Upwards movement continues as expected.

On Balance Volume this week gives important signals on the daily and weekly charts.

Summary: The pullback looks like is over. On Balance Volume makes new all time highs this week on the daily and weekly charts; this supports a bullish wave count.

A new all time high above 2,916.50 would confirm the bullish wave count. At that stage, the target would then be in a small zone from 3,041 (Elliott wave) to 3,045 (classic analysis).

A new low below 2,802.49 would strongly indicate the bearish wave count is most likely. The target for a multi month consolidation of primary wave 4 would then be at either 2,698 (0.236 Fibonacci ratio) or 2,563 (0.382 Fibonacci ratio).

The final target for this bull market to end remains at 3,616, which may be met in October 2019.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

MAIN ELLIOTT WAVE COUNT – BULL

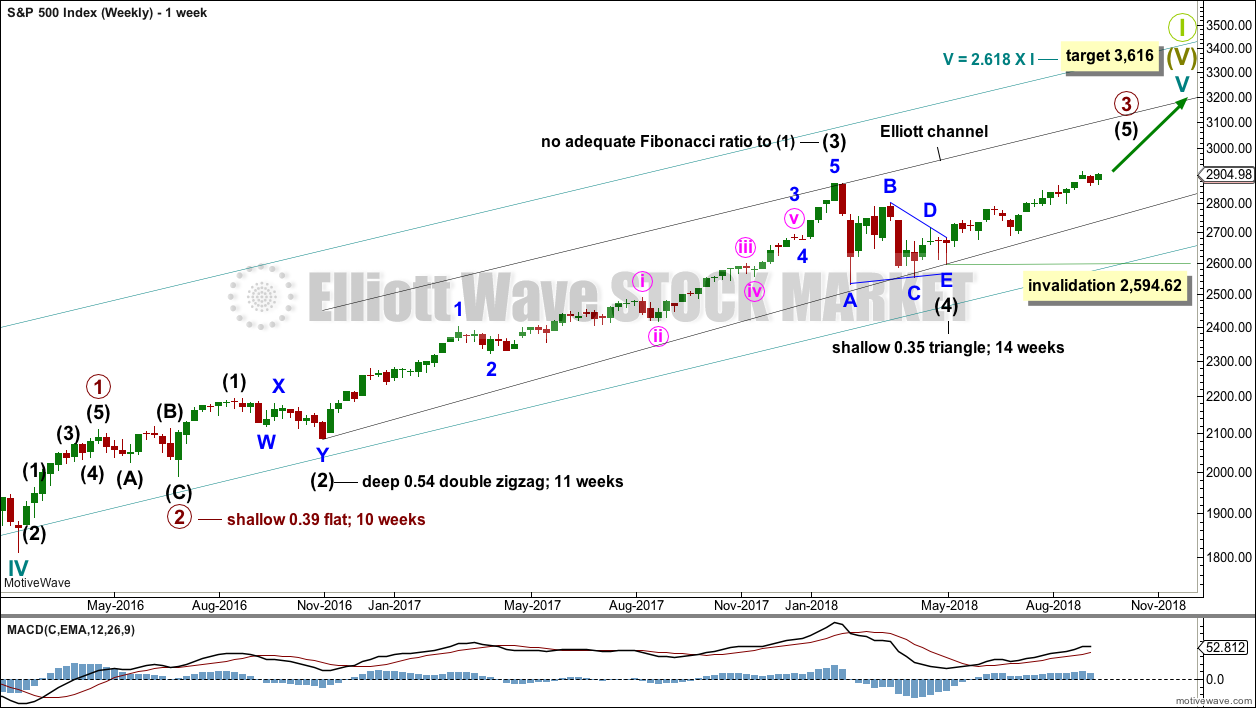

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

At this stage, the expectation is for the final target to me met in October 2019. If price gets up to this target and either the structure is incomplete or price keeps rising through it, then a new higher target would be calculated.

