Upwards movement was expected. Price has moved a little higher.

Summary: The upwards trend should continue. The mid-term Elliott wave target remains the same at 3,010 and the target calculated using the pennant pattern is at 2,956.

Lowry’s Selling Pressure has reached its lowest point yet for the entirety of this bull market, which began in March 2009. This strongly supports a bullish Elliott wave count.

The final target remains the same at 3,045.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last published monthly charts are here. Video is here.

ELLIOTT WAVE COUNTS

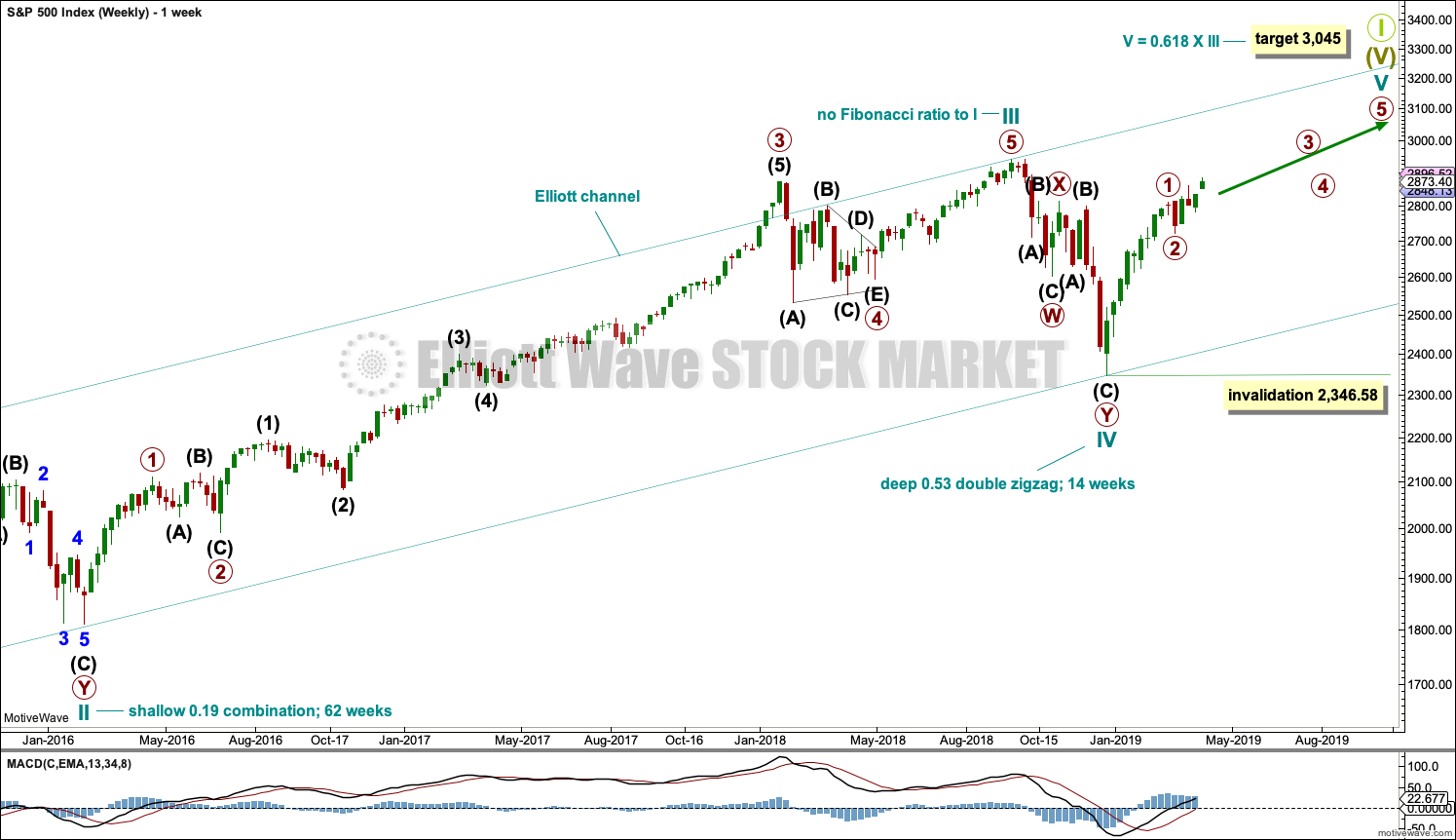

WEEKLY CHART

This weekly chart shows all of cycle waves III, IV and V so far.

