A new high for Monday continues the upwards trend. The Elliott wave count remains the same and the target from the pennant pattern has not yet been met.

Summary: The upwards trend should continue. The mid-term Elliott wave target remains the same at 3,010 and the target calculated using the pennant pattern is at 2,956.

Lowry’s indicators of supply and demand show expanding demand and contracting supply, with buying power making a new rally high and selling power a new bull market low today. This strongly supports the Elliott wave count.

The final target remains the same at 3,045.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last published monthly charts are here. Video is here.

ELLIOTT WAVE COUNTS

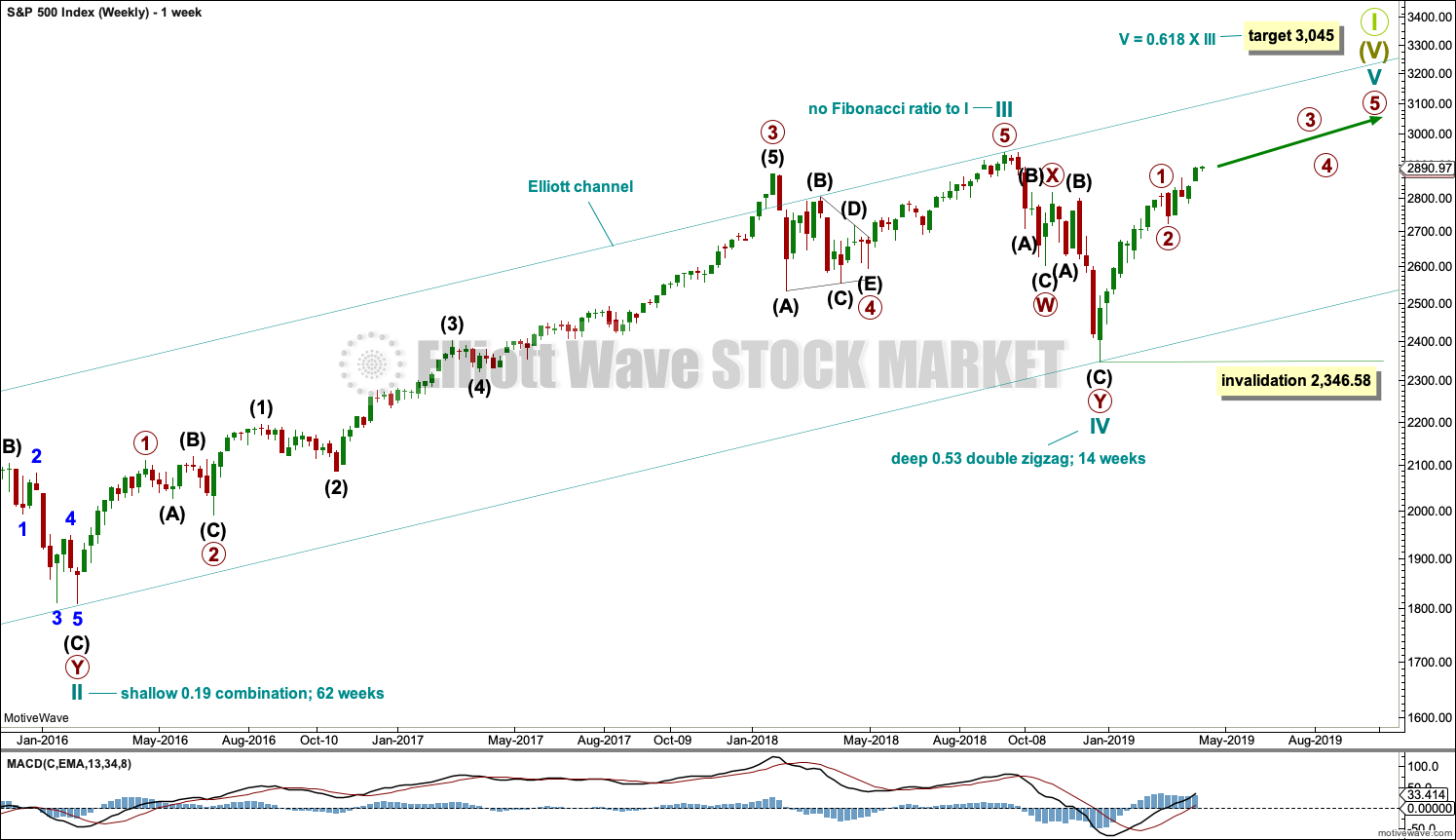

WEEKLY CHART

This weekly chart shows all of cycle waves III, IV and V so far.

