A very small range inside day sees the Elliott wave count slightly changed for the short term. A small triangle may be completing.

Summary: Risk of a pullback is elevated today. Primary wave 2 may begin this week or next. Upwards movement may now be limited to no more than a further 42 points.

A breach of the black Elliott channel and then a new low below 2,631.05 would indicate primary wave 2 has arrived.

The bigger picture still expects that a low may now be in place. The target is at 3,045 with a limit at 3,477.39.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

The monthly chart was last published here.

ELLIOTT WAVE COUNT

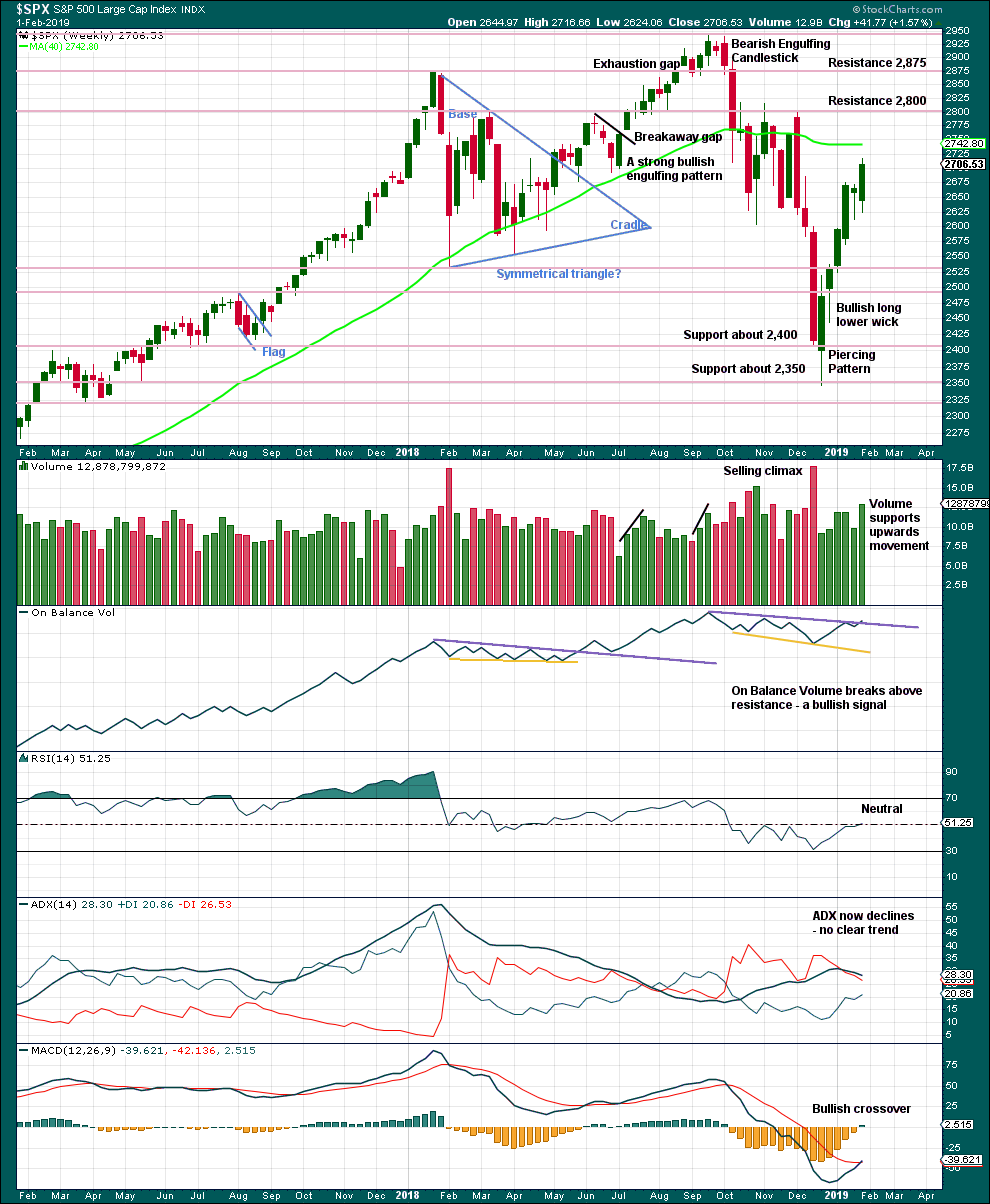

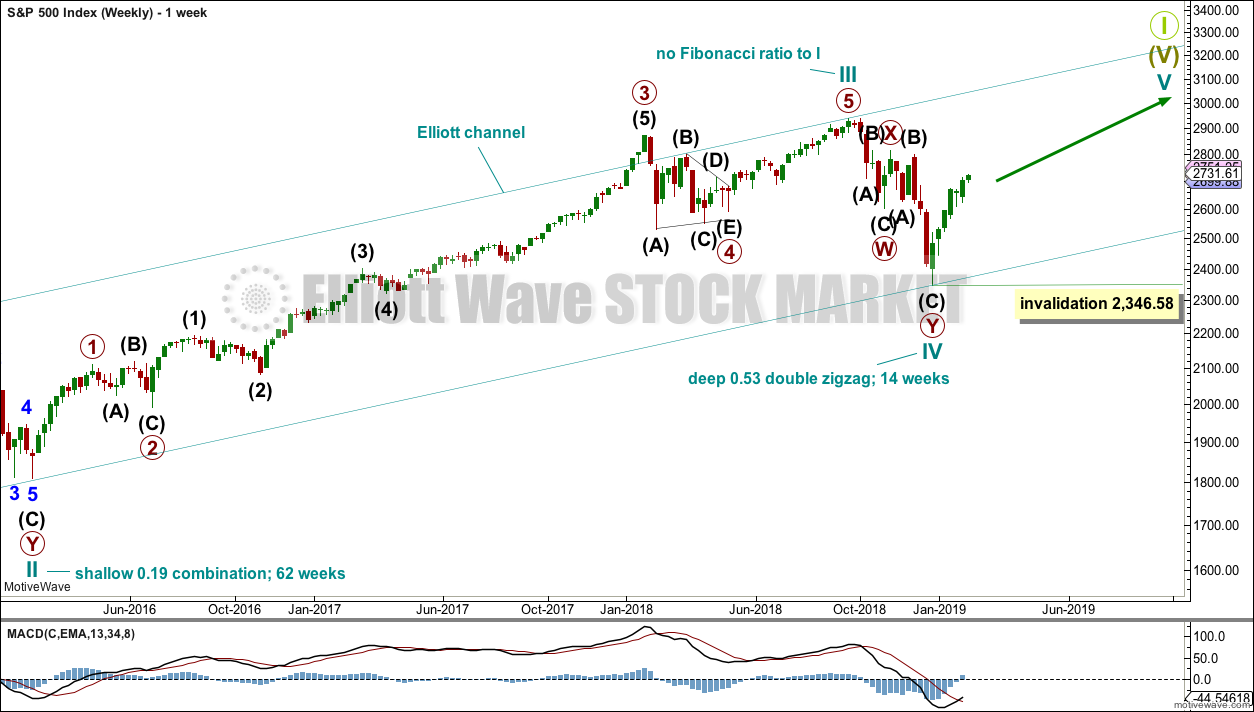

WEEKLY CHART

This weekly chart shows all of cycle waves III, IV and V so far.

Cycle wave II fits as a time consuming double combination: flat – X – zigzag. Combinations tend to be more time consuming corrective structures than zigzags. Cycle wave IV has completed as a multiple zigzag that should be expected to be more brief than cycle wave II.

Cycle wave IV may have ended at the lower edge of the Elliott channel.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Although both cycle waves II and IV are labelled W-X-Y, they are different corrective structures. There are two broad groups of Elliott wave corrective structures: the zigzag family, which are sharp corrections, and all the rest, which are sideways corrections. Multiple zigzags belong to the zigzag family and combinations belong to the sideways family. There is perfect alternation between the possible double zigzag of cycle wave IV and the combination of cycle wave II.

Although there is gross disproportion between the duration of cycle waves II and IV, the size of cycle wave IV in terms of price makes these two corrections look like they should be labelled at the same degree. Proportion is a function of either or both of price and time.

Draw the Elliott channel about Super Cycle wave (V) with the first trend line from the end of cycle wave I (at 2,079.46 on the week beginning 30th November 2014) to the high of cycle wave III, then place a parallel copy on the low of cycle wave II. Cycle wave V may find resistance about the upper edge.

