Upwards movement continues as expected. The Elliott wave targets remain the same.

Summary: The upwards trend should continue. The mid-term Elliott wave target remains the same at 3,010 and the target calculated using the pennant pattern is at 2,956.

Lowry’s Selling Pressure has reached its lowest point yet for the entirety of this bull market, which began in March 2009. This strongly supports a bullish Elliott wave count.

The final target remains the same at 3,045.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last published monthly charts are here. Video is here.

ELLIOTT WAVE COUNTS

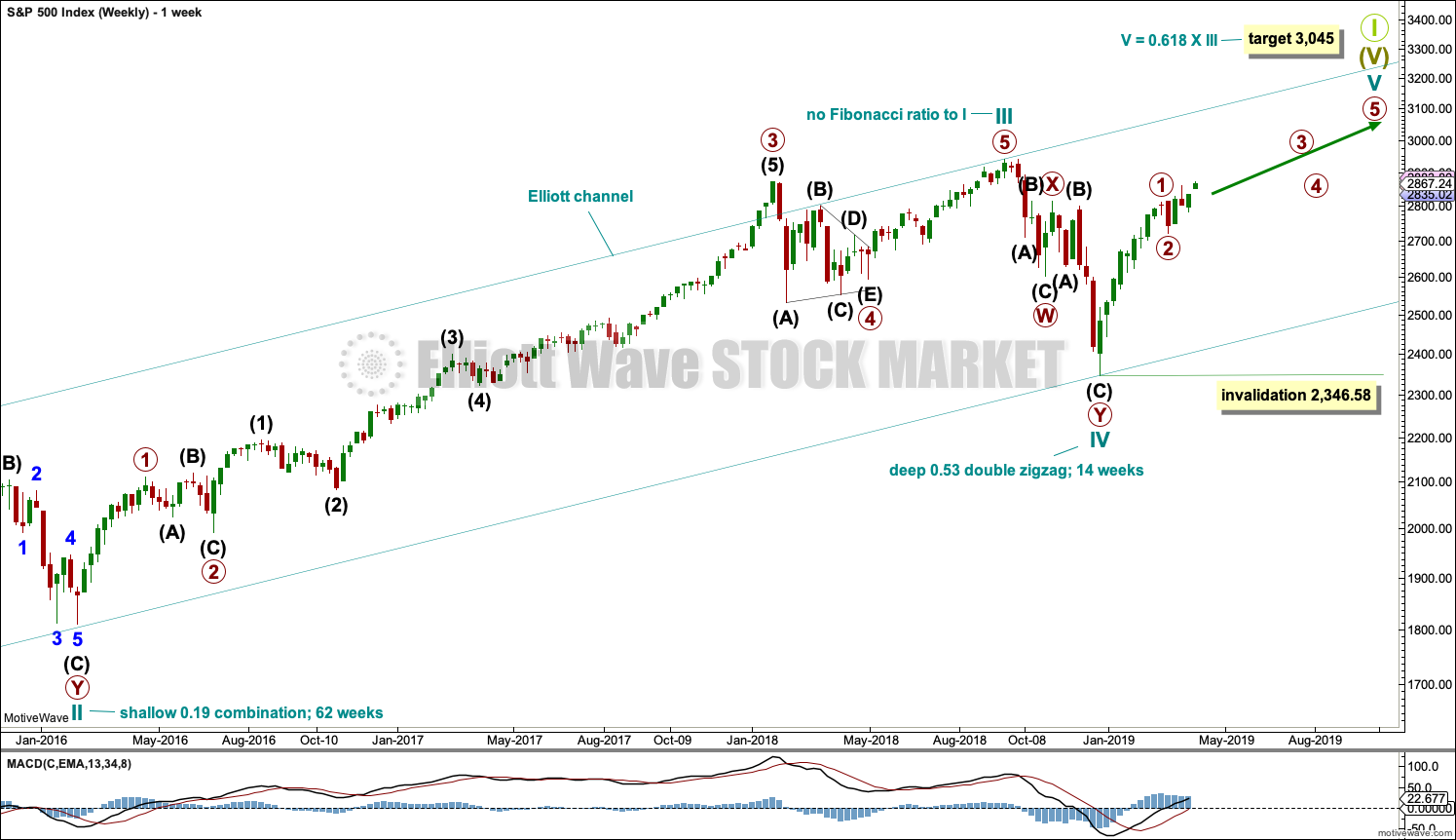

WEEKLY CHART

This weekly chart shows all of cycle waves III, IV and V so far.