Cycle wave II fits as a time consuming double combination: flat – X – zigzag. Combinations tend to be more time consuming corrective structures than zigzags. Cycle wave IV has completed as a multiple zigzag that should be expected to be more brief than cycle wave II.

Cycle wave IV may have ended at the lower edge of the Elliott channel.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Although both cycle waves II and IV are labelled W-X-Y, they are different corrective structures. There are two broad groups of Elliott wave corrective structures: the zigzag family, which are sharp corrections, and all the rest, which are sideways corrections. Multiple zigzags belong to the zigzag family and combinations belong to the sideways family. There is perfect alternation between the possible double zigzag of cycle wave IV and the combination of cycle wave II.

Although there is gross disproportion between the duration of cycle waves II and IV, the size of cycle wave IV in terms of price makes these two corrections look like they should be labelled at the same degree. Proportion is a function of either or both of price and time.

Draw the Elliott channel about Super Cycle wave (V) with the first trend line from the end of cycle wave I (at 2,079.46 on the week beginning 30th November 2014) to the high of cycle wave III, then place a parallel copy on the low of cycle wave II. Cycle wave V may find resistance about the upper edge.

It is possible that cycle wave V may end in October 2019. If it does not end there, or if the AD line makes new all time highs during or after June 2019, then the expectation for cycle wave V to end would be pushed out to March 2020 as the next possibility. Thereafter, the next possibility may be October 2020. March and October are considered as likely months for a bull market to end as in the past they have been popular. That does not mean though that this bull market may not end during any other month.

