The last gap is closed, indicating it should be an exhaustion gap. The bearish wave count now increases in probability, but both bull and bear Elliott wave counts remain valid.

Summary: The probability of the bearish wave count must now be considered to have increased. However, the trend remains upwards while price remains above 2,802.49; a series of higher highs and higher lows remains in place.

A new all time high above 2,916.50 would confirm the bullish wave count. At that stage, the target would then be in a small zone from 3,041 (Elliott wave) to 3,045 (classic analysis).

A new low below 2,802.49 would strongly indicate the bearish wave count is most likely. The target for a multi month consolidation of primary wave 4 would then be at either 2,698 (0.236 Fibonacci ratio) or 2,693 (0.382 Fibonacci ratio).

The final target for this bull market to end remains at 3,616, which may be met in October 2019.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge. If it is over at the last high, it would have ended midway within the channel, which is a typical look for this market.

There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

There is some small indication at this stage that primary wave 3 may have been over at the last high (a bearish hourly wave count is provided for this possibility). If primary wave 4 has arrived, then it may not move into primary wave 1 price territory below 2,111.05.

The channel is redrawn today about cycle wave V from the ends of primary degree waves. If primary wave 3 is over, then the lower edge of this channel may provide support for primary wave 4. Fourth waves are often contained within a channel drawn using this technique, but not always. If primary wave 4 breaches the lower edge of this channel, then it should be expected to find very strong support at the lower edge of the teal channel copied over from the monthly chart. The lower teal trend line has provided support for all corrections within this bull market since March 2009. This line should not be breached while the bull market continues, so primary wave 4 would not be expected to get anywhere near its invalidation point.

At this stage, the expectation is for the final target to me met in October 2019. If price gets up to this target and either the structure is incomplete or price keeps rising through it, then a new higher target would be calculated.

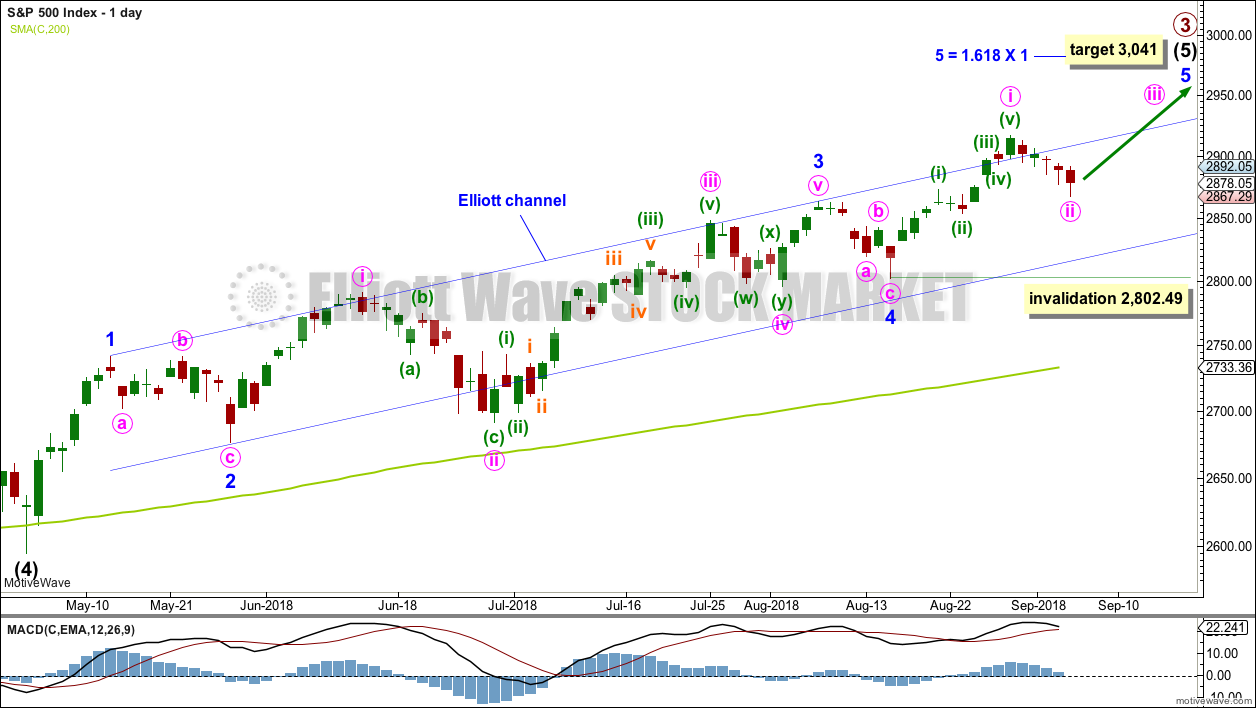

DAILY CHART

Intermediate wave (5) avoided a truncation now that it has a new high above the end of intermediate wave (3) at 2,872.87.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). Intermediate wave (5) has passed equality in length with intermediate wave (1). The next target was at 2,922, 1.618 the length of intermediate wave (1), which may have been almost met.