Cycle wave II fits as a time consuming double combination: flat – X – zigzag. Combinations tend to be more time consuming corrective structures than zigzags. Cycle wave IV has completed as a multiple zigzag that should be expected to be more brief than cycle wave II.

Cycle wave IV may have ended at the lower edge of the Elliott channel.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Although both cycle waves II and IV are labelled W-X-Y, they are different corrective structures. There are two broad groups of Elliott wave corrective structures: the zigzag family, which are sharp corrections, and all the rest, which are sideways corrections. Multiple zigzags belong to the zigzag family and combinations belong to the sideways family. There is perfect alternation between the possible double zigzag of cycle wave IV and the combination of cycle wave II.

Although there is gross disproportion between the duration of cycle waves II and IV, the size of cycle wave IV in terms of price makes these two corrections look like they should be labelled at the same degree. Proportion is a function of either or both of price and time.

Draw the Elliott channel about Super Cycle wave (V) with the first trend line from the end of cycle wave I (at 2,079.46 on the week beginning 30th November 2014) to the high of cycle wave III, then place a parallel copy on the low of cycle wave II. Cycle wave V may find resistance about the upper edge.

It is possible that cycle wave V may end in October 2019. If it does not end there, or if the AD line makes new all time highs during or after June 2019, then the expectation for cycle wave V to end would be pushed out to March 2020 as the next possibility. Thereafter, the next possibility may be October 2020. March and October are considered as likely months for a bull market to end as in the past they have been popular. That does not mean though that this bull market may not end during any other month.

