A test of support about 2,912 was expected to begin the new trading week, which is exactly what has happened.

Summary: Upwards movement is expected to resume tomorrow. The short term target for the next pullback to arrive is about 2,957. The invalidation point is at 2,908.30; but support at the last gap may remain at 2,912.36, so price is not expected to get as low as the invalidation point.

The structure of minor wave 5 is incomplete. The target remains a small zone from 3,041 (Elliott wave) to 3,045 (classic analysis).

Members are advised now that bearish signals do not necessarily mean price must turn here; some bearishness may be expected to begin to develop and strengthen before primary wave 3 finds its end.

Gaps may be used to pull up stops; stops may now be pulled up to just below 2,912.36.

The final target for this bull market to end remains at 3,616, which may be met in October 2019.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

At this stage, the expectation is for the final target to me met in October 2019. If price gets up to this target and either the structure is incomplete or price keeps rising through it, then a new higher target would be calculated.

DAILY CHART

Intermediate wave (5) avoided a truncation now that it has a new high above the end of intermediate wave (3) at 2,872.87.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). Intermediate wave (5) has passed equality in length and 1.618 the length of intermediate wave (1). The next Fibonacci ratio in the sequence is 2.618 giving a target at 3,124. If the target at 3,045 is met and passed, then this would be the next calculated target.

A target for intermediate wave (5) to end is calculated at minor degree. Because this target is so close to the classic analysis target at 3,045, it does have a reasonable probability.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 through to 4 may now all be complete.

Within intermediate wave (5), minor wave 3 was extended and now minor wave 5 looks to be extending. When impulses extend, they show their subdivisions at higher time frames; within minor wave 5, now minute wave ii is clearly visible at the daily chart level. When minute wave iv arrives, it too may last a few days and show up on the daily chart.

Minute wave iii must subdivide as an impulse. It now looks like within it minuette waves (ii) and (iv) are showing up here on the daily chart; this is a typical look for a third wave.

If the degree of labelling within minute wave iii is moved down one degree, then no second wave correction may move beyond its start below 2,864.12.

HOURLY CHART

Within minor wave 5, minute waves i and ii may now be complete. Minute wave iii may only subdivide as an impulse.

Within minute wave iii, minuette waves (i) through to (iv) may now be complete. It is also possible that minuette wave (iv) may continue sideways for another couple of days as a triangle, flat or combination.

Minuette wave (iii) exhibits no Fibonacci ratio to minuette wave (i), but it is longer than minuette wave (i). A target is calculated for minuette wave (v) to exhibit the most common Fibonacci ratio to minuette wave (i).

Minuette wave (iv) may not move into minuette wave (i) price territory below 2,908.30.