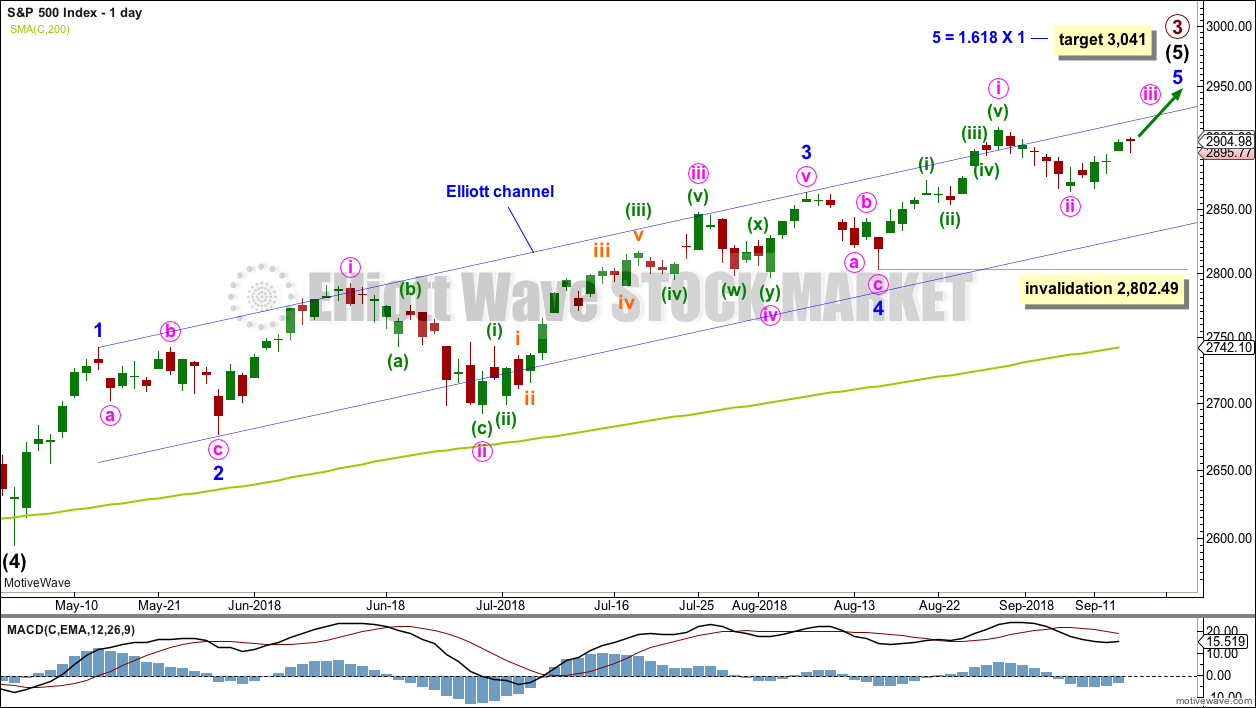

DAILY CHART

Intermediate wave (5) avoided a truncation now that it has a new high above the end of intermediate wave (3) at 2,872.87.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). Intermediate wave (5) has passed equality in length with intermediate wave (1). The next target was at 2,922, 1.618 the length of intermediate wave (1), which may have been almost met.

A target for intermediate wave (5) to end is recalculated at minor degree. Because this target is so close to the classic analysis target at 3,045, it does have a reasonable probability.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 through to 4 may now all be complete.

Assume the upwards trend remains intact while price remains above 2,802.49. The trend remains the same until proven otherwise.

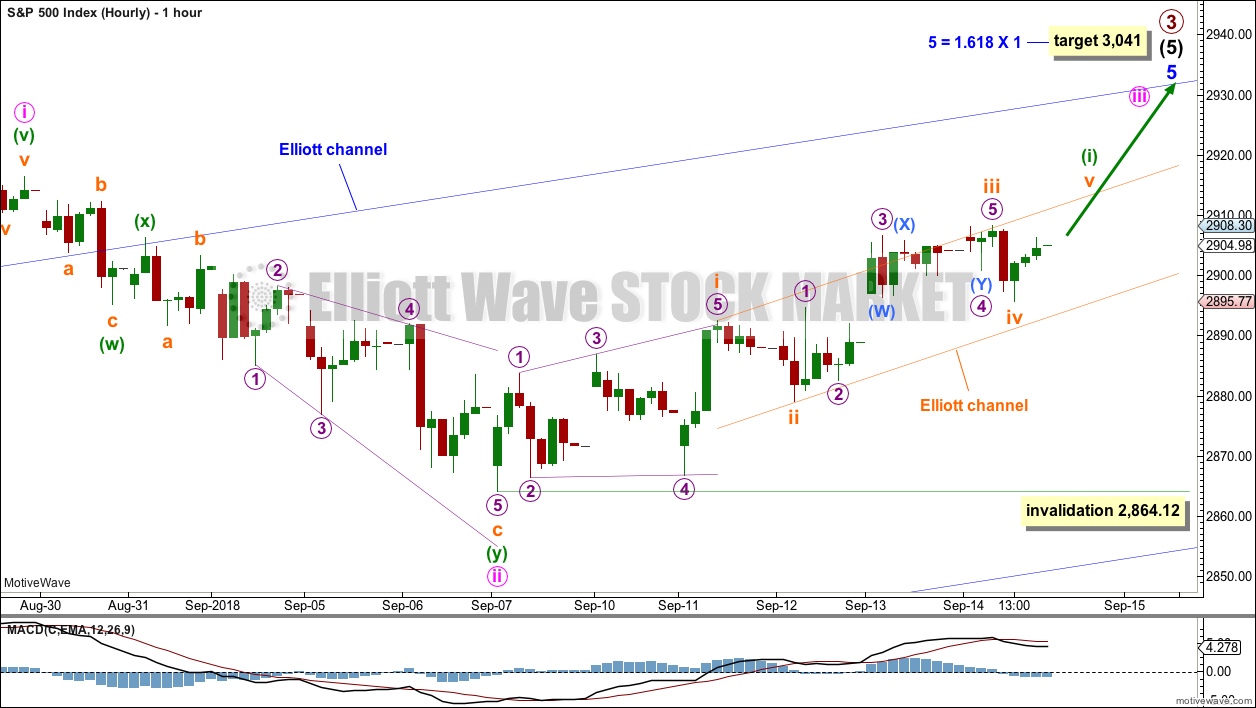

HOURLY CHART

Because we should assume the trend remains the same, until proven otherwise, this will still remain the main wave count while price remains above 2,802.49. At the end of this week, it also now has good support from classic technical analysis.

Within intermediate wave (5) so far, minor wave 1 was relatively short and minor wave 3 extended (but does not exhibit a Fibonacci ratio to minor wave 1). Two actionary waves within an impulse may extend, so minor wave 5 may be extending.

