A new signal today from the AD line requires a new Elliott wave count for the short term expectation. The new Elliott wave count has a new short term target.

Summary: A new all time high from the AD line is very bullish. Expect upwards movement as most likely tomorrow. The short term target is now at 2,759. A limit is at 2,791.21. When this next wave is complete, then another longer lasting pullback may unfold.

The long to mid term Elliott wave target is at 2,922, and a classic analysis target is now at 3,045.

Corrections are an opportunity to join the trend.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An alternate idea at the monthly chart level is given here at the end of this analysis.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

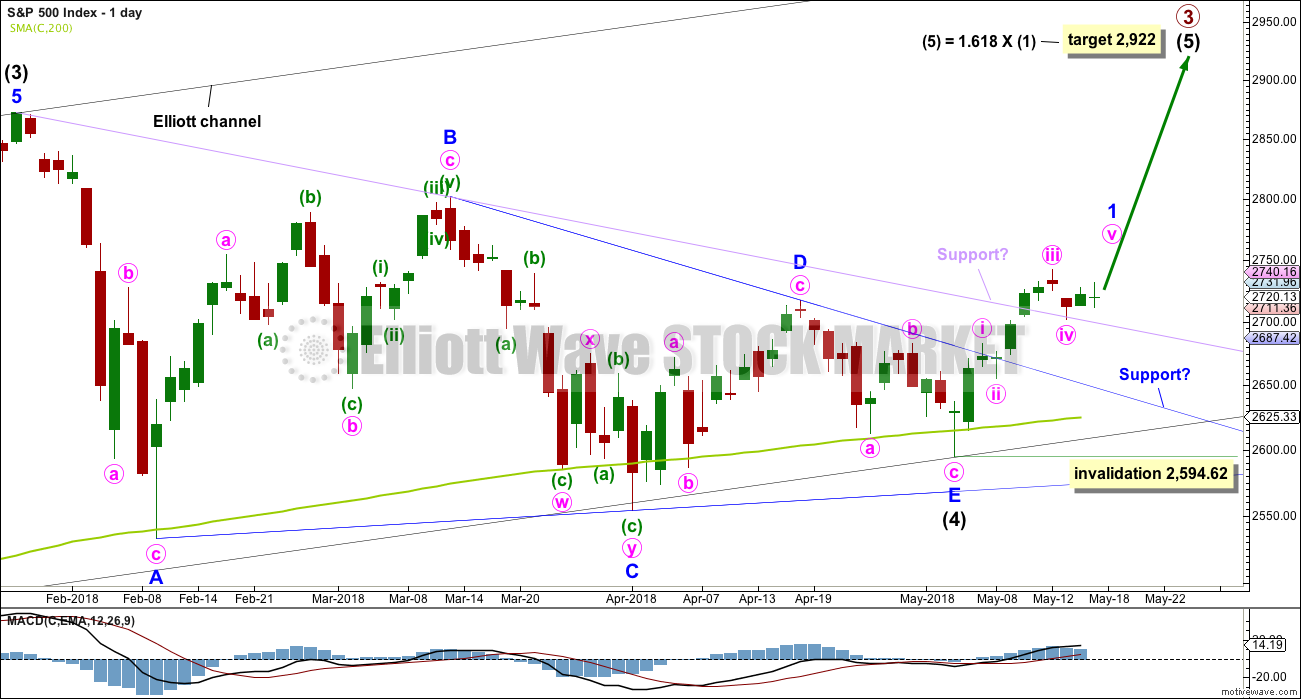

ELLIOTT WAVE COUNT

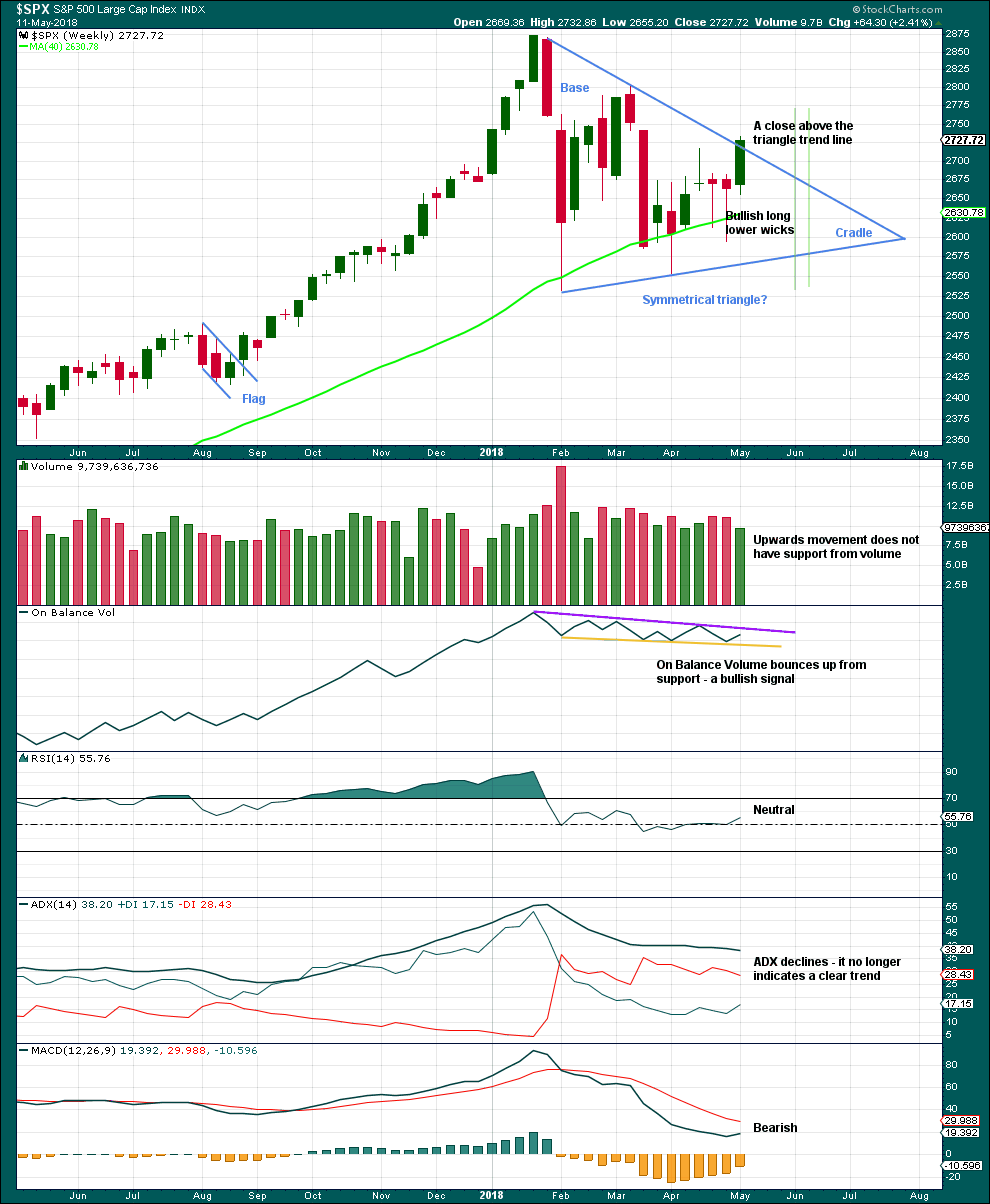

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

Intermediate wave (4) may now be a complete regular contracting triangle lasting fourteen weeks, one longer than a Fibonacci thirteen. There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

If intermediate wave (4) were to continue further as either a flat or combination, both possibilities would require another deep pullback to end at or below 2,532.69. With both On Balance Volume and the AD line making new all time highs, that possibility looks extremely unlikely.

If intermediate wave (4) were to continue further, it would now be grossly disproportionate to intermediate wave (2). Both classic technical analysis and Elliott wave analysis now suggest these alternate ideas should be discarded based upon a very low probability.

The AD line today makes another all time high, so the invalidation point is moved higher at the weekly chart level. Within intermediate wave (5), no second wave correction may move beyond the start of its first wave below 2,594.62.

