Upwards movement continues exactly as the Elliott wave count expects.

On Balance Volume gives a new signal today to support the Elliott wave analysis.

Summary: For the very short term, a small shallow correction may unfold tomorrow.

The last gap may be a breakaway gap, which may offer support at 2,876.16. Gaps can be useful in trading as a place to set stops.

Stops for long positions may be pulled up to just below 2,876.16.

Primary wave 3 may end at any time, but so far there is only a very little indication it may end within the next few days. Expect it is most likely that price may continue higher with brief shallow corrections along the way up.

The mid to longer term target is at 2,922 (Elliott wave), or 2,950 (Elliott wave), or 3,045 (classic analysis). Another multi week to multi month correction is expected at one of these targets.

The final target for this bull market to end remains at 3,616.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

ELLIOTT WAVE COUNT

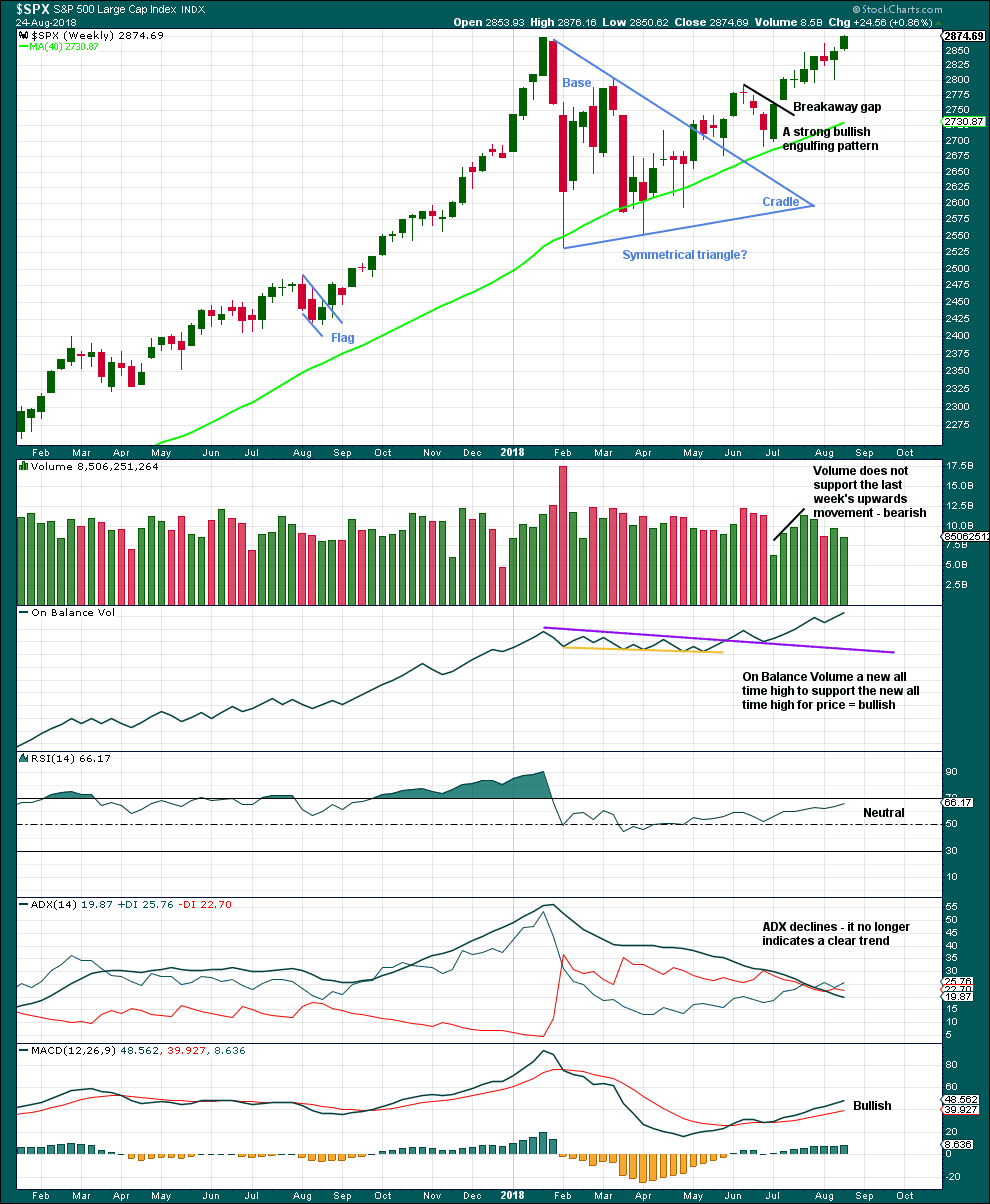

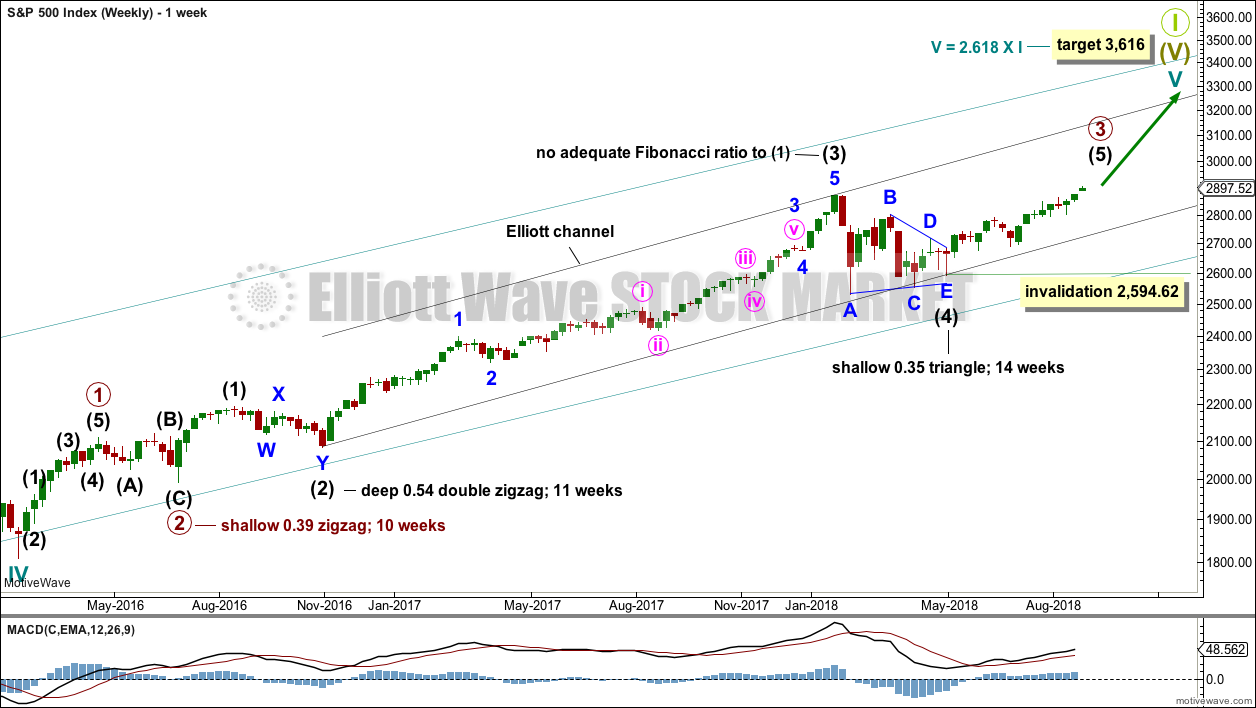

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62. However, the lower edge of the black Elliott channel drawn across the ends of intermediate degree waves should provide very strong support for any deeper pullbacks, holding price well above the invalidation point while intermediate wave (5) unfolds.

At this stage, the expectation is for the final target to me met in October 2019. If price gets up to this target and either the structure is incomplete or price keeps rising through it, then a new higher target would be calculated.

A multi week to multi month consolidation for primary wave 4 is expected on the way up to the final target. This large correction may now be fairly close by in terms of time; classic analysis will be watched carefully to identify early warning signs of its approach.

The last bullish fifth wave of minor wave 5 to end intermediate wave (3) exhibited commodity like behaviour. It was strong and sustained. It is possible that minor wave 5 to end intermediate wave (5) to end primary wave 3 may exhibit similar behaviour, so we should be on the lookout for this possibility. This may happen over the next very few weeks.