MAIN WAVE COUNT

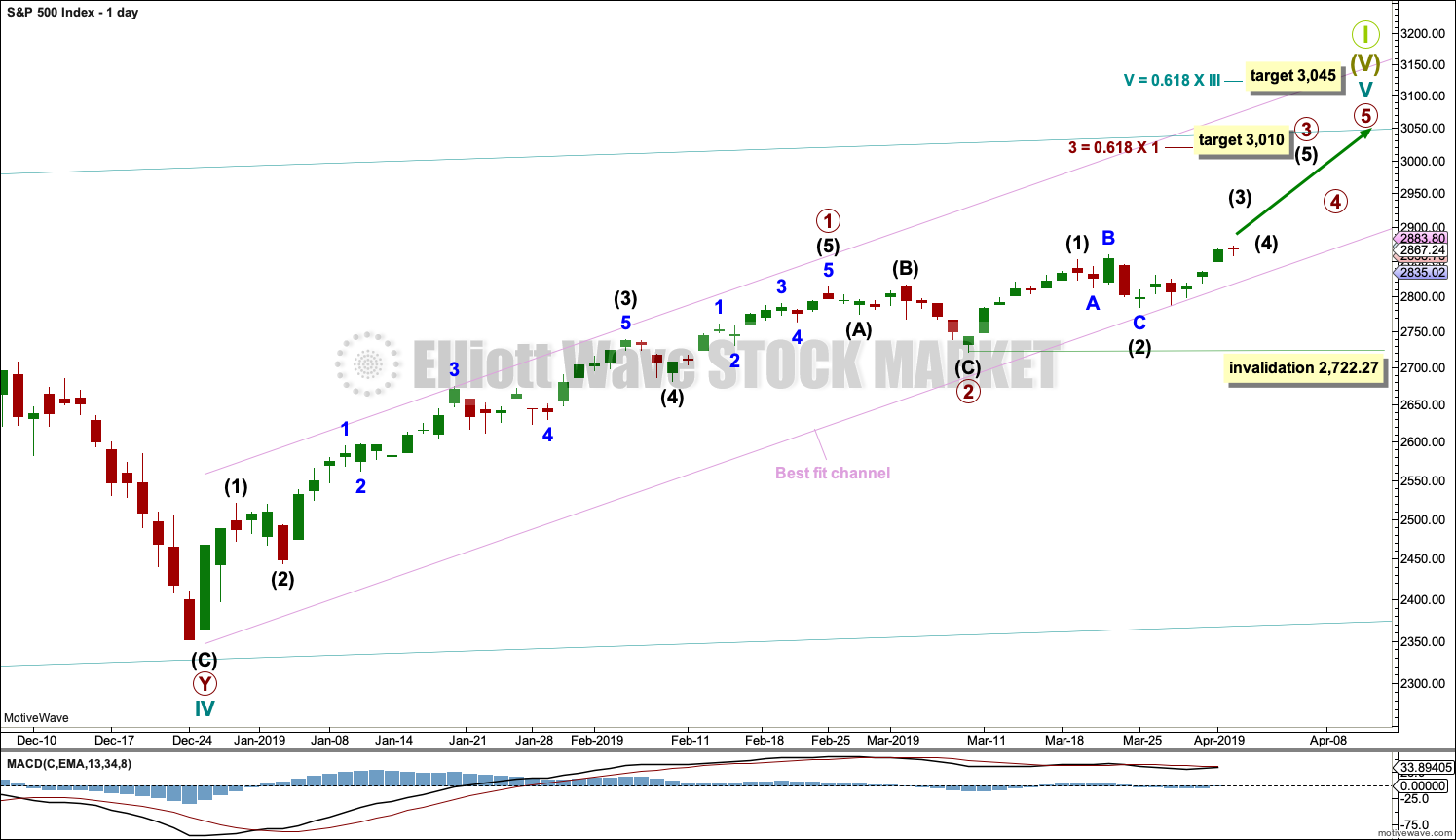

DAILY CHART

The daily chart will focus on the structure of cycle wave V.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A target is calculated for cycle wave V to end prior to this point.

However, members are reminded that there is an alternate monthly wave count that does not have a limit to upwards movement. There is a link to it at the start of each analysis.

Cycle wave V must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common and that will be how it is labelled. A diagonal would be considered if overlapping suggests it.

Primary wave 2 may have been a very brief and shallow expanded flat correction.

Primary wave 3 may now exhibit an increase in upwards momentum. A target is calculated that fits with the higher target for cycle wave V to end.

Within primary wave 3, intermediate wave (2) may not move beyond the start of intermediate wave (1) below 2,722.27.

Intermediate wave (2) may be a complete expanded flat correction. Minor wave B within intermediate wave (2) is 1.2 times the length of minor wave A, which is within the most common range for B waves of flats from 1 to 1.38. Minor wave C may now be complete. It exhibits no Fibonacci ratio to minor wave A.

The channel is adjusted to better show where current small pullbacks are finding support.

