Today both inverted VIX and the AD line give signals for the next direction of price tomorrow.

Summary: The bigger picture still expects that a low may now be in place. The final target is at 3,045 with a limit at 3,477.39.

Along the way up to the final target, two large corrections for primary waves 2 and 4 are expected. It is possible that primary wave 2 has begun at the last high, but no confidence may be had in this view until the black channel on the daily chart is breached.

Assume the trend remains the same, upwards, while price remains within the black channel.

For the short term, a lack of selling pressure indicates the little pullback of the last two sessions may be just another short lived pullback within the ongoing upwards trend. Today both the AD line and inverted VIX give bullish signals.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last published monthly charts are here. Video is here.

ELLIOTT WAVE COUNT

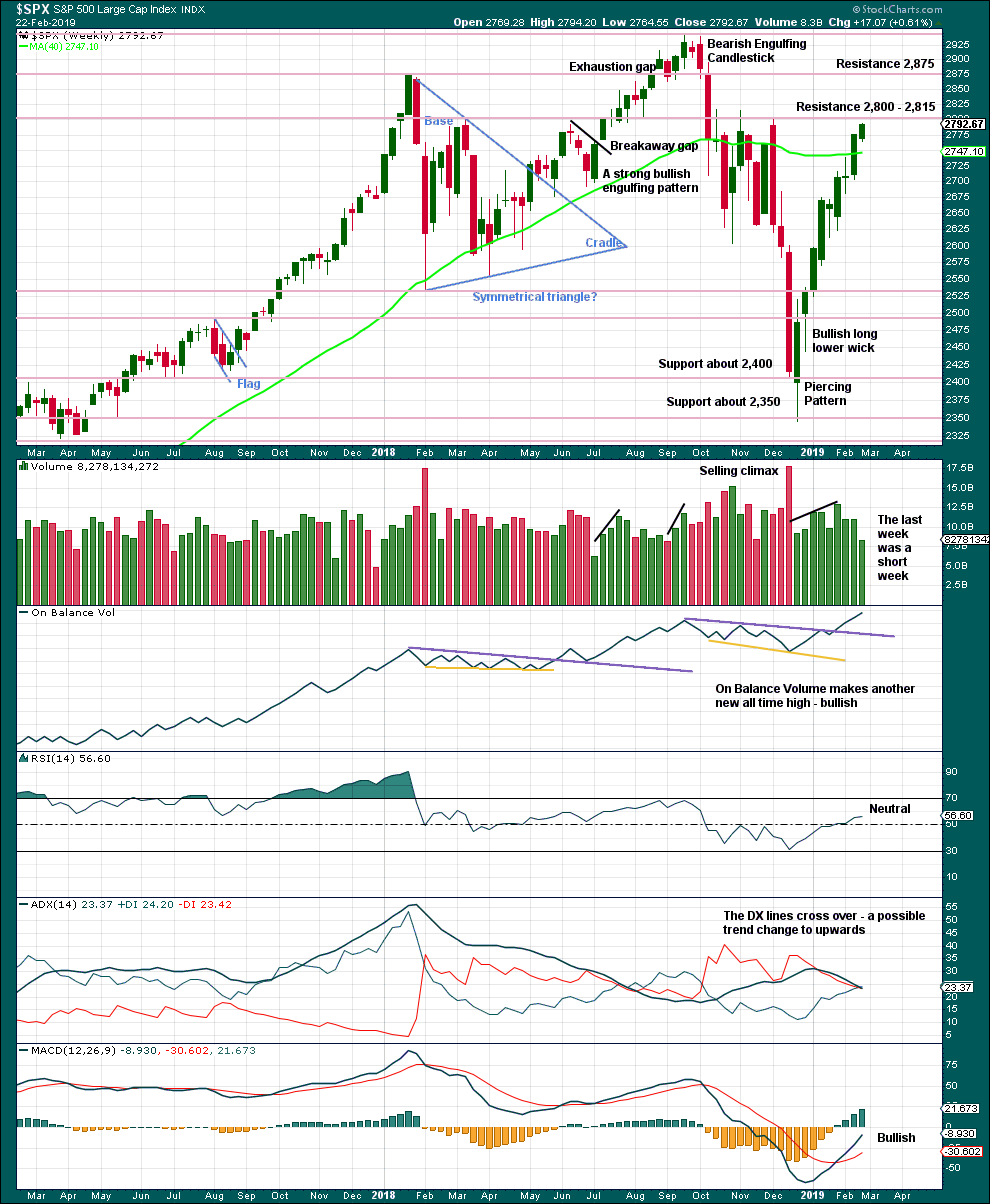

WEEKLY CHART

This weekly chart shows all of cycle waves III, IV and V so far.

Cycle wave II fits as a time consuming double combination: flat – X – zigzag. Combinations tend to be more time consuming corrective structures than zigzags. Cycle wave IV has completed as a multiple zigzag that should be expected to be more brief than cycle wave II.