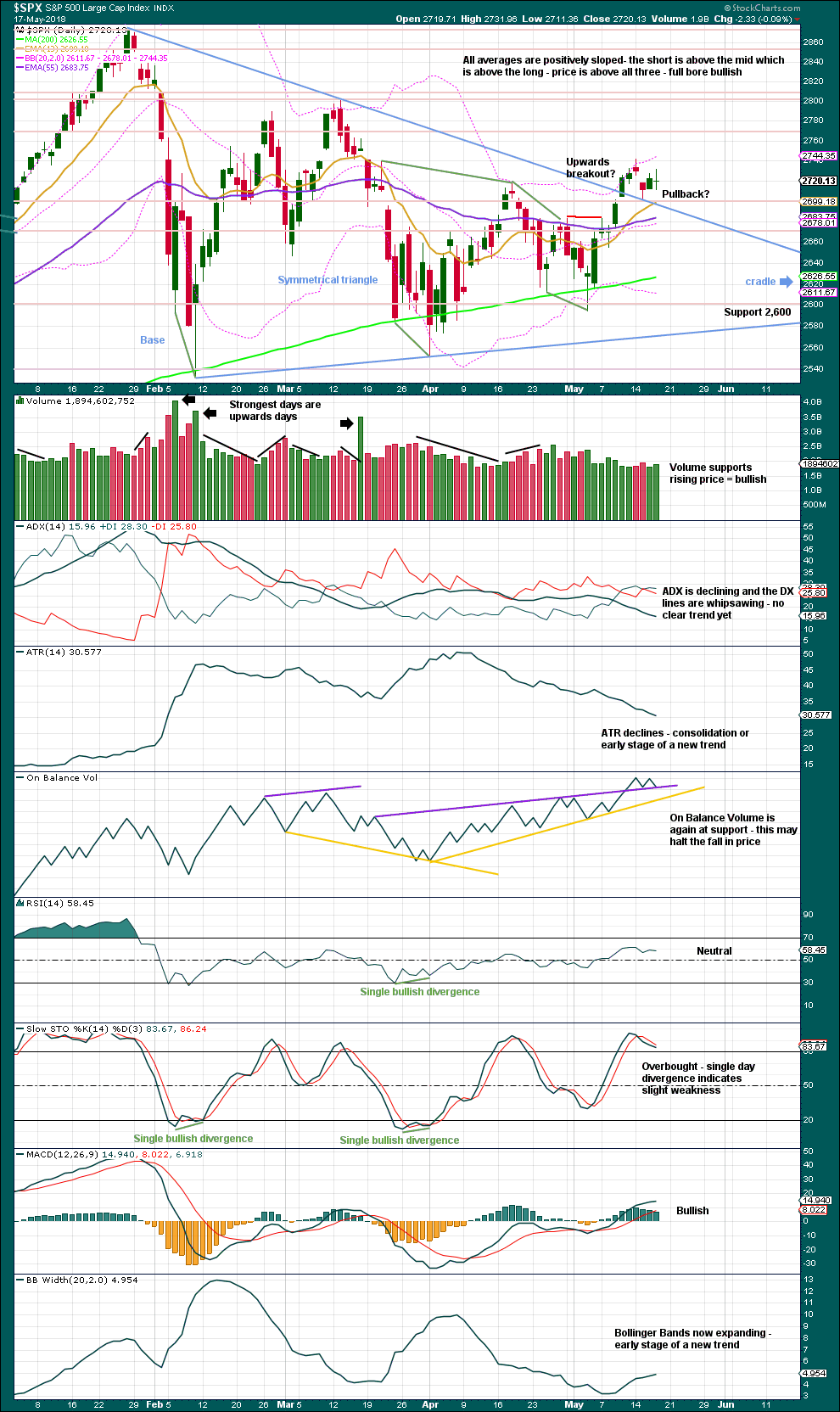

DAILY CHART

It is possible that intermediate wave (4) is a complete regular contracting triangle, the most common type of triangle. Minor wave E may have found support just below the 200 day moving average and ending reasonably short of the A-C trend line. This is the most common look for E waves of triangles.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). The most common Fibonacci ratio would be equality in length with intermediate wave (1), but in this instance that would expect a truncation. The next common Fibonacci ratio is used to calculate a target for intermediate wave (5) to end.