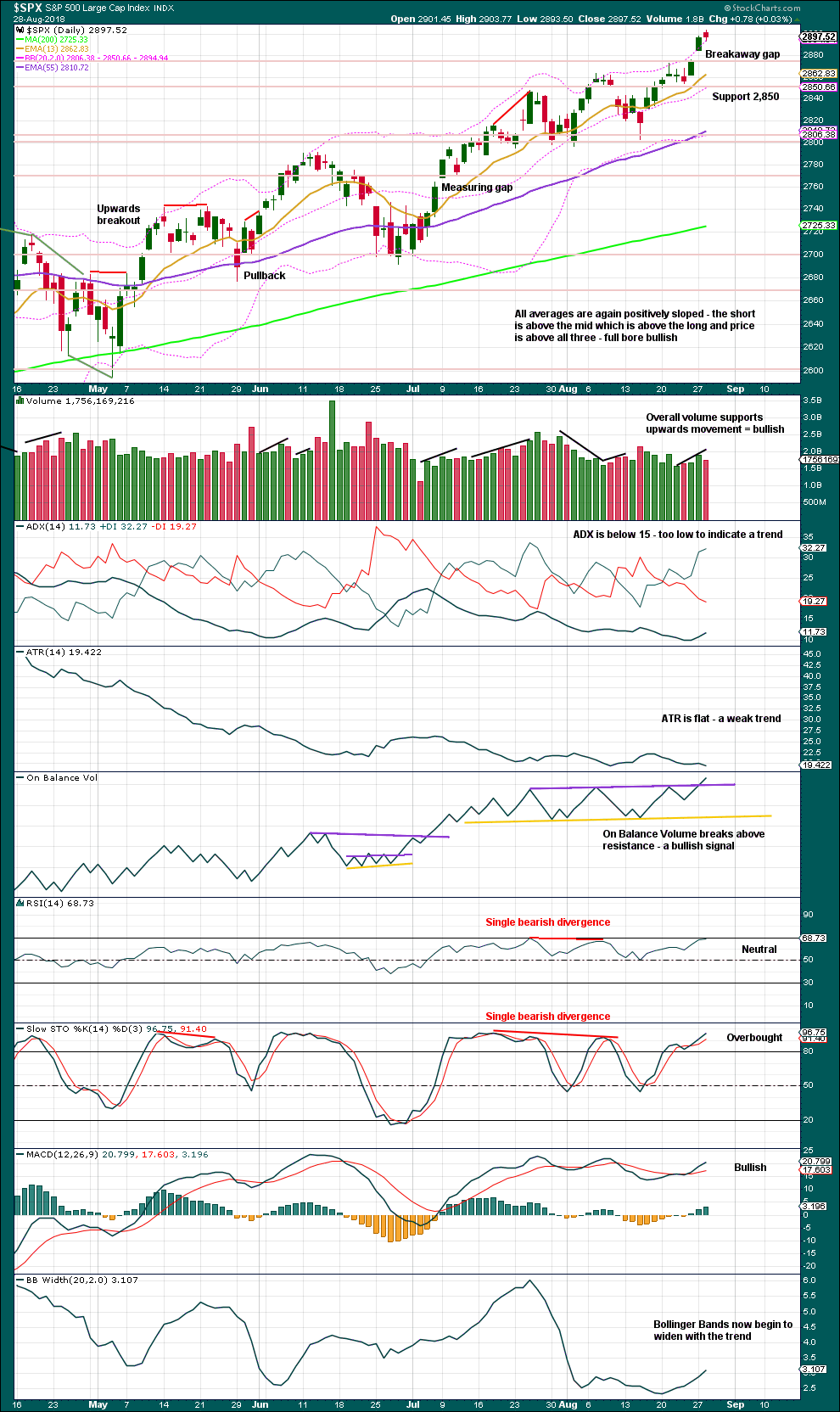

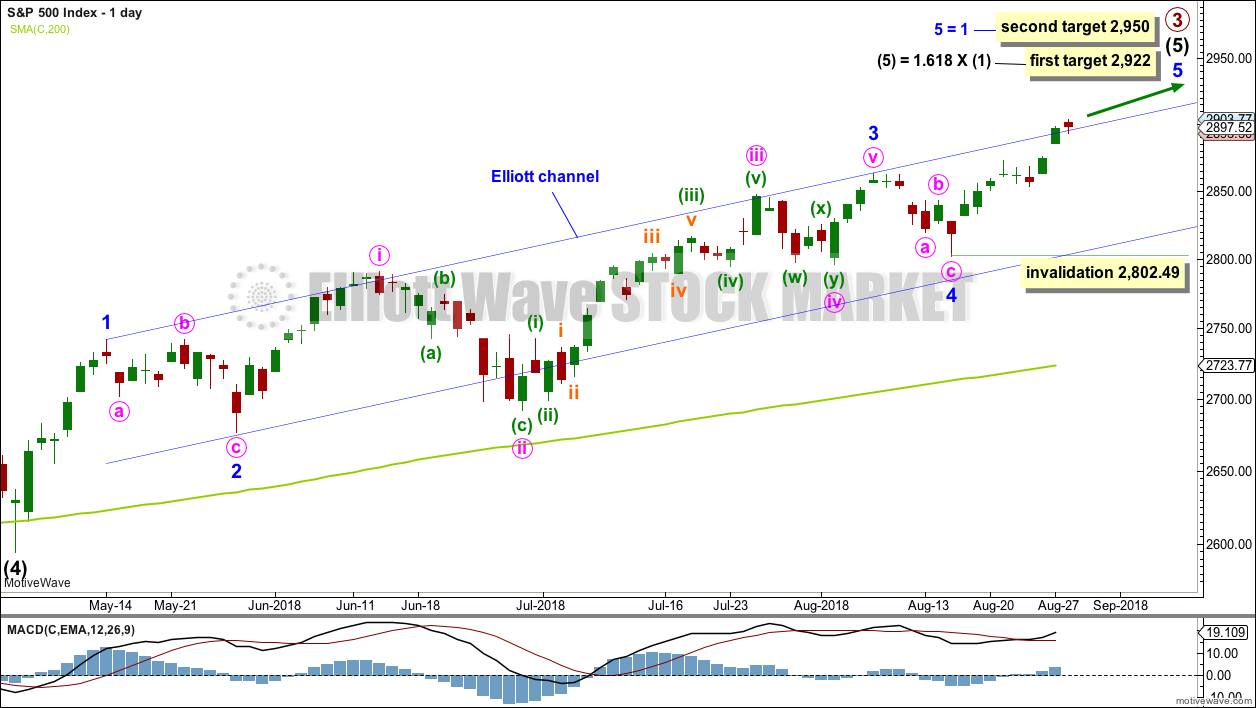

DAILY CHART

Intermediate wave (5) avoided a truncation now that it has a slight new high above the end of intermediate wave (3) at 2,872.87.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). Intermediate wave (5) has passed equality in length with intermediate wave (1). The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 through to 4 may now all be complete.