Cycle wave IV may have ended at the lower edge of the Elliott channel.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Although both cycle waves II and IV are labelled W-X-Y, they are different corrective structures. There are two broad groups of Elliott wave corrective structures: the zigzag family, which are sharp corrections, and all the rest, which are sideways corrections. Multiple zigzags belong to the zigzag family and combinations belong to the sideways family. There is perfect alternation between the possible double zigzag of cycle wave IV and the combination of cycle wave II.

Although there is gross disproportion between the duration of cycle waves II and IV, the size of cycle wave IV in terms of price makes these two corrections look like they should be labelled at the same degree. Proportion is a function of either or both of price and time.

Draw the Elliott channel about Super Cycle wave (V) with the first trend line from the end of cycle wave I (at 2,079.46 on the week beginning 30th November 2014) to the high of cycle wave III, then place a parallel copy on the low of cycle wave II. Cycle wave V may find resistance about the upper edge.

It is possible that cycle wave V may end in October 2019. If it does not end there, or if the AD line makes new all time highs during or after June 2019, then the expectation for cycle wave V to end would be pushed out to March 2020 as the next possibility. Thereafter, the next possibility may be October 2020. March and October are considered as likely months for a bull market to end as in the past they have been popular. That does not mean though that this bull market may not end during any other month.

