Price is moving sideways and remains range bound.

The main Elliott wave count today has good support from classic technical analysis. The AD line (as an indication of market breadth) and moving averages are used to indicate the most likely breakout direction.

Summary: The upwards trend should resume. The mid-term target remains the same at 3,010. Today this view has support from a new all time high from the AD line and a cross of the 50 day moving average above the 200 day moving average.

The final target remains the same at 3,045.

Only a new low below 2,722.27 would indicate a deeper and more sustained pullback would be underway.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last published monthly charts are here. Video is here.

ELLIOTT WAVE COUNTS

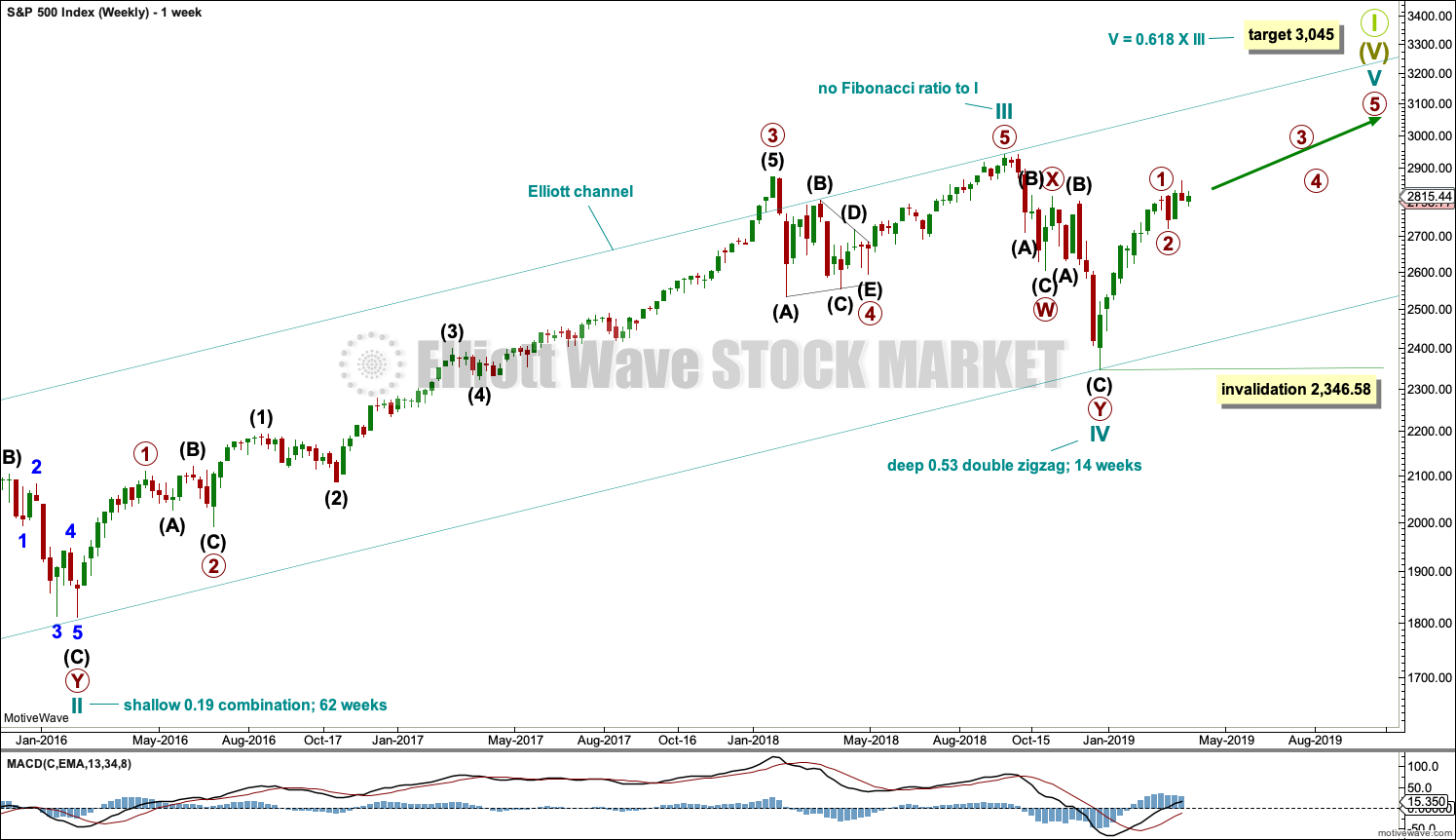

WEEKLY CHART

This weekly chart shows all of cycle waves III, IV and V so far.

