A slight new low and then a bounce was expected for Friday. The session did not begin with a slight new low, but price did bounce.

Summary: In the short term, expect a bounce to continue to about 2,789; it may be choppy and overlapping and may last another one to few days. Thereafter, another wave down may develop.

Always practice good risk management. Always trade with stops and invest only 1-5% of equity on any one trade.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here. Video is here.

An alternate idea at the monthly chart level is given here at the end of this analysis.

An historic example of a cycle degree fifth wave is given at the end of the analysis here.

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique as if intermediate wave (4) was over at the last low. If intermediate wave (4) continues sideways, then the channel may be redrawn when it is over. The upper edge may provide resistance for intermediate wave (5).

Intermediate wave (4) may not move into intermediate wave (1) price territory below 2,193.81. At this stage, it now looks like intermediate wave (4) may be continuing further sideways as a combination, triangle or flat. These three ideas are separated into separate daily charts. All three ideas would see intermediate wave (4) exhibit alternation in structure with the double zigzag of intermediate wave (2).

A double zigzag would also be possible for intermediate wave (4), but because intermediate wave (2) was a double zigzag this is the least likely structure for intermediate wave (4) to be. Alternation should be expected until price proves otherwise.

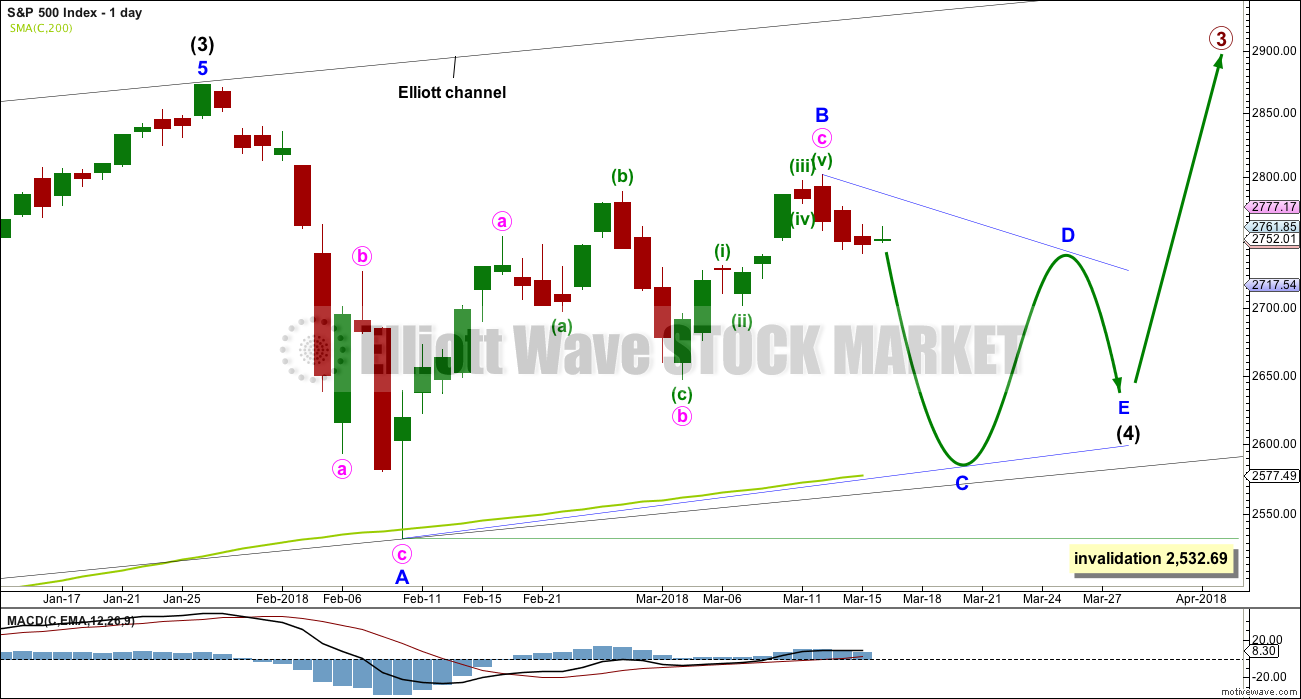

DAILY CHART – TRIANGLE

This first daily chart outlines how intermediate wave (4) may now continue further sideways as a contracting or barrier triangle. It is possible that minor wave B within the triangle was over at the last high, which would mean the triangle would be a regular triangle. Minor wave C downwards may now be underway and may be a single or double zigzag. One of the five sub-waves of a triangle is usually a more complicated multiple, and the most common sub-wave to do this is wave C.

Minor wave C may not make a new low below the end of minor wave A at 2,532.69.

Intermediate wave 2 lasted 11 weeks. If intermediate wave (4) is incomplete, then it would have so far lasted only six weeks. Triangles tend to be very time consuming structures, so intermediate wave (4) may total a Fibonacci 13 or even 21 weeks at its conclusion.

Because this is the only daily chart which expects price to continue to find support at the 200 day moving average, it is presented first; it may have a slightly higher probability than the next two daily charts.

