The upwards trend continues overall as expected. Elliott wave targets remain the same.

Summary: The upwards trend should continue. The mid-term Elliott wave target remains the same at 3,010 and the target calculated using the pennant pattern is at 2,956.

Lowry’s Selling Pressure has reached a new low for the entirety of this bull market, which began in March 2009. This strongly supports a bullish Elliott wave count.

The final target remains the same at 3,045.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last published monthly charts are here. Video is here.

ELLIOTT WAVE COUNTS

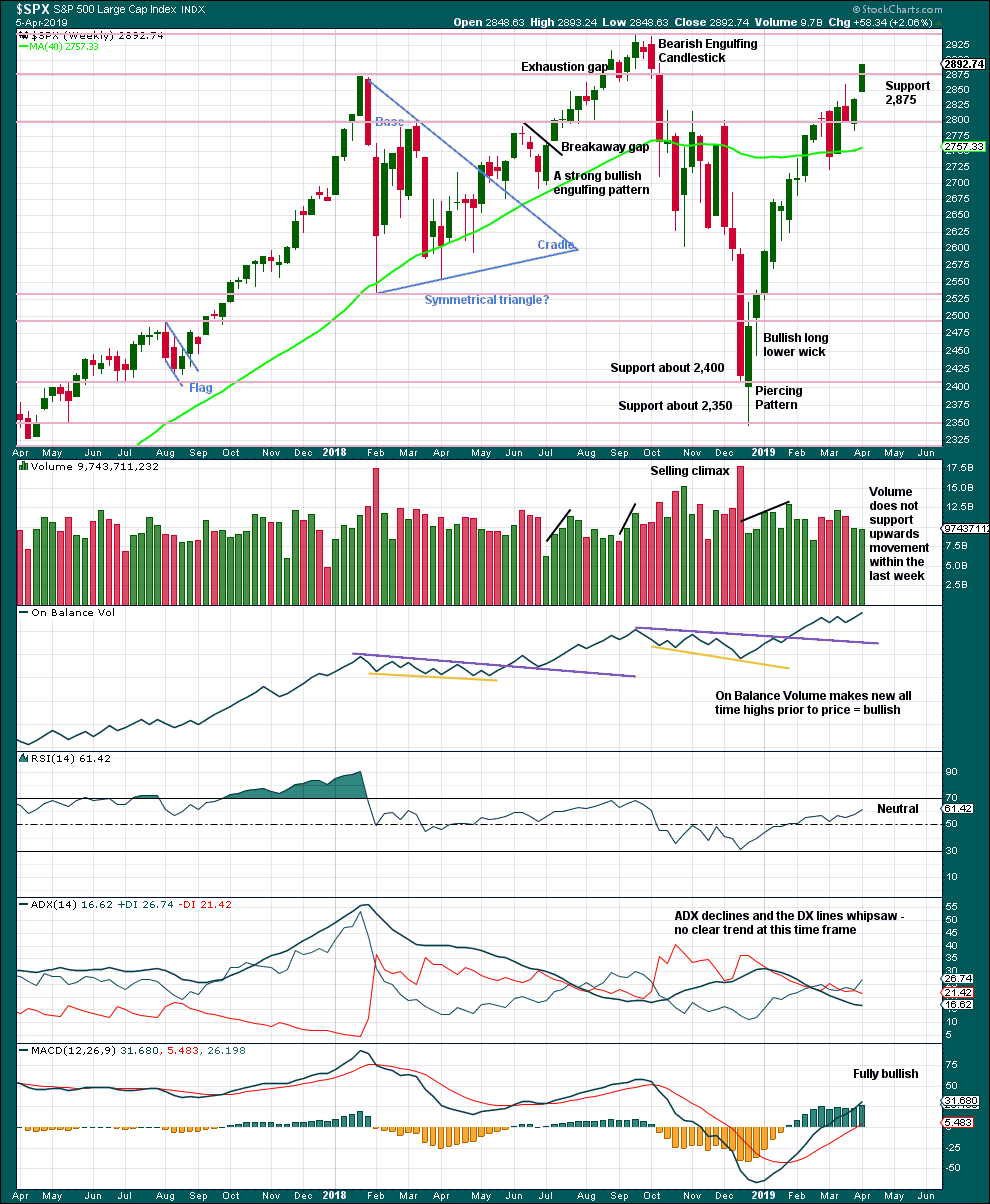

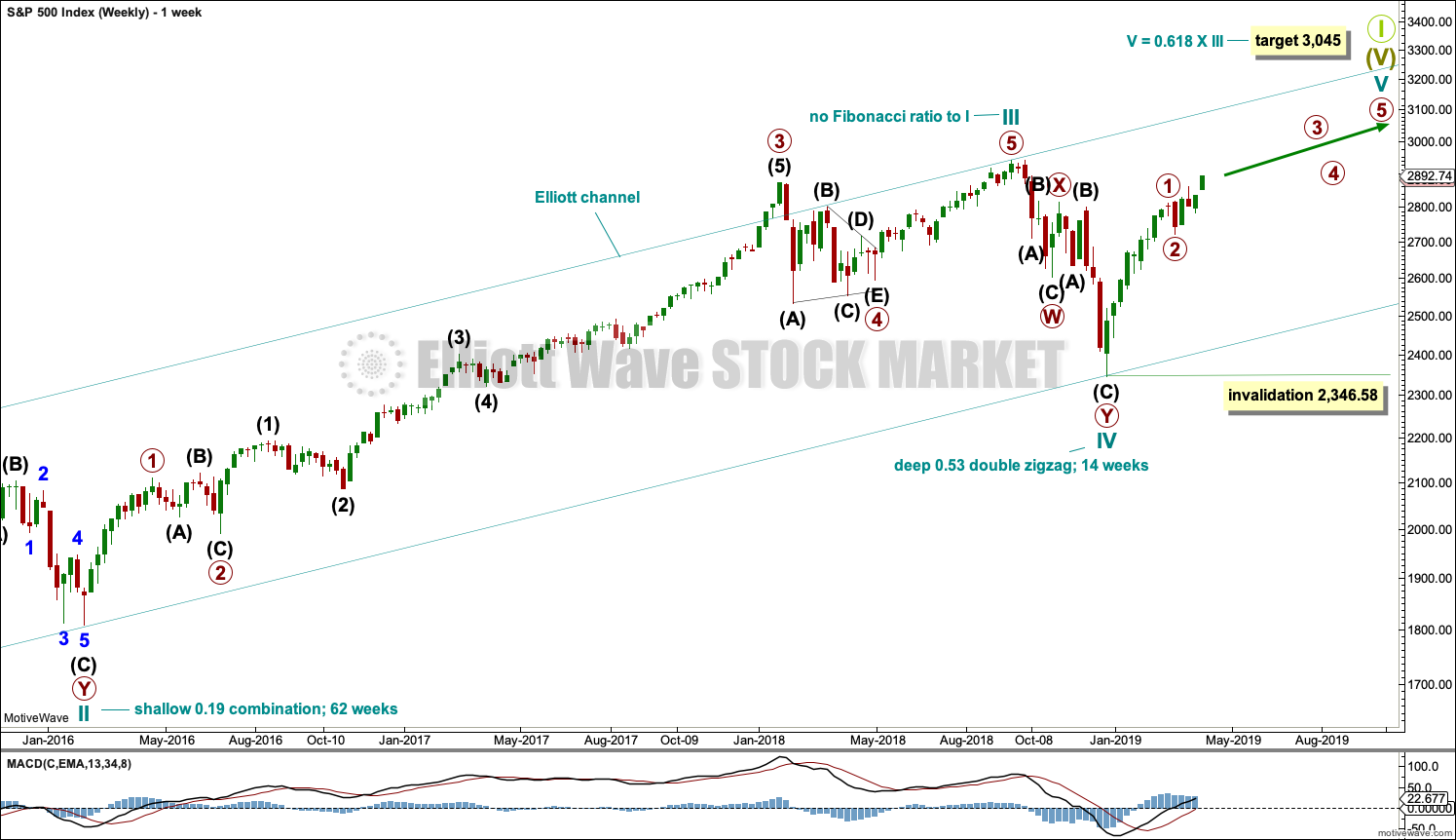

WEEKLY CHART

This weekly chart shows all of cycle waves III, IV and V so far.

Cycle wave II fits as a time consuming double combination: flat – X – zigzag. Combinations tend to be more time consuming corrective structures than zigzags. Cycle wave IV has completed as a multiple zigzag that should be expected to be more brief than cycle wave II.

