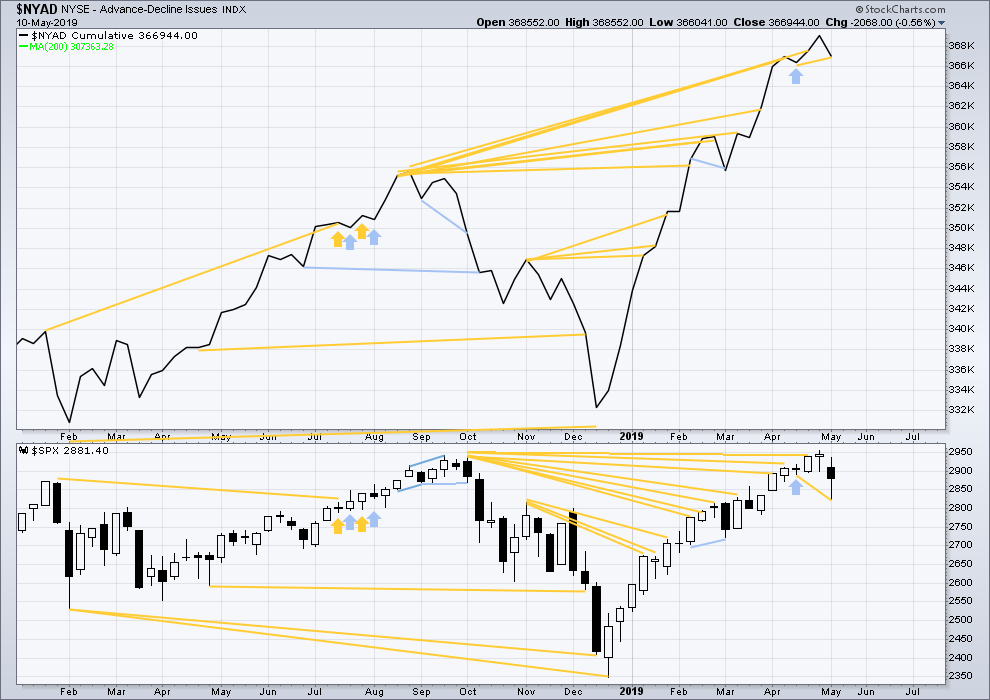

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Every single bear market from the Great Depression and onwards has been preceded by a minimum of 4 months divergence between price and the AD line. With the AD line making a new all time high again last week, the end of this bull market and the start of a new bear market must be a minimum of 4 months away, which is the beginning of September 2019 at this time.

Last week price has made a new low below the low three weeks prior, but the AD line has not. Downwards movement in price this week has not come with a corresponding decline in market breadth. This divergence is bullish for the short term.

Last week all of large, mid and small caps have moved lower. None have made new swing lows below the low of the 25th of March. There is no divergence.

DAILY CHART

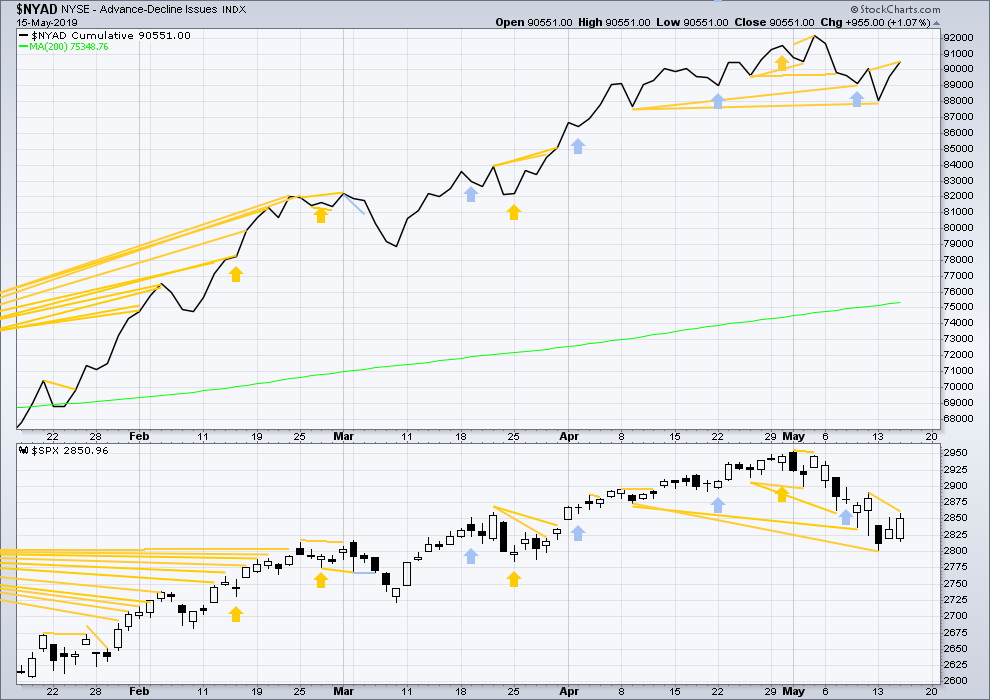

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

The AD line today has made a new short-term high above the prior swing high of the 10th of May, but price has not. This divergence is bullish for the short term and supports the main hourly Elliott wave count.

