Again, upwards movement has continued exactly as last analysis expected. The Elliott wave count has support from classic technical analysis.

Summary: The target for more upwards movement is at 2,804 (Elliott wave) or 2,881 (classic analysis).

At about one of these targets a large pullback for a second wave at primary degree may begin.

For the short term, a breach of the black Elliott channel and then a new low below 2,631.05 would indicate a bigger pullback has arrived.

The bigger picture still expects that a low may now be in place. The target is at 3,045 with a limit at 3,477.39.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

The monthly chart was last published here.

ELLIOTT WAVE COUNT

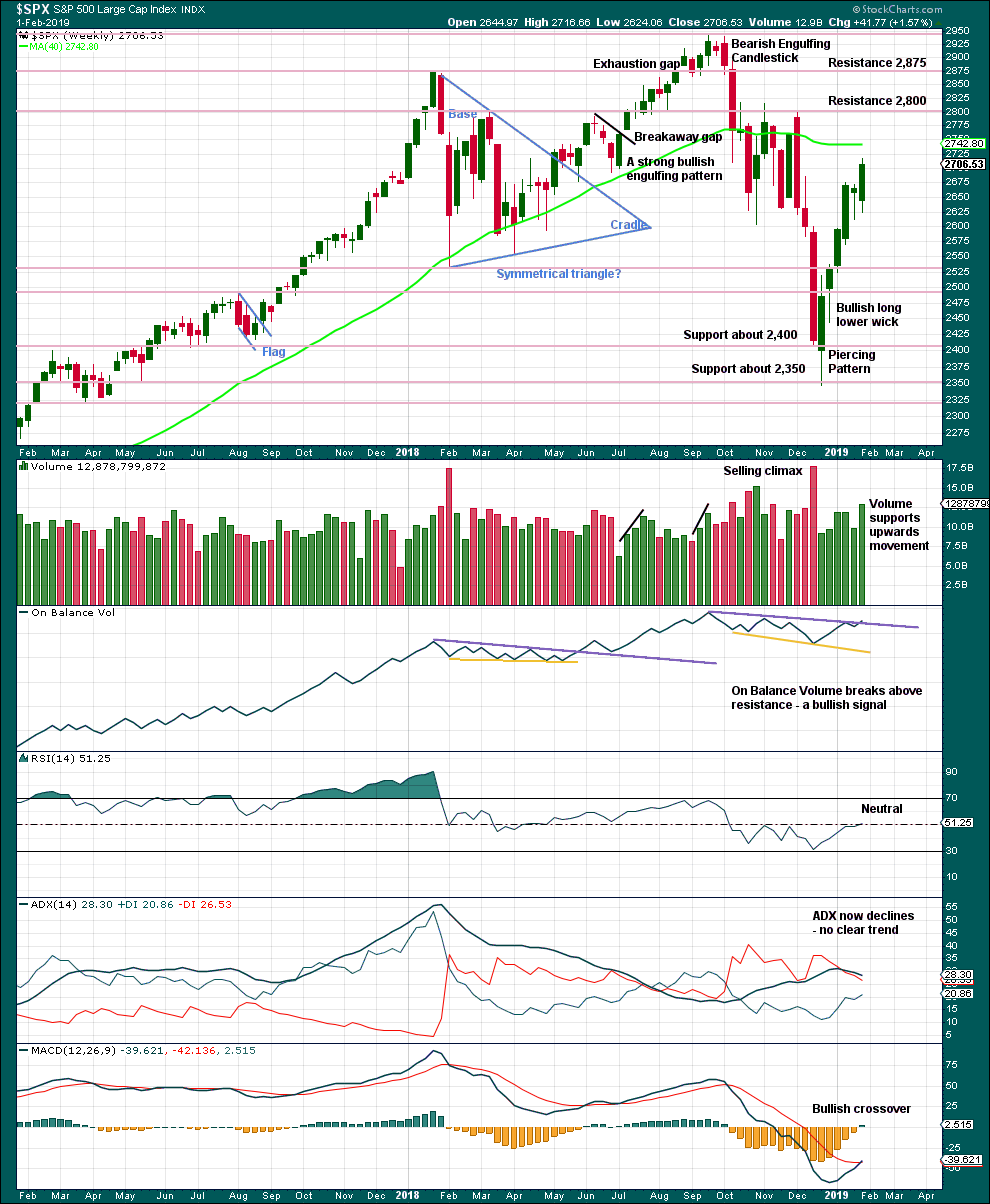

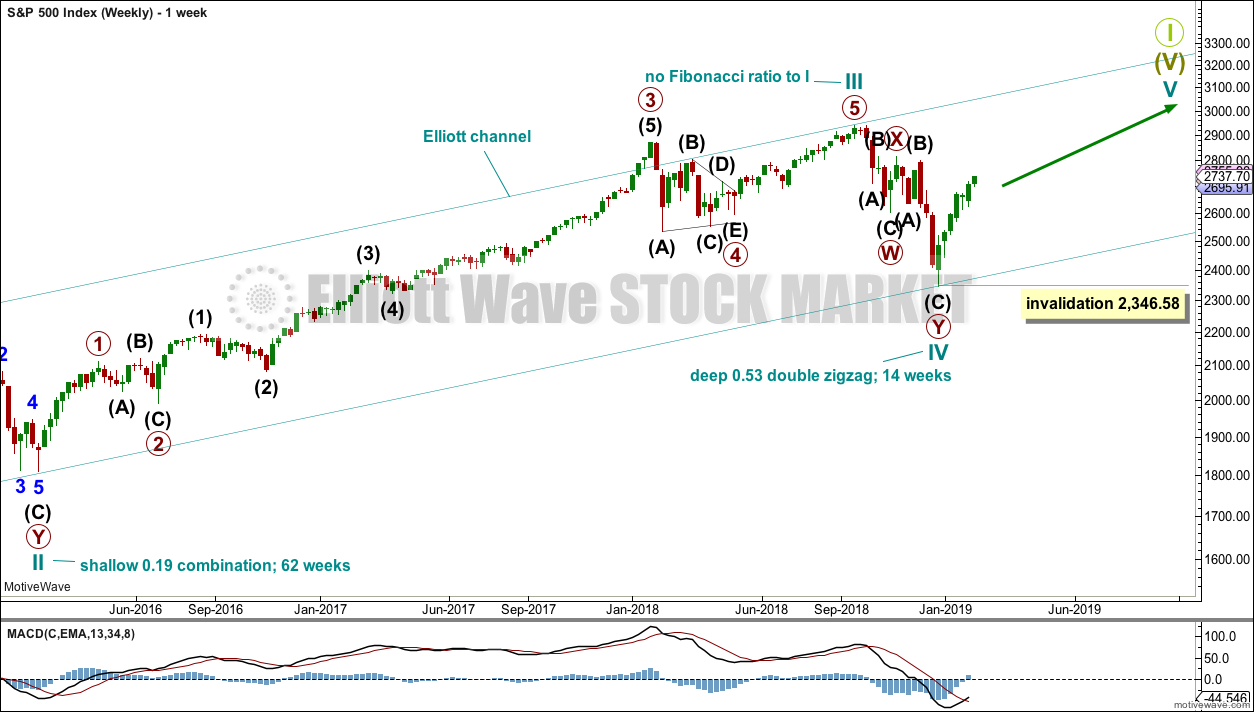

WEEKLY CHART

This weekly chart shows all of cycle waves III, IV and V so far.

Cycle wave II fits as a time consuming double combination: flat – X – zigzag. Combinations tend to be more time consuming corrective structures than zigzags. Cycle wave IV has completed as a multiple zigzag that should be expected to be more brief than cycle wave II.

Cycle wave IV may have ended at the lower edge of the Elliott channel.

Within cycle wave V, no second wave correction may move beyond the start of its first wave below 2,346.58.