Within minor wave 5, minute wave i may have been over at the last high. Minute wave ii may now be a completed double zigzag, ending just below the 0.382 Fibonacci ratio of minute wave i.

Minute wave iii must subdivide as an impulse, and within it minuette wave (i) may be incomplete. When minuette wave (i) is a complete five wave structure, then minuette wave (ii) may not move beyond its start below 2,864.12.

An Elliott channel is drawn about minuette wave (i), and micro wave 3 overshoots the upper edge. If subminuette wave iv continues further, it may find support about the lower edge of this channel. When the channel is breached by downwards movement, that may be an indication that minuette wave (ii) has begun.

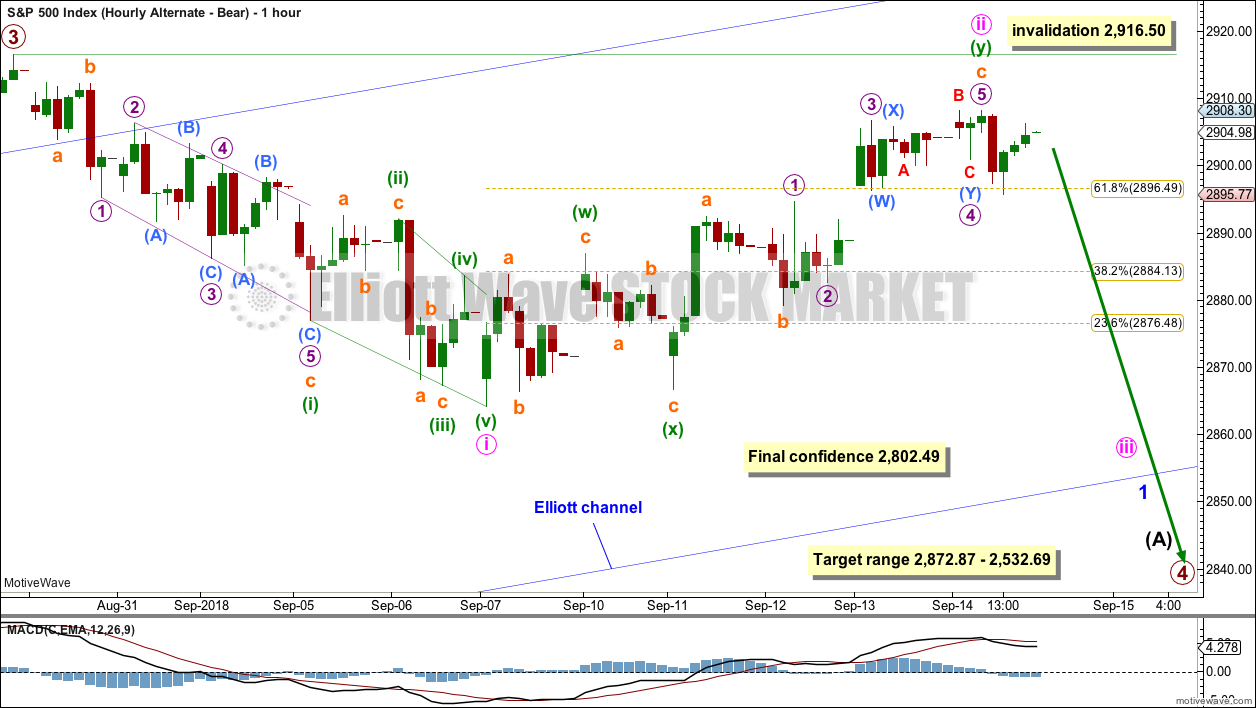

ALTERNATE ELLIOTT WAVE COUNT – BEAR

WEEKLY CHART

The probability of this alternate wave count is reduced at the end of this week because it does not have support from classic technical analysis.

It is possible that primary wave 3 was over at the last high. Fibonacci ratios are noted on the chart.

Primary wave 2 was a shallow flat lasting 10 weeks. Primary wave 4 may be expected to exhibit alternation in one or both of depth and structure. Primary wave 4 may last about a Fibonacci 8, 13 or possibly even 21 weeks to exhibit reasonable proportion to primary wave 2.

Primary wave 2 shows up on the monthly chart. Primary wave 4 may be expected to last at least one month, and likely longer, for the wave count to have the right look at the monthly chart level.

Primary wave 4 may end about the lower edge of the maroon Elliott channel. Primary wave 4 may end within the price territory of the fourth wave of one lesser degree: intermediate wave (4) has its price territory from 2,872.87 to 2,532.69.

The channel on this bear wave count is redrawn about primary degree waves using Elliott’s first technique. The overshoot at the end of intermediate wave (3) is very typical; third waves are usually the strongest wave within an impulse and may end with strength. The lower edge of this channel contains all deeper pullbacks since the end of primary wave 2, and so it looks fairly likely that primary wave 4 may end about the lower edge of this maroon channel.

If primary wave 4 is deeper than expected, then it should find very strong support at the lower edge of the teal channel. This channel, copied over from the monthly chart, has provided support for all deeper pullbacks within this bear market since March 2009.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

DAILY CHART

The first movement down within primary wave 4 should be a five wave structure, which should be visible at the daily chart level. While that is incomplete, no second wave correction may move beyond the start of the first wave above 2,916.50.

