Price moved overall lower as yesterday’s analysis expected.

Summary: A breach of the black Elliott channel has indicated primary wave 2 has arrived.

Primary wave 2 may last about a Fibonacci 13, 21 or 34 sessions in total. The first target is the 0.382 Fibonacci ratio of primary wave 1 about 2,589. The second target is the 0.618 Fibonacci ratio about 2,496.

If the expectation of a primary degree correction here is wrong, it may be in expecting it to be deeper and longer lasting than it turns out to be. There is evidence of underlying strength in this upwards movement from the December low.

The bigger picture still expects that a low may now be in place. At its end, primary wave 2 may offer a good entry opportunity to join the upwards trend.

The target is at 3,045 with a limit at 3,477.39.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

The monthly chart was last published here.

ELLIOTT WAVE COUNT

WEEKLY CHART

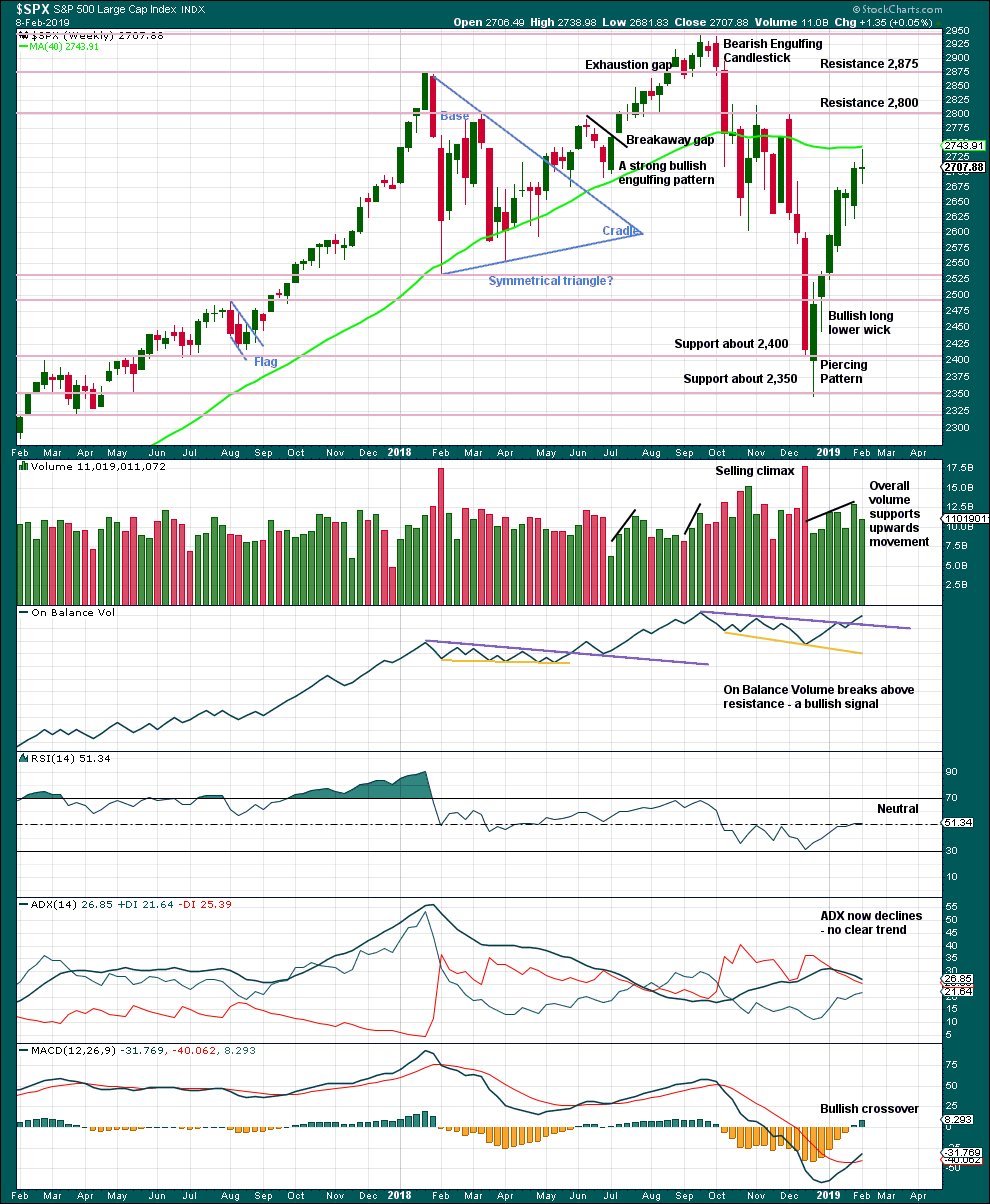

This weekly chart shows all of cycle waves III, IV and V so far.