MAIN WAVE COUNT

DAILY CHART

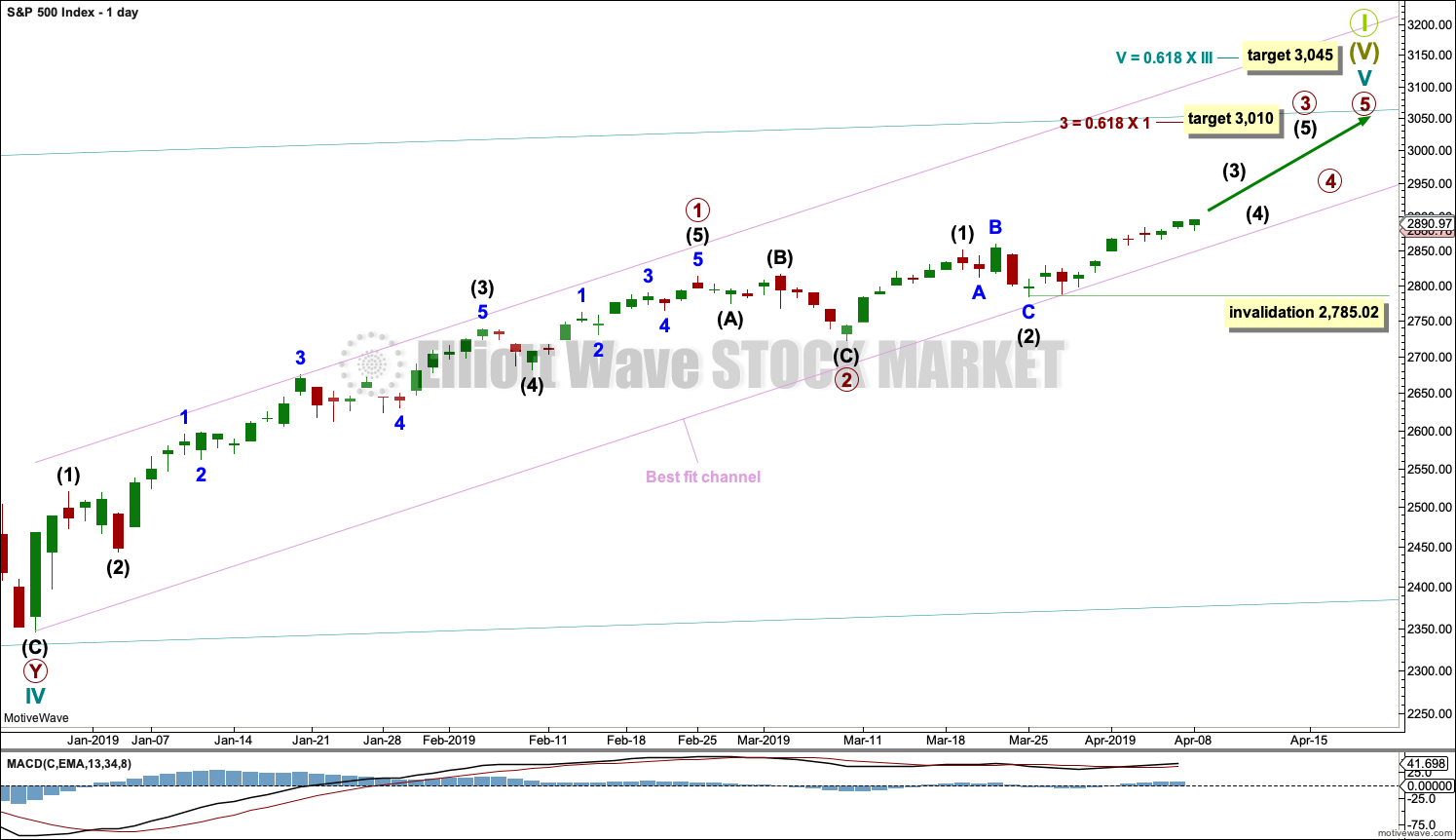

The daily chart will focus on the structure of cycle wave V.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A target is calculated for cycle wave V to end prior to this point.

However, members are reminded that there is an alternate monthly wave count that does not have a limit to upwards movement. There is a link to it at the start of each analysis.

Cycle wave V must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common and that will be how it is labelled. A diagonal would be considered if overlapping suggests it.

Primary wave 2 may have been a very brief and shallow expanded flat correction.

Within primary wave 3, intermediate waves (1) and (2) may be complete. Intermediate wave (3) may only subdivide as an impulse. Within intermediate wave (3), minor wave 2 may not move beyond the start of minor wave 1 below 2,785.02.

The channel is adjusted to better show where small pullbacks are finding support.

HOURLY CHART

Intermediate wave (3) has now moved above the end of intermediate wave (1) meeting a core Elliott wave rule.

So far this labelling agrees with MACD. Minor wave 3 exhibits an increase in momentum beyond that of minor wave 1. Now minor wave 5 exhibits a decline in momentum.

An Elliott channel is drawn about minor wave 3. Draw the first trend line from the end of minor wave 1 to the end of minor wave 3, then pull a parallel copy down to the end of minor wave 2. Minor wave 5 may find resistance about the upper edge of this channel.

Within intermediate wave (3), minor waves 1 through to 4 may now be complete. Minor wave 5 may be extending.

Within minor wave 5 so far, minute waves i and ii may be complete and minute wave iii may have begun. Within minute wave iii, no second wave correction may move beyond its start below 2,880.78.

If this wave count is invalidated with a new low below 2,880.78 tomorrow, then it may be possible that intermediate wave (3) could be over and intermediate wave (4) may have begun.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,852.42. Intermediate wave (4) would most likely be a relatively shallow sideways consolidation. It would most likely unfold as a flat, triangle or combination.

