A small range day moved price slightly higher. This fits the new short-term expectation for the Elliott wave count.

Summary: For the very short term, a small and sharp bounce or a sideways consolidation may unfold over the next few sessions. Thereafter, the pullback is expected to continue lower. It may continue now for another one to few weeks.

The first target is at 2,722 and thereafter at 2,579. The low of December 2018 is expected to remain intact, and this pullback is expected to be followed by a strong third wave up to new all time highs.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

The two Elliott wave counts below will be labelled First and Second rather than main and alternate as they may be about of even probability. When the fifth wave currently unfolding on weekly charts may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

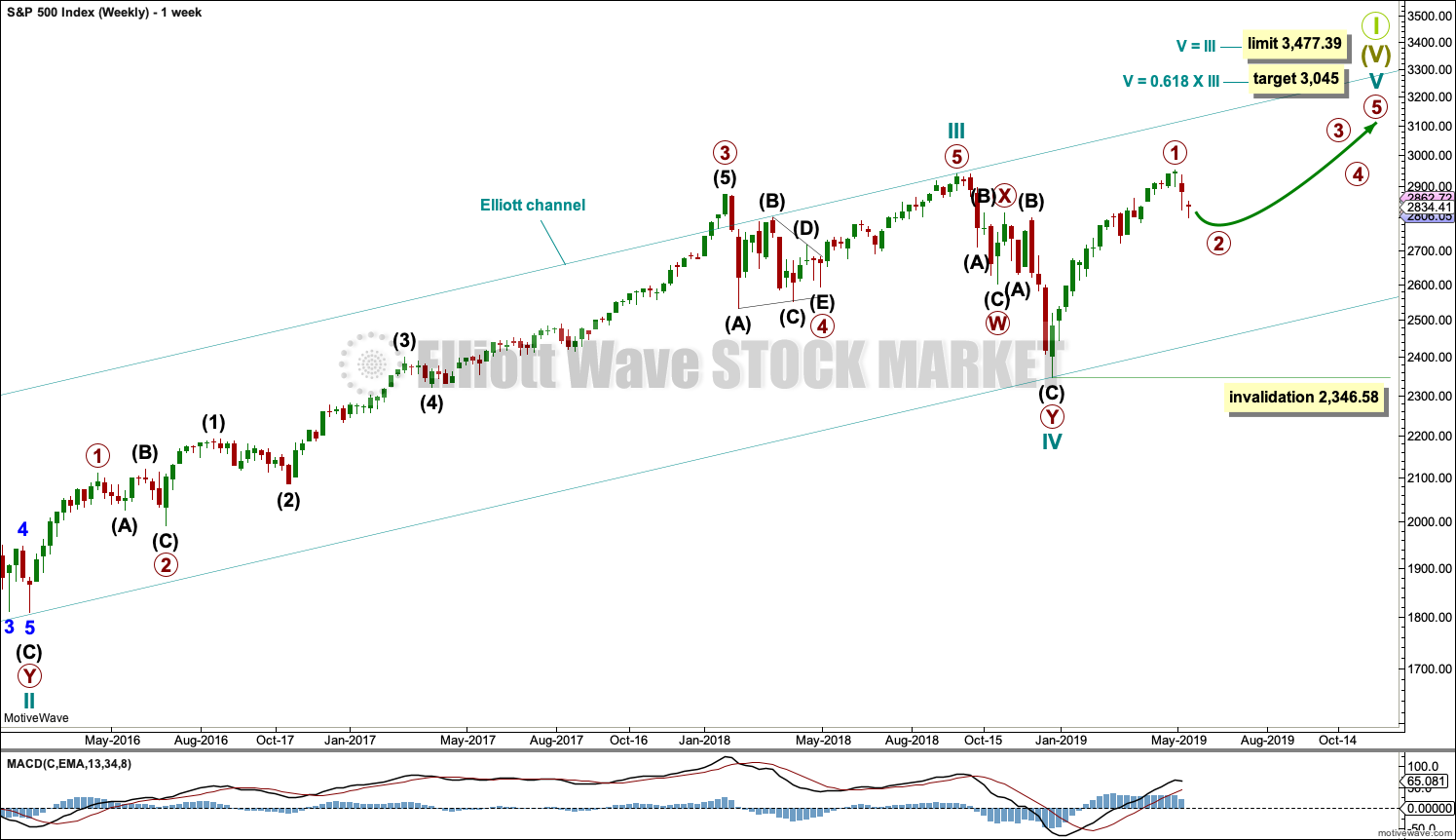

FIRST WAVE COUNT

WEEKLY CHART

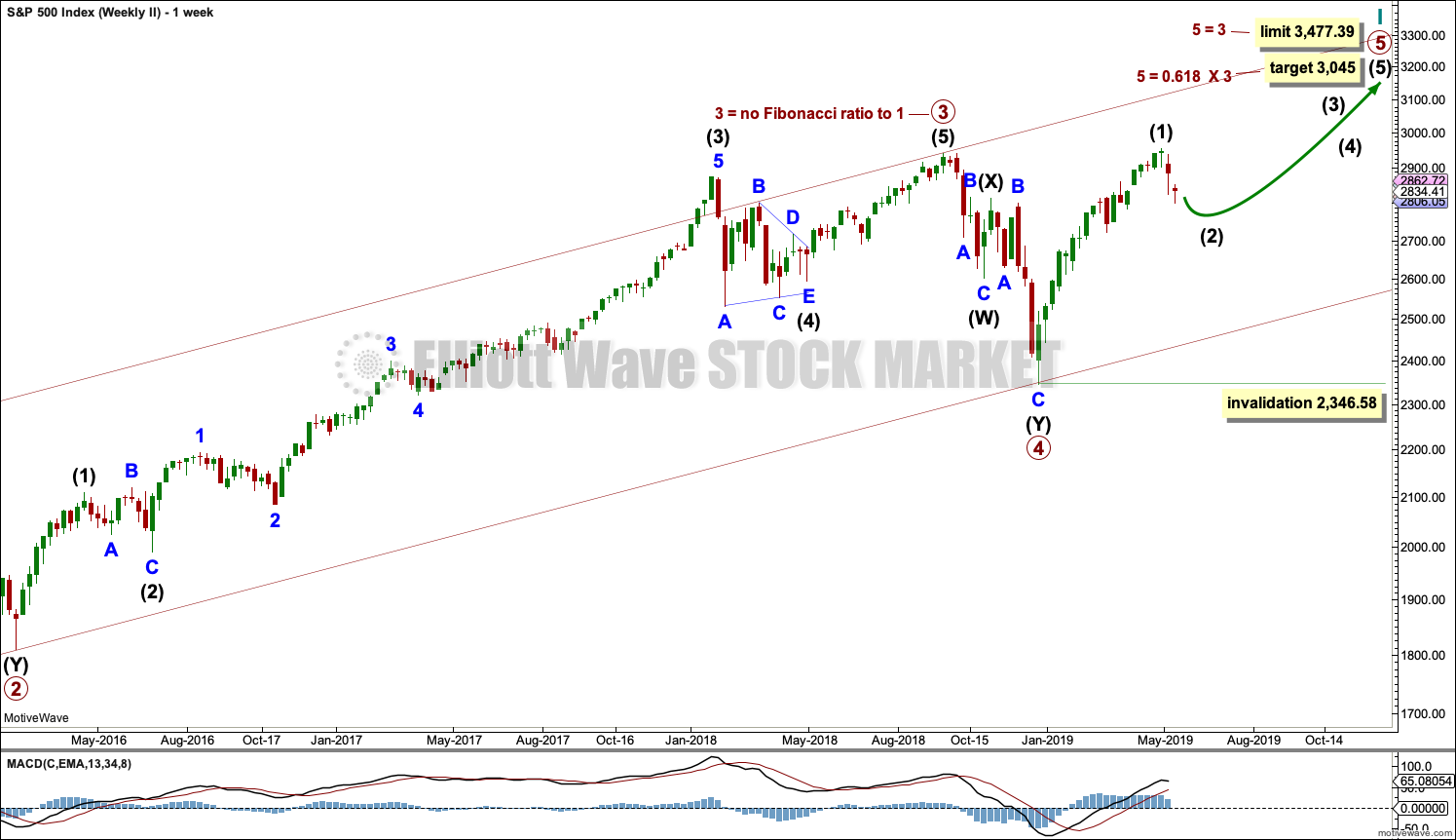

The basic Elliott wave structure consists of a five wave structure up followed by a three wave structure down (for a bull market). This wave count sees the bull market beginning in March 2009 as an incomplete five wave impulse and now within the last fifth wave, which is labelled cycle wave V. This impulse is best viewed on monthly charts. The weekly chart focusses on the end of it.

Elliott wave is fractal. This fifth wave labelled cycle wave V may end a larger fifth wave labelled Super Cycle wave (V), which may end a larger first wave labelled Grand Super Cycle wave I.

The teal Elliott channel is drawn using Elliott’s first technique about the impulse of Super Cycle wave (V). Draw the first trend line from the end of cycle wave I (off to the left of the chart, the weekly candlestick beginning 30th November 2014) to the end of cycle wave III, then place a parallel copy on the end of cycle wave II. This channel perfectly shows where cycle wave IV ended at support. The strongest portion of cycle wave III, the end of primary wave 3, overshoots the upper edge of the channel. This is a typical look for a third wave and suggests the channel is drawn correctly and the way the impulse is counted is correct.

Within Super Cycle wave (V), cycle wave III is shorter than cycle wave I. A core Elliott wave rule states that a third wave may never be the shortest. For this rule to be met in this instance, cycle wave V may not be longer in length than cycle wave III. This limit is at 3,477.39. This limit may still apply if the degree of labelling within cycle wave V is changed all down one degree.

A final target is calculated at cycle degree for the impulse to end.

The structure of cycle wave V is focussed on at the daily chart level below.