Cycle wave II fits as a time consuming double combination: flat – X – zigzag. Combinations tend to be more time consuming corrective structures than zigzags. Cycle wave IV has completed as a multiple zigzag that should be expected to be more brief than cycle wave II.

Cycle wave IV may have ended at the lower edge of the Elliott channel.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Although both cycle waves II and IV are labelled W-X-Y, they are different corrective structures. There are two broad groups of Elliott wave corrective structures: the zigzag family, which are sharp corrections, and all the rest, which are sideways corrections. Multiple zigzags belong to the zigzag family and combinations belong to the sideways family. There is perfect alternation between the possible double zigzag of cycle wave IV and the combination of cycle wave II.

Although there is gross disproportion between the duration of cycle waves II and IV, the size of cycle wave IV in terms of price makes these two corrections look like they should be labelled at the same degree. Proportion is a function of either or both of price and time.

Draw the Elliott channel about Super Cycle wave (V) with the first trend line from the end of cycle wave I (at 2,079.46 on the week beginning 30th November 2014) to the high of cycle wave III, then place a parallel copy on the low of cycle wave II. Cycle wave V may find resistance about the upper edge.

It is possible that cycle wave V may end in October 2019. If it does not end there, or if the AD line makes new all time highs during or after June 2019, then the expectation for cycle wave V to end would be pushed out to March 2020 as the next possibility. Thereafter, the next possibility may be October 2020. March and October are considered as likely months for a bull market to end as in the past they have been popular. That does not mean though that this bull market may not end during any other month.