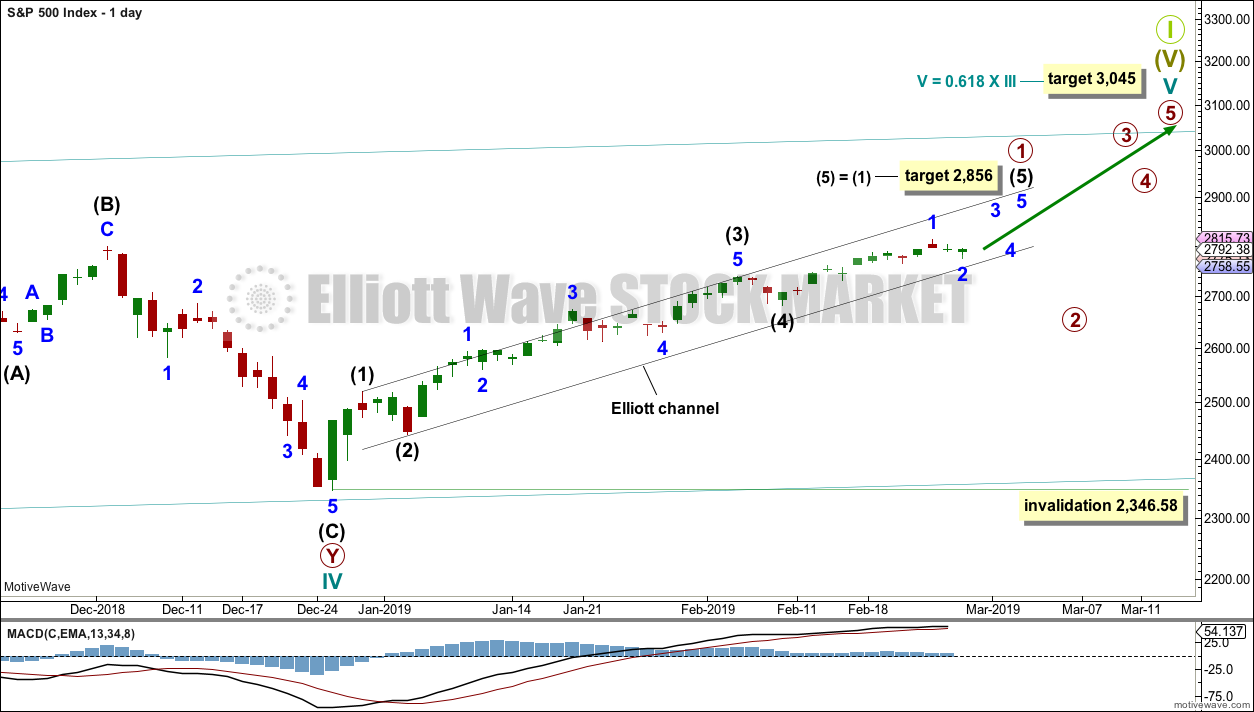

DAILY CHART

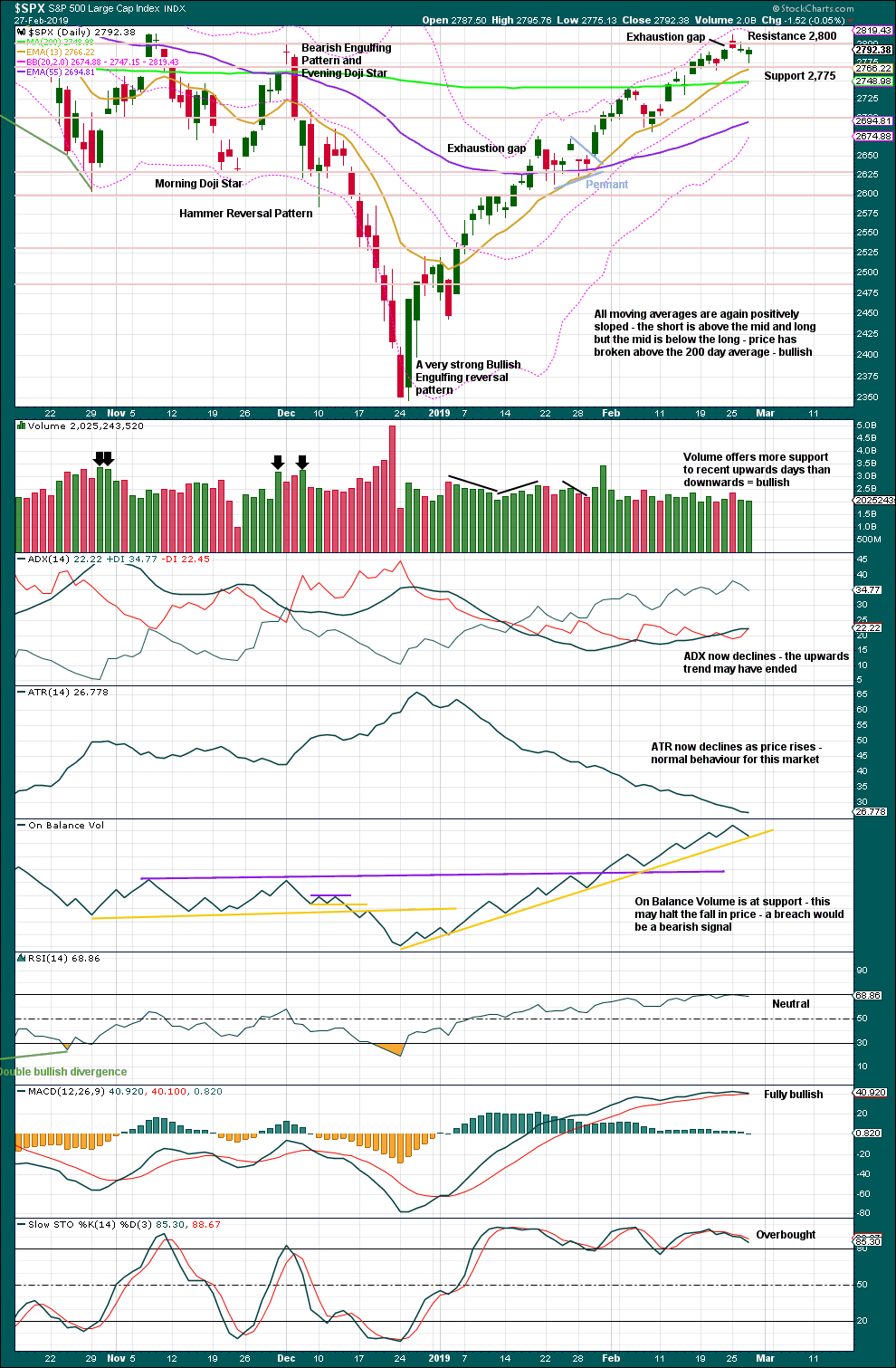

The daily chart will focus on the structure of cycle wave V.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A target is calculated for cycle wave V to end prior to this point.

Cycle wave V must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common and that will be how it is labelled. A diagonal would be considered if overlapping suggests it.

Primary wave 1 is labelled as incomplete.

An Elliott channel is drawn about the impulse of primary wave 1. This channel will now be used to indicate when primary wave 1 is complete and primary wave 2 has begun. When a full daily candlestick prints below the lower edge of the channel and not touching the lower edge, that may be taken as confirmation of a trend change. Assume the trend remains the same, upwards, while price remains within the channel.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

