Yesterday’s Elliott wave count expected more downwards movement, and this view had support from a Bearish Engulfing candlestick reversal pattern on the daily chart. For today’s session, more downwards movement is what has occurred.

Summary: Primary wave 3 may now be complete. A pullback or consolidation here for primary wave 4 may now last about a couple of weeks or so and may end either about 2,899 or the lower edge of the maroon Elliott channel on the daily chart.

For the short term, intermediate wave (B) within primary wave 4 may now move sideways over several sessions. It should not make a new all time high.

The final target remains the same at 3,045. Alternate monthly wave counts allow for a target as high as 4,119.

The biggest picture, Grand Super Cycle analysis, is here.

Monthly charts were last published here, with video here. There are two further alternate monthly charts here, with video here.

ELLIOTT WAVE COUNTS

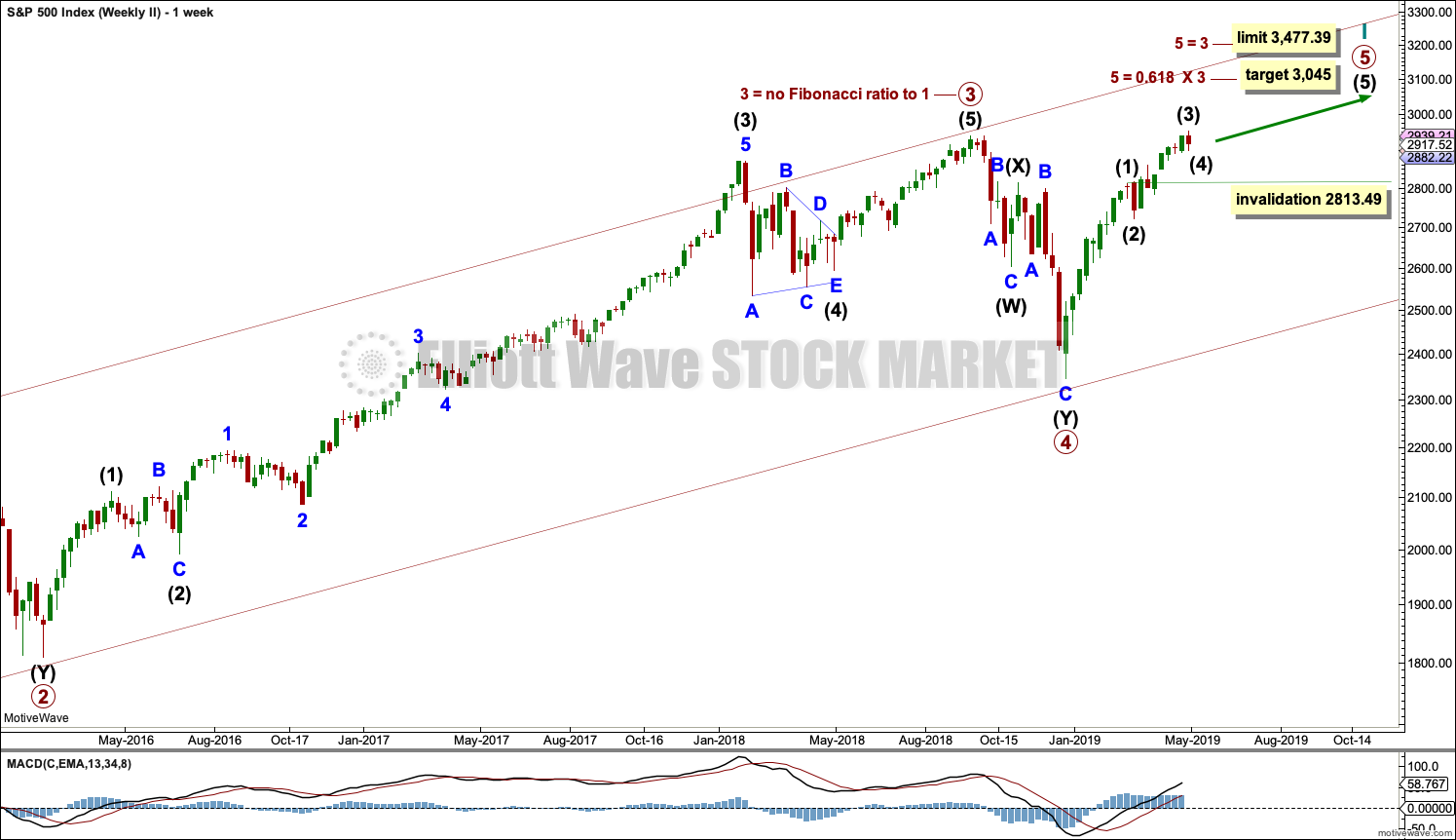

The two Elliott wave counts below will be labelled First and Second rather than main and alternate as they may be about of even probability. When the current impulse of primary wave 5 (second wave count) or cycle wave V (first wave count) may be complete, then these two wave counts will diverge on the severity of the expected following bear market. To see an illustration of this future divergence monthly charts should be viewed.