TECHNICAL ANALYSIS

WEEKLY CHART

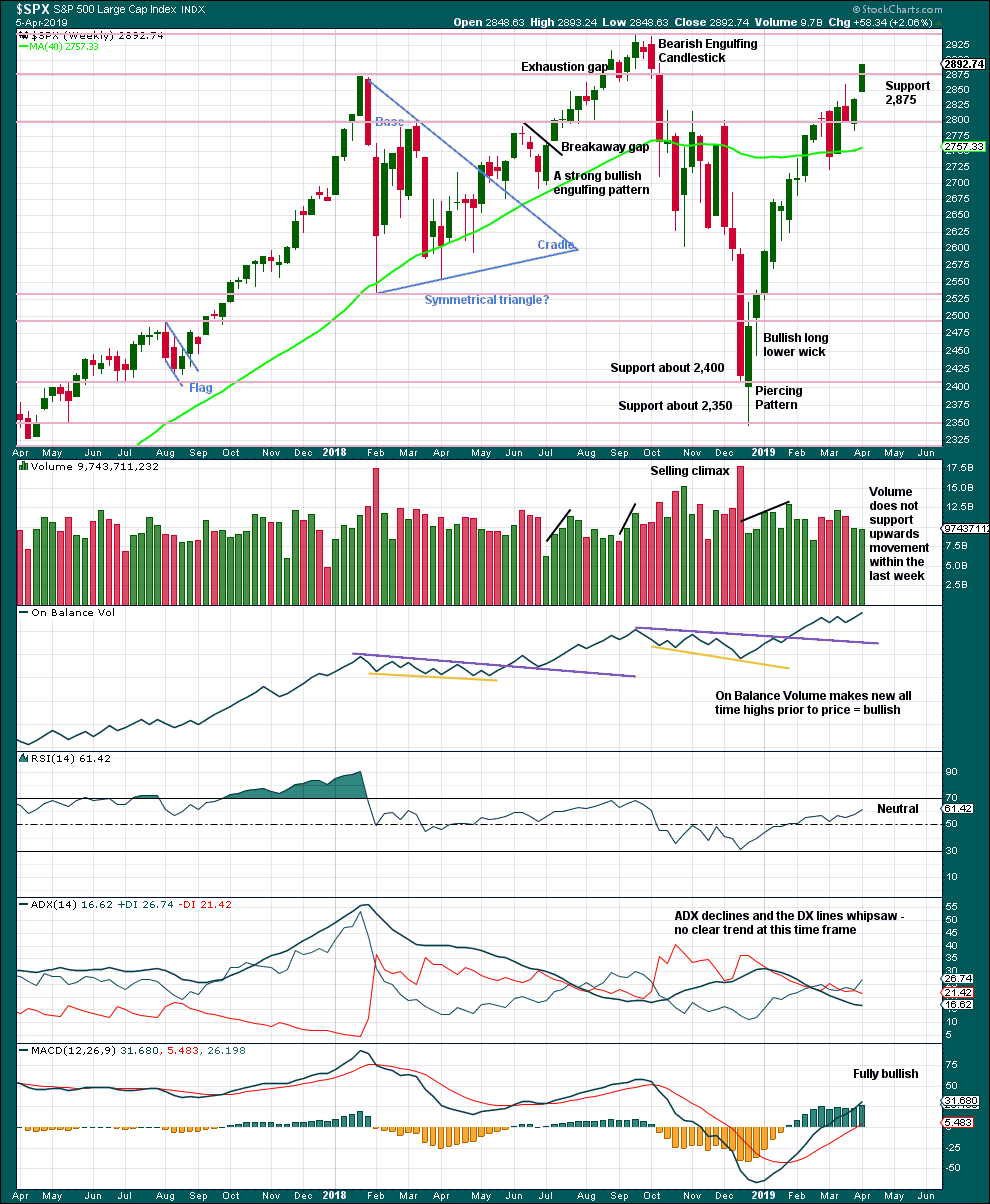

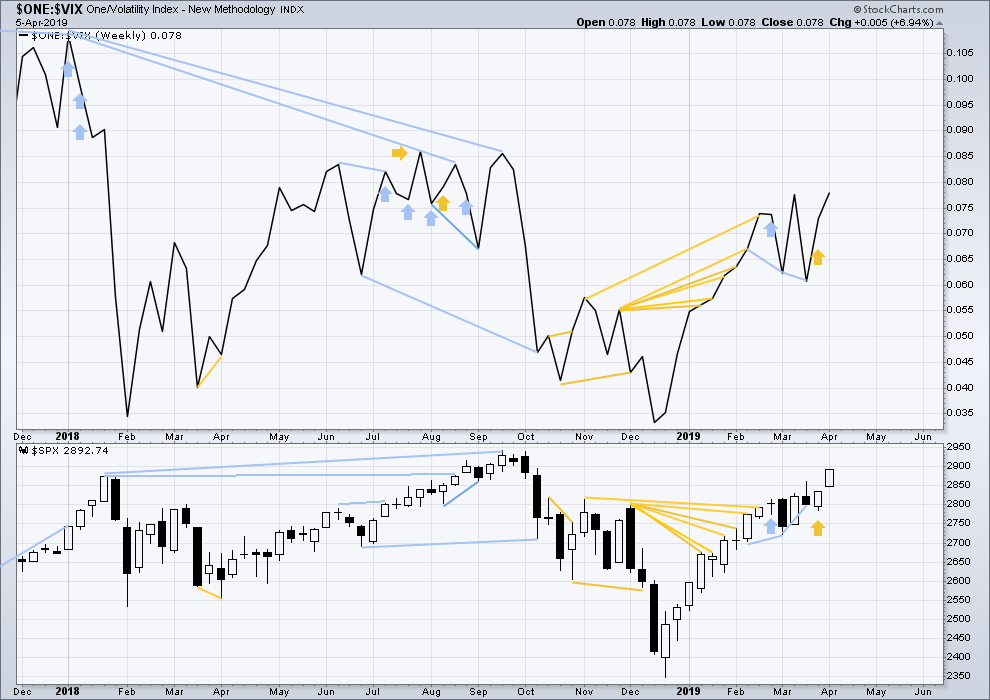

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

A strong upwards week, with price closing near the high for the week, and On Balance Volume making a new all time high suggest more upwards movement this week.