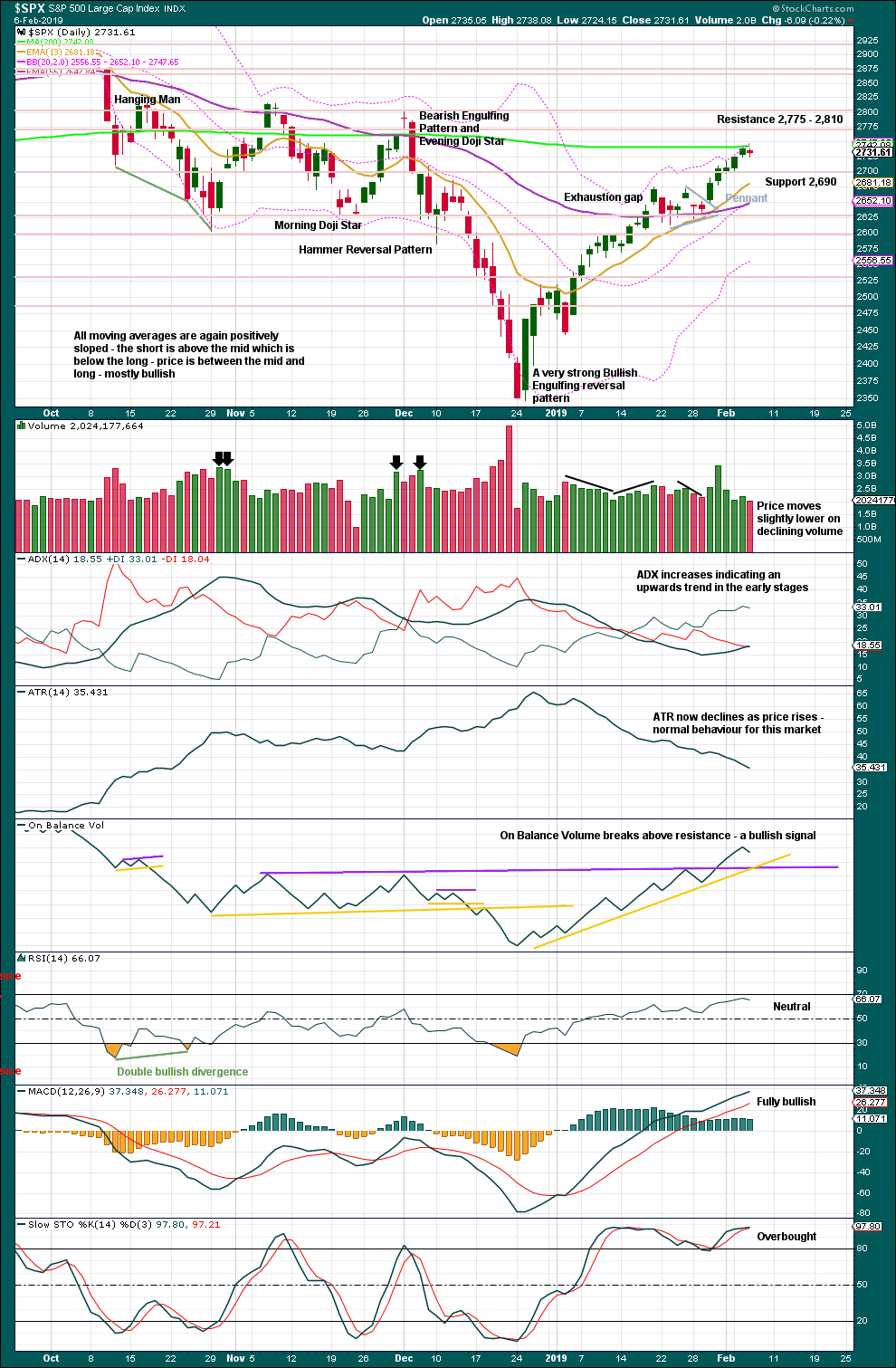

DAILY CHART

The daily chart will focus on the structure of cycle waves IV and V.

