Price moved lower to break below the very close by invalidation point on the hourly chart.

Summary: On Balance Volume and the AD line remain very bullish, supporting the main Elliott wave count. The next target is now at 2,521 to 2,526. It may be met in another 3 sessions.

Stay nimble and keep stops tight. This trend is extreme and over stretched. There is reasonable downside risk.

Always trade with stops and invest only 1-5% of equity on any one trade.

Last monthly and weekly charts are here. Last historic analysis video is here.

Due to strong support for a bullish wave count from On Balance Volume and the AD line, the wave counts are now labeled “main” and “alternate” and have been swapped over.

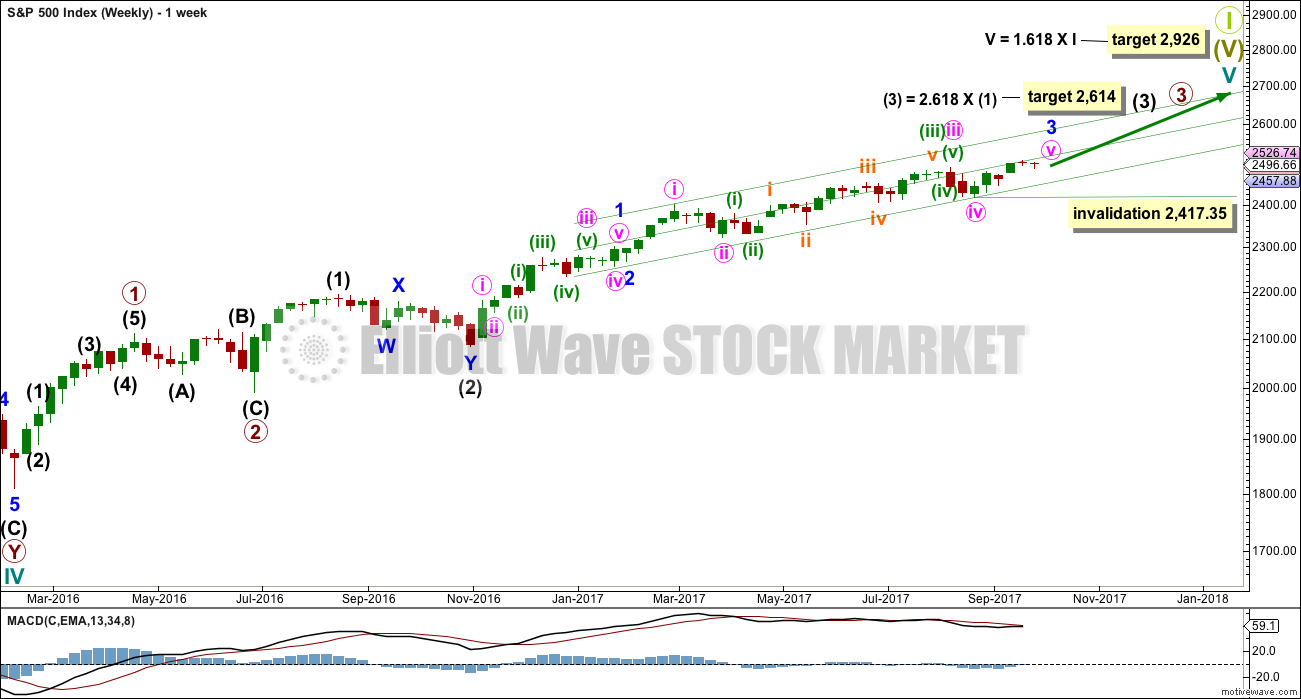

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count has strong support from a clear and strong bullish signal from On Balance Volume. While classic analysis is still very bullish for the short term, there will be corrections along the way up. Indicators are extreme and there is considerable risk to the downside still.

If primary wave 3 isn’t over, then how would the subdivisions fit? Would it fit with MACD? What would be the invalidation point and would the Fibonacci ratios be adequate?

Of several ideas I have tried, this one has the best fit in terms of subdivisions and meets all Elliott wave rules.

Despite this wave count appearing forced and manufactured, and despite persistent weakness in volume and momentum for this third wave, On Balance Volume does now strongly favour it. It may be that as a Grand Super Cycle wave comes to an end, that weakness may develop and persist for very long periods of time (up to three years is warned as possible by Lowry’s for the end of a bull market), so this weakness may be viewed in that larger context.

Within minute wave v, no second wave correction may move beyond the start of its first wave below 2,417.35.

The next reasonable correction should be for intermediate wave (4). When it arrives, it should last over two months in duration, and it may find support about the lower edge of this best fit channel. The correction may be relatively shallow, a choppy overlapping consolidation, at the weekly chart level.