Within cycle wave V, primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

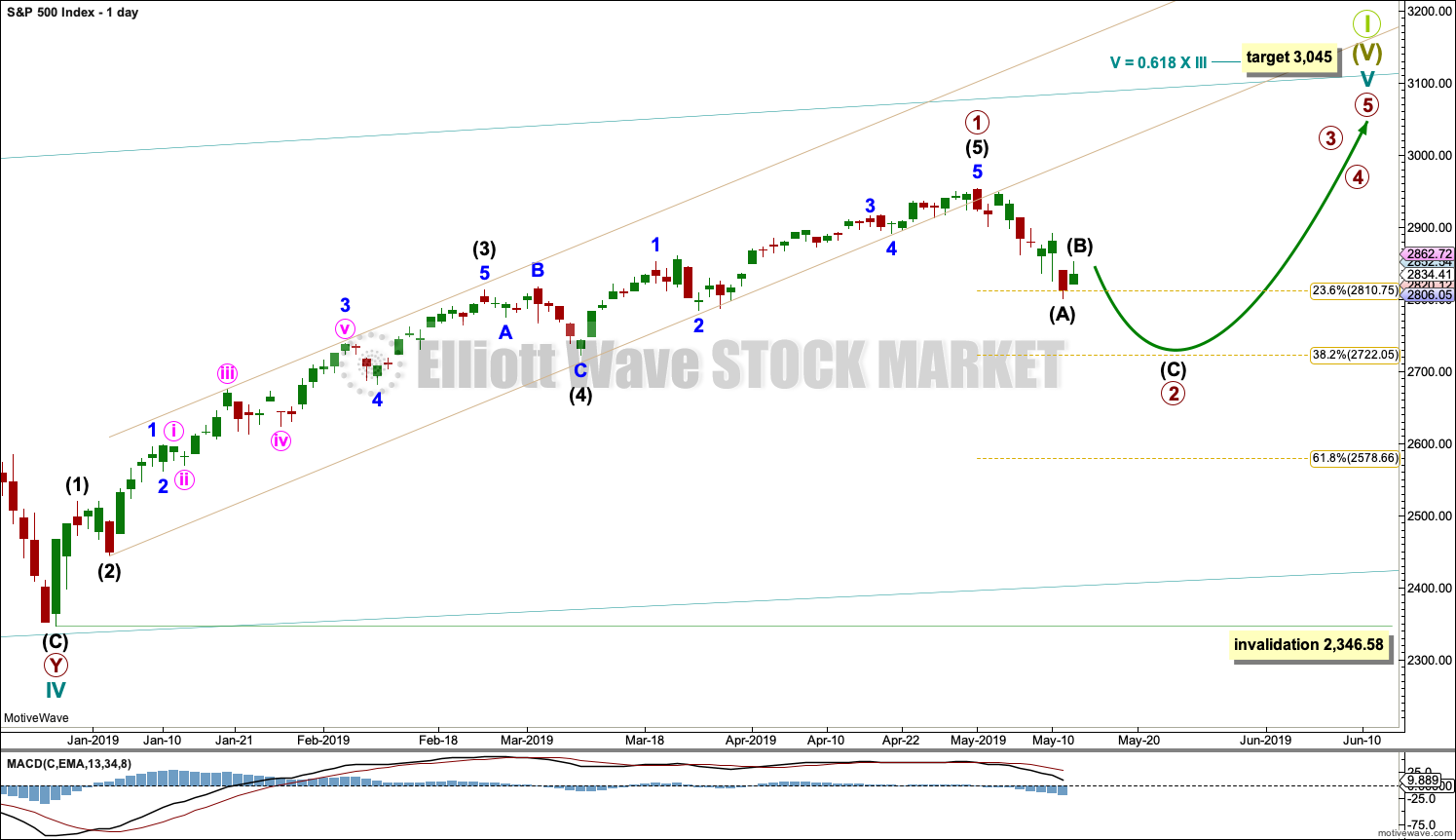

DAILY CHART

Cycle wave V must subdivide as a five wave motive structure. The current pullback will be labelled primary wave 2.

A best fit channel drawn about primary wave 1, to contain all of it, has been breached by primary wave 2.

The most likely structures for primary wave 2 would be a single or multiple zigzag. The first target for primary wave 2 is the 0.382 Fibonacci ratio at 2,722. The next target is the 0.618 Fibonacci ratio at 2,579.

Primary wave 1 may have lasted 18 weeks. Primary wave 2 has so far lasted 2 weeks. It may continue for another 3 weeks to total a Fibonacci 5 or another 6 weeks to total a Fibonacci 8.