Cycle wave IV now looks like a complete double zigzag. This provides perfect alternation with the combination of cycle wave II. Double zigzags are fairly common corrective structures.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A target is calculated for cycle wave V to end prior to this point.

Cycle wave V must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common and that will be how it is labelled. A diagonal would be considered if overlapping suggests it.

Within the five wave structure for cycle wave V, primary wave 1 may be incomplete. A target is calculated for intermediate wave (5) to reach the most common Fibonacci ratio to intermediate wave (1).

Within cycle wave V, primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

Intermediate wave (5) begins at 2,631.05. While price remains within the black Elliott channel and above 2,631.05, assume the trend remains the same. If price breaks below the lower edge of the channel and then makes a new low below the start of intermediate wave (5), then that would indicate primary wave 1 should be over and primary wave 2 should have begun.

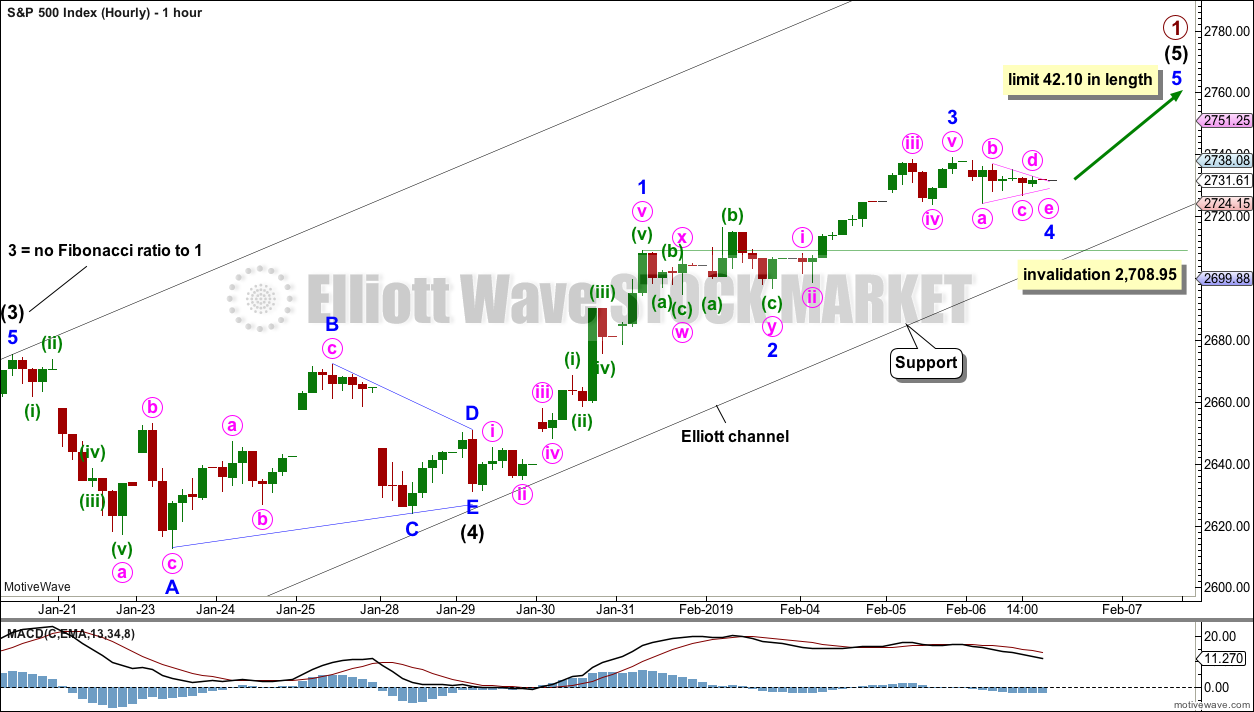

HOURLY CHART

The lower edge of this channel may continue to provide support for corrections within intermediate wave (5).

Intermediate wave (5) must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common, so that shall be how intermediate wave (5) is labelled. An ending diagonal will only be considered if overlapping begins to suggest it.

Within intermediate wave (5), minor waves 1, 2 and 3 may now be complete.

Minor wave 4 may be unfolding as a small Elliott wave triangle. This structure fits well on the five minute chart needing only a very small minute wave e downwards to complete it. However, minor wave 4 may yet morph into a different kind of corrective structure such as a combination. Flexibility is essential with Elliott wave triangles. The triangle will remain valid if price does not move below 2,727. Minute wave e may not move beyond the end of minute wave c.