Although both cycle waves II and IV are labelled W-X-Y, they are different corrective structures. There are two broad groups of Elliott wave corrective structures: the zigzag family, which are sharp corrections, and all the rest, which are sideways corrections. Multiple zigzags belong to the zigzag family and combinations belong to the sideways family. There is perfect alternation between the possible double zigzag of cycle wave IV and the combination of cycle wave II.

Although there is gross disproportion between the duration of cycle waves II and IV, the size of cycle wave IV in terms of price makes these two corrections look like they should be labelled at the same degree. Proportion is a function of either or both of price and time.

Draw the Elliott channel about Super Cycle wave (V) with the first trend line from the end of cycle wave I (at 2,079.46 on the week beginning 30th November 2014) to the high of cycle wave III, then place a parallel copy on the low of cycle wave II. Cycle wave V may find resistance about the upper edge.

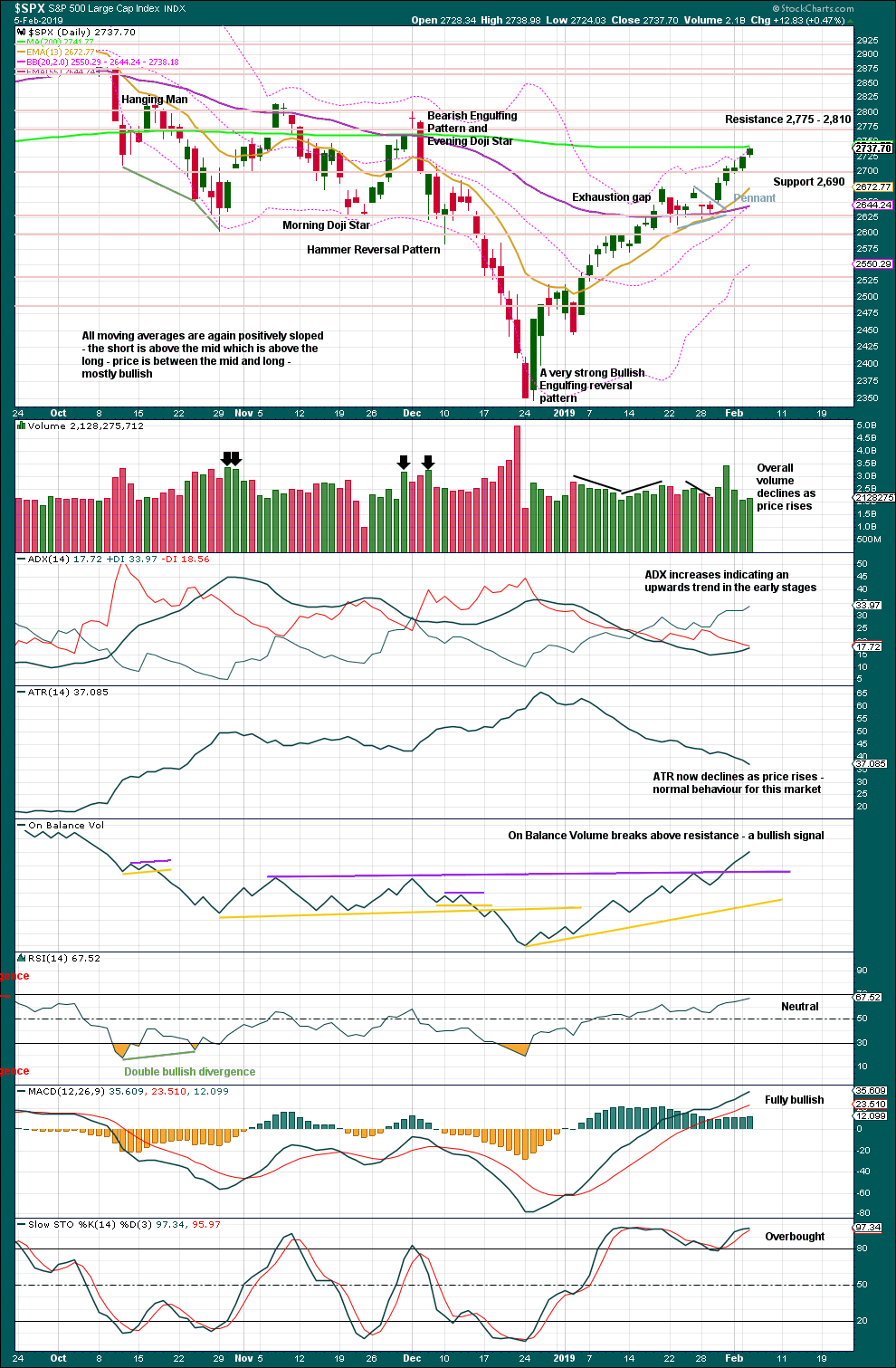

DAILY CHART

The daily chart will focus on the structure of cycle waves IV and V.

Cycle wave IV now looks like a complete double zigzag. This provides perfect alternation with the combination of cycle wave II. Double zigzags are fairly common corrective structures.

Within Super Cycle wave (V), cycle wave III may not be the shortest actionary wave. Because cycle wave III is shorter than cycle wave I, this limits cycle wave V to no longer than equality in length with cycle wave III at 3,477.39. A target is calculated for cycle wave V to end prior to this point.

Cycle wave V must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common and that will be how it is labelled. A diagonal would be considered if overlapping suggests it.

Within the five wave structure for cycle wave V, primary wave 1 may be incomplete. A target is calculated for intermediate wave (5) to reach the most common Fibonacci ratio to intermediate wave (1).

Within cycle wave V, primary wave 2 may not move beyond the start of primary wave 1 below 2,346.58.

Intermediate wave (5) begins at 2,631.05. While price remains within the black Elliott channel and above 2,631.05, assume the trend remains the same. If price breaks below the lower edge of the channel and then makes a new low below the start of intermediate wave (5), then that would indicate primary wave 1 should be over and primary wave 2 should have begun.