Cycle wave II fits as a time consuming double combination: flat – X – zigzag. Combinations tend to be more time consuming corrective structures than zigzags. Cycle wave IV has completed as a multiple zigzag that should be expected to be more brief than cycle wave II.

Cycle wave IV may have ended at the lower edge of the Elliott channel.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Although both cycle waves II and IV are labelled W-X-Y, they are different corrective structures. There are two broad groups of Elliott wave corrective structures: the zigzag family, which are sharp corrections, and all the rest, which are sideways corrections. Multiple zigzags belong to the zigzag family and combinations belong to the sideways family. There is perfect alternation between the possible double zigzag of cycle wave IV and the combination of cycle wave II.

Although there is gross disproportion between the duration of cycle waves II and IV, the size of cycle wave IV in terms of price makes these two corrections look like they should be labelled at the same degree. Proportion is a function of either or both of price and time.

Draw the Elliott channel about Super Cycle wave (V) with the first trend line from the end of cycle wave I (at 2,079.46 on the week beginning 30th November 2014) to the high of cycle wave III, then place a parallel copy on the low of cycle wave II. Cycle wave V may find resistance about the upper edge.

DAILY CHART

The daily chart will focus on the structure of cycle waves IV and V.

Cycle wave IV now looks like a complete double zigzag. This provides perfect alternation with the combination of cycle wave II. Double zigzags are fairly common corrective structures.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A target is calculated for cycle wave V to end prior to this point.

Cycle wave V must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common and that will be how it is labelled. A diagonal would be considered if overlapping suggests it.

Within the five wave structure for cycle wave V, primary wave 1 may now be complete. Primary wave 1 lasted 27 sessions. Primary wave 2 may exhibit good proportion if it lasts a Fibonacci 21 or 34 sessions. Primary wave 2 would most likely subdivide as a zigzag, but it may be any corrective structure except a triangle.

Primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

A new low below the start of intermediate wave (5) at 2,631.05 would add further confidence that primary wave 1 is over and primary wave 2 has begun.

HOURLY CHART

A clear breach of the lower edge of the black Elliott channel indicates primary wave 1 should be over and primary wave 2 should be underway.

The most likely structure for primary wave 2 would be a zigzag. Intermediate wave (A) would most likely subdivide as a five wave structure, most likely an impulse. Within intermediate wave (A), minor wave 2 may not move beyond the start of minor wave 1 above 2,738.98.

Minor wave 2 may end on Monday close to the 0.618 Fibonacci ratio of minor wave 1 at 2,717.15.

The labelling within primary wave 2 may change as it unfolds. It is impossible to tell at this stage which Elliott wave structure it may take.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

From the all time high to the low at the end of December 2018, price moved lower by 20.2% of market value meeting the definition for a bear market.

It should be noted that the large fall in price from May 2011 to October 2011 also met this definition of a bear market, yet it was only a very large pullback within a bull market, which so far has lasted almost 10 years.

Overall, volume supports upwards movement. There is plenty of room for price to rise further.

This week the long legged doji candlestick puts the trend for now from up to neutral. Risk of a pullback is heightened.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Over a fairly long period of time this ageing bull market has been characterised by upwards movement on light and declining volume and low ATR. For the short to mid term, little concern may be had if price now rises again on declining volume. Current market conditions have allowed for this during a sustained rise in price.

It is also normal for this market to have lower ATR during bullish phases, and strongly increasing ATR during bearish phases. Currently, declining ATR is normal and not of a concern.

Considering the larger picture from the Elliott wave count, some weakness approaching the end of Grand Super Cycle wave I is to be expected.