FIRST WAVE COUNT

WEEKLY CHART

This weekly chart shows all of cycle waves III, IV and V so far.

This wave count expects that when cycle wave V completes Super Cycle wave (V) and Grand Super Cycle wave I, that a huge bear market to potentially last decades may begin. It should move substantially below 666.79.

Cycle wave II fits as a time consuming double combination: flat – X – zigzag. Combinations tend to be more time consuming corrective structures than zigzags. Cycle wave IV has completed as a multiple zigzag that should be expected to be more brief than cycle wave II.

Cycle wave IV may have ended at the lower edge of the Elliott channel.

Within cycle wave V, primary waves 1 through to 3 may now be complete. Primary wave 4 may not move into primary wave 1 price territory below 2,813.49.

Although both cycle waves II and IV are labelled W-X-Y, they are different corrective structures. There are two broad groups of Elliott wave corrective structures: the zigzag family, which are sharp corrections, and all the rest, which are sideways corrections. Multiple zigzags belong to the zigzag family and combinations belong to the sideways family. There is perfect alternation between the possible double zigzag of cycle wave IV and the combination of cycle wave II.

Although there is gross disproportion between the duration of cycle waves II and IV, the size of cycle wave IV in terms of price makes these two corrections look like they should be labelled at the same degree. Proportion is a function of either or both of price and time.

Draw the Elliott channel about Super Cycle wave (V) with the first trend line from the end of cycle wave I (at 2,079.46 on the week beginning 30th November 2014) to the high of cycle wave III, then place a parallel copy on the low of cycle wave II. Cycle wave V may find resistance about the upper edge.

It is possible that cycle wave V may end in October 2019. If it does not end there, or if the AD line makes new all time highs during or after June 2019, then the expectation for cycle wave V to end would be pushed out to March 2020 as the next possibility. Thereafter, the next possibility may be October 2020. March and October are considered as likely months for a bull market to end as in the past they have been popular. That does not mean though that this bull market may not end during any other month.

DAILY CHART

The daily chart will focus on the structure of cycle wave V.

Cycle wave V must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common and that will be how it is labelled. A diagonal would be considered if overlapping suggests it.

Primary wave 1 may have been a long extension, a smaller fractal of cycle wave I on the monthly chart.

Primary wave 2 may have been a very brief and shallow expanded flat correction, lasting just short of two weeks.

Primary wave 3 may be complete. It exhibits no Fibonacci ratio to primary wave 1 and is shorter than primary wave 1. This limits primary wave 5 to no longer than equality in length with primary wave 3 at 231.86 points.

Primary wave 4 may be expected to exhibit alternation with primary wave 2. Primary wave 4 may most likely unfold as a single or multiple zigzag, but it may also unfold as a triangle or combination. The least likely structure would be a flat.

A channel is drawn using Elliott’s first technique about the impulse of cycle wave V. Draw the first trend line from the ends of primary waves 1 to 3, then place a parallel copy on the end of primary wave 2. If it is long lasting enough, primary wave 4 may find support about the lower edge of this channel.

Primary wave 4 may not move into primary wave 1 price territory below 2,813.49.