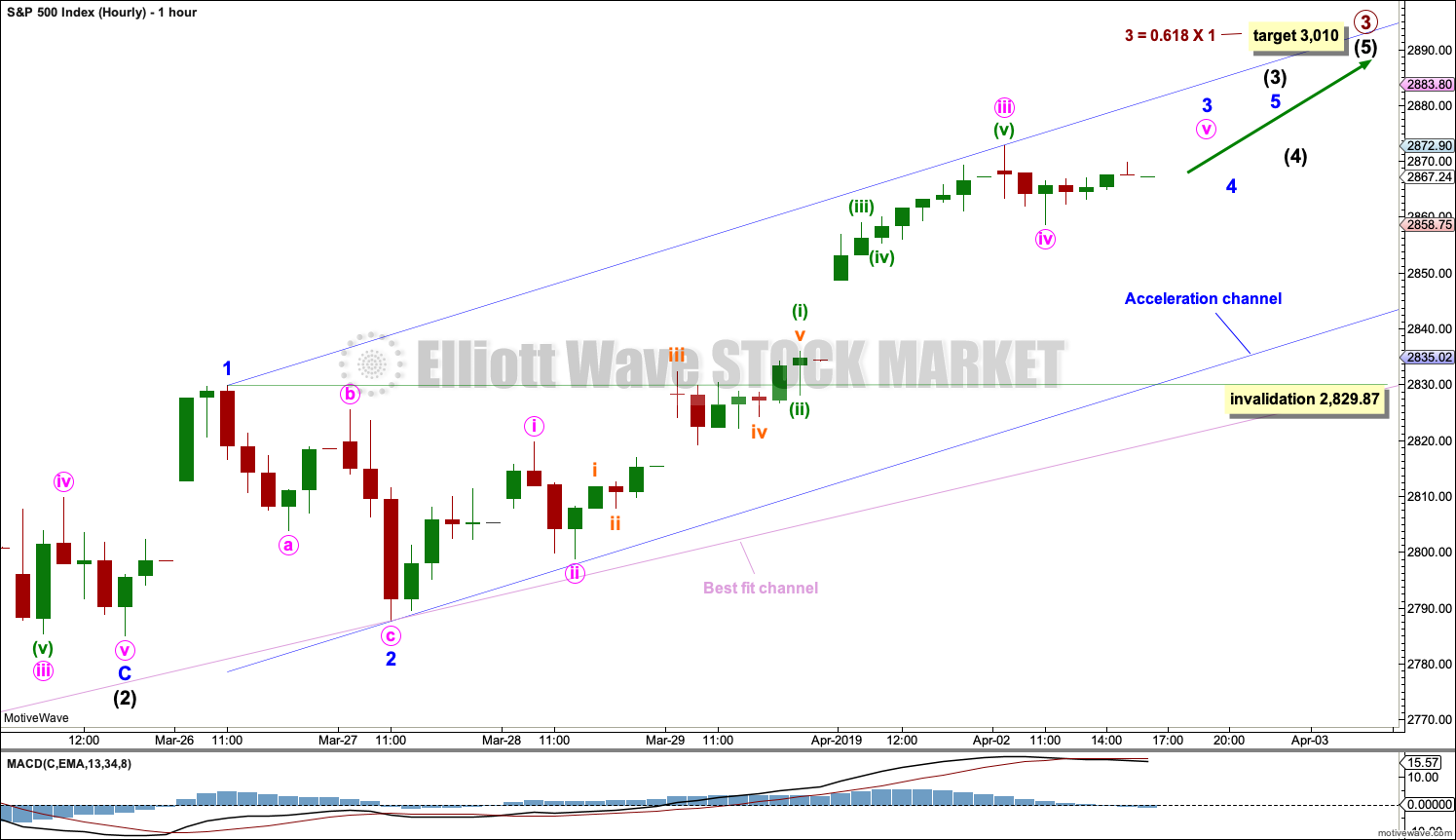

HOURLY CHART

Intermediate wave (2) may be now complete.

Intermediate wave (3) has now moved above the end of intermediate wave (1) meeting a core Elliott wave rule.

All of waves primary wave 3, intermediate wave (3), minor wave 3, minute wave iii and minuette wave (iii) must subdivide as impulses. This wave count now expects a third wave up at five degrees to continue. If labelling here at the hourly chart level is wrong, it may be in prematurely labelling the middle of this third wave complete. This labelling may need to be moved down one degree; the middle of this third wave may still be ahead.

So far this labelling agrees with MACD. Minor wave 3 exhibits an increase in momentum beyond that of minor wave 1.

An acceleration channel is now drawn about minor wave 3. Draw the first trend line from the end of minor wave 1 to the last high, then pull a parallel copy down to the end of minor wave 2. Keep redrawing the channel as price moves higher. When minor wave 3 is over and minor wave 4 arrives, it may find support about the lower edge of this channel.

Minor wave 4 may not move into minor wave 1 price territory below 2,829.87.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

The last completed week is an outside week that closes green with the balance of volume upwards. Volume within last week does not appear to support upwards movement, but a clearer picture may be obtained by looking inside last week’s daily volume bars.

The close for last week is near highs, suggesting more upwards movement to follow.