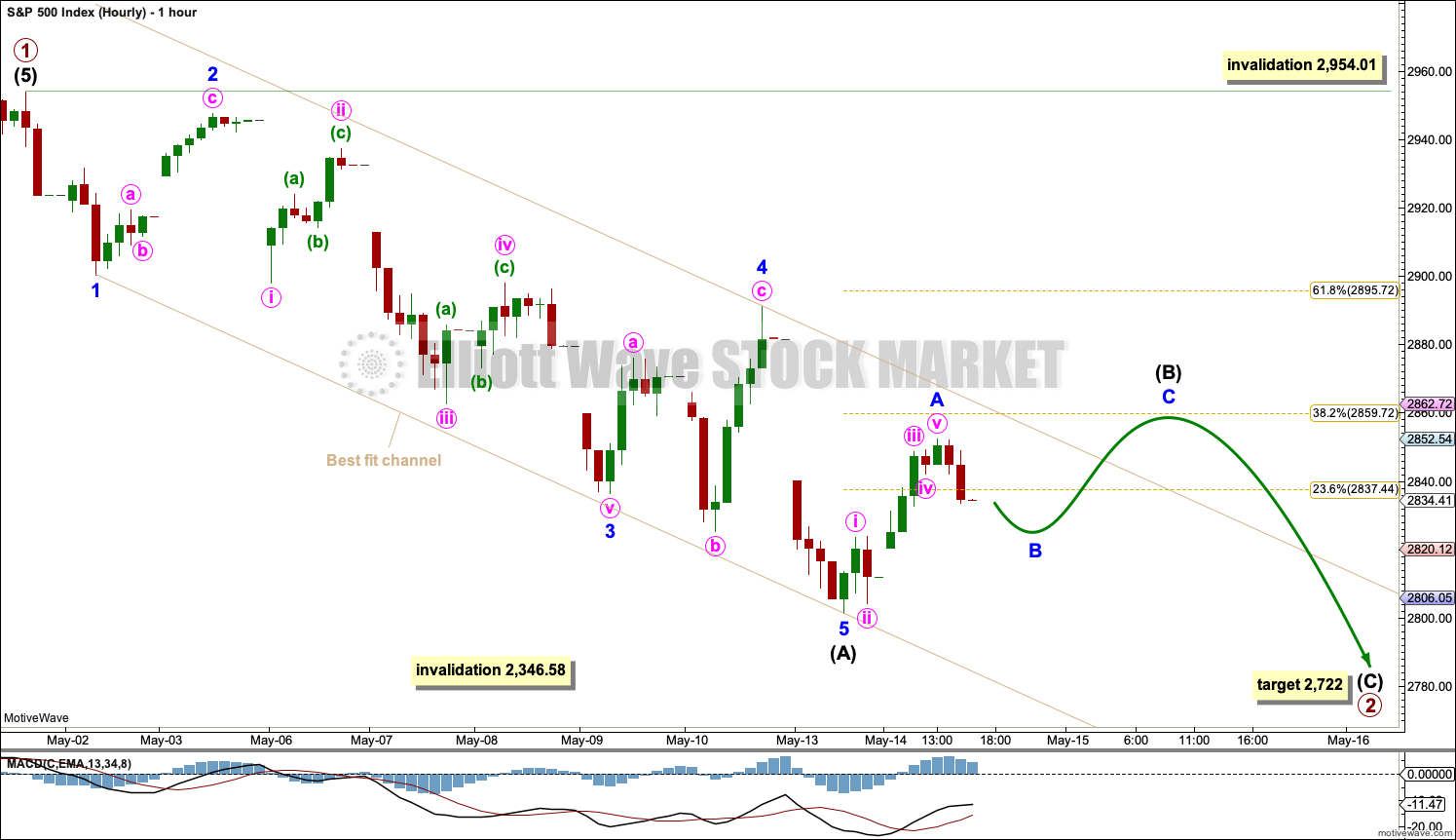

HOURLY CHART

The most likely structures for primary wave 2 are a single or double zigzag. Both would begin with a five wave structure downwards at the hourly chart level. This may now be complete.

A zigzag would subdivide 5-3-5. Intermediate wave (A) may now be a complete five wave structure. Intermediate wave (B) may now unfold. Intermediate wave (B) may not move beyond the start of intermediate wave (A) above 2,954.01.

Intermediate wave (B) may be any one of more than 23 possible Elliott wave corrective structures. It may be a quick sharp single or double zigzag, or it may be a more time consuming complicated consolidation subdividing as a triangle, combination or flat. Focus over the next few sessions will be on identifying when intermediate wave (B) may be complete and intermediate wave (C) downwards may then begin. Today intermediate wave (B) does not look complete.

It is possible that intermediate wave (B) may find resistance at the upper edge of the best fit channel. It is also entirely possible that it may breach the channel which contains intermediate wave (A).

Targets for intermediate wave (B) are the 0.382 and 0.618 Fibonacci Ratios of intermediate wave (A).

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is identical to the first weekly chart, with the sole exception being the degree of labelling.

This weekly chart moves the degree of labelling for the impulse beginning in March 2009 all down one degree. This difference is best viewed on monthly charts.

The impulse is still viewed as nearing an end; a fifth wave is still seen as needing to complete higher. This wave count labels it primary wave 5.