Cycle wave II fits as a time consuming double combination: flat – X – zigzag. Combinations tend to be more time consuming corrective structures than zigzags. Cycle wave IV has completed as a multiple zigzag that should be expected to be more brief than cycle wave II.

Cycle wave IV may have ended at the lower edge of the Elliott channel.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Although both cycle waves II and IV are labelled W-X-Y, they are different corrective structures. There are two broad groups of Elliott wave corrective structures: the zigzag family, which are sharp corrections, and all the rest, which are sideways corrections. Multiple zigzags belong to the zigzag family and combinations belong to the sideways family. There is perfect alternation between the possible double zigzag of cycle wave IV and the combination of cycle wave II.

Although there is gross disproportion between the duration of cycle waves II and IV, the size of cycle wave IV in terms of price makes these two corrections look like they should be labelled at the same degree. Proportion is a function of either or both of price and time.

Draw the Elliott channel about Super Cycle wave (V) with the first trend line from the end of cycle wave I (at 2,079.46 on the week beginning 30th November 2014) to the high of cycle wave III, then place a parallel copy on the low of cycle wave II. Cycle wave V may find resistance about the upper edge.

It is possible that cycle wave V may end in October 2019. If it does not end there, or if the AD line makes new all time highs during or after June 2019, then the expectation for cycle wave V to end would be pushed out to March 2020 as the next possibility. Thereafter, the next possibility may be October 2020. March and October are considered as likely months for a bull market to end as in the past they have been popular. That does not mean though that this bull market may not end during any other month.

MAIN WAVE COUNT

DAILY CHART

The daily chart will focus on the structure of cycle wave V.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A target is calculated for cycle wave V to end prior to this point.

Cycle wave V must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common and that will be how it is labelled. A diagonal would be considered if overlapping suggests it.

Primary wave 2 may have been a very brief and shallow expanded flat correction.

Primary wave 3 may now exhibit an increase in upwards momentum. A target is calculated that fits with the higher target for cycle wave V to end.

Within primary wave 3, intermediate wave (2) may not move beyond the start of intermediate wave (1) below 2,722.27.

Intermediate wave (2) may be a complete expanded flat correction. Minor wave B within intermediate wave (2) is 1.2 times the length of minor wave A, which is within the most common range for B waves of flats from 1 to 1.38. Minor wave C may now be complete. It exhibits no Fibonacci ratio to minor wave A.

The lower edge of the adjusted base channel may provide support for pullbacks along the way up. The channel is now breached by downwards movement. The lower edge of this channel is not showing exactly where price is finding support.