Price has clearly broken out above the upper triangle B-D trend line. This indicates that it should now be over if the triangle is correctly labelled.

A resistance line in lilac is added to this chart. It is the same line as the upper edge of the symmetrical triangle on the daily technical analysis chart. Upwards movement has sliced cleanly through this line, finding no resistance before breaking it. This line may offer some support for any pullbacks. Price is finding support at that line so far. A breach of that line does not mean the classic triangle is invalid and that price must make new lows, only that the pullback is deeper. Look for next support at the blue Elliott wave triangle B-D trend line.

Sometimes the point at which the triangle trend lines cross over sees a trend change. A trend change at that point may be a minor one or a major one. That point is now about the 5th of June.

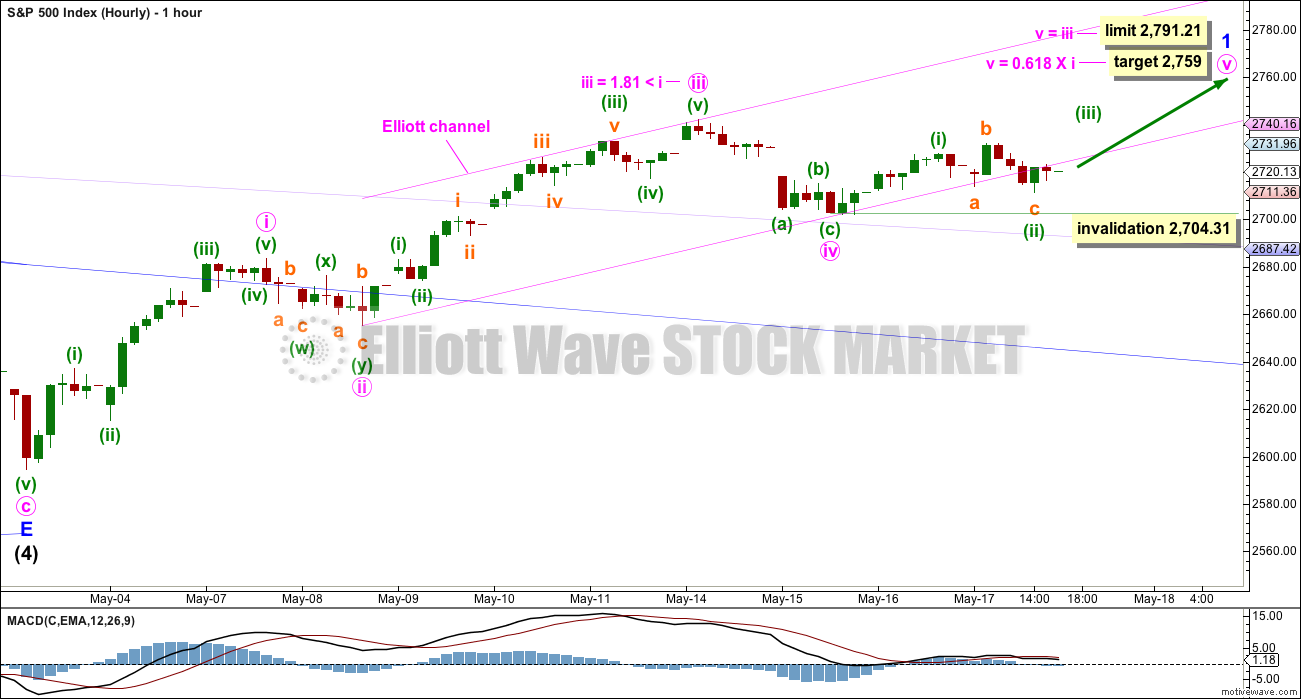

HOURLY CHART

This hourly chart is new today in response to another all time high from the AD line. This is a very bullish signal that should be given weight in this analysis.

Minor wave 1 may be incomplete, and within it minute waves i, ii, iii and iv may all be complete. Only minute wave v may now be needed to complete an impulse upwards.

