A small inside day does not change the Elliott wave count.

Four hourly charts are published today to separate out four different ideas.

Summary: Bottom line: Expect price to continue lower while it remains within the best fit channel on the hourly charts. This view is supported today by a bearish signal from the AD line.

Expect the next wave down to be either about 60 or 107 points in length.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An alternate idea at the monthly chart level is given here at the end of this analysis.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

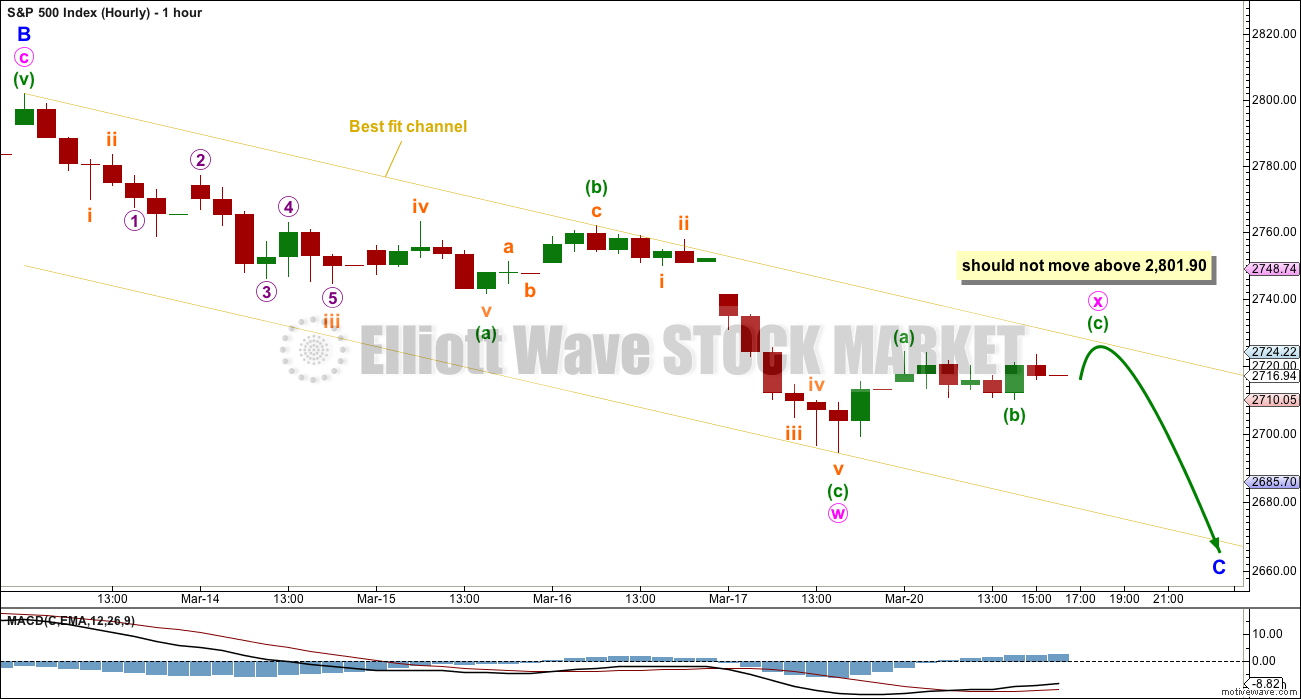

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique as if intermediate wave (4) was over at the last low. If intermediate wave (4) continues sideways, then the channel may be redrawn when it is over. The upper edge may provide resistance for intermediate wave (5).

Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81. At this stage, it now looks like intermediate wave (4) may be continuing further sideways as a combination, triangle or flat. These three ideas are separated into separate daily charts. All three ideas would see intermediate wave (4) exhibit alternation in structure with the double zigzag of intermediate wave (2).

A double zigzag would also be possible for intermediate wave (4), but because intermediate wave (2) was a double zigzag this is the least likely structure for intermediate wave (4) to be. Alternation should be expected until price proves otherwise.