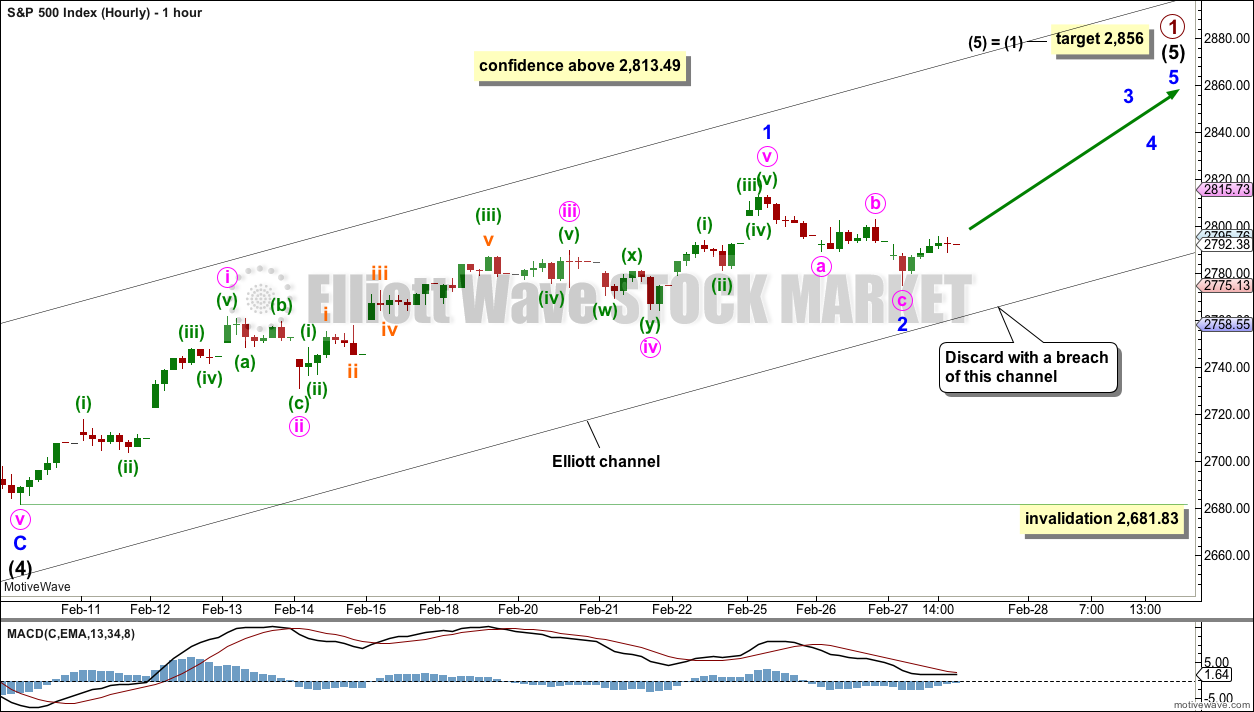

MAIN HOURLY CHART

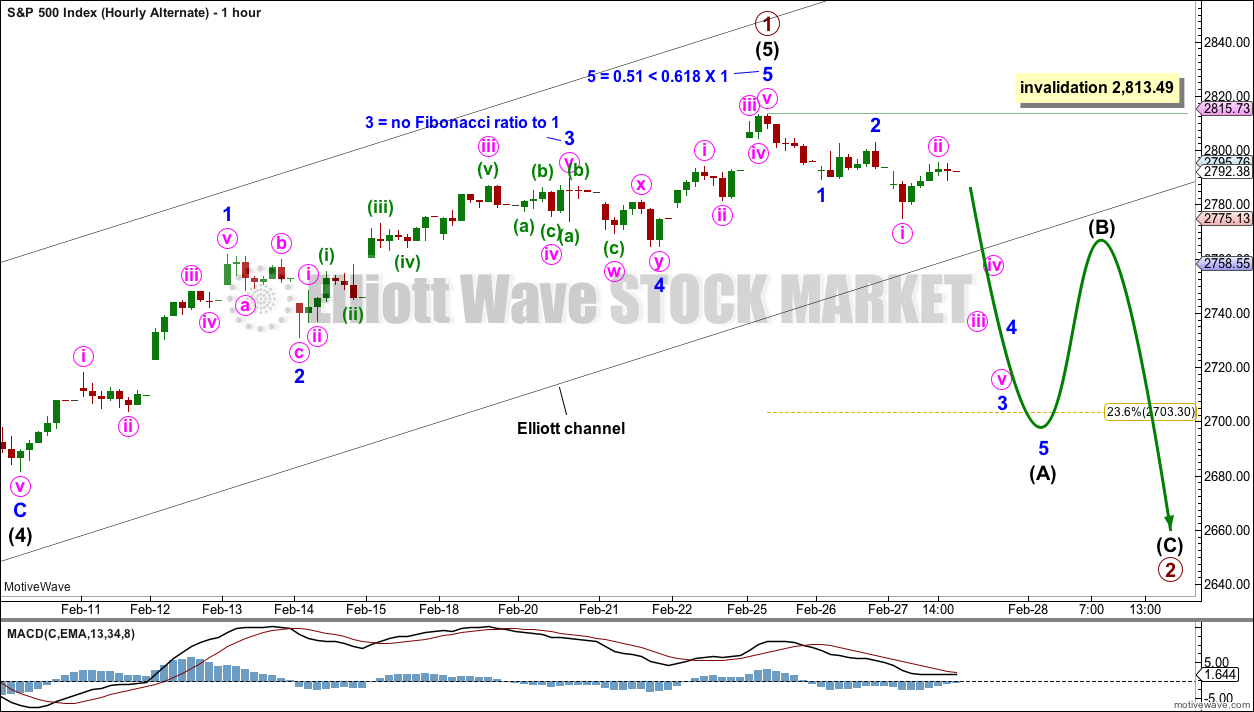

This main hourly wave count expects intermediate wave (5) to be extended.