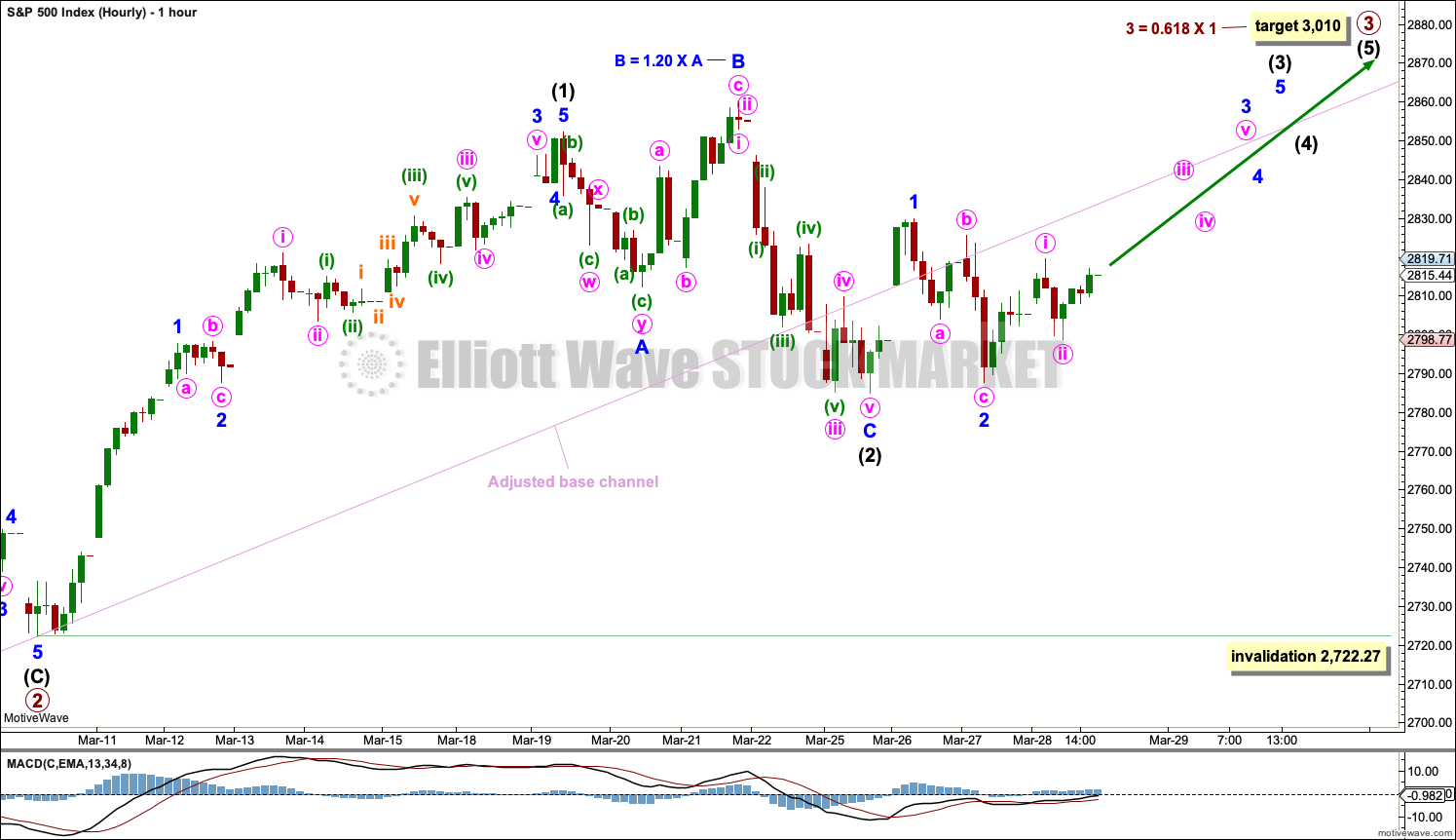

HOURLY CHART

Intermediate wave (2) may be now complete.

Minor wave C subdivides as a completed five wave impulse on the five minute chart.

The adjusted base channel is breached clearly on the hourly chart, but the S&P does not always fit well within trend channels. While a breach of this channel indicates the alternate wave count below should be considered, more weight will be given to classic technical analysis, which still favours this main wave count.

This wave count now expects to see an increase in upwards momentum as a third wave at four degrees begins.

Each of primary wave 3, intermediate wave (3) and minor wave 3 may only subdivide as an impulse. It is normal for this market to exhibit extended third waves. When a third wave extends, the subdivisions often show up on higher time frames. So far this still looks typical.

Minor wave 2 now looks like an obvious three wave structure on the hourly chart.

If it continues lower, then intermediate wave (2) may not move beyond the start of intermediate wave (1) below 2,722.27.

ALTERNATE WAVE COUNT

DAILY CHART

It is also possible that primary wave 2 may continue as an expanded flat correction.

Intermediate wave (B) is 1.51 times the length of intermediate wave (A). This is longer than the common range of 1 to 1.38 but within allowable limits of up to 2.

A target is calculated for intermediate wave (C); it expects to exhibit the most common Fibonacci ratio to intermediate wave (A).