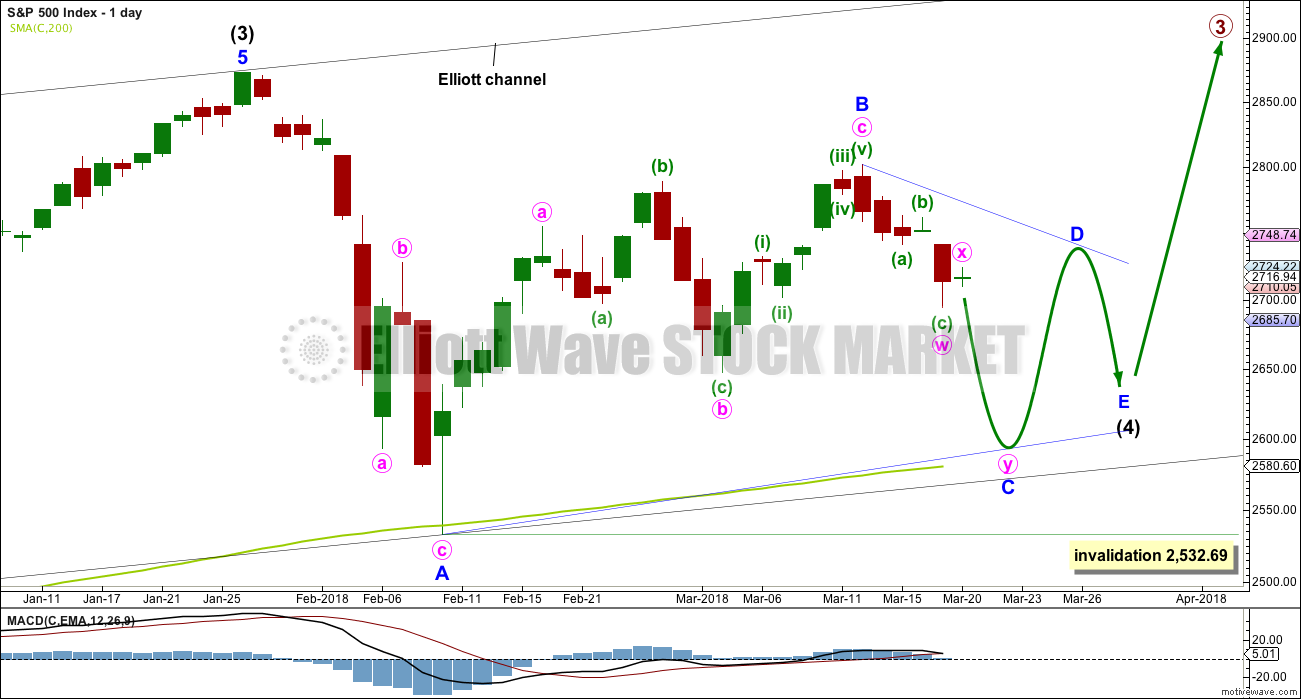

DAILY CHART – TRIANGLE

This first daily chart outlines how intermediate wave (4) may now continue further sideways as a contracting or barrier triangle. It is possible that minor wave B within the triangle was over at the last high, which would mean the triangle would be a regular triangle. Minor wave C downwards may now be underway and may be a single or double zigzag. One of the five sub-waves of a triangle is usually a more complicated multiple, and the most common sub-wave to do this is wave C. It looks like minor wave C may be unfolding as a double zigzag, at this stage, and this is how it will be labelled. Within the double zigzag, minute wave x should not make a new high above the start of minute wave w at 2,801.90.

Minor wave C may not make a new low below the end of minor wave A at 2,532.69.

Intermediate wave 2 lasted 11 weeks. If intermediate wave (4) is incomplete, then it would have so far lasted only seven weeks. Triangles tend to be very time consuming structures, so intermediate wave (4) may total a Fibonacci 13 or even 21 weeks at its conclusion.

Because this is the only daily chart which expects price to continue to find support at the 200 day moving average, it is presented first; it may have a slightly higher probability than the next two daily charts.

HOURLY CHART

If a double zigzag is unfolding lower, then the first zigzag may be complete. The double may be joined by a three in the opposite direction labelled minute wave x.

There is no minimum nor maximum length for X waves within multiples. For double zigzags, the second zigzag exists to deepen the correction when the first zigzag does not move price deep enough. Double zigzags usually have a strong slope, like single zigzags, and to achieve this look their X waves are usually relatively brief and shallow. Minute wave x may find resistance at the upper edge of the best fit channel.

Triangles normally adhere very well to their trend lines. While we cannot tell yet where minor wave D may end and so where the B-D trend line may lie, we can know that it should either have a downwards slope for a contracting triangle or be flat for a barrier triangle. Minute wave X should not break above the B-D trend line, which means it should not make a new high above 2,801.90.

Because it is not known where minute wave x ends and minute wave y begins, a target cannot be calculated for minute wave y. It would be reasonable to expect minute wave y to be about equal in length with minute wave w, which was 107.31 points.

DAILY CHART – COMBINATION

Double combinations are very common structures. The first structure in a possible double combination for intermediate wave (4) would be a complete zigzag labelled minor wave W. The double should be joined by a three in the opposite direction labelled minor wave X, which may be a complete zigzag. X waves within combinations are typically very deep; if minor wave X is over at the last high, then it would be a 0.79 length of minor wave W, which is fairly deep giving it a normal look. There is no minimum nor maximum requirement for X waves within combinations.

The second structure in the double would most likely be a flat correction labelled minor wave Y. It may also be a triangle, but in my experience this is very rare.

A flat correction would subdivide 3-3-5. Minute wave a must be a three wave structure, most likely a zigzag. Minute wave a is today relabelled as an incomplete zigzag, with minuette wave (a) within it an incomplete five wave impulse.

It is also possible that minute wave a may be unfolding as a flat correction, and within it minuette wave (a) may be a complete zigzag. This idea is outlined in the second hourly chart below.

The purpose of combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double usually ends close to the same level as the first. Minor wave Y would be expected to end about the same level as minor wave W at 2,532.69. This would require a strong overshoot or breach of the 200 day moving average, which looks unlikely.