TECHNICAL ANALYSIS

WEEKLY CHART

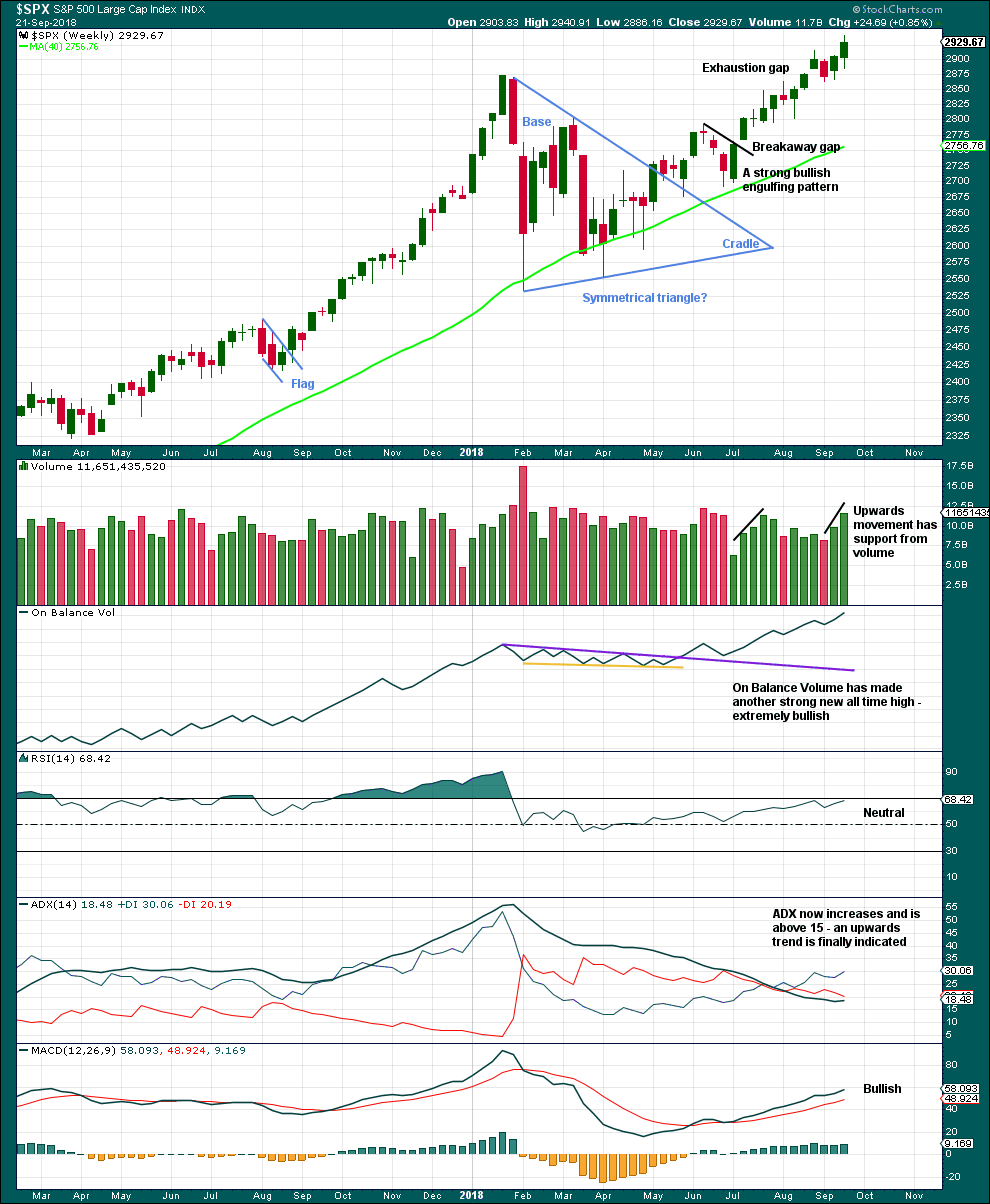

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is very close to the new Elliott wave target at 3,041.

This chart is completely bullish. RSI is not yet overbought, so there is room for price to rise.