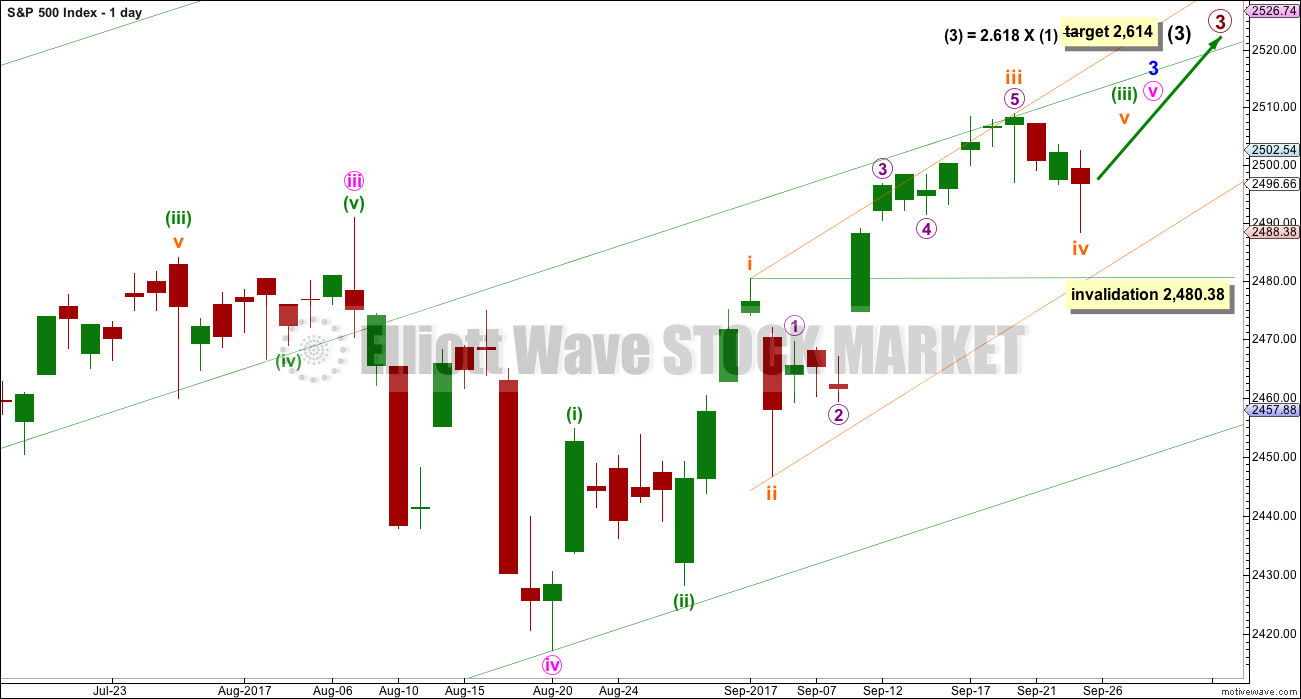

DAILY CHART

To see details of the whole of primary wave 3 so far and compare and contrast with the alternate wave count, see the analysis here.

Minute wave v to complete minor wave 3 must subdivide as a five wave structure. It looks like an incomplete impulse. Within the impulse, subminuette wave iv may not move into subminuette wave i price territory below 2,480.38.

Subminuette wave iv has continued further during Monday’s session. Although it has now lasted three sessions to one session for subminuette wave ii, the structure still has a reasonably normal look at the daily chart level.

So far minuette wave (iii) has lasted 18 sessions. If it exhibits a Fibonacci duration, then the next number in the sequence is 21; this duration would see it end in another 3 sessions.