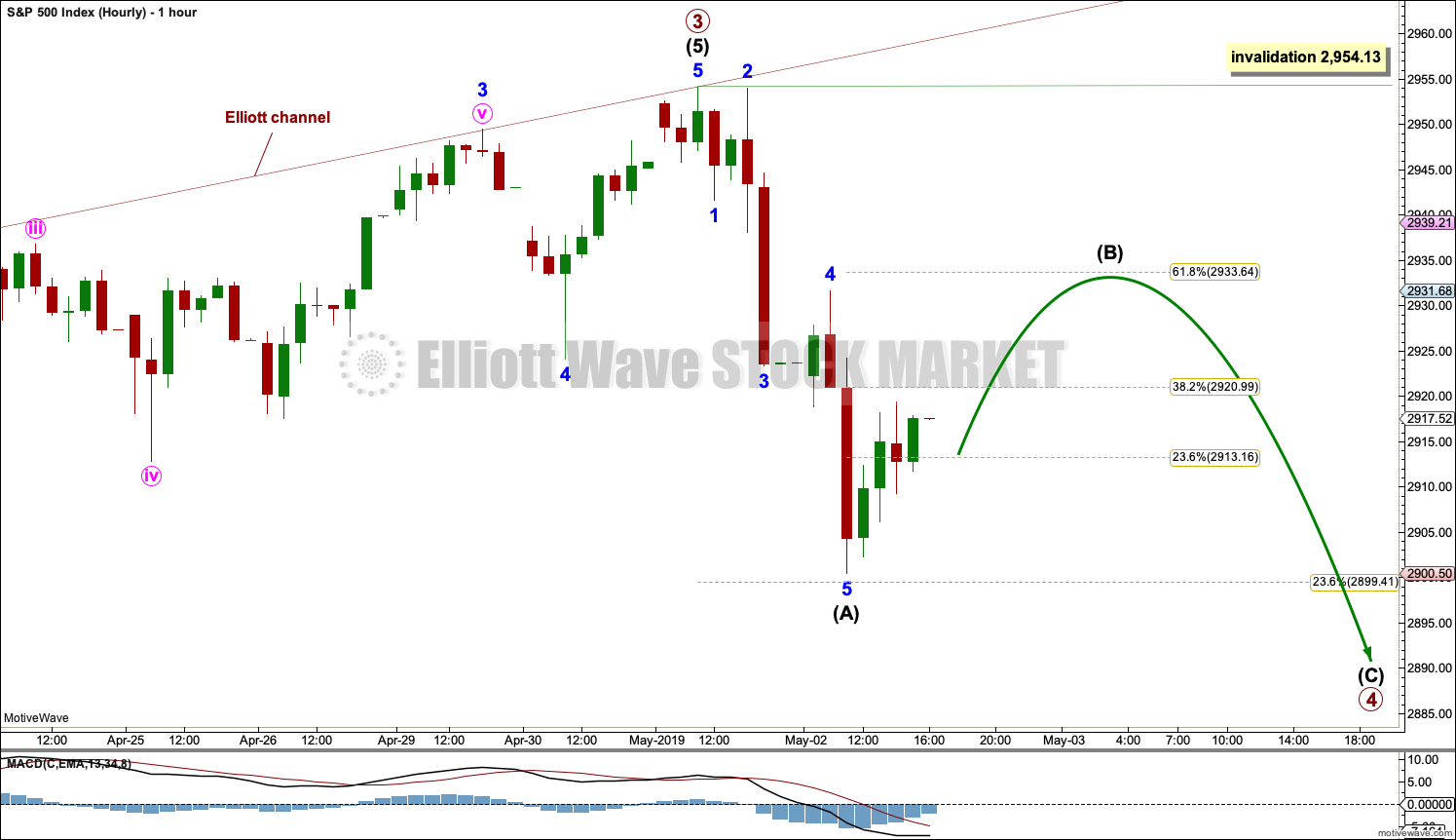

HOURLY CHART

If primary wave 4 has begun, then it should exhibit a five down at the hourly chart level. This would now be complete and is labelled intermediate wave (A).

Because intermediate wave (A) has subdivided as a five, intermediate wave (B) may not move beyond the start of intermediate wave (A) above 2,954.13.

Intermediate wave (B) may have begun today. It may continue for several more sessions. It may subdivide as any one of more than 23 possible corrective Elliott wave structures. It may be a quick and sharp bounce, or it may be a time consuming sideways consolidation. The latter is more likely in order for primary wave 4 to take up time to have good proportion to primary wave 2.

So far primary wave 4 has reached down to almost touch the 0.236 Fibonacci ratio of primary wave 3 and the structure is incomplete. The next possible target for primary wave 4 to end may now be either the 0.382 Fibonacci ratio at 2,865.56, or the lower edge of the maroon Elliott channel, which may be seen on the daily chart.

SECOND WAVE COUNT

WEEKLY CHART

This weekly chart is identical to the first weekly chart, with the sole difference being the degree of labelling.

When cycle wave I is complete, then cycle wave II should meet the technical definition of a bear market as it should retrace more than 20% of cycle wave I, but it may end about either the 0.382 or 0.618 Fibonacci Ratios of cycle wave I. Cycle wave II may end close to the low of primary wave 2 within cycle wave I, which is at 1,810.10.

Thereafter, a new bull market for cycle wave III may begin. It should have support from volume and fundamentals.

The end of Grand Super Cycle wave I may be about 10 years or so away.