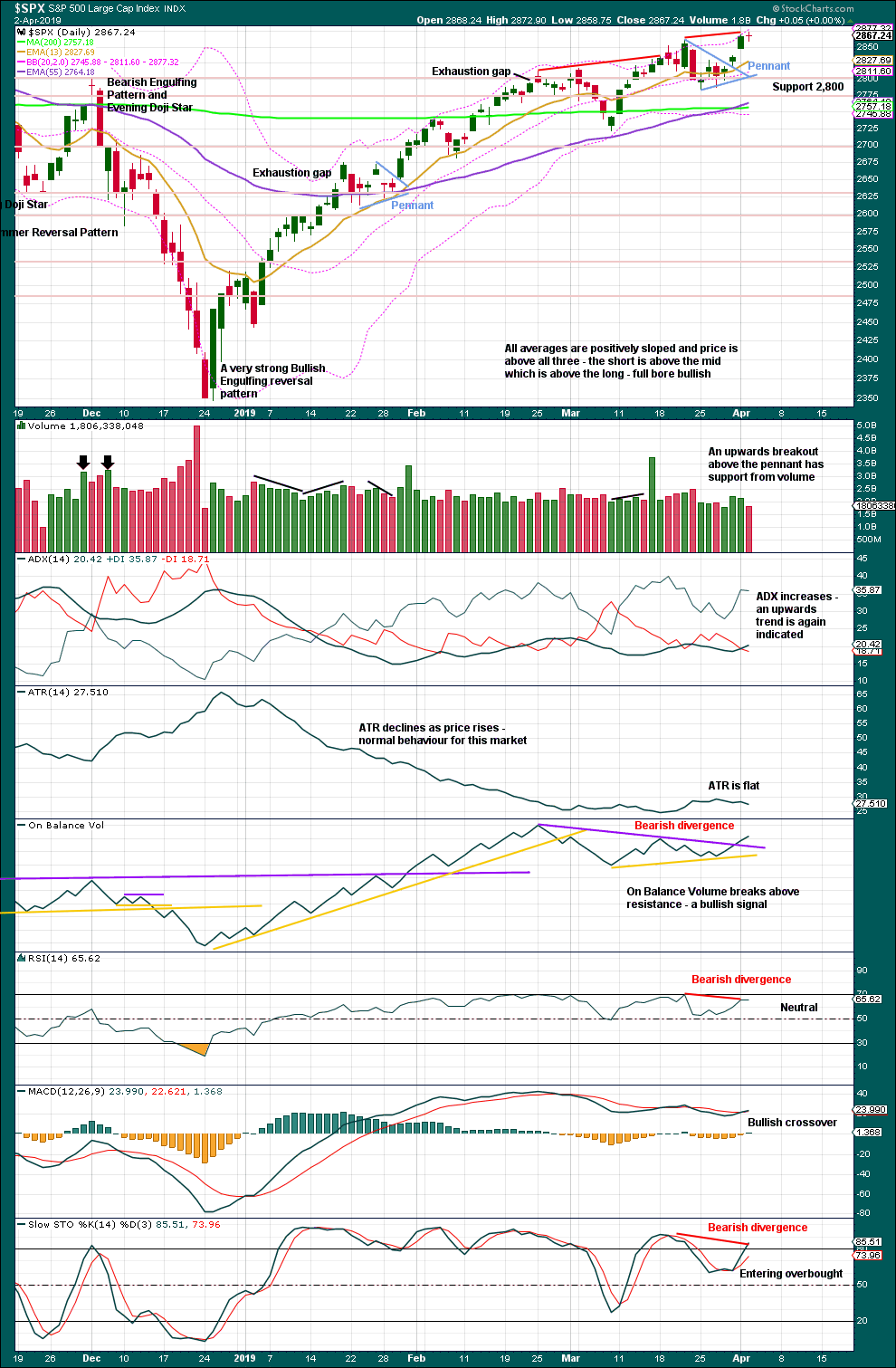

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The December 2018 low is expected to remain intact. The two 90% upwards days on 26th December 2018 and 6th January 2019 indicate this upwards trend has internal strength.

Lowry’s data shows Selling Pressure has reached its lowest point for the entirety of this bull market, which began back in March 2009. This is very bullish and supports the Elliott wave count.

While the last swing low of the 8th of March remains intact, there exists a series of higher highs and higher lows from the major low in December 2018. It would be safest to assume the upwards trend remains intact.

The pennant pattern is a reliable short-term continuation pattern. Friday may have seen an upwards breakout that has the necessary support from volume for confidence. A target calculated using the flag pole is about 2,956.

A slight decline in volume is not concerning given current market conditions. It has been noted for a long time now that price has been rising on light and declining volume. This appears to now be a feature of this ageing bull market.

Likewise, some single divergence today between the new high for price and both of RSI and Stochastics is of little concern. Today this is becoming weaker. It is possible it could simply disappear.

The gap upwards yesterday may be a breakaway gap. These are not usually closed for some time. It may be used as an area of support; the lower edge is at 2,836.03.

The Doji today is not of concern; on its own, a Doji is not a candlestick reversal signal. This represents only a slight pause at this stage.