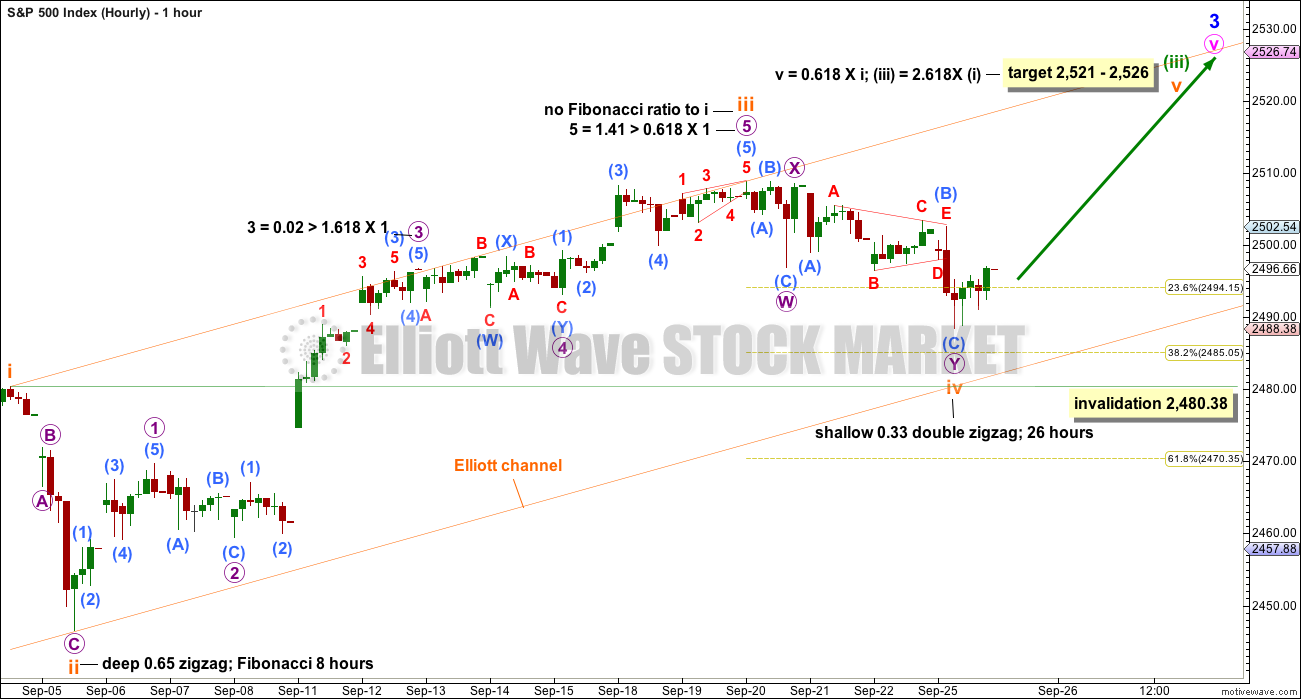

HOURLY CHART

Subminuette wave iv will fit as a completed double zigzag structure (all subdivisions fit on the five minute chart). There is still some alternation between the single zigzag of subminuette wave ii. There is good alternation in depth.

The target is recalculated and is now a 5 point zone.

If subminuette wave iv continues any further tomorrow, then it may not move into subminuette wave i territory below 2,480.38.

If subminuette wave iv does continue any lower, then it may end when price finds support at the lower edge of the orange Elliott channel.

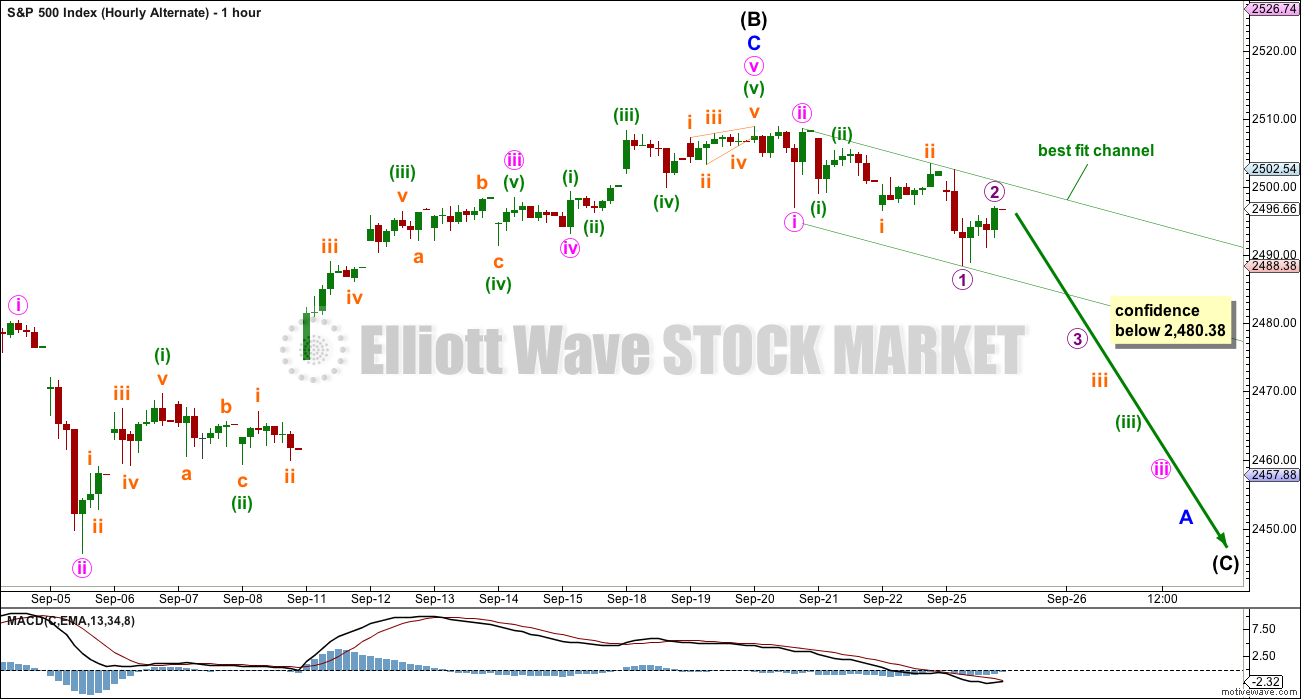

ALTERNATE WAVE COUNT

WEEKLY CHART

Primary wave 3 may be complete. Confidence may be had if price makes a new low below 2,480.38 now. That would invalidate the main wave count at the daily chart level. Fibonacci ratios are calculated at primary and intermediate degree. If primary wave 3 is complete, then it still exhibits the most common Fibonacci ratio to primary wave 1.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05.