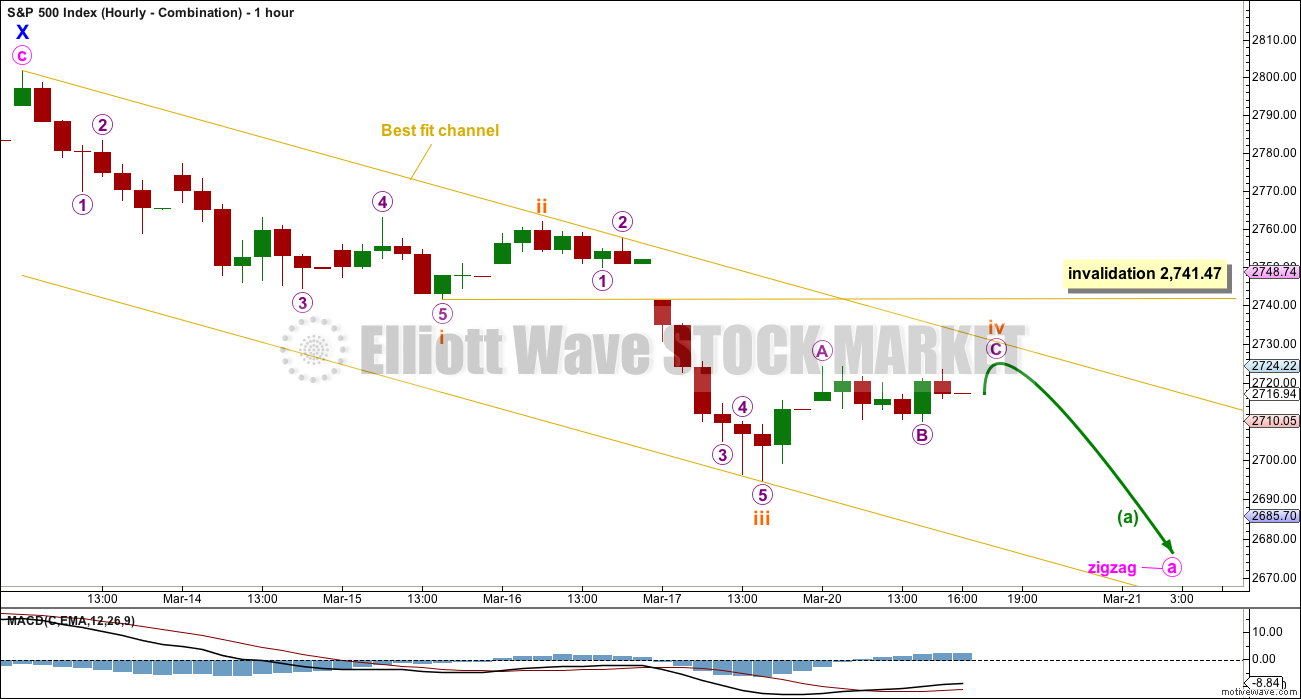

HOURLY CHART – COMBINATION

An impulse may be unfolding lower. This may be minuette wave (a) within a zigzag for minute wave a.

Within the impulse, subminuette wave iv may not move into subminuette wave i price territory above 2,741.47.

A target for subminuette wave v to end cannot be calculated because it is not known where subminuette wave iv ends and subminuette wave v begins. It would most likely be equal in length with subminuette wave i, which was 60.43 points.

This idea of an impulse unfolding lower also works for the first daily chart, which sees a huge triangle unfolding.

HOURLY CHART – COMBINATION II

Minute wave a may be unfolding as a flat correction, to subdivide 3-3-5. Within the flat correction, minuette wave (a) may be a complete zigzag, and now minuette wave (b) may now need to bounce upwards to retrace a minimum 0.9 length of minuette wave (a).

Minuette wave (b) may make a new high above the start of minuette wave (a) as in an expanded flat.

If price makes a new high above 2,741.47, then a little confidence may be had in this idea. The first hourly chart for the triangle wave count would however remain valid and still have a reasonable look.