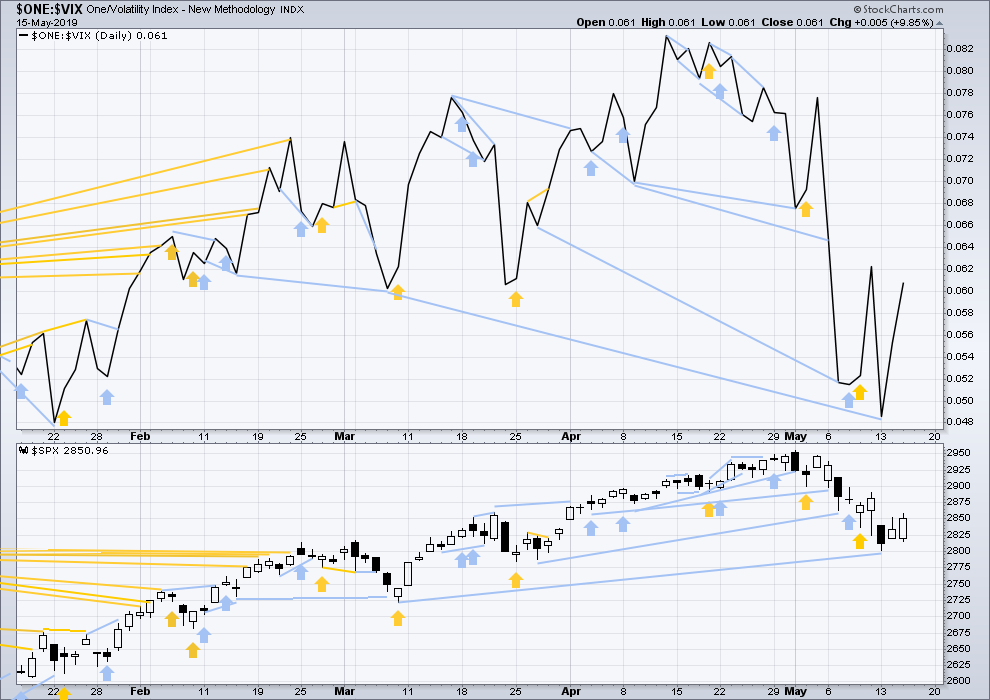

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

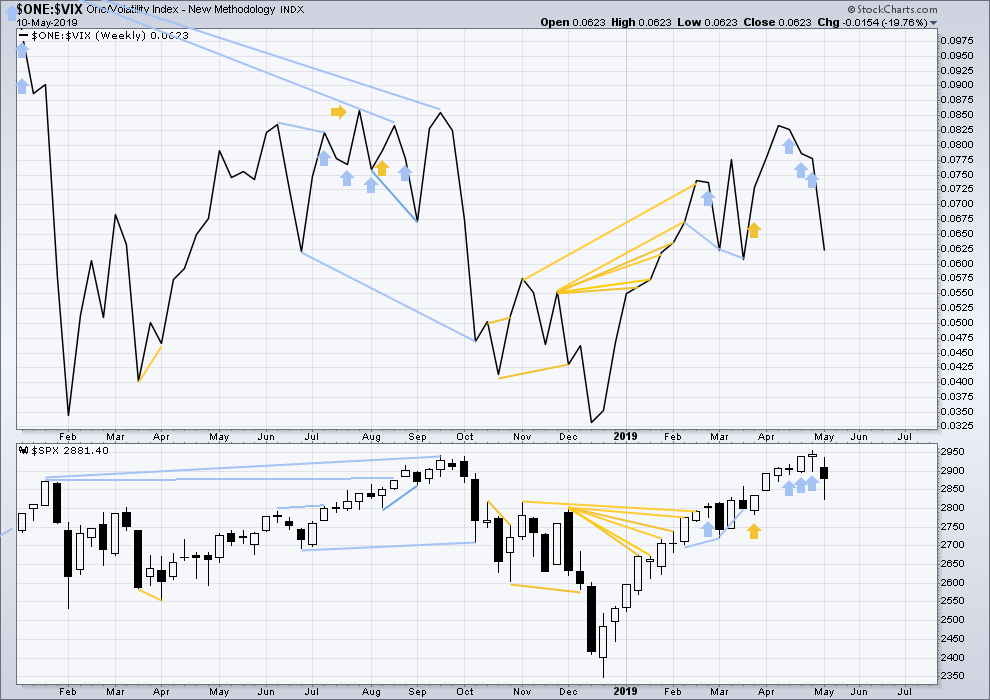

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Three weeks in a row of weekly bearish divergence has now been followed by a reasonable downwards week. It may be resolved here, or it may yet be an indication of further downwards movement in price.