Primary wave 4 should last about 8 weeks minimum for it to have reasonable proportion with primary wave 2. It is the proportion between corrective waves which give a wave count the right look. Primary wave 4 may last 13 or even 21 weeks if it is a triangle or combination. So far it may have completed its sixth week.

If primary wave 4 unfolds as a single or double zigzag, then it may find support about the lower edge of the maroon Elliott channel. If it is a triangle or combination, it may be more shallow, ending about mid way within the channel. At this stage, a single zigzag has been invalidated and a double zigzag is discarded based upon a very low probability. It looks like primary wave 4 is to be a very shallow sideways consolidation rather than a deeper pullback.

Only two daily charts are now published for primary wave 4: a triangle and a combination. It is impossible still for me to tell you with any confidence which of these two structures it may be. The labelling within each idea may still change as the structure unfolds.

The daily charts are presented below in order of probability based upon my judgement.

The final target for Grand Super Cycle wave I to end is at 2,926 where cycle wave V would reach 1.618 the length of cycle wave I.

DAILY CHART – TRIANGLE

This first daily chart will illustrate how price might move if primary wave 4 unfolds as a triangle.

Intermediate wave (B) may be a single zigzag. One of the five sub-waves of a triangle should be a more complicated multiple; most commonly that is wave C. If intermediate wave (B) is correctly labelled as a single zigzag, then intermediate wave (C) may be a longer lasting and more complicated double zigzag.

The triangle may last a total of a Fibonacci 13 or 21 weeks.

Both intermediate waves (A) and (B) look like three wave structures.

Intermediate wave (C) may not move beyond the end of intermediate wave (A).

HOURLY CHART

The best fit channel drawn in last analysis about prior upwards movement has been clearly breached. With price remaining within the Elliott channel on the main hourly chart though, it should not be taken as indication of a trend change. Both channels should be breached for confidence.

A best fit channel is drawn about new downwards movement. If price continues to find resistance about the upper edge, then for the very short term the trend may remain down.

There would now be four overlapping first and second waves complete for this alternate wave count. This wave count expects a strong increase in downwards momentum this week.

DAILY CHART – COMBINATION

A combination for primary wave 4 would still offer some alternation with the regular flat of primary wave 2. Whenever a triangle is considered, always consider a combination alongside it. Very often what looks like a triangle may be unfolding or may even look complete, only for the correction to morph into a combination.

There may only be one zigzag within W, Y and Z of a combination (otherwise the structure is a double or triple zigzag, which is very different and is now discarded). At this stage, that would be intermediate wave (W), which is complete.

Combinations are big sideways movements. To achieve a sideways look their X waves are usually deep (and often also time consuming) and the Y wave ends close to the same level as wave W.

This wave count sees upwards movement continuing as intermediate wave (X). Unfortunately, there is no Elliott wave rule regarding the length of X waves, so they may make new price extremes. I am applying the convention within Elliott wave regarding B waves within flats here to this X wave within a combination: When it reaches more than twice the length of intermediate wave (W), then the idea of a combination continuing should be discarded based upon a very low probability.

With intermediate wave (W) a zigzag, intermediate wave (Y) would most likely be a flat correction but may also be a triangle. Because a triangle for intermediate wave (Y) would essentially be the same wave count as the triangle for the whole of primary wave 4, only a flat correction will be considered.

But first, an indication would be needed that the upwards wave of intermediate wave (X) is over. As yet there is no evidence of this.