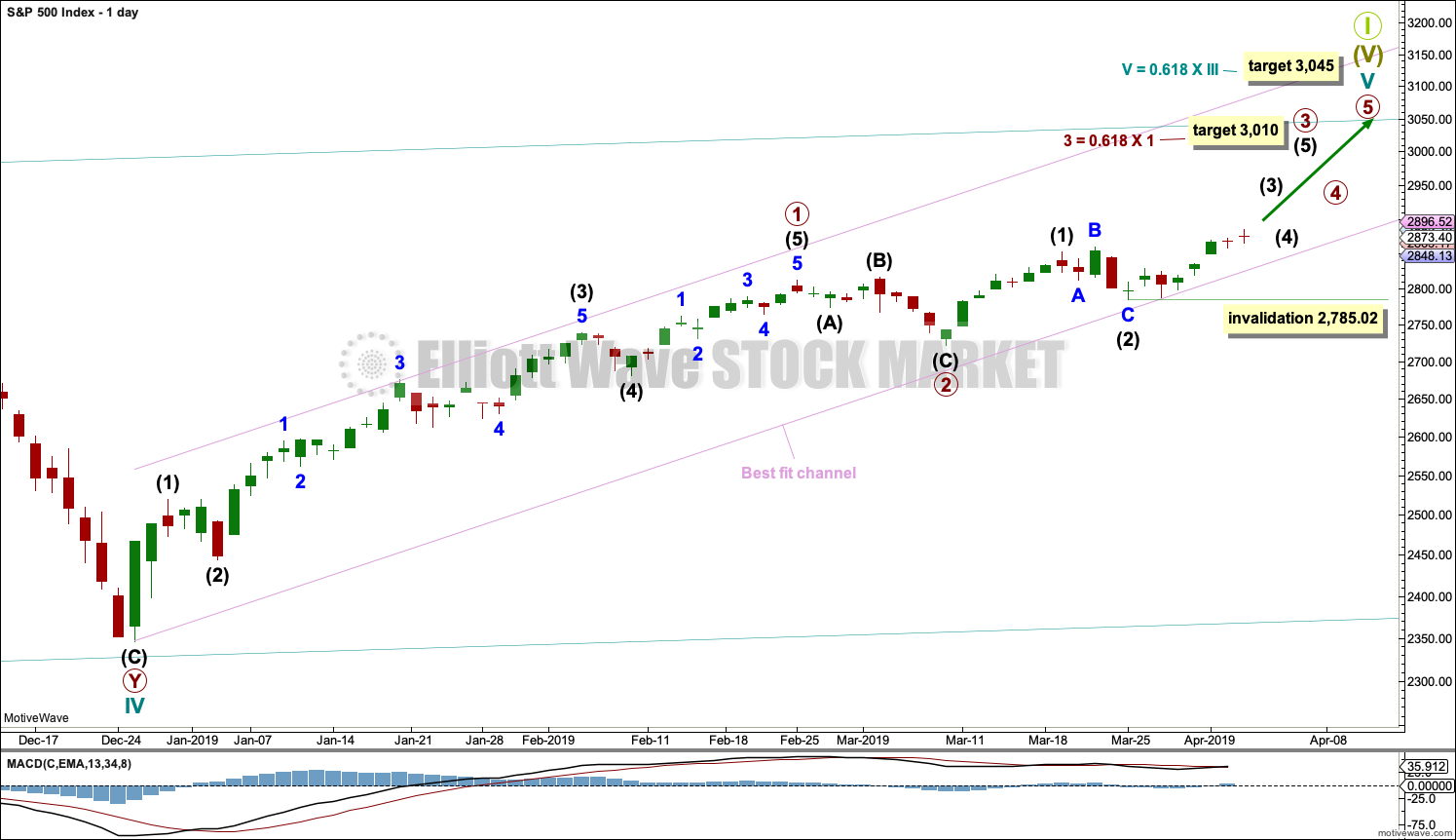

MAIN WAVE COUNT

DAILY CHART

The daily chart will focus on the structure of cycle wave V.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A target is calculated for cycle wave V to end prior to this point.

However, members are reminded that there is an alternate monthly wave count that does not have a limit to upwards movement. There is a link to it at the start of each analysis.

Cycle wave V must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common and that will be how it is labelled. A diagonal would be considered if overlapping suggests it.

Primary wave 2 may have been a very brief and shallow expanded flat correction.

Primary wave 3 may now exhibit an increase in upwards momentum. A target is calculated that fits with the higher target for cycle wave V to end.

Primary wave 3 may now be moving through its middle. Within primary wave 3, intermediate waves (1) and (2) may be complete. Intermediate wave (3) may only subdivide as an impulse. Within intermediate wave (3), minor wave 2 may not move beyond the start of minor wave 1 below 2,785.02.

The channel is adjusted to better show where current small pullbacks are finding support.

HOURLY CHART

Intermediate wave (3) has now moved above the end of intermediate wave (1) meeting a core Elliott wave rule.

So far this labelling agrees with MACD. Minor wave 3 exhibits an increase in momentum beyond that of minor wave 1.

An Elliott channel is now drawn about minor wave 3. Draw the first trend line from the end of minor wave 1 to the end of minor wave 3, then pull a parallel copy down to the end of minor wave 2. Minor wave 4 may find support about the lower edge of this channel.

It is possible today that minor wave 4 may be complete as a brief shallow zigzag. It is also about equally as possible that minor wave 4 may continue sideways as a flat, combination or triangle.

Minor wave 4 may not move into minor wave 1 price territory below 2,829.87.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

The last completed week is an outside week that closes green with the balance of volume upwards. Volume within last week does not appear to support upwards movement, but a clearer picture may be obtained by looking inside last week’s daily volume bars.

The close for last week is near highs, suggesting more upwards movement to follow.