Within intermediate wave (5), minor wave 1 may have been over at the last high. The subdivisions for both hourly charts are today seen in the same way, with the sole exception the degree of labelling. This main hourly chart moves the degree of labelling down one degree.

Minor wave 2 may not move beyond the start of minor wave 1 below 2,681.83. However, if the black channel is breached by downwards movement (not sideways), that would be taken as an indication that this main wave count would be wrong and the alternate may be correct. This wave count would be discarded prior to full invalidation.

Minor wave 3 should now exhibit some increase in upwards momentum. If should have the power to break above resistance at 2,815.

ALTERNATE HOURLY CHART

If the degree of labelling within intermediate wave (5) is moved up one degree, then it is possible that primary wave 1 may be over and primary wave 2 may have just begun at the last high.

Primary wave 2 would most likely subdivide as a zigzag. It must begin with a five down at the hourly chart level, and within this minor wave 2 may not move beyond the start of minor wave 1 above 2,813.49.

The most likely targets for primary wave 2 would be the 0.382 Fibonacci ratio at 2,635.13 or the 0.618 Fibonacci ratio at 2,624.94. Primary wave 2 may last a few weeks.

A clear breach of the black Elliott channel is absolutely required for any confidence in this wave count.

TECHNICAL ANALYSIS

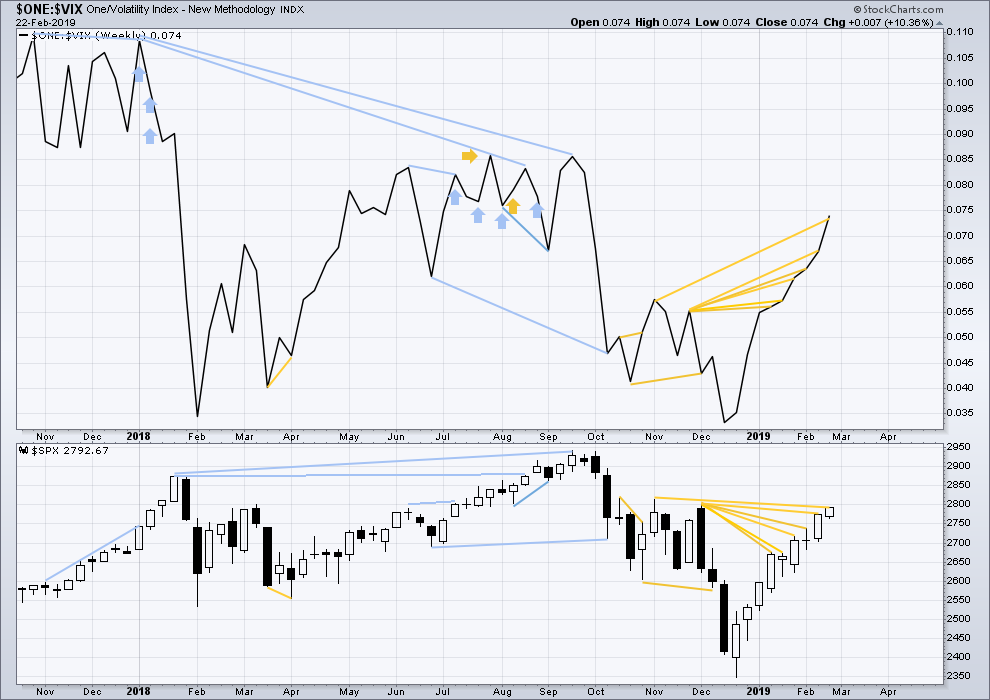

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

Because this week consisted of only four trading days, the decline in volume may not be necessarily bearish. It is necessary this week to look inside the week at daily volume bars to judge the volume profile.

Overall, this chart is bullish and supports the Elliott wave count.