TECHNICAL ANALYSIS

WEEKLY CHART

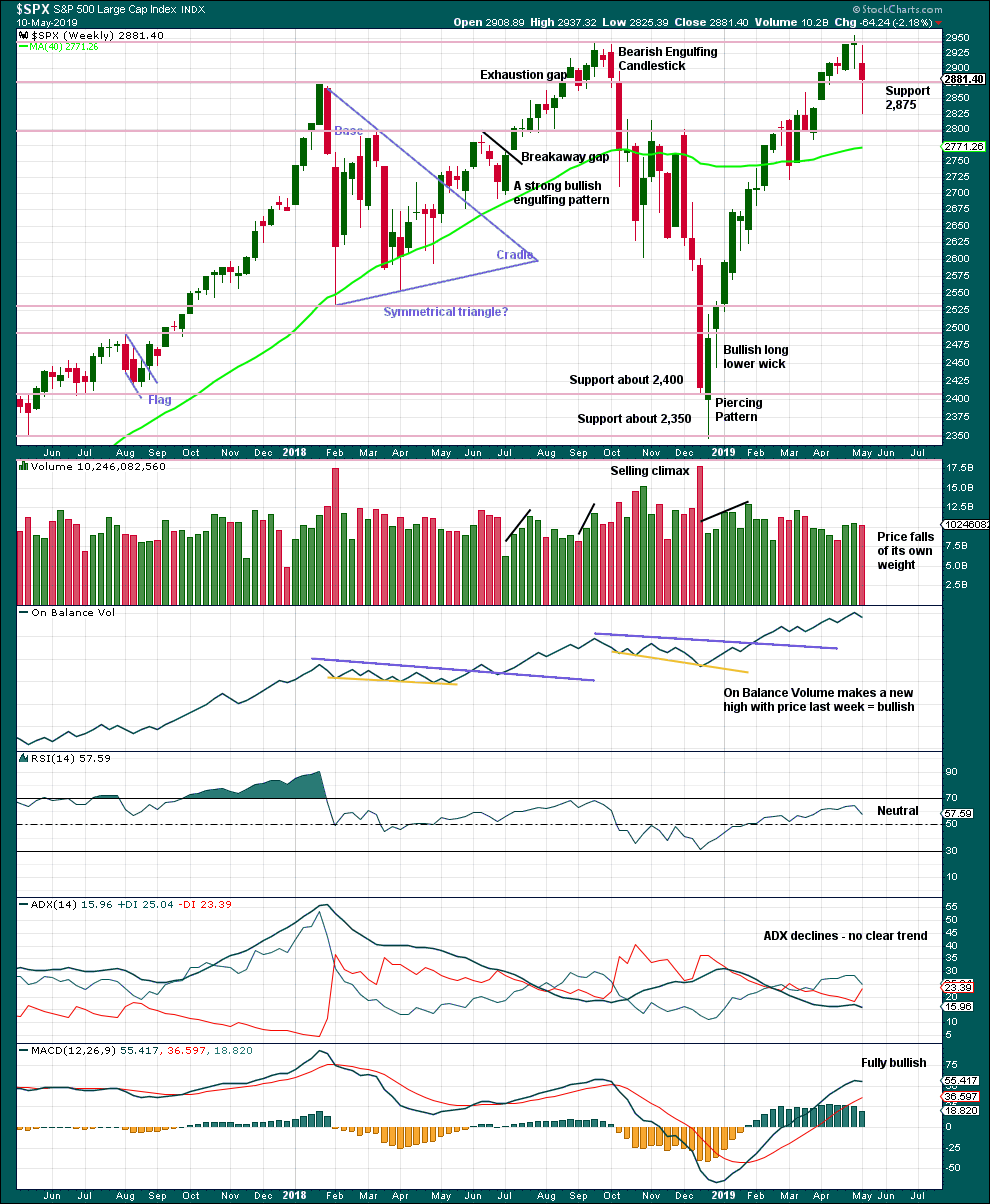

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

The longer lower wick last week is bullish, but the reasonable length of the upper wick reduces the bullishness here.

DAILY CHART

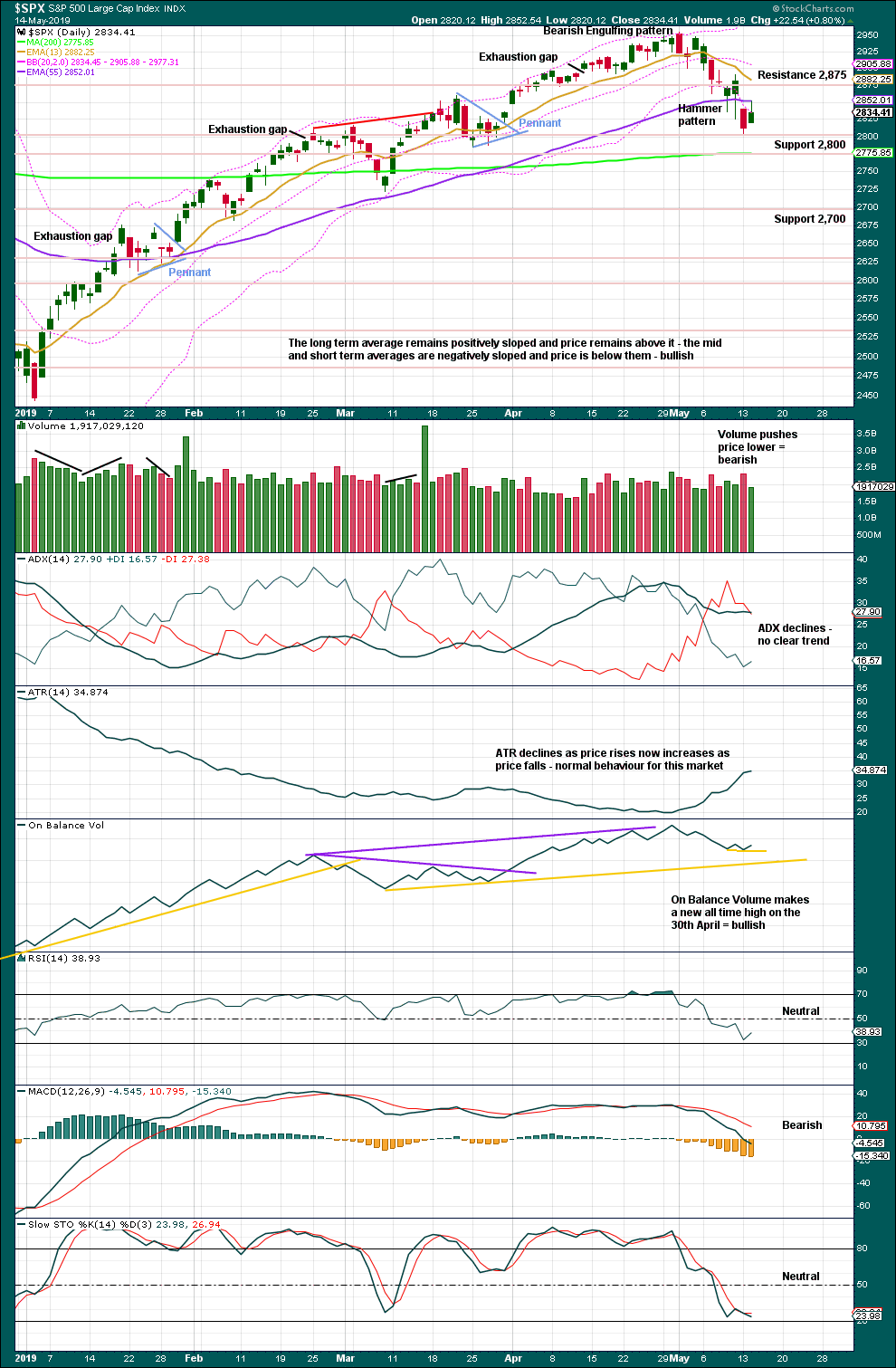

Click chart to enlarge. Chart courtesy of StockCharts.com.