The channel is drawn about intermediate wave (5) using Elliott’s first technique. Price has closed above the upper edge.

Minor wave 5 may be developing some commodity like behaviour. If price can move further above the upper edge of this channel, then it may provide some support.

If price gets to the first target and the structure of minor wave 5 is incomplete, or if price just keeps on rising through the first target, then the second target will be used. Two hourly wave counts are now provided below.

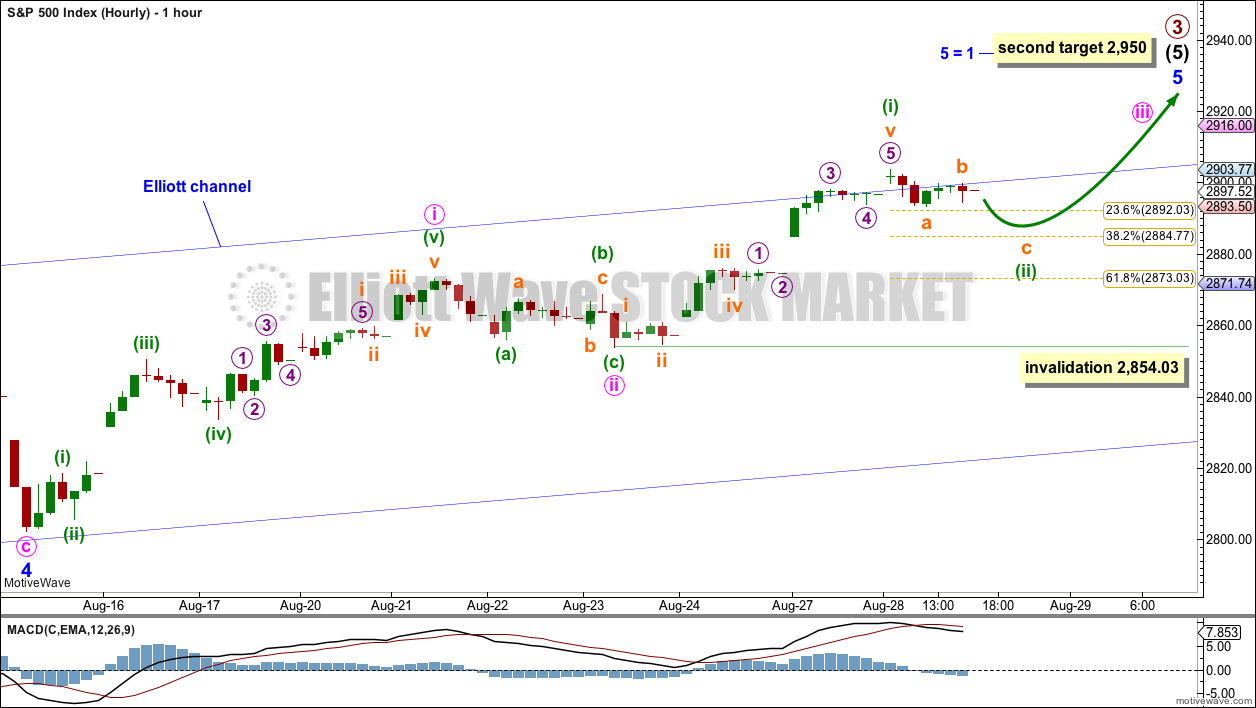

HOURLY CHART

Minor wave 5 may unfold as either an impulse or an ending diagonal. An impulse is more likely.

So far minute waves i and ii may be complete. Minute wave iii may exhibit some further increase in upwards momentum this week.

Minute wave iii may only subdivide as an impulse. It would most likely be longer than minute wave i, and so within it only minuette wave (i) may be complete. Minuette wave (ii) may complete tomorrow as a small shallow zigzag.

Minuette wave (ii) may be surprisingly shallow as the upwards pull of a third wave at two small degrees forces it to be more brief and shallow. Minuette wave (ii) may not move beyond the start of minuette wave (i) below 2,854.03.

When minute waves i to iv may be complete, then the target may be calculated at a third degree. At that stage, the target may widen to a small zone or it may change.

This wave count works best with the second higher target, which would allow room for the structure to complete.