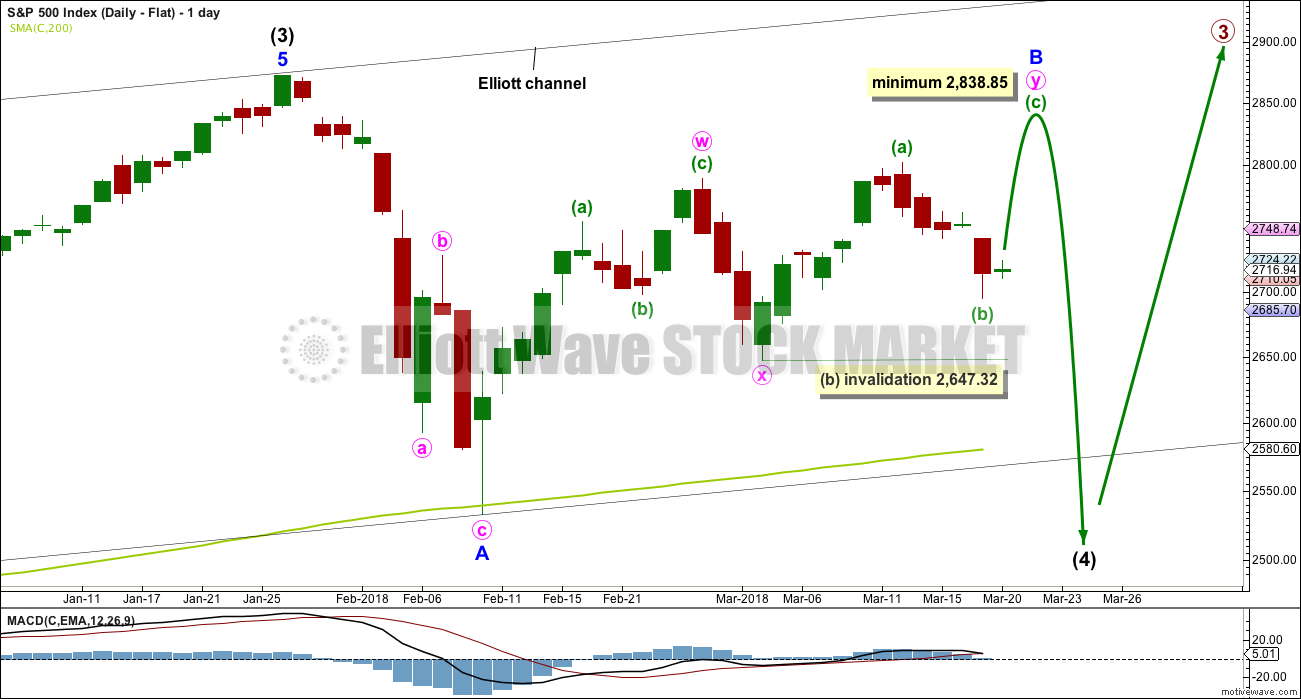

DAILY CHART – FLAT

Flat corrections are very common. The most common type of flat is an expanded flat. This would see minor wave B move above the start of minor wave A at 2,872.87.

Within a flat correction, minor wave B must retrace a minimum 0.9 length of minor wave A at 2,838.85. The most common length for minor wave B within a flat correction would be 1 to 1.38 times the length of minor wave A at 2,872.87 to 3,002.15. An expanded flat would see minor wave B 1.05 times the length of minor wave A or longer, at 2,889.89 or above.

When minor wave B is a complete corrective structure ending at or above the minimum requirement, then minor wave C downwards would be expected to make a new low below the end of minor wave A at 2,532.69 to avoid a truncation.

Minor wave B may be continuing higher as a double zigzag. At this stage, this would be the most likely structure to achieve the height required for minor wave B. Within the second zigzag in the double, minuette wave (b) may not move beyond the start of minuette wave (a) below 2,647.32.

This wave count would require a very substantial breach of the 200 day moving average for the end of intermediate wave (4). This looks unlikely.