Cycle wave IV may have ended at the lower edge of the Elliott channel.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Although both cycle waves II and IV are labelled W-X-Y, they are different corrective structures. There are two broad groups of Elliott wave corrective structures: the zigzag family, which are sharp corrections, and all the rest, which are sideways corrections. Multiple zigzags belong to the zigzag family and combinations belong to the sideways family. There is perfect alternation between the possible double zigzag of cycle wave IV and the combination of cycle wave II.

Although there is gross disproportion between the duration of cycle waves II and IV, the size of cycle wave IV in terms of price makes these two corrections look like they should be labelled at the same degree. Proportion is a function of either or both of price and time.

Draw the Elliott channel about Super Cycle wave (V) with the first trend line from the end of cycle wave I (at 2,079.46 on the week beginning 30th November 2014) to the high of cycle wave III, then place a parallel copy on the low of cycle wave II. Cycle wave V may find resistance about the upper edge.

It is possible that cycle wave V may end in October 2019. If it does not end there, or if the AD line makes new all time highs during or after June 2019, then the expectation for cycle wave V to end would be pushed out to March 2020 as the next possibility. Thereafter, the next possibility may be October 2020. March and October are considered as likely months for a bull market to end as in the past they have been popular. That does not mean though that this bull market may not end during any other month.