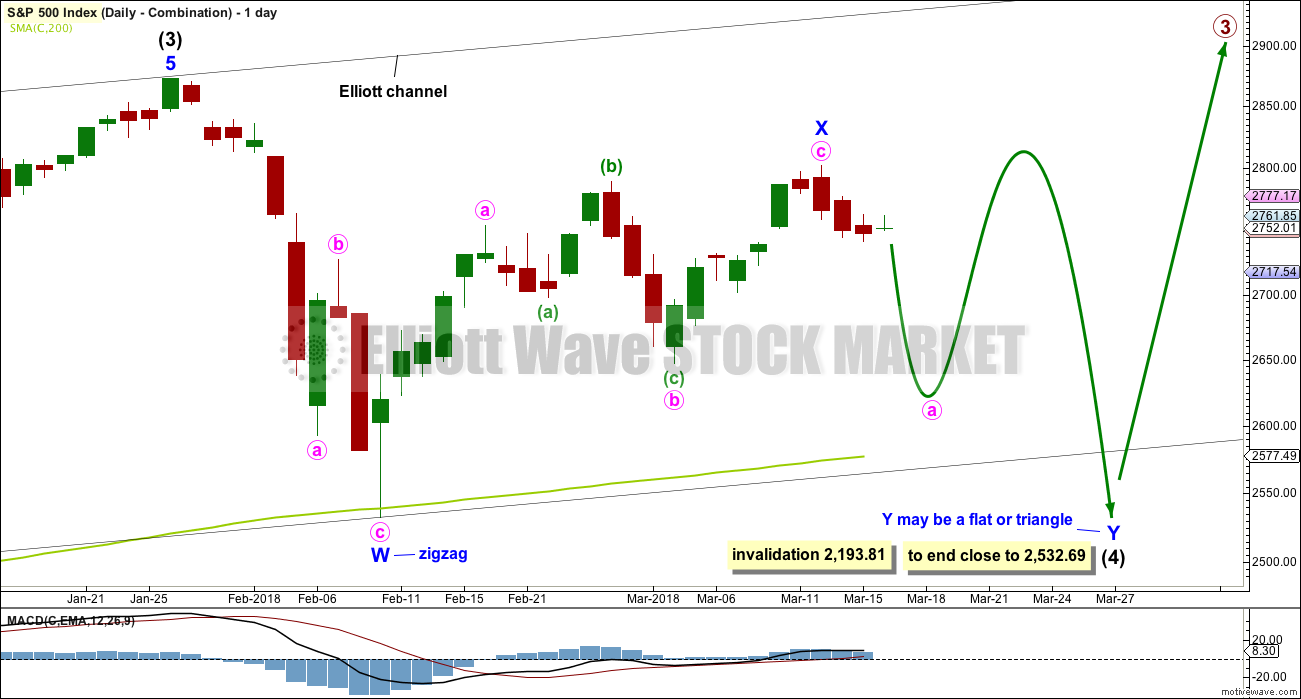

DAILY CHART – COMBINATION

Double combinations are very common structures. The first structure in a possible double combination for intermediate wave (4) would be a complete zigzag labelled minor wave W. The double should be joined by a three in the opposite direction labelled minor wave X, which may be a complete zigzag. X waves within combinations are typically very deep; if minor wave X is over at the last high, then it would be a 0.79 length of minor wave W, which is fairly deep giving it a normal look. There is no minimum nor maximum requirement for X waves within combinations.

The second structure in the double would most likely be a flat correction labelled minor wave Y. It may also be a triangle, but in my experience this is very rare.

A flat correction would subdivide 3-3-5. Minute wave a must be a three wave structure, most likely a zigzag.

The purpose of combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double usually ends close to the same level as the first. Minor wave Y would be expected to end about the same level as minor wave W at 2,532.69. This would require a strong overshoot or breach of the 200 day moving average, which looks unlikely.

HOURLY CHART

The downwards best fit channel is clearly breached by upwards movement at the start of Friday’s session, indicating the last wave down should be complete and a new wave up should be underway.

The last wave down can fit as a five on the hourly and five minute charts. This may be minute wave a of a zigzag.

If minute wave a is correctly analysed as a five, then minute wave b may not move beyond its start above 2,801.90.

Minute wave b may be any corrective structure. It may be expected to last another one to few days. So far the corrective structure has almost reached the 0.382 Fibonacci ratio of minute wave a, already, so it may continue higher now to end closer to the 0.618 Fibonacci ratio at about 2,779.