Within the target range of 2,872.87 to 2,532.69 sit the 0.236 and 0.382 Fibonacci ratios of primary wave 3. The 0.236 Fibonacci ratio at 2,698 would be the first target. If price keeps falling through this first target, then the next target would be the 0.382 Fibonacci ratio at 2,563.

Primary wave 4 would most likely be a zigzag, combination or triangle. Within a zigzag, intermediate wave (A) must subdivide as a five wave structure. Within a combination or triangle, intermediate wave (A) (or (X) ) should subdivide as a three wave structure, most likely a zigzag.

Within primary wave 4, downwards waves may be swift and very strong.

HOURLY CHART

The last wave down, which is here labelled minute wave i, is very choppy and overlapping and will not subdivide as an impulse.

Minute wave i may be seen as a leading contracting diagonal. Within a leading diagonal: sub-waves 1, 3 and 5 are most commonly zigzags but may also sub-divide as impulses, sub-waves 2 and 4 may only subdivide as zigzags, and wave 4 must overlap wave 1 price territory. Within a contracting diagonal, the trend lines must converge. This wave count meets all Elliott wave rules for a leading contracting diagonal, but the extended length of minuette wave (i) gives it a strange look.

Within the zigzag of minuette wave (i), subminuette wave c is seen as an ending expanding diagonal. Within micro wave 5, sub-micro wave (B) is not well contained within the diagonal trend lines. The trend lines do diverge but only barely. This structure also looks strange.

This wave count meets all Elliott wave rules, but it does not have the right look. The probability is low.

Minute wave ii may have moved higher today. It is now a very deep correction and so far still fits as a fairly common double zigzag.

Minute wave ii may not move beyond the start of minute wave i above 2,916.50. A new all time high next week would firmly invalidate this bearish wave count at all time frames.

TECHNICAL ANALYSIS

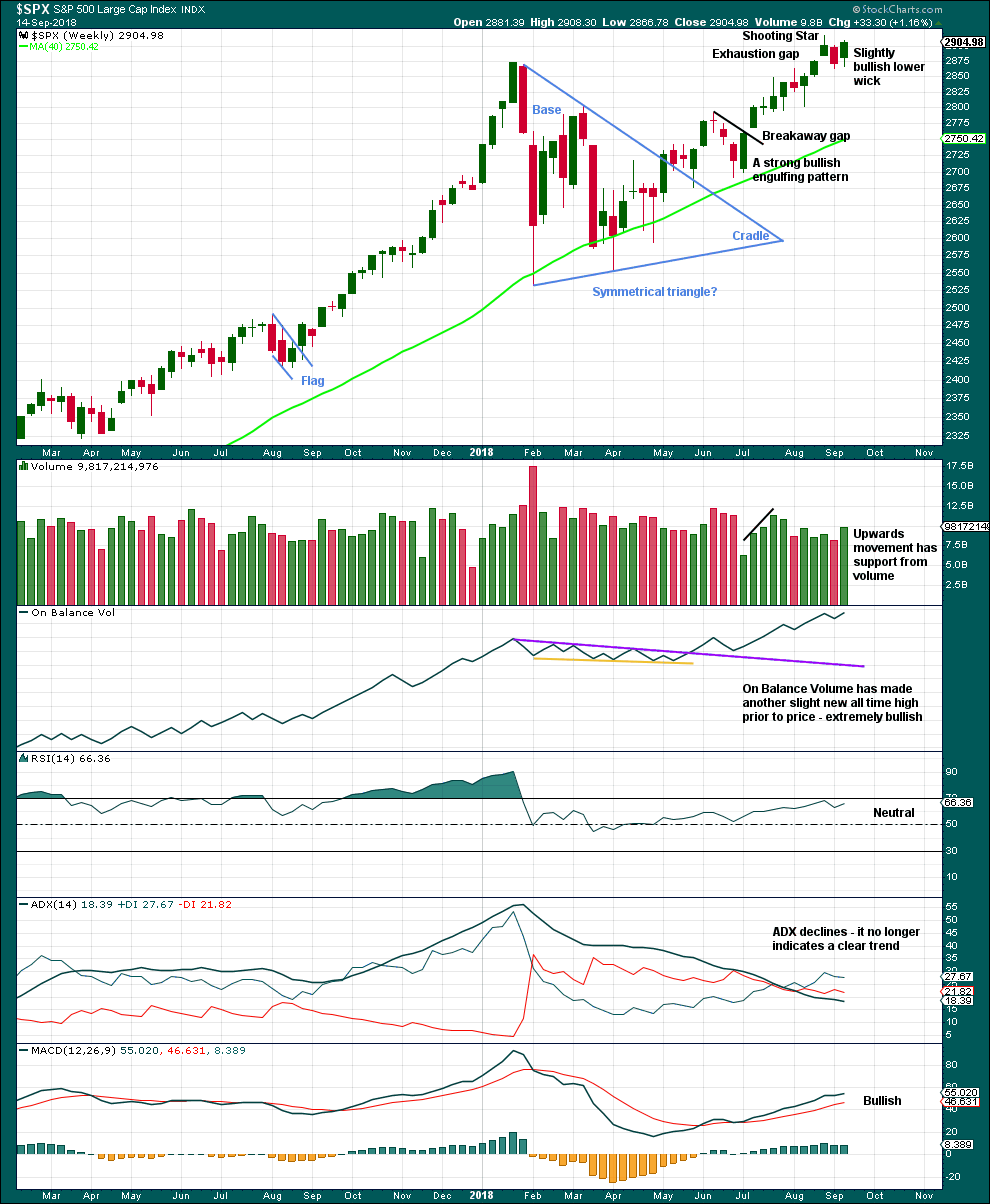

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is very close to the new Elliott wave target at 3,041.