The short-term volume profile is still bearish. The small range upwards day today looks like a small pause within the pullback and not a strong low.

BREADTH – AD LINE

WEEKLY CHART

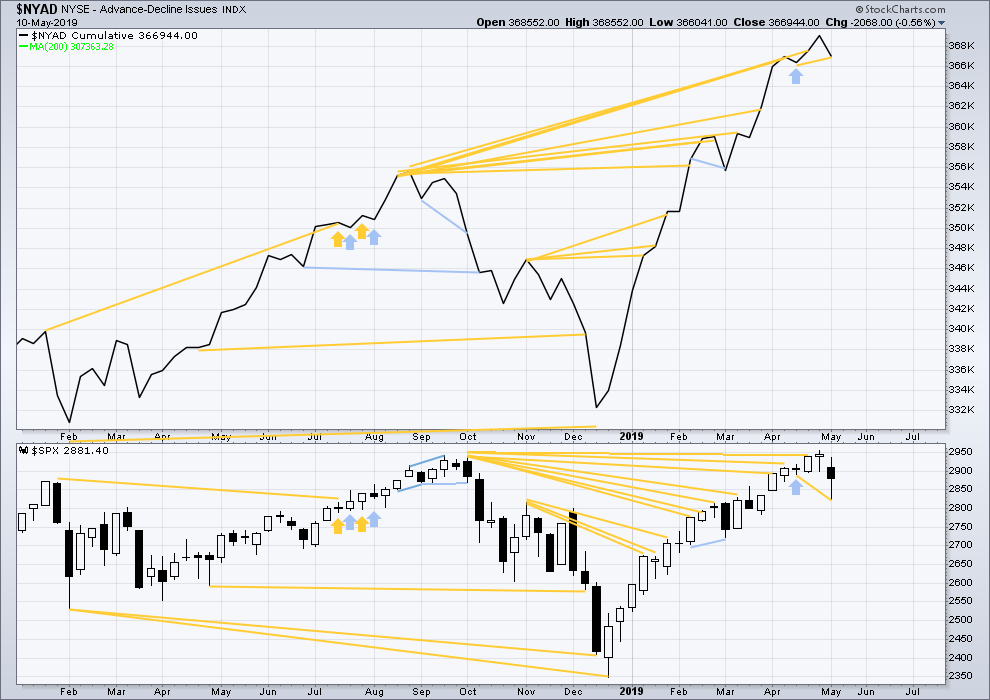

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Every single bear market from the Great Depression and onwards has been preceded by a minimum of 4 months divergence between price and the AD line. With the AD line making a new all time high again last week, the end of this bull market and the start of a new bear market must be a minimum of 4 months away, which is the beginning of September 2019 at this time.

Last week price has made a new low below the low three weeks prior, but the AD line has not. Downwards movement in price this week has not come with a corresponding decline in market breadth. This divergence is bullish for the short term.

Last week all of large, mid and small caps have moved lower. None have made new swing lows below the low of the 25th of March. There is no divergence.

DAILY CHART

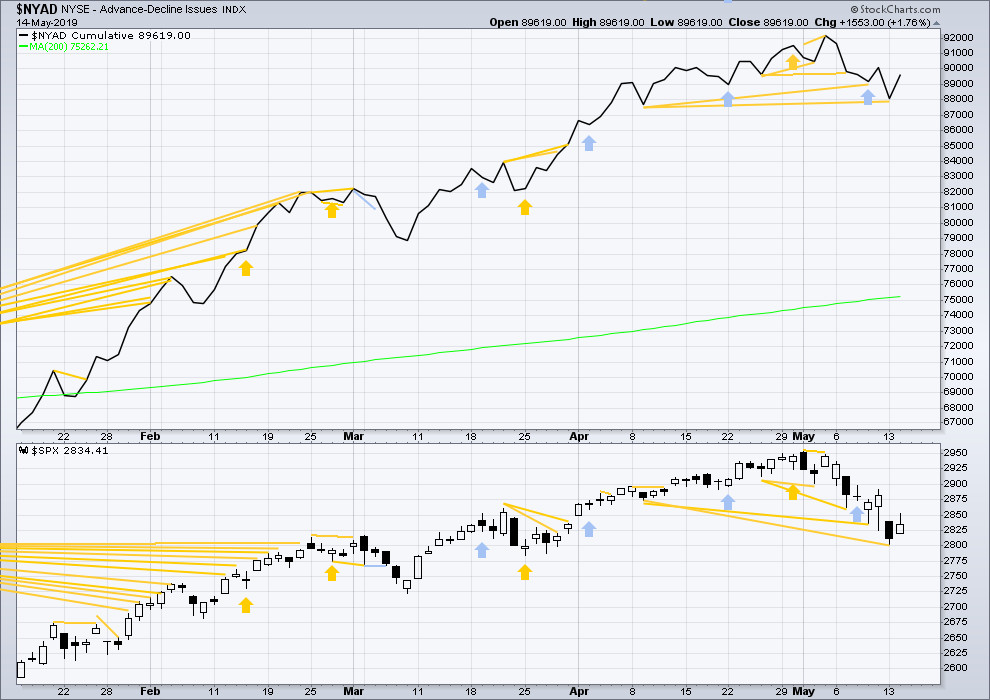

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Bullish mid-term divergence has been followed by a small upwards day. It may be resolved here, or it may still support the idea that this pullback is a short-term counter trend movement within an ongoing bull market.