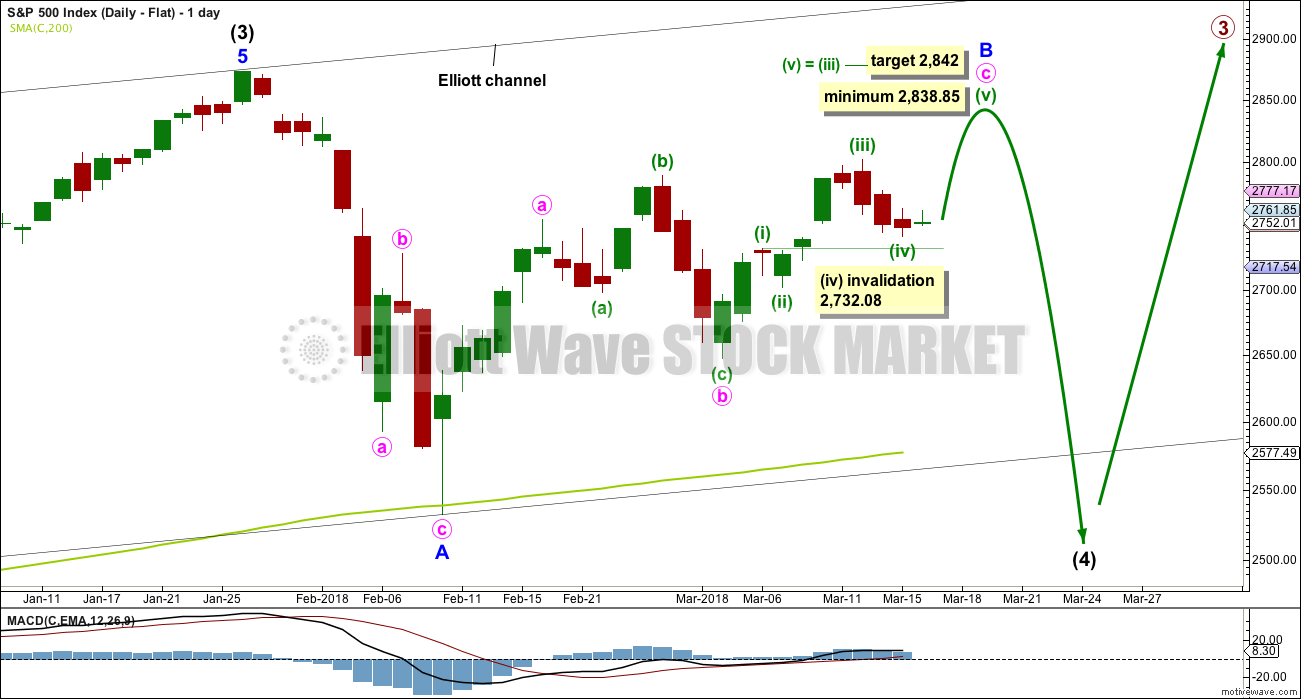

DAILY CHART – FLAT

Flat corrections are very common. The most common type of flat is an expanded flat. This would see minor wave B move above the start of minor wave A at 2,872.87.

Within a flat correction, minor wave B must retrace a minimum 0.9 length of minor wave A at 2,838.85. The most common length for minor wave B within a flat correction would be 1 to 1.38 times the length of minor wave A at 2,872.87 to 3,002.15. An expanded flat would see minor wave B 1.05 times the length of minor wave A or longer, at 2,889.89 or above.

When minor wave B is a complete corrective structure ending at or above the minimum requirement, then minor wave C downwards would be expected to make a new low below the end of minor wave A at 2,532.69 to avoid a truncation.

This wave count would require a very substantial breach of the 200 day moving average for the end of intermediate wave (4). This looks unlikely.

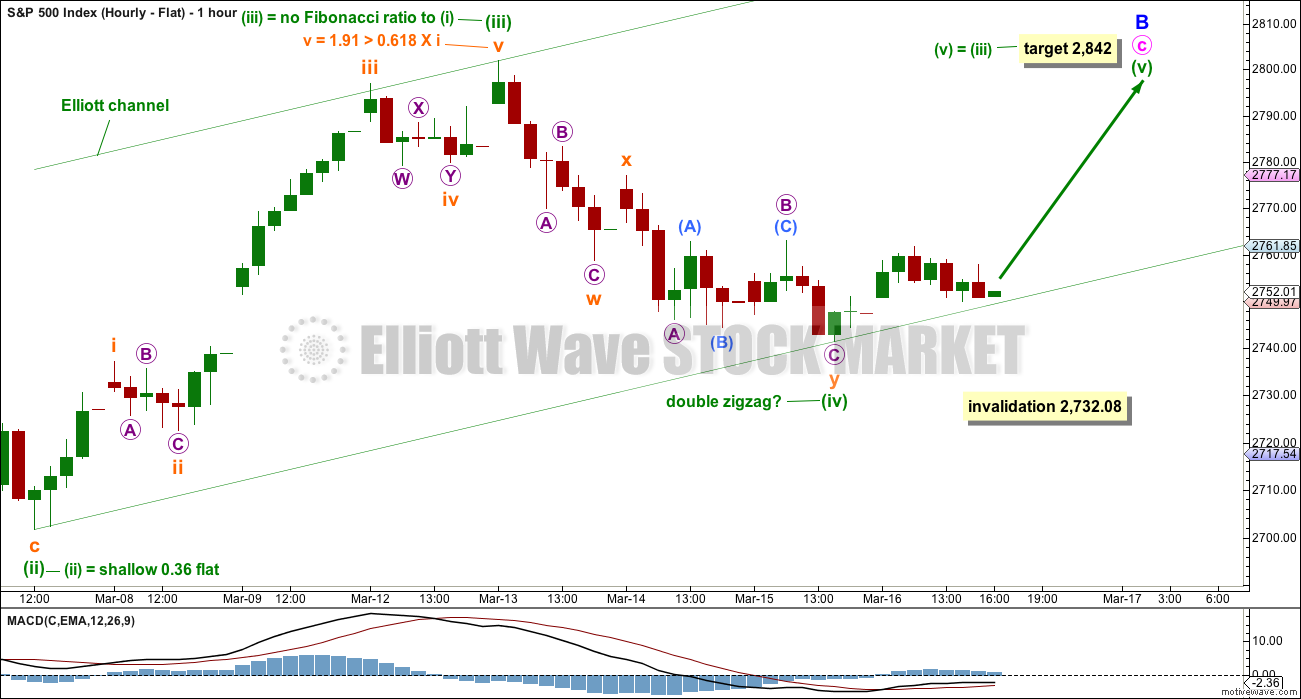

HOURLY CHART – FLAT

It is also possible that upwards movement is not over and minute wave c is incomplete. At this stage, minuette wave (iv) now looks grossly disproportionate to minuette wave (ii), so this wave count no longer has the right look.

If intermediate wave (4) is unfolding as a flat correction, then within it minor wave B has not yet met the minimum requirement of 0.9 the length of minor wave A at 2,838.85.

Within minute wave c, the correction of minuette wave (iv) may not move into minuette wave (i) price territory below 2,732.08.