Intermediate wave (C) must subdivide as a five wave motive structure. Within intermediate wave (C), minor wave 2 may not move beyond the start of minor wave 1 above 2,860.31. This wave count would be discarded with a new high.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

The breach of the channel on the main daily Elliott wave chart indicates this alternate should now be more seriously considered.

TECHNICAL ANALYSIS

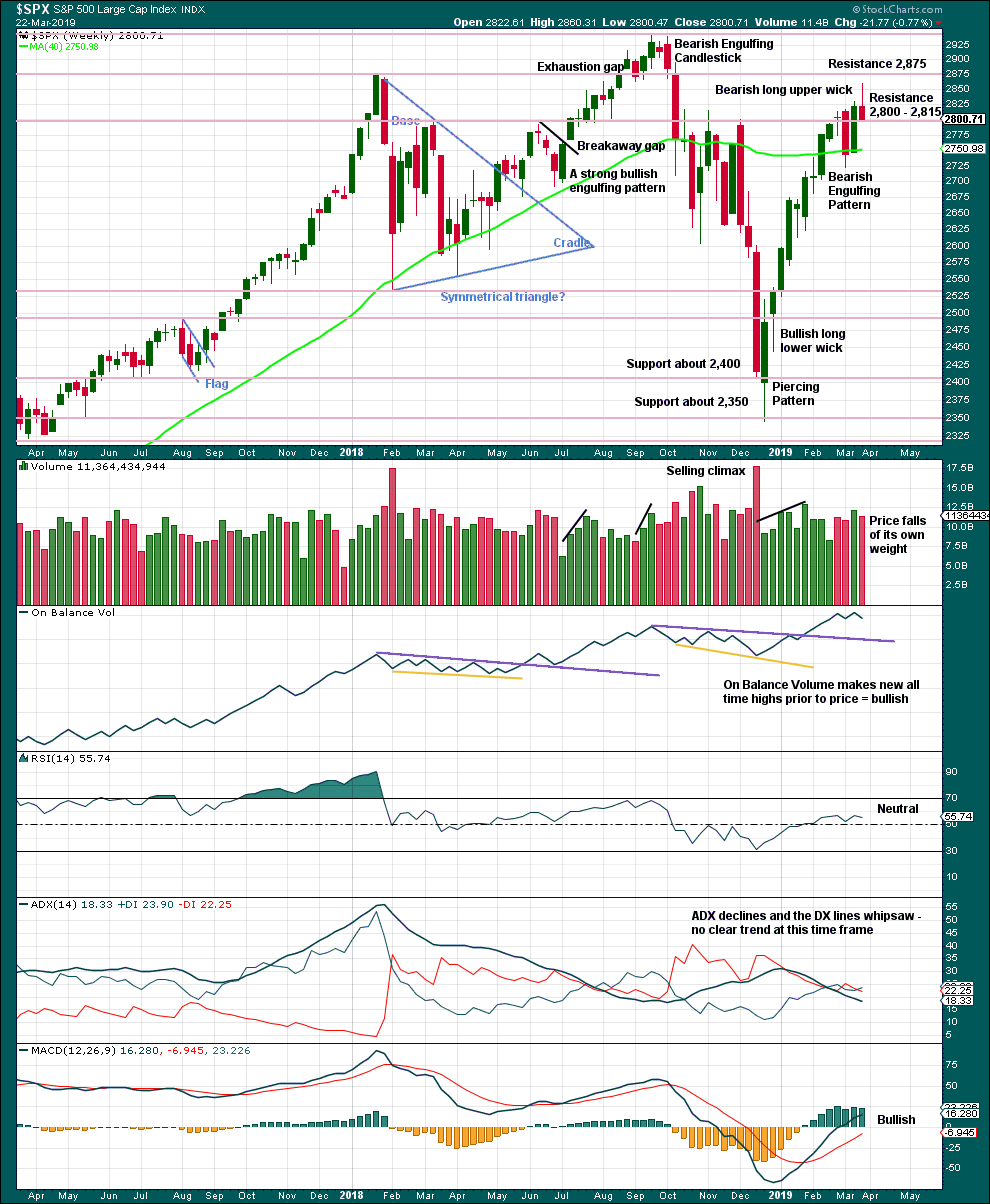

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

The long upper wick last week is bearish.