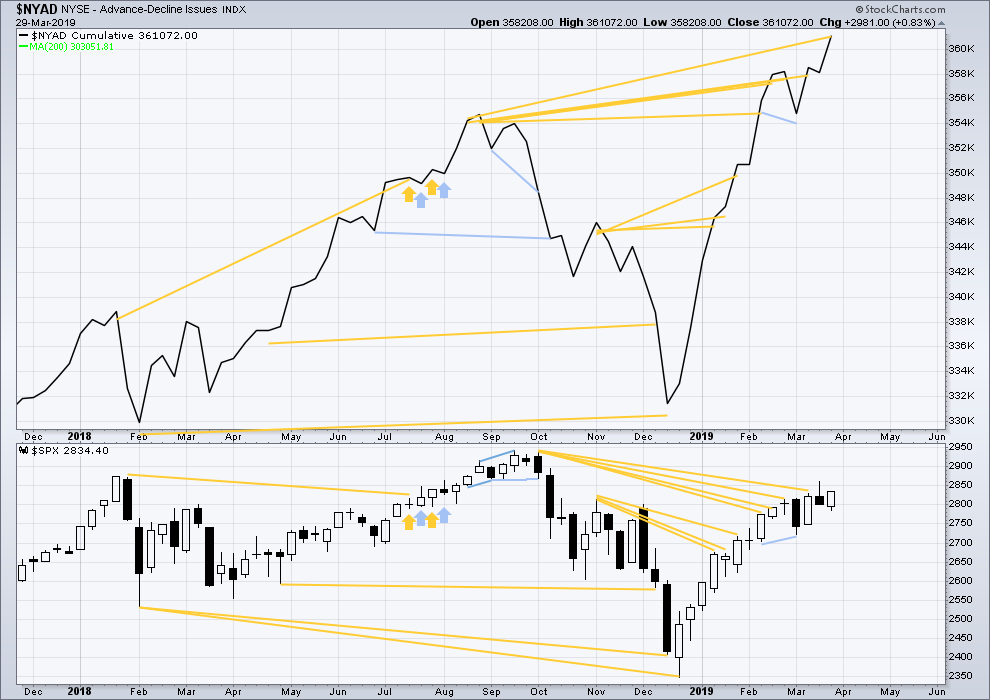

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Every single bear market from the Great Depression and onwards has been preceded by a minimum of 4 months divergence between price and the AD line. With the AD line making a new all time high again last week, the end of this bull market and the start of a new bear market must be a minimum of 4 months away, which is the end of July 2019 at this time.

Last week the AD line makes another new all time high. Bullish mid-term divergence continues.

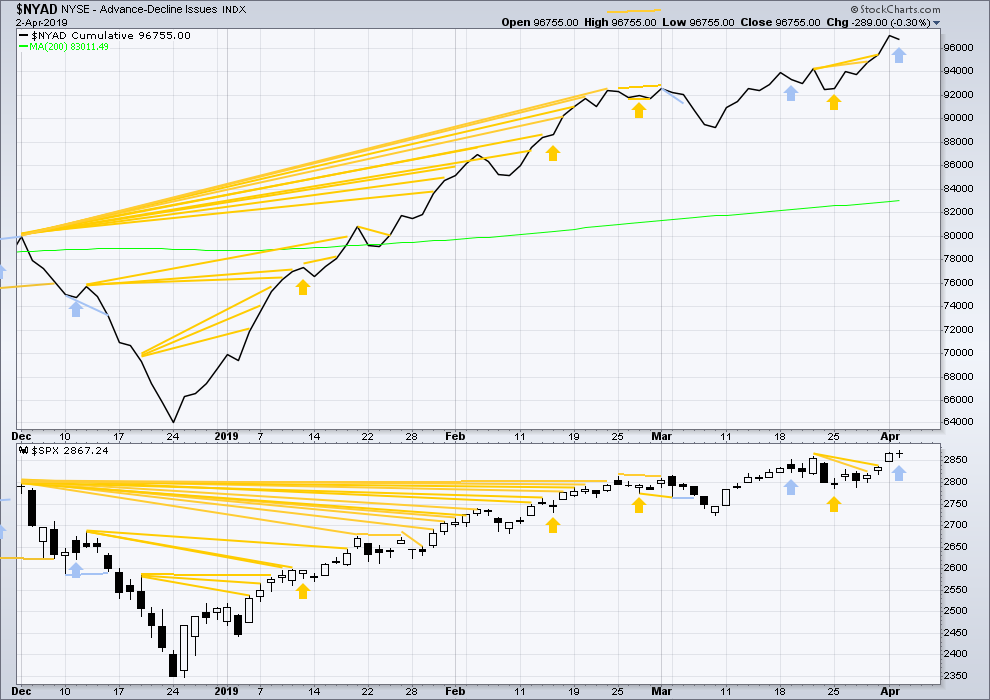

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Today price moved higher, but the AD line has moved slightly lower. This divergence is slight and is bearish for the short term. It may be an early warning sign of minor wave 4 to arrive.