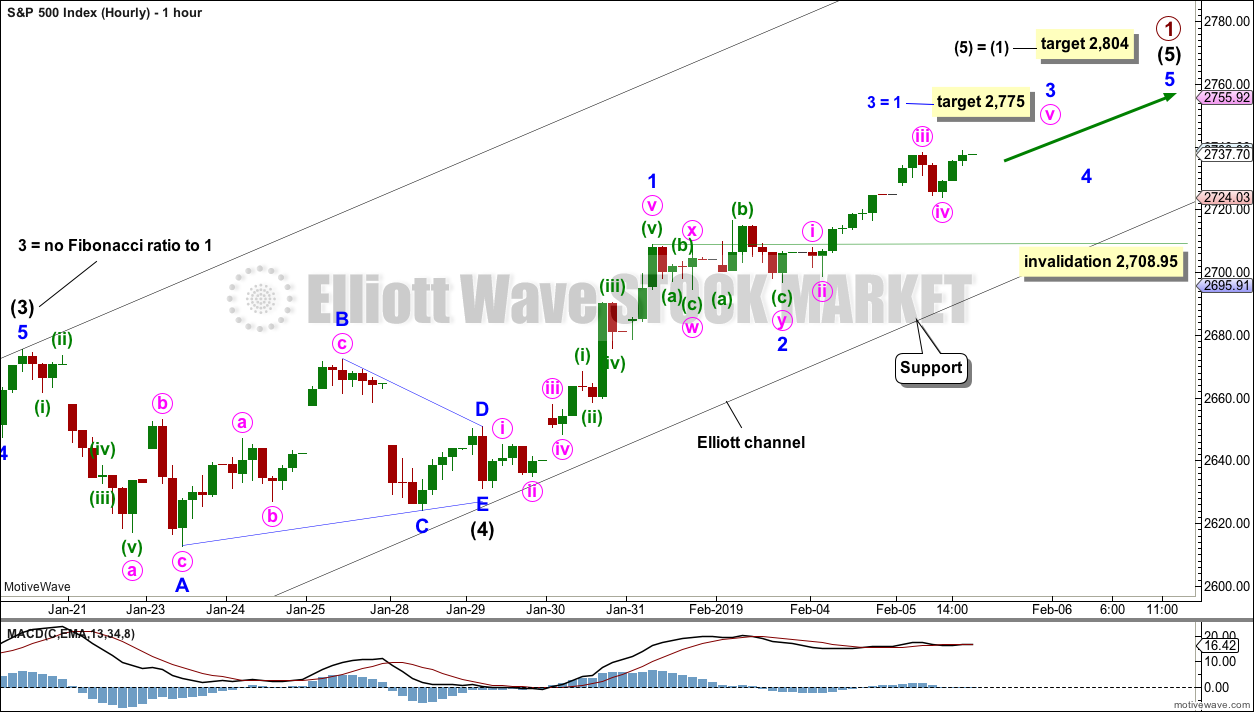

HOURLY CHART

The lower edge of this channel may continue to provide support for corrections within intermediate wave (5).

Intermediate wave (5) must subdivide as a five wave motive structure, either an impulse or an ending diagonal. An impulse is much more common, so that shall be how intermediate wave (5) is labelled. An ending diagonal will only be considered if overlapping begins to suggest it.

Within intermediate wave (5), minor waves 1 and 2 may now be complete. Minor wave 3 may be complete at today’s high, or it may be close to completion. A target is added for a possible end to minor wave 3.

When minor wave 3 is complete, then minor wave 4 may not move into minor wave 1 price territory below 2,708.95.

Assume the upwards trend remains while price remains within the black channel. Primary wave 1 should be considered over only if price breaks below the lower edge of the channel. At that stage, primary wave 2 may be underway.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of et=”_blank”>StockCharts.com.

From the all time high to the low at the end of December 2018, price moved lower by 20.2% of market value meeting the definition for a bear market.

It should be noted that the large fall in price from May 2011 to October 2011 also met this definition of a bear market, yet it was only a very large pullback within a bull market, which so far has lasted almost 10 years.

Overall, volume supports upwards movement last week. There is plenty of room for price to rise further.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Over a fairly long period of time this ageing bull market has been characterised by upwards movement on light and declining volume and low ATR. For the short to mid term, little concern may be had if price now rises again on declining volume. Current market conditions have allowed for this during a sustained rise in price.

It is also normal for this market to have lower ATR during bullish phases, and strongly increasing ATR during bearish phases. Currently, declining ATR is normal and not of a concern.

Considering the larger picture from the Elliott wave count, some weakness approaching the end of Grand Super Cycle wave I is to be expected.

From Kirkpatrick and Dhalquist, “Technical Analysis” page 152:

“A 90% downside day occurs when on a particular day, the percentage of downside volume exceeds the total of upside and downside volume by 90% and the percentage of downside points exceeds the total of gained points and lost points by 90%. A 90% upside day occurs when both the upside volume and points gained are 90% of their respective totals”…

and “A major reversal is singled when an NPDD is followed by a 90% upside day or two 80% upside days back-to-back”.

The current situation saw two 80% downside days on December 20th and 21st, then a near 90% downside day with 88.97% downside on December 24th. This very heavy selling pressure on three sessions together may be sufficient to exhibit the pressure observed in a 90% downside day.

This has now been followed by two 90% upside days: on December 26th and again on 4th January.

The current situation looks very much like a major low has been found.

The target for upwards movement following the pennant pattern remains at 2,881.

Given current market conditions, declining volume and overbought Stochastics will not be given much weight; Stochastics may remain extreme for fairly long periods of time when this market trends.

There is now a little sign of internal weakness with Lowry’s data showing up volume declined from 70% of total volume on Monday to 60% today.

There is an upwards trend in place, and there is room for it to continue further before it becomes extreme.