MAIN WAVE COUNT

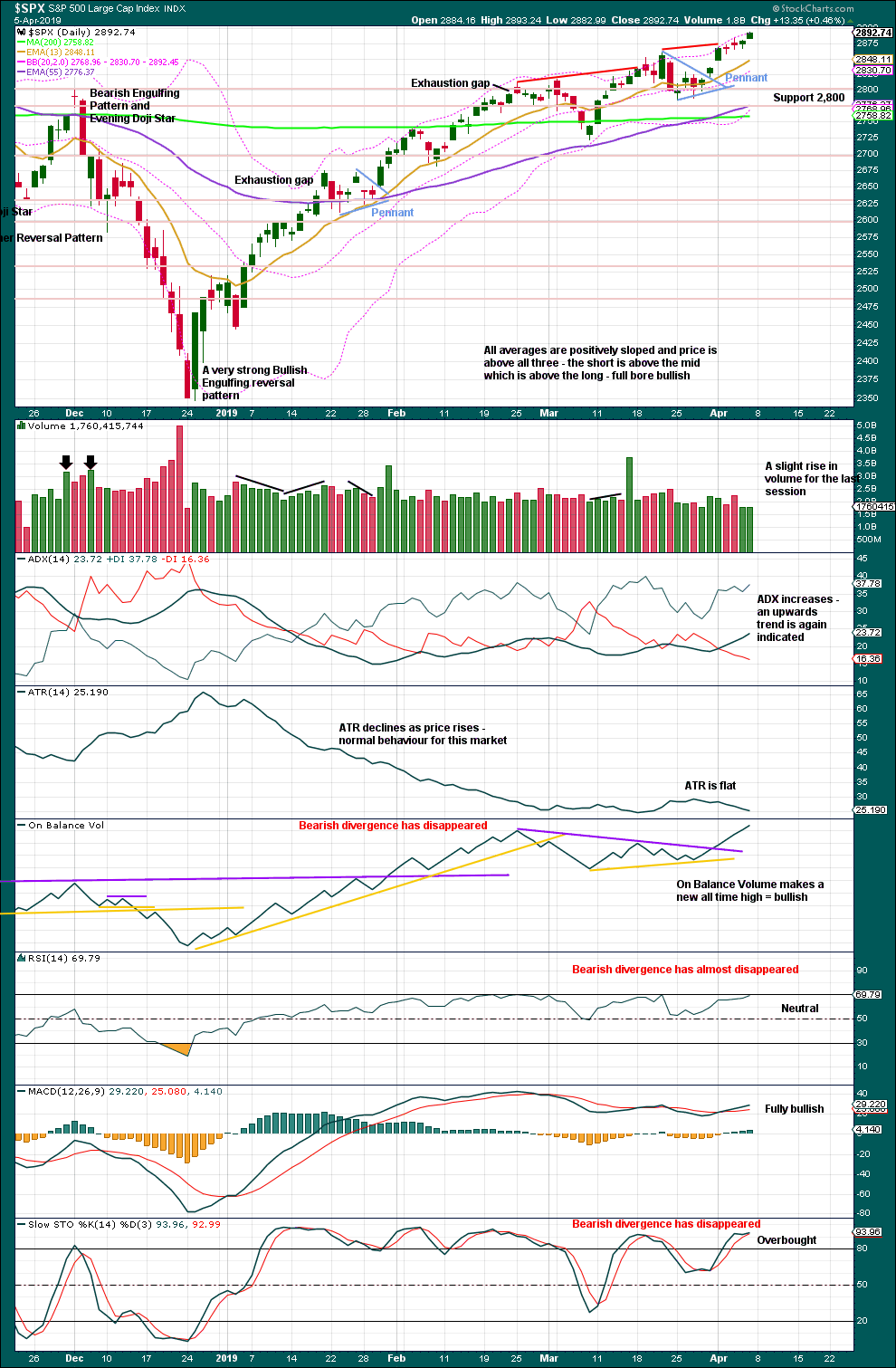

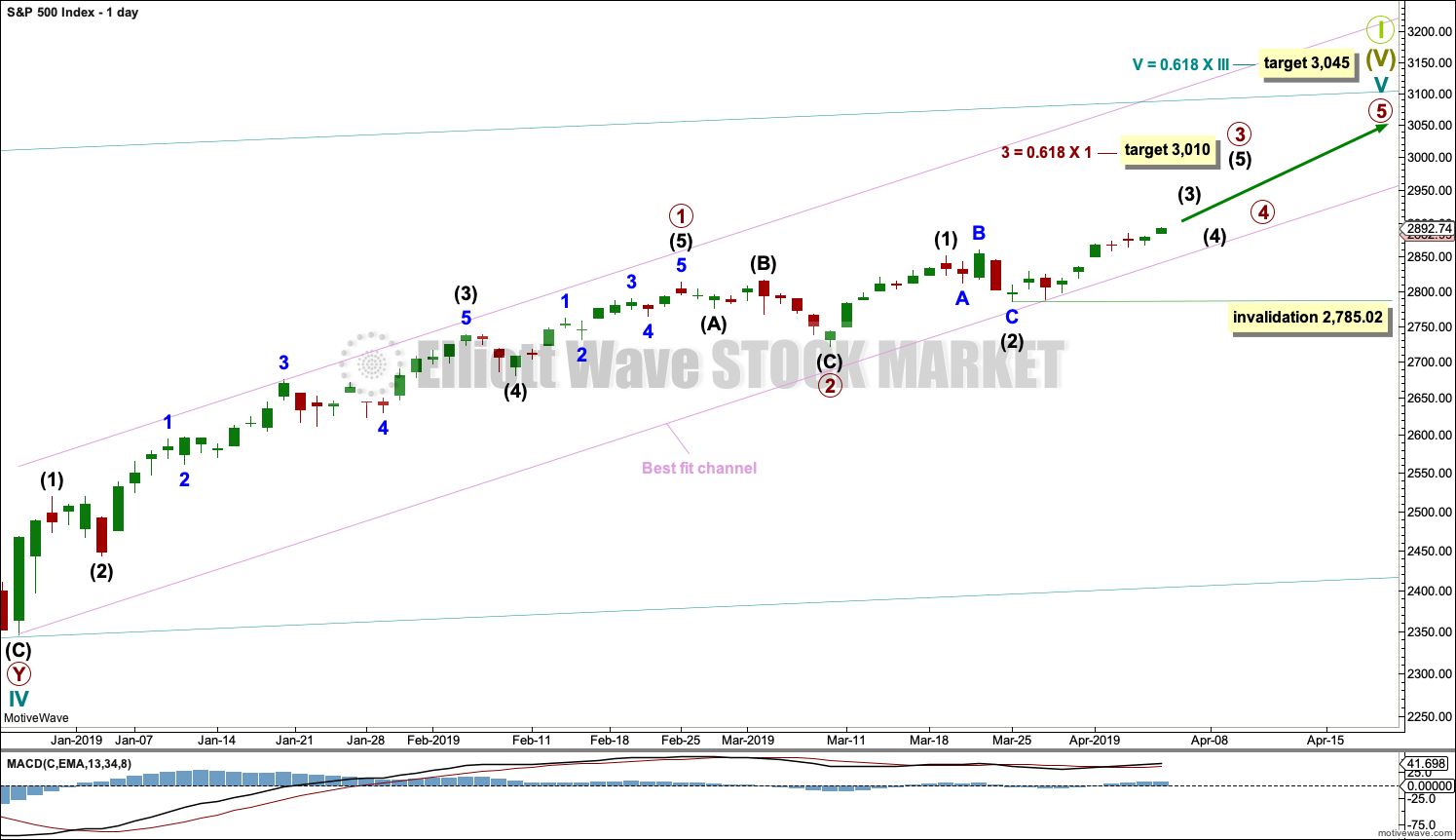

DAILY CHART

The daily chart will focus on the structure of cycle wave V.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A target is calculated for cycle wave V to end prior to this point.

However, members are reminded that there is an alternate monthly wave count that does not have a limit to upwards movement. There is a link to it at the start of each analysis.

Cycle wave V must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common and that will be how it is labelled. A diagonal would be considered if overlapping suggests it.

Primary wave 2 may have been a very brief and shallow expanded flat correction.

Within primary wave 3, intermediate waves (1) and (2) may be complete. Intermediate wave (3) may only subdivide as an impulse. Within intermediate wave (3), minor wave 2 may not move beyond the start of minor wave 1 below 2,785.02.

The channel is adjusted to better show where current small pullbacks are finding support.

HOURLY CHART

Intermediate wave (3) has now moved above the end of intermediate wave (1) meeting a core Elliott wave rule.

So far this labelling agrees with MACD. Minor wave 3 exhibits an increase in momentum beyond that of minor wave 1.

An Elliott channel is now drawn about minor wave 3. Draw the first trend line from the end of minor wave 1 to the end of minor wave 3, then pull a parallel copy down to the end of minor wave 2. Minor wave 5 may find resistance about the upper edge of this channel.

Within intermediate wave (3), minor waves 1 through to 4 may now be complete. Minor wave 5 may be nearing completion.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,852.42. Intermediate wave (4) would most likely be a relatively shallow sideways consolidation. It would most likely unfold as a flat, triangle or combination.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

A strong upwards week, with price closing near the high for the week, and On Balance Volume making a new all time high suggest more upwards movement next week.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The December 2018 low is expected to remain intact. The two 90% upwards days on 26th December 2018 and 6th January 2019 indicate this upwards trend has internal strength.

Lowry’s data shows Selling Pressure has reached a new low for the entirety of this bull market, which began back in March 2009. This is very bullish and supports the Elliott wave count.

While the last swing low of the 25th of March remains intact, there exists a series of higher highs and higher lows from the major low in December 2018. It would be safest to assume the upwards trend remains intact.

The pennant pattern is a reliable short-term continuation pattern. A target calculated using the flag pole is about 2,956.

The gap upwards on the 1st of April may be a breakaway gap. These are not usually closed for some time. It may be used as an area of support; the lower edge is at 2,836.03.

This week On Balance Volume makes a new all time high at the daily chart level. This strongly supports the Elliott wave count.