Minuette wave (iv) has breached a channel drawn using Elliott’s first technique, so the channel is redrawn using the second technique. Draw the first trend line from the ends of minuette waves (ii) to (iv), then place a parallel copy on the end of minuette wave (iii). Minuette wave (v) may end either mid way within this channel, or about the upper edge. Friday’s upwards movement is finding support about the lower edge of this channel.

A target for minute wave c to end is calculated at minuette degree. This would see the minimum requirement for minor wave B just met.

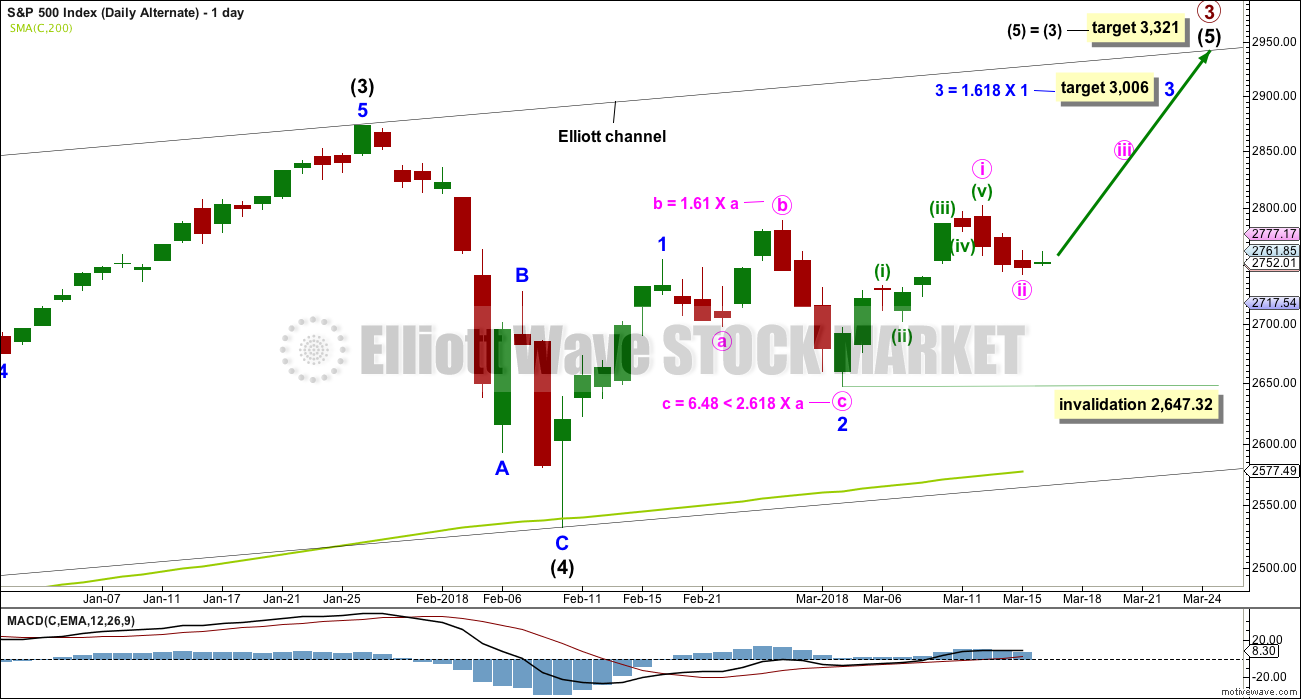

DAILY CHART – ALTERNATE

It is possible still that intermediate wave (4) was complete as a relatively brief and shallow single zigzag.

A new all time high with support from volume and any one of a bullish signal from On Balance Volume or the AD line would see this alternate wave count become the main wave count.

Within minor wave 3, minute wave ii may not move beyond the start of minute wave i below 2,647.32.

This first alternate expects minor wave 1 was an impulse. This is the most common structure for a first wave, so this is the more likely of two alternates presented today.