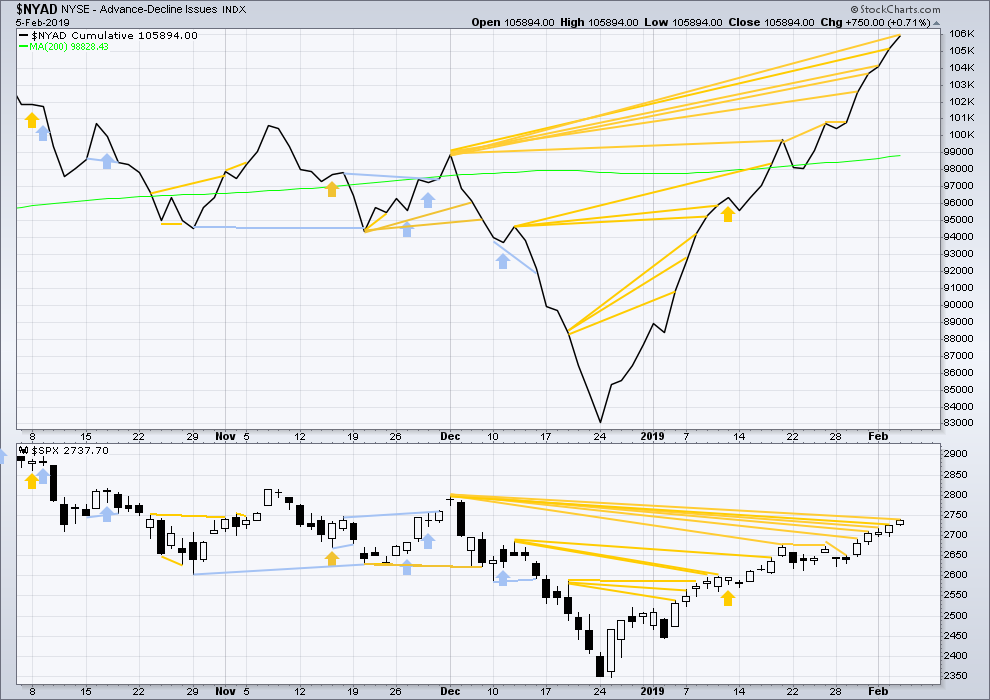

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

The AD line has made yet another new high above the prior swing high of the week beginning 5th of November 2018, but price has not. This divergence is bullish for the mid term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Breadth should be read as a leading indicator.

There is now a cluster of bullish signals from the AD line. This supports the main Elliott wave count.

The AD line continues to make new highs above the prior high of the 3rd of December 2018, but price has not yet matched this high. This divergence is bullish for the mid term.