It now looks most likely that the downwards week last week is a typical backtest of support after the new all time high.

The bullish signal from On Balance Volume is given reasonable weight in this analysis. It supports the main Elliott wave count.

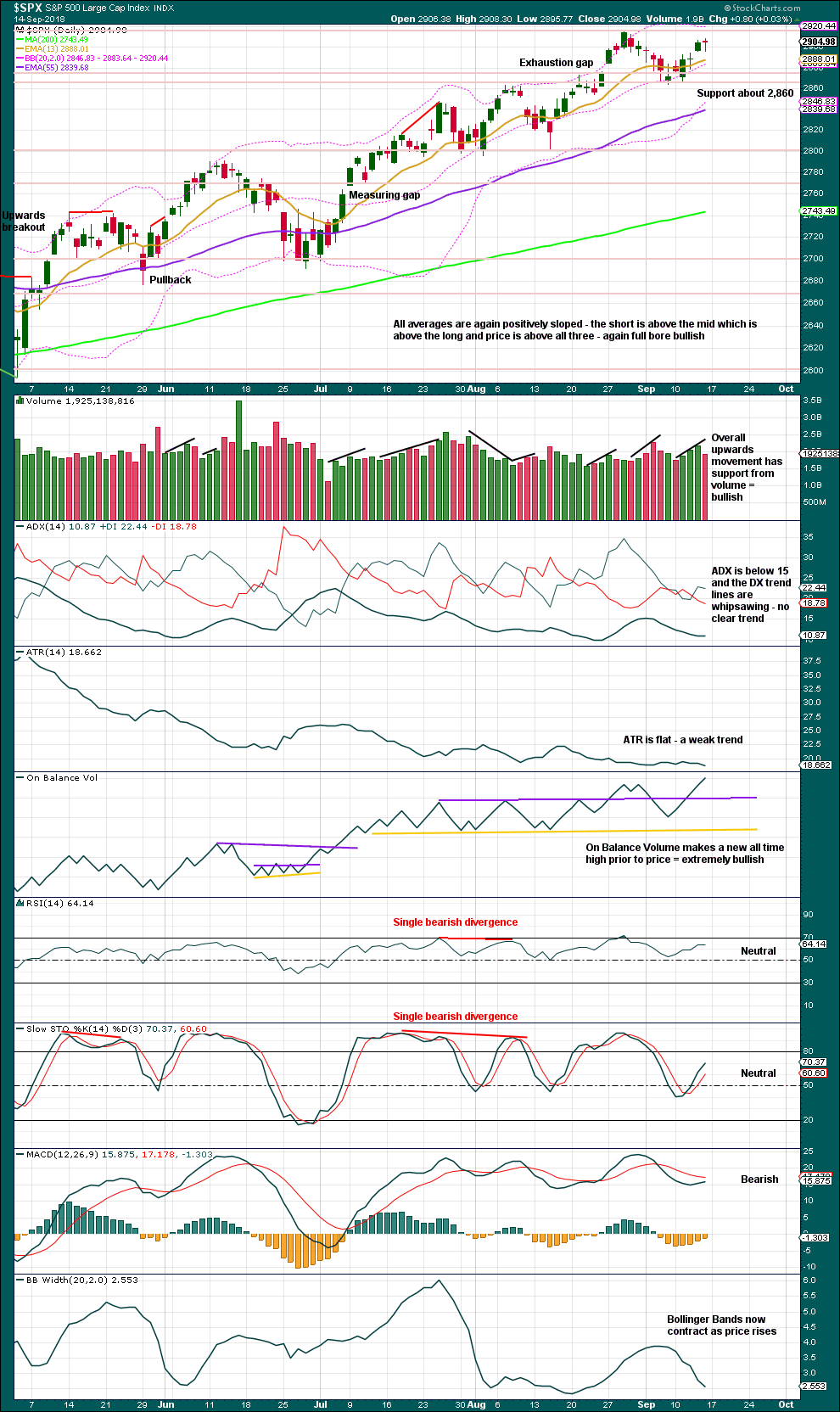

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. While the last swing low at 2,802.49 has not been breached, there will still be a series of higher highs and higher lows in place; the upwards trend should be assumed to remain intact until proven otherwise. A bullish engulfing candlestick pattern with support from volume comes after another pullback. This is a strong indication that the pullback may be over. Look now for the upwards trend to resume.

Downwards movement looks corrective; this does not look like a convincing start to primary wave 4. ATR is weak and volume is now declining.

The gap upwards on Thursday may only be a pattern gap; these are usually closed. However, the gap may also be a breakaway gap; a new all time high would indicate a breakaway gap. At this time, while the picture is unclear, the gap will not be labelled as either pattern or breakaway.

Another new all time high from On Balance Volume means that overall this chart is now very bullish.

An exhaustion gap is the most bearish signal on this chart, and it is for this reason that a bearish alternate is still charted at all time frames.