Support at 2,800 remains. Price has not closed below this point yet.

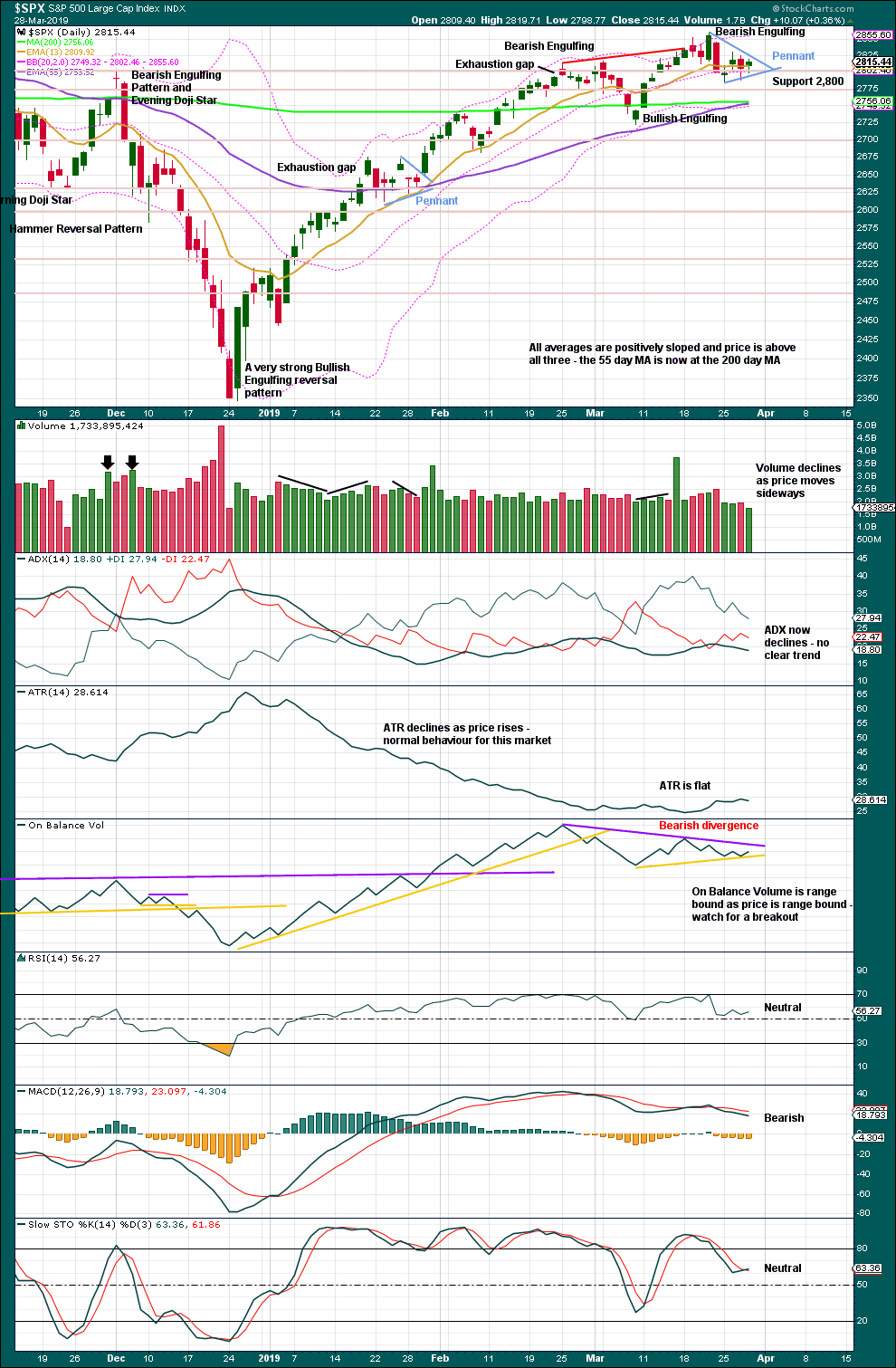

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The December 2018 low is expected to remain intact. The two 90% upwards days on 26th December 2018 and 6th January 2019 indicate this upwards trend has internal strength.