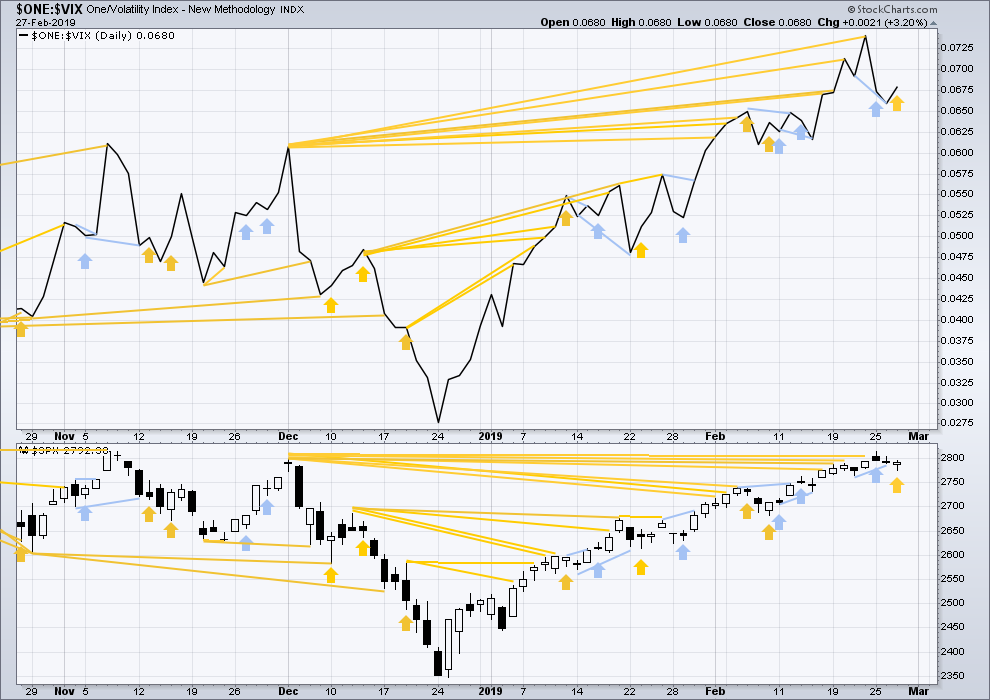

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Over a fairly long period of time this ageing bull market has been characterised by upwards movement on light and declining volume and low ATR. For the short to mid term, little concern may be had if price now rises again on declining volume. Current market conditions have allowed for this during a sustained rise in price.

It is also normal for this market to have lower ATR during bullish phases, and strongly increasing ATR during bearish phases. Currently, declining ATR is normal and not of a concern.

Considering the larger picture from the Elliott wave count, some weakness approaching the end of Grand Super Cycle wave I is to be expected.

From Kirkpatrick and Dhalquist, “Technical Analysis” page 152:

“A 90% downside day occurs when on a particular day, the percentage of downside volume exceeds the total of upside and downside volume by 90% and the percentage of downside points exceeds the total of gained points and lost points by 90%. A 90% upside day occurs when both the upside volume and points gained are 90% of their respective totals”…

and “A major reversal is singled when an NPDD is followed by a 90% upside day or two 80% upside days back-to-back”.

The current situation saw two 80% downside days on December 20th and 21st, then a near 90% downside day with 88.97% downside on December 24th. This very heavy selling pressure on three sessions together may be sufficient to exhibit the pressure observed in a 90% downside day.

This has now been followed by two 90% upside days: on December 26th and again on 4th January.

The current situation looks very much like a major low has been found.

This chart is overall very bullish. Only the moving averages are not yet full bore bullish.

Price is now within a very strong zone of resistance, which sits about 2,800 to 2,815. Again, today the balance of volume was downwards and price moved lower with a lower low and lower high. Again, volume did not push price lower today, downwards movement was weak, and the market fell of its own weight.

The last gap is now closed, so it is renamed an exhaustion gap. This is bearish and may be the first warning of a deeper pullback. But equally as likely, at this stage, it may only indicate another relatively brief pullback or sideways consolidation.

Data at the end of this session indicates this small downwards movement is weak because it lacks selling pressure. So far this looks like another small pullback within an ongoing upwards trend. If price can close above resistance at 2,815 on an upwards day with support from volume, that would be a classic upwards breakout and then more upwards movement should be expected.