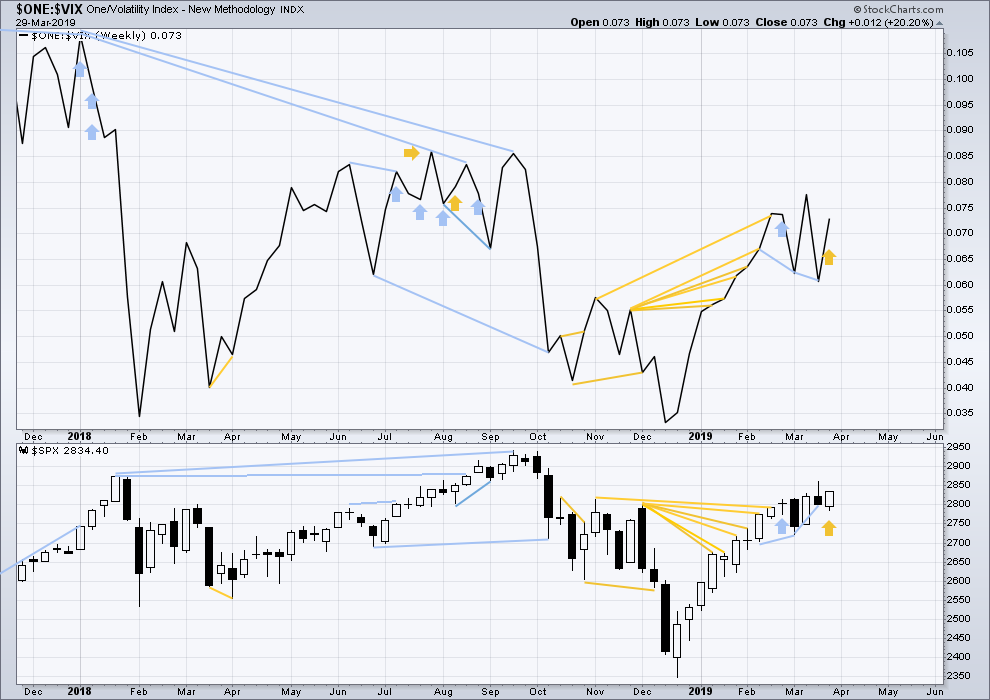

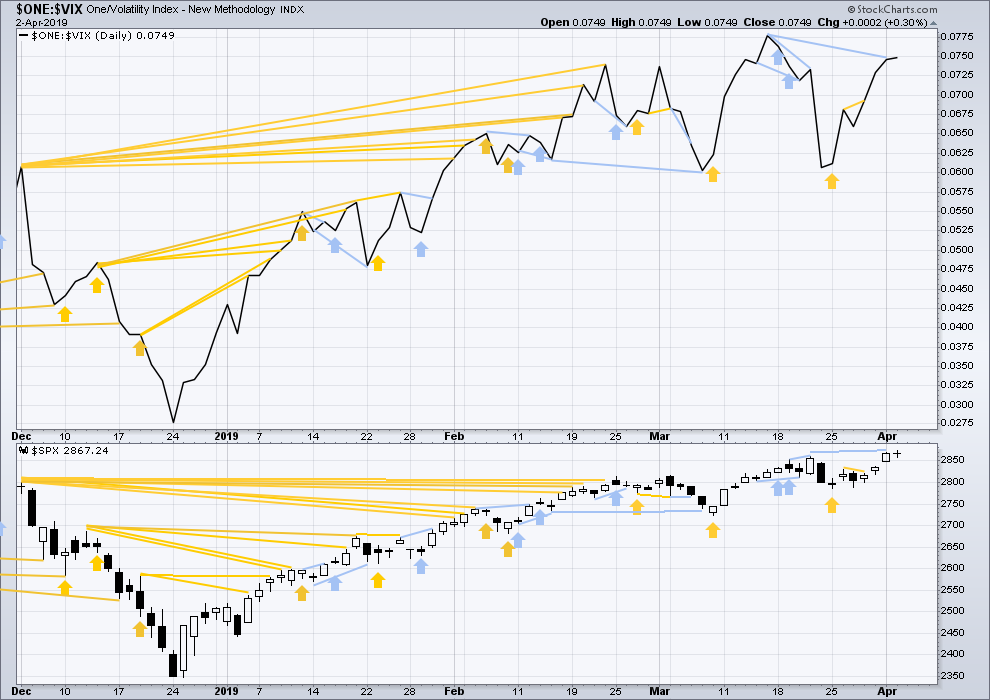

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Last week price moved lower with a lower low and a lower high, but inverted VIX moved higher. This divergence is bullish for the short term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Bearish divergence noted in last analysis has not been followed by any downwards movement. Today both price and inverted VIX have moved higher. Upwards movement today has support from a normal corresponding decline in VIX.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices moving now higher, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91

Nasdaq: 8,133.30.

For the short term, now DJT has made a very slight new low below the prior swing low of the 8th of March. All of the S&P500, DJIA and Nasdaq remain above their prior swing lows of the 8th of March.