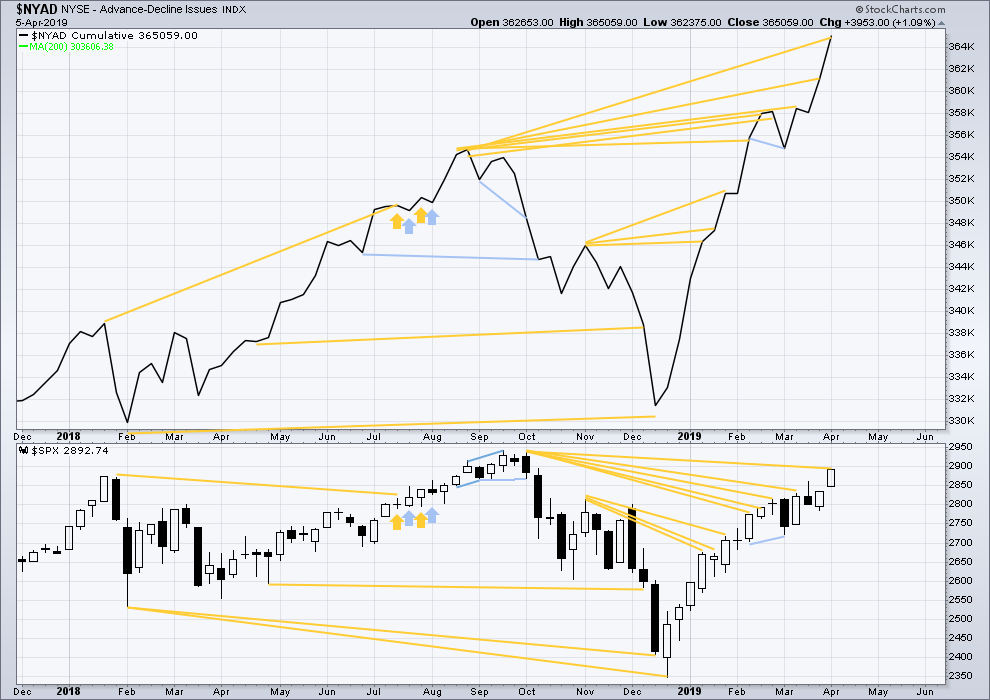

BREADTH – AD LINE

WEEKLY CHART

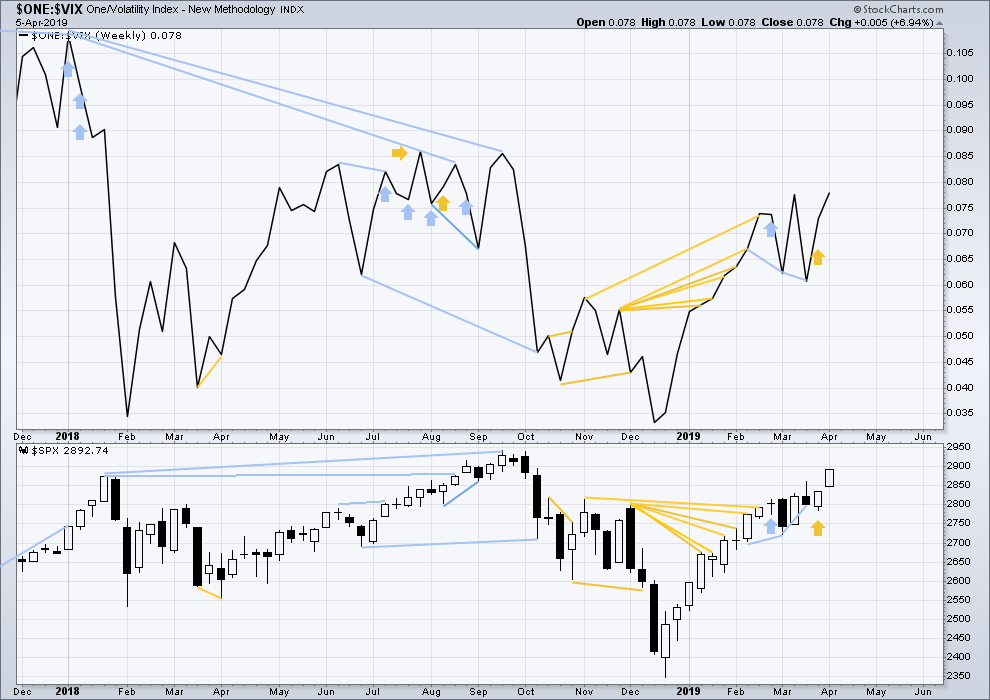

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Every single bear market from the Great Depression and onwards has been preceded by a minimum of 4 months divergence between price and the AD line. With the AD line making a new all time high again last week, the end of this bull market and the start of a new bear market must be a minimum of 4 months away, which is the end of July 2019 at this time.

This week the AD line makes another new all time high. Bullish mid-term divergence continues.