A target for intermediate wave (5) to end is today recalculated at minor degree. Because this target is so close to the classic analysis target at 3,045, it does have a reasonable probability.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 through to 4 may now all be complete.

Assume the upwards trend remains intact while price remains above 2,802.49. The trend remains the same until proven otherwise.

It is possible that primary wave 3 was over at this week’s high and primary wave 4 has just begun. However, a new low below 2,802.49 is required for any confidence whatsoever in this view.

HOURLY CHART

Because we should assume the trend remains the same, until proven otherwise, this will still remain the main wave count while price remains above 2,802.49.

Within intermediate wave (5) so far, minor wave 1 was relatively short and minor wave 3 extended (but does not exhibit a Fibonacci ratio to minor wave 1). Two actionary waves within an impulse may extend, so minor wave 5 may be extending.

Within minor wave 5, minute wave i may have been over at the last high. Minute wave ii may now be a completed double zigzag, ending just below the 0.382 Fibonacci ratio of minute wave i.

If minute wave ii continues any lower, it may not move beyond the start of minute wave i below 2,802.49.

If On Balance Volume or the AD line give another bearish signal that is reasonable, then this wave count may be discarded prior to invalidation.

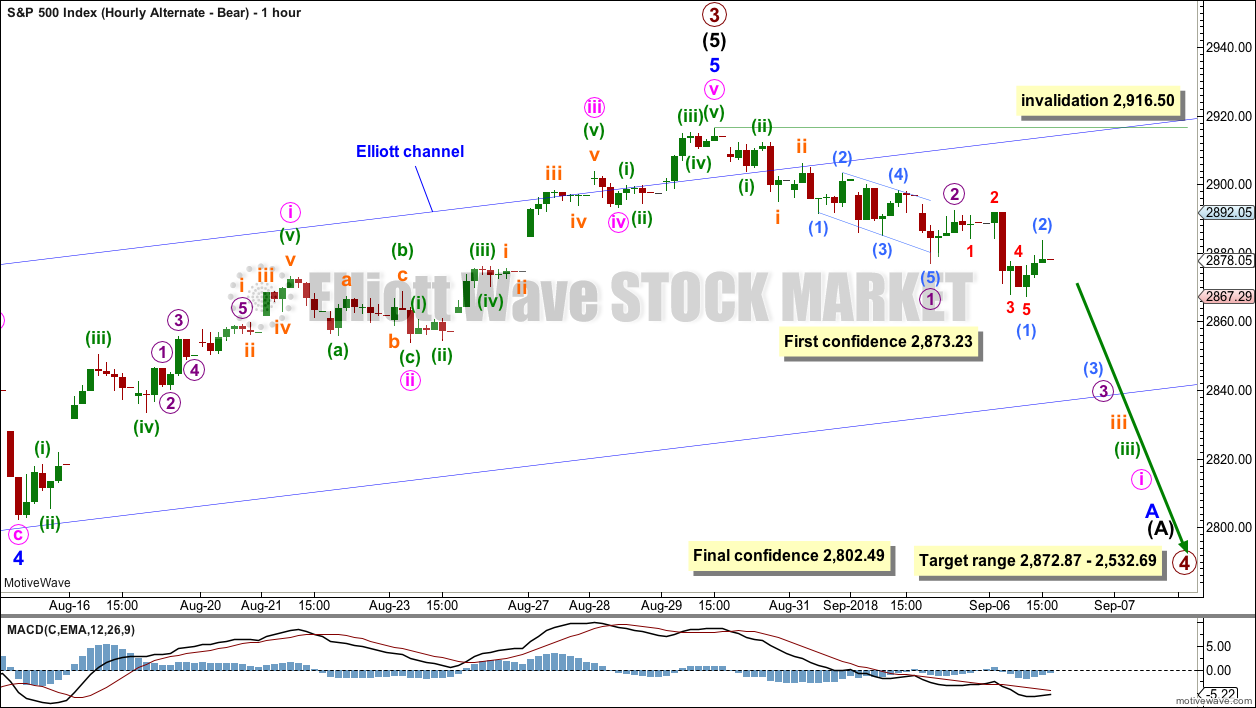

ALTERNATE HOURLY CHART – BEAR

It is possible that primary wave 3 could be over. There is a little support at the end of last week from classic analysis for this wave count but not yet enough for any confidence.

The last gap should be considered an exhaustion gap now that it was closed today, which is further indication that this alternate wave count could be correct, so it is now time to consider it as a reasonable probability. But while price remains above 2,802.49, the probability should still be judged to be lower than the main wave count.

If primary wave 3 is over, then within it intermediate wave (5) would be just 5.16 points short of 1.618 the length of intermediate wave (1).

Ratios within intermediate wave (5) would be: there is no adequate Fibonacci ratio between minor waves 3 and 1, and minor wave 5 would be just 1.32 points short of 0.618 the length of minor wave 3.