From Kirkpatrick and Dhalquist, “Technical Analysis” page 152:

“A 90% downside day occurs when on a particular day, the percentage of downside volume exceeds the total of upside and downside volume by 90% and the percentage of downside points exceeds the total of gained points and lost points by 90%. A 90% upside day occurs when both the upside volume and points gained are 90% of their respective totals”…

and “A major reversal is singled when an NPDD is followed by a 90% upside day or two 80% upside days back-to-back”.

The current situation saw two 80% downside days on December 20th and 21st, then a near 90% downside day with 88.97% downside on December 24th. This very heavy selling pressure on three sessions together may be sufficient to exhibit the pressure observed in a 90% downside day.

This has now been followed by two 90% upside days: on December 26th and again on 4th January.

The current situation looks very much like a major low has been found.

For the short term, price has found resistance at the 200 day moving average. Downwards movement here should be assumed to be another correction within an ongoing upwards trend until proven otherwise.

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The AD line has made yet another new high above the prior swing high of the week beginning 5th of November 2018, but price has not. This divergence is bullish for the mid term.

This week price moved mostly sideways and the AD line is flat. This is considered to exhibit no divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

There is now a cluster of bullish signals from the AD line. This supports the Elliott wave count.

Downwards movement still has support from declining market breadth.

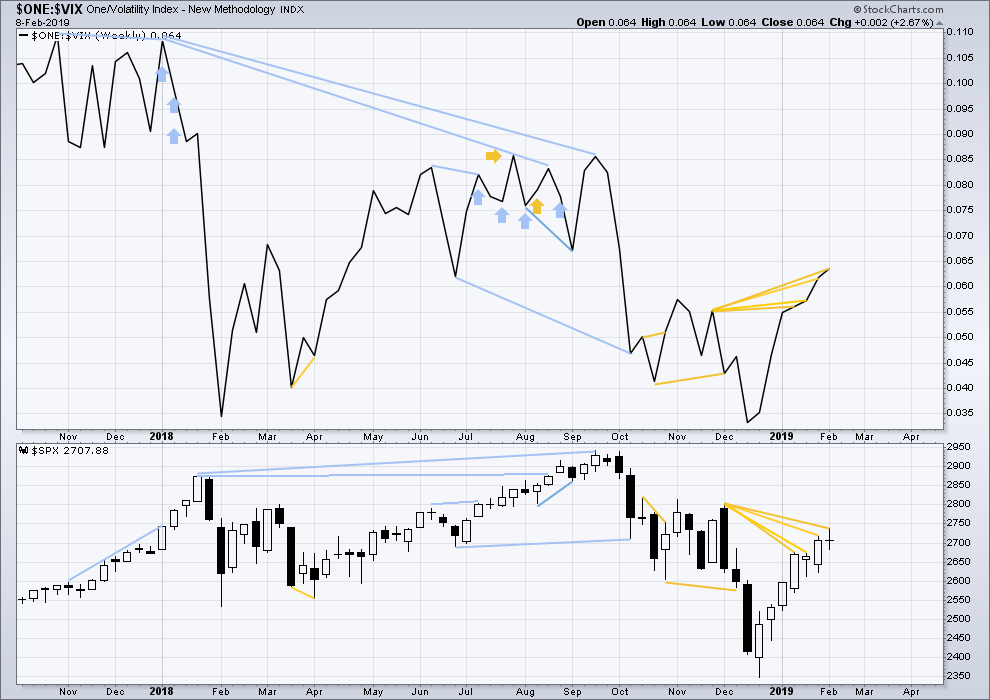

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Inverted VIX has made another new high above the prior swing high of the weeks beginning 26th of November and 3rd of December 2018, but price has not. This divergence is bullish for the mid term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

There is now a cluster of bullish signals from inverted VIX. This supports the Elliott wave count.

For the short term, price moved lower on Friday with a lower low and a lower high, but inverted VIX has moved higher. This divergence is bullish.

DOW THEORY

Dow Theory confirms a bear market. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

Published @ 10:53 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Minor 2 could be over at the high so far today. This is possible.

It is also possible that only minute a may be over at this high. So the invalidation point and risk needs to remain up at the start of minor wave 1.