DAILY CHART

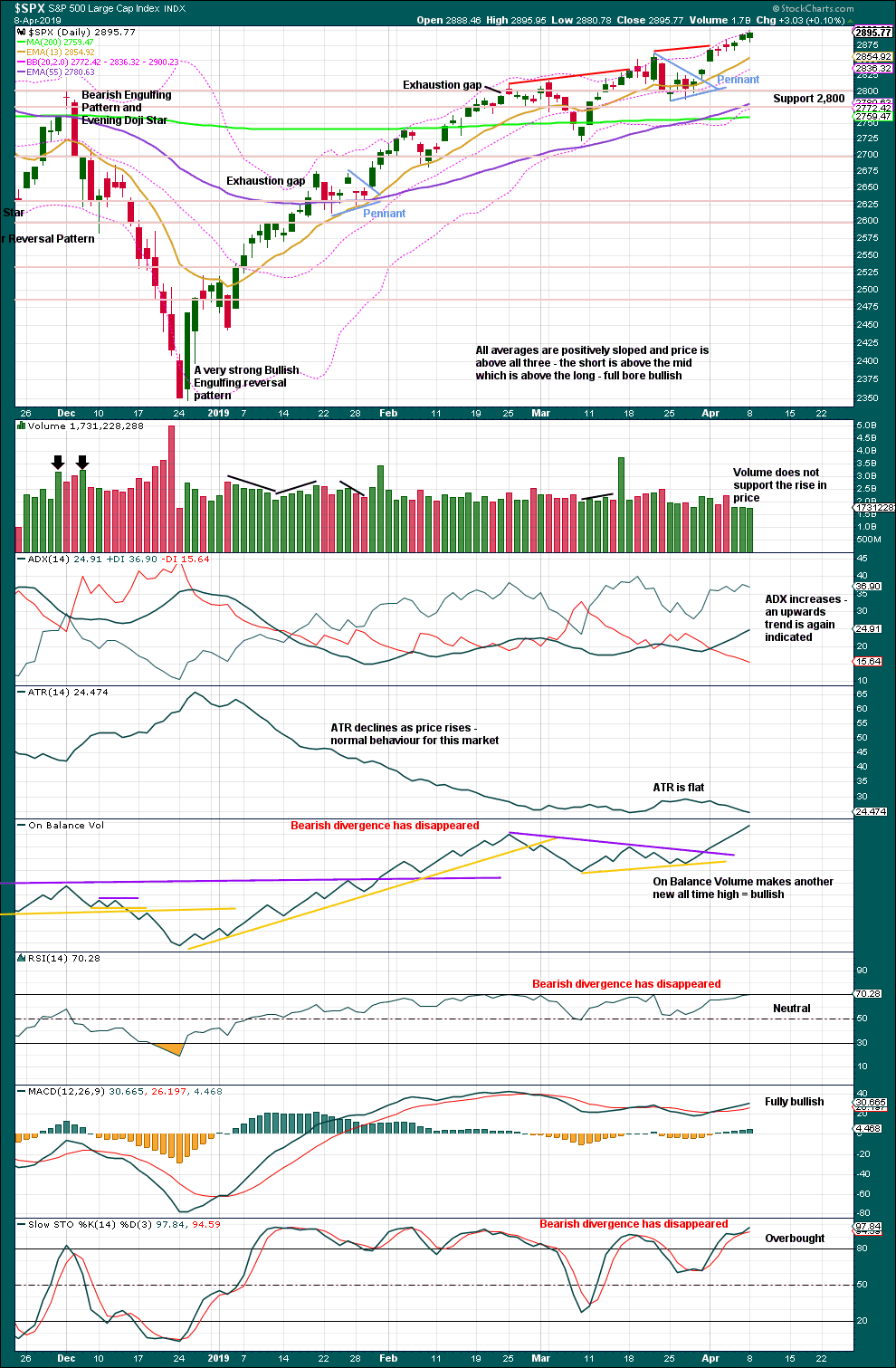

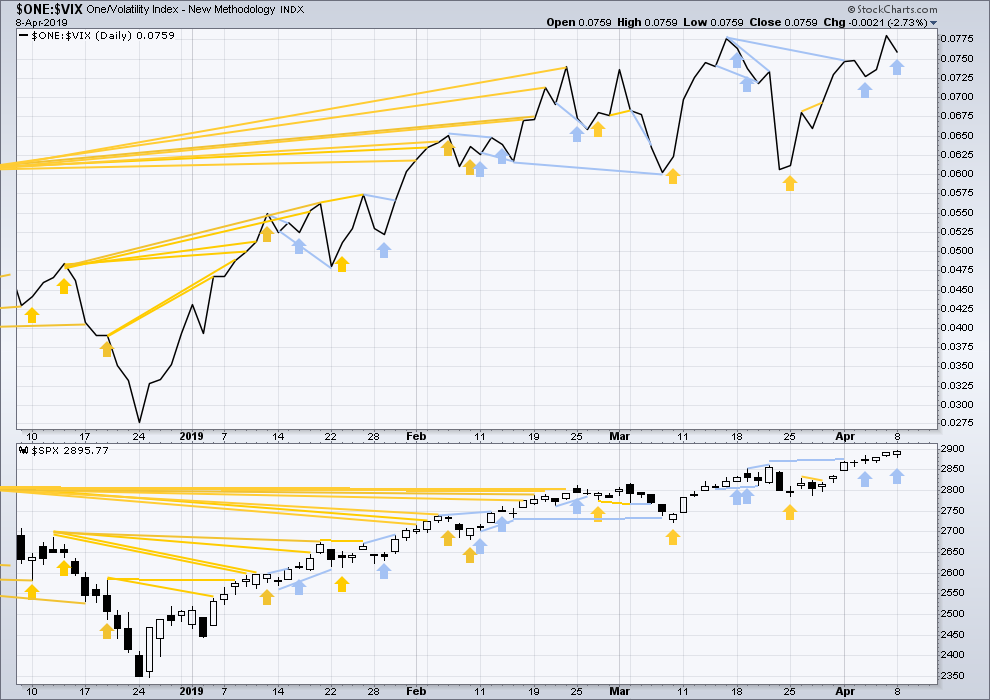

Click chart to enlarge. Chart courtesy of StockCharts.com.

The December 2018 low is expected to remain intact. The two 90% upwards days on 26th December 2018 and 6th January 2019 indicate this upwards trend has internal strength.

Lowry’s data shows Selling Pressure has reached another new low for this bull market, and today Buying Power has reached a new high for this rally. This indicates an expansion in demand and a contraction in supply, which has historically been associated with strong phases of bull markets. This strongly supports the Elliott wave count, which expects new all time highs to come this year.

While the last swing low of the 25th of March remains intact, there exists a series of higher highs and higher lows from the major low in December 2018. It would be safest to assume the upwards trend remains intact.

The pennant pattern is a reliable short-term continuation pattern. A target calculated using the flag pole is about 2,956.