A new low below the second confidence point is now required for any reasonable confidence in this wave count.

At that stage, a multi month consolidation for primary wave 4 would be expected. Primary wave 4 may end within the price territory of the fourth wave of one lesser degree: intermediate wave (4) has its range from 2,872.87 to 2,532.69. Within this range sit the 0.236 and 0.382 Fibonacci ratios of primary wave 3: at 2,698.24 and 2,563.22. These would both be reasonable targets for primary wave 4, with the 0.236 Fibonacci ratio slightly favoured as it would see primary wave 4 sit better within an Elliott channel.

Within primary wave 4, downwards waves may be swift and very strong.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

At this stage, there may now be a series of four first and second waves complete. This wave count would now expect to see an increase in downwards momentum this week.

Classic analysis is giving weak bearish signals. It is time to more seriously consider this wave count.

TECHNICAL ANALYSIS

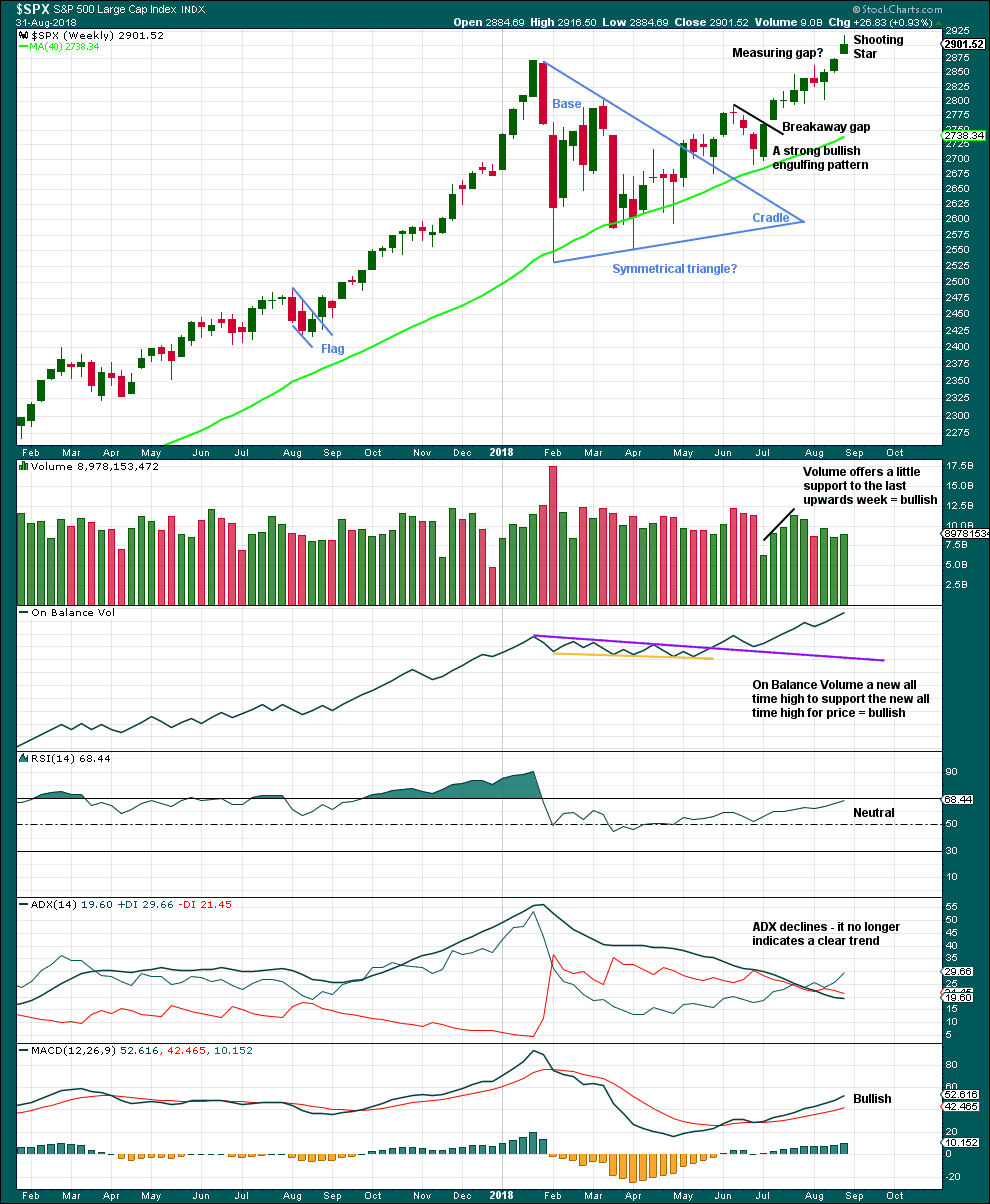

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete. The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,950, so the Elliott wave target may be inadequate. It is 37.28 points below the new higher Elliott wave target.