Minute wave iii is slightly shorter than minute wave i. So that the core Elliott wave rule stating a third wave may never be the shortest is met, minute wave v has a limit of no longer than equality in length with minute wave iii.

Within minute wave v, minuette waves (i) and (ii) may be complete. If minuette wave (ii) continues any further, then it may not move beyond the start of minuette wave (i) below 2,704.31.

So far minute wave v is not remaining neatly within the pink Elliott channel. This is typical behaviour from the S&P. It will often breach channels but continue in the old direction.

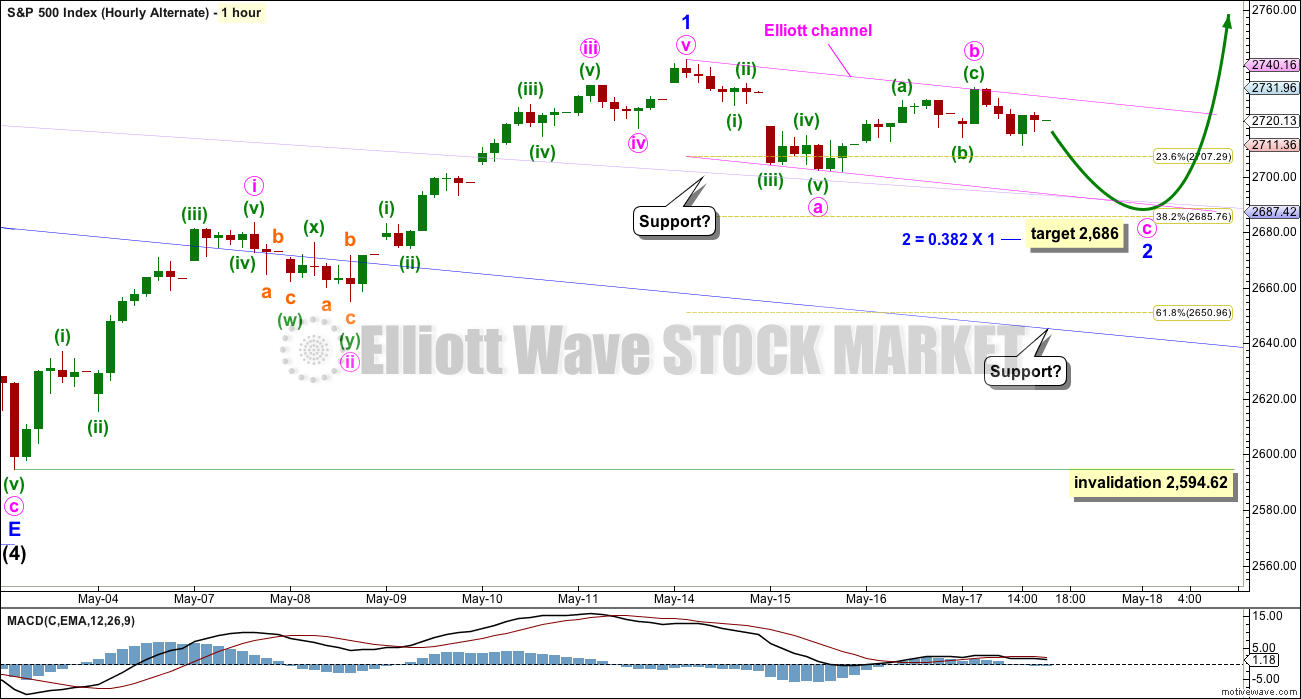

ALTERNATE HOURLY CHART

Minor wave 1 may be a complete five wave impulse. The middle portion of minuette wave (iii) does not have as good a look for this wave count, but the S&P does not always have good looking impulses.

Minor wave 1 may have lasted seven days. Minor wave 2 may be expected to last about three to eight days to have reasonable proportion to minor wave 1. Targets for minor wave 2 may be the 0.382 and 0.618 Fibonacci ratios. If it ends about the 0.382 Fibonacci ratio, then it may continue to find support at the lilac trend line (copied over from the daily chart).