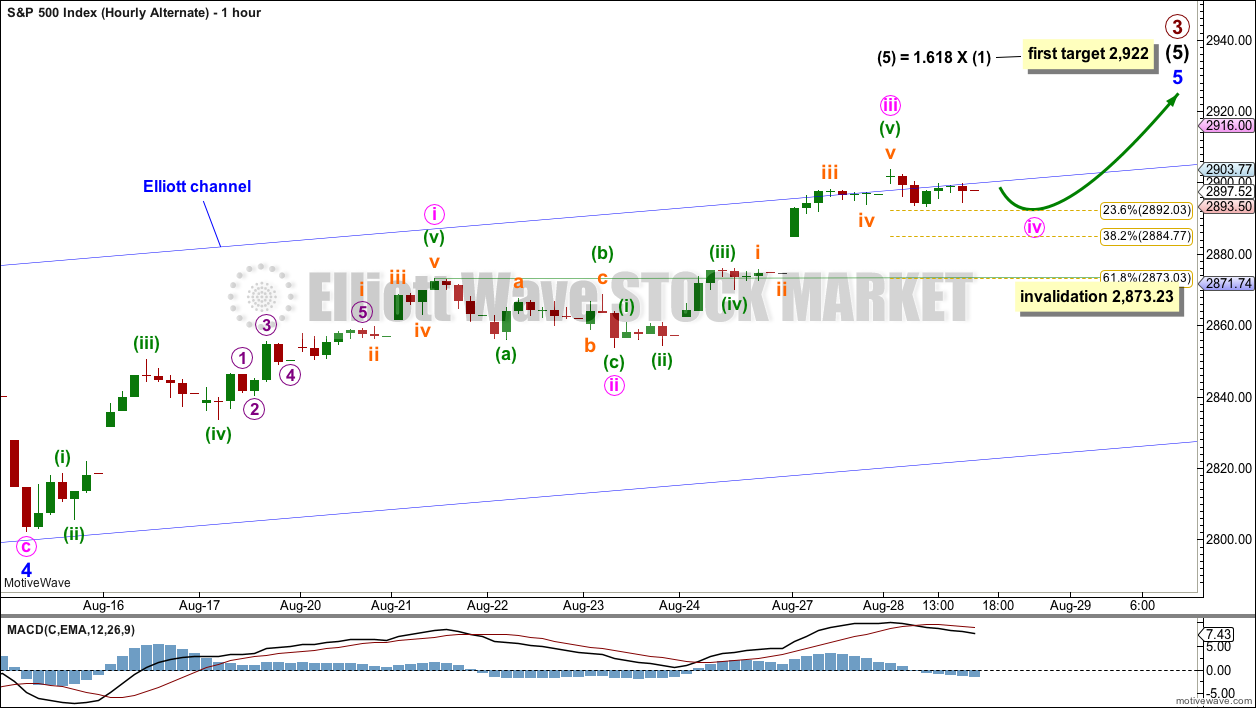

ALTERNATE HOURLY CHART

By simply moving the degree of labelling within the last wave all up one degree, it is possible that minute wave iii could be over. There is no Fibonacci ratio between minute waves i and iii.

Minute wave iii is shorter than minute wave i. Because minute wave iii may not be the shortest actionary wave within minor wave 5 this limits minute wave v to no longer than equality in length with minute wave iii, which was 49.74 points.

Minute wave iv may unfold tomorrow as a shallow sideways flat, combination or triangle to exhibit alternation with the zigzag of minute wave ii. Minute wave iv may not move into minute wave i price territory below 2,873.23.

This wave count only works for the first target at 2,922 because the length of minute wave v is limited.

This wave count is judged to be an alternate because minute wave iii would be less likely to be shorter than minute wave i.