A new all time high for price has support from another new all time high from On Balance Volume at the weekly chart level. This is bullish.

Price can rise in current market conditions on light and declining volume for a reasonable period of time, so lighter volume last week does not mean that the rise in price is unsustainable for the short or mid term.

Another upwards gap may be a measuring gap; it should be assumed to be so until proven otherwise. While this gap remains open, it may be useful in calculating a new short term target at 2,992. If this gap is closed, it may then be considered an exhaustion gap, and that may be taken as a signal that primary wave 4 may have arrived.

This weekly candlestick closes as a Shooting Star. From Steve Nison CMT in “Japanese Candlestick Charting Techniques”, page 74:

“The Japanese aptly say that the shooting star shows trouble overhead. Since it is one session, it is usually not a major reversal signal as is the bearish engulfing pattern or evening star. Nor do I view the shooting star as pivotal resistance as I do with the two previously mentioned patterns.”

This weekly candlestick is a small warning; it may not be read as a reversal signal.

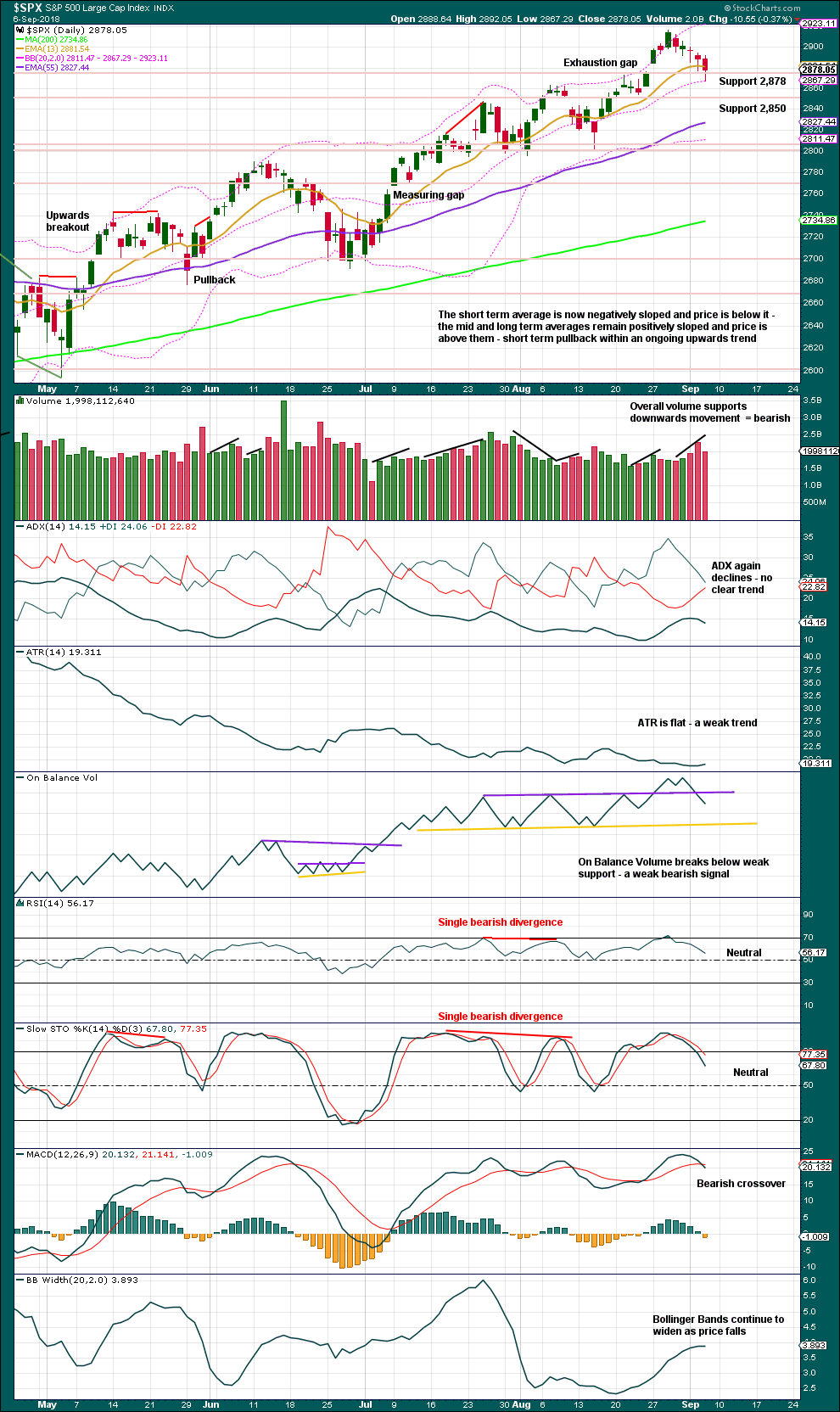

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. This is the definition of an upwards trend. But trends do not move in perfectly straight lines; there are pullbacks and bounces along the way.