Minor wave 4 may not move into minor wave 1 price territory below 2,708.95.

Assume the upwards trend remains while price remains within the black channel. Primary wave 1 should be considered over only if price breaks below the lower edge of the channel. At that stage, primary wave 2 may be underway.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

From the all time high to the low at the end of December 2018, price moved lower by 20.2% of market value meeting the definition for a bear market.

It should be noted that the large fall in price from May 2011 to October 2011 also met this definition of a bear market, yet it was only a very large pullback within a bull market, which so far has lasted almost 10 years.

Overall, volume supports upwards movement last week. There is plenty of room for price to rise further.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Over a fairly long period of time this ageing bull market has been characterised by upwards movement on light and declining volume and low ATR. For the short to mid term, little concern may be had if price now rises again on declining volume. Current market conditions have allowed for this during a sustained rise in price.

It is also normal for this market to have lower ATR during bullish phases, and strongly increasing ATR during bearish phases. Currently, declining ATR is normal and not of a concern.

Considering the larger picture from the Elliott wave count, some weakness approaching the end of Grand Super Cycle wave I is to be expected.

From Kirkpatrick and Dhalquist, “Technical Analysis” page 152:

“A 90% downside day occurs when on a particular day, the percentage of downside volume exceeds the total of upside and downside volume by 90% and the percentage of downside points exceeds the total of gained points and lost points by 90%. A 90% upside day occurs when both the upside volume and points gained are 90% of their respective totals”…

and “A major reversal is singled when an NPDD is followed by a 90% upside day or two 80% upside days back-to-back”.

The current situation saw two 80% downside days on December 20th and 21st, then a near 90% downside day with 88.97% downside on December 24th. This very heavy selling pressure on three sessions together may be sufficient to exhibit the pressure observed in a 90% downside day.

This has now been followed by two 90% upside days: on December 26th and again on 4th January.

The current situation looks very much like a major low has been found.

The target for upwards movement following the pennant pattern remains at 2,881.

Given current market conditions, declining volume and overbought Stochastics will not be given much weight; Stochastics may remain extreme for fairly long periods of time when this market trends.

Price is finding resistance here at the 200 day moving average. There is still room for this upwards trend to continue. Assume the trend remains the same until proven otherwise. At this stage, the risk of a pullback is heightened, but there is no technical evidence it has arrived yet.