DAILY CHART

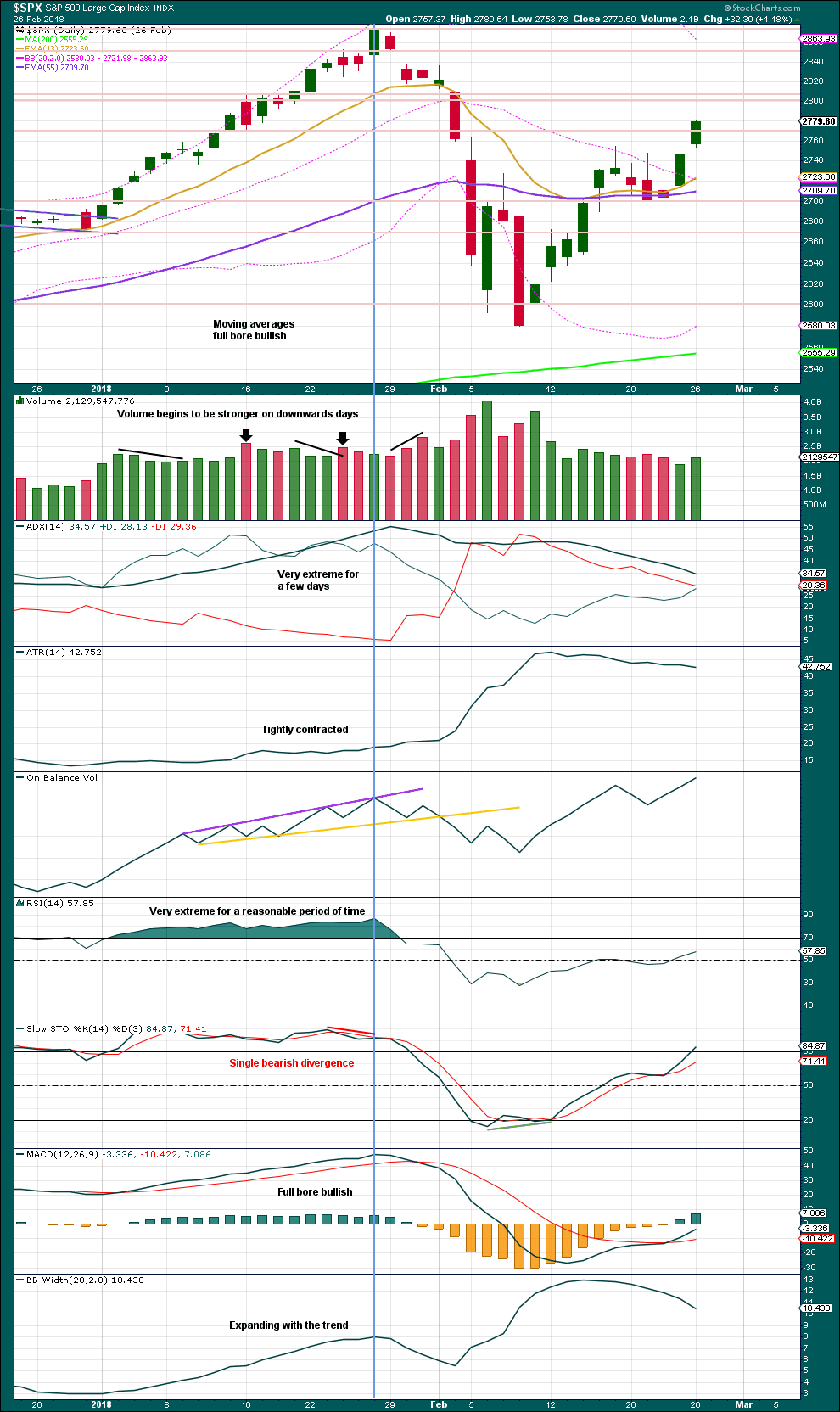

Click chart to enlarge. Chart courtesy of StockCharts.com.

Use the breakaway gap to pull up stops for long positions.

The breakaway gap has its lower edge at 2,012.36. The low for today’s session at 2,912.63 leaves this gap open. If this is a breakaway gap, then it should not be closed and should provide support. So far this downwards day looks like a typical test of support at prior resistance. It would now be typical for price to move up and away.

A new support line is drawn on On Balance Volume. This line has three tests: two prior to being breached and test of support after resistance was broken. This line has small technical significance; it may assist to halt the fall in price here.

The trend remains the same until proven otherwise. The trend at this time is clearly upwards. The target has not yet been met.

At this stage, this chart is mostly bullish even with bearish divergence still present between price and RSI and Stochastics. However, RSI is not extreme and ADX is not extreme. While the breakaway gap remains open, it would be safest to assume the upwards trend remains intact.

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

At this time, there is mid term bearish divergence between price and inverted VIX: price has made another new all time high, but inverted VIX has not. This divergence may persist for some time. It may remain at the end of primary wave 3, and may develop further to the end of primary wave 5.

Upwards movement in price has support last week from a normal corresponding decline in market volatility. There is no new short term divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is mid term divergence with a new all time high from price not supported by a corresponding new all time high from inverted VIX. This divergence is bearish.

The fall in price today has a normal corresponding increase in market volatility. There is no new short term divergence; volatility has not increased beyond recent peaks.

Mid term bearish divergence between price and inverted VIX can be seen on both daily and weekly charts now. However, this may not be a good timing tool in identifying the end of primary wave 3; divergence may develop further before primary wave 3 ends.

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

Price has made a new all time high last week, but it does not have support from rising market breadth. There is now short term bearish divergence at the weekly chart level between price and the AD line. It is possible now that the end of primary wave 3 is quite close.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line on the 29th of August means that the beginning of any bear market may be at the end of December 2018, but it may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

Price has now made new all time highs last week, but the AD line has not. There is now short / mid term divergence at the daily chart level; this is bearish, and it may develop further before primary wave 3 comes to an end.

For the short term, the fall in price today has support from declining market breadth. The AD line is about even with the prior swing low of the 17th of September (it is very slightly above this point). Price is above its equivalent point. There is no short term divergence.