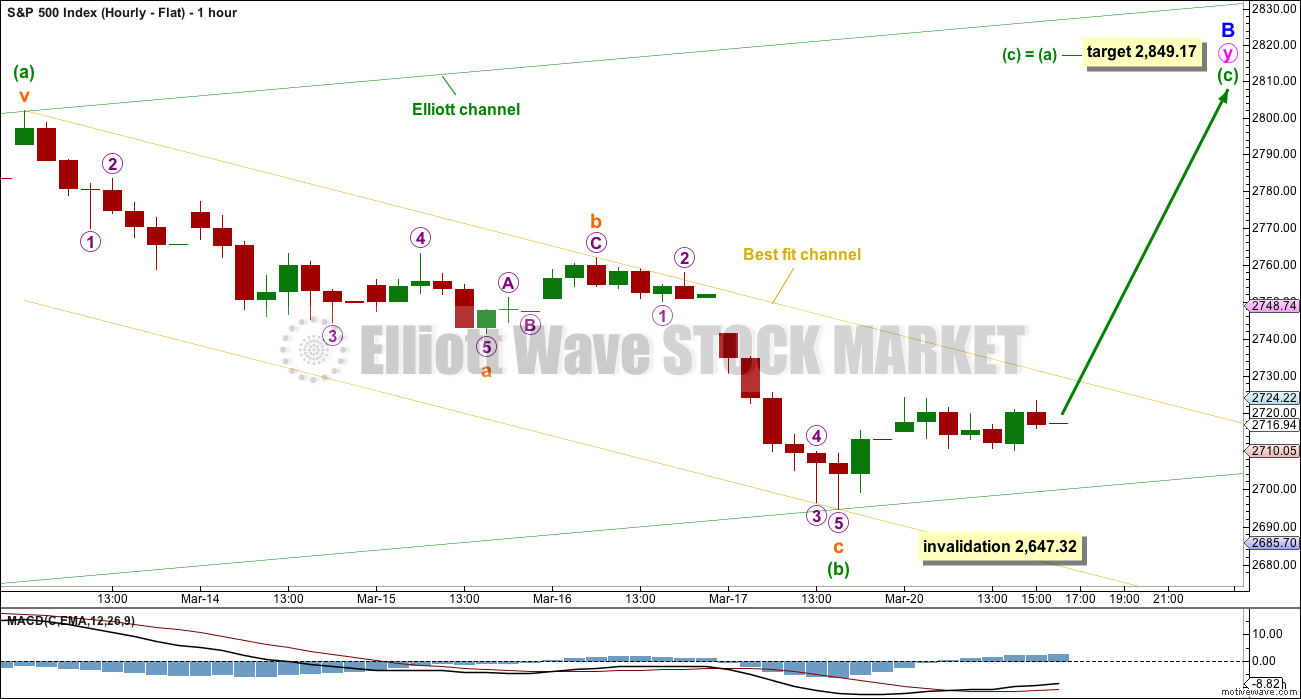

HOURLY CHART – FLAT

If minor wave B is unfolding higher as a double zigzag, then within it minuette wave (b) would very likely be complete at yesterday’s low. A target is calculated assuming the most common Fibonacci ratio between minuette waves (a) and (c). If minuette wave (b) moves lower, then this target must also move correspondingly lower.

It is still possible though that minuette wave (b) could move lower as a double zigzag. The invalidation point must remain at 2,647.32 for this reason.

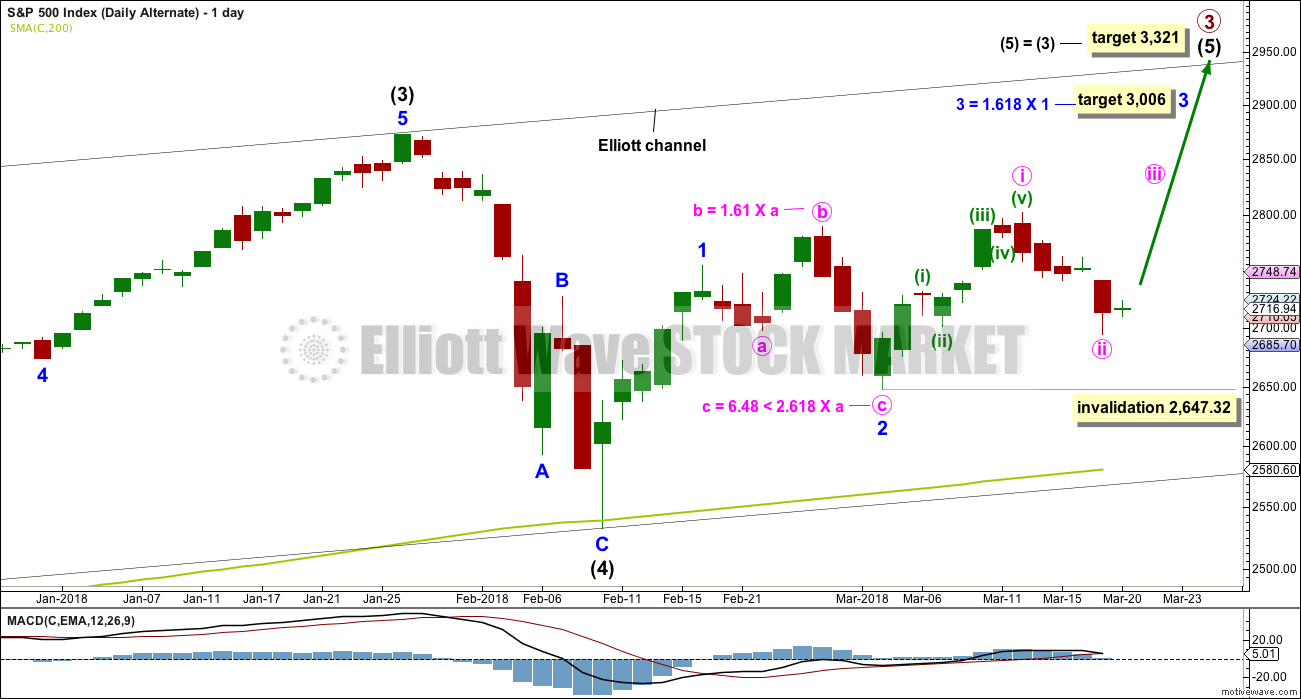

DAILY CHART – ALTERNATE

It is possible still that intermediate wave (4) was complete as a relatively brief and shallow single zigzag.

A new all time high with support from volume and any one of a bullish signal from On Balance Volume or the AD line would see this alternate wave count become the main wave count.

Within minor wave 3, minute wave ii may not move beyond the start of minute wave i below 2,647.32.

This alternate expects minor wave 1 was an impulse.