TECHNICAL ANALYSIS

WEEKLY CHART

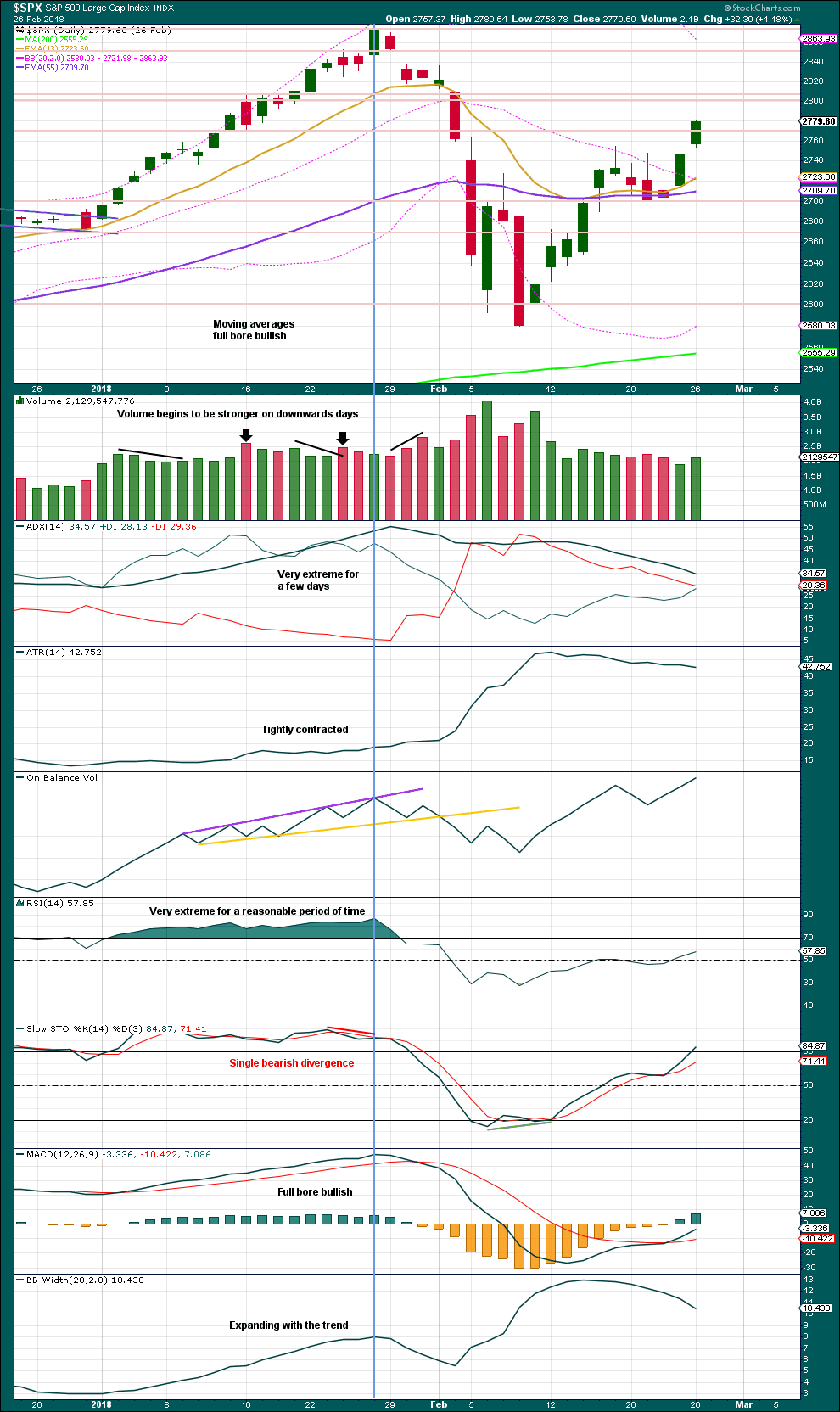

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete. The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

A new all time high for price has support from another new all time high from On Balance Volume at the weekly chart level, although not at the daily chart level. This is bullish.

Price can rise in current market conditions on light and declining volume for a reasonable period of time, so lighter volume last week does not mean that the rise in price is unsustainable for the short or mid term.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Since the low on the 2nd of April, 2018, price has made a series of higher highs and higher lows. This is the definition of an upwards trend. But trends do not move in perfectly straight lines; there are pullbacks and bounces along the way.

Breakaway and measuring gaps can be useful in trading: stops may be adjusted using these gaps. If the last gap is closed, then it would not be a breakaway gap but would then correctly be an exhaustion gap, so a reasonable correction would be expected and long positions should then be closed. If the last gap is closed, that may be taken as a signal that primary wave 3 may be over and primary wave 4 may have arrived.

The bullish signal from On Balance Volume today is not strong because the purple trend line had only three tests. However, another new all time high today from On Balance Volume, which is very bullish, supports upwards movement.

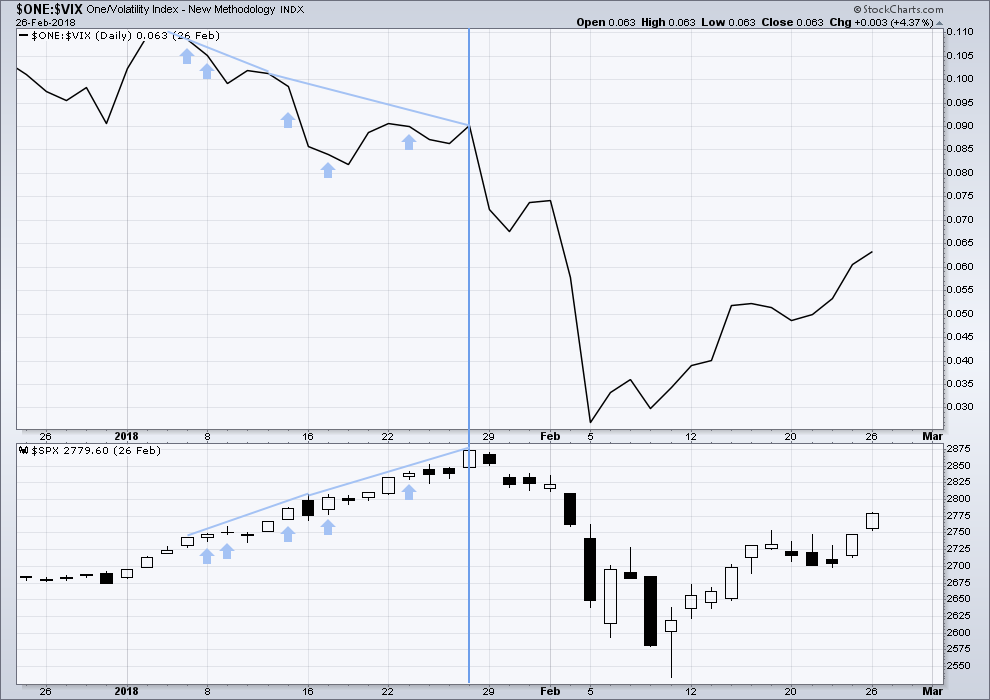

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

At this time, there is mid term bearish divergence between price and inverted VIX: price has made a new all time high, but inverted VIX has not. This divergence may persist for some time and may remain at the end of primary wave 3.

For the short term, upwards movement last week had support from a decline in market volatility. There is no very short term divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is mid term divergence with a new all time high from price not supported by a corresponding new all time high from inverted VIX. This divergence is bearish.