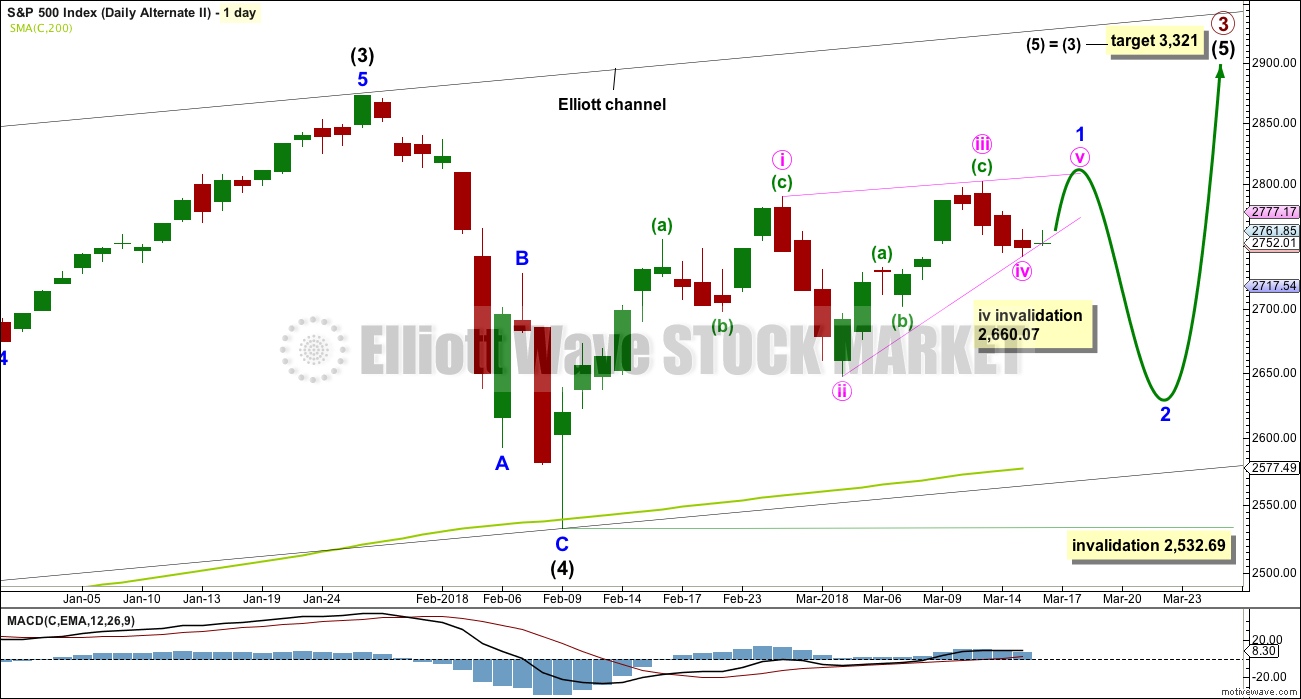

DAILY CHART – SECOND ALTERNATE

It is also possible that minor wave 1 is an incomplete leading contracting diagonal. This is a less common structure for a first wave, so this is the least likely wave count published today.

The diagonal would be contracting because minute wave iii is shorter than minute wave i. Within a contracting diagonal, minute wave iv must be shorter than minute wave ii. Therefore, minute wave iv may not be equal or longer in length than minute wave ii, so it may not reach 2,660.07 or below.

Leading diagonals most often end with a small overshoot of the 1-3 trend line. As soon as price makes a small overshoot here of the upper pink i-iii trend line, if it quickly reverses and moves strongly lower, then this wave count would be indicated as more likely.

Leading diagonals in first wave positions are very commonly followed by very deep second wave corrections. If what looks like a diagonal upwards completes and price quickly reverses, then a Fibonacci retracement would be drawn along the length of the diagonal. Minor wave 2 would be expected to be deeper than the 0.618 Fibonacci ratio of minor wave 1.

Minor wave 2 may not move beyond the start of minor wave 1 below 2,532.69. Minor wave 2 may find support about the 200 day moving average.