TECHNICAL ANALYSIS

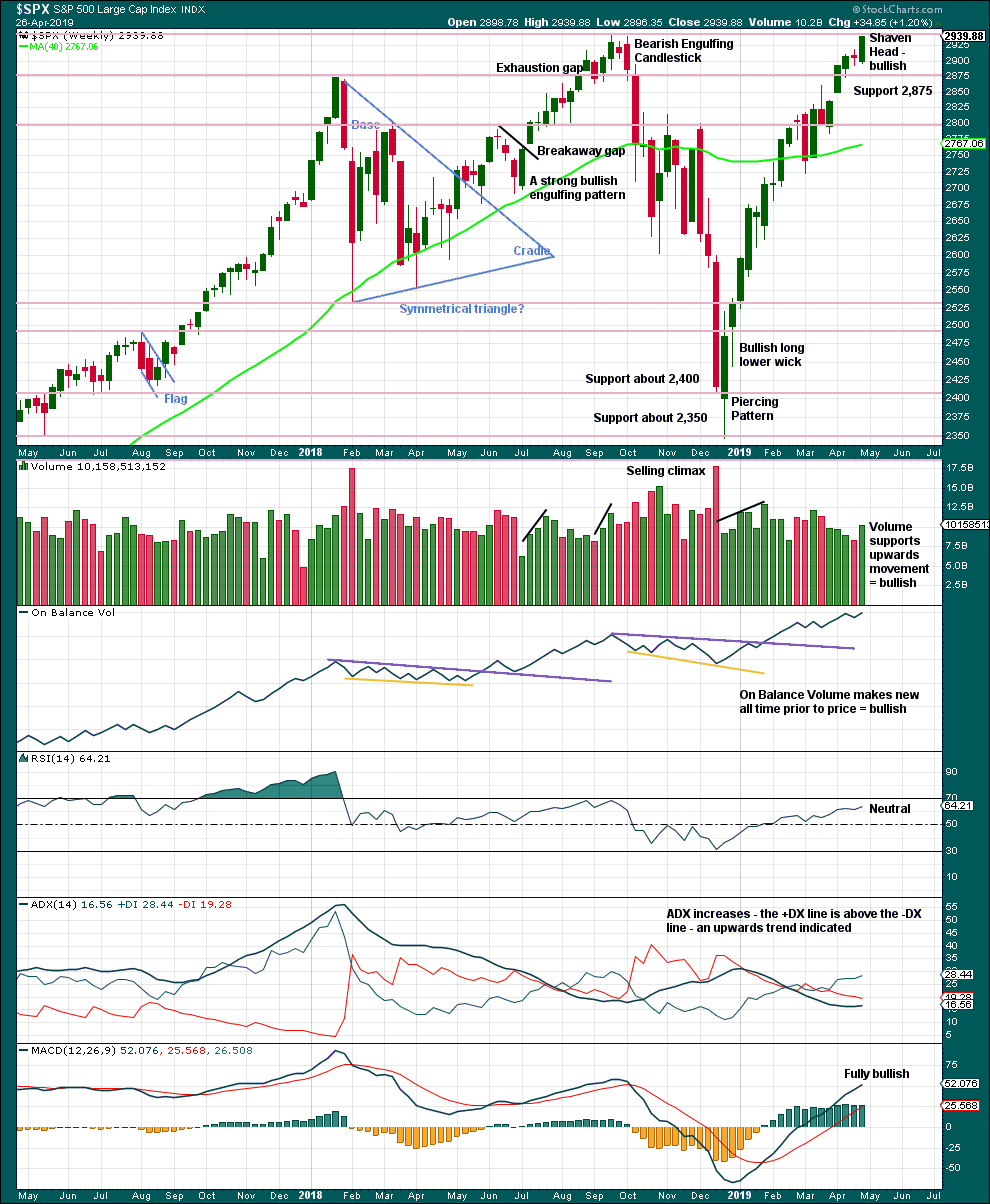

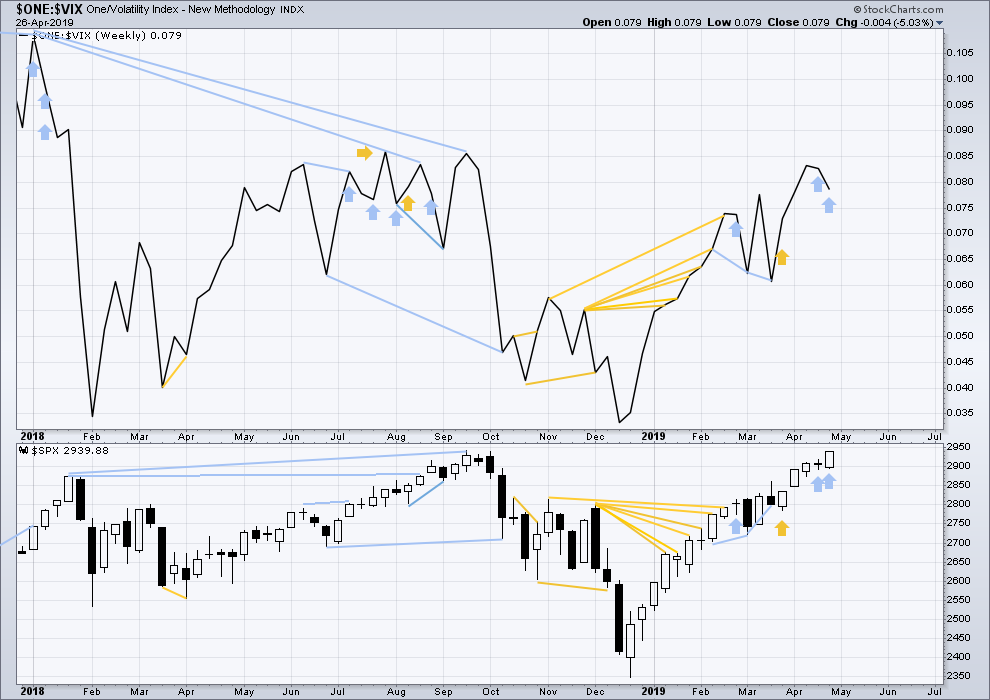

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

Next resistance is about the prior all time high about 2,940.

This chart is fully bullish.