There are now two days of bearish divergence: price has moved strongly higher, but inverted VIX has moved lower. The upwards movement of the last two days from price does not come with a normal corresponding decline in volatility. Volatility has reasonably increased.

This is bearish and may be an early warning sign of primary wave 3 coming to an end and the start of primary wave 4. However, this divergence may yet develop further before primary wave 3 ends.

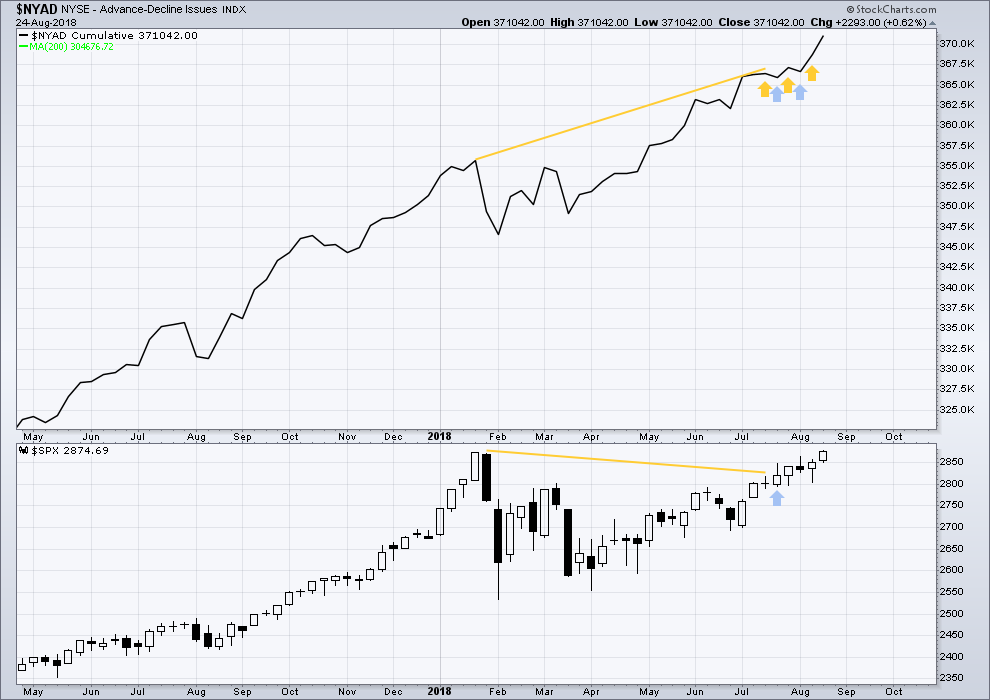

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

Strong bullish divergence noted between price and the AD line has finally been followed by a new all time high from price. This divergence may now be resolved, or it may be followed by more upwards movement.

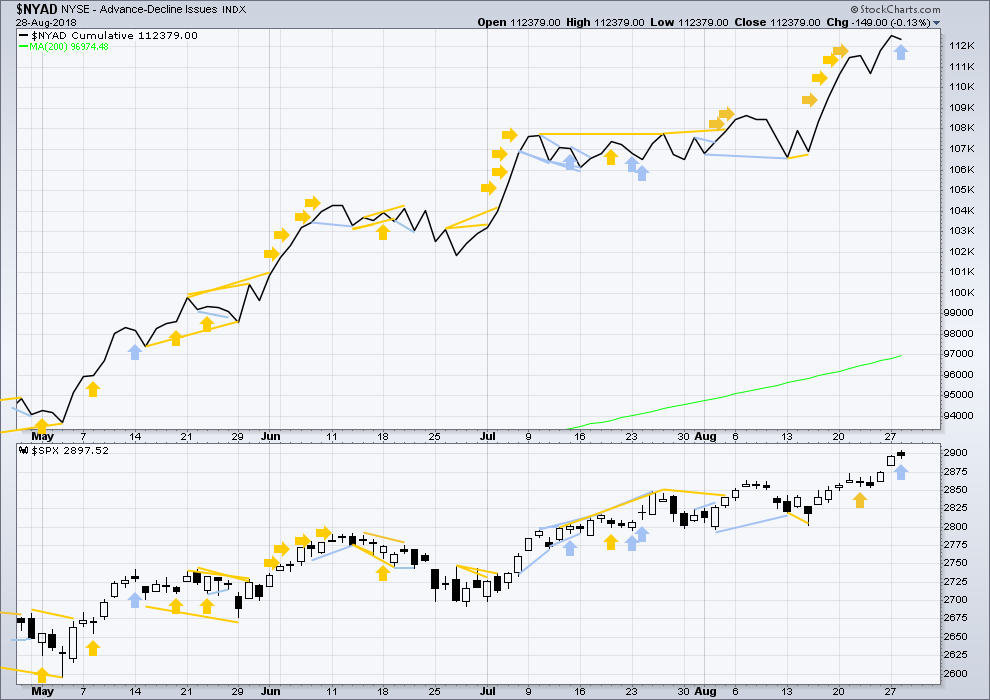

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

Price today has moved higher, but the AD line has moved lower. The rise in price today does not have support from rising market breadth. This divergence is bearish.