TECHNICAL ANALYSIS

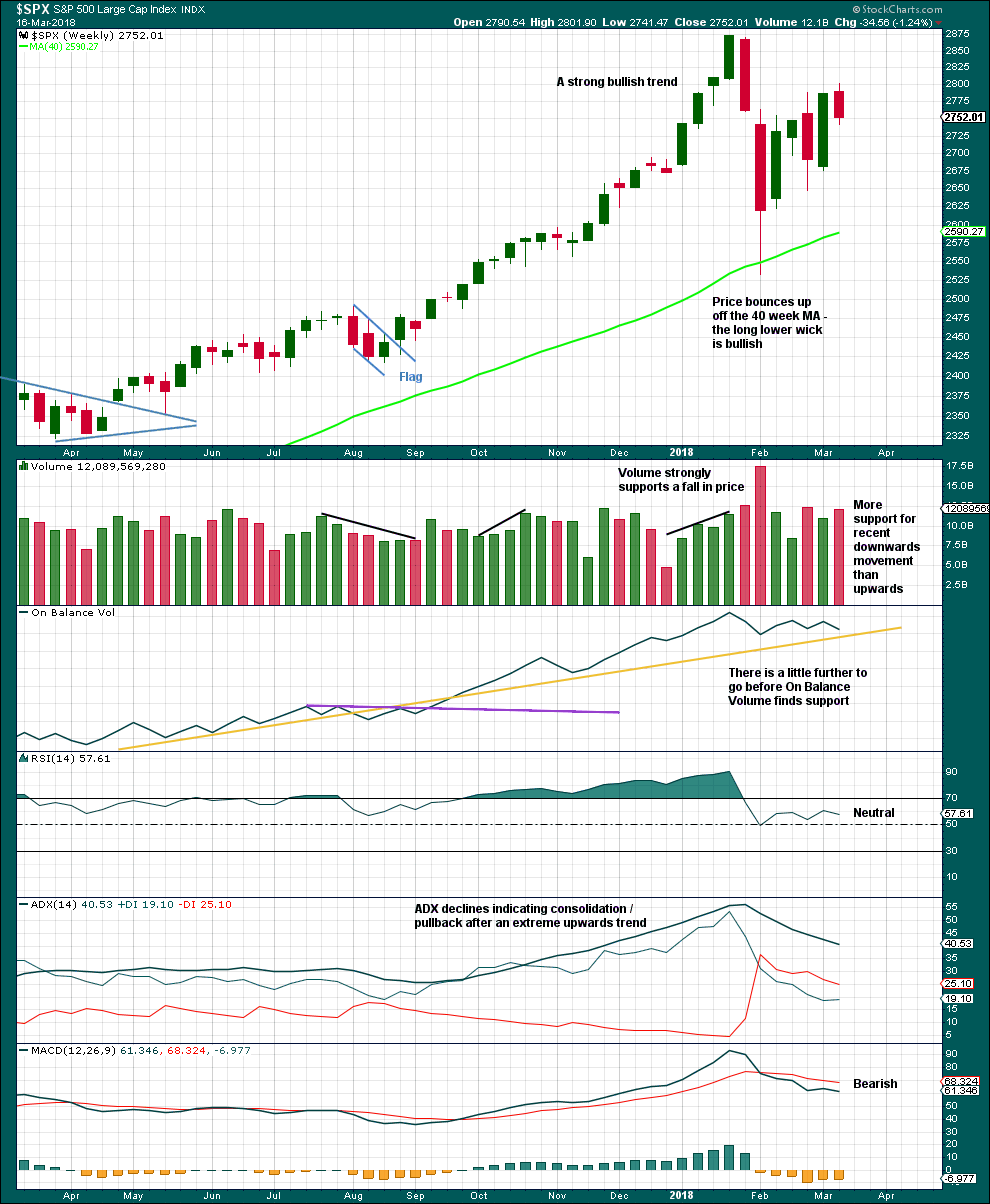

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week moved price higher with a higher high and a higher low, but the candlestick is red and the balance of volume is down. At this time frame, it looks like there may be more support for downwards movement than upwards within the week, but it would be better to look inside the week at daily volume bars to draw a conclusion.

The pullback has brought ADX down from very extreme and RSI down from extremely overbought. There is again room for a new trend to develop.

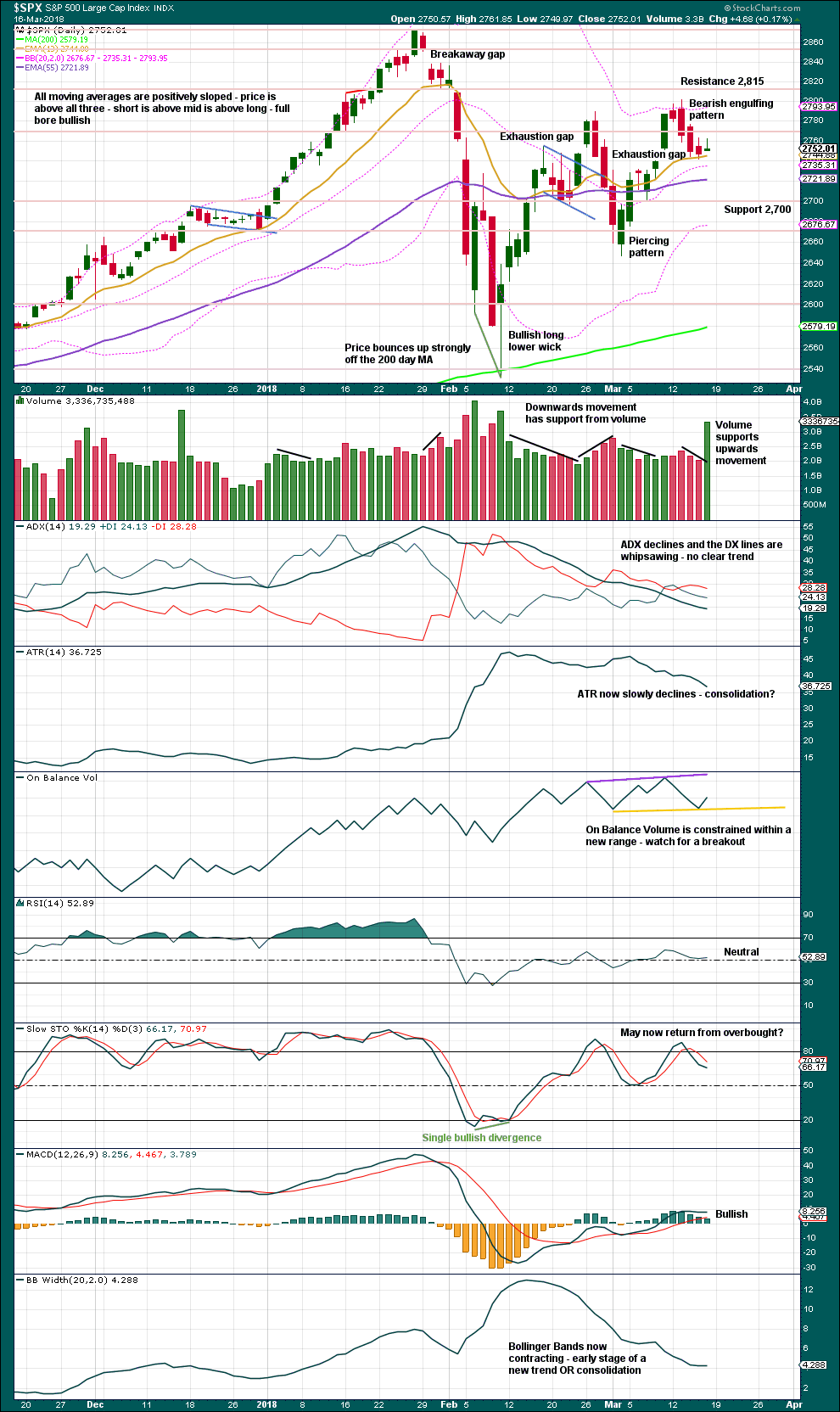

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

While the small amount of upwards movement on Friday does have support from volume, this was an options expiry date and so a volume spike would be expected. Short term volume is bullish still, but the longer upper wick on Friday’s Gravestone doji is bearish. This doji should not be read as a reversal signal though as it does not come at the end of an upwards trend.

The support line for On Balance Volume is redrawn.