All of small, mid and large caps made new all time highs on the 27th of August. There is a little divergence here in breadth with large caps continuing to make new all time today and small and mid caps lagging.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Nasdaq and DJT and now the S&P500 have all made recent new all time highs.

At the end of last week, DJIA has now also made a new all time high. This provides Dow Theory confirmation that the bull market continues.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

ANALYSIS OF THE END OF INTERMEDIATE WAVE (3)

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart looked overly bullish at the end of intermediate wave (3). The only warning in hindsight may have been from volume spiking slightly on downwards days. There was no bearish divergence between price and either of RSI or On Balance Volume.

Single bearish divergence between price and Stochastics was weak, which is often an unreliable signal.

VIX

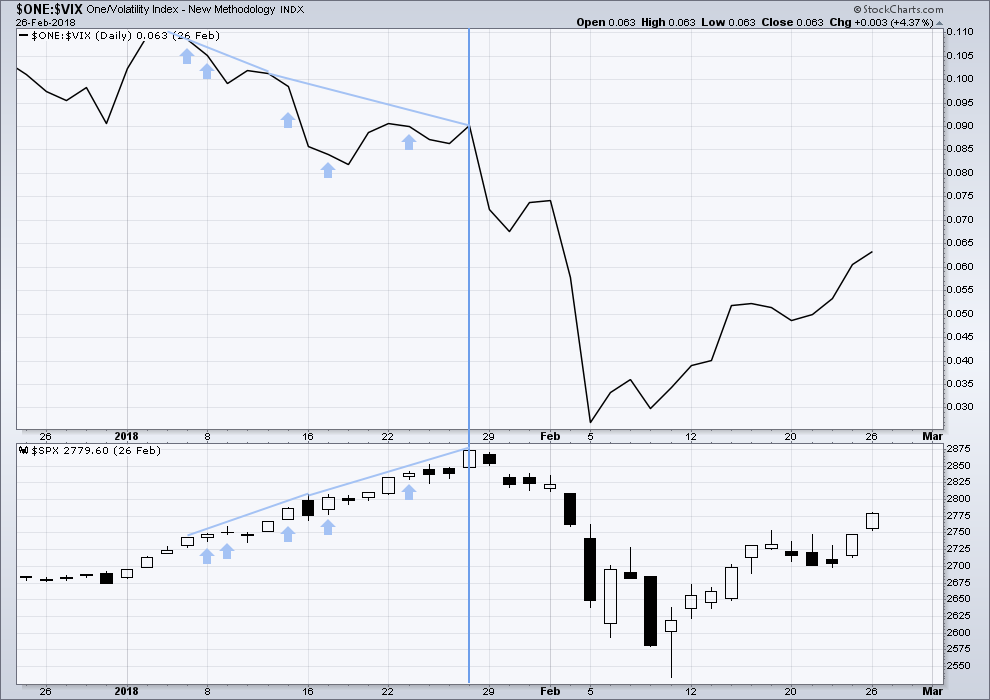

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is a daily chart.

The strongest warning of an approaching intermediate degree correction at the daily chart level came from inverted VIX.

There was strong double bearish divergence at the high of intermediate wave (3), which is noted by the vertical line. There was also a sequence of five days of bearish divergence, days in which price moved higher but inverted VIX moved lower.

AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is a daily chart.

There was only single bearish divergence between price and the AD line at the end of intermediate wave (3). Approaching the high, there were no instances of price moving higher and the AD line moving lower.

Conclusion: When studying the behaviour of price and these indicators just before the start of intermediate wave (4), we may see some clues for warning us of primary wave 4. A cluster of bearish signals from VIX along with a bearish divergence from price and the AD line or On Balance Volume may warn of primary wave 4. The next instance will probably not behave the same as the last, but there may be similarities.

At this time, it does not look like primary wave 4 may begin right now, but we need to be aware of its approach.

Published @ 08:11 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Updated hourly chart:

On the five minute chart submineutte wave i will subdivide as a leading contracting diagonal.

That means the upwards movement labelled subminuette wave i will also subdivide as a triple zigzag (it could also be a double zigzag).

So it could be corrective, or motive.

The wave count remains the same. I’m still expecting most likely upwards movement here, but it’s also possible we could see some sideways movement first.

I agree. My own attempts to find consistent correlation between price and moon phases has been less than stellar, so to speak. It does seem that post full moon price action tends to be higher so I am taking a stab at trading yesterday’s harvest moon with a DIA Oct. 12 259/260 bull put credit spread @ 0.30 per contract. Objective is to get positioned long puts at zero cost basis.