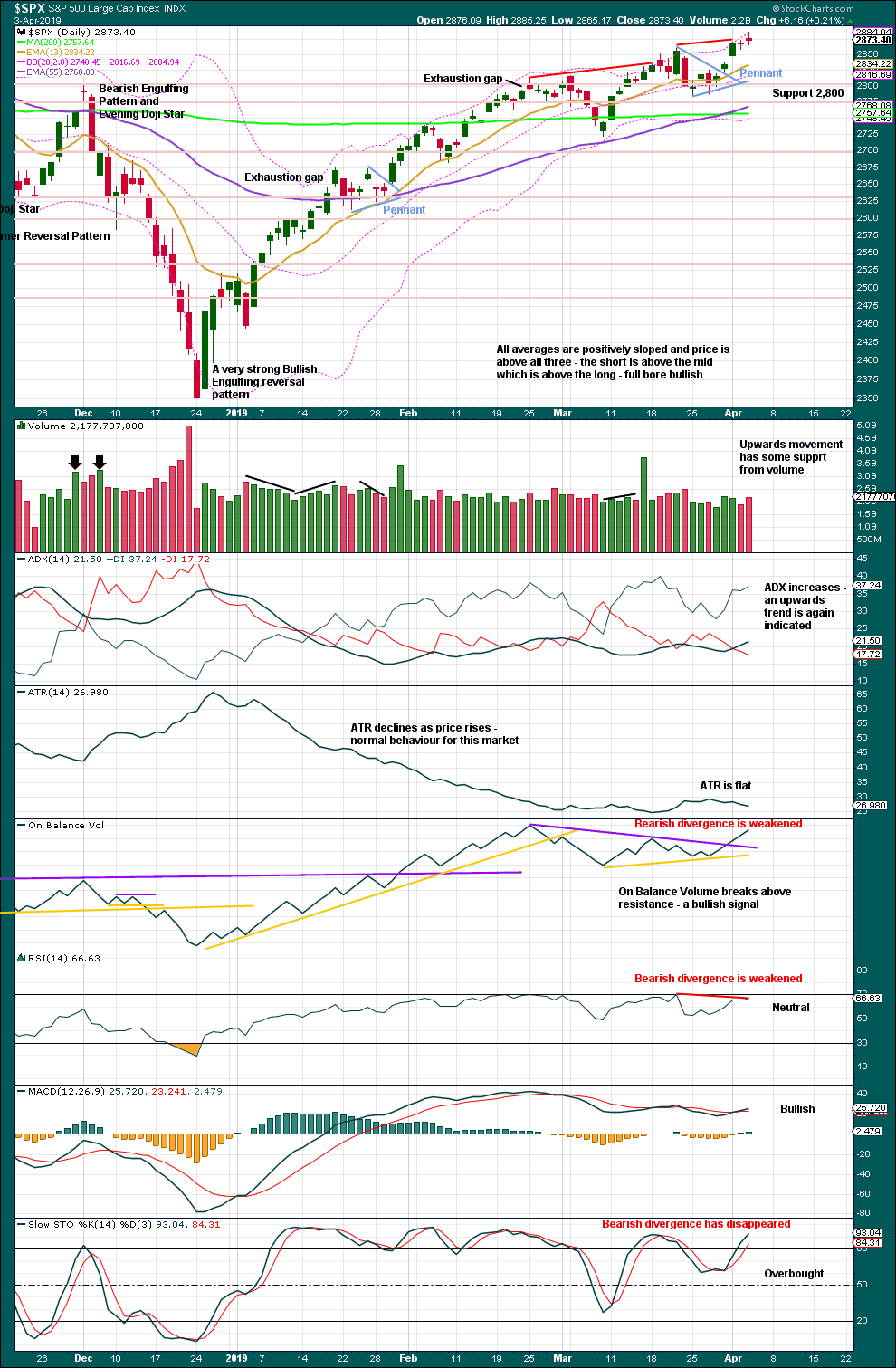

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The December 2018 low is expected to remain intact. The two 90% upwards days on 26th December 2018 and 6th January 2019 indicate this upwards trend has internal strength.