The last gap is now correctly relabelled an exhaustion gap. Closure of the gap is another warning that the upwards trend may be over for now. It is possible that a more time consuming and deep consolidation may now begin.

However, the gap may equally as likely indicate another pullback to remain above the last small swing low at 2,802.49 is underway. While this last swing low remains intact, the upwards trend should be assumed to remain intact.

At this stage, there is no candlestick reversal pattern to support the idea of primary wave 4 arriving, but it must be noted that on the daily chart intermediate wave (4) was not heralded by a candlestick reversal pattern.

The short term volume profile remains bearish. The last signal from On Balance Volume was bearish (but weak) and now MACD gives a bearish signal today.

On the bullish side, the last three daily candlesticks are either neutral (doji) or have longer lower wicks which is slightly bullish. At this stage, the fall in price is not yet convincing as a new trend.

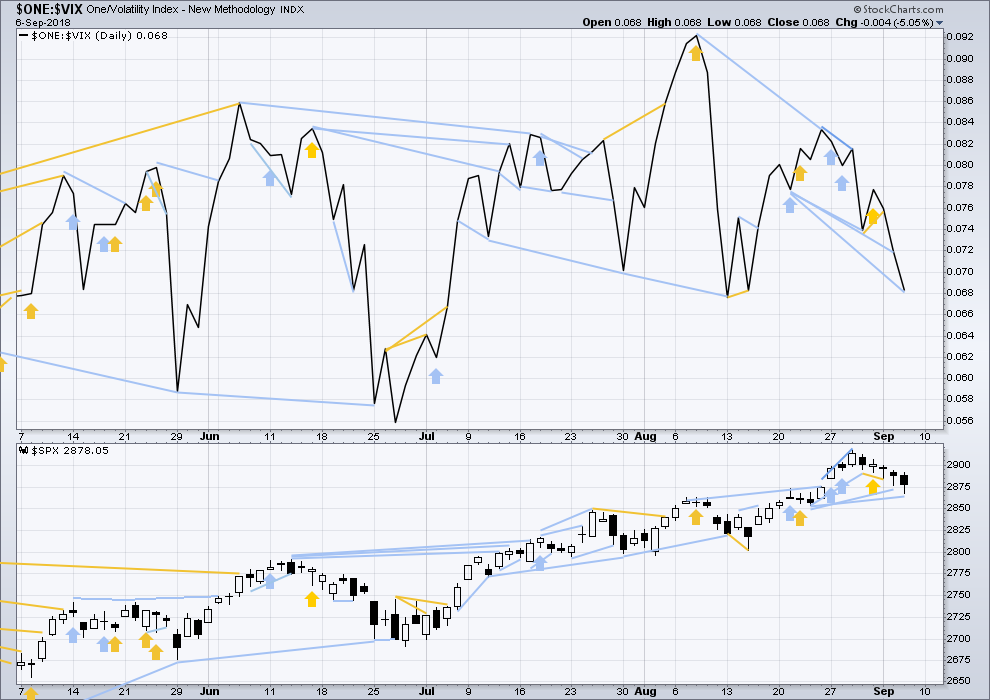

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

At this time, there is mid term bearish divergence between price and inverted VIX: price has made a new all time high, but inverted VIX has not. This divergence may persist for some time and may remain at the end of primary wave 3.

There is single and weak short term bearish divergence between price and inverted VIX: last week price moved higher, but inverted VIX moved lower. Price has not come with a normal corresponding decline in market volatility although it has made new all time highs; volatility has increased. This may be an early warning that primary wave 4 could begin here or fairly soon. It is possible that more instances of weekly divergence may yet develop before primary wave 4 begins.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is mid term divergence with a new all time high from price not supported by a corresponding new all time high from inverted VIX. This divergence is bearish.

Inverted VIX has made a new low below the low six sessions prior, but price has not. This divergence is bearish and strong. However, it is also possible that this is only an early warning and that further bearish divergence may develop before primary wave 4 begins; inverted VIX may not be very useful as a timing tool, only a warning.

There is now a small cluster of bearish signals from inverted VIX, which offer a very small support to the idea that primary wave 4 may begin here or very soon.

Inverted VIX has made another new short term swing low, but price has not. Downwards movement from price comes with a strong increase in market volatility. This divergence is bearish.

There is now a cluster of bearish signals from inverted VIX, but this is still slightly countered by two recent bullish signals. The balance is now more bearish, but it is not as clear as it was at the end of intermediate wave (3).