Let’s see if Mr. Moon delivers! 😉

I’m interested in sell puts on DJX (DIA) and buying ’em back cheaper myself. This is DJX hourly.

The set up for me is a turn off one of these (many possible) blue fibo levels, and the first significant one is now touched (38.2% at 264.9).

I’ll look for buy triggers at the 5/15 minute level, or…wait for the next possible “stop and turn” on the elevator ride down.

DIA 270 puts we sold yesterday are more expensive today.

Fractured markets are unhealthy markets. It is not at all clear to me if this is subterfuge to keep traders confused or we have something else going on here.

It is quite rare to see futures markets strongly diverging from the cash session for very long. Something’s afoot.

For those who like their instruments volatile…BLUE (currently at 143) is still up trending monthly, strongly down trending weekly. However, price has hit and initiated a turn at the daily/hourly timeframes off a major 50% (136.7). This could be a great deep buy point on BLUE…or BLUE may be headed to it’s 61.8% at 113.45. But the fibo turn point sets up a low cost stop exit (134) vs. some significant upside potential.

I will consider if/when I see some bullish momentum develop in the broader market. Right now things are much too meh!

Gdx in overbought (slow stochastic) territory and just broke its upward one hour tredline trend line… might be a good short right about here

SPX is reminding me of that Grateful Dead song “Fire on the Mountain”

“Long distance runner, what are you standing there for?

Get up get out, get out of the door!”

To put it another way….this dog just ain’t huntin’!!!

Let’s be honest, nothing will happen until 2pm Eastern tomorrow ?

good point!

Gap open this morning was weak. They tried to put in a bottom this morning after gap fill with no support but we took out the tail low nonetheless. There is no selling pressure.

Market sinking under its own bloat….

Break up from triangle, testing support from BD trend line….

i’m long and stopping at 29. I’ve sold puts strike 29, Oct 19, so I’m profiting on the high theta period of the option on top of the bullish set up for the short term that should make them close to worthless quick enough. I’m sure there’s +EV here.

my stop will move to 30.45 very quickly though.

my stop is 1/2 at 30.90 (e) and 1/2 at 32.15 (i)

I wonder what’s going to happen to the price of some good microchip companies that are already beaten down when P4 begins: ie AMAT, ESIO, MU, NANO…

IYT has destroyed it’s daily/hourly trend line and broken pretty hard to the down side, all while in a daily squeeze. It’s sitting on both the 23.6% retrace fibo and bullish symmetry (largest down move throughout the up move, shown by the white descending line) price at 203.3. So it’s at the cusp. It’s gonna be a good long if it turns. A short on a break below 203.3 would be counter-trend, as the monthly and weekly trends are up. That said, this market may be headed to the 61.8% at 193.4 very quickly if that break down happens.

PANW (Palo Alto Networks), a monstrously bullish stock, is in an up trend at the monthly level, and neutral at the weekly. This is the daily chart. Another nice pullback to the 21 EMA (blue line), with another higher low, and perhaps in the process of breaking the down trend line at this TF. I’ll be buying on triggers at the hourly.

…and the 3 days of squeeze in play indicates some strong price movement upcoming.

I like DWDP to the long side here, with a higher low forming at the bottom of the large Darvas box range, AND the bottom of that range right at a 61.8% retrace level, AND other close by 38% retrace fibo’s. It add up to likely support, and edge.

My approach here is to sell puts with a strike just below the support, so 67.5. If price gets below 67.5, I stop out by buying back the puts to close. I’ll take some profit 1/2 back up the box, and try for the top end with the 2nd half.

And…is this trading with the trend? I have the weekly trend at neutral, and the monthly trend at neutral.

I’d say no it is not. It’s range trading in a multi-TF trendless period. Of course the daily trend is down, but that’s necessary to get set up at the low side of the range, while the higher TF trends (weekly, monthly) remain neutral.

XLE monthly.

Trend is UP at this TF, and it’s come out of a multi-month squeeze. Similar set up earlier on this chart: the following price action was hugely bullish.

MACD in full bull mode, and price very close to busting out of the top Darvas box (multi-month resistance).

Of course, everything needs to be tempered with our knowledge of an impending P4. But otherwise…this looks goot.

Thank you Lara!