A target is calculated for minor wave 3.

We never closed above the the 2/7 breakdown candle … bearish, right?

Prolonged price action around round number pivots tend to end badly for the bears. So far, the pivot is being defended. I certainly could be wrong, but I expect them to ramp it higher before the down-turn. They have lately been temporarily filling gaps up ahead of a subsequent ramp higher.

Tough market! 🙂

2700 at this point doesn’t seem overly relevant (or “indicative”). That level of 2737…oh yes, tons of historical resistance/support. But 2700…in the middle of the broader battle zone, criss-crossed multiple times. I note the hit and turn today at 2718, off the lower edge of the overhead gap, right at the 61.8%. That’s bearish, unless/until it gets taken out.

Look at ES 5 hour chart….

Looking at /ES 4 hour chart (w/o overnight data).

Trend shows as neutral. MACD bearish. 2700 is cross onece, twice, three times in last few weeks.

And today is a clean hit/turn off a 61.8% at 2719 or so.

Am I missing something?

Not much. Just a massive “Tree Shaking” to ensure no one is positioned for what comes next…. 🙂

Quite some divergence this morning between RUT and SPX/NDX.

Just for fun, below is a chart of the SPX relative to the NYSE AD Line over total issues set to a moving average. Note the negative divergences preceding the Jan-Feb 2018 decline and the end of Sept-Oct decline. Note the negative divergence today.

Yes Sir!

Awesome entry ust ahead mateys!

Roll out the cannons…! 🙂

I am assuming the bombardiers are wearing shorts……

Good eye Rodney! Cool chart and very nice correlation.

It’s Dueling Gaps today! One above, one below, price stuck in the middle…

G.M. Y’all

On Friday I put out this chart. I would like to update the target guidance. The circled level was achieved at a little after 4 AM today. It’s a level but the thinking that’s developing now is that it’s an intermediate level, not the minor 2 level.

With additional data that has printed since then, there is a higher target for minor 2. Don’t freak out because perfectly valid resistance levels will be broken in order to get there. The minor 2 targets are currently: ES target of 2731 and SPX target of 2730.40

If you are waiting for a long entry to enter the trade up to these short targets, that ship may have sailed. The focus now is on waiting for these short levels to trigger. Tight stops on these levels are recommended. The expectation is that these levels will be tagged, and the circuit will flip to selling mode.

Gold (GLD, monthly/weekly/daily/hour clockwise from top left) is in a precarious position, possibly ready to roll over in the top of a big E wave of a 78.6% level in an even bigger triangle. That’s a high leverage set up. Close available stops…nice triggers to the down side (starting with the trend line break, though entry there is clearly big time counter-trend and aggressively front running the anticipated move). I’m going to implement a scale in plan starting quite small and go from there and build a position if/as confirming signals keep rolling in.

If anyone would be interested/willing, I have a first draft article for submission to TASC ready on my visual trend indicator. Looking for constructive criticism, identification of typos, weak descriptions, whatever you find is less than stellar. Hit me at zinc1024 at the gmail place if interested and willing to provide the effort, thanks!

I’m happy to take a look. Sounds interesting. Send it to me Kevin. I’ll look at it later today.

I made some small (mostly grammatical) changes and sent it back.

I like what you’re doing there Kevin! Nicely done!

Some great observations guys!

Love the group and their focus and individual perspectives that helps gain a larger outlook..

The definition of shared conciousness … at work with the the intention to make the proper choice and allow people to feel good about their individual perspectives and give confidence to vehicle they choose to trade to profit from it…

After all… a large part of “winning “.. is choosing the right instrument.. with the right size .. with the right timing …

And this board is unparalleled in helping to slot those choices …

Led by the amazing Lara!

A few small hints that P2 has begun: on Friday even as the market rebounded at end of the day, Gold/USD/bonds were all up also. Seems like a risk off sentiment brewing.

Since the algos have not been doing full blown retracements for entries, a reasonable long entry for this trade would be the pullback to the 1 hour SMA (9) line. The index has been very “aware” of SMA (9).

We’re within sneezing distance of several short entry levels that have been mentioned. If the assumption that we are in minor wave 2 is correct, then the long move needs to end below 2738.98 (just repeating Lara). I love these kinds of trades that occur within a rule-limited range.