BREADTH – AD LINE

WEEKLY CHART

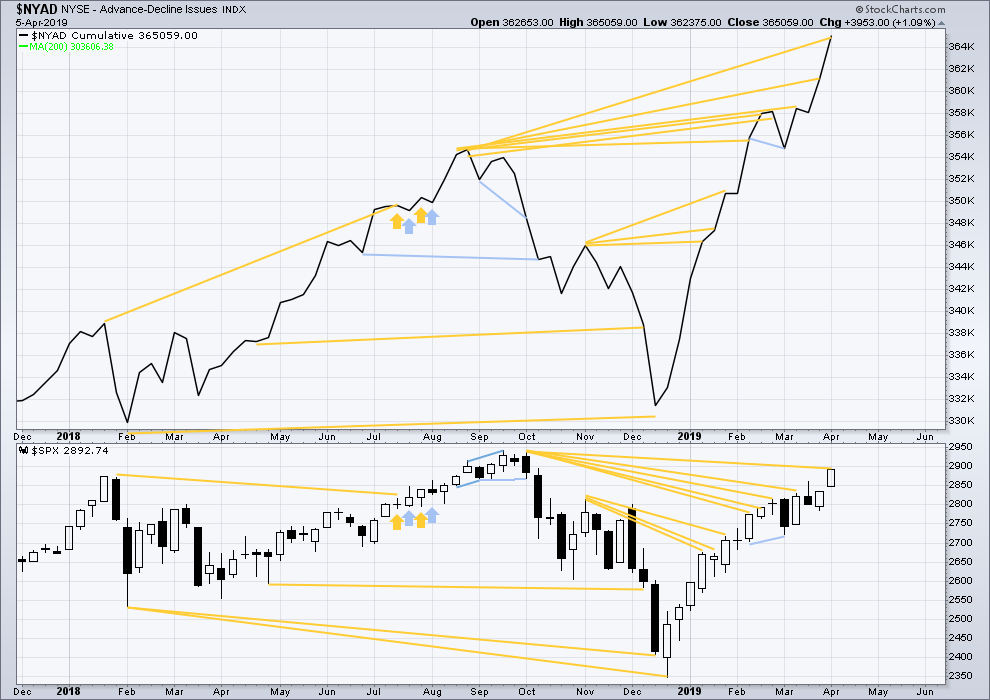

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Every single bear market from the Great Depression and onwards has been preceded by a minimum of 4 months divergence between price and the AD line. With the AD line making a new all time high again last week, the end of this bull market and the start of a new bear market must be a minimum of 4 months away, which is the end of July 2019 at this time.

This week the AD line makes another new all time high. Bullish mid-term divergence continues.

DAILY CHART

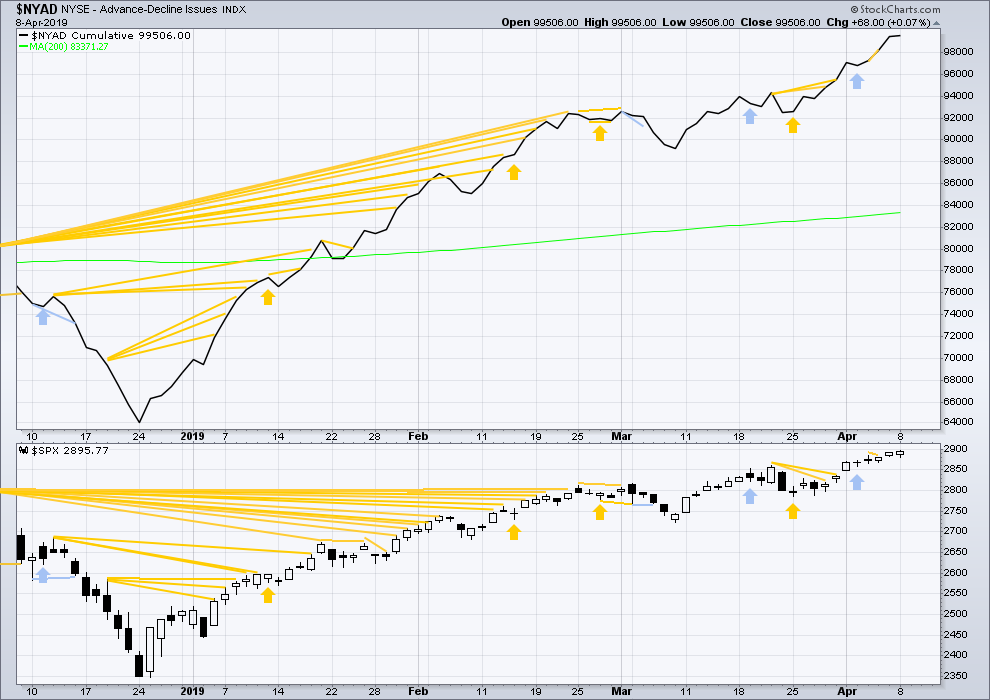

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

At the daily chart level, both the AD line and price make new short-term highs. There is no short-term divergence.