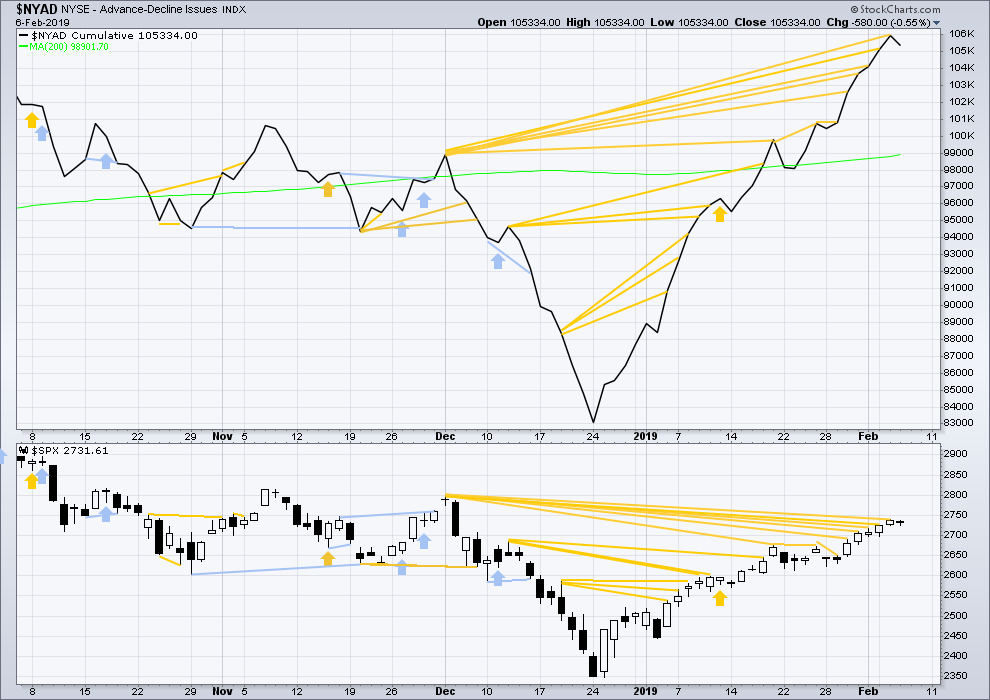

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The AD line has made yet another new high above the prior swing high of the week beginning 5th of November 2018, but price has not. This divergence is bullish for the mid term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

There is now a cluster of bullish signals from the AD line. This supports the Elliott wave count.

A little downwards movement within today’s session has support from declining market breadth.