It was a big blast up late Friday from lows to highs, and if we’re in minor 2, that’s thrust up could have been the A wave. No matter what the structure is, there should be a B/X wave down at some point… your 1 hour SMA (9) line might be a good target for that, thanks for sharing.

It’s definitely unclear what structure minor 2 will form… it would seriously confuse a lot of people if it’s an expanded flat… I hope it turns out to be an easy to spot zig zag…

That’s the most likely structure. A zigzag.

Strong reversal signal on Friday

From this analysis; “Primary wave 2 may last about a Fibonacci 13, 21 or 34 sessions in total.”

There are 24 sessions until the March futures roll over date. If I get a vote, I would love to see the PW2 turn just about then.

I have to say I am a bit suspicious of this initial wave down. The reclaim of the 2700 pivot is a huge red flag for any immediate bearish count. How initial waves down at significant trend changes behave generally provide critical confirmation by how they trade around prior important pivots. A close above on Monday means we head back up in continuation of the prior trend in all likelihood.

Hey Verne,

I was skeptical about this also. There are so many good reasons for the trend to continue going up up up. There were 2 things that won me over. Lara’s analysis and Friday’s session. The entire SPX session yesterday occurred outside of the EW trend channel. In my mind, I’m convinced that this is a failure of the uptrend.

You could be right CM.

I initially thought we had an impulse down with an expanded flat up for a possible second wave but was a bit surprised by 2700 pivot penetration.

Keeping a close eye on the pivot shelf in ES, so far resistance from below.. If top not in, probably quite close…

I think you might be right after all Verne. I was reviewing the chart and minor 1 might have ended at Thursday’s lows. The low on Friday being the B wave of the expanded flat with an impulse up to finish the C wave of minor 2 the last part of Friday.

We might very well start minor 3 down Monday morning…

Either way as you said: the end of the impulse up wave from December lows feels to be very close any way looking at the set up.

Verne,

Very good point & also bid in this market has been incredible but the move down was clearly impulsive & importantly in 5 waves… also NQ had clear 5 waves down with 5 = 1, the only market i m not sure of is RUT, so definitely very interesting week coming up…

Also NQ finished it’s 5 waves down before ES, so I guess it will finish it’s second wave before as well, ie NQ leading it down, so keep an eye on as it could prvoide all the clues…

In my view if you can identify the market which is leading then you can remove a lot guess work but that’s the difficult part ?

ty for those observations HT.

I agree Verne. I’m really suspicious of it too.

When I look at it on my TA chart it really does look like just another little pullback of only a very few days, within an ongoing upwards trend.

Looking back for a historical analogue of the current situation. And guess what is most similar, by far? Yes, the super high momentum run up (like this one) to the 1/29/18 top, then the 1/30/18 gap down day. Which was followed by a 10% sell off on mega-momentum.

I’ve marked all the spots where I see gaps at/soon after significant swing highs, since the ATH on 1/29/18. I see 6 that were followed by “significant” downward price movement, and 3 that were not. #10 here is pending…

Mind the gap!

Great insight. Most of you who have been around awhile know my view of CB influence on market price. I have had some long exchanges with Prechter on the the thesis that “herd sentiment” ALWAYS drives market price. Ultimately, herd sentiment is irrelevant if they have no money. Further, if some other entity with more money than the herd AND a different sentiment than the herd is participating in the market, they will affect price. So we see waves are affected not only by sentiment, but more importantly by PRICE.

And Price is affected by BUYING POWER!

Think about it.

Gaps up represent big orders AT THE MARKET, on open.

I have always suspected they are LEVERAGED orders, and we know what that means. Interesting how often we see them at prior resistance. This is what undelies my thesis about important trend changes and price action around pivots.

When leveraged players with huge buying power (you-know- who) unwind, those pivots are taten out- decisively! Buying power controls price. Price determines the waves. Thosr with the most buying power will therefore control the immediate trend!

Astute observation. I think it was worth my rather long-winded explanation of why I think about gaps and support/resistance pivots the way I do.

#1 with a bullet! Take that all you wabbits.

I demand a rematch, Doc…!

+7 to ya, Rodney! (I sure am late to the party today!)