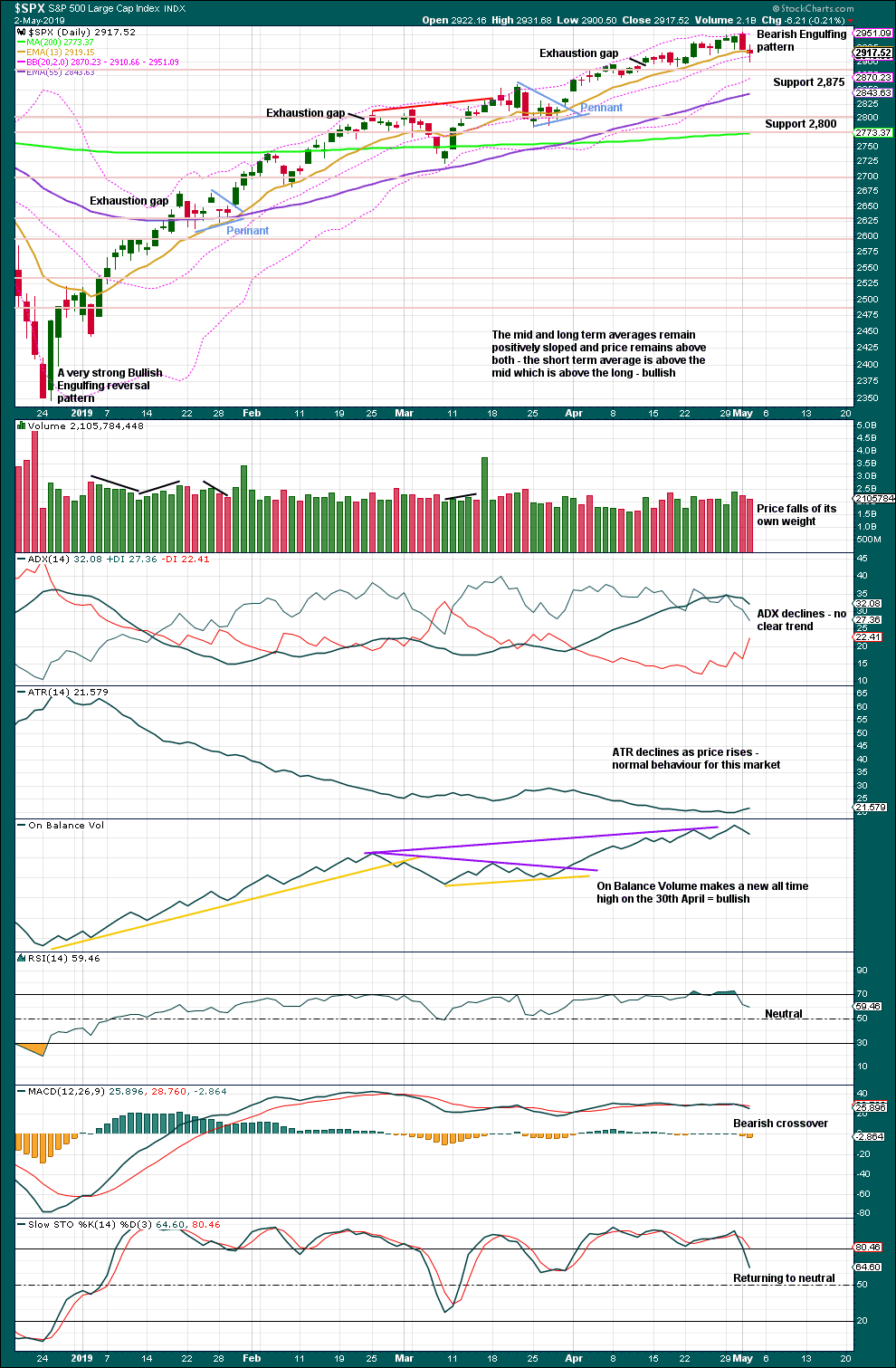

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The December 2018 low is expected to remain intact. The two 90% upwards days on 26th December 2018 and 6th January 2019 indicate this upwards trend has internal strength.