TECHNICAL ANALYSIS

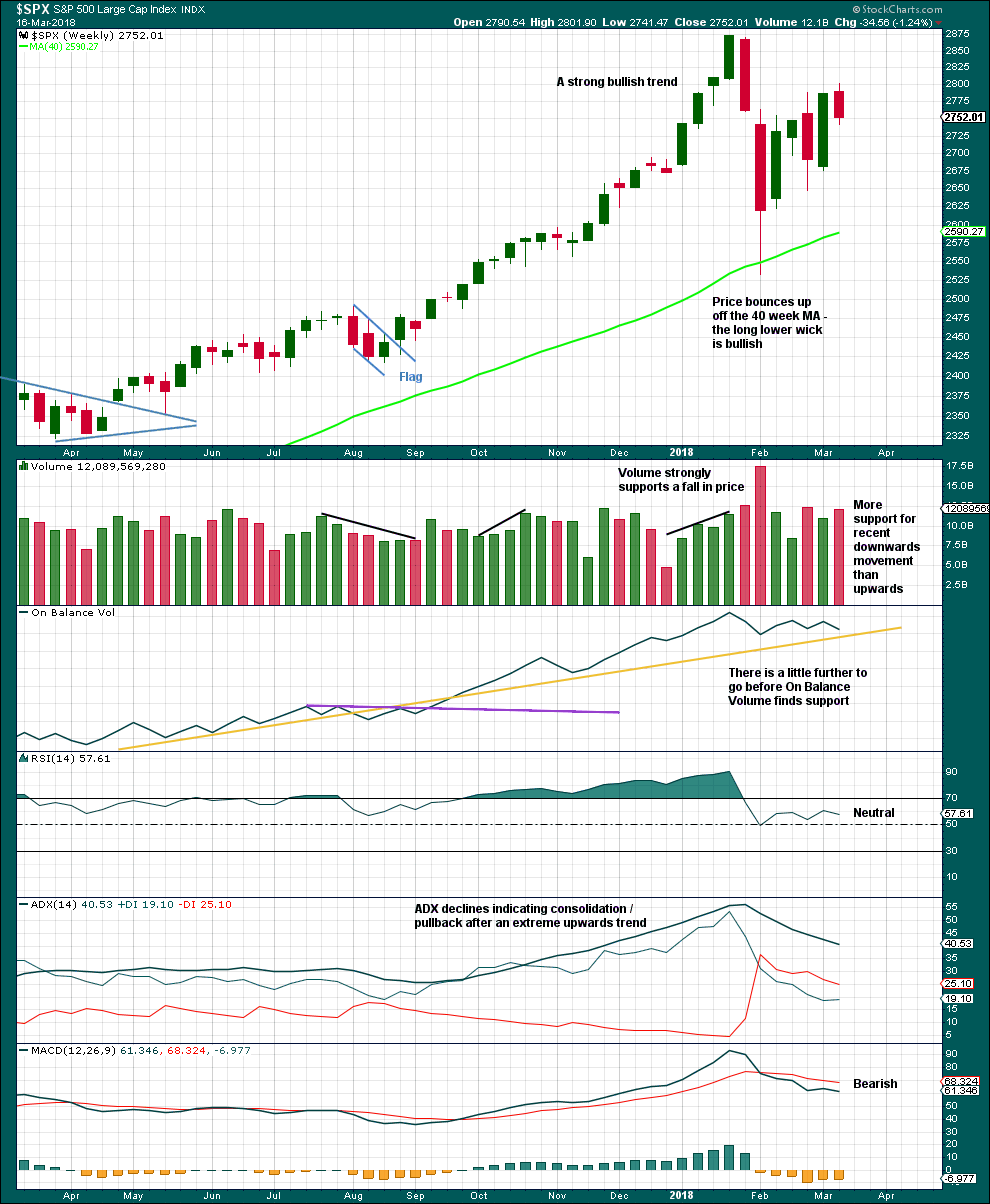

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Last week moved price higher with a higher high and a higher low, but the candlestick is red and the balance of volume is down. At this time frame, it looks like there may be more support for downwards movement than upwards within the week, but it would be better to look inside the week at daily volume bars to draw a conclusion.

The pullback has brought ADX down from very extreme and RSI down from extremely overbought. There is again room for a new trend to develop.