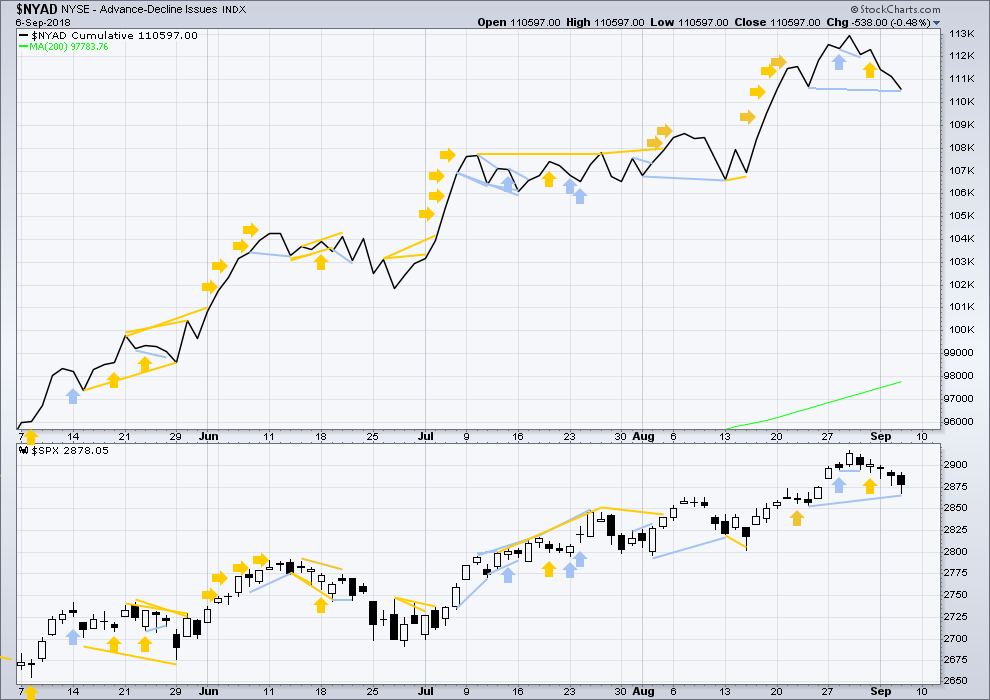

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

The AD line and price both moved higher to new all time highs last week; there is no divergence. The rise in price has support from rising market breadth. This is bullish.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

The AD line today has made a slight new low below the prior swing low of the 23rd of August, but price has not. This divergence is bearish, but it is weak. This adds just a little weight to the bearish Elliott wave count.

All of small, mid and large caps made new all time highs on the 27th of August. There is a little divergence here in breadth with large caps continuing to make new all time highs on the 29th of August and small and mid caps lagging.

Both small and mid caps moved higher but closed red today. This downwards movement from large caps is not shared by small and mid caps, lending just a little weight here to a more bullish outlook.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Nasdaq and DJT and now the S&P500 have all made recent new all time highs. For Dow Theory confirmation of the ongoing bull market, DJIA needs to make a new all time high.

It is noted today that both DJIA and DJT moved higher while S&P500 and Nasdaq moved lower. This downwards movement is not shared by all indices, which may give slight weight to a bullish outlook here.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

ANALYSIS OF THE END OF INTERMEDIATE WAVE (3)