Lowry’s data shows Selling Pressure has reached its lowest point for the entirety of this bull market, which began back in March 2009. This is very bullish and supports the Elliott wave count.

While the last swing low of the 8th of March remains intact, there exists a series of higher highs and higher lows from the major low in December 2018. It would be safest to assume the upwards trend remains intact.

The pennant pattern is a reliable short-term continuation pattern. Friday may have seen an upwards breakout that has the necessary support from volume for confidence. A target calculated using the flag pole is about 2,956.

The gap upwards on the 1st of April may be a breakaway gap. These are not usually closed for some time. It may be used as an area of support; the lower edge is at 2,836.03.

Another Doji today is not of concern; on its own, a Doji is not a candlestick reversal signal. This represents only a slight pause at this stage.

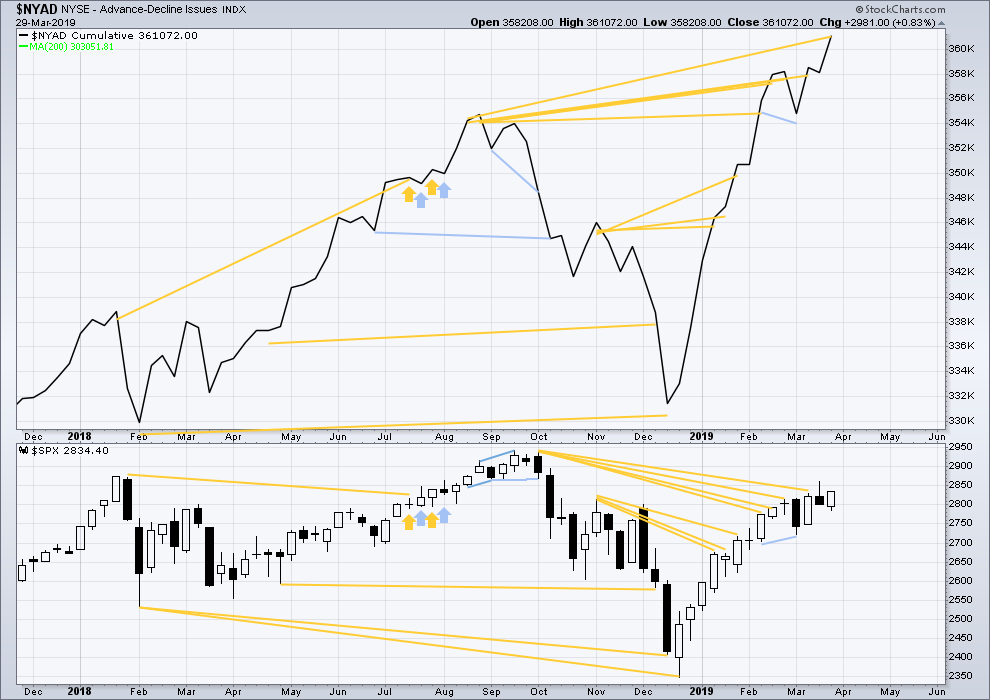

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Every single bear market from the Great Depression and onwards has been preceded by a minimum of 4 months divergence between price and the AD line. With the AD line making a new all time high again last week, the end of this bull market and the start of a new bear market must be a minimum of 4 months away, which is the end of July 2019 at this time.

Last week the AD line makes another new all time high. Bullish mid-term divergence continues.