TECHNICAL ANALYSIS

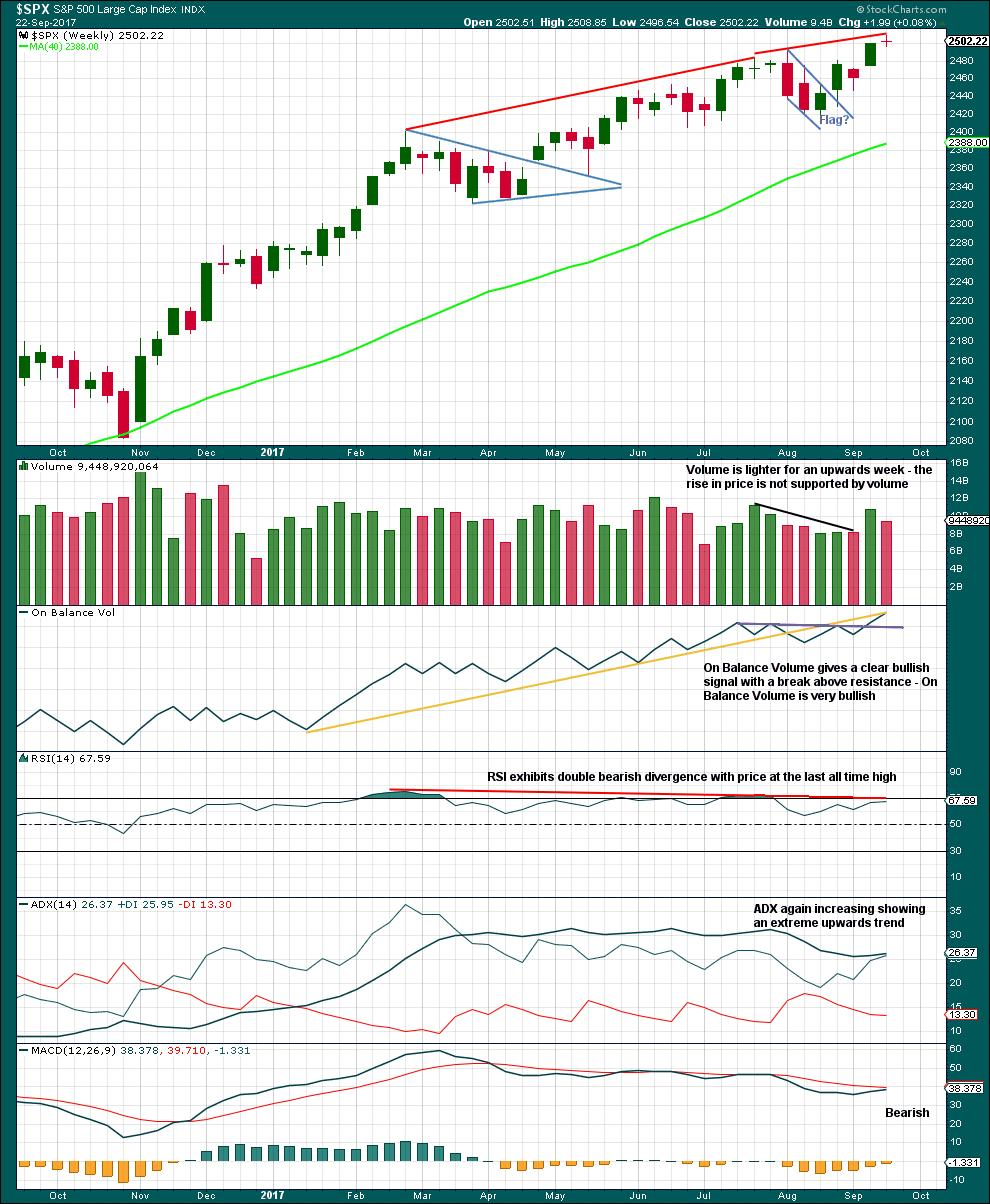

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A strong weekly candlestick gaps higher and has support from volume. This looks like a classic upwards breakout after a small consolidation, and there may have been a small flag pattern in it. This supports the main Elliott wave count.

If the flag pole is taken from 2,405.70 to 2,490.87, then a target for the next wave up may be about 2,527.

The bullish signal from On Balance Volume is clear. It should be given reasonable weight. This supports the main Elliott wave count.

ADX is still just extreme. If the black ADX line crosses above the +DX line, then the upwards trend would no longer be considered extreme. RSI still exhibits double bearish divergence. This trend is extreme; beware that the alternate wave count may still be correct.