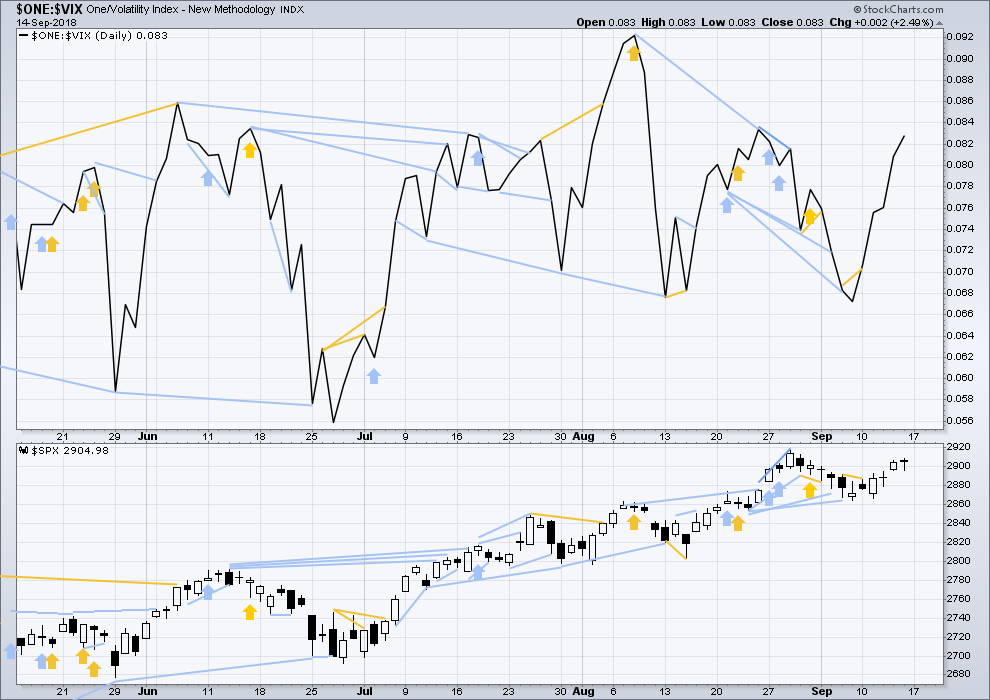

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

At this time, there is mid term bearish divergence between price and inverted VIX: price has made a new all time high, but inverted VIX has not. This divergence may persist for some time. It may remain at the end of primary wave 3, and may develop further to the end of primary wave 5.

Strong bearish divergence noted last week has now been followed by an upwards week. It is considered to have failed.

Upwards movement in price has support this week from a normal corresponding decline in market volatility. There is no new divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is mid term divergence with a new all time high from price not supported by a corresponding new all time high from inverted VIX. This divergence is bearish.

Rising price comes with a normal corresponding decline in market volatility. There is no new divergence.

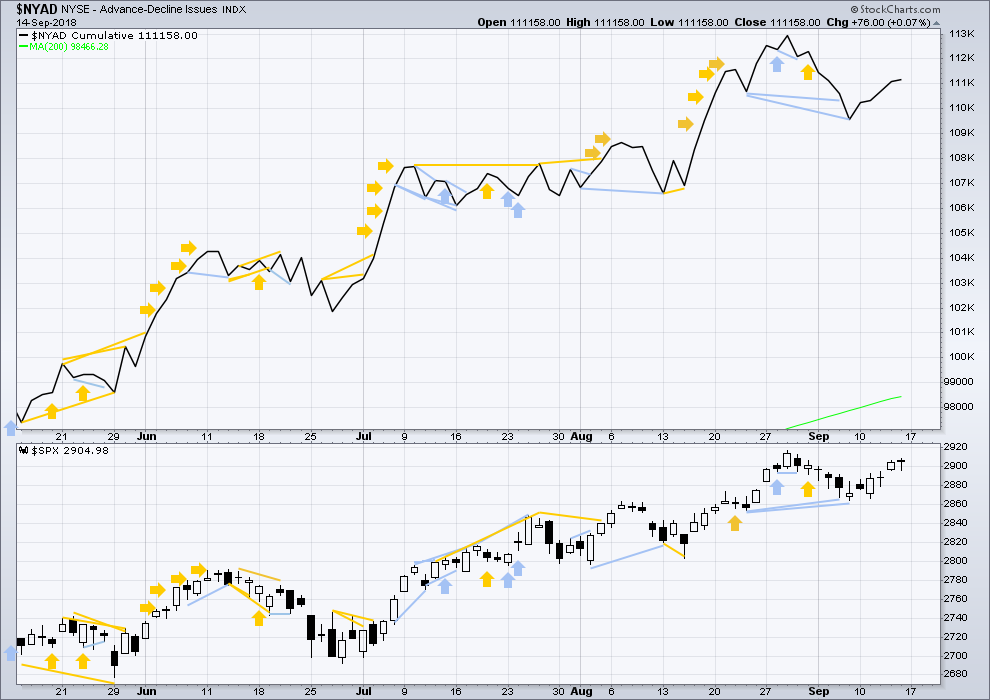

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

Short term weak divergence between price and the AD line noted last week has now been followed by an upwards week. It is considered to have failed.

There is no new divergence this week between price and the AD line.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

Rising price has support from rising market breadth, but breadth is not rising as fast as price. This is a little bearish. Some divergence towards the end of primary wave 3 may be expected to develop; this bearishness may fit the main Elliott wave count.