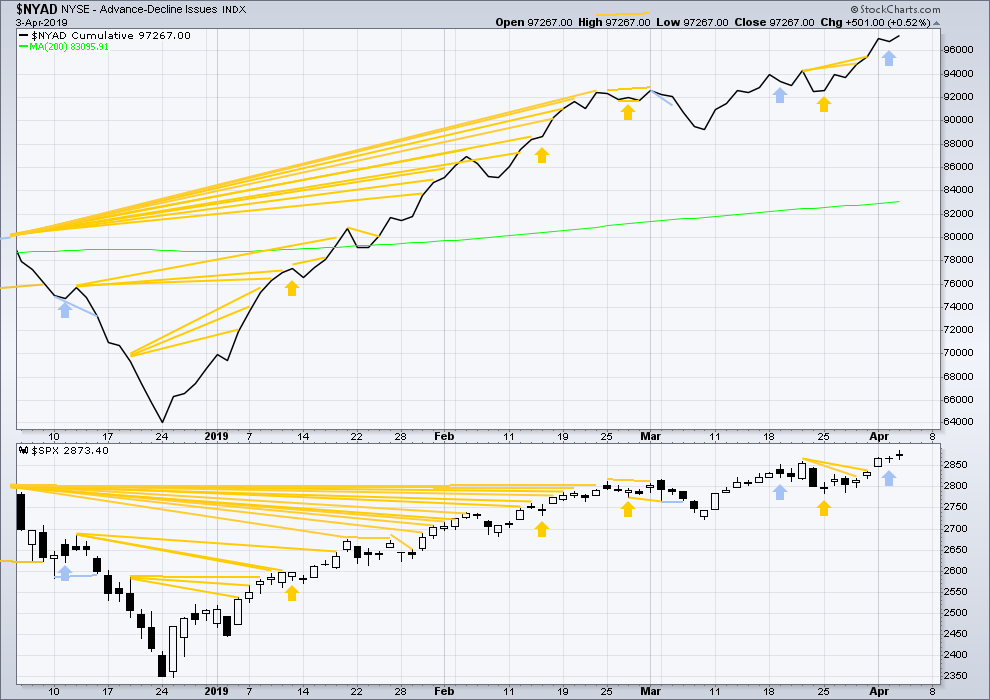

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Today both price and the AD line have moved higher. Upwards movement has support from rising market breadth. There is no divergence.