TECHNICAL ANALYSIS

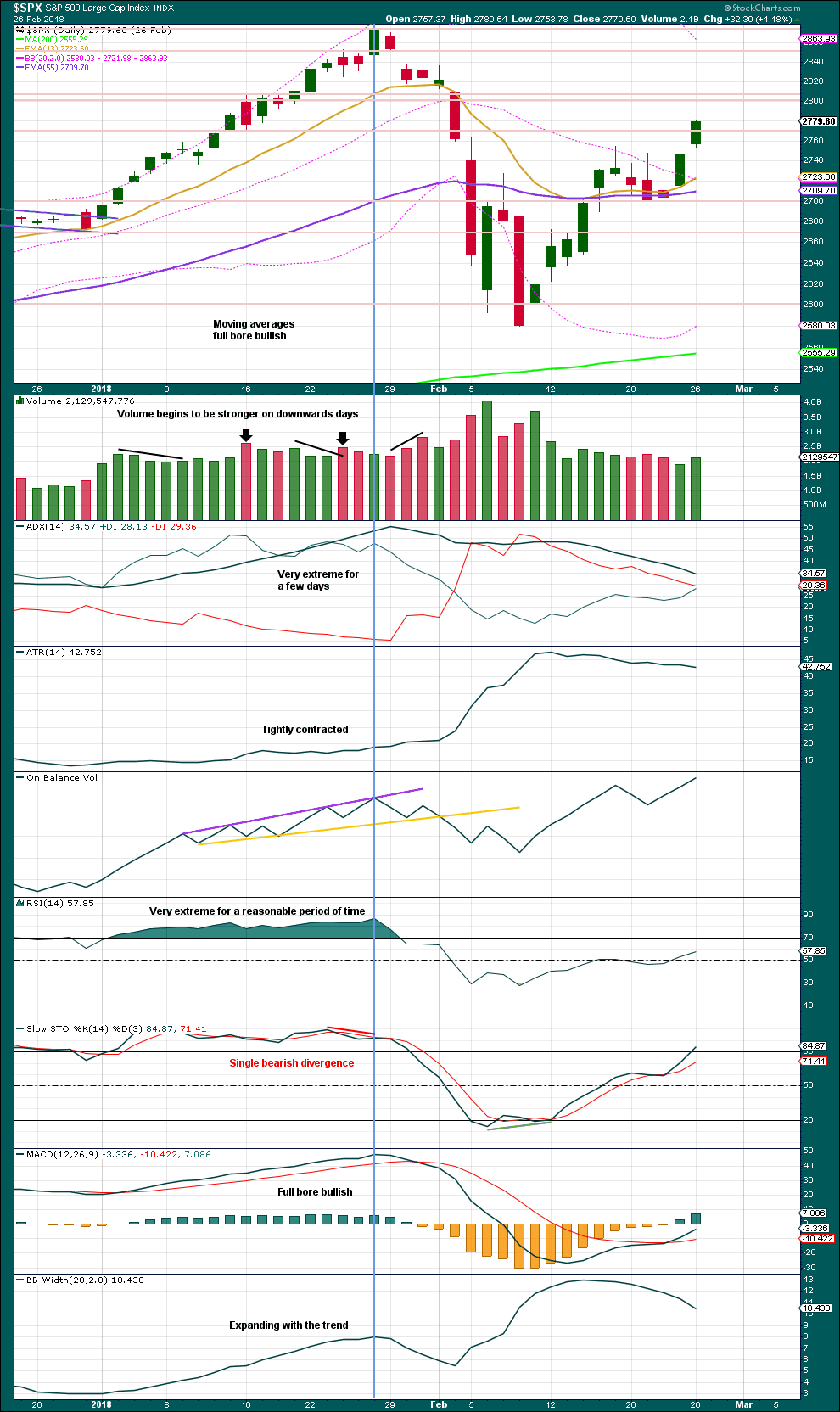

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart looked overly bullish at the end of intermediate wave (3). The only warning in hindsight may have been from volume spiking slightly on downwards days. There was no bearish divergence between price and either of RSI or On Balance Volume.

Single bearish divergence between price and Stochastics was weak, which is often an unreliable signal.

VIX

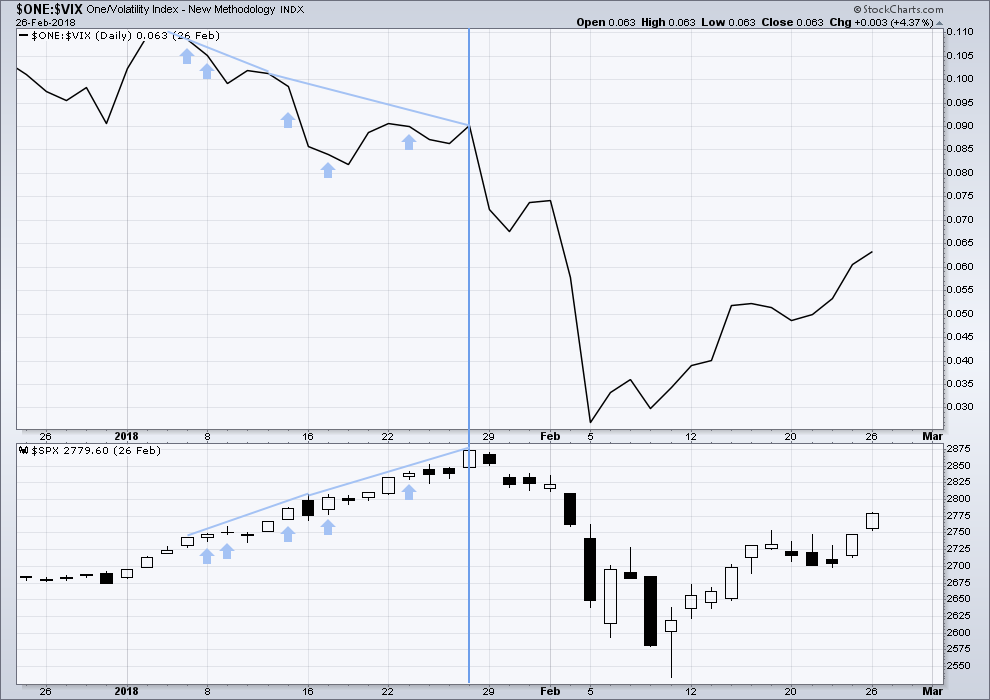

Click chart to enlarge. Chart courtesy of StockCharts.com.

The strongest warning of an approaching intermediate degree correction at the daily chart level came from inverted VIX.

There was strong double bearish divergence at the high of intermediate wave (3), which is noted by the vertical line. There was also a sequence of five days of bearish divergence, days in which price moved higher but inverted VIX moved lower.

AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There was only single bearish divergence between price and the AD line at the end of intermediate wave (3). Approaching the high, there were no instances of price moving higher and the AD line moving lower.