Lowry’s data shows rising Buying Power and falling Selling Pressure. This situation is normally associated with a strong and healthy bull market. Pullbacks are normal and to be expected, and they are more likely to be short term.

While the last swing low of the 8th of March remains intact, there exists a series of higher highs and higher lows from the major low in December 2018. It would be safest to assume the upwards trend remains intact despite a decline in ADX.

Today a possibly small pennant pattern is identified. Flags and pennants are reliable continuation patterns. A target calculated using the flag pole is about 2,958. An upwards breakout would be expected from this pattern.

Today the 50 day moving average crosses above the 200 day moving average (not shown on this chart as I am using a Fibonacci 55 day moving average instead). This would be taken by many traders as a bullish signal.

On Balance Volume will be watched carefully for a signal.

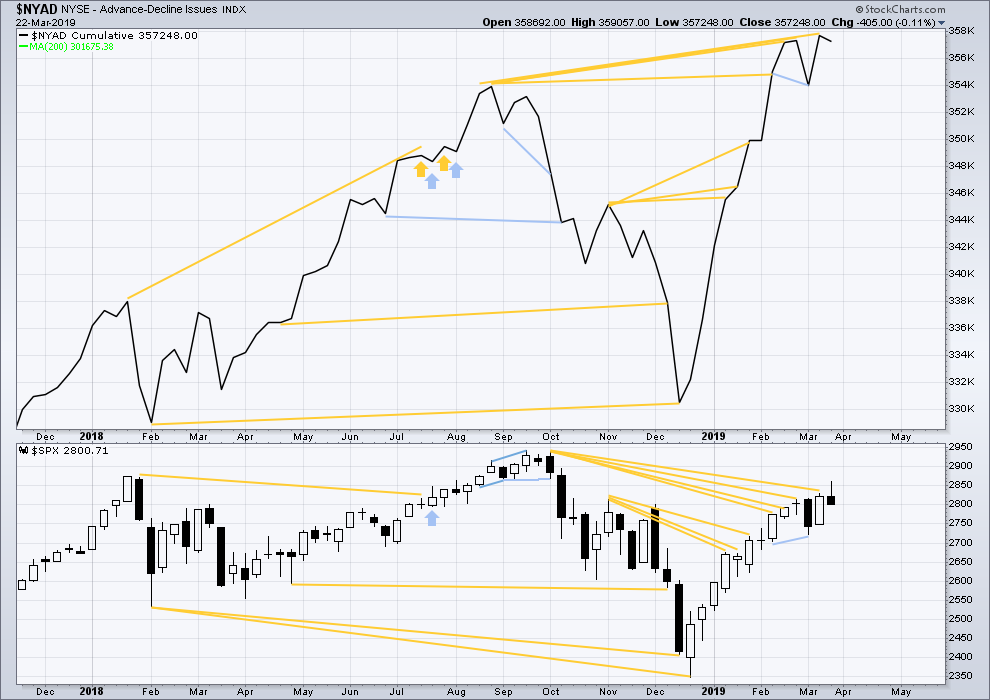

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Every single bear market from the Great Depression and onwards has been preceded by a minimum of 4 months divergence between price and the AD line. With the AD line making a new all time high again last week, the end of this bull market and the start of a new bear market must be a minimum of 4 months away, which is the end of July 2019 at this time.

This week both price and the AD line declined. The AD line is not declining any faster than price, there is no short term divergence.

Last week mid and large caps have declined but have not made new swing lows below the prior swing low of the 8th of March. Small caps have made a new low below their 8th of March low. There is some weakness in this downwards movement. Large caps remain strongest and the decline is focussed mostly in small caps.