The Bearish Engulfing candlestick engulfs the two prior daily candlesticks. Coming after upwards movement, which has reached extreme, it should be given weight. This is a fairly strong bearish reversal signal.

There is support close by at 2,875.

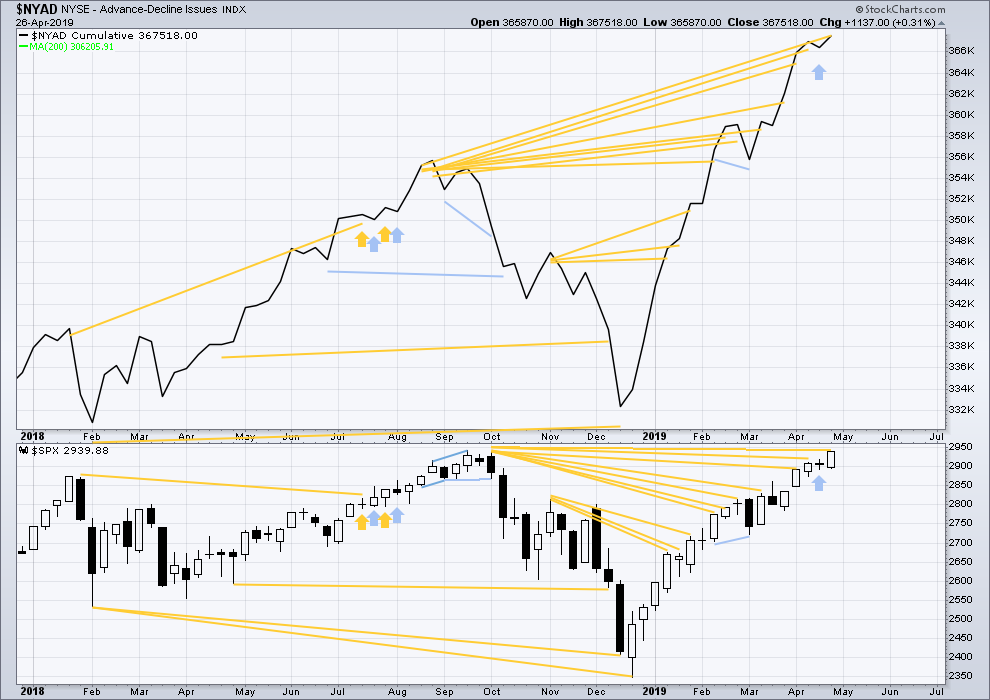

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Every single bear market from the Great Depression and onwards has been preceded by a minimum of 4 months divergence between price and the AD line. With the AD line making a new all time high again in April, the end of this bull market and the start of a new bear market must be a minimum of 4 months away, which is the end of August 2019 at this time.

Last week the AD line makes another new all time high with price failing to make a corresponding new all time high by the slimmest of margins at 1.03 points.

Mid and large caps have both made new highs above the swing high of the 25th of February, but small caps have not. However, small caps AD line has made a new all time high on the 12th of April indicating broad strength underlying this market. Mid and small caps continue to lag. This rise is driven primarily by large caps, which is typical for an aged bull market.