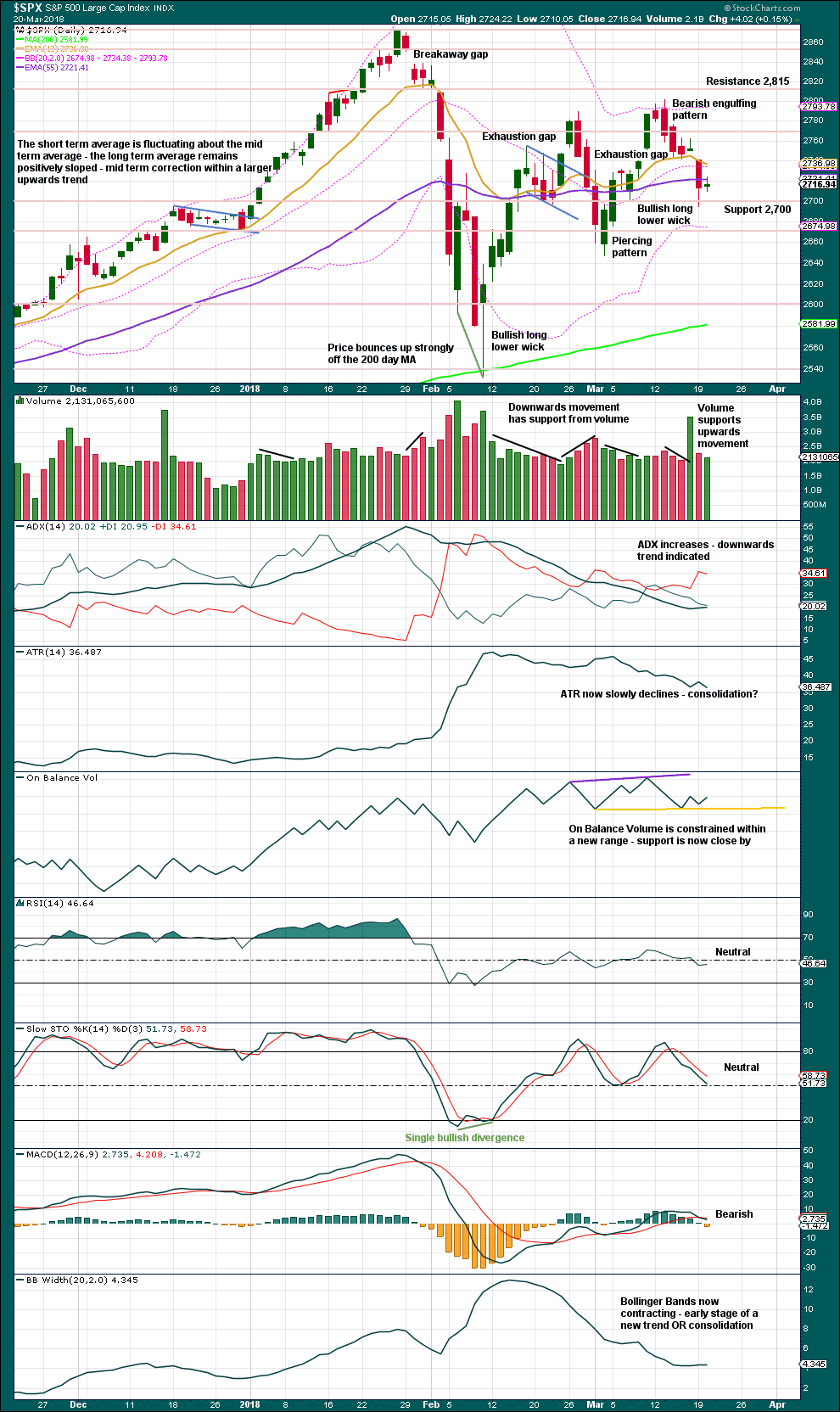

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A lack of support for upwards movement during today’s session changes the short term volume profile to slightly more bearish.

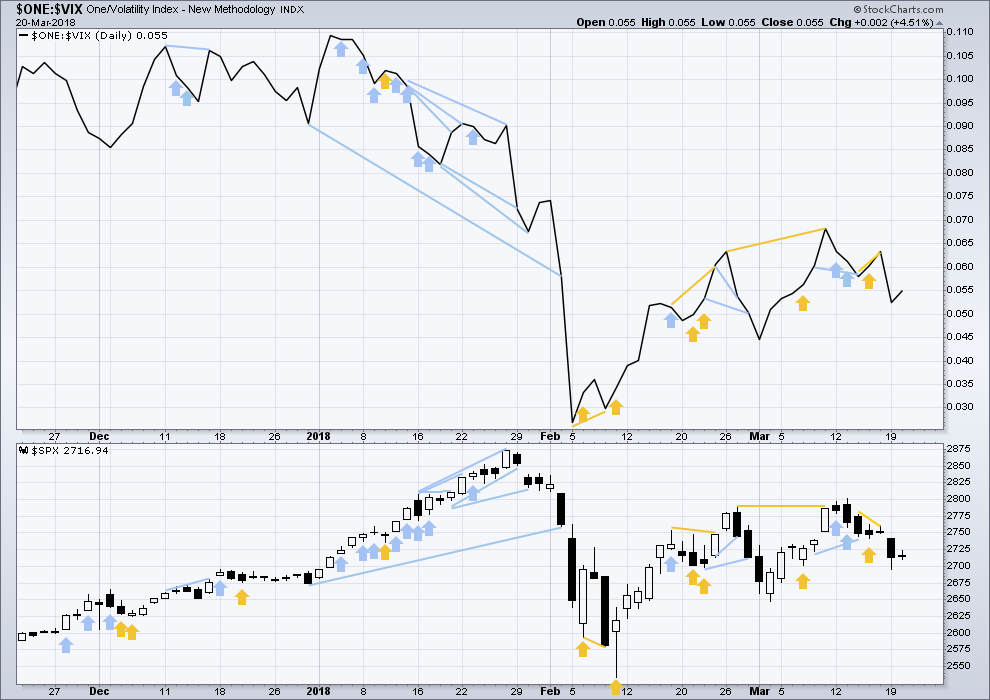

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Price completed an inside day with the balance of volume upwards and the candlestick green. The rise in price during today’s session has a normal decline in market volatility as inverted VIX moves lower. There is no new divergence.

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

All of small, mid and large caps last week completed an outside week. All sectors of the market at this time appear to be in a consolidation.

Breadth should be read as a leading indicator.

The AD line has declined while price moved higher during this session. This divergence is bearish and supports the first two published hourly charts.