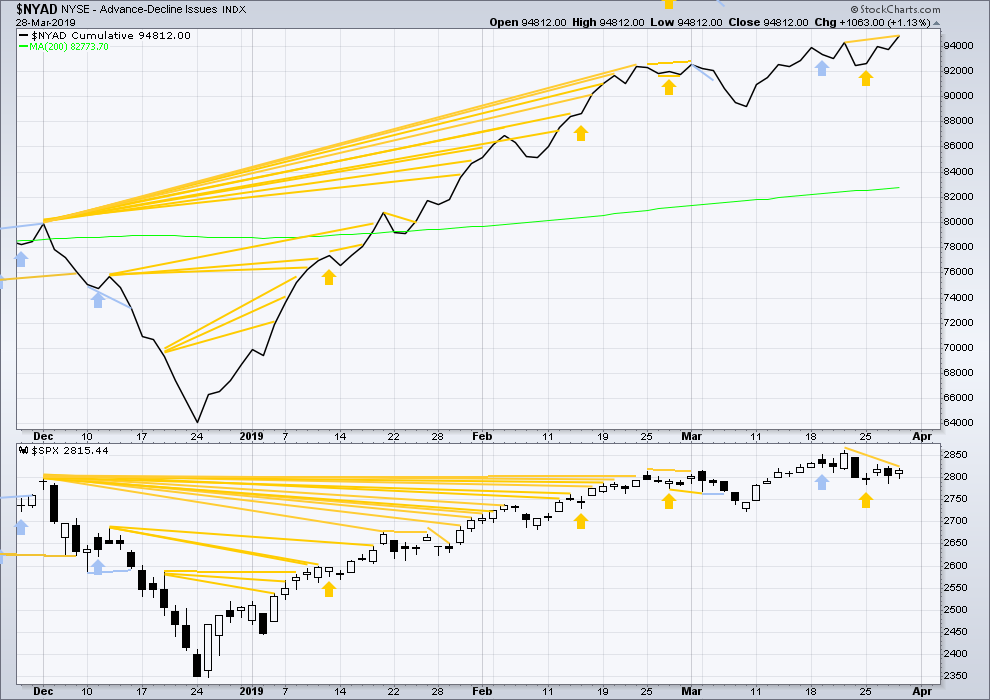

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

Today the AD line makes another new all time high. There is now long and short-term bullish divergence.

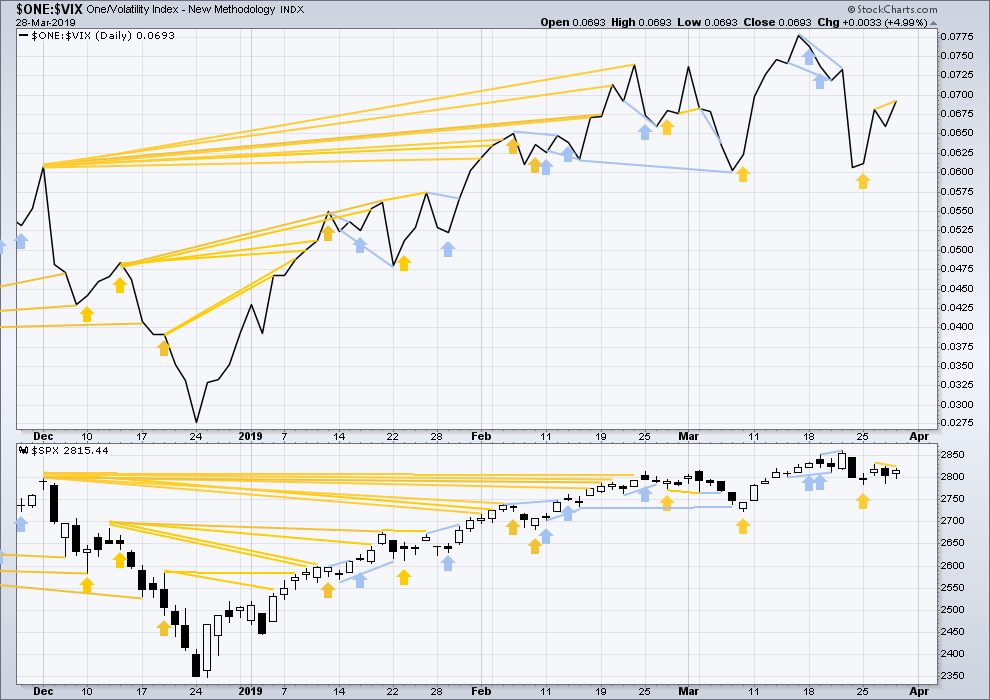

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Inverted VIX has made a new short-term high and a mid-term high along with price. Upwards movement comes with a decline in VIX. There is no short nor mid-term divergence.