Upwards movement has support from rising market breadth. This is bullish.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Last week both price and inverted VIX have moved higher. There is no mid or short-term divergence. Long-term divergence between all time highs remains.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Today price has moved higher, but inverted VIX has moved lower. Upwards movement today has not come with a normal corresponding decline in VIX. VIX has increased. This divergence is bearish for the short term, but it has not very reliable lately and shall not be given weight in this analysis. There are currently five examples on this chart where single day bearish divergence was not followed by any reasonable downwards movement.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices moving now higher, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91

Nasdaq: 8,133.30.

For the short term, now DJT has made a very slight new low below the prior swing low of the 8th of March. All of the S&P500, DJIA and Nasdaq remain above their prior swing lows of the 8th of March.

Published @ 07:24 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

With the hourly chart invalidated minor 5 must now be over. So intermediate (3) should now be over and intermediate (4) should now be underway.

My count of intermediate (3) is slightly adjusted today.

Intermediate (4) may find support at the lower edge of the best fit channel which is copied over from the daily chart. If it doesn’t end there then it may end about the 0.382 Fibonacci ratio.

Did a butterfly in vxxb

Bought 30 of the 28 calls

Sold 60 of the 29

Bought 30 of the 30 calls for .18

For Friday

A slight hedge against the remaining 1000 shares of vxxb I’m long and reload my exit from earlier spike

Exited my gld

Covered my shorts in spy

Exited 1/2 my vxxb

Wishing I wouldn’t have reloaded LYFT ..:)

Looking into a straddle in nflx less than a month out

It’s going one way or the other

The mere idea of going long LYFT gives me heart tremors. Mega billions valuation for a company that burns money and has no hope for YEARS (if that) of ever making a profit. Gad. Sure sign we are in the end days of this crazy bull market, just as the IPO of VALinux back in 1999/2000 (peaked at about 130 on the first day…and was out of business two years later) was sign of things soon to come.

I’m just doing the old buy the dip and wait for the squeeze strategy

I got in at 71.70 and out at 76

Back in at 70.25

And underwater

But they will pump it back up

Pick up a few shares in this 67 range and enjoy the pop above 70

Perhaps “probably”. But if the broader market decides to sell off for another two days, LYFT will quickly be at 62. Not my cup of tea. Trend is nasty down at weekly and daily.

Hey Kevin

What are you seeing on nflx?

I am seeing a move pretty big either way soon

Was looking at near term straddles

Massive daily squeeze, been going on for about 5 weeks!

Given the nature of the overall move, if you forced me to bet, I’d bet the squeeze comes off with a downward move in price, i.e, this is topping action here. Six days to earnings…

Perhaps. But if the broader market decides to sell off for another two days, LYFT will quickly be at 62. Not my cup of tea. Trend is nasty down at weekly and daily. Best of luck on it.

Gold is pissing me off. “Everyone” says gold is “supposed” to be going down, but three hard hits and turns now on the big 38% retrace level. As I said before, I always find gold to be a really, really frustrating market.

once US dollar index breaks up over 97 and stays there, then maybe gold down

Something I think has changed fundamentally with the way gold is trading

It used to be a sure thing two step

Short gold but spy futures

Like clockwork it was used to juice things to the upside

Just like short vol

But the last rise gold had held

So I am buying dips

It’s worked 3 times now

I usually sell short term near money puts to give me a little cushion on entry

This last time a did a straight buy

Kevin, To me…..Looks like gold is in wave 2 up of wave 3 down (B wave down)…..soon to top out before 1310…..looking for waves 3,4,5 to move down to the 1250 area or slightly below.

Thanks. Yea, that’s the theory. I’ve got a bet based on that theory. We’ll see!

Hourly count invalidated, intermediate 2 down in play. An intermediate wave is going to be several days long, expect sideways/down chop here folks. “Should” stay above 2852.

4, correct?

2, 4, yeah, one of those! Sorry.

“Now if a 6…turned out to be 9…I don’t mind! I don’t mind!”

Lara,

Today’s opening summary has the supply and demand information reversed indicating supply is expanding and demand is contracting. You have it opposite (and I assume correctly stated) in the classic TA section. Just a heads up to you and any folks that might be confused.

Have a great day everyone.

So sorry everybody! Yes, they’re the wrong way around in the summary. Will fix.

I’ve just published analysis of Bitcoin over at Elliott wave Gold. Find it here.

1