All of small, mid and large caps made new all time highs on the 27th of August. There is a little divergence here in breadth with large caps continuing to make new all time highs on the 29th of August and small and mid caps lagging.

All of small, mid and large caps saw price rise this week. The rise in price has support from market breadth.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Nasdaq and DJT and now the S&P500 have all made recent new all time highs. For Dow Theory confirmation of the ongoing bull market, DJIA needs to make a new all time high.

DJT made another new all time high this week. It may be leading the market.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

ANALYSIS OF THE END OF INTERMEDIATE WAVE (3)

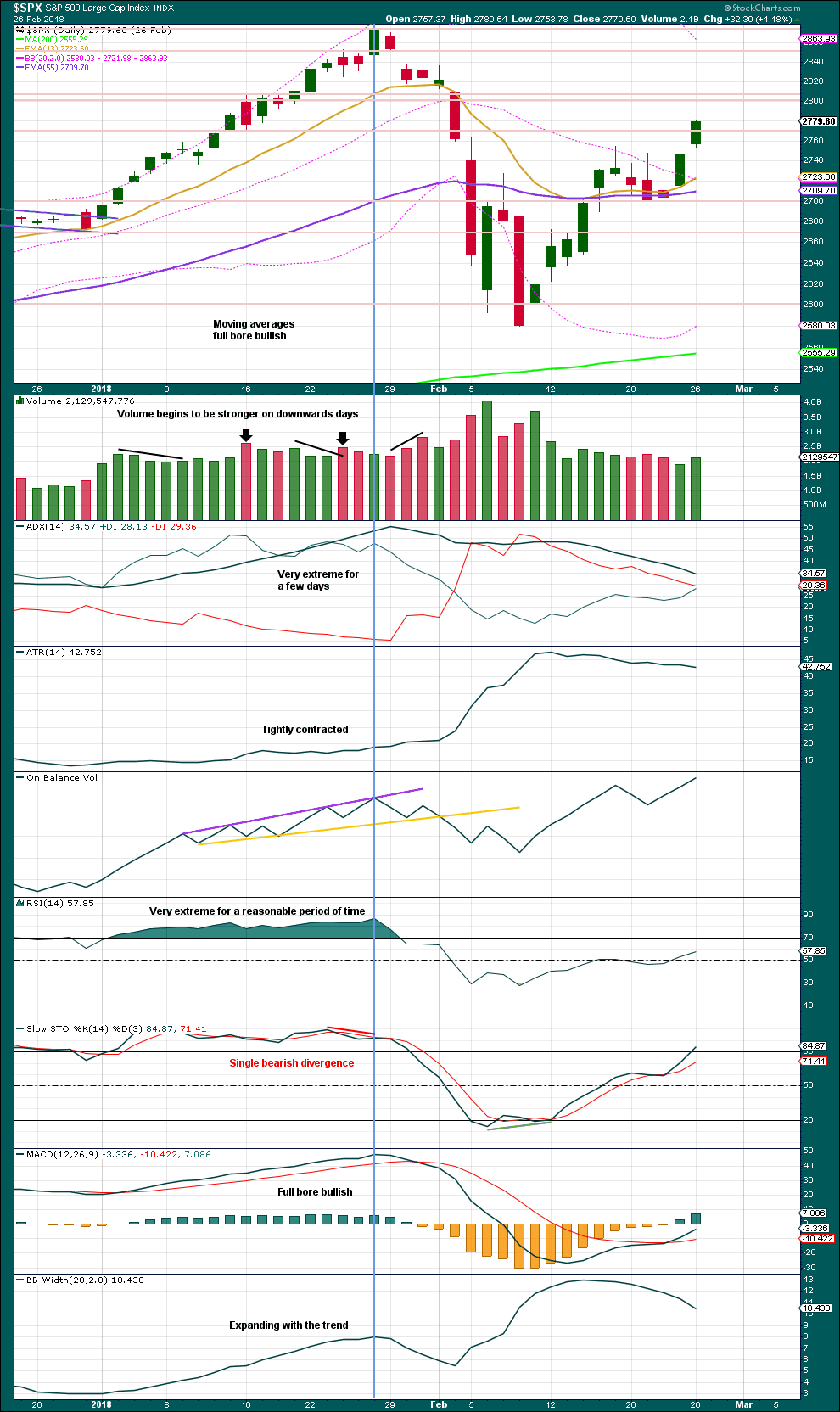

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart looked overly bullish at the end of intermediate wave (3). The only warning in hindsight may have been from volume spiking slightly on downwards days. There was no bearish divergence between price and either of RSI or On Balance Volume.

Single bearish divergence between price and Stochastics was weak, which is often an unreliable signal.