Minor wave 2 may be subdividing as a zigzag, and within it minute wave a may be a complete five wave impulse. Minute wave b may have moved a little higher today. If minute wave a is correctly labelled as a five, then minute wave b may not move beyond its start above 2,742.10.

It is also possible that minute wave a is incorrectly labelled. It may be a complete double zigzag. If minute wave a is a corrective structure, then minor wave 2 may be unfolding as a flat correction. Within a flat correction, minute wave b may make a new high above the start of minute wave a at 2,742.10 as in an expanded flat. It is for this reason that an upper invalidation point is not added to this hourly chart.

Minor wave 2 may not move beyond the start of minor wave 1 below 2,594.62.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A classic symmetrical triangle pattern may be forming. These are different to Elliott wave triangles. Symmetrical triangles may be either continuation or reversal patterns, while Elliott wave triangles are always continuation patterns and have stricter rules.

The vertical green lines are 73% to 75% of the length of the triangle from cradle to base, where a breakout most commonly occurs.

From Dhalquist and Kirkpatrick on trading triangles:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout.”

For this example, the breakout may have happened last week. There was a high trading range within the triangle, but volume declined.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle may now be complete, and price has completed an upwards breakout. There may be some small cause for concern that the upwards breakout does not have support from volume. However, in current market conditions only some small concern is had here. Rising price on light and declining volume has been a feature of this market for many months, yet price continues to rise.

After an upwards breakout, pullbacks occur 59% of the time. A pullback may find support at the upper triangle trend line and may be used as an opportunity to join a trend. The trend line is slightly adjusted today. It may have shown where the small pullback found support three days ago.

Symmetrical triangles suffer from many false breakouts. If price returns back into the triangle, then the breakout will be considered false and the triangle trend line will be redrawn.

The base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This is above the Elliott wave target at 2,922, so the Elliott wave target may be inadequate.

For the short term, the next smaller consolidation or pullback may come about 2,811. This shorter term target is calculated using the measuring gap. That gap may now provide support and may be used to pull up stops on long positions. The gap still remains just open; if tomorrow continues to see higher prices, then this short term target will remain valid.

On Balance Volume has made a new all time high, providing a very strong bullish signal; expect price to follow.

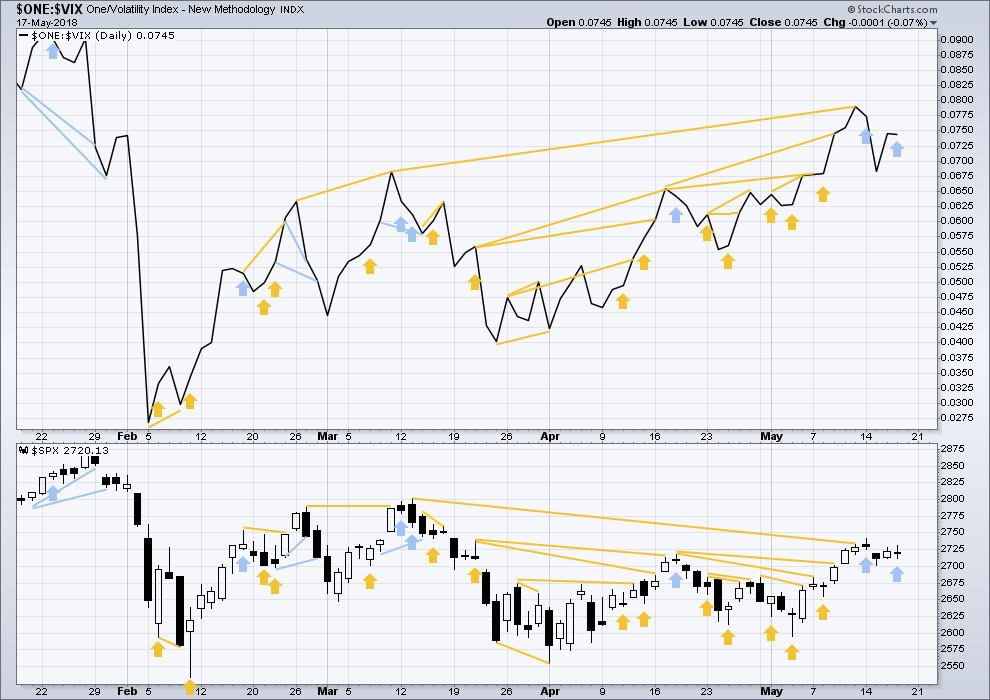

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is still a cluster of bullish signals on inverted VIX. Overall, this may offer support to the main Elliott wave count.