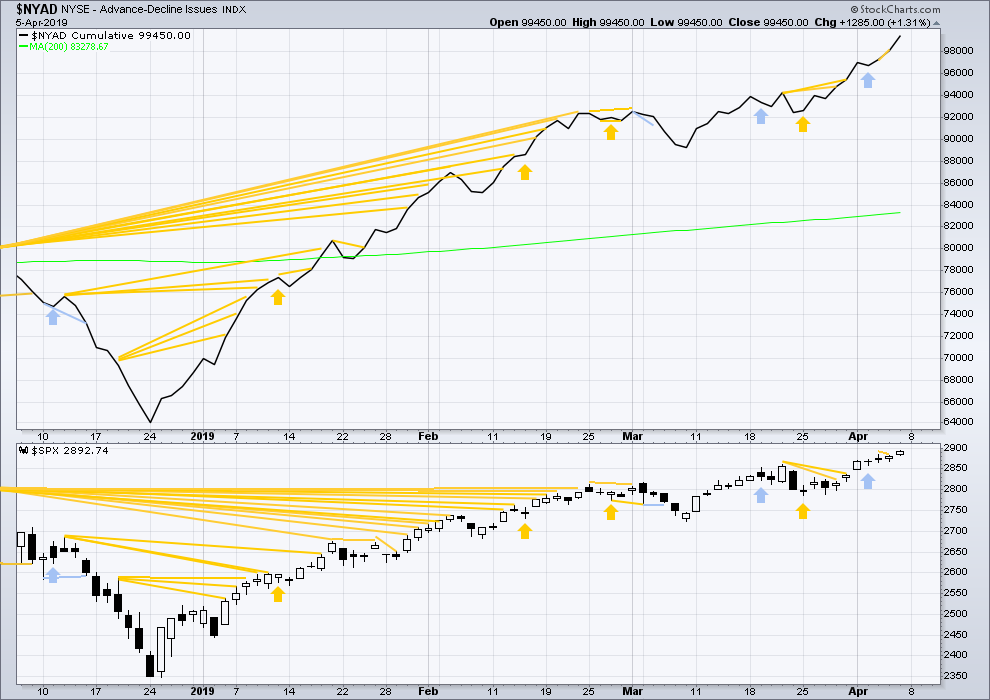

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

At the daily chart level, both the AD line and price make new short-term highs. There is no short-term divergence.

VOLATILITY – INVERTED VIX CHART

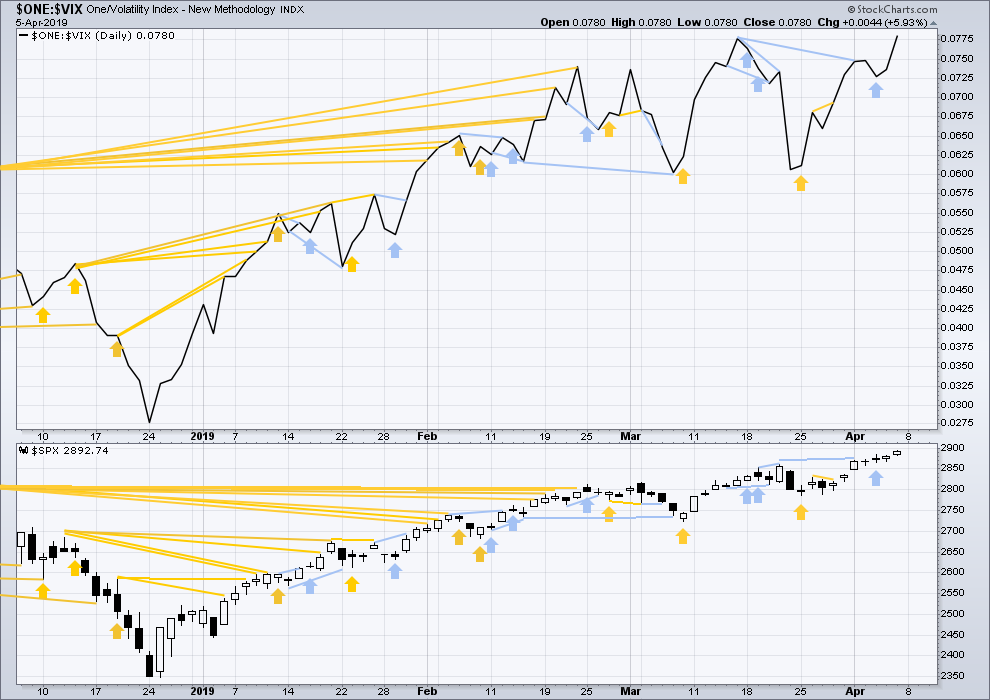

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

This week both price and inverted VIX have moved higher. There is no mid or short-term divergence. Long-term divergence between all time highs remains.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Both price and inverted VIX have now made new short-term highs. There is no longer any bearish divergence; it has now disappeared.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices moving now higher, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91

Nasdaq: 8,133.30.