Some of the very best trading gains are to be made at trend changes, particularly higher degree ones.

Lara frequently reminds us that we should assume the trend remains the same until proven otherwise and that is as sage trading advice as you will ever hear.

It is also true that Lara’s precise price targets is one of the most valuable pieces of information she provides in her analysis. While it may be obvious that the price targets allows sound planning for exiting long trades in an uptrend, it could be easy to overlook the fact that the same targets also provide great information about establishing short positions for an impending trend change.

Based on the SPX target of roughly 3K, DJIA 270 strike puts could end up being the sweet spot for the upcoming P4 correction.

We traded the first batch based not so much on the price target but on the distance DJIA was trading above its upper B band in anticipation of a mean reversion move back down. A good approach would be either getting positioned with bull put spreads on the final wave up, or layering into the 270 strikes, reducing cost basis once we have a count of a count of minute five of minor five up underway. Obviously the same approach would work for SPY puts.

Happy Trading!

Do you really believe they’ll let a 20%+ primary down wave occur, when none has since 08/09? Futures again, relentlessly had the 3am monster blast everything higher. All my companies quant, AI, order book analysis, position trader analysis, etc, etc, etc speaks to literally no organic participants or institutions, moreover the past few months, none of the HFT are holding indexes overnight. BTW the FED Desk recently hired more traders! Apologies for the rant, but they have me believing the manipulation will continue, due the magnitude of recent increases in the level of chicanery. It’s not hard to realize the markets are broken; just look to the bond markets which are infinitely larger and have incredible misspricing of risk. Lara, good job!

Mr. Bear suddenly capitulating to the “certainty” of continued price rise has got to be a hugely bearish indicator (as viewed by contrarian, anyway).

LOL…….Gotta be super close, but they just arrested the decline the past few moments as well

Very insightful comment and while I did not want to be so blunt, I may as well say it. Any serious decline in this market will happen ONLY if CBs have lost the ability to prevent it. In other words, what I am expecting is not merely a correction but an outright collapse. We have not had a consistent downtrend lasting more than a week or two for quite some time and that is truly astonishing in a ten year old run to the upside.

I am still very concerned about smaller degree waves in any wave count that exceed larger degree waves in time and/or displacement as it seems to undermine the very idea of degree in waves. I cannot really complain as the wave targets still turn out to be accurate so I could be missing something here. Chris Cole has part two of his article on vol over at zero hedge today.

Chris and Verne, thanks for the kind words! Always really nice to have it voiced that my work is appreciated. But then, you guys remaining members is appreciation as well for me.

I agree also with Verne’s comment below, when P4 arrives it could be pretty strong and price may only move strongly lower because the banks cannot prevent it. We may see price fall of its own weight a fair amount.

I’ll also note here, that at the end of each major correction there is a fair amount of bearishness here in the membership, right when we should be looking for entry points for long positions again. And so when P4 is mature I’ll be very carefully and calmly looking for:

1. A complete structure

2. Good proportion

3. A price point which invalidates a more bearish alternate and so adds confidence in P5.

Oh yes, and I’ll also be looking for very short term (but clear) bullish divergence between price and RSI. That often (not always) occurs at major lows.

I have a question. I’ll use BABA as the basis for the question.

BABA monthly trend is mildly UP. BABA weekly trend is strongly DOWN. BABA daily trend is NEUTRAL. (I use hueristics on a combination of ADX and CCI to determine trend state, by the way).

If I want to trade with the trend, should I go short or long?

I’d say long. The daily must have been down for the weekly to be down. Now it’s turning to neutral. And monthly has not gone to down. Sounds like it’s turning. That’s just a guess tho, def not trading advice.

I agree Ari.

I’m pretty much these days of the view that the monthly trend is the defining trend, and any trade (at ANY time frame) that is against the monthly is “counter-trend” and starts from a position of negative expectation. I.e., gotta have an INCREDIBLE set-up etc. that gives relatively huge edge to consider a counter-(monthly)-trend trade. Because you are swimming up river, no matter what.

I’m impressed that Verne, a general bear on principle, at this point in our EW cycle (getting pretty close to what should be a major top), is trading long (by selling DIA puts). That’s discipline by a perma-bear!

I was considering “bottom picking” BABA when it bounced off 152, but I think a better buy will come after P4 begins…

You answered your own question. It depends on your trading time frame!