All of small, mid and large caps made new all time highs yesterday.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

Nasdaq and DJT and now the S&P500 have all made recent new all time highs. For Dow Theory confirmation of the ongoing bull market, DJIA needs to make a new all time high.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

ANALYSIS OF THE END OF INTERMEDIATE WAVE (3)

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart looked overly bullish at the end of intermediate wave (3). The only warning in hindsight may have been from volume spiking slightly on downwards days. There was no bearish divergence between price and either of RSI or On Balance Volume.

Single bearish divergence between price and Stochastics was weak, which is often an unreliable signal.

VIX

Click chart to enlarge. Chart courtesy of StockCharts.com.

The strongest warning of an approaching intermediate degree correction at the daily chart level came from inverted VIX.

There was strong double bearish divergence at the high of intermediate wave (3), which is noted by the vertical line. There was also a sequence of five days of bearish divergence, days in which price moved higher but inverted VIX moved lower.

AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There was only single bearish divergence between price and the AD line at the end of intermediate wave (3). Approaching the high, there were no instances of price moving higher and the AD line moving lower.

Conclusion: When studying the behaviour of price and these indicators just before the start of intermediate wave (4), we may see some clues for warning us of primary wave 4. A cluster of bearish signals from VIX along with a bearish divergence from price and the AD line or On Balance Volume may warn of primary wave 4. The next instance will probably not behave the same as the last, but there may be similarities.

At this time, it does not look like primary wave 4 may begin right now, but we need to be aware of its approach.

Published @ 08:44 p.m. EST.

main hourly chart updated:

that bearish signal yesterday from the AD line led to nothing….. yet.

if a cluster of bearish signals develop that would increase the probability of P4 arriving, but right now, that’s not the case

right now minor 5 is looking similar here to the last minor wave 5 to end intermediate (3). and so I’d be expecting this upwards movement to continue now for another one to few weeks.

I’ll keep posting alternates which consider that either P4 could begin right now (if I can find a wave count for that) or that it could begin very soon.

I know we could be surprised by it, but I would rather be prepared.

It seems to me it may be getting close to the time I should take some or all the money off the table on my long term account (weekly – monthly) long positions. They have been ringing a lot of green. Thank you very much Mr. Market. I want to be out of all long positions before or just after Primary 4 begins.

It is also time to begin planning an accumulation of short positions in my short term account which would use leveraged vehilcles. SPXU is a good candidate. UVXY is the most leveraged but carries great volatility / risk not to mention the contango or whatever it is called. It is like a heavy carrying cost. I forget some things in my old age!

Wouldn’t you know this all happens when I am leaving town again. Every time, never fails. I’ll be back next week. I think I’ll be able to so some switching of positions then. Have a great week end and for Americans, a great Labor Day celebration.

On the other hand, this market is exhibiting strong momentum right now. That may speak to the 3000+ SPX target as occurring before Primary 4 begins. A few weeks ago I eluded to the quote of Jesse Livermore where he suggests the biggest failure of traders / investors is taking profits too soon.

I’ll point out what you know: sometimes momentum is the absolute highest right before the fall, witness Jan 2018.

The WC has been awfully accurate ever since price started the intermediate iv. And everything about it at this point indicates the intermediate v/minor v/primary 3 end within days (my best projection right now is Wed-Fri of next week).

I’ve lighten up considerably, and already reduced my profitability as a result. It’s a trade off. As I see it right now, “better safer than sorrier.”

There was no momentum warning prior to the February collapse, and RSI is already showing divergences at the daily and weekly levels. I think we can rest assured that like last time, the crash will be extremely swift. I do think 3000 is within reach, but there is no longer any room for error. Unlike the last 4 months, as intermediate 5 unfolded, we can anticipate a VERY deep correction any time betweeen here and 3000+.

Keep in mind that we might have zero warning about a P4 down initiating. Some type of external event (political or military) could cause an instant -3% (or more) in the market, followed by waves of selling. I won’t be holding broad market positions over night until this P4 starts up. I don’t want to wake up to -3% in the markets with large positions on, and I think that’s a very real possibility here.

More substantial droopage in /ZB as expected through the big range. Might drive another up trend day tomorrow, at least in finance.

“By simply moving the degree of labelling within the last wave all down one degree, it is possible that minute wave iii could be over.”

Up one degree perhaps?

{Primary wave 3 may end at any time}

If it does, what would be the price targets for Primary 4 to end.

The price range of intermediate wave (4). Somewhere in there.

2,872.87 – 2,532.69

If a Fibonacci ratio of primary wave 3 sits within that range, then that would be the initial target.

I cannot know the Fibonacci ratios of primary wave 3 until it’s over though.

Okay, thanks Lara… it could be a material move when it starts.

Any way to sense if just a shallow or deeper P4… lower 1/4 of that range… ahead of time?

Not really. Only an educated guess based upon experience.

I would expect P4 to be larger than intermediate (4).

The downwards waves within it may be quite strong. Volatility should increase strongly, and the AD line should decline substantially to then not properly recover during P5.

Oops! Yes! Will fix now.