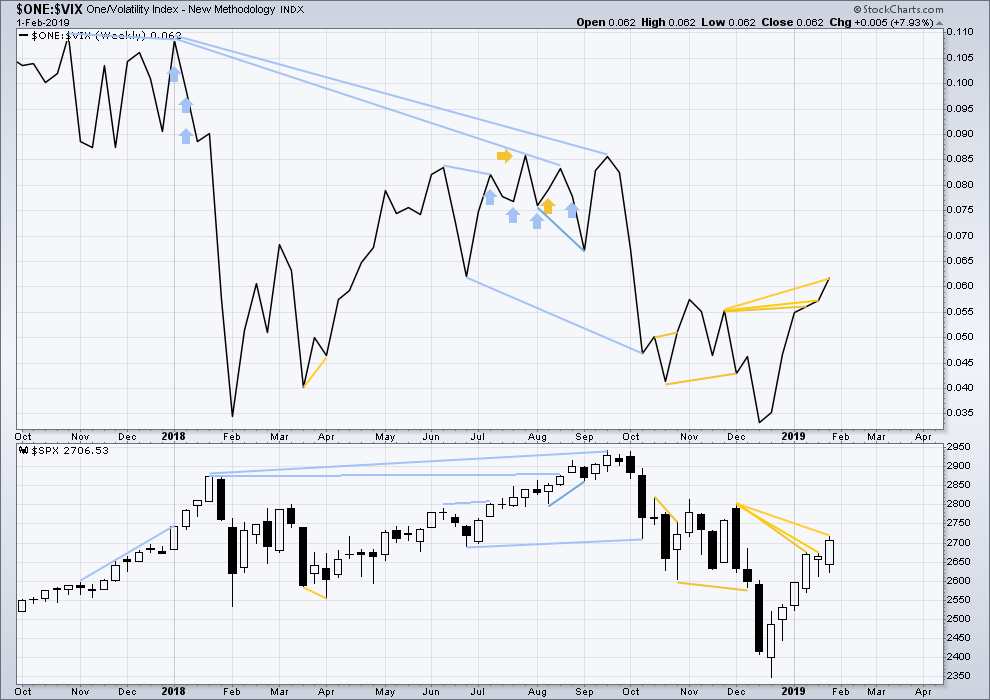

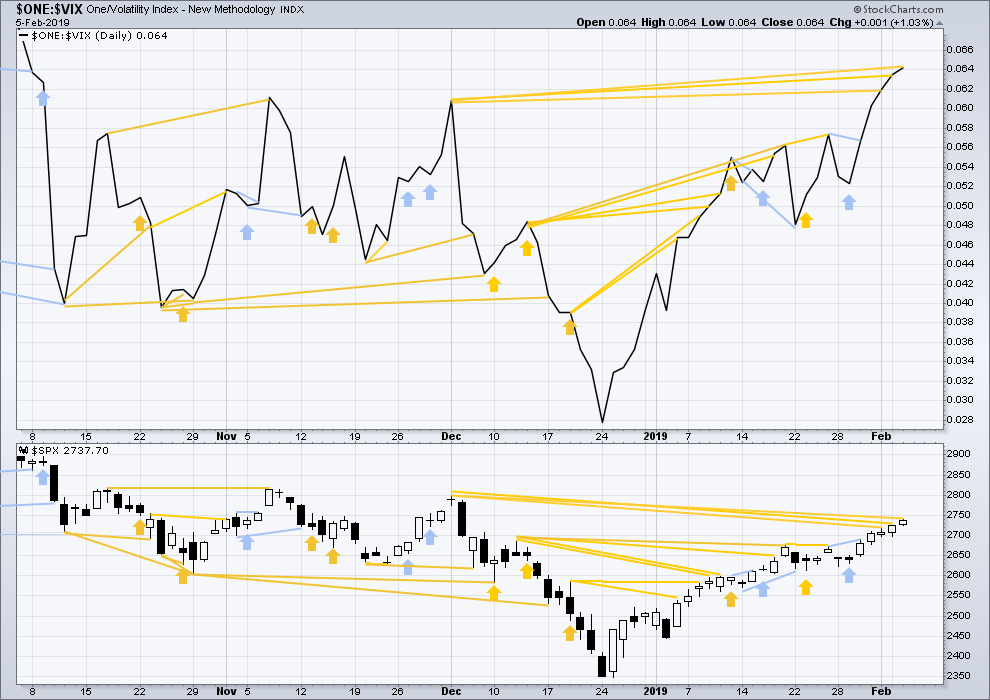

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Again last week, inverted VIX has made another new high above the prior swing high of the weeks beginning 26th of November and 3rd of December 2018, but price has not. This divergence is bullish for the mid term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

There is now a cluster of bullish signals from inverted VIX. This supports the main Elliott wave count.

Inverted VIX made another new high above the prior swing high of the 3rd of December, but price has not yet made a corresponding new high. This divergence is bullish for the mid term.

DOW THEORY

Dow Theory confirms a bear market. This does not necessarily mean a bear market at Grand Super Cycle degree though; Dow Theory makes no comment on Elliott wave counts. On the 25th of August 2015 Dow Theory also confirmed a bear market. The Elliott wave count sees that as part of cycle wave II. After Dow Theory confirmation of a bear market in August 2015, price went on to make new all time highs and the bull market continued.

DJIA: 23,344.52 – a close on the 19th of December at 23,284.97 confirms a bear market.

DJT: 9,806.79 – price has closed below this point on the 13th of December.