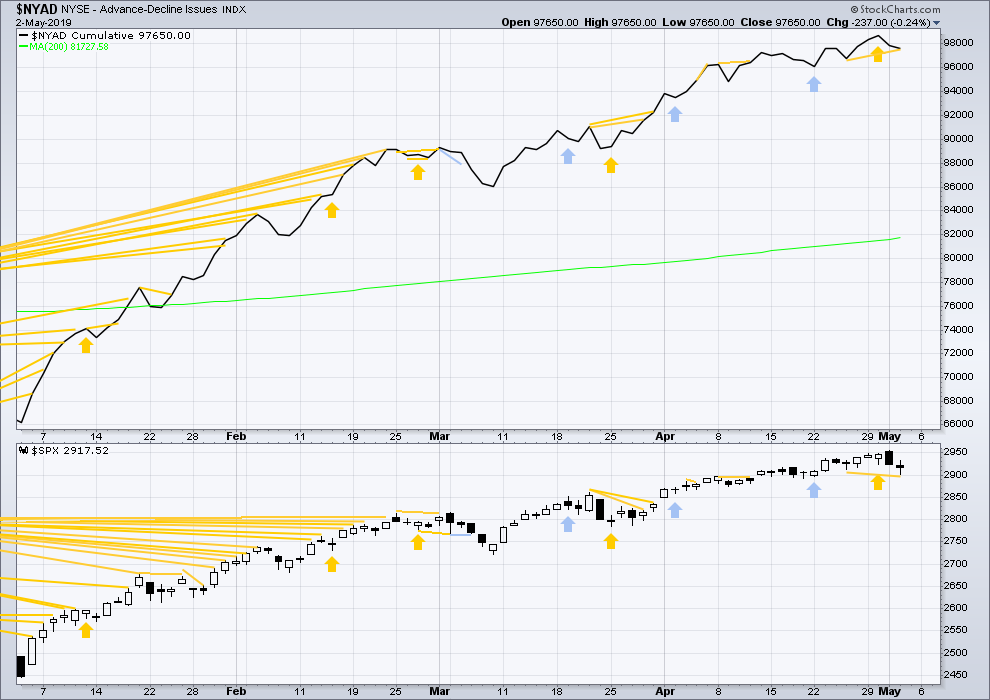

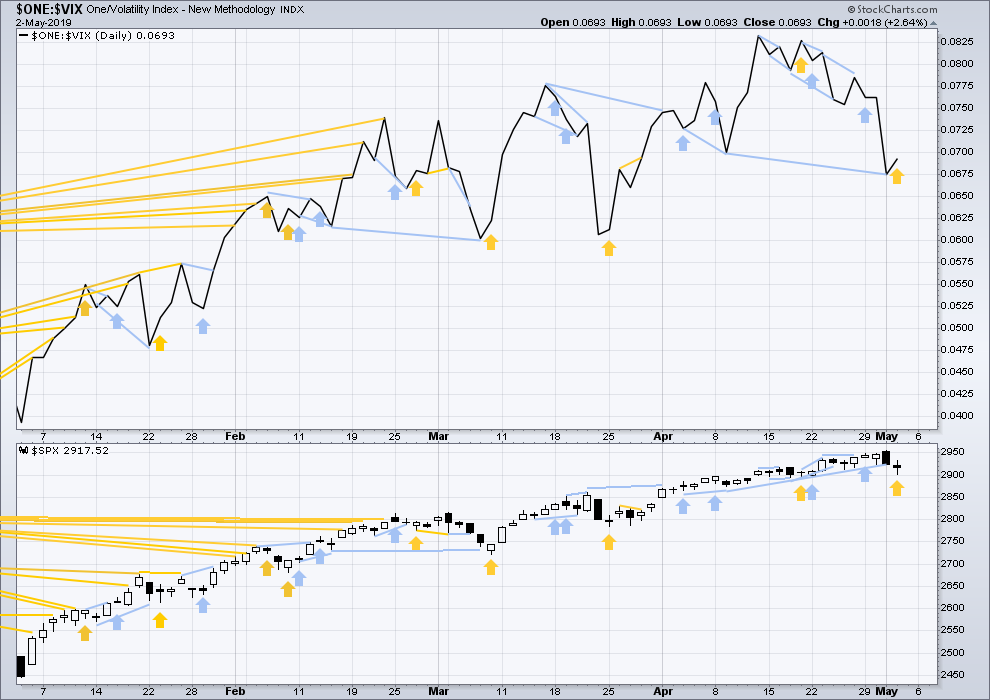

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Today price has made a slight new low below the prior small swing low of the 25th of April, but the AD line has not. Downwards movement lacks support from a corresponding decline in market breadth. This divergence is bullish for the short term and may support the Elliott wave count that expects a bounce or consolidation here for a B wave.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

For two weeks in a row price has moved higher and inverted VIX has moved lower. The week before last was not so clear as the weekly price candlestick was red, but last week is clear. Price has moved strongly higher, but inverted VIX has moved strongly lower. This divergence is bearish for the short to mid term and may be warning of an approaching primary (or intermediate) degree correction.

It is noted that this has occurred before at the end of the strong rise in price up to the high on the 26th of January 2018. The three weeks up to that high saw price clearly move higher and inverted VIX clearly move lower. This divergence persisted for three weeks in that instance, and so may persist for a very few weeks again now before price turns.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Today price has moved lower, but inverted VIX has moved higher. This divergence is bullish for the short term, and coming at the same time as bullish divergence on the AD line it is given a very little weight. This may offer a very little support to the view that a B wave may unfold here.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices moving now higher, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91 – a new all time high has been made on the 29th of April 2019.