Longer-term divergence between price and inverted VIX at the last all time high in September 2018 remains.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Today inverted VIX makes a new high above the prior high two sessions ago, but price has not. This divergence is bullish for the short term.

DOW THEORY

Dow Theory confirmed a bear market in December 2018. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices moving now higher, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91

Nasdaq: 8,133.30.

For the short term, now DJT has made a very slight new low below the prior swing low of the 8th of March. All of the S&P500, DJIA and Nasdaq remain above their prior swing lows of the 8th of March.

Published @ 08:05 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Hourly chart updated:

This wave count now expects an upwards breakout most likely on Monday for the middle of a third wave.

I don’t think the middle of it passed today, it’s too short.

Please correct me if I’m wrong, folks, but it looks to me like this morning’s high may be minute three complete, and the current sideways chop may be minute four? Unless maybe you bump it down one degree?

Anyway, I got cautiously long this morning in my longer-term accounts. Will get out quick if it goes hard the other way.

that’s what I am counting on

Maybe Monday they close the gap

SPX 2831 is the 61.8% retrace level of the 3/21-25 move down, and cracking it would be huge in my book for the bull case for SPX. Could happen here today…

“There may now be another first and second wave completing today. I’ve checked the subdivisions of minute wave i on the five and one minute charts, it fits”

I liked her confidence yesterday so I added to my SPY calls at the close …..

My view of NDX is supportive of the bullish case in general. Clear break back upward through a descending trend line, and back up “into” the large and strong up channel NDX has been tracking since late December. Hourly trend back to strong up.

SPX has the same look. Breakout from a pennant.

RH, took a bite…

You took RH long here after this giant gap down? Beware falling knives…

Like an iron chef

It is starting to feel a little lonely here now.

Lara’s count is right on track. Now we start to see confirmations of the bullish move in the technicals etc as we go up to a new ATH. If we ever get a good trade deal with China, it should lead to strengthen this move. As I have said before, I looking for 3477+ on the SPX sometime this year. Only time will tell.

I’m staying cautious, but leaning to the long side as of this morning. That said, a huge reversal and a slamming sell off all next week would surprise me zero. I don’t think this is a set up in which to get complacent with a “it’s going up so a little down is okay” attitude holding long positions (not that you are, this comment is mostly for myself!). Until we clearly see more bullish evidence. There’s just too much potential structurally for this to be a big 2 high and the start of a huge 3 down. I want to see that evidence reduced/destroyed before I get to giddy on the long side. Today is a good start so far…but we know this market can reverse hard intraday! No time to wander off and play guitar or tiddlywinks.

Breaking above 2830 this morning is quite important. But more important is the McClellan oscillator. It has come from below -40 to above +20 as of this morning. It needs to close above +20 today. That will be a bullish signal confirming the low of Intermediate 2 (and Minor 2) as labeled in Lara’s main count is completed. It also gives additional support to the Zwieg Breadth Thrust of early January and indicates the next leg up is underway. Finally as Lara has stated several times, selling pressure is at a very low level relatively speaking.

As a result, the movement now in price, first to 2875 on the way to 3000, will be to final confirmation. Soon, money will begin to chase this bull leg upwards as the herd becomes afraid of being left behind; greed. Then will come Primary 4.

Just my thoughts of course. In full disclosure, I am fully long.

Ah, bull eyes!

It’s friday, soon it’ll be time for beer eyes!

Tell me more about your use of the McClellan Oscillator. When I apply it with default settings on SPX daily, it gives me a reading at the moment around 11.3. It has default settings of the fast and slow ema’s at 19 and 39 respectively. Is that right? I’ve found some info that talks about 19 and 29, but that also doesn’t give me a reading of 20+ either.

Kevin,

Send an email to rodneymruk at gmail dot com. I will send you the link to the chart I use. I do not want to post it here because it is from another pay subscription site and sort of proprietary. I suppose, with a lot of work, I could produce it myself but it is so much easier to just click the link from the other site.

#1