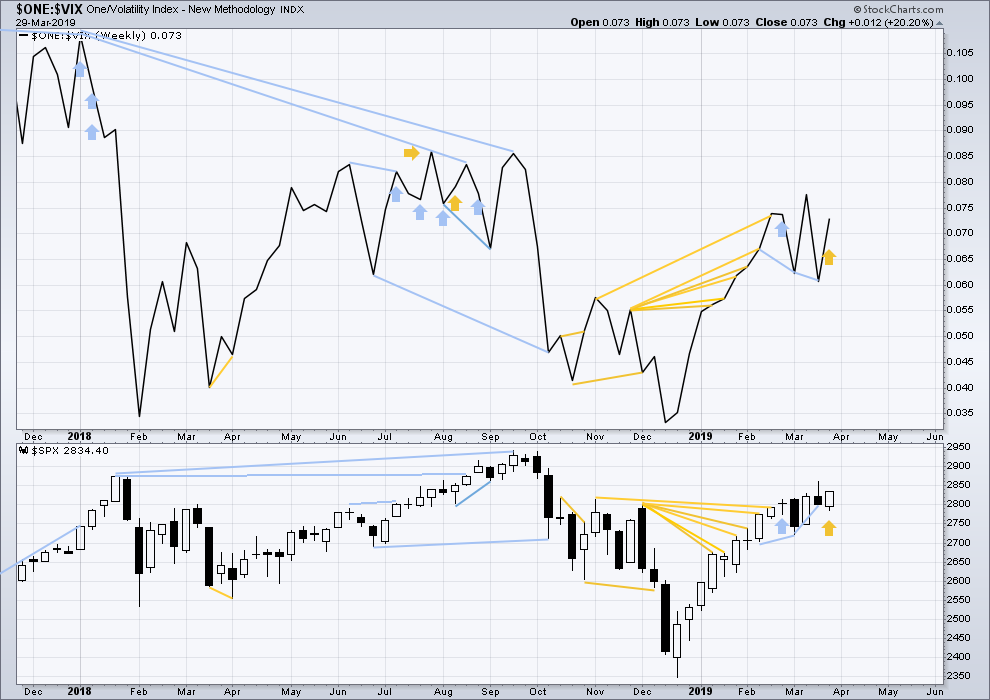

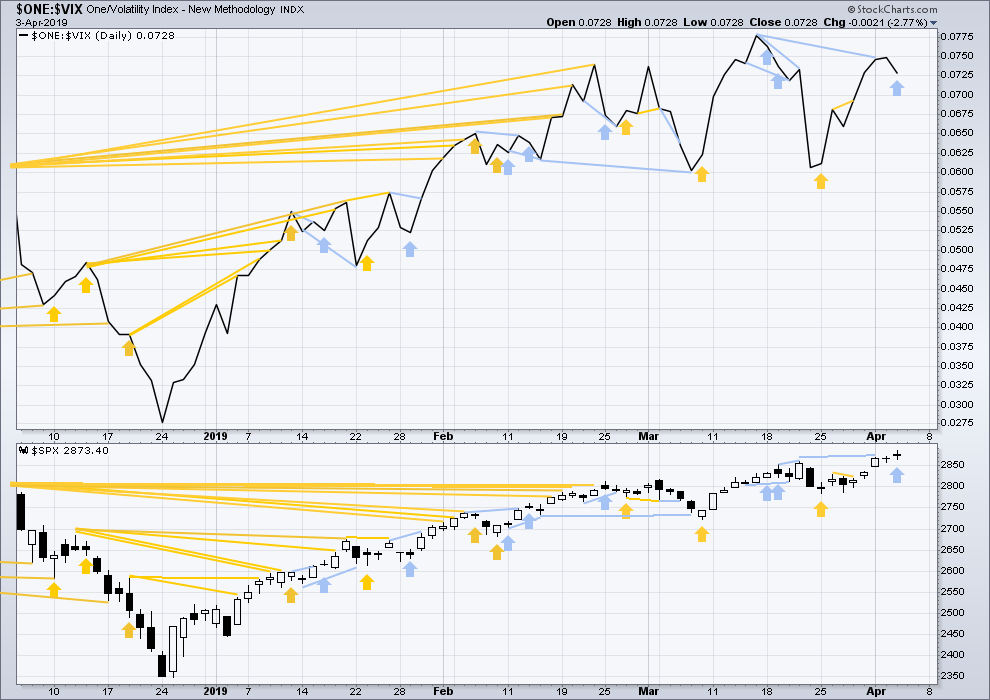

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Last week price moved lower with a lower low and a lower high, but inverted VIX moved higher. This divergence is bullish for the short term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Today price moved higher, but inverted VIX has moved lower. Upwards movement today did not have a normal corresponding decline in volatility. This divergence is bearish for the short term, but it is given little weight in this analysis as it has not been very reliable recently. There are four examples on this chart where this single day bearish divergence has been followed either immediately or after just one day of more upwards movement.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices moving now higher, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91

Nasdaq: 8,133.30.

For the short term, now DJT has made a very slight new low below the prior swing low of the 8th of March. All of the S&P500, DJIA and Nasdaq remain above their prior swing lows of the 8th of March.

Published @ 09:00 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Hourly chart updated:

Minor 4 may be continuing sideways as a regular contracting triangle which may be almost complete.

My view of the market today reminds me of that old Dilbert about the marketing guy asked by the R&D guy, “what are the requirements for the new product?” “well…I had some but…thinking…changing…changing…okay, but I can’t tell you yet”. “No problem, I’ll hire some goons to beat them out of you.”

Ka-splash. All who ever spent time in product R&D understand.

Now it looks like this whole 4 may indeed be a triangle and a final E down is coming due soon. Maaaaaybe…..

Bought a little LYFT edit

Best of luck there. Don’t over extend your stay. Lyft won’t make a profit for years and years, if ever, and when bad market times come, that stock is going to take a very big haircut. In my opinion. But it might be good for a bounce here.