Inverted VIX is much higher than the prior swing high of the 9th / 13th March, but price is not yet. Reading VIX as a leading indicator, this divergence is bullish.

Price moved slightly higher today, but inverted VIX moved slightly lower. This divergence is bearish, but it is weak.

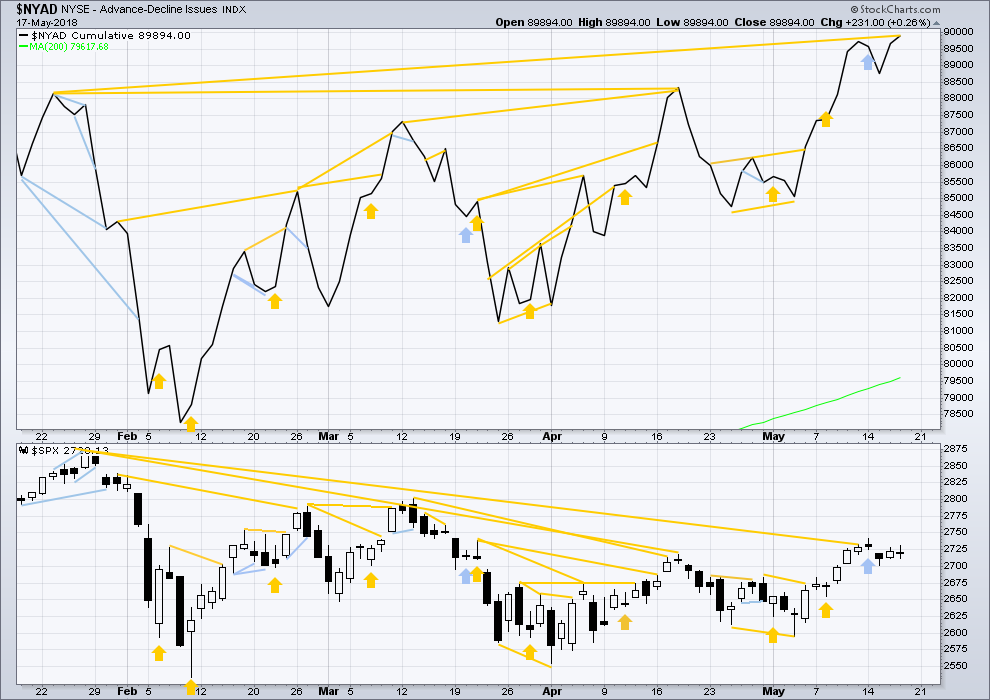

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line means that any bear market may now be an absolute minimum of 4 months away. It may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Small caps have made a new all time high last week, but mid and large caps have yet to do so. This divergence may be interpreted as bullish. Small caps may now be leading the market.

Breadth should be read as a leading indicator.

There has been a cluster of bullish signals from the AD line in the last few weeks. This also overall offers good support to the main Elliott wave count.

The AD line has made another new all time high. This is a very strong bullish signal, and is one reason why the more bearish Elliott wave counts are discarded. It is extremely likely now that price shall follow with a new all time high.

Both price and the AD line moved higher today.

The AD line has made another new all time high. This is very bullish and supports the main Elliott wave count at all time frames.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

At this stage, only DJIA has made a new major swing low. DJT also needs to make a new major swing low for Dow Theory to indicate a switch from a bull market to a bear market. For an extended Dow Theory, which includes the S&P500 and Nasdaq, these two markets also need to make new major swing lows.

Charts showing each prior major swing low used for Dow Theory may be seen at the end of this analysis here.

Published @ 10:20 p.m. EST.

Updated hourly chart:

This now looks more likely. Again.