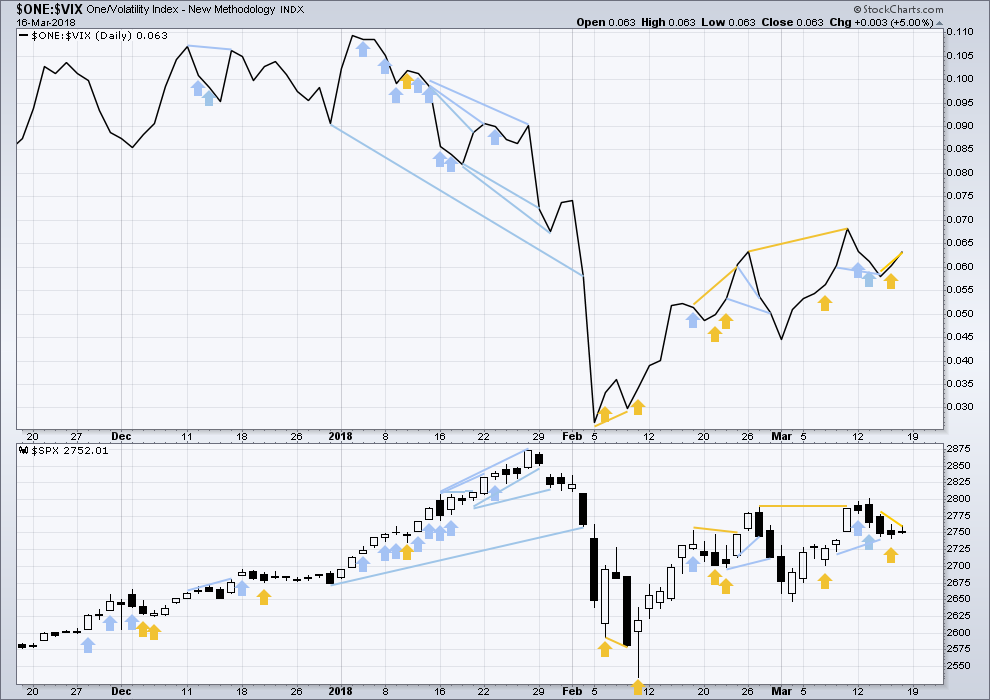

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

So that colour blind members are included, bearish signals will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

Bullish divergence in last analysis has been followed by an upwards day. This may now be resolved, or it may need another upwards day to resolve it.

Inverted VIX on Friday made a new high above the prior high three sessions ago, but price has not. This divergence is bullish.

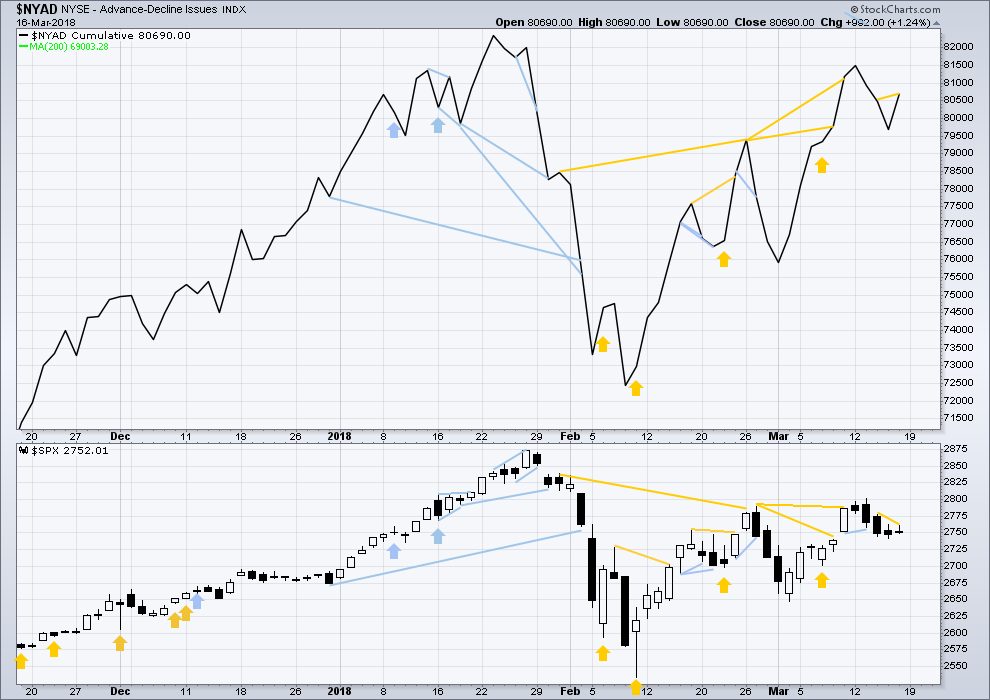

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

All of small, mid and large caps last week completed an outside week. All sectors of the market at this time appear to be in a consolidation.

Breadth should be read as a leading indicator.

The AD line on Friday has made a new high above the prior high three sessions ago, but price has not. This divergence is bullish.

DOW THEORY

All indices have made new all time highs as recently as eight weeks ago, confirming the ongoing bull market.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,039.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

Published @ 06:30 p.m. EST on 17th March, 2018.

The 2700 pivot and fibo’s in the area held for today! Tomorrow is…”another day!”, however. Meanwhile, I’ve probably got too many longs but buy triggers have been going off so…best of Monday evening to all.

Updated hourly chart:

Minute c has passed equality with minute a. The next Fibonacci ratio in the sequence is used to calculate a target.

I’m also going to have to consider an alternate of an impulse unfolding lower, rather than a zigzag. The invalidation point for that idea would now be 2,741.47, the low of minute wave a. That could be a first wave, and an upcoming fourth wave correction may not move back up into first wave price territory.

We didn’t get the upwards movement for minute b that I had expected. A nice illustration there of how difficult B waves are and why I dislike them so much.