Nasdaq: 8,133.30 – a new high has been made on 24th of April 2019.

Published @ 07:44 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Hourly chart updated:

Intermediate (B) should be over here if my wave count is right.

I may need to move the degree of labelling within primary 4 down one degree; a zigzag may be completing as the first structure in a double combination.

Primary 4 may also be a triangle.

I don’t know how you guy are counting this but I’ve got yesterday as a completed 4 and we are working a 5 to new highs

Could be. In which case, action is now in the iv of the 5 wave v up. Hmmm….

Thats what I’m thinking looking for a move down to previous 4 at around 2934 ish on /es

Although this could only be minor 4 of 3.

Looks too small and brief for a Primary 4, IMHO

Agreed. I think a combination or triangle needs to be considered now.

ES approaching a level to reckon with.

Not to quibble but…your retrace levels are backwards. So that’s a 76.4% it’s approaching. I find the 78.6% (sqrt(phi)) to be more significant, typically. About 2948.5 on /ES. Watching for a possible hit/turn there carefully myself.

Kevin you are dead right. One set of charting software does this and another does that. I wholeheartedly agree with what you said. The less than accurate stuff comes from Interactive Brokers (black background). The accurate stuff come from TradingView charts (clear and easy to read).

And a nice turn here off that level (2949 is the high I see). Close enough to perfect. Does it hold….(I’m short)….not a fan of counter trend trading but I also believe in the adage, “Use the Wave Count, Luke!!!”.

May the Wave Count be with you! (and me…)

I don’t think IB’s charting is “inaccurate”, but the way you create a set of fibo retrace levels is “backwards” from the way it’s done on ToS and probably tradingview too. Just mark you points in opposite order on IB (mark the “retrace from” point first, and the “retrace to” point second) and they will come out right.

Thanks Kevin. I really do appreciate your help. It’s a good thought, but the levels remain the same. Whether top to bottom or bottom to top, it still plots the 76.4 %. This will bug me for quite a while. I’ll be using TradingView charts for the fibonnaci work, where I can get the 78.6 % plotted.

I stand corrected. Here is the right level. The chart is 3 days of ES 1 hour candles. The chart is not real time. It is delayed. The ES has actually hit the top of the blue area.

SPX up past the 62%, the 78% is about 2943. High potential turn level.

A-D very strong, 430-73

Peter what’s your short plan here? I’m thinking I take a turn back into the gap…otherwise I’m waiting to see it get around the 78% level and turn and take it there with a very tight stop.

Closed my spxl and long RTY. Gonna watch for more evidence that we are gonna go back down

The levels are not exact on this chart. They are close but not precise.

going short to close the gap….

yea that head fake down pulled me in too for a little beachhead position, but no go.

I love Lara’s analysis! If primary 4 wants to start things down with a head and shoulders, this could be what it’s drawing. The chart is the past 8 sessions of the ES, using 4 hour candles. A reasonable target that fits into the TA picture could take the right shoulder up to 2938 ish. I’m putting out a bunch of maybe’s but maybe that’s what it’s doing.

Lara, quick ‘Q … I’m thrown off by this:

Summary: Primary wave 3 may now be complete. A pullback or consolidation here for primary wave 4 may now last about a couple of weeks or so and may end either about 2,899 or the lower edge of the maroon Elliott channel on the daily chart.

The session low (yesterday) was a point and a half above 2899. My question is; Is the primary 4 point is a lot lower than that?

I’m going to take a stab at an answer: if it turns out to be a flat, the C wave down should end “about 2899”. Otherwise, the likelihood is it goes deeper with some other structure.

Thx K!

Upon further review (as the NFL says) Lara writes in the expanded statement about the First Wave count, hourly chart; “The next possible target for primary wave 4 to end may now be either the 0.382 Fibonacci ratio at 2,865.56, or the lower edge of the maroon Elliott channel, which may be seen on the daily chart.”

Another question for Lara… The First Wave Count, hourly chart has several fib levels. I get where you are pulling from on them, but the 23.6 towards the bottom of the chart has me staring off into space. I don’t see any references on the other charts. I’m wondering where it’s generated from and what significance it holds?

I see you’ve answered the first question.

2nd question: That’s the 0.236 Fibonacci level of primary wave 3; I’ve drawn that along the length of primary wave 3 from its start on 8th of March at 2,722.27 to the high on 1st of May at 2,954.13

Maybe I’ll make them different colours to make it a little clearer?

1st?

if you aren’t sure maybe not?

ah shucks.

Again?