Updated other hourly chart (this one is labelled main in this analysis)

With downwards / sideways movement today this now looks less likely

So… $SPX could go up from here, or it could go down from here before it goes up…

I appreciate your precision and care, Lara! Some days we just don’t know. Sometimes, we can know almost for certain. Just not today.

It sure does look like a classic pullback after a breakout. And price continues to be above that lilac trend line.

So yeah, that line may be tested again, or it may not be.

But with both On Balance Volume and the AD line making new all time highs, the longer term bull market looks so extremely likely. It’s just the short term gyrations that are proving harder to get exactly right.

Looking for VIX to be one of the signals at the start of Monday’s session, prepared with SPY 271 straddle with June 15th expiration. The Hourly Chart and Alternate Hourly Chart both look equally convincing, so I turn to a straddle in a situation like this rather than sitting on the sidelines waiting for price to make it’s next move. Enjoy your weekend everyone!

For me at the moment, the elephant in the room is this complete lack of any upward push after a theoretically complete iv wave. Similarly, looking at the alternate hourly, the rather unusual structure and timing of this 2 wave. The lack of proportionality leads me to wonder if “it’s all corrrective” as opposed to motive. I wonder wonder wonder…what’s next.

How about the minor 1 wave up is complete…because wave v is TRUNCATED??? Unlikely…maybe it’s just SPX being ill-proportioned, and the v wave up will come on Monday. Maybe…but this looks a bit ready to roll over and sell off to me. In a manner not consistent with said sell off being part of the motive wave up.

It does appear the week is going to end leaving the market with Dark Cloud Cover on the weekly SPX and NDX charts. Last time was the March 11 week, and initiated a massive sell off. I know our counts don’t indicate that here, now. But gotta consider every possibility. I still have my “speed lines” on this chart, showing the rates of relatively recent longer term price climbs. If the lowest of these gets violated…I get serious about the short side, fast. The combination possibility for the intermediate 4 is not dead and buried yet. Until then, one day at a time.

Right on Kevin, just got short term short signals on NASDAQ and XLF, still holding VIX positions, barely above water at this point. (not trading advice).

yea finance is getting hit hard. On the other side…if/when it bottoms and starts rising, that’s going to perhaps light some jets on the broader market. It’s strange because finance should be popping in this rising interest rate environment, but that’s not been happening. It’s a muddled mess, really. Perhaps next week will bring some clarity on direction. Let’s face it, the market is balanced on the head of a pin here; either the “breakout” of the triangle holds and the market goes, or, the intermediate combination comes back to life as the market tanks. I continue to believe there’s tons of pent up “energy” waiting to flow into the market, but whether that’s expended via buying or selling remains to be seen!!

The fight to be first has disappeared. Fashions come and go.

What doesn’t change is Mr. Market is out to do the most damage to the most possible people. Lets see what he has in store for us today. Is Minor 2 done or not? Right now, 45 minutes before the open, SPX futures are flat, NDX is down 0.20% and DJIA is up 0.20%. No clue here.

Perhaps today will give us some insight for we must always remember the #1 indicator that trumps all other indicators is price.

Where,oh where is Mr. Wabbit?

Right about Mr. Market. Look for him to shake out long eager beavers today ahead of the next move higher. I expect to buy back remaining short calls today. Have a great trading day everyone!

Good ol’ Microsoft. If ya have a back up PC and MS decides its time for updates…they all update! Usually an extra 10 minutes perhaps of boot time…my desktop is now 1 hour in, and only 49% complete! Fired up the laptop…updating!!! Fortunately that only took the 10 minutes. Just goes to show, redundancy but with common parts is still subject to system wide failure if the common parts fail simultaneously across the redundant systems. Grrrr……..Moral, ALWAYS make sure the night before the computer is booting all the way up with all updates complete, across BOTH MAIN AND BACKUP COMPUTERS!!

One hour and 45 minutes for this latest desktop Windows 10 update. That’s going to impact global productivity this quarter, lol!!! If you are a windows user and haven’t done this update yet, be forewarned! Fire it up, then fire up your cigar or spliff, enjoy some fine brandy…and wait!