I am posting two of my SPX daily charts. The first shows the larger picture back to the middle of 2016. The second is a closer view extending back only to the middle of 2017. Note how the SPX broke down in Feb 2018 through my lower channel line of the bull move from September 2017. This move down also broke through all my moving averages. It has since moved back up to the underside of that same lower channel line two times. Each entrancement has failed.

I am thankful I exited all my longs last week (due to Lara’s excellent analysis). It looks to me like a high probability we will test the Feb. 2018 low of 2532. If the main count Combination pattern is correct, we should break 2500 to the downside. At that point I will be looking for positive divergences on the 4 hour and daily charts to seek a long entry.

2nd chart

I’m tracking this view (second alternate hourly) closely as well, which suggests significant up movement to complete an E wave of a leading 1 up, as Lara describes. The D low can be anywhere…up to a point, which I think is about 2670. Below that, it’s no longer a diagonal. From my perspective, particularly with NDX be general so strong, I think this is as likely as a further immediate sharp break to the down side here. (Ignoring external shocks, which I believe are in a “higher probability than normal” period right now!) Shocks could send this market into free fall very quickly.

I should say “revised second alternate hourly”…the low of the D wave is obviously much deeper now.

Hi Kevin

I would agree 2670ish give or take a few points would could keep the diagonal alive.

A diagonal needs to be labelled 1-2-3-4-5

It shouldn’t be labelled A-B-C-D-E. That’s a triangle and the rules are different.

I thought I heard the teacher walking by…lol! TY Lara. Got it! Letters for triangles, #’s for diags.

LOL

Yeah, can’t help the teacher thing

Thank you for sharing Rodney

Looks and feels to me that a turn may come any time between now and Wednesday.

So, I will be looking to for an entry price.

The SPX bear flag on the 5 minute chart I pointed out last week, projects a move down to at least 2690. This should get the ball rolling downhill for the main count either a wave Minor C of a triangle or Minor Y of a combination.

The second daily alternate seems to be blown away now, and the leading horses are the triangle and combination for the big 4 in progress. Indicating price should have some ways to fall here. 2700 is like a big black hole, sucking price back down to it, perhaps. Though anything is possible, the market will get whipped this week by external economic and political news I’m sure, and it’s hard to see how any of it will be bullish, frankly. Though I suppose the FOMC could say they are going to tighten more slowly…but that would be surprising?

I have a 50% fibo at 2725 offering support. After that there’s a big gap until a cluster of a 62%, 50% and 38% show up in the range of 2707 down to 2699. And no obvious other swing high/low support in the gap. I note that so far RUT has not faded much and seems to be the strongs of the 4 major indices. I’m suspicious the markets turn back up at least for some time period today, very soon. SPX is currently holding at some swing high support from March 5, and NDX is sitting on a 50% fibo. Interesting market.

Timing cycle wise, I’m looking for an SPX low right around the 11am timeframe (eastern time).

Oops, I meant 12pm-ish. For some reasons, some of my charts are on central time, some on eastern, while I am on pacific…very confusing!

Hi Kevin

Do you think that the 2699 – 2707 price support holds?

Thanks

Answer A: I have no idea, beyond today.

Answer B: For today…probably. Price has already fallen hard, micro time cycles indicates a short term (at least) low should be showing up soon.

My one concern about that though is that I don’t see NDX sitting on any fibo’s at all; it doesn’t look like it’s reached a stable bottom. So…we’ll see!

Yep. If intermediate (4) is over then intermediate (5) must be an impulse now.

So, how does everybody find the new layout for the home page?

Your feedback will be carefully considered…

So far I like the layout. Give me another week or so to confirm that initial opinion. It is not as though the previous layout was bad, however. But the new layout does give more options without as much scrolling. So, yeah, I like it. I also like the weekly update with gold, gdx, spx, and oil.

Great, thanks Rodney for your feedback.

That weekly update with Gold, Oil and S&P500 is currently public, but in another couple of weeks it may be another subscription and private.

Much better, thanks. More organized, easy to find different reports. Perhaps…a bit more organization by time? A clear initial section of “today’s” (latest) reports, with a little separation of the “archive” reports might be nice.

Good idea! Thanks Kevin

Clean and pleasant. Nice new look! (I also appreciate not having to scroll past the full length of your public posts.)

Yeah, I thought that would be a good bonus. I find that annoying too!

We know from market price action that a big move is coming, but at the moment it is not clear which direction the break will be. One approach, rather than trying to catch the day to day gyrations of the market would be to get positioned for a big move in either direction, and for option traders a straddle would be one way to do it. Carefully selected contracts are going to easily return 10X in the coming move, so the strategy should return a minimum of 5X with an equally weighted trade. Clearly it would be better than that as the loosing side would be exited once the breakout direction is clear and rolled into the correct directional trade.

Looking after AUM for a few folk for the next several months so wont”t be posting as often. Have a great weekend and best of luck to everyone!

Nice to hear from you again Verne. Wishing you a prosperous few months!

Thanks Rod. We got those portfolios properly hedged in the nick of time!

Glad you are also escaping the current down draft. Trade safe bud….

Thank you for the excellent explanation Verne!

Most welcome Lara. I ate my own cooking and closed my SPY 274 strike short puts at the open and rode the 272 strikes down for a textbook pivot on the spread. Spreads are a great tool in times of uncertainty!

Also a nice return on Triple Q puts owing to the huge bearish engulfing candle, confirmed with island reversal today. SPX surrender of 50 day with gap down noteworthy…

Thank you Lara. Excellent as always. Oh yeah, I am first for the weekend.

Cheers Rodney!