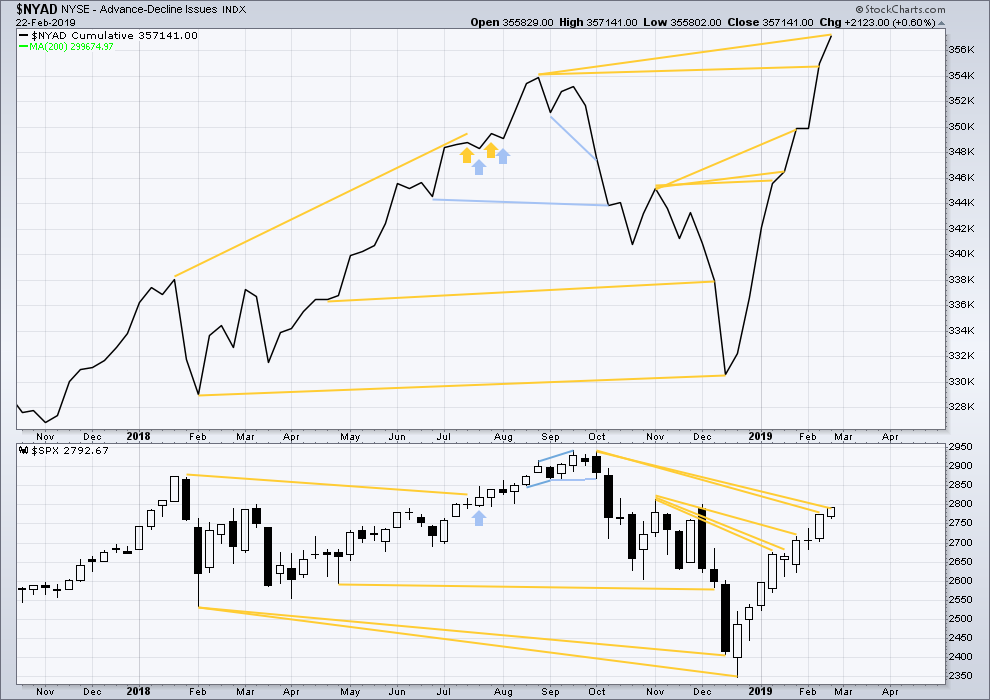

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Every single bear market from the Great Depression and onwards has been preceded by a minimum of 4-6 months divergence between price and the AD line. With the AD line making a new all time high again last week, the end of this bull market and the start of a new bear market must be a minimum of 4 months away, which is mid to end June 2019 at this time.

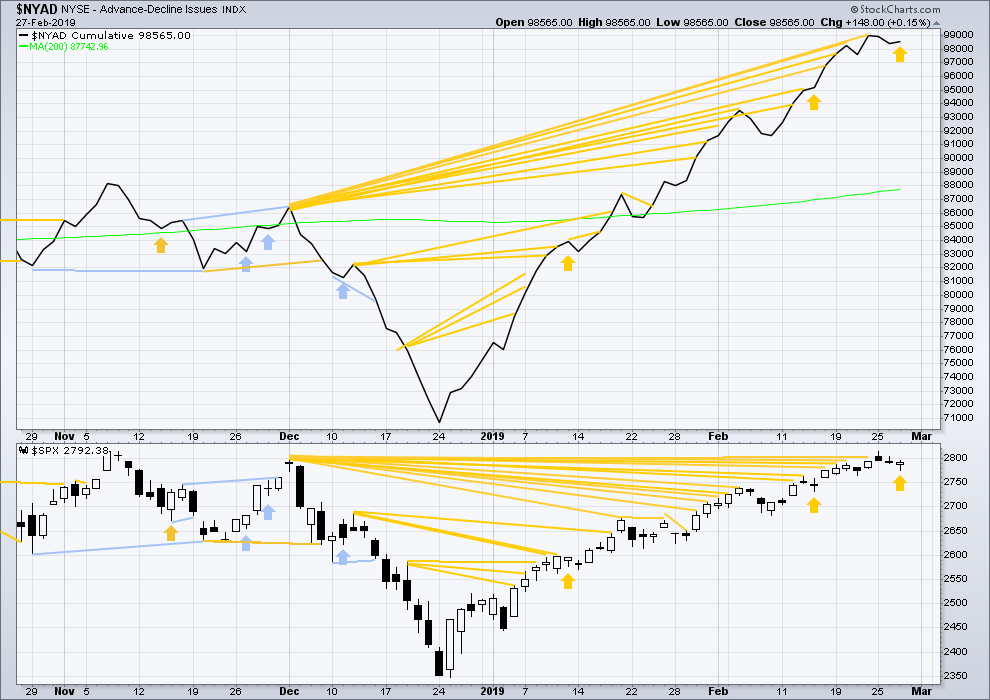

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

There is now a cluster of bullish signals from the AD line. This supports the Elliott wave count.

Today price moved lower, but the AD line moved a little higher. Downwards movement today did not have support from a decline in market breadth. The increase in breadth today is bullish.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Inverted VIX has made a new high above the prior swing high of the week beginning 5th of November 2018, but price has not. This divergence is bullish for the mid term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

There is now a cluster of bullish signals from inverted VIX that support the Elliott wave count.

Today price has moved lower, but inverted VIX has moved higher. Downwards movement today has not come with a normal corresponding increase in volatility; with VIX declining, this downwards movement looks weak. This divergence is bullish for the short term.

DOW THEORY

Dow Theory confirms a bear market. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

With all the indices moving now higher, Dow Theory would confirm a bull market if the following highs are made:

DJIA: 26,951.81

DJT: 11,623.58

S&P500: 2,940.91

Nasdaq: 8,133.30.

Published @ 05:55 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Ok

Gm is a great short cake scalp over 40$ right now

They will let you cover in mid to low 39’s no problem

Have been takening several slices over the last month and just covered again today

Also upside Netflix calls within 3% of today’s price

Seem to be getting eaten

Third week I slowly gone green after lots of sounds and fury spikes

If you doubled on the spikes and sling it back

You have made real money

So that looks like distribution and a safe place to sell out of money calls short period

Same thing with spy

Selling upside calls on this type of consolidation over short time frames

Is finally paying after this relentless bull up

And they sell Monday wed and Friday

So several days during week to play casino and let momo traders who are late to the party have their upside calls go poof

Main hourly chart updated:

Almost no change here. I’m leaving the invalidation point as is to allow for the possibility that minor wave 2 may continue lower as a double zigzag. If it does that I’d expect strong support at the lower edge of the black channel.