Today both the AD line and price have moved a little higher. There is no new short-term divergence.

VOLATILITY – INVERTED VIX CHART

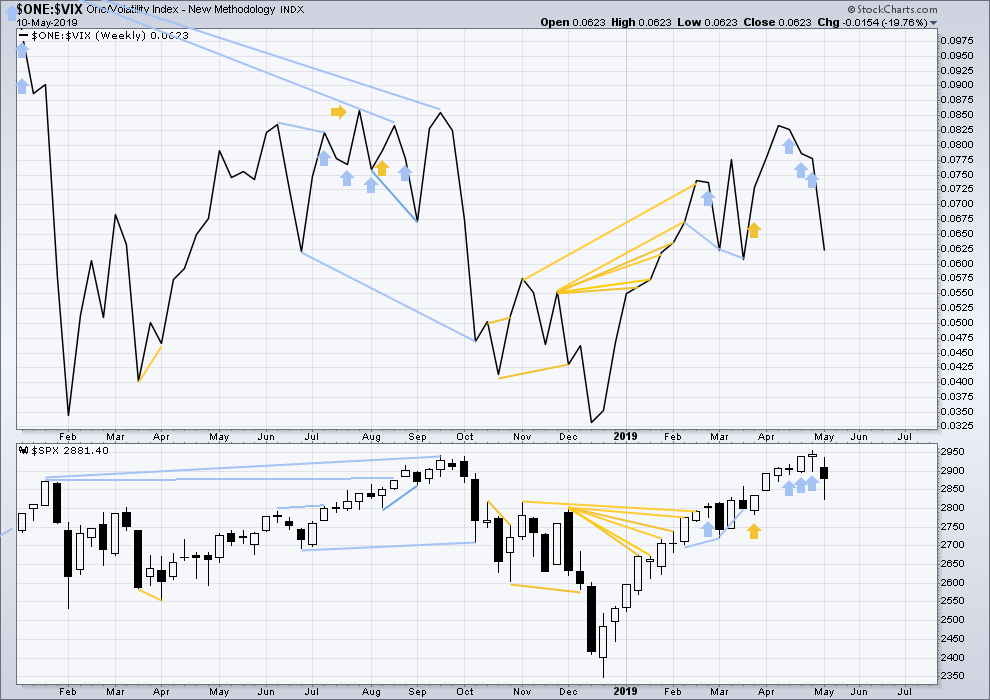

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Three weeks in a row of weekly bearish divergence has now been followed by a reasonable downwards week. It may be resolved here, or it may yet be an indication of further downwards movement in price.

Last week both price and inverted VIX have moved lower. Inverted VIX is not moving any faster than price. There is no short-term divergence.

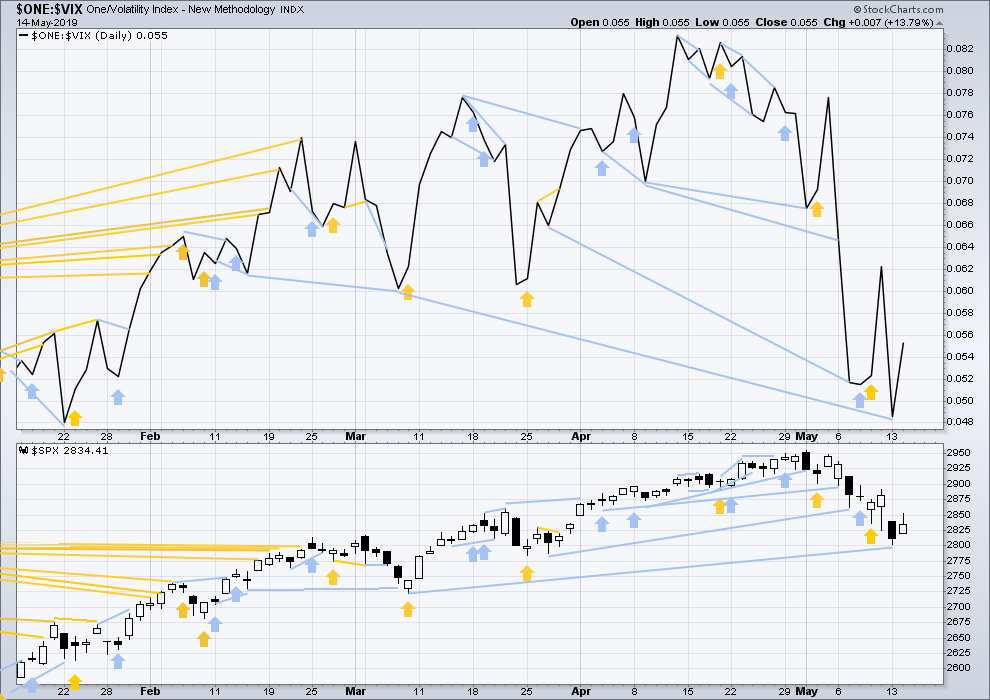

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Short to mid-term bearish divergence has not yet been followed by any downwards movement.

Today both price and inverted VIX have moved higher. There is no new short-term divergence.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices moving now higher, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91 – a new all time high has been made on the 29th of April 2019.

Nasdaq: 8,133.30 – a new high has been made on 24th of April 2019.