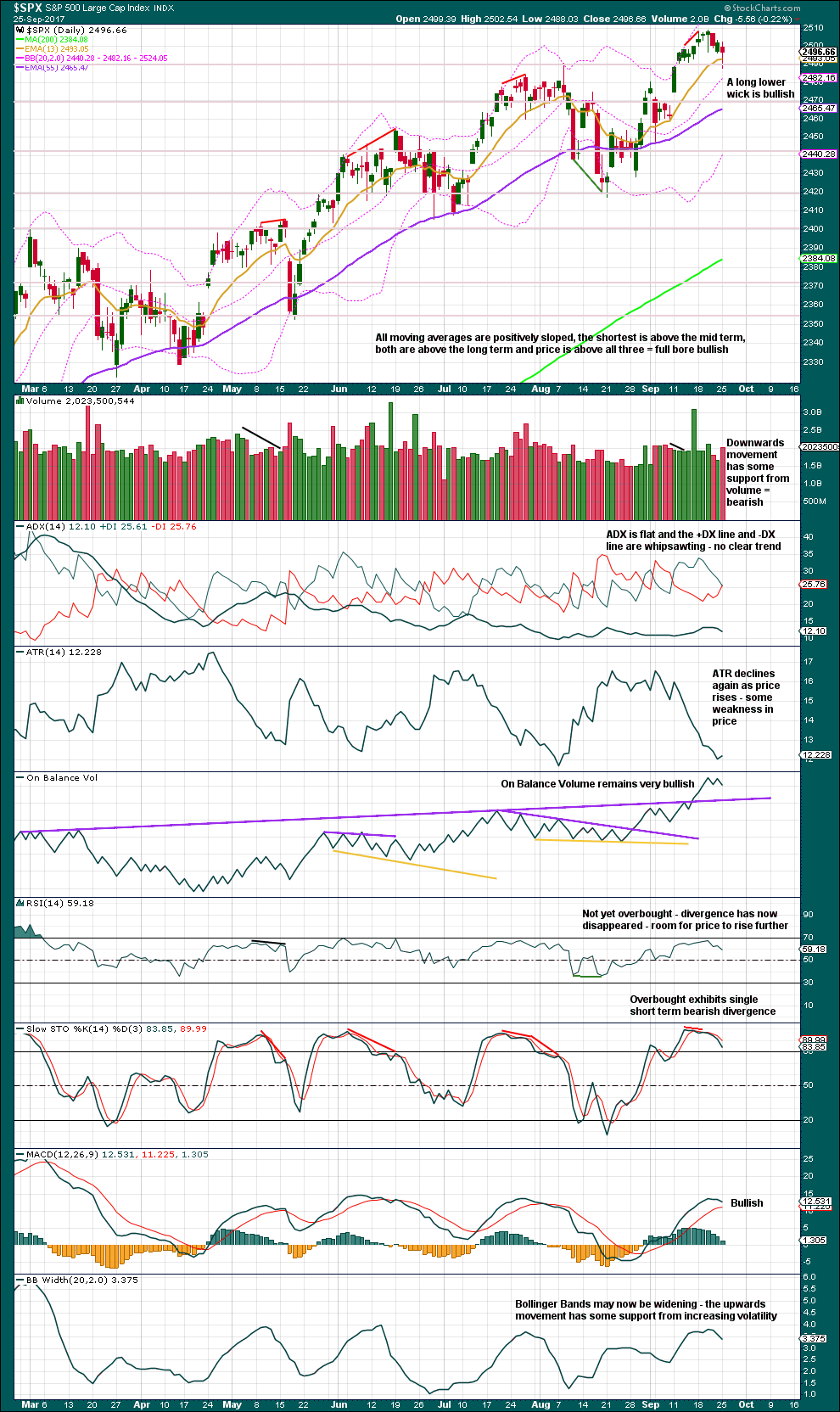

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has now moved lower overall for a few days after the Hanging Man candlestick pattern.

Another long lower wick on today’s candlestick is bullish. As this candlestick is not the end of a downwards trend of any reasonable length, it will not be read as a Hammer pattern. Reversal patterns should only be read as such when they come after a trend and not within a possible consolidation as this one may be. There has to be something to reverse.

The long lower wick may still be read as bullish. Long lower candlestick wicks are a feature in this market at the end of smaller pullbacks and consolidations .

Support for downwards movement from volume today contradicts the bullishness in the candlestick wick. But with On Balance Volume still very bullish overall, this chart still looks more bullish than bearish.