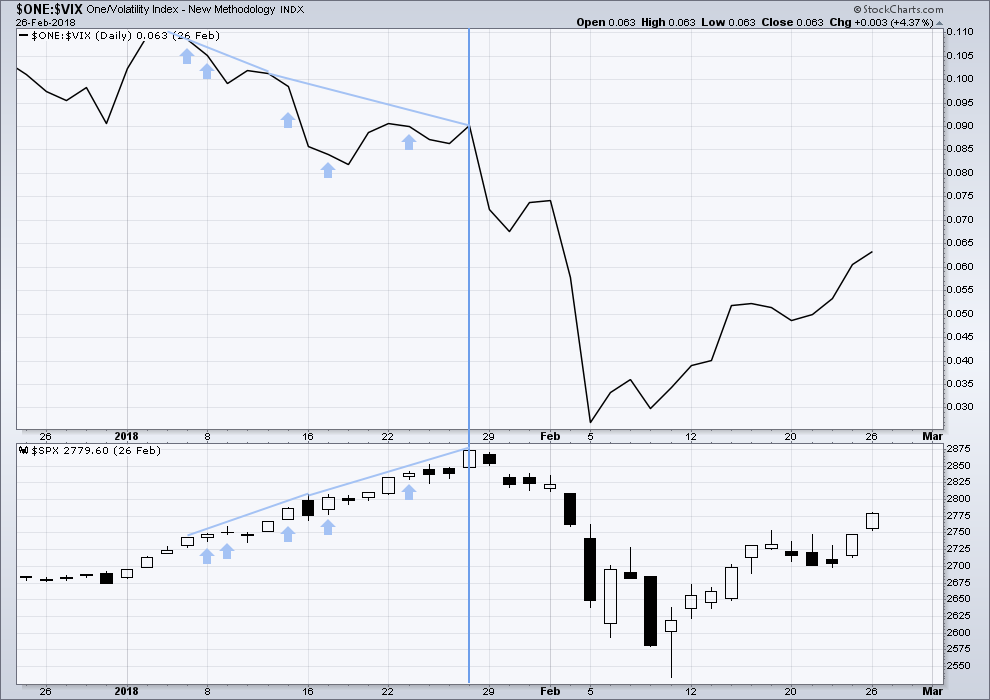

VIX

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is a daily chart.

The strongest warning of an approaching intermediate degree correction at the daily chart level came from inverted VIX.

There was strong double bearish divergence at the high of intermediate wave (3), which is noted by the vertical line. There was also a sequence of five days of bearish divergence, days in which price moved higher but inverted VIX moved lower.

AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is a daily chart.

There was only single bearish divergence between price and the AD line at the end of intermediate wave (3). Approaching the high, there were no instances of price moving higher and the AD line moving lower.

Conclusion: When studying the behaviour of price and these indicators just before the start of intermediate wave (4), we may see some clues for warning us of primary wave 4. A cluster of bearish signals from VIX along with a bearish divergence from price and the AD line or On Balance Volume may warn of primary wave 4. The next instance will probably not behave the same as the last, but there may be similarities.

At this time, it does not look like primary wave 4 may begin right now, but we need to be aware of its approach.

Published @ 11:06 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

FWIW, my trend indicator is now showing “strongly down” on the SPX hourly. And now hour #2 of a squeeze in development.

Good morning everybody.

Taking a look at this pullback on the five minute chart, it looks like an incomplete double zigzag. If my expectation of it to get down to the 0.618 Fibonacci ratio is wrong it may be too low. It may be more shallow than this, because it’s not the first second wave correction within minor 5.

At the moment SPX has bounced on the 50% level at 2886. That’s a legitimate retrace level to me, though it still may not hold. This ii down may just be winding up here. I’d expect the 62% and maybe even the 78% level to be hit before it’s over.

Now it’s double bottomed off that 50%, which adds so real weight to the potential that this is it re: the bottom of this ii. I still think it’s a bit unlikely but possible. After all, the market needs to get on with some iii of iii type action, something to float some boats and fulfill wave counts!

Hi Kevin

Do you follow the Russell 2000?

If you do, do you think that index might have already topped?

Thank You

If we think the SPX has not topped (i.e., a top is due at an estimated date of Oct 2019), then no, I don’t think the RUT has topped overall either.

Whether it’s topped here for a significant pullback…I don’t think so. Long pattern now of higher swing lows on the daily chart, until that pattern breaks…it’s a bull market afaiac.

It may have completed a small ED last week.

Larger wedge not quite broken but currently tapping the lower boundary.

A break and close below IWM 169.50 would be near-term bearish.

Surprisingly to me, advancers vs. decliners for SP5000 are over 1-1 at the moment, even while RUT and NDX are running 1-2 and 1-4, respectively. So maybe this day will turn around.

First! Numero Uno – #1 – opposite of last – leading pole position – etc. etc. etc.

Thanks, Lara. It looks like we have a launching pad established to move to a new ATH and up towards 3000 SPX. Exciting for the bulls.

Have a great weekend everyone. Perfect timing for a break. I am headed to the mountains next week. That is if my bruised foot heals in time. We have a glorious weather forecast for the next couple of weeks. Perhaps I will see some snow up around 8000 feet in elevation.

Hi Rodney. I hope your foot heals quickly, and you see lots of snow, and the bears are all going into hibernation for now and do not bother you.

I’ve done some more work in our bush looking after Kiwi this weekend and am happy to say they are all doing well.

I also would like members to know (not that it is of any consequence to you all) that I have ordered a new surfboard from my shaper and I am incredibly excited about it. So excited I have to do Happy Morning dances every morning. I’ll post a pic when it’s done.

Silly I know, but happy.

Will the picture be of you doing your Happy Morning Dance or of the surfboard? Frankly, I’d love to see a video of both!

Happy dance on the surfboard from a nose mounted GoPro while riding a iii of a 3?

Congrats on the new stick.

Pic will be posted of the new surfboard, not of the silly Happy Morning dance. That’s just silly.