Published @ 08:17 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Hourly chart updated:

It is now possible that intermediate (B) is over as a brief shallow zigzag.

But it is equally as likely that it may continue sideways as a flat, combination or triangle, or higher as a double zigzag.

Depending on how strong or weak today is I may relabel intermediate (B) as incomplete.

Either way, the next move may be down. The question only right now for the short term is, how deep.

For those who like catching falling knives…HAL might be in a pretty good buy position right here. A double bottom showing on the weekly/daily charts, a massive sell off over the last month, and now a polarity shift to “up” on the hourly. Hourly trend is still neutral but I expect to see “up” flashing there very soon with any more movement up in price. But it IS a counter trend trade, the weekly and monthly are STRONG DOWN.

I have pulled the trigger and exited all my SPX long positions today. The upside potential is present but limited. The downside risk at this time is significant. Although the target to the downside is 2722 for completion of Primary 2, the invalidation point is all the way down at 2346.58. I will sit on hands as Intermediate B completes leading to Intermediate C of Primary 2. Once we are persuaded that has started, it will be time to consider a short position. If I miss it, that is okay. My main goal now is the go long at the end of Primary 2.

This last trade was profitable. Not as much as it was when SPX was at 2950. But profitable none the less and I never complain when a trade is closed profitably.

I ran into the sales pitch on the EWI site for the “Dick Diamond trading method”. Digging into it, hmm, “looks interesting”. Then I hit the sales price for the “video course” (including “templates” and follow up Q&A)….$7000!!!! Wowza!!! That got my attention (“must be valuable!”). So I started digging around…and found the Diamond book online (PDF), for free, with full detailed descriptions of the trading method. Now that’s a price I like. As my son said, “I guess some people just don’t like reading!”. Lol!!!! Well I do, reading through it now…

The book is good. Especially the emotional discipline stuff.

Looks like this system (at the 2 minute level, and while he says it “works at any time frame”, I’ve read other arguments that it is reasonably reliable only at very short timeframes, which makes sense because he uses incredibly tight stops) is really a largely mechanical scalping system. For grinding our very, very small percentage profits, a couple times a day.

He presents three types of trading set ups. I’ll just describe one: you wait for both full bullish or bearish alignment of the 21, 55 and 89 period EMA’s, and Williams %R to go above -20 (bullish) or -80 (bearish). And you take the trade. “Stop 2 ticks below your entry price”. In other words, super tight. If price action is sluggish after entry, GET OUT. The target is to get in on a high momentum move in the 2 minute timeframe, and if it doesn’t develop, don’t wait for the stop. Once you have some profit, jack the stop to BE. Take profit while momentum is still high (he’s vague about specific exit strategies from what I’ve read so far). That’s about it. Anyone want to pay $7000 for that? Lol!!!! Okay, there are two other variants that use other specific indicators, but it’s “the same deal” largely.

I don’t think this method works with options because the % moves you are shooting for will get overwhelmed with the very high total cost (spread + commissions) of options. I think you have to directly buy/sell the instrument, and in serious volume to make $. So one issue is exposure, the risk that the market jacks against you fast and furious and your stop is executed WAY away from it’s price.

Stop at “2 ticks” is a publishing error. Book came in the mail with a note that it should say, “2 points.” Apparently the PDF edition you have was not corrected.

I’ve found his trading discipline rules to be helpful, but not his charts. And you’re right… he fails to mention exit strategies. A very odd oversight, IMO.

I had the great privilege of trading live with Dick before he passed away.

He was truly one of the best ever!

R.I.P. Diamond Man!

A great privilege for sure, Verne! Wow!

I never met the man, so it suprised me how sad I felt when I learned that he had died.

Minor B may have completed at this morning’s low. A move above Minor A will confirm it. Approximate levels to watch: 2860 for 38% retrace or 2890 for 62% retrace. If we reach 2860 and above, I will close all my long positions by the end of the day.

that’s how I plan on playing it……. but honestly nothing would surprise me at this point (like GOT)

which GoT? the fantasy one, or the real one being played out on the world stage?….(cue the dragons!)….

Hey Kevin, are you out there? Anything ever come of your $gbtc position? I went heavy under 5 and sold out yesterday… I’ve requested a bitcoin update from Lara- her last update indicated the skys the limit from here.

I honestly don’t remember when I exited off hand, but “too soon” as it appears now! Lol!!! Anyway, at the moment it’s hugely extended/”overbought”. Completely above higher volatility bands. Not close to set up for me to consider reentry. If you are in and holding, best of luck! It hasn’t even reached the 23.6% retrace level yet, so yes, it could run like crazy. I might (might) consider taking another position on a pullback.

Things are feeling quite bearish.

Bigger picture, are we back to the worst case bearish scenario potentially starting in October?

In my opinion we are too far away from October to know for sure where we might be at that time. But Lara’s main count does call for Super Cycle I to complete around 3050 SPX and that could certainly happen in October. I would guess closer to August. The Alternate Weekly calls for Cylce Wave I to complete around 3050 SPX and the time frame could be exactly the same. The difference between the two is not when the top occurs. But rather how long and how deep will be the bear market to follow.

All that being said, both weekly counts allow for a maximum target of 3477 SPX. I am of the opinion we will approach this target sometime in 2020. Furthermore, there are other alternates that approach or exceed SPX 4000. I give these a realistic chance of materializing.

Right now, I focus on the main count and look to how the market will behave at 3050.

Thanks Rodney!

Two 1’s in a row. Will that mean good fortune tomorrow?

ronu,

Do you think you can capture a trifecta?