S&P500: 2,532.69 – a close on the 19th of December at 2,506.96 provides support to a bear market conclusion.

Nasdaq: 6,630.67 – a close on the 19th of December at 6,618.86 provides support to a bear market conclusion.

Published @ 07:43 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Updated hourly chart:

If this relabelling of minor 3 as over is correct, then minor 3 is shorter than minor 1. This limits minor 5 to no longer than equality in length with minor 3 at 42.10 points so that minor 3 is not the shortest wave.

For that reason the target is removed, it would be too high.

Primary 1 may be over sooner.

Lol!

You are the best triangle spotter on the planet! 🙂

So true, so true. This triangle stops being a triangle at 8:45 tonight (EST). We should get a breakout sometime in the next four hours.

PS — the 2729.36 line is the middle of the triangle

Yep! We are trading the anticipated move with a massive bull put credit spread on SPY of 271.5/272 strikes. Plan is to exit short leg at break even or any CLOSE below SPX 2700 or gap below, ( expiration Monday Feb 11) or break-even whichever comes first. Good luck everyone! 🙂

Tricky 4th waves, doing their thing again. It seems like a triangle to me… both SPX and VIX down today. That to me pointing to higher prices. But it does have a topping feel to it, doesn’t it?

Anyone looking into nibbling natural gas? Possible bottom forming. I usually avoid this since it’s so volatile, but looks like it’s forming a bottom. However prices can meander here for a while…

/NG…talk about a falling knife!

Big NYTimes article a day or two ago on the Permian basin oil fracking industry. Now considered the largest oil field in the world (larger than the largest Saudi field) and a huge driver the oil glut, with rapidly increasing production expected. Fundamentals appear strongly supportive of Lara’s oil EW call that a huge bear market in oil is coming. So while /NG at 2.6 or so seems low…it may not be in the future.

on the SPX 5 minute I see a flat, then an X wave up, and now perhaps a zig-zag down with the C down in progress…so a combination iv? Maybe.

that’s what I see too

ED …. not to be confused with erectile dysfunction

At the moment, it looks more like the minute 4 continued as a flat, and perhaps is now over. But the situation is highly fluid and changeable at the moment. If price gets back above 2739, a flat minute 4 would be my call.

funny lesson, my SPXL position stop got hit at yesterdays lows…. leveraged vehicle

good news ….. SPY calls are still rocking!

I’m expecting RUT to get down to below 1490, a down move of roughly the same size as the 3 largest retraces through the entire up move off the Dec lows (“bearish symmetry”). IF it cracks the trend line of the entire up move, which is right now at about 1510.

this (hourly). white lines down are the symmetric projections of prior retraces.

Added pretty heavy to my gm short @ 40.60

Don’t like it on the gap open break above the 61.8%, myself. I won’t short this now unless/until I see a significant reversal and a break below the low of Monday, at least.

I’m with you on that

I find that sometimes on these fundamenatlly challenged companies… going into a questionable cycle ..

That have had a real nice run and are overbought going into earnings …

That those type final pops are a great place to hit them…

I went for a quick hit to cost average my initial leg

And can now be a little more discerning about the trading shirts above 40$

Covered them at 39.85

Now feel much better about my first leg in at 39.10.. will hold those and trade above

Great trade!

GM is going to zero.

A friend up North said Barra was up there recently and canned 90% of workers, including management, in one of their biggest plants…

Thanks Verne

In this world of computer trading I love it when fundamentally challenged manufacturing companies are bought up strong on short squeezes and overall bullish trends

Those last “pops “are nice set ups

I’m not covering my shorts that I set a little above 39 for quite a while

I will trade shorts above that if I get another chance

Thanks for your input on this last push to the 200 day…

Markets at critical levels.

We are overbought in a rising wedge pattern and facing the all-important 200 day SMA pivot…a time for very tight stops on long trades imho…

Couldn’t agree more, the market is stretched. Watch out for the minor 4 starting when price gets around the 2746.5 level, which is both the 200 sma (2744 I have it to be more precise) and the expected move price level for the week.