A breach of that channel would still see me discard this wave count (by downwards movement, not sideways).

Alternate hourly chart updated:

No change here either. I’m still allowing for minor 2 here to continue higher as a flat correction.

Based on Verne’s triangle comment ….. good long entry coming up

Sorry Peter, that makes no sense.

C waves don’t subdivide as triangles.

Could be B wave of a Zig Zag, unless I’m mistaken… 🙂

I think this is the triangle referred to. SPX hourly.

I think what Verne is saying is that the minute ii as labeled by Lara is forming a triangle. I think…

all I know is price is executing sideways slop (nominally “consolidation”, but could be “topping action” too). And it could go on for days.

Watch for a sharp break down though. Remember Feb 2018. This still has some significant similarities.

Stultifying trading day. This could go on until the end of the month. Four more trading days left on this March futures contract. It can’t happen fast enough.

Minute ii can’t be a triangle, triangles don’t occur in second waves.

Triangles only occur in positions of wave B, 4, X, Y or Z.

IYT is giving sell signals on a turn on the daily off/over overlapped 61.8%/78.6% levels. I’ve put on a bear put spread for 3/15 here.

Meanwhile I see RUT is giving a clear head and shoulders top look on the hourly. The second shoulder is almost complete.

In a time when it seems the US Congress is so divided and dysfunctional, I am elated to share this bit of great news. A link to the entire story is at the end.

—————————————————————————————

In a period when the political left and right seem to agree on nothing, both arms of Congress this month voiced overwhelming support for a sweeping conservation bill.

On Tuesday, SB47 — the Natural Resources Management Act — passed the House by a vote of 363-62 just 2 weeks after it passed the Senate 92-8. It will now head to the White House for the president’s signature.

The bill not only protects more than 2 million acres of public land and 676 miles of rivers, but it also permanently reauthorizes the Land and Water Conservation Fund (LWCF) — what many outdoor groups have called the linchpin of America’s public land and water protections. Last year, Congress let the LWCF expire after more than 50 years of funding.

—————————————————————————————

https://gearjunkie.com/house-senate-pass-natural-resources-management-act-lwcf-2019?utm_source=GearJunkie+Weekly+Newsletter&utm_campaign=7a1f5bb515-EMAIL_CAMPAIGN_2019_02_27_10_27&utm_medium=email&utm_term=0_4761d8db2c-7a1f5bb515-23177641

Some positive action on the environmental side from this administration is a breath of fresh air. The “new” EPA and department of interior have not been kind to the preservation of natural resources and the environment, so far.

My sister is a board member of Friends of the River, the organization in CA that fights for free and flowing rivers and their general protection. Protecting our natural resources from comprehensive corporate exploitation is critically important.

IYT is giving sell signals on a turn on the daily off/over overlapped 61.8%/78.6% levels. I’ve put on a bear put spread for 3/15 here.

Meanwhile I see RUT is giving a clear head and shoulders top look on the hourly. The second shoulder is almost complete.

If SPX closes on Friday at or lower than today, it’s going to be dark cloud cover on the weekly.

We now have two down days (lower high and low than prior bar’s) in a row, last seen in this bull phase on 1/23 and 2/8. Those two were of similar depth and the highs-lows form the current channel. This pullback however is only about 1/2 the depth of those, and hence is only 1/2 way into the channel. Rather “weak” as pullbacks in this now 2 month long bull phase go.

Overhead resistance is likely to be fierce. I’m a bit suspicious we see many days here of fairly narrow range sideways junky action. Maybe topping and then some acceleration downward, or maybe a bigger iv and another v up. The future isn’t written; either can happen.

So far, there’s no price action YET speaking to a larger correction downward initiating. The bearish alternate is reasonable, but IMO low probability until some kind of real bearish evidence comes up to support it. If anything, this looks more like a market consolidating quickly and strongly and about to make a charge on the overhead resistance.

Fundamentally, the market may be in an extended bullish glow from the Fed about coursing in Jan/Feb from their Dec position. Arguably a huge rocket booster for the market for which the effects should linger.

There was a screamin’ long day trade or longer term trade entry opportunity today (yesterday/Wed) as price touched and turned off the 78.6% of the prior up move at 2775. Arrgggh, because I missed it, and I should not have. Not next time though.

Once more into the breach dead friends, once more…

“If anything, this looks more like a market consolidating quickly and strongly and about to make a charge on the overhead resistance.”

I agree with that statement Kevin. I think its harnessing energy to grind to newer recent highs… That’s been the story of this whole move up from December lows, and with VIX going lower in tandem, I don’t think its about to change until VIX goes below its lower bowlinger band for a day or two…

Triangle. Generally penultimate patterns.

Looks like one more wave up…!

Are you guessing up to 2820 maybe?

I suspect they are going to push slightly past it…and we know why! 🙂

Hey, what do you know? First today. Good for me. (I guess).

Drat. Stopped out again!