Published @ 07:20 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Hourly chart updated:

Minor 3 now looks like a very nice impulse.

Now to see a little pullback / consolidation complete for minor 4. The 0.236 Fibonacci ratio is favoured as a target because it sits within the price territory of the fourth wave of one lesser degree.

I’m a thinkin’ a 5 wave A down here of a iv initiating, myself. 2866-68 has lots of support and three close fibos, a 23, 62 and 78%’r. Watch for a possible turn there to complete the A.

Also…possible this is the C of an expanding flat, with this morning’s down move the A and the upmove the B…

Lots of /ES (futures) support at the low here, fibo and prior swing highs. This is hourly including overnight.

Anyone want to buy some pot? CRON (daily chart) has retraced to a 38.2% at about 18 (after a high of 25), and might be ready to initiate another run up. I might try a puff here as I see the 5 minute and hourly start to up trend. Whether or not to inhale will be the question…

I took a DRIP position instead

Not sure if I want go long CRON … I’ll probably just short the cartels.

I mentioned 2884-5 as a strong resistance and possible pivot high spot yesterday. Price has tagged it now. A 100% and a 1.61% are there. Might be it to the up side today.

That 100% held perfectly, with a nice little double top on the 5 minute and hourly charts.

Highly likely turn spot for this profit taking sell off is a 61.8% at 2868.8. If that falls, then the 78.6% at 2864.4. I’ll be watching carefully as I don’t have the ‘nads (or lack of sense??) to short in the face of what is clearly a raging bull market. “Buy the pullbacks” sounds more sane to me and that’s what happening right now.

I mentioned 2884-6 as a strong resistance and possible pivot high spot yesterday. Price has tagged it now. A 100% and a 1.61% are there. Might be it to the up side today.

Anyone concerned about the gap up left open in the ES futures on Sunday night/Monday? I know gaps in SPX cash may not fill for a looong time, but gaps left open on ES futures is pretty rare sine it “almost” trades 24hrs/day…

If we get a correction, i see it going there at least… good target!

The last two SPX upswings, projected from the recent swing low, both point towards a swing high around 2920-26. Often the market is symmetric like that.

Lara,

I’m wondering if it possible that we are still in Primary 1 of Cycle Wave 5. Just looking at the weekly chart it seems like Primary 3 will be too short and compressed in terms of time. Also, if we are going to see a multi-month divergence of the AD line, I would think Cycle 5 would still have a ways to go. So I am thinking, perhaps, that we are still waiting for a Primary 2, and that we might see the divergence emerge during Primary Wave 3 or 4.

Thanks,

Peter

FWIW, I think the Alternate Monthly count solves those issues. This is why I have been favoring the Alternate.

For the main count it doesn’t really work in terms of the final target 3,045 and the limit 3,477.39.

But as Rodney says, the alternate count completely resolves your issues here. That allows for cycle V to be much longer.

I love how the waves relate to the golden and divine ratios…. it has a such a genuine feeling of balance and truth …

And then you watch how these moves happen most times… especially these big bullish impulse moves …

And you see algo headline manipulation overnight with thinly traded stock and volatility futures markets to “ set” a price

And you get a little taste of bile in your throat

The creato’s golden ratio corrupted by polluted manmade artificial manipulations

As traders all you can do is trade what you have.. and don’t try and swim up stream too often..:)

My good morning coffee reflection

For a true feeling of oneness with the universe…try taking a short right as price moving up tags a 78.6% or a 61.8%. No waiting for signs of a turn…just go! Trust in the fractal structure, Luke. “It’s like nothin’ else to make you feel sure you’re alive”. I do it…sometimes. And often when I don’t, I really regret it!

Yes brother

I shorted the 277-278 for .45 at the open

With the intention to go short or scalp

Oneness with the universe

2880 was good enough for me

Also my last 29-28 vxxb put spread sale fill

8 points past chart monkeys call

And I see a small turn coming on Lara’s count

Might be a small window

But I can squeeze my bear suit in

I’m watching /CL very closely here now. It’s approach a HUUUUGE 61.8% retrace level at 63.71, and it’s logically just about time for this multi-month kick-back rally to end. /CL is at 62.37 at the moment.

Nice tip Kevin

I rolled my 277-278 spread to Friday for a couple pennies

Give me

More time

This action is very pushy

I’ll let it exhaust itself

I spy with my little eye a bearish divergence in daily MACD as well.

Lots of those bearish divergences around. Meanwhile, early overnight action is up, but that could easily sell off and more by morning.

Finally, a first

Second behind the first first.