Last week both price and inverted VIX have moved lower. Inverted VIX is not moving any faster than price. There is no short-term divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Today both price and inverted VIX have moved higher. There is no new short-term divergence.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices moving now higher, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91 – a new all time high has been made on the 29th of April 2019.

Nasdaq: 8,133.30 – a new high has been made on 24th of April 2019.

Published @ 07:40 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Hi All!

Very busy the last several weeks having fun with the beta version of “The War Room”

We made some awesome trades during earnings season. Quite a few straddles and also a few directional trades based on option open interest. We went live today!

Lock and Load!

Hope everyone is having lots of fun trading the recent volatility….

Nice to see Kevin still posting those great charts! 🙂

What is the “war room” if you dont mind me asking? Glad to see you back it was lonely being the only bear here. Lol

Hourly chart updated:

Intermediate (B) now looks like a quicker sharper zigzag. The structure is not yet complete, minor C looks like an incomplete five.

Within minor C minute iv may not move into minute i price territory. This means now a new low below 2,858.68 could not be a fourth wave correction within minor C, and so at that stage minor C would have to be over. 2,858.68 is now a price point which will indicate that intermediate (B) could be over.

Yep! One more wave up!

Nice! 🙂

Hey Verne. I agree. Tomorrow or the day after may be the time to put on your shorts. Nice to see you back.

Lara, I LOVE when the update comes out before the closing bell!!! Often after a day of trading, I seem to get tunnel vision. .. thank you!

I’m sorry it’s been later lately. Daylight savings in EST and the end of daylight savings here in NZ means it’s so much earlier in my day.

And it’s getting cold and dark here in the mornings…. ugh.

Still, I have a 7am alarm. My teenager 🙂

Lotsa hot steaming Java! 🙂

Hi Rod!

Great timing as usual managing your long positions.

Hopefully another good long entry coming up soon!

I think 2890s might become a neckline for a potential H&S, we could drop from here to 2700s then back to 2890s then back to 2800, would create a nice H&S on daily with 150-200 point target above 2890s

Maybe we need to see 2900 or so before another good drop?

I am not buying the rally as in thinking the correction is over. On the 5 and 60 minute charts, it sure has the look of a three wave move that may has rolled over. But I am not yet willing to take a short position either with the buy signals I mentioned below. I give the odds in favor of Lara’s corrective count. The next larger move may be to 2722. Only a new high will invalidate the current count and may morph into a flat or some other structure allowing the ‘B’ wave to make a new ATH.

Just my thoughts right now.

2910-2920 a former support/resistance shelf and a definite magnet for a re-test…

At this point in the day, SPX at 2877, I like the alternate hourly count with Intermediate B completing as a simple zig-zag around 2895.

$NYMO has currently crossed the zero point which is part of the confirmation of the buy signal. It needs to close above zero and then above +20 for final confirmation.

Boat load of resistance (gray) and of course the 62%. Market seems poised for a turn back down here.

Bought a few SPY puts pretty close to the high here…we’ll see. Good R/R, assuming up/down is a coin toss, and it should be a bit better odds than that to the down here methinks.

same plan, GL

Short NQ with a tight stop. Will see…

Whipped out.

Tomorrow…! 🙂

Yep.

We have the following buy signals this past few days. These are all daily data. For #2 & 3 it requires three days closing prices.

1)$NYMO (McClellan Oscillator that is essentially a moving average of A-D breadth) closed below its lower BB then proceeded to close above it.

2)VIX closed above its upper BB, then closed below the upper BB, then closed lower.

3)SPX closed below its lower BB, then closed above the lower BB, then closed higher.

These indicators are very good and reliable. However, they are not perfect. I have seen false signals. In addition, they do not give an upside target. Therefore, they can just indicate the end of a powerful decline with a relatively small advance to follow. However, they do often (more often than not) indicate the beginning of a strong rally.

Please note: the inverse of these indicators does not work well to indicate a top.

Nice! I’m loving today’s action (being a tad underwater on a position or two)…

past the 38%. can we get to 2890? Maybe!

Well, I exited my largish SPX position at a bit of a loss (countered by various wins so overall, flat for the day) right here. Better safe than sorry. I’m also rather aggressively taking smaller profits on other positions, “getting lighter” in anticipation of more selling Friday and/or next week, to work through the rest of this big 4.

Is this real? I am the the one? The first of my kind? The reader of wisdom?

Had a little Game of Thrones going there.

Davey, you certainly are first. Most importantly, you kept Ronu from getting a rare trifecta. You have the gratitude of the masses who play the game.

Drat!

You guys are hilarious 🙂