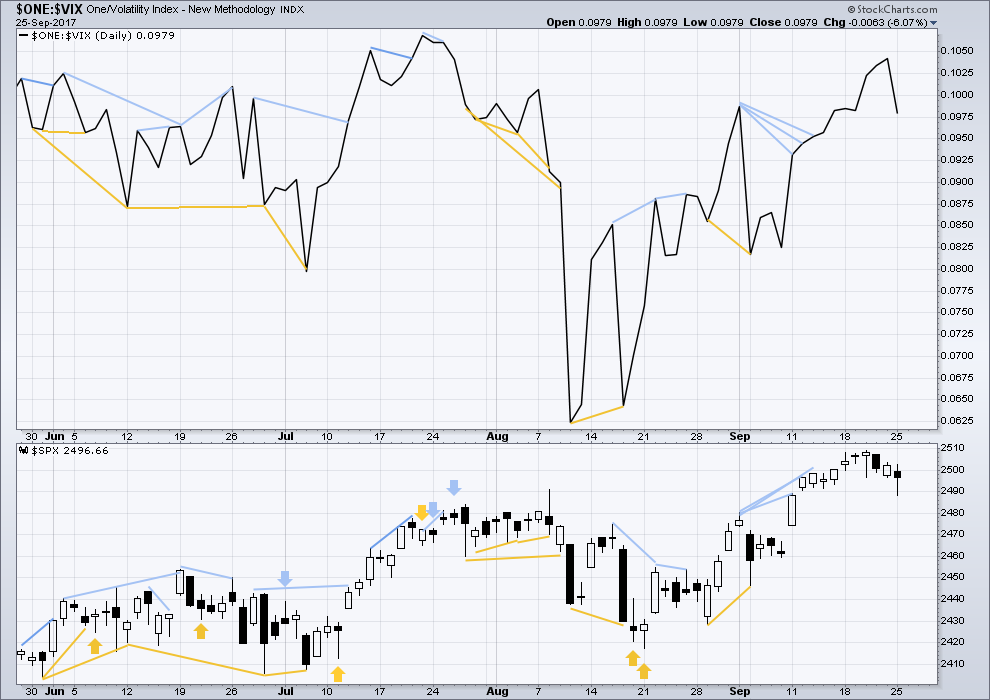

VOLATILITY – INVERTED VIX CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is still mid and longer term bearish divergence, but it has been noted in the past that divergence over a longer term does not seem to work as well for VIX. Short term bearish divergence has disappeared.

There is no new short term divergence with price and inverted VIX.

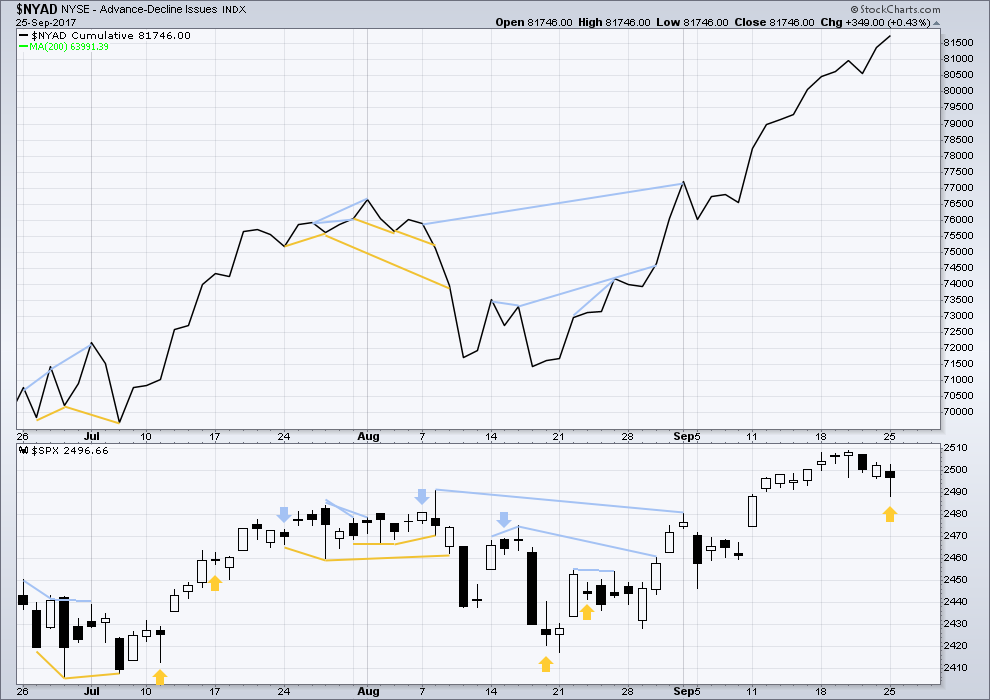

BREADTH – AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

With the last all time high for price, the AD line also made a new all time high. Up to the last high for price there was support from rising market breadth.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market.

Price moved lower today but the AD line has moved higher. This will be interpreted as bullish divergence. A new high for breadth may be a leading indicator of new highs for price this week. This supports the main Elliott wave count.

DOW THEORY

The S&P’s new all time high last week is confirmed by DJIA and Nasdaq also making new all time highs. However, DJT has not yet made a new all time high, so the continuation of the bull market at this stage lacks confirmation.

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 17,883.56.

DJT: 7,029.41.

S&P500: 2,083.79.

Nasdaq: 5,034.41.

Charts showing each prior major swing low used for Dow Theory are here.

Published @ 09:35 p.m. EST.

not looking very bullish at the moment!

Get this feeling that tech will be saving the day here real quick with some sector rotation.

Have you been looking at the serious divergences with all the charts of the big players in the tech sector? They generally lead the way not the other way around. I would not bet on it! 🙂

Indeed Verne, for what it’s worth, I could see a very short term burst to 2526 range, but my spidey sense, built on trading since I was 14 and managing money since 23(36 now) can feel a trend change a coming. To me this appears to be a distribution phase, and as Joseph articulated, could be baiting the bulls.

Hourly chart updated:

I’m a bit nervous about pulling the invalidation point up again to see subminuette iv complete. But really, now for the sake of reasonable proportion, it should be complete.

A leading expanding diagonal unfolding for a small first wave may be what’s happening today. If that’s the case, look out for a deep correction for micro 2 to get close to 2,488.38 (yesterdays low) but to now move to a new low below it.