DOW THEORY

All indices have made new all time highs as recently as eight weeks ago, confirming the ongoing bull market.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,039.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

Published @ 10:07 p.m. EST.

I’ve done a new USD Index EW and TA over at EWG. It’s here.

Thank you Lara for the Us Dollar update.

so if it stays above the 88.25 level your still bullish?

Thank You

I’m a bit more bearish than bullish on USD ATM.

The first / main wave count there is bearish.

First / main hourly chart updated with a target now:

May have to redraw that trend channel too actually

This must be the big rally now.

In SPXU… modest position, prudent stop.

That was a explosive rally LOL

Kevin you were right before when you said this was a bull trap.

Who knows but this is looking extremely weak

Any thoughts here.

Thanks

It’s tracking to the several day move up being an ABC correction, and now launching an impulse (motive wave!) down, I’d say. So far looks like a 1-2 is in and it’s in a 3 down, overall of who knows what degree. The 3 down probably has just done a 1 down and a 2 up could kick price up the 2727 again (62% retrace). Overall I’m with Rodney and Curtis: I think we are off to the downside races. Got bites down, and now flat waiting to see if that 2 up fires off.

It’s tracking to the several day move up being an ABC correction, and now launching an impulse down, I’d say. So far looks like a 1-2 is in and it’s in a 3 down, overall of who knows what degree. The 3 down probably has just done a 1 down and a 2 up could kick price up the 2727 again (62% retrace). Overall I’m with Rodney and Curtis: I think we are off to the downside races. I got bites down, and am now flat waiting to see if that 2 up fires off.

Tech is weak. It led on the way up and is leading on the way down!

My SPX view going into the crazy times….about to complete an ABC up with a 5 wave C up….

Thanks. Looks good to me. We have resistance above from the gap on Monday’s opening (3/19). The gap is about 2741 to 2750. But we also have the invalidation point at 2741.47 for this count.

If it closes the gap, then I would think that may be a strong bull signal, at least short term (days).

The bear count holding…market still ringing like a bell, but it’s fading slowly.

Yep. I see that too. I’m standing by here at the moment for a possible buy signal on the short side.

Thank you, Kevin!

38.2% at 2735, logical spot for a turn if this is an ABC up off the March 18 low. And if it’s an impulse up, ending the wave 3 and starting a (small) wave 4 down.

Hi Kevin

if your idea is correct here and it turns down from the 2735 – 2740 level

Whats your small wave 4 down target?

Thank You

If this movement is an impulse up? It would probably be around 2725. But more optimistically for the setup is the possibility this is a wave 2 zigzag up, the low on March 18 completed a (5 wave) 1 down, and a fresh wave 5 down (a 3) would be kicking off with a turn here. Either way, I take the short on EMA crossover, stochastics and MACD signals at the 5 minute level, AFTER I get confirming sell triggers (swing high penetrated to downside in particular and 8/34 EMA cross). And see how far it goes! It could be madness soon, and I find when it is it’s often dangerous, wild swings before a new trend is established.

In fact there’s a whole cluster of fibos just under and at that breakaway down gap, ranging from 2735-2741. Lots of historical resistance also in this zone. And voodoo hour is approaching.

I got some bites on the long side, and now it’s really pushing up a bit.

But is this a bull trap??? We’ll see by 2:15-2:30pm eastern….

Well this is one of those times when we have alternates galore. That is why it is so very difficult to trade these 4th waves. We must let market price show us how this will be resolved. I am sitting on hands until we see those results. However, that being said, I think the resolution will be to the downside with a revisit of the SPX 2500 area. Have a great day.

I am in a trial period, learning and assessing MotiveWave. Today I use the combination of thinkorswim, along with the IB traderworkstation charts. Obviously, MotiveWave (ultimate…) can do some amazing auto analysis re EW and Gartley, and makes EW creation and adjustment far easier than “manual”. Anyone use MW and have anything negative to say, or areas I should look at and assess that maybe aren’t so great? It’s a lot of money, and I’m quite undecided at this point. I DO like the ability to more broadly and quickly do wave analysis across different issues. I’d prefer if I buy it to not have to use thinkorswim, which in turn leads to the usability of their API (java??? yuck…) for customizing charts. Many things to consider and assess quickly, as a 20% sale ends in a few day.

Kevin,

I have been using MW for several years and find it a great platform for EW analysis as well as most technical indicators. It interfaces well with TD Ameritrade API with order excecution (on chart)and account management. MW also allows multiple broker accounts. MW techs are very active in keeping the program up to date and continuously improving features. If you can program in JAVA the MW API provides a seamless method to create your own technical indicators and/or automated Strategies. I don’t find the automated EW features particularly useful but others do. However, the EW tools make keeping charts updated a breeze.

Thanks Gary!

Don’t use the auto label feature. It can come up with some invalid wave counts. Some of the rules they’ve written into the program are just wrong.

But apart from that, I couldn’t work without it. It’s quick and easier to do wave counts, change degrees of labelling, calculate wave lengths and so targets.

It will tell you if you’ve broken a rule which is helpful, but some of the warnings are wrong (eg. it thinks 4 overlapping 2 is a problem, when the rule is 4 may not overlap 1)

Foistus!!!