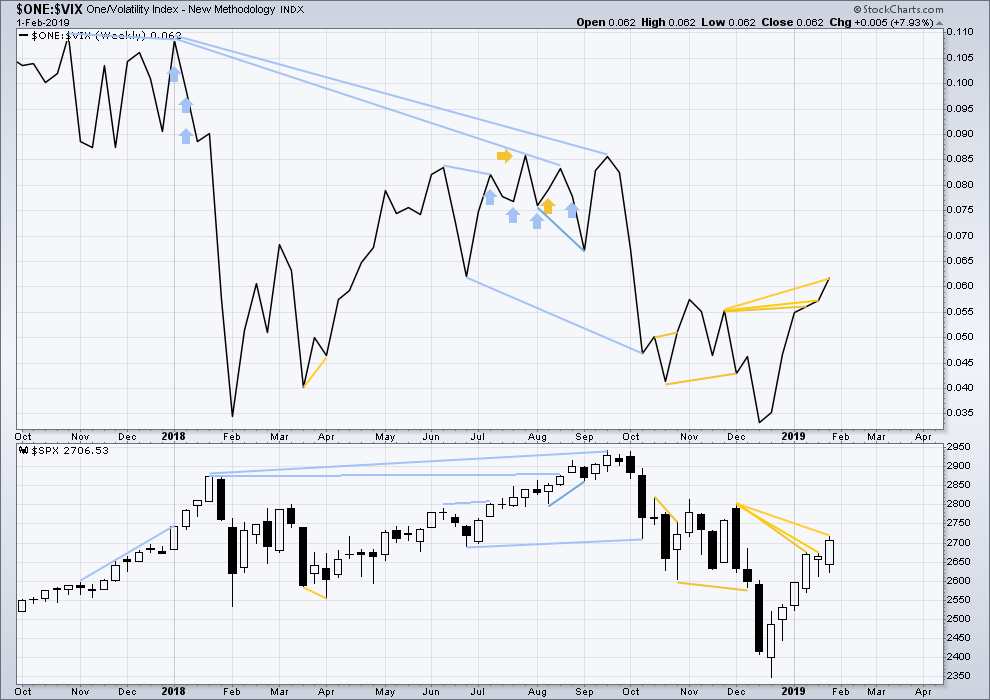

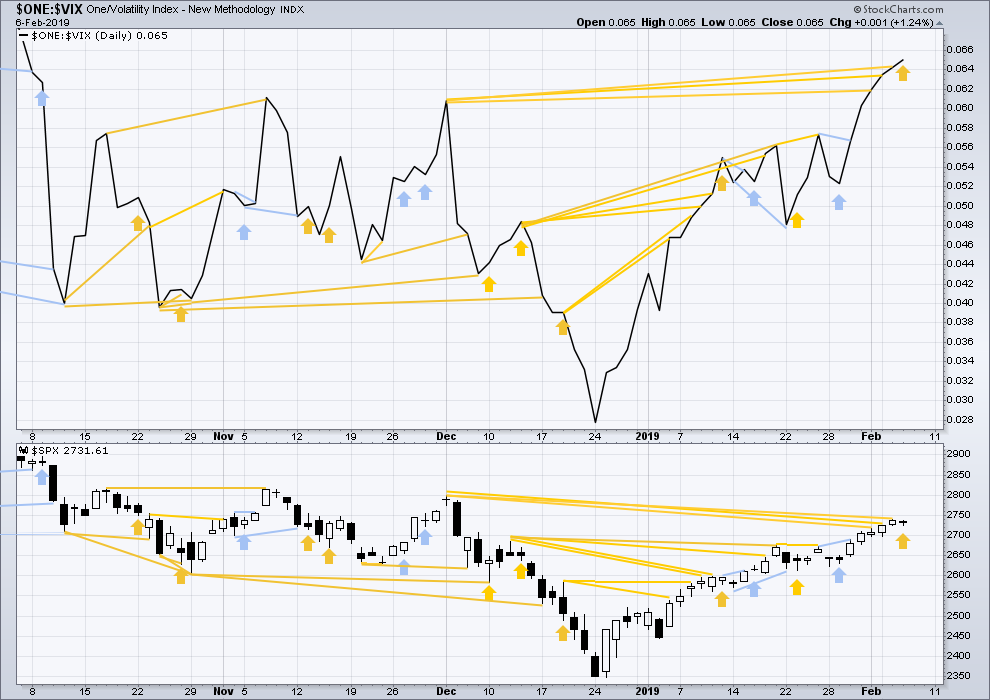

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Again last week, inverted VIX has made another new high above the prior swing high of the weeks beginning 26th of November and 3rd of December 2018, but price has not. This divergence is bullish for the mid term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

There is now a cluster of bullish signals from inverted VIX. This supports the Elliott wave count.

Today price moved lower within the session, but inverted VIX moved higher. This divergence is bullish for the short term.

DOW THEORY

Dow Theory confirms a bear market. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

Published @ 07:06 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Hourly chart updated:

I’m going to call Primary 2 as now just underway. The first target will be the 0.382 Fibonacci ratio at 2,579.84. If price keeps falling through that first target then the next target would be the 0.618 Fibonacci ratio at 2,490.77.

Primary 1 lasted 27 sessions. I’d expect primary 2 to last about the same, maybe. Give or take about 5 sessions either side.

A nice illustration of the danger of triangles. What looked like a nice little triangle for minor 4 yesterday now looks like it was a small series of first and second waves to the downside.

Yes indeed! Quite a few of the traders wanted to open a wider spread as we were sure the break would be upwards. The master Bryan insisted:

Keep the spread tight!!

I am SO glad we did.

As traders we never stop learning to ALWAYS LIMIT RISK!!

Position already nicely in the green due to our tight half point spread!

Lock and Load!! 🙂 🙂 🙂

A test from underneath of the EW channel line might occur here without violating the initial impulse structure down. I.e. the subminuette iv could push up further before we see more downward movement. Maybe even back up to the edge of that big gap overhead.

a battle to reclaim 2700?

i just made the bet it isn’t. upside risk, about 10 pts, downside opportunity…lots more!

got out BE…

starting to look like an A down of a zig zag is complete and the B up is in progress.

Agreed. I managed to grab a tiny profit on this bounce, but it’s looking messy. As in corrective. STS ES in place.

Absolutely!

They are naturally going to “shake the trees” on the channel break…

They will have CLOSE above the pivot and well as overcome the double rejection at the 200 day to change the immediate bearish prospects imho…

Haven’t seen a large strong down trend hour like this since very early January in SPX.

The white line is the lower expected move level for the week.

both SPX and RUT showing signs of stalling/turning (for a bit) off 38.2% fibos (2691 and 1494).

Hourly count invalidated by a hair. But enough.

…and there goes the Elliott channel.

The last two times SPX approached the 200 day ma it was from below like we are now. Each of those times, it gapped above the 200 day ma only to surrender and fall below it one or three days later. Today we are going to open with a gap down.

The question is, are we still in Minor 4 of Intermediate 5 of Primary 1, or has Primary 2 begun? I don’t pretend to know the answer. But I do think we are within days of the top of Primary 1 as Lara has indicated in her summary commentary. Watch the lower channel line on the hourly chart for a break. I am looking for a low of Primary 2 around 2550. But it can go all the way down to 2400 and a bit below without invalidating the count.

The next good set up to go long will come at the end of Primary 2 as we enter a Primary 3 up. If you would like to do some trading between now and then, now is the time to put on your shorts and go for a run.

Have a great day.

Hi Rod. Hope the shoulder is healing beautifully bud! 🙂

Looks like might have reached end of Primary 1?