Conclusion: When studying the behaviour of price and these indicators just before the start of intermediate wave (4), we may see some clues for warning us of primary wave 4. A cluster of bearish signals from VIX along with a bearish divergence from price and the AD line or On Balance Volume may warn of primary wave 4. The next instance will probably not behave the same as the last, but there may be similarities.

At this time, it does not look like primary wave 4 may begin right now, but we need to be aware of its approach.

Published @ 08:30 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Another fairly unconvincing downwards day. If this is the start of primary wave 4, then it’s weak.

It looks corrective, and more like another pullback within primary wave 3. So far.

Between 2881 and 2883.8 should be just about the closing price for SPX today. 2883.8 is right on the upper 21 period daily keltner, while 2881 is right at the revised downtrend line. a fair way to come back up but let’s see…

I guess not today. The lows are right at the pivot high support from early August, which is also a 23% retrace of one of the larger swings. Maybe that will hold next week.

But as a ii wave down…doesn’t look done to me. ii’s are “often” deep. The cluster of fibos (78% and 38%) at 2827-31 looks like the most likely next level down, though there are few other possible turn levels higher too.

Did you fall for the bankster brinksmanship?

What was the dead give-away?

I’m outta here till next week. Take care all!

Isn’t amazing how much bullish sentiment a few hundred billion dumped into the cash and futures markets will buy? Yes, it sure is! 🙂

A Friday Larry Williams OOPS day would be VERY bullish (in my opinion). Oops days are when in a significant downtrend a gap down open occurs and the day finishes up above the prior day close.

Particularly if the close was also above that darn down channel line that this 2 down (?) has formed. But my best guess is that a range is now established and it’s going to meander inside that range the rest of the day. Unless this really is the start of the P4, in which case, a mid-late day large sell off could possible be coming at us.

Ergo, I have no clue what this market will do next. Watching….

Tagged the upper down channel line…and turned tail. Back all the way in the channel? Or up again for another test?

In keeping with full disclosure, my short term account has accumulated long positions this morning near the lows. I am now fully long in short term account. Long term account has remained with long positions during this correction from 2917.

This is my thinking; not only does Lara have a bullish main count, but the recent action has been a breakout of a six month consolidation ( 2872 to 2532, Feb through Aug) and the recent correction to 2864 is a normal and to be expected return to the top of the consolidation (~2872). Classical technical analysis indicates the longer the period of consolidation, the longer the period of a move upon breakout. In addition, the classical TA target is (2872-2532) + 2872 = 3212. So the potential upside is significant, ~12%. Furthermore, I have the ability to curtail any losses with a nearby stop loss order. Thus, I believe this is a good risk-reward ratio trade.

In any event, full disclosure.

Today’s gap open to the downside and a move upwards since then, is setting up a one day reversal pattern. If we close in the green for the day, especially if we can close up strongly, the pattern will be confirmed and a low should be in place. This is in keeping with Lara’s current main hourly count where today’s low is now the minute ii bottom or completion of the corrective wave. Confirmation will come on a new ATH.

Interesting day, lets see how it ends up.

Your principled approach Rodney is outstanding, thank you for sharing.

Nice Rodney. Based on solid technical analysis.

That’s the nice thing about technical analysis. Technical analysis can tell you not only when to get in, but just as importantly, when to get out.

As you can plainly see on the 15 minute chart, the vol short selling cohort, whoever they may be, threw down the gauntlet in another defence of 15.35 and they got hammered!!

Strong hands accumulating long vol and were having none of that….not today!! Buckle up! 🙂

Guten Morgen!

Market price action now is all about leverage and the still unwound risk parity trade. It is astonishing that VIX going to historic highs failed to fully unwind it. Most agree that vol is headed higher but few are expecting the Feb highs to be repeated. I suspect they will be exceeded. Long vol is the next big money trade. Soon it will be Silver and Gold.

Watch VIX 15 closely. It will tell you what to expect from today’s price action.

Have a great trading day and a wonderful and restful weekend everyone!

Hi Joseph, Cesar is working on your log in problem now.

Is anyone else having any issues with logging in?

I’ll check back here later tonight, and then first thing tomorrow to look for any replies.

Thanks guys!

I am having some problems also. I sometime get shunted to a page asking me to re-enter password. It has a big “W” on the page. I won’t sign in on that because it look like a “phishing” scam. I’m not sure if that is the same problem others are having?

The big “W” is the default WordPress login page. You’ll see it if your first attempt fails. I saw it this morning too, logging in on my iphone (ewsm website, not the app). But here I am.

Hi Lara: Able to log in from all parts of the webpage today, however,

The login from the top of page menu is a Single Login… which is normal.

The login when you click on your work 1st then login and the right side of the page login is a double login. … meaning after the 1st login you get bounced to a page with a W on it and have to login again… then I am in.

I am really sorry guys for the continued hassle.

I’m passing your comments onto Cesar. He’s got some good information now on what’s happening, thanks to your responses. Pretty sure I know what he’s going to be up to this weekend!