For the short term, now DJT has made a very slight new low below the prior swing low of the 8th of March. All of the S&P500, DJIA and Nasdaq remain above their prior swing lows of the 8th of March.

Published @ 07:50 p.m. EST on April 6, 2019.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Goooood morning everybody!

Hourly chart updated:

Within minor 5 there is now a five up complete. I’m moving the degree of labelling within it down one degree to see this as only minute i within minor 5 now complete.

Minute ii may not move beyond the start of minute i below 2,865.17.

And so a new low by any amount at any time frame now below 2,865.17 may not be a second wave correction within minor wave 5, so at that stage minor 5 must be over. Which would mean that intermediate (3) would most likely also be over in its entirety.

So that’s now the price point which may tell us that intermediate (4) has arrived.

Until then, assume the upwards trend remains. There remains underlying strength within this market.

I’m on a small road trip this week, still in the Coromandel. Staying in Whangamata, one of the surfing meccas of New Zealand. Off shortly to surf the beach break (while I wait for New York to close and data to be finalised), then when the tide is low late this afternoon may have a go at the Whangamata bar which peels long lefts.

I am in a very happy place today.

That’s so awesome Lara …

Happy places are very special !

Enjoy every minute Lara 🙂

Have a swell time.

Reloaded LYFT for another go round

Shares sold at 76…

Let’s see if this can become a trader down here

Is this a “b” finishing? Not a pretty move

Wow, /CL has now pushed above the 61.8 of it’s massive 2018 high to low move (77 to 42, now its at 64 and still rising). Not even a pause there. Next up is the 78.6% at 69.5.

I shorted today’s high, tight stop

Some thoughts to share. Thinking about 2 traders from the past and thinking about the 2872 target; the 3 are linked.

Trader 1 had a saying that he often used, “the bull market will be over when there are no longer any bears left in the market” and, “the bear market will be over when there are no longer any bulls left in the market”. Looking at the current bull move since December I’m not seeing many bears around now. Lara’s comment on this thread resonates with me. She writes, “Lowry’s Selling Pressure has reached its lowest point yet for the entirety of this bull market, which began in March 2009.”

Trader 2 is a heavy weight. When you think about the saying “that decision is made way above my pay grade”, he’s one of those decision making guys. Our nickname for him was never meanspirited or mocking; we called him ET which is short for Enormous Trousers. The ET comment that is burned in my brain is, “It doesn’t matter where it trades. The only thing that matters is where it closes.”

My whole trading philosophy is about “them” sending signals on the ES futures chart using Heikin-Ashi charts. It’s using money to paint a candle in order to send a signal. Once a candle is printed, it serves a purpose in signaling something.

So, what is the market doing now? Scott Evans asked me this question a few days ago regarding the 2872.

Let’s look at the 2872 target. The actual modeled target is 2871.75. I use 2872 because for 2871.75 to trade, 2872 must print. Okay, so how does the signal get sent. It looks like they are using the weekly ES close. Let’s look.

The chart shown shows the weekly close at 2871.19, which is partially incorrect. Once the software can catch up to the correlation that price is a function of trading in .25 increments (.00 .25 .50 .75) the data will show that the weekly close is 2871.75

Another thing seen from the weekly ES chart is the volume. The current weekly ES volume is the lowest weekly volume from September 2018 through last week. (over 7 months)

Update

Sigh, the weekly close is officialy 2870.75 which is 1 handle below the target.

I enjoy watching the Ciovacco Capital weekly videos. I would like to take a chapter from him, and say; going forward, let’s have an open mind to the possibility that the market may be signaling a strategic reversal in a weekly time frame. TBD.

That said, I am looking at two ES levels that are calculated, (not modeled), that could be the top touch and go points. The one that excites me is 2899.50 because it would support a theory I’m working on. The other is 2933.50 which is the EW calculated level that is being seen. Hitting these levels doesn’t eliminate the possibility of a close this week below 2871.75

One last thing. I have no doubt about Lara’s upper targets. I think it’s great that she makes her wonderful skills available to us. Big gratitude for that.

Thanks brother

That 2872 target has been very helpful to me…

Thanks very much chartmonkey.

Also, love your handle

#1 has been claimed.

Aha! the streak is broken…