After that, up up and away to new highs.

“but to now move to a new low below it.”

sorry everybody, that should read to NOT move to a new low below it.

Fat fingers typing here 🙂 Only one coffee

Lots of conflicting signals across markets. RUT and Transports at new highs, clear downtrends in Tech and quite an island reversal pattern in NVDA. It is starting to look like we are seeing consolidation in the 2500 pivot area ahead of a run higher. The pattern has been well established. Sideways trading around these pivots almost invariably results in upward break-outs. Strangely enough, VIX also seems to have broken above a bullish falling wedge so really hard to say with any confidence what comes next…..my bias is bullish until we take out 2470….

And On Balance Volume and breadth for S&P are very bullish.

Those consolidations? When we get bullish signals from OB V during them we’ve learned over these last few months to take that seriously.

Doesn’t always work of course, but ATM seems to be working much more often than it fails.

With energy ripping, it really took the breadth of SPX higher.

Tech sector money flow evidencing some really interesting buying patterns with sell orders being exactly matched with buys. Decline would have been much steeper yesterday absent these cash dumps. I am starting to wonder how these buying patterns might affect volume profile and possibly mask price action that is weaker than it appears. We could get doji candles today in both DJI and SPX, on days when other indices are making new ATHs. Fractured markets….

Yeah it has that very “when in doubt, sit out” feeling to it. Gap fill and VIX pop really looked like it was going to get things going, but alas same story again.

Clearly deep pockets are stoking the price action. Not sure how long they can keep it up. I suspect any resulting upside pop is not going to be sustainable. Looking at the charts in the tech sector, something does not look or feel quite right about unbridled bullishness at this juncture…. 🙂

I’ve highly customized my trend color study. I’m using an 8 period ADX, an ADX>15 as the fundamental “trend on/off” indicator, and I’m buffering transitions, meaning, if ADX is high and the last bar is trend colored (red or green), then a trend reversal requires not just a cross of DIPlus and DIMinus, but also ADX higher than one bar ago. Otherwise, you get “false reversals” on the chart as I see it. I like it, I find it valuable as a quick glance tool when looking at a daily, an hourly, and a five minute, as per the screen.

$RUT/IWM keeps cruising along. Thought about buying some calls early last week but didn’t want to “chase the trade”. Well, you never know.

What do you make of the very different daily chart patterns in SPX / NDX / RUT? Shouldn’t they come together at some point before the BIG downturn?

Yeah Ron, I here ya. However, this finally looks like a real market to me where sectors are performing irrespective of the broader indexes. RUT is in broadening pattern that I have getting to the 146-148 range. I’ve been building short since it hit 144, but it’s certainly trading like a commodity. NDX looks to be entering a downtrend with divergences and bear cross on weekly and daily time scales. Nice bounce to 50-day and a short at yesterday’s low break should be in order.

Thanks Chris.

Yes, NDX is showing as trending down now on the my daily chart, has been trending down since last Wed on my hourly, and just popped to trending down on the 5 minute. On the hourly, a nice pullback up to the 21 bar EMA. One concern is on the daily, price is sitting on the lower B and K bands, and looking likely to roll back up.

It’s also of course consistently uptrending on the weekly. I think the highest weight evidence is the weekly, and the oscillating on the day chart off the B and K bands, with price just now settling on the lower of those bands. I put on a short and took it off quick as I considered more thoroughly. The trend should continue, and while the daily is down instantly, it appears that will change quickly, if the past 6 months behavior holds constant.

Yeh, I got burned again. Must learn to stay out until clear trend is established one way or other.

Me too… yesterday in VXX. So thankful for stops!

They pulled out all the stops. Hammered VIX, hammered Gold, hammered the Yen. Oops! 🙂

VIX moved back down to tag wedge upper boundary…

VIX broke above a bullish falling wedge so it does look like more downside ahead…if the breakout is real it should close above 12.50 tomorrow.

SPX is doing another “scallop top”. There’s a stochastics bearish divergence. Price has just moved upder my (21 period) upper bollinger, and my (21 period) upper keltner. And my fast ADX trend indicator (8 period) just went red on the daily. Timing cycle wise, another scallop top is certainly due. Many reason why the market “should” inexorably bend down here and go visit that 55 EMA on the daily chart. Which would mean back to the P4 alternate count. As I see it, Monday’s low (the 23% fibo) is KEY, along with any breakage of the 21 period EMA on the daily. If broken to the downside, price is certainly going to the 38%, and most likely all the way to the 62%. There may be more upside first, similar to some of the broadening scallop tops over the last several months (June). A failed 5 up here that forms a double top wouldn’t be surprising, before the daily trend goes red.

The wabbit must be asleep!

good job,, you caught the wabbit down in his hole,, hee hee,, he could be busy again.

I heard that guys!