Yeah man

Just had a feeling

It’s a short term trade

Picked it up a little under 71

Will exit at 76

Shorted some gm trading shares at 38.90

Got back into gld today at 121.70

Also sold the 68 69 calls in cl for tomorrow

A few contracts

There is no option volume there

Kinda surprised

Gold, and the Miners, look pretty toppy to me here…..looks like wave 3 down will commence shortly.

I like the look of the hit and turn of the SPX hourly off the 21 period ema. Very bullish looking to me. Long here, very tight stop => B.E. stop as soon as reasonable.

this look, the blue line is the 21 ema.

Doing this as the exit of a coiling structure AND the backing of the bullish wavecount (end of small iv wave potentially) all add up to me to a GO trigger. I could be wrong…

I got a big bet off AM lows too

Nice update

A

Ill sell the 286-285 put spread for tomorrow on spy

Hedge my 277-278 call spread and remaining vxx puts

287-288 calls

Hard to believe a week ago we were 100 points lower

Lots of up days

Keeping that in mind for further up bets

May not go down

But as mentioned before they do a good job of scooping call buyer money on sideways consolidation

XLF not in a coil, hopefully the rest of the market follows the financials UP

we will see

Hey Cm

How are you feeling about your 2872 getting hit

Are you treating it as a top ?

I appreciate your contributions and that call helped me set some guidelines

Along with Lara’s excellent work of course …

Hope you profited greatly from the run

Anyone else thinking minor wave 4 triangle, a-b-c done, d-e coming up

Or A down, b triangle working, c to come. I hate triangles.

You either are way too busy getting whipsawed with a triangle…or way too bored waiting for it to exit!

exactly

Coiling…

I’m quite suspicious that this coiling action is a B wave after yesterday’s A wave down, and we have a C down coming to complete a iv.

Vxxb and vix futures are catching a bid

So I am thinking one more down

Covered my low and middle batches of vxx 29-28 put spreads for this week

Holding only first entry

After big runs I have noticed

Before any drops

The price will hold so peopleon the wrong side of the trade have to cover their margin calls at the “hold up”

Just theories ..:)

This hourly view of RUT tells me to watch for short triggers.

The polarity of the swing structure has inverted here to DOWN…and if this current upswing ends and turns below that prior swing high, it’s an excellent short set up in my book. Stop above the swing high, get on board on a break of the 21 ema (blue line), take 1/2 or so fairly quickly to de-risk.

Would shorting here be a “with the trend” or a counter-trend trade? Well, the monthly trend I have as DOWN. The weekly is neutral. The daily is up. So I can argue it’s with the monthly trend, selling a “pullback” (rise) at the daily timeframe.

The mitigating factor here is the strongly bullish EW count we have going on SPX, and hence arguably the market more broadly.

Well, I am leaning bullish as per Lara’s count, as the bid in this market has been incredible…

But looking at other assets like Oil, USD, DAX etc…

I am not sure how oil can drop to new lows in the 3rd / C wave and SPX can stay at these highs..

Considering that if we do get bullish move in USD, Commodities & almost all risk assets could drop…

So are we really in a B wave of cycle IV, which has been a massive short squeeze, and we do get a C down to lower lows than Dec??

Or we are just completing the P1 & still have P2 pending??

Or Oil just chops around these levels for all summer and let SPX make new highs??

So I am keeping an open mind and not gonna fight the market, if we do start to drop from here…. it indeed is at an interesting place…

Also the RUT is bothering me, it doesn’t seem to be in an impulse from the recent lows, also NDX looks stretched…..

Appears we have the late stage bull market behavior where big caps, techs and maybe now banks do well, and small caps diverge. (Of course, at the moment this morning…RUT is the leader just behind DJIA, so day to day it varies.)

You nailed my outlooks and positions on them: long $, short gold, short bonds. And only carefully day trading the indexes, I do NOT want to get caught in an epic sell off here, though I acknowledge that risk avoidance is reducing my trading gains as the market continues to ascend.

Waiting to add oil related shorts, when I see evidence of an oil turn.

I’ll take this spot.